B2B Data UK (2026): What's Legal, Accurate, and Worth Buying

If you're searching for b2b data uk, the real problem isn't finding a list - it's finding data you can actually use without wrecking deliverability or stepping into PECR/UK GDPR trouble. I've watched teams miss CTPS screening on "perfectly good" dial lists and rack up complaints in a week. The fix's boring and repeatable: pick the right sourcing route, then run a tight acceptance test before you scale.

Look, most UK teams don't have a "data problem." They've got a workflow problem.

What you need (quick version)

Use this as your "don't overthink it" checklist - because most UK teams overthink tools and underthink process.

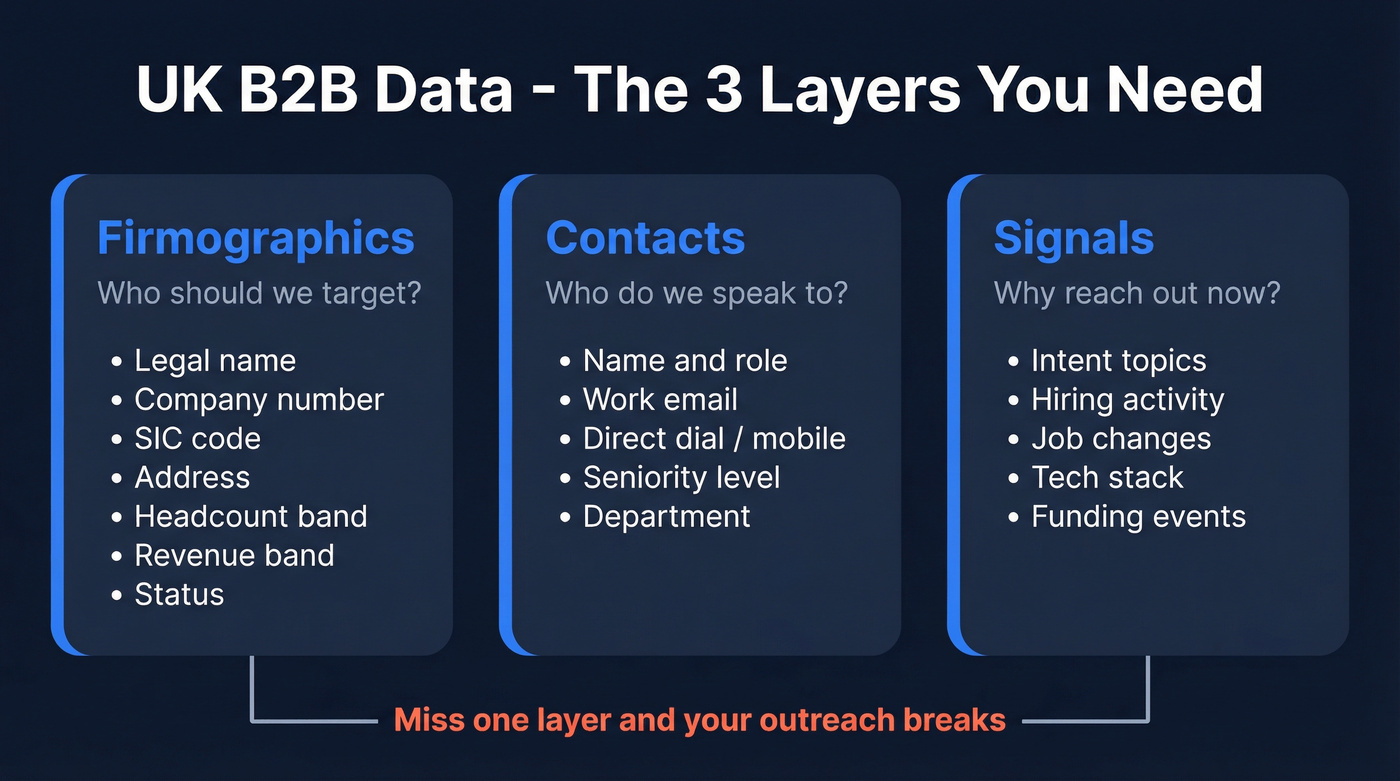

UK B2B data = firmographics + contacts + signals. Miss one layer and you either target the wrong companies (firmographics), fail to reach humans (contacts), or waste cycles on accounts that aren't buying (signals).

Quick checklist (what to buy or build)

- Firmographics (company-level): legal name, company number, address, SIC, status, incorporation date, headcount band, revenue band, locations.

- Contacts (person-level): name, role, work email, phone/mobile, seniority, department.

- Signals (timing/fit): intent topics, hiring, job changes, tech stack, web activity.

