How to Get Leads for Small Business in 2026 (That Actually Convert)

Finding leads isn't the hard part anymore. The hard part is getting leads that answer, show up, and buy - without you living on your phone 14 hours a day. In 2026, the small businesses that win aren't the ones "doing more marketing." They're the ones running a tighter system for leads for small business.

Here's the thing: most "bad leads" are just slow follow-up.

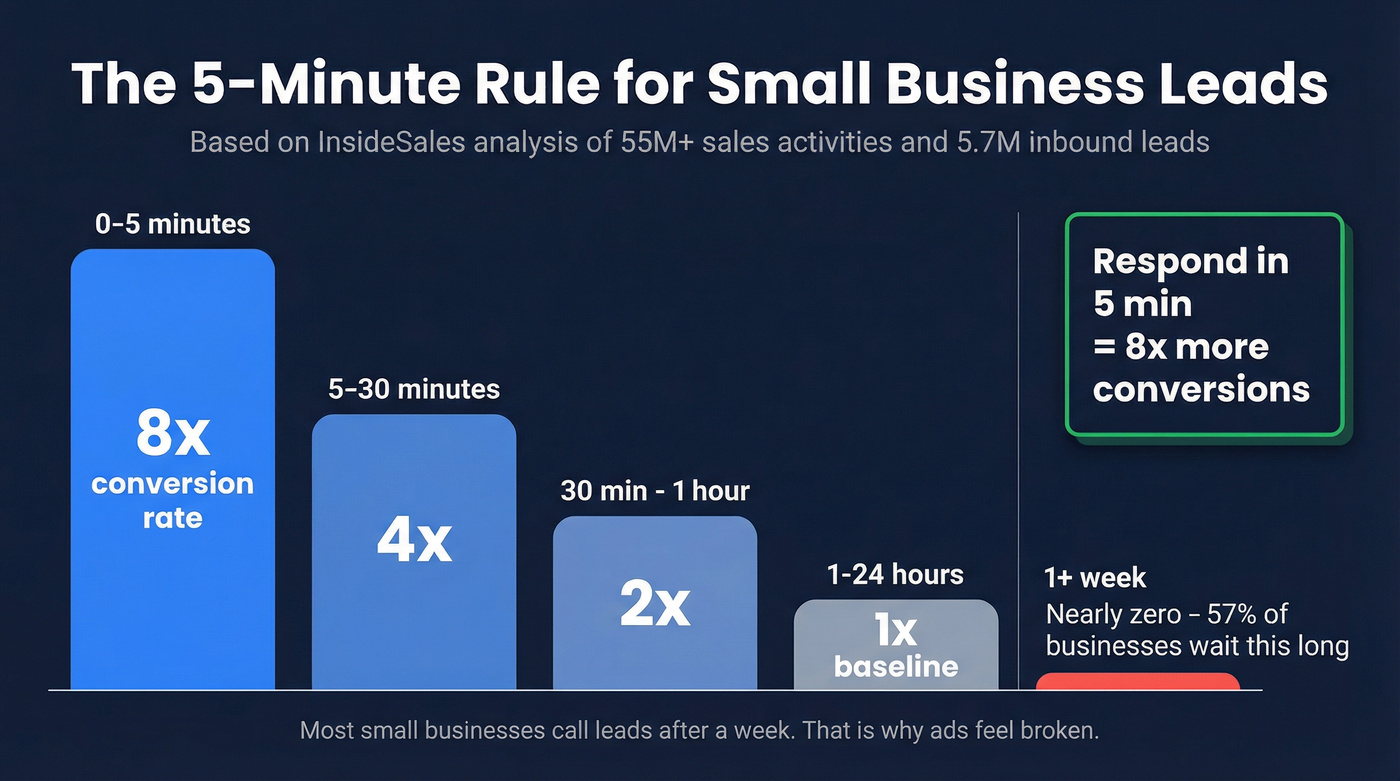

InsideSales found conversion is 8x higher when you respond in the first 5 minutes. Almost nobody does. If you fix nothing else this month, fix that.

What you need (quick version)

- Set a 5-minute response SLA (call + text/email)

- Pick 2 channels for 90 days (local/paid/outbound/partners)

- Track source -> stage -> next step weekly (spreadsheet -> CRM)

What counts as a lead (and a qualified lead) for SMBs

A lead is just a person or business that raised their hand (form fill, call, DM, quote request) or fits your target and is reachable (you found them via outreach). That's it.

A qualified lead is different: it's a lead that has a realistic path to becoming revenue. For small businesses, qualification isn't about fancy scoring models. It's about not wasting Tuesday afternoon on someone who was never going to buy.

