Plivo alternatives (2026): Better SMS/Voice APIs Without Surprise Fees

$15k/month in SMS spend can look stable - until the bill jumps 30% and nobody can explain why. Your per-SMS rate didn't change. Your volume didn't spike. But carrier pass-through fees moved, 10DLC fees hit, and finance decided you "must have changed something."

That's what "Plivo alternatives" really means in 2026: predictable total cost and the ability to explain deliverability when things get weird.

Look, if your deal sizes are small and you're not sending at serious volume, you don't need a "platform." You need clean logs, sane pricing, and a provider that won't turn debugging into a scavenger hunt.

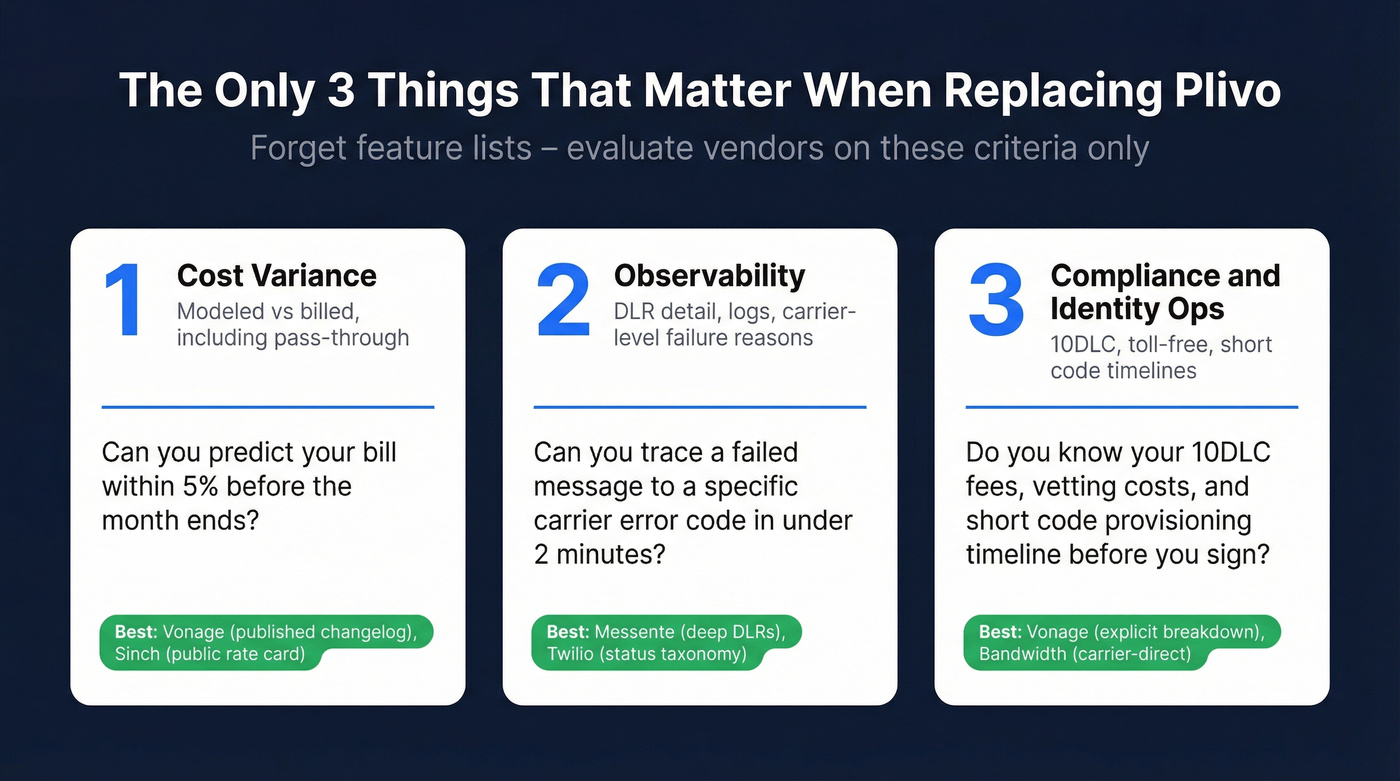

Evaluate vendors on three things only:

- Cost variance (modeled vs billed, including pass-through)

- Observability (DLR detail, logs, carrier-level failure reasons)

- Compliance + identity ops (10DLC, toll-free, short code timelines)

Our picks (TL;DR): the best Plivo alternatives

- Twilio - best overall ecosystem (but watch failed-message fees)

- Pick this when: you want the broadest APIs, docs, SDKs, and integrations.

- Expect: great tooling, higher "extras," and a real tax on messages that end up in a Failed status.

Prospeo - best conversion layer after you pick a CPaaS

- Pick this when: you're accountable for outcomes and list quality (fewer wasted sends/calls, higher pickup/response).

- Use it alongside: any CPaaS you choose.

Vonage Communications APIs - best for true-cost transparency

- Pick this when: you want the clearest 10DLC + pass-through breakdown and a published pass-through fee changelog.

Sinch - best "published rate card" trial pick

- Pick this when: you want public US anchors (SMS + numbers + short codes) to sanity-check your model.

Messente - best for high-volume deliverability visibility

- Pick this when: you need deep DLRs, traceability, and controlled fallback routing (like Viber) at scale.