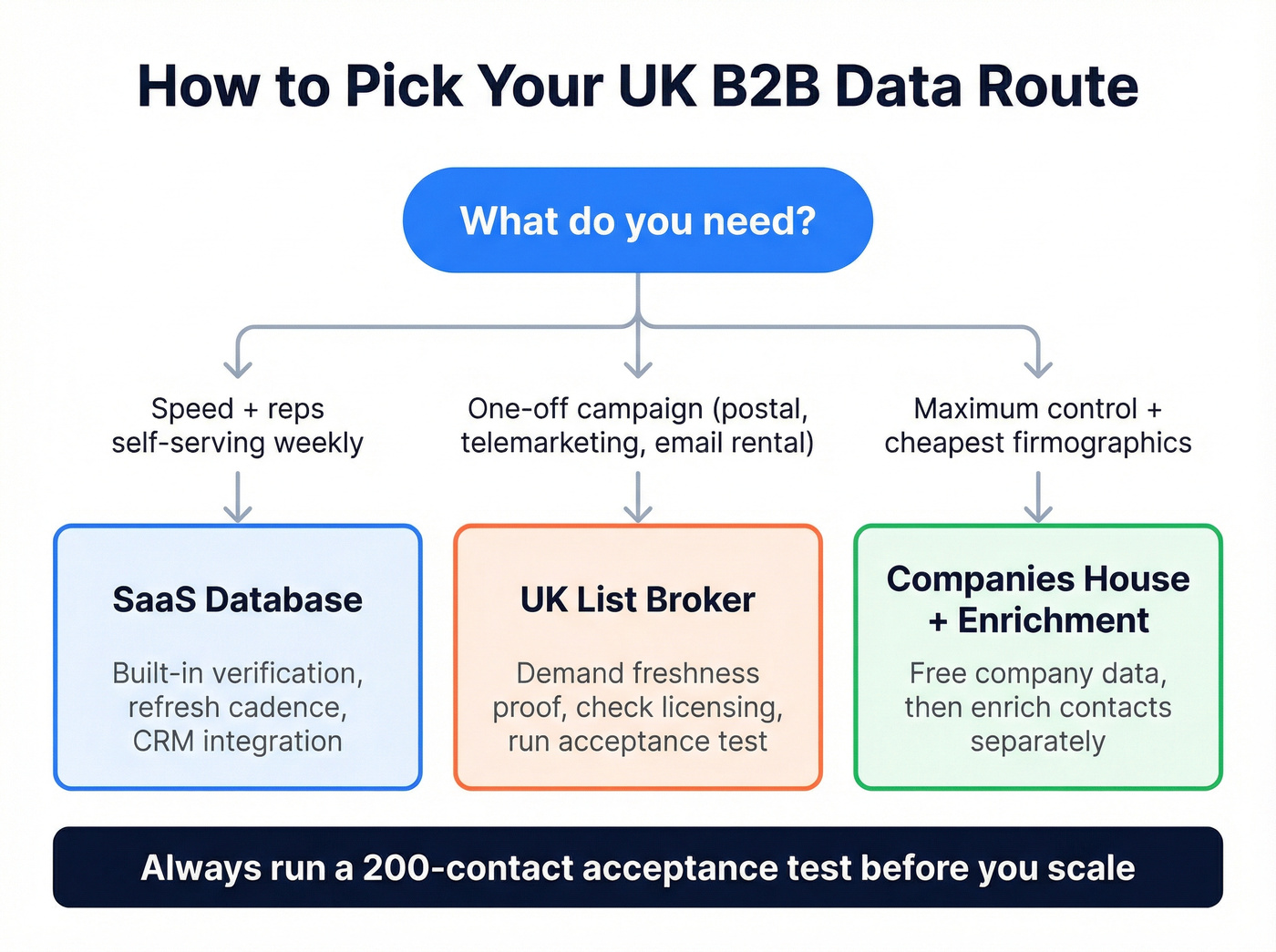

Mini decision tree (pick your route)

- If you need speed + reps self-serving lists every week -> choose a SaaS database.

- If you need a one-off campaign (postal/telemarketing/email rental) -> use a UK list broker, but demand freshness proof and licensing clarity.

- If you need maximum control + cheapest firmographics -> start with Companies House, then enrich contacts separately.

Three "do this if you're X" examples:

- UK SDR team of 3 doing email-first outbound: buy a SaaS database with built-in verification and a refresh cadence you can audit; run a 200-contact acceptance test before you touch your main domain.

- Call-heavy team (mobiles matter): prioritize phone-verified mobiles and automate TPS + CTPS screening; connect rate beats "number coverage" every time.

- Founder-led / data-ops-light: don't DIY a pipeline on day one. Start with a self-serve tool, prove replies and meetings, then decide if Companies House + enrichment is worth the ops load.

What "UK B2B data" actually means (and what it doesn't)

People say "UK business data" like it's one thing you buy once and you're done. It's three layers that often come from different sources - and get governed by different rules.

1) Firmographics (company data) is the "who should we target?" layer.

Examples: SIC 2007 codes, registered address, company status, incorporation date, filing activity, size proxies.

2) Contacts (business contact data) is the "who do we speak to?" layer.

Examples: "Head of Procurement," "IT Director," named employees, work emails, direct dials/mobiles.

3) Signals (intent/technographics/events) is the "why now?" layer.

Examples: intent topics, job postings, headcount growth, funding, tech installed, leadership changes.

Here's the line that saves you trouble: Companies House is excellent for firmographics, and useless for permission. It's a public register that helps you build a clean company universe and validate identity. It doesn't give you an opted-in marketing list for named contacts.

Where UK teams get burned:

- They pull Companies House data, then treat it like a marketing list.