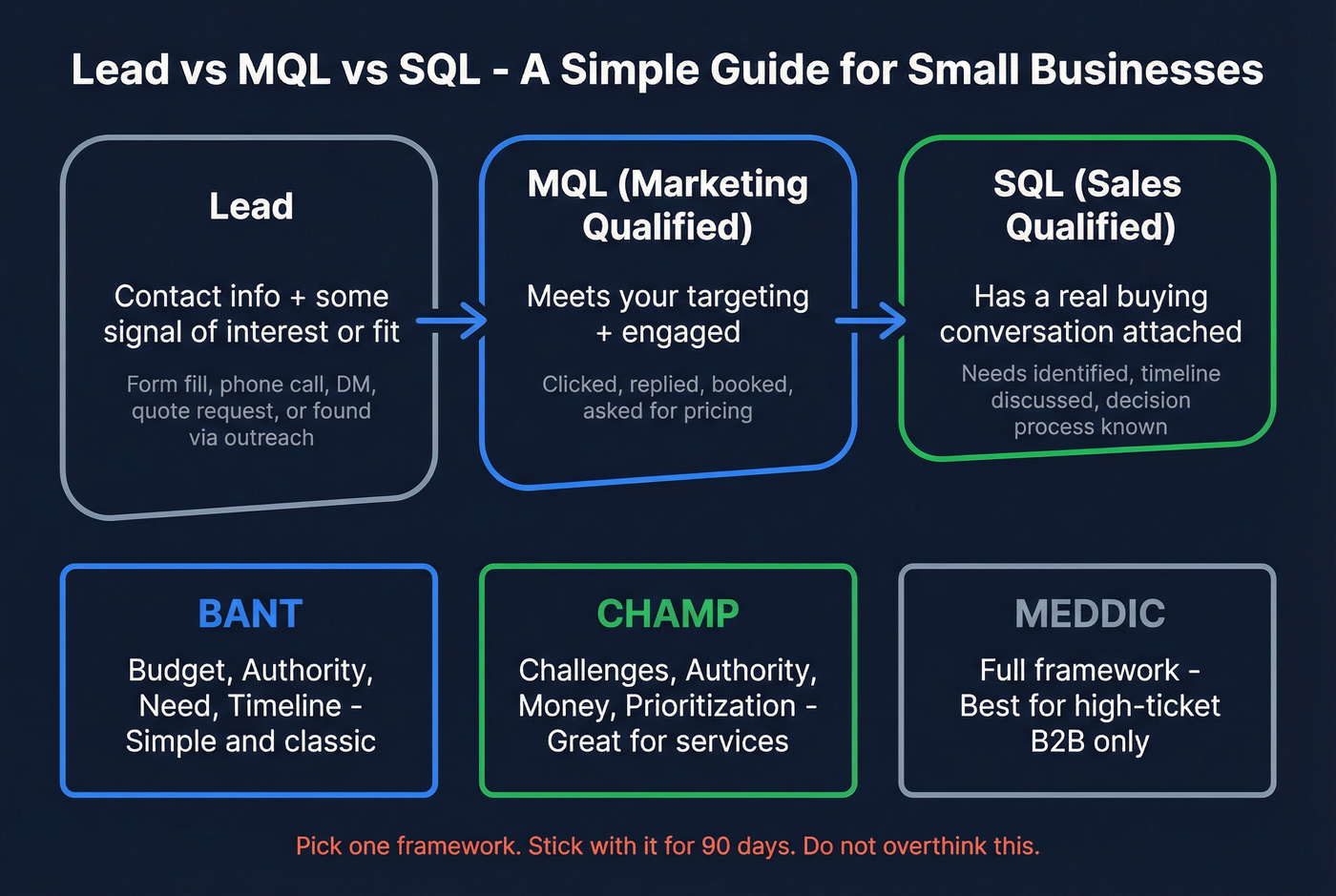

Here's a simple way to think about it:

- Lead: contact info + some signal of interest or fit

- MQL (marketing-qualified lead): meets your basic targeting + engaged (clicked, replied, booked, asked for pricing)

- SQL (sales-qualified lead): has a real buying conversation attached (needs, timeline, decision process)

Pick one qualification lens and stick to it for 90 days:

- BANT: Budget, Authority, Need, Timeline (simple, classic)

- CHAMP: Challenges, Authority, Money, Prioritization (better for consultative services)

- MEDDIC: Metrics, Economic buyer, Decision criteria, Decision process, Identify pain, Champion (great for higher-ticket B2B; too much for many SMBs)

Mini checklist (SMB-friendly):

- Do they fit your ICP (industry, location, size)?

- Can you reach them (phone/email)?

- Do they have a problem you solve?

- Is there a next step you can ask for (call, visit, quote, demo)?

The 5-minute rule: the fastest way to get leads to convert

Most small businesses try to "get more leads" when they really need to handle the leads they've already got. If you're wondering how to increase your sales leads without adding more spend, start here.

InsideSales analyzed 55M+ sales activities and 5.7M inbound leads across 400+ companies. The punchline's simple: respond in the first five minutes and conversion is 8x higher. Wait longer and it falls off a cliff. They also found 57.1% of first call attempts happen after more than a week--which is wild, and also explains why so many owners swear "ads don't work."

Real talk: if you're paying for leads and calling them tomorrow, you're donating money to competitors.

