Closing the Sale With Follow-Up: The Data-Backed Playbook for 2026

You sent the proposal Thursday afternoon. It's now Tuesday. No reply. You check your inbox again - nothing. You draft a "just checking in" email, stare at it, delete it, and wonder if following up again makes you look desperate.

It doesn't. What's actually desperate is watching a qualified deal die because you stopped reaching out after two attempts. 80% of sales require five or more follow-ups to close - yet 92% of reps stop after four or fewer attempts. Closing the sale with follow-up isn't about being pushy. It's about being present when 35-50% of deals go to the vendor that responds first.

84% of sales reps missed their quota last year. The follow-up gap isn't the only reason, but it's the easiest one to fix. You don't need a new tech stack. You don't need a better pitch deck. You need a system for staying in front of buyers who are interested but distracted, overwhelmed, or stuck in internal consensus hell.

That's what this playbook covers - the exact cadences, templates, scripts, and mindset shifts that turn "no response" into closed revenue.

The Framework in Three Bullets

If you're short on time:

Follow up 8 times across 3+ channels (email, phone/voicemail, social, text) over 17-21 days - then send a breakup email. Eight touchpoints is the benchmark from RAIN Group's research. After that, diminishing returns kick in.

Every follow-up must deliver value or create curiosity. "Just checking in" trains prospects to ignore you. Share a case study, ask a specific question, or reference something from your last conversation.

Verify your contact data before you start. The best cadence in the world fails if 30% of your emails bounce and your phone numbers ring disconnected lines. Fix the data first, then run the plays. (If you need a process, start with a simple email verification workflow.)

Why Prospects Ghost (And Why It Isn't About You)

The silence after a proposal feels personal. It's not.

An average of 7 people are involved in B2B buying decisions at mid-sized firms. Your champion might love your solution, but they're fighting for budget against three other priorities, navigating a procurement process designed in 1997, and trying to get a VP they've never met to approve a vendor they've never heard of. 89% of B2B buyers report that a deal stalled in the past year, often due to budget freezes and internal factors. [Buyers spend only 17%](https://www.gartner.com/en/newsroom/press-releases/2020-09-15-gartner-says-80 - of-b2b-sales-interactions-between-su) of their total buying time meeting with potential suppliers. The other 83%? Internal meetings, research, consensus-building, and dealing with fires that have nothing to do with your deal.

Jeff Shore writes about this dynamic in Follow Up and Close the Sale: the moment a buyer walks out of your demo or finishes reading your proposal, their enthusiasm is at its highest. Every hour that passes without follow-up, that emotional peak erodes. Not because they lost interest - because seven other things demanded their attention.

I've seen reps project their own buying behavior onto prospects: "I'd respond if I wanted it." But you're not juggling a 7-person buying committee, a frozen budget, and a CEO who just changed strategic priorities mid-quarter.

The prospect isn't ghosting you. They're drowning. Your follow-up is the lifeline.

28% of reps cite "sales process taking too long" as the #1 reason prospects back out. But the process doesn't take too long because the buyer is slow. It takes too long because the seller stops pushing it forward - stops securing next steps and lets momentum die between touchpoints. If you want a tighter operating rhythm, borrow a simple pipeline review cadence.

80% of sales need 5+ follow-ups - but none of them work if your emails bounce. Prospeo's 98% email accuracy and 125M+ verified mobile numbers mean every touchpoint in your cadence actually reaches a real person.

Stop following up into the void. Start with data that connects.

The Follow-Up Numbers You Need to Know

Before we get into cadences and templates, let's ground this in data:

| Stat | Number | Source |

|---|---|---|

| Sales needing 5+ follow-ups | 80% | Close.com / Flowlu |

| Reps who stop after 4 or fewer attempts | 92% | Close.com |

| Reps who never follow up at all | 48% | 2xSolutions |

| Close rate on first contact | 2% | Flowlu |

| Buyers who say no 4x first | 60% | Flowlu |

| Deals won by first responder | 35-50% | Speed-to-lead research |

| Conversion lift responding in 1 min | 391% | Chili Piper (4M submissions) |

| Conversion lift responding in 5 min | 9x | Flowlu (separate study) |

| Avg company response time | 42 hours | 2xSolutions |

| Touchpoints to get meeting | 8 | RAIN Group |

| Voicemail + email reply lift | 2.73% to 5.87% | Gong (300M+ calls) |

| Avg B2B close rate | 29% | Industry benchmark |

| Texts opened within 15 min | 97% | Close.com |

The speed-to-lead numbers are staggering. Chili Piper's analysis of ~4 million form submissions found that responding within one minute increases conversions by 391%. The 9x lift at five minutes comes from a separate Flowlu study - different dataset, same conclusion. Yet the average response time among US companies is 42 hours. And 23% of companies never respond at all. If you want to benchmark your team, start with average lead response time.

That 42-hour gap is where your competitors are winning deals you should've closed.

The voicemail data from Gong's analysis of 300M+ cold calls is equally revealing. Leaving a voicemail more than doubled email reply rates - from 2.73% to 5.87%%. The voicemail isn't about getting a callback. It's about getting your email opened.

One opinion I'll stand behind: If your average deal size is below $10K, you probably don't need a 21-day multi-channel cadence. A tight 7-day sequence with email, phone, and text will outperform a bloated enterprise cadence that your reps won't actually execute. The best cadence is the one your team runs consistently - not the one that looks impressive on a whiteboard. For more examples, see a sales cadence example.