- They buy a broker "B2B email list," then assume it's safe because it's "business."

Both fail in production. Treat data sourcing and outreach compliance as separate workstreams that meet at verification + suppression.

UK compliance basics for UK outreach (PECR + UK GDPR)

UK outreach compliance is two frameworks working together:

- PECR governs channels (email/text/calls) and opt-out registers like TPS/CTPS.

- UK GDPR governs personal data processing (named employees, identifiable work emails, phone numbers tied to a person).

The ICO's B2B marketing guidance is the best starting point. Bookmark the ICO's "business-to-business marketing" guidance.

What counts as "direct marketing" (the part people forget)

Direct marketing is broader than "sales email." It includes promoting your aims and ideals as well as products/services. Operationally, treat any outbound message that tries to influence a decision as direct marketing - because that's how it'll be viewed when a complaint lands.

Also: PECR covers automated calls and faxes. Most B2B teams never touch them, but the rules exist and they sit under the same "don't be sloppy with consent/objections" umbrella.

The decision tree you actually need

Step 1: What channel are you using?

- Email / text (electronic mail)

- Live calls

- Post

- Automated calls / faxes (rare, but covered)

Step 2: Who's the subscriber type under PECR?

PECR splits "subscribers" into:

- Corporate subscribers: companies, LLPs, Scottish partnerships, some public bodies.

- Individual subscribers: sole traders and certain partnerships (treated like individuals).

That distinction drives most of the "is UK cold email legal?" confusion.

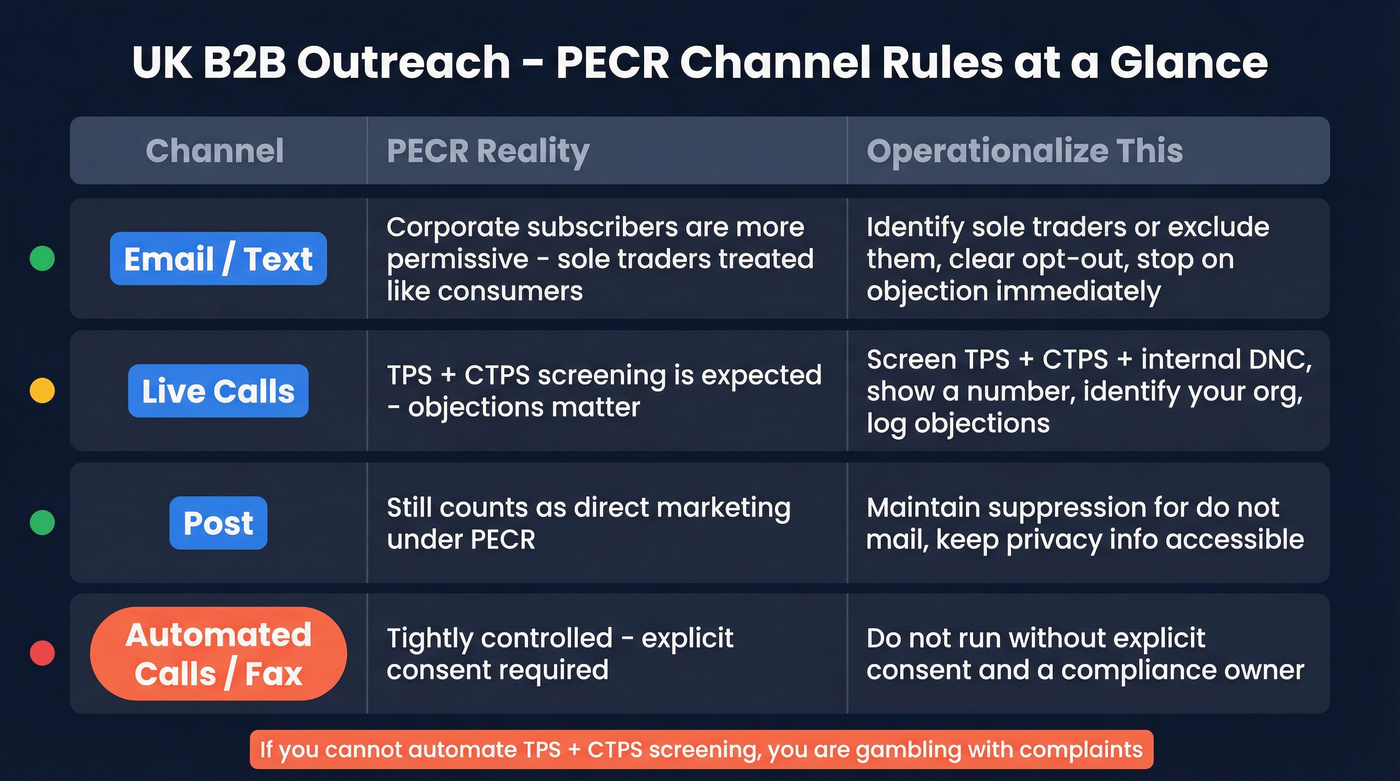

Channel checklist (operational rules you can hand to an SDR manager)

| Channel | PECR reality check | What you must operationalize |

|---|---|---|

| Email / text | Corporate subscribers are more permissive; sole traders are treated like consumers | Identify sole traders or exclude them; include clear opt-out; stop on objection immediately |

| Live calls | TPS + CTPS screening is expected; objections matter | Screen TPS + CTPS + internal DNC; show a number; identify your org; log objections |

| Post | Still direct marketing | Maintain suppression for "do not mail"; don't reuse addresses in ways people won't expect; keep privacy info accessible |

| Automated calls / faxes | Covered by PECR and tightly controlled | Don't run these without explicit consent and a compliance owner |

Email/text under PECR: corporate vs sole trader

Corporate subscribers: B2B cold email exists in the UK because corporate subscriber rules are more permissive. That doesn't mean "spray and pray." It means you still need discipline: relevance, transparency, and opt-out.