Use this if:

- You get inbound calls/forms/messages and you're not replying instantly

- You're paying for ads and "the leads suck"

- You've got a small team and need a repeatable process

Skip this if:

- You truly can't respond quickly (fix staffing/coverage first)

- Your sales cycle starts with a scheduled consult only (still respond fast, but optimize for booking)

SLA checklist (what "5 minutes" means):

- 0-5 minutes: call + text (or email) immediately

- 5-30 minutes: second call attempt + short "can I help?" message

- 30 minutes-24 hours: 3-touch sequence (call + text/email + voicemail)

- Day 2-7: 5-7 total touches across 2 channels

- After day 7: move to nurture (monthly value touch)

A simple cadence you can copy/paste (0-5-30-24):

- 0 min: call -> if no answer, text: "Saw your request - want a quick quote or a quick call?"

- 5 min: email with 2 options (book link + "reply with your address/requirements")

- 30 min: call again + voicemail (10 seconds, no rambling)

- 24 hrs: final "still want help?" message + one qualifying question

Copy/paste follow-up scripts (voicemail + SMS + email)

These are short on purpose. Long messages feel needy and get ignored.

Voicemail (10-12 seconds)

"Hey {{Name}}, it's {{YourName}} from {{Business}}. I saw your request for {{service}}. I can help - what's the best time today to call you back? You can also text me at this number."

SMS (first text, right after the call)

"Hi {{Name}}--{{YourName}} here. Got your request for {{service}}. Quick question: is this for {{option A}} or {{option B}}? If you want, grab a time here: {{booking link}}."

Email (5-minute email, two options)

Subject: Quick question about {{service}}

Hi {{Name}}, I saw your request for {{service}}. Two fast options:

- Book a quick call: {{booking link}}

- Reply with {{one key qualifier: address / size / timeline}} and I'll send pricing. --{{YourName}}

"Still want help?" message (24-hour close-the-loop)

"Hey {{Name}}--should I close this out, or do you still want help with {{service}}? If yes, what's your target timeline: this week or later?"

30-day lead system rollout (SMB)

If you try to fix lead gen and fix sales at the same time, you'll do neither. This 30-day rollout keeps it tight, and it's one of the cleanest ways to get new business leads without burning out.

Week 1 - Speed + tracking (foundation)

- Set your 5-minute SLA coverage (who responds, when, and how)

- Create a simple lead tracker (fields below) and review it every Monday

- Add a booking link and a "call/text now" button everywhere leads come in

Week 2 - Channel #1 (pick the fastest win)

- Local service: Google Business Profile + review ask system

- B2B service: outbound list + first 100-message sequence

- Ecommerce: paid social + email/SMS capture

- Define your qualification question (the one that filters time-wasters)

Week 3 - Channel #2 (your compounding channel)

- Local: Google Ads (tight keywords + call tracking)

- B2B: partnerships (adjacent vendors) or SEO pillar page

- Ecommerce: retargeting + post-purchase referral offer

- Add one "proof asset" (case study, before/after, testimonial reel)

Week 4 - Cut waste + double down

- Review leads by source: close rate, show rate, speed-to-lead

- Kill one thing that's draining time (bad keywords, weak audience, junk directory)

- Tighten your follow-up: add touches where deals stall (usually day 2-4)

Hot take: if your average customer value is under $1,000, you don't need a "marketing machine." You need fast response, clean qualification, and one channel you can run every week without quitting.

Your 5-minute SLA means nothing if you're calling the wrong number. Prospeo gives small businesses access to 143M+ verified emails and 125M+ direct dials - refreshed every 7 days - so your speed-to-lead actually converts. At $0.01 per email, it costs less than the coffee you drink while waiting for bad leads to call back.

Build your first qualified lead list in under 10 minutes.

