What Is Company Profiling? A Practical Definition + Template

A company profile that's 90 days old isn't "slightly outdated." It's actively dangerous.

Reps pitch the wrong product line, you miss the new VP hire who actually owns the budget, and you waste cycles on accounts that quietly switched vendors. If you're asking what is company profiling, it's the antidote: a repeatable way to collect, validate, and monitor company data so your team makes better decisions.

Here's the thing: profiling only works if you treat it like a living system, not a one-time homework assignment.

What is company profiling (and what it isn't)

Company profiling is a repeatable workflow: you gather, analyze, and document the information that explains how a company works, what it's prioritizing, and what's changing. The output is the company profile: a deliverable your team can reuse across sales, marketing, partnerships, and risk.

Profiles decay fast. Build a profile in October, and by December the company reorganizes, hires a new security leader, changes packaging, and moves budget from one team to another; if you don't refresh, your "research" misleads the next rep who touches the account.

Company profiling isn't:

- A background check (profiling builds context; background checks verify facts and compliance).

- A pitch deck (pitch decks persuade; profiles inform decisions).

- A data dump (more fields doesn't mean more clarity).

What it is vs what it isn't (quick callout) Company profiling (process): ongoing research + synthesis + monitoring Company profile (deliverable): a shareable doc/record that gets stale Background check: verification/compliance (sanctions, litigation, identity) "Account notes": useful, but usually unstructured and non-repeatable

Company profile vs corporate profile (don't mix these up)

These terms get used interchangeably, but in practice they're different:

| Term | What it usually means | Where it shows up |

|---|---|---|

| Company profile | A working internal record used for targeting, routing, outreach, and account planning | CRM, account plans, ABM docs, partner briefs |

| Corporate profile | A polished "about the company" narrative used for brand, PR, and investor-facing messaging | Website "About," media kits, IR decks |

If you're doing GTM work, you want the company profile: structured, sourced, dated, and built to change actions.

What you need (quick version)

- Minimum viable schema: 12-20 fields you can fill fast, plus provenance (where it came from) and last verified date (when it was true).

- 5-step workflow:

- Identify the entity (legal name + IDs)

- Capture static firmographics + ownership

- Add dynamic signals (hiring, tech, intent-ish behaviors)

- Write 5-10 "so what" insights (decision-grade)

- Set monitoring triggers + refresh cadence

- Refresh cadence: most firmographics are safe on a 14-30 day refresh, but signals (jobs, leadership, product changes) need weekly monitoring for priority accounts.

