The 8 Sales Pipeline Challenges Killing Your Revenue in 2026 (And How to Fix Each One)

It's the last week of the quarter. Your CRM says $2.4M in pipeline. You know - you know - a third of those deals are dead. You forecast $1.8M, miss by 15%, and the board asks what happened. Again.

Here's the thing: sales pipeline challenges aren't new. But they're measurably worse right now. Win rates dropped from the 31-40% bracket to the 21-25% range over the past year, and there's no sign of recovery. Buyers use LLMs to pre-qualify vendors before they'll even take a call. The average B2B deal now involves 13 decision-makers. Fewer than 43% of sellers hit quota attainment in recent quarters. And one SaaS AE on Reddit summed it up perfectly: "I feel like I'm busting my ass on outbound and nothing is biting. Inbound has also drastically slowed down."

The environment has shifted. Your pipeline management needs to shift with it.

But here's the counterintuitive part: economic pressure is actually shortening buying cycles. Average sales cycles dropped from 11.3 months to 10.1 months over the past year, and 49% of buyers say economic conditions shortened their buying cycles - with 62% saying those pressures pushed them to engage sellers earlier. The window is smaller, but it's opening sooner. Teams that recognize this are winning. Teams running a 2022 playbook are bleeding pipeline.

What follows isn't vague advice. It's eight specific pipeline problems backed by the latest data, with conversion benchmarks, revenue impact math, and frameworks to fix each one.

