Contact Rate vs Connect Rate: What's the Difference (and How to Fix Both)

"Contact rate vs connect rate" is why your dialer dashboard looks fine while your reps swear they talked to nobody.

You run 500 dials in a week. The dashboard says 25% "connect rate." Then you listen to calls and realize you only had 8 real conversations.

Most teams aren't failing at cold calling. They're mixing two or three definitions into one KPI, then fixing the wrong thing.

Hot take: on lower-priced deals, obsessing over a single blended "connect rate" KPI is a waste of time. Split the metrics, fix the bottleneck, move on.

My recommendation: track Connect (includes voicemail/IVR if you choose) and Pickup (live answer) separately, then use RPC as the scoreboard. That's how you stop arguing about performance and start improving it.

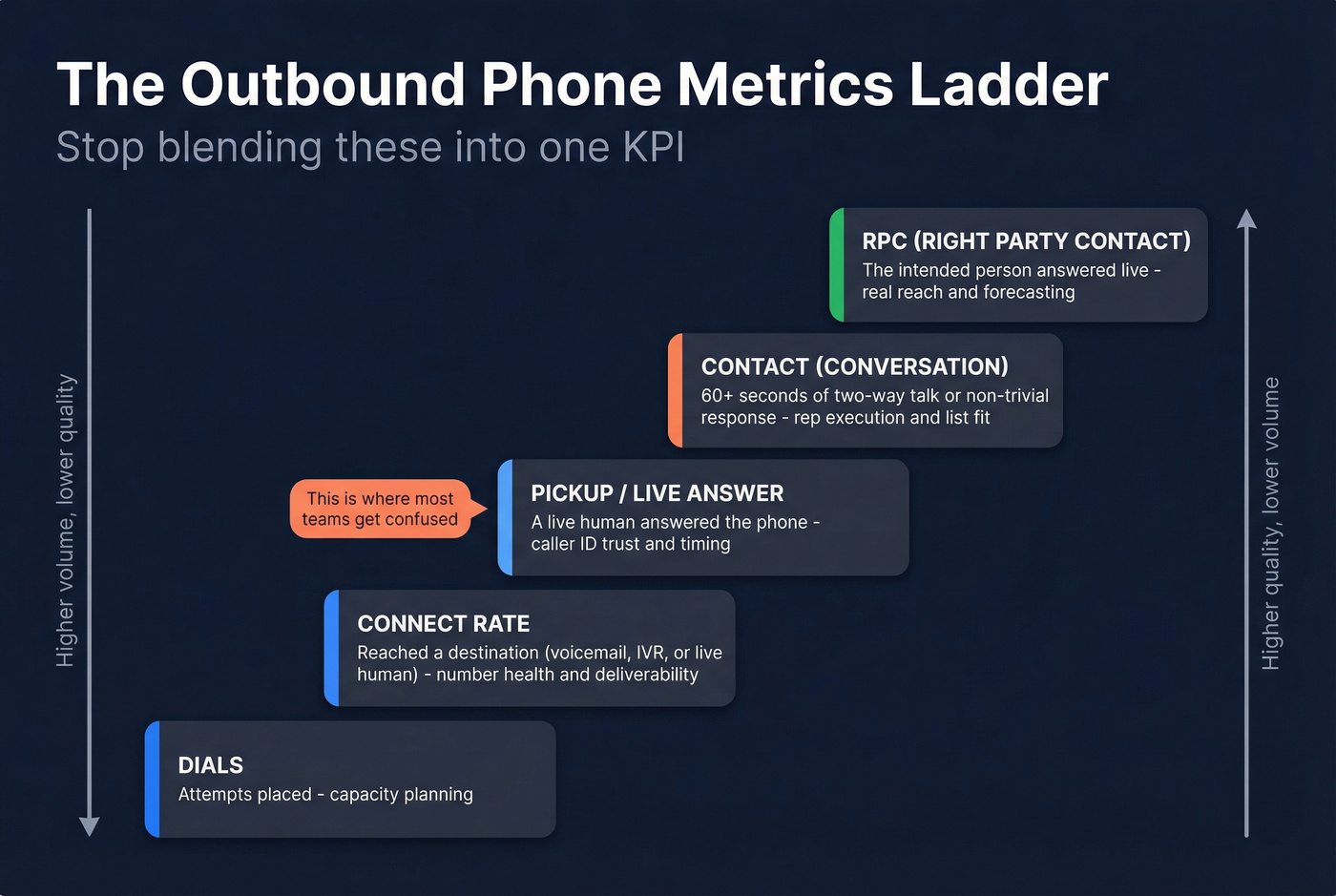

Use this simple ladder (phone-only):

- Connect = the call reached something (including voicemail/IVR if you choose)

- Pickup = a live human answered

- Contact = a real two-way conversation (you must define it)

- RPC = the intended person answered live

Quick disambiguation: some vendors use "connection" across channels (email replies, social DMs, etc.). This guide is phone metrics only. For multi-channel, track reply rate and meeting rate separately and keep them out of your phone "connect" KPI.

