Wiza Pricing in 2026: What Every Plan Actually Costs You

You're on the Wiza pricing page, toggling between "Monthly" and "Annual," and the numbers change so dramatically you wonder if you're looking at two different products. On one side: credit-capped plans at $49-$199/month. On the other: "Unlimited" plans at $83-$166/month. Neither tells you the full story - because the real cost of using Wiza includes a subscription to another platform they don't mention on the pricing page.

The pricing isn't bad. It's confusing. And confusion costs money when you pick the wrong plan.

Over 50,000 companies use Wiza (the company's been around since 2019, with a ~31-person team split between Newark, DE and Toronto), and I'd bet a significant chunk of them are overpaying because the annual vs. monthly toggle creates two completely different pricing structures with different credit systems, different feature sets, and different export caps.

What You Need to Know About Wiza's Plans (Quick Version)

Three things before you dig in:

First, annual plans say "unlimited" but cap you at 30,000 exports per year. Monthly plans give you fixed credits that don't roll over. Pick wrong and you're either overpaying or hitting walls.

Second, the pricing page doesn't include LinkedIn Sales Navigator ($79-$149/mo per user), which you need for Wiza's core prospecting workflow. Your real minimum cost is $162-$232/mo, not $83/mo.

Here's the quick-scan version:

| Plan | Annual Price | What You Get |

|---|---|---|

| Free | $0/mo | 25 credits on signup, 20 emails + 5 phones/mo |

| $83/mo ($990/yr) | Unlimited emails, $0.35/phone, 30K exports/yr | |

| Email + Phone | $166/mo ($1,990/yr) | Unlimited emails + phones, 30K exports/yr |

| Team | $449/mo ($5,388/yr) | 3+ users, 30K exports/mo, API, CSM |

Now let's break down what each plan actually costs in practice.

Full Plan-by-Plan Breakdown

Free Plan

No credit card, 25 credits on signup, 20 emails and 5 phone numbers per month. It's enough to test whether Wiza's data quality works for your ICP - not enough to run any real prospecting. Think of it as a trial that never expires but never scales.

Monthly Plans (Starter, Email, Email + Phone)

This is where most people start, and where the per-contact math gets expensive fast.

| Monthly Plan | Price | Emails | Phones | Overage (Email) | Overage (Phone) |

|---|---|---|---|---|---|

| Starter | $49/mo | 100 | 100 | $0.15 | $0.35 |

| $99/mo | 500 | Pay-per-use | $0.15 | $0.35 | |

| Email + Phone | $199/mo | 500 | 500 | $0.15 | $0.35 |

Let's do the per-contact math on the Email plan: 500 emails for $99 = $0.20 per email. On the Email + Phone plan: 1,000 total contacts (500 email + 500 phone) for $199 = $0.20 per contact if you use both equally. Hit your cap and start paying overages? That jumps to $0.35 for phones and $0.15 for extra emails.

The Starter plan at $49/mo gives you 100 of each - fine for a founder doing light prospecting, but at $0.49 per email (or $0.245 per contact if you max out both), it's the most expensive per-unit option by far.

Annual Plans (Email, Email + Phone)

Switch to annual billing and every plan suddenly says "Unlimited." Here's what that actually means:

| Annual Plan | Monthly Equiv. | Annual Total | Emails | Phones | Export Cap |

|---|---|---|---|---|---|

| $83/mo | $990/yr | Unlimited | $0.35 each | 30,000/yr | |

| Email + Phone | $166/mo | $1,990/yr | Unlimited | Unlimited | 30,000/yr |

Both include AI Research, CRM integrations (Salesforce, HubSpot), and the Wiza prospecting platform. The savings over monthly are real - roughly 17% less per month.

But "unlimited" has a ceiling: 30,000 exports per year. That's about 2,500 per month on average. For a solo SDR running heavy outbound, that's manageable. For a team of 5 sharing individual annual plans? You're looking at 500 exports per person per month. That's not unlimited in any meaningful sense.

Team Plan

Starting at $449/mo billed annually ($5,388/yr) for 3+ users. This is where Wiza unlocks features that should honestly be in every plan: CSV import, API access, a dedicated success manager, and - critically - 30,000 exports per month, not per year.

The help center previously listed this at $399/mo, so there's been a price bump. The Team plan is the only tier where "unlimited" actually feels unlimited for a small sales team.

