50+ Social Selling Statistics Every Sales Team Needs in 2026

84% of sales reps missed their quota last year, according to Salesforce's latest data. Not half. Not "a significant portion." Eighty-four percent. Meanwhile, the average cold call converts to an appointment 0.3% of the time - a number so low it's basically a rounding error.

The social selling statistics below tell a different story. Social is the only outreach channel where the math actually works.

Three Stats That Frame Everything

- Social media outreach gets a 42% response rate vs. 23% for cold calls and 26% for email - nearly double the next-best channel.

- Reps who use social selling are 51% more likely to hit quota. Teams that do it consistently are 40% more likely to hit revenue goals.

- AI-augmented sellers are 3.7x more likely to meet quota - a stat almost no other roundup covers.

Below: 50+ social selling stats across 8 categories, every one sourced with year and methodology where available. We also flag a widely-cited Gartner stat that every competitor article gets wrong.

Why Most Social Selling Stats Lists Get the Numbers Wrong

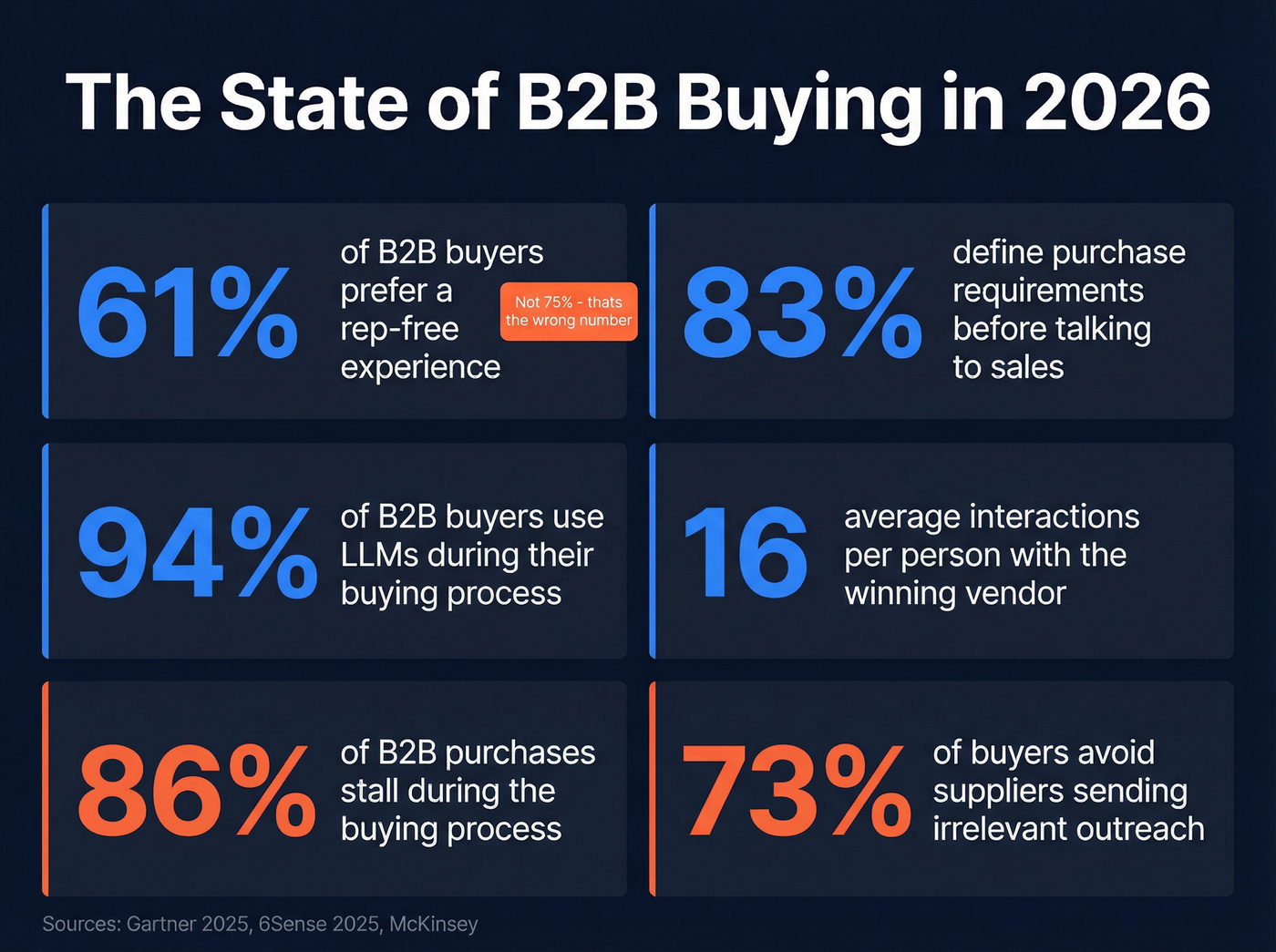

Most articles recycle the same numbers from 2019 without checking if they're still accurate. The worst offender: a "Gartner" stat claiming 75% of B2B buyers prefer a rep-free experience. That number is wrong. The actual figure is 61%.

Here's the thing: social selling works, but the why has shifted. In 2020, it worked because buyers were on social media. In 2026, it works because buyers are drowning in AI-generated noise and craving human signal. The cold call success rate of 0.3% isn't just a fun stat - it's a death sentence for teams still running pure outbound playbooks.

Hot take: If your average deal size sits below $10K, you probably don't need a $30K/year sales intelligence platform. But you absolutely need a social selling program. The ROI math is unbeatable at every contract value.

The State of B2B Buying in 2026

1. 61% of B2B buyers prefer an overall rep-free buying experience.

This comes from Gartner's June 2025 survey of 632 B2B buyers. Not 75% - 61%. Every competitor article on the first page of Google cites the 75% number, which comes from an older survey with different framing. The real number is still a majority, but it tells a different story. Buyers don't hate reps. They hate bad reps who show up unprepared.

