Intent Signals: What They Are, Why They Matter, and How to Actually Use Them in 2026

You don't need an intent data platform. You need an intent signal workflow.

That distinction costs companies $35,000/year when they get it wrong - buying enterprise software that flags 500 "high-intent" accounts, only for BDRs to discover disconnected phones, bounced emails, and prospects who already signed with a competitor last month. The difference between wasted budget and pipeline comes down to architecture, not spend.

What You Need (Quick Version)

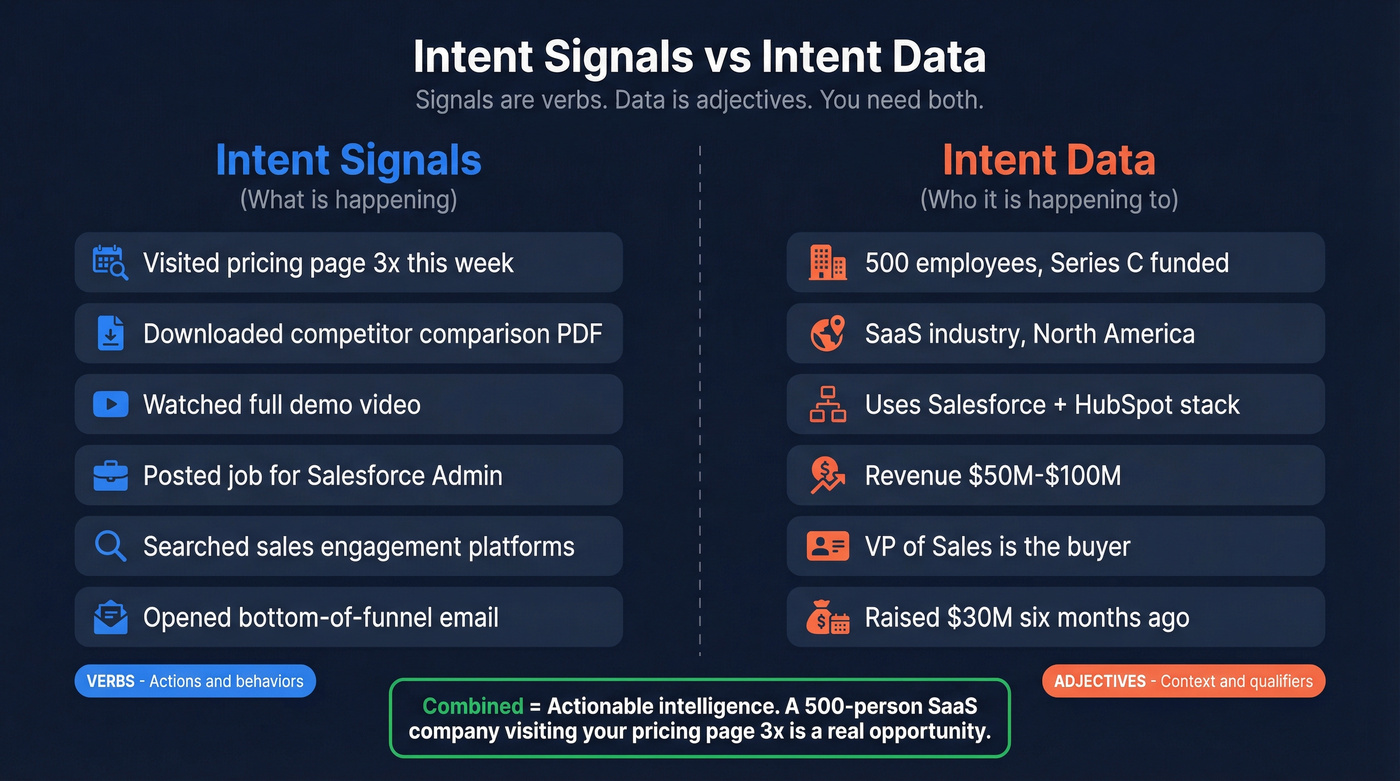

Intent signals and intent data aren't the same thing. Signals are behaviors - someone visiting your pricing page, downloading a competitor comparison, hiring for a role your product supports. Data is context - firmographics, technographics, demographics. Think of signals as verbs and data as adjectives. You need both, but most teams overspend on adjectives and underinvest in verbs.

Here's the state of play:

- Only 25% of B2B companies use intent data today. But 99% of large corporations use it in some form. The gap is closing fast.

- Buyers complete 60-90% of their decision-making before they ever talk to a vendor. If you're waiting for hand-raisers, you're seeing 10% of the picture.

- You don't need a $35K platform to start. A functional intent stack runs $200-$500/month if you pick the right tools.

- 98% of marketers consider intent data fundamental for demand generation - almost half view it as the heart of their entire B2B marketing operation.

Now let's get into the mechanics.

What Are Intent Signals? (And How They Differ from Intent Data)

The industry uses "intent signals" and "intent data" interchangeably. They're quite different, and confusing them leads to bad purchasing decisions.

Intent signals are observable behaviors that indicate a person or company is interested in a problem your product solves. A prospect visiting your pricing page three times in a week - that's a buying signal. A company posting a job for "Salesforce Administrator" when you sell Salesforce consulting - signal. A VP downloading a competitor's whitepaper on data enrichment - signal.

Signals are verbs. They describe actions.

