How to Automate Sales Signals (From Trigger to Outreach)

Finding "signals" is easy. Turning them into revenue is the hard part.

PunchB2B (2026) pegs only ~5% of your TAM as in-market at any moment. If you're blasting the other 95% with generic sequences, you're paying for noise. The fix is to automate sales signals end-to-end, so a trigger becomes an owner, a next step, and a measurable outcome (not just another alert).

Here's the thing: alerts aren't automation.

An alert is a dopamine hit. Automation is routing + next step + measurement.

What you need (quick version)

Use this as your build checklist. If you can't check every box, you don't have an automated signal system yet - you've got notifications.

- The 7-layer architecture (end-to-end)

- Ingest signals -> normalize -> score/decay -> dedupe/stack -> enrich/verify -> route -> activate/log + measure

- The 12-signal rule (so you don't drown)

- Pick 12 signals max for v1: 4 strong, 6 medium, 2 experimental

- If you can't explain the "why now?" in one sentence, it's not a signal - it's trivia

- Three plays you can implement this week

- Pricing spike play: pricing/plan page visits + ICP match -> task + same-day email

- Hiring/funding play: funding or headcount growth -> route to AE/SDR + 3-touch sequence

- Closed-lost resurrection: competitor comparison or category research -> revive last opp owner + short "timing changed?" note

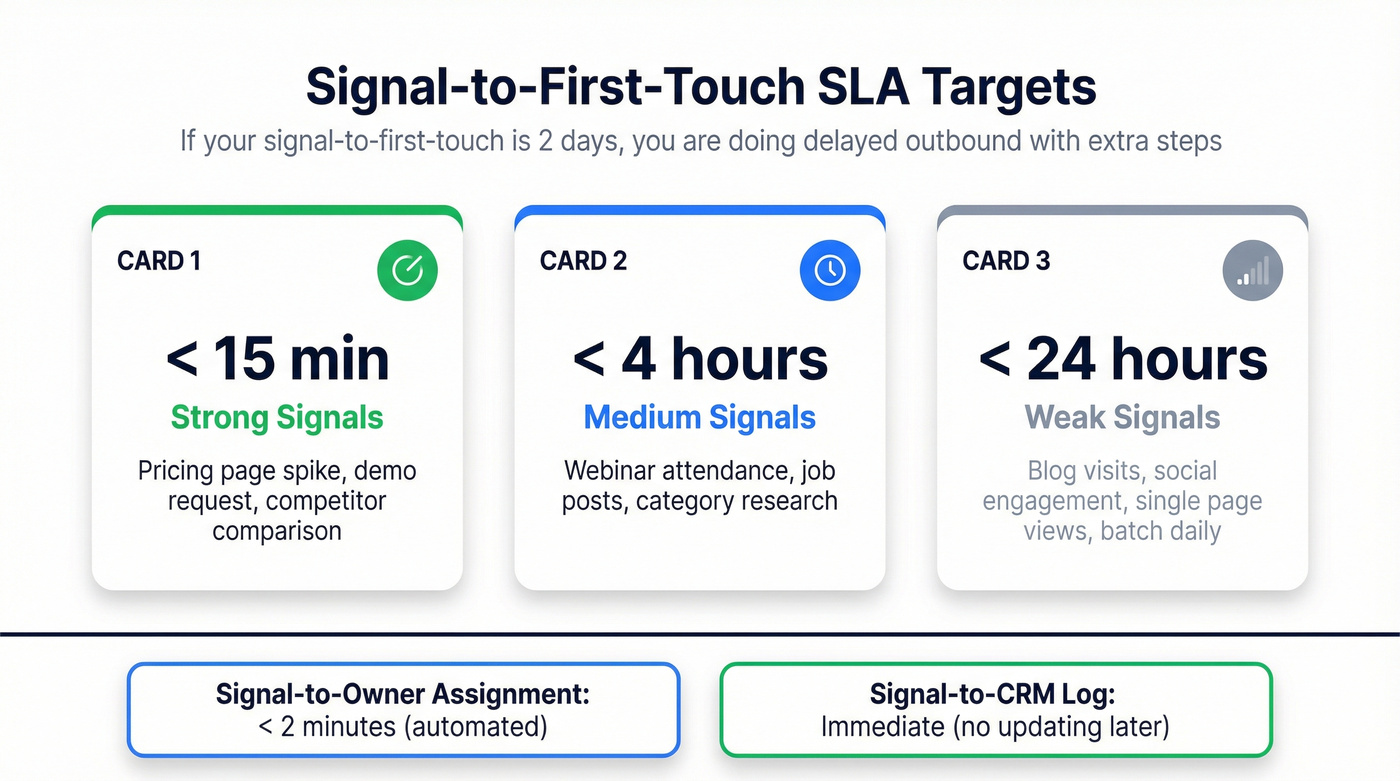

- SLA targets (signal-to-first-touch)

- Strong signals: < 15 minutes

- Medium signals: < 4 hours

- Weak signals: < 24 hours (or batch daily)

- Minimum tool stack (don't overbuy)

- Runner: Zapier / Make / n8n

- Signal sources: first-party web + one external feed (intent, jobs, news, review sites)

- Contact activation layer: a verified email + mobile workflow (this is where most teams faceplant) - see email verification

- Sequencer: Instantly / Outreach / Salesloft

- CRM logging: HubSpot or Salesforce (plus a simple "Intent Signals" object)

Two non-negotiables if you want this to actually work:

- Dedupe + stacking (otherwise reps mute you), and

- Contact-level activation (otherwise every "signal" becomes manual research).

Hot take: if your average deal's on the smaller side, you probably don't need an enterprise ABM suite to automate sales signals. You need a tight scoring model, fast routing, and verified contacts - then you'll beat teams paying six figures for dashboards nobody uses. (If you're trying to keep ABM lean, ABM without expensive tools is the move.)

What "sales signals" are (and why most programs fail)

Sales signals are time-bound indicators that a specific account (or person) is more likely to buy now than they were last week.

TheSignal.club has the cleanest framing I've seen: TAM changes yearly, but your Signal-Based Market (SBM) changes daily. Your job isn't "find leads." It's answer one question: why am I reaching out to this company/person today?

Most programs fail for one boring reason: they stop at dashboards.

Use this if: you can route a signal to an owner, generate a next step, and log the outcome back to the system. Skip this if: your plan's "send alerts to Slack and hope reps do something."

