Lead Search Engine: Definition, How It Works & Costs (2026)

Finding leads used to mean "buy a database, export a list, hope it's right." Now buyers expect search: fresh results, filters that map to an ICP, and contact data that doesn't torch deliverability. That's the promise of a lead search engine.

Here's the part nobody can ignore: if your first 500 "verified" emails bounce at 8%, your domain's the one paying the price, not the data vendor.

Most teams don't have a "lead problem." They have a data hygiene problem that shows up as a lead problem.

What you need (quick version)

G2, citing Site-Seeker, found 70% consider lead intelligence effective for prospecting new customers. That only holds when you run it like an ops workflow, not a one-click list export.

Here's the checklist I use to pick and implement a lead search engine without creating a downstream mess:

- Start with ICP inputs you can actually filter on

- Industry, company size, geo, title/seniority, technographics, growth signals

- Run search like a query, not a "list purchase"

- Save searches, iterate, and expect to refine after the first 200 leads

- Verify before you outreach

- "Verified" must mean outcomes (valid/invalid/catch-all/unknown), not vibes (how to verify an email address)

- Dedupe before you sync

- Dedupe at the contact level and the account level (or Salesforce will punish you)

- Sync to CRM with rules

- Field mapping, ownership, lifecycle stage, and suppression lists (how to keep CRM data clean)

- Then outreach

- Sequencer rules, throttling, and bounce monitoring (email deliverability)

Operationally, the workflow is: ICP -> search -> verify -> dedupe -> CRM sync -> outreach.

If you want a quality benchmark to measure everyone else against, Prospeo's a clean reference point: 98% verified email accuracy with a 7-day refresh cadence (many providers refresh every ~6 weeks). That gap's the difference between "this segment works" and "why are we bouncing 12%?"

Lead search engine (definition): what it is - and what it isn't

A lead search engine is a system that helps you discover and qualify prospects by searching for people and companies that match your ICP, then returns usable contact and company data you can activate in your CRM or outbound stack. In other words, it's a search engine for leads your team can run repeatedly, not a one-off list purchase.

The key idea is query-first discovery. Instead of licensing a static list and hoping it's current, you run searches (filters + keywords), save them, and re-run them as your ICP evolves. Vendors like Dealcode popularized the "real-time search" framing - treating prospecting more like a search process than a database rental - which is a helpful mental model even if the underlying data sources differ by tool.

At minimum, a lead search engine should return the fields you need to route, personalize, and dedupe:

- Contact name

- Job title + seniority

- Company + website/domain

- Location (city/state/country)

- Industry/category

- Company size (employees)

It is

- A query-driven way to build lead lists (filters + keywords + saved searches)

- A workflow that can verify, normalize, and export data so it's usable in CRM/outreach

- A repeatable process your team can run weekly, not a one-time "data buy"

It isn't

- A CRM (even if it has a lightweight one)

- A sales engagement platform (even if it exports into one)

- A guarantee of accuracy just because a record exists

- A replacement for ops hygiene (dedupe, suppression, routing, and consent handling)

If you remember one thing: it's only "good" if it produces records your systems can trust - and your reps'll actually use.

