The Best Free Sales Intelligence Tools in 2026 - What's Actually Free, What's Not, and What's Worth It

There are 153 free sales intelligence products on G2 right now. About a dozen are genuinely useful. The rest are free trials disguised as free plans, data-sharing traps, or tools so limited they'll waste more time than they save.

Why Most "Free Sales Intelligence" Lists Are Useless

Sales reps spend 60% of their time on non-selling tasks - admin, data entry, searching for contact info. That's from Salesforce's State of Sales report, and it hasn't improved in years. Meanwhile, 70% of sales reps say they feel overwhelmed by their tool stack, and the average sales tech stack runs 8.3 tools at $187/rep/month. That's $2,244/rep/year before a single email gets sent.

So when someone searches for free B2B contact data tools, they're not looking for a curated list of 47 logos. They want tools that actually work without a credit card.

Here's the problem: most lists pad their rankings with tools that aren't free (UpLead's 7-day trial, Cognism's 25-lead sample), tools that aren't sales intelligence (Calendly, Notion, Canva), or tools where "free" means "we harvest your email contacts in exchange for data access." I signed up for every free plan on this list, mapped the actual credit limits, and ran test searches to verify accuracy claims. Every tool here has a permanent free plan that renews monthly with no time limit, or it's explicitly called out as a trial.

One more thing: this list only includes tools that find, verify, or enrich B2B contact data. No CRMs, no dialers, no scheduling tools. Pure sales intelligence.

