How to Build a Pipeline Review Cadence That Drives Revenue (Not Just Meetings)

Sales leader Richard Harris once had a rep quit - not because she couldn't sell, but because his pipeline review meetings were so painful she'd rather leave than sit through another one. She had her own path to closing deals. He never bothered to understand it. That story should haunt every manager who runs pipeline reviews on autopilot.

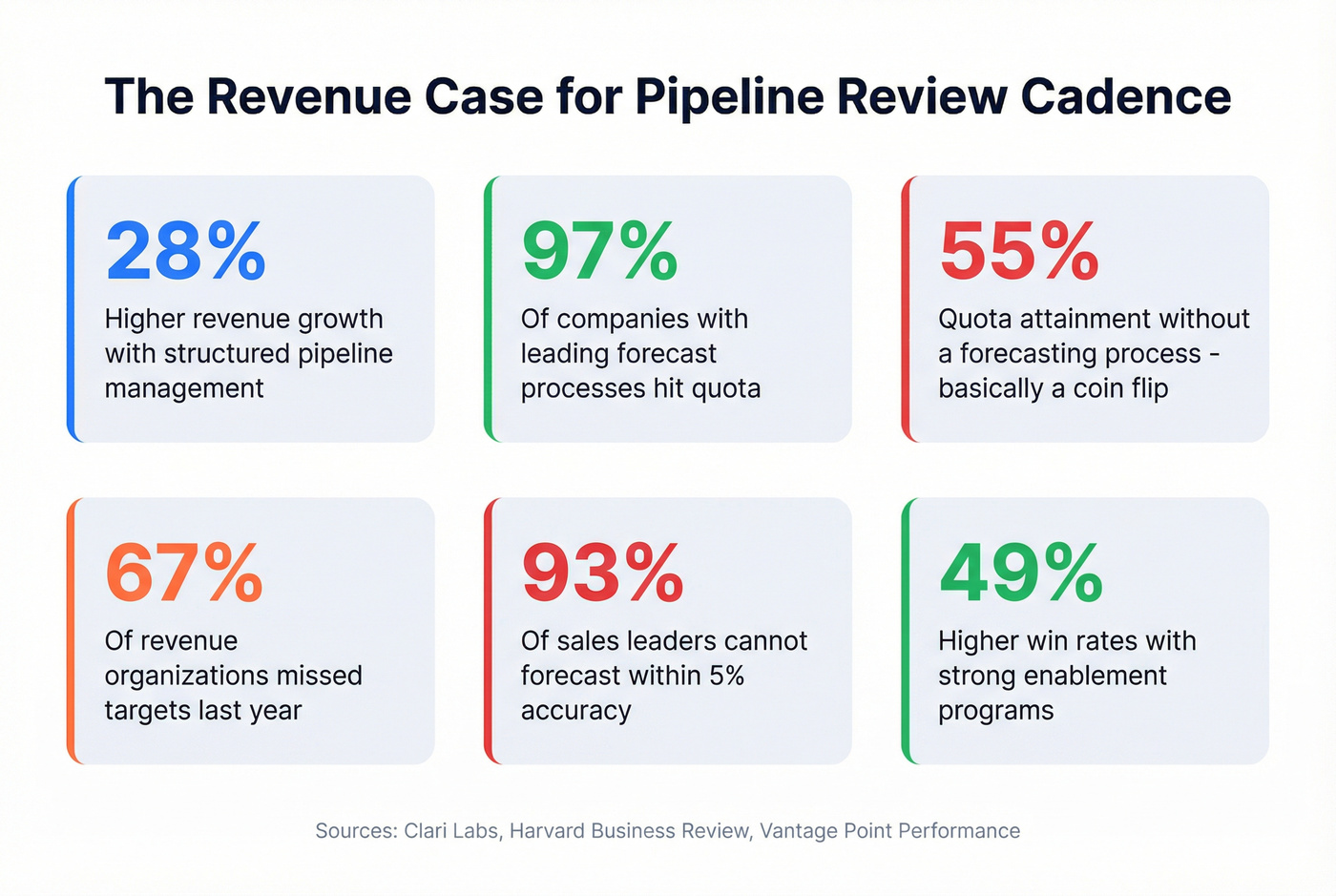

Here's the uncomfortable math: 93% of sales leaders can't forecast revenue within 5%, even with two weeks left in the quarter. 73% of forecast misses trace back to poor pipeline reviews. A semiconductor sales manager on Reddit managing 150 reps admitted his pipeline was "realistically inflated by about 60%" - wrong dollar values, outdated contact info, fantasy close dates. Every initiative to fix it was "only a temporary fix." He'd been fighting the same battle for years.

Your pipeline review cadence isn't a calendar problem. It's a revenue problem.

And reviewing more often won't help if you're reviewing wrong.

What You Need (Quick Version)

If you're short on time, here's the framework in 60 seconds:

- Four-layer cadence: Weekly 1:1 → biweekly team → monthly forecast → quarterly planning. Jump to the framework.

- The single highest-leverage fix: Buyer-driven, calendarized next steps on every deal. Deals with specific scheduled next steps are 53% more likely to close. Nothing else comes close.

- The contrarian take: Three pipeline reviews per week is a nightmare, not a strategy. One Reddit poster described exactly this setup and asked "is this normal?" It's not. Jump to the mistakes section.

- Data quality: 91% of CRM data is incomplete. Your cadence is irrelevant if you're coaching reps on ghost deals. Jump to the data section.

- Copy-paste agenda template for your next 1:1 - minute-by-minute, with pre-work checklists for both manager and rep. Jump to the template.

- Hot take: If your average deal size is under $10K, you probably don't need MEDDPICC-level pipeline reviews. BANT and a tight weekly forecast cadence will outperform an over-engineered process every time.

Why Your Review Cadence Matters More Than You Think

There's a revenue gap between teams that run structured pipeline reviews and teams that wing it. The gap is enormous.

