Outbound Pipeline Generation in 2026 (Operator Playbook + Templates)

Outbound pipeline generation's easy to describe and brutally easy to mess up. The failure pattern's consistent: teams scale volume before they lock definitions, verify data, and protect deliverability - then wonder why "more activity" produces less revenue.

Hot take: if you're selling a low-priced product with a short sales cycle, you don't need a "pipeline machine." You need a tight offer, fast follow-up, and clean lists. Most teams overbuild the system and underinvest in the basics.

Look, I've sat in too many Monday forecast calls where everyone celebrates "activity" while the number quietly slips.

What you need (quick version)

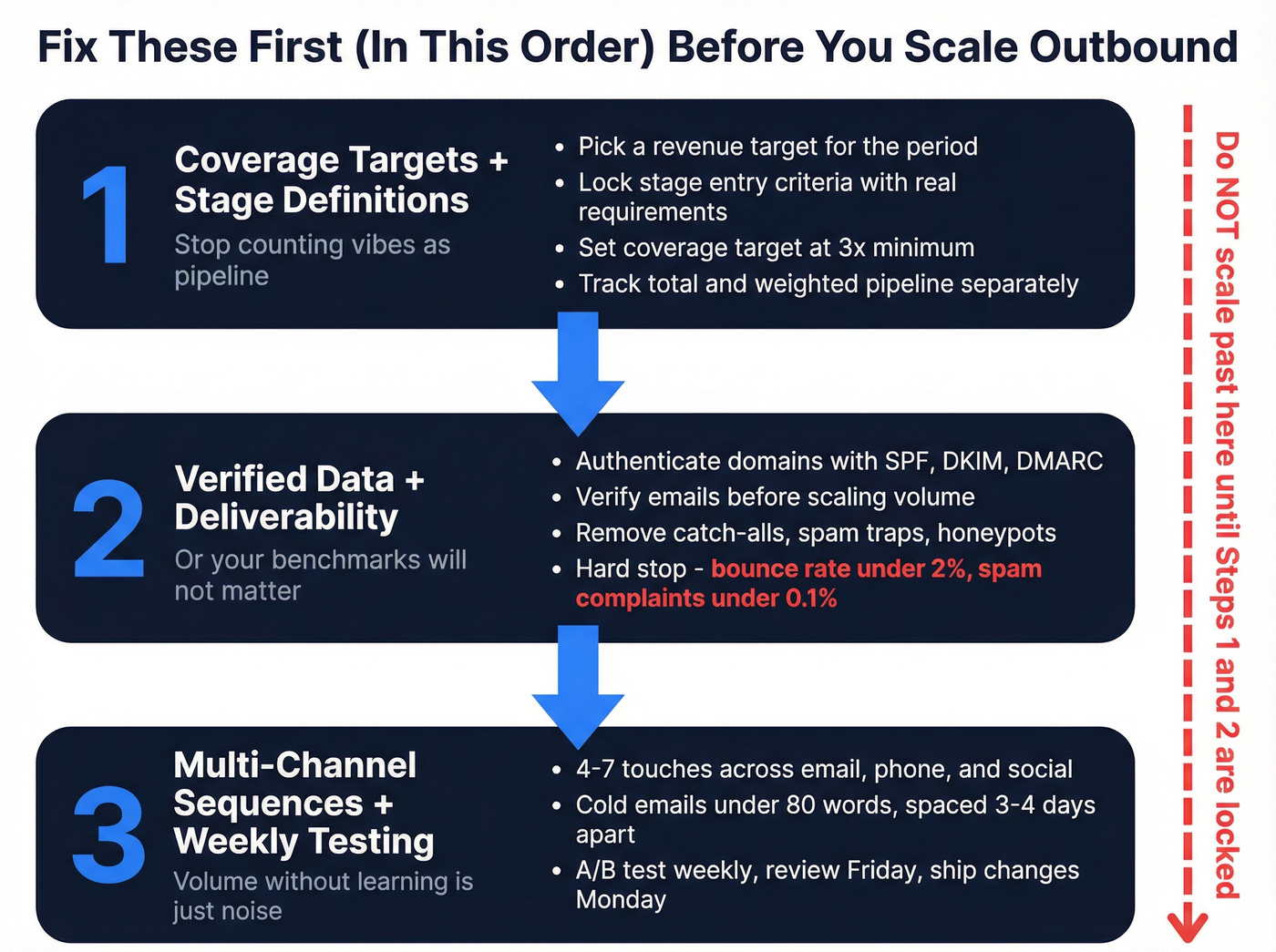

Use this as your fix-first checklist before you hire more SDRs, buy more tools, or crank volume.

Coverage target (what it means): the multiple of weighted pipeline you need versus your go-get gap so you can hit the number without praying for miracles.

Governance teaser: decide, in writing, what counts as sourced vs influenced pipeline - otherwise every channel will "win" and your forecast will lose.

Hard stop rule: don't scale outbound until bounce rate's under 2% and spam complaints are under 0.1% on the sending domain. If you're above either, you're not "testing," you're damaging your ability to reach inboxes.

Fix-first (in this order)

1) Coverage targets + stage definitions (stop counting vibes as pipeline)

- Pick a revenue target for the period (month/quarter/year).

- Lock stage entry criteria (what must be true to enter Discovery, Demo, Proposal, etc.).

- Set stage weights (start with defaults, then replace with your historical conversion).

- Track total pipeline and weighted pipeline separately.

