How to Increase Close Rate (Win Rate) in B2B Sales

Most "increase close rate" advice fails because it attacks the wrong denominator. Teams think they've got a closing problem, but they've actually got a targeting problem, a qualification problem, or a "proposal -> silence" problem.

And if you're measuring "close rate" as won deals divided by raw leads, you'll always feel behind because you're mixing marketing funnel performance with sales execution. That's how you end up coaching AEs on objection handling when the real issue is that half your opps never had a reachable stakeholder in the first place.

Here's the thing: the fix isn't one magic script.

It's tightening the process stage by stage so fewer bad-fit deals enter, and fewer good-fit deals stall. Below is the stage-by-stage system to lift win rate without adding pipeline, built around the same fundamentals strong teams use once they stop guessing and start controlling stages.

Why your close rate feels low (and why most advice misses)

Close rate feels low when you're doing a lot of work and not getting a lot of wins. The classic symptom: you run a solid discovery, the buyer says "send the proposal," you send it... and then you get silence. Two follow-ups later, you're wondering if you got politely brushed off.

Here's the contrarian take: most teams don't have a closing problem. They've got a measurement problem and a pipeline hygiene problem.

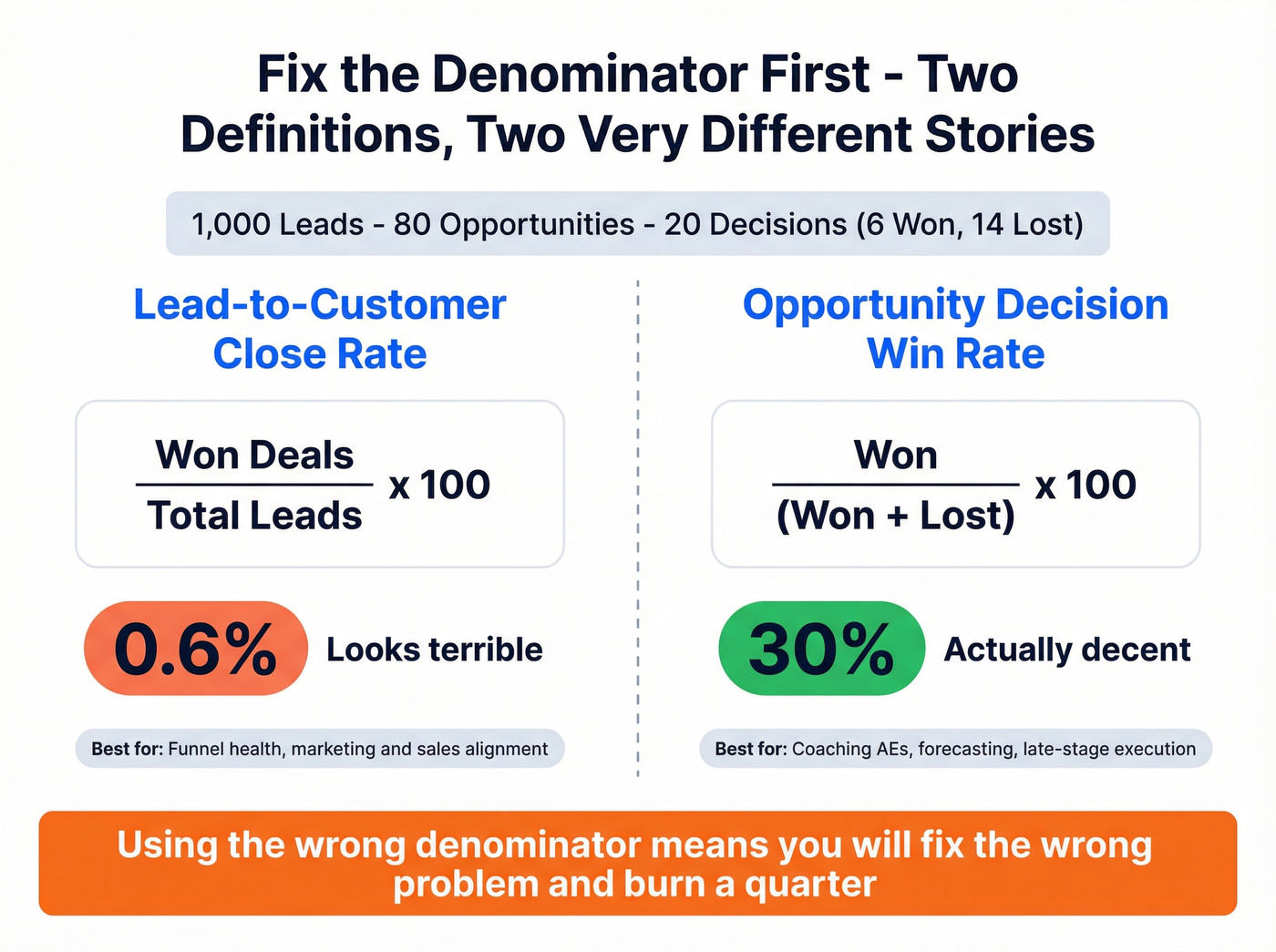

Measurement problem: "Close rate" gets used in two incompatible ways (lead-to-customer vs opportunity win rate). If you don't define it, you'll "fix" the wrong stage and burn a quarter.

Pipeline hygiene problem: If you let weak-fit accounts and unreachable stakeholders become opportunities, your win rate will look bad no matter how good your AEs are. The fastest win-rate lift I've seen in real teams wasn't a new pitch. It was a stricter gate for what counts as an opportunity.

Hot take: if your deal size is small and your cycle is short, you don't need a "closing masterclass." You need fewer junk opps and tighter next-step control.

