The Best B2B Lead Generation Companies (and Tools) in 2026

Most teams pay for "lead gen" twice: once to a vendor, and again in rep hours wasted on bad contacts and no-show meetings.

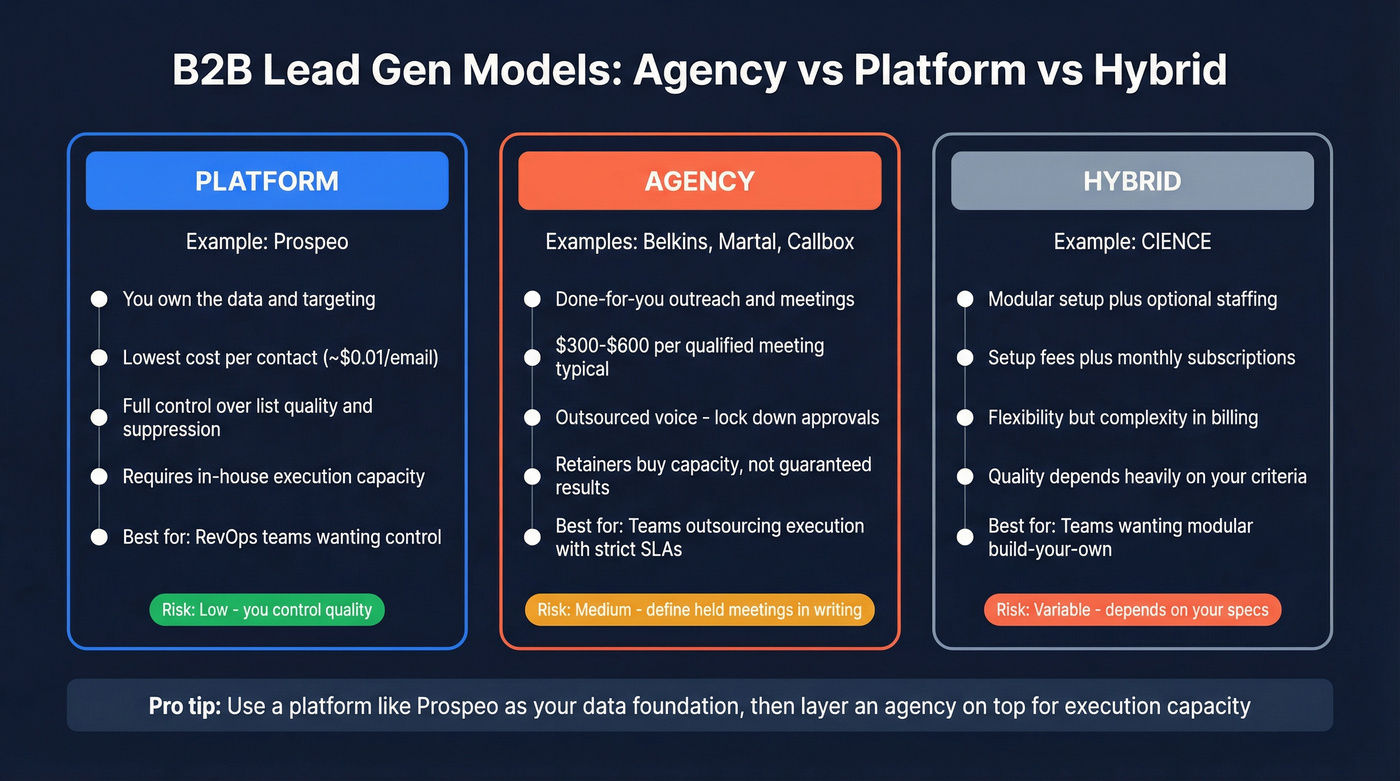

The fix isn't more hustle. It's picking the right model (agency vs platform vs hybrid), then locking the economics in writing.

If you're comparing b2b lead generation companies, this list is built to keep you out of the usual traps: vague "qualified" definitions, paying for booked (not held) meetings, and contracts that protect the vendor more than your pipeline.

Here's the 2026 shortlist I'd put in front of a VP Sales who needs pipeline without getting stuck in a long agreement.

Our picks (TL;DR): best B2B lead gen options in 2026

If you're deciding between agency vs platform, start here. This is the section that changes the budget.