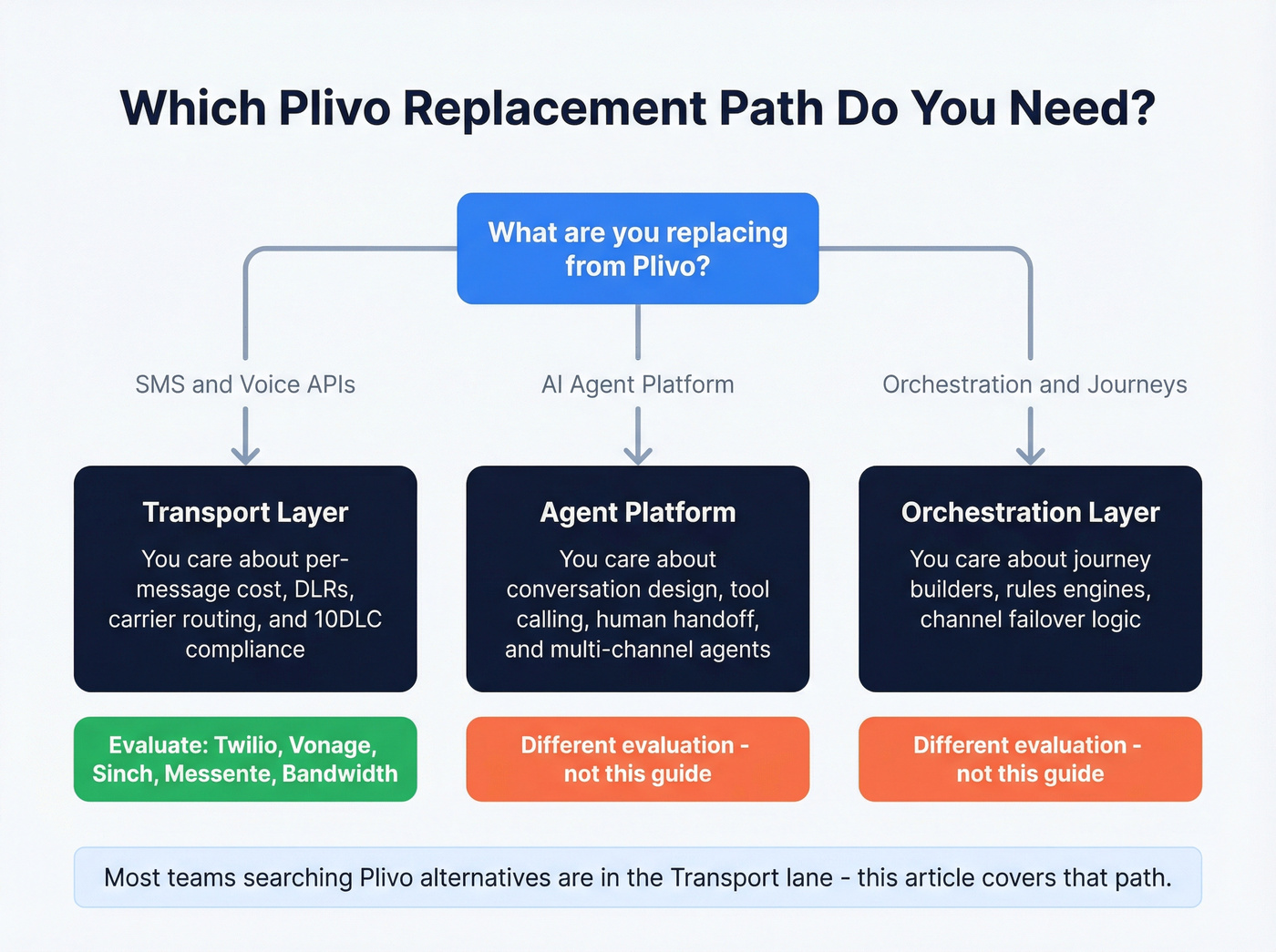

Pick your replacement path (CPaaS vs AI agents vs orchestration)

Plivo isn't just "SMS + voice APIs" anymore - it also positions as an AI Agent Platform across voice/chat/SMS/WhatsApp. Before you swap vendors, decide what you're actually replacing.

- Replacing transport (SMS/voice APIs): this article's shortlist (Twilio, Vonage, Sinch, Messente, Bandwidth, Azure/AWS) is the right lane.

- Replacing an agent platform: you'll evaluate conversation design, tool calling, handoff to humans, and channel orchestration - not just per-message fees.

- Replacing orchestration: you'll care about journey builders, rules engines, and channel failover more than raw API primitives.

Most teams searching Plivo alternatives are in the first lane: reliable delivery + explainable billing.