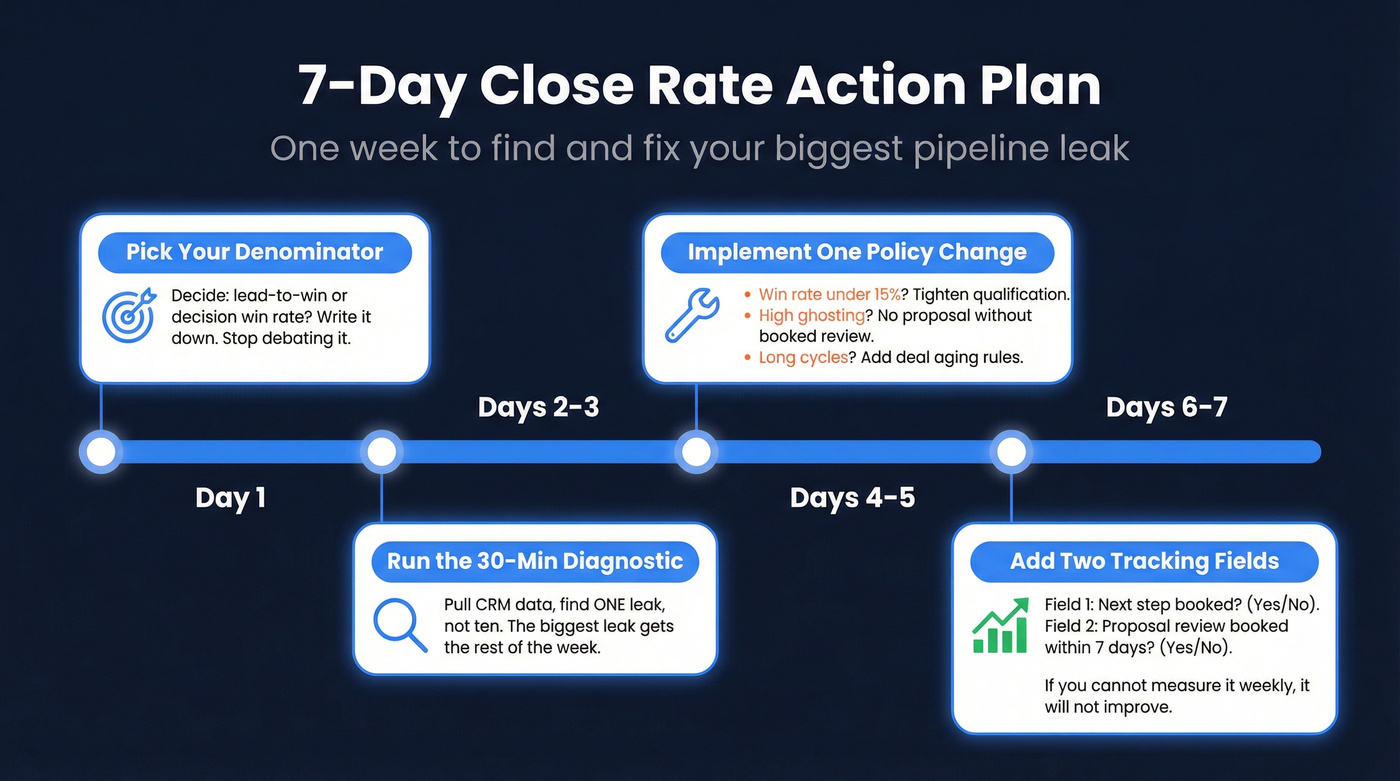

Do this in 7 days (a mini-plan that moves the number)

Day 1: Pick the denominator + freeze it. Decide whether you're optimizing lead-to-win or decision win rate (won/(won+lost)). Put it in writing and stop debating it.

Days 2-3: Run the 30-minute diagnostic (see "30-minute diagnostic"). You're looking for one leak, not ten. The biggest leak gets the week.

Days 4-5: Implement one policy change. Pick the one that matches your leak:

- Low win rate (<15%): tighten qualification gate (see "Discovery that disqualifies").

- High proposal ghosting: "no proposal without a booked review" (see "Proposal control").

- Long cycle time: deal aging rules + MAP requirement (see "Speed to decision" and "Mutual Action Plans").

Days 6-7: Add two tracking fields and start measuring. If you can't measure it weekly, it won't improve.

- Next-step booked? (Yes/No at every stage change)

- Proposal review booked within 7 days? (Yes/No)

What to measure weekly (so you don't drift back)

Track these five numbers every Monday:

- Decision win rate (won/(won+lost))

- No-decision rate (stalled/recycled + "no decision" losses)

- Median days in stage (by stage)

- % opps with a dated next step

- % proposals with a review meeting booked

What you need (quick version)

Use this as your operating checklist. If you do nothing else this month, do these.

3 process changes to trial first (highest impact):

- Define win rate correctly (pick one denominator and stick to it).

- Run a Mutual Action Plan (MAP) on every real deal (anything with multiple stakeholders or procurement).

- Never send a proposal without a booked review meeting (proposal is the agenda for the next conversation, not an attachment).