The failure mode looks like this:

- Marketing buys intent.

- RevOps builds a dashboard.

- SDRs get a firehose of "surging accounts."

- Nobody knows who to contact, what to say, or whether it worked.

- Three months later, the tool gets blamed.

I've watched teams spend more time debating "which intent provider is best" than building the routing + activation layer. Provider choice matters, sure, but the plumbing matters more, and it's where most teams quietly give up. (If you want a clean baseline on the category, start with intent signals.)

Signal taxonomy you'll automate in 2026

Reply.io's taxonomy is the one I use because it maps cleanly to systems design: first-, second-, and third-party signals.

The nuance that matters: most intent is account-level, but outreach is executed at contact-level. That mismatch is where signal programs go to die.

| Signal type | What it is | Examples | Typical granularity | Best use |

|---|---|---|---|---|

| First-party | Your owned data | site visits, demo requests, email clicks, product usage | Contact + account | fastest routing |

| Second-party | Partner/platform data | review-site activity, event platforms, professional network engagement | Mostly account-level | category intent |

| Third-party | Co-op / aggregated research | topic consumption, competitive research, technographics | Account | top-of-funnel focus |

Quick examples that actually map to plays:

- First-party: pricing page visits, "book a demo" starts, high-intent docs views.

- Second-party: category page views on review sites, competitor comparisons, event attendance.

- Third-party: surging on "data enrichment API" or "sales engagement platform" topics.

Account-level vs contact-level reality (don't ignore this):

- Account-level tells you who is warm.

- Contact-level tells you who to message.

- If you can't reliably produce the right persona with a verified email/mobile, your "signal" becomes a research task - aka manual work. (This is where key decision makers + a persona map pays off.)

Layer 5 is where signal stacks break - you've got a warm account and no verified contacts. Prospeo's 143M+ verified emails (98% accuracy) and 125M+ mobile numbers (30% pickup rate) plug directly into your automation layer via API, Zapier, Make, or n8n. Hit your 15-minute SLA on strong signals without manual research.

Stop letting warm signals die in a spreadsheet. Enrich and activate them now.

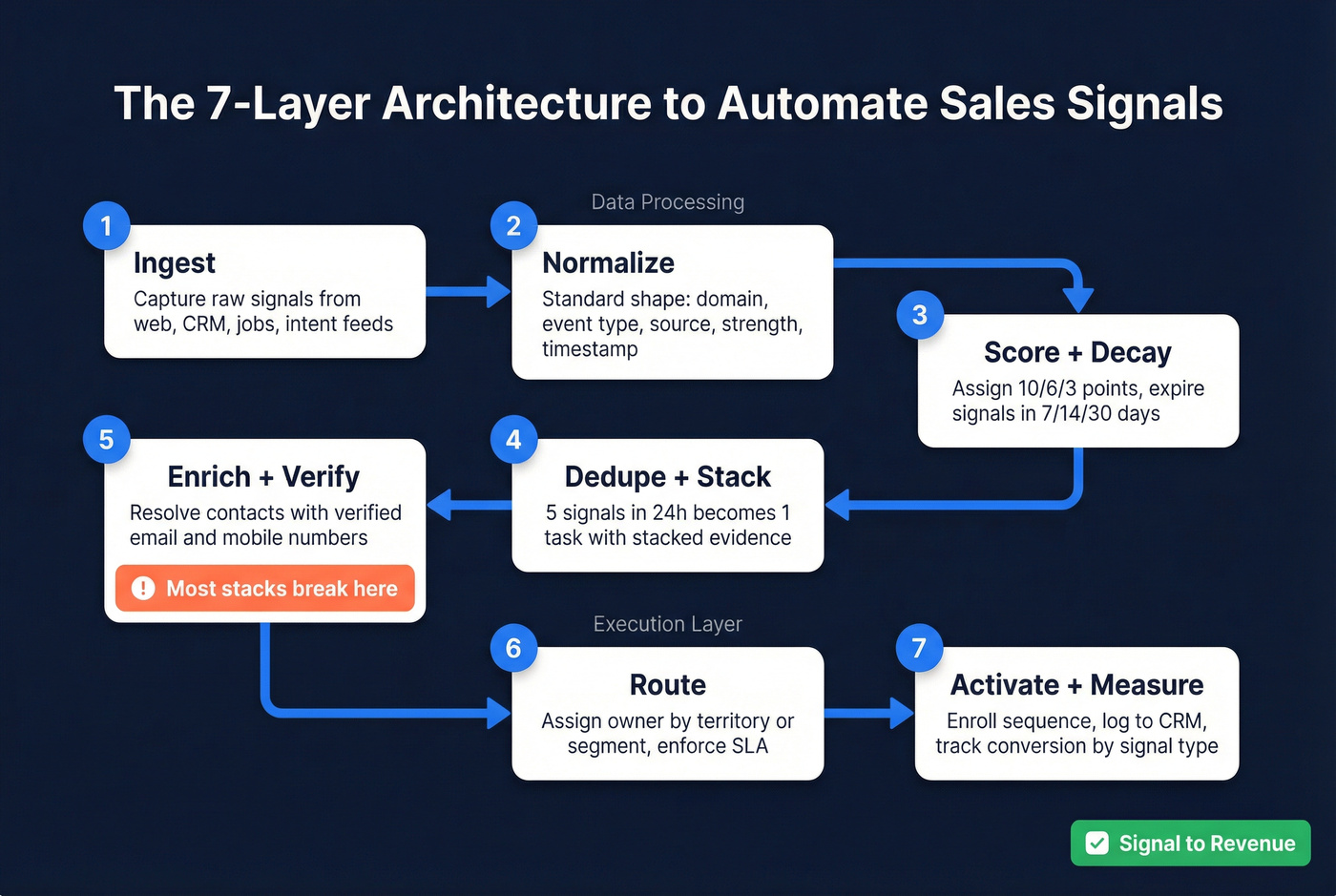

The 7-layer architecture to automate sales signals (signal -> revenue)

This is the buildable blueprint. Keep it boring. Boring systems scale.

Layer 1: Ingestion (capture signals)

- Sources: website visitor tools, RSS/news, job boards, intent providers, CRM events (stage changes), product analytics, and yes - company social pages (announcements hit there first).

