Prospect Follow Up in 2026: The Complete Cadence + Template Playbook

$15k of pipeline sitting in "No response" isn't a pipeline problem. It's a prospect follow up system problem.

And in 2026, it's also a deliverability problem: a painful chunk of your "best" copy never gets seen.

Look, if your average deal is in the lower five figures, you don't need a fancy follow-up framework. You need clean data, a simple cadence, and a next step that's stupid-easy to say yes to.

What you need (quick version)

- Use a stage-based cadence (inbound vs outbound vs post-demo vs post-proposal).

- Default to 5-8 touches; the first follow-up lifts replies 65.8% (Instantly, via Backlinko's dataset).

- Mix channels; directional benchmark: multichannel outreach is reported to lift responses up to ~287% vs single-channel. Use that to set expectations, not to forecast your quarter.

- Protect deliverability:

- Yahoo requires <0.3% spam complaints, List-Unsubscribe, and honoring unsubscribes within 2 days.

- Outlook.com consumer domains at >5,000 emails/day require SPF/DKIM/DMARC.

- Prevent mid-funnel ghosting with a Mutual Action Plan (MAP) table and a locked next step.

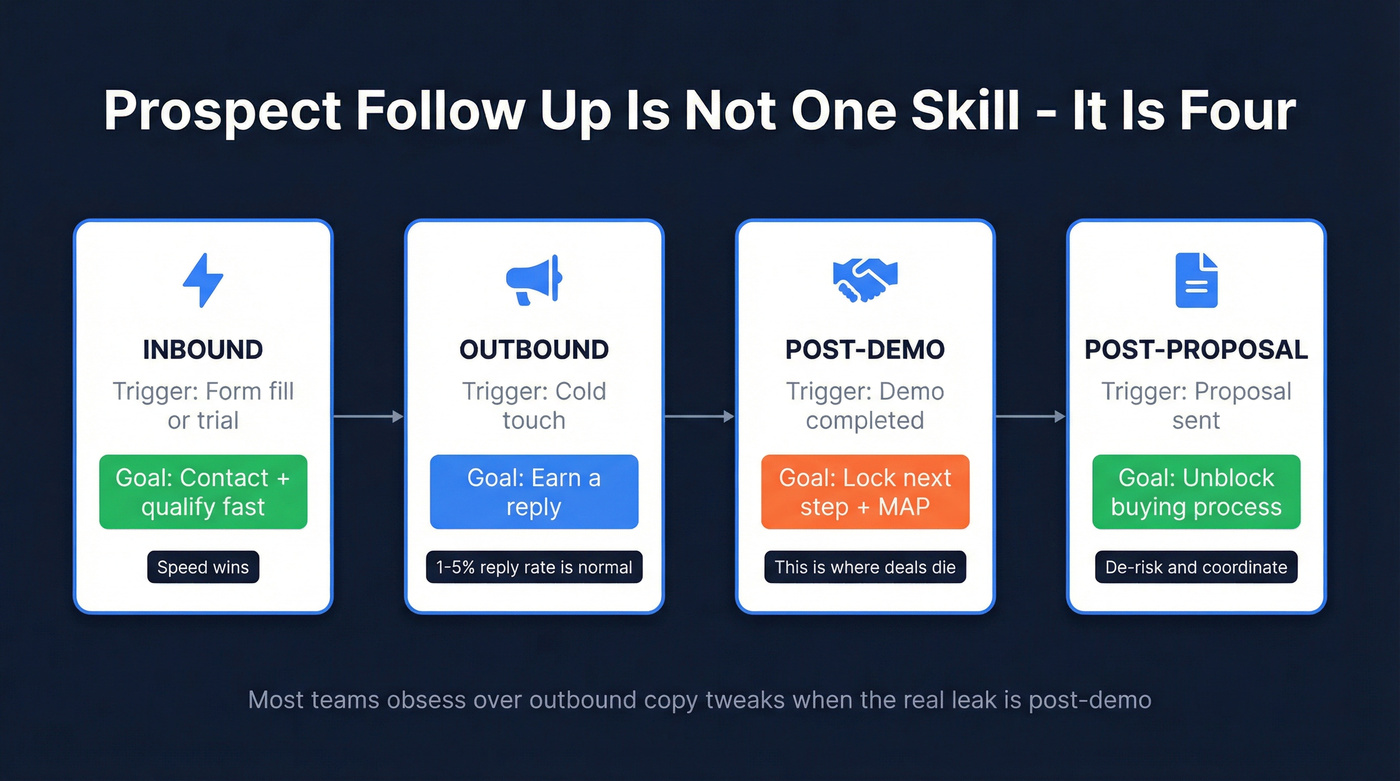

Prospect follow up means different things by stage

"Follow up" gets treated like one skill. It's not.

