How Does 6sense Actually Work? The Technical Explainer Nobody Else Wrote

You just sat through a 6sense demo. The rep showed you a dashboard full of accounts "in the Decision stage," intent signals firing, and AI predictions about who's ready to buy. It looked incredible. But when you asked how it actually knows all this, the answer was vague. "Our AI analyzes billions of signals." Cool. That's not an answer.

So how does 6sense work, really? Here's the technical architecture, the scoring models, the data sources, and the honest limitations that the sales deck glosses over.

The Short Version

6sense is an AI-powered ABM platform that identifies anonymous website visitors at the account level, scores their buying intent across multiple dimensions, and predicts when they're ready to purchase. The technology is genuinely impressive - it maps 4B+ IP addresses to companies, runs five distinct scoring models simultaneously, and ingests intent signals from first-party, second-party, and third-party sources to predict buying stages.

But here's what the demo won't emphasize: it costs $60K-$200K/year for the full platform, takes about 3 months to implement, and only identifies companies, not people. You'll know Company X is researching your category. You won't know which person at Company X to call until they fill out a form.

The Problem 6sense Solves

The "dark funnel" isn't a marketing buzzword - it's a real measurement gap that costs B2B companies deals every quarter.

Here's the math. Per 6sense's 2023 Buyer Experience Report, the average B2B buying committee generates roughly 4,000 digital and real-life investigative interactions across about three vendor options before making a purchase decision. Of those 4,000 interactions, only 1% are visible to the vendor's team. The other 99% happen on industry publications, review sites, competitor pages, podcasts, private communities, and general web research that your CRM never sees.

Forrester puts it at 57-70% of the buyer journey happening anonymously online. By the time a prospect fills out your demo form, 78% of them have already nailed down their specs. And 84% end up buying from the first seller who contacts them.

That last stat should keep you up at night.

If you're not the first seller to reach a buyer who's already 70% through their journey, you've probably already lost. This is the problem 6sense was built to solve: turning anonymous web behavior into actionable account intelligence - identifying which companies are researching your category, what stage they're in, and when to engage. Only about 10% of your total addressable market is actively buying at any given time. 6sense's core promise is helping you find that 10%.

