Key Decision Makers: How to Find & Reach Them in 2026

Your champion just left. You find out on a Tuesday morning - a LinkedIn update, a new title at a company you've never heard of. The deal you've been working for four months? It's floating. No internal advocate, no backup contacts, no path to the actual budget holder.

This happens constantly.

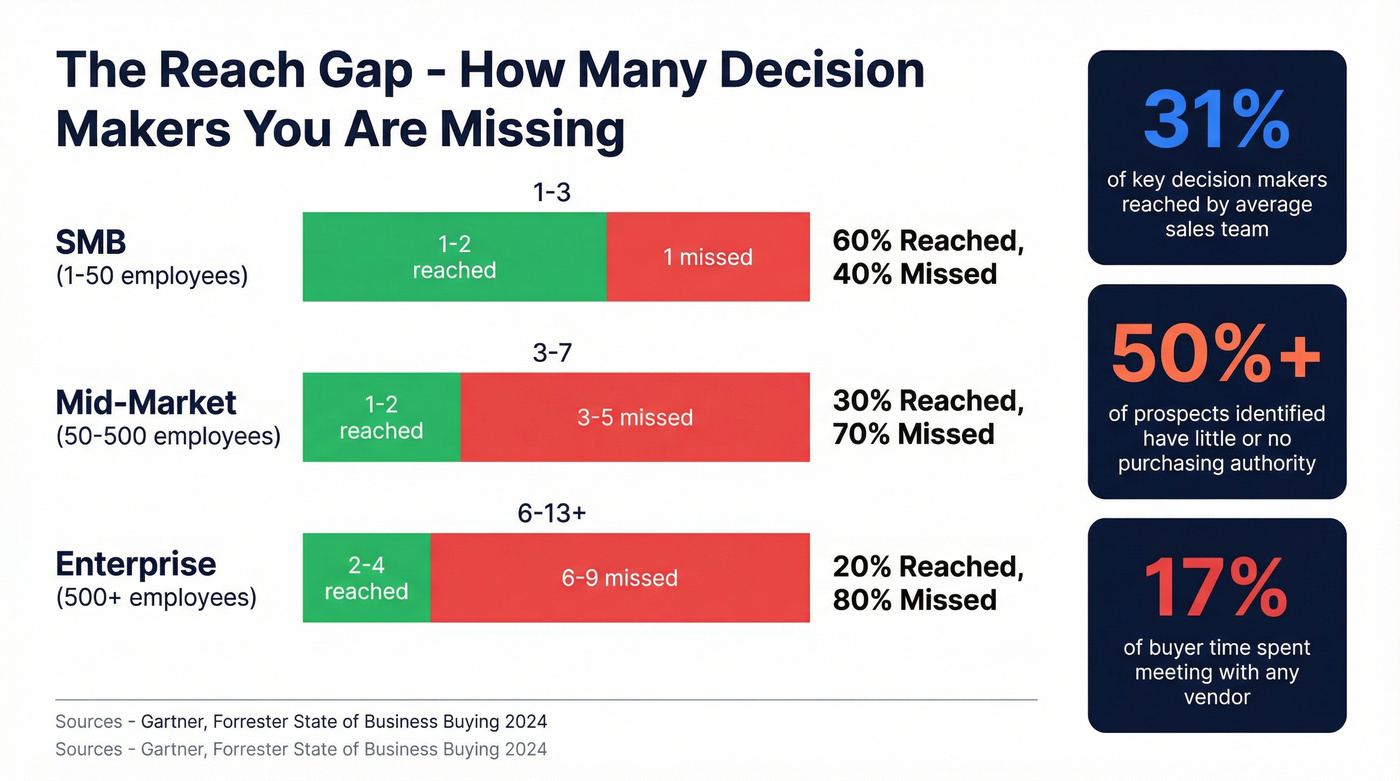

86% of B2B purchases stall. The root cause isn't product fit or pricing - it's that sales teams reach only 31% of the key decision makers in their target accounts. You're selling to a fraction of the people who matter, and hoping that fraction can carry the deal across the finish line.