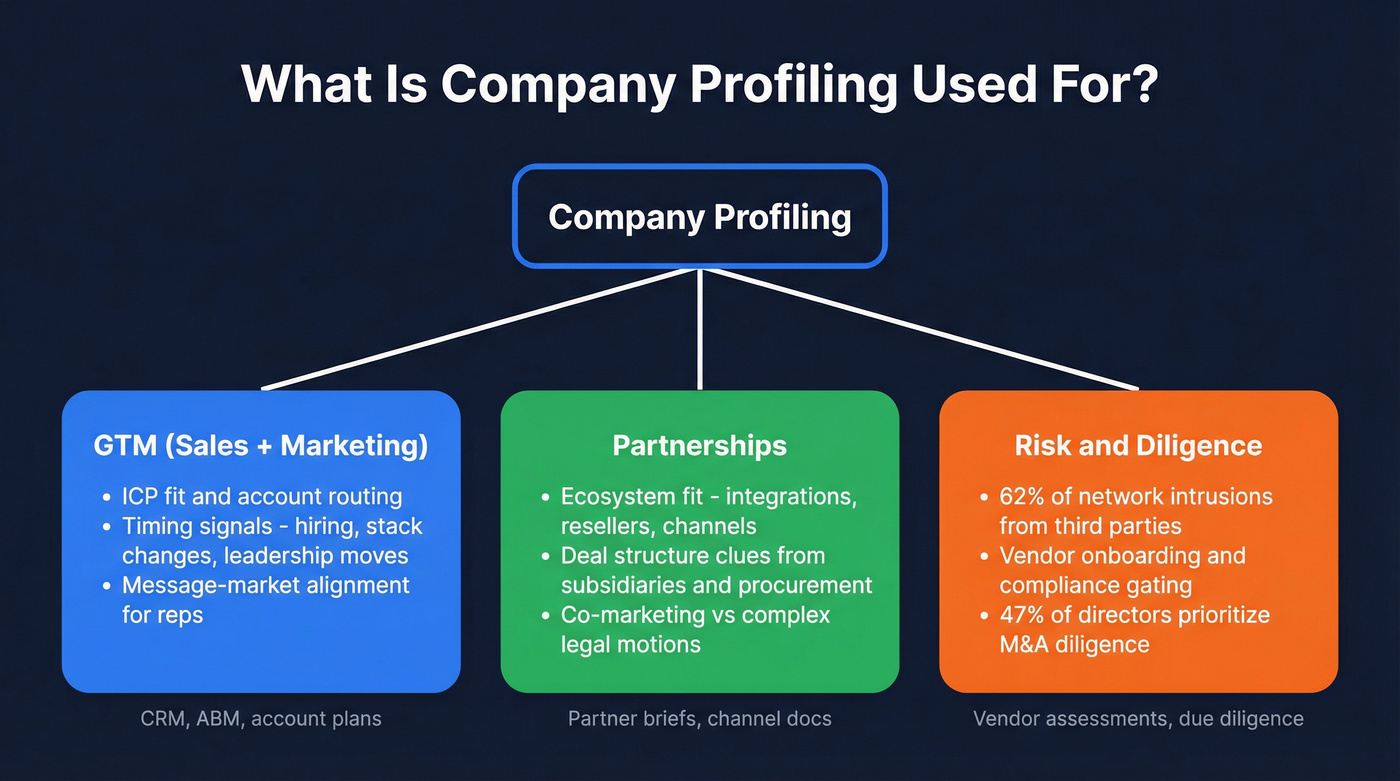

What is company profiling used for? (GTM, partnerships, risk)

Company profiling is a force multiplier anywhere decisions depend on "is this the right company, right now, with the right stakeholders?"

GTM (sales + marketing)

- ICP fit and routing: size band, region, industry, ownership, and tech stack determine where the account goes and whether it's worth touching. (If you need a simple tiering model, start with account segmentation.)

- Timing: hiring spikes, stack changes, and leadership moves create openings you can win.

- Message-market alignment: profiles stop reps from pitching generic value props that don't match the company's priorities.

I've seen teams build beautiful 40-field templates, then ignore them because nobody can keep them current. That's not a tooling problem. That's a process problem.

Hot take: if you're selling a lower-priced product, you probably don't need a deep-dive profile. You need a tight MV profile, clean entity matching, and monitoring so you don't chase ghosts.

Partnerships

- Ecosystem fit: who they integrate with, who they resell, and what channels they already use.

- Deal structure clues: subsidiaries, regions, and procurement patterns tell you whether you're walking into a simple co-marketing motion or a six-month legal slog.

Risk, vendor onboarding, and diligence

- Third-party risk: BitSight reports third-party relationships drive 62% of network intrusions, and 72% of organizations have had at least one significant third-party disruption.

- M&A and strategic diligence: a Diligent survey found 47% of directors treat M&A as a strategic priority, which means more teams get pulled into diligence-grade profiling whether they like it or not.

When deep-dive profiling is worth it Do the diligence-grade version when (1) the contract's large, (2) the relationship's operationally risky, or (3) you'll regret being wrong more than you'll regret spending time.