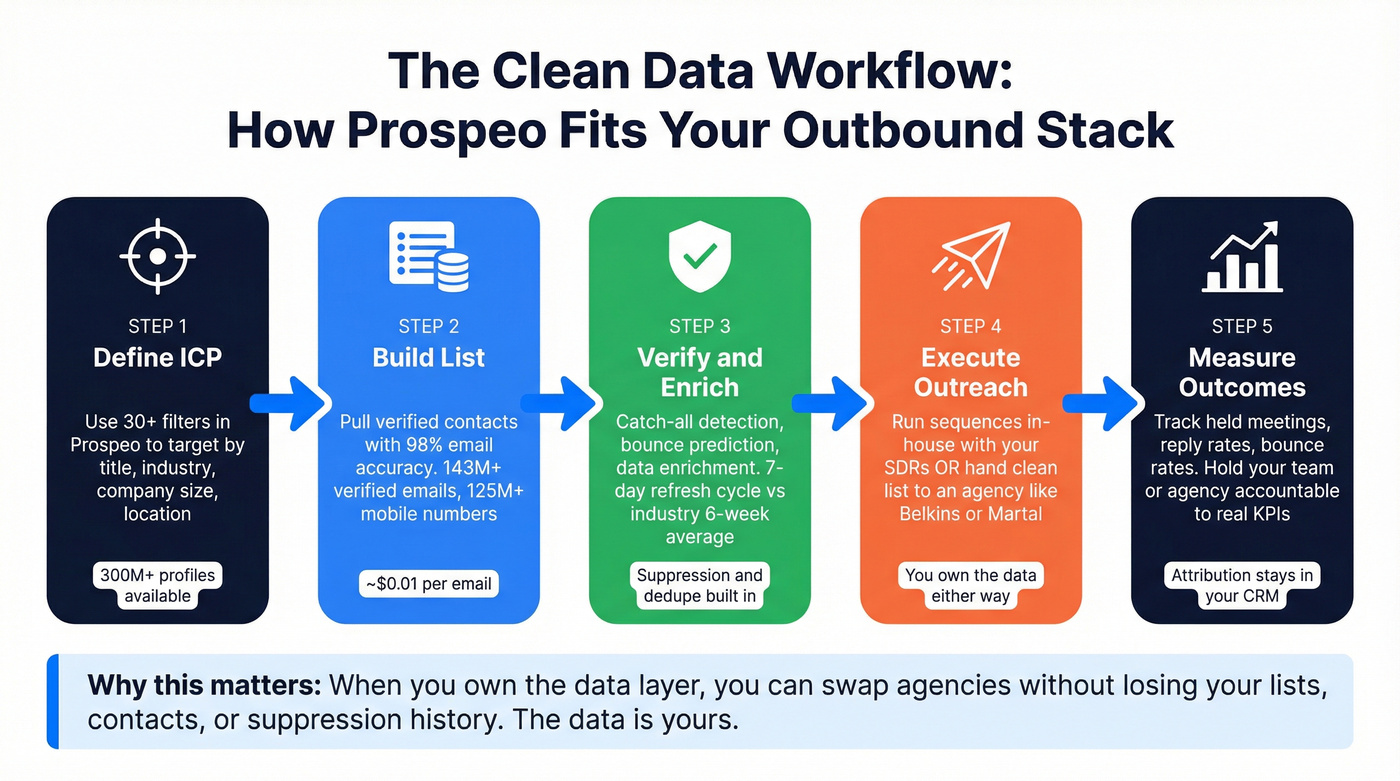

Prospeo (platform) - best when you want to own your data quality and targeting with 98% verified email accuracy and a 7-day refresh cycle (most databases refresh on roughly a 6-week cadence). It's the cleanest control layer for list building, verification, and enrichment before you ever hit send. Best setup: use Prospeo as the data foundation, then run outreach in-house or pair it with an agency for execution capacity.

Belkins (agency) - best when you want an omnichannel appointment-setting engine that treats deliverability as a deliverable (not a footnote). Non-negotiable: define "qualified, held meeting" in writing and enforce a rebooking policy.

Martal Group (agency) - best when you want transparent outbound throughput with a clear pilot structure and published activity/output ranges you can sanity-check. Works best: when you already know your ICP and can approve messaging quickly.

Callbox (agency) - best when you need an enterprise "campaign pod" across regions, channels, and languages and you want a staffed team, not a single SDR-for-hire. Reality check: pods scale in chunks; multi-region adds cost fast.

Pricing reality check (so you don't get surprised):

- Pay-per-meeting commonly lands at $300-$600 per qualified meeting - but only "held" meetings count in real life.

- A healthy held-meeting rate is 70-80%. Below 70%, you're paying a hidden tax unless your contract forces rebooking.

Who this list is for

- Founder-led outbound that needs to scale without torching domains.

- RevOps teams that want measurable held-meeting economics.

- Sales leaders comparing agencies vs platforms without hand-wavy answers.

Hot take: if your average deal size is in the low five figures, you usually don't need an "all-in-one" enterprise data suite. You need clean data, tight targeting, and a contract that makes vendors pay for quality.

