How to Get Car Leads (and Actually Convert Them) in 2026

$20 per lead and nobody replies. Then you try "better" leads at $40 each and they're unrealistic. Meanwhile you're staring at a $2,100/month bill and thinking: "Is it me... or are these lead vendors just a tax?"

If you're searching for how to get car leads, here's the uncomfortable truth: most dealerships don't have a lead problem. They've got a lead leak problem.

This playbook's for BDC managers, GSMs, and owners who already have internet leads coming in but can't turn them into appointments consistently.

If you're a one-person used lot, skip straight to Facebook Marketplace + Google Business Profile and ignore everything that smells like "enterprise process."

(Internal: Lead response scripts library • Marketplace video checklist • TCPA consent language template)

What you need (quick version)

Implement first (non-negotiable trio):

- <5-minute first response (human) for every internet lead (with after-hours coverage)

- Google Business Profile cleanup + a review engine (consistent reviews, correct categories, service/parts profiles)

- Facebook Marketplace video + 7-day boost cycles (with fatigue resets)

Your minimum stack (keep it boring):

- CRM with lead routing + task automation (no "inbox chaos")

- Call tracking + recording (so you can coach, not guess) - see sales call review options

- Text + email that logs to CRM (and respects consent) - use compliant sales text message templates

- A simple dashboard: time-to-first-touch, contact rate, appt set, show, close (build a simple revenue dashboard)

Weekly operating rhythm:

- 2x/week lead response QA (10 random leads, listen/read the first 24 hours)

- 1x/week Marketplace refresh + boost reset

- 1x/week GBP mini-audit (photos, posts, reviews, categories)

If you're building partner/referral leads (B2B):

- Use Prospeo for fast, verified contact data when you're reaching out to local employers, fleet managers, credit unions, and other partners (see business contacts workflows).

Why you feel like you need "more leads" (but don't)

The loudest pain in dealer forums isn't "we can't get leads." It's "we paid for leads and nothing happened."

You'll see the same pattern: ~$20/lead with lots of leads but no replies, then ~$40/lead where people reply but the expectations are fantasy, and the monthly spend creeps up to $2,100/mo without a clean way to attribute sales. And then somebody drops the nuclear quote every vendor hates: "AutoTrader is a joke, I literally get 0 calls." Fair or not, that's the lived experience for a lot of rooftops: paying for distribution without getting conversations.

Buying more leads when your response process is sloppy is like pouring water into a bucket with a hole. You'll feel busy. You won't feel profitable.

The fix isn't sexy:

- Respond faster (tighten speed to lead metrics)

- Respond in more than one channel

- Answer the actual question

- Get to an appointment with two clear options

- Track the funnel so you know where you're bleeding out (common sales pipeline challenges show up here)

One hard line that'll save you money: if your first-touch time's over 60 minutes, pause paid lead spend for 2 weeks and fix routing + coverage first. You'll come back spending less and closing more.

Diagnose the real problem with funnel benchmarks (before you buy anything)