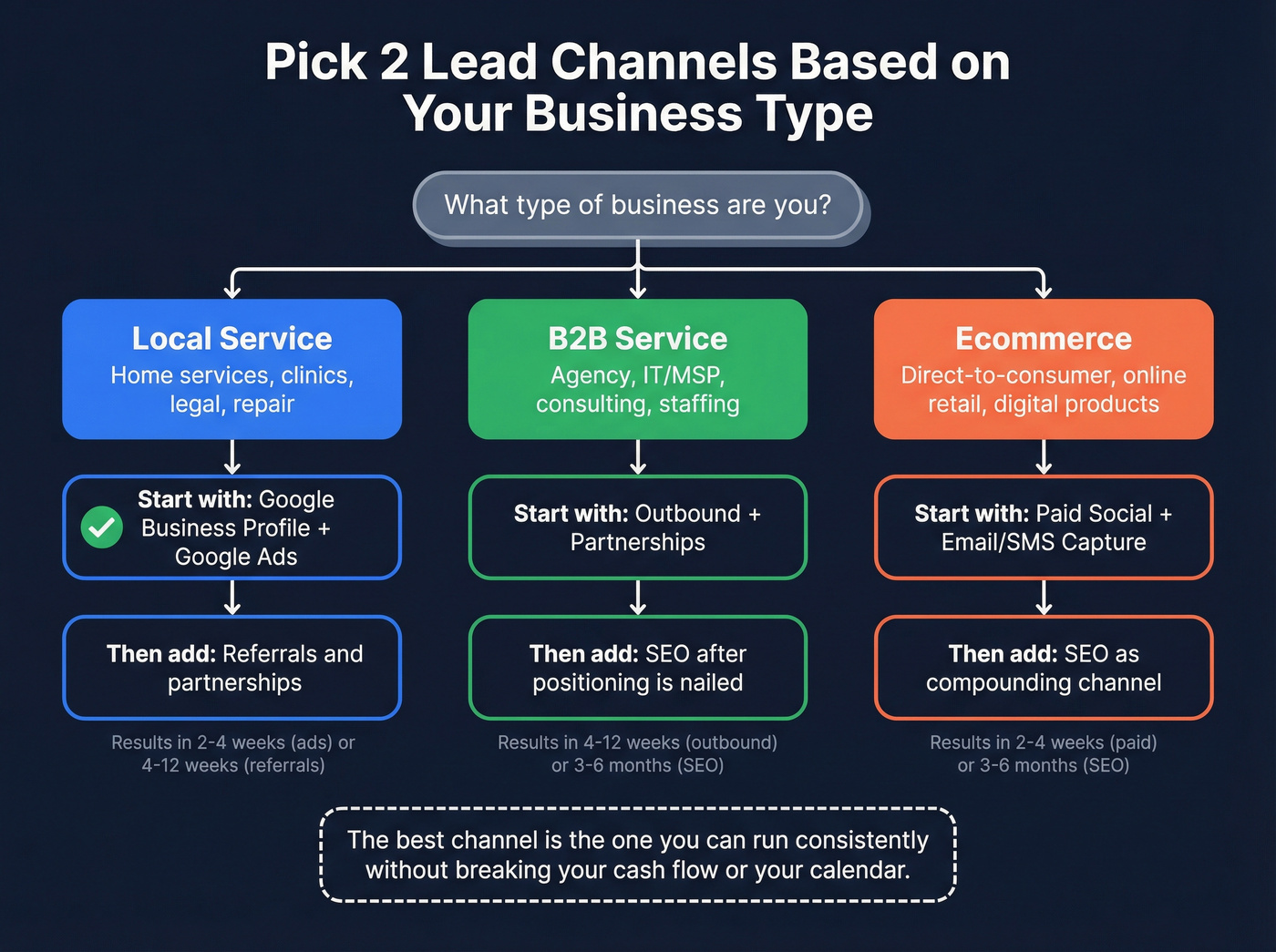

Pick 2 channels (not 6): choose based on your business type

Small businesses lose months by dabbling. Two channels for 90 days beats six channels for two weeks each.

Use this decision tree:

If you're a local service business (home services, clinics, legal, repair, local B2C):

- Start with Google Business Profile (GBP) + Google Ads (if you can afford it)

- Add referrals/partners once you've got happy customers

If you're a B2B service business (agency, IT/MSP, consulting, staffing, software dev):

- Start with outbound + partnerships

- Add SEO once you've nailed your positioning and case studies

If you're ecommerce:

- Start with paid social + email/SMS capture

- Add SEO as a compounding channel after you've found winning offers

Time-to-results expectations (realistic):

- PPC/search ads: 2-4 weeks to see signal (and you'll still need iteration)

- SEO/content: 3-6+ months to feel compounding impact

- Referrals/partners: 4-12 weeks to build a predictable flow

The "best channel" is the one you can run consistently without breaking your cash flow or your calendar.