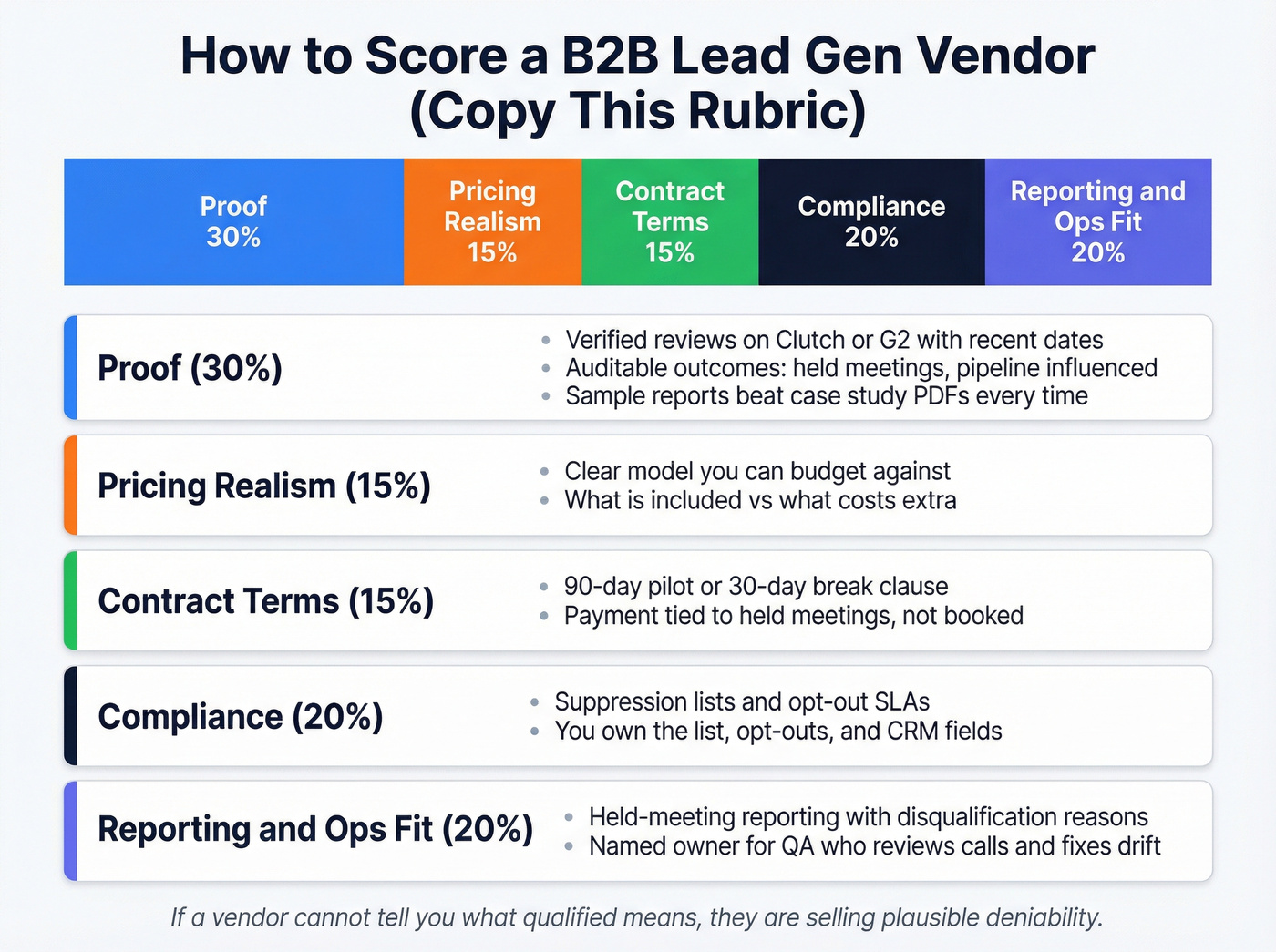

How we ranked b2b lead generation companies (and why most lists are ads)

Clutch is useful, but it's not gospel. Their lead gen category shows Ratings updated Feb 17, 2026 and 3,059 providers listed, with a review verification process (client interviews/project audits) and "Verified providers" checks. That's a better starting point than random listicles, but it still rewards whoever's best at asking for reviews.

We've used the rubric below in bake-offs where the best-sounding vendor lost because they couldn't report held meetings cleanly, couldn't explain disqualification reasons, or tried to hide behind "activity" metrics once the first month didn't pop.

Look, if a vendor can't tell you what "qualified" means, they're not selling lead gen. They're selling plausible deniability.

Scoring rubric (copy/paste)

Proof (30%)

- Verified reviews (Clutch/G2), review volume, and recentness

- Outcomes you can audit: held meetings, opportunities created, pipeline influenced

- A sample report screenshot (even redacted) beats a case study PDF every time

Pricing realism (15%)

- Clear model (retainer, pay-per-meeting, hybrid)

- Anchors you can budget against (not a mystery "custom" quote)

- What's included vs add-ons (domains, inboxes, data, calling, creative)

Contract terms (15%)

- A 90-day pilot option (or a clean 30-day break clause)

- Payment tied to held meetings (or an explicit no-show recovery policy)

- Exit clauses that don't punish you for underperformance

Compliance & data handling (20%)

- Suppression lists, opt-out SLAs, consent records (especially for calling/texting)

- GDPR/CCPA posture and DPAs

- Clear ownership: you own the list, opt-outs, and CRM fields

Reporting & ops fit (20%)

- Held-meeting reporting, reasons for disqualification, and conversion to opportunity

- CRM hygiene: dedupe rules, field mapping, and attribution

- A named owner for QA (who listens to calls, reviews replies, and fixes drift)

One opinion I'll defend: the fastest way to waste a quarter is to buy "meetings" without defining what counts, then discover you paid for interns booking demos with students, consultants, and vendors trying to sell you something.

Most lead gen agencies charge $300-$600 per meeting - and half that cost is wasted on bad contact data. Prospeo gives you the data layer that makes every dollar work harder: 98% verified emails, 125M+ direct dials, and a 7-day refresh cycle so your lists never go stale. Own your pipeline economics at ~$0.01/email instead of paying agency markups on data you should control.