The right cadence depends on what the buyer just did (or didn't do), and what you're trying to achieve.

Inbound follow-up is about speed and qualification. Outbound follow-up is about earning attention. Post-demo follow-up is about momentum and alignment. Post-proposal follow-up is about de-risking and coordination.

Here's the simplest way to frame it:

| Stage | Trigger | Goal of follow-up | What "good" looks like |

|---|---|---|---|

| Inbound | Form fill / trial | Contact + qualify fast | Meeting booked or disqualified |

| Outbound | Cold touch | Create a reason to reply | A "yes/no/redirect" response |

| Post-demo -> pre-proposal | Demo completed | Lock next step + MAP | Date on calendar + owners |

| Post-proposal/contract | Proposal sent | Unblock buying process | Clear blocker + timeline |

Most teams obsess over outbound copy tweaks when the real leak is post-demo. Deals don't die because your subject line lacked "curiosity." They die because nobody captured the next step while the buyer still cared.

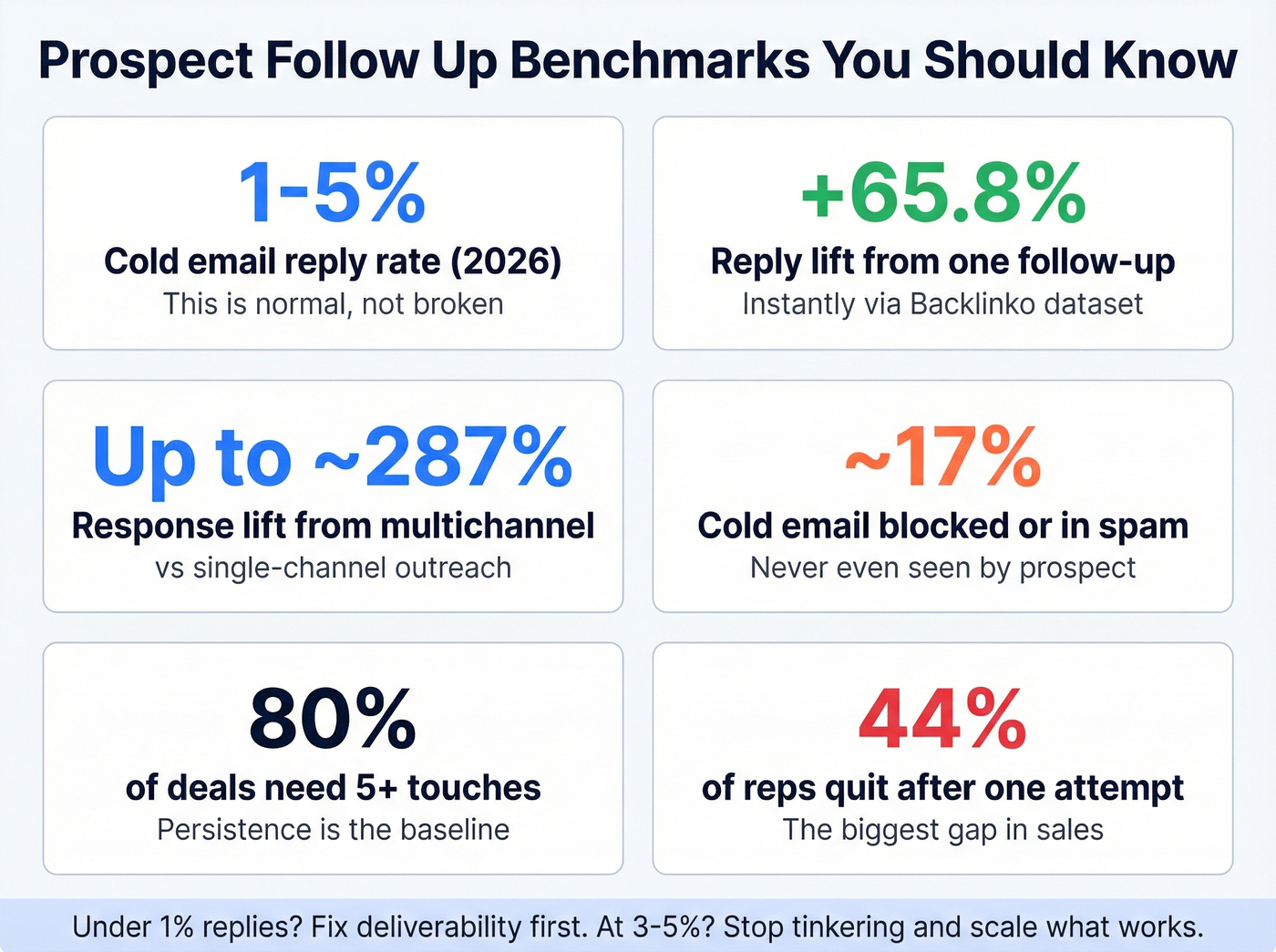

Benchmarks to set expectations (so you don't overreact)

If you expect every sequence to print meetings, you'll thrash: new subject lines, new personas, new tools, and zero learning.

