Account Segmentation: The RevOps Playbook for 2026

Most segmentation projects fail for one boring reason: nothing downstream changes. Reps still work the same accounts, CS still runs the same cadence, and marketing still blasts the same invite.

Account segmentation only matters when it changes routing, SLAs, plays, and measurement.

Everything else is a spreadsheet hobby.

What you need (quick version)

Minimum viable setup. Nail this before you build anything fancier.

Pick 3 tiers + 1 score. Tier 1 = scarce, high-touch. Tier 2 = targeted, semi-personalized. Tier 3 = long-tail, scaled. Add one account score (Fit/Intent/Engagement) as the "who's hot right now" layer across all tiers.

Set tier volumes to match capacity. T1: 25-50 accounts. T2: 100-250. T3: 500-2,000. This creates a tiered structure your team can actually staff.

Quarterly tier review, continuous scoring with decay. Tiers change quarterly so territories don't thrash. Engagement updates continuously and decays so last quarter's clicks don't stay "hot."

One trigger that forces action. Example: Account score > 100 creates an AE task and triggers an SDR sequence enrollment within 24 hours.

Make segments visible where work happens. CRM views, assignment rules, dashboards, and sequencer lists - not a slide deck.

Account segmentation (definition) - and what it's not

Account segmentation is the operational act of grouping accounts into buckets that get different treatment: different owners, different SLAs, different plays, different spend, and different success metrics.

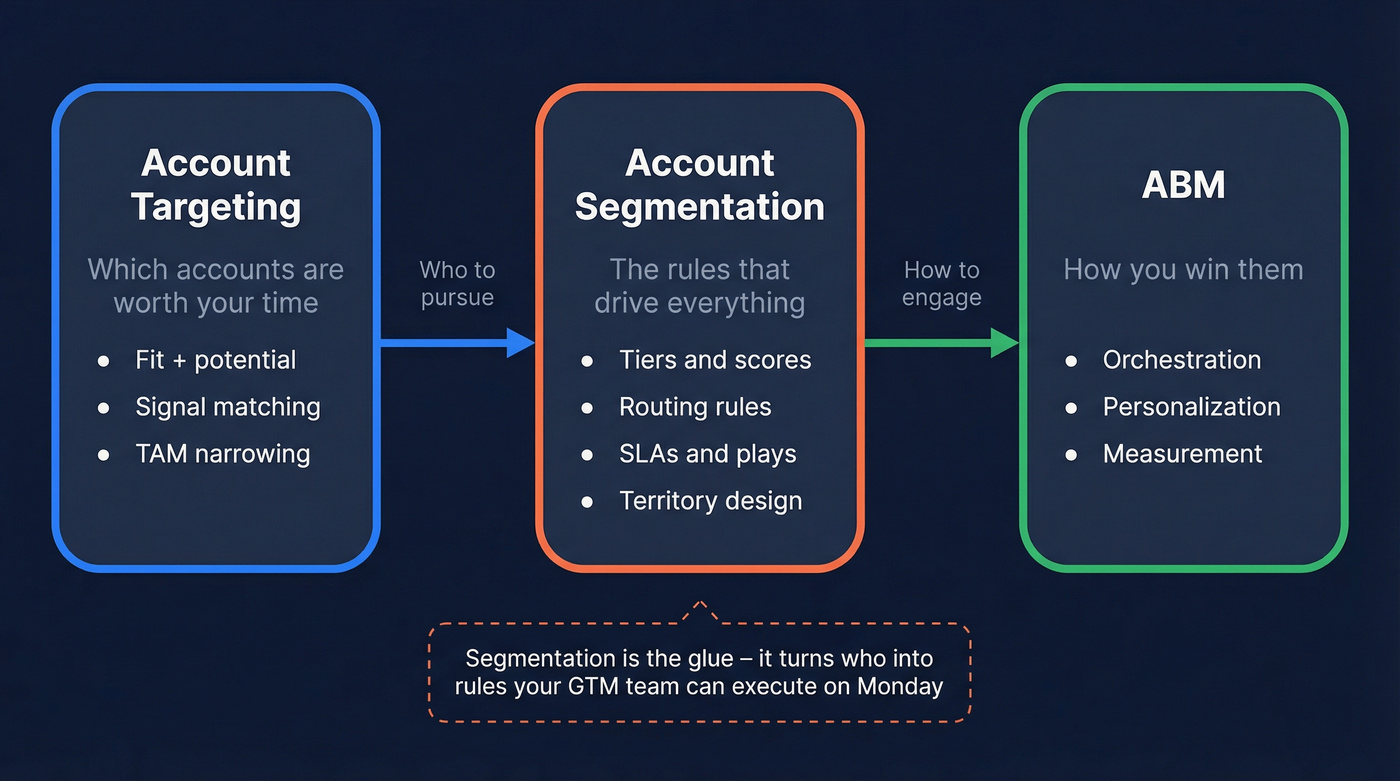

A clean boundary that helps: account targeting is who you go after, and ABM is how you engage them. Segmentation is the glue that turns "who" into rules your GTM can execute - especially when you're doing target account segmentation for a defined list of named accounts.