The Quick Diagnostic

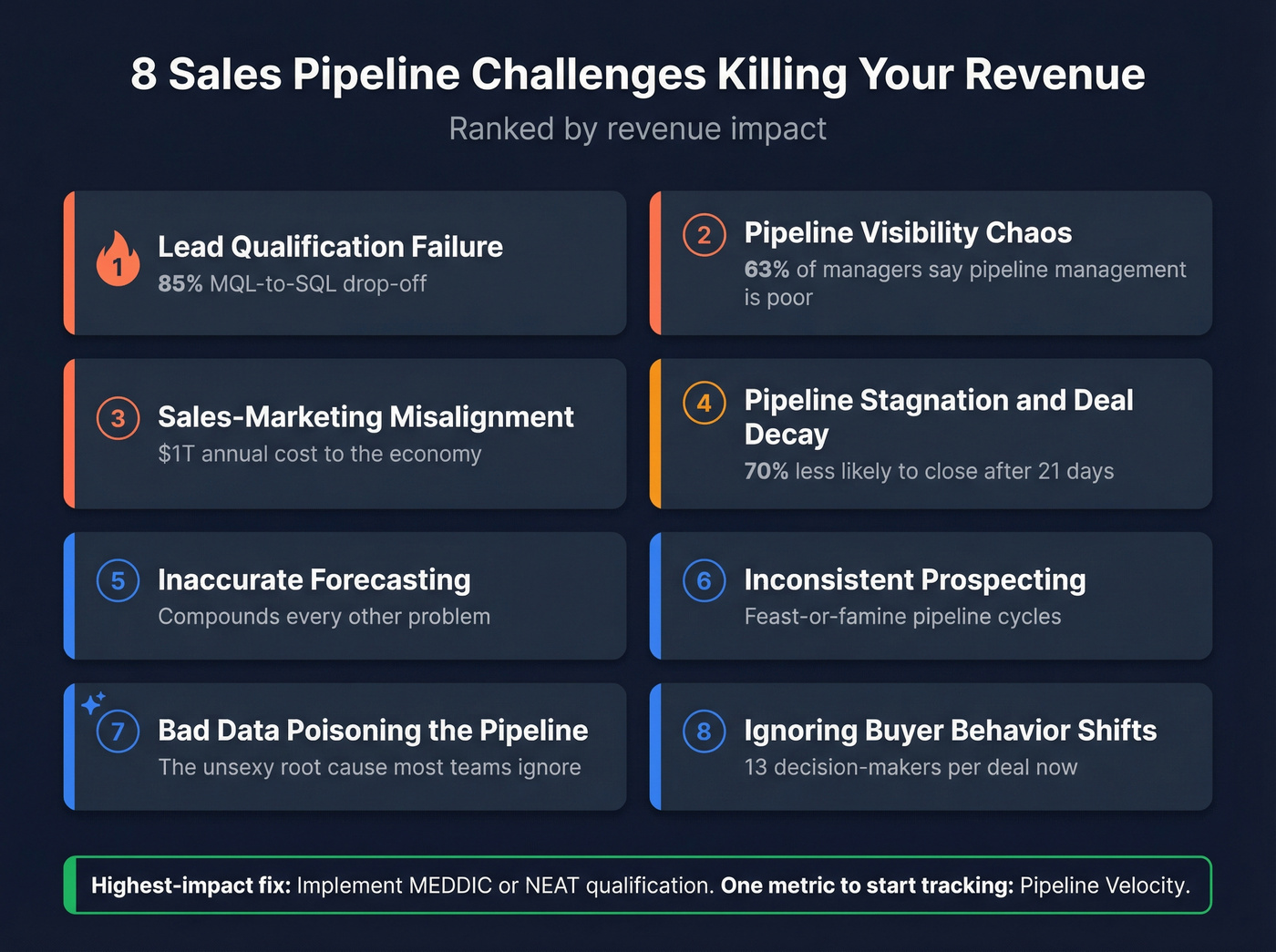

If you're short on time, here's the list:

- Lead qualification failure (85% MQL-to-SQL drop-off)

- Pipeline visibility chaos

- Sales-marketing misalignment ($1T annual cost)

- Pipeline stagnation and deal decay

- Inaccurate forecasting

- Inconsistent prospecting

- Bad data poisoning the pipeline

- Ignoring buyer behavior shifts

The single highest-impact fix: Implement a real qualification framework (MEDDIC or NEAT, not BANT - more on that below).

The one metric to start tracking today: Pipeline velocity. It diagnoses every other problem on this list.

The unsexy root cause most teams ignore: Bad contact data. Bounced emails, dead dials, and phantom pipeline all trace back to stale records. A data platform with verified emails and a weekly refresh cycle solves this at the source - before bad data ever enters your CRM.

Now let's get into the details.