Why this matters: The 14-point gap between the real number (61%) and the widely-cited one (75%) changes the narrative entirely. At 75%, you'd conclude buyers want to be left alone. At 61%, the conclusion is that buyers want better sellers - which is exactly what social selling produces.

2. 83% of buyers mostly or fully define purchase requirements before speaking with sales.

6Sense's 2025 buyer behavior research. By the time a rep gets involved, the buyer has already decided what they need. Social selling lets you influence that decision before the formal buying process starts.

3. 94% of B2B buyers use LLMs during their buying process.

Your buyers are asking ChatGPT about your product before they ask you. If your reps aren't creating content that shows up in those conversations, they're invisible.

4. Average sales cycles compressed from 11.3 months to 10.1 months.

Economic pressure is forcing faster decisions. 49% of buyers say economic conditions shortened their buying cycles, and 62% say those pressures pushed them to engage sellers earlier. The point of first contact moved from 69% to 61% of the journey - outreach pulled forward roughly 6-7 weeks. That's a window social sellers are uniquely positioned to fill.

5. 75% of B2B buyers take longer to make purchase decisions now than in 2023.

This seems to contradict stat 4, but it doesn't. Cycles compressed for urgent purchases while considered purchases got slower and more complex. Buyers now use an average of 10 different interaction channels - up from 5 in 2016. Social is one of the few channels that works across both fast and slow buying motions.

6. 86% of B2B purchases stall during the buying process.

And 81% of buyers end up dissatisfied with the provider they ultimately choose. More than 40% of deals stall due to internal misalignment within buying groups. Social selling doesn't just help you find buyers - it helps you arm your champion to sell internally.

7. Buyers average 16 interactions per person with the winning vendor.

Sixteen touches. That's not a cold email sequence - that's a relationship. Social platforms are where those interactions happen organically.

8. 73% of B2B buyers actively avoid suppliers who send irrelevant outreach.

Nearly three-quarters of your prospects are filtering you out before you get a chance. Generic "just checking in" messages on any channel are dead.

9. 69% of buyers report inconsistencies between a vendor's website and what sellers tell them.

Buyers are cross-referencing everything. If your reps' social content contradicts your marketing, you've got a credibility problem that no amount of follow-up can fix.