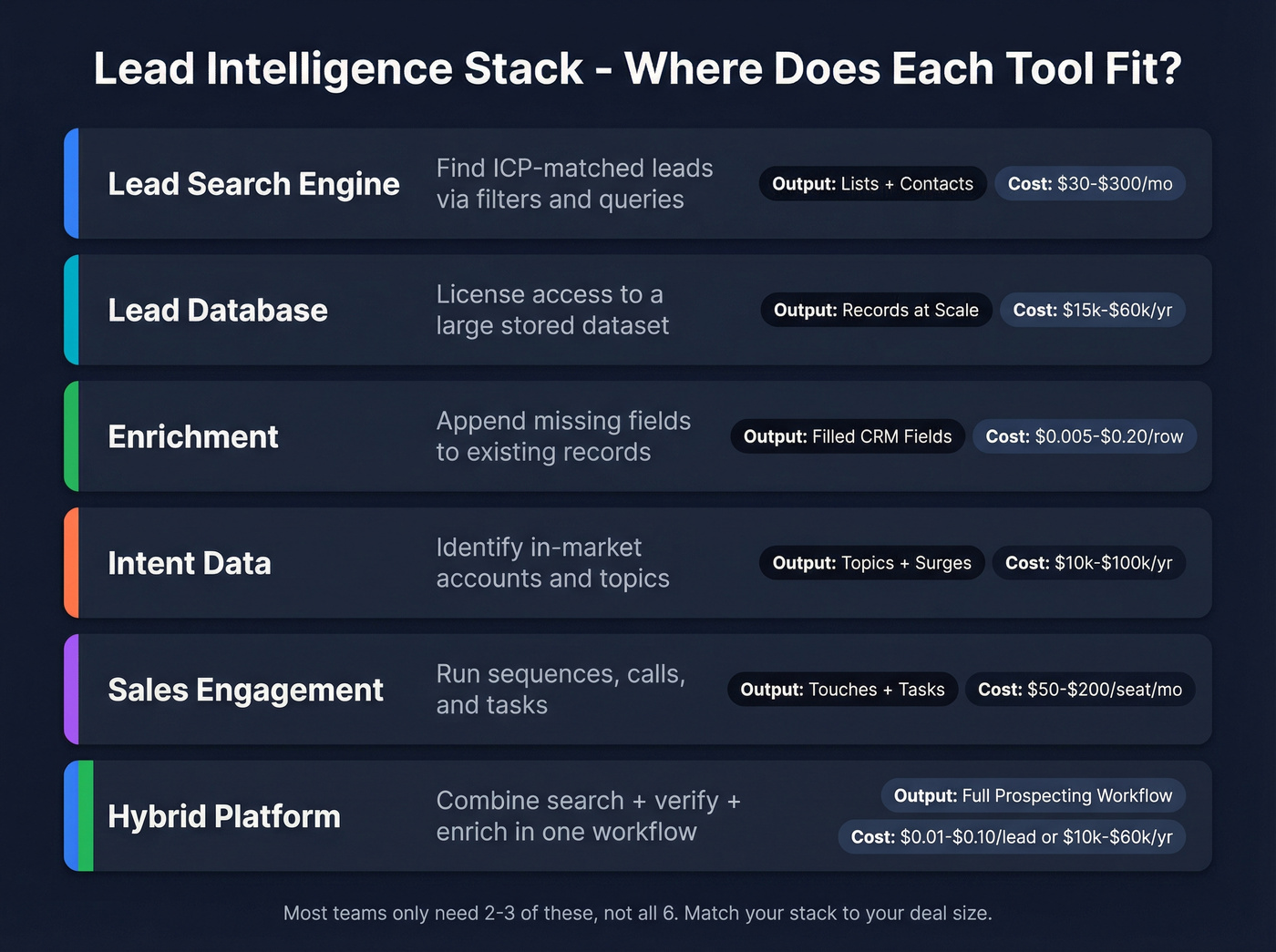

Lead search engine vs database vs enrichment vs intent vs sales engagement

Most teams mix these categories up, then wonder why they're paying twice, or why the "data tool" didn't fix pipeline.

Lead intelligence is the umbrella: data collected about leads and prospects to assess fit vs your ICP. A lead search engine is one way to access that intelligence, but it isn't the whole stack.

Here's the clean taxonomy:

| Category | What it does | Output | Typical cost |

|---|---|---|---|

| Lead search engine | Find ICP-matched leads via filters/queries | Lists + contacts | $30-$300/mo (self-serve) |

| Lead database | License access to a large stored dataset | Records at scale | $15k-$60k/yr |

| Enrichment | Append missing fields to existing records | Filled CRM fields | $0.005-$0.20/row |

| Intent data | Identify in-market accounts/topics | Topics + surges | $10k-$100k/yr |

| Sales engagement | Run sequences/calls/tasks | Touches + tasks | $50-$200/seat/mo |

| Hybrid platforms | Combine search + verify + enrich (+ sometimes intent) | Prospecting workflow | Credits ($0.01-$0.10/lead) or annual ($10k-$60k/yr) |

A practical way to think about it:

- Database = what exists in the warehouse.

- Search engine = how fast you can find the right slice.

- Enrichment = how you fix what's missing (often via waterfall enrichment).

- Intent = who's warm right now (intent signals).

- Engagement = how you run touches at scale (Instantly, Smartlead, Lemlist, Outreach, Salesloft).

Hot take: ZoomInfo's still the best "all-in-one" suite. But most teams don't need all-in-one. If your average deal's in the low five figures and you're still nailing ICP, paying for enterprise sprawl is usually self-inflicted pain.

You just read why most lead search engines fail: stale data, no verification, and bounce rates that kill domains. Prospeo refreshes every 7 days, verifies emails through a 5-step process with spam-trap removal, and delivers 98% accuracy - at $0.01 per email.

Run your first ICP search with 100 free credits. No contract, no sales call.