Contact rate vs connect rate: standard definitions (plus pickup + RPC)

The confusion comes from one word: connect. Dialers use it to mean "the call technically connected." Sales leaders use it to mean "I spoke to a prospect." Those aren't the same thing, and blending them wrecks coaching.

Here's the clean ladder that works in any dialer + CRM:

| Metric | What it is | What it is not | Best for |

|---|---|---|---|

| Dials | Attempts placed | "People reached" | Capacity planning |

| Connect rate | Call reached a destination (voicemail/IVR/live human) | A conversation | Number health + deliverability |

| Pickup / Live answer | A live human answered | Voicemail, IVR, recordings | Caller ID trust + timing |

| Contact (Conversation) | Two-way talk that clears a minimum bar | "Any hello" | Rep execution + list-message fit |

| RPC (Right Party Contact) | Intended person answered live | Gatekeeper, wrong party, voicemail | Real reach + routing |

The one definition you must lock down: "Contact"

"Contact rate" is the slipperiest metric in outbound. If you don't standardize it, it turns every pipeline review into a vibes-based argument.

Pick one of these and name it explicitly in dashboards:

- Contact (Conversation) = >=60 seconds of two-way talk or the prospect gives a non-trivial response (more than yes/no)

- Contact (Qualified) = RPC + at least one discovery question answered (timing, current tool, pain, etc.)

Both are valid.

Calling both of them "contact rate" is the problem.

Common vendor misuse (and why it breaks your team)

These are the three definitions that cause the most damage:

"Connect = anything that didn't fail" (includes voicemail/IVR) Great for telecom health. Terrible for rep coaching. It inflates success and hides spam-labeling problems.

"Connect = live answer" (any human) Better, but it still muddles gatekeepers and wrong parties with real prospects.

"Contact = any live answer" This makes your "contact rate" look healthy while your pipeline stays flat, because you're counting the wrong humans.

This is also where teams get tangled in contact rate vs connect rate vs answer rate debates: one dashboard is reporting "connected to something," another is reporting "someone answered," and a third is reporting "we actually talked." If you don't label the rung, you can't coach the fix.

Operationally, the clean split looks like this: JustCall defines Connect rate as calls that connect (including voicemail/agent connection) and pickup rate as live answers. And CallCentreHelper's RPC definition is the gold standard for outbound: the intended person answered live - no voicemail, no gatekeeper, no wrong party.

My stance for B2B outbound is simple:

- Use Connect to manage list/telecom health.

- Use Pickup to manage trust (spam labeling) and timing.

- Use RPC to manage performance and forecasting.

- Use Contact only after you standardize it as "Conversation" or "Qualified."

Formulas (with one denominator rule) + worked example (100 dials)

One denominator rule: keep the denominator as total dials for every top-line rate. Don't switch denominators mid-funnel unless you're doing a deeper diagnostic, because that's how teams accidentally "improve" a metric by changing the math instead of changing outcomes.

Core formulas:

- Connect rate = Connects ÷ Dials

- Pickup rate (live answer) = Live answers ÷ Dials

- Contact rate = Conversations ÷ Dials

- RPC rate = Right-party answers ÷ Dials

My favorite "connect rate" definition for sales ops is Gong's, because it explicitly uses answered by a prospect ÷ dials. That's closer to pickup/RPC than to "connected to voicemail," and it's usually what reps mean when they say "nobody picked up."

Worked example (100 dials)

Let's say you place 100 dials and outcomes look like this:

- 55 no answer

- 10 busy

- 5 not in service/wrong number

- 20 voicemail (left message)

- 10 live answers

- 6 are gatekeepers/wrong party

- 4 are the intended prospects (RPC)

- 2 of those 4 become "real conversations" (your defined Contact)

Now watch how rates change depending on what you count.

If voicemail counts as connect:

- Connect rate = (20 voicemail + 10 live answers) ÷ 100 = 30%

- Pickup rate = 10 live answers ÷ 100 = 10%

- RPC rate = 4 right-party ÷ 100 = 4%

- Contact rate = 2 conversations ÷ 100 = 2%

If connect means "answered by the prospect" (Gong-style):

- "Connect" (prospect-answered) = 4 ÷ 100 = 4%

Same dialing. Same list. Your "connect rate" just went from 30% to 4% based purely on definitions.