They usually can't.

The buying committee has grown. The number of stakeholders has ballooned. The old playbook of finding "the decision maker" - singular - doesn't work when there are 6 to 13 people who can say no and only one or two who can say yes. As one sales rep put it on Reddit: "There are a dozen people with similar titles - it's impossible to figure out who the right person to talk to is."

The short version of what you need to know:

- There's no single person with final say. B2B deals involve 6-13 stakeholders, and the average sales team reaches only 31% of them. Over half of prospects identified through traditional methods have little or no purchasing authority.

- Map all 10 roles, qualify with MEDDIC, and multi-thread. Single-threaded deals win 5% of the time. Engaging 5 contacts in the same account pushes that to 30%.

What Is a Key Decision Maker?

A key decision maker is the person (or people) with the authority to approve budget, sign contracts, or kill a deal. That's the simple version. The complicated version is that "authority" in B2B looks nothing like it did even five years ago.

The original framework comes from Webster & Wind in 1972. They identified five roles in any organizational purchase: Influencer, Gatekeeper, Buyer, User, and Decision-maker. Clean. Elegant. And increasingly incomplete. Thomas Bonoma expanded on this in his Harvard Business Review piece "Who Really Does the Buying?" - arguing that informal veto power matters as much as formal authority. The person who can quietly kill your deal in a hallway conversation is just as important as the person who signs the contract.

A peer-reviewed study in Industrial Marketing Management argues that buying centers have evolved into "buying ecosystems" - driven by digitalization, cross-functional dependencies, and the sheer number of tools modern companies run. Forrester's research backs this up: large organizations now use 367 apps across the business. Every one of those apps was purchased by a committee, and every committee had overlapping stakeholders with different agendas.

So when someone says "I need to reach the decision maker," the honest answer is: which one? The person who controls the budget isn't always the person who picks the vendor. The person who picks the vendor isn't always the person who signs the contract. And the person who signs the contract often defers to the person who'll actually use the product every day.

That 81% buyer dissatisfaction number? It's partly because sellers optimize for the wrong stakeholder. They close the CFO but lose the end users. They win the technical evaluation but never address the legal reviewer's concerns. The deal closes, but the relationship starts broken.

Look - if you're still searching for "the decision maker" as a single human being, you're solving the wrong problem. Understanding the key decision makers in a company means mapping the full web of authority, influence, and veto power. (If you want the deeper model behind this, see B2B decision making.)

How Many Stakeholders Are in a Typical Deal?

The answer depends on who you ask and how big the deal is. But every credible source agrees: it's more than you think.

Gartner puts the typical buying group at 6-10 decision makers, each entering the process with 4-5 pieces of independent research they've already done before talking to any vendor. Other research pushes that number to 13. The variation isn't contradictory - it reflects deal complexity.

Here's the segmentation that actually matters:

| Company Size | Employees | Typical Decision Makers | Who You're Reaching |

|---|---|---|---|

| SMB | 1-50 | 1-3 | Founders, dept heads |

| Mid-Market | 50-500 | 3-7 | VPs, directors, finance |

| Enterprise | 500+ | 6-13+ | Cross-functional committee |

Each of those stakeholders spends [only 17% of their total purchasing time](https://www.gartner.com/en/newsroom/press-releases/2020-09-15-gartner-says-80 - of-b2b-sales-interactions-between-su) meeting with potential vendors. The rest? Internal meetings, independent research, consensus-building. You're competing for a sliver of their attention.

And here's the stat that should keep you up at night: over 50% of prospects identified through traditional methods have little or no purchasing authority. You're not just reaching too few people - you're reaching the wrong ones.

The math is brutal. If there are 10 people with buying authority and your team reaches 3 of them (the 31% average), you're missing 7 people who can influence, delay, or kill your deal. Every one of those 7 has done their own research, formed their own opinions, and has their own priorities that nobody on your team is addressing.

You're missing 7 out of 10 decision makers in every deal. Prospeo's 300M+ profiles with 30+ filters - job title, department, seniority, buyer intent - let you map the entire buying committee in minutes, not weeks. 98% email accuracy means you actually reach them.