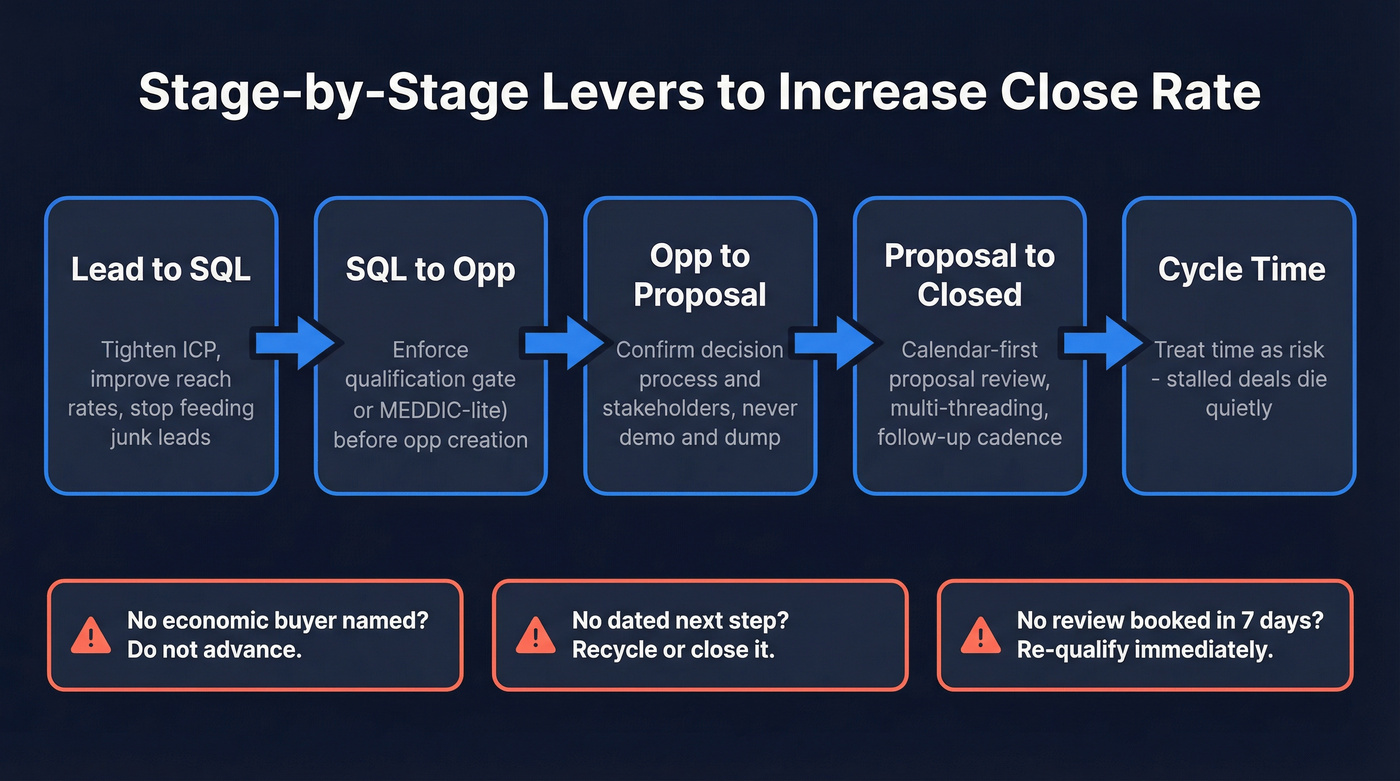

Stage-by-stage levers (quick checklist):

- Lead -> SQL: tighten ICP, improve reach rates, stop feeding junk leads into sales.

- SQL -> Opp: enforce a qualification gate (BANT or MEDDIC-lite) before opp creation.

- Opp -> Proposal: don't demo and dump; confirm decision process + stakeholders first.

- Proposal -> Closed: calendar-first proposal review, follow-up cadence, multi-threading.

- Cycle time: treat time as a risk factor; deals that stall don't "eventually close," they die quietly.

Three policies that raise close rate fast (steal these):

- If you can't name the economic buyer by end of discovery, don't advance stages.

- If a deal has no dated next step, it's not an opportunity; recycle or close it.

- If a proposal's sent and no review's booked within 7 days, re-qualify the decision process immediately.

Define close rate vs win rate (fix the denominator first)

You can't improve performance until you decide what you're measuring. In most orgs, "close rate" gets used in two incompatible ways, so teams argue about performance while looking at different math.

Lead-to-customer close rate (marketing + sales) A common funnel definition is won deals / total leads x 100. It's useful when you want one number for the whole funnel.

Opportunity decision win rate (sales execution) The clean sales-only definition is won / (won + lost) x 100 for a given period. It excludes open deals and ignores leads that never became real opportunities.

Mini example (why this matters):

- You generated 1,000 leads.

- 80 became opportunities.

- 20 reached a decision this quarter: 6 won, 14 lost.

Your numbers:

- Lead-to-win close rate = 6 / 1,000 = 0.6%

- Opportunity decision win rate = 6 / (6+14) = 30%

When to use which:

- Use lead-to-win to diagnose marketing/sales alignment, lead quality, and handoff.

- Use decision win rate to coach AEs, improve late-stage execution, and forecast.

Reporting period rule (non-negotiable): Pick a fixed window (monthly/quarterly) and measure closed outcomes in that window. If you want to analyze "created this quarter," do it as a cohort (created in Q1 -> closed by end of Q2).