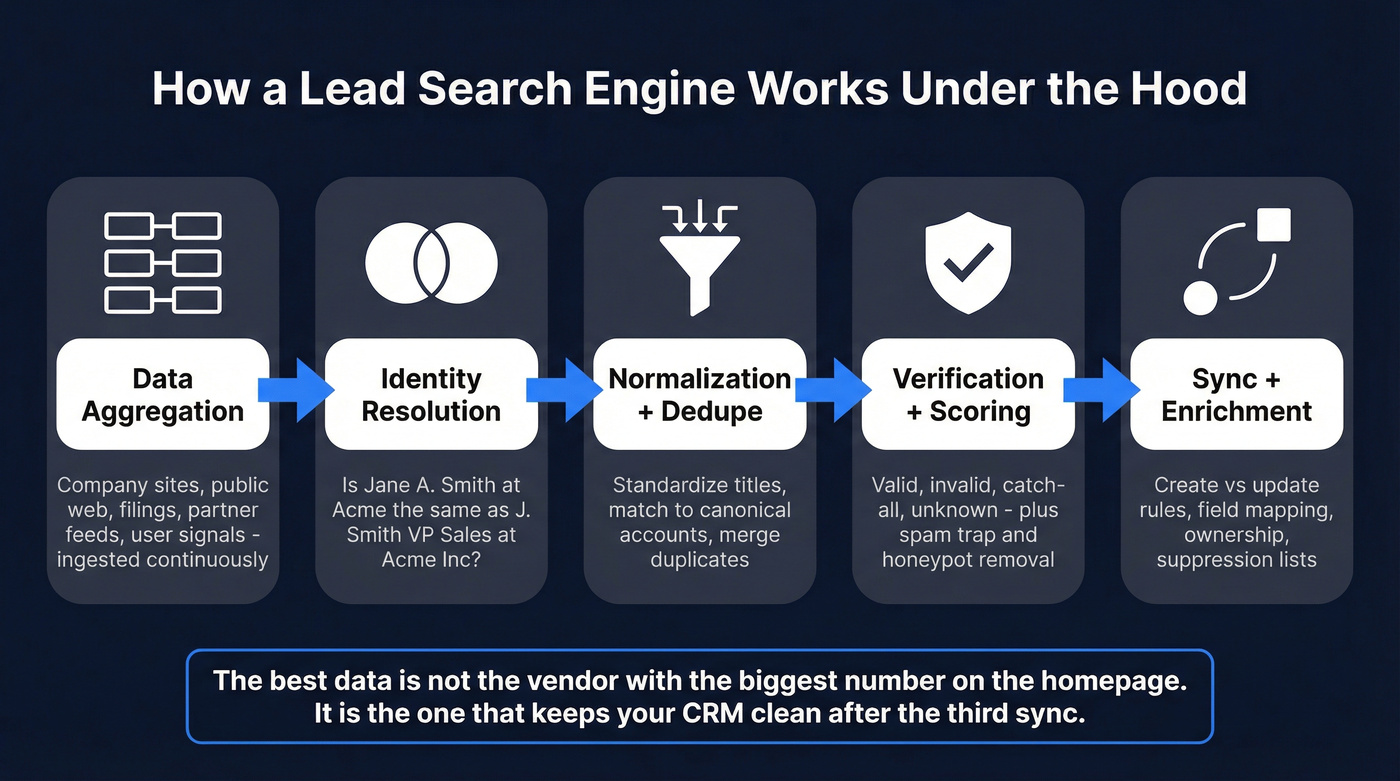

How a lead search engine works under the hood (the data pipeline)

Under the hood, serious tools follow the same pipeline. The differences are coverage, freshness, match rate, and how honestly they meter usage.

Data aggregation Data gets collected from many sources: company sites, public web pages, filings, partner feeds, and user-contributed signals. The best systems ingest continuously, not on a quarterly refresh (how B2B data is collected).

Identity resolution The system decides whether "Jane A. Smith at Acme" is the same person as "J. Smith, VP Sales, Acme Inc." This is where duplicates are born, and where CRM trust dies.

Normalization + deduplication Titles get standardized, companies get matched to a canonical account, locations get cleaned, and duplicates get merged. This matters more than raw database size because it determines whether Salesforce/HubSpot stays usable.

Verification + scoring Email and phone verification should return explicit outcomes (valid/invalid/catch-all/unknown) and ideally flag risky records (spam traps/honeypots). This is the difference between "we sent 2,000 emails" and "we kept inbox placement intact."

Sync + enrichment (API, CSV, or native integrations) This is where a lead search engine becomes operational: create vs update rules, field mapping, ownership, lifecycle stage, and suppression logic. If you don't control this, you inflate MQLs, break routing, and annoy AEs.

In our experience, the "best data" isn't the vendor with the biggest number on the homepage. It's the one that keeps your CRM clean after the third sync, when you're running weekly searches, multiple segments, and two different outbound motions.

If you're building anything beyond manual exports, look for API match rate, dedupe controls, and whether the tool plays nicely with Clay, Zapier/Make, and your CRM.

"Real-time" and "verified" aren't marketing - here's what to measure

"Real-time" and "verified" only matter if you can measure them. Otherwise you're buying confidence.

The two metrics that matter most

- Accuracy (deliverability accuracy, not "record accuracy") You want a tool that can tell you, clearly, what percentage of emails it verifies successfully, and what "verified" means operationally.