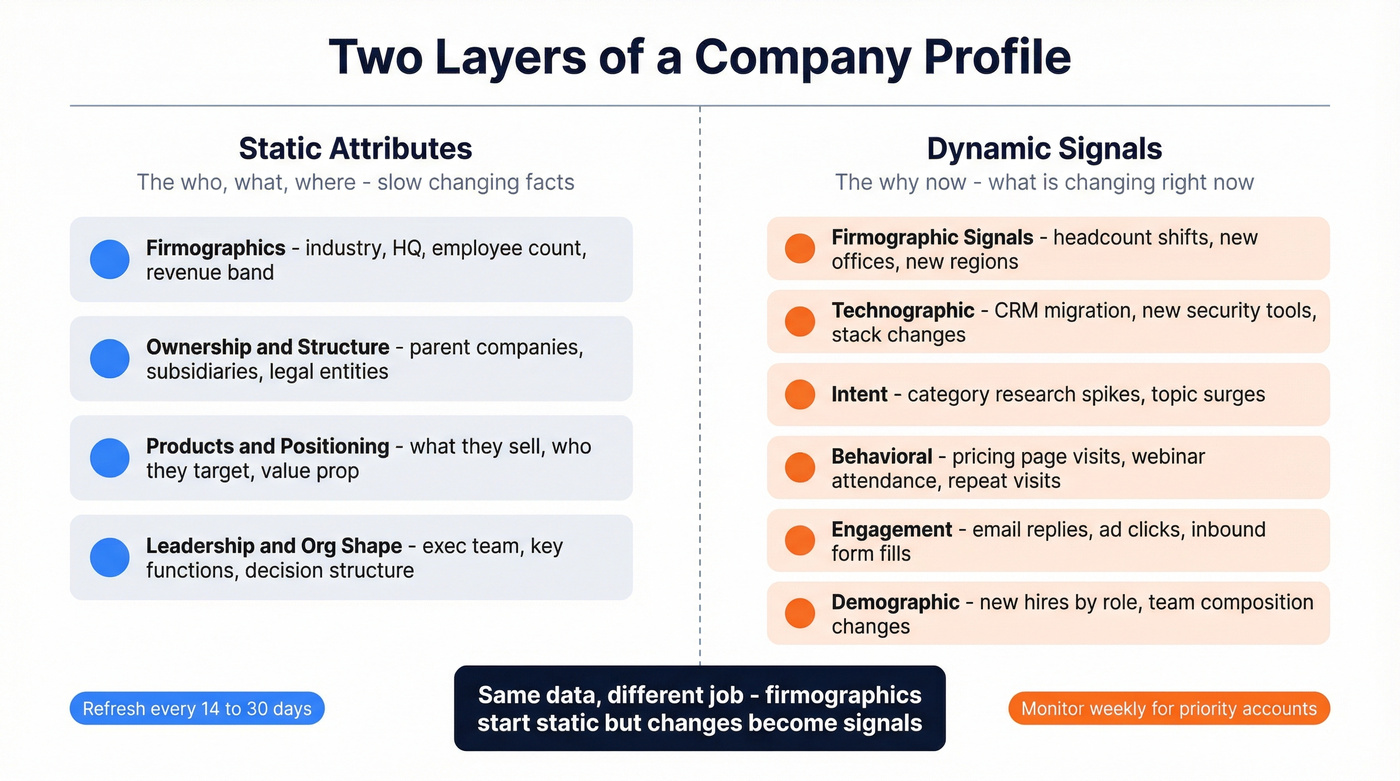

What goes into a company profile (static attributes + dynamic signals)

A useful profile has two layers: static attributes (slow-changing facts) and dynamic signals (what's changing right now). Most teams over-collect the first and under-invest in the second.

Static attributes (the "who/what/where")

- Firmographics: industry, HQ, employee count, revenue band, regions served.

- Ownership & structure: parent/subsidiaries, legal entities, key locations.

- Products/services & positioning: what they sell, who they sell to, and how they describe value.

- Leadership & org shape: exec team, key functions, and how centralized decisions seem.

Dynamic signals (the "why now")

A practical way to organize signals is the LeadGenius six-category taxonomy.

| Signal category (LeadGenius) | Examples | Best for |

|---|---|---|

| Firmographic | headcount band change, new region, new office | routing, segmentation, territory rules |

| Technographic | new analytics tool, CRM migration, security tooling | integration/replacement plays |

| Intent | researching a category, surging on specific topics | prioritization and timing |

| Behavioral | repeated site visits, pricing-page views, webinar attendance | "lean-in" accounts for SDR/AE focus |

| Engagement | email replies, ad engagement, inbound form fills | sequencing and next-best action |

| Demographic | role seniority, team composition, geo coverage | multi-threading and persona targeting |

Same data, different job: firmographics often start "static," but the changes (headcount band shifts, new regions) are signals.

