The Best Email Lead Scraping Tools in 2026: Accuracy Data, Real Pricing, and Honest Reviews

Every email lead scraping tool claims 95%+ accuracy on their marketing page. Then you load 5,000 contacts into your sequencer and watch 30% bounce on the first send. Your domain reputation tanks, your ESP flags you, and you're back on Google looking for something better.

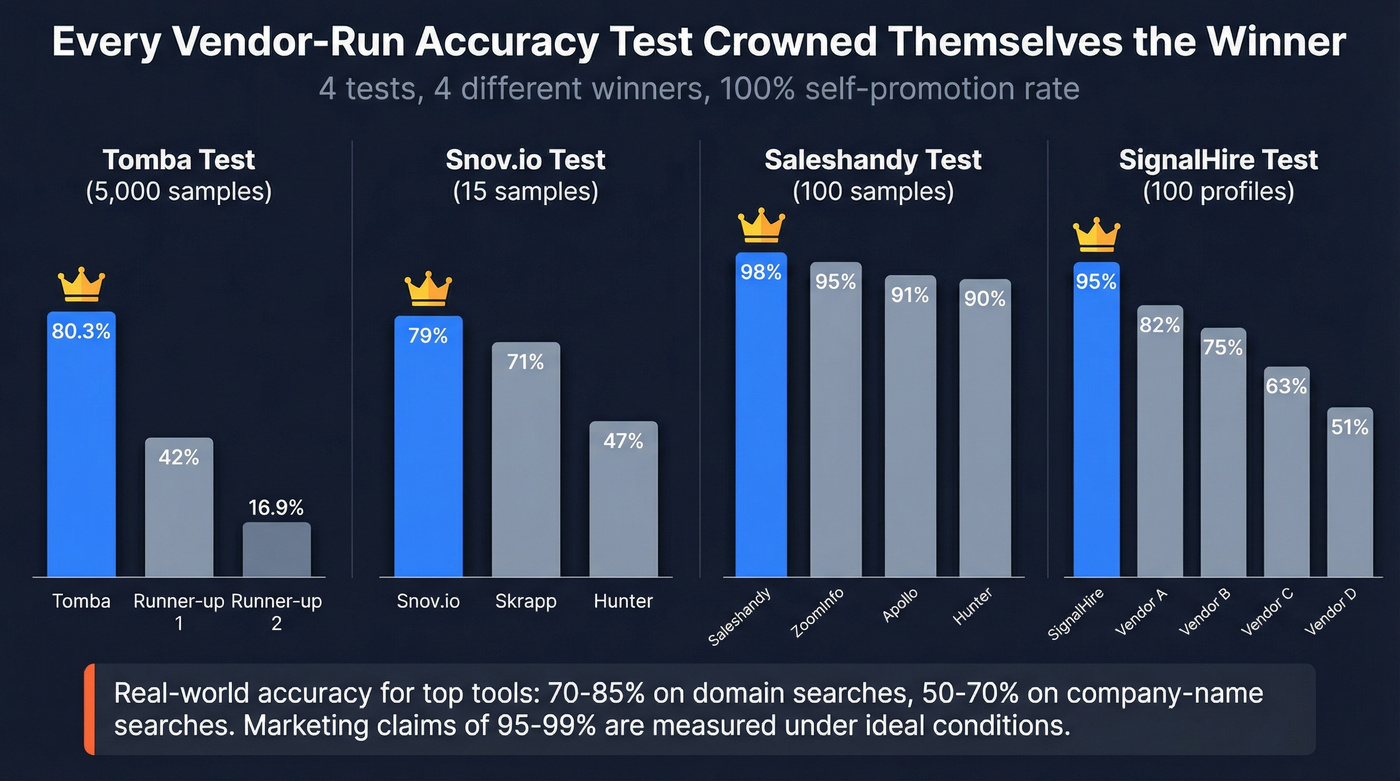

Inside sales reps cover 4x the prospects at half the cost of field sales - but only if the emails they're sending actually land. We've tracked four notable accuracy tests published recently, and every single one was run by a vendor that crowned themselves the winner. That tells you everything about the state of this market.

The tools below are ranked by what actually matters: verified accuracy in real-world conditions, cost per usable lead, and whether the tool fits your workflow or just adds another tab to your browser. We also dug into practitioner data from teams sending 400K+ cold emails per year - the kind of people who've burned through every tool on this list and know which ones actually perform.

Our Picks (TL;DR)

| Tool | Best For | Starting Price |

|---|---|---|

| Prospeo | Email accuracy & freshness | Free / ~$0.01/email |

| Apollo.io | All-in-one prospecting | Free / $49/user/mo |

| Hunter.io | Domain-based email search | Free / $34/mo |

Situational picks:

| Tool | Best For | Starting Price |

|---|---|---|

| ZoomInfo | Enterprise ABM + intent | ~$15K+/yr (custom) |

| Skrapp.io | Pay only for valid emails | Free / $30/mo |

Prospeo leads on raw email accuracy - 98% verified with a 7-day data refresh cycle that's roughly 6x faster than the industry average. Apollo wins on breadth: 275M+ contacts, built-in sequences, and a free tier that's actually usable. Hunter is the simplest domain search tool and the one most people already know. ZoomInfo makes sense if you're running enterprise ABM with intent data and have the budget. Skrapp's fair-credit policy means you don't pay for invalid results - a model more tools should copy.