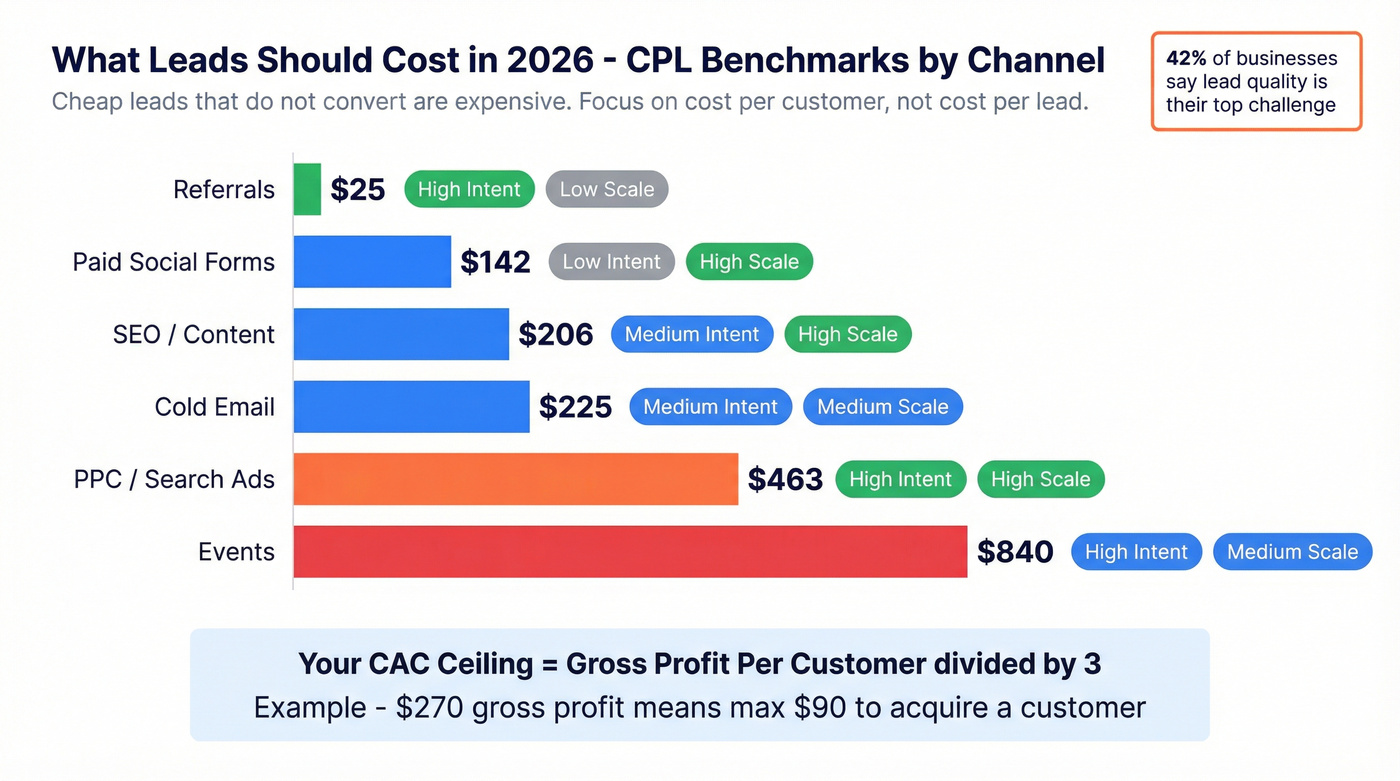

What leads should cost in 2026 (benchmarks + CAC ceiling)

Cost per lead (CPL) is useful, but it's also how teams lie to themselves. Cheap leads that don't convert are expensive. Sopro's channel benchmarks are a solid baseline for B2B-style lead gen, and the key insight is the same across industries: 42% cite lead quality as the top challenge.

Here are practical CPL ranges to anchor your expectations:

| Channel | Typical CPL | Best for | Main risk | Quality fix |

|---|---|---|---|---|

| Referrals | ~$25 | Trust-heavy buys | Not scalable | Ask weekly |

| SEO | ~$206 | Long-term demand | Slow ramp | ICP landing pages |

| PPC/search | ~$463 | High intent now | Costs rising | Negative keywords |

| Paid social forms | ~$142 | Volume + retarget | Low intent | Qualify in-form |

| Cold email | ~$225 | B2B targeting | Bad data | Verify + segment |

| Events | ~$840 | Big-ticket B2B | Time + travel | Pre-book meetings |

| Directories | Not public | Local/vertical | Junk inquiries | Narrow categories |

Now set a CAC ceiling so you don't "win leads" and lose money.

Two rules that keep SMBs sane:

- 3:1 CLV:CAC is a healthy benchmark (your customer lifetime value should be ~3x your acquisition cost). (If you want the math, see CAC ceiling.)

- CAC ceiling (simple): Max CAC = (Gross profit per customer) / 3

Worked CAC example #1 (local service business)

Let's say you run a local HVAC repair business.

- Average job revenue: $450

- Gross margin: 60%

- Gross profit per customer: $270

- CAC ceiling: $270 / 3 = $90

Now compare channels:

- If Google Ads CPL is $120 and you close 40% of leads: CAC = $120 / 0.40 = $300 (you're upside down)

- If referrals CPL is $25 and you close 60%: CAC = $25 / 0.60 = $41.67 (this is why referrals feel like magic)

Operator move: for low-ticket services, you either (1) raise AOV with maintenance plans/upsells, or (2) tighten keywords and qualification so you're not paying for "price shoppers."

Worked CAC example #2 (B2B service business)

Now say you run a B2B IT/MSP with a $2,000/month retainer and 12-month average retention.

- Annual revenue: $24,000

- Gross margin: 50%

- Gross profit per customer: $12,000

- CAC ceiling: $12,000 / 3 = $4,000

If cold email CPL is $225 and you close 10% of leads: CAC = $225 / 0.10 = $2,250 (healthy)

If events CPL is $840 and you close 15%: CAC = $840 / 0.15 = $5,600 (too high unless retention or margin is better)

For deeper channel ranges, Sopro's benchmark post is worth skimming: B2B cost per lead benchmarks by channel and industry.

Lead sources that work: channel playbooks for small teams

Local leads via Google Business Profile (GBP) (best for local services)

GBP's the closest thing to "free high-intent leads" that still exists. If you're local and you're not taking GBP seriously, you're basically paying a tax to competitors who are.

