Bombora vs ZoomInfo: Which Intent Data Platform Is Worth Your Budget in 2026?

You pull the weekly Surge report from Bombora. Twelve accounts are lighting up on "cloud migration" and "vendor evaluation." Great - now what? You've got company names but zero contacts. No emails, no direct dials, no way to actually reach the people behind the intent signals. So you open ZoomInfo to find the contacts and realize you're paying two platforms $50K+ combined to do what should be one job.

That's the central tension behind every Bombora vs ZoomInfo comparison. One platform does intent data better than almost anyone. The other bundles contacts and intent into a single (expensive) login. Neither gives you both at a price that makes your CFO comfortable.

B2B buyers complete 70-90% of their journey independently before ever contacting a vendor. Intent data catches them during that invisible window. The question isn't whether you need it - it's whether you need to spend $30K+ to get it.

30-Second Verdict

Best pure intent data: Bombora. Deeper taxonomy (17,210+ topics), consent-based Data Co-op, higher satisfaction scores on TrustRadius (8.5 vs 8.2), and a Likelihood to Recommend score of 9.3 vs ZoomInfo's 8.3. If you already have a contact database and just need the intent layer, this is the move.

Best all-in-one platform: ZoomInfo. Contacts + intent in one login. But intent is a paid add-on - $9,000 to $40,000/year on top of your base contract. That sticker shock is real.

Hot take: If your average deal size sits below $15K, you probably don't need either of these platforms directly. Several tools embed Bombora's intent data at a fraction of the cost and pair it with the verified contacts Bombora can't give you.