How 6sense Identifies Anonymous Buyers

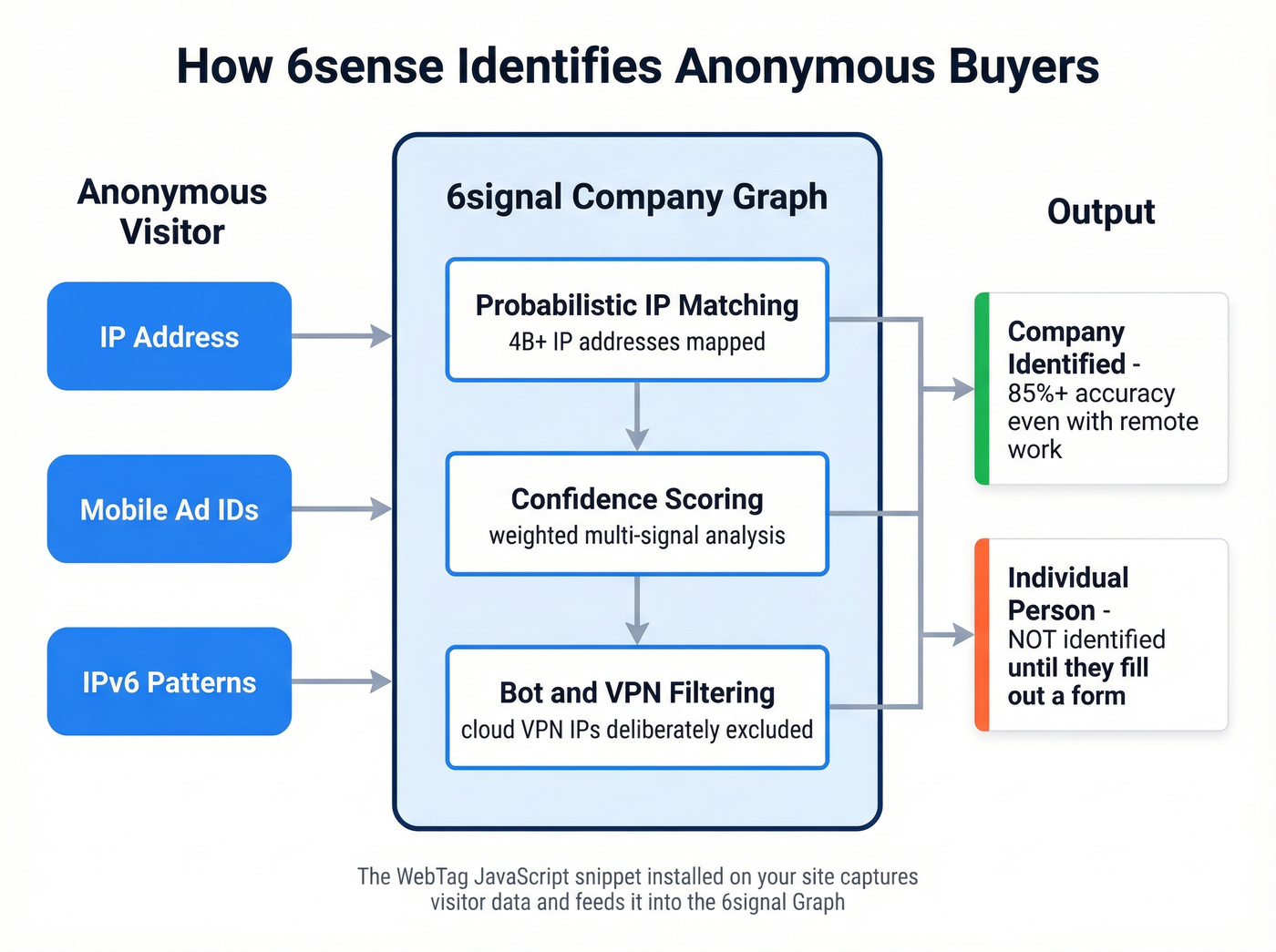

The 6signal Company Graph and Reverse IP Matching

The foundation of everything 6sense does is its proprietary 6signal Company Graph - a continuously updated database that maps IP addresses to companies.

The Graph covers 4B+ IP addresses and uses probability-based matching rather than deterministic lookups. When someone visits your website, 6sense captures their IP address via a JavaScript tag (the "WebTag") installed on your site. The Graph then matches that IP to a company with a confidence score.

This isn't as simple as "IP X belongs to Company Y." In the age of shared office spaces, ISPs serving multiple businesses, and remote workers on residential connections, the Graph uses probabilistic models that weigh multiple signals to determine the most likely company match. The system also uses secondary markers like mobile advertising IDs to triangulate connections when IP alone isn't sufficient. Think of it as a mesh of identifiers rather than a single lookup table.

Remote Work, VPNs, and Accuracy

The obvious question: does any of this work when everyone's at home?

Mostly yes. 6sense CTO Viral Bajaria has stated the platform maintains 85%+ accuracy even with remote work patterns. Most companies only route internal resource access through VPNs. General web browsing - the kind that generates intent signals - typically bypasses the corporate VPN entirely. So when your prospect researches your category from their home office, that traffic is still visible to 6sense's matching system.

Cloud-hosted VPN IP addresses are deliberately ignored because they're difficult to verify and susceptible to bot traffic. Smart design choice - better to skip uncertain matches than to pollute the data.

IPv6 - The Cookieless Future Play

In September 2023, 6sense became the first in the industry to match accounts based on IPv6 addresses. This matters more than it sounds.

IPv4 supports 4.3 billion unique addresses. IPv6 supports 340 trillion trillion trillion. That's not a typo. IPv6 also rotates addresses frequently, making account matching significantly harder because there are no static identifiers to anchor to.

6sense's approach here is predictive rather than deterministic - the 6signal Graph uses pattern recognition to associate rotating IPv6 addresses with companies over time. This positions them well for the cookieless future, since their identification system has always relied on IP-based matching rather than third-party cookies. While competitors scramble to replace cookie-based tracking, 6sense's core architecture doesn't need to change.

6sense identifies companies. But you still need the person to call. Prospeo fills that gap with 143M+ verified emails at 98% accuracy and 125M+ verified mobile numbers - for $0.01/email instead of $60K/year.

Turn anonymous account signals into real conversations today.