Sole traders / individual subscribers: treat them like consumer marketing. If your list includes trades and micro-firms, you can't assume "corporate."

Rule of thumb for sole trader handling (simple and safe):

- If you can't confidently classify the record as corporate, route it to consent-first (content download, event invite, partnership outreach) or exclude it from cold email.

- If you sell into local services (builders, clinics, independent consultants), assume you've got sole traders in the mix and build a separate segment with stricter rules.

Live calls under PECR: TPS + CTPS isn't optional

For live marketing calls:

- Don't call numbers registered with TPS or CTPS unless you've got consent to override.

- Don't call anyone who objected (your internal suppression list's as important as TPS/CTPS).

- Identify your organisation, present a number, and provide contact details if asked.

- Screen against both TPS and CTPS, not just one.

Hot take: if you can't automate TPS + CTPS screening, you're not "doing outbound"--you're gambling with complaints.

UK GDPR: if it's a person, you need a lawful basis + transparency

Even when PECR is permissive, UK GDPR still applies if you process personal data. A named employee is still a person.

You need:

- A lawful basis (legitimate interests is common for prospecting)

- Transparency (privacy info that explains what you're doing)

- A clean objection/opt-out process (and you honor it)

Legitimate interests: use it properly (copy/paste LIA template)

Legitimate interests works when you do it like an adult: write it down, keep it consistent, and apply safeguards. Reference: "legitimate interests: when you can rely on it".

LIA template (bullet version):

- Purpose test: We process B2B contact data to reach relevant roles at relevant companies about a product/service that fits their job function.

- Necessity test: Email/phone outreach is necessary because we can't reach these prospects effectively through public channels alone.

- Balancing test:

- Reasonable expectation: message is role-relevant and business-context.

- Impact: low; we minimize data and frequency.

- Safeguards: clear opt-out, fast suppression, no sensitive data, retention limits, audit trail.

- Outcome: Proceed for corporate subscribers; apply stricter handling/exclusion for sole traders.

