Deal Risk Champion Leaves: The 48-Hour Rescue Plan (2026)

The fastest way to torch a good deal is to lose your champion and pretend nothing changed. Your forecast doesn't slip with a bang. It slips with "no worries, let's reschedule" and then three weeks of silence.

Here's the angle: treat a champion departure like an incident. You need a clock, owners, and a few artifacts that let a new stakeholder get up to speed without you re-running Discovery like it's Groundhog Day.

And yes, you can save a lot of these deals in 48 hours if you stop writing "just checking in" and start rebuilding ownership.

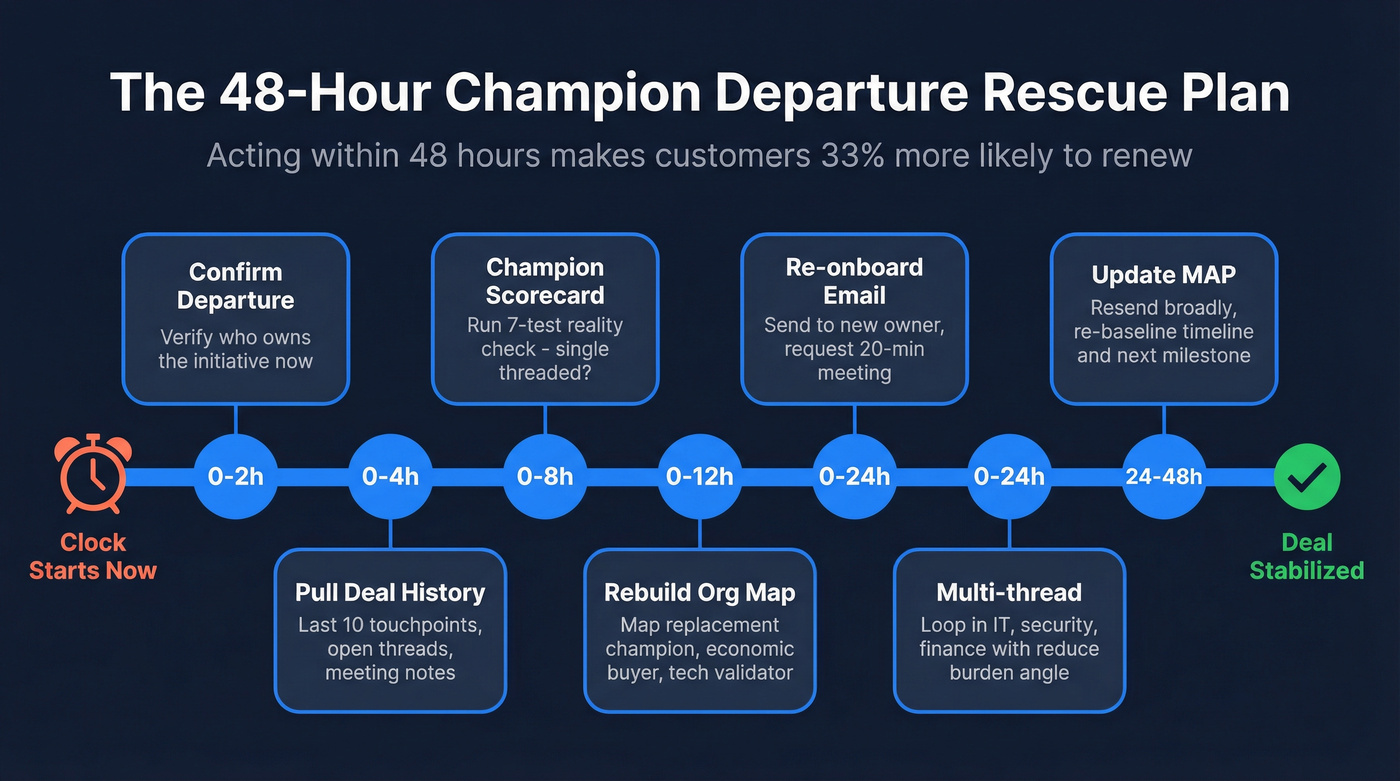

What to do in the first 48 hours (SLA)

Print this. Put it in your deal desk doc. Run it the same way every time.