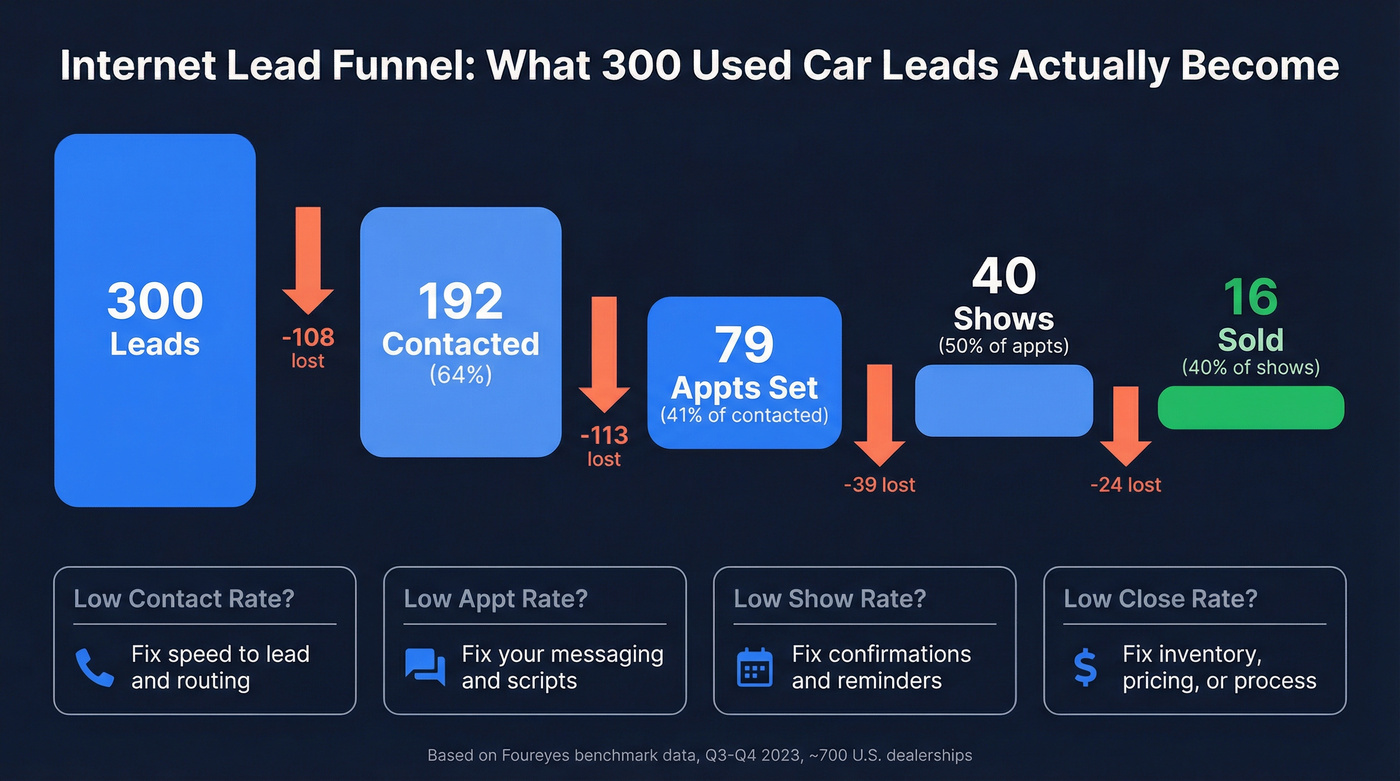

If you don't know your funnel math, every lead source looks "bad." Use these internet-lead benchmarks from Foureyes as your baseline.

Foureyes benchmark dataset (Q3-Q4 2023, ~700 U.S. dealerships). It's still one of the cleanest baselines because it's measured consistently across stores.

Internet lead funnel benchmarks (Foureyes)

| Segment | Contact | Appt set | Show | Close |

|---|---|---|---|---|

| New (internet) | 60% | 32% | 56% | 42% |

| Used (internet) | 64% | 41% | 50% | 40% |

How to read this correctly: "Appointment set" is a percent of contacted leads, "show" is a percent of appointments, and "close" is a percent of shows.

Mini-calculator (use your last 30 days)

Let's say you got 300 internet leads for used cars.

- Contacted: 300 x 64% = 192

- Appointments set: 192 x 41% = 79

- Shows: 79 x 50% = 40

- Sold: 40 x 40% = 16 units

Now do the same with your real numbers.

If you're below benchmark at contact, you don't need more leads - you need speed-to-lead, routing, and multi-path follow-up.

If you're fine at contact but low at appointments, your messaging's weak (you're not answering the question, you're not giving options, you're not reducing friction). If you want to pressure-test your sequencing, use a follow up email sequence strategy.

If your show rate is low, your confirmation process is broken (no reminders, no value framing, no "what to bring," no trade/payment pre-work).

If your close rate is low, that's usually inventory/pricing/process. Marketing can't fix that alone.

I've watched teams double lead volume and sell the same number of cars because they never fixed the contact-to-appointment step. Don't be that store.

Your dealership's B2B referral pipeline - fleet managers, credit union officers, local employers - depends on reaching the right person fast. Prospeo gives you verified emails and direct dials for 300M+ professionals, so your partner outreach actually lands.

Stop guessing at email addresses. Start booking fleet and referral meetings.