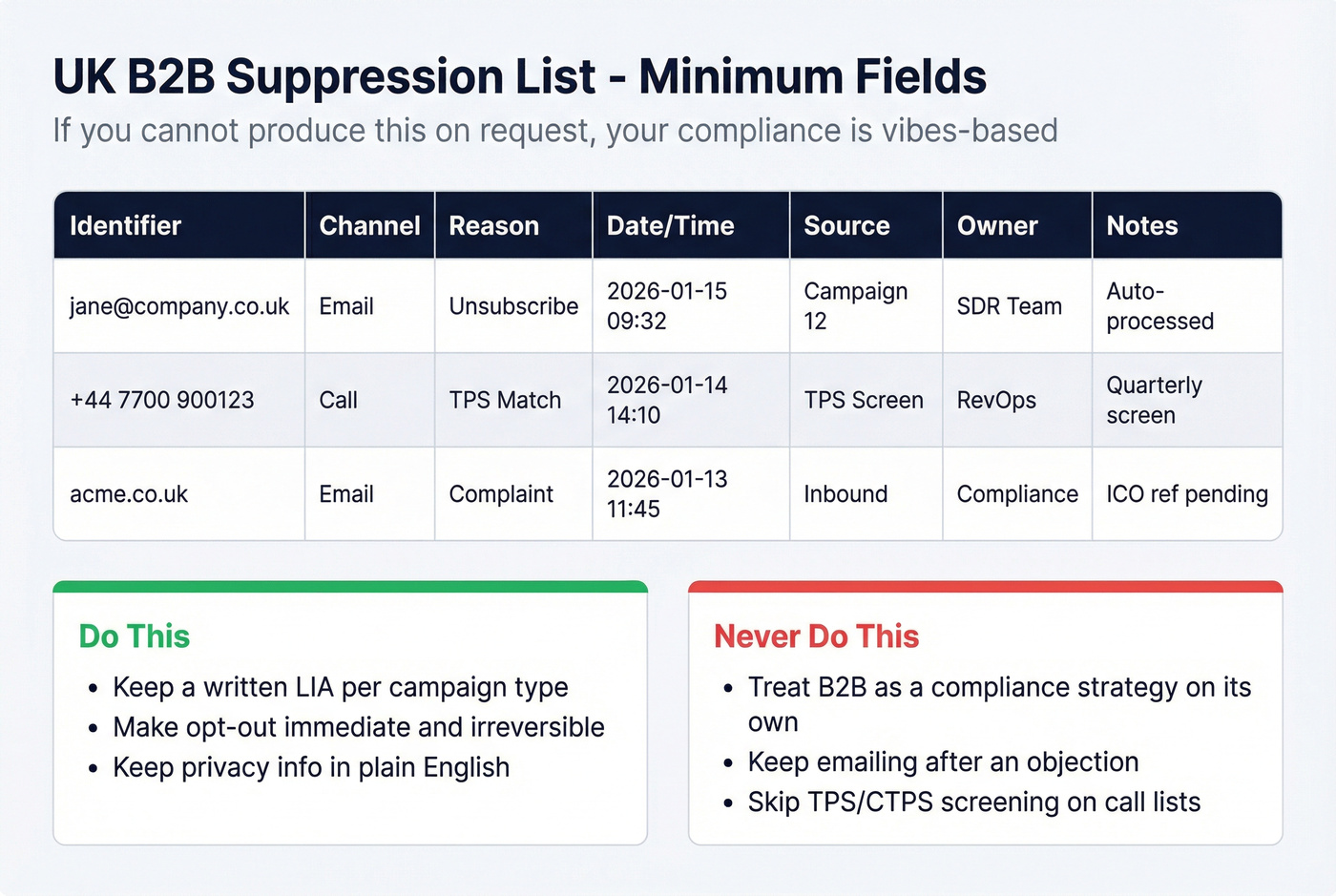

Suppression list: minimum fields (so you can prove you're in control)

If you can't produce this list on request, your compliance posture is vibes-based.

Minimum fields to store:

- Identifier: email, domain, phone

- Channel (email/call/post)

- Reason (unsubscribe, objection, TPS/CTPS match, complaint)

- Date/time

- Source (campaign/tool/import)

- Owner (who processed it)

- Optional but smart: message ID, call recording reference, notes

Do:

- Keep a written LIA and reuse it per campaign type.

- Make opt-out immediate and irreversible in your systems.

- Keep privacy info plain English and easy to find.

Don't:

- Treat "it's B2B" as a compliance strategy.

- Keep emailing after an objection. That's how you earn an ICO complaint trail.

You just read why UK B2B data quality matters more than volume. Prospeo delivers 98% verified email accuracy with a 7-day refresh cycle - not the 6-week lag that wrecks deliverability and triggers ICO complaints. 125M+ verified mobiles with 30% pickup rate, so your call team isn't burning hours on dead numbers before TPS screening even starts.

Stop gambling on stale UK data. Run a 200-contact acceptance test free.

How to buy b2b data uk: SaaS vs brokers vs Companies House

There are three routes. Most teams choose based on sticker price and regret it based on workflow.

Route 1) SaaS databases (subscription tools)

Use this if: you need reps to self-serve lists weekly, enrich inbound leads, and push clean data into CRM/sequencers. Skip this if: you only need a one-time list and you won't reuse the platform.

Hidden costs you'll pay anyway (plan for them):

- CRM hygiene: dedupe rules, field mapping, and ownership logic.

- Export discipline: reps'll export too much unless you set guardrails.

- Deliverability risk: if verification's weak, your domain reputation eats the bill.

Who owns it: usually RevOps (systems + governance) with SDR leadership enforcing usage.

Route 2) UK list brokers / list rental

Use this if: you're running a specific campaign (postal, telemarketing, or a tightly defined segment) and you need someone to package it fast. Skip this if: you care about ongoing freshness, dedupe, and repeatable workflows.

Hidden costs:

- Licensing risk: "rental vs multi-use" terms get messy fast.

- Freshness risk: the list looks big until you measure bounce/connect.

- Compliance overhead: you still need suppression, TPS/CTPS screening, and proof of how objections are handled.

Who owns it: often Marketing Ops (campaign execution) with Legal/RevOps reviewing licensing and suppression.

What UK buyers complain about (practitioner sentiment): broker lists feel overpriced and old, and GDPR-era changes reduced the "magic" of broker data. Translation: don't buy on counts - buy on a test batch and a written refresh cadence.

Route 3) DIY: Companies House + enrichment

Use this if: you want a free, auditable company universe and you've got someone who can handle CSVs/APIs and data hygiene. Skip this if: you need named contacts tomorrow and nobody wants to own data ops.

Hidden costs:

- Ops time: ingestion, keys, updates, and monitoring.

- Data modeling: you'll build a schema whether you admit it or not.

- Contact gap: you still need a contact source and verification.

Who owns it: RevOps / Data (pipeline + governance). If nobody owns it, it dies.

Quick comparison table (route-level, UK-localized)

| Route | Speed to first campaign | Best for | Typical cost (UK reality) |

|---|---|---|---|

| SaaS database | Fast (days) | Always-on outbound + enrichment | ~£40-£150/user/mo SMB tools; ~£10k-£50k+/yr enterprise suites |

| UK broker/rental | Medium (1-3 weeks) | One-off campaigns | ~£500-£10,000+ depending on fields + licence |

| DIY (Companies House) | Slow -> fast (once built) | Control + cheap firmographics | £0 data + £50-£500/mo tooling + ops time |

Marketplace angle: if you need niche datasets (install base, sector-specific lists), DataRade is useful as a directory because it surfaces selection attributes like API availability, refresh cadence, and sample access. Start at DataRade's UK B2B data category.