Intent data is the contextual layer that makes signals meaningful. Company size, industry, tech stack, funding stage, geographic location - these are the adjectives that help you decide whether a signal matters. A 5-person startup hitting your pricing page is different from a 500-person company doing the same thing.

The Gradient Works framework puts it cleanly: signals tell you what's happening, data tells you who it's happening to. Most teams buy an intent data platform expecting signals, then wonder why a list of "high-intent accounts" doesn't convert. The platform gave them adjectives when they needed verbs.

There's an entire world of anonymous signals beyond hand-raisers like form fills. Reverse IP lookup reveals which companies visit your site. Pricing page views, demo video watches, security documentation downloads - these are all signals that never generate a lead form submission. B2B buyers conduct an average of 12 online searches before visiting a specific brand's website. If you're only tracking the people who raise their hands, you're missing most of the market.

Signal-based selling takes this further. Purchase intent data answers a narrow question: "Is this account actively researching solutions like ours?" Signal-based selling uses multiple data points - leadership changes, funding rounds, tech stack changes, job postings, competitor contract renewals - to identify accounts entering or approaching evaluation mode, not just the ones already deep in it.

The practical difference: intent data catches accounts mid-funnel. Signal-based selling catches them before they even know they're in a buying cycle.

Types of Buyer Intent Signals

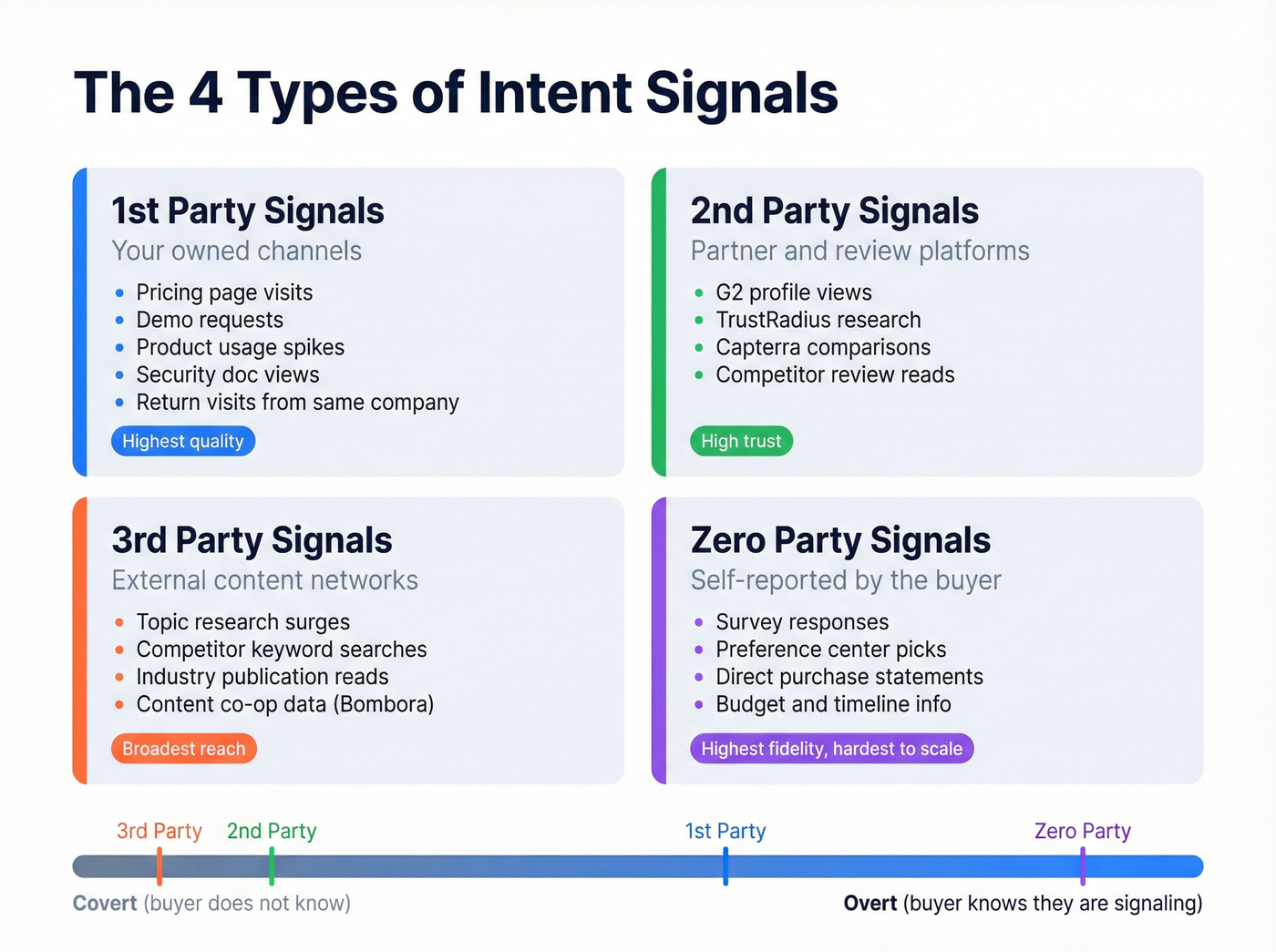

Not all signals carry equal weight. Understanding the taxonomy helps you build a stack that captures the right behaviors at the right time.

First-Party Signals

These come from your owned channels - your website, product, email, and content. They're the highest-quality signals you'll get because they represent direct engagement with your brand.