Boundary bullets (use these to keep everyone honest):

- Segmentation changes: routing/ownership, SLAs, plays, coverage, and dashboards.

- Segmentation isn't: a branding exercise, a one-time TAM slide, or a 12-segment taxonomy nobody can remember.

- Segmentation must answer: "What do we do differently on Monday?"

Salesforce also draws a useful line:

- Market segmentation = splitting the broader market (including prospects) to find new opportunities.

- Customer segmentation = splitting existing customers to tailor retention, expansion, and service.

Account segmentation vs ICP

ICP is your "best customer" definition. Segmentation is how you apply that definition across a messy market.

Hot take: if your team's still arguing about "the ICP," you've probably got multiple ICPs and you're trying to force them into one. Stop. Name the 2-3 ICPs you actually sell to, then build a system that gives each a different play.

Account segmentation vs account targeting vs ABM

- Account targeting: which accounts are worth time (fit + potential + signals).

- ABM: how you win them (orchestration, personalization, channels, measurement).

- Account segmentation: the tiers and scores that drive territory management, routing rules, SLAs, and plays.

Why it matters in 2026 (and what changes when you do it)

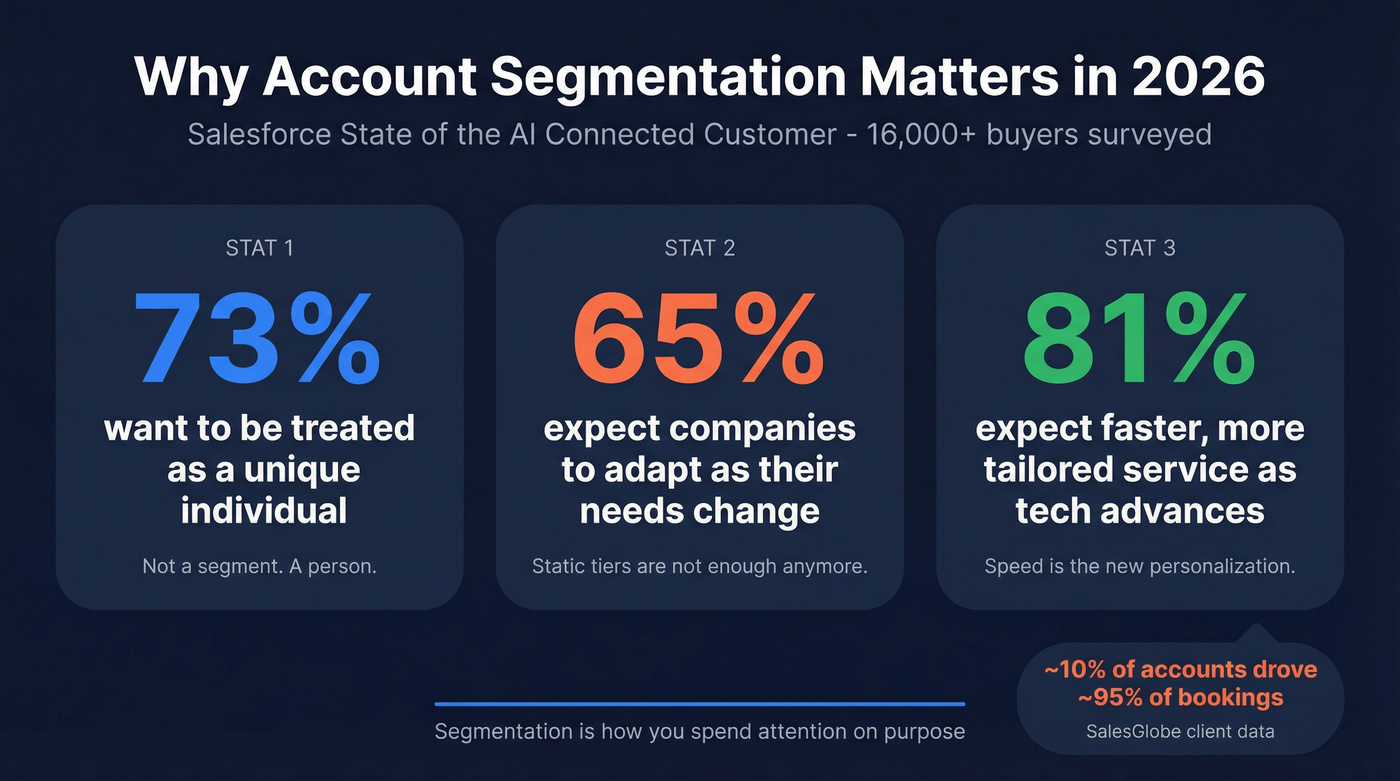

Salesforce's State of the AI Connected Customer (16,000+ consumers and business buyers worldwide) found 73% want to be treated as a unique individual, 65% expect companies to adapt as needs change, and 81% expect faster, more tailored service as tech advances.