Clean data first. Then decide if you even need an agency.

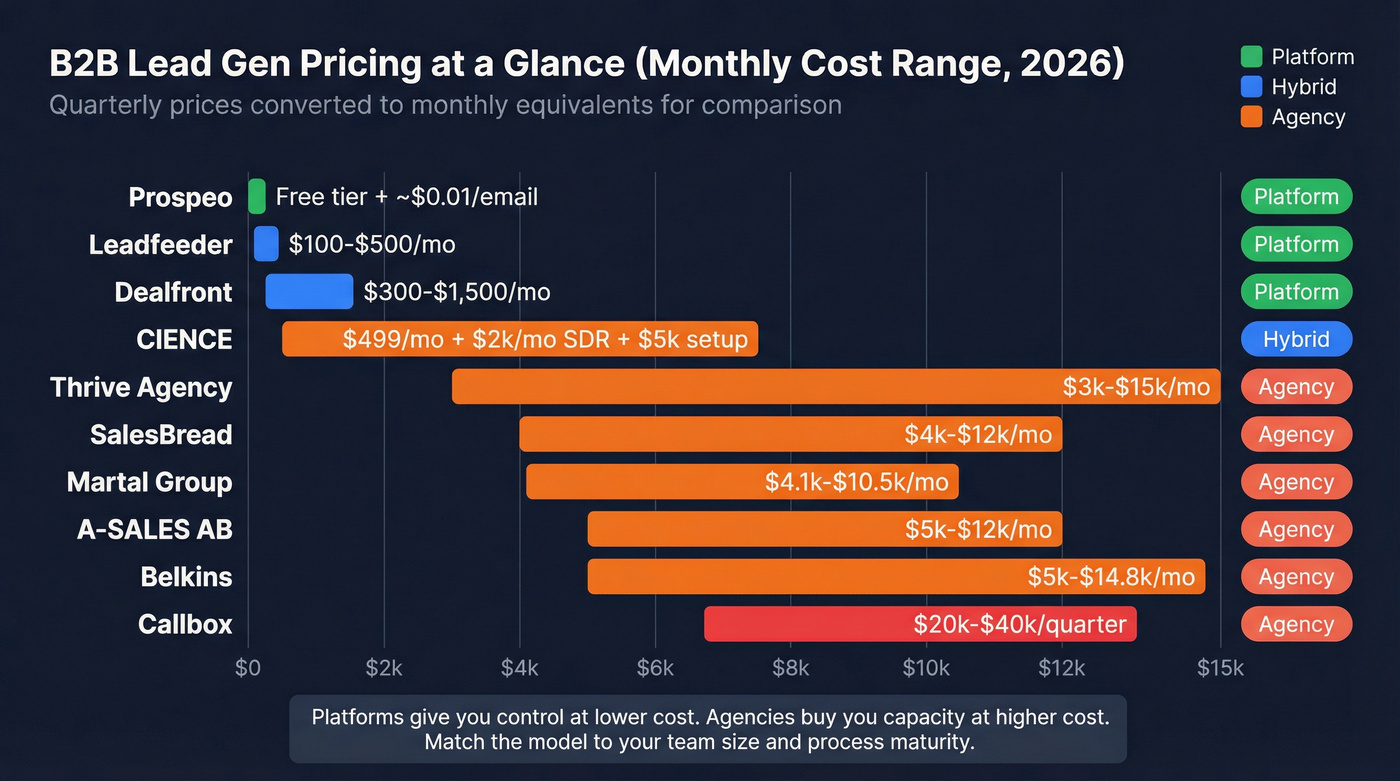

Pricing & model comparison table (what you'll actually pay)

Most teams don't fail at lead gen because they picked the "wrong" vendor. They fail because they budgeted for one model and got billed like another.

Three patterns show up constantly:

- Agencies price risk into retainers. If your ICP is hard (enterprise, regulated, niche titles), you pay for the learning curve.

- Pay-per-meeting is only cheap if you pay on held. If you pay on "booked," your true cost per held meeting jumps fast.

- Platforms are cheaper, and more controllable. That's a feature if you have even a basic outbound process.

Condensed "pick fast" table (mobile-friendly)

| Provider | Type | Best for | Price anchor | Winner pick (who should choose it) |

|---|---|---|---|---|

| Belkins | Agency | Omnichannel meetings | ~$5.5k/mo | Best for teams outsourcing execution with strict SLAs |

| Martal Group | Agency | Pilot + throughput | $4.1k-$10.5k/mo | Best for defined ICP + fast iteration |

| Callbox | Agency | Enterprise pods | $20k-$40k/qtr | Best for multi-region programs |

| CIENCE | Hybrid | Modular build/run | $5k setup + $499/mo | Best for modular + optional staffing |

| Dealfront | Platform | Intent + routing | $300-$1.5k/mo | Best for intent-led prioritization |

| Leadfeeder | Platform | Visitor ID | $100-$500/mo | Best for inbound-led teams with traffic |

| Thrive Agency | Agency | Full-service demand gen | $3k-$15k/mo | Best for "one vendor" marketing + sales support |

| SalesBread | Agency | Outbound appt setting | $4k-$12k/mo | Best for outbound-only programs (after vetting) |

| A-SALES AB | Agency | Structured outbound | $5k-$12k/mo | Best for process-driven outbound with QA |