The Accuracy Reality Check - What Independent Tests Actually Show

Before picking a tool, you need to understand what "accuracy" actually means in this space. It doesn't mean what vendors want you to think.

Four notable tests have been published recently. All four were run by vendors. All four showed the vendor's own tool winning. That's a 100% self-promotion rate.

Snov.io's 15-prospect test showed a completely different picture on verified emails: Snov.io 79% verified, Skrapp 71%, GetProspect 50%, Hunter 47%. On a 15-prospect sample, the margin of error is enormous - but the "risky email" breakdown is still useful for protecting sender reputation.

Saleshandy's 100-contact test produced the highest numbers across the board: Saleshandy 98%, ZoomInfo 95%, GetProspect 95%, UpLead 95%, Apollo 91%, Hunter 90%. These numbers are higher because they tested against a list of 100 verified business contacts - a much easier task than blind prospecting.

SignalHire's 17-tool test found accuracy ranging from 51% to 95% across platforms.

| Test Publisher | Sample Size | Winner | Range |

|---|---|---|---|

| Tomba | 5,000 | Tomba (80.3%) | 16.9-80.3% |

| Snov.io | 15 | Snov.io (79%) | 24-79% |

| Saleshandy | 100 | Saleshandy (98%) | 90-98% |

| SignalHire | 100 profiles | Varies | 51-95% |

The honest takeaway: top-tier tools typically land around 70-85% on domain searches and 50-70% on company-name searches in real-world prospecting. Marketing pages claiming 95-99% are measuring under ideal conditions - known contacts, clean domains, US-heavy datasets.

