B2B Sales Pipeline Management in 2026 (Stages, KPIs, Benchmarks, Governance)

B2B sales pipeline management isn't a dashboard problem. It's a discipline problem.

A fancy CRM view won't save a pipeline that's built on vibes. If your stages don't mean anything, your "forecast" is just a group chat with numbers.

Here's the fix: tighter stage criteria, a scorecard you actually review weekly, and governance that keeps the CRM honest without making reps hate their lives.

What you need (quick version)

- Lock stage definitions first. If your stages don't have exit criteria, your forecast's fiction.

- Run a weekly scorecard (non-negotiable): coverage, velocity, stage conversion, aging/slippage.

- Make "next step" a required outcome, not a note. Every active deal needs a dated next step tied to a buyer commitment.

- Kill zombie deals on a timer. Set stale thresholds by stage and auto-flag anything past 1.5-2.0x your median days-in-stage.

- Governance beats heroics. Required fields by stage, close date audits, and push counters do more for forecast accuracy than another enablement deck.

- Fix pipeline inputs upstream. Bad contact data creates fake activity and empty early-stage pipeline; verified contacts keep "we reached out" from turning into bounce-driven noise.

What pipeline management is (and isn't)

Pipeline management's the operating system for revenue: how you define stages, move deals forward, measure health, and produce a forecast you can defend. Done well, it gives you visibility (what's real), conversion (where to coach), and forecasting (what you'll actually book).

Done poorly, it's a CRM full of opinion-based stages ("Negotiation" because the rep feels good), zombie deals that never die, and contact records so messy you can't even tell if anyone spoke to the buyer.

Most "pipeline problems" are governance problems wearing a coaching hat. Teams burn months rewriting talk tracks when the real issue's simple: reps can advance stages without a buyer commitment.

Use pipeline management for:

- Predictable forecasting (inside a tight error band)

- Coaching based on stage conversion and deal aging

- Capacity planning (pipeline creation vs quota)

- Catching leaks early (SLA breaches, duplicates, stalled stages)

Skip pipeline management theater like:

- "Pipeline reviews" that are just rep storytelling

- Stages with no entry/exit criteria

- Activity metrics that reward spam (emails sent) over progress (next step secured)

Look, the goal isn't a perfect CRM. It's a pipeline that behaves like a system: inputs -> process -> outputs.

Pipeline vs funnel (and how to map them in your CRM)

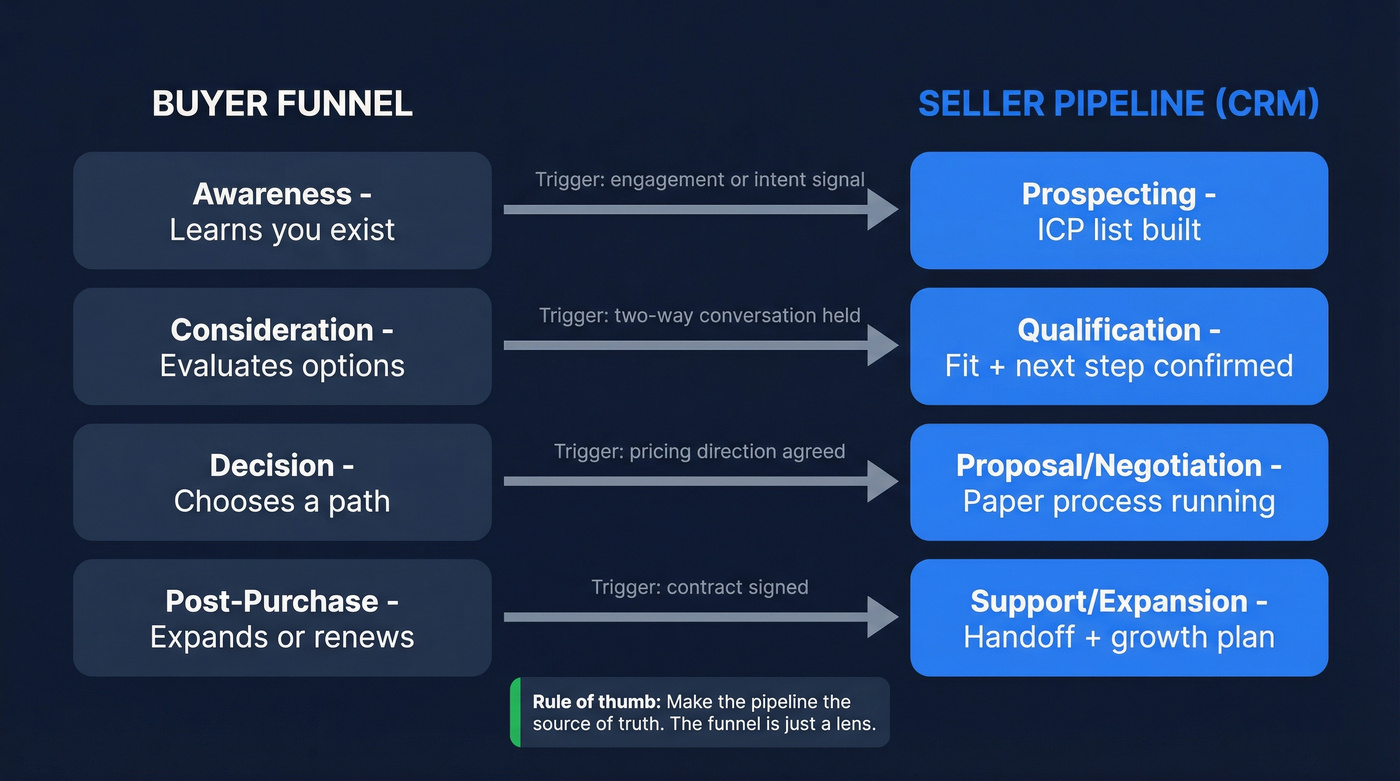

A funnel is the buyer journey. A pipeline is the seller's execution path inside your CRM. Mixing them is how you end up with stages like "Awareness" in Salesforce, which is basically saying "we don't know what's happening."

