Average Lead Response Time: What the Latest Data Actually Shows

It's Monday morning. You open Salesforce, and there are 47 leads from the weekend sitting untouched. The oldest one came in Friday at 6:12 PM - a VP of Operations who filled out your demo request form, probably while comparing three vendors. That was 63 hours ago. She's already signed with someone else.

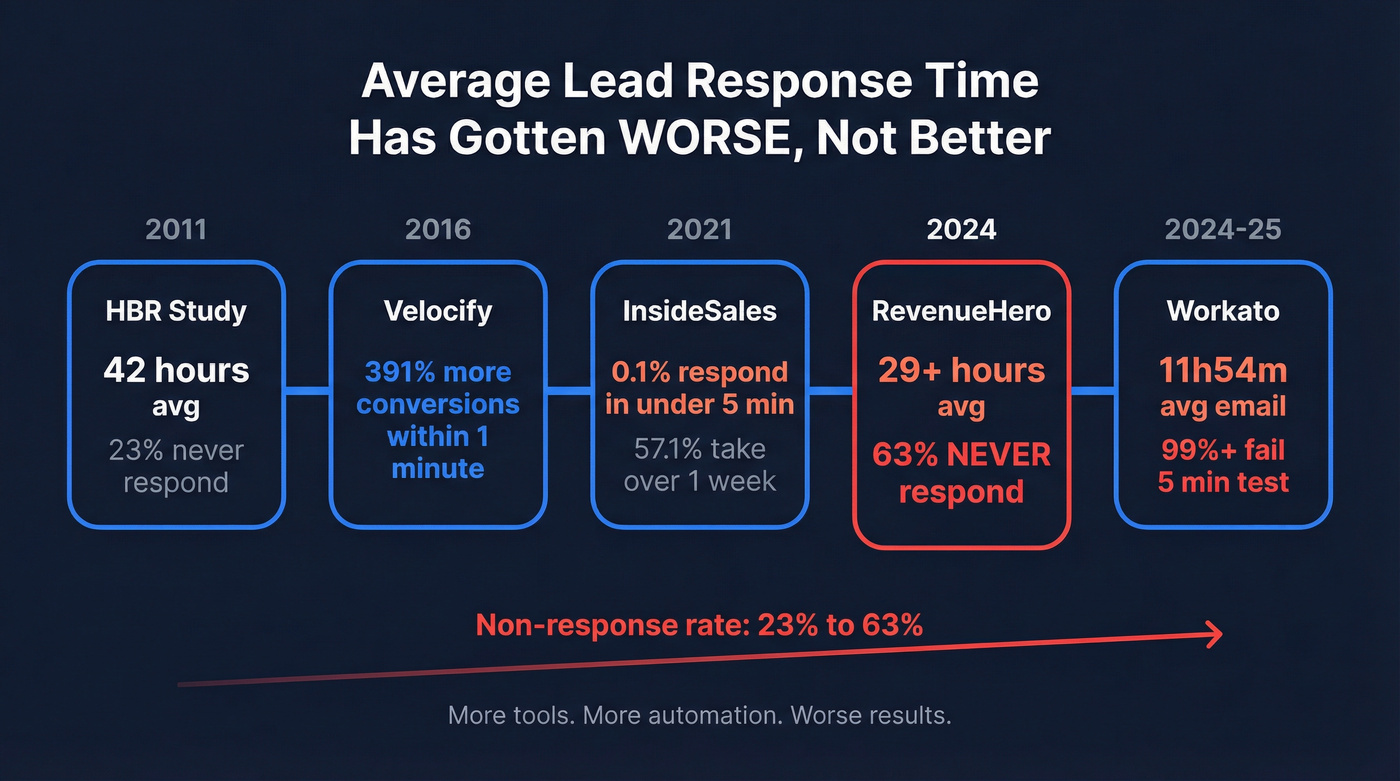

This isn't a hypothetical. A RevenueHero study of 1,000+ companies found the average lead response time is over 29 hours. And 63% of companies never respond at all. Not slowly - never. The data on speed to lead has gotten worse, not better, despite a decade of automation tools designed to fix exactly this problem.