Birdeye's State of Google Business Profiles data is a good gut-check:

- 64% of businesses have verified their profile

- Verified profiles average 1,803 monthly views

- 24% of verified businesses get 50+ monthly calls per month

GBP checklist that actually matters:

- Verify your profile and keep it stable (don't spam edits during verification)

- Primary category matters (it's the biggest local pack lever)

- Keep NAP consistent (name, address, phone) across your site + directories

- Add services/products with clear descriptions (not keyword soup)

- Turn on messaging if you can respond fast (tie it to your 5-minute SLA)

- Seed Q&A with real questions customers ask (and answer them)

Hot take: most "GBP optimization" advice is fluff. The basics - category, NAP, reviews, photos, and fast responses - beat fancy hacks.

GBP optimization that moves the needle (photos, reviews, offers)

Photos aren't decoration. They're conversion assets.

Rio SEO quotes Google: businesses that add photos get 42% more direction requests and 35% more website clicks than businesses that don't.

Do this (weekly cadence works):

- Add 5-10 new photos/week (team, work-in-progress, before/after, storefront, vehicles)

- Ask for reviews at the moment of value (job done, issue resolved, deliverable shipped)

- Reply to every review (yes, even the 5-stars - short is fine)

- Post one update/week: offer, seasonal service, FAQ, or "recent work" proof

- Add an "offer" post when you're running promos (with a clear end date)

If you're short on time, prioritize: reviews first, then photos, then posts.

For the photo benchmark, see: Rio SEO's GBP photo optimization breakdown.

Google Ads for high-intent leads (when you need demand now)

Google Ads is expensive, but it's still the most reliable "I need leads this month" lever for a lot of small businesses - because search intent is real, and you can buy it on purpose.

WordStream analyzed 16,000+ campaigns running Apr 2024-Mar 2025 and pegged the average CTR at 6.66%. Costs increased in 87% of industries, but conversion rates improved in 65%. Translation: the winners aren't the cheapest accounts. They're the best-managed ones, with clean tracking and ruthless keyword discipline.

Pros:

- High intent (people are actively searching)

- You can control geography and schedule

- You can see results in weeks, not quarters

Cons:

- You'll pay for mistakes (broad match + no negatives = pain)

- Lead quality swings wildly by keyword

- Tracking's often broken in SMB setups

Budget guardrails (starter reality):

- $500-$3,000/month is enough to learn in most local niches

- Start with 1-2 services, 1-2 locations, and tight keyword themes

- Use call extensions and track calls as conversions

If you want the benchmark context, WordStream's post is the one to read: Google Ads benchmarks.

Facebook/Instagram Lead Ads (cheap CPL, harder qualification)

Facebook/Instagram Lead Ads are the classic small business trap: the CPL looks amazing, and then your calendar fills with people who "just wanted pricing" and disappear.

WordStream's benchmark across 1,000+ campaigns puts average leads CPL at $27.66 (up 20.94% YoY). They also highlight the gap: Lead Ads CPC averages $1.92 vs Google's $5.26. Cheaper clicks don't mean better buyers.

When Lead Ads win

- You sell something impulse-friendly (fitness intro offer, low-ticket service, simple quote)

- You can follow up in minutes and book fast

When Lead Ads disappoint

- You sell complex, high-ticket work and you're asking people to "talk to sales" cold

Operator tactics that actually change quality:

- Retarget warm audiences first (site visitors, video viewers, engaged followers) before cold

- Exclude job seekers (interests like "job hunting" and broad "employment" behaviors)

- Use higher-intent objectives when you can (send to a landing page for high-ticket instead of instant forms)

- If you do instant forms, use "Higher intent" form type and add 2-3 qualifiers (budget, timeline, location)

- Put instant booking on the thank-you screen (don't rely on chasing)

- Follow up in 5 minutes (Lead Ads decay fast)

Benchmarks here: WordStream Facebook ads benchmarks.

Partnerships + referrals (the cheapest leads, if you systemize it)

Referrals are still the best "lead source" in terms of trust and close rate. They're also the least systemized, which is why most SMBs get random referrals instead of predictable ones.

Sopro's benchmark pegs referrals at about ~$25 CPL. That tracks with reality: the real cost is your time and your follow-up.

Simple referral script (send right after a win):

"Quick favor - do you know one person who'd benefit from the same result? If you intro us, I'll take great care of them."

Checklist:

- Decide your referral partners (adjacent services, not competitors)

- Ask when value is delivered (not when you're desperate)

- Make the offer simple: $100-$300 credit, gift card, or donation - whatever fits your margins

- Follow up twice (most referrals die in the "good idea" stage)

I've seen small teams double pipeline just by making referral asks a weekly habit instead of a once-a-year awkward request.

Directories/marketplaces (when buyers are already shopping)

Directories work when you treat them like a sales channel, not a logo placement. The mistake is buying the biggest package, picking broad categories, then responding tomorrow.