| Metric | Formula | Best for | Trap |

|---|---|---|---|

| Close rate | Won/Leads | Funnel health | Blames sales |

| Win rate | Won/(Won+Lost) | Sales execution | Ignores stalls |

| Throughput | Closed/Created opps | Volume | Hides stalls |

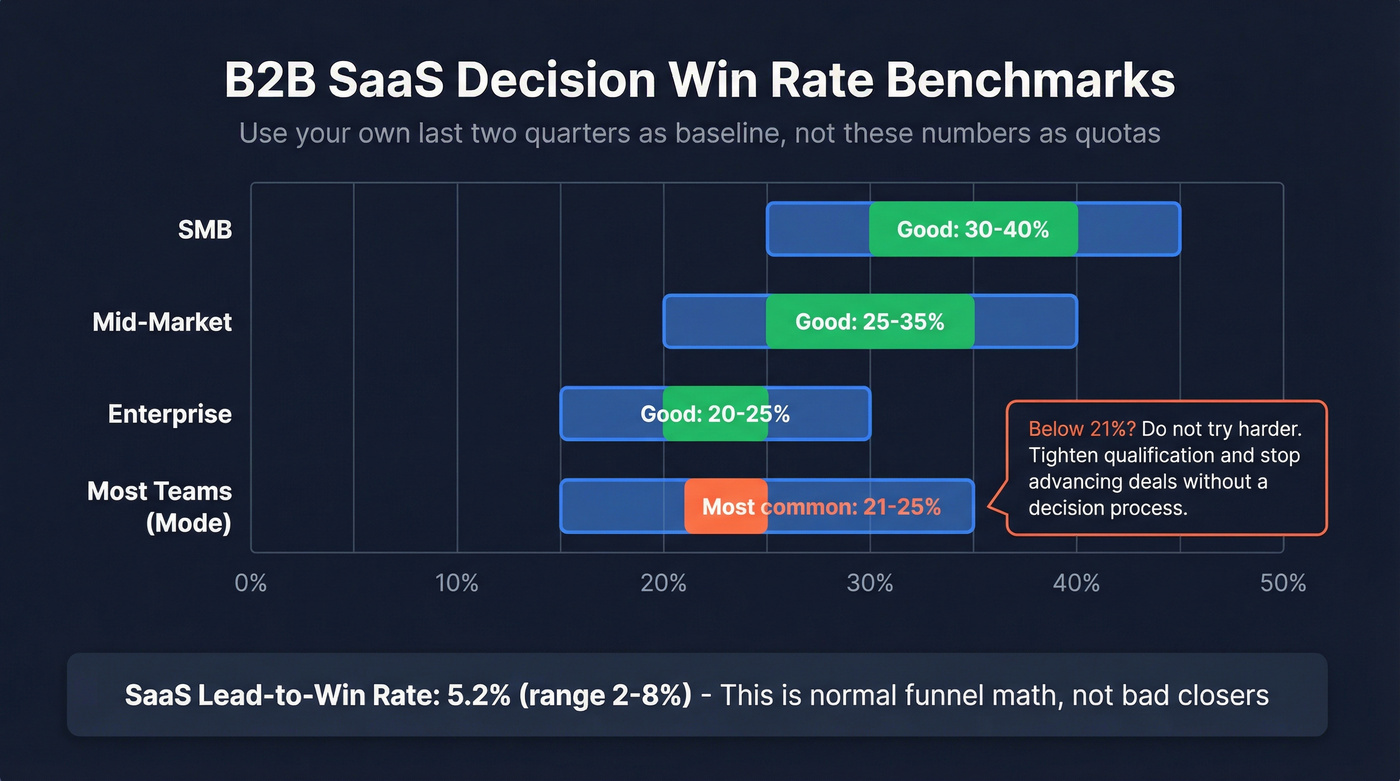

Benchmarks: what "good" looks like (and how to use it)

Benchmarks are a sanity check. Don't set quotas from them. Use your own last two quarters as the baseline, then improve one stage at a time.

The latest published Outreach benchmark (2026) shows the largest group of teams sits in the 21-25% decision win rate bracket. If you're below that, don't "try harder." Tighten qualification and stop advancing deals without a decision process. That single change improves the quality of what reaches late stage, which is why it moves win rate faster than another objection-handling training.

Forecastio's SaaS segmentation benchmarks show the typical pattern: SMB win rates run higher; enterprise runs lower because stakeholders and procurement multiply.

Also: don't confuse win rate with lead-to-win. First Page Sage puts SaaS lead-to-win at 5.2%. That's normal funnel math, not "bad closers."

| Segment | Good decision win rate | Typical range | Metric |

|---|---|---|---|

| SMB | 30-40% | 25-45% | Opp win rate |

| Mid-market | 25-35% | 20-40% | Opp win rate |

| Enterprise | 20-25% | 15-30% | Opp win rate |

| Many teams (mode) | 21-25% | 15-35% | Opp win rate |

| SaaS lead-to-win | 5.2% | 2-8% | Lead-to-win |

The benchmark most teams ignore: no-decision rate

Track: % of opps that end in no decision (stalled >X days, recycled, or closed-lost "no decision"). If it's >30-40% in complex sales, your MAP discipline and next-step control are broken.

Pick an X that matches your motion:

- SMB: 30-45 days

- Mid-market: 60-90 days

- Enterprise: 120-180 days

How to benchmark your own cohorts (without lying to yourself)

Do this once per quarter:

- Cohort A: opps created in Q1 -> % closed-won by end of Q2

- Cohort B: opps created in Q2 -> % closed-won by end of Q3

This stops the classic dashboard mistake: mixing "created this quarter" with "closed this quarter" and calling it performance.

You just read that the fastest win-rate lift comes from stricter pipeline gates - not better scripts. But gating works only when every opp has a reachable stakeholder. Prospeo gives you 98% verified emails and 125M+ direct dials so your AEs stop chasing ghosts and start closing real buyers.

Stop losing deals to unreachable stakeholders. Start with 100 free credits.

30-minute diagnostic to find the leak by stage

You don't need a six-week RevOps project to find the leak. You need 30 minutes, a CRM export, and the discipline to look at stage conversion like a mechanic looks at an engine. If you've been asking how to improve closing rates, this is the fastest way to get a real answer.

The stage breakdown (use this exact spine)

Track these conversions for the last full quarter:

- Lead -> SQL (or inbound lead -> meeting booked)

- SQL -> Opportunity created

- Opportunity -> Proposal/Quote sent

- Proposal -> Closed (won or lost)

- Decision win rate (won / (won+lost))

- No-decision rate (stalled/recycled + "no decision" losses)

Add one more that most teams ignore:

- Proposal purgatory rate = proposals sent that don't get a scheduled review within 7 days

That's not a follow-up problem. It's a process-control problem.