Examples: pricing page visits, demo requests, product usage spikes, email opens on bottom-of-funnel content, return visits from the same company within a short window. Security and compliance page visits are an overlooked gem - when a prospect's legal or IT team starts vetting your security docs, that's a buying signal most teams miss entirely.

Second-Party Signals

These come from partner platforms and review sites where buyers research solutions. G2, TrustRadius, Capterra - when someone reads reviews of your product (or your competitors), that's a second-party signal.

Third-Party Signals

These come from external publishers, content networks, and data cooperatives. Bombora's co-op of 5,000+ B2B websites is the canonical example - they track which companies are consuming content on specific topics across thousands of sites.

Examples: topic-level research surges (a company suddenly reading 3x more content about "sales engagement platforms"), competitor keyword searches, industry publication engagement.

Zero-Party Signals

This category gets overlooked. Zero-party intent is self-reported: survey responses, preference center selections, direct statements of buying priorities. ZoomInfo calls these "Scoops" - verified human intelligence about upcoming purchases, budget allocations, and project timelines. They're the highest-fidelity signals available because the buyer told you what they want. The downside: they're rare and hard to scale.

Overt vs. Covert Signals

Beyond the source taxonomy, signals split into overt (the buyer knows they're signaling) and covert (they don't).

Overt signals: form fills, demo requests, pricing inquiries, direct outreach. These are hand-raisers. Every team tracks them. They're also the smallest slice of buyer activity.

Covert signals: anonymous website visits, content consumption patterns, hiring activity, technology changes, champion job changes. This is where the real intelligence lives.

The nine signal types that matter most in 2026:

- Hiring activity - A company posting for roles your product supports signals budget and need.

- High-intent page visits - Pricing, security, integration pages indicate late-stage evaluation.

- Champion job changes - Your best customer's VP of Sales just moved to a new company. That's a warm intro.

- Competitor insights - Accounts researching your competitors are in-market by definition.

- Funding events - A fresh Series B means new budget, new initiatives, and new tool purchases. One of the strongest buying signals for mid-market and startup-focused sellers.

- Community engagement - Activity in relevant Slack groups, forums, and communities.

- Technology changes - A company dropping a competitor's tool or adopting complementary tech.

- Content engagement - Consuming bottom-of-funnel content (case studies, ROI calculators, comparison guides).

- Interactive demo engagement - Prospects who complete product demos without talking to sales are self-qualifying.

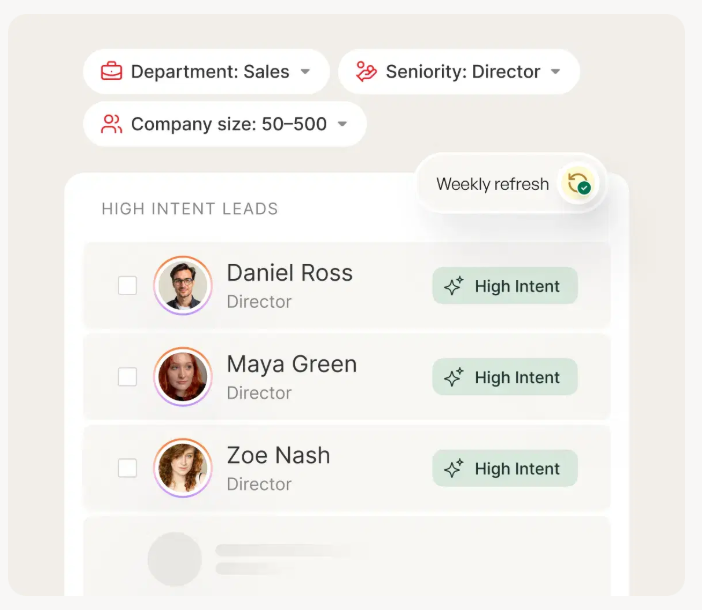

Intent signals tell you who's ready to buy. Prospeo tells you how to reach them. Layer Bombora intent data across 15,000 topics with 300M+ verified profiles, 98% email accuracy, and 125M+ direct dials - all refreshed every 7 days, not 6 weeks.

Turn intent signals into booked meetings, not bounced emails.