A clean mapping keeps marketing and sales aligned without forcing one team's language onto the other.

| Funnel (buyer) | Buyer intent | Pipeline (seller) | CRM evidence |

|---|---|---|---|

| Awareness | Learns you exist | Prospecting | ICP list built |

| Consideration | Evaluates options | Qualification | Fit + next step |

| Decision | Chooses a path | Proposal/Negotiation | Paper process |

| Post-purchase | Expands/renews | Support/Expansion | Handoff + plan |

The practical move: keep your CRM pipeline stages action-based and auditable (meetings, discovery outcomes, proposal sent, legal started). Then use funnel reporting in your BI layer or marketing automation where it belongs.

Example mapping that works in real life:

- Awareness -> Prospecting (seller's building and targeting accounts)

- Consideration -> Qualification (seller confirms fit + process)

- Decision -> Proposal/Negotiation (seller runs paper process)

- Post-purchase -> Support/Expansion (seller/CS drives adoption + growth)

If you want a single source of truth, make the pipeline the truth. The funnel can be a lens.

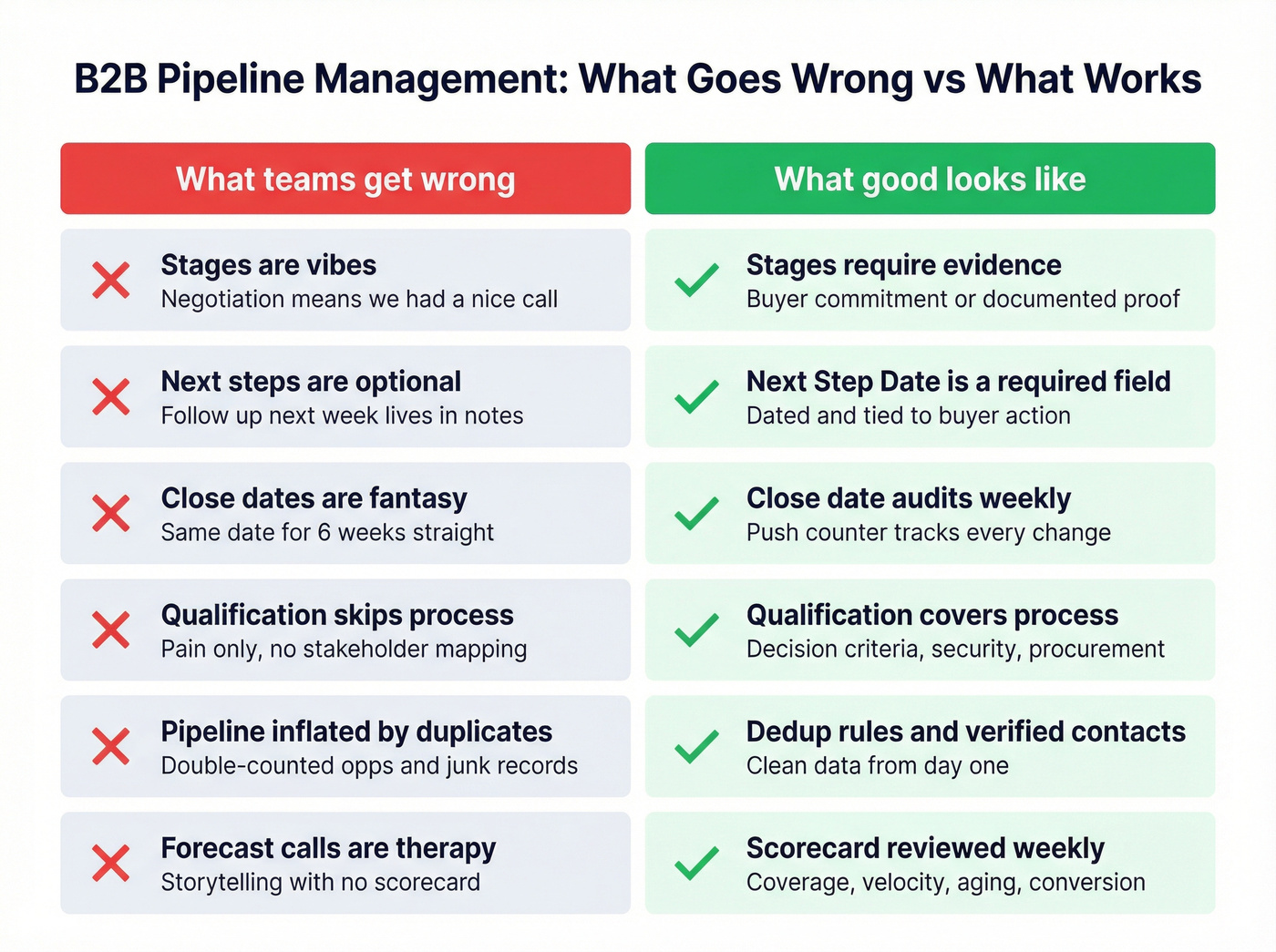

What teams get wrong (what I hear in audits)

This is the stuff that shows up in almost every "pipeline cleanup" project, no matter the industry.

- Stages are vibes, not evidence. "Negotiation" means "we had a nice call," and suddenly the quarter's "covered."