Worksheet: pull these numbers (copy/paste)

From HubSpot/Salesforce/Pipedrive/Zoho, pull:

leads created (or inbound conversations started)

SQLs created

opps created

proposals sent

closed-won

closed-lost

- median days from opp created -> closed

- median days from proposal sent -> closed

- % opps with next meeting scheduled at proposal send date (sample 30 deals)

Then compute:

- Lead->SQL %

- SQL->Opp %

- Opp->Proposal %

- Proposal->Close %

- Decision win rate = won / (won+lost)

- Proposal purgatory % (from your sample)

Output: your close-rate scorecard

Copy this into a doc/spreadsheet and fill it in:

| Scorecard line | Your # |

|---|---|

| Lead->SQL conversion % | |

| SQL->Opp conversion % | |

| Opp->Proposal conversion % | |

| Proposal->Decision conversion % | |

| Decision win rate % | |

| No-decision rate % | |

| Proposal purgatory % (no review in 7 days) | |

| Median days opp->close | |

| Median days proposal->close | |

| Next-step compliance % (dated next step logged) | |

| Top 2 loss themes (validated) |

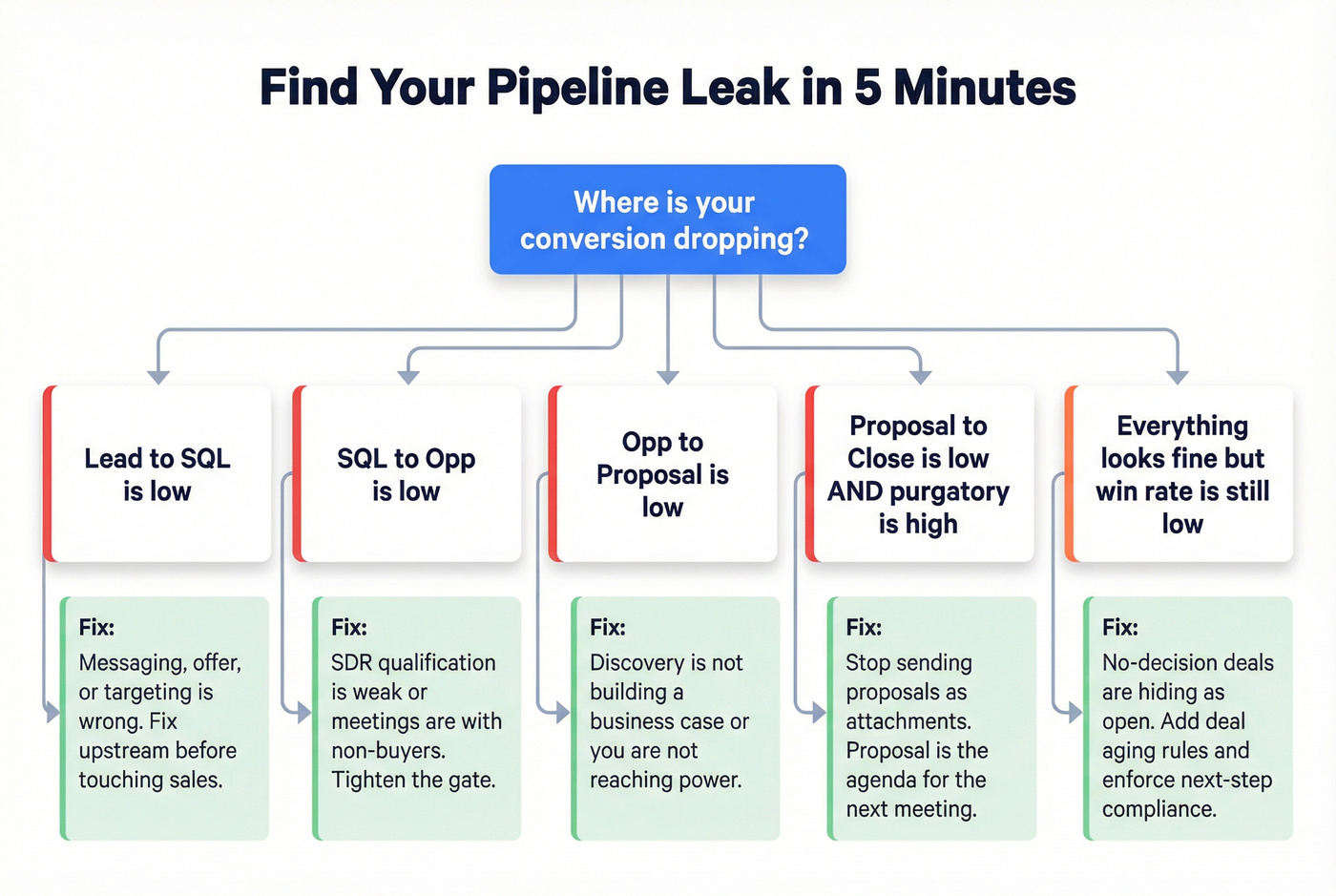

Decision tree: diagnose the leak fast

If Lead->SQL is low: Your messaging/offer/targeting is wrong or leads can't reach you. Fix upstream.

If SQL->Opp is low: Your SDR qualification's weak or you're booking meetings with non-buyers. Tighten the gate.

If Opp->Proposal is low: Discovery isn't creating a business case or you're not reaching power.

If Proposal->Close is low AND proposal purgatory is high: You're sending proposals as a handoff instead of a meeting. Fix proposal control.

If everything looks fine but win rate's still low: You're letting no-decision masquerade as "still open," and cycle time's killing you.

CRM loss reasons aren't trusted metadata. Do this instead.

Keep your CRM fields, but stop treating them as truth. Here's the fast replacement:

- Pull 20 closed-lost deals from last quarter.

- Read the last 10 activities (calls, emails, notes).

- Tag each deal with one real reason from this list:

- No economic buyer access

- No decision process / unclear steps

- No measurable pain

- Procurement/security stalled

- Competitive displacement

- Timing/budget shifted

- Compare your tags to the CRM loss reasons. The gap tells you what to fix first.

Klue's win/loss research puts a number on why this works: 91% of CRM data is incomplete, and 70% decays annually. So "lost to price" often means "rep clicked something to close the record."