Intent Signals by the Numbers

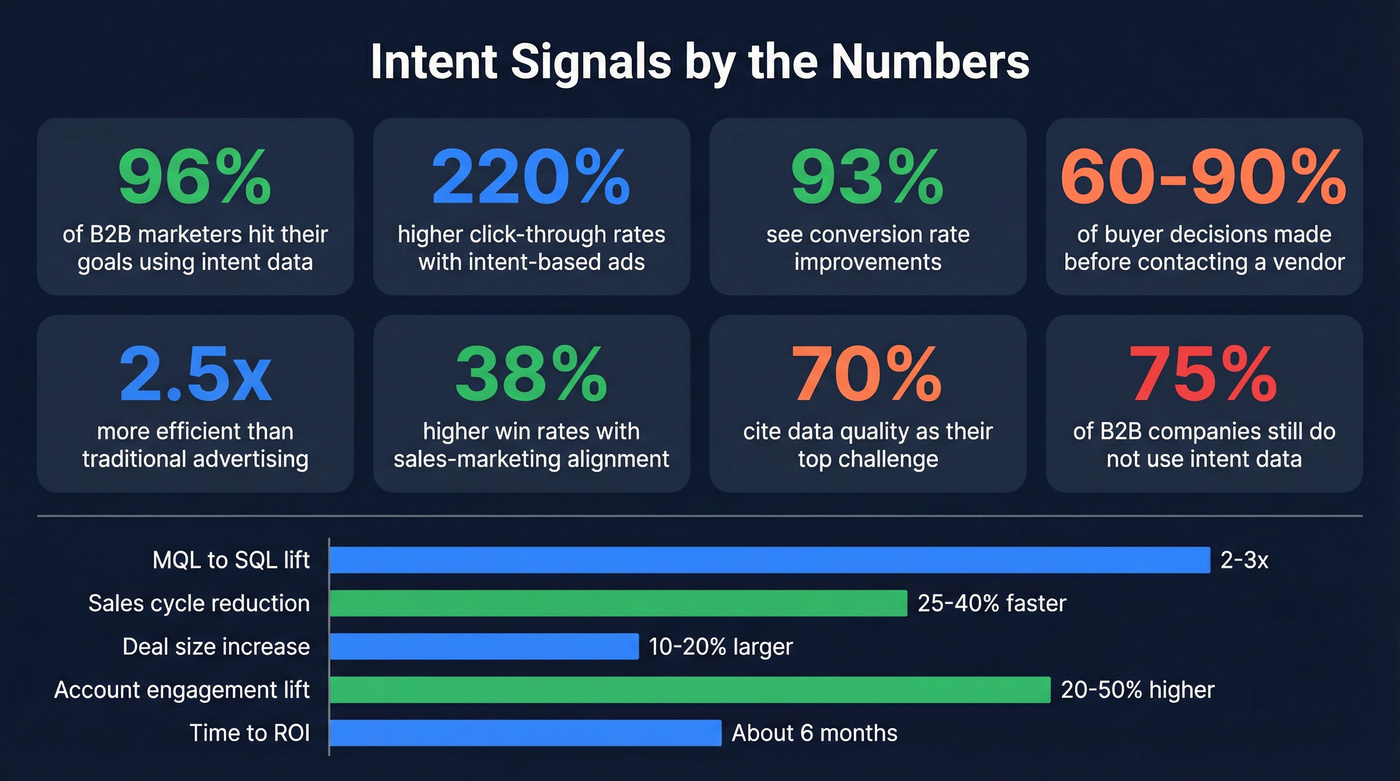

The business case isn't theoretical anymore. The adoption gap between enterprises and everyone else is the real story.

Adoption and ROI:

- 96% of B2B marketers report achieving their goals using intent data

- 93% see conversion rate improvements

- 99% of businesses report increased sales or ROI after implementing intent data

- Intent data typically shows ROI within 6 months

Advertising efficiency:

- Intent-based ads achieve 220% higher click-through rates

- Intent-based advertising delivers 2.5x efficiency over traditional approaches

- 82% report faster lead conversion with intent-driven demand generation campaigns

Sales-marketing alignment:

- Organizations with strong sales-marketing alignment through intent data report 36% higher customer retention and 38% higher sales win rates

- 55% of marketers use a combination of first-party and third-party data to capture the full picture

The adoption gap:

- Only 25% of B2B businesses currently use intent data

- But 99% of large corporations use it in some form

- 50% of businesses not currently using intent data plan to start next year

- 40% of businesses dedicate more than half their marketing budget to intent data

The challenge:

- 70% cite data quality as their top challenge

- The #1 practitioner complaint: "Intent data tools are too generic - they don't match my ICP"

- Teams still need 3-4 tools to get the full picture

| Metric | Benchmark Range |

|---|---|

| MQL to SQL lift | 2-3x higher |

| Sales cycle reduction | 25-40% faster |

| Deal size increase | 10-20% larger |

| Account engagement lift | 20-50% higher |

| Time to ROI | ~6 months |

Here's the stat that should keep you up at night: buyers complete 60-90% of their decision-making before contacting vendors, reviewing an average of 11 pieces of content. If you're not tracking those pre-contact behaviors, you're playing the game blind while your competitors see the whole board.