Here's what the numbers actually say, why most teams are measuring the wrong thing, and how to fix it without buying another platform you won't configure.

The Short Version

If you're pressed for time:

- The real average is 29+ hours, not the commonly cited 42 hours from a 2011 HBR study. That 29-hour figure only counts companies that respond at all - 63% don't.

- 78% of buyers purchase from the first company that responds. Not the best. Not the cheapest. The first.

- The 5-minute benchmark is aspirational. Only 0.1% of companies actually engage inbound leads within 5 minutes. Aim for under 1 hour first - leads contacted within that window are 7x more likely to qualify.

- Your bottleneck probably isn't lazy reps. It's processing time: enrichment, routing, assignment, bad data. The average time for a personalized email is nearly 12 hours. Blaming SDRs for slow response when the system takes half a day to route a lead is like blaming the pilot for a delayed flight caused by ground crew.

What Is Lead Response Time?

Lead response time measures the gap between when a prospect raises their hand - fills out a form, sends an email, requests a demo - and when your team makes first contact. Simple concept. Messy in practice.

The LeanData framework breaks it into two components:

Lead Response Time = Lead Processing Time + Representative Response Time

Lead processing time covers everything before a rep sees the lead: data enrichment, lead-to-account matching, territory assignment, routing rules, round-robin logic. Representative response time is the gap between the lead landing in a rep's queue and the rep picking up the phone or hitting send.

Here's what most teams miss: when companies struggle with slow response times, the cause is almost always buried in processing, not rep behavior. Your SDR might respond within 3 minutes of seeing a lead - but if it took 8 hours for the lead to get routed to them, your actual response time is 8 hours and 3 minutes.

One more distinction that matters: median vs. average. If 9 leads get a response in 10 minutes and 1 lead sits for 72 hours, your average is 7+ hours but your median is 10 minutes. Median tells you what's typical. Average tells you how bad your worst cases are. You need both, but median is the better operational metric.

The Workato study found the average personalized email takes 11h54m - most of that is processing time, not rep laziness. Prospeo eliminates the enrichment bottleneck with 98% verified emails, pre-matched mobile numbers, and instant CRM enrichment that returns 50+ data points per contact. When your lead data arrives clean and routed, reps respond in minutes instead of hours.

Stop losing deals to enrichment lag. Respond before your competitors even see the lead.

Lead Response Time Statistics in 2026

The most-cited stat - 42 hours average - comes from a 2011 Harvard Business Review study by Oldroyd, McElheran, and Elkington. That study analyzed 15,000 unique leads and 100,000 call attempts. It was groundbreaking. It's also 15 years old.

The real situation has gotten worse.

| Study | Year | Sample Size | Key Finding |

|---|---|---|---|

| HBR (Oldroyd et al.) | 2011 | 15K leads, 100K calls | 42-hour avg; 7x qualification within 1 hour |

| Velocify | 2016 | Millions of records | 391% conversion boost within 1 minute |

| InsideSales | 2021 | 55M activities, 5.7M leads | 0.1% engaged in <5 min; 57.1% take >1 week |

| RevenueHero | 2024 | 1,000+ companies | 63% never respond; 29+ hour avg |

| Workato | 2024-25 | 114 B2B companies | 99%+ fail 5-min test; 11h54m avg email |

The trend line is damning. In 2011, 23% of companies never responded at all. By 2024, that number had risen to 63%. More tools, more automation, worse results.

The Velocify stat deserves a closer look because it gets misquoted constantly. Their original 2016 analysis covered millions of lead records across hundreds of client databases: prospects called within one minute were 391% more likely to convert than those called after that. Not 391% more likely to answer - 391% more likely to convert. That's the stat that launched a thousand speed-to-lead tools, and it holds up.