DIY UK firmographics with Companies House (free) - workflow + constraints

Companies House is the cleanest free foundation for UK firmographics. It's not glamorous. It's dependable. And it gives you a defensible company universe before you spend money on contacts.

Step-by-step workflow (the practical version)

Inputs

- Companies House bulk products (monthly snapshot + accounts + PSC)

- A spreadsheet for small tests; a database (BigQuery/Postgres) for anything serious

- Your ICP rules (SIC, status, size proxy, geography)

Steps

Download the monthly snapshot (CSV ZIP). It's compiled to the end of the previous month and published within 5 working days. This becomes your baseline universe.

Filter to "live" companies and your SIC 2007 codes. SIC is self-reported and messy. It still works as a first-pass filter when you combine it with other signals (filing activity, location, size proxies).

Add accounts cadence for "freshness" signals. Accounts bulk data comes as free ZIPs of electronically filed accounts in XBRL/iXBRL. The cadence matters: Tue-Sat daily files, with Tuesday including the previous Sat/Sun/Mon. About 75% of 2.2M accounts expected each year are filed electronically, which makes this dataset useful for monitoring.

Ops constraint that matters: daily accounts files are only hosted for 60 calendar days. If you're building a monitoring pipeline, mirror them to your own storage.

Pull PSC data when ownership matters. PSC is a snapshot in a single JSON file. For regulated industries, procurement-heavy deals, or risk scoring, PSC is genuinely valuable context.

Use the API for enrichment, not brute-force scraping. The Companies House API limit is 600 requests / 5 minutes per application. Build a queue, cache results, and only call the API when you need deltas.

Create a stable company key. Use company number as your primary key. Names change. Company numbers don't.

A simple schema that works (keep it boring)

If you're building a usable "company universe," store these fields at minimum:

- company_number (primary key)

- company_name

- company_status (active/dissolved/etc.)

- incorporation_date

- sic_codes (array)

- registered_address (structured)

- accounts_last_made_up_to + accounts_next_due

- confirmation_statement_last_made_up_to + next_due

- has_charges (useful risk proxy in some segments)

- psc_present (boolean) + PSC summary fields if needed

- ingested_at + source_file_date (so you can audit freshness)

This is enough to: (1) build ICP segments, (2) dedupe accounts, (3) track "alive and filing" signals, and (4) join to enrichment/contact data later.

Constraints (don't skip these)

- Registered office address isn't always the operating location.

- SIC can be wrong or too broad.

- None of this gives you permissioned marketing emails.

- DIY shifts work from "budget" to "ops." Someone must own updates, dedupe, and governance.

Official overview: Companies House data products.

Build a UK list that won't bounce (practical workflow)

Most UK prospecting data problems show up as deliverability problems first. You won't notice stale titles until later. You will notice a 12% bounce rate immediately.

This workflow is what we use when we want something repeatable and measurable, because it forces you to start with a clean company universe, pull only the roles you can actually sell to, and then prove the data's safe before you let anyone export 10,000 records into a sequencer.

Inputs -> steps -> outputs (recipe)

Inputs

- Firmographic universe (Companies House or your CRM account list)

- ICP filters (SIC/industry, geo, size proxy, tech, hiring)

- A contact enrichment source (database or enrichment API)

- Suppression lists (unsubscribe, objections, TPS/CTPS for calls)

Steps

Start with firmographics -> build your target account list. Live status, SIC, region, size proxy, and "must exclude" categories. Keep it strict.

Enrich contacts -> map roles to your buying committee. Don't pull "CEO only." In UK mid-market, finance + ops + IT often decide together.

Verify -> only send to verified emails. Catch-all domains are where teams lie to themselves. Treat catch-all as "holdout" until it proves safe.

Suppress -> remove objections/unsubscribes and apply channel rules. Email suppression is table stakes. For calling, screen TPS + CTPS and your internal "do not call" list.

Launch small -> measure bounce rate + reply rate + connect rate. There's no UK-wide accuracy benchmark you can outsource. Your numbers on your ICP are the truth.

The tight tool pick (built for deliverability)

We've tested this exact setup on a UK SaaS team that was convinced their copy was the issue; the real issue was data quality, and once they stopped sending to catch-all and unverified addresses, replies went up without changing a single line of messaging.

If you're building a repeatable process, these are the two pages you'll actually use:

30-minute UK B2B data quality acceptance test (before you scale)

There's no reproducible UK-wide benchmark you can trust end-to-end. Your test is the benchmark.

I've run bake-offs where the "best" dataset on paper lost because it created duplicates, inflated counts with generic inboxes, and tanked deliverability in week one. You don't need a 3-month evaluation. You need 30 minutes and a small batch.

The acceptance test (do this every time)

Prep (5 minutes)

- Pick 100-300 contacts from your exact ICP (not random global data).

- Mix enterprise + mid-market, London + regions, and a few industries.

- Define success metrics before you pull the data.