What a Healthy Pipeline Actually Looks Like

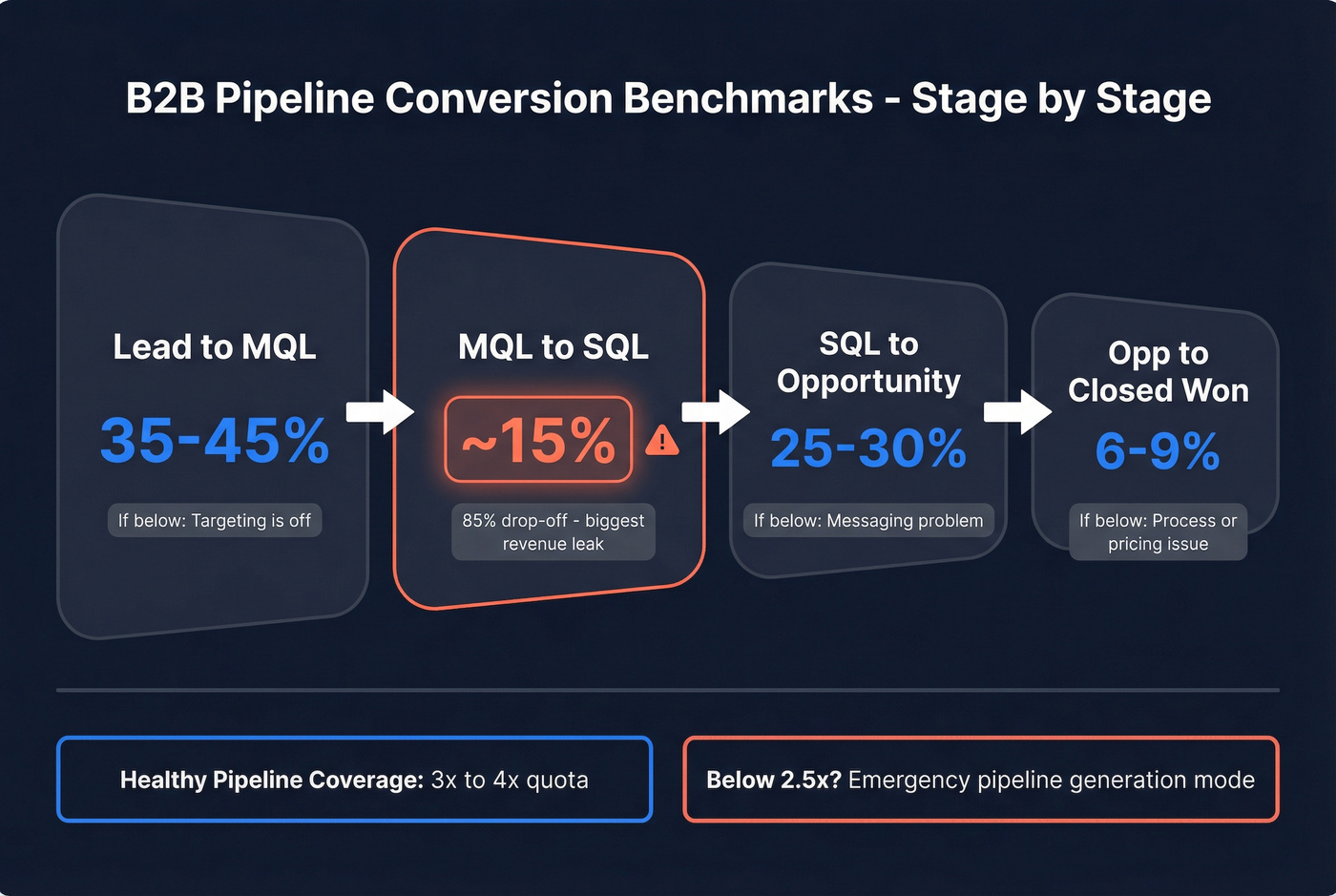

Before diagnosing what's broken, you need to know what "good" looks like. Most teams don't. They track pipeline coverage and total dollar value without understanding stage-by-stage conversion benchmarks - which is like checking your bank balance without looking at your monthly burn rate.

Here's what the data says:

| Stage | Avg Conversion | What It Means | If You're Below |

|---|---|---|---|

| Lead to MQL | 35-45% | Marketing filter | Targeting is off |

| MQL to SQL | ~15% | Biggest drop-off | Qualification broken |

| SQL to Opportunity | 25-30% | Sales engagement | Messaging problem |

| Opp to Closed-Won | 6-9% | Execution | Process or pricing |

That MQL-to-SQL number is the one that should scare you. An 85% drop-off at that stage is the single largest revenue leak in most B2B pipelines. If you're losing more than 85% of MQLs before they become SQLs, your qualification criteria - or your sales-marketing handoff - is fundamentally broken.

Pipeline coverage ratio: The standard is 3:1 to 4:1 - meaning $3-$4 in pipeline for every $1 of quota. Enterprise teams with lower win rates should target 4-5x. Below 2.5x? That's emergency pipeline generation mode. Stop reading this article and go prospect.

Weighted pipeline value should sit between 0.8x and 1.2x of your target. Below 0.8x signals execution or qualification problems. Above 1.2x often means you're stuffing the pipe with deals that won't close.

Here's what most teams miss: pipeline coverage ratios are meaningless if 30-40% of your pipeline is phantom deals that will never close. A "4x pipeline" that's 35% dead weight is really a 2.6x pipeline. The numbers look healthy on the dashboard, but the reality underneath is anemic. That's why the fix starts with honest stage definitions and regular purges.

For context, here's how conversion rates vary by industry:

| Industry | Avg Conversion Rate |

|---|---|

| Legal Services | 7.4% |

| HVAC | 3.1% |

| Staffing & Recruiting | 2.9% |

| Real Estate | 2.7% |

| Higher Education | 2.8% |

| Manufacturing | 2.2% |

| Financial Services | 1.9% |

| Biotech | 1.8% |

| B2B SaaS | 1.1% |

| Software Development | 1.1% |

SaaS benchmarks vary wildly by segment. Top performers achieve 40-50% higher conversion rates than the median - the gap between bottom and top is enormous, and it's almost entirely an execution gap.

Challenge #7 is the root cause of every other pipeline problem on this list. Stale contacts, bounced emails, and dead dials create phantom pipeline that inflates your forecast and kills your velocity. Prospeo refreshes 300M+ profiles every 7 days - not every 6 weeks - with 98% email accuracy and 125M+ verified mobile numbers.

Stop forecasting on fiction. Start with data that actually connects.

The 8 Pipeline Pitfalls That Actually Matter

1. Lead Qualification Failure

This is the #1 seller challenge heading into 2026. It shifted from "opportunity management" to "lead qualification" as the top concern over the past year.

The math is brutal: 85% of MQLs never become SQLs. For every 200 MQLs your marketing team celebrates, only 30 make it to a sales conversation. The rest are either unqualified, poorly timed, or defined so differently by sales and marketing that nobody agrees on what "qualified" even means.

The fix isn't more leads. It's a better framework.