The Workato study is the most sobering recent data point. They filled out demo request forms at 114 B2B companies. Zero called within 5 minutes. Only 1 sent a personalized email within 5 minutes. Nearly 1 in 5 never responded by email at all. The average personalized email response took 11 hours and 54 minutes.

The 42-hour average from HBR is the number everyone cites because it sounds bad enough to motivate action but not so bad that it seems unbelievable. The actual 2024 data is worse. Most companies aren't slow - they're absent.

Why Lead Response Time Matters (The Cost of Waiting)

The Revenue Math

Let's make this concrete. The Credofy framework models it simply: at $100 per customer and 100 inbound leads, a fast-responding team (3% conversion) generates $300. A slow-responding team (0.15% conversion) generates $15. That's a $285 loss per 100 leads - not from bad marketing, not from a weak product, but from picking up the phone too late.

Scale that up. B2B marketers spend over $4.6 billion annually on advertising. An estimated $2.7 billion of that is wasted due to slow or nonexistent follow-up. You're paying to generate leads and then letting them rot.

As Brian Lim, CEO of iHeartRaves and INTO THE AM, put it: "Every hour of delay not only decreases your chances of connecting with a lead but also gives your competitors a chance to swoop in." That's not a theoretical risk - 35-50% of sales go to the vendor that responds first.

The InsideSales data makes the decay curve explicit: conversion rates are 8x greater in the first 5 minutes compared to the 5-minute-to-24-hour window. After 24 hours, you're essentially cold-calling someone who's already moved on.

What Buyers Actually Expect

The buyer expectation data is unambiguous:

- 78% of customers buy from the first business that responds

- 66% say speed is as important as price

- 82% rate an immediate response (within 10 minutes) as important or very important

- 88% expect an email reply within 1 hour

That last stat should keep you up at night. 88% expect an email reply within 1 hour, and the Workato study found the average personalized email response takes nearly 12 hours. The gap between expectation and reality isn't a crack - it's a canyon.

Leads contacted within 1 hour are 60x more likely to qualify than those contacted after 24 hours. Within 5 minutes, they're 21x more likely to enter the sales process than at 30 minutes. The math is brutal and it compounds: every minute you wait, the probability of conversion drops, and the probability of a competitor responding rises.