Full comparison table (detail)

| Provider | Type | Best for | Pricing model | Realistic price range/anchor | Proof signals | Contract/pilot notes | Watch-outs |

|---|---|---|---|---|---|---|---|

| Prospeo | Platform | Verified data | Credits | Free + ~$0.01/email | 15,000+ companies; 40,000+ Chrome extension users | No contract | Own your targeting + list hygiene |

| Belkins | Agency | Omnichannel appts | Retainer | ~$5.5k/mo (10+ mtgs) | Clutch 4.9/230 | Often 3-6 mo | Define "qualified" + pay on held |

| Martal Group | Agency | Pilot + throughput | Retainer | $4.1k-$10.5k/mo | Clutch 4.8/105 | 3-mo pilot | Throughput needs QA + tight ICP |

| Callbox | Agency | Enterprise pods | Subscription | $20k-$40k/qtr | G2 4.5/91 | Pod-based | Multi-region adds pods (cost jumps) |

| CIENCE | Hybrid | Modular build | Setup + sub | $5k + $499/mo + $2k/mo | Clutch 4.2/142 | Modular | Quality depends on your criteria |

| Dealfront | Platform | Intent + activation | Seat + modules | $300-$1.5k/mo | Mid-market adoption | Annual common | Intent needs routing + SLA |

| Leadfeeder | Platform | Visitor ID | Traffic + features | $100-$500/mo | Category staple | Monthly/annual | Needs real traffic + filters |

| Thrive Agency | Agency | Inbound+outbound | Retainer | $3k-$15k/mo | Broad reviews | 3-6 mo | Ensure outbound has an owner |

| SalesBread | Agency | Appt setting | Retainer | $4k-$12k/mo | Outbound specialization | Pilot varies | Enforce held-meeting KPI |

| A-SALES AB | Agency | Structured outbound | Retainer | $5k-$12k/mo | Clutch 4.9/62 | Pilot common | QA calls + calibration matter |

How to interpret pricing without getting played

- Retainers buy you capacity. Your job is to force that capacity to produce held meetings that convert.

- Pay-per-meeting shifts risk to the vendor only if you pay on held and enforce qualification criteria.

- Platforms shift risk to you, but you get control: list quality, suppression, dedupe, and attribution.

If Finance wants predictability, choose a retainer with a pilot and a held-meeting floor. If Sales wants speed, choose pay-per-held-meeting. If RevOps wants control, choose a platform and build a repeatable list -> verify -> sequence workflow.

Top companies and tools (2026 shortlist)

Prospeo - best self-serve B2B data for accuracy + freshness (Tier 1)

Prospeo is "The B2B data platform built for accuracy" and, in our experience, it's the fastest way to stop the quiet leak that kills outbound: stale contacts and unverified emails. You get 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers, all refreshed on a 7-day cycle (industry average: 6 weeks), plus 30+ search filters so you can build lists that don't collapse the moment you hit "send."

Here's a scenario we've seen more times than we'd like to admit: a team hires an appointment-setting agency, the agency pulls a list from "somewhere," bounce rates spike, domains get bruised, and now everyone's arguing about copy while deliverability is on fire. A self-serve data layer fixes that because you can verify, enrich, dedupe, and suppress before outreach, then hand the clean list to your SDRs or your agency and hold them to outcomes instead of excuses.

Prospeo's pricing is transparent (free tier plus credits; email pricing is ~$0.01/email). The free tier includes 75 emails + 100 Chrome extension credits per month, which is enough to test an ICP slice, validate deliverability, and prove whether your offer gets replies before you scale volume.

Best setup: use Prospeo as the data control layer, then run execution in-house or with an agency.

Links: Pricing, B2B leads database, Data enrichment, Integrations.

Belkins - omnichannel appointment setting that takes deliverability seriously (Tier 1)

Belkins runs like a real appointment-setting operation: list building, inbox management, deliverability, multichannel touches, and packaging that forces clarity. Their packages are organized by yearly appointments - For small business (30+), Growth (100+), and Growth Plus (200+) - and include no-show recovery, which is exactly the kind of clause that protects your budget.

The tradeoff is brand control. When you outsource execution, you're outsourcing your voice, and if you don't lock approvals down you'll wake up to messaging you wouldn't send yourself.

My recommendation: insist on a weekly report that shows held meetings by segment (persona/industry/geo) plus disqualification reason codes. If they can't produce that, you're buying activity.

Pricing snapshot: $5,000-$14,800+/mo, with ~$5,500/mo as a common anchor for 10+ meetings.

Martal Group - transparent outbound throughput + a pilot you can actually enforce (Tier 1)

Martal's best trait is transparency. Their Tier 1A is a 3-month pilot, then monthly subscription, which forces both sides to learn fast and gives you a clean exit if the ICP or offer is wrong.

They also publish funnel ranges you can sanity-check: 3,000-5,000 prospects, 9,000-12,000 emails, 250-450 calls, 20-30 qualified leads, and 5-15 flipped leads in a typical month. That's what real outbound volume looks like, and it matters because it lets you spot nonsense promises before you sign anything.