Where 6sense Gets Its Intent Data

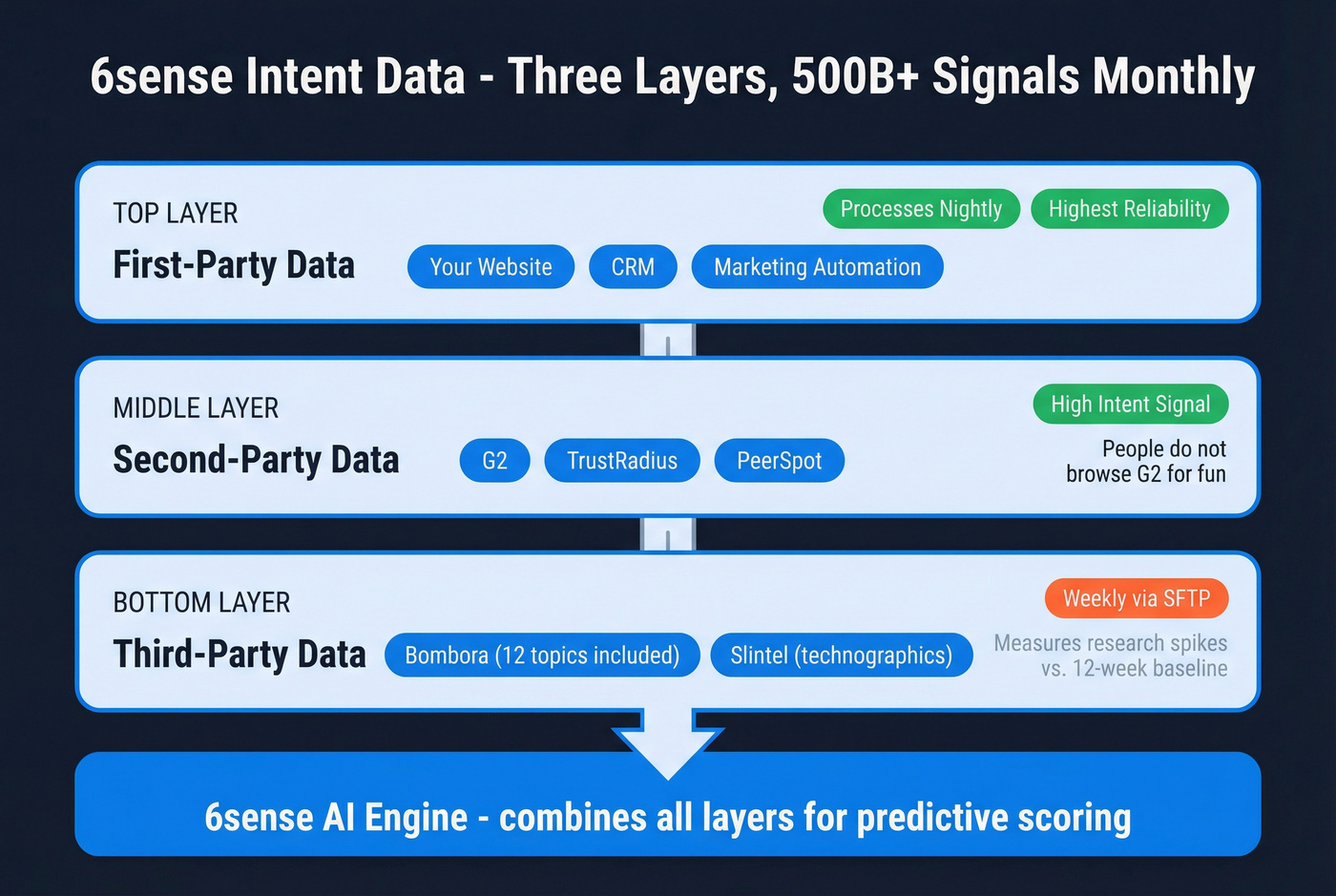

6sense processes 500B+ buyer signals monthly across three data layers, each serving a different purpose:

| Data Layer | Sources | What It Captures |

|---|---|---|

| First-party | Your website, CRM, MAP | Page views, form fills, email opens |

| Second-party | G2, TrustRadius, PeerSpot | Review site research activity |

| Third-party | Bombora + proprietary | Broader web intent signals |

First-party data is the most reliable layer. Once you install the WebTag on your site, 6sense captures every page view, time on site, and content interaction - then matches it to accounts via the Company Graph.