Companies with effective pipeline management see 28% higher revenue growth year over year. That's not a marginal improvement - it's the difference between hitting plan and missing by a mile.

And it gets worse for the "we'll figure it out" crowd: 97% of companies with industry-leading forecasting processes hit quota. For companies without? Just 55%. That's nearly a coin flip versus near-certainty.

Most teams are on the wrong side. 67% of revenue organizations missed their targets last year, per Clari Labs research. Two-thirds. That's not a rounding error - it's a systemic failure in how teams inspect and manage their pipeline. Companies with strong enablement programs see 49% higher win rates on forecasted deals, which means the process itself creates the advantage. Not the talent, not the product, not the market - the process. Companies with a well-defined sales process generate 18% more revenue than competitors. Full stop.

Look: if your pipeline reviews are 30-minute status updates where reps narrate their deal notes while the manager nods, you're in the 67% that misses. The cadence isn't what makes reviews work. It's what happens inside them. But without the right cadence, even great review practices fall apart because they happen too late or too infrequently to catch deals before they die.

The Pipeline Review Cadence Framework

The mistake most teams make is treating "pipeline review" as a single meeting type. It's not. It's four distinct meetings with different purposes, attendees, and frequencies. Collapsing them into one weekly call is why your reviews feel like a waste of time.

Here's the four-layer model:

| Layer | Frequency | Duration | Attendees | Focus |

|---|---|---|---|---|

| 1:1 Review | Weekly | 30-45 min | Manager + rep | Deal coaching |

| Team Review | Biweekly | 60-90 min | Full team | Patterns & resources |

| Forecast Review | Monthly | 90-120 min | Leadership + mgrs | Commit & coverage |

| Pipeline Planning | Quarterly | Half-day | Sales leadership + RevOps | Strategy & capacity |

Each layer feeds the next. Weekly insights surface patterns in biweekly team reviews. Team patterns inform monthly forecasts. Monthly forecasts shape quarterly planning.

Weekly 1:1 Reviews (30-45 Minutes)

Use this if: You have reps managing 15+ active deals, your sales cycle runs 30+ days, or you're seeing deals stall without clear reasons.