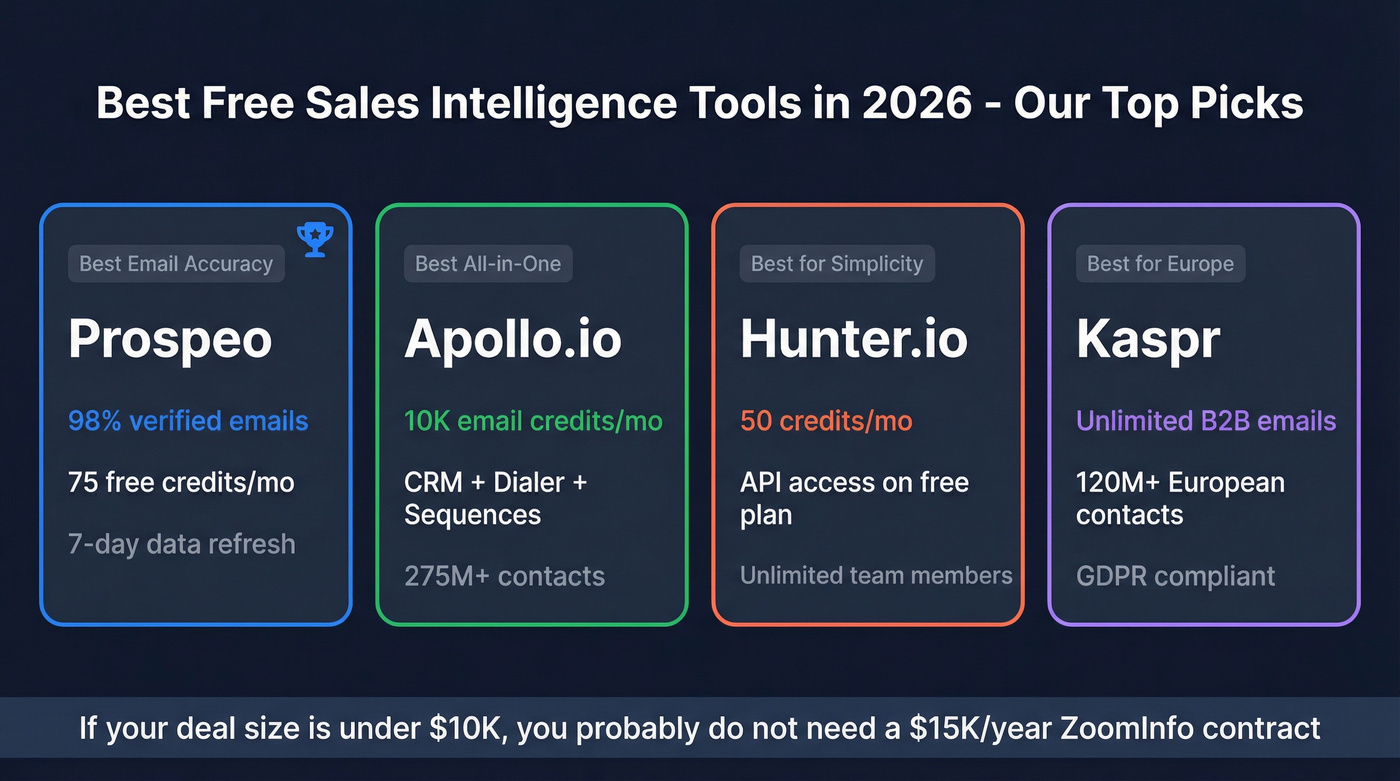

Our Picks (TL;DR)

| Pick | Tool | Why |

|---|---|---|

| Best for email accuracy | Prospeo | 98% verified emails, 75 free/mo, 7-day data refresh |

| Best all-in-one free plan | Apollo.io | 10K email credits, sequences, CRM, dialer - all free |

| Best for simplicity | Hunter.io | 50 credits/mo, API access, unlimited team members |

| Best for Europe | Kaspr | Unlimited B2B emails, 120M+ European contacts |

Hot take: If your average deal size sits below $10K, you almost certainly don't need a $15K/year ZoomInfo contract. A well-stacked set of free tools covers 80% of what ZoomInfo does - and the 20% you lose is enterprise workflow polish, not data quality.

Most free tools trade data quantity for quality. Prospeo gives you 98% email accuracy on a 7-day refresh cycle - not the 6-week-old data you'll get from Apollo or Lusha. 75 free credits/month, no trial expiration, no credit card.

Stop bouncing emails. Start booking meetings with verified data.

"Free" vs. "Free Trial" - Tools That Aren't Actually Free

Before we get into the list, let's kill some myths. These tools show up in every "free sales intelligence" article, and none of them are actually free:

ZoomInfo - ZoomInfo Lite exists, but it requires installing a local app that connects to your email and uses NLP to extract business contacts from your inbox. You're paying with your data. The real ZoomInfo platform starts at $14,995/year. That's not a typo.

UpLead - Offers a 7-day trial with 5 credits. Five. That's enough to test the UI, not to run a campaign. After the trial, Essentials starts at $99/mo.

Cognism - No free plan at all. You get a 25-lead trial to evaluate their Diamond Data, then it's enterprise pricing - typically $15,000-$25,000+/year.

The distinction matters: a free plan renews monthly with no time limit. A free trial expires, then you pay.