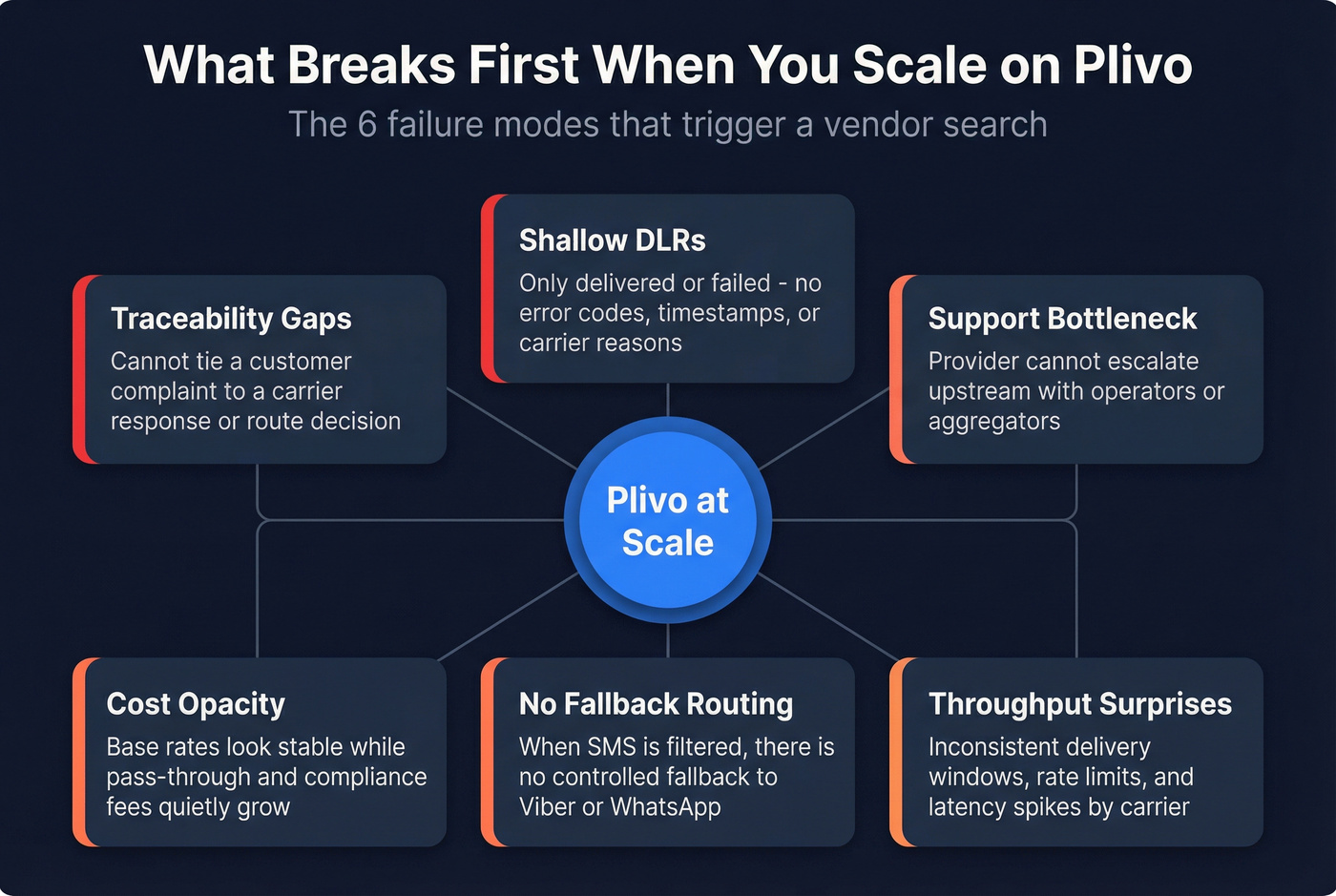

Why teams replace Plivo (what breaks at scale)

Plivo can run perfectly fine at low volume. The pain shows up when you're operating at "real" volume and you need answers fast: why did this message fail, on which carrier, on which route, with which error code, and what changed since yesterday?

I've seen this play out in a very specific way: a logistics operator pushing 50,000+ SMS/day across four countries hit the classic failure mode - unexplained delivery failures, no easy traceability, and reporting that was too thin to prove what happened. That's the moment you stop shopping for an SMS API and start shopping for observability.

What usually breaks first:

- Traceability gaps: you can't tie a customer complaint to a carrier response, route decision, or template version.

- Shallow DLRs: "delivered/failed" isn't enough; you need error codes, timestamps, and carrier-level reasons.

- Support that can't escalate: if your provider can't work upstream with operators/aggregators, you're stuck guessing.

- Cost opacity: base rates look stable while pass-through and compliance fees quietly expand.

- Fallback routing gaps: when SMS is filtered, you want controlled fallback (Viber/WhatsApp/etc.), not a dead end.

- Throughput surprises: inconsistent delivery windows by carrier, rate limits, or latency spikes.

What that operator learned (use this as your buyer checklist)

- Plivo: fine at first, then traceability became the bottleneck.

- Sinch: solid published pricing anchors, but operational complexity still needs an owner.

- Messente: the win was diagnostics + routing control (and fallback), not "cheaper SMS."

Plivo alternatives: quick comparison table (real-world criteria)

Most charts obsess over "$ per SMS." In the US, the real differentiators are: 10DLC fees, carrier pass-through, failure fees, and short code cost + timeline (because product teams love promising launches that short code provisioning can't meet).