Skip this if: Your cycle is under 14 days and reps close 50+ deals per month - at that velocity, a weekly review becomes a bottleneck. Shift to exception-based reviews (only flagging deals that break pattern).

The weekly 1:1 is the backbone. Focus on 3-5 high-value or at-risk deals, not the entire pipeline. This isn't a status update - it's a coaching session. The manager's job is to pressure-test assumptions, not ask "what's happening with Acme?" and listen to a five-minute monologue.

The deal-by-deal inspection format works: Deal Context (1-2 min) → Qualification Validation (3-5 min) → Progression Evidence (3-5 min) → Risk Assessment (2-3 min) → Action Plan (2-3 min). That's 12-20 minutes per deal. Three deals fills a 30-minute slot perfectly.

Biweekly Team Reviews (60-90 Minutes)

The biweekly team review exists for cross-pollination. Pick 2-3 deals from different reps and review them as a group. The goal isn't to embarrass anyone - it's to identify patterns that no individual rep can see.

Are deals stalling at the same stage? Is one vertical converting faster than others? Does the team need SE support concentrated in a specific week? These are resource allocation questions that only surface when you look across the pipeline, not within it.

Keep the agenda tight: 15 minutes on pipeline health metrics, 30-40 minutes on deal deep-dives, 15 minutes on pattern discussion and action items.

Monthly Forecast Reviews (90-120 Minutes)

This is where managers meet leadership. The conversation shifts from individual deals to portfolio-level questions: What's in commit? What's the coverage ratio? Where are the risks concentrated?

The monthly forecast review is not a bigger version of the weekly 1:1. It's a different meeting entirely. You're evaluating pipeline progression - how much moved from Stage 2 to Stage 3 this month, what slipped, what's new. Coverage ratios (3-6x quota is the benchmark) tell you whether you have enough pipeline to absorb the inevitable losses.

Quarterly Pipeline Planning (Half-Day)

Clari's 13-week quarter model maps specific cadence "moments" across the quarter. The quarterly planning session is where you zoom out: capacity planning, territory adjustments, process improvements, and strategic pipeline health.

This is the meeting where you ask whether your pipeline creation engine is working, not whether individual deals will close. It's also where you recalibrate quotas based on actual pipeline reality - something that semiconductor sales manager with 150 reps and 12-month cycles desperately needed. A thorough Q4 pipeline planning session is especially critical, since it sets the foundation for next year's targets and exposes coverage gaps before the new fiscal year begins.