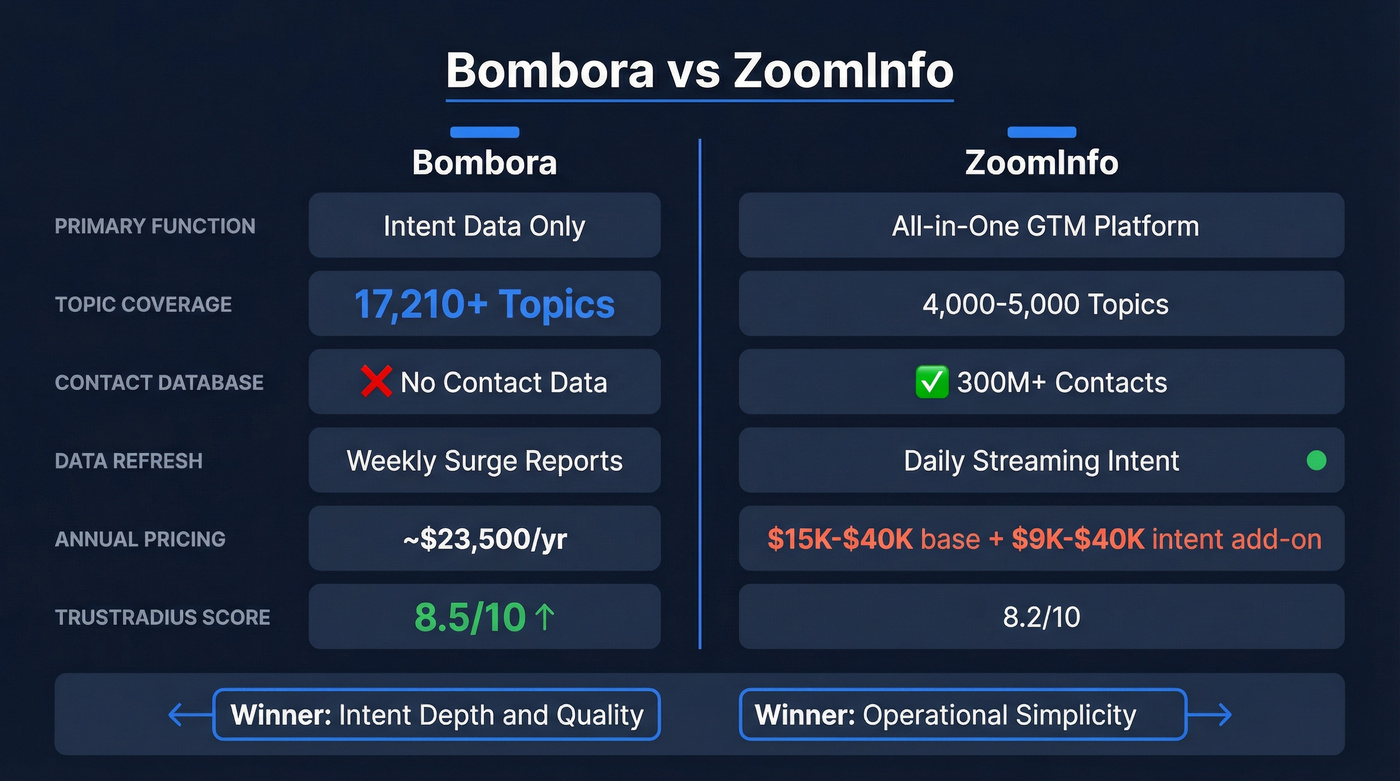

TL;DR Comparison Table

| Dimension | Bombora | ZoomInfo |

|---|---|---|

| Primary function | Intent data only | All-in-one GTM platform |

| Intent methodology | Consent-based Co-op | Multi-signal proprietary |

| Topic count | 17,210+ | ~4,000-5,000 |

| Data refresh | Weekly Surge | Daily Streaming |

| Contact data | No | Yes (300M+) |

| Annual pricing | ~$23,500 (intent only) | $15K-$40K base + $9K-$40K intent |

| G2 rating | 4.4/5 (155 reviews) | 4.5/5 (8,765 reviews) |

| TrustRadius score | 8.5/10 (42 ratings) | 8.2/10 (740 ratings) |

| Best for | Marketing ABM teams | Sales-led orgs needing one login |

| Winner | Intent depth & quality | Operational simplicity |

Stop paying $50K+ for two platforms. Prospeo embeds Bombora intent data across 15,000 topics and pairs it with 143M+ verified emails and 125M+ direct dials - so you go from intent signal to booked meeting without switching tabs.

Intent signals without contacts are just expensive trivia. Fix that.

The Backstory - From Partners to Competitors

Bombora and ZoomInfo used to be on the same team. For years, ZoomInfo licensed Bombora's intent data through a revenue-sharing agreement - Bombora's Company Surge signals powered ZoomInfo's intent features. Clean arrangement. Bombora did the intent, ZoomInfo did the contacts.

That partnership terminated in early 2020. What followed wasn't pretty.

The two companies ended up in a lawsuit centered on the revenue-sharing agreement and how it ended. For two years, they were in active litigation while simultaneously competing for the same buyers. The suit settled in June 2022 with undisclosed terms.

The key line from the settlement press release: "The agreement does not encompass resumption of the business partnership." Translation: they shook hands, walked away, and went back to competing. Both CEOs issued diplomatic statements - Matlick praised ZoomInfo's privacy compliance, Schuck acknowledged Bombora's role in B2B intent data. Polite words from two companies that were suing each other months earlier.

Today, ZoomInfo is absent from Bombora's partner page. ZoomInfo built its own proprietary intent data stack post-2020, pulling from web activity, job transitions, competitive shifts, and technographic changes rather than Bombora's publisher Co-op. They're fully competitive now, and the product philosophies have diverged significantly.

What Each Platform Actually Does

What Bombora Does (and Doesn't Do)

Bombora is a pure-play intent data company. It does one thing - track which companies are actively researching specific B2B topics - and it does it better than most alternatives.

The engine behind it is the Data Co-op: a network of 5,000+ B2B publisher websites, 86% of which are exclusive to Bombora. When someone at a target company reads articles about "cloud security" or "ERP migration" across these publisher sites, Bombora captures that behavior. It processes 17 billion interactions per month and resolves them to 2.8 million businesses using a patented method that fuses deterministic, behavioral, and IP-to-company data.

The topic taxonomy is where Bombora flexes hardest. They track 17,210+ intent topics, and the number keeps climbing as they add new topics quarterly. Their BERT-based NLP models understand context, not just keywords. When someone reads about "Apple," the system knows whether they're researching the tech company or the fruit. That sounds trivial until you realize most keyword-based intent tools can't make that distinction.

Bombora's publisher network skews toward tech-focused publications. If you're selling into manufacturing, healthcare, or financial services, the coverage will be thinner than what you'd get for SaaS or IT categories. Not a dealbreaker, but worth testing with a pilot before committing.