That's why teams fight about performance when they're really fighting about math.

You just learned that your 30% "connect rate" might really be a 4% RPC rate. The fastest fix isn't better dialing - it's better data. Prospeo's 125M+ verified mobile numbers deliver a 30% pickup rate, turning more dials into live conversations with the right person.

Stop inflating connect rates. Start reaching real buyers.

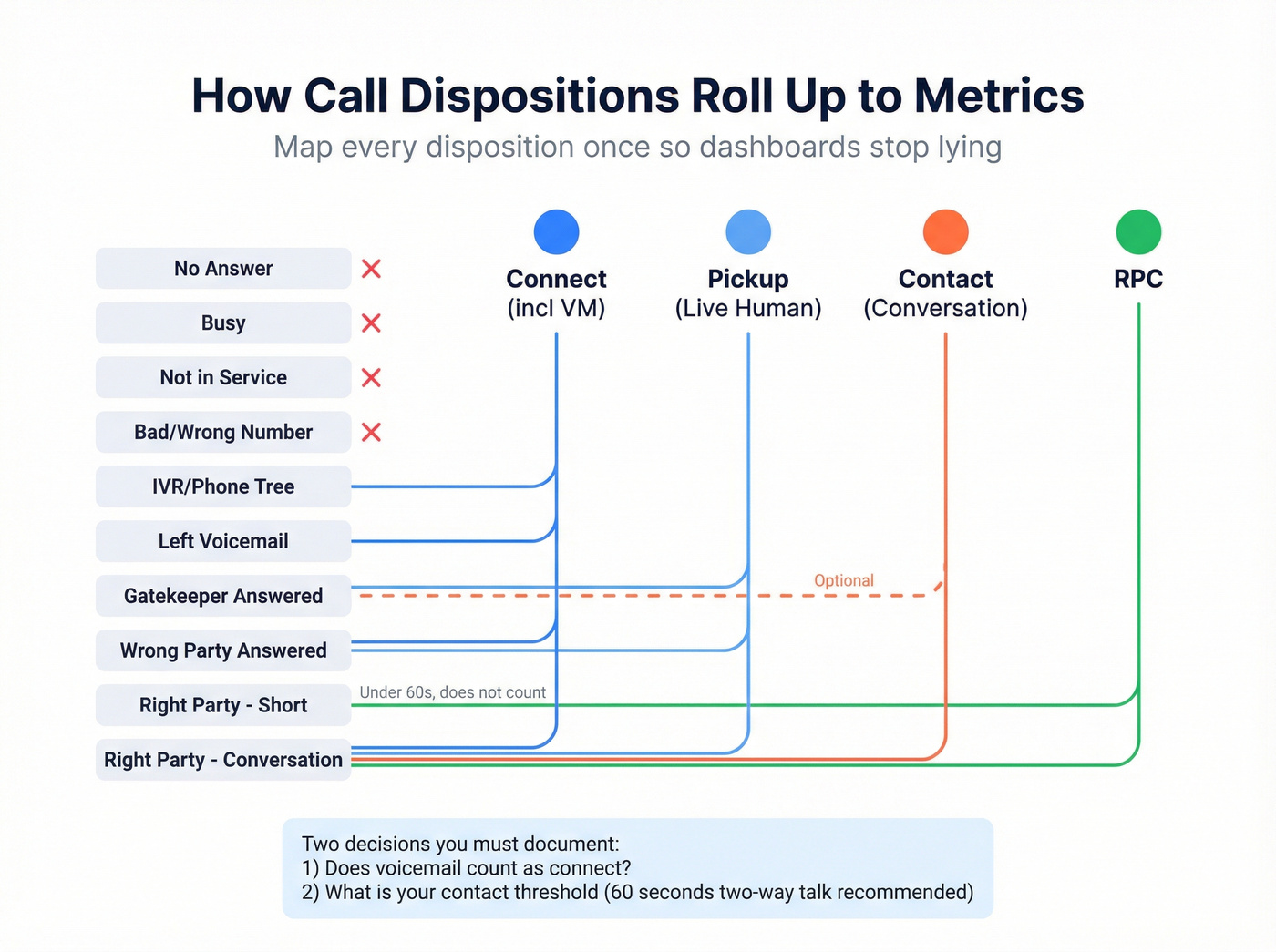

Disposition-to-metric mapping (so dashboards stop lying)

If you want consistent reporting, you need dispositions that roll up into metrics the same way every time.