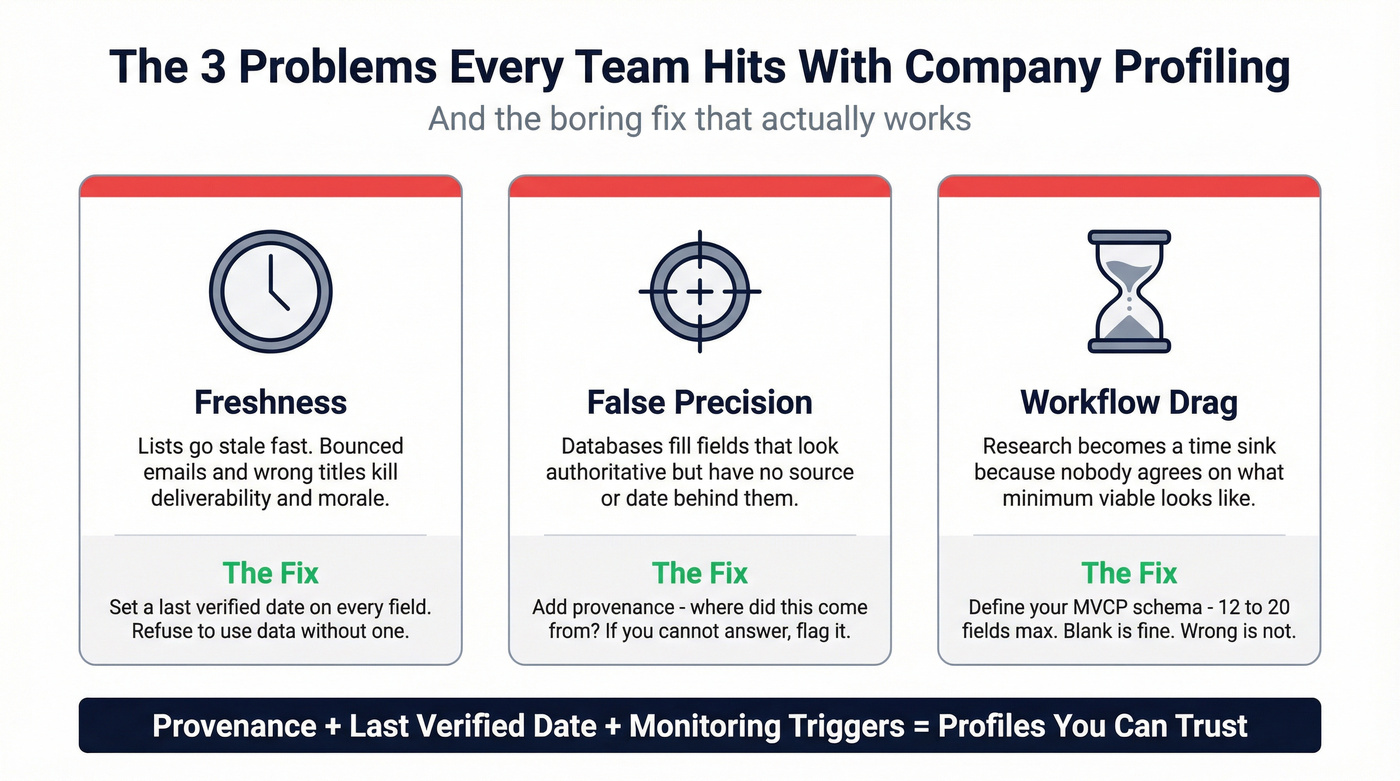

What teams complain about (and they're right)

Practitioners keep running into the same three problems:

- Freshness: lists go stale fast; bounced emails and wrong titles kill deliverability and morale. (If you want the mechanics, see B2B contact data decay.)

- False precision: databases fill fields that look authoritative but aren't sourced or dated.

- Workflow drag: "research" becomes a time sink because nobody agrees on minimum viable.

The fix is boring and effective: provenance + last verified date + monitoring triggers.

You just read that company profiles decay fast - hiring changes, reorgs, stack swaps. Prospeo's 7-day data refresh cycle means your profiles stay current while competitors work with 6-week-old data. Pull firmographics, technographics, intent signals, and verified contacts from 300M+ profiles with 30+ filters. That's your MVCP filled in minutes, not hours.

Build company profiles that are accurate today, not three months ago.

Minimum viable vs deep-dive company profile (copy/paste schema)

Most teams fail at profiling because they start with a "deep" template and never finish it. Start with a minimum viable company profile (MVCP), then expand only when the account justifies it.

Non-negotiables for both schemas:

- Provenance: where each field came from (URL, filing, registry, database).

- Last verified date: when you last checked it.

- Anchor identifiers: LEI, DUNS, registration number (and any internal account ID).

We've tested this in RevOps workflows, and the single biggest quality jump comes from adding "last verified" and refusing to treat blank fields as a personal failure. Blank is fine. Wrong is not.

Minimum viable company profile (MVCP) schema

| Field | Why it matters | Best source | Refresh |

|---|---|---|---|

| Legal name | Entity match | Registry/filings | Quarterly |

| Trade name(s) | Search + dedupe | Website/registry | Quarterly |

| Reg # / LEI / DUNS | Anchor ID | Registry/LEI | Quarterly |

| HQ country/city | Routing | Website/registry | 30 days |

| Employee band | Segmentation | Hiring/data tools | 30 days |

| Industry/category | ICP fit | Site + databases | 30 days |

| Ownership (parent) | Who buys | Filings/registry | Quarterly |

| Core product lines | Pitch relevance | Website | 30 days |

| Target customers | Use cases | Website/case studies | 30 days |

| Top 3 competitors | Positioning | Site + search | Quarterly |

| Current stack (top 5) | Trigger plays | Tech tools | 30 days |

| Recent "why now" | Timing | News/jobs | Weekly (top accts) |

| Provenance | Trust | Your record | Every edit |

| Last verified date | Freshness | Your record | Every edit |

Deep-dive schema (diligence-grade)

| Field | Why it matters | Best source | Refresh |

|---|---|---|---|

| Entity map (subsidiaries) | Sell to right unit | Filings/registry | Quarterly |