- Set a coverage target: 3x minimum, 3x-5x typical (segment-specific later).

2) Verified data + deliverability (or your "benchmarks" won't matter)

- Authenticate domains (SPF/DKIM/DMARC), add one-click unsubscribe, monitor spam complaints.

- Verify emails before you scale volume; Prospeo's built for this exact data-quality control job.

- Remove catch-alls, spam traps, honeypots, and role accounts from sequences.

3) 4-7 touch multi-channel + weekly testing (volume without learning is just noise)

- Run 4-7 touches across email + phone + social to build a reliable cold outreach pipeline.

- Keep cold emails under 80 words and space touches 3-4 days apart.

- A/B test weekly (subject, opener, CTA, persona angle).

- Review results every Friday and ship one change every Monday.

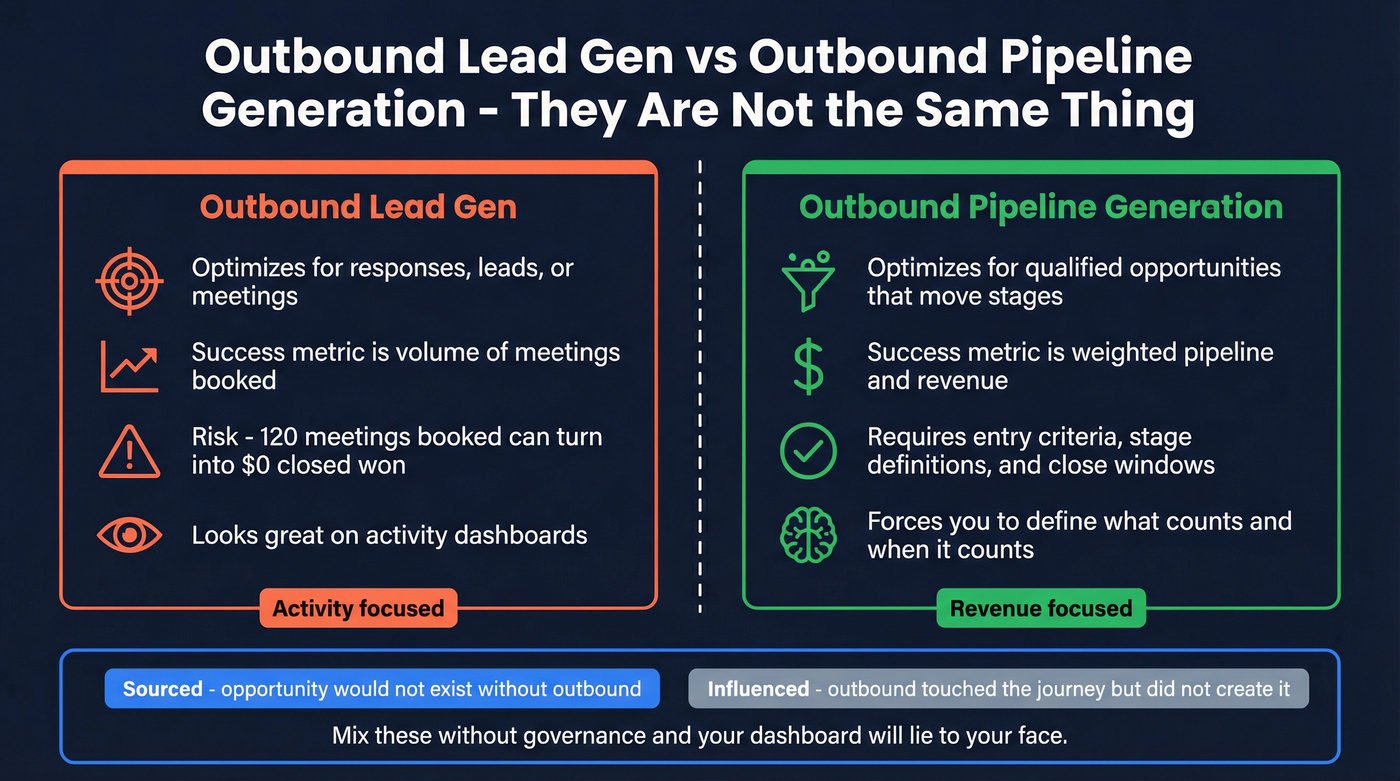

Outbound pipeline generation (definition + what it isn't)

Outbound pipeline generation's the repeatable process of creating sales-qualified opportunities (and ultimately revenue) by proactively reaching a defined set of accounts and people - turning outbound activity into an outbound sales pipeline you can forecast.

It's not the same thing as outbound lead gen.

Outbound lead gen optimizes for responses, leads, or meetings. Pipeline work optimizes for opportunities that meet your entry criteria, move stages, and close inside a defined time window.

That difference stops being academic the first time you're in a forecast call explaining why "120 meetings booked" turned into "$0 closed-won." It forces you to define what counts, when it counts, and how it converts.

One more distinction that matters in 2026: sourced vs influenced.

- Sourced pipeline is created by outbound (the opportunity wouldn't exist without it).

- Influenced pipeline is pipeline that had outbound touches somewhere in the journey, but wasn't created by outbound.

Mix those without governance and you'll build a beautiful dashboard that lies to your face.

Email's harder than it used to be.

Treat deliverability like infrastructure, not a "marketing problem." (If you need the mechanics, start with email deliverability.)

The outbound pipeline model (stages + entry criteria)

If your stages don't have entry criteria, you don't have a pipeline model - you've got a shared hallucination.