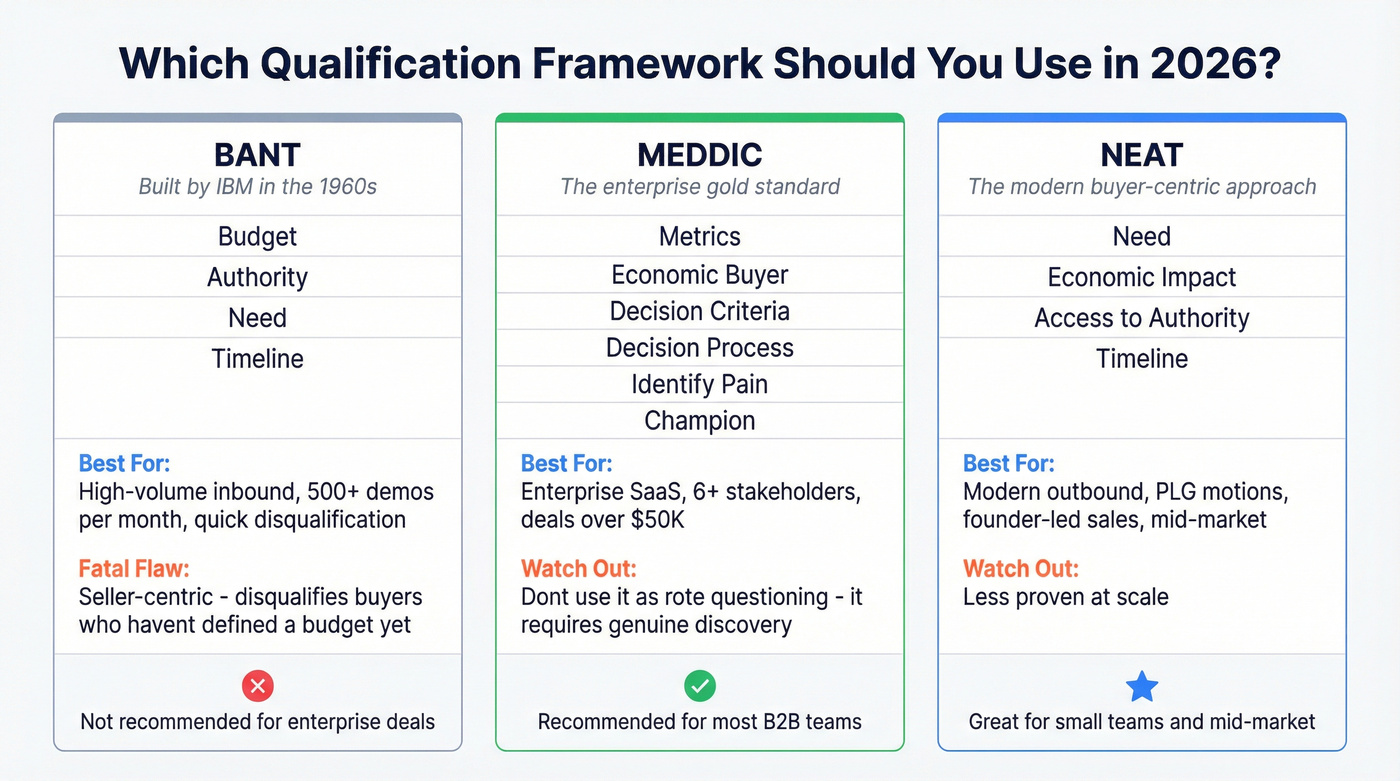

BANT (Budget, Authority, Need, Timeline) was built by IBM in the 1960s. It works for high-volume inbound where you're triaging 500+ demos a month and need quick disqualification. Its fatal flaw: it's seller-centric. Modern buyers show up with 90% of their research done but often without a formal budget line item. BANT disqualifies them prematurely.

MEDDIC (Metrics, Economic Buyer, Decision Criteria/Process, Pain, Champion) is the gold standard for enterprise SaaS with 6+ stakeholders and complex decision processes. The risk is misapplying it as rote questioning instead of genuine discovery. Used well, it's the best framework available for deals over $50K.

NEAT (Need, Economic Impact, Access to Authority, Timeline) is buyer-centric and works best for modern outbound, PLG motions, and founder-led sales. Less proven at scale, but the right choice if your team is small and your deals are mid-market.

If you're using BANT for enterprise deals in 2026, you're disqualifying good opportunities because the buyer hasn't defined a budget yet - which is how modern buying works. Switch to MEDDIC.

A cybersecurity company used an AI-augmented qualification model and saw MQL-to-SQL conversion jump 38% within six months. The leads didn't change. The qualification approach did.

2. Pipeline Visibility Chaos

"Pipeline is overflowing one minute, empty the next." That's a business owner on Reddit describing their sales operation. Same thread: "Three people spending hours redoing the same proposal because nobody noticed it was already finished."