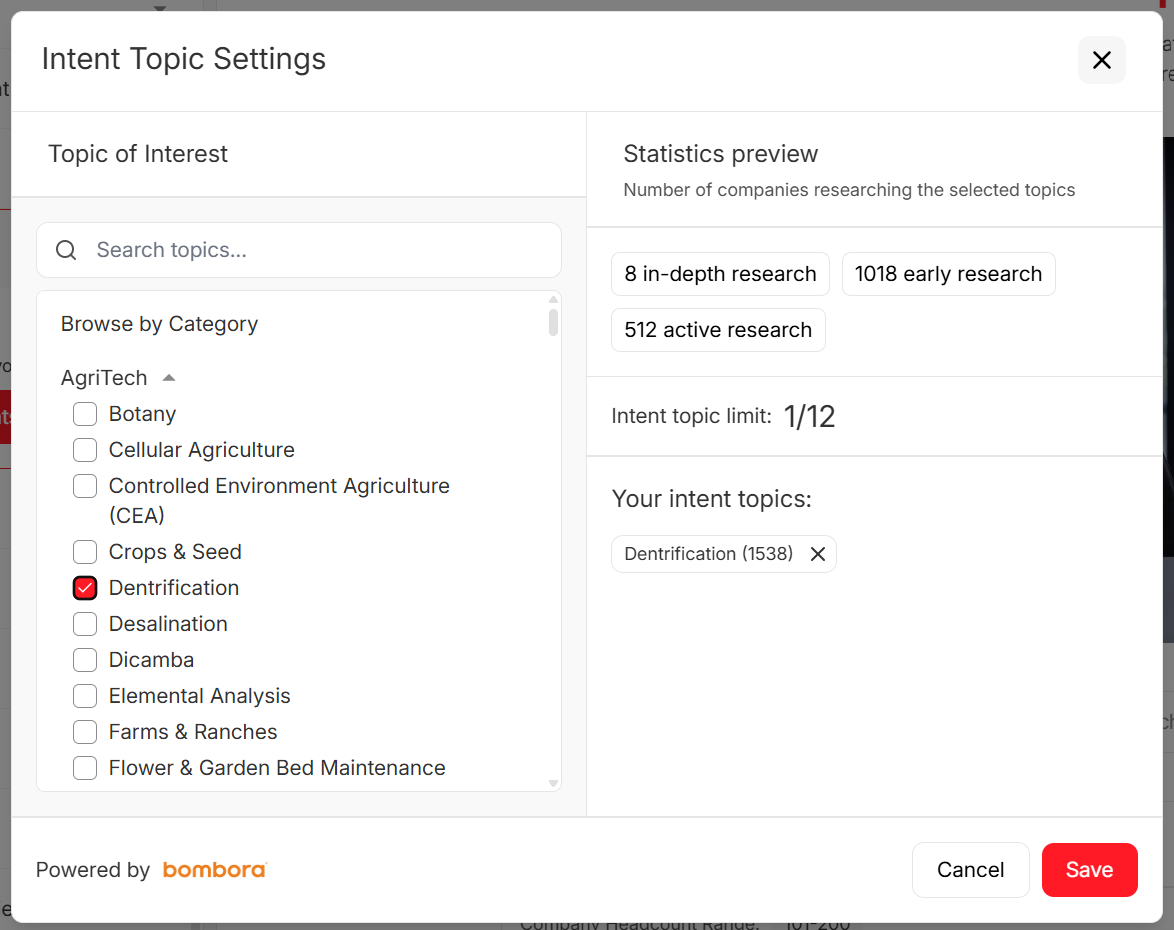

Bombora delivers weekly Company Surge reports showing which accounts are surging on your selected topics. The data is consent-based - collected directly from publishers, not scraped or siphoned from bidstream data. Average implementation takes about a month, and most teams report seeing meaningful ROI around the 17-month mark.

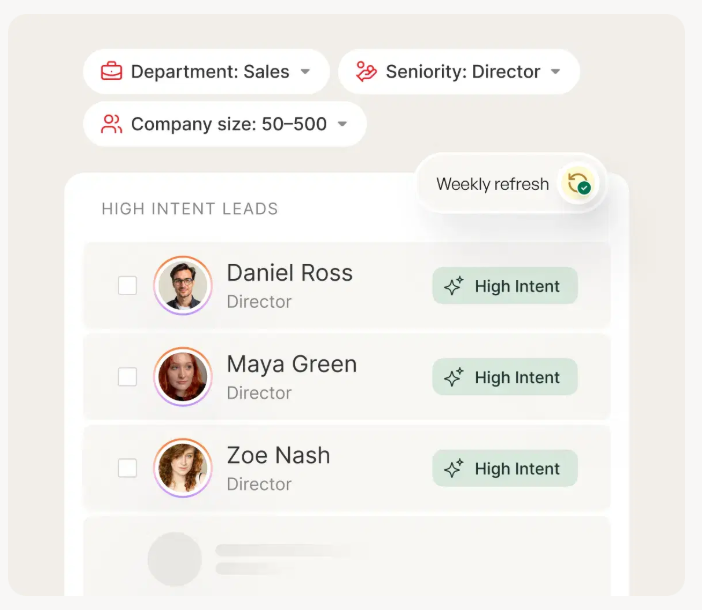

The critical limitation: Bombora provides company-level signals only. It tells you Acme Corp is researching "sales automation." It doesn't tell you who at Acme Corp is doing the research. No emails, no phone numbers, no individual contacts. As one Gartner reviewer put it, Bombora's intent data is "more predictive than the intent add-ons you get with contact data providers" - but you still need a separate tool to act on those signals.