Funnel math sanity check (use this in vendor calls):

- If an agency promises enterprise meetings with 500 emails/month, they're not doing outbound. They're doing wishful thinking.

- If they run 10k+ touches/month and can't explain qualification drift, they're spraying.

Pricing snapshot: $4.1k-$10.5k/mo.

Callbox - enterprise "campaign pods" (when you need a staffed unit, not a vendor) (Tier 1)

Callbox is built for companies that want a staffed execution unit. Their "Campaign Pod" model bundles multiple roles, which is why it works for complex, multi-region programs and why it costs more than a single-channel appointment setter.

What a pod usually includes (and why it matters):

| Pod role | Why it matters |

|---|---|

| SDR/Caller | Generates conversations, not just clicks |

| List/Data support | Keeps targeting and suppression clean |

| Campaign manager | Prevents ICP drift and message chaos |

| Tech support | Keeps tooling, tracking, and routing working |

Pricing snapshot: $20k-$40k quarterly (about $6.7k-$13.3k/month equivalent).

If you're only targeting one region and one persona, you don't need a pod.

If you're running multiple geos, multiple languages, and multiple offers, you do.

CIENCE Technologies - modular hybrid pricing (platform + services + optional SDRs) (Tier 2)

CIENCE is a hybrid vendor that publishes a modular structure you can budget against. You can buy the platform, add execution services, and optionally staff SDR capacity via their marketplace.

Published structure:

- $5,000 one-time setup (5-day sprint)

- $499/month platform license (includes 75,000 credits)

- $2,000/month strategic execution services

- SDR marketplace: $1,500-$5,500/month per SDR (level/region), plus $1,000 one-time onboarding per SDR

This model wins when you want to start lean, then add capacity without switching vendors. It fails when you don't control qualification criteria, because "meetings" becomes the goal instead of pipeline.

Dealfront - intent signals + outbound activation (Tier 2)

Dealfront is a strong choice when your bottleneck isn't finding contacts, it's prioritization. Visitor identification and intent signals help you focus outreach on accounts already showing buying behavior.

Pricing snapshot: $300-$1,500/month.

My opinion: intent data is only valuable if you have a routing SLA. If "high intent" sits in a dashboard for a week, you paid for trivia.

Leadfeeder - website visitor identification (Tier 2)

Leadfeeder isn't an outbound replacement. It's a way to stop wasting demand you already paid for by turning anonymous site visits into account-level leads.

When it wins / when it fails

| Wins when... | Fails when... |

|---|---|

| You have steady qualified traffic | Your traffic's tiny or mostly unqualified |

| You can define "high intent" pages | You treat every visit like a lead |

| Sales follows up within 24-48 hours | Follow-up's slow or inconsistent |

Pricing snapshot: $100-$500/month.

Thrive Agency - full-service demand gen (Tier 2)

Thrive is a broader demand gen agency: SEO, paid, creative, site work, and outbound support. It's useful when you want one vendor to cover multiple channels and you have the budget to manage a bigger scope.

Full-service agencies drift into activity theater unless you force outcome reporting. If you hire Thrive, assign a single internal owner responsible for held-meeting reporting and pipeline attribution.

Pricing snapshot: $3,000-$15,000/month depending on scope and channels.

SalesBread - outbound appointment setting (Tier 2)

SalesBread is positioned squarely in outbound appointment setting. The market's crowded here, so your vetting process matters more than the logo.

My recommendation: treat any outbound agency like a measurable production line. Run a pilot, enforce held-meeting payment triggers, and require disqualification reason codes.

Pricing snapshot: $4,000-$12,000/month.

A-SALES AB - structured outbound with clear process (Tier 2)

A-SALES AB shows up with concrete outcome rollups in Clutch summaries (including a realistic distribution of results). That's what you want: not perfection, but transparency.

Outbound quality varies by list, offer, and QA. Make them walk you through how they prevent qualification drift and how they handle disputes.

Pricing snapshot: $5,000-$12,000/month.

Semrush Agencies Directory (Tier 3)

Semrush's directory is useful for breadth: it helps you find niche agencies by geography and service type fast. Use it to build a shortlist, then apply the rubric and insist on a pilot.

Pricing snapshot: the directory's free; agencies commonly land $3k-$20k/mo depending on scope.

Adjacent tools you'll add once basics work (Tier 3)

These aren't agencies, but they show up in real stacks: data platforms, contact lookup tools, chat/conversational capture, and attribution. Budget ranges vary widely, and that's the point: add them after ICP, messaging, and list hygiene are stable.

If you're rebuilding the stack, start with a lean B2B sales stack so you don't buy overlapping tools.

Other commonly-shortlisted options (Tier 3)

You'll also see Cleverly (social-first outreach), Smith.ai (inbound call/chat answering), and UnboundB2B (lead research/content syndication) on shortlists. Useful, but only if they match your motion.

Skip these if you're still guessing at your ICP. You'll just buy more noise, faster.

Benchmarks & outcome math (CPL, cost per meeting, and held-meeting math)

Leads aren't meetings, and meetings aren't pipeline. You need a translation layer that turns spend into outcomes you can manage, because "we sent 40,000 emails" isn't a business result and "we booked 30 meetings" is meaningless if 12 were no-shows and 10 were the wrong persona.