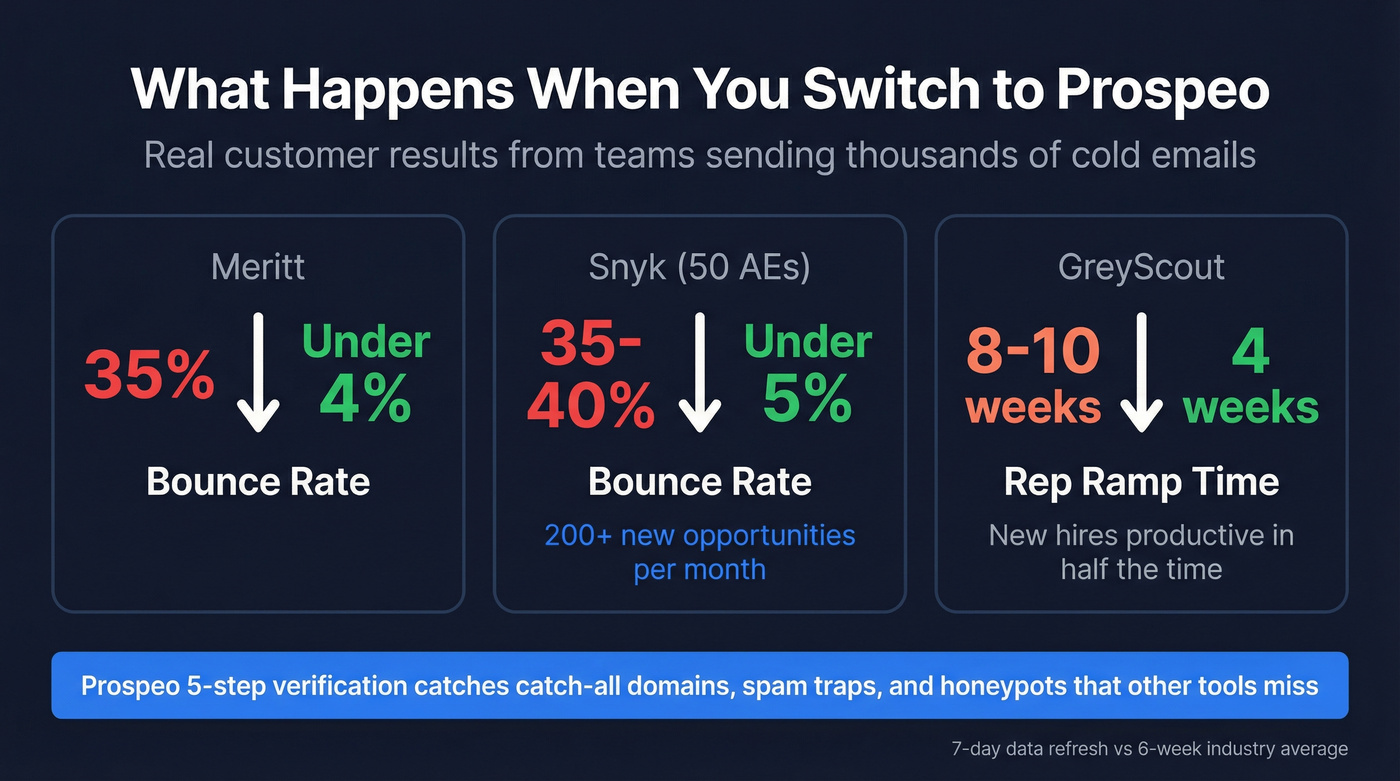

You just read the accuracy data. Most email scraping tools land 70-85% in real-world conditions. Prospeo hits 98% verified - backed by a 5-step process that catches spam traps, honeypots, and catch-all domains. Meritt dropped bounces from 35% to under 4%. Snyk's 50 AEs went from 40% bounces to under 5%.

Stop paying for emails that bounce. Start with 75 free verified emails.

The 12 Best Lead Scraping and Email Finder Tools

| Tool | Database | Free Tier | Paid From | Differentiator |

|---|---|---|---|---|

| Apollo.io | 275M+ contacts | 10,000 email credits/mo | $49/user/mo | All-in-one + sequences |

| Hunter.io | - | 50 credits/mo | $34/mo | Domain search simplicity |

| Snov.io | Large (undisclosed) | 50 credits | $39/mo ($29.25 annual) | Outreach + CRM built in |

| ZoomInfo | 235M+ contacts | 25 leads/mo | ~$15K+/yr | Intent data + ABM |

| Skrapp.io | 200M+ profiles | 100 credits/mo | $30/mo | Fair credit policy |

| Tool | Database | Free Tier | Paid From | Differentiator |

|---|---|---|---|---|

| Lusha | 280M+ contacts | 40 credits/mo | ~$22-36/user/mo | Quick enrichment |

| GetProspect | Undisclosed | 50 credits/mo | $49/mo | Rollover credits |

| UpLead | 160M+ contacts | 5 credits | $74/mo | Accuracy guarantee |

| ContactOut | 300M professionals | Limited | ~$49/mo | Personal emails + recruiting |

| AeroLeads | Undisclosed | Limited | ~$39/mo | Simple prospecting |

| Outscraper | N/A (scraping) | First 500 leads free | Pay-per-result | Google Maps data |

Prospeo

Prospeo's entire value proposition is that the emails you export actually work. 300M+ professional profiles, 143M+ verified emails, 125M+ verified mobile numbers - all refreshed on a 7-day cycle. The industry average refresh is six weeks. That gap is the difference between emailing someone at their current job and emailing a dead inbox they abandoned two months ago.

The 5-step verification process catches what other tools miss: catch-all domains, spam traps, honeypots. Meritt switched and saw bounce rates drop from 35% to under 4%. Snyk's 50-person AE team went from 35-40% bounces to under 5%, generating 200+ new opportunities per month. GreyScout cut rep ramp time from 8-10 weeks to 4 weeks after switching - new hires were productive in half the time because they weren't wasting cycles on dead leads.

Pair that with 30+ search filters (buyer intent via Bombora, technographics, job changes, funding signals) and you've got a tool that finds the right people and gives you emails that actually land. Free tier gives you 75 emails and 100 Chrome extension credits per month. Paid plans run about $0.01 per email - roughly 90% cheaper per lead than ZoomInfo. No annual contracts, no sales calls required.