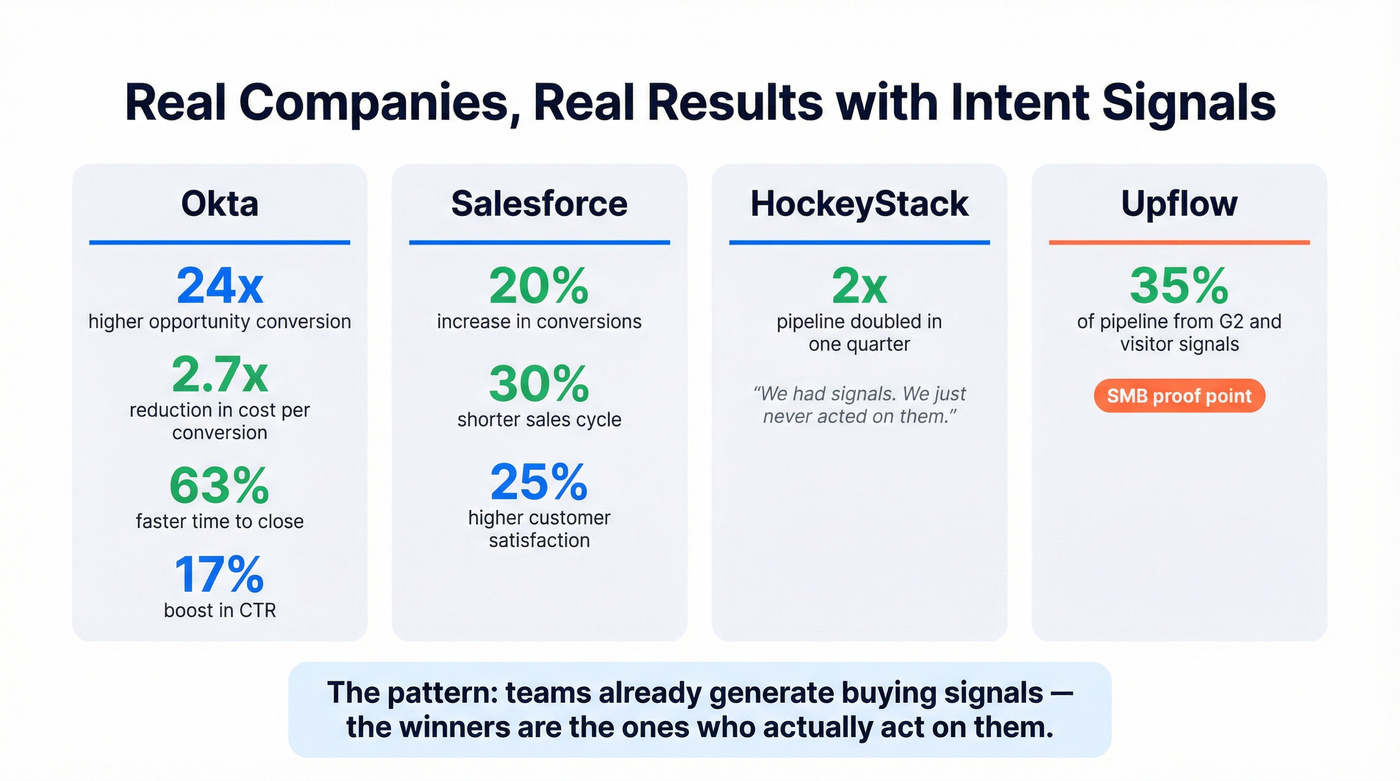

Real Results - Named Case Studies

Stats are convincing. Named companies with specific numbers are more convincing.

Okta

Okta's intent-driven ABM program produced the kind of results that make CFOs stop questioning the budget: a 24x higher opportunity conversion rate, a 2.7x reduction in cost per conversion, a 17% boost in CTR, and a 63% reduction in time from opportunity to closed deal.

The quote from Okta's digital team lead says it all: "It's clear we made the right decision when we decided to focus on intent data... it was like a switch flipped."

That 63% faster close is the number that matters most. Intent data didn't just find more leads - it found leads that were already further down the buying journey, compressing the entire sales cycle.

Salesforce

Even Salesforce - a company that literally sells CRM software - needed external signals to optimize their own pipeline. They reported a 20% increase in conversion rates, 30% reduction in sales cycle length, and 25% increase in customer satisfaction after implementing buyer intent data.

Nobody's too sophisticated for this.

HockeyStack

HockeyStack doubled their pipeline in a single quarter by acting on signals they'd been ignoring. CRO Emir Atli put it bluntly: "We have a lot of high-intent triggers. But we never acted on signals like interactive demo visitors, product page visitors, company page followers."

The lesson: most teams are already generating buying signals. They're just not doing anything with them.

Upflow

This one matters for SMBs who think intent data is only for enterprise. Upflow, a B2B payments company, attributed 35% of their pipeline to G2 and website visitor signals. They started with SEO, layered in G2 intent, then added website visitor identification. Their key insight: "We're converting 30-40% of website traffic into leads. What about the remaining 60-70%?"

They used a simple 1-4 star lead scoring system. Low-intent visitors got nurture campaigns. High-intent accounts triggered Slack alerts and automatic Salesforce account creation. No $35K platform required.

sevDesk

sevDesk's CRO manager placed interactive demos on high-intent pages and generated 527 leads with a 28% conversion rate using firmographic data from account reveal. That's a conversion rate most outbound teams would kill for - achieved by matching the right content to the right signal at the right moment.

How to Build Your Intent Signal Stack

Most implementations fail not because the data is bad, but because there's no architecture connecting signals to actions. I've watched teams spend six figures on intent platforms only to export CSVs and email them around. The goal isn't to collect more data. It's to make every captured signal have a destination, a purpose, and an owner.

Here's the four-layer framework that actually works.

Layer 1: Ingest

This is where signals enter your system. You need three categories flowing in:

First-party: Website analytics, product usage data, email engagement, form submissions. Tools like Google Analytics, your marketing automation platform, and your product's event tracking.

Second-party: G2 buyer intent, review site activity, partner ecosystem signals. These typically come via API integrations or native connectors.

Third-party: Bombora topic surges, technographic changes, hiring signals, funding events. These come from data providers - either standalone (Bombora) or bundled into platforms (6sense, Demandbase).

Every signal entering your system should carry metadata: source, timestamp, account/contact ID, signal category, event type, and weight. Without this structure, you'll drown in noise.

Layer 2: Normalize & Score

Different tools define "engagement" differently. A Bombora topic surge score of 80 doesn't mean the same thing as a G2 comparison page visit. You need a normalization layer that translates signals into a common scoring framework.