- Output: raw events into a queue (sheet, database, or webhook endpoint).

Layer 2: Normalization (make signals comparable)

Convert every event into a standard shape:

account_domain,event_type,source,topic,strength,timestamp

Rules that save you later:

- Map domains to CRM Account IDs.

- Store the original URL/text snippet (so reps can sanity-check fast).

- If you can't map to an account, it's not routable yet - park it in a "needs mapping" queue.

Layer 3: Scoring + decay (so time matters)

- Assign a base score by event type.

- Apply decay windows:

- Strong: expires in 3-7 days

- Medium: 7-14 days

- Weak: 14-30 days

- Keep a "current intent score" per account that updates continuously. (If you want a modern model that doesn’t get overcomplicated, use account scoring as your reference frame.)

Opinion: teams overthink scoring. Start with 10/6/3, ship it, then adjust based on meeting rate. A perfect model that launches in 90 days loses to a decent model that launches next week.

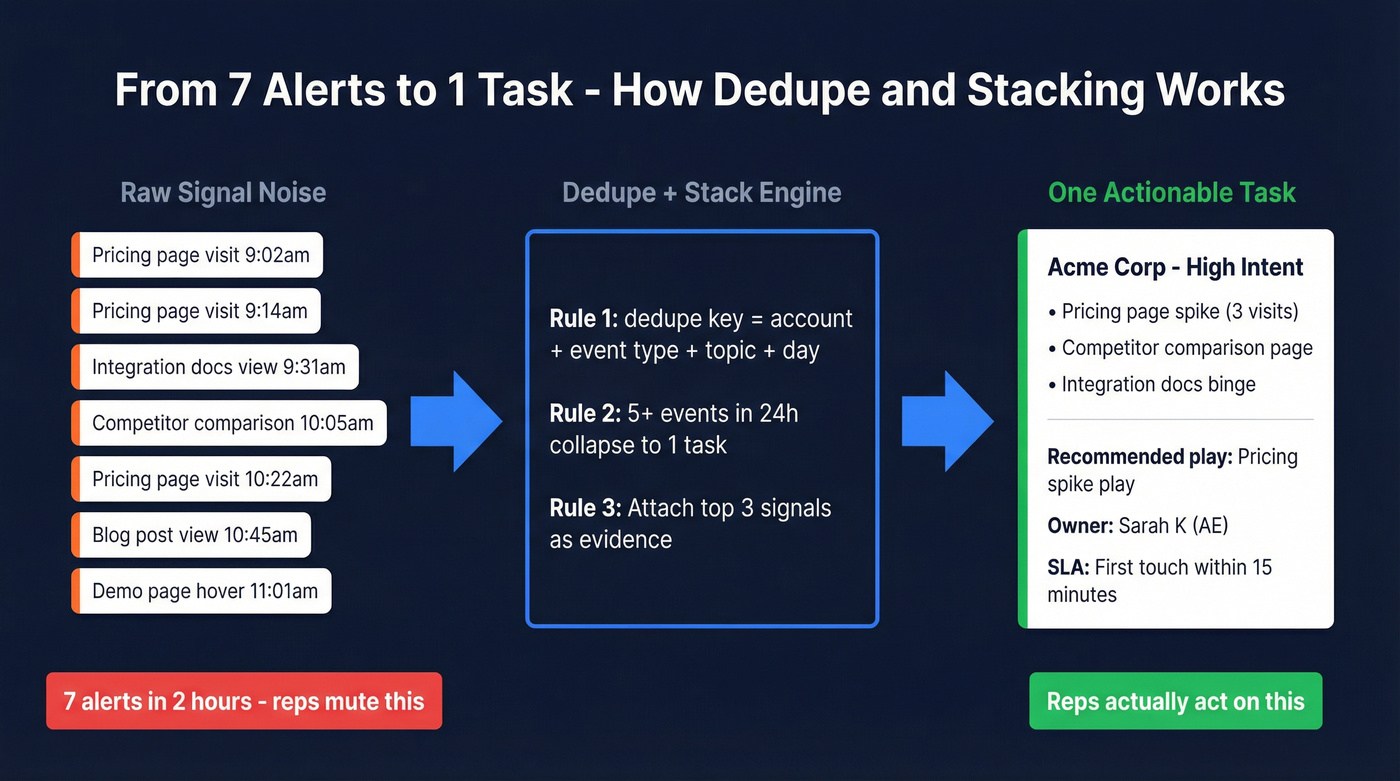

Layer 4: Dedupe + stacking (so reps don't hate you)

- Collapse noisy bursts into one actionable item.

- Example: "5 signals in 24h -> 1 task."

- Stack signals into a single "why now" narrative.

Layer 5: Enrichment + verification (make it usable)

This is where most stacks break. You've got a warm account... and no trustworthy contacts. If you’re still guessing addresses, stop and use a real email lookup + verification step.

One more practical point: if you're serious about SLAs, mobile can't be an afterthought. A 30% mobile pickup rate changes what "fast follow-up" even means when a strong signal hits at 4:45pm and you want a conversation before the day ends. (If you’re building a call-first motion, use this B2B phone number workflow.)

Layer 6: Routing (owner + SLA)

- Route by territory, segment, named accounts, or existing opp ownership.

- Create explicit SLAs:

- Strong signals: route to human + task in minutes

- Medium: route to sequence enrollment within hours

- Weak signals: batch to a daily "review queue" (Tie this to speed-to-lead metrics so ops can enforce it.)

Layer 7: Activation + logging + measurement loop

- Activation: enroll in sequence, create task, or trigger a call block.

- Logging: write back to CRM (signal object + activity).

- Measurement: track conversion by signal type, score band, and play.

SLA targets that actually work in the wild:

- Signal-to-owner assignment: < 2 minutes (automation)

- Signal-to-first-touch: 15 minutes (strong), 4 hours (medium)

- Signal-to-CRM log: immediate (no "I'll update later")

If your "signal-to-first-touch" is 2 days, you're not doing signal-based selling. You're doing delayed outbound with extra steps.