CPL benchmarks (blended) by industry

From First Page Sage's 2026 benchmarks, blended cost per lead averages:

- B2B SaaS: $237

- IT/MSP: $503

- Manufacturing: $553

- Cybersecurity: $406

That's why "just run ads" isn't a plan unless your conversion path is tight. If your lead-to-meeting rate is weak, you're buying expensive form fills, not pipeline. Report: average cost per lead by industry (2026).

The only meeting benchmark that matters: held rate

Across appointment-setting benchmarks, 70-80% held rate is the target. Below 70% should trigger rebooking clauses or fee credits.

If a vendor can't tell you their held rate, you're buying a black box.

In-house SDR economics (what "DIY" really costs)

A fully loaded SDR costs $9,800-$14,200/month once you include base, variable, tools, and management overhead. If they produce 10-14 qualified meetings/month, you're effectively paying $821-$1,150 per meeting before you factor ramp time and churn.

Two practical implications:

- If your SDR ramp is 60-90 days, your first-quarter cost per meeting is higher than your spreadsheet says.

- If your list quality is poor, you'll blame the SDR when the real issue is bounces and spam placement.

If you want to gut-check your funnel, start with outbound pipeline generation math before you hire.

Pay-per-meeting economics (the "booked vs held" trap)

Pay-per-meeting is commonly $300-$600 for a qualified meeting. The only number that matters is cost per held meeting.

Mini math example:

- You pay $300 per meeting booked

- No-show rate is 25%

- Held meetings = 75% of booked

True cost per held meeting = $300 / 0.75 = $400

Now add the second trap: if "qualified" is vague, you'll pay for meetings that never become opportunities.

Retainer economics (how to judge if you're getting value)

Retainers are usually $4k-$15k/month for reputable outbound agencies. Evaluate them on:

- Held meetings

- Opportunity conversion

- Pipeline created per segment

- Time-to-first-meeting (and whether it improves after calibration)

| Model | Typical cost | Winner KPI | Who wins with it |

|---|---|---|---|

| In-house SDR | $821-$1,150/held mtg | opp conversion | Teams with strong enablement + lists |

| Pay-per-held-meeting | $300-$600/held mtg | held rate + ICP match | Teams that want risk shifted to vendor |

| Retainer agency | $4k-$15k/mo | held + pipeline | Teams that want capacity + speed |

One strong opinion: most "copy optimization" projects are really data quality projects in disguise. Fix bounces and spam placement first; your reply rate follows.

Vetting checklist + contract red flags (copy/paste SLA clauses)

If you're hiring an agency, your job isn't to "pick the best one." It's to write a contract that makes mediocre vendors impossible to hide.

I've seen teams burn 6 months because they were too polite to ask for a held-meeting definition up front, then spent the rest of the engagement arguing about edge cases while the vendor kept invoicing on "booked" meetings that never happened.

If you need a standard for what "qualified" should mean in your CRM, use a lead qualification framework and keep it consistent across vendors.

Non-negotiable vetting checklist

1) Define qualified + held meeting in writing

- ICP match: industry, size, geo

- Right persona/seniority

- Buyer has a real problem you solve (not "curious")

- Meeting is held (attended by the prospect)

- Disqualification reason codes (dropdowns, not just free text)

2) Enforce a held-rate expectation

- Target: 70-80% held rate

- Below 70% triggers rebooking or fee credits

- No "we can't control no-shows" excuses; your contract can

3) Require reporting that maps to pipeline

Weekly report should include:

- Held meetings by segment (persona/industry/geo)

- Show rate and no-show reasons

- Disqualification reasons (coded)

- Opportunity creation by cohort (even if early/rough)

- A short "what changed this week" note (targeting, copy, offer, list source)

If your internal process is messy, a lightweight lead qualification process is usually the fastest fix.

4) Own your data + suppression

- You own the list, suppression, and opt-outs

- Vendor must dedupe against your CRM before outreach

- Vendor must return all contacted records with timestamps and channel used

5) Demand a pilot structure

- Require a 90-day paid pilot with explicit KPIs

- Include a calibration checkpoint at day 14 and day 30

- Include a clean exit clause if held meetings don't materialize

Contract red flags (walk away)

- "Qualified" is vague or changes midstream.

- You pay for no-shows with no recovery policy.

- They push 6-12 month lock-ins before proving held meetings.

- They report activity (emails sent, opens) instead of outcomes.

- They won't share targeting logic or list sources.

Copy/paste SLA clauses (edit to your needs)

- Payment trigger: "Fees apply only to meetings that are held and meet the Qualification Criteria in Exhibit A."

- Show-rate: "Vendor will maintain a monthly held-meeting rate of at least 70%. If below, Vendor will rebook at no charge until met."

- Dispute window: "Client may dispute a meeting within 5 business days with reason code (ICP mismatch, wrong persona, no-show, etc.)."

- Reporting cadence: "Weekly report includes held meetings, show rate, disqualification reasons, and opportunity conversion for prior cohorts."

- Pilot exit: "Either party may terminate after 90 days with 15 days' notice."