- Next steps are optional. Reps write "follow up next week" in notes, but there's no dated buyer commitment.

- Close dates are fantasy. Late-stage deals keep the same close date for 6 weeks because nobody wants to be the person who admits it slipped.

- Qualification is backwards. Teams qualify on pain and ignore process (stakeholders, security, procurement), then act surprised when deals stall.

- Pipeline is inflated by duplicates and junk records. Two routing rules fight each other, and you get double-counted opps and fake activity.

- Forecast calls are therapy. Lots of storytelling, zero scorecard, and no consequences for stale deals.

In our experience, the fastest "turnaround" isn't a new playbook. It's making stage movement require proof.

Zombie deals start with bad data. If your early-stage pipeline is full of bounced emails and wrong numbers, no amount of stage governance will save your forecast. Prospeo delivers 98% email accuracy and 125M+ verified mobiles - refreshed every 7 days, not 6 weeks.

Stop coaching reps on deals that were dead at first contact.

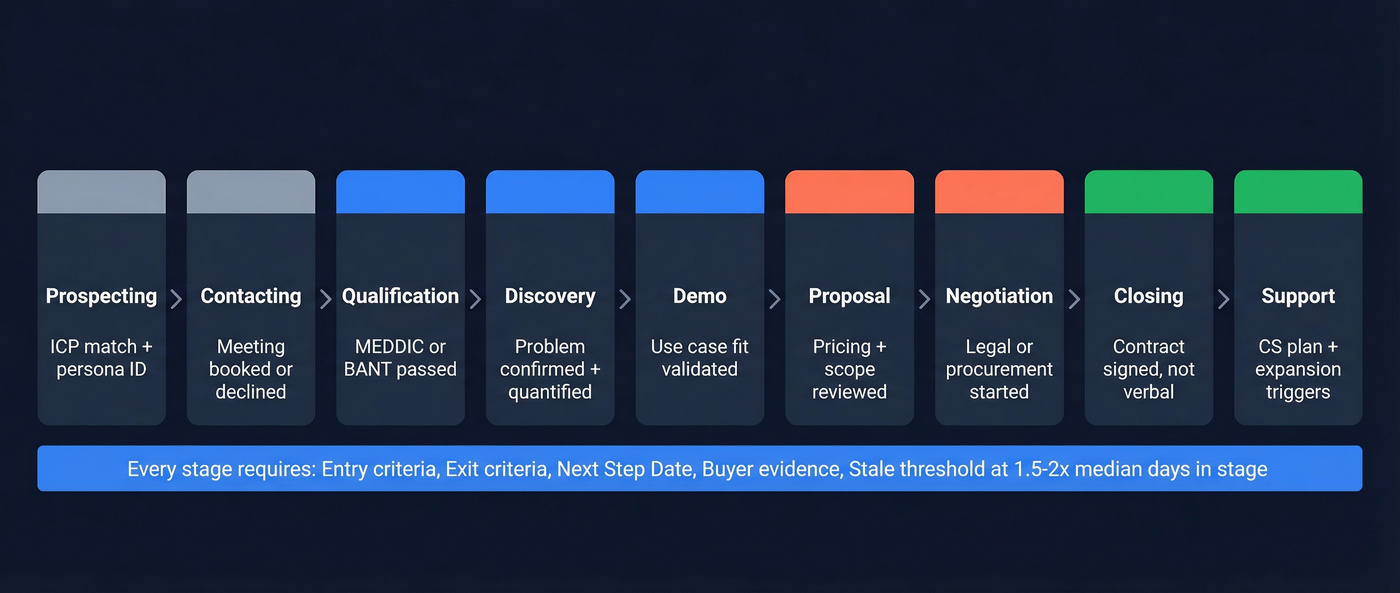

Pipeline stages template you can copy (9 stages + criteria)

This 9-stage model (Prospecting -> Support) is a solid default because it's specific enough to govern, but not so granular that reps game it. The rule that matters: every stage has entry + exit criteria. If you can't write those down, the stage doesn't exist.

Copy/paste stage worksheet (use this for any stage)

Use this block to standardize your pipeline in Salesforce, HubSpot, Dynamics, or Pipedrive.

Stage name:

- Entry criteria (observable):

- Exit criteria (observable):

- Required CRM fields (minimum): Next Step Date, Exit Criteria Met (Y/N), Amount, Close Date

- Buyer evidence (what must exist): meeting held, email confirmation, MAP step, redlines, etc.

- Disqualifier codes (pick 5-8): Not ICP, No access, No urgency, No budget, Lost to competitor, No decision, Security blocked, Timing

- Default stale threshold: 1.5-2.0x your median days-in-stage (by segment)

Prospecting (entry/exit criteria examples)

Entry criteria (to enter stage):

- Account matches ICP (industry, size, geo, tech stack)

- At least one target persona identified (economic buyer or champion profile)

- A reason to believe there's a problem you solve (trigger, intent, job change, growth)

Exit criteria (to leave stage):

- A target contact engages (reply, call connect, form fill), or

- A meeting is requested, or

- You disqualify with a reason code (not ICP / no use case / no access)

Anti-pattern: Prospecting as a parking lot for every account you've ever heard of.

Contacting (meeting commitment as exit)

Entry criteria:

- Outreach is in motion (sequence, calls, social touches)

- You've got a valid contact path (email/phone) for at least one persona

Exit criteria:

- A meeting is scheduled (date/time on calendar), or

- The prospect explicitly declines and you log the reason, or

- You route to nurture with a defined re-engagement date

What to enforce: "Contacted" doesn't mean "we sent 6 emails." It means "we got a buyer response or a booked meeting."