- Refresh cadence (how quickly records get re-checked) Weekly refresh beats monthly refresh. Fresh org charts and job changes are where reply rates come from.

I've watched teams declare "cold email is dead" when the real issue was stale titles and a 10-15% bounce rate dragging down domain reputation (what is domain reputation).

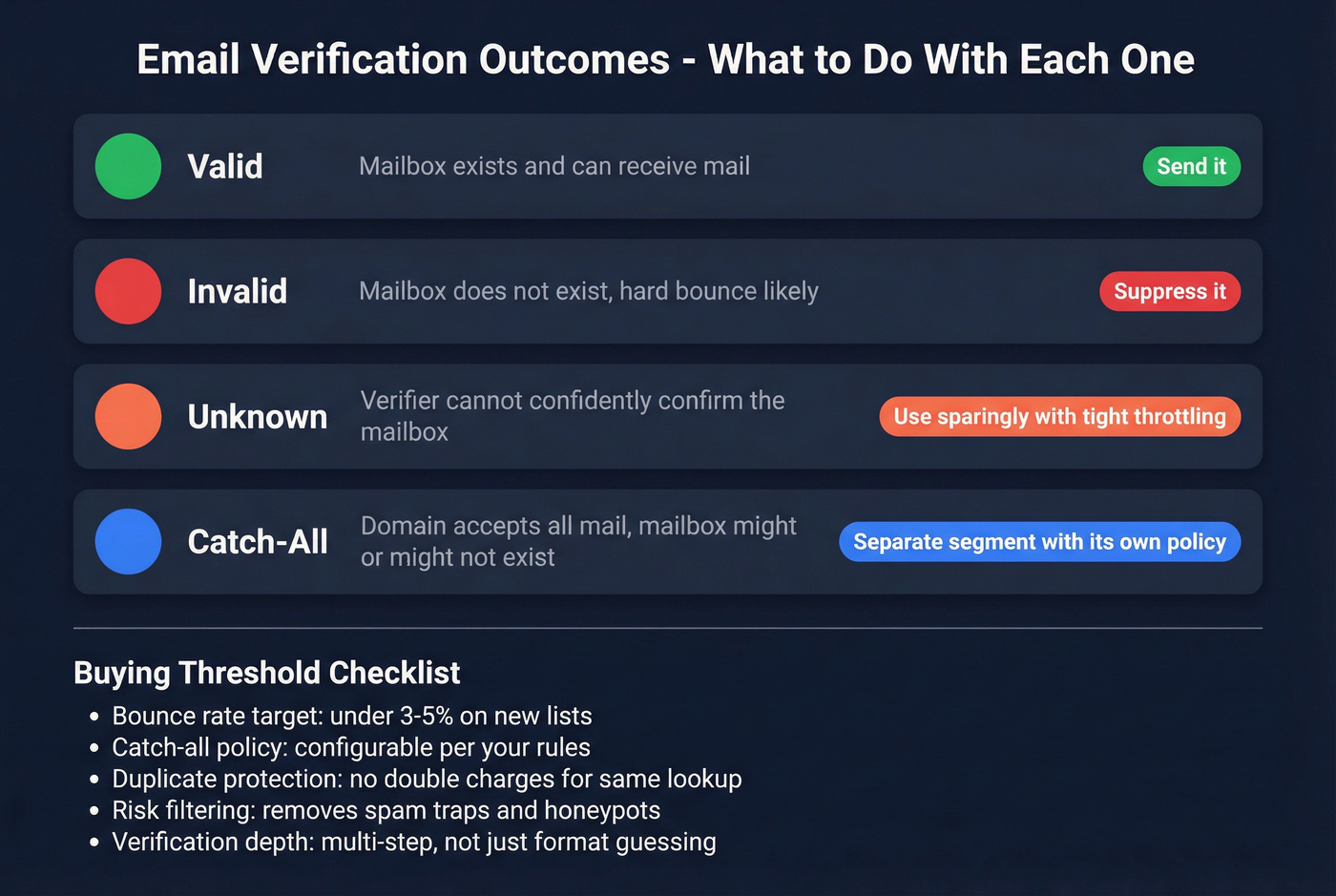

Verification outcomes you should demand (and how to use them)

A real verification system returns outcomes like:

- Valid: mailbox exists and can receive mail Use it.

- Invalid: mailbox doesn't exist / hard bounce likely Suppress it.

- Unknown: verifier can't confidently confirm Use sparingly and only with tight throttling.

- Catch-all: domain accepts all mail; mailbox might exist, might not Treat as a separate segment with its own policy.

Catch-all handling is where lazy tools wreck deliverability. The right approach is simple: label it correctly, then let you decide what to do (send, don't send, or send only when other signals are strong).