The 2026 twist: buyers move faster, signals are noisier, and attention's your scarcest resource. Segmentation is how you spend attention on purpose.

Before: everyone works "their patch," SDRs spray sequences, AEs cherry-pick, marketing measures MQLs, CS runs one cadence for whales and minnows. After: Tier 1 gets named ownership and multi-threading, Tier 2 gets tight SLAs and repeatable plays, Tier 3 gets scaled coverage - and your score tells you what deserves attention this week.

One practical lever most teams ignore: segmentation should change territory design and quota math. Tier 1 = named books with higher expectation per account, Tier 2 = pooled coverage with volume targets, Tier 3 = programmatic with efficiency targets. If quota ignores tier mix, your model won't survive the first comp-plan argument, because the rep with 40 Tier 1 accounts and the rep with 1,200 Tier 3 accounts aren't doing the same job even if the CRM says they both "own accounts."

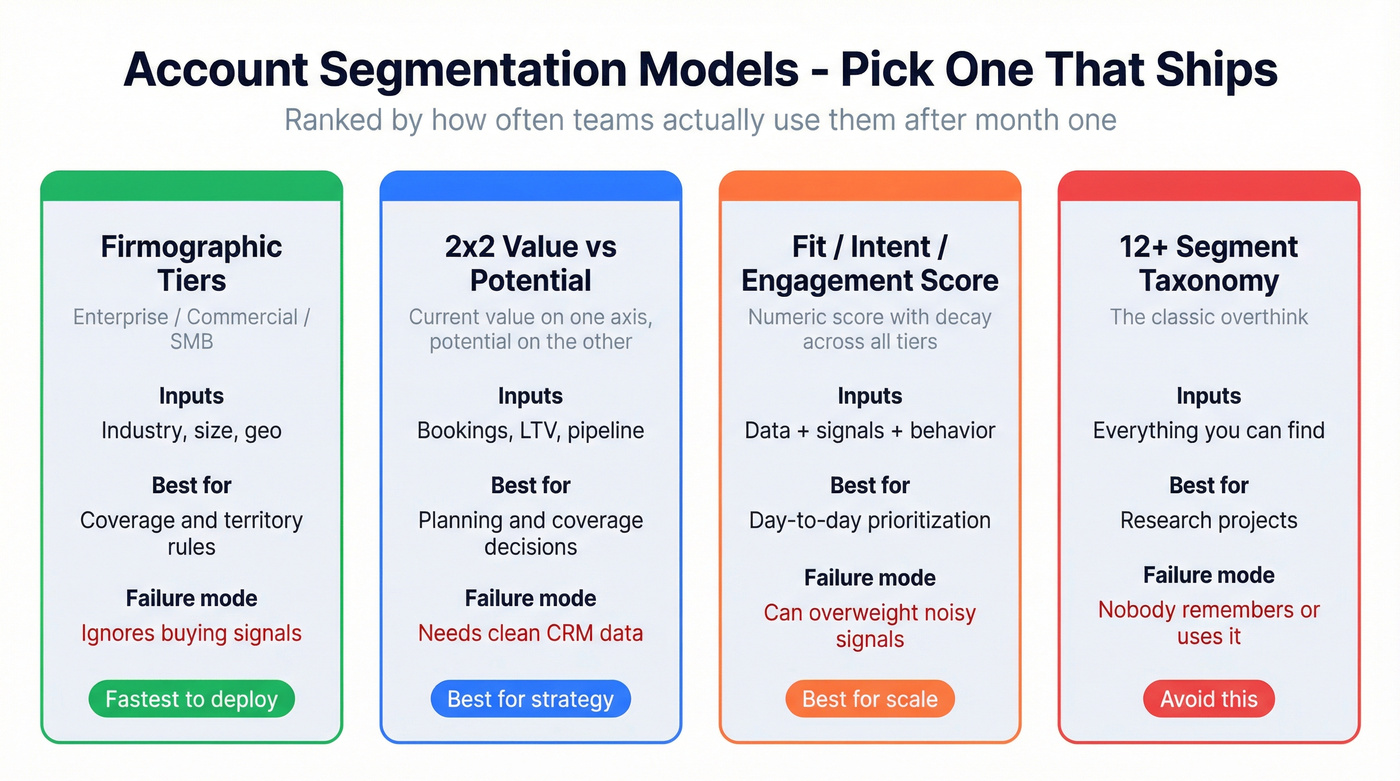

Account segmentation models that actually get used

Most models die because they're too clever. They produce 12 segments, nobody remembers what they mean, and the CRM becomes a museum.