Second-party data comes from partnerships with review sites like G2, TrustRadius, and PeerSpot. When a prospect researches your category on G2, that signal flows into 6sense. This is genuinely valuable because review site activity is high-intent - people don't browse G2 for fun.

Third-party data is where Bombora comes in. All 6sense platform customers get access to 12 Bombora topics with scores of 70+. If you have a separate Bombora subscription, you can access expanded topic data. Bombora's methodology analyzes sustained intent on a topic over the past 3 weeks compared to typical levels over the previous 12 weeks - so it's measuring spikes in research activity, not just baseline interest.

Bombora delivers Company Surge data to 6sense weekly via SFTP. That means third-party intent signals have a slight lag compared to first-party data, which processes nightly.

6sense also acquired Slintel to bolster its contact database with technographic data and direct contact information. We'll get to why that acquisition matters - and where it falls short - later.

The AI Behind 6sense's Predictions

Most articles about 6sense say "it uses AI" and leave it there. The actual machine learning architecture is more nuanced and worth understanding if you're going to spend six figures on it.

6sense employs three main algorithmic approaches working in parallel:

Time-series analysis tracks behavior patterns over time. It's looking for acceleration - an account that went from reading one blog post a month to consuming five competitor comparison pages in a week. The temporal dimension is critical because intent isn't a snapshot; it's a trajectory.

Classification algorithms segment accounts by conversion likelihood. These models are trained on your historical opportunity data - which accounts converted, what signals preceded conversion, and what firmographic/technographic characteristics they shared. The more closed-won data you feed it, the better these models perform. This is why 6sense takes months to fully optimize.

Deep learning networks handle the complex, multi-dimensional relationships between signals. When you're combining IP-based identification, Bombora topic scores, first-party engagement, review site activity, firmographic fit, and technographic overlap, the interaction effects are too complex for simpler models. Deep learning excels here.

NLP layers sit on top to analyze the content of interactions - what keywords prospects are searching, what topics they're consuming, and how that language maps to buying intent versus casual research.

Here's the thing: the quality of these predictions is directly proportional to the quality and volume of your historical data. A company with 50 closed-won deals will get mediocre predictions. A company with 5,000 will get much better ones. The models continuously learn from new data, but they need something to learn from.