Multi-thread every deal with verified contacts for $0.01 each.

The 10 Decision-Maker Roles in Every B2B Deal

Forget the old five-role model. Modern B2B deals involve a more nuanced cast of characters. Research from Traction Complete identifies 10 distinct roles that show up across complex purchases. Not every deal has all 10, but if you're selling into mid-market or enterprise accounts, most of these people exist - whether you've identified them or not.

| Role | Alias | What They Control | How to Spot Them |

|---|---|---|---|

| Project Sponsor | The Spark | Initiates buying process | First inbound inquiry |

| Champion | The Advocate | Sells internally for you | Shares docs, maps the org |

| Executive Sponsor | The Final Say | Senior air cover | VP+ who joins one call |

| Financial Approver | Budget Owner | Controls the money | Signs POs, owns P&L |

| Technical Buyer | Feasibility Gate | Evaluates technical fit | Asks about APIs/security |

| Operations Owner | The Enabler | Operational alignment | Worries about timelines |

| Business User | The Practitioner | Daily end user | "What does day-to-day look like?" |

| Legal Reviewer | Risk Manager | Compliance and legal | Appears late, asks about DPAs |

| Influencer | Trusted Voice | Shapes opinions informally | Unlisted but respected |

| Final Authority | Veto Power | Ultimate sign-off | CEO/board you never meet |

The Champion isn't the Decision Maker. As Becc Holland puts it: "The decision-maker is the final person for sign-off. But they're supported or detracted by everyone around them." Your champion is the person spending political capital internally to push your deal forward. If they're not putting their own reputation on the line - sharing internal decks, bringing detractors into the room - they're a fan, not a champion.

The Financial Approver and the Executive Sponsor are often different people. The VP of Sales might sponsor the initiative, but the CFO controls the budget. Sellers who conflate these two roles end up with verbal commitments that never convert to signed contracts.

Watch out for the Fake Decision Maker. This is the person who enthusiastically engages, takes every call, and assures you they "just need to run it by a few people." They have zero budget authority. The test: ask them to sign an NDA. Real decision makers sign NDAs without blinking. Fake ones stall, defer, or suddenly need to "check with legal." If your primary contact can't sign a basic NDA, they can't sign a contract either.

The Legal Reviewer shows up late and kills deals. This is the role most sellers forget until week 11 of a 12-week sales cycle. Legal doesn't care about your product's features. They care about data residency, liability caps, and indemnification clauses. If you haven't prepped for this conversation, your deal stalls in the final mile.

Influencers are invisible until they're not. They don't show up on org charts. They don't attend demos. But when the buying committee meets internally, the influencer's opinion carries weight - exactly the kind of informal veto power Bonoma warned about decades ago.

How to Identify Key Decision Makers

Free Research Methods

You don't need a $30K tool to start finding the right people at a target company. You need 10 minutes and a browser.

- Company website and about page. Leadership teams, board members, and department heads are often listed publicly.

- Professional profiles. Search by title at the target company. Look at who's been promoted recently, who's new, and who's been there long enough to have institutional influence. (If you want a repeatable workflow, use this prospect research system.)

- Annual reports and SEC filings. For public companies, 10-K filings list key executives and reveal organizational structure.

- Conference speaker lists. The person presenting at industry events is often the internal champion for that topic.

- Digital footprint. Podcasts, newsletters, GitHub contributions - these reveal who's thinking publicly about the problems you solve.

- Alumni networks. People who worked together at previous companies often move in clusters. If your champion left, check where their former colleagues landed.

Prioritize your list before you start outreach. Belkins recommends a decomposition framework: categorize leads by industry, solution fit, and technology stack, then rank by ease of sale, sales potential, and market growth. This prevents the common mistake of treating all 10 stakeholders as equally important - they're not. Learning to prioritize decision makers in sales early saves your team from spreading effort too thin across low-impact contacts.

This gets you names and context. It doesn't get you verified contact data. That's where tools come in.