The Follow-Up Cadence Framework

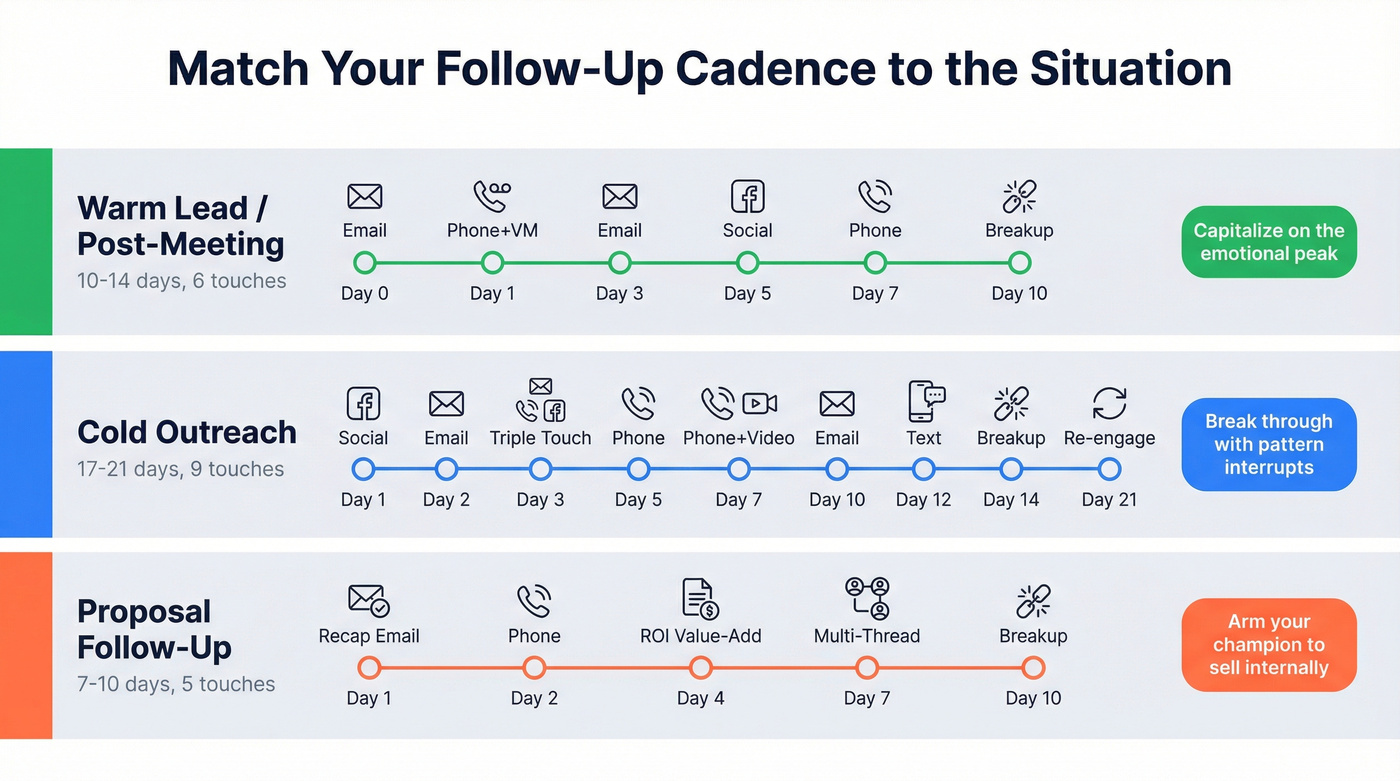

A cadence without structure is just random pestering. The frameworks below give you specific actions for specific days, tailored to three scenarios you'll face constantly. Adapt the timing to your deal size - enterprise deals with 6+ month cycles should double the spacing between touchpoints, while SMB/transactional sales can compress the warm lead cadence to 7 days.

Warm Lead / Post-Meeting Cadence (10-14 Days)

This is for prospects who've had a conversation with you - a demo, a discovery call, a meeting at an event. Jeff Shore's principle applies here: capitalize on the emotional peak immediately. Day 0 isn't optional.

| Day | Channel | Action | Intent |

|---|---|---|---|

| 0 | Same-day recap + next steps | Lock in momentum | |

| 1 | Phone + VM | Call, leave voicemail | Get email opened |

| 3 | Value-add (case study) | Prove ROI | |

| 5 | Social | Engage with their content | Stay visible |

| 7 | Phone | Direct call, no voicemail | Live conversation |

| 10 | Breakup email | Trigger response |

Day 0 is the most important touchpoint in this entire cadence. Send the recap within two hours of the meeting - not the next morning. Reference specific things they said. Attach anything you promised. Propose a concrete next step with a date. The buyer's enthusiasm is peaking right now. Don't waste it.

By Day 3, shift from recap to value. Send a case study from a similar company, a relevant data point, or a resource that addresses the specific objection they raised. This isn't about you - it's about making their internal case easier to build.

Cold Outreach Cadence (17-21 Days)

This framework draws from Cognism's cadence methodology developed with Morgan J Ingram. High-growth organizations average 16 touchpoints per prospect within 2-4 weeks. This cadence hits 10-12 - enough to break through without burning the relationship. (If you want a deliverability-first variant, use a B2B cold email sequence as the base.)

| Day | Channel | Action | Intent |

|---|---|---|---|

| 1 | Social | Connection request (blank) | Get accepted |

| 2 | Cold email, 75-100 words | Spark interest | |

| 3 | Phone + VM + Email | Triple touch | Break through |

| 5 | Phone | Call, no voicemail | Live connect |

| 7 | Phone + Video | Call + send video | Pattern interrupt |

| 10 | Highly personalized | Prove research | |

| 12 | Text/SMS | Short, direct message | New channel |

| 14 | Breakup email | Loss aversion | |

| 21 | Re-engagement | Fresh angle |

The Day 3 triple touch is aggressive - and it works. A cold call followed by a voicemail followed by an email creates three impressions in a single day. The voicemail primes them to open the email. The email gives them an easy way to respond.

By Day 10, if they haven't responded, go deep on personalization. Reference their company's recent funding round, a job posting that signals a pain point, or a specific initiative from their latest earnings call. Generic doesn't cut it at this stage.

How to Close a Sale With a Proposal Follow-Up (7-10 Days)

This is the one that keeps reps up at night. You sent the proposal. They said they'd review it. And then... silence.

| Day | Channel | Action | Intent |

|---|---|---|---|

| 1 | Recap referencing specifics | Prove listening | |

| 2 | Phone | Direct call | Get live reaction |

| 4 | Value-add (ROI calc) | Arm the champion | |

| 7 | Phone + Email | Multi-thread a new contact | Expand access |

| 10 | Breakup email | Force a decision |

Day 1 isn't "just following up on the proposal." It's: "Hi Sarah, wanted to flag the implementation timeline on page 3 - based on what you said about your Q3 launch, we'd need to kick off by March 15 to hit that window." Reference specific proposal details. Prove you were listening.