Lead Response Time Benchmarks by Channel and Industry

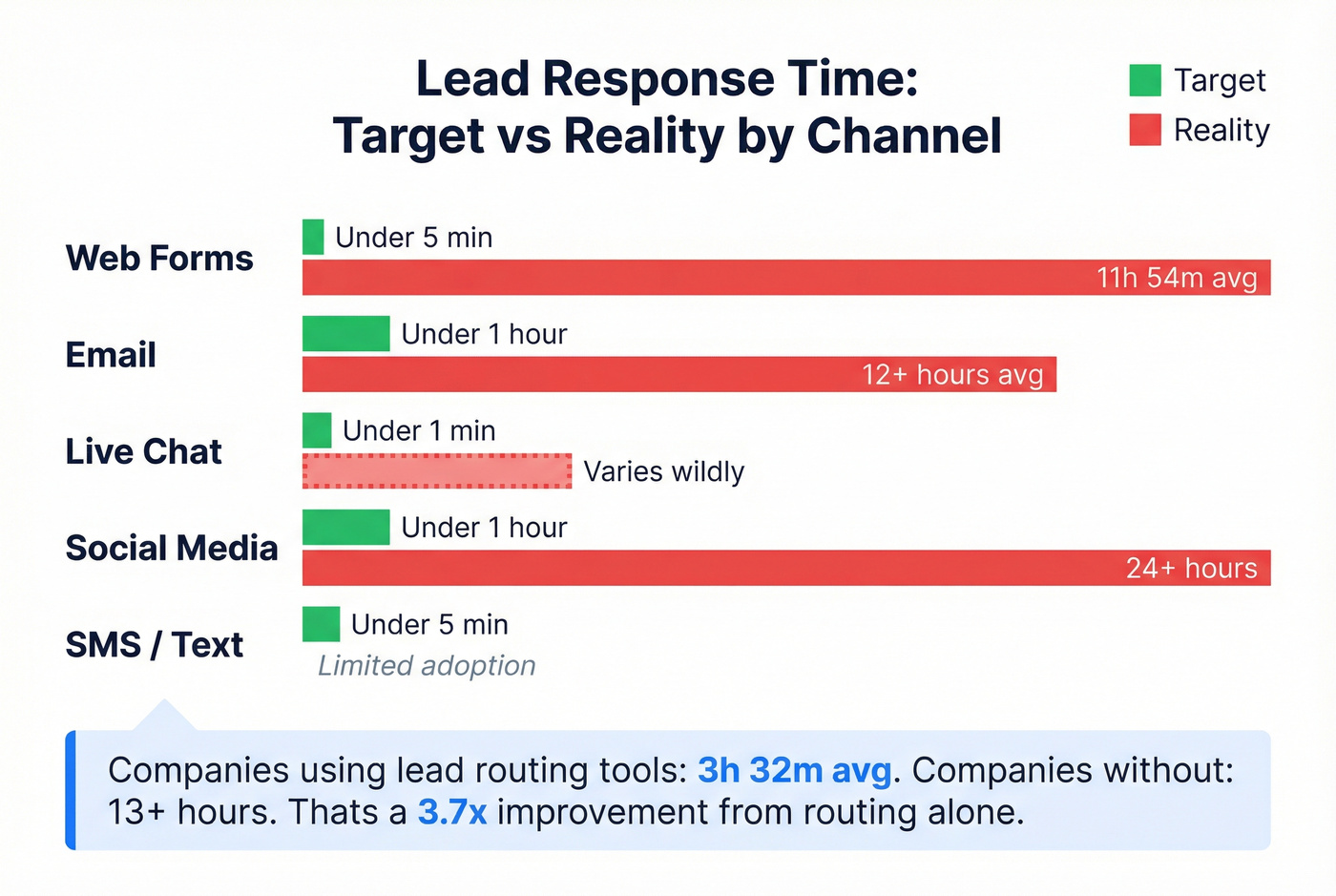

Benchmarks by Channel

Not all channels run on the same clock. A live chat visitor expects a response in seconds. A webinar attendee expects a follow-up email within a day.

| Channel | Target Response | Reality |

|---|---|---|

| Web forms | Under 5 min | 11h54m avg personalized email |

| Under 1 hour | 12+ hours avg | |

| Live chat | Under 1 min | Varies wildly |

| Social media | Under 1 hour | Often 24+ hours |

| SMS/text | Under 5 min | Limited adoption |

The gap between website lead form response time targets and reality is the most expensive one. Web form leads have the highest intent - someone actively sought you out, found your site, and filled out a form. And the average company takes nearly 12 hours to send a personalized email response.

Companies using lead routing tools average 3 hours and 32 minutes response time. Companies without them average 13+ hours. That's a 3.7x improvement from routing alone - no rep behavior change required.

Benchmarks by Industry

Here's an uncomfortable truth: legal services is the only industry with rigorous, longitudinal response time data. The Hennessey Digital 2025 study tracked 1,300+ law firm websites across 150,000 data points over 5 years.

| Metric | 2021 | 2025 | Change |

|---|---|---|---|

| Respond <5 min | 13% | 25% | +92% |

| No response at all | 40% | 26% | -35% |

| Median response | 25-33 min | 13 min | ~50% faster |

Legal is improving - but 26% still don't respond at all, and only 25% hit the 5-minute mark. That's the best-studied industry.