On G2, Plivo is 4.5/5 (747 reviews) vs Twilio 4.1/5 (500 reviews). Ratings won't predict deliverability, but they do hint at support expectations.

| Tool | US base rate anchor* | 10DLC (1x + mo) | Pass-through (examples) | Failure fees / add-ons | Short code (cost + timeline) | Best for | Pricing model signal |

|---|---|---|---|---|---|---|---|

| Plivo | Estimate: ~$0.006-$0.012 | Estimate: $40-$150 + $1.5-$30 | Carrier-driven | Provider-specific | Estimate: $500-$1,500/mo + 8-12 wks | Simple CPaaS builds that don't need deep routing | Usage + compliance fees; totals vary by route/identity |

| Prospeo | N/A (data layer) | N/A | N/A | N/A | N/A | Verified contacts to cut wasted sends/calls | Free tier + credit-based paid (~$0.01/email; 10 credits/mobile) |

| Twilio | $0.0083/SMS seg | Reg + campaign fees | Carrier fees apply | $0.001 failed | Estimate: $1,000-$2,500/mo + 8-12 wks | Fastest dev velocity + broadest APIs | Public usage pricing + pass-through + add-ons |

| Vonage | Estimate: ~$0.007-$0.010 | $4.50 + $41.50 (1x) + $1.50-$30/mo | T-Mobile $0.0045 (Jan 19, 2026); AT&T $0.0035 SMS / $0.009 MMS (Apr 1, 2026) | Pass-through-forward | Estimate: $1,000-$2,500/mo + 8-12 wks | US A2P cost modeling + fee transparency | Negotiated base + published fee schedules/changelog |

| Sinch | $0.0078 send/recv | Reg + campaign fees | Carrier fees apply | Short code ops fees | $500 random / $1,000 vanity + ops; timeline varies | Public rate card sanity checks | Public anchors + pass-through + identity fees |

| Messente | Estimate: ~$0.006-$0.012 (route-based) | Typically bundled into program setup | Smart routing | Analytics/routing features | Estimate: $1,000-$3,000/mo + 8-12 wks | DLR depth + routing + fallback at scale | PAYG min + volume commits; routing-centric |

| Bandwidth | $0.004 outbound | Reg + $10/mo (typical) | Carrier-direct economics | Premium support add-on | Estimate: $1,000-$2,500/mo + 8-12 wks | US scale with carrier-direct posture | Low usage + paid support tiers |

| Azure ACS | $0.0075 (TFN) | $4 + $40 (one-time) | Surcharges listed | TFN surcharges | Estimate: $1,000-$2,500/mo + 8-12 wks | Azure shops + published surcharges | Hyperscaler pricing + published surcharges |

| AWS SNS/EUM | Region-variable | $4 + $10/mo (common) | Identity fees listed | SMS Protect $0.01 | $650 setup + $995/mo + ~12 wks | AWS governance + identity management | Infra-style pricing + identity fees |

*Anchors are US messaging usage rates where vendors publish them. Where vendors don't publish a US base rate, the table uses a reasonable market estimate for budgeting.