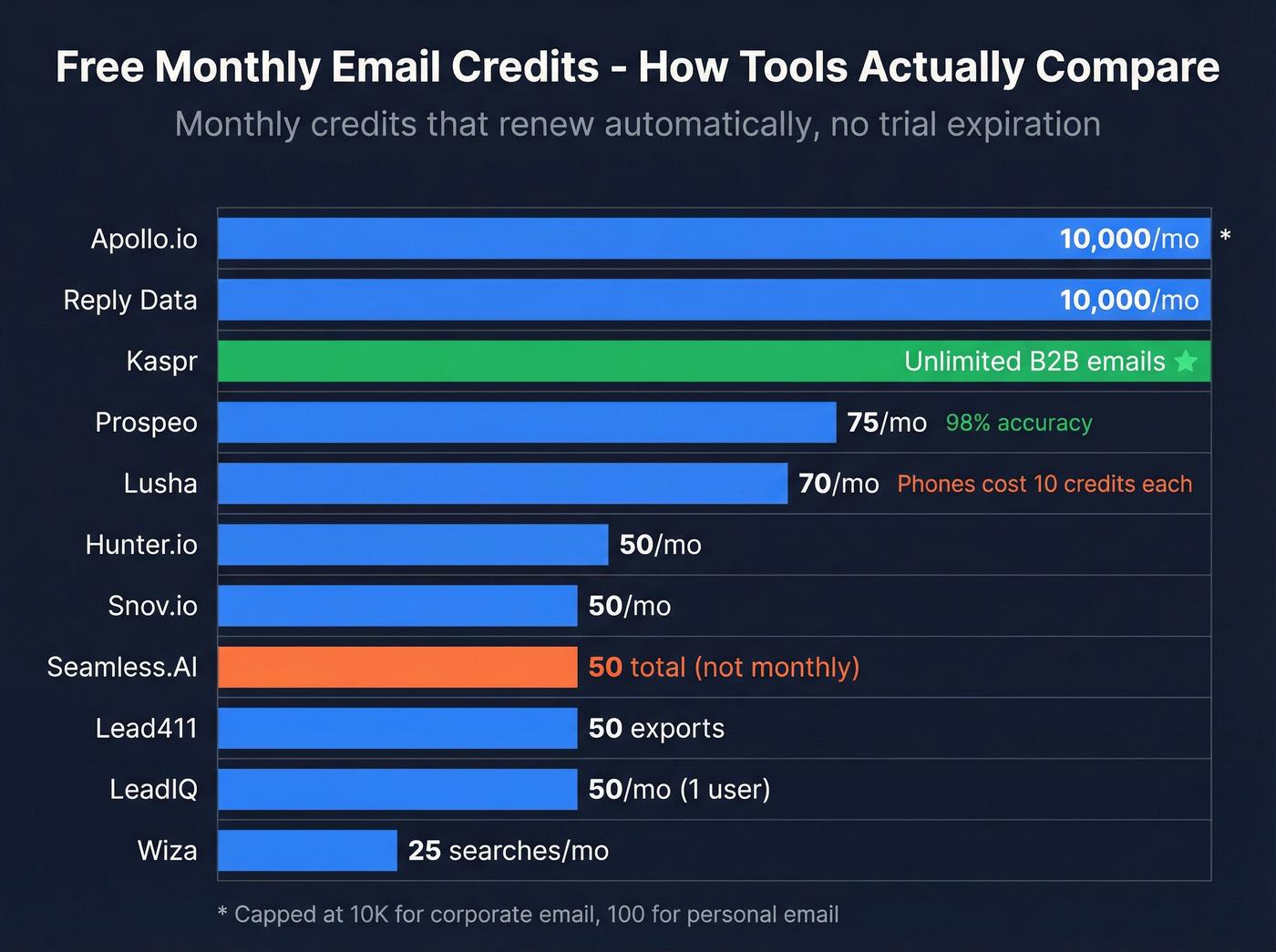

Free Plan Comparison Tables

Here's every tool side by side. I split this into two tables so you can actually read them on a phone.

Table 1: What You Actually Get for Free

| Tool | Free Credits (Email) | Phone Credits | Credit Cost (Email / Phone) | Best For |

|---|---|---|---|---|

| Apollo.io | 10K/mo* | 5/mo | 1 / 1 | All-in-one |

| Hunter.io | 50/mo | - | 1 (verify: 0.5) | Email finding |

| Kaspr | Unlimited | Monthly allotment | 1 / varies | European data |

| Snov.io | 50/mo | - | 1 / - | Warm-up |

| Lusha | 70/mo | From email pool | 1 / 10 | Quick lookups |

| Seamless.AI | 50 total | Included | 1 / 1 | Large DB |

| Reply Data | 10K/mo | - | 1 / - | Volume |

| Dealfront | 100 companies/mo | - | N/A | Visitor ID |

| Lead411 | 50 exports | - | 1 / - | US data |

| LeadIQ | 50 (1 user) | From pool (10 cr each) | 1 / 10 | CRM push |

| Wiza | 25 searches/mo | - | 1 / - | Navigator users |

Apollo's "unlimited" email credits cap at 10,000/month for corporate email users, 100/month for personal email.

Table 2: Quality, Ratings, and Paid Pricing

| Tool | Database | Email Accuracy | G2 Rating | Paid Starting Price |

|---|---|---|---|---|

| Apollo.io | 275M+ | ~85-90% | 4.7/5 | $49/user/mo |

| Hunter.io | - | - | 4.4/5 | $34/mo |

| Kaspr | 120M+ (EU) | - | 4.4/5 | $49/user/mo |

| Snov.io | - | - | 4.6/5 | $39/mo |

| Lusha | 280M+ | - | 4.3/5 | $29.90/user/mo |

| Seamless.AI | - | ~85% email | 4.4/5 | ~$79/user/mo |

| Reply Data | 140M+ | - | 4.6/5 | From $49/mo |

| Dealfront | - | - | 4.3/5 | EUR99/mo |

| Lead411 | - | 96% (claimed) | 4.5/5 | $49/mo |

| LeadIQ | - | - | 4.2/5 | $200/mo |

| Wiza | - | - | 4.5/5 | $83/mo |

The 12 Best Free Sales Intelligence Tools in 2026

Prospeo - Best for Email Accuracy and Verified Mobile Numbers

Use it if you care more about data quality than data quantity. Prospeo's 98% email accuracy isn't a marketing number - Snyk's 50-person AE team dropped bounce rates from 35-40% to under 5% after switching, and their AE-sourced pipeline jumped 180%.