Important nuance: Apollo's roll-up is built for sequencing logic (did you reach the intended contact enough to stop the sequence?). Your outbound ops metrics might use Connect (incl. voicemail) as a deliverability measure. Those are different systems, so we show both.

In Apollo sequences, marking a call as Connected stops the contact from advancing; Not connected continues.

Disposition mapping table (recommended roll-ups)

| Disposition | Apollo roll-up (sequencing) | Your Connect (incl. VM) | Pickup (live human) | Contact (Conversation) | RPC |

|---|---|---|---|---|---|

| No answer | Not Connected | No | No | No | No |

| Busy | Not Connected | No | No | No | No |

| Not in service | Not Connected | No | No | No | No |

| Bad/wrong number | Not Connected | No | No | No | No |

| IVR / phone tree | Not Connected | Yes | No | No | No |

| Left voicemail | Not Connected | Yes | No | No | No |

| Gatekeeper answered | Not Connected | Yes | Yes | Optional* | No |

| Wrong party answered | Not Connected | Yes | Yes | No | No |

| Right party answered - short | Connected | Yes | Yes | No (if <60s) | Yes |

| Right party answered - conversation | Connected | Yes | Yes | Yes | Yes |

*Gatekeepers: I treat them as Pickup = yes and RPC = no every time. For Contact, decide based on your motion. If gatekeepers are a meaningful part of routing (healthcare, education, local gov), count them as a separate metric like Gatekeeper Contacts instead of polluting "contact rate."

Two choices you must document (or your metrics will drift)

Do you count voicemail/IVR as a connect? Yes for deliverability + number health. No for rep coaching.

What's your Contact threshold? If you pick >=60 seconds two-way talk, your contact rate becomes coachable. If you pick "any live answer," your contact rate becomes noise.