63% of sales managers say their organization does a poor job managing its pipeline. I'd bet the other 37% just haven't looked closely enough.

The root cause is almost always vague stage definitions. When "Qualified" means something different to every rep, your pipeline view is fiction. The fix is embarrassingly simple but rarely implemented:

- Replace generic stages with specific ones. Not "Qualified" - instead, "Budget Confirmed" or "Executive Sponsor Engaged" or "Problem Validated." Each stage needs explicit entry and exit criteria tied to buyer behaviors, not seller activities.

- Run weekly pipeline reviews. Not monthly. Weekly. Review every deal that hasn't had buyer activity in 14 days. If a deal sits untouched for 30 days, it's dead - move it out.

- Document action items. Every review should produce specific next steps with owners and deadlines. "Follow up with the prospect" isn't an action item. "Send the ROI model to the CFO by Thursday" is.

The 3-question deal quality check: Before any deal advances a stage, ask: (1) Has the buyer taken a concrete action in the last 14 days? (2) Can you name the economic buyer and their top priority? (3) Is there a defined event or deadline driving the timeline? If you can't answer yes to all three, the deal doesn't move.

Companies that define a clear sales process grow revenue 18% faster. Companies that optimize pipeline management grow 28% faster than peers. This isn't rocket science - it's discipline.

3. Sales-Marketing Misalignment

Here's a scenario we've seen play out dozens of times: the SDR team generates 200 MQLs. Marketing celebrates. Only 30 make it to SQL. Sales says the leads are garbage. Marketing says sales isn't following up. Nobody's looking at the handoff criteria because there aren't any.

The cost of this dysfunction? $1T annual cost across the economy, per Harvard Business Review. And only 8% of companies have strong alignment between sales and marketing.

| Misaligned Teams | Aligned Teams |

|---|---|

| 62% define "qualified lead" differently | Shared lead definition across both teams |

| Sales reps ignore 50% of marketing leads | 19% faster revenue growth |

| 79% of marketing leads never convert | 300% more likely to exceed acquisition targets |

| Lead handoffs "very effective" only 29% | 38% higher win rates |

Sales pros at aligned companies are 103% more likely to exceed their goals. That's not a marginal improvement - it's a fundamentally different outcome.

The middle of the funnel is the breaking point for 53% of companies. That's exactly where the sales-marketing handoff happens. The fix isn't a quarterly alignment meeting - it's shared definitions, shared KPIs, and a shared funnel. If marketing is measured on MQL volume and sales is measured on closed revenue, you've built a system that incentivizes misalignment.

Start here: get your sales and marketing leaders in a room and agree on one definition of "qualified lead." Write it down. Put it in the CRM. Measure both teams against it.