If I had to pick three models (in order), it'd be:

- Firmographic tiers (fastest path to usable)

- 2x2: current value vs potential value (best for planning and coverage)

- Fit/Intent/Engagement score (best for day-to-day prioritization)

In one SalesGlobe client dataset, ~10% of accounts drove ~95% of bookings and ~90% of active pipeline/renewals. That's the job: find the small set that deserves disproportionate attention - and prove it with outcomes.

Model 1: Simple firmographic tiers (Enterprise/Commercial/SMB)

Segment by industry + employee band + revenue band + region. It's stable, easy to explain, and good enough to start.

Use it when: you need territory rules and coverage ratios more than perfect prioritization. Skip it when: accounts in the same band behave wildly differently (common in security, data, infra).

Model 2: 2x2 - current value vs potential value (quarterly refresh)

This is "strategy meets ops": one axis is current value (what they've done with you), the other is potential value (what they could do).

- Current value: recent bookings, LTV

- Potential: average deal size, open pipeline + renewal TCV, products owned, employees/sites

Refresh it quarterly. Monthly refresh thrashes territories; annual refresh lies to you.

Model 3: Fit/Intent/Engagement score (the one that scales)

Instead of inventing more segments, keep tiers simple and add a score that answers:

- Fit: should we ever care?

- Intent: are they in-market?

- Engagement: are they responding to us?

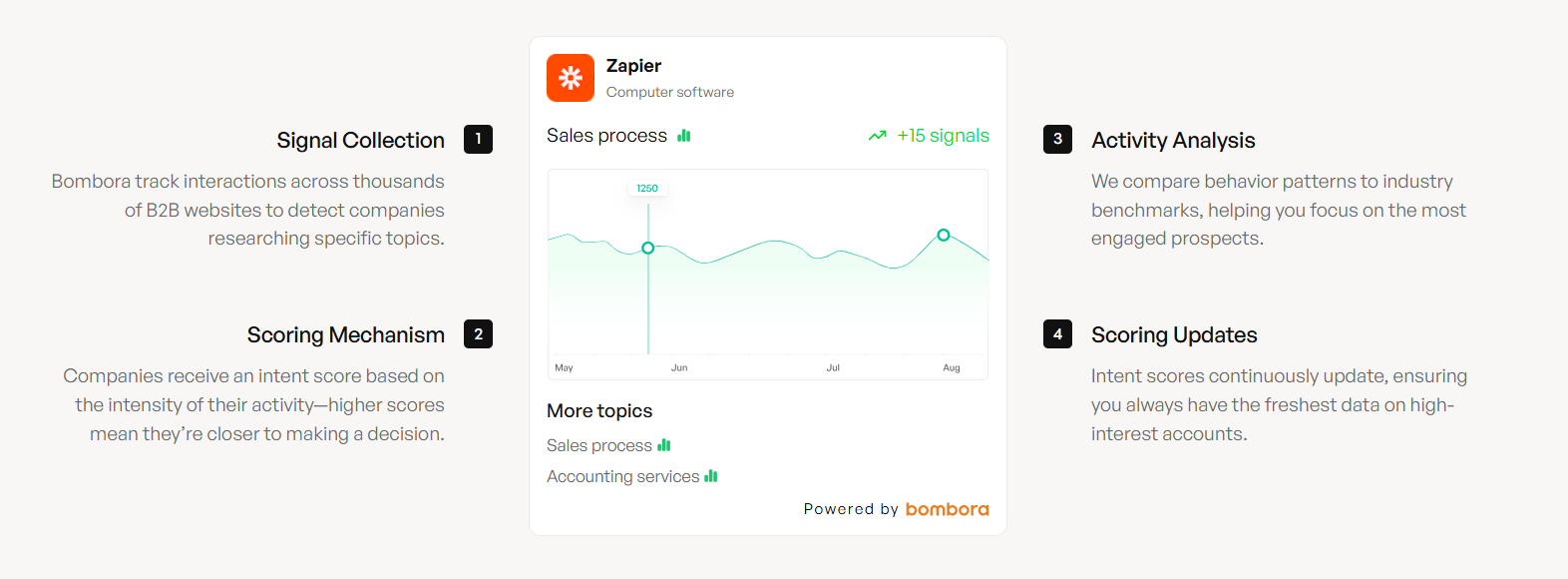

This survives contact churn, product launches, and market shifts because it's numeric, it decays, and it can trigger automation in Salesforce, HubSpot, Outreach, or Salesloft. It also supports dynamic segmentation: your tiers stay stable, while the score updates as signals change.

We've tested this approach with teams that tried to build "the perfect segmentation taxonomy" first, and it's always the same story: the taxonomy looks smart in a doc, then dies the moment the first SDR asks, "Cool... so who do I call today?"