A practical threshold checklist (what "good" looks like)

Use these as buying thresholds:

- Bounce rate target: under 3-5% on new lists

- Catch-all policy: configurable (send / don't send / send only with extra signals)

- Duplicate protection: doesn't charge twice for the same lookup; suppresses previously exported leads

- Risk filtering: removes spam traps and honeypots

- Verification depth: multi-step verification, not just format guessing

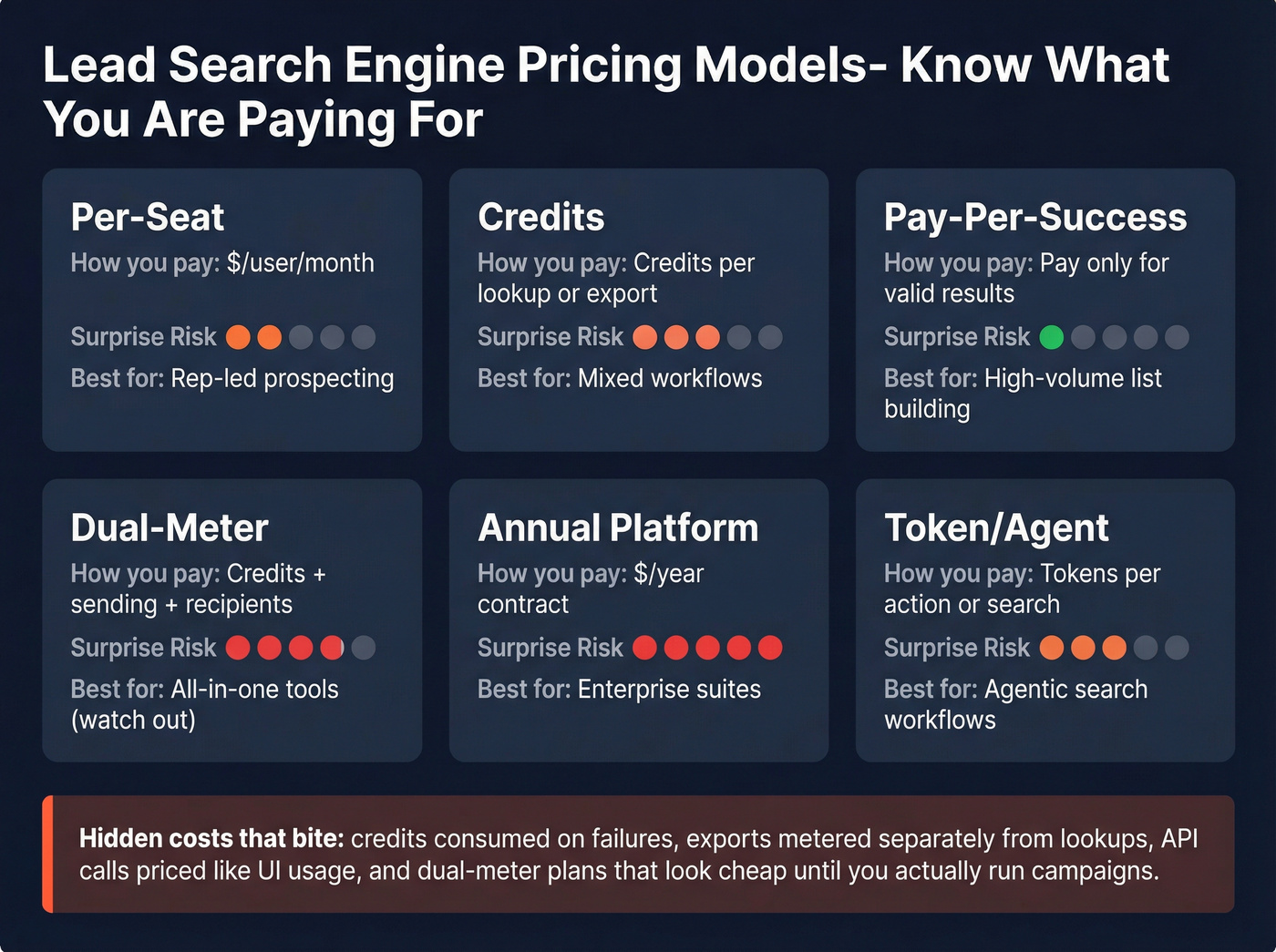

Lead search engine pricing models (and why your bill surprises you)

Pricing is where lead search engines get annoying fast. Not because they're expensive, but because metering rules quietly punish normal RevOps workflows.

Here are the common models:

| Pricing model | How you pay | Surprise risk | Best for |

|---|---|---|---|

| Per-seat | $/user/mo | Seats creep | Rep-led prospecting |

| Credits | Credits per lookup/export | Credit burn | Mixed workflows |

| Pay-per-success | Pay per valid result | Low | High-volume list building |

| Dual-meter | Credits + sending/recipients | High | "All-in-one" tools |

| Annual platform | $/year contract | Very high | Enterprise suites |

| Token/agent pricing | Tokens per action/search | Medium | Agentic search workflows |

One sentence on token pricing because it's showing up more: Dealcode offers token-based plans starting around EUR99/month and scaling into enterprise.