Wiza's real cost is $162-$232/mo once you add Sales Navigator - and credits still expire unused. Prospeo's built-in database of 300M+ profiles with 30+ filters eliminates the LinkedIn dependency entirely. At ~$0.01/email with 98% accuracy, you pay 20x less per contact.

Stop subsidizing LinkedIn just to prospect. Get 100 free credits now.

What the Pricing Page Doesn't Tell You

LinkedIn Sales Navigator Is a Required Add-On

Here's the number that changes the entire calculation: LinkedIn Sales Navigator costs $79-$149/mo per user. Wiza's core workflow - extracting and enriching contacts from Sales Navigator searches - doesn't work without it.

So your real minimum cost on the annual Email plan isn't $83/mo. It's $162-$232/mo per user.

For a 3-person SDR team on the Email plan, that's $486-$696/mo just for Wiza + Sales Navigator - before you've paid for a sequencing tool, before you've sent a single email. Add the Email + Phone annual plan and you're at $735-$945/mo for three reps.

In our experience evaluating these tools, the Sales Navigator dependency is the single biggest hidden cost. It effectively doubles the sticker price for every user, and the pricing page says nothing about it.

Credits Don't Roll Over

This is confirmed in Wiza's help center. Unused credits expire at the end of each billing cycle. No exceptions, no banking.

The impact is real for inconsistent prospectors. One reviewer put it plainly: "Credits can disappear quickly if you only prospect occasionally." If you're a founder who prospects heavily for two weeks then goes heads-down on product for a month, you're paying full price for credits you'll never use. Your effective per-contact cost skyrockets.

The "Unlimited" Cap and Other Fine Print

The 30,000 exports/year cap on individual annual plans deserves more attention than it gets.

That's a fair-use limit, not unlimited. For context: if you're building targeted lists of 200-300 contacts per campaign and running 2-3 campaigns per month, you'll burn through that cap by Q3.

Other fine print worth knowing:

- Auto-renewal on annual plans. You need to give 30 days' notice before your renewal date to cancel. Multiple users report friction with this process - one described it as "automatic renewals and you won't hear from them unless they want more money."

- CSV import and API access are locked to the Team plan ($449/mo). If you need to enrich existing lists or build automated workflows, individual plans won't cut it. If you're comparing API-heavy options, see Extruct AI vs ZoomInfo.

- No downgrade path mid-cycle. You're locked into your plan tier for the billing period.

Annual vs. Monthly - Which Should You Choose?

The break-even math is straightforward. On the Email plan: monthly costs $99/mo ($1,188/yr) vs. annual at $83/mo ($990/yr). You save $198/year by going annual - about 17%. On Email + Phone: monthly is $199/mo ($2,388/yr) vs. annual at $166/mo ($1,990/yr). That's $398/year in savings.

But annual only makes sense if you'll use it consistently. As one founder noted in his review: "At $83/month it's a little pricey unless you're using consistently. That said it's more affordable than its closest competitors."

Go annual if: You're an SDR or recruiter prospecting daily, you've already committed to Sales Navigator, and you'll realistically use 2,000+ exports per month. Tie it back to your account-based marketing goals so volume matches your targets.

Stay monthly if: You're testing Wiza against other tools, your prospecting is seasonal or project-based, or you're a solo founder who prospects in bursts. The flexibility to cancel is worth the premium.

Skip both if: You're an agency managing multiple client campaigns. The individual export caps will strangle you. Either negotiate a Team plan or look at tools with more generous volume pricing.

How to Get a Discount on Wiza

You've got a few levers:

- NachoNacho marketplace: 20% cashback on all plans, forever. That's up to $2,400/year in savings. Catch: new accounts only - you can't retroactively apply it to an existing subscription.

- Freelance Stack: 20% off any plan. Similar deal, different marketplace.

- Annual billing: Saves ~17% over monthly across all tiers. Easiest discount available.

- Enterprise negotiation: At 10+ seats, push for 15-25% off list price. At 20+ users, per-seat costs typically drop to ~$100/mo. Multi-year commitments can lock in an additional 10-15%. If you're selling through partners, consider structuring channel sales incentive programs to protect margin.

Here's the thing: the NachoNacho cashback stacked with annual billing is the best deal available. On the Email + Phone annual plan ($1,990/yr), 20% cashback saves you ~$398 - bringing your effective cost to about $133/mo.