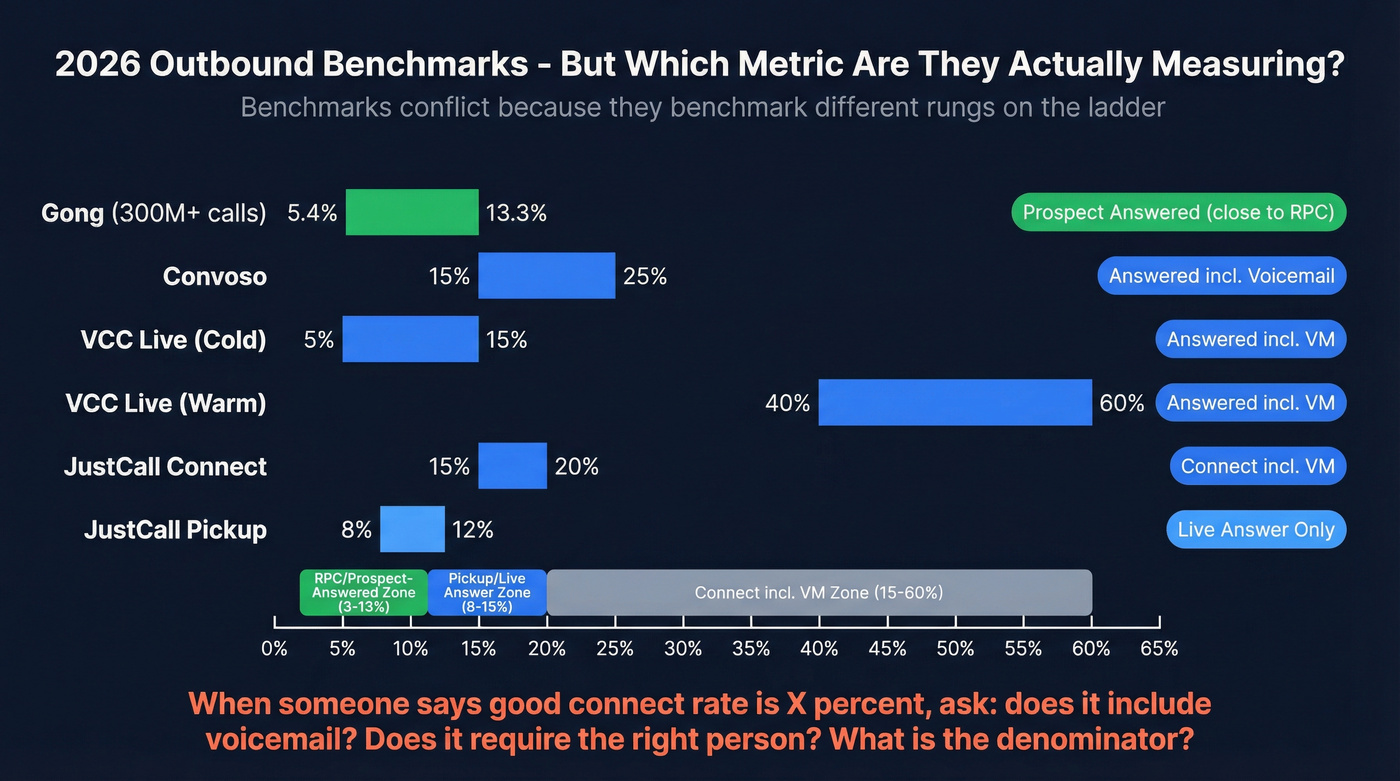

Benchmarks in 2026 (and why numbers conflict)

Benchmarks conflict because they're benchmarking different rungs on the ladder. If you don't label the rung, the number isn't useful.

Benchmark table (with definition labels)

| Source | Metric name | Definition label | Benchmark |

|---|---|---|---|

| Gong (300M+ calls) | Connect rate | Prospect-answered | Avg 5.4%, top quartile 13.3% |

| Convoso | Connection/contact | Answered (incl. voicemail) ÷ calls placed | 15-25% on fresh/healthy lists |

| VCC Live | Connection rate | Answered incl. VM | Cold 5-15%, Warm 40-60% |

| VCC Live | Connection rate | Answered incl. VM | B2B 15-40%, B2C 10-30% |

| JustCall (B2B) | Connect rate | Connect incl. VM | 15-20% |

| JustCall (B2B) | Pickup rate | Live answer | 8-12% |

JustCall also publishes an industry table of average connect rate ranges. Use it only if your definition matches theirs (connect including voicemail/agent connection).