| Financials (public) | Budget reality | 10-K/10-Q | Quarterly |

| Funding & investors | Growth pressure | Databases/news | 30 days |

| Strategic initiatives | Align pitch | Earnings/news | Monthly |

| Leadership changes | New priorities | Press/filings | Weekly |

| Org design (functions) | Multi-thread | Jobs/org data | 30 days |

| Tech stack (full) | Replace/compete | Tech tools | 30 days |

| Security/compliance posture | Risk gating | Policies/certs | Quarterly |

| Procurement signals | Buying motion | Jobs/docs | Monthly |

| Partnerships/ecosystem | Channel angles | Site/news | Monthly |

| Litigation/regulatory | Deal risk | Filings/news | Monthly |

| Reputation/sentiment | Objections | Reviews/news | Monthly |

| M&A activity | Timing | 8-K/news | Weekly |

| Provenance | Audit trail | Your record | Every edit |

| Last verified date | Freshness | Your record | Every edit |

Deep-dive profiles aren't "better." They're more expensive.

If the profile won't change a decision, it's busywork.

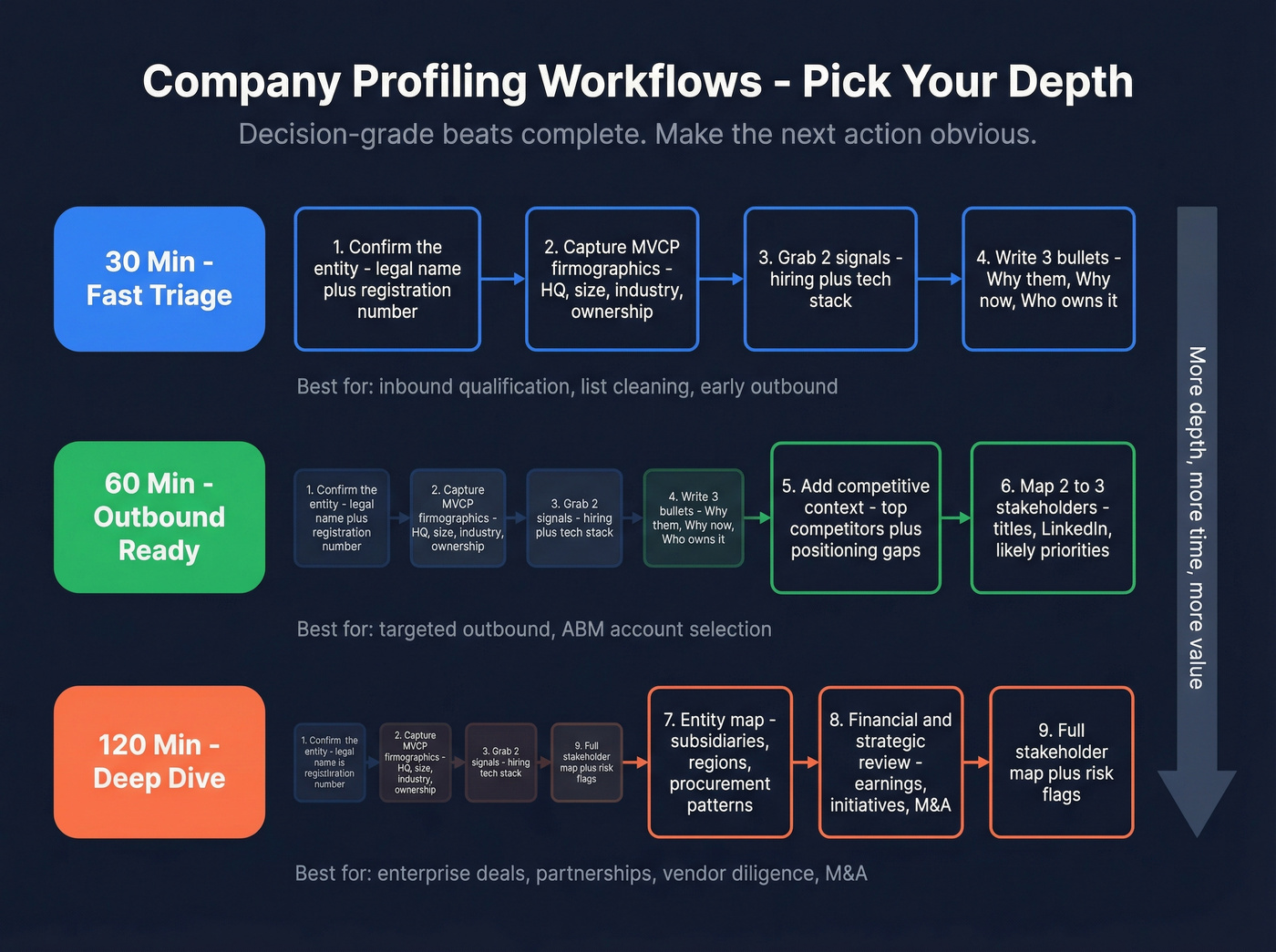

How to do company profiling (30/60/120-minute workflows)

Decision-grade beats complete. Your goal's to make the next action obvious: pursue, deprioritize, or re-route.