For other verticals, we're working with conversion rate data rather than response time data specifically. Ruler Analytics' analysis of 100M+ data points shows massive variation: legal services converts at 7.4%, manufacturing at 2.2%, SaaS at 1.1%. Some of that gap is response time. Some is sales cycle complexity. But when SaaS companies convert at 1.1% and legal converts at 7.4%, you have to wonder how much of that 6x gap is just lawyers picking up the phone faster.

Industry estimates based on available data: SaaS/tech companies average 12-24 hours, real estate 15-30 minutes (high competition forces speed), financial services 4-8 hours, healthcare 24-48 hours. These aren't as rigorously measured as legal, but they're directionally correct.

Common Mistakes That Kill Your Response Time

Process Mistakes

Creating leads at the wrong moment. If you create a lead in your CRM the instant someone downloads a whitepaper, you're sending ice-cold contacts to sales. If you wait until they've hit three intent signals and requested a demo, you've already lost the speed advantage. The sweet spot is somewhere in between, and most teams haven't defined where.

Unclear ownership. This is the silent killer. A lead comes in, and either three people follow up (the prospect gets three emails in 20 minutes and thinks you're desperate) or nobody follows up (everyone assumed someone else had it). Round-robin assignment with clear rules isn't optional - it's the difference between a functioning pipeline and chaos.

Sales doesn't trust marketing leads. I've seen this pattern destroy response times at otherwise well-run companies. Marketing generates leads, sales views them as garbage, reps deprioritize follow-up, response times balloon, conversion drops, and marketing gets blamed for "low-quality leads." The actual problem was a 14-hour response time turning warm leads cold.

No post-assignment tracking. The lead gets handed to a rep, and then... silence. No activity logging, no SLA alerts, no visibility into whether the rep actually called. If you're not tracking what happens after assignment, you're flying blind.

Data Quality Mistakes

Nobody talks about this in speed-to-lead articles: your data is wrong.

Picture this. An SDR gets a lead notification, opens the record, and starts dialing. The phone number is disconnected. They try the email - it bounces. They look up the company - the contact left 6 months ago. The rep just burned 8 minutes on a dead lead, and their motivation to sprint on the next one drops.

When 20-35% of your records have outdated contact info - and that's a conservative estimate for most B2B databases - your "5-minute response" reaches nobody. You're speed-dialing voicemail boxes and sending emails to accounts that no longer exist.

This is where data quality and response time intersect. Enriching leads before routing adds seconds to processing time but saves hours of wasted rep effort. Tools like Prospeo return 50+ data points per contact with a 92% match rate, which means your routing rules actually have accurate data to work with - job title, department, company size - before the lead hits a rep's queue.

How to Improve Lead Response Time

Fix Your Processing Pipeline First

If you take one thing from this article, let it be this: 80% of response time delay is processing, not rep behavior.

The Workato data backs it up. Companies with routing tools average 3.5 hours. Companies without them average 13+ hours. That's a 9.5-hour improvement from fixing the plumbing, not from motivating reps to move faster.

Start here:

- Audit your current processing time. Measure the gap between form submission timestamp and lead assignment timestamp. If it's more than 5 minutes, you have a processing problem.

- Automate enrichment. Manual data entry by SDRs is a response time killer. Automated enrichment should fire the moment a lead enters your system.

- Simplify routing rules. I've seen companies with 47 routing rules that take 3 minutes just to evaluate. If your routing logic requires a flowchart to explain, it's too complex.

- Set SLA alerts. If a lead sits unassigned for more than 10 minutes, someone should get pinged. If it sits uncontacted for more than 30 minutes, it should escalate.

Once you're generating 300-400+ unique monthly inbound leads, a dedicated lead response rep pays for itself. Below that threshold, SLA alerts and routing automation cover the gap.

Optimize Your Lead Form Response Time

The Chili Piper 2026 benchmark report analyzed nearly 4 million form submissions and found something that should change how you think about forms entirely.