What ZoomInfo Does (and Charges Extra For)

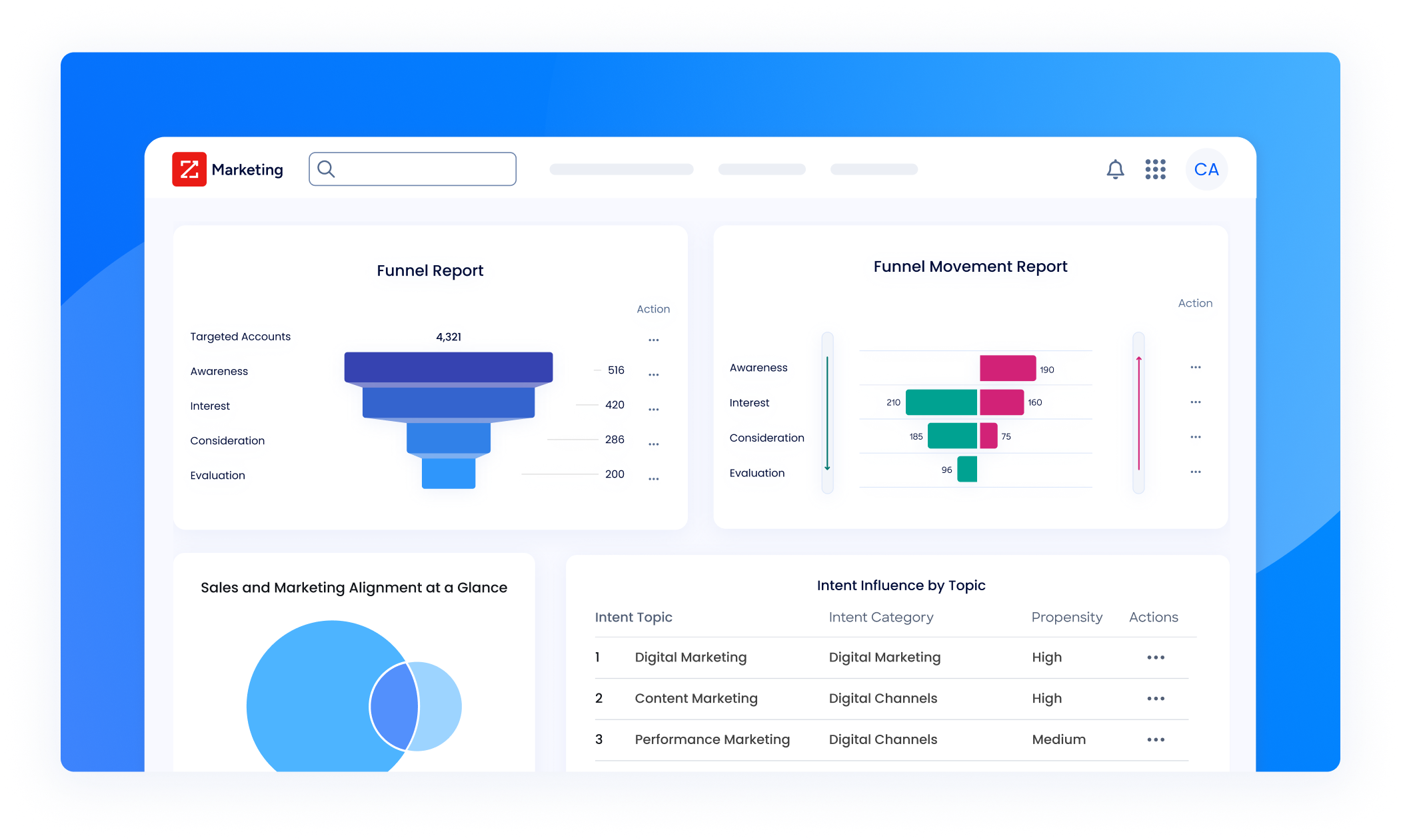

ZoomInfo is the 800-pound gorilla of B2B data - an all-in-one GTM platform spanning SalesOS, MarketingOS, and OperationsOS, with 300M+ B2B contacts and a suite of tools covering everything from prospecting to conversation intelligence to digital advertising.

Intent data is part of the story, but it's not included in the base price.

This is the detail that catches most buyers off guard. ZoomInfo's intent signals are a paid add-on, and the cost depends on your plan tier. On the Professional plan, you get access to just 6 intent topics for an extra $9,000/year. Six topics. For nine grand.

The intent data itself has improved significantly since ZoomInfo built its own stack post-Bombora. Their Streaming Intent feature refreshes daily (vs. Bombora's weekly cadence), and they process 1.5 billion data points daily, capturing 58 million intent signals weekly. The sources go beyond traditional publisher data: web activity, job transitions, competitive shifts, and technographic changes all feed the model.