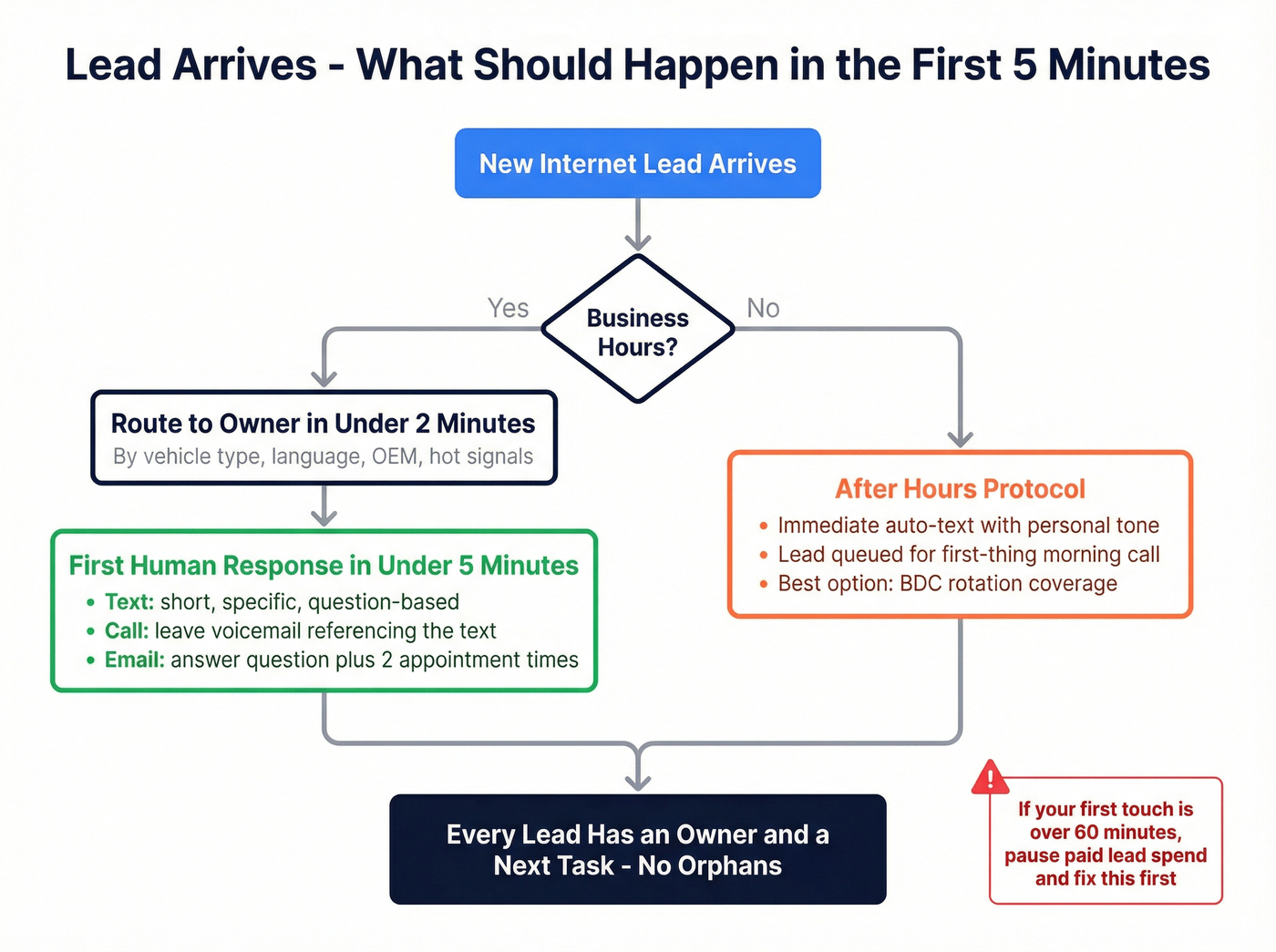

How to get car leads by fixing your follow-up system (speed-to-lead + multi-path)

Pied Piper's 2026 PSI Internet Lead Effectiveness (ILE) Auto Industry Study hit 4,023 dealership websites and scored the industry at 65/100.

Only 49% of dealers used multiple paths (email/phone/text). And 19% didn't personally respond at all. That's not a marketing problem. That's a management problem.

AutoAlert's benchmark for time-to-first-touch is blunt: <15 minutes is best-in-class, <1 hour is competitive.

Your internal target should be tighter.

<5 minutes for the first human response.

Not an auto-reply. A human.

Your SLA (non-negotiables)

Use this if you want predictable appointments:

- <5 minutes first human response during business hours

- Lead routing rules by: vehicle type (new/used), language, OEM, and "hot" signals (payment/trade questions, "today" intent)

- After-hours coverage: immediate text + next-morning call queue; best is a BDC rotation

- No orphan leads: every lead gets an owner and a next task within 2 minutes of arrival

Skip this if you can't enforce it: buying more leads. You'll just buy more missed calls and unanswered texts.

Two fastest on-site lead magnets (trade-in range + payment options)

If you want more leads without paying a vendor, stop treating your website like a brochure.

The two highest-converting "raise your hand" actions are:

- Trade-in range (people want a number, even if it's a range)

- Payment options (people want to know if it fits their monthly reality)

Operationally, this works because it gives your team a clean reason to follow up with specifics.

Use this line in your first response (text or email):

- "Send your ZIP + trade VIN and miles, and I'll send your out-the-door number plus two payment paths (finance and lease if available)."

That one sentence does three things: it answers the question, it moves the deal forward, and it filters out the shoppers who were never real.