Quality gates (20 minutes)

- Bounce rate gate (email):

- Target: <3% hard bounce on first send

- Yellow: 3-5% (tighten verification + remove catch-all)

- Red: >5% (don't scale; change source)

- Duplication gate (CRM hygiene):

- Target: <2% duplicates created in CRM

- Red: >5% duplicates (your matching rules or vendor keys are weak)

- Freshness gate (titles/tenure):

- Require a stated refresh cadence. If a vendor won't state it, treat the data as stale.

- Spot-check 20 contacts: current titles, still employed, correct company.

- Phone usefulness gate (if calling):

- Measure connect rate on 30-50 dials.

- If connects are weak, switch providers or change your calling motion.

Compliance gates (5 minutes)

Confirm you can maintain:

- An internal suppression list (unsubscribe/objection)

- TPS + CTPS screening for live calls

- A documented legitimate interests balancing test for your outreach processing

Mini table: pass/fail thresholds

| Check | Pass | Caution | Fail |

|---|---|---|---|

| Hard bounce | <3% | 3-5% | >5% |

| Duplicates | <2% | 2-5% | >5% |

| Refresh info | Clear | Vague | None |

| Call connect | Track it | Low | Unknown |

Building compliant UK outbound means firmographics, verified contacts, and timing signals - all fresh. Prospeo combines 300M+ profiles, 30+ filters including intent data and job changes, plus GDPR-compliant sourcing at $0.01/email. No contracts, no sales calls, no sole-trader surprises in your lists.

Get the three layers of UK B2B data from one self-serve platform.

UK B2B data tools and providers worth considering (by scenario)

ZoomInfo is still the default reference point in this category - even in the UK. Here's my take: ZoomInfo is the best all-in-one suite, but most UK teams don't need an all-in-one suite. If your outbound motion is email-first and your deal size isn't truly enterprise, you'll get more ROI from accuracy + freshness + clean workflows than from a giant platform you barely use.

Scenario A: Outbound email-first (deliverability is the KPI)

Pick tools that win on verification, refresh cadence, and CRM hygiene.

Prospeo (Tier 1) - best for accuracy + freshness + self-serve Pricing anchor: transparent credit-based pricing; effective cost is often around ~$0.01 per verified email depending on the credit pack. 10 credits per mobile. Free tier includes 75 emails + 100 extension credits/month.

Apollo - best for outbound workflow in one place Apollo's a fast way for SMB teams to combine database + sequencing + basic dialing without stitching five tools together. If you're standing up outbound from scratch, Apollo's workflow speed is hard to beat. Pricing anchor: Free, then $49 / $79 / $119 per user/month (Organization plan has a 3-user minimum).

Scenario B: Call-heavy (mobiles + TPS/CTPS ops)

If calling's your edge, prioritize phone-verified mobiles and build TPS/CTPS screening into the process. "More numbers" doesn't matter; connect rate matters.

Cognism - best-known UK/EU outbound posture + phone-verified mobiles Cognism is the pick when you want a UK/EU-forward posture and you care about phone-verified mobile data (their "Diamond Data" is the reason people buy). Pricing anchor: quote-based; expect low five figures/year minimum for most teams, scaling with seats and add-ons.

Kaspr - straightforward UK-friendly pricing for phone add-ons Kaspr is a practical option when you want predictable per-user pricing and visible add-on economics. Pricing anchor: Starter £39/user/mo (annual) or £51 (monthly); Business £69 (annual) or £85 (monthly). Monthly add-ons price phone credits at about £0.12-£0.13 per phone credit at 500-1,000 credits.

Scenario C: DIY firmographics + enrichment pipeline (RevOps/API-led)

This is for teams that want a Companies House-based universe and then layer contacts/signals on top.

Companies House (DIY base) - best free firmographics foundation Use it for the company universe, keys, and auditability. Then enrich contacts separately.

Dealfront - strong Europe angle if you want visitor ID + sales intelligence Dealfront combines visitor identification with a Europe-focused sales intelligence product. If you run UK demand gen and want "which companies hit our site?" alongside outbound targeting, it's a coherent stack. Pricing anchor: Leadfeeder plans start at EUR99/mo (annual billing) or EUR165/mo (monthly billing) for up to 50 identified companies/month. Sales Intelligence often lands around $20k-$40k/year for larger setups.

DataGardener - UK company intelligence when Companies House isn't enough DataGardener is a common UK pick when you want richer UK company context than the raw register provides (useful for segmentation and account research). Pricing anchor: often ~£500-£5,000/year for small teams, scaling up with seats/data access.

Broker-style providers (useful, but only if you buy like a skeptic)

Brokers can work for one-off campaigns, especially post and telemarketing. The failure mode is predictable: big counts, vague freshness, restrictive licensing.

Skip this route if you can't get a sample batch and the licence terms in writing.

Prospect360 - broker-style packaging (validate everything) Expect 12-month licences, optional TPS/CTPS screening, and segment-based pricing. Pricing anchor: often ~£500-£5,000 for many segments; larger multi-use licences go higher.

Marketscan / Databroker / InFynd / Market Location - common UK brokers Same pattern: segmentation + licence terms + optional screening. Pricing anchor: often ~£1,000-£10,000+ depending on size, fields, and reuse rights.