4. Pipeline Stagnation and Deal Decay

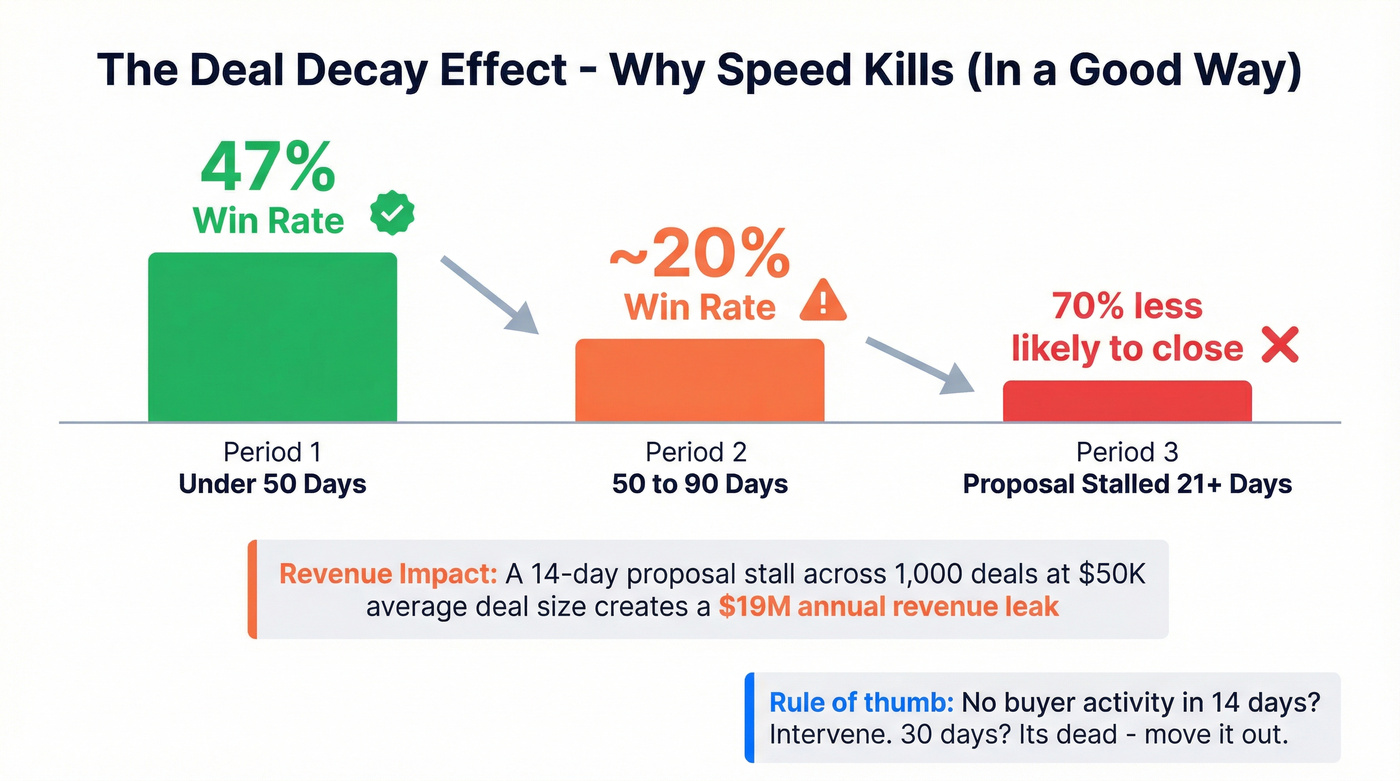

Deals don't die dramatically. They decay quietly. A proposal goes out, the champion goes silent for a week, then two weeks, then the deal sits in your pipeline for three months while you tell yourself it's "still alive."

The data is unforgiving:

- Deals stuck in the proposal stage for more than 21 days are 70% less likely to close

- Opportunities closed within 50 days have a 47% win rate - after 50 days, it drops below 20%

- 27% of sales reps say long sales cycles are their biggest barrier to hitting quota

Let's do the revenue math. Say you have 1,000 opportunities at $50K average deal size, 25% win rate, and a 90-day cycle. That's $1.39M in monthly pipeline velocity. Now add a 14-day proposal stall across the board - velocity drops to $1.20M/month. That's a $19M annual revenue leak.

The fix is a combination of process and courage:

- Set deal decay triggers. Any deal without buyer-side activity in 21 days gets flagged. At 30 days, it gets a "last chance" outreach. At 45 days, it's moved to closed-lost.

- Send the break-up email at 30 days. Give the prospect three options: (1) still interested, let's reschedule, (2) interested but timing is wrong - follow up in Q[X], (3) no longer a fit. Most reps avoid this because they're afraid of the answer. That fear is what keeps dead deals in your pipeline.

- Track cycle length by stage, not just overall. The bottleneck is usually in one specific stage. Find it. Fix it. B2B companies with 30-45 day cycles see up to 38% higher velocity.

5. Inaccurate Forecasting

79% of sales organizations miss their forecasts by more than 10%. Only 7% hit 90%+ accuracy. And 87% of finance executives say forecasts are outdated by the time stakeholders see them.

Here's the part that should make you angry: 66% of companies still use spreadsheet-based forecasting. And roughly 90% of spreadsheets contain errors. We're making multi-million-dollar resource allocation decisions based on tools that can't reliably add up a column.

The traditional forecast process is broken at every level. Sales ops teams spend 4-12+ hours per cycle crunching numbers. Reps sandbag or inflate depending on whether they're ahead or behind. Managers add "cushion." By the time the number reaches the board, it's been through so many layers of human bias that it's essentially fiction.

AI-powered forecasting achieves 20% better accuracy than manual methods, with some teams reaching 98%. Companies with accurate forecasts are 10% more likely to grow revenue year-over-year and 7.3% more likely to hit quota.

The contrarian take: the problem isn't your forecasting tool. It's your pipeline hygiene. If 30-40% of your pipeline is phantom deals, no algorithm - AI or otherwise - can produce an accurate forecast. Clean pipeline beats a sophisticated forecast model. Every time.

6. Inconsistent Prospecting and Pipeline Generation

The feast-or-famine cycle is the most predictable failure mode in sales. Reps close a big deal, stop prospecting for two weeks, then panic when the pipeline dries up next month. Rinse, repeat, every quarter.