Model comparison table

| Model | Inputs | Output | Best for | Failure mode |

|---|---|---|---|---|

| Firmographic tiers | Industry, size, geo | 3 tiers | Coverage/territory | Ignores signals |

| 2x2 value/potential | Bookings, LTV, pipe | 4 quadrants | Planning | Bad CRM data |

| Fit/Intent/Eng. | Data + signals | Score + tiers | Prioritization | Overweight noise |

| 12+ segments | Everything | Many buckets | Research | Nobody uses it |

Your Tier 1 accounts deserve verified contacts, not bounced emails. Prospeo gives you 98% accurate emails and 125M+ verified mobiles so your segmentation actually converts. Layer intent data across 15,000 topics to fuel your Fit/Intent/Engagement score with real buying signals - refreshed every 7 days.

Stop segmenting accounts you can't actually reach.

Spreadsheet-ready scoring rubric (copy/paste template)

Don't start with machine learning. Start with a rubric you can explain in 60 seconds.

Use Fit (0-100) + Intent (0-100) + Engagement (0-100) -> total 0-300 account score. Tiers are capacity-based; score is action-based.

Fit (stable) - suggested weights

- Industry match (25%)

- Employee band (20%)

- Revenue band (15%)

- Region coverage (10%)

- Tech stack fit (20%)

- Growth signals (10%)

Intent (high-signal only) - suggested weights + extra triggers

Keep intent tight. A few trusted signals beat a dozen noisy ones.

- Topic intent surge (45%)

- Hiring for relevant roles (15%)

- Funding / expansion event (10%)

- Competitive tech change (10%)

- Champion movement / job changes (10%)

- Previous users now at a target account (10%)

Those last two are sneaky powerful. When a champion lands somewhere new, your "cold" account isn't cold.

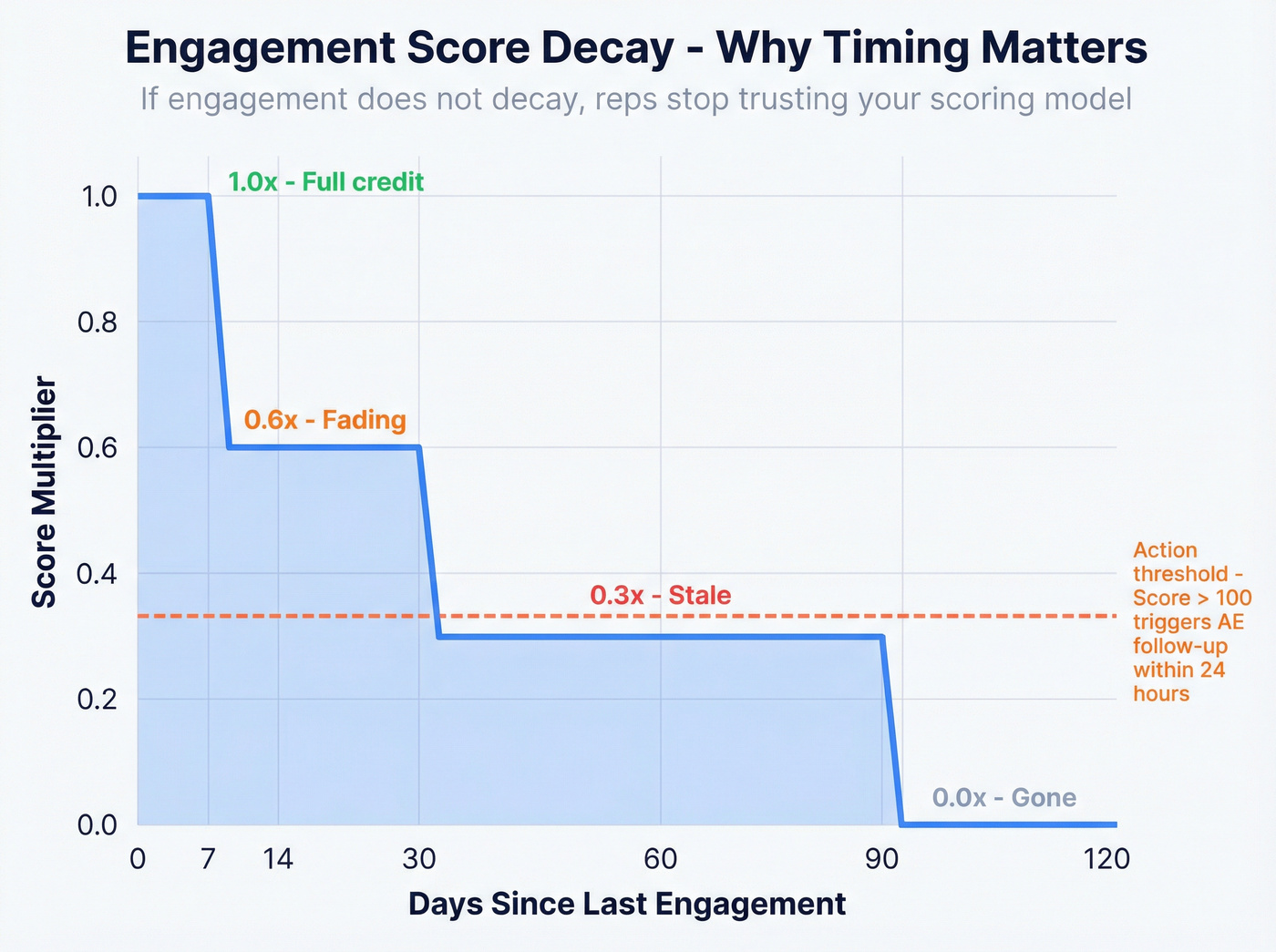

Engagement - decay + follow-up threshold

Engagement must decay or reps stop trusting it.