The hidden costs that bite teams

- Credits consumed on failures (invalid/unknown) Paying to be told "no" is a bad deal.

- Exports metered separately from lookups If you already paid to find it, paying again to export is pure friction.

- API calls priced like UI usage If you enrich at scale, this can double your effective cost.

- Dual-meter plans (credits + recipients + add-ons) These look cheap until you actually run campaigns.

Opinionated rule: avoid dual-meter plans unless you've got someone forecasting both credits and recipients every month. Otherwise you'll hit limits mid-campaign and blame your reps.

A worked example: cost per valid lead (sanity-check your quote)

Let's say you need 1,000 valid emails/month for outbound. If your vendor charges for invalids, duplicates, or exports, your "cost per lead" math's already wrong, so bake those rules into the model before you sign anything.

- Pay-per-success model (example: $0.03 per valid) 1,000 x $0.03 = $30/month (plus any export fees if charged).

- Credits model (example: ~$0.01 per email) 1,000 x $0.01 = $10/month (assuming you're not charged for invalids/duplicates).

- Per-seat model (example: $99/seat/mo, 5 seats) $495/month whether you pull 200 leads or 20,000.

This is why "cheap per seat" is often expensive, and why "expensive credits" can be a bargain if verification is strict and billing is fair.

Concrete tool pricing examples (so you can model it)

Instantly SuperSearch (subscription + credits) SuperSearch is priced at $47 / $97 / $197 per month (Growth / Supersonic / Hyper Credits). Credit ranges by plan: Growth 1,500-2,000 credits/mo, Supersonic 5,000-7,500, Hyper Credits 10,000-200,000, and Enterprise 200,000+.

Budgeting nuance that matters: Instantly sells SuperSearch (data) separately from Outreach (sending) and CRM. Outreach tiers have their own limits, for example: Growth includes 1,000 uploaded contacts + 5,000 emails/month, Hypergrowth includes 25,000 uploaded contacts + 100,000 emails/month, and Light Speed goes up to 500,000 emails/month. SuperSearch is an add-on-style purchase, not bundled into those send limits.

Generect (pay-per-success, wallet model) Free searches, then $0.03 per valid email found and $0.02 per export, with a $20 minimum deposit. Clean unit economics.

Seamless.AI (free tier, then sales-led pricing) Free plan includes 1,000 credits/user/year. Paid tiers are sales-led. Users complain about credit burn and the time it takes to get a straight answer on packaging. Reported paid pricing often lands around $79/user/month plus $49 per 500 credits, with enterprise around $149/user/month and a 5-seat minimum.

Snov.io (dual-meter: credits + recipients + add-ons) Starter is $29.25/mo (annual) with 1,000 credits and 5,000 recipients; Pro is $74.25/mo (annual) with 5,000 credits and 25,000 recipients. "Recipients" is the sending-side cap: how many unique people you can email in a month through their outreach features. Then there's a separate $69/mo per automation slot add-on. Powerful, but you've got to forecast both meters.

Skrapp (credits with rollover) Starts at $30/mo. Credits roll over, and the credit rules feel fair (no double-billing duplicates; no charge for invalid/unknown). This is how credit systems should work.

Compliance & risk basics (GDPR/CCPA/TCPA) for lead search

Compliance isn't a legal memo. It's an operational checklist.

Use this if

- You can honor opt-outs across every system (CRM + sequencer + dialer)

- You can screen against DNC lists for calling

- You've got a process for data deletion requests and audit trails

Skip this (or slow down) if

- Your team can't reliably suppress contacts across tools

- You're blasting mobile numbers without TCPA awareness

- You don't know where your data's stored or how opt-out is enforced

Look, if you can't do suppression cleanly, don't scale outreach. You'll just scale complaints.

Risk checklist (the basics that keep you out of trouble):

- TCPA: penalties run $500-$1,500 per call for violations.

- CCPA: B2B contacts have been covered since Jan 1, 2023.

- GDPR: you need a lawful basis, clear notices where required, and a real opt-out process.

- Operational requirements: DNC screening, suppression lists, and opt-out handling across email and phone.

How to choose a lead search engine (decision framework)

Two scenarios drive almost every "we need a lead search engine" purchase.

Scenario A: Bounce rate is hurting deliverability

If your first sequence bounces 8-15%, you're not just wasting sends, you're damaging domain reputation and inbox placement. In that world, the best tool's the one that optimizes for verification quality and catch-all handling, even if it returns fewer total contacts.

Decision rules:

- Prioritize verification outcomes and risk filtering over database size.

- Prefer billing that doesn't punish you for invalid/unknown.