Qualification (MEDDIC/BANT tie-in; confirmed next step)

Qualification is where pipelines get inflated. Reps move deals forward because they're excited, not because the buyer's qualified.

Entry criteria:

- First real two-way conversation happened (call held or meaningful email exchange)

- Basic fit looks plausible

Exit criteria (pick a framework and stick to it):

- MEDDIC-style: metrics/pain identified, economic buyer path understood, decision criteria/process known, champion identified

- BANT-style: budget range, authority path, need, timeline

Minimum bar either way:

- Confirmed next step with date (discovery, demo, stakeholder meeting)

- Clear disqualifier if it's not real (no access, no urgency, no use case)

Here's the thing: if your deal sizes are small, you probably don't need "enterprise-grade forecasting AI." You need ruthless qualification and a Next Step Date that's actually enforced.

Assessment / Discovery outcomes (template-style)

Discovery isn't a stage because you held a call. It's a stage because you produced an outcome.

Required CRM fields (minimum):

- Problem statement (text)

- Primary use case (picklist)

- Stakeholders identified (number + roles)

- Next Step Date (date)

- Exit Criteria Met (Y/N)

Buyer evidence required:

- Buyer-confirmed problem statement in their language (email or call notes)

- At least one quantified impact (even directional)

- Next meeting scheduled (demo or technical deep dive)

Common disqualifier codes here:

- No compelling event

- No access to decision team

- "Just researching" with no next step

Demonstration (demo outcomes)

Entry criteria:

- Demo is scheduled for a specific use case (not "show me the platform")

- Success criteria defined (what "good" looks like)

Exit criteria:

- Buyer agrees the solution fits the use case

- Technical requirements surfaced (security, integrations, data)

- Decision process confirmed (who signs, what steps)

- Next step scheduled: proposal review, pilot, security review

Anti-pattern: demos that end with "send me something." That's not progress.

Proposal outcomes (add evidence + governance)

Entry criteria:

- Pricing/packaging direction agreed (at least a range)

- Scope defined (what's included, timeline, services)

Required evidence in CRM:

- Proposal review meeting on calendar (not optional)

- Stakeholder list includes signer path

- Paper process steps captured (legal/procurement/security)

Exit criteria:

- Proposal delivered to the right stakeholders

- Proposal review meeting held (not just emailed)

- Budget range validated

- Paper process steps documented with owners

Negotiation outcomes (legal/procurement started; add push reasons)

Entry criteria:

- Buyer confirms intent to proceed pending paper process

- Legal/procurement/security steps are initiated

Required evidence in CRM:

- Procurement/legal stage = started (checkbox or date field)

- Redlines received OR procurement ticket created

- Close plan dates + owners

Common push reason codes (track these):

- Legal queue

- Procurement cycle

- Security review

- Internal approval (buyer)

- Budget reallocation

- Stakeholder change

Closing (contract received vs "verbal yes")

Entry criteria:

- Final terms agreed in principle

- Contract's in circulation

Exit criteria (Closed Won):

- Contract received (signed order form / executed agreement)

- Billing details confirmed

- Implementation kickoff scheduled

Don't accept "verbal yes" as Closed Won. That's how you miss quarters.

Support/Expansion handoff (post-sale governance)

Entry criteria:

- Deal is Closed Won

- Handoff assets exist (notes, stakeholders, success criteria)

Exit criteria:

- Customer success plan created (first 30/60/90 days)

- Expansion triggers defined (usage, new team, renewal timeline)

- Account ownership and next meeting scheduled

Pipeline management doesn't stop at Closed Won. Expansion pipeline's still pipeline, and it needs the same hygiene.