Category selection rules:

- Pick 1-2 narrow categories where you're genuinely top-tier (avoid "General Contractor"-style buckets)

- Choose categories that match high-intent searches ("emergency," "same-day," "commercial," "licensed")

- If the directory allows it, show service area + minimum job size to filter tire-kickers

Profile conversion checklist:

- Lead with a specific offer ("Same-day inspections," "Free 10-min assessment," "24/7 dispatch")

- Add proof: 3 testimonials, 5 before/after photos, licenses/insurance

- Use a direct call button and a booking link (don't hide behind a contact form)

Non-negotiables:

- Use call tracking so you know if the directory produces customers

- Apply your 5-minute SLA to directory inquiries (directories punish slow responders)

Industrial/manufacturing note: if you sell into industrial buyers, Thomasnet is the directory that matters. It's built for supplier discovery with a performance-based listing model where you pay when buyers actively interact with your company, and programs often land in the mid four figures to low five figures per year depending on category competitiveness and lead volume.

B2B outbound (when you can name your ideal customer)

Outbound works when you can clearly say who you want: industry, size, region, job title, and a reason they'd care. It fails when you blast generic lists and hope.

A scenario we've watched play out: an MSP owner pulls 2,000 "IT manager" emails from a random list, sends one generic pitch, gets a pile of bounces, and then wonders why deliverability fell apart for the next month. The fix isn't "write better copy." It's starting with a smaller, cleaner list, verifying contacts, and running a sequence you can actually respond to quickly.

A clean outbound workflow (that doesn't wreck deliverability):

- Define ICP + trigger: "10-200 employees, uses X tech, hiring for Y, in Z region"

- Build a target account list: 200-500 companies to start

- Find contacts: owner/founder for SMB, or department head for larger firms

- Verify -> dedupe -> suppress opt-outs: quality controls before you send anything

- Launch a small sequence: 50-100 new contacts/day, personalize lightly, iterate weekly

- Route replies fast: your 5-minute SLA applies here too

What SMB owners complain about (and how to fix it):

- "Maps show businesses, not the buyer." Fix: build lists by job role + company signals, not just a business name.

- "Enterprise databases miss owners." Fix: prioritize founder/owner targeting and direct dials for SMB-sized accounts.

- "DMs get ignored." Fix: use DMs as a follow-up channel, not the first touch - lead with email/phone and a clear ask.

For list building and verification, tools like Prospeo (tagline: "The B2B data platform built for accuracy") are built for this exact workflow: you filter by role/industry/region, export a tight list, and keep deliverability intact with 98% verified email accuracy and a 7-day refresh cycle so you're not emailing people who left the company two months ago. (If you're comparing options, start with B2B lead generation companies & tools.)

Right before you export, do it like an operator: set industry + headcount + region + job title, then toggle "verified emails only." Export CSV, dedupe, and suppress opt-outs before you load anything into a sequencer.

Buying leads & lead lists: when it works (and when it backfires)

Buying leads is generally legal, but outreach is regulated. The list isn't the risk--your consent, opt-out handling, and truthful messaging are.

Buying leads can work, but only if you treat it like buying inventory: inspect it before you bet the month on it. (Deeper vendor vetting: buying leads.)

Use this if:

- You need volume fast and you've got a strong follow-up system

- You can test small, measure conversion, and cut losers quickly

Skip this if:

- You don't have suppression/opt-out handling

- You can't verify freshness and reachability

- You're hoping a list will "solve marketing"

Mini rubric (data-quality rules that matter):

- Verification: emails/phones are validated (not just guessed)

- Freshness: last updated within 30-90 days for SMB decision-makers

- Suppression: remove opt-outs, existing customers, and "do not contact"

- Sample test: buy/receive a small sample and measure bounce + connect + reply rates

Salesgenie (Data Axle) is a common option in the "buy a list" world. They say they ran a blind audit of 100,000+ records at a 95% confidence level and ranked highest versus four other large providers. They don't publish the full report, so treat it as a credibility signal, not a guarantee.

If you buy lists, your first KPI isn't CPL. It's bounce rate, connect rate, and reply rate.

Minimum-viable tracking system (spreadsheet -> CRM) + weekly cadence

Most SMB lead gen "doesn't work" because nobody can answer basic questions like: which channel produced customers last month, and what did it cost?

Start with a spreadsheet. HubSpot's lead tracker template guidance is refreshingly realistic: it's ideal for 25-75 leads, over 2-6 months, with 1-2 hours/week of maintenance. When it gets painful, import into a free CRM.

One sentence that'll save you a lot of money: if you can't track it, don't scale it.

Here's the minimum viable weekly cadence:

- Monday (15 min): review last week's leads by source and stage

- Midweek (15 min): check follow-ups due today + overdue

- Friday (30 min): update outcomes, estimate value, decide next week's focus

Tracking fields (don't overthink it):

| Field | Example |

|---|---|

| Source | GBP / Ads / Referral |

| Date | 2026-02-17 |

| Stage | New / Contacted / Booked |

| Last touch | Call / Email / Text |

| Next follow-up date | 2026-02-19 |

| Outcome | Won / Lost / No show |

| Est. value | $2,500 |

| Notes | Needs quote by Fri |

If you want a clean starting point, HubSpot's template is free: HubSpot lead tracker template.