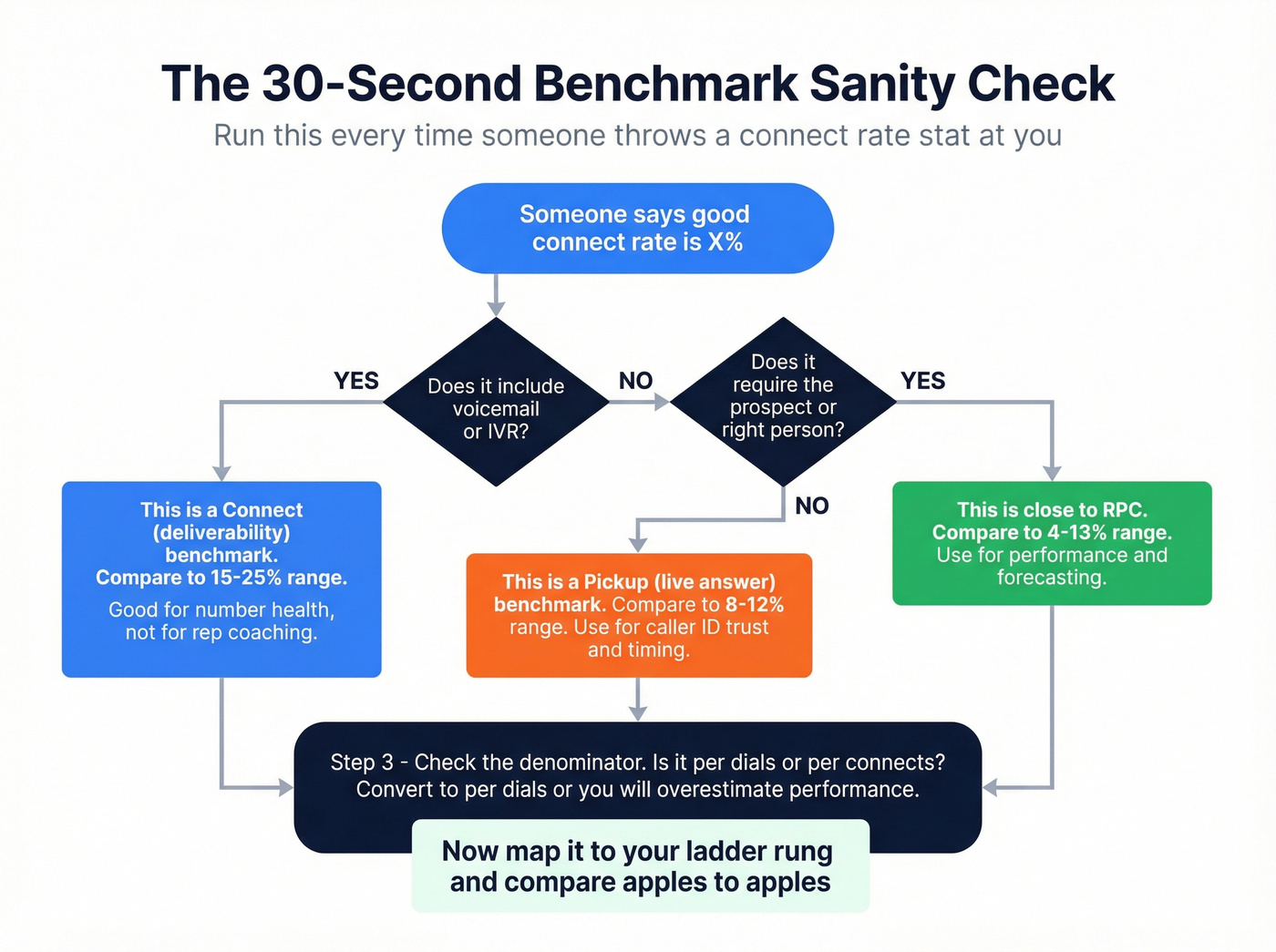

How to reconcile any benchmark you see (steal this mini-method)

When someone throws a "good connect rate is X%" stat at you, run this 30-second checklist:

Does it include voicemail/IVR? If yes, it's a Connect (deliverability) benchmark, not a conversation benchmark.

Does it require the prospect/right person? If yes, it's closer to RPC (even if they call it connect).

What's the denominator? If it's "per connects" instead of "per dials," convert it back to dials or you'll overestimate performance.

Then map it to your ladder rung and compare apples to apples.

Translations that make the benchmarks usable

Gong's 5.4% average connect (prospect-answered) implies roughly 19 dials per prospect answer on average, and about 8 dials at the top quartile (13.3%). That gap is why list quality and caller ID trust beat "dial more" every day of the week, because one team is spending its day talking and the other is spending its day listening to rings.

Convoso's 15-25% is "answered (including voicemail) ÷ calls placed" on fresh/healthy lists. It's a deliverability number. Treat it like "conversations" and you'll set impossible expectations, then act surprised when reps burn out and managers start coaching scripts that were never the bottleneck.

Real talk: if your dashboard says 20% connect rate but your reps feel stonewalled, you're staring at connect-including-voicemail while your reps live in pickup/RPC.

Why connect and contact rates are dropping in 2026 (it's not "best time to call")

Timing matters, but it isn't the macro trend.

The macro trend's simple: people don't answer unknown calls, and carriers/OS layers keep getting more aggressive about screening and labeling.

Hiya's State of the Call 2025 put hard numbers on it:

- 80% of unidentified calls go unanswered

- 48% of consumers never answer unidentified calls

- The report is based on 262.8B calls analyzed plus surveys of 12,000+ consumers

- 1 in 4 spam calls use AI-generated voices, which accelerates screening behavior even for legitimate businesses

That's before you factor in device-level call screening, assistant-based screening, and "answer for me" behaviors. The practical effect is that dialing hygiene now includes identity and trust, not just volume, and the teams that treat "no answer" as a rep problem end up thrashing for weeks while the real issue sits in their number reputation and list quality.

If your pickup rate's sliding quarter over quarter, you aren't imagining it.

The environment changed.

Caller ID reputation + spam labeling mechanics (what to monitor)

Spam labeling's the silent killer because it doesn't show up as a "bounce." It shows up as no answer and straight-to-voicemail.

The most useful mental model: reputation is dynamic. You don't fix it once. You manage it continuously.

Numeracle's 2025 numbers make that obvious:

- 1,032,800+ numbers protected

- 161,440+ remediations in 2025 (up 44% YoY)

- 66.8M branded calls enabled in 2025

- Labels can reappear because carrier algorithms keep reassessing behavior

Weekly RevOps checklist (the stuff that actually catches problems)

- Pickup rate by number/DID (not just by rep)

- % calls going to voicemail in <2 rings (screening smell)

- Gap between Connect (incl. VM) and Pickup (gap widening = trust problem)

- Answer rate by geography (local presence can help; don't abuse it)

- Complaint signals ("you showed up as spam")

Use / skip guidance (so you don't waste a quarter)

Use:

- A small pool of numbers with consistent behavior

- Branded caller ID where available

- Remediation workflows if you do real volume

Skip:

- Random number rotation as your first move (it often makes reputation worse)

- Treating spam labels as an SDR problem (it's a systems problem)

I've watched teams rewrite scripts for a month when the real issue was half their numbers getting flagged. The script never had a chance.