Time decay multiplier:

- 0-7 days: 1.0x

- 8-30 days: 0.6x

- 31-90 days: 0.3x

- 91+ days: 0.0x

Threshold that works: Account score > 100 triggers AE follow-up within 24 hours (SDR assist for Tier 1-2).

Copy/paste rubric tables (mobile-friendly)

Fit + Intent

| Field | Bands | Points |

|---|---|---|

| Industry fit | Match / No | 20 / 0 |

| Employee band | <200 / 200-1k / >1k | 5 / 12 / 20 |

| Revenue band | <50M / 50-500M / >500M | 5 / 12 / 20 |

| Region | Core / Edge / No | 15 / 8 / 0 |

| Tech fit | Yes / No | 20 / 0 |

| Growth | <5% / 5-15% / >15% | 5 / 10 / 15 |

| Intent topics | Low / Med / High | 5 / 15 / 30 |

| Hiring signal | 0 / 1-2 / 3+ | 0 / 10 / 20 |

| Funding/event | Yes / No | 15 / 0 |

| Tech change | Yes / No | 15 / 0 |

| Champion move | Yes / No | 15 / 0 |

Engagement

| Field | Bands | Points |

|---|---|---|

| Web visits | 0 / 1-3 / 4+ | 0 / 8 / 15 |

| Email replies | 0 / 1 / 2+ | 0 / 20 / 35 |

| Meetings held | 0 / 1 / 2+ | 0 / 25 / 40 |

Scoring validation checklist (do this before you automate anything)

- Run the score on 50 known accounts (mix of wins, losses, active pipe, dead).

- Check distribution: you want a curve, not "everything is 40-60."

- Correlate with outcomes: win rate, ASP, sales cycle, expansion rate.

- Adjust weights once, then lock for the quarter.

- Document 3 examples of "why this account is hot" so reps trust it.

Data you need for segmentation (and how to keep it fresh)

Segmentation quality is capped by data quality. If firmographics are stale, tiers drift. If contacts are wrong, engagement lies.

A practical input checklist:

- Firmographic: industry, revenue, headcount, HQ/region

- Technographic: tools, cloud, security/data stack (often inferred from website scripts/pixels, job posts, and public docs)

- Intent: topic surges, in-market signals

- Behavioral: site visits, email engagement, product usage

- Org/role: department, seniority, buying committee

- Chronographic: funding, hiring spikes, acquisitions, renewals

The refresh loop that keeps segmentation trustworthy (weekly):

- Enrich missing firmographics/technographics

- Verify emails + mobiles for new contacts

- Append intent topics and job-change signals

- De-dupe and push updates into CRM fields used by scoring

- Recompute scores nightly; review tier changes quarterly

Here's the thing: most teams don't have a segmentation problem. They've got a "we can't reach the right people twice in a row" problem, and the scoring model gets blamed for what is really stale contact data.

In our experience, a self-serve data layer like Prospeo ("The B2B data platform built for accuracy") earns its keep when your model depends on contactability and weekly freshness: 300M+ profiles, 143M+ verified emails, 125M+ verified mobile numbers, 98% verified email accuracy, and a 7-day refresh cycle (industry average: 6 weeks). It also includes 15,000 intent topics powered by Bombora, 30+ search filters, and 50+ enrichment data points per contact, plus native integrations (Salesforce, HubSpot, Clay, Zapier, Make, and more) so the fields your score depends on don't rot in a CSV.

Pricing reality check (data layer)

- Prospeo: ~$0.01/email; 10 credits per mobile number; free tier includes 75 emails + 100 extension credits/month; no contracts

- ZoomInfo: typically $30k+/year and up once you add seats/modules (enterprise contracts)

- D&B: another enterprise-grade option for broad firmographic coverage if you can handle contract complexity

- ABM agencies: 1:many ~$100k-$300k/year; 1:few ~$200k-$600k/year; true 1:1 often $30k-$100k+ per account

If you want a practical read on segmentation mechanics (separate from account segmentation), FullStory's overview is a decent primer: data segmentation guide.

Account hierarchies & rollups (parent/child) - the part everyone ignores

If you don't handle hierarchies, your segmentation will double-count, mis-route, and mis-measure. This is the RevOps landmine.