First 48 hours (SLA):

- 0-2 hours: Confirm the departure + who owns the initiative now (don't guess).

- 0-4 hours: Pull your last 10 touchpoints + meeting notes + open threads (security, legal, ROI, timeline).

- 0-8 hours: Run the "real champion vs friendly user" scorecard (below). If you fail 2+, treat the deal as single-threaded.

- 0-12 hours: Build a replacement stakeholder map (minimum viable buying committee: champion replacement, economic buyer, technical validator).

- 0-24 hours: Send the re-onboard email to the new owner + request a 20-minute "you, we, me" meeting.

- 0-24 hours: Multi-thread with permission: loop in IT/security and finance with a "reduce burden" angle (scripts below).

- 24-48 hours: Update MAP, resend it broadly, and re-baseline timeline + next milestone in writing.

3 things to implement this quarter (so this hurts less next time):

- MAP as a default artifact on every deal past Discovery.

- 3-thread minimum by mid-funnel (user/champion + technical + economic).

- A real 48-hour playbook with owners (AE/SE/CSM/exec sponsor) and templates.

One practical enabler: tools like Prospeo can help you rebuild stakeholder coverage fast when intros stall, so you're not stuck waiting for a forwarding address.

Why risk spikes when a champion leaves (and what actually resets)

A champion leaving doesn't "pause" a deal. It removes the person doing internal work on your behalf, and the account snaps back to the safest default: status quo, risk avoidance, and internal politics.

I've watched this happen in the same pattern across SMB and enterprise: the calendar holds for a week, everyone stays polite, and then the new owner quietly re-litigates the basics because they didn't pick the tool, they didn't sell it internally, and they don't want to inherit a mess.

Here's what actually resets when the internal owner disappears:

- Budget ownership: the new owner didn't ask for this line item, so they reopen "do we even need it?"

- Success metrics: your champion's KPI framing dies with them; the replacement brings a different scoreboard.

- Security posture: the new technical owner re-asks the same questions, but with different standards and a slower tempo.

- Procurement gates: vendor onboarding steps, PO rules, and signature paths are personal. Change the person, change the path.

- Internal narrative: your story ("why now," "why us," "why this price") stops circulating. Silence fills the gap.