Use these as guardrails:

- Cold email reply rates (2026): 1-5% is normal.

- One follow-up increases replies by 65.8% (Instantly, via Backlinko's dataset).

- Directional benchmark: multichannel outreach is reported to lift responses up to ~287% vs single-channel.

- Directional: some benchmark roundups estimate ~17% of cold email gets blocked or lands in spam.

Two stats that explain why "5-8 touches" isn't aggressive - it's reality:

- 80% of deals require 5+ touches to close.

- 44% of reps give up after one.

A practical interpretation:

- If you're under 1% replies, assume deliverability or list quality until proven otherwise.

- If you're at 1-2%, you're fine. Optimize systematically.

- If you're at 3-5%, stop tinkering and scale what's working while protecting your domain.

You just read it: a huge chunk of "they're ignoring me" is actually "you're not reaching them." Prospeo's 5-step verification delivers 98% email accuracy and 125M+ verified mobile numbers - so your 5-8 touch cadence actually lands. Bounce rates drop under 4%, like they did for Snyk's 50 AEs.

Fix reachability before you rewrite Touch #6.

The follow-up decision tree (why they're silent - and what to do)

Most "no response" situations aren't mysterious. They fall into a few buckets.

Run this like a checklist before you write your 7th "just bumping this" email.

If-then decision tree

1) If it wasn't delivered (or it landed in spam)

Signs: bounces climb, replies drop overnight, opens vanish, Outlook rejects.

Do: pause the sequence, check authentication (SPF/DKIM/DMARC), reduce volume, and clean the list.

Do next: resend from a healthy domain only after hygiene's fixed.

2) If you're talking to the wrong person

Signs: no engagement + org is large + your message assumes authority they don't have.

Do: send a redirect email: "Who owns X?" and add 2-3 adjacent roles (manager + director + ops/IT).

Do next: fix CRM routing so you stop repeating the mistake.

3) If it's not a priority (but could be later)

Signs: "Not now," vague delays, no internal deadline.

Do: ask a timing question tied to a business event: "Is this a Q2 or Q3 project?"

Do next: set a calendar follow-up and send one useful asset, not three.

4) If internal consensus is missing

Signs: "Need to loop in..." "We're aligning..." "We're evaluating options."

Do: propose a 15-minute buying group call and introduce a MAP.

Do next: ask for names, not titles.

5) If timing is real (budget cycle, renewal, hiring freeze)

Signs: specific dates, procurement windows, fiscal year language.

Do: lock a future meeting now ("Let's pencil the week of...") and go quiet until then.

Do next: send one pre-read 48 hours before the meeting.

6) If pricing/procurement is the blocker

Signs: "Send pricing," "Need approval," "Legal review."

Do: ask what they're comparing and what approval threshold applies.

Do next: offer two packages (good/better) to speed decisions.

7) If security review is the blocker

Signs: SOC2 questions, vendor risk forms, SSO requirements.

Do: send the security packet and ask for their checklist.

Do next: schedule a 20-minute security Q&A instead of 19 emails.

8) If you lost the next step (classic post-demo failure)

Signs: demo ended with "We'll get back to you."

Do: send a recap within 24 hours with a proposed date/time for the next meeting.

Do next: if they don't pick, send two options and a MAP draft.

Here's the thing: a huge chunk of "they're ignoring me" is actually "you're not reaching them." Bad emails bounce, catch-all domains swallow messages, and wrong numbers waste call blocks.

Fix reachability before you write Touch #6.