The 30-minute workflow (fast triage)

- Confirm the entity: legal name + registration number (or equivalent).

- Capture MVCP firmographics: HQ, size band, industry, ownership.

- Grab 2 dynamic signals: hiring + tech stack is the best default combo.

- Write 3 bullets: "Why them," "Why now," "Who likely owns it."

Use this for inbound qualification, list cleaning, and early outbound targeting. (For a tighter pre-outreach process, use this prospect research before outreach system.)

The 60-minute workflow (outbound-ready)

- Do the 30-minute steps.

- Add competitive context: top competitors + "build vs buy" posture. (This pairs well with competitive intelligence for B2B sales.)

- Add buying constraints: compliance, regions, procurement hints.

- Draft a point of view: 5-7 sentences a rep can use in a first call.

This is the sweet spot for most B2B teams.

The 120-minute workflow (strategic account prep)

- Do the 60-minute steps.

- Build an entity + stakeholder map: parent/subsidiaries + likely functions involved. (If you need a practical outreach approach, see ABM multi-threading.)

- Pull primary sources: filings (if public), legal docs, investor materials.

- Add monitoring triggers (jobs, press, legal, product pages).

- Produce a one-page "so what" summary plus a structured schema record.

Real talk: thorough research for large accounts takes 2-3 days. That's normal. The mistake is trying to "AI your way out of it" and ending up with confident nonsense; use AI as a last pass to summarize and spot gaps, not as the foundation.

Where to find reliable company data (public vs private vs nonprofit)

The reliability of your profile depends on whether the company is forced to disclose. Public companies are easiest. Private companies are structurally opaque. Nonprofits are weirdly transparent if you know where to look.

Source matrix by company type

| Company type | Best primary sources | What you'll get | Gotchas |

|---|---|---|---|

| Public | SEC EDGAR, IR site | Financials, risks | Dense, slow |

| Private | Site, news, databases | Funding, headcount | Missing fields |

| Nonprofit | IRS search, Form 990 | Revenue, exec pay | Lagged data |

For public companies, EDGAR's the free goldmine. The filings you'll use most:

- 10-K (annual, deep risk + strategy)

- 10-Q (quarterly updates)

- 8-K (material events: exec changes, M&A, major contracts)

For nonprofits, start with the IRS Tax Exempt Organization Search, then follow the Form 990 ecosystem (GuideStar-style databases, charity evaluators, and state charity registries). Two moves that save hours: check alternate names and abbreviations (nonprofits love shortened names), and confirm whether it's a subsidiary or chapter so you don't profile the wrong entity while the budget sits at the parent.

For private companies, accept the constraint: limited disclosure requirements, confidentiality, and no standardized reporting. Use databases for triangulation, then validate with primary sources (site, news, hiring, registries). Hiring signals and technographics do more real work here than "estimated revenue" fields.

External reading that matches the definitions used here: Viewpoint's company profiling primer and Coresignal's modern definition.

Data quality, entity resolution, and the "golden record" problem

If you've ever had "Acme Inc." duplicated three times in your CRM, you've met the golden record problem.

Entity data is fragmented by design. There's no single, universal US companies registry; incorporation happens at the state level, which means formats and identifiers vary widely. That's why name match is a trap, and why the same company shows up as "Acme," "ACME, Inc," and "Acme Holdings (US) LLC" depending on where the record came from and who typed it in.

OpenCorporates is a strong grounding layer here: 220M+ companies across 140+ jurisdictions. It's especially useful when you need to reconcile subsidiaries, alternate spellings, and cross-border entities.

Two rules that prevent most CRM chaos:

- Anchor on identifiers (registration number, LEI, DUNS) before you enrich anything.

- Store provenance + versioning so you can explain why a field exists and when it changed. (This is a core data quality habit, not a one-off cleanup.)

Registry data also isn't automatically "true." Companies House is a primary source for filings and document images, but it warns it doesn't check the accuracy of information filed. Treat registries as "officially submitted," not "verified reality."

Pitfalls & fixes (RevOps-friendly)

Pitfall: merging by company name only Fix: require one anchor ID + domain + HQ country to merge

Pitfall: overwriting good data with worse enrichment Fix: survivorship rules (prefer filings/registry over scraped fields)

Pitfall: snapshot accuracy that degrades over time Fix: measure accuracy over time, not just at import

Pitfall: "complete" profiles nobody reads Fix: force a 10-line executive summary field

If you only do one thing: MVCP + monitoring beats a deep template you never finish.

Monitoring & change detection (profiles decay - make them living)

A profile is either living, or it's lying.