How 6sense Scores and Prioritizes Accounts

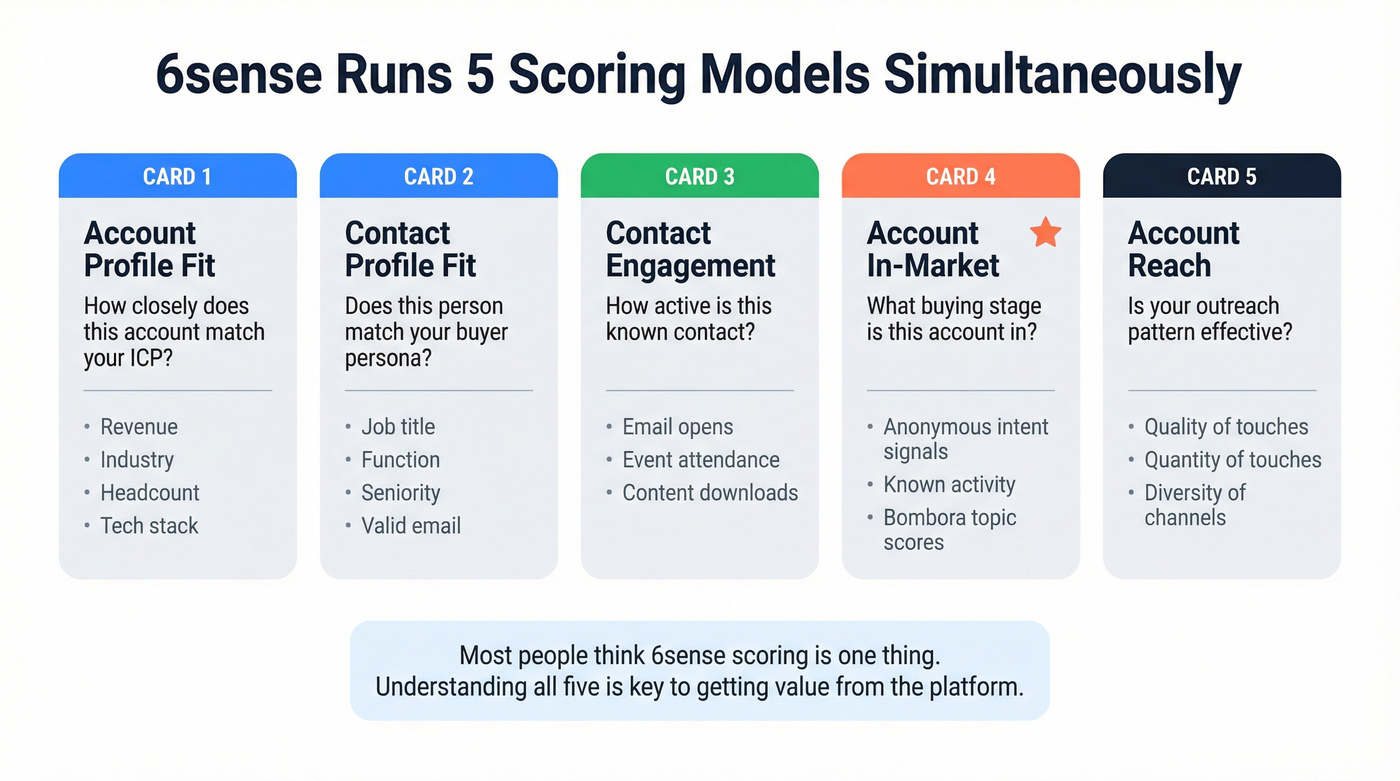

The Five Score Types

Most reviews mention "6sense scoring" as if it's one thing. It's five. The platform runs five distinct scoring models simultaneously, each measuring something different:

| Score | What It Measures | Key Inputs |

|---|---|---|

| Account Profile Fit | ICP similarity | Revenue, industry, headcount, tech stack |

| Contact Profile Fit | Individual match | Job title, function, seniority, valid email |

| Contact Engagement | First-party activity | Email opens, event attendance, content downloads |

| Account In-Market | Buying stage | Anonymous + known intent signals combined |

| Account Reach | Outreach effectiveness | Quality, quantity, diversity of touches |

Account Profile Fit uses firmographic and technographic factors plus your historical opportunity data to determine how closely an account resembles your best customers. Contact Profile Fit does the same at the individual level.

Contact Engagement measures how much a known contact has interacted with your marketing and sales tactics. Account In-Market is the big one - it combines anonymous and known signals to determine the predictive buying stage.

Account Reach is the most underappreciated score. It measures whether your outreach to an account matches the patterns that historically led to won deals - are you reaching enough people, in the right roles, through diverse enough channels?