Simple scoring example:

| Signal | Score |

|---|---|

| Blog visit | +2 |

| Case study download | +5 |

| Pricing page visit | +10 |

| Demo request | +25 |

| Competitor comparison | +8 |

| Job posting (relevant role) | +6 |

| Return visit (same week) | +7 |

Stack these scores at the account level. A company that hits +30 in a week looks very different from one that triggered a single blog visit.

Layer 3: Route

Scoring tiers determine where accounts go:

- TOFU (low score): Retarget with awareness content. No sales touch.

- MOFU (medium score): Nurture campaigns. Marketing owns the relationship.

- BOFU (high score): Route to sales with context. Slack alert, Salesforce task, or direct notification to the account owner.

The routing layer is where most teams break down. They score accounts but don't automate the handoff. Use Zapier, Tray.io, Hightouch, or native CRM workflows to make routing automatic. If a human has to manually check a dashboard to find high-intent accounts, you've already lost the timing advantage. If you're building this end-to-end, start with a blueprint to automate sales signals before you add more data sources.

Layer 4: Act

Here's where signals either create pipeline or die in a spreadsheet. Acting on them requires two things: knowing what to say and knowing who to say it to.

The "what to say" part comes from the signal itself - reference the topic, not the behavior. (More on this in the next section.)

Using Buying Signals for Sales Without Being Creepy

I've seen this go wrong more times than I can count. A BDR gets a "high-intent" alert, fires off an email that says "I noticed your team was on our website," and the prospect immediately feels surveilled.

One practitioner on Reddit nailed the problem: "A line like 'I saw your team on our site' just doesn't feel strong enough and a bit creepy and desperate."

The fix is simple but requires discipline: reference the topic, not the behavior.

Don't say: "I noticed your team visited our pricing page three times this week."

Do say: "We've been helping [similar companies] solve [the problem your pricing page addresses]. Here's how [Company X] cut their [metric] by 30%."

The prospect doesn't need to know you're tracking them. They need to feel like you understand their problem. Each signal tells you what to talk about. It shouldn't tell them that you're watching.

Here's the deeper strategic problem: when everyone uses the same third-party intent data, you're all reaching out to the same accounts at the same time with the same generic messaging. As one practitioner put it, "Clay is great but it gets pricey quickly, and when everyone uses the same data, it ends up being a commodity that drives zero edge."

Hot take: if your average deal size is under $10K, you probably don't need third-party intent data at all. Your first-party signals - website visitors, product usage data, email engagement - are more than enough to prioritize outreach. Nobody else has this data. The teams that win aren't the ones with the most expensive intent platform. They're the ones who build proprietary signal workflows that competitors can't replicate. If you want a practical framework for the outreach layer, pair signals with a proven B2B cold email sequence so the handoff actually converts. Save the Bombora subscription for when you're selling $50K+ deals where the cost of missing an in-market account actually justifies the spend.

Common Mistakes Teams Make with Intent Data

Most intent data is wasted. Not because the data is bad, but because teams make predictable mistakes with good data.

1. Confusing traffic with intent. High traffic and zero conversions isn't traction - it's noise. A spike in website visitors doesn't mean accounts are in-market. It might mean your blog post went viral on Hacker News and attracted developers who'll never buy. Intent requires context: who visited, what they looked at, and how often they came back.

2. Treating intent data as a silver bullet. Intent data indicates research activity, not purchase readiness. An account consuming content about "sales engagement platforms" might be evaluating vendors, writing a blog post, or doing competitive research for their own product. Without additional signals (budget, authority, timeline), you're guessing.

3. Failing to connect signals to messaging. This is the most expensive mistake. You pay for intent data, identify high-intent accounts, then send the same generic outreach you'd send to a cold list. The signal told you exactly what they're interested in. Use it.

4. Ignoring signal decay. A signal from three months ago carries little value. Many intent platforms deliver weekly batch updates, which means by the time your BDR acts on a signal, the prospect has already moved on. If your provider updates weekly, you're already behind teams using near-real-time alerts.

5. Assuming more signals = better outcomes. Volume doesn't correlate with quality. Teams that ingest every possible signal source end up with noise-flooded dashboards and alert fatigue. Five high-quality signals that trigger specific actions beat fifty signals that sit in a report nobody reads.

6. Ignoring where technical buyers actually research. For technical buyers - developers, DevOps, security engineers - traditional intent providers miss where these people spend time. GitHub, Hacker News, Discord, niche Slack communities: none of this shows up in Bombora's co-op. If you sell to engineers, you need community-native signals, not just B2B content consumption data.

7. Using intent data when it can't help you. Look, intent data is the wrong investment when buyers don't leave trackable digital signals (common in offline-heavy industries), your sales cycle is too short to act on signals before they decay, you don't have the capacity to act on signals within 48 hours, or the data doesn't integrate with your existing tools. Buying intent data you can't operationalize is worse than not buying it at all.

The Reddit reality check: An analysis of 1,100 practitioner posts about B2B intent data surfaced the same frustrations over and over: "Intent data tools are too generic." "Signals are outdated or misleading." "We still need 3-4 tools to get the full picture." "AI tools promise automation but require too much setup."

The pattern is clear. The problem isn't the concept of intent data. It's the execution.

Tools Compared (With Actual Pricing)

Your finance team is asking why you're paying $35K/year for an intent platform with no attributable closed deals. Fair question. Let's look at what's actually available, what it costs, and what it's good for.