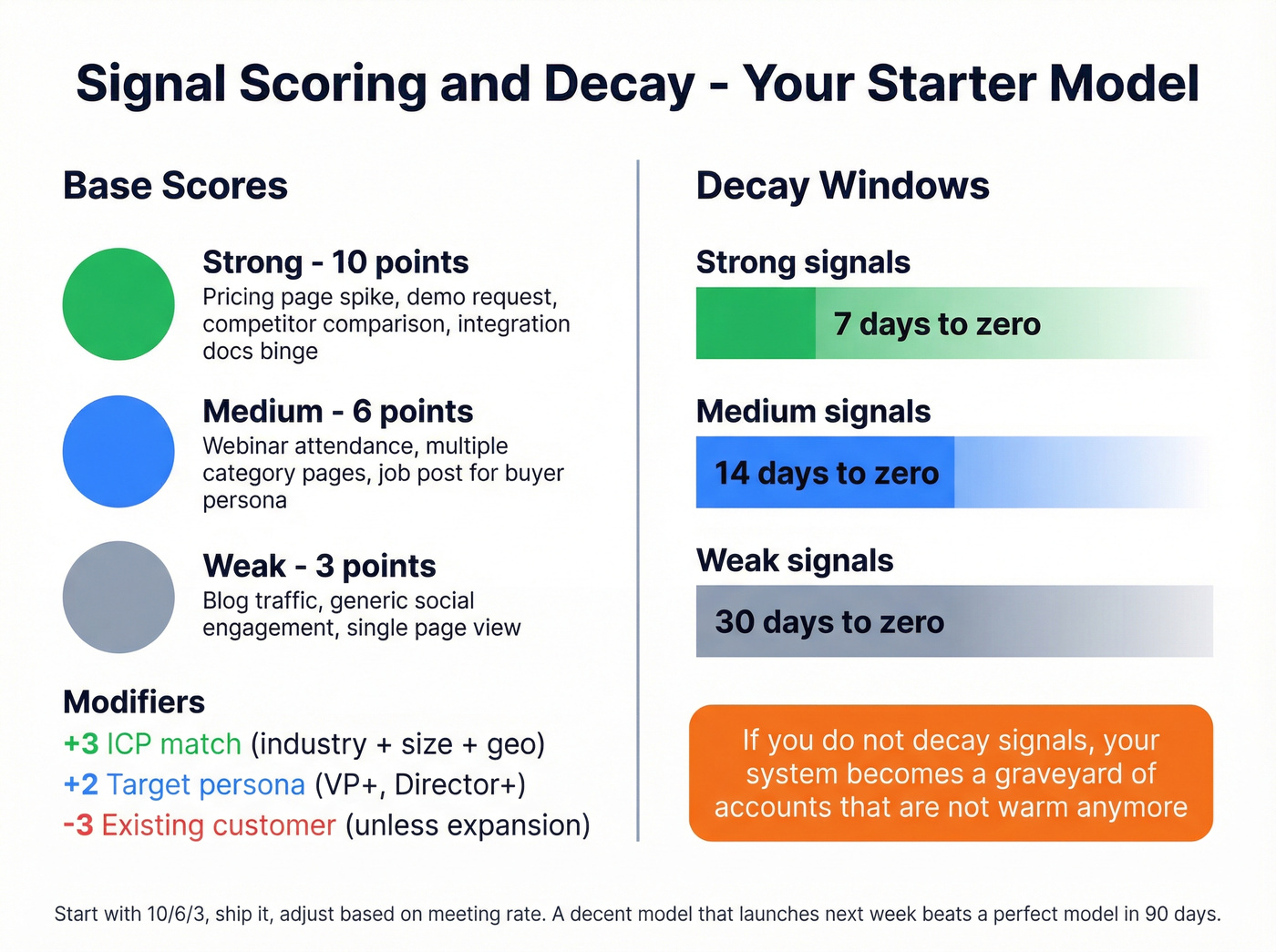

Engineer signal quality (scoring, decay, dedupe, stacking)

Signal quality's a math problem pretending to be a tooling problem.

Scoring: start simple, then earn complexity

SaaS Weekly's heuristic is the right default: pricing page strong, blog weak.

A practical starter scoring ladder:

- 10 points (strong): pricing/plan page spike, demo request, competitor comparison, "integration docs" binge

- 6 points (medium): webinar attendance, multiple category pages, job post for your buyer persona

- 3 points (weak): blog traffic, generic social engagement, single page view

Then add modifiers:

- +3 if ICP match (industry + size + geo)

- +2 if target persona present (VP+, Director+)

- -3 if existing customer (unless it's an expansion play)

Decay: timebox the "why now"

Signals rot. Fast.

A clean rule:

- Strong signals decay to zero in 7 days

- Medium in 14 days

- Weak in 30 days

If you don't decay, your system becomes a graveyard of "warm" accounts that aren't warm anymore.

Dedupe: "5 signals in 24h -> 1 task"

This one rule saves your reps.

- Create a

dedupe_key = account_id + event_type + topic + day - If 5+ events hit the same dedupe_key in 24 hours:

- create one task

- attach the stacked evidence (top 3 events)

- recommend one play

I've run bake-offs where the "best" intent feed lost because it created 200 tasks/day and reps muted it. Noise kills adoption faster than bad data.

Stacking: turn breadcrumbs into a reason

A single weak signal is nothing. Three related signals is a story.

Example stack:

- Surging on "sales engagement platform"

- Two job posts for SDR Manager + RevOps

- Pricing page spike

That's not "intent." That's "they're rebuilding outbound."

False positives: they're normal (plan for them)

Co-op intent is powerful, but it's also noisy because researching software is literally someone's job. Design around it:

- require stacking for outreach

- use holdouts (measurement section)

- route weak signals to nurture, not SDR tasks

CRM schema + routing logic (copy/paste templates)

If you want automation, you need a place to store signals that isn't a Slack channel.

"Intent Signals" custom object (copy/paste fields)

Create a custom object called Intent Signals (HubSpot custom object or Salesforce custom object). Minimum fields:

| Field | Type | Example |

|---|---|---|

| event_type | picklist | pricing_spike |

| source | picklist | first_party_web |

| topic | text | sales intelligence |

| strength | number | 10 |

| timestamp | datetime | 2026-02-17T10:42Z |

| decay_until | datetime | 2026-02-24T10:42Z |

| account_id | lookup | 001... |

| contact_id | lookup | 003... |

| dedupe_key | text | 001_pricing_salesintel_2026-02-17 |

| recommended_play | picklist | pricing_spike_fast_follow |

Optional but high-use:

stack_summary(long text): "3 signals in 2h: pricing + competitor + hiring"owner_id(lookup): who's accountablestatus(picklist): new / routed / touched / won / ignoredevidence_url(text): link to the page/article/post that triggered the signalevidence_snippet(long text): the 1-2 lines a rep can paste into a notepersona_target(picklist): RevOps / Sales / IT / Finance (so enrichment is deterministic)

Routing rules (simple enough to maintain)

Use deterministic routing first. AI routing comes later.