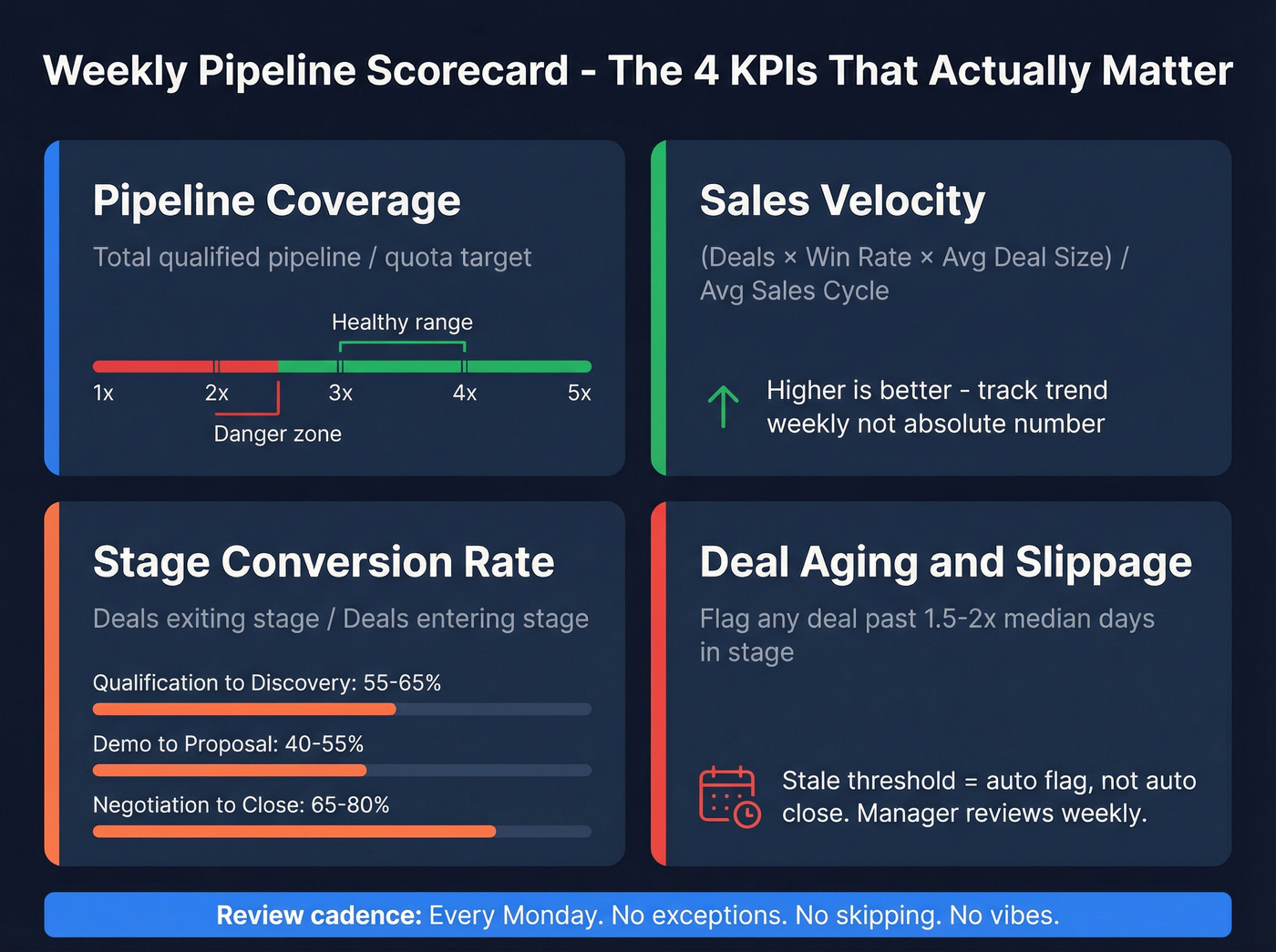

B2B sales pipeline management scorecard (KPIs + formulas + what "good" looks like)

If you only do one thing weekly: review a scorecard, not a story. A weekly scorecard is the difference between "we feel good about the quarter" and "we can defend the number."

A FirstPageSage benchmark analysis (247 B2B orgs, North America, Jan 12-Apr 18, 2026) found weekly tracking correlates with 87% forecast accuracy vs 52% for ad-hoc tracking. That gap isn't luck. It's cadence + accountability.

Weekly scorecard template (copy/paste)

Use this as your default dashboard. Cut by segment (SMB / MM / ENT) and by source (inbound / outbound). If you don't segment, you'll "fix" the wrong problem, and you'll waste a quarter proving it.

| Metric | Formula | Segment cut | Green | Yellow | Red |

|---|---|---|---|---|---|

| Pipeline creation | $ new opps created this week | inbound/outbound | >= weekly target | 70-99% | <70% |

| Unweighted coverage | Open pipeline ÷ target | by quarter | >= 3.5x | 2.5-3.49x | <2.5x |

| Weighted coverage | Σ(amount×prob) ÷ target | by quarter | >= 2.3x | 1.7-2.29x | <1.7x |

| Stage conversion | Stage B ÷ Stage A | by stage | >= last 8-wk median | -10% vs median | -20% vs median |

| Median days-in-stage | median(age) | by stage | <= median | 1.0-1.5x | >1.5x |

| Stale opps % | opps > stale threshold ÷ open opps | by stage | <10% | 10-20% | >20% |

| Close date pushes | # pushes per late-stage opp | by rep | 0-1 | 2 | >=3 |

| Next step missing % | opps missing Next Step Date ÷ open opps | overall | <5% | 5-10% | >10% |

My recommendation: treat Next step missing as an automatic red. If a deal has no dated buyer commitment, it's not forecastable.

Default thresholds (use these until you've got your own baselines)

- Stale = 1.5-2.0x median days-in-stage (by segment).

- Push count >=2 in late stages = forecast risk.

- Next Step Date missing rate <5% is the standard; >10% means your CRM's lying.

- Proposal stage with no scheduled review = stage inflation (fix the stage gate, not the rep).

Coverage (unweighted vs weighted; what to use by default)

Unweighted coverage is the blunt instrument:

- Coverage = Total open pipeline ÷ Target

It's useful for a quick sanity check. It's also how teams convince themselves they're fine while half the pipeline's junk.

Weighted coverage is the adult version:

- Weighted pipeline (expected revenue) = Σ (Deal amount × Win probability)

- Weighted coverage = Weighted pipeline ÷ Target

Weighted should be your default because it forces you to confront stage quality. If your stage probabilities are wrong, fix the stages and governance, not the math.

What "good" looks like (defaults you can run with):

- SMB: 2.5-3.5x unweighted, 1.8-2.4x weighted

- Mid-market: 3.0-4.0x unweighted, 2.0-2.6x weighted

- Enterprise: 3.5-5.0x unweighted, 2.2-3.0x weighted

Those ranges work when your stage gates are real and your weights are calibrated quarterly.

Velocity (formula + the only levers that matter)

Sales velocity tells you how fast your pipeline turns into revenue.

Sales velocity = (Opportunities × Avg deal size × Win rate) ÷ Sales cycle length

This metric's useful because it points to exactly four levers:

- Low opp count -> pipeline creation problem

- Low deal size -> packaging/ICP problem

- Low win rate -> qualification/process problem

- Long cycle -> friction (security, stakeholders, procurement, weak MAP)

The fastest velocity gains usually come from late-stage execution: proposal review discipline, paper process tracking, and close plan ownership.