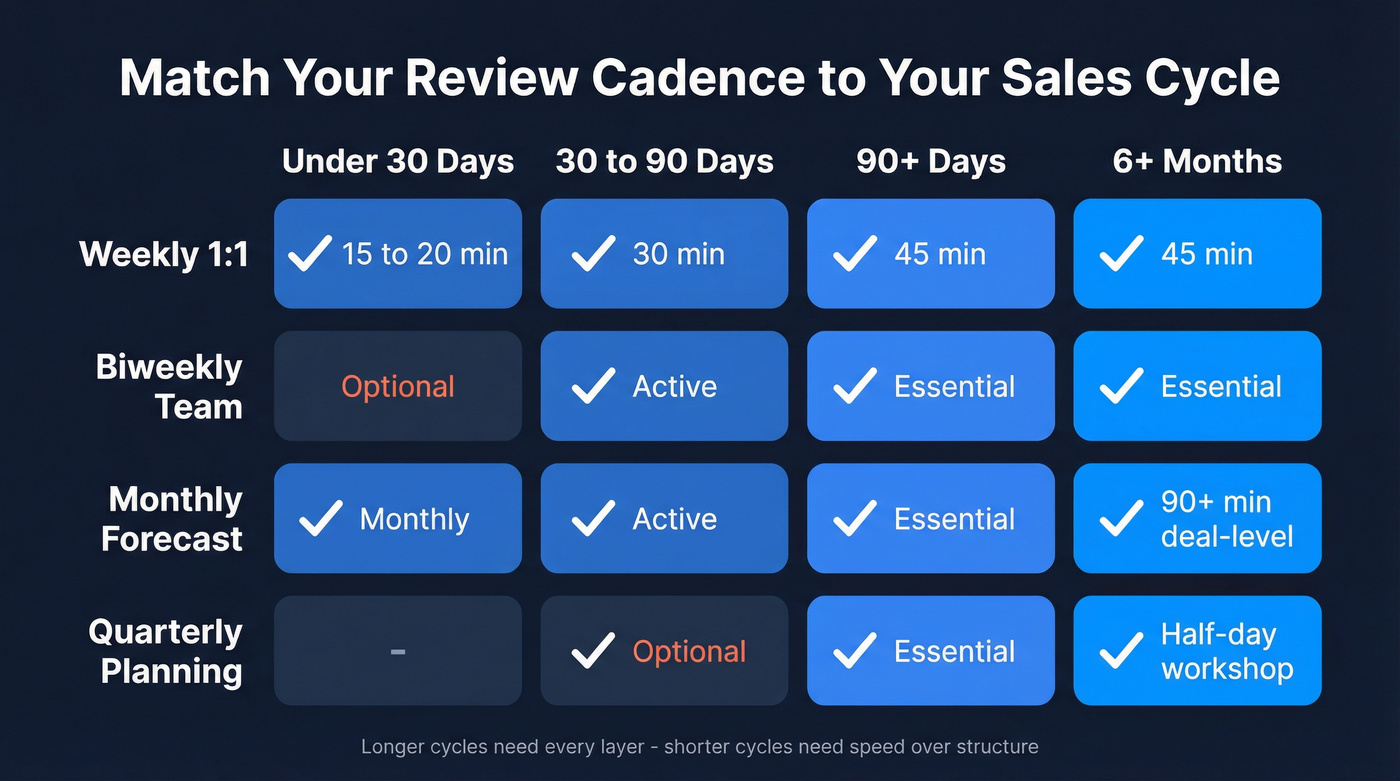

Cadence by Sales Cycle Length

Your review rhythm should flex based on your sales cycle. A team closing deals in 15 days doesn't need the same structure as a team running 9-month enterprise cycles. This is arguably the most important variable, and most guides ignore it entirely.

| Cycle Length | Weekly 1:1 | Biweekly Team | Monthly Forecast | Quarterly Planning |

|---|---|---|---|---|

| < 30 days | ✓ (15-20 min) | Optional | Monthly | Skip |

| 30-90 days | ✓ (30 min) | ✓ | ✓ | Optional |

| 90+ days | ✓ (45 min) | ✓ | ✓ | ✓ |

| 6+ months | ✓ (45 min) | ✓ | ✓ (90+ min, deal-level) | ✓ (half-day) |

For short-cycle teams (under 30 days), weekly 1:1s are sufficient - keep them tight at 15-20 minutes. The pipeline moves too fast for biweekly team reviews to stay relevant.

For long-cycle enterprise teams (6+ months), you need every layer. That semiconductor manager with 12-month cycles and 150 reps needed quarterly planning workshops that shorter-cycle teams can safely skip. When deals take a year to close, quarterly is the minimum cadence for strategic course correction.

91% of CRM data is incomplete. Your pipeline review cadence is irrelevant if reps are coaching on ghost contacts. Prospeo enriches your CRM with 50+ data points per contact at a 92% match rate - refreshed every 7 days, not 6 weeks.

Stop reviewing dead deals. Start with data you can trust.