Rule set (starter):

- If

account.has_open_opp = true-> route to opp owner - Else if

account.tier = named-> route to named AE - Else if

strength >= 8-> route to SDR queue + SLA 15 min - Else -> add to "daily review" list

Now the part most teams miss: routing isn't just "who owns it." It's also what happens next.

Add two more fields and your automation gets 10x easier:

next_action_type: task / sequence / call block / nurturenext_action_sla_minutes: 15 / 240 / 1440

Then your runner (Zapier/Make/n8n) can do dumb, reliable logic:

- If

next_action_type = sequence-> enroll contact(s) + write activity - If

task-> create task with stack summary + evidence - If

nurture-> add to list + suppress SDR tasks

Buying group mapping (so signals don't die in "who do I email?")

Signals hit accounts. Deals close with buying groups.

Do this once, and your activation becomes automatic:

- Create a persona map per product line: Economic buyer, champion, technical evaluator, procurement.

- For each persona, define:

- departments + seniority bands

- 3-5 title keywords

- exclude keywords (intern, student, recruiter)

- Store it as a simple table in your CRM or a config sheet your workflows read. (If you want examples that don’t suck, use these buyer persona examples.)

Example (simple, works):

- Economic: VP/Head/Director in the owning function

- Champion: Manager/Lead in the owning function

- Technical: IT/Security/RevOps (depending on product)

- Procurement: Finance/Procurement titles (only after engagement)

This is how you turn "account is warm" into "here are 3 people to contact, ranked."

HubSpot workflow idea: copy company intent to contacts

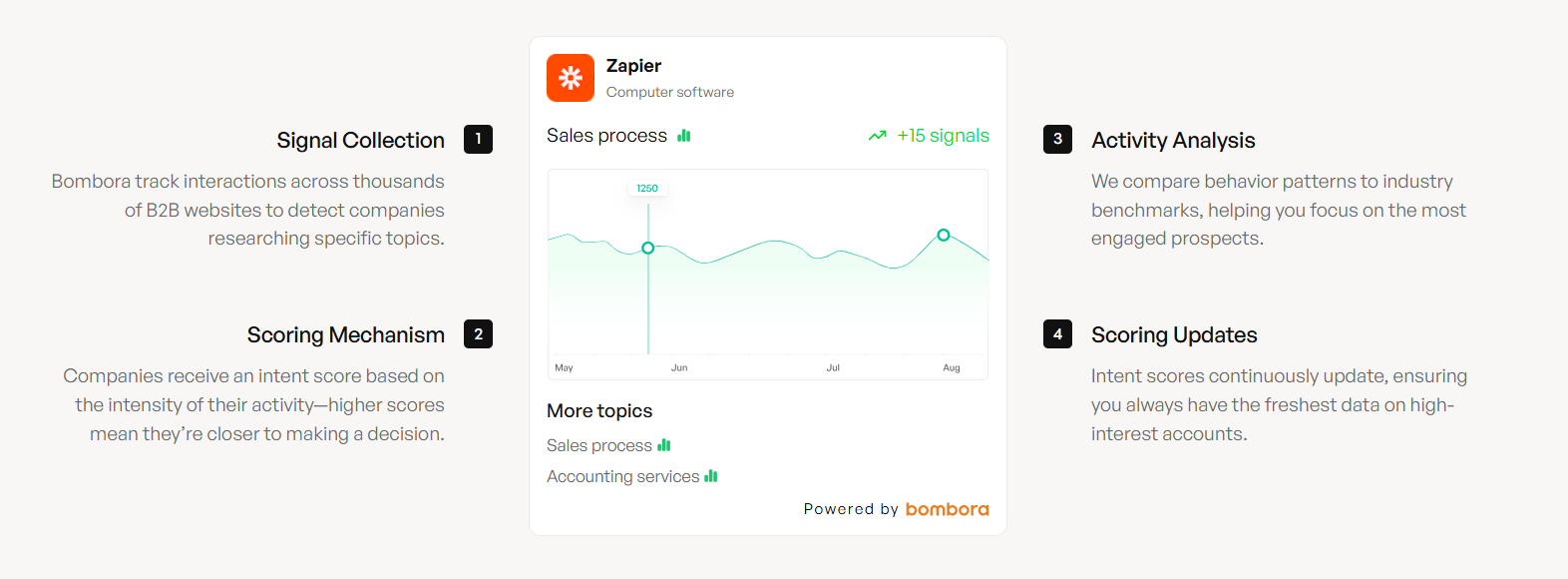

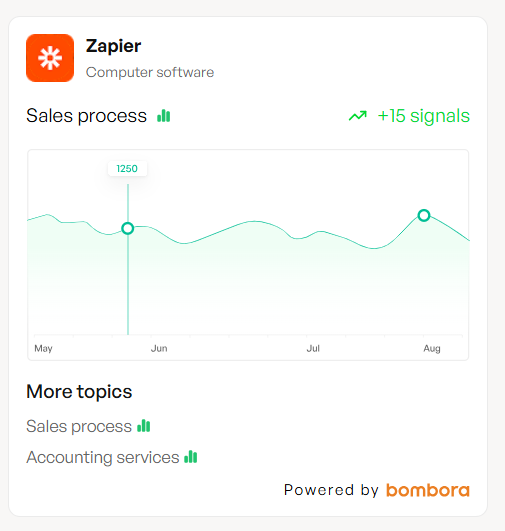

A super practical pattern: keep intent at the company level, then copy the most recent intent topic down to relevant contacts so reps can sequence without hunting. This "copy company intent to contacts" workflow shows up in Gartner Peer Insights Bombora reviews.