Social Selling Performance Statistics

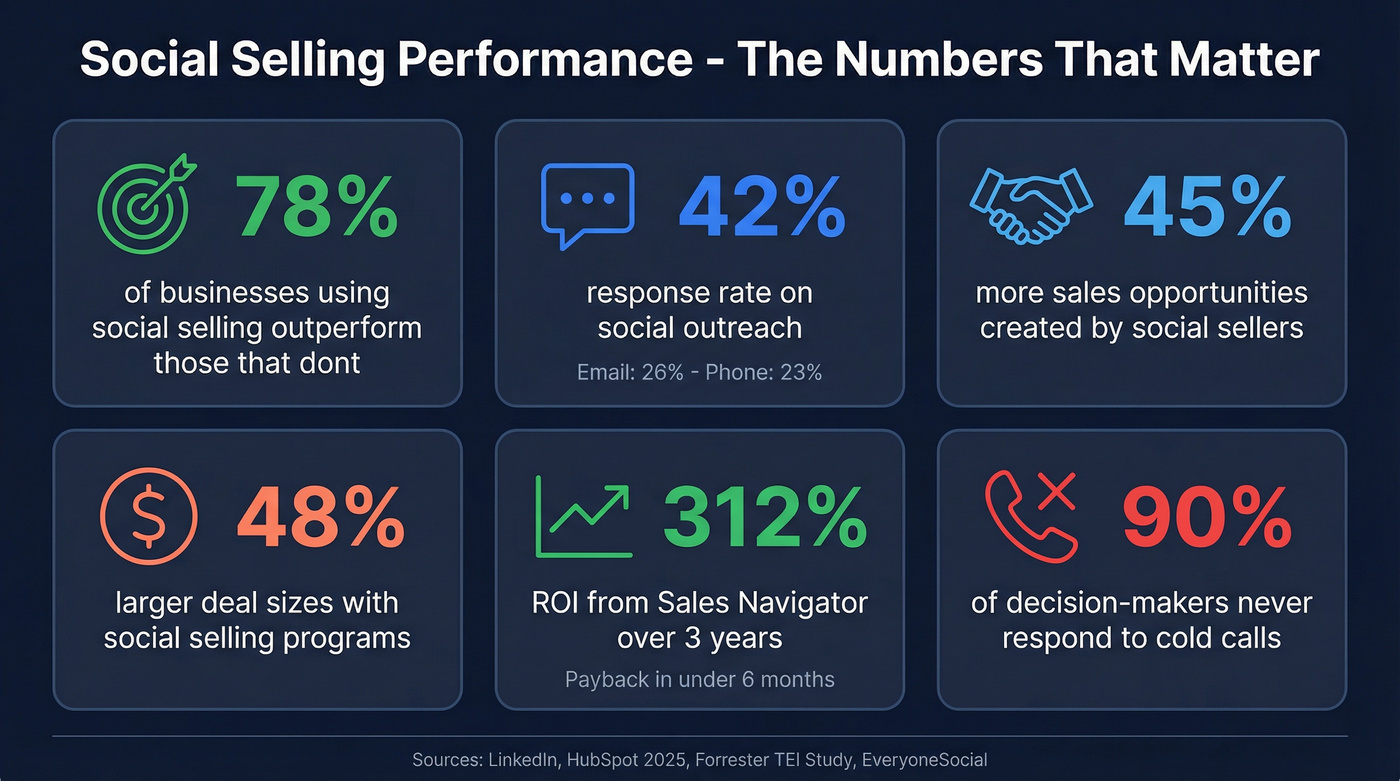

10. 78% of businesses using social selling outperform those that don't.

LinkedIn's own data, consistent for years. The gap isn't closing - it's widening as social-first buyers become the norm.

11. Social media outreach gets a 42% response rate vs. 26% for email and 23% for phone.

HubSpot's 2025 Sales Trends Report, surveying 1,000 global sales professionals. This is the single most important stat in this article. Social isn't just "another channel" - it's the highest-performing outreach channel by a wide margin.

12. Reps using social selling are 51% more likely to hit quota.

And companies with consistent social selling processes are 40% more likely to hit revenue goals.

13. Social sellers create 45% more sales opportunities than peers with larger deals.

EveryoneSocial found that a strong social selling program delivers 16% better win rates, 2x pipeline, and 48% larger deal sizes. The deal size number is the one that gets CFOs' attention.

14. 64% of reps using social media hit team quota vs. 49% who don't.

That's a 15-point gap. For a 50-person sales team, that's the difference between 32 reps hitting quota and 25.

15. 98% of sales agents with over 5,000 LinkedIn connections meet or surpass their quota.

This is one of the most striking stats I've come across. Network size isn't vanity - it's pipeline infrastructure. Every connection is a potential warm introduction.