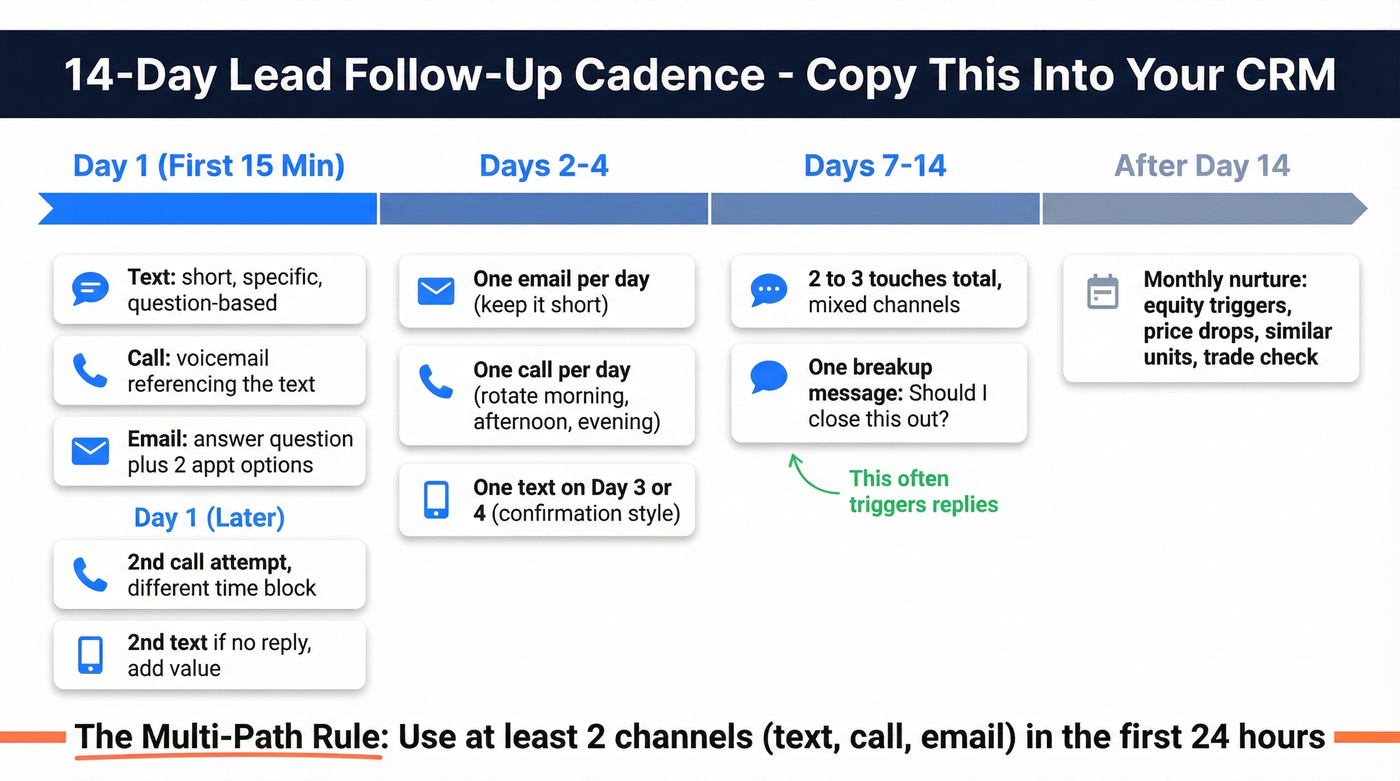

14-day cadence (copy/paste)

Put this in your CRM as an automation + task bundle. The goal is multi-path without being spammy (see outreach sequences mechanics).

Day 1 (first 15 minutes)

- Text: short, specific, question-based

- Call: leave a voicemail that references the text

- Email: answer the question + 2 appointment options

Day 1 (later)

- 2nd call attempt (different time block)

- 2nd text if no response (value add: availability, options)

Day 2-4

- One email per day (short)

- One call attempt per day (rotate morning/afternoon/evening)

- One text on Day 3 or 4 (confirmation-style)

Day 7-14

- 2-3 touches total, mixed channel

- One "breakup" style message ("Should I close this out?") often triggers replies

After Day 14

- Monthly nurture (equity/service triggers, price drops, similar units, trade check)

Callout box: The "multi-path" rule If you only email, you'll miss people who live in text. If you only text, you'll miss people who screen unknown numbers. Use at least two paths in the first 24 hours.

(Internal: copy/paste templates in the Lead response scripts library.)

What "good" looks like in messages

Digital Dealer's recap of the Pied Piper data shows 69% of dealers now answer the customer's question in email/text. That's progress. It's also your easiest edge, because plenty of stores still dodge specifics to "get them in."

A good first response does four things:

- Answers the question (price, availability, miles, trim, warranty, fees - whatever they asked)

- Confirms availability (and sets expectation: "I can hold it for X minutes")

- Gives two appointment options ("Today 5:40 or tomorrow 10:20?")

- Sets the next step (trade + payment path, without interrogating)

Example text (first response):

- "Hey Jamie - got your note on the 2021 Camry SE. It's available right now. Want to see it today at 5:40 or tomorrow at 10:20?"

Example email (short, appointment-forward):

- Subject: "Camry SE availability + 2 times"

- Body: "It's here and ready. Out-the-door depends on tax/plate, but I can send a full breakdown. Want 5:40 today or 10:20 tomorrow?"