Compliance in 2026 (TCPA opt-outs + privacy thresholds)

Compliance isn't "enterprise stuff" anymore. If you call/text leads, buy lists, or run lead forms, you need a basic ruleset so you don't create legal risk - or just annoy people into blocking you.

You might've heard headlines about "one-to-one consent" changes. Those were delayed and later struck down. The operational rule you must follow in 2026 is revocation: assume opt-outs can come from anywhere and process them fast.

TCPA consent revocation rules (effective Apr 11, 2026) are the big operational change:

- People can revoke consent using any reasonable method (SMS, email, voicemail, live call, etc.) if intent's clear.

- You must honor opt-outs within 10 business days.

- You can send a confirmation SMS within 5 minutes, but it must be non-promotional.

Do / don't checklist:

- Do keep a suppression list (phone + email) and actually use it

- Do log opt-outs immediately in your CRM/spreadsheet

- Do allow simple replies like "STOP" to work

- Don't keep texting because "it's a good lead"

- Don't mix confirmation with marketing ("You're opted out - by the way, 20% off!")

Privacy thresholds (CCPA/CPRA) matter if you're bigger - or growing fast in California:

- Revenue threshold: $26.625M annual gross revenue

- Data threshold: 100,000 consumers/households

- Clarifying regulations effective Jan 1, 2026

Most true small businesses won't hit those thresholds, but the habits still matter: minimize data, secure it, and don't share it casually.

Tools that help you capture, qualify, and follow up (budget-friendly)

This isn't a "buy more software" problem. It's a "use a few basics consistently" problem.

Here's a lightweight stack that covers 90% of SMB lead handling:

| Need | Tool type | Typical price | Use it when... |

|---|---|---|---|

| Track leads | Spreadsheet | $0 | You need visibility today and you're under ~75 active leads/month. |

| Lead tracker | HubSpot template | $0 | You want a ready-made sheet with stages and follow-up fields. |

| CRM | Free tier CRM | $0-$50/user/mo | You're missing follow-ups or need pipeline + reminders. |

| Scheduling | Booking tool | $0-$15/user/mo | You want fewer back-and-forth texts and more booked leads. |

| Call tracking | Call tracking | $30-$100/mo | You spend on ads/directories and need to know what drives calls. |

| Forms/chat | Website forms | $0-$50/mo | You want to capture leads after hours and route them instantly. |

Two "step-up" tools worth knowing once you have volume:

- Keap (CRM + automation for SMBs): great when you need follow-up sequences, tagging, and basic marketing automation without building a Frankenstack. Expect ~$150-$300/month depending on contacts and features.

- Leadfeeder-style website visitor identification: useful for B2B when you already have traffic and want to see which companies are visiting key pages so you can prioritize outreach. Expect ~$100-$250/month for small teams, depending on traffic and seats.

Quick guidance:

- Use HubSpot's free tracker/template until follow-up starts slipping, then move to a free CRM tier. (Options: CRM software for small businesses.)

- Add call tracking once you're spending real money on ads (otherwise you're guessing).

- If you're doing B2B outbound, verified contact data is the difference between "this works" and "my domain got cooked." (See: email verification.)

Running outbound as your B2B channel? Skip the list-building headaches. Prospeo's 30+ filters let you target by industry, headcount, funding, tech stack, and buyer intent - then delivers 98% accurate contact data so your 100-message sequence actually lands in real inboxes, not spam traps.

Bounce rates under 4% aren't luck - they're better data.

FAQ: leads for small business

What's the fastest way to get more leads for a small business?

The fastest lever is speed-to-lead: call within 5 minutes, send a text/email immediately, then follow a 0-5-30-24 cadence for the first day. InsideSales found conversion is 8x higher when you respond in the first five minutes. If you can't hit 5 minutes, aim for 15.

How much should a small business pay per lead in 2026?

Back into CPL from profit: set a CAC ceiling at gross profit per customer / 3 (a 3:1 CLV:CAC target), then see what CPL works at your close rate. Benchmarks to sanity-check: referrals ~$25, SEO ~$206, PPC ~$463, cold email ~$225, events ~$840.

Are Facebook Lead Ads good for small businesses or low-quality?

Facebook Lead Ads can work, but they skew lower-intent unless you qualify hard: use "Higher intent" forms, add 2-3 qualifiers (budget/timeline/location), and push instant booking on the thank-you screen. WordStream's average CPL is $27.66, so you're buying volume - your follow-up speed decides if it turns into revenue.

What's a good free tool for finding B2B contacts for outreach?

For self-serve prospecting, Prospeo's a strong free starting point because it includes 75 email credits plus 100 Chrome extension credits per month and delivers 98% verified email accuracy with a 7-day refresh cycle. If you're testing outbound, start with 200-500 target accounts, export verified contacts, and track bounce rate under 3-5%.

If you only do three things this month: tighten your 5-minute SLA, commit to two channels for 90 days, and track source -> stage -> next step every week. That combo turns leads for small business into customers, not just "more inquiries."