Apollo.io

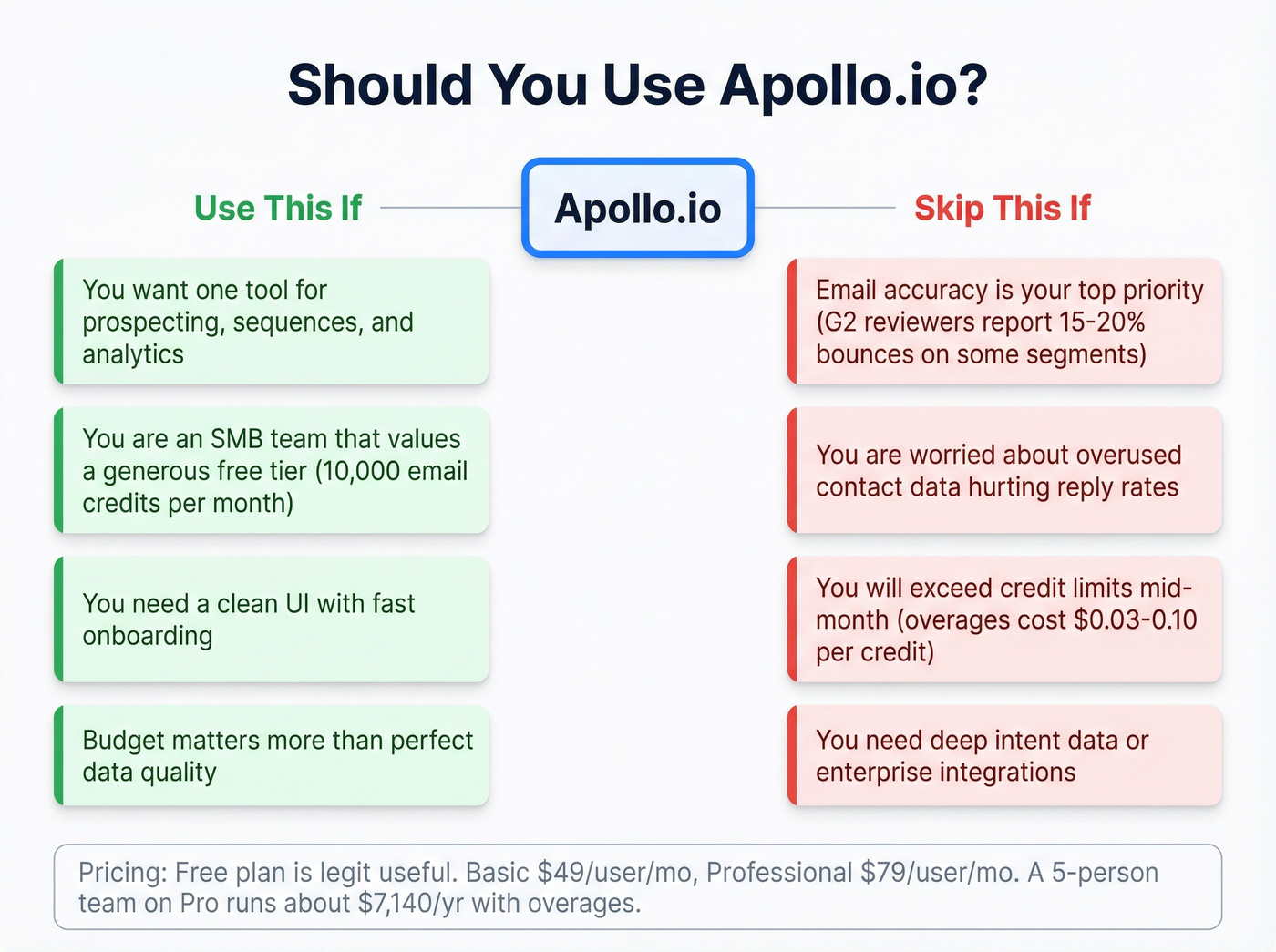

Use this if you want one tool for prospecting, sequencing, and basic analytics. Apollo's 275M+ contact database paired with built-in email sequences, a dialer, and an unusually generous free tier (10,000 email credits/month) makes it the obvious starting point for most SMB teams. The UI is clean, onboarding takes minutes, and you can go from search to sent sequence without leaving the platform.

Skip this if data accuracy is your top priority. G2 reviewers often mention email bounce rates hitting 15-20% on certain segments. A common complaint on Reddit: Apollo data is "overused" - everyone's hitting the same contacts with recycled leads, which tanks reply rates. I've seen teams get excited about the volume, then frustrated when a quarter of their sequences bounce.

Pricing: Free plan is legitimately useful. Basic starts at $49/user/month (annual), Professional at $79/user/month. A 5-person SDR team on Professional runs about $7,140/year with typical credit overages. Those overages cost $0.03-0.10 per additional credit - and SDRs burning through export credits mid-month is a real pattern.

Hunter.io

Hunter built its reputation on one thing: type in a domain, get every email pattern associated with it. Six million users didn't choose Hunter because it's the most feature-rich tool - they chose it because it does domain search cleanly and reliably.

The unified credit system is straightforward: 1 credit per email found, 0.5 credits per verification. Free tier gives you 50 credits/month. Starter runs $34/month (annual) for 2,000 credits, Growth hits $104/month (annual) for 10,000. All plans include unlimited team members - a nice touch that Apollo and Lusha don't match.

Where Hunter falls short: vendor benchmarks rank it around 35-47% accuracy for raw email finding depending on methodology. The domain search approach works well for known companies but struggles with smaller firms that don't have established email patterns. And unlike Skrapp, Hunter charges you whether the email is valid or not.

Snov.io

Snov.io is the Swiss Army knife of this category - email finder, email verifier, outreach sequences, CRM, and mailbox warm-up all bundled into one platform.

Pros:

- All-in-one platform eliminates tool sprawl. Find emails, verify them, send sequences, and manage deals without leaving Snov.io.

- LinkedIn automation add-on ($69/month per slot) for multi-channel outreach.

- Unused credits roll over with plan autorenewal on premium plans.

- Starter pricing at $39/month ($29.25/month annual) for 1,000 credits is competitive.

- Built-in mailbox warm-up saves you from paying for a separate tool.

Cons:

- Domain search accuracy tested at 39.5% in one benchmark - decent. But company-name search was nearly a total miss (19 valid emails out of 2,500). If your workflow depends on company name lookups, Snov.io isn't the tool.