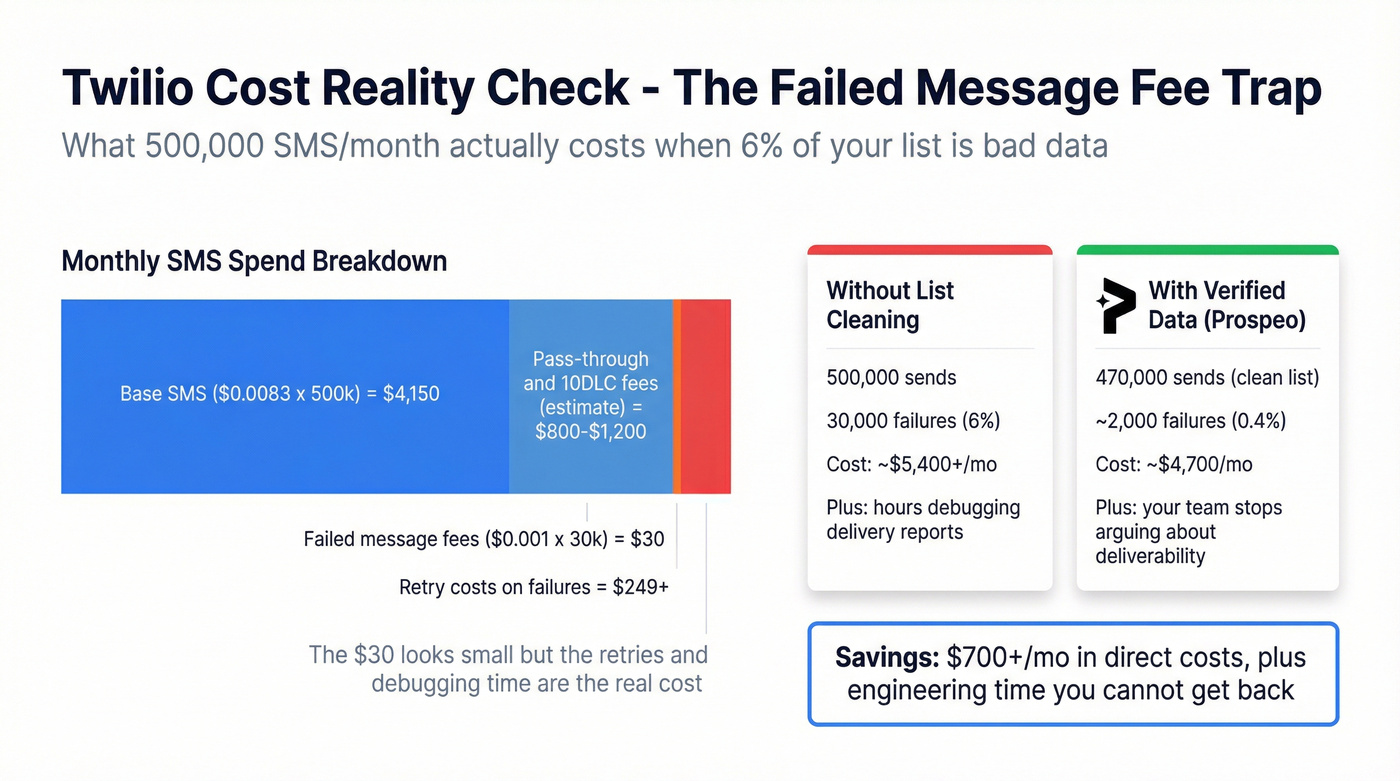

Every failed SMS costs you - Twilio literally charges $0.001 per failure. The fix isn't a better CPaaS. It's better data upstream. Prospeo gives you 98% verified emails and 125M+ verified mobiles with a 30% pickup rate, so your sends and calls actually connect.

Stop paying CPaaS providers to deliver messages to nobody.

The best Plivo alternatives (mini-reviews)

Twilio

Best for Teams that want the widest CPaaS ecosystem and don't want to fight the tooling.

What you get

- Best-in-class docs/SDKs, a console most developers already know, and a deep product bench (messaging, voice, verification, etc.).

- Clear US anchors for budgeting: $0.0083 outbound per SMS segment and $0.0083 inbound.

- MMS matters for "bill jumps": $0.022 outbound / $0.0165 inbound in the US. If your templates accidentally flip to MMS, you'll feel it immediately.

- Engineering fit: strong webhook/event model, good message status taxonomy, and easy log export.

Pricing reality Twilio's straightforward on base usage and less straightforward on the total stack: 10DLC fees + carrier pass-through + add-ons.

Watch-outs

- The $0.001 per failed message fee is brutal when you're debugging deliverability or cleaning up list quality (it applies when the message status is Failed).

- At scale, you'll spend time explaining line items to finance unless you model everything up front.

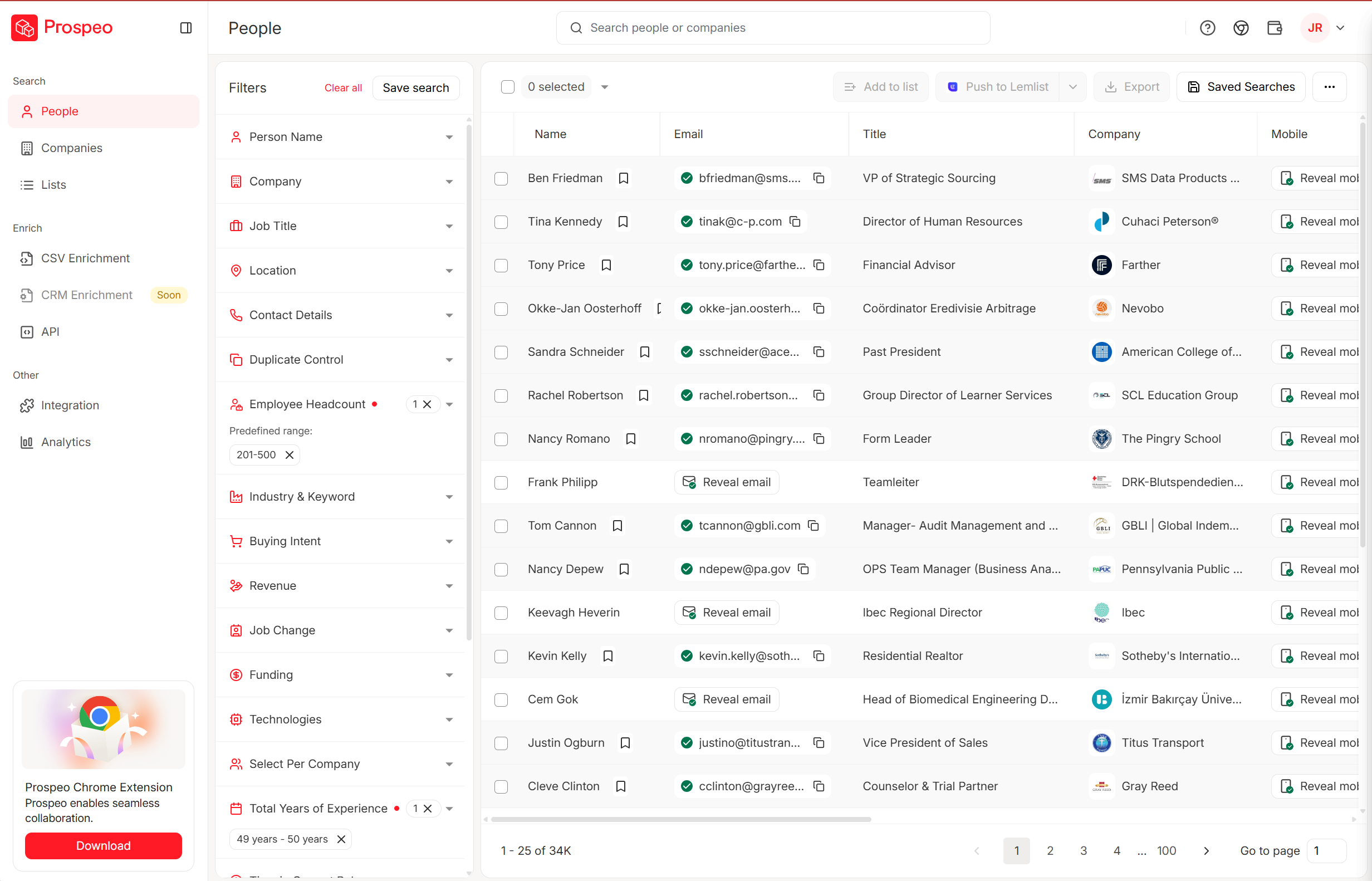

Prospeo (The B2B data platform built for accuracy)