The free plan gives you 75 verified emails and 100 Chrome extension credits every month - no time limit, no credit card, self-serve signup. That's enough to build a targeted list of decision-makers at 15-20 companies. The Chrome extension (40,000+ users) works on company websites, professional profiles, and CRMs. The database covers 300M+ profiles with 30+ search filters, including buyer intent powered by 15,000 Bombora topics. Phone numbers pull from the same credit pool at 10 credits each.

What separates Prospeo from most tools on this list is the 7-day data refresh cycle. The industry average is six weeks. That means the email you pull today was verified within the last week, not the last month and a half. On paid plans, you're looking at roughly $0.01/email - 90% cheaper than ZoomInfo per lead.

Pair it with Apollo or Lemlist for outreach sequences and a built-in dialer.

Apollo.io - Best All-in-One Free Plan

Use it if you want prospecting, sequences, a CRM, and a dialer in one tool for $0. Apollo's free plan is genuinely impressive - 10,000 email credits/month, 5,000 AI email composer credits, 100 AI research power-ups, 2 sequences, a Chrome extension, basic intent data, and a 250/day email sending limit.

Here's the catch, though: Apollo markets "unlimited email credits" on the free plan. It's not unlimited. Corporate email users cap at 10,000/month. Personal email users cap at 100/month. And you only get 10 export credits - meaning you can look at contacts inside Apollo all day, but exporting to Salesforce, Outreach, or CSV burns a different, much scarcer credit type.

Mobile numbers? Five per month.

Apollo's database covers 275M+ contacts, and accuracy runs around 85-90% for emails. That's solid but not exceptional. Where Apollo wins over ZoomInfo: you get 80% of the functionality at $0. Where ZoomInfo still wins: US database depth, intent data granularity, and phone number coverage.

G2: 4.7/5 across 9,400+ reviews. Paid plans start at $49/user/month.

Skip it if you need verified phone numbers at scale or can't tolerate a 10-15% bounce rate on emails.

Hunter.io - Best for Simple Email Finding

Hunter is the tool I recommend to anyone who says "I just need to find someone's email." No bells, no bloat. The free plan gives you 50 credits/month with no time limit, and email verification costs just 0.5 credits - so you effectively get 100 verifications.

The free plan includes API access (rare at this tier), a Chrome extension, Google Sheets add-on, unlimited team members, and CRM integrations. You also get one connected email account for sequences, 500 recipients per campaign, and 10 Signals - hiring and funding activity alerts that are unusual for a free tier.

Skip it if you need phone numbers (Hunter doesn't do phones), bulk search, or a large database to prospect from. Hunter excels at finding and verifying emails for people you've already identified - it's not a discovery tool.

Paid plans start at $34/mo (annual) for 2,000 credits.

Kaspr - Best for European Prospecting

The case for Kaspr: if you're selling into EMEA, most US-centric tools will leave you with thin, outdated contact lists. Kaspr offers unlimited B2B emails on the free plan, plus a monthly allotment of phone credits. That "unlimited emails" part is real - no asterisk, no hidden cap.

Kaspr's database covers 120M+ European contacts, verified every 60 days. It's technically part of the Cognism family, but the datasets are separate - Kaspr doesn't include Cognism's Diamond Data or intent signals. Think of it as Cognism's self-serve little sibling, built for solo reps and small teams. GDPR compliance is baked in from day one, which matters if you're prospecting across EU borders.

Skip it if your ICP is primarily North American. Kaspr's US coverage is thin compared to Apollo or other US-focused tools.

Paid plans start at $49/user/month.

Snov.io - Best Free Plan with Email Warm-Up

Use it if you're launching cold email for the first time and need warm-up included. Snov.io's free plan gives you 50 credits/month, 100 recipients, and - here's the differentiator - one email warm-up slot. No other free plan on this list includes warm-up.