- Credit system uses 1 credit per action (search, find, verify), which means a single contact can cost 2-3 credits by the time you've found and verified them.

- The CRM is basic compared to dedicated tools. Fine for small teams, frustrating for anyone with a real sales process.

Snov.io is the anti-ZoomInfo - self-serve, transparent pricing, and built for teams of 1-10 who want everything in one place.

ZoomInfo

One pattern I see repeatedly: teams buy ZoomInfo for the database, then realize they're paying for intent data, chat, workflow automation, and a dozen other modules they never turn on. A 10-seat contract with intent data and mobile numbers can run $40-60K/year. That's real money for a Series A company.

But here's why enterprise teams keep renewing: ZoomInfo's 235M+ contact database is still the deepest for US-based B2B prospecting. The intent data is useful enough to justify the cost for ABM - knowing which accounts are actively researching your category changes how you prioritize outreach. The integrations with Marketo, Outreach, Salesforce, and other major enterprise tools are mature and well-maintained.

Skip this if you're under 50 employees, selling outside the US primarily, or running a lean outbound motion. The minimum contract is typically $15K/year, and you'll need a demo to get a real quote. The fact that ZoomInfo still doesn't publish pricing in 2026 is a tax on buyers' time.

Skrapp.io

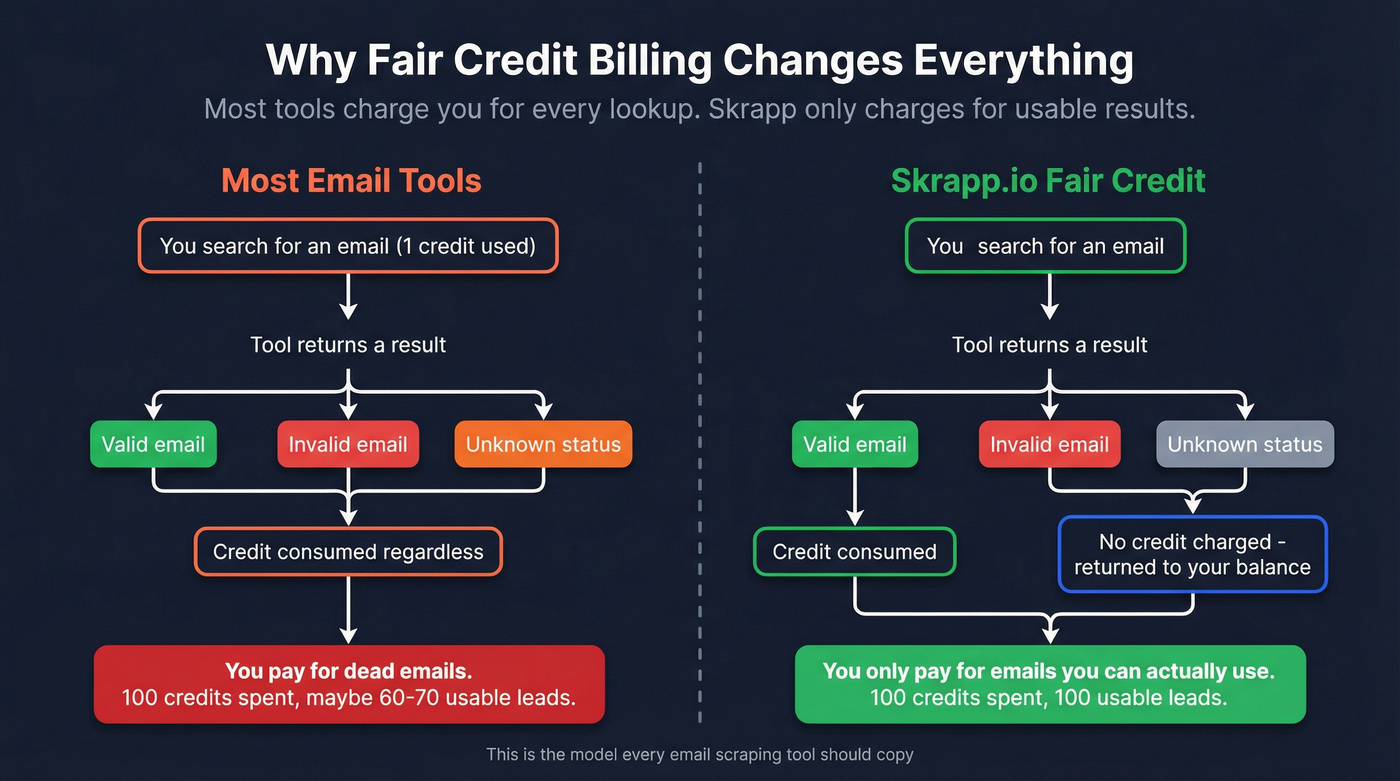

Skrapp's fair-credit policy is the feature every other tool should copy: you don't get charged for invalid or unknown emails. Only "Valid" and "Catch-all" results consume credits.