Workflow logic:

- Trigger: new Intent Signal on company

- Action: find contacts where

job_function in (Sales, RevOps, IT)andseniority >= Manager - Copy fields:

last_intent_topiclast_intent_strengthlast_intent_timestamp

- Enroll contacts into the right play

Suppression lists (the guardrail that prevents brand damage)

If you automate signals, you must automate who not to contact:

- current customers (unless expansion play)

- open support escalations

- active opportunities in late stage (unless AE requests)

- do-not-contact / unsubscribed / bounced previously

- competitors and partners (tag them once; suppress forever)

This is boring governance. It's also what keeps your "signal engine" from becoming a compliance incident.

Implementation walkthrough (the $10K automation, rebuilt)

A Reddit builder sold a real-time intent automation for $10K. The outline's solid: monitor 100+ RSS feeds -> research -> CRM note + personalized message.

Let's rebuild it using the 7 layers so it isn't a fragile science project, and so you can automate buying-signal workflows without relying on reps to interpret raw alerts. (If you want a tighter list of triggers, start with buying signals for outbound.)

Here's a scenario I've seen play out: a Series A announcement drops at 9:10am, your competitor emails the CEO by 9:25am, and your team sees the "surge" in a dashboard the next morning. Same account, same news, totally different outcome.

Step 1: Ingest (Layer 1)

Triggers to monitor:

- Funding: press releases, Crunchbase updates, VC blogs

- Partnership: PR Newswire, vendor partner pages

- Product launch: company blog RSS, changelog RSS

- Fastest early source: company social pages (launches and hiring often hit there before press)

Map:

- Funding ->

event_type = funding - Partnership ->

event_type = partnership - Product launch ->

event_type = product_launch

Step 2: Normalize + score (Layers 2-3)

Normalize each item into:

- domain

- event_type

- timestamp

- strength (starter: funding=8, partnership=7, product_launch=6)

Add decay:

- funding: 14 days

- partnership: 10 days

- product launch: 7 days

Step 3: Dedupe + stack (Layer 4)

If the same account hits multiple events in 48 hours, create one stacked signal:

- "Funding + product launch in 2 days"

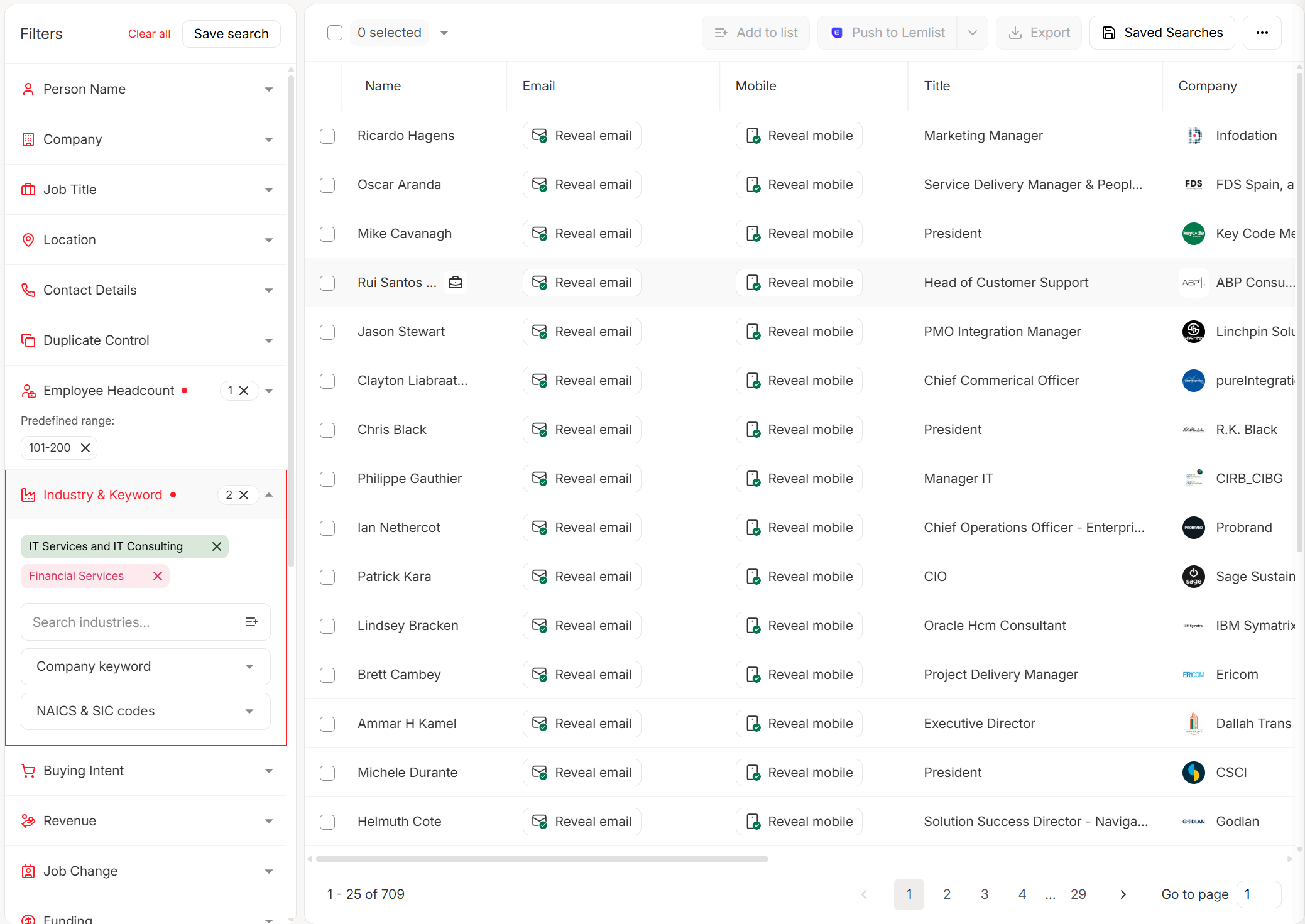

Step 4: Enrich + verify contacts before outreach (Layer 5)

This is the part most automations skip, then wonder why bounce rates spike.

If you're doing this at any real volume, you want enrichment and verification to be automatic, not a rep habit. Prospeo's a clean fit because it gives you verified emails and mobiles (with real-time verification), plus native integrations for places teams actually send from. It also helps that it's self-serve with no contracts, so you can wire it into workflows without a procurement detour.

If you're wiring this into your stack, start with the integrations page so your runner can push contacts straight into your CRM/sequencer.

In the UI, you'll typically see a results table with contact names, titles, verified email status, mobile availability, and an export panel to push into your CRM or sequencer.