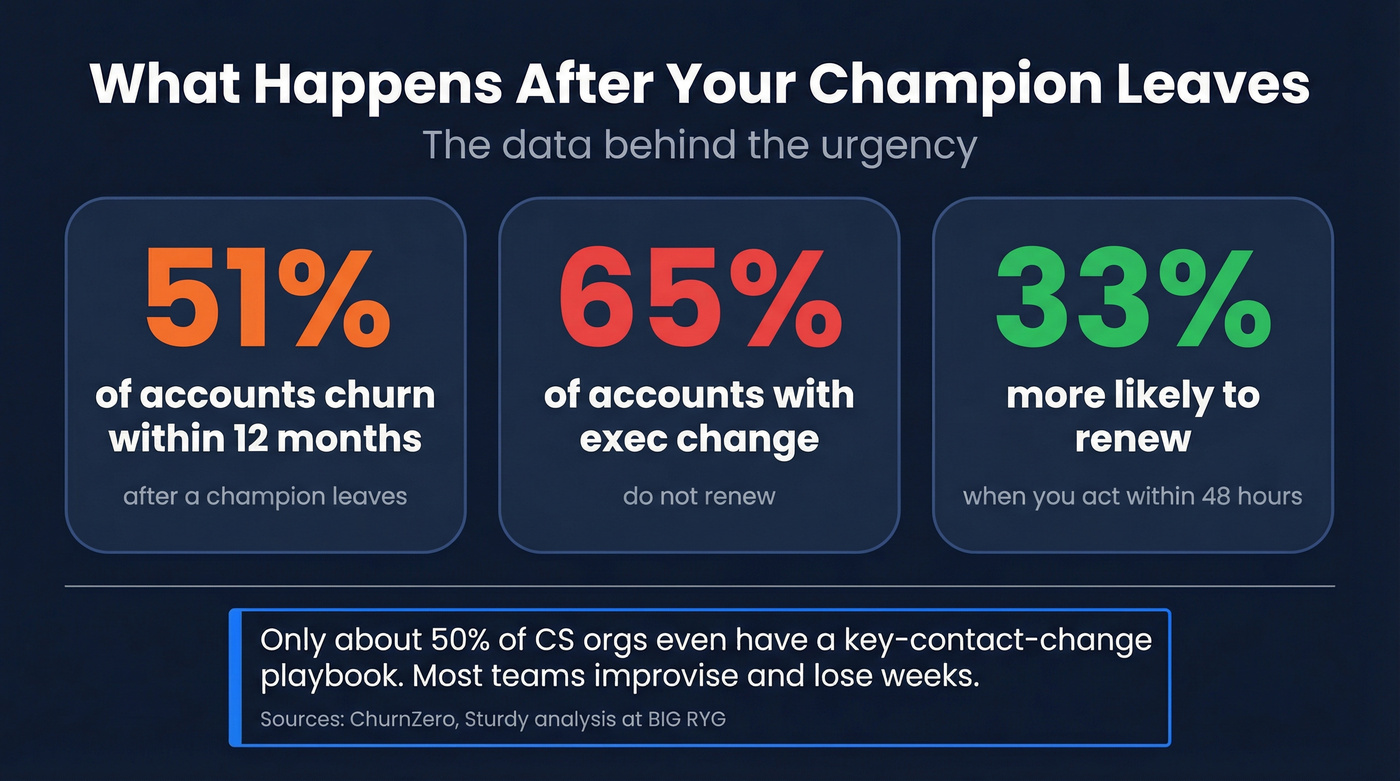

A benchmark worth taking seriously: ChurnZero has pointed out that only about half of CS orgs even have a key-contact-change playbook. Most teams improvise, lose weeks, then act shocked when the deal slips.

And the ugly retention math shows how violent this pattern gets after a champion change. A Sturdy analysis presented at BIG RYG (shared via ChurnZero) found 51% of accounts churn within 12 months after a champion leaves, and 65% of accounts with an executive change don't renew. Different stage, same mechanism: ownership changes and the initiative gets re-litigated.

Acting within 48 hours makes customers 33% more likely to renew. Translate that to pipeline: speed keeps the reset from hardening into "next quarter."

Hot take: if your deal depends on one person's enthusiasm, it wasn't a deal. It was a relationship.