Sales Intelligence Tools

The core problem: you've identified 8 people in the buying committee, but you have contact data for 2 of them. The gap between identification and outreach is where deals stall.

LinkedIn Sales Navigator ($99-179/mo) is the universal starting point for org mapping - great for identifying who's at a company and understanding reporting structures, but it won't give you the direct contact data you need for outreach.

ZoomInfo is the enterprise default. Massive US database, workflow automation, intent data. But a 10-seat contract with the modules you actually need runs $15-40K/year. That's real money for teams under 50 people. (If you're evaluating it, start with ZoomInfo pricing and is ZoomInfo accurate.)

Apollo works for free-to-affordable prospecting - the free tier is genuinely useful, and paid plans run $49-99/mo per user. The database is broad but accuracy drops off for mobile numbers and non-US contacts. (More on that here: Apollo.io accuracy.)

Cognism is the play for EU coverage - strong mobile verification and roughly 90% coverage for European decision makers. Expect $1,000-3,000/mo for small teams.

Skip Cognism if you're US-only. Skip ZoomInfo if your team is under 20 reps. Both are great tools solving problems you might not have.

Intent Data for Timing Your Outreach

Knowing who to reach is half the problem. Knowing when to reach them is the other half.

Account-level intent data (Bombora at ~$25-50K/year, 6sense at $100K+/year, G2 Buyer Intent at ~$10-30K/year) tells you a company is researching a topic. Contact-level intent tells you which specific people are showing buying signals - far more actionable for decision-maker targeting. (See intent signals for a practical taxonomy.)

Intent data decays fast. A company researching your category today will have a shortlist by next week. Speed is the differentiator, not sophistication.

Frameworks for Qualifying Key Decision Makers

Once you've identified potential stakeholders, you need a system for figuring out who actually matters. Four frameworks dominate B2B sales, and they're not interchangeable.

| Framework | Best For | Core Question | Weakness | Verdict |

|---|---|---|---|---|

| MEDDIC | Enterprise, complex deals | Who has the money and the influence? | Overkill for transactional sales | Start here for most B2B deals |

| BANT | High-velocity inbound | Can they buy, and do they need it now? | Too shallow for multi-stakeholder deals | Quick pre-filter only |

| CHAMP | Buyer-centric selling | What problem are they solving? | Doesn't map the full committee | Best for product-led motions |

| NEAT | Consultative sales | What's the economic impact of inaction? | Requires deep discovery skills | Use when deals exceed $100K ACV |

MEDDIC is the industry standard for complex B2B. Created by John McMahon in 1996 at PTC - where it helped the company grow from $300M to $1B in sales - it stands for Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, Champion.

Two letters matter more than the others.

E - Economic Buyer. The person who controls the budget and has final sign-off authority. Look for C-suite, VPs, or department heads with P&L responsibility. If you can't name the Economic Buyer, you don't have a qualified deal.

C - Champion. The person willing to spend political capital on your behalf. The test: are they sharing internal decks with you? Mapping the org chart? Bringing detractors into the room? If not, they're a fan, not a champion.

BANT (Budget, Authority, Need, Timeline) works as a quick pre-filter for inbound leads - IBM created it in the 1960s and it's still useful for high-velocity motions. But it's too shallow for enterprise. "Do you have budget?" is a yes/no question that tells you nothing about the 12 other stakeholders who'll weigh in.

We recommend requiring at least Metrics + Economic Buyer + Pain + Champion confirmed before committing high-touch field resources. I've seen teams waste months on deals where they had a champion but never identified the economic buyer. The champion was enthusiastic. The deal was dead. Nobody knew until the contract sat unsigned for six weeks.

Why Single-Threading Kills Deals

Remember the opening scenario? Your champion left. The deal is floating. This isn't an edge case - it's the default outcome for single-threaded deals.

UserGems analyzed 500 closed-won and closed-lost opportunities using ML models. The finding: a single-threaded opportunity has a 5% chance of winning. Engage 5 contacts in the same account, and that jumps to 30%. A 6X improvement.