How Wiza's Cost Compares to Alternatives

We've run the per-contact math across five tools at the 500-email/month level, and the gap is wider than most people expect.

| Tool | Entry Price | Per-Email Cost (500/mo) | Per-Phone Cost | Database Size | Free Tier | Best For | Contract Required |

|---|---|---|---|---|---|---|---|

| Wiza | $83/mo (annual) | ~$0.17 | $0.35 | 850M+ | ✅ (20 emails) | LinkedIn-heavy prospecting | Annual for unlimited plans |

| Apollo | $0 (free tier) | ~$0.10-0.20 | Included in credits | 270M+ | ✅ (100 credits) | All-in-one sales platform | No |

| Lusha | $29.90/mo (annual) | ~$0.12 | ~$1.20 (10 credits) | 100M+ | ✅ (70 credits) | Low-volume, email-only teams | No |

| RocketReach | $33/mo (annual) | ~$0.33 | Included (Pro+) | 700M+ | ✅ (5 lookups) | Broad non-LinkedIn coverage | No |

Prospeo - Best Value Per Contact

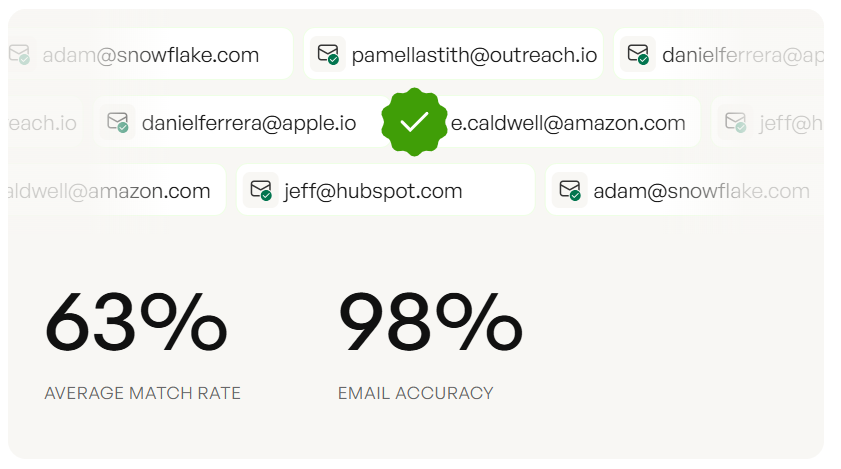

At ~$0.01 per email, Prospeo's per-contact cost is an order of magnitude cheaper than Wiza. The platform covers 300M+ professional profiles with 98% email accuracy and 125M+ verified mobile numbers. Data refreshes every 7 days - compared to the industry average of 6 weeks.

The free tier gives you 75 emails and 100 Chrome extension credits per month. No credit card, no contracts, no third-party subscription required. That last point matters: unlike Wiza, you don't need to stack a $79-$149/mo Sales Navigator subscription on top. Search by 30+ filters, verify, and export from one platform. I've seen teams cut their total prospecting spend by 60-70% just by eliminating that dependency.

Apollo.io - Best All-in-One Platform

Apollo is a prospecting database and a sales engagement platform built into the same product - and that's its biggest advantage over Wiza. Where Wiza is export-only (you still need a separate tool to actually reach your prospects), Apollo includes email sequences, a dialer, A/B testing, and workflow automation. If you're deciding between Apollo-adjacent options, see DitLead vs Apollo.io.

Free tier with 100 credits/month, Basic at $49/mo, Professional at $79-99/mo, and Organization at $119-149/mo (minimum 3 users). The contact database covers 270M+ profiles. If you're already running Outreach or Salesloft, Apollo's built-in engagement features are redundant. But if you want everything in one place and you're not locked into a LinkedIn-first workflow, Apollo delivers more per dollar than Wiza.

Lusha - Simplest for Low-Volume Teams

Skip this if you need phone numbers. Lusha's credit system is dead simple - 1 credit per email, 10 credits per phone - but that simplicity turns brutal for phone-heavy prospectors. On the Pro plan at $29.90/mo (annual) for 250 credits, you get just 25 phone numbers. At $1.20 per phone reveal, the math gets ugly fast.

For email-only work, though, Lusha is competitive: 250 emails for $29.90 = $0.12/email. Free plan gives you 70 credits/month. Premium runs $69.90/mo for 600 credits.

One meaningful advantage over Wiza: Lusha rolls over unused credits on monthly plans (up to 2x your limit). For inconsistent prospectors who hate watching credits evaporate, that's a real differentiator.