ZoomInfo's Guided Intent feature uses AI to recommend topics correlated with your previous wins - a genuine differentiator that Bombora doesn't offer. And Forrester named ZoomInfo a Leader in The Forrester Wave: Intent Data Providers For B2B, Q1 2025.

But the topic taxonomy runs an estimated 4,000-5,000 topics - less than a third of Bombora's coverage. Plan-tier limits mean most customers can only actively monitor a fraction of those. Multiple users also flag browser performance issues with the platform, something you won't encounter with a lightweight intent-only tool like Bombora.

Where ZoomInfo wins: contacts and intent in one platform, daily refresh, and AI-powered topic recommendations. Where Bombora still wins: taxonomy depth, data quality, and the consent-based methodology that makes compliance teams sleep better.

How Their Intent Data Methodologies Compare

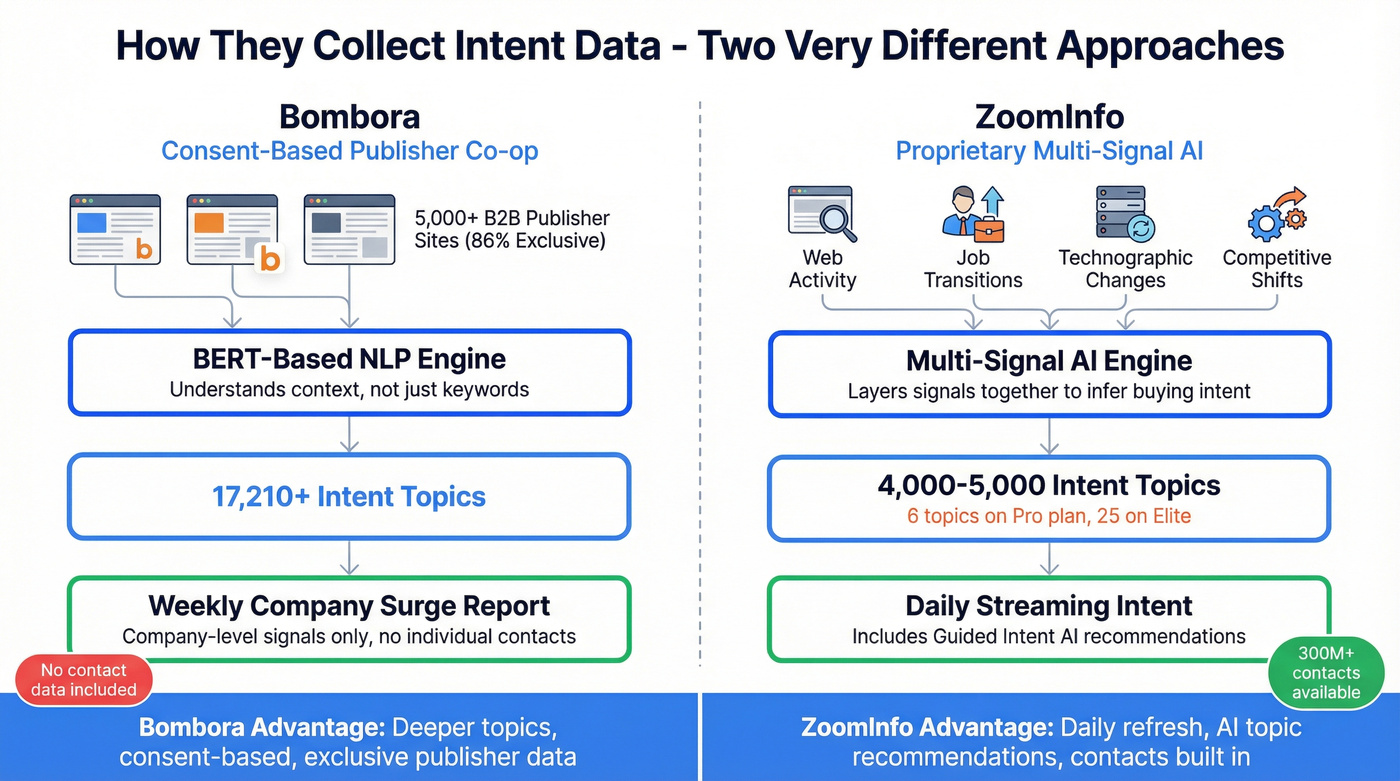

The philosophical split between these two platforms runs deep.

Bombora's approach is cooperative and consent-based. Five thousand B2B publishers contribute their audience data to the Co-op. When professionals consume content across these sites, Bombora captures the behavior with explicit consent. The BERT-based NLP engine categorizes that consumption into 17,210+ topics, and the Company Surge algorithm scores how much a given company's research activity exceeds its baseline.