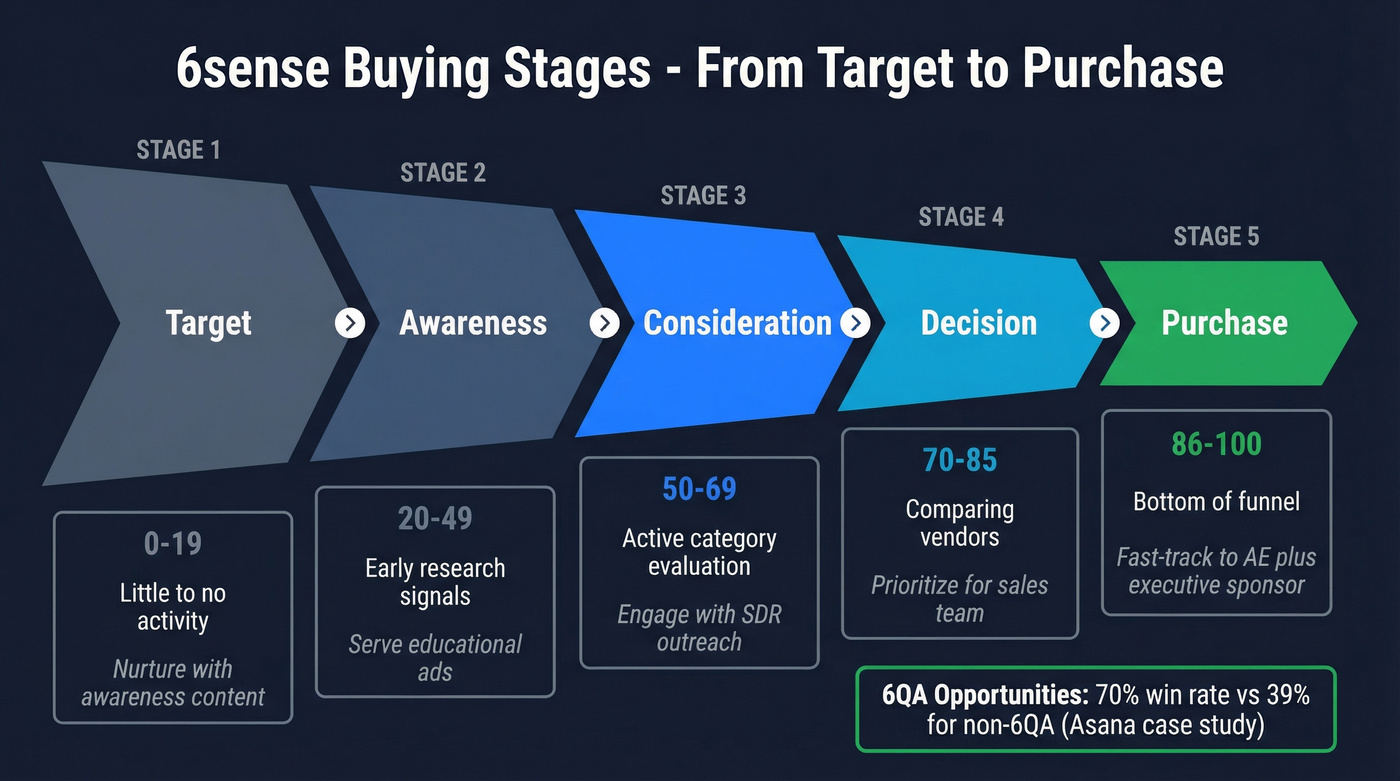

The Five Buying Stages

The Account In-Market score maps to five buying stages, each with a numerical range and a clear operational implication:

| Stage | Score Range | What It Means | Your Move |

|---|---|---|---|

| Target | 0-19 | Little to no activity | Nurture with awareness content |

| Awareness | 20-49 | Early research signals | Serve educational ads |

| Consideration | 50-69 | Active category evaluation | Engage with SDR outreach |

| Decision | 70-85 | Comparing vendors | Prioritize for sales |

| Purchase | 86-100 | Bottom of funnel | Fast-track to AE + executive sponsor |

These scores predict the likelihood of an account opening or progressing an opportunity in the next 90 days. The Asana case study quantifies the impact: 6QA (6sense Qualified Account) opportunities hit 70% win rates vs. 39% for non-6QA accounts.

The operational value is in the transitions. When an account jumps from Awareness to Consideration, that's your trigger to shift from passive advertising to active outreach. When it hits Decision, your AE should already have a personalized sequence ready.

One caveat we've seen play out in practice: the model can be "generous" with stage assignments. A single landing page visit sometimes pushes an account into Purchase stage, which feels aggressive. Calibrate your expectations and validate against actual pipeline outcomes during the first few months.

What Implementation Actually Looks Like

6sense isn't a tool you sign up for on Monday and use on Tuesday. Average implementation time is 3 months per G2 data, and that's not sandbagging - it's genuinely complex.

Week 1-2: Foundation

- Install the WebTag (JavaScript snippet) on all web properties

- Integrate CRM (Salesforce, HubSpot) and marketing automation platform

- Configure field mapping between 6sense and your systems

- Set up SSO and user permissions

Week 3-4: Configuration

- Specify intent keywords (the topics you want to track)

- Build initial segments for advertising and orchestration

- Create mapping profiles for how 6sense data flows into your CRM

- Configure consent settings for GDPR/privacy compliance

Week 5-8: Activation

- Set up persona maps (which job titles matter at target accounts)

- Configure AI Writer for personalized messaging

- Build initial orchestration workflows

- Set up alerts for sales teams

Week 8-12: Optimization

- Predictive models begin producing initial results (4-8 weeks minimum)

- Calibrate scoring thresholds against actual pipeline data

- Train sales teams on interpreting buying stages

- Full optimization takes 3-6 months

The data pipeline runs nightly, with changes propagating within 24-36 hours. If an account hits your website today, you'll see it in 6sense tomorrow - not instantly. This matters for fast-moving sales cycles.