Form scheduling - letting prospects book a meeting directly from the form - doubles inbound conversion rates. From 30% to 66.7%. Only 8% of top B2B SaaS companies use it.

Let that sink in. A feature that doubles conversion, and 92% of top SaaS companies haven't implemented it.

Other form findings that matter: removing double form fill (where someone fills out a form, then gets sent to another form) increases conversion by 50%. Loading time matters too - competitors in Chili Piper's analysis had 30-45 second load times. Every second of friction is a percentage point of conversion you're leaving on the table.

The live calling option - where a rep calls the prospect while they're still on the page - hits a 69.2% conversion rate. That's not a typo. If you can get a rep on the phone with a prospect within 60 seconds of form submission, you'll convert more than two-thirds of qualified leads. This is the sub-10-second workflow that separates the fastest companies from everyone else.

Solve the After-Hours Problem

The Reddit threads on this are painful to read. "Most leads come in after 6pm... and by morning, they've already booked with someone else." "We're losing a lot of leads after hours and it's starting to hurt."

This is the operational reality that 5-minute-response evangelists ignore. Your best internet leads often come in when nobody's working. A VP researching solutions at 9 PM isn't going to wait until your 8 AM shift starts.

If your deal sizes exceed $20k and you don't have after-hours coverage, you're leaving six figures on the table annually. The math is simple - even a basic AI chatbot that qualifies and books meetings will pay for itself within the first month.

Solutions that actually work:

- AI chatbots. They boost conversion by 23%, and 64% of customers cite 24/7 availability as a key benefit. They won't close deals, but they'll qualify, answer FAQs, and book meetings while your team sleeps.

- Automated booking tools. Calendly's free tier handles basic scheduling. Chili Piper (from ~$150/mo) handles form-to-meeting routing. The prospect books a slot, and your rep wakes up to a confirmed meeting instead of a stale lead.

- SMS auto-responders. A simple "Thanks for reaching out - we'll call you first thing tomorrow at 9 AM. Does that work?" sent within 60 seconds of form submission keeps the prospect engaged and sets an expectation.

The goal isn't to have reps working at midnight. It's to make sure the prospect knows you exist and has a reason to wait for you instead of moving to the next vendor.

Build a Follow-Up Cadence That Works

The Belkins 2025 study analyzed 16.5 million cold emails across 93 business domains and found something counterintuitive: the highest reply rate (8.4%) comes from the first email. Performance declines with each follow-up, and 4+ emails in a sequence triples unsubscribe and spam complaint rates.

This doesn't mean "only send one email." It means front-load your best content and don't rely on volume to compensate for weak messaging.

Other cadence insights:

- C-suite responds at 5% vs. entry-level at 8%. Executives are harder to reach, and more follow-ups won't fix that - better targeting will.

- Small businesses (2-50 employees) start at 9.2% reply rate. Enterprises are, in Belkins' words, "allergic to persistence."

- Velocify found that up to 6 follow-ups at strategic intervals improved contact rates significantly. The key word is "strategic" - not 6 emails in 3 days, but 6 touchpoints over 2-3 weeks with varied channels and messaging.

The optimal cadence for inbound leads looks different from cold outreach. For inbound: call within 5 minutes, email within 15 minutes, second call at 1 hour, email at 4 hours, call at 24 hours, final email at 48 hours. After that, move to a nurture sequence. Don't keep hammering.

Fix Your Data Before You Fix Your Speed

Routing automation is only as good as the data it routes on. If 30% of your records have outdated contact info, you're speed-dialing voicemail boxes and bouncing emails off defunct addresses. Your measured response time might say 4 minutes, but your effective response time - the time until you actually reach a human - could be days.

This is the hidden multiplier that inflates effective response time across the board. A rep who calls 10 leads in 10 minutes but reaches 0 humans hasn't responded to anything. They've just burned through a list.