You also get an integrated CRM and email campaign functionality on the free tier. For a solo founder or early-stage SDR who needs to start sending without buying three separate tools, Snov.io packs a lot into $0.

The catch: no bulk search, no bulk verification, no integrations (HubSpot, Pipedrive), and no API on the free plan. You're limited to manual, one-at-a-time prospecting. Once you outgrow that, Starter runs $39/mo for 1,000 credits. G2: 4.6/5.

Skip it if you need volume. Fifty credits and 100 recipients won't sustain a team.

Lusha - Decent Free Tier, Punishing Credit Math

Lusha's free plan looks generous at first glance: 70 credits/month, browser extension, CRM integrations. Then you do the math.

Emails cost 1 credit each. Phone numbers cost 10 credits each. That means your 70 monthly credits buy you either 70 emails, or 7 phone numbers, or some mix in between. For a tool that markets itself on direct dials, getting seven phone numbers a month is borderline useless for active prospecting.

The database is solid - 280M+ contacts - and the browser extension works well for quick lookups. But the credit system is designed to push you toward Pro at $29.90/user/month fast. If you primarily need emails, Apollo gives you far more on free. If you need phones, you'll burn through Lusha's free tier in a single afternoon.

Seamless.AI - Big Database, Frustrating Experience

Look, Seamless.AI's free plan is 50 credits total (not monthly - total), and Reddit users report burning through them in about two days. Email accuracy runs around 85%, phone accuracy closer to 60%. The database is large, but the experience is rough.

The biggest frustration? Pricing. Seamless doesn't publish it. You have to talk to sales. Reddit threads peg Pro at roughly $79/user/month for 1,000 credits, with Enterprise at ~$149/user/month (5-user minimum). One user reported spending $177/month after buying add-on credit packs just to sustain basic prospecting volume.

G2: 4.4/5 across 5,200+ reviews - which tells you the tool has fans. But the #1 complaint across forums is pricing transparency. As one Reddit user put it: "Just put the damn prices on your website."

Skip this if you value transparency. Start with Apollo instead.

Reply Data - Most Generous Free Credit Count

Reply Data flies under the radar, but it offers 10,000 free data credits per month from a 140M+ contact database. That's the most generous free tier in this entire category by a wide margin. Credits are allocated teamwide, so a small team can share the pool.

The trade-off: Reply Data is less established than Apollo or Hunter, and there aren't published accuracy benchmarks. You're getting volume, not necessarily quality. Pair it with an email verification tool to clean the output before sending.

Paid Reply.io plans start from $49/mo for the full outreach platform.

Dealfront (Leadfeeder) - Best for Website Visitor Intelligence

Dealfront works differently from everything else on this list. Instead of searching a database, it identifies companies visiting your website - up to 100 per month on the free plan, with 7 days of data storage.

The limitation: it identifies companies, not individuals. You'll see "Acme Corp visited your pricing page 3 times this week," but you won't get the name or email of who was browsing. That's where pairing matters - use a contact data tool to turn that anonymous visit into verified contacts with direct dials.

GDPR compliant, built for European markets. Paid plans start at EUR99/mo (annual). Think of Dealfront as the intent signal layer, not the contact data layer.

Lead411, LeadIQ, Wiza, and Cognism - Honorable Mentions

Lead411 gives you 50 free exports with a Chrome extension. They claim 96% email deliverability, and the US data is solid for mid-market prospecting. Paid plans start at $49/mo. Worth testing if your ICP is US-based SMBs.

LeadIQ offers 50 credits on the free plan for a single user. Like Lusha, phone numbers cost 10 credits each - so you're looking at 5 phones max. The real pain point is the upgrade cliff: Pro jumps to $200/month. That's steep for what's essentially a professional-profile-to-CRM bridge.

Wiza gives you 25 free searches per month and pulls contacts directly from Sales Navigator. Niche, but useful if you're already a Navigator user and want a lightweight way to export contacts. Paid plans start at $83/mo.

Cognism doesn't have a free plan. Period. You get a 25-lead trial to evaluate their Diamond Data (87% connect rate on phone-verified mobiles), then it's enterprise pricing - typically $15,000-$25,000+/year. Excellent for EMEA compliance and verified mobiles, but this isn't a free tool by any definition.