Budget for dedicated marketing ops and sales ops resources during onboarding. 6sense Academy offers admin and onboarding certifications, but someone on your team needs to own this full-time for the first quarter.

Does 6sense Actually Work? Real Results

ROI Case Studies

6sense publishes detailed case studies with named companies and specific metrics. These are vendor-reported from companies with mature ABM programs - treat them as best-case scenarios, not average outcomes:

| Company | Key Result | Context |

|---|---|---|

| Iron Mountain | 21x ROI | 47% decrease in display CPL |

| Asana | 2.5x larger deals, 70% vs 39% win rate | Rolled out to 90 users in 4 weeks |

| Blue Yonder | 12x ROI on LinkedIn ads | 170+ new logos engaged |

| Flexera | +82% pipeline | Go-live in 8 weeks |

| Malbek | 22x ROI | 14x increase in BDR capacity |

| Simpro | 34% YoY MQL increase | 80% reduction in MQL loss |

| Rithum | 6QA = 58% of Q2 opportunities | Intent-driven pipeline |

The Asana numbers are particularly striking: 6QA opportunities averaged 2.5x larger deal sizes, win rates jumped 32 percentage points, and deals closed roughly 25% faster. But Asana isn't a scrappy startup figuring out product-market fit. They had dedicated ABM teams, clean CRM data, and the resources to implement properly. The ROI you'll see depends heavily on your data maturity, team resources, and willingness to invest 3-6 months before expecting returns.

What 1,306 G2 Reviewers Say

6sense holds a 4.3/5 rating on G2 across 1,306 reviews. The distribution skews positive: 57% five-star, 34% four-star, with virtually no one- or two-star reviews.

What users love most (by mention count):

- Intent Data: 273 mentions

- Features: 202 mentions

- Ease of Use: 190 mentions

- Lead Generation: 182 mentions

What users complain about most:

- Steep Learning Curve: 141 mentions

- Learning Difficulty: 116 mentions

- Complexity: 96 mentions

- Missing Features: 77 mentions

The user breakdown matters: 700 mid-market reviewers, 471 enterprise, and only 109 small business. This is overwhelmingly a mid-market and enterprise tool.

The pattern is clear: when 6sense works, users love the intent data. When it doesn't, they blame the learning curve. Both are true simultaneously.

Where 6sense Falls Short

Account-Level Only - No Contact Identification

This is 6sense's most fundamental limitation, and it's the one that matters most for sales teams.

6sense tells you Company X is in the Decision stage. It doesn't tell you who at Company X is doing the research. As Anastasiia Binns, Head of RevOps at Semble, put it: "Intent data shows you companies who are MORE LIKELY to buy. We sell and market to individuals."

There's also a multi-division problem. When multiple business units share one domain - think GE Healthcare vs GE Aviation - intent signals get mixed up or misattributed.

The Black Box Problem

Sales reps are told to "trust the algorithm" when an account gets flagged as in-market. But there's limited transparency into why a specific account was scored the way it was. Which signals fired? How heavily were they weighted?

This opacity creates a trust gap. I've seen teams struggle to answer the basic question: "Would we have won this deal anyway?" Pipeline "influence" is easy to claim - 6sense touched the account at some point, so it gets credit. Revenue attribution is much harder to prove.

Modern Signal Blind Spots

The platform built to illuminate the dark funnel now faces its own blind spots.

When buyers research via ChatGPT queries, private Slack communities, AI assistants, or closed Discord groups, none of those signals show up in 6sense. The dark funnel is getting darker, and traditional intent signals data models - including 6sense's - can't capture research that happens outside the indexed web.

Steep Learning Curve - and Blunt Practitioner Feedback

With 141+ G2 mentions of "steep learning curve," this isn't a minor gripe - it's the platform's defining user experience challenge. The segmentation engine has 80+ filters, which is powerful but overwhelming. And the predictive models require ongoing calibration that most marketing teams aren't staffed for.

Sales practitioners on Reddit are even blunter. One user who deployed 6sense at multiple companies called it "completely useless" for their team. Another who spent money on 6sense, ZoomInfo, and Bombora said they were "mostly disappointed." These aren't universal experiences - but they're a reality check against the polished case studies.