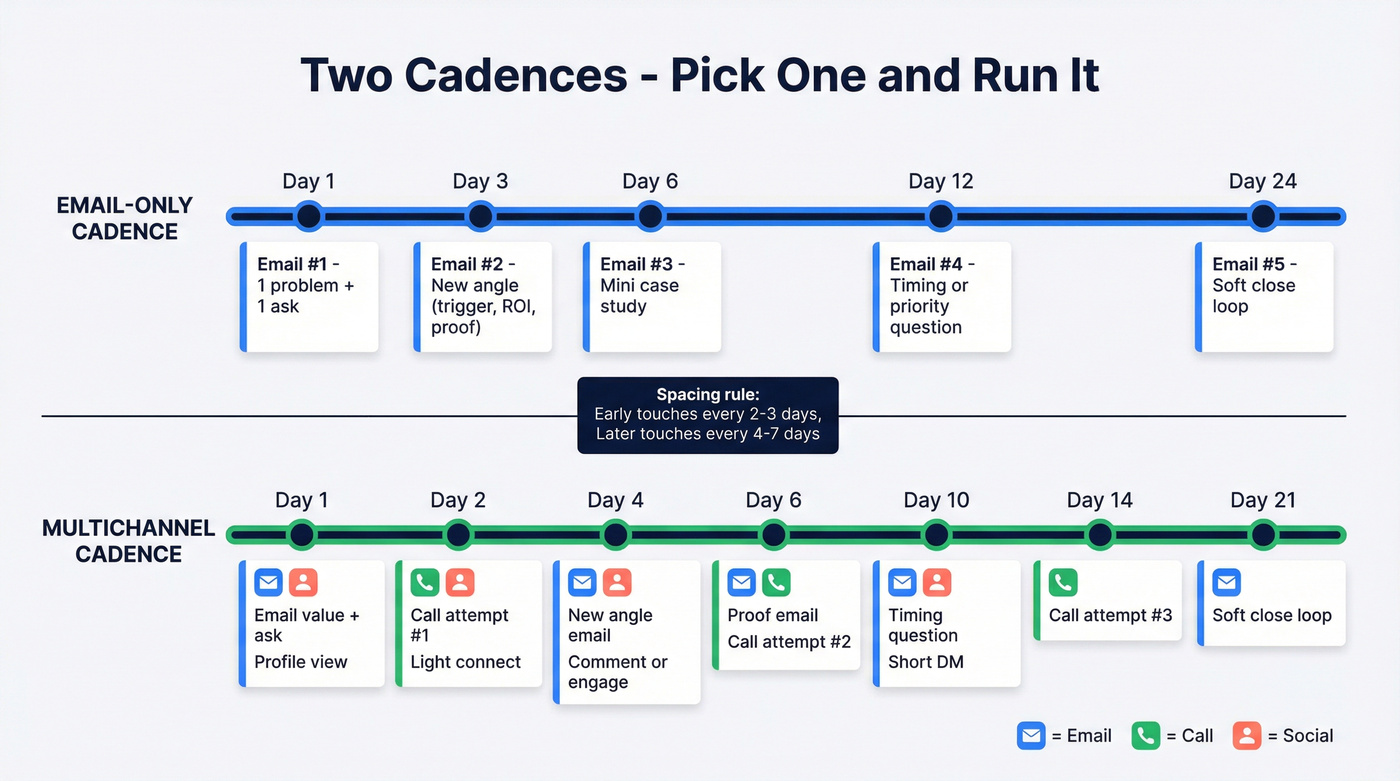

The default prospect follow up cadence (5-8 touches) + multichannel variant

Run one default cadence until you've got a documented reason to change it. Most teams fail because every rep improvises.

Spacing rules that work:

- Early touches: every 2-3 days (you're still top-of-mind).

- Later touches: every 4-7 days (persistent without becoming noise).

A clean baseline schedule is Day 1 / 3 / 6 / 12 / 24. Add 1-3 touches only for high-value accounts or complex buying groups.

What counts as a "new angle" (use this menu)

If Touch #2 is just Touch #1 with different adjectives, you're training prospects to ignore you.

Pick a real angle:

- Trigger event: funding, hiring, new leader, tech change, policy change.

- Competitor compare: "Teams switching from X usually do it because..." (keep it factual, not snarky).

- ROI calc: a back-of-napkin estimate with your assumptions stated.

- Security answer: preempt the top 2 security objections with a short checklist.

- Stakeholder enablement: a forwardable note your champion can paste internally.

Table A: Email-only cadence (deliverability-safe)

| Day | Touch | Subject | What to send | Use this if | Skip this if |

|---|---|---|---|---|---|

| 1 | Email #1 | Simple | 1 problem + 1 ask | You have a tight ICP | You're spraying lists |

| 3 | Email #2 | "Re:" | New angle (menu above) | You can add value | You're repeating yourself |

| 6 | Email #3 | Proof | 1 mini case | You have a relevant win | Your proof's generic |

| 12 | Email #4 | Question | Timing/priority | You want a "no" | You'll pester forever |

| 24 | Email #5 | Close loop | Soft exit + option | You want clean pipeline | You'll send ultimatums |

Deliverability-safe rules inside the cadence:

- Keep threads short. Touch #4 isn't the time for your life story.

- Don't reply-all yourself into spam with 12-message chains.

- If unsubscribes spike, stop and fix targeting and hygiene.