More than 80% of single-threaded deals fail when the champion leaves the company. And champion turnover is constant - one study found 62% of marketing professionals were considering a job change. Your single point of contact is always one resignation away from disappearing. (To operationalize this, build a job change sales outreach motion.)

Pre-demo multi-threading means getting multiple stakeholders on the first call. Don't just invite your champion - ask them to bring the technical evaluator, the budget owner, or the end user. "Who else would find this useful?" is the simplest multi-threading question in sales.

Post-demo multi-threading means building separate relationships with each stakeholder based on their unique priorities. The CFO gets ROI analysis. The VP of Ops gets implementation timelines. The end user gets a sandbox. Same product, different conversations.

Multi-threading also means you need verified contact data for 5-8 people per account, not just one. You can't engage 5 contacts if you only have an email address for 1. This is where most teams hit a wall - they understand the theory of multi-threading but lack the operational infrastructure to execute it. (If you want the ABM version, see ABM multi-threading.)

Here's the thing: if your deal size is under $10K, you probably don't need ZoomInfo-level data. But you absolutely need accurate contact data for multiple stakeholders. The $15-40K enterprise platforms are built for teams running complex ABM plays across hundreds of accounts. Most teams need verified emails and direct dials for 5-10 people at 20-50 target accounts. That's a fundamentally different problem - and one that doesn't require a six-figure contract to solve.

Single-threading feels efficient. You've got a great relationship with one person. They're responsive. They're enthusiastic. But enthusiasm isn't authority, and one relationship isn't a deal. The data is unambiguous: multi-thread or lose.

How to Reach Key Decision Makers Once You've Found Them

Cold Calling and Direct Dials

Picture this: it's 2:15 PM on a Wednesday. You dial a switchboard number, navigate an automated menu, get transferred to a department, and land in voicemail. That's the 3-5% connect rate reality of calling general lines.

Direct dials flip the math entirely - 8-15% connect rates. Over a month of 50 daily dials, that's the difference between 100 real conversations and 30. (Benchmarks and scripts here: B2B cold calling guide.)

What surprised us: 60% of decision makers actually prefer cold calls over email for high-value solutions. Phone is the highest-performing outbound channel in 2026, driven by digital fatigue and inbox overload from automated sequences. B2B isn't becoming more digital - it's becoming more human again. And 78-82% of buyers have agreed to meetings that originated from cold calls. The channel isn't dead. Your data is.

Cold Email That Actually Gets Replies

Three rules. That's it.

- Drop your sequences to 3 steps max. Almost all replies come from steps 1, 2, and 3. Steps 4 through 8 generate diminishing returns and increase spam risk.

- Personalize beyond {{first_name}}. Emails with personalized subject lines are 26% more likely to be opened. Reference a trigger event, a specific challenge, or something from their digital footprint.

- Verify before you send. If 35% of your emails bounce, your domain reputation degrades and your entire outbound motion suffers. We've seen bounce rates above 15% tank an entire domain's reputation within two weeks. The biggest lever isn't copywriting - it's list quality. (Use this email verification list SOP to keep bounces down.)

Cold email delivers an average $42 ROI for every $1 spent. Response rates typically hover between 1-5%, with top performers hitting 10-15%. But deliverability collapsed in late 2024 when inbox providers tightened filtering. Bad data - bounced emails, spam traps, invalid addresses - burns your domain reputation. And once your domain is flagged, even good emails to good addresses land in spam. (If you're troubleshooting, start with email deliverability.)

Messaging Each Type of Decision Maker

Grey Matter's framework nails this: when your messaging tries to speak to all stakeholders at once, it speaks to none of them.

| Stakeholder | What They Care About | Lead With |

|---|---|---|

| CFO / Financial Approver | ROI, risk reduction, payback period | Hard numbers, case studies with $ outcomes |

| VP of Operations | Implementation effort, disruption | Timeline, migration plan, support model |

| Technical Buyer | Security, integrations, scalability | Architecture docs, API specs, compliance certs |

| End Users | Usability, daily workflow impact | Product demo, sandbox access, peer reviews |

| Legal Reviewer | Data privacy, liability, contract terms | DPA, SOC 2 report, redline-ready MSA |

Build a core narrative that branches into role-specific proof points. The positioning test: swap your company name with a competitor's. If the messaging still makes sense, you don't have positioning - you have generic claims.