Prospeo's email verification runs in real-time with 98% accuracy - compared to the 70-85% you'll get from most databases. The 125M+ verified mobile numbers carry a 30% pickup rate, meaning reps actually connect with humans instead of leaving voicemails. And the 7-day data refresh cycle means the contact who changed jobs last month doesn't sit in your CRM for 6 weeks with a dead email address. Clean data means your first attempt actually reaches a person, and that's the only response time metric that matters.

78% of buyers sign with whoever responds first. But you can't respond fast if you're stuck verifying emails and hunting for direct dials. Prospeo delivers 143M+ verified emails and 125M+ mobile numbers on a 7-day refresh cycle - so every lead hits your reps with accurate contact data from the start. At $0.01 per email, bad data stops being your most expensive bottleneck.

Be the first vendor to respond with data that actually connects.

How to Measure Lead Response Time Correctly

Most teams measure this metric wrong. They pull an average from their CRM, see "4 hours," and think they're doing okay.

They're not.

One critical distinction before you start: don't count automated confirmation emails as "responses." Your autoresponder firing in 2 seconds isn't a response - it's an acknowledgment. Measure time to first human contact. That's the number that correlates with conversion.

Track three data points:

- Fastest response time - your best case. This tells you what's possible with your current setup.

- Median response time - your typical case. This is the number that actually represents your team's performance.

- Slowest response time - your worst case. This tells you where leads are falling through cracks.

Why median over average? Because averages lie. If 90% of your leads get a response in 8 minutes and 10% sit for 3 days (weekends, routing errors, rep PTO), your average is several hours. Your median is 8 minutes. The median tells you what's normal. The average tells you something's broken for a subset of leads - which is also important, but it's a different problem.

Break your measurement down by:

- Channel: Web forms, chat, events, inbound calls, partner referrals

- Lead source: MQL, SDR handoff, demo request, content download

- Time of day: Business hours vs. after-hours

- Rep: Individual performance varies wildly - we've seen 10x gaps between fastest and slowest reps on the same team

The metrics that matter beyond raw response time: contact rate (what percentage of leads do you actually reach?), qualification rate (of those you reach, how many qualify?), and revenue per lead. A 3-minute response time means nothing if you're reaching disconnected numbers.

Skip the aspirational targets if you're currently at 12 hours. Get to under 1 hour first. Then 30 minutes. Then 15. Then 5. Incremental improvement beats moonshot goals that nobody hits. The companies that actually achieve sub-5-minute response built that capability over years, not weeks.

FAQ

What is a good average lead response time?

Under 5 minutes is the gold standard, but only 0.1% of companies achieve it. A realistic first target is under 1 hour - leads contacted within that window are 7x more likely to qualify. The biggest ROI comes from moving from "hours" to "under an hour," not from shaving seconds off an already-fast time.

How do you calculate lead response time?

Divide total response time across all leads by the number of leads for the average, but use median instead to avoid outlier distortion. Break it into processing time (form submission to rep assignment) and rep response time (assignment to first contact). Measure both separately - the fix for each is completely different.

Why is lead response time getting worse despite better technology?

The RevenueHero data shows 63% of companies don't respond at all, up from 23% in 2011. The problem isn't tool availability - it's process and data quality. Companies buy routing tools but misconfigure them, collect leads but skip after-hours coverage, and run enrichment on databases that are 30% outdated.

Does lead response time matter for B2B as much as B2C?

Yes. Workato tested 114 B2B companies and 99%+ failed the 5-minute test. B2B buyers expect the same speed; 78% buy from the first responder regardless of industry. The idea that B2B buyers are "patient" because sales cycles are longer is flat-out wrong - they're evaluating multiple vendors simultaneously, and the first to respond sets the anchor.

How does bad contact data affect response time?

If 20-30% of records have outdated emails or wrong numbers, your CRM says "5-minute response" while your effective response time - time until you reach an actual human - stretches to days. Prospeo's 98% email accuracy and 7-day data refresh cycle ensure reps connect on the first attempt instead of burning through stale records.