Table B: Multichannel cadence (email + call + social)

This is the version we recommend for most B2B motions because it gives you more chances to be seen without blasting email volume.

| Day | Call | Social | Goal | |

|---|---|---|---|---|

| 1 | Value + ask | - | View/profile touch | Get noticed |

| 2 | - | Call attempt #1 | Light connect | Create familiarity |

| 4 | New angle | - | Comment/engage | Earn attention |

| 6 | Proof | Call attempt #2 | - | Add credibility |

| 10 | Timing Q | - | Short DM | Force a decision |

| 14 | - | Call attempt #3 | - | Catch them live |

| 21 | Soft close loop | - | - | Clean exit |

Use this if:

- You can call in the prospect's local time.

- You've got enough data quality to avoid wrong numbers.

- You're selling something that requires trust (that's most B2B).

Skip this if:

- You can't call (privacy rules, gatekeepers, no direct dials).

- Your team can't run multichannel without getting sloppy.

- You're in a regulated segment where social touches create risk.

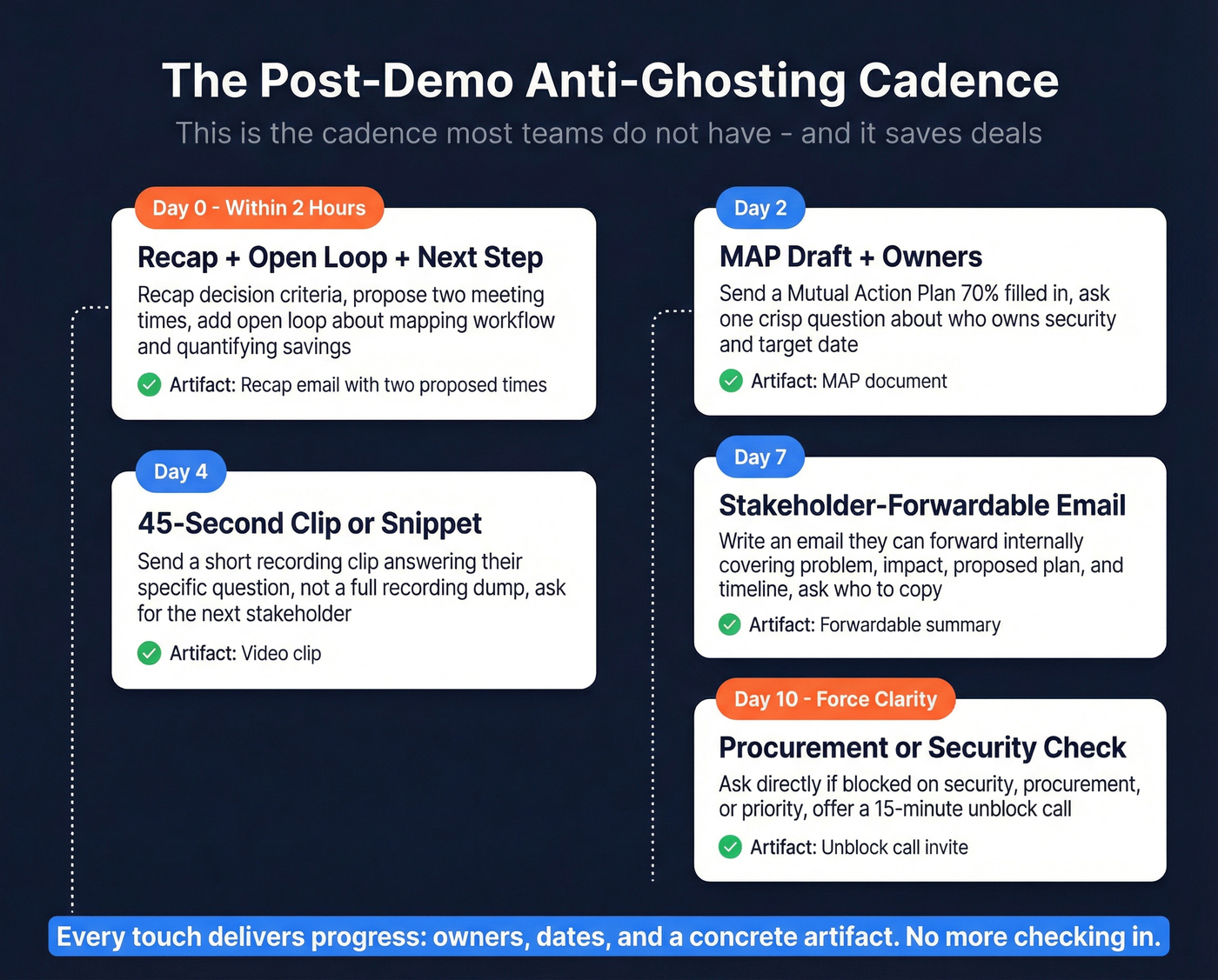

Post-demo -> pre-proposal anti-ghosting micro-cadence (10 days, 5 touches)

This is the cadence most teams don't have - and it's the one that saves deals.