Here's a practical template you can copy into your CRM stage definitions. The stage-weight examples below are common SaaS defaults used by operators; they're good until you replace them with your own historicals.

| Stage | Entry criteria (minimum) | Weight example |

|---|---|---|

| Prospecting | Target account + persona | 0% |

| Meeting set | Invite accepted | 0% |

| Discovery | Discovery held + pain confirmed | 10-15% |

| Demo / Presentation | Demo done + next step booked | ~30% |

| Proposal / Quote | Commercials sent | ~50% |

| Negotiation / Contract | Legal/procurement engaged | Up to 80% |

| Verbal commit | "Yes" pending signature | 90-95% |

| Closed won | Signed | 100% |

To keep the table readable, put the detail in your stage notes. Use these operator-grade add-ons:

- Discovery (required fields): problem statement, current workflow, impact, timeline, decision process, next meeting date.

- Demo (required fields): use case agreed, success criteria, stakeholders list, mutual action plan started.

- Proposal (required fields): pricing sent, procurement path, target close date, champion confirmed.

Two operator rules that save teams months of arguing:

- Don't weight stages you can't audit. If "Discovery" means "rep had a nice chat," weighting's fantasy.

- Separate "meeting set" from "discovery held." The #1 forecasting error is counting "meeting set" as "discovery held"--no-show + wrong persona inflates pipeline and wrecks forecasting.

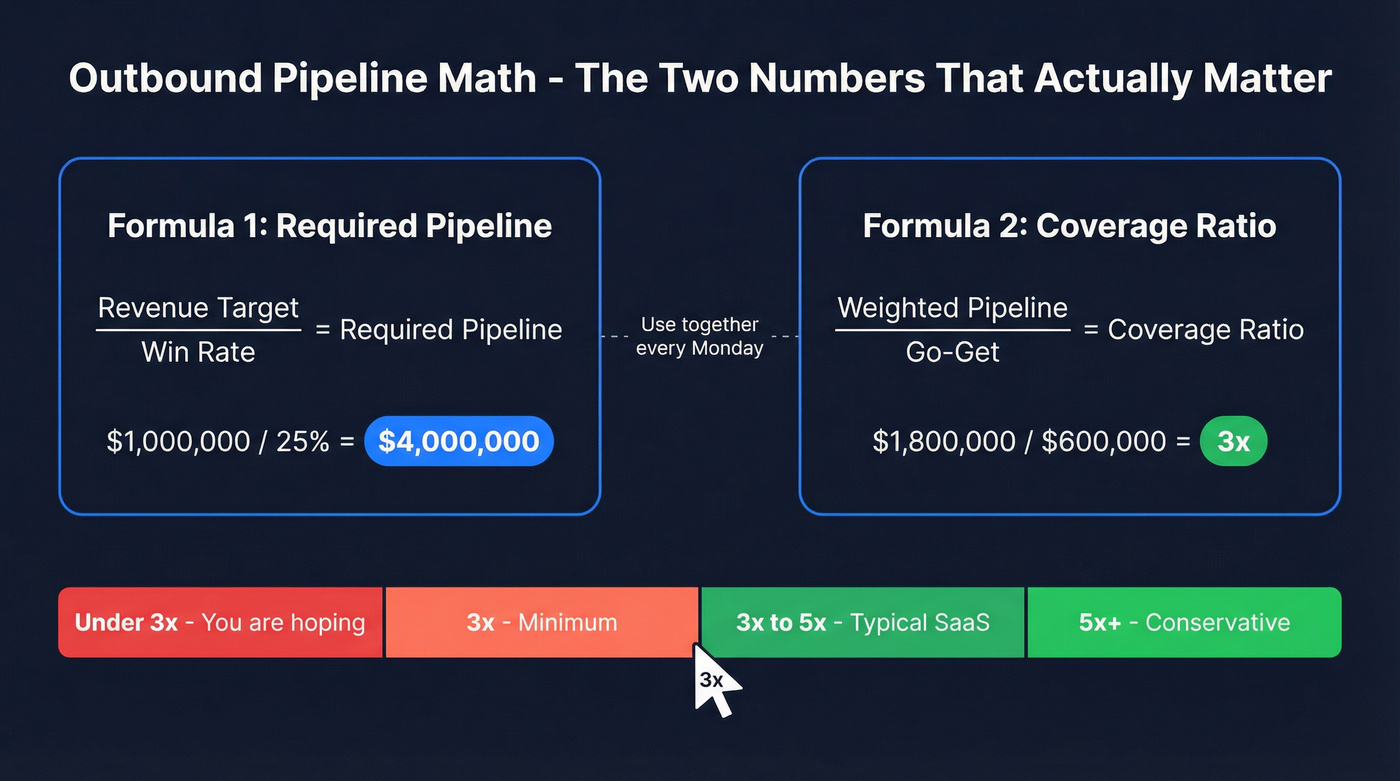

Pipeline math for outbound pipeline generation (coverage, weighted, go-get)

Outbound pipeline generation's a math problem wearing a messaging costume. If the math's wrong, you'll keep "improving copy" while the real issue is coverage, conversion, or capacity.

The three numbers you need every Monday

Revenue Target (RT) What you need to close in the period.

Win Rate (WR) Closed-won divided by qualified opportunities (use your definition of "qualified," not marketing's).

Go-Get (GG) The gap between target and what's already essentially committed.