Step 5: Route + activate (Layers 6-7)

Routing:

- Funding -> AE owner (if named) else SDR

- Partnership -> SDR + partner-specific sequence

- Product launch -> SDR + "launch congrats" micro-sequence

Activation:

- Create CRM note: "Trigger: Funding round; recommended play: Hiring/Funding"

- Enroll in a 3-touch sequence with the stacked context

I've seen this exact workflow outperform "expensive intent" simply because it hits fast and doesn't bounce.

Tooling + pricing to automate sales signals (from $47/mo to $215k/yr)

You can build a usable signal system for under $500/month, or you can spend enterprise money. The difference isn't "better signals." It's volume, integrations, governance, and how much you want bundled.

A quick ZoomInfo lens (because everyone's thinking it): ZoomInfo's still the heavyweight for broad US coverage + workflow breadth, but it's also where teams end up paying tens of thousands per year once you add seats and modules. If you're primarily trying to automate sales signals, you don't need a giant suite. You need clean plumbing and activation-ready contacts. (If you’re pressure-testing vendors, see ZoomInfo pricing.)

Stack table (layers -> tools)

| Layer | Tool options | Best for | Typical cost (2026) | Key limitation |

|---|---|---|---|---|

| Signals | 6sense, Demandbase, Bombora | intent at scale | $60k-$300k/yr (6sense), $30k-$150k+/yr (Demandbase), $20k-$120k/yr (Bombora; quote-based) | mostly account-level |

| Orchestration | Clay, Zapier/Make/n8n | workflows + logic | $50-$500/mo (Zapier/Make), $0-$200+/mo infra (n8n self-host) + ops time, $149-$800/mo (Clay) | setup time |

| Sequencing | Instantly, Outreach, Salesloft | fast outbound | $47-$358/mo (Instantly), ~$1,200-$2,500+/user/yr (Outreach est.), ~$1,200-$2,400+/user/yr (Salesloft est.) | not "signals" by itself |

| CRM | HubSpot/Salesforce | logging + routing | $0-$2,000+/mo (HubSpot tiers), ~$25-$300/user/mo (Salesforce editions/add-ons est.) | admin overhead |

Enterprise gating criteria (don't buy tools that fail security review)

Even if you're SMB today, build like you'll be audited tomorrow. When you evaluate tools that touch personal data, check:

- SOC 2 (or equivalent) and security documentation

- GDPR/CCPA support, DPAs, and opt-out handling (practical guide: GDPR for sales and marketing)

- RBAC (role-based access control) and least-privilege permissions

- Audit logs (who exported what, when)

- Data retention and deletion controls

- Suppression lists and "do not contact" enforcement

If a tool can't tell you who exported a list last Tuesday, it's not a signal system. It's a leak waiting to happen.

Tier 1 tools (the ones you'll actually evaluate)

Prospeo (activation-ready contact layer)

Prospeo, "The B2B data platform built for accuracy", is what I'd put in the activation layer for signal-based selling: 98% email accuracy, 300M+ profiles, 143M+ verified emails, 125M+ verified mobiles, and a 7-day refresh. It's also self-serve (no contracts) and GDPR compliant, which makes implementation fast instead of political.

Pricing's transparent and credit-based. There's a free tier with 75 emails + 100 extension credits/month, and paid plans typically land around ~$39-$300/mo for SMB teams depending on volume. Cost-wise, you're looking at ~$0.01/email, and mobiles are 10 credits per number.

External link: https://prospeo.io/pricing

Clay (orchestration + enrichment workflows)

Clay is the RevOps engineer's playground. It's best when you need "weirdly specific" lists, multi-step enrichment, and waterfall logic (Find -> Enrich -> Transform -> Export). Once it's dialed in, it's one of the most reliable ways to chain providers and build repeatable signal-to-contact workflows.

Tradeoff: it's not plug-and-play. You'll tinker. Teams that like systems love Clay; teams that want a button abandon it.

Pricing: typically ~$149-$800/mo depending on seats + credit volume.

Autobound (signal engine + personalization)

Autobound is a strong "trigger -> message" product when you don't want to build ingestion yourself. It pulls signals from places most stacks ignore (think SEC filings, earnings transcripts, Reddit, and GitHub) and can push outreach fast.

Autobound advertises performance like 60-120x faster research-to-message and 20-40% reply lift depending on workflow and baseline. Treat those as directional, not a promise, but the product's genuinely built around speed.

Pricing is explicit: $12,396-$99,000/yr depending on plan (Starter through Enterprise). Signal Engine starts at Pro.

What practitioners actually say (useful, unglamorous truth)

- Clay: unbeatable for "weirdly specific lists," but you need someone who enjoys building workflows.

- Apollo: the default starter database - fast to launch, but quality varies by niche/region, so you need verification before you scale.

- Amplemarket: attractive because it bundles signals + data + outreach; the trade is a steeper learning curve and more "one system" commitment.

- Lusha: great when you need a phone number right now; coverage swings by region.

This is the stuff that decides adoption in week 3, long after the demo glow wears off.

Tier 2 tools (strong by use case)

Instantly (sequencing + sending + SuperSearch)

Best when: you want a simple, fast sequencer with clear pricing, and you're feeding it scored/deduped signals from elsewhere. Avoid when: you need deep governance, complex permissions, or enterprise reporting as the core requirement. Budget note: Instantly Outreach plans run $47/mo, $97/mo, or $358/mo. SuperSearch and add-ons can push total spend higher, but it's still usually cheaper than suite pricing.

6sense (enterprise intent with a real free entry point)

Best when: you already run ABM, have enough traffic/volume to train models, and you want predictive account identification. Avoid when: you don't have ops capacity - implementation's real work. Budget note: Sales Intelligence has a free entry point (50 credits/mo), then paid packages typically land $60k-$300k/yr.

Demandbase (ABM suite with platform-fee reality)

Best when: you want ABM orchestration + ads + account experiences in one platform and you'll actually use the modules. Avoid when: you just need "signals -> tasks -> sequences." It's overkill. Budget note: typical range $30k-$150k+/yr depending on modules and scale. A commonly cited anchor is $215k/yr from an AWS Marketplace listing example for a 12-month Demandbase One contract.