ZoomInfo's approach is proprietary and multi-signal. Rather than relying on a publisher network, ZoomInfo aggregates signals from web activity, job postings, technographic changes, competitive intelligence, and more. Their AI layers these signals together to infer buying intent. Guided Intent then recommends which topics to track based on patterns from your closed-won deals.

| Dimension | Bombora | ZoomInfo |

|---|---|---|

| Methodology | Publisher Co-op | Multi-signal AI |

| Topic count | 17,210+ | ~4,000-5,000 |

| Topic limits | No hard limit (5-25 recommended) | 6 (Pro) to 25 (Elite) |

| Refresh cadence | Weekly | Daily |

| Data consent | Explicit, Co-op | Proprietary collection |

| AI features | BERT NLP | Guided Intent |

| Winner | Depth & compliance | Speed & automation |

The topic taxonomy gap is significant. Bombora's 17,210 topics let you get granular - tracking not just "cybersecurity" but specific sub-topics like "zero trust architecture" or "SIEM migration." ZoomInfo's smaller taxonomy means you're working with broader categories. And the plan-tier limits are frustrating: paying $15K/year for a Professional plan and getting only 6 monitorable topics feels like buying a sports car with a speed limiter.

On freshness, ZoomInfo has the clear edge. Daily Streaming Intent updates mean your SDRs can prioritize accounts that surged yesterday, not last week. Bombora's weekly cadence works fine for strategic ABM campaigns and marketing plays, but if your motion is "call surging accounts within 24 hours," daily matters.

I've found the accuracy question matters less than the coverage question - a signal you never see is worse than a signal that's occasionally noisy. No independent head-to-head accuracy test exists, so take both vendors' claims with appropriate skepticism.

Bombora's 86% exclusive publisher data is a genuine moat. No other intent provider can replicate that network. ZoomInfo's Guided Intent is a genuine differentiator. Neither advantage is decisive on its own - it depends on whether you need breadth of topics or speed of signals.

Pricing - The Real Numbers

Both Bombora and ZoomInfo refuse to publish pricing. That tells you everything about how they sell.