Formula 1: Required Pipeline (generation goal)

Required Pipeline = Revenue Target / Win Rate

Example:

- Revenue Target = $1,000,000 this quarter

- Win Rate = 25%

- Required Pipeline = $1,000,000 / 0.25 = $4,000,000

That's not "nice to have." That's the amount of qualified pipeline you need created (or present) to have a real shot at the number.

Formula 2: Coverage Ratio (health metric)

Coverage Ratio = Weighted Pipeline / Go-Get

Where:

- Weighted Pipeline = sum of (Deal Amount x Stage Weight)

- Go-Get = Revenue Target - (Closed Won + near-certain commits)

If your go-get's $600k and your weighted pipeline's $1.8M, your coverage ratio's 3x.

Coverage targets that keep you honest

Use these defaults, then replace them with your historicals:

- 3x minimum (below this, you're hoping)

- 3x-5x typical for venture-backed SaaS

- SMB / faster cycles: 1.5x-2x can be enough with fast cycles and high win rates

- Enterprise / longer cycles: 4x-5x is common with long cycles and lower win rates

Blunt call: if your weighted coverage's under 3x, stop debating copy and fix list quality + stage governance.

Total pipeline vs weighted pipeline (the "pipeline theater" trap)

Total pipeline's useful for activity tracking. It's terrible for forecasting.

Weighted pipeline's what you should use for coverage, because it bakes in stage reality. The catch: your weights must be grounded in actual conversion, not optimism.

Operationalize it like this:

- Start with default weights (Discovery 10-15%, Demo ~30%, Proposal ~50%, Negotiation up to 80%, Verbal 90-95%).

- After 60-90 days, replace each weight with your own: Stage Weight = historical close rate from that stage

If you want a faster spreadsheet version, use a pipeline generation calculator.

Bonus: pipeline velocity (sanity check)

If pipeline looks "big" but revenue isn't moving, pipeline velocity exposes the bottleneck:

Pipeline Velocity = (# Opps x Avg Deal Size x Win Rate) / Sales Cycle Days

Median velocity's often in the high four figures per day, and enterprise teams can run much higher. If you're far below your segment, you've got a conversion or cycle-time problem - not a "more leads" problem.

Your coverage ratio means nothing if 35% of emails bounce. Prospeo's 5-step verification, catch-all handling, and spam-trap removal keep bounce rates under 2% - the hard stop rule this playbook demands. At $0.01 per email, clean data costs less than one wasted SDR hour.

Stop scaling volume on dirty lists. Verify first.

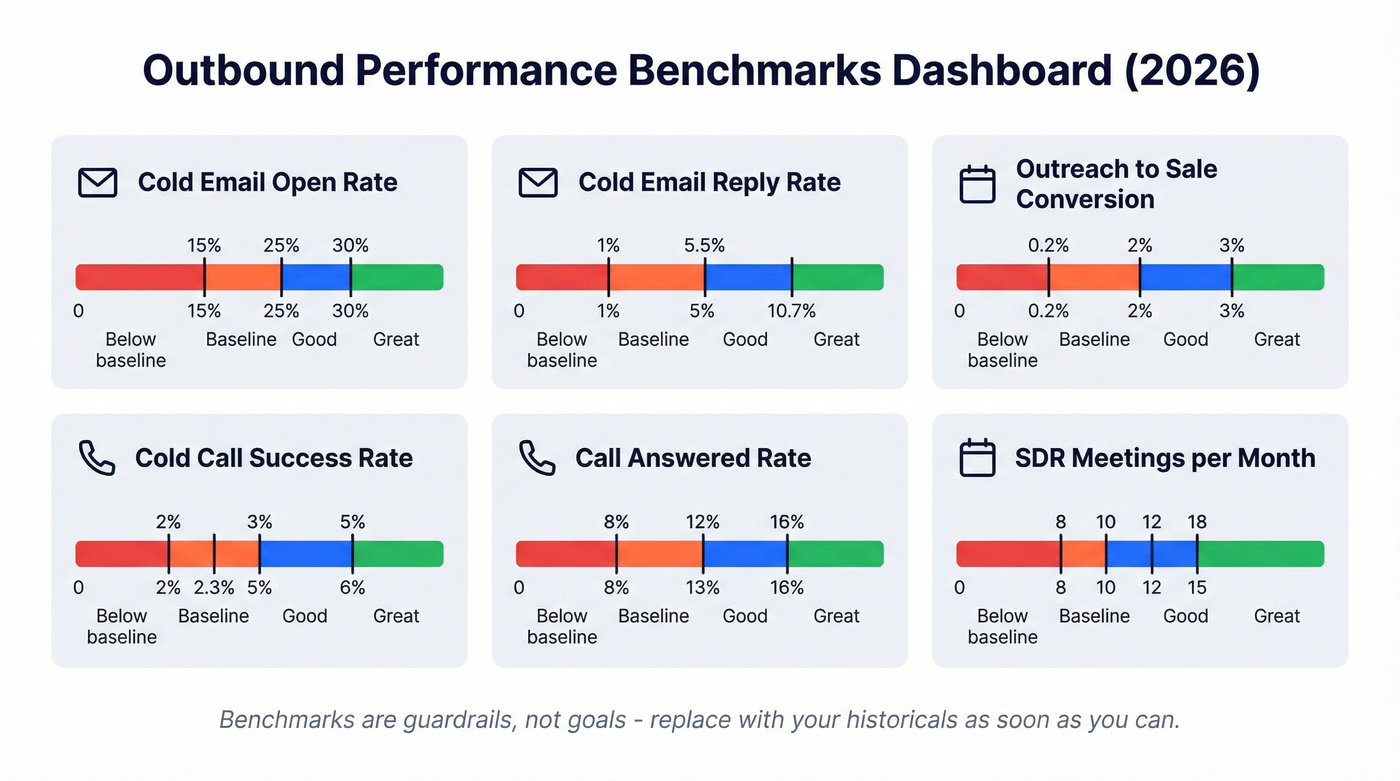

Benchmarks dashboard (2026) for outbound performance

Benchmarks are guardrails, not goals. Use your historicals as truth, and use these ranges to spot when something's broken.