44% of salespeople give up after just one touch. It takes 8+ touches to close a deal. That gap is where pipeline goes to die.

The structural problem is getting worse: fewer SDRs on average means more pipeline ownership is falling to AEs. And AEs who are busy closing deals don't prospect consistently. It's not a motivation problem - it's a time allocation problem.

One data point that should change your behavior: contacting leads within 24 hours of their first engagement increases conversion by 5x. Not 5%. Five times. Speed-to-lead isn't a nice-to-have - it's the single highest-leverage prospecting behavior.

The fix is a non-negotiable prospecting block. Every AE, every day, 60-90 minutes of outbound. Not "when I have time." Not "after I finish my proposals." Blocked on the calendar like a customer meeting. Companies that enforce this see pipeline consistency smooth out within one quarter.

7. Bad Data Poisoning the Pipeline

Skip this section if your CRM bounce rate is under 5% and your contact data is less than 30 days old. For everyone else - and that's most of you - this is probably the root cause of half the problems above.

Sales teams waste up to 40% of their time dealing with inaccurate or incomplete contact data. That's nearly half your team's capacity consumed by bad phone numbers, bounced emails, wrong titles, and contacts who left the company six months ago.

Here's the causal chain: bad email addresses lead to bounced sequences, which damage sender reputation, which tanks deliverability on good emails too. Dead dials waste call blocks and kill rep confidence in outbound. Stale contacts inflate pipeline with phantom deals that make your forecast a fantasy. I've seen teams where 35-40% of their "pipeline" was built on contacts who'd already churned out of their roles.

If you want to quantify the impact, start with contact data decay and a simple data quality scorecard.

8. Ignoring Buyer Behavior Shifts

The way people buy has changed more in the last two years than in the previous decade. If your pipeline process was designed for 2022 buyers, it's already obsolete.

The numbers: 94% of B2B buyers now use LLMs during their buying process. 83% define their purchase requirements before ever talking to a sales rep. The average buyer has 16 interactions - content views, emails, calls, demos, and meetings - with the winning vendor. And 75% say they'd prefer a rep-free experience entirely.

But here's the stat that flips the narrative: B2B buyers are 1.8x more likely to complete a high-quality deal when engaging with digital tools in partnership with a sales rep versus independently, per Gartner. Buyers say they want rep-free. They get better outcomes with rep engagement. This is the single most important insight for pipeline strategy in 2026: the rep's role isn't disappearing - it's shifting from information delivery to decision guidance.

Formal buying committees are giving way to fluid "buying networks" - internal stakeholders, external peers, AI agents, and digital communities all influencing the decision. First contact has moved from 69% to 61% of the buyer journey, meaning outreach is being pulled forward by roughly 6-7 weeks. The old model of finding "the decision-maker" and running a linear sales process doesn't map to how deals actually happen anymore.

86% of B2B purchases stall during the buying process. And 90% of 2.5 million+ analyzed sales calls contained markers of customer indecision - not objection, but indecision.

Your biggest competitor isn't another vendor. It's the status quo and the fear of making the wrong choice.

The implication for pipeline management: your stages need to reflect buyer behavior, not seller activity. "Demo completed" is a seller milestone. "Champion confirmed internal alignment with finance" is a buyer milestone. The second one actually predicts whether the deal will close.

How to Diagnose Everything With One Metric: Pipeline Velocity

If you only track one pipeline metric, make it velocity. It captures all four failure modes in one number.

Pipeline Velocity = (Number of Opportunities x Average Deal Size x Win Rate) / Sales Cycle Length

Here's a worked example. Say you have:

- 150 qualified opportunities

- $45K average deal size

- 22% win rate

- 75-day average cycle

Velocity = (150 x $45,000 x 0.22) / 75 = $19,800/day in expected revenue.

Now improve just one lever. Cut cycle length from 75 to 60 days (a realistic 20% improvement): velocity jumps to $24,750/day. That's a $1.8M annual difference from one lever.

Each variable maps directly to a specific challenge:

- Low opportunity count - prospecting problem (Challenge 6)

- Shrinking deal size - qualification problem (Challenge 1)

- Low win rate - messaging or buyer alignment problem (Challenge 8)

- Long cycle length - process or stagnation problem (Challenge 4)

Track it monthly. Pipeline acceleration strategies can reduce B2B sales cycles by as much as 40%, but you won't know what's working unless you're measuring.

How AI Is Changing Pipeline Management

89% of revenue organizations now use AI, up from 34% in 2023. That's not a trend - it's a full-stack shift in how revenue teams operate.