That alone makes it worth considering if you're tired of burning credits on dead addresses.

The database covers 200M+ profiles. Free tier gives you 100 credits/month with rollover - yes, even free credits roll over. Paid plans start at $30/month (annual) for 1,000 credits. In one vendor-run benchmark, Skrapp hit 42.8% overall (40% on domain searches). That's middle-of-the-pack, but the fair-credit model means you're only paying for what works.

Best for teams who want predictable costs and hate credit waste. Skip it if you need outreach features built in - Skrapp is a pure finder/verifier.

Lusha

Lusha is the tool you install when you're already looking at a prospect and need their contact info right now. The Chrome extension is fast, the enrichment is solid, and the 280M+ contact database is competitive.

Free tier gives you 40 credits/month. Paid plans commonly land around $22-36/user/month on annual billing depending on the plan. The per-seat pricing adds up quickly - a 5-person team can easily run a few thousand dollars per year before you hit any limits.

The limitation: Lusha isn't built for large-scale list building. It's an enrichment tool, not a prospecting platform. If you already have a list of target accounts and need to fill in emails and phone numbers, Lusha is fast and reliable. If you need to build that list from scratch, look elsewhere.

GetProspect

GetProspect is the budget pick that doesn't feel budget. Free tier gives you 50 credits/month, and the Starter plan at $49/month for 2,000 credits is reasonable. The standout feature: credits roll over month to month, so you're not losing unused credits at the end of each billing cycle.

Accuracy results vary by test methodology - one benchmark put it at 95%, another at 61.9%. The real-world range is likely 65-80%. Good enough for teams on a tight budget who verify separately.

UpLead

UpLead markets a 95% data accuracy guarantee - if an email bounces, you get the credit back. The database covers 160M+ contacts.

The catch: pricing starts at $74/month, jumping to $149/month for the Plus plan. That's expensive per-credit compared to Apollo or Snov.io. And the free trial is only 5 credits, which doesn't let you evaluate much.

ContactOut

Niche tool focused on recruiting and personal email addresses. If you're a recruiter who needs personal Gmail/Yahoo addresses alongside work emails, ContactOut fills that gap. Pricing starts around $49/month. Not built for sales prospecting at scale.

AeroLeads

Basic prospecting tool for small teams. One benchmark scored it at 67%, which is respectable. Pricing starts around $39/month. The interface feels dated compared to Apollo or Snov.io, and the feature set is thin. Fine for solopreneurs, outgrown quickly by growing teams.

Outscraper

Completely different animal.

Outscraper lets you scrape business directories and pull local business data from Google Maps at scale. Free tier covers the first 500 leads. Paid tiers start around $6 per 1,000 records (and can drop to around $2 per 1,000 at high volume). If you're selling to local businesses - restaurants, dentists, contractors - this is the tool. For B2B SaaS prospecting, look elsewhere.

Notable Mentions

Cognism - The go-to for EU/UK verified mobile numbers. If you're prospecting European markets and need direct dials, Cognism is the specialist. Starts around $15,000/year, priced for mid-market and up.

People Data Labs (PDL) - API-first data provider built for technical teams building custom enrichment workflows. If you have engineers who'd rather write code than click through a UI, PDL is the right fit. Pricing starts around $0.01-0.04 per API call depending on volume.

Clay - The workflow orchestration layer that's gaining serious traction. Clay doesn't have its own database - it connects to 50+ data providers and lets you build enrichment sequences visually. Starts around $134-149/month depending on billing. Best for RevOps teams who want maximum flexibility.

Breeze Intelligence (Clearbit/HubSpot) - If your entire GTM stack runs on HubSpot, Breeze Intelligence enriches contacts natively without leaving the CRM. Starts around $0.30-0.60 per enrichment credit.

You're comparing email lead scraping tools because your current one is burning your domain. At $0.01 per email with 143M+ verified addresses refreshed every 7 days, Prospeo costs 90% less than ZoomInfo and refreshes data 6x faster than the industry average. No contracts, no sales calls.

Get emails that actually land - test it on your next campaign.

Email Lead Scraping Tool Pricing Compared

Raw pricing doesn't tell you what you're actually paying per usable lead. A tool that charges $0.03 per credit but delivers 60% accuracy costs more per verified email than one charging $0.05 with 90% accuracy. Here's the math:

| Tool | Free Tier | Starting Paid | Mid-Tier | Credits/mo |

|---|---|---|---|---|

| Prospeo | 75 emails/mo | ~$0.01/email | Scales with volume | Flexible |

| Apollo.io | 10,000 email credits/mo | $49/user/mo | $79/user/mo | Unlimited email credits (paid) |