Day 0 (within 2 hours): "Recap + open loop + next step"

- Recap the decision criteria and propose two times.

- Add an open loop: "Next time we'll map your current workflow and quantify savings."

Day 2: "MAP draft + owners"

- Send a MAP draft 70% filled in.

- Ask one crisp question: "Who owns security, and what's your target date?"

Day 4: "45-second clip/snippet"

- Send a short recording clip answering their question (not a full recording dump).

- Ask for the stakeholder you need next.

Day 7: "Stakeholder-forwardable email"

- Write an email they can forward internally: problem, impact, proposed plan, timeline.

- Ask: "Who should I copy so we don't play telephone?"

Day 10: "Procurement/security check"

- Force clarity: "Are we blocked on security, procurement, or priority?"

- Offer a 15-minute unblock call.

This cadence works because it replaces "checking in" with progress: owners, dates, and a concrete artifact each time.

If you can't call (privacy laws, gatekeepers): email-only fallback cadence

When calling decision-makers isn't realistic, you win by being useful, brief, and easy to redirect.

Spacing: Day 1 / 4 / 8 / 15 / 27 (slightly longer gaps to protect deliverability and reduce annoyance).

What to send (value-add assets that earn replies):

- A 6-line ROI snippet with assumptions: "If you process ~X/month, savings is ~Y."

- A 45-second clip answering their question (post-demo) or a 2-sentence "here's how teams handle X" (outbound).

- A security packet link + checklist question: "Do you require SSO, SCIM, or a vendor risk form?"

- A one-page implementation plan: week-by-week, who does what.

- A stakeholder-forwardable summary (your champion's best friend).

Redirect pattern (use it early): "Who's the right owner for {{topic}} at {{Company}}? If it's not you, I'll reach out to the right person and leave you out of it."

Channel timing that actually moves replies (email vs call)

Email timing matters, but call timing is where teams leave money on the table, especially when you're trying to follow up leads fast after an inbound trigger.

Use these call windows as defaults (then test by persona/industry):

- Best cold call window: 8-11 AM local time with a 15% higher connection rate.

- Secondary window: 3-6 PM, with a 4-5 PM peak.

- Worst time during the workday: around 1 PM (lunch + meeting transitions).

Checklist for timing follow-ups:

- Call within the window, then email 3-5 minutes later: "Tried you just now - quick question..."

- If you're calling EMEA from the US, block your calendar. Don't "fit it in."

- If you're using sequences (Outreach, Salesloft, HubSpot), align tasks to local time zones or reps'll call at nonsense hours.

Revenue.io's breakdown is a solid reference: best time to cold call prospects.

Templates library (short, stage-specific, non-cringe)

Templates don't win deals. They win replies.

The deal gets won when your follow-up makes the next step easy.

Rules:

- One email = one job.

- Ask for a specific next step (time, owner, decision).

- Don't guilt people for being busy. It's weak and it burns goodwill.

Inbound speed-to-lead email (5-minute standard)

HBR's speed-to-lead piece is still the canonical reference: The Short Life of Online Sales Leads. The MIT/InsideSales "Lead Response Management" PDF is the artifact teams still pass around: MIT-InsideSales Lead Response Management PDF.

Subject: Quick question about {{trigger}} Hi {{FirstName}} - saw your {{form/trial}} come through.

What are you hoping to improve: {{Option A}} or {{Option B}}? If you've got 10 minutes today, I can point you to the fastest path.

Outbound follow-up (new angle, 3 sentences)

Subject: Re: {{topic}} {{FirstName}}, different angle: teams look at {{problem}} when {{event}} happens. Is {{Company}} dealing with that this quarter? If it's not you, who owns it?

Post-demo recap + next step + open loop (send within 24 hours)

Subject: Recap + next step for {{Company}} Thanks for today - here's what I heard:

- {{pain}}

- {{goal}}

- {{constraint}}

Next step: {{meeting purpose}} on {{two time options}} with {{stakeholders}}.

Open loop for next time: we'll map your current workflow and quantify savings - Tuesday or Thursday?

Post-demo "45-second clip" follow-up (Avoma-style, high reply rate)

Subject: 45s clip on {{their question}} {{FirstName}} - here's the 45-second clip where we answered your question on {{topic}}: {{link}}. To keep momentum, who should join the next step - {{role A}} or {{role B}}? If you want, I'll send a one-page MAP with owners + dates.