Getting Past Gatekeepers

Myth: Gatekeepers exist to block you. Reality: Gatekeepers block unclear opportunities. If you can't articulate in one sentence why the person you're trying to reach would want to hear from you, the gatekeeper is doing their job correctly.

Myth: You need to "get past" the gatekeeper. Reality: Position them as guides. "Can you point me to who owns vendor evaluation for [category]?" works better than trying to push past them. They know the org. You don't.

Myth: A blocked path means a dead account. Reality: When buying groups average 10-11 stakeholders, there are multiple valid entry points. If the VP won't take your call, the director will. If the director is traveling, the project sponsor is the better first conversation anyway.

Trigger Events That Create Openings

95% of the time, the winning vendor is already on the Day One shortlist. 80% of deals are won by the pre-contact favorite. If you're not reaching the right people before they've made up their minds, you've already lost.

Trigger events create the window:

- Leadership transitions. New executives spend 70% of their budget within their first 100 days. This is your highest-signal trigger.

- Reorganizations. New reporting structures mean new priorities, new budget allocations, and new decision makers who haven't formed vendor preferences yet.

- Funding events. A Series B or growth round means the company is about to hire, buy tools, and scale operations.

- New strategic initiatives. A company announcing a "digital transformation" or "AI-first strategy" is about to evaluate a lot of vendors very quickly.

- Content re-engagement. Someone who downloaded your whitepaper six months ago and just visited your pricing page is warmer than any cold list.

94% of buyers now use LLMs during their purchasing process. They're researching before you even know they're in-market. Speed matters - intent decays fast. (If you want a system for this, see automate sales signals.)

One framework most teams miss: the "Not Right Now" pipeline. Most reps categorize prospects as Yes or No. But B2B buying is messier than that. The company that said "not right now" six months ago just hired a new CTO - that's a trigger. Build trigger-based monitoring into your weekly workflow, not as a quarterly exercise, but as the primary mechanism for pipeline generation. The "not right now" accounts are where your next quarter's pipeline lives.

Champions leave. Contacts go dark. Single-threaded deals win 5% of the time. Prospeo tracks job changes, surfaces direct dials (125M+ verified mobiles), and refreshes data every 7 days - so you always know who holds budget authority right now, not six weeks ago.

Stop losing deals because your only contact left the company.

FAQ

What's the difference between a decision maker and an influencer?

A decision maker has authority to approve budget or sign contracts; an influencer shapes opinions but can't authorize a purchase alone. You need both - influencers often control access to budget holders and can champion or quietly kill your deal internally.

How many decision makers are involved in a typical B2B purchase?

Between 6 and 13 depending on deal size and company complexity. SMBs typically involve 1-3 stakeholders, while enterprise deals pull in 6-13+ across multiple departments - each with their own research and priorities.

How do I find key decision makers at a company I want to sell to?

Start with free research: company websites, professional profiles, conference speaker lists, and SEC filings for public companies. Then use a tool like Prospeo (75 free emails/month) or Apollo to get verified emails and direct dials for the specific people you've identified. Prioritize contacts with P&L or budget authority first.

What is multi-threading in sales and why does it matter?

Multi-threading means engaging multiple stakeholders in a target account instead of relying on one contact. Single-threaded deals win only 5% of the time; engaging 5 contacts pushes win rates to 30% - a 6X improvement backed by UserGems data across 500 opportunities.

What's the best framework for qualifying decision makers in B2B?

MEDDIC is the standard for complex B2B deals. Focus on the "E" (Economic Buyer) and "C" (Champion) - if you can't name both with confidence, you don't have a qualified opportunity. BANT works as a quick pre-filter for inbound but is too shallow for enterprise.