Prospeo isn't a CPaaS replacement, and that's the point. If you're switching away from Plivo because costs are spiking, a chunk of that pain is self-inflicted: dead numbers, stale contacts, and retries that rack up pass-through and failure fees while your team argues about "deliverability."

We've tested this pattern across outbound teams: the fastest way to make any SMS/voice provider look better is to stop sending to bad data in the first place.

Best for Cutting wasted sends/calls and lifting pickup/response after you've chosen your SMS/voice provider.

What you get

- 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers, refreshed every 7 days (industry average: 6 weeks).

- 98% verified email accuracy and a 30% mobile pickup rate across regions.

- Enrichment that actually works in ops workflows: 92% API match rate, and 83% of leads come back with contact data, with 50+ data points per contact.

- Practical ways to use it day-to-day: 30+ search filters, intent data across 15,000 topics (powered by Bombora), plus native integrations (Salesforce, HubSpot, Smartlead, Instantly, Lemlist, Clay, Zapier, Make) and a Chrome extension used by 40,000+ people.

A quick scenario (because this is where budgets get real): if you're sending 500,000 SMS/month and even 6% of numbers are dead, that's 30,000 messages you pay for, then pay again to debug, then pay again when product asks you to "retry." Clean the list first, and suddenly your CPaaS "pricing problem" shrinks into something you can actually control.

Pricing reality There's a free tier (75 emails + 100 extension credits/month). Paid plans are credit-based: about $0.01 per verified email and 10 credits per mobile.

Vonage Communications APIs (Nexmo)

Best for US A2P programs where you need fee transparency and a clean explanation of pass-through changes.

What you get

- A 10DLC fee structure that's explicit enough to model: $4.50 brand registration, $41.50 standard vetting (or $101.50 enhanced vetting), and common campaign tiers like $1.50 (low volume), $2 (sole proprietor), $10 (standard), and $30 (agents/franchises) depending on use case.

- Published pass-through updates that prevent "mystery" bill spikes. In 2026, examples include T-Mobile/Sprint/US Cellular $0.0045 (effective Jan 19, 2026) and AT&T $0.0035 SMS / $0.0090 MMS (effective Apr 1, 2026).

- Engineering fit: good for teams that want a predictable compliance + billing paper trail.

Pricing reality US base rates are often negotiated (budget ~$0.007-$0.010/SMS as a planning range), but the real value is the published fee mechanics.

Watch-outs Pass-through-forward billing can feel busy if your org expects a single blended rate.

Sinch

Best for A trial-first shortlist where you want published US anchors (SMS, numbers, short codes) to keep your spreadsheet honest.

What you get

- Public US SMS pricing: $0.0078 to send and $0.0078 to receive (carrier fees apply).

- Clear number costs for 10DLC: $1/month + $1 setup.

- US short code economics are spelled out: $500 random / $1,000 vanity + $100 management fee, plus operational line items (carrier setup/migration fees).

- Engineering fit: straightforward APIs and predictable number management for common use cases.

Pricing reality

Sinch is excellent for modeling: base + carrier fees + 10DLC registration/campaign fees. If you're moving to short codes, treat it like a mini-project, not a toggle.

Watch-outs Sinch can feel enterprise in process. If nobody owns compliance, templates, and routing, you'll stall.

Messente

Best for High-volume messaging where you care more about DLR depth, traceability, and routing control than brand recognition.

What you get

- Delivery receipts that are actually useful in operations: error codes, timestamps, and failure reasons you can trend and act on.

- Routing controls designed for real-world filtering: smart routing plus controlled fallback options (including Viber in supported regions).

- Support behavior that matters in production: help diagnosing filtering patterns, template issues, and route performance - not just "it failed."

Pricing reality Messente isn't positioned as "cheap and casual." Budget ~EUR500/month minimum for PAYG, with commitment plans commonly starting around ~EUR25k/month and scaling with volume and routing needs. For US-only low volume, it's overkill; for multi-country high volume, it's an operator tool.

Skip this if... you send only a few thousand messages/month. The minimums and routing features won't pay back.

Engineering fit: what to test in a pilot (by vendor)

If you only test "can we send a message," you're not running a pilot - you're running a demo. In a real bake-off, the winner is the vendor that can explain the other 4-10% of outcomes, and do it with logs your engineers can actually use.

Here's the engineering selector I use:

| Vendor | DLR detail | Routing/fallback controls | Logs + export |

|---|---|---|---|

| Twilio | Strong status taxonomy; good webhooks | Good, product-dependent | Strong console + export |

| Vonage | Strong for fee/compliance traceability | Solid | Good for auditability |

| Sinch | Solid, varies by route | Solid | Good for modeling + ops |

| Messente | Deep, ops-grade | Strong (routing-first) | Built for tracing |

One sentence rule: if a vendor can't explain failures at the carrier level during a pilot, they won't explain them in production.