Day 4 is where you arm your champion. Send an ROI calculator they can forward to their CFO. A one-page competitive comparison they can share in their internal meeting. Make it easy for them to sell internally.

Day 7 is the multi-threading trigger. If your main contact has gone dark, it's time to reach another stakeholder. (If you need a structured approach, use an ABM multi-threading playbook.)

Multi-Channel Follow-Up Playbook

Each channel has a specific role in your cadence:

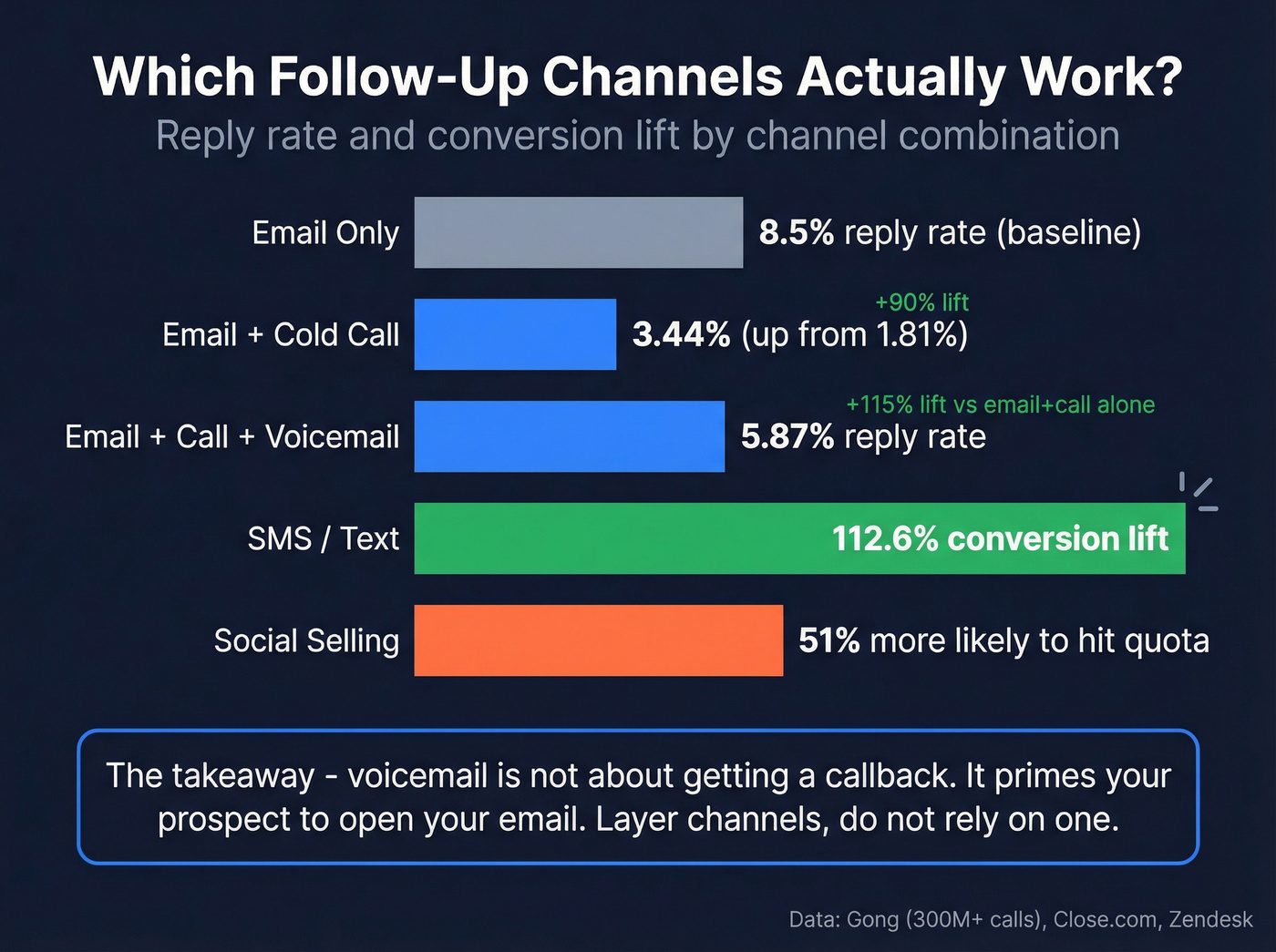

| Channel | Reply Rate Lift | Best For | Data Source |

|---|---|---|---|

| Email only | 8.5% baseline | Async communication, value delivery | Zendesk |

| Email + cold call | 3.44% (from 1.81%) | Breaking through to new prospects | Gong, 300M+ calls |