Snapshot accuracy is easy: you check it once and feel good. Over-time accuracy is what matters, because your profile's only useful if it stays aligned with reality between refreshes.

Monitoring checklist (what to watch)

- Careers page (new teams, new regions, new priorities)

- Press/news page (partnerships, launches, awards)

- Legal/terms/security pages (compliance posture changes)

- Investor/announcements (funding, acquisitions)

- Product pages/pricing (packaging shifts)

OSINT-style monitoring tools like Visualping or Wachete make this simple: pick a page, define the area to watch, get alerted when it changes.

How to measure profile accuracy over time (the part most teams skip)

If you want profiling to be a system (not vibes), you need a testing loop:

- Run a regular "vertical slice" audit: sample a set of accounts and re-check your highest-impact fields (ownership, employee band, key execs, core product lines, top tech).

- Track field-level drift: measure which fields change most and tighten refresh SLAs around them (jobs/leadership weekly; firmographics monthly; entity structure quarterly).

- Enforce "last verified" SLAs: if a field is past SLA, it's treated as stale in downstream workflows (routing, scoring, outreach). (This is easiest to operationalize with account scoring rules.)

- Keep auditability: store provenance and prior values so you can explain changes instead of arguing about them.

Triggers table (cadence by importance)

| Trigger type | Weekly | Monthly | Quarterly |

|---|---|---|---|

| Exec changes | Top accts | Mid accts | Long tail |

| Hiring spikes | Top accts | Mid accts | - |

| Tech stack shifts | Top accts | Mid accts | Long tail |

| Financial filings | - | - | Public only |

| Legal/policy changes | Top accts | Mid accts | Long tail |

Company profiling guardrails (legal, ethical, and privacy)

Company profiling is powerful, and it's easy to abuse. The line's simple: profile companies to make business decisions; don't profile people in ways that create discrimination risk.

Look, if your "profiling" doc turns into a quiet list of who you don't want to sell to, you've built a liability, not a GTM asset.

Legal + privacy checklist

- Collect what you can justify: every field should have a business purpose (routing, risk, messaging, procurement). If you can't explain why you store it, don't store it.

- Avoid sensitive personal data: don't infer protected characteristics (health, religion, ethnicity, political views) and don't store anything that looks like it.

- Respect opt-outs and suppression lists: if a contact opts out, that preference must propagate across tools and exports.

- Minimize retention: keep profiles current, but don't keep unnecessary personal details forever.

- Separate GTM profiling from risk profiling: vendor risk and M&A diligence often require stricter sourcing, review, and access controls than sales research.

- Document provenance: if you can't show where a claim came from, it doesn't belong in a profile that influences decisions. (If you're running outbound in the EU/UK, align this with GDPR for Sales and Marketing.)

Tools + typical pricing ranges (and turning profiles into outreach)

Tools shouldn't be the profile. They should make the profile faster, fresher, and more usable.

Pricing sidebar (typical ranges)

| Tool | Typical pricing | Best for |

|---|---|---|

| Prospeo | Free tier available; paid typically ~$39-$500/month | Verified emails/mobiles + self-serve list building |

| Apollo | Free; $49-$99/user/month | SMB outbound + basic enrichment |

| Crunchbase | $300-$1,500/user/year | Funding + private-company context |

| BuiltWith | $3,000-$10,000/year | Technographics (web-detectable stack) |

| Similarweb | $15,000-$50,000/year | Traffic + channel benchmarking |

| ZoomInfo | $15,000-$50,000/year | Enterprise GTM suite baseline |

| PitchBook | $20,000-$80,000/year | Private markets + diligence |

| Dun & Bradstreet / Hoovers | $10,000-$60,000+/year (org license) | Firmographics backbone + credit-style data |

| Capital IQ / FactSet | $15,000-$50,000+/user/year | Public markets + financial research |

| Tableau / Power BI | $10-$70/user/month | Dashboards + distribution |

ZoomInfo's the expensive suite baseline; the others are point solutions you pick based on the job.

Prospeo (The B2B data platform built for accuracy)

Prospeo fits after you've done the profiling work and you need the verified contact layer to execute outreach without burning deliverability. It's the best pick for email accuracy, data freshness, and self-serve B2B data. (If you’re comparing vendors, start with best B2B data providers.)

What matters in practice:

- 98% email accuracy

- 7-day data refresh cycle (industry average: 6 weeks)

- 300M+ professional profiles, plus 143M+ verified emails and 125M+ verified mobile numbers

- 30% mobile pickup rate across all regions

- 92% API match rate and 83% enrichment match rate (share of leads returned with contact data)

A quick scenario we've watched play out: RevOps builds a clean target list, SDRs pull contacts from a generic database, bounce rates spike, domains get warmed down, and suddenly everyone's arguing about "messaging" instead of fixing the data. Verified contacts don't solve everything, but they stop the self-inflicted wounds. (If you’re troubleshooting bounces, see 550 Recipient Rejected.)