By 2027, 95% of seller research workflows will begin with AI, per Gartner. 45% of teams already use a hybrid AI-SDR model where AI handles research, personalization, and initial outreach while humans manage relationships and complex negotiations.

The results are real: 100% of teams using AI-assisted prospecting report saving more than 1 hour per week. AI coaching tools shave 11 days off sales cycles and boost win rates by up to 10 percentage points on deals over $50K. AI-powered forecasting is hitting 98% accuracy for some teams, compared to the 78% industry average with traditional methods.

But here's what to implement now versus what's still hype:

Implement now: AI for lead scoring and prioritization, automated CRM data entry, AI-assisted email personalization, deal risk scoring, and forecast modeling. These are mature, proven, and available in most modern sales stacks.

Still maturing: Fully autonomous AI SDRs, agentic AI that executes multi-step sales plays without human oversight, and AI-driven negotiation. These are coming, but they're not reliable enough to bet your pipeline on in 2026.

The biggest AI win isn't a flashy feature - it's eliminating the 4-12 hours per forecast cycle that sales ops teams spend manually crunching numbers. That time goes back to actually selling.

Your Pipeline Fix Priority List

If you've read this far, you're probably wondering where to start. Here's the priority order - do these in sequence, not in parallel:

Purge phantom deals. This week. Every deal without buyer-side activity in 30 days gets moved to closed-lost. Your pipeline number will drop. Your forecast accuracy will jump. This is the single most impactful thing you can do today.

Implement a qualification framework. MEDDIC for enterprise, NEAT for mid-market and PLG. Train your team. Enforce it in pipeline reviews. No framework, no forecast. (If you need a starting point, use a lead qualification framework scorecard.)

Start tracking pipeline velocity monthly. Use the formula above. Identify which lever is weakest. Focus there.

Fix your data quality. Audit your CRM for bounce rates, contact freshness, and duplicate records. Set up automated enrichment so bad data stops entering the pipeline in the first place. Use a repeatable SOP like how to keep CRM data clean.

Align sales and marketing on shared definitions and KPIs. One definition of "qualified." One shared funnel. Measured together, not separately.

Real talk: if your deals average under $15K, you probably don't need a complex tech stack to fix your pipeline. You need a clean contact database, a real qualification framework, and the discipline to purge dead deals weekly. The companies we see struggling most aren't under-tooled - they're under-disciplined.

Clean pipeline beats big pipeline. Every time. A $2M pipeline with 80% deal quality will outperform a $5M pipeline with 30% deal quality - and it'll be a hell of a lot easier to forecast. Most sales pipeline challenges trace back to this one truth: accuracy beats volume.

Your MQL-to-SQL conversion is bleeding out because reps waste hours chasing bad contact data instead of running discovery. Prospeo delivers 50+ enrichment data points per contact at $0.01/email, so your team qualifies real buyers - not ghost records. One team tripled their pipeline from $100K to $300K/week after switching.

Fix the data and the qualification problem fixes itself.

FAQ

What's the biggest sales pipeline challenge in 2026?

Lead qualification failure is the single largest revenue leak in most B2B pipelines, with an 85% drop-off between MQL and SQL stages. Implementing a qualification framework like MEDDIC or NEAT - and aligning sales and marketing on shared lead definitions - is the highest-impact fix available.

What's a healthy pipeline coverage ratio?

The industry standard is 3:1 to 4:1, meaning you need $3-$4 in pipeline for every $1 of quota. Enterprise teams with lower win rates should target 4-5x coverage. Below 2.5x means you're in emergency pipeline generation mode and need to prioritize top-of-funnel activity immediately.

How do you calculate pipeline velocity?

Pipeline velocity equals the number of opportunities multiplied by average deal size multiplied by win rate, divided by sales cycle length in days. Track it monthly - each variable maps to a specific problem. Low opportunities signal a prospecting gap, low win rate signals a messaging issue, and long cycles point to process stagnation.

Why do B2B deals stall mid-pipeline?

Customer indecision - not competitor objections - is the #1 cause; 90% of 2.5M+ analyzed sales calls show indecision markers. Combine that with 13-person buying committees and 30-40% of pipeline built on stale contact data, and structural stagnation is inevitable. Weekly purges and buyer-milestone stages prevent phantom deals from inflating your numbers.

How can AI improve pipeline management?

AI-powered forecasting achieves 20% better accuracy than manual methods, with top teams reaching 98%. Hybrid AI-SDR models save reps 1+ hours per week on research and personalization, while AI coaching tools shave 11 days off sales cycles and boost win rates by up to 10 points on deals over $50K.