| Email + call + VM | 5.87% | Priming email opens | Gong, 300M+ calls |

| SMS/text | 112.6% conversion lift | Urgent, time-sensitive follow-ups | Close.com |

| Social selling | 51% more likely to hit quota | Staying visible between touches | Industry research |

Email - Templates That Get Replies

Only 8.5% of outreach emails get responses. That's the baseline you're working against. Three things move the needle: short length (75-100 words), "interest" CTAs instead of meeting asks (2x more effective), and camouflaged subject lines - short, lowercase, four words or fewer, resembling internal messages. If you want more tested angles, steal ideas from these cold email subject lines.

Template 1: Post-Meeting Value-Add (Day 3)

Subject: that metric you mentioned

Hey [Name],

You mentioned [specific metric/challenge] during our call. Just came across this - [Company X] was dealing with the same thing and saw [specific result] after [timeframe].

Case study attached. Thought it might help your internal conversation.

Worth a quick look?

Template 2: No-Response Follow-Up #3 (Day 7-10)

Subject: quick question

[Name], I've reached out a couple times - totally understand if the timing's off.

Curious: is [specific problem] still a priority this quarter, or has something else taken the front seat?

Either way, happy to share what we're seeing work for [similar companies].

Template 3: Re-Engagement After 30+ Days

Subject: things changed since we talked

Hey [Name],

It's been a few weeks. Since we last spoke, we've [new feature/case study/data point that's relevant to their situation].

If [original pain point] is still on your radar, I've got a fresh angle worth 10 minutes. If not, no hard feelings - just say the word.

Phone + Voicemail - The Reply Rate Multiplier

Cold calling nearly doubles email reply rates - from 1.81% to 3.44% - even if you don't connect live. Leaving a voicemail doubles it again to 5.87%. The math is clear: phone isn't dead, it's a force multiplier for email. (If you want benchmarks and scripts, use this B2B cold calling guide.)

The goal of a voicemail isn't a callback. It's to get your email opened. Keep it under 20-30 seconds. State your number twice. Create curiosity without giving everything away.

Voicemail Script 1: Social Proof

"Hi [Name], it's [Your Name] from [Company]. I've been working with [similar company] on [specific challenge] - they cut [metric] by [result] in [timeframe]. I'd love to share how. My number is [number]. Again, that's [number]. I'll drop you an email too."

Voicemail Script 2: Ultra-Short Curiosity

"Hi [Name], it's [Your Name]. Could you call me back? The number's [number]. That's [number]. Thanks."

That second one feels uncomfortably short. It works precisely because it creates curiosity. They'll check your email to figure out who you are.

SMS/Text - The Overlooked Channel

97% of text messages are opened within 15 minutes. Text follow-ups produce a 112.6% higher conversion rate than any other single channel. Yet most B2B reps never send a single text. If you need copy-and-paste options, start with sales text message templates.

The rules are different here: keep it under 160 characters, use it only after you've had at least one prior interaction (cold texts feel invasive), and always identify yourself.

Text Template: Post-Proposal Nudge

Hi [Name], it's [Your Name] from [Company]. Wanted to make sure the proposal landed - any questions I can answer before your team meets Thursday?

Text Template: Meeting Confirmation

[Name] - confirming our call tomorrow at 2pm ET. I'll send the Zoom link tonight. Anything specific you want me to cover?

Don't overuse this channel. One or two texts per cadence, max. The power of text is its novelty in B2B - burn that by texting five times and you'll get blocked.

Social Touches - The Warm Layer

75% of B2B buyers use social media to inform purchase decisions. Social sellers are 51% more likely to hit quota, and 78% outsell peers who don't use social. This channel isn't about selling - it's about staying visible between emails and calls. For more data points, see these social selling statistics.