| KPI | Baseline | Good | Great |

|---|---|---|---|

| Cold email open rate | 15-25% | 25-30% | 30% |

| Cold email reply rate | 1-5% | 5.5%+ | 10.7%+ |

| Cold outreach -> sale conversion | 0.2-2% | 2%+ | 3%+ |

| Cold call success | ~2.3% | 3-5% | 6%+ |

| Call answered rate | 8-12% | 13-15% | 16%+ |

| SDR meetings / month | 8-10 | 12-15 | 18+ |

How to read this without lying to yourself:

- Opens are a weak KPI post-privacy, but they're still a deliverability smoke test. If opens crater while targeting stays constant, inboxing's slipping or your domain reputation's getting throttled.

- Cold email reply rate: under 1% is almost always list + deliverability, not "bad subject lines."

- Cold calling: answered rate isn't meeting rate, but it's the first gate. If your answered rate's awful, your "calling script" isn't the problem. Your numbers are.

- SDR meetings: 8-10/month is a fair median; 12-15 is top quartile; 18+ is elite.

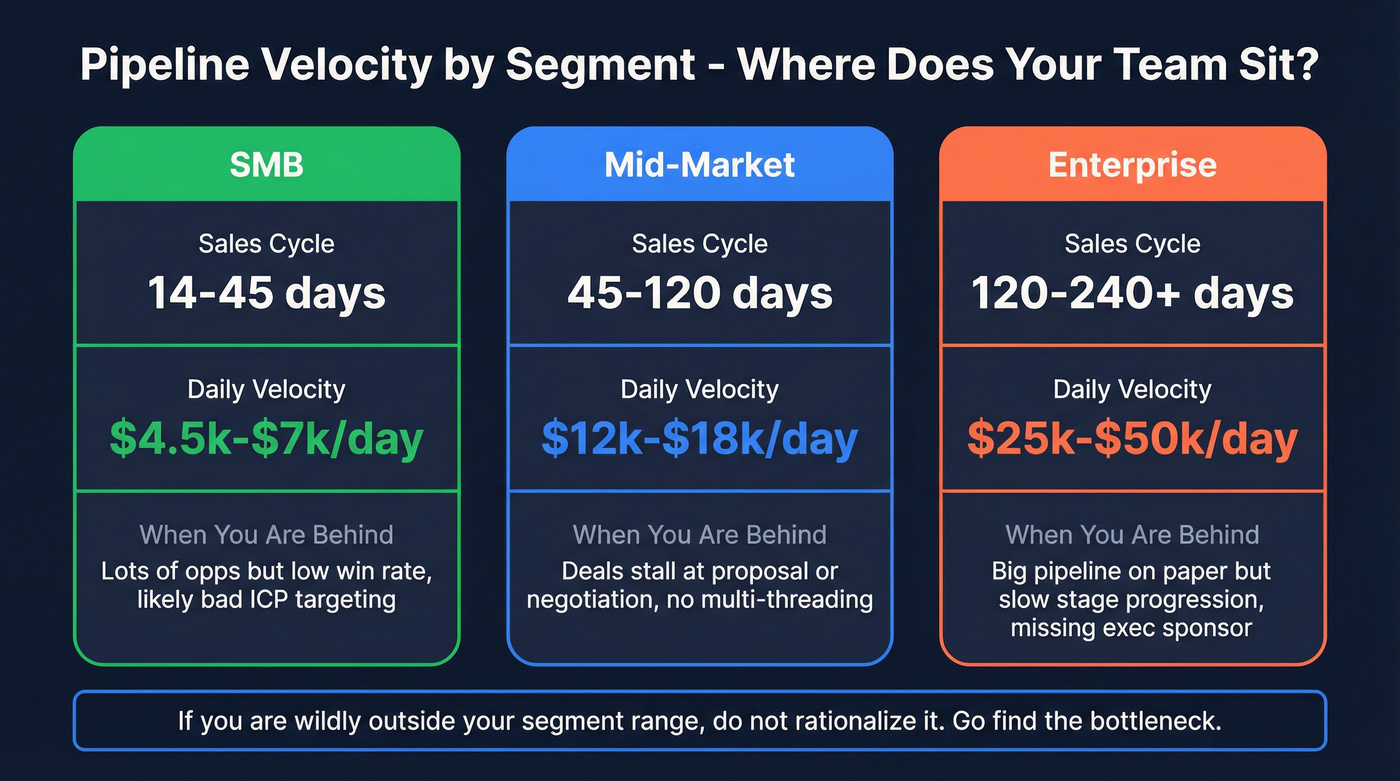

Benchmarks by segment (velocity sanity check)

Use velocity to sanity-check whether your pipeline math matches your motion.

| Segment | Typical sales cycle | Velocity (2026) | What "behind" looks like |

|---|---|---|---|

| SMB | 14-45 days | ~$4.5k-$7k/day | Lots of opps, low win rate (bad ICP) |

| Mid-market | 45-120 days | ~$12k-$18k/day | Stalls in proposal/negotiation (no multi-thread) |

| Enterprise | 120-240+ days | ~$25k-$50k/day | "Big pipeline," slow stage progression (no plan, no exec sponsor) |

If you're wildly outside your segment range, don't rationalize it. Go find the bottleneck.