Tier 2 Plivo alternatives (good fits in specific architectures)

Bandwidth (carrier-direct posture)

Bandwidth is the "carrier-direct economics" option for US scale. The base usage can look great (for example, $0.004/SMS outbound for US 10DLC), which is why finance teams love it.

My opinion: Bandwidth's a strong pick when you have an ops owner who'll actually run telecom like telecom. If you expect white-glove debugging without paying for it, you'll be disappointed.

Pricing signal: low usage rates + 10DLC fees + premium support that often starts around $3,000/month.

Azure Communication Services (ACS)

ACS is unusually transparent for a hyperscaler: it publishes base usage, leasing, and carrier surcharges.

- Toll-free SMS: $0.0075 send/receive plus surcharge $0.0025 send / $0.0010 receive.

- 10DLC fees: $4 brand + $40 vetting one-time.

Big constraint to know: GCC Moderate doesn't support 10DLC, which pushes you toward toll-free in that environment.

AWS SNS + AWS End User Messaging

AWS is ideal when you want messaging to behave like infrastructure: IAM, governance, and identity economics are first-class.

- Short code: $650 setup + $995/month, provisioning ~12 weeks.

- 10DLC: $4 registration one-time + $10/month (regular) / $2/month (low-volume) campaign.

- Add-on: AWS End User Messaging SMS Protect at $0.01/message in monitor/filter modes.

Bird (MessageBird)

Bird is an omnichannel play with a real compliance angle. The part teams miss is that compliance fees and penalties can hurt more than per-message rates.

- $15 per campaign registration (10DLC use case registration).

- $250 ghost campaign fine risk if a campaign is inactive for 60 days (passed through when carriers assess it).

Infobip

Infobip is the enterprise/global choice when you care about coverage, operator relationships, and governance. It's also one of the few vendors that treats operator economics as a first-class artifact (separate operator fee sheets).

Also considered (Tier 3)

- Telnyx: Cost-competitive CPaaS that often prices below Twilio for US messaging. Pricing signal: typically $0.004-$0.008/SMS plus 10DLC registration/campaign fees.

- Webex Connect: Enterprise orchestration and journey tooling. Pricing signal: typically $15k-$80k/year depending on channels and seats.

- Exotel: Strong regional/India-forward option. Pricing signal: typically $500-$5k/month depending on voice + messaging mix.

- DIDlogic: Telecom-focused provider for teams doing SIP trunks/numbers/routing. Pricing signal: typically $100-$1,000/month plus usage.

- Flowroute: Voice/SIP leaning. Pricing signal: typically $0.005-$0.015/min voice plus numbers.

- ClickSend: Simple messaging for SMB workflows. Pricing signal: typically $0.01-$0.03/SMS depending on country/volume.

- Bitrix24: CRM suite with messaging features. Pricing signal: typically $50-$300/month for suite tiers.

The real cost of US SMS (10DLC + pass-through + failure fees)

If you want to stop getting surprised, model SMS like a worksheet. Base rate's step one, not the answer.

Step-by-step cost model

- Base usage

- Example anchor: Twilio US SMS $0.0083 per segment.

- 10DLC one-time fees

- Example anchor: Vonage $4.50 brand registration + $41.50 vetting.

- 10DLC monthly campaign fees

- Example tiers you'll actually see: $1.50 low volume, $2 sole proprietor, $10 standard, $30 agents/franchises (varies by provider and use case).

- Carrier pass-through fees (per message)

- These change even if your base rate doesn't. That's the core reason bills jump.

- Add-ons and operational taxes

- Twilio: $0.001 per failed message when status is "Failed."

- Azure ACS: toll-free surcharges $0.0025 send / $0.0010 receive on top of usage.

- AWS: fraud tooling like SMS Protect $0.01/message.

Cost stack worksheet (mini table)

| Line item | Example | What it does |

|---|---|---|

| Base SMS | $0.0078-$0.0083 | Usage anchor |

| 10DLC 1x | $45-$150 | Brand + vetting |

| 10DLC mo | $1.5-$30 | Campaign tier |

| Pass-through | $0.003-$0.005 | Carrier fees |

| Failures | $0.001 failed | Debug tax |

| Surcharges | $0.001-$0.003 | TFN extras |

10DLC gotchas that quietly change your model

These are the line items that cause "we didn't change anything" arguments:

- Vetting events: budget for periodic re-vetting events (example anchor: $15 vetting event in some schedules).

- Authentication + Verification: some providers price this as a separate line item (example anchor: $12.50).

- Campaign tier drift: if your use case changes (or gets reclassified), your monthly campaign fee can jump from $1.50 to $10 to $30 without your base SMS rate moving.

Why your bill jumps (even when your per-SMS rate didn't)

Carrier pass-through fees are the silent killer because they look like vendor margin until you see a changelog.

Vonage's published updates show exactly how this happens in 2026:

- Jan 19, 2026: T-Mobile/Sprint/US Cellular pass-through increased to $0.0045 (outbound SMS).

- Apr 1, 2026: AT&T pass-through increased to $0.0035 (SMS) and $0.0090 (MMS), impacting outbound and inbound on AT&T.