What to Cover in Every Pipeline Review

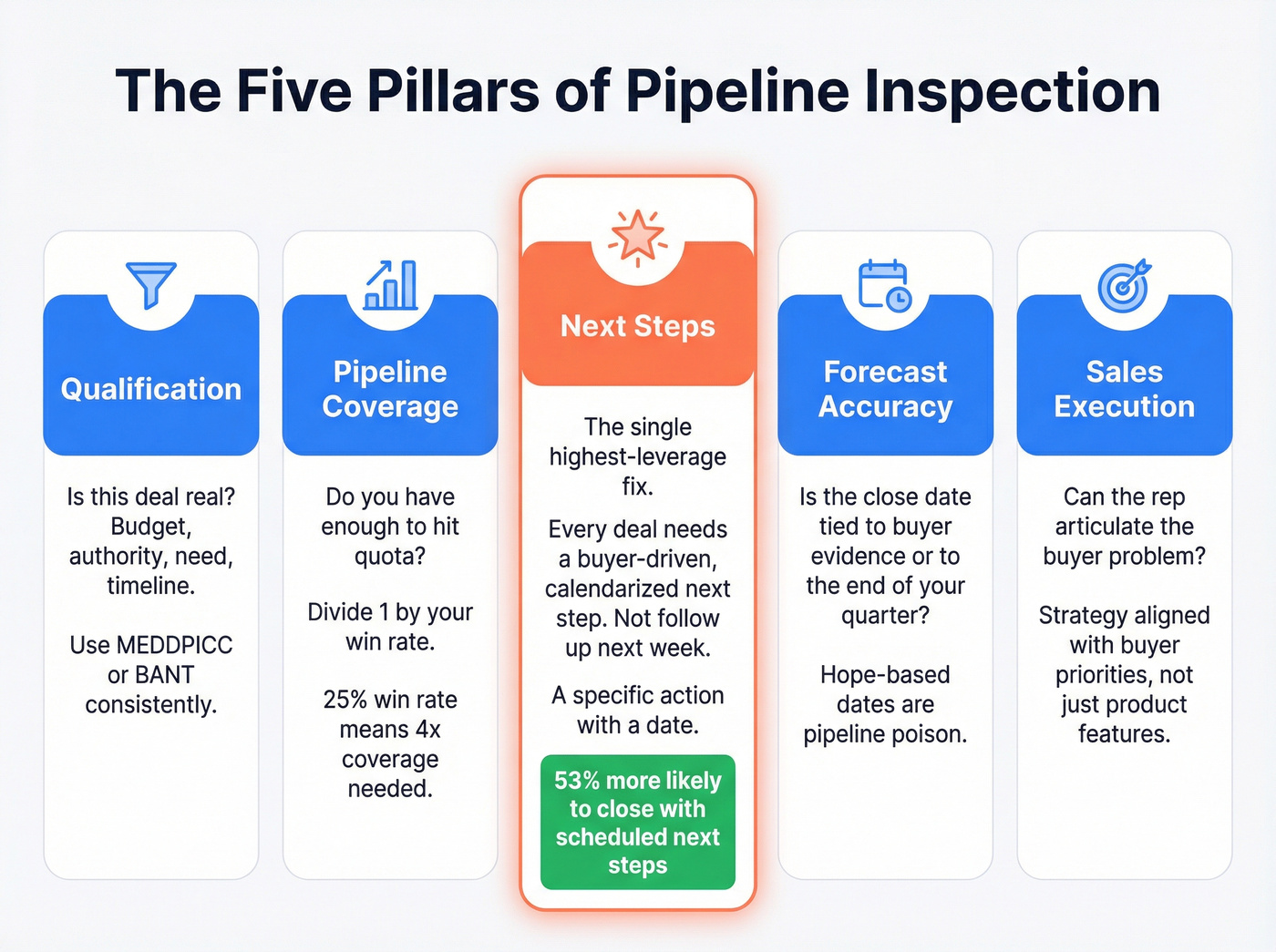

The Five Pillars of Pipeline Inspection

Regardless of cadence, every review should touch these five areas. We've seen teams run reviews that cover three of these and wonder why deals still slip.

1. Qualification. Is this deal real? Does the buyer have budget, authority, need, and timeline? Or is this a "friendly prospect" who takes your calls but will never sign? Use your chosen framework (MEDDPICC, BANT, whatever) consistently. (If you want a tighter rubric, borrow a sales qualification checklist.)