Post-proposal nudge (2-3 days later)

Subject: Quick check on the proposal Hey {{FirstName}} - did you get a chance to review the proposal? At this step the blocker is almost always pricing structure, implementation timing, security review, or missing stakeholders - which one is it? If it's easier, I can jump on for 10 minutes and we'll decide the next step live.

Voicemail script (15 seconds) + "text/email after call" line

Voicemail (15s): "Hey {{FirstName}}, it's {{Name}}. Quick question on {{one specific outcome}} - nothing urgent. I'll send a short email as well. My number is {{number}}."

Email/text right after the call:

Subject: Tried you just now "Just tried you - quick yes/no: should I speak with you about {{topic}}, or is someone else the right owner?"

Soft close-the-loop (breakup alternative)

Breakup emails fail when they sound like a power move. Skip the "closing your file" nonsense.

Subject: Should I pause? {{FirstName}} - I haven't heard back, so I'm going to pause outreach for now. If {{problem}} becomes a priority, want me to send a quick plan for how teams handle it? Either way, what's the right timing?

Stop mid-funnel ghosting with a Mutual Action Plan (MAP)

Post-demo ghosting usually isn't "no interest." It's "too many moving parts."

Buying groups are typically 6-10 people, they consult 4-5 sources, 77% say the process is too complex, and 95% pivot when new insights appear (Gartner stats, as quoted by Dock). That's why your champion goes quiet: they're coordinating a committee, and you're not in the room for most of those conversations.

A MAP fixes this by turning "next steps" into a shared checklist with milestones in buyer language, one owner per action, dates that map to internal deadlines, and explicit dependencies (security, procurement, legal, IT) so you stop guessing why the deal's stuck and start clearing the actual bottleneck.

Blunt rule: a MAP isn't a fake deadline generator; it's a buyer-deadline mirror.

Copy/paste MAP template

| Milestone | Buyer owner | Seller owner | Due date | Dependencies | Status | Next check-in |

|---|---|---|---|---|---|---|

| Confirm success criteria | Not started | |||||

| Stakeholder review | ||||||

| Security questionnaire | Sec team | |||||

| Procurement steps | Budget owner | |||||

| Final decision call | All present | |||||

| Contract sent | Legal | |||||

| Kickoff scheduled | Implementation |

How to use it without being weird:

- Bring it up at the end of the demo: "Want me to draft a MAP so we don't lose momentum?"

- Fill the first 30% yourself, then ask them to correct it.

- End every follow-up with one MAP question: "Who owns the security step, and what's the due date?"

Follow-up that doesn't wreck your domain (2026 deliverability rules)

In 2026, deliverability isn't optional plumbing. It's the game.

Authentication (non-negotiable)

Yahoo (all senders + bulk senders):

- Authenticate (SPF or DKIM minimum; bulk needs SPF + DKIM + DMARC).

- Keep spam complaints below 0.3%.

- Support List-Unsubscribe and include a visible unsubscribe link.

- Honor unsubscribes within 2 days.

Official doc: Yahoo sender best practices.

Outlook.com (consumer domains) for >5,000 emails/day:

- Requires SPF, DKIM, DMARC (DMARC at least p=none, aligned).

- Non-compliant mail gets junked and can be rejected with: "550; 5.7.515 Access denied... does not meet the required authentication level."

Official doc: Outlook high-volume sender requirements.

Unsubscribe (do it cleanly)

One-click unsubscribe (RFC 8058):

- Add List-Unsubscribe with an HTTPS URL.

- Add List-Unsubscribe-Post: List-Unsubscribe=One-Click so mailbox providers can process it cleanly. Mailgun's explainer is the clearest walkthrough: what RFC 8058 is and how it works.

Hygiene (the part that decides your fate)

If your list's dirty, your follow-ups create bounces and complaints, and that tanks your domain. Fix reachability before you rewrite subject lines.

Operator "metrics tripwires" (stop sending when...)

These aren't universal laws. They're the thresholds that keep your domain alive.

- Bounce rate: stop sending when it's >2-3% on a send, or when it jumps 2x above your baseline. Action: pause, verify the list, remove risky/catch-all, reduce volume.

- Spam complaint rate: set an internal tripwire at >0.1%; treat 0.3% as the hard ceiling (Yahoo). Action: stop the sequence, tighten targeting, add List-Unsubscribe if missing.

- Unsubscribe rate: if it spikes above your normal level, assume your targeting or offer's off. Action: narrow ICP, rewrite the first email to be more specific, reduce volume.