RocketReach - Largest Contact Database Beyond LinkedIn

RocketReach's 700M+ profiles make it the biggest contact database on this list - nearly double Apollo's and more than double Lusha's. Essentials starts at ~$33/mo (annual) for email-only lookups, Pro at ~$75/mo adds phone numbers, and Ultimate at ~$175/mo includes API access and intent data.

The gotcha: export quotas are often lower than lookup quotas, which adds a layer of complexity most users don't expect. You can find 500 contacts but only export 300. Strong choice for data enrichment workflows where you need broad coverage across industries and geographies outside the LinkedIn ecosystem.

If you're evaluating similar tools, you may also want to compare this pricing model to other list-building and enrichment providers like FindThatLead Pricing.

Is Wiza Worth the Price?

Wiza carries a 4.5/5 on G2 across 1,070+ reviews, a 4.3/5 on Capterra with 24 reviews, and a 4.8/5 on the Chrome Web Store. Those are solid numbers. Users consistently praise the LinkedIn integration speed and email accuracy.

Here's my honest take: Wiza is the best tool for LinkedIn-specific prospecting. But most teams don't actually need a LinkedIn-specific prospecting tool. The Sales Navigator dependency means you're paying a premium for a workflow that only makes sense if LinkedIn is your primary source of leads. If you prospect across multiple channels - company websites, industry directories, existing CRM data - you're paying for a LinkedIn-first architecture you won't fully use. If you're comparing other niche providers, you might also look at Boundo pros and cons or GoAgentic pros and cons.

Wiza's sweet spot is mid-market SaaS companies with 11-50 employees, primarily in North America, where the sales team lives inside LinkedIn Sales Navigator all day. If that's you, the cost makes sense.

But the complaints are consistent and worth taking seriously.

No credit rollover punishes inconsistent users. If you're not prospecting every week, your per-contact cost inflates beyond what the plan math suggests.

Annual lock-in with auto-renewal catches people off guard. The 30-day cancellation notice requirement means you can't just let your subscription lapse.

Post-sale support drops off. One AE gave Wiza 2/5 stars: "Not enough emails and phones, so many times I've seen there's no data. Also takes forever to show you the information." If support and coaching matter to your team, consider pairing any tool with a clear process for sales call review software and enablement.

Wiza IS worth it if: You're a heavy LinkedIn prospector already paying for Sales Navigator, you need real-time verification on LinkedIn-sourced leads, and you'll consistently use 2,000+ exports per month.

Wiza ISN'T worth it if: You don't use Sales Navigator, your prospecting is inconsistent, you need API access (locked to the $449/mo Team plan), or you're price-sensitive on a per-contact basis. If calling is a big part of your outbound motion, make sure your stack (and compliance) is dialed in with a predictive dialer strategy.

Wiza caps "unlimited" plans at 30K exports/year and locks API access behind $449/mo. Prospeo gives you API enrichment with a 92% match rate, 50+ data points per contact, and a 7-day data refresh cycle - on every plan. No export ceilings, no expired credits.

Uncapped data, real accuracy, zero LinkedIn tax. See the difference yourself.

FAQ

Does Wiza have a free plan?

Yes - 20 emails and 5 phone numbers per month, no credit card required, plus 25 one-time credits on signup. It's enough to test data quality on a handful of prospects but not enough for real outbound volume. You'll know within a day whether the data fits your ICP.

Do Wiza credits roll over to the next month?

No. Unused credits expire at the end of each billing cycle. If your prospecting volume fluctuates, your effective per-contact cost will be significantly higher than the plan math suggests. Lusha rolls over credits (up to 2x your limit), and Prospeo's free tier resets monthly with no commitment - both handle inconsistent usage better.

Does Wiza require LinkedIn Sales Navigator?

For its core prospecting features, yes. Sales Navigator runs $79-$149/mo per user on top of your Wiza subscription, making the real minimum cost $162-$232/mo per user. Tools like Prospeo and Apollo don't require any third-party subscription to access their full databases.

Can you cancel Wiza anytime?

Monthly plans cancel anytime. Annual plans auto-renew and require 30-day notice before the renewal date. Miss that window and you're locked in for another year. Multiple users report difficulty with this process, so mark your calendar well in advance.

What's a cheaper alternative to Wiza with similar email accuracy?

Prospeo delivers 98% email accuracy at ~$0.01/email - roughly 17x cheaper per contact than Wiza's annual Email plan. The free tier includes 75 emails per month with no credit card or Sales Navigator subscription required, making total cost of ownership significantly lower for most teams.