Here's the truth: agencies don't become bad after you sign. Incentives were misaligned from day one, or they weren't.

Compliance checklist for outbound & lead buying (GDPR/CCPA/TCPA + consent records)

Compliance isn't a legal checkbox. It's budget protection.

If you're unsure where the lines are, keep a practical GDPR for Sales and Marketing checklist in your outbound SOP.

US (TCPA) basics in plain English

- TCPA penalties run $500-$1,500 per violation.

- Opt-outs must be honored within 10 business days.

- If you're calling/texting using automated systems, consent rules get strict fast.

Critical rule for bought leads (effective Jan 27, 2025)

- One-to-one consent means seller-by-seller consent for robocalls/robotexts. You can't buy a "consented lead" list and assume you're covered.

- You need consent recordkeeping: who consented, when, how, what they saw, and which seller they consented to.

2026 update to plan around: broader opt-out scope provisions were delayed until Apr 11, 2026. Build suppression workflows that can scale to universal opt-outs without breaking your outbound motion.

EU (GDPR) outbound checklist

- Lawful basis documented (and consistent with your outreach)

- Clear identification + easy opt-out

- Suppression lists enforced across vendors

- DPAs available and signed where needed

- A process to fulfill access/deletion requests without scrambling

Contract requirements to include (simple and enforceable)

- Vendor must maintain and apply a global suppression list.

- Vendor must provide consent records for any lead sold as "consented."

- Vendor must notify you within 48 hours of any complaint spike or deliverability issue.

- Vendor must provide a weekly export of contacted records (so you can audit).

Data quality & deliverability: the hidden lever behind every "lead gen company"

Most teams treat data like a commodity. Then they wonder why their "top agency" can't book meetings.

Bad data creates a chain reaction:

- Bad data -> bounces

- Bounces -> spam placement

- Spam placement -> fewer replies

- Fewer replies -> fewer meetings

- Fewer meetings -> you blame the agency

Here's what to measure weekly (and what "good" looks like):

- Bounce rate: aim for under 4-5%

- Spam placement / inboxing: track by domain and mailbox provider

- Reply rate by segment: persona + industry + region (find where it breaks)

- Held rate: if held rate drops, your qualification or reminder process is broken

- Duplicate rate: duplicates inflate volume and wreck attribution

If you need a formal scorecard, use a simple data quality rubric so you can compare vendors and lists apples-to-apples.

A concrete example from a Prospeo customer scenario: Meritt (B2B services firm) cut bounce rate from 35% to under 4% and tripled pipeline from $100K to $300K/week after fixing list quality and verification. That wasn't "better copy." That was better inputs.

If you're using an agency, controlling this layer is how you keep them honest. If you're running in-house, it's how you stop burning domains and SDR time.

If you're troubleshooting bounces, the 550 Recipient Rejected guide is a fast starting point.

Whether you run outbound in-house or pair with an agency, data quality is the variable that decides your cost per held meeting. Prospeo's 300M+ profiles with 30+ filters - buyer intent, technographics, job changes, headcount growth - let you build lists that actually convert. Teams using Prospeo book 26% more meetings than ZoomInfo users and 35% more than Apollo.

Stop subsidizing bad data. Start with 100 free credits today.

FAQ

What's the difference between a B2B lead gen company and a lead gen platform?

A B2B lead gen company is a services partner that books meetings or delivers leads for you, while a lead gen platform is software you use to find, verify, and enrich prospects yourself. In practice, agencies sell execution capacity and platforms sell control, and a lot of teams pair both so they can scale outreach volume without letting data quality slide.

What should a "qualified, held meeting" definition include?

A qualified, held meeting should require ICP match (industry, size, geo), the right persona/seniority, and a confirmed problem you solve, and it only counts if the prospect attends. Add reason codes plus a 5-business-day dispute window so you don't pay for mismatches, vendors, or no-shows.

How much do B2B lead generation companies cost in 2026?

Most reputable outbound agencies cost $4,000-$15,000/month, while enterprise pod models often run $20k-$40k per quarter depending on regions and channels. Pay-per-meeting commonly lands at $300-$600, but your real cost depends on whether you pay on booked vs held and whether your held rate stays above 70%.

How long until an outbound agency should produce meetings?

A competent outbound agency should show early signal in 2-3 weeks (replies, positive intent, calibration) and first held meetings in 4-6 weeks for many mid-market segments. If there's no measurable progress by week 6, something's broken: targeting, offer, list quality, or deliverability, and you should force a reset.

What's a good free alternative to expensive B2B data providers?

For most teams, start with a self-serve tool that includes verification and enrichment so you can keep bounce rates under 4-5%. Prospeo's free tier includes 75 emails + 100 Chrome extension credits/month, and it's built around 98% verified email accuracy and a 7-day refresh, which is a strong baseline before you pay for bigger suites.

Summary: how to choose b2b lead generation companies without wasting a quarter

If you take one thing from this list, make it this: the best partner is the one whose incentives line up with held meetings and pipeline, not activity.

Shortlist a few b2b lead generation companies, force a pilot, pay on held outcomes where possible, and keep your data quality under your control, or you'll spend the quarter arguing about why the meetings didn't convert.