- Sudden open collapse + reply collapse: assume spam placement. Action: stop blasting, warm up slowly, fix authentication and hygiene before resuming.

One more strong opinion: if you're "testing copy" while your bounce rate's 6%, you're not testing anything. You're just burning domains.

Before touch #2-#8: verify reachability (the hidden follow-up lever)

Follow-up performance is capped by three rates:

- Bounce rate (kills deliverability)

- Complaint rate (kills inboxing)

- Connect rate (determines whether calls are worth it)

If those are bad, more touches just means more damage.

We've tested this in real outbound ops: the fastest "reply rate win" is usually boring. It's cleaning the list, removing risky results, and making sure the phone steps aren't dialling dead ends.

Here's a workflow that works at SMB and mid-market scale:

- Verify emails in real time before you add prospects to a sequence.

- Remove spam traps/honeypots and risky catch-all results.

- Enrich missing mobiles so call steps aren't wasted, especially when you're following up on mobile to catch buyers between meetings.

- Export only "sendable" contacts into your sequencer/CRM.

A quick scenario we've seen too many times: a rep runs Touch #1 to 800 "target accounts," gets 0.6% replies, and starts rewriting everything. Then you look at the send report and it's 4.8% bounces plus a pile of catch-all domains. No cadence fixes that.

If you want the cleanest path to this workflow, use:

- Mobile Finder for verified mobile numbers: https://prospeo.io/lead-mobile-finder

- The Chrome extension for prospecting from any website or inside your CRM: https://prospeo.io/contact-finder-extension

- Data enrichment to refresh stale records at scale: https://prospeo.io/b2b-data-enrichment

Proof this isn't theoretical: Meritt cut bounce rate from 35% to under 4% and tripled pipeline from $100K to $300K/week after fixing data quality and reachability.

Improve your follow-up system with a 2-week testing loop

If your follow-up system feels random, it's because you're not running it like an experiment.

Run one change for 2 weeks, then decide. Not two days. Not three sequences at once.

2-week follow-up scorecard

Track:

- Reply rate (positive + negative)

- Meeting rate

- Waste rate (bad fits + wrong people)

- Time spent per meeting booked

- Cost per meeting (data + tools + labor)

- Bounce rate

- Complaint rate

- Unsubscribe rate

- Connect rate (calls)

Experiment plan (pick one variable):

- New angle email on Touch #2

- Add a call step on Day 2

- Swap proof point (case study vs ROI)

- Tighten ICP filters (smaller list, higher intent)

- Add one post-demo asset (MAP draft, clip, ROI calc, security packet)

I've run bake-offs where the "best" copy lost because the list was trash. The scorecard makes that obvious fast.

Multichannel follow-up only works when you have real phone numbers and deliverable emails. Prospeo refreshes every 7 days - not 6 weeks - so your cadence hits live inboxes and active numbers. At $0.01 per email, bad data isn't a budget problem. It's a choice.

Stop following up into the void. Start with clean data.

FAQ

How many times should you follow up with a prospect?

Most B2B sequences perform best at 5-8 total touches because the first follow-up alone lifts replies by 65.8%, and most deals require multiple nudges to surface timing or ownership. Stop earlier if you get a clear "no," unsubscribes spike, or deliverability metrics hit your tripwires.

How long should you wait between follow-ups?

Use 2-3 days between early touches, then 4-7 days later in the sequence to stay persistent without becoming noise. A clean default schedule is Day 1 / 3 / 6 / 12 / 24, then pause. For inbound leads, follow up in minutes, not days.

What do you say when a prospect doesn't respond after a demo?

Send a recap within 24 hours with three bullets (pains/goals/constraints) and propose two specific times for the next step. Then run the 10-day post-demo micro-cadence: MAP draft, a short clip answering their question, a forwardable stakeholder note, and a procurement/security unblock check.

Are breakup emails a good idea?

Breakup emails work only when they're respectful and low-pressure, and you should send one at the end of a sequence (around Day 21-27) to clean up pipeline. Aggressive "closing your file" language kills intent. Use a soft pause, offer a useful next step, and ask for timing.

What's a good free tool to reduce bounces before follow-ups?

A good free starting point is Prospeo's free tier (75 email credits + 100 extension credits/month) to verify emails before you send Touch #2, plus a basic SPF/DKIM/DMARC check on your domain. If bounces are above 2-3%, pause sending and clean the list before you scale volume.

Summary: the prospect follow up system that actually works

A solid prospect follow up setup in 2026 is boring on purpose: stage-based cadences, 5-8 touches with real new angles, a MAP to prevent post-demo drift, and strict deliverability hygiene so your messages get seen.

If replies are low, fix reachability first. Then iterate with a 2-week testing loop instead of thrashing.