Enterprise intent platforms are wildly overpriced for teams under 50 reps. But there are options at every budget level. If you're evaluating providers, it helps to start with a broader shortlist of the best B2B data providers before you go deep on intent.

Enterprise Tier

| Tool | Best For | Intent Type | Pricing | Key Limitation |

|---|---|---|---|---|

| Bombora | Pure intent data | 3rd-party co-op | ~$25-50K/yr | No workflow layer |

| 6sense | Enterprise ABM | Derived/blended | ~$35K+/yr | 3-6 mo. implementation |

| Demandbase | ABM + advertising | Blended | ~$35-100K+/yr | Enterprise-only |

| ZoomInfo | All-in-one GTM | Blended | ~$15-40K/yr | Module bloat, cost |

| TechTarget | Tech vertical | 1st-party pubs | ~$20-40K/yr | Tech vendors only |

| G2 Intent | Review-based | 2nd-party | ~$10-30K/yr | Narrow signal type |

SMB & Mid-Market Tier

| Tool | Best For | Intent Type | Pricing | Key Limitation |

|---|---|---|---|---|

| Prospeo | Intent + contacts | Bombora-powered | Free-$39+/mo | Not an ABM suite |

| Cognism | EMEA mobile data | 3rd-party | ~$1-3K/mo | US depth weaker |

| Databar.ai | Multi-source API | Aggregated | From $39/mo | DIY assembly needed |

| Apollo.io | SMB prospecting | Basic signals | From $49/mo | Intent is shallow |

| Leadfeeder (Dealfront) | EU visitor ID | 1st-party | ~$99-300/mo | Account-level only |

Bombora

Bombora is the backbone of third-party intent data. Their Company Surge methodology tracks content consumption across a cooperative of 5,000+ B2B websites, covering 12,000+ topics. When an account's research activity on a topic spikes above their baseline, Bombora flags it.

What makes Bombora unique: they're a pure data provider. No workflow layer, no sequencing, no CRM. They sell the signal, and you decide what to do with it. This is a strength if you've got the infrastructure to act on raw signals. It's a weakness if you need a turnkey platform. If you're comparing datasets and fit, see a direct breakdown in Bombora vs ZoomInfo.

Many of the biggest names in the space - 6sense, Demandbase, and others - license Bombora data. So when you buy from those platforms, you're often getting Bombora signals with additional layers on top.

Pricing runs ~$25,000-$50,000/year for mid-market contracts. Not cheap, but you're buying the most widely trusted third-party intent dataset in B2B.

6sense

6sense is the enterprise ABM platform that synthesizes first-party signals, Bombora data, G2 intent, and TrustRadius activity into AI-driven buying stage predictions. Their "Revenue AI" engine assigns accounts to stages (Awareness, Consideration, Decision, Purchase) and recommends actions for each.

It's powerful. It's also complex. Implementation takes 3-6 months, pricing starts around $35,000/year and scales significantly higher, and you'll need a dedicated RevOps person to manage it. The derived intent model - where AI synthesizes multiple signal sources into a single score - creates a black box. You're trusting the algorithm's interpretation of buying stages. If you want a technical explainer before you buy, start with how 6sense works.

Use this if: You're a 100+ person sales org running coordinated account-based marketing across marketing, sales, and CS, and you have the RevOps headcount to implement and maintain it.

Skip this if: You're under 50 reps, don't have a dedicated ABM team, or need to show ROI in under 6 months. The implementation timeline alone will eat your first two quarters.

ZoomInfo earned Leader status in the Forrester Wave B2B Intent Data Providers Q1 2025 evaluation. Intentsify scored highest overall, receiving perfect marks in 12 of 21 criteria - worth a look if you're evaluating enterprise options.

Mid-Tier Options: Demandbase, ZoomInfo, Cognism, Databar.ai

Demandbase emphasizes B2B advertising alongside intent, aggregating signals from its own network plus Bombora. If your primary use case is intent-driven ad targeting (not just sales outreach), Demandbase has the strongest advertising integration. Pricing is enterprise-custom, typically $35,000-$100,000+/year.

ZoomInfo bundles intent data into its broader GTM platform. The signals are solid, but you're paying for the entire platform whether you use it or not. Entry-level contracts start around $15K/year, but a 10-seat contract with intent data and mobile numbers can run $40-60K/year. The #1 complaint on Reddit? Price. Specifically, paying for modules you don't use. If you're sanity-checking vendor claims, it's worth reading Is ZoomInfo Accurate? alongside your trial.

Cognism wins for EMEA-focused teams. Their mobile verification and GDPR compliance are best-in-class for European markets. Intent data comes via Bombora integration. Pricing runs ~$1,000-$3,000/month. Where Cognism falls short: US database depth. Where it wins: EMEA compliance and verified European mobile numbers.

Databar.ai takes a different approach - multi-source aggregation with waterfall enrichment that delivers 20-30% better coverage than single providers. Consumption-based pricing starts at $39/month. Powerful if you've got the technical chops to assemble your own stack, frustrating if you want something turnkey.

Quick Mentions

TechTarget's Priority Engine delivers first-party intent from the largest network of enterprise tech media properties. Excellent if you sell technology products. Irrelevant if you don't. ~$20,000-$40,000/year.

G2 Buyer Intent provides second-party signals from review activity - who's comparing you, reading your reviews, or browsing your category. 12% of closed-won deals show direct G2 signal influence. Pricing bundles into G2 marketing solutions, typically $10,000-$30,000/year.