The uncomfortable truth up front: standard Salesforce reporting handles one layer of hierarchy cleanly. If stakeholders expect infinite rollups in native reports, reset expectations early, because you'll otherwise spend weeks building dashboards that look right and are wrong.

Here's a step-by-step that works.

Step 1: Define the account unit. Legal entity, billing entity, location, or business unit - pick one and document it.

Step 2: Enforce Parent Account hygiene. If Parent Account is wrong, rollups are fantasy.

Step 3: Build rollup-based segments using thresholds.

Examples:

- Segment hierarchies with >= 2 opportunities, each >= $50k

- Segment top parents where aggregated annual revenue is >= $600M

- Filter to top-most parents by requiring Parent Account is blank

Step 4: Decide what rolls up (and what shouldn't). Engagement rollups are useful, but they're blunt. Decide whether the parent inherits max child score, sum, or weighted.

Step 5: Don't mix routing and measurement units. If you route by child and measure by parent, you'll create ghost coverage and inflated dashboards.

Pitfalls worth memorizing:

- Don't use child accounts to represent product installs - use a custom object.

- Don't score parent and child the same way without explicit rollup rules.

Account segmentation activation: routing, SLAs, plays, and coverage by tier

This is where it becomes real. Your tiers and score should drive:

- who owns the account

- how fast they respond

- what plays they run

- what "success" means

This is also where account-based segmentation either works or fails: if the segment doesn't change routing and plays, it isn't a segment - it's a label.

Pre-sale SLAs by tier (response time, touches, channels)

- Tier 1: respond within 1 business hour to score triggers; 12-18 touches/21 days; email + phone + exec outreach

- Tier 2: respond within 4 business hours; 8-12 touches/21 days; email + phone

- Tier 3: respond within 24 hours; 5-8 touches/14 days; mostly email

Post-sale coverage model (CS/KAM)

Coverage ratios as a sanity check:

- Tier 1 > $1M ARR: 1:1

- Tier 2 $250k-$1M ARR: 1:5

- Tier 3 < $250k ARR: 1:50+

If you assign 200 accounts to a CSM and call them "strategic," you're not running segmentation - you're renaming a backlog.

Where segments must appear in CRM (minimum spec)

At minimum:

- Account fields: Tier, Fit score, Intent score, Engagement score, Total score, Last score change date

- Views: "Tier 1 Hot (score > 100)", "Tier 2 Warming", "At Risk (post-sale)"

- Routing rules: inbound + tasks by Tier + score threshold

- Dashboards: penetration, coverage, SLA compliance, pipeline by tier

Mini playbook table:

| Tier | Owner model | SLA | Plays | Success metric |

|---|---|---|---|---|

| T1 | Named AE+SDR | <1 hr | Multi-thread | Meetings/pipe |

| T2 | Pooled SDR | <4 hrs | Repeatable | Opp creation |

| T3 | Scaled | <24 hrs | Low-touch | Efficient pipe |

KPIs: penetration, drift, decay

If you don't measure segmentation, it turns into vibes. Your dashboard should prove two things: (1) segments predict outcomes, and (2) the team's working them.

Core ABM-style KPI:

- Account Penetration Rate = (Engaged/Won Target Accounts ÷ Total Target Accounts) × 100

Use TAM for market sizing, but run execution on a TAL (target account list). A focused TAL is usually 50-200 accounts, and 20-30% penetration is strong for enterprise ABM.

Validation metrics to tune tiers and weights:

- L2O, win rate, sales cycle length, ASP

- Expansion rate, churn, NRR/GRR

- "Hot account" conversion (score > 100 -> meeting -> opp) by tier

Score decay checks:

- % of accounts whose engagement score decays to 0 after 90 days

- Median days from "hot" to first meeting

- Tier drift: % of accounts that move tiers each quarter (too much = unstable)

Dashboard tiles (concrete spec):

- Hot accounts worked within SLA % (by tier, last 7/30 days)

- Meetings per 100 hot accounts (by tier)

- Opp creation rate from hot accounts (by tier)

- Win rate + ASP by tier (rolling 90 days)

- Sales cycle length by tier

- Tier drift % (quarterly) + list of promoted/demoted accounts

- Data freshness: % of Tier 1 accounts with verified email + >=3 contacts

For ABM measurement context, Salesmotion's KPI breakdown is a solid reference: account-based marketing metrics.

Governance + buy-in (so segments don't rot)

Segmentation's a living system. If you don't schedule maintenance, it rots quietly and then fails loudly.

And yes, I've watched this happen: a team ships a beautiful tier model, nobody owns the quarterly review, six months later half the "Tier 1" list is companies that churned or got acquired, and the CRO decides segmentation "doesn't work." It's not that it doesn't work. It's that nobody ran it.

How to get buy-in in one workshop (90 minutes)

This is the change-management piece most RevOps teams skip - and it's why the model gets ignored.