16. Sales Navigator delivers 312% ROI over three years with payback in under 6 months.

Forrester's Total Economic Impact study found Sales Navigator users also saw +42% larger deal sizes and +59% revenue influence.

Case Study: Commvault's Social Selling Transformation

Commvault, the enterprise data management company, partnered with Tribal Impact to roll out a structured social selling program across their sales organization. The results: 61% more pipeline and 52% more sales opportunities directly attributed to social selling activities. What made it work wasn't the tools - it was the training. Reps learned to engage with prospect content consistently before ever sending a pitch. I've seen this pattern repeat across every successful social selling rollout: the companies that invest in behavior change, not just tool access, are the ones that see real pipeline impact.

17. 90% of decision-makers "never" respond to cold calls.

Compare that to the 42% response rate on social. The channel shift isn't a preference - it's a mandate.

18. Across multiple studies, social selling teams generate an estimated 20-30% more revenue - a composite drawn from LinkedIn's 78% outperformance data, SalesforLife's 40% revenue goal advantage, and McKinsey's hybrid selling research showing 50% higher revenue.

19. 89% of top-performing salespeople say social networking platforms are important in closing deals.

Not "helpful." Not "nice to have." Important in closing deals. The top performers aren't debating whether social works - they're debating which platform to prioritize.

Social selling creates 45% more opportunities - but only if you can reach those warm prospects with verified contact data. Prospeo gives you 98% accurate emails and 125M+ direct dials so your social engagement converts to booked meetings, not dead ends.

Turn social engagement into pipeline with data that actually connects.

Social Selling by Platform

Not all platforms are equal for B2B. Here's where the data actually points:

| Platform | B2B Conversion | ROI / Performance | Best For |

|---|---|---|---|

| 2.74% | 192-229% (3-year) | B2B leads, ABM | |

| 0.77% | Moderate | SMB/local targeting | |

| X/Twitter | 0.69% | Low | Tech/startup conversations |

| YouTube | 5.91% engagement | High (organic) | Thought leadership via video |

| TikTok | 5.75% engagement | N/A for B2B | Skip for enterprise B2B |

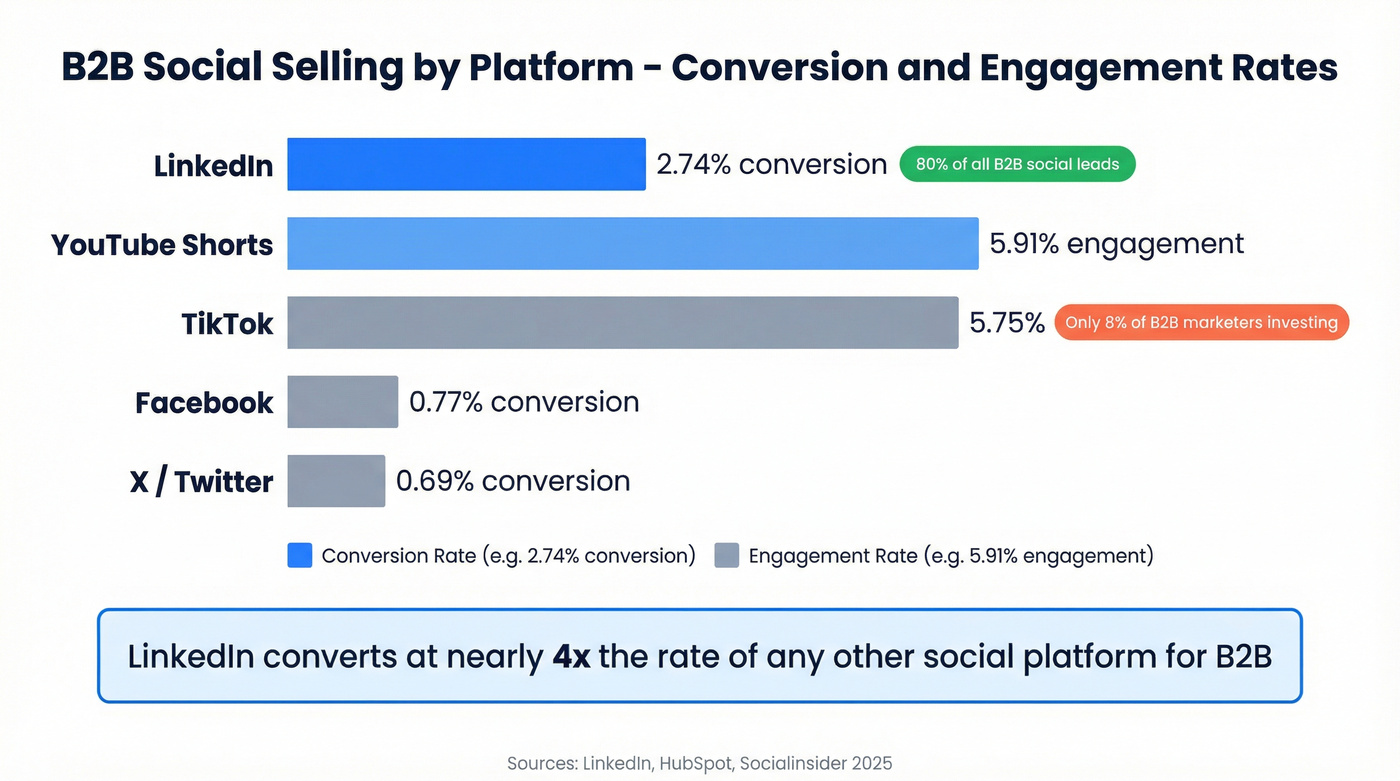

20. LinkedIn generates 80% of all B2B social media leads.

Four out of five B2B leads from social come through LinkedIn. Nothing else is close.

21. LinkedIn's visitor-to-lead conversion rate is 2.74%.

Compare that to Twitter's 0.69% and Facebook's 0.77%. LinkedIn converts at nearly 4x the rate of any other social platform for B2B.

22. LinkedIn organic delivers 192% ROI; LinkedIn paid delivers 229% ROI.

Both organic and paid outperform most other B2B marketing channels, including Google Ads.

23. YouTube Shorts has the highest short-form engagement rate at 5.91%.

If your reps aren't creating short-form video content, they're missing the format with the highest engagement.

24. Only 8% of B2B marketers plan to invest in TikTok.

Despite 5.75% engagement rates, B2B marketers aren't buying in. The audience skews too young and too consumer for most B2B use cases. I've seen early-stage SaaS founders build real pipeline there, but it's not scalable for enterprise sales teams. Skip it unless your ICP is under 35.

25. Only 1% of LinkedIn's 1 billion+ users share content weekly - but they generate 9 billion impressions.

The opportunity is enormous precisely because so few people are creating. If your reps post consistently, they're competing against 1% of the platform, not 100%.

26. 70% of marketers report LinkedIn generated positive ROI.

No other social platform comes close to this satisfaction rate for B2B.