2. Pipeline Coverage. Do you have enough pipeline to hit quota? Calculate yours: divide 1 by your win rate. If your win rate is 25%, you need 4x coverage. If it's 15%, you need closer to 7x. Simple math, but most teams don't do it at the rep level - and that's where it matters most.

3. Next Steps. This is the single most important pillar. Every deal must have a buyer-driven, calendarized next step. Not "follow up next week." Not "send info." A specific action, owned by the buyer, with a date. Deals with no advancement in 30 days and no clear next step need reassessment.

4. Forecast Accuracy. Is the close date tied to buyer evidence (a compelling event, a mutual action plan) or to the end of your quarter? Hope-based close dates are pipeline poison. (If your org still debates definitions, align on what is a sales forecast.)

5. Sales Execution. Can the rep articulate the buyer's problem? Does the deal strategy align with buyer priorities? Are they addressing business challenges or just pushing product features?

Using an In-Quarter Opportunities Saved View

One of the most underrated review tactics is building an in-quarter opportunities saved view in your CRM - a filtered dashboard that shows only deals flagged as at-risk during the current quarter that were subsequently rescued through coaching interventions. This view gives you a direct line of sight into the ROI of your review process. If the number is low, your reviews aren't catching slipping deals early enough. If it's high, you know your inspection process is working and you can double down on the coaching patterns that saved those deals.

Applying MEDDPICC During Reviews

MEDDPICC works best for complex B2B with multiple stakeholders and long cycles. For transactional deals under $10K, BANT is sufficient. Pick one, apply it consistently, and make it the shared language of every review.

Here's each element mapped to a specific review question:

- Metrics: "What quantifiable business outcome has the buyer agreed this solves?"

- Economic Buyer: "Have we confirmed who owns the budget? Have we met them?"

- Decision Criteria: "What are the top 3 factors they're evaluating us on?"

- Decision Process: "Walk me through every approval step between now and signature."

- Paper Process: "What does procurement need? Legal? How long does that take?"

- Identify Pain: "What's the specific pain driving urgency? What happens if they do nothing?"

- Champion: "Who's actively pushing this internally? What have they done to prove it?"

- Competition: "Who else are they evaluating? What's our positioning against them?"

If a rep can't answer these for a deal in Stage 3+, the deal isn't in Stage 3. It's in Stage 1 wearing a costume.

Pipeline Review Agenda Template (Copy This)

Here's a minute-by-minute breakdown for a 30-minute 1:1 review covering three deals. Steal this.

Rep Pre-Work (Before the Meeting):

- Update CRM - every deal should reflect current reality

- Document activity from the past week (calls, emails, meetings)

- Identify 3 deals to review: 1 high-value, 1 at-risk, 1 newly added

- Prepare specific questions for manager coaching

- Review action items from last week's review

Manager Pre-Work (Before the Meeting):

- Review pipeline dashboard for anomalies

- Flag warning signs: no activity 14+ days, stage duration outliers, missing data fields

- Identify coaching opportunities based on patterns (a simple deal health score helps you triage fast)

The 30-Minute Agenda:

| Time | Activity | Focus |

|---|---|---|

| 0:00-2:00 | Quick check-in | Last week's action items - done or not? |

| 2:00-12:00 | Deal #1 deep-dive | Full inspection framework |

| 12:00-22:00 | Deal #2 deep-dive | Full inspection framework |

| 22:00-27:00 | Deal #3 (quick) | Surface check or new deal validation |

| 27:00-29:00 | Lost deals & learnings | What closed-lost? One takeaway. |

| 29:00-30:00 | Weekly feedback | Blockers? Support needed? |

Pull up Pipeline CRM's Kanban view sorted by stage duration. Deals sitting in "Proposal Sent" for three weeks jump out immediately - that's your review agenda building itself.

Every review ends with owned, dated action items. "Follow up with the champion" isn't an action item. "Email Sarah the ROI calculator by Thursday and confirm the procurement timeline" is.

Pipeline Review Mistakes That Kill Deals

I've watched teams make every one of these. Some of them more than once.