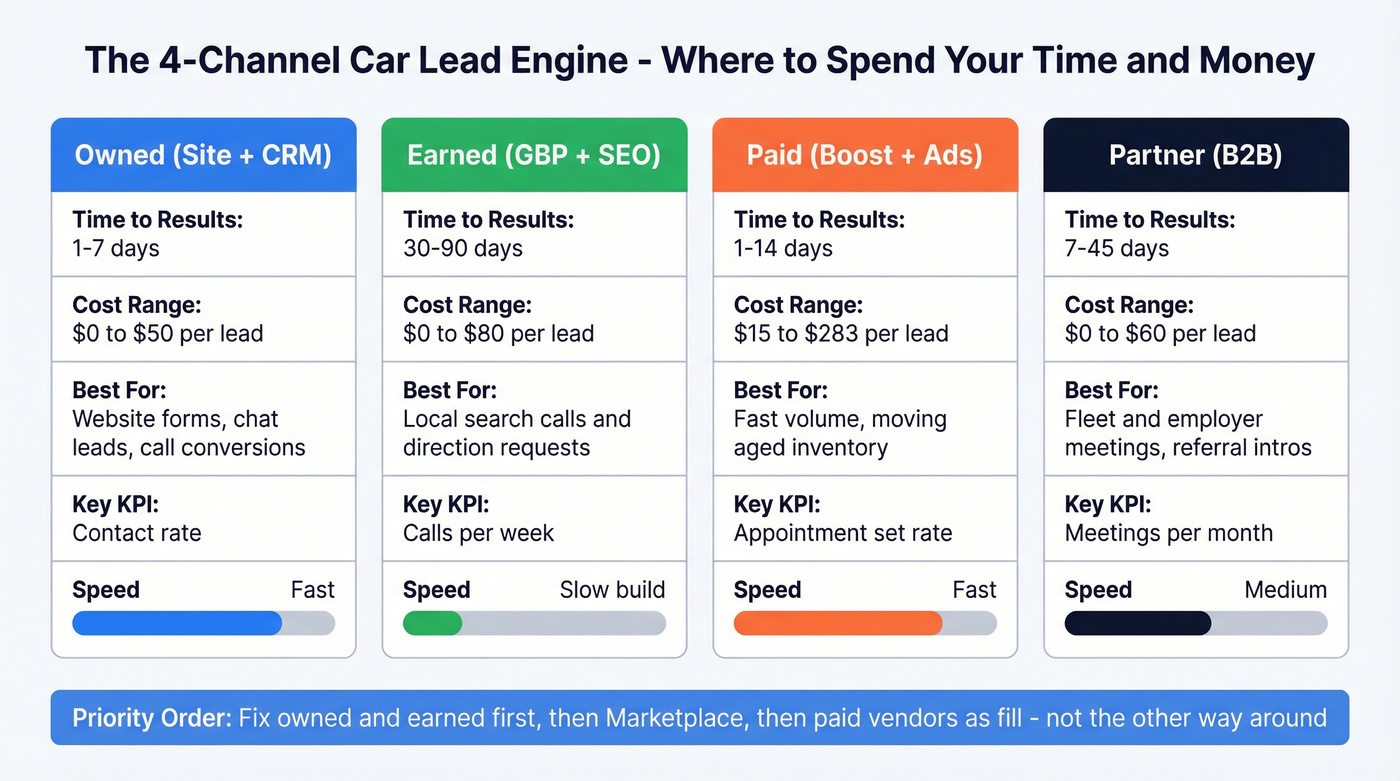

The 4-channel car lead engine (Owned, Earned, Paid, Partner)

DemandLocal's stat that matters most for planning is local: 71% of consumers shop within 10 miles. So your channel priority should be local-first, not "spray the internet and pray."

Also: lead costs are all over the place. Planning CPL ranges from $42.95 to $283 per lead depending on channel and mix. If someone promises $10 leads forever, they're either cherry-picking or ignoring quality.

Channel map (what to run, what to measure)

| Channel | Time-to-results | Cost range | Best for | Key KPI |

|---|---|---|---|---|

| Owned (site/CRM) | 1-7 days | $0-$50/lead | website form/chat leads + call conversions | contact % |

| Earned (GBP/SEO) | 30-90 days | $0-$80/lead | calls + direction requests from local search | calls/week |

| Paid (boost/ads) | 1-14 days | $15-$283/lead | fast volume + moving aged units | appt set % |

| Partner (B2B) | 7-45 days | $0-$60/lead | fleet/employer meetings + referral intros | meetings/mo |

Hot take: most dealerships should treat third-party lead vendors as "fill" after owned + earned + Marketplace are operating cleanly. Vendors can work, but they're the last lever, not the first.

Here's how to allocate time and budget without overthinking it:

- Small used lot (1-10 people): 60% Marketplace, 30% GBP/reviews, 10% paid retargeting. Keep the CRM simple and obsess over response time.

- Mid-size rooftop: 35% Marketplace, 35% GBP/SEO + reviews, 20% paid, 10% partner. Add call tracking and weekly QA so you can coach the team.

- Multi-rooftop / high volume: 25% Marketplace, 30% GBP/SEO, 30% paid, 15% partner. You win on process: routing, coverage, and consistent trade/payment workflows.

Owned doesn't mean "we have a website." It means you operationalize conversion: every form routes instantly, every call's tracked, trade/payment tools trigger a task, and your team has scripts that answer the question in the first touch.