Thought Leadership and Employee Advocacy Statistics

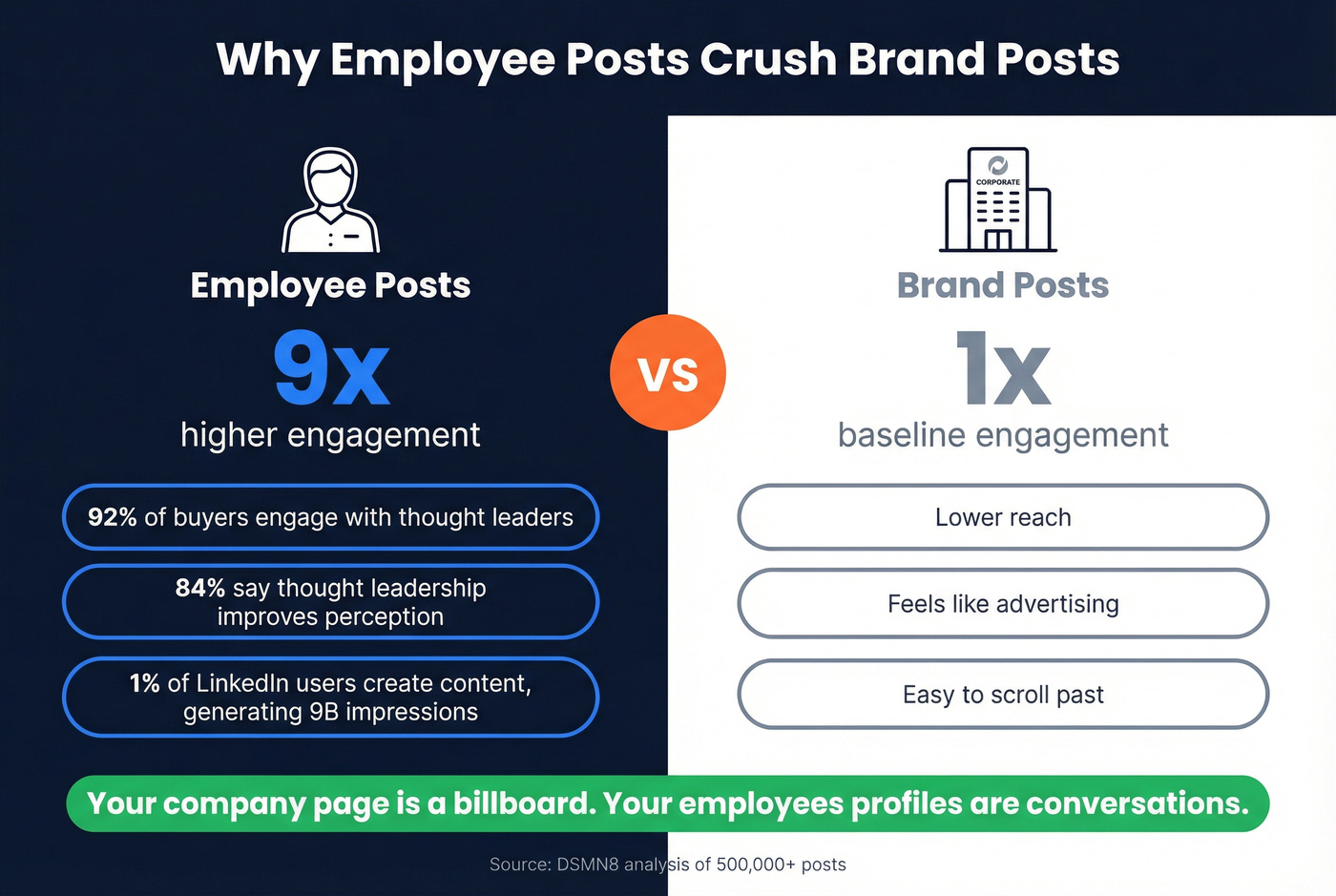

27. 92% of B2B buyers engage with salespeople recognized as industry thought leaders.

Buyers don't just tolerate thought leadership - they actively seek it out. If your reps are posting generic company updates, they're invisible.

28. 84% of B2B buyers say thought leadership improves their perception of a company.

Perception drives shortlists. Shortlists drive deals.

29. Employee posts get 9x higher engagement than brand posts.

DSMN8 analyzed 500,000+ posts and found this consistently. Your company page is a billboard. Your employees' profiles are conversations.

30. Brand messages reach 561% further when shared by employees vs. official brand channels.

5.6x the reach. Employee advocacy isn't a nice program to run - it's the highest-leverage distribution channel most companies ignore.

31. 55% of decision-makers use thought leadership as part of their vetting process.

More than half of the people deciding whether to buy from you are reading your team's content as part of due diligence.

32. Edelman's 2025 report identifies "hidden buyers" - internal influencers whose involvement isn't visible but whose influence can fast-track or halt deals.

These aren't the people on your call. They're the internal champions (or blockers) consuming your team's thought leadership behind the scenes. They value bold, perspective-shifting ideas - not safe corporate content. Strong thought leadership helps lesser-known brands compete against incumbents with 10x the marketing budget.

33. Audiences trust employees more than influencers or CEOs.

The era of the polished executive thought leader is fading. Buyers want to hear from the people actually doing the work.

AI and Social Selling - The 2026 Inflection Point

This is the section no other social selling stats article covers well. AI isn't just changing how sellers work - it's changing how buyers buy.

The adoption curve:

- 2023: 24% of sales reps using AI

- 2024: 43% using AI

- 2025: 56% using AI daily

That's a 133% increase in two years. The gap between AI users and non-users is becoming a chasm.

34. Sellers who effectively partner with AI tools are 3.7x more likely to meet quota.

Not 37% more likely - 3.7 times more likely. This is the single biggest performance multiplier in modern sales.

35. Early AI deployments in sales have boosted win rates by more than 30%.

Bain & Company identified 25 AI use cases across the sales lifecycle, from prospecting to proposal generation.

36. Sellers spend only 25% of their working hours on direct selling.

Three-quarters of a rep's day goes to admin, research, CRM updates, and internal meetings. AI could double the time spent actually selling.