Agenda:

- Agree on the account unit (parent vs child) and the source-of-truth fields

- Pick 3 tiers + 1 score (no exceptions in v1)

- Validate on 20 known accounts (10 wins, 5 losses, 5 "should-have-won")

- Define the plays + SLAs per tier (what changes Monday)

- Lock a quarterly review cadence and name an owner

Rule that keeps politics out: cap quarterly re-tiering to 5-10% of accounts unless there's a reorg or a product/market shift. Stability beats perfection.

Cadence (default)

- Monthly: SLA compliance + penetration + hot-account conversion

- Quarterly: tier review + scoring weight tuning + hierarchy audit

- Annually: ICP refresh + territory model + CS coverage model refresh

Re-tier rules (simple, defensible)

Use explicit promotion/demotion rules so it doesn't become a debate:

- Up-tier if account health >= 80 and expansion probability >= 30%

- Up-tier if open expansion pipeline >= $250k (or your threshold)

- Down-tier if health < 60 for 2 consecutive months

- Down-tier if no engaged contacts for 90 days (after decay)

- Freeze tier changes during territory reassignments (avoid double thrash)

Worked example: Security SaaS segmentation (what changes Monday)

A mid-market security SaaS team sells $25k-$150k ACV with a mix of inbound and outbound. They were "segmenting" by employee count only, which meant reps treated a 2,000-employee company browsing pricing the same as a 2,000-employee company that hadn't shown intent in a year.

They moved to 3 tiers + 1 score:

- Tier 1 (40 accounts): regulated industries + high expansion potential. Named AE+SDR. SLA: 1 hour on score triggers. Play: multi-thread (security + IT + procurement), exec email on meeting set, and a "risk audit" offer.

- Tier 2 (180 accounts): good fit, moderate potential. Pooled SDR. SLA: 4 hours. Play: two repeatable sequences (cloud posture vs endpoint), plus retargeting.

- Tier 3 (1,200 accounts): long tail. Programmatic. SLA: 24 hours. Play: intent-based nurture only.

Trigger: score > 110 enrolls SDR sequence + creates AE task. Result that mattered: reps stopped arguing about "my patch" and started working the same hot list. Pipeline quality improved because Tier 1 required 3+ contacts and a next step before an opp could be created.

Common failure modes (and fixes)

Failure mode: "Enterprise" becomes a junk drawer.

Fix: keep tiers capacity-based, then use the score to prioritize inside tiers.

Failure mode: you refresh yearly.

Fix: quarterly tier review, continuous engagement scoring with decay.

Failure mode: nobody uses it.

Fix: wire it into routing rules, sequencer lists, and dashboards - if it doesn't change a rep's daily list, it's dead.

Failure mode: hierarchy breaks everything.

Fix: define the account unit, enforce Parent Account hygiene, and decide rollup rules before scoring.

Look, if your deliverability's cooked, segmentation won't save you. Bad data + burned domains + "personalized" spam is still spam.

Operators also shared Instantly's 2026 benchmark summary: average reply rate ~3.43%, top quartile 5.5%+, top decile 10.7%+. Most lift comes from deliverability and list quality/segmentation, not clever personalization.

If you want an ABM segmentation lens, UserGems has a practical overview: account-based marketing segmentation.

If you do only one thing this week...

Run your scoring rubric on 50 known accounts, then force one operational change: a single score trigger that creates a task and enrolls a sequence with a real SLA. If your account segmentation doesn't produce a better "today list," it isn't finished.

FAQ

What's the difference between account segmentation and ICP?

ICP defines what a great customer looks like; account segmentation groups accounts into tiers and scores that get different routing, SLAs, and plays. You can have multiple ICPs, but you still want a simple system the team can execute daily.

How many segments should a B2B team have?

Most teams should run 3 tiers plus a single account score. More than 8 segments collapses into confusion, inconsistent routing, and dashboards nobody trusts. If you need nuance, add scoring instead of buckets.

How often should you refresh account segments?

Refresh tiers quarterly so territories and coverage stay stable, and refresh engagement scoring continuously with decay so "hot" accounts don't stay hot forever. Strategic segmentation stays stable; tactical prioritization updates as signals change.

How do you avoid double counting with parent/child accounts?

Pick one reporting unit (often the top parent), define rollup rules (max vs sum vs weighted), and filter views to top parents where Parent Account is blank. Without explicit rollups, you'll mis-route accounts and inflate pipeline and engagement.

What's a good free tool to keep segmentation data fresh?

For most teams, start with a weekly enrichment + verification loop and a free tier from a self-serve data provider. Prospeo's free plan includes 75 verified emails + 100 extension credits/month and runs on a 7-day refresh cycle, which is ideal when your scoring depends on current contacts and intent.

Scoring accounts on fit and intent means nothing if your contact data is stale. Prospeo refreshes 300M+ profiles every 7 days - not the 6-week industry average. Enrich your CRM segments with 50+ data points per contact at $0.01/email, so every tier gets the right play with the right data.

Turn your segmentation spreadsheet into pipeline that books meetings.