If you want one stat to anchor your local-first bias, use DemandLocal's compilation here: DemandLocal's dealer lead gen stats.

Bonus channel: private-party seller (FSBO) outreach for acquisition + replacement sales

Most stores ignore FSBO because it feels like extra work. It's not. It's one of the cleanest ways to create inventory opportunities and replacement conversations.

Here's a real scenario I've seen play out: a used-car manager had two Camry-sized holes in the lot and no clean auction buys that week, so he had a coordinator DM 25 private sellers with a simple "15-minute appraisal today" offer. They booked 6 appraisals, bought 2 cars, and sold 1 replacement to a seller who didn't take the offer but liked the payment options on a similar unit. That's three deals from outreach that cost basically nothing.

Simple flow:

- Find private-party listings in your market (common platforms + local groups).

- Offer a fast appraisal appointment (same day if possible).

- If they don't sell to you, you still earn the right to pitch a replacement.

Message template (text/DM):

- "Hey [Name] - I'm with [Dealership]. If you're still selling the [Year/Model], we can do a 15-minute appraisal today and give you a written offer. If you're replacing it, I can also show you a couple options that match your payment range."

This works because you're not begging for a lead. You're offering a concrete next step.

How to get car leads with Facebook Marketplace (posting + boosting + fatigue control)

Marketplace's still the most operator-friendly channel because it's immediate. You post inventory, you get messages, you work them like mini internet leads.

Here's the thing: it's also the easiest place to get sloppy, get flagged, and burn hours.

Posting cadence that doesn't get you banned

Rule #1: don't behave like a bot.

CARVID reports from a 90-day dealer test that manual posting runs 5-8 minutes per car, and posting too fast or too repetitively can trigger 7-30 day bans.

Rules of thumb that keep you alive:

- Don't dump 40 listings in 10 minutes

- Vary captions and photo order (uniqueness matters)

- Use real walkaround videos (they look human)

- Pace uploads across the day (or assign a daily posting block)

If you use a posting tool, CARVID's pricing is straightforward: $249 / $499 / $799 per month depending on inventory/users. For most stores, that's cheaper than paying a coordinator to do nothing but post.

Creative that wins (and why video matters)

Video's the cheat code.

CARVID reports video listings drive 3.2x more inquiries than photo-only. Treat that as directional truth: video creates trust faster than any caption ever will.

Quick shot list (60-90 seconds):

- Start with the odometer + VIN plate (trust signal)

- Exterior walkaround (slow, no whip pans)

- Tires + any notable cosmetic flaws (reduce "gotcha" later)

- Interior front seats + dash + infotainment

- Trunk/cargo + rear seats

- Cold start + quick idle sound

- End with: "Message me 'YES' and I'll send pricing + availability"

(Internal: printable version in the Marketplace video checklist.)

Boosting rules + realistic budgets

Boosting's where most stores waste money by set-it-and-forget-it behavior.

Planning numbers:

- Minimum boost: $5/day

- Good test: $35 over 3 days

- CPC varies by market; plan around ~$0.58-$0.70 as a starting point

Fatigue is real:

- After ~5 impressions per person, CTR drops and CPC jumps 20-30%

- Fix: 7-day boosts, pause 2-3 days, then relaunch

When to duplicate vs edit:

- Edit if the listing's still getting organic saves/messages (light reset)

- Duplicate if CPC's climbing and engagement's dead (new ad ID reset)

- Renew the listing around day 7 to pop back up organically

Budget table (simple planning)

| Goal | Daily boost | Cycle | Notes |

|---|---|---|---|

| Test 1 car | $12/day | 3 days | $35 test |

| Push 5 cars | $25-$40/day | 7 days | rotate winners |

| Move aged units | $40-$80/day | 7 days | pause 2-3 days |

For boosting mechanics and reset tactics, LeadsBridge's walkthrough is solid: how to boost Facebook Marketplace.

Google Business Profile & local SEO checklist (dealer benchmarks you can use in 2026)

GBP's the most boring lead source. It's also the one that compounds.

SearchLab analyzed 2,260 dealership GBPs and the "average dealer" sits at 2,195 reviews with a 4.3 rating. That's your competitive set, whether you like it or not.

They also found:

- 47% are missing separate Service and Parts profiles

- 21% are missing AutoDealer schema

- Only 17% use all category slots

- Google removed GBP Q&A earlier in 2026, so it wasn't included in their analysis - don't build your strategy around it

GBP checklist (do this before you buy more ads)

Profile fundamentals

- Primary category is correct (don't get cute)

- Use all category slots (you're competing with stores that do)

- Services filled out (sales + service)

- Hours correct (including holidays)

- Appointment URL works on mobile

Reviews engine

- Ask every sold + every RO close (two different scripts)

- Reply to reviews daily (yes, daily)

- Route negative reviews to a manager within 2 hours

Department profiles

- Separate Service and Parts GBPs (47% don't - easy edge)

- Unique photos for each profile (not copy/paste)

Website basics

- Homepage loads fast (SearchLab's average was 2.5 seconds)

- AutoDealer schema present (fix if you're in the 21% missing it)

Mini-audit targets (use these as "good enough")

- Rating: 4.3+ (don't chase 5.0 with fake reviews, it backfires)

- Reviews: within striking distance of top 3 local competitors

- Categories: 10/10 used

- Service/Parts profiles: yes

(Internal: use this GBP mini-audit template in your weekly rhythm.)