Enterprise suite reference (for completeness)

- ZoomInfo - the enterprise suite, priced like one ZoomInfo is best when you need heavy ABM signals, workflows, and you can live with annual contracts. Pricing anchor: starts at $15,000/year for up to 3 users with 5,000 credits, and many mid-market setups land $30k-$50k+/year once you add seats and signals.

Quick pricing + fit table (mobile-friendly)

| Provider | Pricing model | Best for | UK fit (specific) |

|---|---|---|---|

| Prospeo | Credits, self-serve | Verified email + fast refresh | Strong on deliverability + enrichment workflows |

| Apollo | Seat-based | Outbound workflow | Strong for SMB outbound execution |

| Cognism | Quote-based | Phone-verified mobiles | Strong for UK/EU call-heavy teams |

| Kaspr | Seat + add-ons | Cost-controlled phone credits | Strong for UK-friendly pricing + add-ons |

| Dealfront | Hybrid | Visitor ID + EU sales intel | Strong for EU/UK demand gen + targeting |

| ZoomInfo | Annual contract | ABM suite | Strong for enterprise suite buyers |

Vendor evaluation scorecard (use this to pick fast)

This is how you beat listicles and demos: score vendors on the things that actually change outcomes.

Use 0-2 points each (0 = no/unclear, 1 = partial, 2 = strong/clear). Total out of 16.

- Refresh cadence (stated and auditable)

- Verification method (real-time, catch-all handling, spam-trap protection)

- UK mobile coverage quality (not just "we have numbers"--prove connect rate)

- API availability (search/enrich, rate limits, docs)

- DPA availability + GDPR posture (clear, accessible)

- Suppression support (easy opt-out handling, exports, audit trail)

- Export limits + governance controls (prevents "export everything" chaos)

- Licensing clarity (rental vs multi-use, reuse rights, refresh terms)

If a vendor can't answer #1, #2, and #8 clearly, don't buy. You're not buying data - you're buying future cleanup work.

Pricing reality in 2026 (how UK B2B data is actually charged)

UK buyers get tripped up because "price" isn't one thing. It's a pricing model plus a usage pattern.

Two teams can pay the same sticker price and get wildly different ROI depending on whether they burn credits on phones, export everything, or only enrich inbound, and that's before you count the time spent cleaning duplicates and chasing unsubscribes across three systems.

The four models you'll see

- Seat-based (per user/month): predictable budgeting; costs scale with headcount.

- Credit-based: pay per reveal/export (email vs phone priced differently).

- Quote-based annual contracts: common for enterprise suites and "signals + governance" platforms.

- Per-1,000 records / dataset licensing: typical for brokers and marketplaces.

Mini table: model anchors (forecasting shortcuts)

| Model | Example | Cost anchor |

|---|---|---|

| Seat-based | Apollo | $49-$119/user/mo |

| Credit-based | Lusha | $29.90+/mo (credits) |

| GBP + add-ons | Kaspr | £39-£85/user/mo |

| Annual suite | ZoomInfo | ~$15k-$50k+/yr (typical buyer-reported range) |

Final recommendation (what to do next)

Don't start with demos. Start with your motion and your measurement plan.

Three hard calls:

- If you're email-first: prioritize verification + refresh cadence. Your domain reputation's an asset - protect it.

- If you're call-first: prioritize phone-verified mobiles and automate TPS + CTPS screening. Connect rate's the only metric that matters.

- If you're budget-first: use Companies House for firmographics, then pay for contact accuracy. Free firmographics + paid contacts beats cheap contacts every time.

Do this / don't do this:

- Do run the 30-minute acceptance test on 100-300 ICP contacts.

- Do lock suppression fields and ownership before the first campaign.

- Do write one LIA per campaign type and reuse it.

- Don't buy broker lists without written refresh cadence and reuse rights.

- Don't scale outreach until bounce and duplicates are under control.

- Don't treat "B2B" as a compliance strategy.

If you take nothing else away: b2b data uk is a workflow problem, not a shopping problem - source it the right way, verify it hard, suppress aggressively, and only then scale.

FAQ: UK B2B data, compliance, and sourcing

Is it legal to email UK businesses using purchased B2B data?

Yes--it's legal when you email corporate subscribers with a lawful basis under UK GDPR, clear transparency, and a working opt-out. In practice, keep hard bounces under 3%, include an unsubscribe in every message, and suppress objections the same day to avoid complaint spikes.

Can I cold call UK businesses if the number is on TPS or CTPS?

No--if a number's registered with TPS or CTPS, you shouldn't make live marketing calls unless you've got consent to override. Operationally, screen TPS + CTPS before dialing, maintain an internal "do not call" list, and log objections with a timestamp so you can prove suppression.

What's the difference between corporate subscribers and sole traders under PECR?

Corporate subscribers (companies, LLPs, many public bodies) can be contacted more permissively by email under PECR, while sole traders and certain partnerships are treated like individuals. A practical rule: if you can't confidently classify a record as corporate, exclude it from cold email or move it into a consent-first segment.

What's a good free tool for verifying UK prospect emails before outreach?

Prospeo's free tier includes 75 email credits plus 100 extension credits per month, with 98% verified email accuracy and a 7-day refresh cycle. Verify a 100-300 contact batch first and only scale when hard bounces stay below 3%.