Fix the pipeline before the call (ICP, qualification, and reach)

If you want a higher close rate, stop letting bad opportunities exist. That's the unsexy truth, and it's the core of close-rate improvement in any B2B motion.

I've seen teams spend months rewriting talk tracks while their pipeline stayed full of deals that never had a real buyer, never had a deadline, and never had a second stakeholder. Their "close rate problem" disappeared the week they stopped creating opps for those meetings.

Gartner's most recent published Digital Markets data (2026) shows buyers are almost 3x more likely to complete a deal when they get consistent information across your website and sales conversations, yet 58% experience discrepancies. Your website, security page, pricing logic, and sales talk track have to match, or you'll bleed deals before the second call.

That same Gartner research also shows 75% of B2B buyers prefer to transact without direct sales interaction. So "closing" includes product education, self-serve proof, and frictionless evaluation, not just AE performance.

Use this / Skip this (pipeline hygiene edition)

Use this if:

- Reps complain about tire kickers and no-shows.

- Your late-stage win rate's fine, but overall close rate's ugly.

- You see lots of "unresponsive" or "couldn't reach" outcomes.

Skip this if:

- Your ICP's tight, connect rates are high, and opp creation rules are enforced.

- Your losses are clearly competitive late-stage (jump to MAPs + proposal control).

Checklist: upstream fixes that move win rate

ICP (sales + marketing together):

- Define must-have firmographics (industry, size, region).

- Define must-have triggers (hiring, tech stack, growth, compliance events).

- Define must-not-have disqualifiers (budget band, maturity, tech constraints).

Lead scoring (behavioral, not vibes):

- Weight pricing page, integration docs, and security page higher than blog reads.

- Don't hand off to sales until the score says "sales-ready."

Qualification gate before opp creation (pick one):

- BANT for simpler cycles.

- MEDDIC-lite for complex cycles (economic buyer + decision process are mandatory).

ABM callout (mid-market/enterprise win-rate lever)

If you sell mid-market or enterprise, ABM-style account selection is a direct win-rate lever. Gartner reports 41% of businesses using an account-based strategy increase win rates and close bigger deals. Fewer accounts, deeper research, more stakeholders mapped early.

And none of this matters if you can't reach the right people. Better targeting plus verified contact data raises connect rates, reduces "unreachable stakeholder" stalls, and keeps your pipeline clean.

Workflow that improves outcomes upstream:

- Build an ICP list (role, headcount growth, technographics, funding, etc.).

- Layer buyer intent across 15,000 topics (Bombora-powered) so you only sequence accounts showing in-market signals.

- Verify emails/mobiles in real time so reps stop chasing ghosts.

- Export/enrich into your CRM or sequencer and run outreach with fewer bounces and higher connect rates.

Want the database view? Start with the B2B leads database.

Discovery that disqualifies (protects win rate)

Good discovery doesn't build rapport. It earns the right to progress the deal, or it kills it fast.

MEDDIC remains the best mental model because it forces you to prove the deal's real:

- Metrics: what measurable outcome matters?

- Economic Buyer: who can say yes?

- Decision Criteria: what are they evaluating?

- Decision Process: how does approval work?

- Identify Pain: what's the cost of doing nothing?

- Champion: who'll sell internally?

The most common failure mode is predictable: reps pitch too early, everyone feels good after the demo, and then the deal collapses later when buying dynamics show up.

Talk tracks that keep you in control (without sounding aggressive)

Use these verbatim.

- Economic buyer: "Who signs this if we get it right?"

- Decision process: "Walk me through the steps from 'yes' to 'live' - including procurement and security."

- Multi-threading: "Before we end, who else needs to see this to make a decision?"

- Timeline: "What business event forces a decision?"

- Cost of delay: "What happens if you don't solve this in the next 90 days?"

Discovery question bank (10 questions mapped to MEDDIC)

Metrics

- "What metric moves if this works - time saved, revenue, risk reduction?"

- "What's that worth in dollars or hours per month?"

Economic Buyer 3) "Who owns the budget for this category?" 4) "If they disagree, what happens to the project?"

Decision Criteria 5) "What are the top 3 criteria you'll use to choose a vendor?" 6) "What would disqualify us immediately?"

Decision Process 7) "What are the exact steps after this call - who approves what, and when?" 8) "What's the procurement/security path, and how long does it take here?"

Pain 9) "What's the cost of doing nothing for another quarter?"

Champion 10) "Who's driving this internally, and what do they need to look good?"

Do this / Don't do this (the win-rate version of discovery)

Do this:

- Confirm the decision process before you schedule a second demo.

- Get 2-3 stakeholders named before the first demo ends.

- Write down a dated next step in the meeting, not after.

Don't do this:

- Advance stages because the buyer said "looks good."

- Send "more info" as a substitute for a decision step.

- Let a champion "handle it internally" without a plan.

Disqualify triggers (say it out loud)

Disqualify doesn't mean being rude. It means being honest.

- No access to economic buyer after two attempts

- No decision process ("send info," "we'll see")

- No timeline tied to a business event

- No measurable pain (it's a nice-to-have)

- No internal owner (no champion behavior)

If your decision win rate's under 15%, stop trying to generate more pipeline and fix qualification for two weeks. That single move raises results faster than any new script.

Proposal control: stop ghosting by making the proposal a meeting

Proposal ghosting is the most preventable leak in B2B sales. It keeps happening because reps treat "send me a proposal" as a task, not a buying step.

A proposal isn't a deliverable. It's a conversation.

The practitioner rule: "proposal is the next conversation"

A consistent field rule (popular in sales communities): build it fast and try to get it signed on the call, or treat the proposal as the agenda for the next call.

Use this exact language:

- "I'm sending this over now so we can get it signed and get moving."

- If you can't do it instantly: "Do you have 10 minutes later today so I can make sure the proposal matches exactly what you need?"

If they won't book 10 minutes to review something they "want," you just learned the deal isn't real yet.