37. 94% of buyers use LLMs during their buying process; 89% ultimately purchase solutions with AI features.

Your buyers are using AI to evaluate you. If your reps aren't using AI to engage them, there's an asymmetry that doesn't favor you.

38. Generative AI is used in 15.1% of marketing activities, up 116% since 2024.

Marketing teams are adopting faster than sales teams. The social selling teams that integrate AI for content creation, prospect research, and personalization will pull ahead fast.

39. AI users are 2x as likely to exceed their sales targets.

Not just meet targets - exceed them. The data is unambiguous.

40. 53% of sales professionals say selling is harder now than a year ago.

This is the context behind the AI stats. Selling is getting harder - more channels, more noise, longer buying committees. AI isn't optional anymore. It's the only way to keep pace.

Is LinkedIn's Social Selling Index Still Relevant?

Real talk: the SSI is becoming a vanity metric.

LinkedIn introduced the Social Selling Index in 2014 and made it broadly available in 2015. Its four pillars - Professional Brand, Finding Right People, Engaging with Insights, and Building Relationships - each scored out of 25 points. The original studies showed "Social Selling Leaders" generated 45% more opportunities and were 51% more likely to hit quota. Those stats are still cited everywhere.

But LinkedIn's algorithm has fundamentally changed. Richard van der Blom's "Algorithm InSights 2025" report found organic reach dropped by nearly 50%. Volume-first behavior - the kind that inflates SSI scores - is now actively downranked. LinkedIn shifted to a "combined reputation system" where your profile claims, content topics, and engagement patterns all need to align.

Here's the problem: you can have a high SSI by posting daily motivational content and engaging with everything in your feed. But if you claim to be a "SaaS sales expert" while engaging with inspirational quotes, LinkedIn's system sees the mismatch. Your distribution gets throttled even as your SSI stays high.

In our experience, teams that obsess over SSI scores tend to optimize for the wrong things - post frequency and connection volume instead of conversation quality and pipeline influence.

41. Organic reach on LinkedIn dropped ~50% in 2025, but deep engagement increased for those providing substance.

The SSI isn't useless - it's just not the scoreboard anymore. Track profile visits from decision-makers, qualified conversations started, and pipeline influenced instead.

Social Selling Mistakes - What the Data Says

Mistake #1: Connect-and-pitch. 73% of B2B buyers actively avoid suppliers who send irrelevant outreach. The "Hey [First Name], I noticed we're both in [Industry]..." template is dead. Buyers can smell automation from a mile away.

Fix: Engage with a prospect's content 2-3 times before sending any message. Reference something specific they've posted.

Mistake #2: Wrong platform, wrong tone. 81% of people find unsolicited Facebook messages from sales agents "creepy." 78% are turned off by friend requests from salespeople. Facebook is personal space.

Fix: Match your platform to your buyer's professional context. For B2B, that's LinkedIn first, everything else second.

Mistake #3: No training, no strategy. 93% of sales executives have received zero formal training on social selling. Two-thirds of companies have no social media strategy for their sales organization. We've seen teams burn months of social selling goodwill with a single poorly-timed pitch that a basic playbook would have prevented.

Fix: Build a 30-day onboarding module. Profile optimization, content cadence, engagement playbook.

Mistake #4: Chasing vanity metrics. With organic reach down 50%, posting more doesn't mean reaching more. Volume-first behavior gets punished by the algorithm.

Fix: Measure profile visits from ICP accounts, DM conversations with decision-makers, and meetings booked. That's it.

Mistake #5: Following up with bad contact data. You spent weeks building rapport on social. A prospect engages with your content, responds to a DM, shows genuine interest. Then you follow up with an email that bounces or a phone number that's disconnected. All that trust-building - wasted. When social engagement converts to real interest, you need contact data that actually works, which is why tools like Prospeo exist with 98% email accuracy and a 7-day data refresh cycle.

Social Selling ROI - How It Compares to Other Channels

Social selling doesn't exist in a vacuum. Here's how it stacks up using 2025 benchmarks from Data-Mania and FirstPageSage:

| Channel | 3-Year ROI | Break-Even |

|---|---|---|

| SEO | 748% | ~9 months |

| Email Marketing | 261% | ~7 months |

| LinkedIn Paid | 229% | ~6 months |

| Webinars | 213% | ~6 months |

| Google Ads | 200% | ~4 months |

| LinkedIn Organic | 192% | ~6 months |

| PPC (non-Google) | 36% | ~4 months |

42. LinkedIn paid social delivers 229% ROI - higher than Google Ads.

That surprises most people. Google Ads gets all the budget love, but LinkedIn paid outperforms it on a 3-year basis for B2B.