Apollo.io offers basic signals alongside its prospecting database at $49+/month. The intent capabilities are shallow compared to dedicated providers, but for SMBs who need "good enough" signals bundled with contact data, it's a starting point.

Leadfeeder (Dealfront) focuses on European website visitor identification. Account-level only, ~$99-$300/month. Useful as one signal source in a broader stack, not as a standalone solution.

AI and the Future of Intent Signals

AI is transforming these signals from static scores into dynamic, self-improving systems. The shift is already underway, and in our experience, the teams adopting AI-driven scoring are pulling ahead fast. If you're deciding between approaches, use this AI lead scoring vs traditional lead scoring breakdown to pick the right model for your data volume.

The AI learning loop works in four stages: data collection, pattern recognition, intent modeling, continuous learning. Each cycle makes the model better at distinguishing real buying intent from noise. ML now differentiates between research intent ("best AI sales automation tools" = evaluation phase) and purchase intent ("buy AI sales platform" = ready to purchase) based on language patterns alone.

Dynamic scoring rules are replacing static point systems. Instead of manually assigning +10 to a pricing page visit, AI adjusts weights based on what actually converts. If pricing page visits from companies with 50-200 employees convert at 3x the rate of enterprise visits, the model learns that and adjusts scores automatically.

Autonomous lead segmentation is already here. AI agents monitor signals for sales teams in real time, segment accounts by buying stage and fit, trigger personalized outreach sequences, and adjust messaging based on engagement patterns - all without human intervention. A practical example: "If a lead revisits the pricing page twice in 24 hours, trigger a personalized follow-up referencing the specific features they viewed."

Post-sale, AI-driven intent detection spots early disengagement signals - declining product usage, reduced support ticket volume, decreased login frequency - to prevent churn before the customer even considers leaving.

The numbers support the trend: a third of companies already use AI for intent data analysis, 84% report it helped them understand customer intentions, and 47% of marketers plan to expand AI use in their strategies. The Intent-Based Networking market was valued at ~$2.9 billion in 2025 and is projected to grow at 25% CAGR to $27.3 billion by 2035. We're moving from "AI-assisted" to "AI-driven" workflows, and the teams that adopt early will have a compounding advantage.

Privacy and Compliance in 2026

The compliance environment for intent data is shifting fast, and ignoring it is a business risk, not just a legal one.

GDPR's refinement phase is introducing nuance that matters for intent data. A proposed analytics exemption would allow non-intrusive first-party audience measurement cookies without consent. The new concept of "subjective identifiability" means data is considered anonymous if you can't identify the user - even if someone else theoretically could. Both changes favor first-party intent strategies. If you're operationalizing this for outbound, align your stack with a practical GDPR for Sales and Marketing workflow.

Key regulatory developments:

- India's DPDPA is coming online with heavy penalties for consent handling failures

- Global Privacy Control (GPC) signals are increasingly treated as binding user intent

- IP-only tracking is under increased scrutiny across jurisdictions

- Maryland explicitly bans dark patterns in cookie banners

- Multiple US states (Delaware, New Hampshire, New Jersey, Minnesota, Connecticut) have new or updated privacy laws recognizing Universal Opt-Out Mechanisms

Cookie deprecation is forcing the entire industry toward first-party data strategies. Third-party cookies are disappearing, and intent data providers that relied on cross-site tracking are scrambling to adapt. Gmail's November 2025 authentication rules made SPF, DKIM, and DMARC mandatory for high-volume senders - Microsoft, Apple, and Yahoo are expected to follow. If your workflow includes cold email, make sure your SPF DKIM, and DMARC setup is solid before you scale.

The bottom line: "You're no longer just being judged on what your policy says. You're being judged on what your systems actually do."

For intent data buyers, this means prioritizing providers with transparent data collection methodologies, consent-based cooperative models (like Bombora's co-op), and GDPR-compliant contact data with opt-out enforced globally.

You don't need a $35K intent platform when Prospeo combines buyer intent tracking, job change alerts, technographic filters, and funding signals - with verified contact data attached. At $0.01/email, your intent stack just got 90% cheaper.

Stop paying enterprise prices for signals you can't act on.

FAQ

What's the difference between intent signals and intent data?

Intent signals are observable behaviors indicating buying interest - pricing page visits, content downloads, hiring activity, technology changes. Intent data is contextual information (firmographics, technographics) that makes those signals meaningful. Signals are verbs; data is adjectives. You need both to prioritize accounts effectively.

How much does an intent data stack cost for a small team?

How quickly can you see ROI from intent signals?

Most organizations report ROI within 6 months. The fastest wins come from first-party signals (website visitor identification, pricing page alerts) because they require minimal setup. Third-party platforms with 3-6 month implementations take longer. Start with what you own, then layer in external data.

Are intent signals still reliable after cookie deprecation?

Yes, but the signal mix is shifting. First-party signals (your website, product, email engagement) and consent-based cooperative data (Bombora's 5,000+ site co-op) are more important than ever. IP-based identification, contextual intent, and authenticated user data all work without cookies. Teams investing in first-party signal infrastructure now will have a significant edge.

What are the best free or low-cost intent data tools?

Prospeo tracks 15,000 Bombora-powered topics and offers a free tier with 75 verified emails per month. Apollo.io includes basic signals from $49/month. Leadfeeder starts around $99/month for website visitor identification. A combined stack under $500/month covers most SMB needs - no enterprise contract required.