Snyk's 50 AEs cut bounce rates from 35% to under 5% and grew pipeline 180%. Stack Optimize built to $1M ARR with zero domain flags. The difference wasn't more tools - it was accurate data at $0.01/email.

Free sales intelligence that doesn't cost you your deliverability.

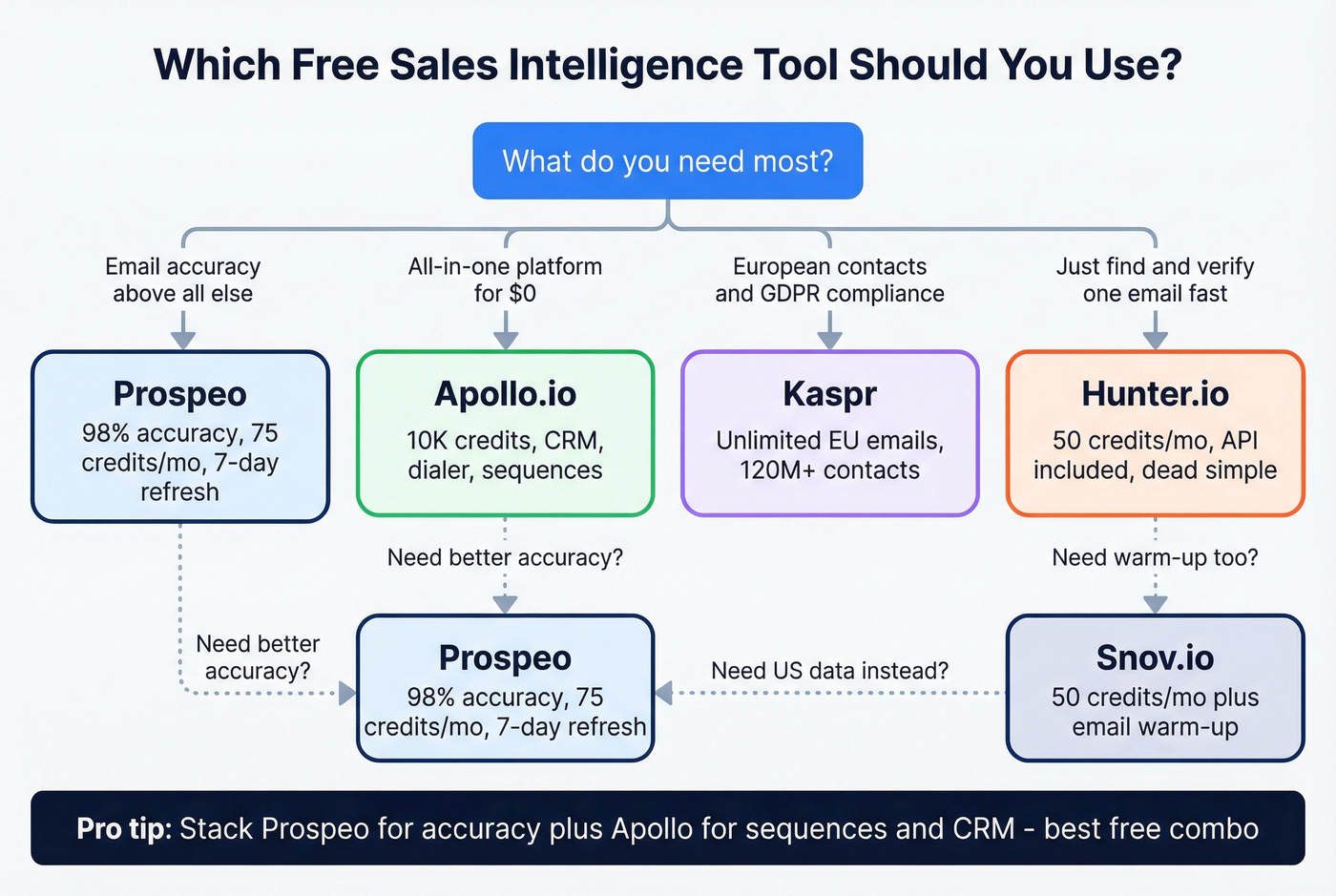

How to Stack Free Tools for a $0 Sales Intelligence Setup

The smartest teams don't pick one free tool - they stack two or three. Here's how to do it without creating the overlapping-tool mess that costs the average team $2,340/rep/year.