Stage conversion + aging + slippage (how to read the dashboard)

Stage conversion answers: where do deals die?

- Example: Qualification -> Discovery conversion rate

- If it drops, you're either targeting the wrong accounts or letting reps "qualify" without a real next step.

Stage aging answers: where do deals stall?

- Track median days-in-stage by segment.

- Flag anything beyond 1.5-2.0x median as stale.

Slippage answers: how often do late-stage deals move the goalposts?

- Track close date pushes and stage regressions.

- Don't argue about "confidence." Count pushes.

2026 benchmarks (based on Jan-Apr 2026 data)

Benchmarks are only useful if they're segmented. Comparing your enterprise motion to a high-velocity SMB benchmark is how you end up with bad decisions and worse comp plans.

Dataset: FirstPageSage analysis of 247 B2B orgs (North America), data collection Jan 12-Apr 18, 2026. Use these as medians, then compare against your own segmented baselines.

Industry medians (deal size, win rate, cycle, velocity)

| Industry | Deal size | Win rate | Cycle | Velocity |

|---|---|---|---|---|

| SaaS & Tech | $12.4k | 22% | 67d | $1,847/d |

| Financial Svcs | $31.2k | 18% | 89d | $2,134/d |

| Healthcare/MedTech | $18.7k | 25% | 72d | $1,523/d |

| Manufacturing | $47.8k | 19% | 124d | $1,289/d |

| Prof. Services | $8.9k | 28% | 51d | $876/d |

| Real Estate/Constr. | $89.3k | 16% | 147d | $2,456/d |

| Marketing/Advertising | $15.2k | 24% | 58d | $743/d |

Interpretation that actually helps:

- Manufacturing's deal size is big, but cycle length drags velocity down.

- Real Estate/Construction runs huge deals with long cycles; forecasting discipline matters more than "more leads."

- Professional Services wins more often, but deal size caps velocity.

If you want the underlying write-up, here's the FirstPageSage pipeline velocity benchmarks.

Velocity by company revenue band

| Revenue band | Opps | Deal | Win | Cycle | Velocity |

|---|---|---|---|---|---|

| $1M-$5M | 18 | $6.2k | 26% | 43d | $687/d |

| $5M-$25M | 27 | $12.8k | 23% | 61d | $1,303/d |

| $25M-$100M | 57 | $22.7k | 21% | 78d | $3,484/d |

| $100M-$500M | 98 | $35.3k | 19% | 95d | $6,919/d |

| $500M+ | 156 | $57.6k | 17% | 118d | $12,945/d |

Two practical takeaways:

- Bigger companies don't win more. They win slightly less often, but they win bigger.

- Cycle length is a velocity killer. Shortening cycle time in late stages is one of the highest-ROI RevOps projects you can run.

Pipeline coverage: how much is enough (and why 3-5x is lazy math)

Coverage is the most abused metric in revenue. People quote "3-5x" like it's physics, then wonder why they still miss.

Outreach's segmentation is a better starting point:

- SMB: 2-3x

- Mid-market: 2.5-4x

- Enterprise: 3-5x

You can read their framing in Outreach's pipeline coverage ratio guide.

But the anchor is win rate:

Required coverage ≈ 1 ÷ Win rate Example: 25% win rate -> need 4x unweighted coverage to break even.

Then upgrade to weighted coverage once your stage gates are real. A KeyBanc-based synthesis for $5M-$50M ARR SaaS gives a practical target when probabilities are calibrated:

- 2.1x weighted coverage (median, companies hitting plan)

- 2.8x weighted coverage (top quartile)

That's why "3-5x" is lazy: it's usually unweighted, and it ignores whether your pipeline's actually winnable.

Coverage math you can steal

- Win rate 20% -> plan for ~5x unweighted

- Win rate 30% -> plan for ~3.3x unweighted

- With accurate weights -> 2-3x weighted is often enough

Find the leaks: stage conversion benchmarks + a leak audit

Conversion benchmarks don't tell you what to do. They tell you where to look first.

DigitalBloom's compilation gives a useful anchor for Opp -> Close:

- SMB/mid-market: 39%

- Enterprise: 31%

If your Opp -> Close is 15%, you don't have a "top-of-funnel" problem. You've got a qualification and process problem.

Leak diagnostic table (quick triage)

| Symptom | Likely leak | What to check |

|---|---|---|

| High pipeline, low wins | Stage inflation | Exit criteria, weights |

| Lots of early opps | Bad qualification | MEDDIC/BANT fields |

| Late-stage stalls | Paper process | Legal start, MAP |

| "No decision" losses | Weak champion | Stakeholder map |

| Weird reporting | Duplicates/SLA | Dedupe + routing |

Channel mini-benchmarks (directional)

| Channel | Visitor->Lead | MQL->SQL | Opp->Close |

|---|---|---|---|

| SEO | 2.1% | 51% | 38% |

| PPC | 0.7% | 26% | 35% |

| Events | 1.0% | 24% | 40% |

Leak audit (do this in 60 minutes)

- Pull stage conversion by segment (SMB vs enterprise, inbound vs outbound, region).

- Find the first cliff. The biggest drop is where you start.

- Check for duplicates. Duplicate accounts/contacts create fake touches and double-counted pipeline.

- Check SLA breaches. If inbound hand-raisers wait hours, you're donating pipeline to competitors.

- Check stage inflation. Deals in Proposal with no proposal review meeting are inflated.

- Check stale deals. Anything beyond your stale threshold is a zombie, not coverage.

I've run bake-offs where the "pipeline problem" was literally 18% duplicate opps created by two routing rules fighting each other. Fixing that did more than any new playbook, and it stopped the weekly argument about whether the team was "working hard enough."