Blank connection requests get higher acceptance rates than those with notes. Once connected, use the CCQ method: Compliment something specific about their work, find Commonalities (shared connections, industry, experience), then ask a Question that opens dialogue.

Social Message Template: CCQ Method

Hey [Name], really liked your post on [specific topic] - especially the point about [specific detail]. I've been working on something similar with [industry/company type]. Curious: how's your team approaching [related challenge] this quarter?

The Breakup Email - Your Highest-ROI Message

The breakup email gets a 33% response rate. That's from HubSpot's enterprise account team. It's the highest-performing email in most cadences, and the psychology is simple: loss aversion. Humans are 2x more likely to act to prevent a loss than to gain a benefit.

Template 1: Direct Close-the-Loop

Subject: is this goodbye [Name]?

[Name], I've reached out several times and haven't heard back. I completely respect that - you're busy, and this might not be the right time.

I'm going to close out your file on my end. If [original pain point] comes back up, you know where to find me.

One last thing: [link to relevant resource]. Figured it might be useful regardless.

Template 2: Soft Resource-Share

Subject: closing the loop

Hey [Name], I'll take the hint - timing's not right, and that's okay.

Before I go, here's [resource/case study] that addresses [their specific challenge]. No strings attached.

If anything changes, I'm a reply away.

The key: actually stop after the breakup. If they don't respond, move them to quarterly re-engagement. The breakup only works if it's real.

Follow-Up Mistakes That Kill the Sale

1. "Just checking in" emails. This is the single most common follow-up mistake, and it signals exactly one thing: you have nothing valuable to say. Every touchpoint must deliver an insight, a resource, or a question. If you can't think of something worth sharing, you're not ready to follow up yet.

2. Talking more than listening. Jeremy Miner's framework is simple: the prospect should do 80-90% of the talking. When you follow up, reference their words, not yours. "You mentioned your team spends 6 hours a week on manual data entry" hits harder than "Our platform automates data entry."

3. Trying to close too early. Cheesy closing techniques - the assumptive close on call two, the "if I could show you X, would you sign today?" - break trust faster than anything. You earn the close through value touches. If you've delivered genuine insight across 6-8 touchpoints, the close becomes a natural next step, not a pressure tactic.

4. Single-channel follow-up. Email-only cadences leave 60%+ of potential responses on the table. The data is unambiguous: adding phone doubles your email reply rate. Adding voicemail doubles it again. Adding social keeps you visible between direct outreach. Adding text gives you a 97% open rate. Minimum three channels.

5. Bad contact data. This one's frustrating because it's so preventable. The best cadence in the world fails if 30% of your emails bounce and your phone numbers are disconnected. Bounced emails don't just waste a touchpoint - they tank your domain reputation, which means future emails land in spam. It's a compounding problem. If you're troubleshooting bounces, start with 550 Recipient Rejected.

We use Prospeo for this - 98% email accuracy, a 7-day data refresh cycle, and 125M+ verified mobile numbers. One team cut their bounce rate from 35% to under 4% after switching, which tripled their connect rate to 20-25%. The cadence didn't change. The data quality did. Verify first, follow up second.

Advanced Tactics - Multi-Threading and AI

Multi-Threading: Engage the Whole Buying Committee

Analysis of 1.8M sales opportunities shows that deals that close have 2x as many buyer contacts as deals that don't. Multi-threading - engaging multiple stakeholders within an account - boosts win rates by 130% on deals over $50K. Selling teams for closed-won deals are 67% larger than for lost deals. Involving a sales engineer jumps win rates by an additional 30%.

The practical application: identify 2-3 stakeholders per account and tailor messaging by role. Your champion gets the product deep-dive. The economic buyer gets the ROI case. The end user gets the "here's how your daily workflow changes" angle.

In the post-proposal cadence, Day 7 is your multi-threading trigger. If your main contact has gone dark, reach out to another stakeholder with a different angle: "Hi [Name], I've been working with [Champion] on [project]. Wanted to share [specific resource relevant to their role] - thought it might be useful as you evaluate options."