| Hunter.io | 50 credits/mo | $34/mo | $104/mo | 2K-10K |

| Snov.io | 50 credits | $39/mo ($29.25 annual) | $74.25/mo | 1K-5K |

| ZoomInfo | 25 leads/mo | ~$15K/yr | ~$25-40K/yr | Custom |

| Skrapp.io | 100 credits/mo | $30/mo | $119/mo | 1K-5K |

| Lusha | 40 credits/mo | ~$22-36/user/mo | $79/user/mo | Per-seat |

| GetProspect | 50 credits/mo | $49/mo | $99/mo | 2K-5K |

| UpLead | 5 credits | $74/mo | $149/mo | Limited |

Now here's the number that actually matters - cost per verified, deliverable lead:

| Tool | Est. Accuracy | Cost/Credit | Cost/Verified Lead | Winner? |

|---|---|---|---|---|

| Prospeo | 98% | ~$0.01 | ~$0.01 | Best value |

| Apollo.io | 80-85% | ~$0.03-0.05 | ~$0.04-0.06 | Best free tier |

| Hunter.io | 70-80% | ~$0.02 | ~$0.02-0.03 | Simplest UX |

| Snov.io | 75-80% | ~$0.03 | ~$0.03-0.04 | Best all-in-one |

| Skrapp.io | 70-75% | ~$0.03 | ~$0.03-0.04 | Fairest credit model |

| UpLead | 85-90% | ~$0.15 | ~$0.17 | Best bounce guarantee |

| ZoomInfo | 85-90% | ~$0.50-1.00 | ~$0.55-1.10 | Best intent data |

The DIY scraping comparison is worth a look too: practitioners report $0.01-0.10 per record for DIY database lead scraping (using tools like PhantomBuster, Apify, or custom Python scripts) versus $0.10-1.00+ per contact for pre-built purchased lists. Those purchased lists also decay 25-30% annually, so you're paying premium prices for data that's already going stale.

The cheapest tool isn't always the best value. But when one tool delivers 98% accuracy at $0.01 per email and another delivers 85-90% at $0.50-1.00+, the math isn't complicated. You're paying 50-100x more per verified lead for a tool that bounces more often.

Advanced Strategy - Waterfall Enrichment and High-Intent Signals

If you're relying on a single email finding tool, you're leaving 15-40% of your addressable market on the table. No single database covers everyone.

The Waterfall Approach

Waterfall enrichment is the fix. Run your prospect list through Provider A. Whatever doesn't match, run through Provider B. Then Provider C. Each provider's database has different coverage gaps, so stacking them fills holes that any single tool misses.

Without waterfall enrichment, roughly 60% of leads come back with usable contact info. With a proper waterfall stack, that jumps to 85%+. Guideflow reported a 37% increase in sales pipeline after implementing this approach.

Here's a practical waterfall workflow:

- Start with your primary finder. Apollo or Hunter for initial email discovery - they're fast and have broad coverage.

- Run misses through a second source. Snov.io, GetProspect, or Lusha catch contacts the first tool missed.

- Verify everything through a dedicated verification layer. Even if you use Apollo or Hunter as your primary finder, running results through a 5-step verification process catches the 15-20% of "verified" emails that would actually bounce. (If you need options, see email verifier websites.)

- Use Clay for edge cases. When traditional waterfall tools return nothing, Clay's Claygent agent searches the web like a human would - checking company pages, press releases, and directories. It's slower and more expensive, but it finds contacts that database tools can't.

Competitor Website Scraping for Leads: The Tactic Nobody Talks About

One Reddit practitioner running 464K cold emails per year shared a telling stat: scraping competitor followers and running them through a non-default data source produced a 2.1% reply rate versus 0.7% from Apollo alone. That's 3x the replies just by using data sources your competitors aren't.

The playbook: scrape followers from 12+ competitor pages, filter for ICP fit, and run them through your enrichment stack. This practitioner pulled 330K leads, qualified 150K, and built a pipeline that outperformed every other channel. The key insight is that competitor followers have already self-selected as interested in your category - they're warmer than any cold list you'll buy.

Job Postings, Events, and Review Platforms as Intent Signals

Here's a tactic no other tool roundup will give you: scrape job postings as buying signals. A company hiring SDRs or growth marketers has confirmed growth intent. They're scaling outbound, which means they need data tools, sequencing tools, and everything in between. Job boards are public data, and tools like PhantomBuster or custom scrapers can extract them at scale.

You can also scrape event attendee lists from conferences and webinars in your industry - attendees at niche events have already signaled interest in the topic, making them far warmer than a generic cold list.

Review platform scraping (G2, Capterra) produces insane conversion rates. Companies actively reviewing competitors in your category are in-market right now. Scrape reviewer profiles, enrich with emails, and you're reaching buyers at the exact moment they're evaluating solutions. One practitioner called this the highest-converting lead source they'd ever tested.

Mistakes That Kill Your Deliverability

You can pick the perfect tool and still destroy your sender reputation. Here are the mistakes I see teams make repeatedly:

1. Skipping verification entirely. Without verification, scraped lists can have 30-40% bounce rates. Your ESP will throttle or ban you after one bad send. Always verify before sending - even if the tool says the emails are "verified." (Use a repeatable email verification list SOP.)