RevOps-grade governance (rules that make forecasts real)

Governance is where pipeline management becomes real, or collapses into CRM cosplay. The trick is making rules strict enough to protect data quality, but not so strict that reps type "-" into required fields just to save.

Governance rules table (policy -> enforce -> report)

| Policy | How to enforce | What to report weekly |

|---|---|---|

| Next Step Date required (post-Qualification) | Required field + can't save stage change without it | % opps missing next step (target <5%) |

| Exit Criteria Met checkbox | Stage gate checkbox required to advance | Stage moves without criteria (count + rep) |

| Proposal requires review meeting | Validation rule: Proposal stage needs meeting date | Proposal opps with no review scheduled |

| Close date audit (late stages) | Validation: close date must match "contract expected" | Avg push days + push count by rep |

| Push counter | Workflow increments on close date change | % late-stage opps with >=2 pushes |

| Required fields by stage | Stage-based required properties | Missing-field rate by stage |

| No duplicate accounts/contacts | Dedupe rules + merge queue | Duplicate rate + time-to-merge |

| Inbound SLA | Routing + auto-reassign timers | SLA compliance % + meeting set rate |

| Stage history is sacred | Lock stage history edits | Manual edits to stage history (should be zero) |

This table's the backbone. Without it, "pipeline management" is just meetings.

Stage gates without rep-hostile CRM (avoid junk "-" values)

Use required fields by stage, but keep them tight and meaningful. A practical set that works across CRMs:

- Exit Criteria Met (Y/N)

- Next Step Date (required for every open stage after Qualification)

- Decision Maker Confirmed (Y/N by Proposal)

- Validated Budget Range (picklist by Proposal)

Make "Next Step Date" the hill you die on. If there's no next step, it's not an active deal.

Skip/back rules (decide once, then measure it)

You need an explicit decision on two things:

- Can reps skip stages?

- My default: no skipping from Qualification -> Proposal. If a deal can't survive Discovery and a Demo outcome, it's not real.

- Exception: inbound "RFP-in-hand" deals can jump, but only with required evidence attached.

- Can deals move backwards?

- My default: yes, backwards moves are allowed and healthy, if they're honest. A deal that regresses from Negotiation to Discovery because a new stakeholder appeared is reality, not failure.

What to measure:

- Skip rate (stage passed vs stage attained)

- Regression rate (backwards moves per opp)

- Impact on velocity (skipped deals often look fast until they blow up late)

Close date audits + push counters (how to measure slippage)

Close dates are the #1 place reps lie to themselves (and you). Fix it with two mechanics:

- Close date audit rule: late-stage deals must have a close date that matches when the contract is expected to be received, not "when we hope procurement moves."

- Push counter: increment when the close date is pushed out (don't count pull-ins).

Then report:

- Push count by rep

- Push count by stage

- Push count by segment

Rule-of-thumb industry reality: 30-60% of late-stage deals slip at least once per quarter. The goal isn't to shame slippage. It's to see it early enough to backfill.

Inbound SLA (speed-to-lead) and routing

Inbound pipeline's fragile. If you respond slowly, you're basically paying to generate leads for someone else.

A workable SLA policy:

- Hand-raiser response within 5 minutes during business hours

- If not accepted, auto-reassign after 10 minutes

- If no meeting booked within 24 hours, route to SDR re-engagement

Routing should be deterministic (territory/segment rules), and you should report SLA breaches weekly.

Pipeline inputs: dedupe + enrichment + verified contacts (Prospeo)

Pipeline governance fails upstream when contact data's wrong. If emails bounce, phone numbers are dead, or contacts are duplicated, reps create "activity" that never turns into conversations, and your early-stage pipeline becomes a mirage.

Prospeo ("The B2B data platform built for accuracy") fixes that input problem with 98% verified email accuracy, real-time email/mobile verification, and a 7-day data refresh cycle (industry average: 6 weeks). RevOps teams also use it for CRM and CSV enrichment: 83% of leads come back with contact data, with 50+ data points per enrichment and a 92% API match rate, so your pipeline reporting isn't built on half-empty records.

If you're already drowning in bad data, skip the "let's clean it later" plan. Later never comes.

Salesforce/HubSpot implementation notes (so this actually ships)

- Salesforce: use Validation Rules for stage gates, a Flow for push counters, and a report type that shows stage history + close date changes.

- HubSpot: use required properties by pipeline stage, workflows to flag stale deals, and a custom "Push Count" property updated on close date changes.

The best implementation is the one your admins can maintain without a six-month consulting project.

Deal aging + zombie deals (how to prune without killing real deals)

Aging is the quiet killer because it makes coverage look healthy while the pipeline's stale.

Umbrex's approach is the most practical: define stale as 1.5-2.0x median days-in-stage for that stage and segment. Don't guess. Compute your median, then set thresholds.

Stage-by-stage stale thresholds (illustrative example)

Use this as a starting point, then replace with your medians.

| Stage | Typical median (example) | Stale threshold (1.5x) | Hard stale (2.0x) | Action |

|---|---|---|---|---|

| Qualification | 7 days | 11 days | 14 days | Require next step or disqualify |

| Discovery | 14 days | 21 days | 28 days | Manager review + MAP update |

| Demo | 10 days | 15 days | 20 days | Confirm success criteria + stakeholders |

| Proposal | 14 days | 21 days | 28 days | No review meeting = regress stage |

| Negotiation | 21 days | 32 days | 42 days | Push reason code + exec unblock |

| Closing | 7 days | 11 days | 14 days | Contract-in-circulation proof required |

Add a no-activity rule for mid/late stages:

- No activity in 14 days -> flagged for review (or auto-regress to earlier stage)

Then introduce one concept that makes forecasts more honest:

Age-adjusted weighted pipeline: apply a probability penalty to stale deals (or cap their probability) so your "expected revenue" isn't inflated by zombies.