You need a dedicated RevOps resource - ideally someone who's implemented 6sense before - or you'll spend months underutilizing a six-figure investment.

Skip This If...

Look, 6sense is still the most technically sophisticated ABM platform on the market. But most B2B teams don't need this level of sophistication. If your average deal size is under $25K or you're running fewer than 500 target accounts, you're buying a Formula 1 car to drive to the grocery store. Modular tools - Bombora for intent, a solid contact data platform for outreach - will get you 80% of the value at 20% of the cost.

If you're looking for a lighter-weight approach, start with ABM without expensive tools and a clean account list before you commit to an enterprise platform.

6sense Pricing - What You'll Actually Pay

6sense's pricing is frustratingly opaque for a platform that costs this much. Here's what we've pieced together:

| Tier | Price Range | What You Get |

|---|---|---|

| Free | $0 (50 credits, 1 user) | Basic Sales Intelligence |

| Sales Intelligence | ~$30K-$50K/year | Data credits + prospecting |

| SI + Predictive AI | ~$50K-$80K/year | Add predictive scoring |

| Revenue Marketing (full) | $60K-$200K+/year | Full ABM platform |

The average contract value is $56,762/year, but that's skewed by smaller Sales Intelligence-only deals. A mid-market company buying the full Revenue Marketing platform should expect $60K-$120K/year. Enterprise deployments with multiple business units run $120K-$200K+.

Two-year commitments are typical. Credits expire at the end of each contract year - use them or lose them. And the modules stack: intent data, advertising, orchestration, and predictive AI are often separate line items that add up fast.

The free tier (50 credits/month, 1 user) is worth trying if you want to kick the tires on Sales Intelligence. But it won't give you any sense of the predictive or ABM capabilities that justify the real price tag.

From Account Signals to Actual Conversations

Here's the gap nobody in the 6sense demo addresses directly: the platform identifies the account, but your sales reps call people, not companies.

6sense's own contact data - built on the Slintel acquisition plus partnerships with People Data Labs and Cognism - is consistently rated as its weakest feature in user reviews. Multiple G2 reviewers flag phone number and email accuracy as a pain point.

This is where Prospeo fills the gap. The workflow we've seen work best: export your 6sense in-market account list, search those companies in Prospeo with role and seniority filters, get verified emails and direct dials, then push to your sequencer. You go from "Company X is in the Decision stage" to "here are the three people on the buying committee" in minutes - with 98% email accuracy and 125M+ verified mobile numbers backing the data.

If you want to sanity-check your outreach stack, compare cold email outreach tools and review how B2B contact data decay impacts bounce rates and reply rates.

6sense tells you Company X is in-market. Prospeo tells you exactly who to reach - name, verified email, direct dial - with 30+ filters including buyer intent powered by the same Bombora data. No $60K commitment required.

Skip the six-figure contract and start reaching buyers for $0.01 each.

FAQ

How long does 6sense take to implement?

Average implementation is 3 months. The WebTag and CRM integrations go live in weeks, but predictive models need 4-8 weeks for initial results and 3-6 months for full optimization. Budget for a dedicated ops resource during onboarding.

Can 6sense identify individual visitors?

No - it identifies companies visiting your website, not individual people. You'll know Company X is researching your category but not which person is browsing. To bridge that gap, pair 6sense with a contact data tool to find verified emails and direct dials at flagged accounts.

Is 6sense worth it for small businesses?

Probably not. With full-platform pricing starting around $60K/year and typical 2-year commitments, 6sense is built for mid-market and enterprise teams running mature ABM programs. Companies with deal sizes under $30K get more value from modular tools at a fraction of the cost.

How accurate is 6sense intent data?

6sense maintains 85%+ accuracy on account matching even with remote work patterns. Intent data across all providers is directional, not deterministic - it shows which companies are more likely to buy, not which ones will definitely buy. Validate against your pipeline during the first quarter.

What's the difference between 6sense and Bombora?

Bombora is a pure-play intent data provider selling Company Surge data. 6sense is a full ABM platform that uses Bombora as one input alongside its own AI, predictive scoring, advertising, and orchestration capabilities. 6sense costs 5-10x more but does far more than intent alone.