Profile -> outreach workflow (what actually works):

- Export target accounts (domains + company names).

- Filter contacts by role, seniority, region, and technographics.

- Verify in real time, export only valid contacts, then push to your CRM/sequencer. (For more options, compare email lookup tools.)

BuiltWith (technographics for "what do they run?") - best when your ICP is tool-specific

BuiltWith is the "tell me what's on their website" workhorse. If your ICP is tied to a CMS, analytics stack, ad pixel, CRM, or payment provider, this is the fastest way to validate "they run X" before you write a sequence.

- Buy it if: your targeting depends on a specific tool footprint.

- Skip it if: you need internal-system visibility (it can't see what isn't web-detectable).

Typical pricing: $3,000-$10,000/year depending on exports and features.

Crunchbase (private-company triangulation) - best first tab for funding context

Crunchbase is the fastest way to get private-company context: funding rounds, investors, key people, acquisitions, and basic descriptors.

- Buy it if: you sell into venture-backed ecosystems or need investor narrative fast.

- Skip it if: you expect it to reliably produce undisclosed revenue/financials.

Typical pricing: $300-$1,500/user/year.

OpenCorporates (entity resolution + registry grounding) - best for "which entity is this?"

Use OpenCorporates when names get messy: subsidiaries, similar names, cross-border entities, and "which Acme is the real Acme?" problems.

Typical pricing: free search for basics; API/data licensing typically $5,000-$50,000/year depending on usage and redistribution.

Wappalyzer (lightweight technographics) - best for spot checks

Wappalyzer's the scrappy alternative when you don't need a full technographics platform. It's great for quick checks like "Shopify or not?" and "what analytics tool is installed?"

Typical pricing: free/basic tiers; paid plans typically $20-$200/month (higher for teams/API).

Visualping or Wachete (change detection) - best for monitoring triggers

Point these at careers pages, legal pages, press pages, and product/pricing pages. Get alerted when something changes.

Typical pricing: $10-$100/month depending on monitored pages and alert frequency.

Similarweb (digital footprint) - skip it for contact discovery

Similarweb's useful for market sizing and competitor benchmarking (traffic, channels, audience). It's not a contact database, and it won't fix a stale CRM.

Typical pricing: $15,000-$50,000/year.

PitchBook (private markets) - don't buy it for outbound

PitchBook is overkill for day-to-day GTM profiling. It's worth it when you need diligence-grade private market intelligence: ownership, investors, deals, comparables, and transaction context.

Typical pricing: $20,000-$80,000/year depending on seats and modules.

The article's biggest lesson: provenance and freshness make or break a company profile. Prospeo delivers 98% email accuracy, 92% API match rates, and 50+ data points per enrichment - all with a last-verified window measured in days, not weeks. Enrich your CRM or CSV in bulk and finally kill the "false precision" problem.

Every data point sourced, verified, and refreshed weekly at $0.01 per email.

Copy the MVCP table, fill it for 10 accounts this week, and set three monitoring triggers per account (careers, press, pricing). You'll feel the difference immediately.

FAQ

What's the difference between company profiling and a company profile?

Company profiling is the ongoing process of collecting, validating, synthesizing, and monitoring company information, while a company profile is the internal record you publish for reuse. In practice, the process includes refresh rules and triggers; the document's just a snapshot that goes stale without upkeep.

How often should you update a company profile?

Most firmographics can refresh every 14-30 days, but high-signal fields (hiring, leadership changes, tech stack shifts, product/pricing pages) should be monitored weekly for priority accounts. A simple default is weekly for top accounts, monthly for mid-tier, and quarterly for long-tail records.

Is company profiling the same as a background check?

No. Company profiling builds context for decisions like fit, timing, stakeholders, and operational risk, while a background check is verification and compliance (identity, sanctions, litigation, regulatory issues). If you need evidentiary certainty, use a background-check workflow; for GTM decisions, use a living profile.

How do you turn a company profile into a verified outreach list?

Start with 2-3 filters from the profile (domain, region, role/seniority, and one signal like technographics), then verify contacts before you export anything. Prospeo supports 30+ filters plus real-time verification, with 98% email accuracy and a 7-day refresh cycle, so you only push valid emails and reachable mobiles into your sequencer.

Summary

So, what is company profiling in plain English? It's a living workflow for turning messy company data into a decision-grade profile, then keeping it fresh with provenance, last-verified dates, and monitoring triggers. Start with the MV schema, expand only when the deal or risk justifies it, and use verified contact data to turn profiles into outreach that actually lands.