If you want the raw benchmark context, here's the report: SearchLab's 2026 GBP report (auto edition).

Service lane -> sales workflow (highest-intent leads you already own)

Service lane leads are the closest thing to "free high intent" you'll ever get. They're already your customers, already on-site, and already thinking about money.

Affinitiv's triggers are the right ones to operationalize:

- Aging out of warranty

- Rising repair costs / unexpected bills

- Mileage and repair frequency trends

- Vehicle age + service history signals that scream "replacement cycle"

The mistake is treating this like a marketing campaign. It's an in-store workflow.

Text-based workflow diagram:

Service appointment booked -> Trigger flagged (warranty/repairs/mileage) -> Advisor offers a real-time upgrade option during visit -> Quick appraisal/trade range -> Sales notified immediately -> Seamless handoff (same-day intro) -> Follow-up scheduled if they don't bite

Advisor script (the version that doesn't feel gross)

When the customer says, "I'm just here for service," your advisor should agree - and still open the door.

Use this:

- "Totally - let's get you taken care of. Quick heads-up: based on your mileage and what we're seeing today, a lot of customers ask what their car's worth right now. Want a quick trade range while you're here? No obligation."

If they say no:

- "No problem. If anything changes, I can text you a trade range later - what's the best number?"

If they say yes, the handoff has to be immediate:

- "Perfect. I'll have [Name] grab a quick appraisal while we're finishing your RO. It takes about 10 minutes."

Handoff checklist (so it doesn't die in the hallway):

- One owner for the handoff (named salesperson)

- One script for advisors (no awkward "sales pitch")

- One offer format (simple: trade range + 2 payment paths)

- One SLA: sales meets customer within 10 minutes or calls within 30

I've seen stores "launch" service-to-sales three times and fail because nobody owned the handoff. That drives me nuts, because it's such a fixable problem.

Make it a process, not a poster.

Compliance in 2026 (TCPA + TSR) - read this before you text/call

If you're texting and calling leads, compliance isn't optional. The penalties are the kind that ruin a month.

TCPA do/don't checklist

Do:

- Get one-to-one written consent per company (effective Jan 27, 2026)

- Keep consent records: timestamp, method, exact language

- Include opt-out language for texts ("Reply STOP to opt out")

- Honor revocation via any reasonable method (effective Apr 11, 2026)

- Process opt-outs within 10 business days

- Respect quiet hours: 8am-9pm in the recipient's time zone

Don't:

- Text/call people because a "lead generator" said they consented to "partners"

- Force a single revocation method ("only email us to opt out")

- Keep texting after STOP

- Repurpose consent from unrelated forms - outreach must be logically and topically related to the context where consent was captured

Penalties are commonly cited at $500-$1,500 per violation. That adds up fast when you're blasting templates.

A simple consent language example (use your lawyer, but stop winging it)

Put dealership-specific language right on the form, and store the exact version you used.

Example (web form checkbox text):

- "By checking this box, I agree to receive calls and texts from [Dealership Name] at the number provided, including automated marketing messages. Consent isn't a condition of purchase. Msg/data rates may apply. Reply STOP to opt out."

What to store in your CRM (minimum):

- lead source + landing page URL

- timestamp + IP (if captured)

- the exact consent text version (copy/paste it into a field)

- proof of opt-out (and the timestamp you processed it)

Vendor leads: treat them as guilty until proven compliant. If the consent language doesn't name your dealership and match the context of the form, don't text. Call carefully, document everything, and move them into an email-first path until you've got clean consent.

(Internal: grab the TCPA consent language template.)

TSR (Telemarketing Sales Rule) basics

If you're running telemarketing campaigns, TSR adds guardrails:

- Do Not Call provisions

- Time-of-day restrictions

- Recordkeeping for 2 years

The FTC's guide is the cleanest reference: Complying with the Telemarketing Sales Rule.

Partnership leads you can create this week (B2B referral engine)

This is the antidote to paying $20-$40 for leads that ghost you: build relationships where the "lead" comes with trust.

Who to partner with (and what to offer)

Targets that consistently produce:

- Local employers (employee purchase programs)

- Fleet managers (replacement cycles + maintenance)

- Property managers (resident perks, move-in offers)

- Credit unions (preferred dealer program)

- Insurance brokers (total-loss replacements)

- Service vendors (tire shops, detailers, body shops)

What to offer (keep it simple):

- Dedicated contact + priority appointment slots

- A small, clear perk (service credit, accessory credit, or preferred pricing)

- A monthly "inventory highlight" email they can forward internally

Outreach workflow (list -> verify -> sequence -> track)

You need decision-makers, not generic inboxes.