Capacity planning (how many SDRs/AEs you need + ramp)

Capacity planning's where outbound programs quietly fail. Teams set a pipeline target, then staff like it's vibes-based.

Pipeline support's chronically under-resourced. Capacity planning's how you prevent burnout and churn - especially when leadership decides "we'll just do more outbound."

Step 1: Pick your "kitchen chain" (one metric per link)

Use a simple chain:

Accounts -> Touches -> Conversations -> Meetings (S1) -> Sales Accepted (S2) -> Closed Won

You don't need perfect numbers. You need consistent definitions.

Step 2: Set capacity assumptions (start conservative)

Planning defaults when a team has no historicals yet:

- Meeting -> opportunity created: 20-40% (ICP fit + AE discipline)

- Opportunity -> closed-won: 15-30% (segment + cycle)

Replace these with your historicals as soon as you've got 2-3 months of data.

Step 3: Daily activity benchmarks (what "top quartile" looks like)

A practical top-quartile activity range per SDR per day:

| Metric (per SDR per day) | Top quartile |

|---|---|

| Calls | 70-80 |

| Emails | 45-55 |

| Social touches | 25-35 |

| Total touches | 140-170 |

And conversion-to-meeting ranges that make those activities meaningful:

| Channel | Conversion to meeting |

|---|---|

| Calls | 2.0-3.5% |

| 0.8-2.0% | |

| Social DM | 2.0-4.5% |

| Multi-touch sequence (blended) | 4.0-7.0% |

Strong opinion: if your team's "busy" but nowhere near these activity levels, you don't have a messaging problem - you've got a management and workflow problem.

Step 4: Throughput reality (S1 creation)

Operator defaults that keep plans honest:

- SDR capacity: ~15 S1 opportunities/month

- AE capacity: ~30 S1 opportunities/month

This is a forcing function: if AEs can only run 15 first meetings a month, hiring SDRs won't fix throughput. It creates backlog and slows follow-up.

Step 5: Account for ramp (or your plan's fantasy)

In our experience, ramp to full productivity takes 3-4 months. Month 1's often 20-30% of target; month 4's where consistency shows up.

Spreadsheet ramp adjustment:

- Month 1: 25%

- Month 2: 50%

- Month 3: 75%

- Month 4+: 100%

Step 6: Failure modes + fixes (capacity edition)

- Failure mode: SDRs generate meetings AEs don't run. Fix: cap meeting volume per AE, enforce an SLA on follow-up, and stop booking "maybe" meetings.

- Failure mode: AEs reject meetings and SDRs spiral. Fix: define S2 acceptance criteria and run weekly calibration with examples.

- Failure mode: activity's high, output's low. Fix: tighten ICP slices, add verified mobiles, and stop single-threading (see buying committee section).

Step 7: Hiring logic (SDR vs AE)

Use this rule:

- If AEs have unused capacity, hire SDRs first.

- If SDRs generate more S1s than AEs can run, hire AEs (or fix AE process).

I've watched teams add three SDRs to "fix pipeline" while AEs sat on 40 untouched leads each.

That's not pipeline. That's neglect.

Channel mix + buying committee coverage (how to not stall in single-thread)

Single-threading's the silent killer of outbound pipeline. You book a meeting with one champion, it goes well, then nothing - no procurement, no security, no exec sponsor, no timeline.

Pickup's down. Don't run phone-first unless you've got verified mobiles and a real calling block, because otherwise you're just training your team to hate the phone.

Activity mix (a practical heuristic)

A workable split for mid-market and enterprise motions:

- 55% phone

- 30% social

- 15% email

Skip phone-first if you don't have verified phone coverage. You'll burn hours dialing dead numbers and convince yourself "calling doesn't work."

Buying committee reality (and the 5 roles to cover)

Buying committees are big now. The exact number doesn't matter. The operational implication does: one-thread deals die.

Cover these 5 roles in almost any B2B deal:

- Economic buyer (budget owner)

- Champion (day-to-day owner)

- Technical evaluator (security/IT/engineering)

- Procurement/legal (process gatekeepers)

- Executive sponsor (priority + urgency)

Rule: one meeting should lead to 2-3 additional stakeholders within 14 days, or you're drifting. If you need a system for this, use an ABM multi-threading approach.

Signals > personalization: how to prioritize accounts (3 signal tiers)

Most teams waste personalization on accounts that aren't in-market. Flip it: route accounts by signal strength, then personalize within the tier.

- Tier 1 - Known intent: active topic intent + ICP match. Put these into a fast, direct sequence with a clear "why now" and a short meeting CTA.

- Tier 2 - Champion moves: job changes into your target function, new leader hires, or internal reorg signals. Run a "new leader" sequence: credibility + quick diagnostic + stakeholder mapping.

- Tier 3 - Inferred intent: headcount growth, department buildout, tech stack fit, hiring velocity. Use a slower, education-first sequence and aim for discovery, not demo.

This is the operator answer to "intent tiers" and the AI-SDR hype: signals decide who gets attention; good sequencing decides what happens next.