What Bombora Actually Costs

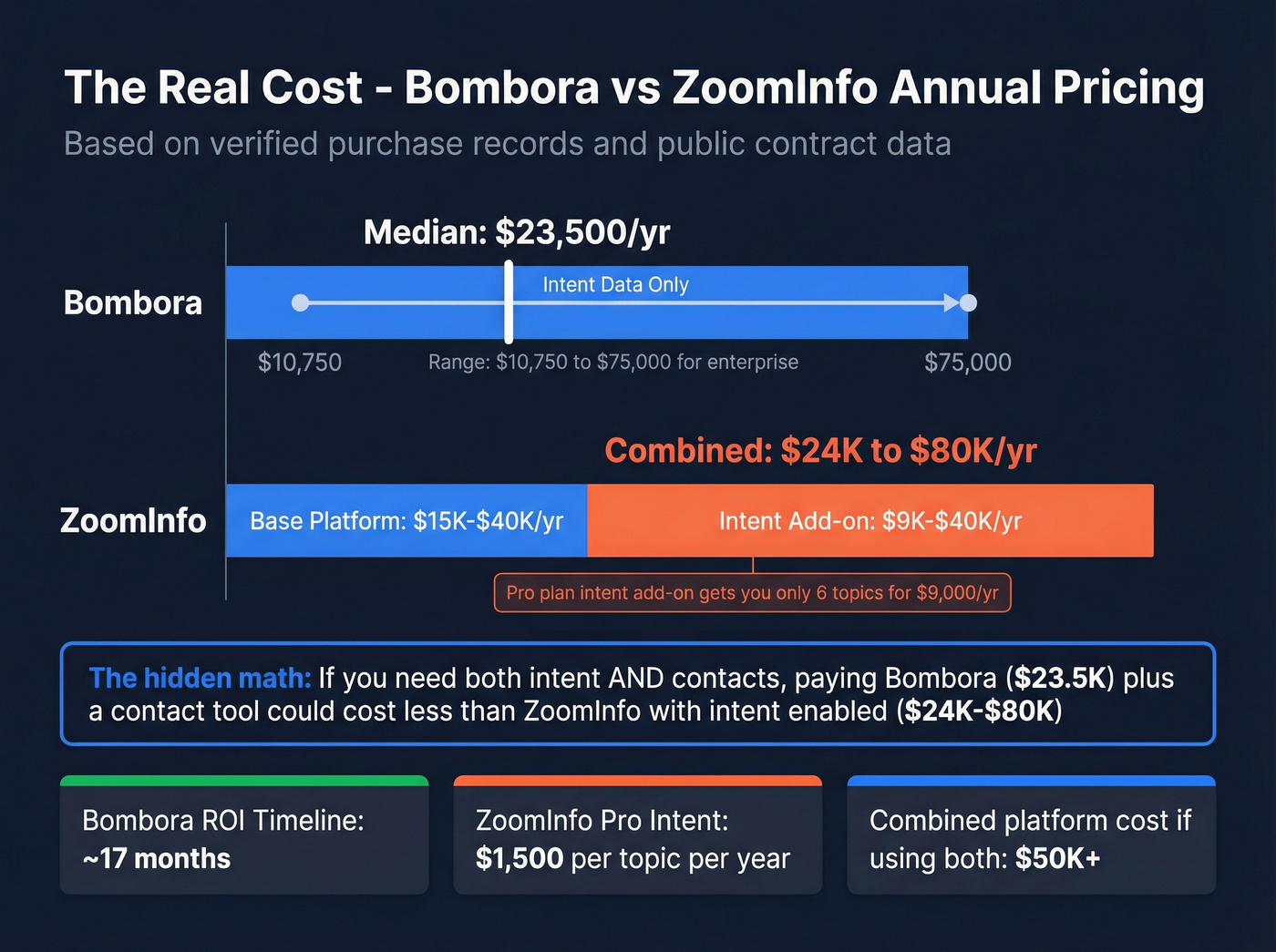

Based on 32 verified purchase records, the median Bombora contract runs $23,500/year. The range spans $10,750 on the low end to $75,000 for enterprise deployments.

Per-seat pricing starts around $2,500. What you actually pay depends on three variables: number of topics tracked, data volume, and integrations needed. Bombora recommends starting with 5-25 topics, and the more topics you add, the higher the bill climbs. Buyers save 12% on average through negotiation, so don't accept the first quote. You can use ZoomInfo's pricing as a bargaining chip and vice versa.

$23,500/year for intent data alone - with no contacts included - is a tough sell for companies under 200 employees. Bombora is primarily an enterprise add-on, not a standalone tool for SMBs.

What ZoomInfo Actually Costs (Including the Intent Add-On Trap)

ZoomInfo's base plans run:

- Professional: ~$14,995/year (3 seats)

- Advanced: ~$24,995/year

- Elite: ~$39,995/year

Additional seats cost $1,500/year on Professional, $2,500/year on Advanced and Elite.

Now add intent data:

- Professional intent add-on: $9,000/year (6 topics)

- Advanced intent add-on: $12,000-$20,000/year

- Elite intent add-on: $20,000-$40,000/year (up to 25 topics)

A realistic scenario: a 5-person team on Advanced runs ~$34,000/year for the base platform. Add the intent add-on ($12,000-$20,000) and you're at $46,000-$54,000/year. Enterprise deals regularly exceed $60,000-$100,000/year.

And here's what makes RevOps teams furious: auto-renewal with a 60-day cancellation window, 10-20% price increases at renewal, and credits that don't roll over. Miss that cancellation window by a week and you're locked in for another year at a higher rate. We've seen teams get burned by this repeatedly.

Pricing Summary: Total Cost of Intent + Contacts

| Approach | Annual cost | What you get |

|---|---|---|

| ZoomInfo all-in-one | $35K-$80K/yr | Contacts + intent (limited topics) |

| Bombora + contact tool | $23K + contact tool | Deep intent + separate contacts |

| Prospeo (Bombora-powered) | ~$0.01/email, free tier | 15K topics + 300M+ profiles |

The math is stark. ZoomInfo gives you everything in one login but charges a premium for it. Bombora gives you better intent data but you're buying contacts separately. And tools like Prospeo bundle Bombora-powered intent with verified contacts at a fraction of either price - which is why the "skip both" option keeps growing.

What Users Actually Say - Ratings and Reviews

Numbers first, then the quotes that matter.

| Platform | G2 | TrustRadius | Recommend |

|---|---|---|---|

| Bombora | 4.4/5 (155 reviews) | 8.5/10 (42 ratings) | 9.3/10 |

| ZoomInfo Sales | 4.5/5 (8,765 reviews) | 8.2/10 (740 ratings) | 8.3/10 |

On G2, ZoomInfo edges Bombora on overall rating (4.5 vs 4.4), but Bombora wins on the dimensions that matter for a specialized tool: Ease of Use (+0.3), Quality of Support (+0.5), and Product Direction (+0.6). When users rate where the product is headed, Bombora scores 9.1 vs ZoomInfo's 8.5. That's a meaningful gap.

On TrustRadius, Bombora flips the script: 8.5/10 vs ZoomInfo's 8.2/10. Bombora's Likelihood to Recommend score (9.3) crushes ZoomInfo's (8.3). And 96% of Bombora users say it's good value for price, compared to 90% for ZoomInfo.

The user quotes tell the real story:

"Bombora is still the best intent data provider but ZoomInfo is catching up very quick."

"ZoomInfo's intent data is lagging behind rivals such as Bombora."