This isn't going around your champion. It's giving your champion air cover. When three people in the org have seen your name and your value prop, the internal conversation shifts from "should we do this?" to "when do we start?"

AI-Powered Follow-Up: Scale What Works

Sellers who frequently use AI generate 77% more revenue than those who don't - across 7.1M analyzed opportunities. 83% of teams using AI reported revenue growth, compared to 66% of teams without it. And 78% of AI-using teams say deal cycles are shorter.

Here's the thing: don't use AI to write your follow-ups. Use it for the parts humans are terrible at - figuring out when to send, personalizing 200 emails without losing your mind, and making sure nobody falls through the cracks. One company cut proposal creation time from 3 weeks to 2 hours using AI-assisted workflows, leading to a 5% revenue increase because reps spent less time on docs and more time on conversations. If you're building this into your sequencing, see AI in sales cadences.

For building accurate prospect lists before you automate, tools like Prospeo's Chrome extension pull verified emails and direct dials from any professional profile or company website. The free tier gives you 75 verified emails per month - enough to test the impact on your numbers before committing.

Keep the human voice in your messaging. AI can draft, suggest timing, and personalize at scale. But the follow-up that closes the deal still sounds like a person who genuinely understands the prospect's problem.

The Mindset Shift: Persistence as Service

Steli Efti, CEO of Close.com, once followed up 48 times with an investor who'd shown initial interest. Forty-eight times. The investor finally responded, they met, and he invested. Efti's philosophy: "I keep following up until I get a response. I don't care what the response is as long as I get one."

That sounds extreme. It is extreme.

But the underlying principle isn't about being relentless for its own sake. It's about reframing what follow-up actually is. Efti puts it this way: "Following up isn't about nagging - it's about helping people make the right decision." When you believe your solution genuinely helps the prospect, every follow-up is an act of service.

Jeff Shore calls this "the knee of the curve" - the point where most reps quit, right before the breakthrough. The reps who hit the top 1% aren't smarter or more talented. They just don't stop.

Look, I'm not saying follow up 48 times with every prospect. But stop counting follow-ups. Start counting value touches. If every message you send delivers genuine insight, the prospect will never feel pestered - they'll feel served. And when they're ready to buy, you'll be the only rep still in the conversation.

One more thing worth remembering: the deal that's dead today could reopen in six months. People change roles, budgets reset, and priorities shift. A post-sale follow-up - checking in after the close to ensure onboarding went smoothly, asking for referrals, preventing buyer's remorse - turns a one-time customer into a long-term revenue source. Closing the sale with follow-up doesn't end at the signature. It's how you build a pipeline that compounds.

The average company takes 42 hours to respond to a lead. Cut that to minutes by having direct dials and verified emails ready before the deal even starts. Prospeo refreshes all data every 7 days - not 6 weeks like competitors.

Win the speed-to-lead race with contacts that are always fresh.

FAQ

How many follow-ups does it take to close a sale?

Most sales require 5-8 follow-ups across multiple channels, with 8 touchpoints as the RAIN Group benchmark for booking a meeting. After 8-10 attempts with zero response, send a breakup email and shift to quarterly re-engagement. Never delete a prospect - budgets reset and priorities change.

What should you say instead of "just checking in"?

Share a case study, an industry data point, or a question tied to their specific situation - e.g., "You mentioned Q3 was the target - is that still the timeline?" Every message needs a concrete reason to respond. Generic check-ins train buyers to ignore you.

How do you follow up on a proposal without being pushy?

Lead with value each time - an ROI calculator, a competitive one-pager, or a relevant insight their team can use internally. When every touchpoint helps the prospect build their business case, persistence feels like service. After 6-8 value touches, the close becomes a natural next step.

Does verifying contact data before follow-up actually matter?

Bounced emails don't just waste touchpoints - they destroy your domain reputation and push future messages to spam. One team cut bounce rates from 35% to under 4% after switching to verified data, tripling their connect rate to 20-25%. Verify data first, then run your cadence.

When should you stop following up with a prospect?

After 8-10 touchpoints with no response, send a breakup email - these get a 33% response rate. If still no reply, move to quarterly re-engagement with a fresh angle. The deal that's dead today may reopen when budgets reset.