Diagnostic playbook: what to fix based on your numbers (threshold-based)

You don't need a perfect model. You need a model that tells you what to fix first.

Track these four rates on the same denominator (dials):

- Connect (incl. voicemail)

- Pickup (live answer)

- RPC

- Contact (Conversation or Qualified - pick one)

The 4-metric scorecard (print this, run it weekly)

Healthy starting ranges for cold B2B outbound (phone-only):

- Connect (incl. VM): 15-25% (below 12% = number/data health problem)

- Pickup (live answer): 6-12% (below 5% = trust/timing problem)

- RPC: 2-6% (below 2% = targeting/routing problem)

- Contact (Conversation >=60s): 1-3% (below 1% = messaging/execution problem)

These aren't laws of physics. They're triage thresholds that keep you from guessing.

Quick decision table: "If X, do Y"

| Pattern | What you see | Likely cause | Fix first |

|---|---|---|---|

| A | Connect OK, Pickup low | Trust + targeting | Caller ID + segmentation |

| B | Connect low | Bad data/number health | Data hygiene + enrichment |

| C | Pickup OK, RPC/Contact low | Execution/routing | Talk track + gatekeeper routing |

Pattern A: Connect OK, Pickup low

Example: 22% connect incl. voicemail, 6% pickup.

Your calls reach phones, but humans don't pick up. Fix caller ID reputation/spam labeling first, then segmentation (stop calling people who'll never care), then time windows by persona (finance vs IT vs founders behave differently).

Pattern B: Connect low

Example: 8-10% connect incl. voicemail.

That's list decay or number health. Suppress dead/wrong numbers fast, fill coverage gaps (missing mobiles/direct dials), and watch DID health (burned numbers show up as sudden drops by number).

Pattern C: Pickup OK, RPC/Contact low

Example: 10% pickup, 2% RPC, 0.7% contact.

That's rep execution + routing: gatekeeper handling, right-party confirmation in the first 5 seconds, and disposition discipline so you don't poison your own data.

Tie it back to staffing math: VCC Live's activity expectations for cold outbound are 80-150 calls/day/agent. If your RPC rate's 3%, that's 2-5 right-party conversations per day. That's what you staff and forecast to, not the vanity connect rate.

How to improve connect rate and contact rate (prioritized levers)

If you try to fix everything at once, you'll fix nothing. This order works because it removes the biggest sources of fake progress first.

Lever 1: Fix the easiest variable first: data hygiene

Phone data fails silently. Emails bounce; phone numbers waste your reps' day.

Coldcallbenchmarks tested nine phone data providers and found accuracy ranging 63-91% and coverage 26-92% on the same set of verified contacts. That's why two teams can run the same playbook and get totally different results.

Here's the thing: the fastest lift usually isn't a new script. It's stopping your team from dialing dead records.

In our experience, the cleanest workflow is boring and effective: enrich your list, filter to verified mobiles/direct dials, suppress bad numbers, and only then push it into the dialer. If you do that weekly, your Connect and Pickup rates stop swinging, and coaching gets way easier because you're not diagnosing noise. (If you want the full SOP, see B2B contact data decay and data quality.)

Prospeo is a natural fit for this step because it's "The B2B data platform built for accuracy": 300M+ professional profiles, 143M+ verified emails at 98% accuracy, and 125M+ verified mobile numbers with a 30% pickup rate, all refreshed every 7 days (the industry average is 6 weeks). It also returns contact data on 83% enrichment match rate with a 92% API match rate, so you can run the cleanup as a repeatable RevOps job instead of a one-off spreadsheet scramble.

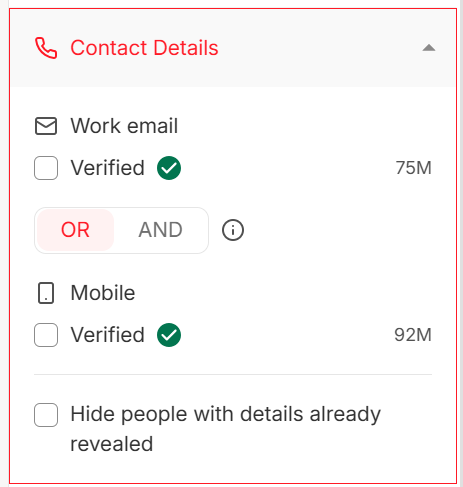

Practical workflow (no magic features required): upload a CSV or enrich via CRM/API, filter to records with verified mobiles, then export/sync the cleaned data back to your CRM/dialer so reps suppress dead numbers and spend dials on callable contacts. If you need a buyer’s guide for tooling, start with lead enrichment tools and B2B phone number.