In our experience, the fastest way to get partner meetings is to treat it like a light outbound motion: tight list, correct roles, short message, and a simple ask. Prospeo ("The B2B data platform built for accuracy") fits well here because it's self-serve and built around data freshness and email accuracy: 300M+ professional profiles, 143M+ verified emails, 125M+ verified mobile numbers, and 98% verified email accuracy on a 7-day refresh cycle (see B2B contact data decay benchmarks).

Workflow:

- Build a list of 50-150 local partner orgs (employers, property groups, fleets)

- Pull verified contacts for HR, ops, fleet, and benefits roles (use an email lookup workflow)

- Tag them in your CRM as "Partner Prospect" and run a short, value-led sequence

- Track replies and book 10-minute intro calls (don't pitch a "program" in a novel)

One message template (email + call opener)

Email (partner offer)

- Subject: "Employee vehicle perk for [Company Name]?"

- Body: "Hey [Name] - I'm [Name] at [Dealership]. We're setting up a simple employee vehicle perk for a few local employers: priority appointments + a small service credit on purchase. Worth a 10-minute call this week to see if it fits [Company]?"

Call opener

- "Hi [Name], it's [Name] at [Dealership]. Quick one - are you the right person for employee perks or fleet replacement partnerships? I'm calling about a simple local program we're rolling out."

30-day implementation plan (owners, cadence, KPIs)

This rollout works because it's sequenced: build the follow-up system first, then turn up volume.

Week-by-week plan

Week 1: SLA + routing + scripts

- Set the <5-minute first human response SLA

- Fix routing rules + after-hours coverage

- Install the 14-day cadence in CRM

- QA: review 10 leads and score the first 24 hours (multi-path or not)

Week 2: Marketplace cadence + boosts

- Standardize video walkaround format

- Set posting pace (avoid bans)

- Run $35/3-day boost tests on 3-5 units

- Move to 7-day boosts + 2-3 day pauses for fatigue resets

Week 3: GBP audit vs benchmarks

- Categories: fill all slots

- Reviews: launch daily ask + daily reply habit

- Create/clean separate Service and Parts profiles

- Fix AutoDealer schema gap if you've got it

Week 4: service lane handoff + partner outreach

- Implement service triggers + real-time offer workflow

- Train advisors + define the sales handoff SLA

- Build your first partner list and start outreach

KPI scoreboard (track weekly)

| KPI | Target (starting) | Strong | Notes |

|---|---|---|---|

| First touch time | <5 min | <15 min | <1 hr = ok |

| Contact rate | 60-64% | 70%+ | Foureyes base |

| Appt set (of contact) | 32-41% | 45%+ | new vs used |

| Show rate | 50-56% | 60%+ | confirm process |

| Close (of shows) | 40-42% | 45%+ | sales process |

| Multi-path in 24h | 60%+ | 80%+ | beat 49% avg |

If you're improving time-to-first-touch and multi-path, you'll usually see contact and appointment rates move within two weeks. That's the fastest "lead gen" you'll ever buy.

You just learned that buying more leads without fixing your process is throwing money away. The same applies to B2B partner outreach - bad contact data kills dealership referral programs before they start. Prospeo delivers 98% accurate emails at $0.01 each, refreshed every 7 days.

Reach every fleet manager and credit union contact on the first try.

FAQ: getting more car leads in 2026

How fast should you respond to an internet lead?

Under 5 minutes with a first human touch during business hours. AutoAlert's benchmark is <15 minutes best-in-class and <1 hour competitive. If you can't hit this, fix routing and after-hours coverage before spending more on ads or third-party leads.

Are Facebook Marketplace car leads worth it in 2026?

Yes - when you post consistently, use walkaround video, and run boosts in 7-day cycles with 2-3 day pauses to reset fatigue. CARVID reports video listings drive 3.2x more inquiries than photo-only, which is why Marketplace can outperform "better" leads if your follow-up's tight.

Should I buy leads or fix my follow-up process first?

Fix follow-up first. If your contact rate or appointment set rate is below the Foureyes benchmarks (60-64% contact; 32-41% appt set of contact), more volume just multiplies waste. Enforce multi-path in the first 24 hours and a <5-minute first response, then scale paid sources.

Can I text car leads in 2026 without getting sued?

Yes, but only with clean consent that names your dealership and is stored with a timestamp and the exact consent language. Use STOP opt-out language, respect 8am-9pm quiet hours, and process opt-outs within 10 business days. Assume vendor "partner consent" isn't usable for texting unless it's one-to-one.

Summary: how to get car leads without lighting money on fire

If you want a reliable answer to how to get car leads in 2026, stop hunting for a magical source and start plugging the leaks: enforce a <5-minute human response, go multi-path in the first 24 hours, and run a simple 4-channel engine (Marketplace, GBP/local SEO, service lane, and partner referrals). Once the process is tight, paid lead volume finally scales instead of silently bleeding you.