Sequence design rules (what to send, how often, how to test)

Most sequences fail because they're written like marketing copy and sent like spam.

The rules (2026 reality)

- 4-7 touches is the sweet spot. Past 7, returns drop unless each touch adds new value.

- Keep emails under 80 words. Short wins because it's scannable on mobile and doesn't trigger "this is a pitch deck" fatigue.

- Space touches 3-4 days apart.

- Run weekly A/B tests. If you're not testing weekly, you're not learning fast enough. (If you're building a testing system, start with A/B Testing Lead Generation Campaigns.)

A scenario you'll recognize: a rep sends Email 1, gets no reply, then "circles back" two weeks later with the same ask, to the same person, with no new information, and wonders why outbound "isn't working." That's not outbound. That's procrastination with a send button.

A sequence template you can steal (7 touches, multi-channel)

Touch 1 (Email): 1-sentence relevance + 1-sentence proof + 1 question Touch 2 (Call): reference email + 20-second value hypothesis Touch 3 (Social): connect + short note (no pitch) Touch 4 (Email "reply-style"): "Quick bump - wrong person?" + 2 options Touch 5 (Call): new angle (trigger, job change, tech stack) Touch 6 (Email): micro-case study (2 lines) + CTA Touch 7 (Breakup): polite close + permission to follow up later

Testing cadence (what to test first)

Weekly test priority:

- ICP slice (industry, headcount, tech stack)

- Offer angle (cost reduction vs revenue vs risk)

- CTA (15-min fit check vs "who owns X?")

- Subject line (last, not first)

If your list is wrong, no subject line will save you.

Deliverability (Gmail/Yahoo rules) + why bad data kills pipeline

Deliverability's a gating function. If inboxing drops, your benchmarks collapse, SDR morale tanks, and leadership blames the team instead of the infrastructure.

Minimum standard (non-negotiable)

For bulk senders, the baseline requirements are straightforward:

- Authenticate with SPF, DKIM, DMARC

- Provide one-click unsubscribe

- Honor unsubscribes within 2 days

- Keep spam complaints under 0.3%

Operationally, treat 0.10% spam complaints as the line you don't cross. Once you get flagged, climbing back out takes time, and time's the one thing your quarter doesn't have.

These requirements, introduced a couple years back, are still the enforcement standard in 2026.

Failure modes + fixes (deliverability edition)

- Spam complaints over 0.1%: pause outbound on that domain, tighten targeting, and remove risky segments. Don't "push through it."

- Bounce rate over 2%: stop sending, verify the list, and remove catch-alls/role accounts/stale contacts.

- Reply rate collapses while activity stays flat: assume inboxing slipped until proven otherwise; check spam placement and domain reputation.

Why bad data kills pipeline (fast)

Bad data doesn't just create bounces. It creates:

- Higher spam complaints (wrong person, wrong company)

- Lower engagement (hurts reputation)

- More blocks (domain throttling)

- Wasted SDR time (dead numbers, wrong titles)

We've watched outbound programs "mysteriously" improve after one change: stop sending to unverified lists. Everything else - copy, cadence, channels - works better when you're reaching real inboxes, and that compounding effect is exactly why teams that take data hygiene seriously pull away over a quarter.

Compliance basics (US/EU/Canada)

You don't need a law degree to run compliant outbound, but you do need discipline:

- Identify yourself clearly (company name + contact info in the email).

- Make opt-out effortless (one-click unsubscribe is the standard; honor it fast).

- Respect timing rules (process unsubscribes within required windows; don't "re-add" people).

- Keep records for GDPR/CASL (lawful basis, suppression lists, and proof of opt-out handling).

- Don't scrape indiscriminately (build lists from vetted sources, and enforce opt-out globally).

Compliance isn't just risk management - it protects deliverability. The inbox punishes sloppy behavior long before regulators do.

List building + verification workflow (the execution layer)

The clean workflow is: define list spec -> build list -> verify -> enrich -> push to sequencer/CRM -> measure with consistent fields.

This execution layer's also where most B2B pipeline efforts either compound (clean data + clean definitions) or collapse (dirty lists + fuzzy stages).

Step-by-step workflow (copy this)

Step 1: Define your list spec (before you touch a tool)

- ICP filters: industry, headcount, geography, technographics, growth signals (see ideal customer)

- Personas: 2-3 primary roles + 2 secondary roles (for multi-threading)

- Exclusions: existing customers, open opps, competitors, bad-fit segments

Step 2: Build the list with filters (not "search and pray")

Step 3: Verify and standardize before you sequence Verify emails, remove risky addresses, and standardize fields like persona, segment, region, and source. This is what makes reporting and routing work later. (If you need the SOP, use an email verification list.)

Step 4: Enrich and push into your systems Enrich missing fields and push to your sequencer/CRM with mapped properties so AEs can accept/reject meetings cleanly. If you're building workflows, start with your enrichment schema and only then worry about copy.

Skip this section if you're a founder sending 30 hand-picked emails a week from one inbox. You're not doing "pipeline generation" yet, and that's fine.

Now, if you're running real volume, you need a real system.

Measurement governance (stop "pipeline theater")

Outbound gets political fast because everyone wants credit. Governance keeps the system honest and prevents "pipeline growth" from turning into attribution games.

Rules that keep reporting clean

Rule 1: Never blend attribution models arithmetically Don't add numbers from a data-driven model to last-touch CRM attribution. Compare them, don't sum them.