Pruning isn't about killing deals. It's about forcing clarity, and clarity is what makes forecasts usable.

Weekly operating rhythm (the meeting system that doesn't waste time)

Most pipeline meetings waste time because they're unstructured and emotional. A good operating rhythm is boring, and that's the point.

A cadence that sticks:

- Weekly forecast meeting

- Weekly sales-wide deal teardown

- Monthly win/loss review (win/loss review)

Target: forecast accuracy within 5% of actual bookings. That level of accuracy changes how the whole company operates: hiring plans get calmer, spend gets easier to justify, and the board stops treating every quarter like a surprise.

Weekly forecast agenda (45 minutes)

Use the "volume, value, coverage, velocity" framing:

- Volume: opps created this week vs required

- Value: pipeline $ created vs target

- Coverage: unweighted + weighted for the quarter

- Velocity: trend vs last 4 weeks

Then focus only on:

- Deals that changed stage

- Deals with close date pushes

- Deals past stale threshold

- Gaps by segment (enterprise vs mid-market, inbound vs outbound)

Weekly deal teardown (30 minutes)

Pick one deal that was "late-stage" and didn't close (or slipped). Then answer:

- Which stage gate failed?

- Which stakeholder showed up late?

- Which paper-process step was discovered too late?

- What field/rule would've caught this earlier?

This meeting's where governance gets smarter.

Roles (RACI-style, lightweight)

- Sales leader (A): commits forecast, sets priorities

- RevOps (R): publishes scorecard, enforces rules, flags anomalies

- AEs/Managers (R): update next steps, fix stale deals before meeting

- Marketing/SDR lead (C): pipeline creation inputs + SLA performance

- Finance (I): consumes forecast, doesn't run the meeting

Tools & automation (vendor-neutral stack by job-to-be-done)

This isn't a roundup. It's the minimum stack that supports clean stages, clean data, and clean forecasting, and it's where most teams decide which tools they actually need versus what just looks good in a demo.

- CRM (system of record): Salesforce, HubSpot, Dynamics, Pipedrive

- Forecasting & pipeline inspection: Clari (enterprise/custom)

- Conversation intelligence: Gong (enterprise/custom)

- Scheduling + routing: Calendly (free + paid tiers), Chili Piper (paid tiers)

- Data enrichment & verification: Prospeo, ZoomInfo, Apollo, Clearbit

If you're strapped for time and budget, skip conversation intelligence for now and put the money into data verification + enrichment. Stage gates can't save you if your inputs are trash.

Prospeo (Tier 1: accuracy + freshness for pipeline inputs)

Prospeo is the B2B data platform built for accuracy, and it shows up where pipeline management actually breaks: inputs. It includes 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers, with 98% email accuracy and a 7-day refresh cycle.

Pricing's self-serve and transparent: free tier (75 emails + 100 Chrome extension credits/month), and emails run at ~$0.01/email on paid plans (mobiles cost 10 credits per number). If you want the tiers, go straight to https://prospeo.io/pricing.

If you want a deeper view on verification vendors, start with an email verifier shortlist.

Your Prospecting and Contacting stages leak pipeline when reps can't reach real buyers. Prospeo's 300M+ verified profiles with 30+ filters - intent data, job changes, technographics - mean every deal entering your pipeline starts with a valid contact path.

Fill your pipeline with real buyers, not bounce-driven noise.

Summary: make the pipeline a system (not a story)

B2B sales pipeline management works when you treat it like an operating system: stage criteria you can audit, a weekly scorecard you actually run, lightweight governance that prevents fantasy close dates, and upstream data hygiene so activity reflects real buyer contact. Nail those basics and your forecast stops being a debate and starts being a tool.

If you want to go deeper on forecast mechanics, see our guide to a sales forecast.

FAQ

What's the difference between a B2B sales pipeline and a sales funnel?

A B2B sales funnel describes the buyer journey (awareness to purchase), while a B2B sales pipeline describes seller-controlled steps in your CRM (prospecting to close). Funnels help you understand demand and intent; pipelines help you govern execution, measure stage conversion, and produce a forecast you can run the business on.

What KPIs should I review weekly to manage pipeline health?

Review pipeline creation, coverage, velocity, stage conversion, and aging/slippage every week. Coverage tells you if you've got enough pipeline, velocity shows how fast revenue moves, stage conversion reveals leaks, and aging flags stalled deals before they poison your forecast. Operationally: keep Next Step Date missing rate under 5%, and treat push count >=2 in late stages as a forecast risk that needs a plan.

What is a good pipeline coverage ratio in 2026?

Use win-rate math as the anchor: required unweighted coverage ≈ 1 ÷ win rate (25% win rate needs ~4x). As a default by segment, SMB 2-3x, mid-market 2.5-4x, enterprise 3-5x works when your stages are governed. Once probabilities are calibrated, weighted coverage targets are typically lower (often 2-3x) and more honest.

How do I keep CRM pipeline data clean without slowing reps down (and what tools help, like Prospeo)?

Keep required fields minimal and outcome-based: Next Step Date, Exit Criteria Met, Decision Maker Confirmed, and Validated Budget Range by stage. Add close date audits and a push counter so slippage becomes measurable. For upstream hygiene, Prospeo verifies emails and mobiles and enriches CRM records on a 7-day refresh cycle, so reps spend less time working bad data and more time booking real conversations.