- Treat catch-all as a separate segment with its own policy.

Scenario B: You need a new segment this week, but your data is stale

This is the RevOps fire drill: "We're launching into fintech next week" and your current provider's titles are behind reality. Freshness becomes the constraint, not features.

Decision rules:

- Prioritize refresh cadence and search flexibility (filters + technographics + growth signals).

- Avoid tools that meter exports and lookups separately if you iterate fast.

- Make sure you can push clean data into HubSpot/Salesforce without creating duplicates.

Here's a scenario I've seen play out: a team exports 3,000 "VP Marketing" contacts for a new vertical, syncs them straight into HubSpot, and only then realizes 20% are actually "Marketing Manager" or "Growth Lead" because the titles haven't been refreshed in weeks; the SDRs lose a week cleaning it up, and leadership blames outbound instead of the data.

Scenario C: You're building workflows (not lists)

If you're using Clay, webhooks, enrichment APIs, or routing logic, you're not "prospecting." You're building a data pipeline.

Decision rules:

- Prioritize API match rate, dedupe controls, and stable field mapping.

- Look for native integrations (CRM + sequencers) so you aren't duct-taping CSVs forever.

- Make sure the vendor's credit model doesn't punish automation.

Rule-of-thumb picks (opinionated, and useful)

Use these as fast shortcuts:

- Pick ZoomInfo if you need phones + intent + enterprise workflows and you'll actually implement them; otherwise it's overkill.

- Pick Apollo if you want a broad, rep-friendly prospecting UI and can tolerate occasional data cleanup.

- Pick Cognism if your motion's phone-heavy in regulated markets and compliance posture is a buying criterion.

- Pick Lusha if you mainly need direct dials for SMB/mid-market and want a simple extension-led workflow.

- Pick Clearbit/Breeze-style enrichment if your priority's enriching inbound leads and routing in HubSpot, not outbound list building.

- Pick a self-serve lead search engine if you want predictable unit economics and you hate annual contracts.

What users complain about (patterns you should watch for)

These are the recurring gotchas that show up in reviews and community threads:

- Seamless.AI (common user reports):

- Credits disappear faster than expected (credit burn).

- Packaging/pricing feels opaque once you leave the free tier.

- Support and account management can be slow when you hit limits.

- RocketReach (review pattern):

- A May 2026 G2 review flags unreliable personal Gmail matching and frustration with support response.

- Dual-meter tools (Snov.io-style):

- Teams budget credits but forget recipients/sending caps, then campaigns stall mid-month.

Tools that match the "lead search engine" definition (shortlist)

These aren't the only tools in the market. They're the ones that behave like one in practice: searchable discovery + verification + export/sync mechanics you can operationalize. If you're evaluating options, shortlist tools that can prove freshness and verification in a pilot, not just "database size."

Prospeo - The B2B data platform built for accuracy

I've seen too many teams light up a new domain, buy a big list, and then spend the next month wondering why deliverability fell off a cliff. If deliverability's the constraint, accuracy and refresh cadence beat "coverage" every time.

Prospeo is built for that reality: 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers, backed by 98% verified email accuracy and a 7-day data refresh cycle. It's also built like an ops-friendly system: 92% API match rate and 83% enrichment match rate, returning 50+ data points per enrichment.

Search stays practical (30+ filters), including intent across 15,000 topics powered by Bombora, and it plugs into the tools teams actually run day to day: Salesforce, HubSpot, Instantly, Smartlead, Lemlist, Clay, Zapier, Make, and n8n.

If you want to see the product surfaces that matter for a lead search workflow, these are the three I'd check first:

- https://prospeo.io/b2b-leads-database

- https://prospeo.io/email-finder

- https://prospeo.io/data-enrichment-api

Instantly SuperSearch - Best for all-in-one outreach + lists (with clear packaging)

Instantly SuperSearch is one of the cleanest offers for teams that want leads and sending in the same ecosystem, but still want the budget to make sense. SuperSearch pricing is $47/$97/$197 per month (Growth/Supersonic/Hyper Credits) with credit ranges of 1,500-2,000, 5,000-7,500, and 10,000-200,000 credits per month (Enterprise 200,000+).

The important budgeting detail: SuperSearch is separate from Instantly Outreach and Instantly CRM. Outreach plans have their own uploaded-contact and monthly email limits (for example, Growth 1,000 uploads + 5,000 emails/mo, Hypergrowth 25,000 + 100,000, Light Speed up to 500,000 emails/mo). That separation is good because it prevents "data usage" from quietly eating your "sending usage."

Generect - Best for pay-per-success unit economics

Generect is the most finance-friendly model on this shortlist. You run free searches, then pay $0.03 per valid email found and $0.02 per export, with a $20 minimum deposit. No seat math, no annual negotiation.