Rule 2: Define sourced vs influenced in one sentence each

- Outbound-sourced pipeline: the opportunity was created from an outbound touch and meets your S2 criteria.

- Outbound-influenced pipeline: outbound touches occurred before opportunity creation, but outbound didn't create the opportunity.

Rule 3: Stage entry criteria are mandatory If reps can move deals without meeting criteria, weighted pipeline becomes fiction.

Rule 4: Weighting must be based on historical conversion Defaults are for day 1. Historical conversion is for every day after.

Rule 5: Filter pipeline by sales cycle Only count pipeline that can realistically close in-period. Otherwise you'll "hit coverage" with deals that've got zero chance of closing this quarter.

If you want the broader operating layer, map this to B2B sales pipeline management rules.

Weekly operator scorecard template (copy/paste)

Use this in a doc or spreadsheet and review it every Monday:

- Weighted coverage ratio (this period): ___x

- Go-get (this period): $___

- New S1 created (last week): ___

- S1 -> S2 acceptance rate: ___%

- New pipeline sourced (last week): $___ (total) / $___ (weighted)

- Median time-to-first-touch after inbound/hand-off: ___ hours

- Bounce rate (last week): ___%

- Spam complaint rate (last week): ___%

- Meetings held rate (held / set): ___%

- Top 2 ICP slices by reply rate: ___ / ___

Worked example (copy/paste spreadsheet math)

Let's use clean, simple numbers so you can model this in five minutes.

Assumptions

- ACV: $25,000

- S1 -> S2: 50%

- S2 -> Closed Won: 20%

- SDR capacity: 15 S1 opps/month

- SDR team: 6 SDRs

- Ramp factor: 75% (use this if the team's new)

Monthly math

- SDR output (S1/month): 6 x 15 = 90 S1/month

- If ramping at 75%: 90 x 0.75 = 67.5 S1/month

Now convert:

- S2/month = 90 x 50% = 45 S2/month

- Wins/month = 45 x 20% = 9 wins/month

- ARR/month = 9 x $25,000 = $225,000

Annualized view (the headline)

- Wins/year = 9 x 12 = 108 wins/year

- ARR/year = 108 x $25,000 = $2.7M ARR

| Metric | Value |

|---|---|

| SDRs | 6 |

| S1 / month | 90 |

| Wins / year | 108 |

| ARR / year | $2.7M |

Spreadsheet columns + formulas (template)

Create a sheet with these columns (one row per month):

- A: Month

- B: # SDRs

- C: S1 per SDR (target)

- D: Ramp factor (0.25 / 0.50 / 0.75 / 1.00)

- E: S1 created ->

=B2*C2*D2 - F: S1->S2 rate

- G: S2 created ->

=E2*F2 - H: S2->Win rate

- I: Wins ->

=G2*H2 - J: ACV

- K: New ARR ->

=I2*J2

If you want to tie it back to coverage:

- L: Revenue target (period)

- M: Win rate (period)

- N: Required pipeline ->

=L2/M2 - O: Weighted pipeline (current)

- P: Go-get ->

=L2-(ClosedWon+Commits)(use two input cells) - Q: Coverage ratio ->

=O2/P2

Planning defaults you can swap in if you don't track S1/S2 yet:

- Meeting -> opportunity created: 20-40%

- Opportunity -> close: 15-30%

FAQ

What's the difference between outbound lead gen and outbound pipeline generation?

Outbound lead gen optimizes for responses and meetings. Outbound pipeline generation optimizes for qualified opportunities that meet stage entry criteria and can realistically close in-period, typically requiring 3x+ weighted coverage. The difference is governance: definitions, stage weighting, and coverage math that predict revenue instead of celebrating activity.

What pipeline coverage ratio should we target in 2026?

Most B2B SaaS teams should target 3x minimum weighted pipeline coverage, with 3x-5x typical depending on win rate and sales cycle length. Faster SMB motions can run 1.5x-2x. Enterprise motions often need 4x-5x to offset longer cycles and lower win rates.

How many meetings per SDR per month is "good" in 2026?

A solid benchmark is 8-10 qualified meetings per SDR per month as the median, 12-15 as top quartile, and 18+ as elite performance. If you're below 8 consistently, fix list quality, territory design, and AE acceptance discipline before you blame effort.

What deliverability requirements matter most for cold outbound today?

The non-negotiables are SPF/DKIM/DMARC authentication, one-click unsubscribe, honoring unsubscribes within 2 days, and keeping spam complaints under 0.3% (with Gmail recommending under 0.10%). If spam complaints exceed 0.1% or bounces exceed 2%, pause that domain and clean targeting and list hygiene.

What's a good free tool to reduce bounces before launching outbound?

For small teams, start with Prospeo's free tier (75 email credits + 100 Chrome extension credits/month) to verify emails before sending, then add a sequencer you already use. Aim for under 2% bounces and under 0.1% spam complaints before increasing volume, because domain reputation's harder to rebuild than a list.

Pipeline math says you need 3-5x weighted coverage to hit the number. That math collapses when reps prospect from stale databases refreshed every 6 weeks. Prospeo refreshes every 7 days across 300M+ profiles - so your pipeline model reflects reality, not last quarter's org chart.

Build pipeline on data that's actually current.

Summary (what to do next)

If you want outbound pipeline generation to work in 2026, treat it like an operating system: lock stage definitions, plan coverage with weighted math, staff to real capacity, and protect deliverability with verified data.

Do that, and your sequences become a lever - not a lottery ticket.