If you're sending millions of messages, a $0.001-$0.002 delta isn't noise. It's a budget line, and it's the kind of change that makes finance think engineering broke something.

What to check when the bill jumps:

- Carrier mix: did traffic shift toward a carrier with higher pass-through?

- Message type: did you increase segments (longer templates) or shift to MMS?

- Failure rate: did filtering spike, triggering failure fees or retries?

- Campaign status: did a campaign get re-vetted or moved tiers?

- Origination identity: did you move between 10DLC, toll-free, and short code?

Deliverability & debugging checklist (what to demand in a pilot)

Deliverability checklist (non-negotiables)

- DLR error codes + timestamps (not just delivered/failed)

- Carrier-level failure reasons (filtered vs unreachable vs blocked vs invalid)

- Throughput + latency metrics by carrier and route

- Provable opt-out handling (STOP/HELP flows, suppression lists)

- Template guidance (reduce filtering and segment bloat)

- Fallback routing (SMS -> Viber/WhatsApp/etc.) with rules you control

- Audit trail: message ID, route decision, retries, final disposition

Tie this back to the operator story above: the reliability jump (roughly ~90% to 96%+) came from better diagnostics + controlled fallback, not from shaving fractions of a cent off base rates.

Pilot scorecard (simple and decisive)

- Delivery rate by carrier (not blended)

- Failure taxonomy coverage: % of failures with an actionable reason

- Latency p50/p95 and peak-hour behavior

- Support escalation time: time to a real root cause

- Cost variance: modeled vs billed totals (including pass-through)

Migration plan (30 days): parallel run, cutover, rollback

Don't big-bang a CPaaS migration. Parallel run it, measure it, then cut over with a rollback plan you can execute quickly.

Week 1: Baseline + requirements

- Export 2-4 weeks of message logs from Plivo: delivery, failures, latency, and carrier mix if available.

- Define success metrics: delivery rate by carrier, latency, and cost variance.

- Lock your origination identity plan (10DLC vs toll-free vs short code) and start registrations immediately.

Week 2: Parallel send (10-20% traffic)

- Route a controlled slice (by geography or use case) to the new vendor.

- Keep templates identical so you're testing the network/tooling, not copy changes.

Week 3: Expand + debug

- Increase to 50-70% traffic if metrics hold.

- Work the failure taxonomy: require carrier-level reasons and DLR detail.

- Tune throughput and retry logic.

Week 4: Cutover + rollback readiness

- Cut over remaining traffic.

- Keep Plivo credentials and routing ready for rollback for at least 2 weeks.

What to measure (table)

| Metric | Target | Why it matters |

|---|---|---|

| ASR | Higher is better | Answer success (voice) |

| PDD | Lower is better | Post-dial delay (voice) |

| Latency | p95 stable | UX + trust |

| DLR detail | 90%+ coded | Debug speed |

| Cost variance | <5-10% | Finance trust |

| Carrier split | Known | Explains deltas |

FAQs about Plivo alternatives (10DLC, toll-free, short codes)

What's the biggest hidden cost when switching from Plivo in the US?

The hidden cost is the full fee stack: 10DLC one-time registration/vetting, monthly campaign fees, carrier pass-through fees that can change mid-year, and add-ons like failure fees or fraud tooling. A solid model targets <5-10% variance between forecast and billed totals.

10DLC vs toll-free vs short code: which should I use?

10DLC is the default for most US A2P programs because it balances cost, throughput, and compliance. Toll-free can onboard faster but adds surcharges. Short codes fit brand-critical high volume but often take 8-12 weeks to provision. If you need a launch in under 30 days, plan around 10DLC or toll-free.

Why do carrier pass-through fees change during the year?

US operators update A2P fee schedules and CPaaS vendors pass those fees through per message, so your base rate can stay flat while your effective cost rises. In 2026, published examples include T-Mobile/Sprint/US Cellular at $0.0045 and AT&T at $0.0035 (SMS) / $0.0090 (MMS).

What's a good free way to reduce wasted SMS sends after I switch providers?

Clean your contact data so you stop sending to dead numbers. Prospeo's free tier includes 75 emails plus 100 Chrome extension credits per month with real-time verification, and teams pair that with any CPaaS to cut failure rates and avoid paying "debug taxes" like $0.001 per failed message.

Final recommendation: pick a path, then trial 2-3 vendors

Stop evaluating 10+ tools. Pick a path, then run a 30-day parallel pilot with a cost model that includes 10DLC + pass-through + add-ons.

Decision tree (use this and move on):

- If you want the safest developer default -> Twilio.

- If finance is driving the decision and you need fee transparency -> Vonage.

- If you need public pricing anchors to keep everyone honest -> Sinch.

- If deliverability debugging and routing control are the job -> Messente.

- If you're all-in on cloud governance -> Azure ACS (Azure) or AWS End User Messaging/SNS (AWS).

Run the pilot, demand carrier-level failure reasons, and compare modeled vs billed totals. If a vendor can't explain your failures and your fees, it's a black box - and you'll be back searching Plivo alternatives again in six months.

You just spent hours modeling SMS costs, pass-throughs, and 10DLC fees. None of that matters if 15% of your list is dead numbers. Prospeo's 7-day data refresh and 5-step verification mean your contact lists stay current - not 6 weeks stale like competitor data.

Fix your list quality first. Your CPaaS bill will follow.