The non-negotiable policy: never send without a booked review

If you want one operational change that lifts close rate fast, it's this:

No proposal goes out unless the review meeting's on the calendar.

Calendar-first micro-script:

- "Happy to send it. Let's lock 20 minutes to walk through it together so nothing gets misread. Does tomorrow at 2 or 4 work?"

Polite pushaway:

- "Totally fine. When should we reconnect to review and decide? If we don't set time, these tend to stall."

Proposal review meeting agenda (10 minutes, tight, effective)

This is the structure that prevents "I'll look at it later."

- 1 min: Confirm objective + decision date

- 2 min: Restate scope (what's included / not included)

- 3 min: Walk pricing + terms (no surprises)

- 2 min: Confirm stakeholders + approval steps

- 2 min: Ask for decision and set the next dated step (signature, security, procurement)

Signature-on-call checklist (use when the deal's ready)

- Economic buyer present (or has pre-approved)

- Final scope confirmed in writing

- Start date and implementation owner agreed

- Procurement path known (or not required)

- Next step is "sign" not "review"

Follow-up isn't annoying. It's expected.

Proposify's data supports three operational rules:

- 48% of reps never reach the second follow-up -> follow-up becomes a scheduled task sequence, not rep discretion.

- Buyers expect 2-4 follow-ups -> pre-commit the cadence in the proposal review call ("I'll follow up tomorrow and Friday").

- When more than one stakeholder views a proposal, close rate doubles -> for deals above your threshold (pick one: $10k, $25k, $50k), require 2+ stakeholders invited to the review.

What to do in practice:

- Set follow-up expectations before you send.

- Use proposal tracking to see who viewed and who didn't.

- Multi-thread immediately if only one person engaged.

Speed to decision: cycle time is the silent close-rate killer

The latest published Outreach dataset (2026) has the most actionable stat in modern sales ops: deals closed within 50 days show 47% win rate. After 50 days, win rate drops to ~20% or lower. Time's a qualification factor. Treat it like one.

Longer cycles create more chances for priorities to change, champions to leave, budgets to shift, and procurement to slow-roll you. Deals don't "mature." They rot, slowly, while your forecast keeps pretending they're fine and your reps keep "checking in" because nobody wants to be the person who closes a deal-likely-to-close.

How to shorten cycle time without discounting

Discounting's the lazy lever. These work better:

- Trade concessions for speed: "If we can get this signed by Friday, I can prioritize implementation next week."

- Pre-wire procurement early: ask for the process the moment the buyer says "this looks good," not after the proposal.

- Send the security pack before they ask: SOC2, DPA, pen test summary, FAQ, whatever your buyers always request.

- Use a decision date: "If we're not deciding by March 18, we should pause and revisit next quarter."

- Force multi-threading: one-thread deals stretch; buying-group deals close.

Deal aging rules (copy/paste policy)

Pick your thresholds and enforce them.

- No dated next step in 7 days -> close-lost (no decision) or recycle to nurture.

- Proposal sent + no review booked in 7 days -> re-qualify decision process and stakeholders; don't "follow up forever."

- Deal age >50 days -> require MAP + economic buyer meeting to keep it open.

- Stage age limit: if a deal sits in a stage longer than your median x 1.5, it triggers manager review.

Red flags by stage age (what "stalled" looks like)

- Discovery stage stalled: you don't have measurable pain or a real owner.

- Post-demo stalled: you didn't map stakeholders; the buyer's "socializing" without you.

- Proposal stage stalled: you sent it as an attachment, not a meeting.

- Procurement stalled: you entered procurement without an internal champion and a decision date.

Mutual Action Plans (MAPs): the highest-impact late-stage change

MAPs are the closest thing to a cheat code for complex deals because they turn vague momentum into visible commitments.

Outreach's MAP research (latest published, 2026) shows deals with a mutual action plan have a 26% higher win rate than deals without one. Only 45% of sellers use MAPs consistently (43% sometimes, 12% never), so doing this well is an immediate edge.

Buying complexity is why MAPs work:

- Buying groups run 6-10 stakeholders

- Each person consults 4-5 sources

- 77% say B2B buying's too complex

- 95% pivot when new insights show up

Your job isn't just selling. It's buyer enablement: making the path to yes easier than the path to delay.

How to introduce a MAP without sounding corporate

Say this:

- "This is a shared plan so your team isn't doing extra work. I'll draft it, you tell me what's wrong, and we'll run it together."

Then make stage names buyer-friendly. Don't write "Stage 4: Negotiation." Write "Contract review" or "Security sign-off."

Copy/paste MAP template (clean format)

Deal overview

| Field | Example |

|---|---|

| Objective | Reduce onboarding time 30% |

| Success metrics | Time-to-value, adoption |

| Target decision date | 2026-03-24 |

| Buyer stakeholders | Ops Director, Finance, Security |

| Seller team | AE + SE |

Milestones

| Milestone | Date | Buyer owner | Seller owner | Deliverables | Status |

|---|---|---|---|---|---|

| Fit validation | 2026-03-05 | Ops Director | AE/SE | Demo, requirements | In progress |

| Business case | 2026-03-12 | Finance | AE | ROI model, pricing | Not started |

| Security & legal | 2026-03-19 | Security lead | SE | SOC2, DPA, answers | Not started |

| Final decision | 2026-03-24 | Economic buyer | AE | Final proposal | Not started |

| Kickoff | 2026-04-01 | Project owner | CS | Kickoff agenda | Not started |

Two rules that make MAPs work:

- Revisit it every meeting (start and end).

- Assign buyer owners (if it's all seller-owned, it's not mutual).

Templates you can copy today (recap, follow-up, pushaway, breakup)

Send a recap within 24 hours. It's not politeness. It's deal control, and it's a practical answer to how to improve close rates without adding more meetings.

Template usage rules (so these get replies)

- Subject line: short + specific (no "checking in").

- One email = one ask.