1. Running status updates instead of coaching sessions. The diagnostic: the manager asks "what's happening with Acme?" and the rep improvises a narrative. Nobody learns anything. The fix: require pre-work. Inspect evidence - emails, call recordings, buyer responses. If the rep can't show progression evidence, the deal hasn't progressed.

2. Over-reviewing (the 3x/week trap). A poster on Reddit described having Monday pipeline review, Wednesday pipeline review, and Friday performance review. They asked "is this normal?" It's not - it's a recipe for sandbagging and rep burnout. Weekly 1:1, max. If you need more frequent reviews, your process is broken, not your cadence.

3. Relying on gut feeling instead of data. The diagnostic: "I feel good about this deal" with zero evidence. The fix: evidence-based stage criteria. A deal is in Stage 3 because it meets specific, documented exit criteria - not because the rep had a nice lunch with the prospect.

4. Stage inflation. Deals advance without meeting exit criteria. Max 5 entry/exit criteria per stage. If a deal can't meet them, it doesn't move. Period. This is the single fastest way to clean up an inflated pipeline - and the one most managers resist because it makes the number look worse before it gets better. (If this is a recurring issue, start with the root sales pipeline challenges.)

5. Hope-based close dates. Close dates clustered around quarter end with no buyer evidence supporting the timeline. Deals with clear purchase timelines close 68% faster; "vague" timelines result in 3x more slip to next quarter. Tie every close date to a compelling event and a mutual action plan. This is exactly what triggers the end-of-quarter sales scramble - a pile of deals with artificial deadlines and no real buyer urgency behind them.

6. No documented action items. The same deals get discussed week after week with no progress. 80% of deals require 5+ touches, yet 44% of reps quit after one. Every review must end with owned, dated action items. Review them at the start of the next meeting. If they're not done, that's the conversation.

7. Creating a blame culture. This is what killed Richard Harris's relationship with that rep who quit. When reviews feel like interrogations, reps withhold information, pipeline goes underground, and you lose visibility entirely. Coaching prompts beat cross-examinations: "What do we know versus what are we assuming?" lands better than "Why hasn't this deal closed yet?" every single time. The moment a rep starts hiding deals from you, your review structure is worthless - no matter how well-designed it is.

Pipeline Metrics That Matter Between Reviews

Pipeline Velocity Formula

Pipeline velocity tells you how fast revenue moves through your pipeline. Here's the formula:

Pipeline Velocity = (Opportunities x Avg Deal Size x Win Rate) / Sales Cycle Length

Worked example: You have 50 qualified opportunities, average deal size of $30,000, a 25% win rate, and a 60-day sales cycle.

(50 x $30,000 x 0.25) / 60 = $6,250/day in pipeline velocity.

Want to increase velocity? You've got four levers. More opportunities. Bigger deals. Higher win rate. Shorter cycle. Most teams obsess over the first lever (more pipeline!) when improving win rate or shortening cycle length often has a bigger impact with less effort. I'd start with cycle length - it's the lever with the fastest feedback loop.

Key Benchmarks to Track

| Metric | Benchmark | Red Flag |

|---|---|---|

| Pipeline coverage | 3-6x quota | Below 3x |

| Win rate | > 50% is strong | Below 20% |

| Stage duration | Varies by cycle | 2x avg = stalled |

| Deals idle > 14 days | Track weekly | 26% win rate drop |

| Deals idle > 30 days | Immediate action | 80% less likely to close |

That last row is the killer.

Deals with no activity for 30+ days are 80% less likely to close, yet they sit in active forecasts everywhere. Reps spend only 28% of their time selling - the rest goes to admin, CRM updates, and internal meetings. Stale deals compound the problem by consuming review time that should go to live opportunities.

In Pipeline CRM, the Grow plan (~$49/user/month) includes deal intelligence fields like "Days since Latest Activity" and "Latest Activity Category" - exactly the signals you need to flag at-risk deals before your review, not during it. Set up automations to surface deals with no activity in 14+ days so stale deals appear automatically instead of hiding until the quarterly reckoning.