43. SEO delivers 748% ROI but takes 9 months to break even.

Social selling is the bridge. It generates pipeline while your SEO program matures.

44. The global social commerce market hit $2 trillion in 2025 and is projected to reach $8.5 trillion by 2030.

That's a 26.2% CAGR. Social isn't just a lead gen channel - it's becoming a transaction channel.

Social Selling Trends for 2026

45. AI-generated content surpassed human-written content online for the first time in 2025.

This makes human social selling content more valuable, not less. Authenticity is the new scarcity.

46. Brands are intentionally moving away from polished content.

Imperfections signal authenticity. The perfectly designed carousel is losing to the rough-around-the-edges selfie video. Winning brands are leaning into this deliberately.

47. Google has started indexing public Instagram content.

Social SEO is becoming real. Your reps' social posts aren't just reaching followers - they're showing up in search results. This changes the ROI calculation for social content entirely.

48. LinkedIn's audience is getting younger, and video features are expanding.

Short-form video on LinkedIn is still early - which means early movers have disproportionate reach. If you're planning your 2026 social selling strategy, video should be a core pillar, not an experiment.

49. Social platforms are becoming sources of consent-based first-party data.

As third-party cookies die, social platforms hold the richest behavioral data. The companies that build social selling programs now are also building first-party data moats.

50. 5.66 billion people are active on social media worldwide in 2026, with ad spending projected to reach $317 billion.

The total addressable audience for social selling has never been larger. Users now maintain multiple identities across apps, which means your buyers are reachable across more surfaces than ever - but each surface requires a different approach.

51. 114.3 million social media buyers in the U.S. alone.

That's 33% of the population purchasing through social channels. The B2B side of this is still early, but the infrastructure is being built fast.

How to Act on These Social Selling Statistics

50+ stats mean nothing if they don't change behavior. Here's a four-step framework:

Audit: Only about 35% of B2B sales teams have a formal social selling program. Start by answering: do your reps have optimized profiles? Are they posting? Are they engaging with prospects' content? If the answer to any of these is "I don't know," you're in the majority - and that's the problem.

Train: 93% of sales executives have zero formal social selling training. Even 15 minutes a day of intentional engagement works. Build a simple playbook: 5 minutes reading ICP content, 5 minutes commenting, 5 minutes creating.

Measure: Stop tracking likes. Measure profile visits from decision-makers, qualified conversations started, and pipeline influenced. Those are the metrics that correlate with revenue.

Buyers average 16 interactions before choosing a vendor. Social is where those touches happen - but you still need verified emails and mobiles to close the loop. Prospeo delivers 300M+ profiles refreshed every 7 days at $0.01/lead.

Stop warming up prospects you can't actually reach.

FAQ

What is the success rate of social selling?

Social sellers outperform peers by a wide margin: 78% of businesses using social selling outperform those that don't, reps are 51% more likely to hit quota, and social outreach gets a 42% response rate compared to 23% for phone and 26% for email. Teams with consistent programs are 40% more likely to hit revenue goals.

Which social media platform is best for B2B social selling?

LinkedIn generates 80% of all B2B social media leads with a 2.74% visitor-to-lead conversion rate - nearly 4x higher than Twitter or Facebook. It delivers 192-229% ROI over three years. No other platform comes close for B2B pipeline generation.

How do you turn social selling engagement into actual pipeline?

Engage with a prospect's content 2-3 times, then send a personalized message referencing their posts. Once they respond, move the conversation to email or phone using verified contact data. Prospeo's free tier (75 emails/month) lets you test this workflow alongside tools like Sales Navigator without a major budget commitment.

Where do these social selling statistics come from?

Every stat is sourced from named research: HubSpot's 2025 Sales Trends Report, Gartner's 2025 buyer surveys, 6Sense's buyer behavior research, Edelman's Thought Leadership Impact studies, LinkedIn's SSI research, and Forrester's Total Economic Impact analyses. Where a stat is a composite, we say so explicitly.