- Offer two time options whenever you want a meeting.

- Restate the decision date (or ask for it).

- Never end with "Thoughts?" It invites silence.

24-hour recap (post-discovery/demo)

Subject: Recap + next steps for [Company]

Thanks for today. Here's what I heard:

- Goal: [business outcome]

- Current pain: [cost of status quo]

- Success looks like: [metric]

- Decision process: [steps + people]

- Target decision date: [date]

Next step: [meeting name] on [date/time]. I'll bring [deliverable]. You'll bring [stakeholder/info].

Attach: MAP draft (if multi-stakeholder) + security pack link (if relevant). Don't attach: a proposal before the review's booked.

Proposal review invite (calendar-first)

Subject: Proposal for [Company] - review live

I can send the proposal today. Quick ask: let's book 20 minutes to walk through it together so nothing gets misread.

Does [two time options] work? If not, send a time that's better and I'll lock it.

"Where do we stand?" (pushaway structure)

Subject: Quick check-in on [Project]

I haven't heard back, so I'm assuming one of these is true:

- Timing shifted

- You solved this another way

- It's still a priority, but you got pulled into other fires

Which is it? If it's (3), what's a realistic date to pick this back up?

Breakup / close-the-loop

Subject: Closing the loop?

I'm going to close this out on my side so I'm not spamming you.

If you want to restart later, reply with "restart" and I'll send a couple times. If you've gone a different direction, a one-line "not moving forward" helps.

Compounding system: win/loss interviews (not CRM guesswork)

If you want close-rate improvement that compounds, stop guessing and start interviewing buyers. Your CRM's a log of rep activity. It's not a reliable record of buyer truth.

Real talk: if your team can't name the top 2 reasons you lose (and the top reason deals go to no decision) without staring at a dashboard, you're flying blind.

Interview question set (steal this)

Keep it 20-30 minutes. Ask the same questions every time.

For wins

- "What was the moment you decided we were the right choice?"

- "What almost derailed the deal?"

- "What content or proof mattered most (security, ROI, references, demo)?"

- "Who had the strongest objections internally, and why?"

For losses / no-decision 5) "What did you choose instead (competitor, build, do nothing)?" 6) "What was missing or unclear in our process?" 7) "What risk felt biggest (implementation, security, career risk, budget)?" 8) "What would we need to change to be shortlisted next time?"

For both 9) "What were your top 3 decision criteria?" 10) "Who else influenced the decision that we didn't speak with?"

Do this / Don't do this (so interviews produce action)

Do this:

- Have Sales Ops/CS/Marketing run the interview (not the rep).

- Tag each interview with one primary reason and one secondary reason.

- Separate "lost" from "no decision." No decision's its own disease.

Don't do this:

- Turn interviews into a debate about pricing.

- Collect insights and do nothing with them.

- Change five things at once and call it "enablement."

How to synthesize interviews into one quarterly change

This is the part most teams skip, and it's why they stay stuck.

- Run 10 interviews (mix of wins, losses, no-decision).

- Create a simple tally:

- Top 3 decision criteria

- Top 3 deal-killers

- Top 3 "proof assets" buyers asked for

- Pick one quarterly change that maps to the biggest pattern:

- If security stalls dominate -> build a security pack + pre-send it at stage X.

- If "no decision" dominates -> enforce MAP + next-step policy.

- If "unclear ROI" dominates -> standardize an ROI model in discovery.

- If competitive displacement dominates -> update battlecards + run a competitive demo path.

Then measure it next quarter using the same scorecard from the diagnostic. One change per quarter is how you compound instead of thrash.

Close Rate Operating System (weekly meeting agenda + metrics)

Most teams talk about pipeline volume. High-performing teams run a weekly cadence on conversion and control because that's how you improve sales close rates without relying on hero reps.

Run this 25-minute meeting every week:

- 5 min - Scorecard review: decision win rate, no-decision rate, proposal purgatory %, median cycle time

- 5 min - Stage control: % opps with dated next step; % proposals with review booked

- 10 min - Deal aging exceptions: any deal >50 days or stage age >1.5x median gets a decision: MAP + EB meeting, or recycle/close

- 5 min - One fix: pick one micro-change for the week (script, stage exit criteria, asset)

This is boring.

It also works.

FAQ

What's the difference between close rate and win rate?

Close rate's typically won deals divided by total leads, while win rate's won divided by (won + lost) at the decision stage. If you want a sales-only metric, use win rate and review it weekly with stage conversion and no-decision rate.

What is a good B2B win rate in 2026?

For many B2B teams, 20-30% decision win rate is healthy. SMB often lands 30-40%, while enterprise is commonly 20-25% because buying groups and procurement add friction and extend cycle time.

How do I stop getting ghosted after sending a proposal?

Book a 20-minute review call before you send the proposal, then run a tight agenda and pre-commit to 2-4 follow-ups. For larger deals, invite 2+ stakeholders to the review because multi-view proposals close at roughly double the rate.

How can better contact data help teams close more deals?

Better contact data reduces "unreachable stakeholder" stalls and makes early multi-threading easier, which lowers no-decision outcomes. Prospeo gives 98% verified emails, 125M+ verified mobile numbers, and a 7-day refresh cycle, so reps reach decision-makers faster and keep pipeline cleaner.

Summary: the stage-by-stage way to increase close rate

To increase close rate without "trying harder," fix the denominator, run a 30-minute stage diagnostic, and then enforce two rules: every deal has a dated next step, and proposals are reviewed live (not emailed into the void). Add MAPs for multi-stakeholder deals and treat cycle time as a qualification factor because stalled deals don't magically come back.

Half the 'proposal silence' problem is that you never had the economic buyer's real contact info. Prospeo's 7-day data refresh and 30% mobile pickup rate mean your multi-threading actually connects - to the right people, with current data, not 6-week-old records.

Multi-thread with verified direct dials, not LinkedIn prayers.