Stack 1: Solo SDR or Founder

Prospeo + Apollo.io + Dealfront

Use Dealfront to see which companies are hitting your website. Run those company names through your data tool to pull verified emails and mobiles for decision-makers. Load those contacts into Apollo's free CRM and send sequences using Apollo's 250/day email limit.

Total cost: $0. Total monthly capacity: 100 identified companies, 75 verified contacts, 10,000 email lookups, 2 active sequences.

Stack 2: European-Focused Team

Kaspr + a verification layer

Kaspr handles European contact discovery with unlimited B2B emails and solid phone credits. Since Kaspr's 60-day verification cycle means some data will be stale, always run contacts through a verification step before they hit your sequencer. Broad European coverage with a quality gate on top.

Stack 3: Agency Scaling Multiple Clients

Hunter.io + Snov.io + a verification tool

Hunter's API on the free plan lets you automate email finding for client domains. Layer in bulk verification and enrichment to ensure nothing bounces. Snov.io's free warm-up slot keeps your sending domain healthy while you ramp new client campaigns.

This stack works because each tool does one thing well, and none of them overlap. Intentional stacking beats buying one expensive tool that does everything at 70%.

Mistakes That Make Free Sales Intelligence Tools Useless

1. Confusing free plans with free trials. UpLead's 5-credit, 7-day trial isn't a free plan. Cognism's 25-lead sample isn't a free plan. If it expires, it's a trial. Budget accordingly.

2. Treating all credits as equal. On Lusha, 70 credits sounds generous until you realize phone numbers cost 10 credits each. On LeadIQ, same story. Always calculate what you actually get - emails, phones, and exports - not just the headline credit number.

3. Skipping email verification. This is the mistake that costs the most. One bad campaign with a 20%+ bounce rate can damage your sender reputation for months. I've seen teams nuke a perfectly good domain in a single afternoon because they trusted a source tool's accuracy claims without verifying independently. Verify everything before it hits your sequencer, regardless of what the tool says.

4. Using one tool for everything instead of stacking. No single free plan covers prospecting, verification, intent, and outreach. Apollo comes closest, but its email accuracy (~85-90%) means you're still sending to bad addresses. Stack a verification layer on top.

5. Treating sales intelligence as just contact data. True intelligence includes behavioral signals, buying intent, and engagement patterns. A name and email gets you in the door. Knowing that the prospect's company just raised a Series B, hired three new SDRs, and is actively researching your category - that's what gets you a reply. Look for tools that surface intent and trigger events, not just contact records.

FAQ

What's the difference between sales intelligence and sales prospecting tools?

Sales intelligence tools provide data about who to contact and when - firmographics, technographics, intent signals, org charts. Prospecting tools handle the outreach: sequences, dialers, email campaigns. Many platforms like Apollo blend both, but the distinction matters when stacking free tiers. Pick one tool for data, another for sending.

Are free sales intelligence tools accurate enough for real outbound campaigns?

Accuracy ranges from around 60% on phone numbers (Seamless.AI) to 98% on verified emails (Prospeo). Free tools can absolutely power real campaigns, but you must verify before sending. One bad campaign with a 20%+ bounce rate can tank your domain reputation for months. Always run contacts through a verification step, even if the source tool claims high accuracy.

How many leads can I realistically find per month using only free tools?

Stacking a few free tiers - 75 verified emails from one tool, 10,000 lookups from another, and 50 credits from a third - gives you hundreds of verified contacts monthly at $0. The bottleneck isn't lead volume; it's export limits. Apollo's 10 export credits on the free plan will hit a wall long before you exhaust the email credit cap.

Is ZoomInfo actually free?

No. ZoomInfo Lite requires sharing your email contacts via a local app that extracts business data from your inbox. The main platform starts at $14,995/year for Professional, with Advanced at $24,995 and Elite at $39,995. Additional users run $1,500-$2,500 each. It's an enterprise product with enterprise pricing.

Which free tool has the best email accuracy for outbound?

Prospeo leads at 98% verified email accuracy with a 5-step verification process and 7-day data refresh cycle. Most other free tools hover around 85%. If deliverability matters to your outbound motion - and it should - accuracy is the single most important metric to compare.