Bombora (intent backbone at massive scale)

Best when: you want third-party topic intent as a backbone and you already have routing + activation figured out. Avoid when: you expect person-level precision out of the box. Budget note: typically ~$20k-$120k/yr depending on volume and integrations.

User sentiment matches reality: Bombora's powerful, but false positives are part of the deal, and relevance can vary for UK-based teams. The upside's also real: when it's integrated cleanly into CRM workflows, it becomes usable instead of "another dashboard."

Tier 3 tools (useful, but not the core "signals" layer)

One-liners, because that's all most teams need:

- Apollo - Use it for fast list building and basic enrichment; verify before you scale. ~$59-$119/user/mo (plus higher tiers).

- Amplemarket - Use it when you want signals + data + outreach in one motion. ~$1,000-$4,000/mo depending on seats/volume.

- Lusha - Use it for quick direct-dial lookups. ~$39-$99/user/mo plus credits.

- Koala - Use it for website visitor identification + routing to sales. ~$500-$5,000/mo (traffic-based, est.).

- Common Room - Use it for community/product-led signals and account matching. ~$1,000-$8,000/mo (seat + community size, est.).

- Clearbit - Use it for enrichment and form shortening; often bundled into broader data stacks. ~$1,000-$10,000+/mo (volume-based, est.).

- BuiltWith - Use it for technographics and stack detection. ~$300-$1,500/mo (plan-based, est.).

Your 7-layer architecture needs contact data that refreshes as fast as signals decay. Prospeo's 7-day refresh cycle means the emails and mobiles you route to reps are current - not 6 weeks stale. At $0.01 per email with 92% API match rates, enrichment scales without blowing your budget.

Fresh signals deserve fresh data. Start enriching for free today.

Measurement + governance (holdouts, KPIs, "don't be creepy")

If you can't prove lift, your signal program becomes a permanent budget argument.

Measurement checklist (the discipline most teams skip)

- Holdout groups: keep 10-20% of eligible accounts un-contacted for each play

- Minimum run time: run each play for 2-4 weeks (or until you hit a meaningful sample)

- Primary KPIs (pick 2-3):

- meeting rate per signal type

- opp creation rate

- pipeline per 100 signaled accounts

- Secondary KPIs:

- time-to-first-touch (SLA adherence)

- bounce rate (activation quality)

- task acceptance rate (rep adoption)

- unsubscribe/complaint rate (message-market fit + targeting)

Real talk: if your bounce rate's high, your "signal program" is just a deliverability problem wearing a new hat. (Fix the root cause with an email verification list SOP.)

How to run holdouts without making reps revolt

Holdouts fail when they feel like sabotage. Make them operationally clean:

- Randomize at the account level (not contact), per play.

- Keep holdouts out of SDR task queues entirely (no temptation).

- Let AEs override holdout status for named accounts (but log overrides).

- Report results in a simple table: Eligible -> Contacted -> Meetings -> Opps -> Pipeline vs holdout.

If you can't show lift against a holdout, you don't have a signal program. You've got a story.

Governance: don't reference creepy signals

Some signals should guide timing, not appear in the message.

Don't say:

- "I saw you reading our docs..."

- "I noticed you compared us on a review site..."

Do say:

- "Teams evaluating X usually run into Y..."

- "When companies scale outbound, Z becomes a bottleneck..."

My rule: if the prospect would ask "how do you know that?", don't put it in the email. Use it to pick the right angle, then write like a normal human.

Enterprise guardrails (compliance + auditability)

If you automate sales signals, you're automating personal data handling. Put these guardrails in place early:

- RBAC: only ops can export; reps can view/sequence

- Audit logs: exports, enrichments, and list downloads

- Suppression enforcement: global DNC, customers, open escalations, competitors

- Data retention: auto-delete stale signal records after decay + a buffer (for example, 90 days)

- Consent + opt-out: honor unsubscribes everywhere, not just in one tool

This is also how you keep procurement from killing your project later.

Three short message templates (by signal type)

Pricing spike (strong)

Subject: Quick question on {category} Teams evaluating {category} usually hit {pain}. If you're pressure-testing options, I can share a 2-minute checklist.

Hiring/funding (medium-strong)

Subject: Congrats on the news Congrats on {funding/hiring}. When teams scale {function}, {problem} shows up fast. Want a short teardown of what we see work?

Closed-lost resurrection (stacked)

Subject: Timing changed? We spoke a while back about {problem}. If priorities shifted (new team / new initiative), happy to revisit with what's changed since then.

FAQ: Automating sales signals

What's the difference between intent data and sales signals? Intent data's usually third-party, account-level research behavior, while sales signals are time-bound triggers you can act on across first-, second-, and third-party sources. In practice, a "signal" only counts if it routes to an owner, triggers a next step, and logs an outcome back to CRM within 24 hours.

How fast should "signal-to-first-touch" be? For most outbound teams, aim for under 15 minutes on strong triggers, under 4 hours on medium ones, and same-day batching for weak ones. If you treat every trigger like a fire drill, reps'll ignore all of them, so tie SLA to strength and enforce it in routing.

How do you reduce false positives from intent providers? Require 2-3 related events before outreach, apply decay windows (7/14/30 days), and dedupe bursts into one task per account per day. Then run 10-20% holdouts per play; if lift doesn't beat holdout, your "signal" is just noise.

Which automation runner should I use: Zapier, Make, or n8n? Zapier's best for shipping simple workflows in a day, Make is best for branching logic with visibility, and n8n is best for high volume and ownership (especially self-hosted). A practical rule: if you're processing hundreds of events/day, n8n usually pays for itself in control and cost.

What's a good free tool to turn signals into verified contacts? Prospeo's free tier includes 75 email credits + 100 extension credits per month, which is enough to activate a small set of high-intent accounts without wrecking deliverability. Pair it with a basic runner (Zapier/Make) and a sequencer, and you can test one play in a week.

Your next moves (do this in order)

Pick 12 signals and ship v1 in a week. Don't boil the ocean.

Then implement decay + dedupe + stacking so reps don't get flooded. Finally, wire contact activation (persona mapping + verification) so every routed signal can become an actual touch, not a research task. Run holdouts from day one, and you'll have the only metric that matters: lift.

If you do just one thing today: build the "Intent Signals" object in your CRM and force every signal to land there. Once signals are stored, everything else - routing, sequences, measurement - becomes a solvable engineering problem. That's the difference between "we get alerts" and "we automate sales signals."