2. Emailing role-based addresses. Addresses like info@, sales@, support@ rarely reach decision-makers. They trigger spam complaints at higher rates than personal addresses. Filter them out before they enter your sequences.

3. Treating scraped data as evergreen. People change jobs. Domains expire. Bought lists decay 25-30% annually. If you scraped a list three months ago and haven't re-verified it, expect a meaningful chunk to bounce. Re-verify monthly at minimum.

4. Not validating MX records and SMTP responses. A syntactically correct email doesn't mean the mailbox exists. Tools that skip MX record lookups and SMTP handshake verification will pass through dead domains and non-existent mailboxes. Make sure your verification layer checks both. (Related: verify an email address.)

5. Missing disposable and temporary domains. Prospects using Guerrilla Mail, Mailinator, or other disposable email services will never see your outreach. These addresses self-destruct within hours. Filter them out before they inflate your "valid" count.

6. Not deduplicating. Scraping multiple sources without deduplication means you're emailing the same person from different sequences. That's a fast track to spam complaints and blocklists.

7. Ignoring GDPR. GDPR treats any email linked to a specific person as personal data. Sending without a legitimate basis (like legitimate interest for B2B) can violate GDPR. This applies to any EU/UK contacts, regardless of where your company is based. (See GDPR for Sales and Marketing.)

8. Using scraped lists on ESPs that ban them. Most email service providers and CRMs explicitly prohibit scraped or purchased lists in their terms of service. Accounts get suspended. Use dedicated cold email tools (Instantly, Smartlead, Lemlist) that are built for outbound. (If you’re choosing a sender, compare cold email outreach tools.)

Which Email Lead Scraping Tool Is Right for You?

Here's the decision framework I'd use:

Enterprise ABM with intent data --> ZoomInfo. Nothing else matches its combination of US database depth, intent signals, and enterprise integrations. Just make sure you'll actually use the modules you're paying for.

Outbound + simple workflow --> Apollo.io. The free tier alone covers most early-stage teams. Built-in sequences mean one fewer tool to manage. Accept the 80-85% accuracy and verify separately.

Email accuracy above everything --> Prospeo. If your domain reputation has been damaged by bad data, or you're an agency managing client domains where bounces are unacceptable, 98% accuracy and a 7-day refresh cycle are the answer. Stack Optimize built to $1M ARR using it with deliverability consistently above 94%.

EU/UK mobile numbers --> Cognism. Verified phone numbers for European markets are Cognism's specialty. Starts around $15,000/year.

Quick enrichment on existing leads --> Lusha. Fast Chrome extension, solid data, per-seat pricing. Not for list building, but great for filling gaps.

API-first / technical teams --> People Data Labs. If your engineers want to build custom enrichment pipelines, PDL's API is the cleanest option in the market.

HubSpot-native teams --> Breeze Intelligence. Enrichment that lives inside your CRM without another integration to manage.

Bootstrapped and scrappy --> Combine a free-tier finder (Apollo's 10,000 email credits/month) with a free-tier verification layer. That combination gives you broad discovery and verified accuracy at zero cost.

Here's the hot take most articles won't give you: if your average deal size is under $10K, you probably don't need ZoomInfo-level data. A $15K+/year data contract eating into deals worth $8K each doesn't make financial sense. Two tools at $50-100/month total will cover 90% of what you need. Teams that stack five or six data tools end up with duplicate contacts, conflicting data, and a RevOps nightmare. Pick a finder, pick a verifier, and move on. The marginal return on tool #4 is almost always negative.

FAQ

What's the difference between email scraping, email finding, and email enrichment?

Email scraping crawls web pages to extract addresses from HTML. Email finding uses pattern recognition and database matching to predict work emails from a name and company. Enrichment adds data points (phone, title, company info) to contacts you already have. Most modern tools blend all three, and many now include built-in verification to bridge raw extraction and deliverable contacts.

How accurate are email lead scraping tools in real-world prospecting?

Top-tier tools typically land 70-85% accuracy on domain searches and 50-70% on company-name searches, despite marketing claims of 95-99%. Always run a separate verification pass before sending regardless of the tool - it's the single highest-ROI step in any outbound workflow.

Is scraping emails for lead generation legal?

GDPR treats any email linked to a person as personal data, requiring legitimate basis for processing. CAN-SPAM regulates commercial email but doesn't prohibit scraping itself. Most ESPs ban scraped lists in their terms of service - use dedicated cold email platforms like Instantly, Smartlead, or Lemlist for outbound sends.

How many lead scraping tools do I actually need?

Two to three maximum: one finder (Apollo, Hunter, or Snov.io), one verification layer, and optionally one enrichment tool. A waterfall approach - running misses through sequential providers - pushes coverage from 60% to 85%+. More than three tools creates diminishing returns and data management headaches.