SDR Year-End Pipeline: Special Considerations

The final weeks of the fiscal year create unique pipeline dynamics that your standard cadence can't handle. SDR year-end pipeline deserves its own review rhythm because the deals being sourced in November and December behave differently - buyers are distracted by budget freezes, holiday schedules, and internal planning cycles.

During this period, tighten your weekly 1:1s to focus specifically on deal velocity and buyer engagement signals. SDRs should be qualifying harder, not softer, because every deal that enters the pipeline in Q4 without genuine buyer intent will clog your forecast for months.

The best teams use Q4 to build pipeline for Q1, not to chase deals that were never going to close this year. Shift your SDR review conversations accordingly - measure meetings booked for January, not just December close dates. Pair this with a dedicated Q4 planning session where leadership evaluates which late-stage deals have real momentum and which are wishful thinking dressed up as commit.

Fix Your Data Before You Fix Your Cadence

Here's the thing nobody wants to hear: none of the frameworks, templates, or cadences above matter if your underlying data is garbage.

91% of CRM data is incomplete. 70% of it goes bad or becomes obsolete every year. That semiconductor manager's 60% pipeline inflation? It wasn't a process problem - it was a data problem. Wrong dollar values, outdated contact info, fantasy close dates. He was making decisions on fiction.

If you're running pipeline reviews on dirty data, you're coaching reps based on deals that don't exist, contacts who've changed jobs, and companies that have been acquired. Your "pipeline coverage" number is meaningless if a third of those deals have dead email addresses and disconnected phone numbers.

Practical steps to fix this:

- Audit active contacts. Run your pipeline contacts through an email verification tool. You'll be shocked how many bounce.

- Set up automated enrichment. Your CRM data decays every week. Tools like Prospeo refresh contact records on a 7-day cycle and verify emails at 98% accuracy, so your pipeline reflects current reality - not last quarter's org chart. (If you want options, compare email verifier websites.)

- Establish a data hygiene cadence. Weekly checks prevent decay. Monthly reviews correct drift. Treat it like brushing your teeth - skip it and the problems compound fast. (Use this SOP on how to keep CRM data clean.)

Your pipeline reviews are only as good as your data. Fix the foundation before you optimize the cadence.

That 60% pipeline inflation problem? It starts with outdated contacts and wrong emails. Prospeo delivers 98% email accuracy and 125M+ verified mobile numbers so every deal in your review has a real buyer attached to it.

Clean pipeline data at $0.01 per email. No contracts, no sales calls.

FAQ

How often should you review your sales pipeline?

Weekly 1:1s for most teams - 30 minutes, focused on 3-5 deals. Add biweekly team reviews for 30-90 day cycles, monthly forecast reviews for 90+ day cycles, and quarterly planning for 6+ month enterprise deals. Match your review rhythm to cycle length so nothing slips between sessions.

What's the difference between a pipeline review and a forecast call?

Pipeline reviews inspect deal health and coach reps on advancing specific opportunities. Forecast calls evaluate commit numbers, coverage ratios, and portfolio-level risk for leadership. Combining them into one meeting guarantees you'll do both poorly - separate them by audience and purpose.

How do you fix a pipeline that's inflated by 40-60%?

Implement evidence-based stage criteria, require buyer-driven next steps on every deal, and create "parking lot" rules for stale deals idle 14-30 days. Run a one-time pipeline audit, then maintain weekly hygiene. Verify that your contact data is current so inflation isn't hiding behind outdated records.

What qualification framework works best for pipeline reviews?

MEDDPICC for complex B2B with multiple stakeholders and deal sizes above $25K. BANT for transactional, shorter-cycle deals. The framework matters less than consistency - pick one, train the team, and make it the shared language of every review.

Can I improve pipeline data quality without a big budget?

Yes. Prospeo's free tier includes 75 email credits and 100 Chrome extension credits per month - enough to audit your highest-value pipeline contacts. Run at-risk deals through email verification to confirm you're coaching on real opportunities, not records with bounced addresses and outdated titles.