If you're running high-volume list building and you want to measure everything as cost-per-valid, this model's hard to beat.

Seamless.AI - Big footprint, but expect sales-led friction

Seamless.AI is popular because it's easy for reps to research a contact quickly, and the free tier (1,000 credits/user/year) gets teams hooked.

But once you outgrow free, you're in sales-led land. Users report two problems over and over: credit burn and pricing opacity. Reported paid pricing often lands around $79/user/month plus $49 per 500 credits, with enterprise around $149/user/month and a 5-seat minimum.

If you're SMB and you value speed, my advice is blunt: skip opaque, sales-led pricing unless you're sure you'll use it daily.

Skrapp / Snov.io / RocketReach / FindThatLead (quick fit notes)

- Skrapp: Starts at $30/mo. Rollover credits + fair billing rules. Best if you hate credit games.

- Snov.io: $29.25/mo Starter or $74.25/mo Pro (annual). Dual-meter: credits (data actions) and recipients (sending cap), plus $69/mo per automation slot. Best if you want data + outreach in one tool and you'll forecast both meters.

- RocketReach: Free $0 (5 lookups/mo), Essentials $69 (100 lookups/mo), Pro $119 (250), Ultimate $209 (500). Best for occasional lookups (email/phone). A May 2026 G2 review flags unreliable personal Gmail matching and frustration with support response, so keep it to professional emails and verify before sending.

- FindThatLead: $27/$150/$199 per month. Best if you want a simple "pay for verified" style credit system for fast list iteration.

Quick comparison table (pricing model + best for)

| Tool | Pricing signal | Model | Best for |

|---|---|---|---|

| Prospeo | ~$0.01/email | Credits | Deliverability + freshness |

| Instantly SuperSearch | $47-$197/mo | Subscription + credits | Outreach + lists in one ecosystem |

| Generect | $0.03/valid | Pay-per-success | Forecastable cost per valid |

| Seamless.AI | $0 + sales-led | Seats + credits | Rep-led research at scale |

| Skrapp | $30/mo | Credits | Fair billing + rollover |

| Snov.io | $29.25+/mo | Dual-meter | Data + outreach (if you forecast) |

| RocketReach | $0-$209/mo | Lookups | Occasional lookups (verify first) |

| FindThatLead | $27+/mo | Credits | Simple verified-email list building |

The article's workflow is ICP → search → verify → dedupe → CRM sync → outreach. Prospeo handles steps 1-5 natively: 30+ filters, 300M+ profiles, built-in verification, automatic deduplication, and direct Salesforce/HubSpot sync with field mapping.

Replace your fragmented lead search stack with one platform that actually works.

FAQ about lead search engines

What's the difference between a lead search engine and a lead database?

A lead search engine is query-first: you filter and discover ICP-matched leads, then verify and export them. A lead database is storage-first: a large dataset you license access to. In practice, search engines optimize for speed, freshness, and workflow; databases optimize for coverage and enterprise features.

What does "verified email" actually mean (valid vs catch-all vs unknown)?

Verified email means the tool tested deliverability and returned a status: valid (deliverable), invalid (hard bounce likely), unknown (can't confirm), or catch-all (domain accepts all mail). Treat catch-all as its own segment; many teams only mail it when other signals are strong and keep throttles tighter.

Are lead search engines GDPR/CCPA compliant by default?

No. Compliance depends on sourcing, opt-out enforcement, DPAs, and your internal suppression process. You still need suppression lists, opt-out handling across tools, and DNC screening for calling. CCPA applies to B2B contacts since Jan 1, 2023, so deletion/access workflows and audit trails matter.

What pricing model is best: credits, per-seat, or pay-per-success?

Pay-per-success is easiest to forecast because you pay for valid outcomes. Credits are great when the vendor doesn't charge for invalids/duplicates and makes consumption rules obvious. Per-seat works when usage is consistent across reps, but it gets wasteful fast when only a few power users do most of the prospecting.

Which tool is a good free option to test before you commit?

For a real pilot, use a free tier that lets you verify and export enough records to measure bounce rate on at least 50-100 contacts. Prospeo's free tier includes 75 emails + 100 extension credits/month, and RocketReach also offers 5 lookups/month. Verify before sending and track bounces like it's a production campaign.

Next steps: run a 200-lead pilot (and make the tool prove it)

Don't choose a tool from a demo. Choose it from a pilot.

Run a 200-lead test in one segment and track:

- Bounce rate (target under 3-5%)

- Catch-all rate (and your policy performance)

- Duplicate rate (contact + account)

- CRM match rate (how many records map cleanly to existing accounts/contacts)

- Cost per valid lead (not cost per exported row)

- Reply/meeting rate (only after the data metrics look healthy)

If the tool can't deliver clean data at 200 leads, it won't magically behave at 20,000.

The best lead search engine is the one your reps trust after week two because the data holds up.