Right before you push the list live, you want to see three fields: verified mobile found, verification status, and last refresh date. If you can't see those, you're guessing.

Lever 2: Protect number health (so you don't get screened)

If Pickup is low but Connect incl. voicemail is fine, trust is the bottleneck.

Do the basics consistently:

- Keep a stable pool of numbers (don't rotate like crazy)

- Watch for sudden drops by DID (burned-number signature)

- Use branded caller ID where possible

- Keep call patterns human (predictable bursts look spammy)

Also: understand STIR/SHAKEN at a high level. It won't make people answer, but it's part of the ecosystem that influences trust and labeling. For broader outbound guardrails, align this with your outbound calling strategy.

Lever 3: Tune your dialing system (without buying shiny objects)

Dialers help, but they aren't a cheat code.

Cost reality (per-agent, typical ranges):

- Power dialer: $50-150/agent/month

- Predictive dialer: $150-300/agent/month

Predictive can increase volume, but it can also create dead air if AMD and pacing aren't tuned. If your Pickup rate's already low, predictive makes the experience worse and trains prospects to ignore you. If you're evaluating options, use a power dialer vs predictive dialer rubric.

Focus on:

- AMD tuning (reduce false positives that drop real humans)

- Retry strategy (don't hammer the same prospect five times in one hour)

- Time windows (test 2-3 per persona; keep what wins)

- Local presence (use sparingly; it isn't a substitute for trust)

Lever 4: Improve contact/RPC conversion (what happens after pickup)

Once you get live answers, the game changes.

To lift conversation rate and RPC:

- Open with a right-party confirmation in the first 5 seconds

- Separate dispositions for gatekeeper vs wrong party vs right party

- Build a gatekeeper routing path (department routing beats "can you transfer me?")

- Coach to a single goal: earn permission for the next step, not "pitch on pickup"

If your reps need a tighter coaching loop, pair this with a cold call coaching scorecard and how to ask for the right contact person scripts.

I've run bake-offs where two teams had the same dialer and list, and the better team got 2-3x more RPC because they treated gatekeepers as a routing problem, not an objection.

FAQ

Is connect rate the same as contact rate?

No. Connect rate measures whether a call reached a destination (often including voicemail/IVR), while contact rate measures whether you had a two-way conversation that meets your threshold (for example, >=60 seconds). In most B2B teams, connect will be 15-25% while conversation-based contact is closer to 1-3% on cold lists.

Does voicemail count as a "connect"?

Voicemail should count as a connect only for deliverability and number-health reporting, not for rep performance. A clean setup is two KPIs: Connect (incl. voicemail) and Pickup (live answer), with typical cold B2B pickup ranges around 6-12% on healthy numbers.

What's a good connect rate for cold calling in 2026?

A "good" number depends on the definition you're using. Gong's prospect-answered connect rate averages 5.4% (top quartile 13.3%), while dialer-style connect rates that include voicemail often land around 15-25% on fresh lists. Label the rung before you compare.

What is Right Party Contact (RPC) and why is it better than "contact rate"?

RPC means the intended person answered live, excluding voicemail, gatekeepers, and wrong parties. It's better than contact rate because it's unambiguous and forecastable: many cold B2B teams operate around 2-6% RPC, and anything below 2% usually points to targeting or routing issues.

What's a good free option for improving list quality before you dial?

Prospeo's free tier includes 75 email credits plus 100 Chrome extension credits per month, which is enough to clean a small outbound list before a sprint. For best results, enrich your CSV/CRM, filter to verified mobiles, and suppress bad numbers so your Pickup and RPC rates don't get crushed by list decay.

Bad numbers tank every metric on the ladder - connect, pickup, RPC, all of it. Prospeo refreshes 300M+ profiles every 7 days (not 6 weeks), so your reps dial numbers that actually ring. At $0.01 per email and 10 credits per verified mobile, fixing your data costs less than one wasted hour of dials.

Clean data turns your dialer dashboard into real pipeline.

Summary: stop arguing about contact rate vs connect rate - label the rung

If you take one thing from this: contact rate vs connect rate isn't a philosophical debate, it's a labeling problem. Split Connect (deliverability), Pickup (live answers), and RPC (Right Party Contact) (right person reached), then define Contact as either Conversation or Qualified. Once the ladder's clear, the fixes become obvious and your dashboards stop gaslighting your reps.