"ZoomInfo is a one stop shop for B2B GTM data where Bombora is [intent-only]."

"ZoomInfo has a leg up on Bombora as they now have streaming intent data which updates daily, vs Bombora that only updates weekly."

This isn't a fair fight on market share - ZoomInfo has roughly 24,000 customers vs Bombora's ~280. But market share isn't the question. The question is whether ZoomInfo's intent data, specifically, is worth paying extra for when Bombora's is widely considered better. For most marketing teams, the answer is no. For sales teams that need contacts and intent in one platform, the answer is yes - if the budget allows.

When to Choose Bombora, ZoomInfo, or Neither

When Bombora Is the Right Call

Bombora does one thing and does it well. Choose it when:

- You're an enterprise marketing team running ABM and need the deepest possible intent taxonomy. 17,210+ topics that competitors can't match.

- You already have a contact data tool and need a pure intent layer on top. Buying Bombora as an add-on is cleaner than ripping out your stack to consolidate into ZoomInfo.

- You're tracking 10+ niche topics and need the granularity to distinguish between "cloud security" and "cloud security for healthcare." Bombora's BERT-based NLP handles this.

- GDPR compliance is non-negotiable. Bombora's Co-op model is consent-based by design, which makes European compliance teams significantly more comfortable (see our practical guide to GDPR for Sales and Marketing).

Budget reality: $23K+/year for intent alone, plus whatever you're spending on contacts separately.

When ZoomInfo Is the Right Call

ZoomInfo makes sense when operational simplicity matters more than intent data depth.

The strongest case for ZoomInfo is a sales-led org where SDRs need contacts and intent in one platform. Having reps toggle between Bombora and a separate contact tool creates friction - extra logins, manual account matching, broken workflows. ZoomInfo eliminates that by putting everything behind one login. The integration just works.

The second strongest case is speed. If your playbook is "call surging accounts within 24 hours," ZoomInfo's daily Streaming Intent beats Bombora's weekly cadence. And if you don't know which topics to track, Guided Intent's AI can analyze your closed-won deals and suggest the right ones - something Bombora doesn't offer.

If you're already on ZoomInfo for contacts and want to add intent without introducing another vendor, the add-on pricing is steep but the operational overhead is zero.

Budget reality: $40K-$80K/year for a meaningful deployment with intent.

Skip Both: The Stacking Approach

Here's what most comparison articles won't tell you: you don't need to buy Bombora or ZoomInfo directly.

Many platforms already embed Bombora's intent data. Apollo, Cognism, 6sense, and others pipe Bombora's signals into their own products. If you're using one of these tools, you already have access to Bombora-quality intent without a separate $23K contract.

For the enterprise ABM play, 6sense is the aggregator - it pulls intent from Bombora, G2, Gartner, TechTarget, and PeerSpot, then layers AI predictions on top. Powerful but expensive: $60K-$120K+/year. Demandbase One offers a full ABM platform with embedded intent, typically running $50K-$100K+/year for enterprise deployments. TechTarget Priority Engine consistently earns the highest intent data ratings on TrustRadius for both SMB and enterprise, with custom pricing generally in the mid-five-figures range.

If you want the playbook for using signals without buying a six-figure ABM suite, start with intent data for SDRs and build from there.

Bombora tells you which accounts are surging. ZoomInfo charges $9K extra for 6 intent topics. Prospeo gives you 15,000 Bombora-powered intent topics, 98% email accuracy, and 30% mobile pickup rates - at 90% less than ZoomInfo.

Start with 100 free credits. No contract, no sales call required.

FAQ

Does Bombora provide contact information?

No. Bombora provides company-level intent signals only - it identifies which organizations are researching specific topics, not which individuals to contact. You'll need a separate tool like Prospeo, Apollo, or ZoomInfo to find verified emails and phone numbers at those surging accounts.

Is ZoomInfo's intent data included in the base price?

No. ZoomInfo's intent data is a paid add-on costing $9,000-$40,000/year depending on your plan tier. The Professional plan limits you to just 6 intent topics. Elite plans allow up to 25 topics. This is the single most common pricing surprise for new ZoomInfo buyers.

How many intent topics does Bombora track vs ZoomInfo?

Bombora offers 17,210+ intent topics with new topics added quarterly. ZoomInfo offers an estimated 4,000-5,000 topics but limits active monitoring based on plan tier - as few as 6 on Professional. Bombora's taxonomy advantage is roughly 3-4x.

Can I get Bombora intent data without a direct Bombora contract?

Are Bombora and ZoomInfo still partners?

No. Their revenue-sharing agreement ended in early 2020, leading to a lawsuit settled in June 2022. The settlement explicitly stated it "does not encompass resumption of the business partnership." They're direct competitors now, with ZoomInfo running its own proprietary intent data stack.