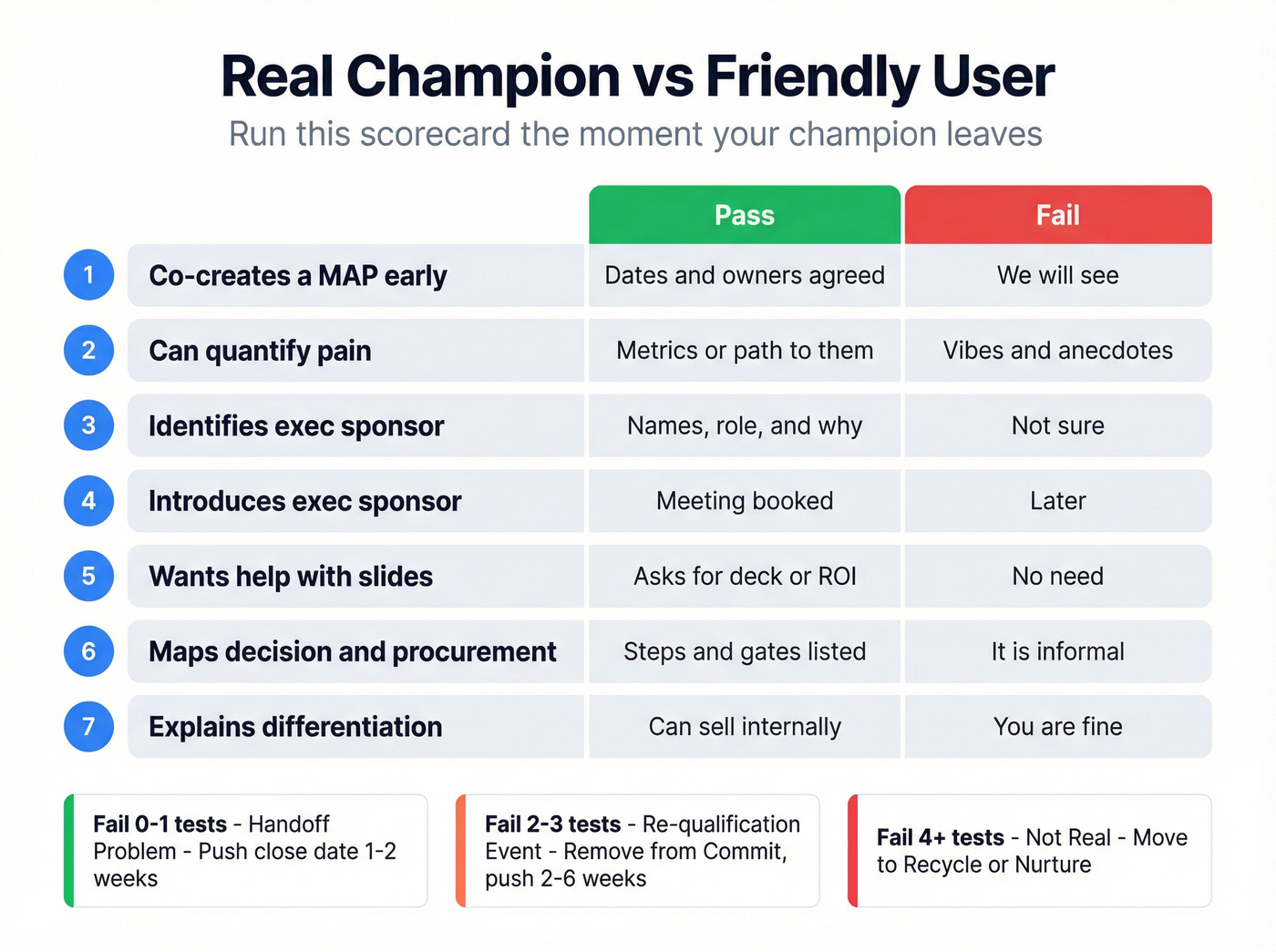

Did you have a real champion - or a friendly user?

A champion leaving only kills deals that were already fragile. The fastest way to know which kind you had is to run a pass/fail scorecard based on SalesHood's champion tests.

Champion reality check (7 tests)

| Test | Pass looks like | Fail looks like |

|---|---|---|

| Co-creates a MAP early | Dates + owners agreed | "We'll see" |

| Can quantify pain | Metrics or path to them | Vibes + anecdotes |

| Identifies exec sponsor | Names + role + why | "Not sure" |

| Introduces exec sponsor | Meeting booked | "Later" |

| Wants help w/ slides | Asks for deck/ROI | "No need" |

| Maps decision + procurement | Steps + gates | "It's informal" |

| Explains differentiation | Can sell internally | "You're fine" |

If/then actions (and what to do in CRM)

Fail 0-1 tests (real champion): treat this as a handoff problem. CRM move: keep stage, but push close date 1-2 weeks and create a task bundle: "Re-onboard + MAP resend + 3-thread rebuild."

Fail 2-3 tests (single-threaded): treat this as a re-qualification event. CRM move: keep stage but remove from Commit, push close date 2-6 weeks, and require a new technical + economic thread before you re-commit.

Fail 4+ tests (not real): assume the deal was never real. CRM move: move to Recycle/Nurture unless you can book an exec sponsor within 7 days.

Stop doing this: sending "just checking in" emails to the replacement owner. That's how deals die politely.

Send a MAP and make one clear ask.

3 successor "commitment asks" that prove the deal's still alive

Use these in your re-onboard meeting. They're simple, and they force clarity.

"Can you confirm the decision path in writing?" (one email listing steps + who signs) Proves: procurement gates and signature path still exist.

"Can we book a 15-minute security working session with the technical owner?" Proves: technical validation is real, not a stall tactic.

"Can you forward this 1-page business case to finance/procurement and CC me?" Proves: they'll do internal work, not just attend calls.

When a champion leaves, your 48-hour clock starts. Don't waste it waiting for introductions that never come. Prospeo gives you direct access to 300M+ profiles with 30+ filters - find the replacement champion, economic buyer, and technical validator in minutes, not weeks. 98% email accuracy means your re-onboard email actually lands.

Stop waiting for a forwarding address. Find the new stakeholder yourself.

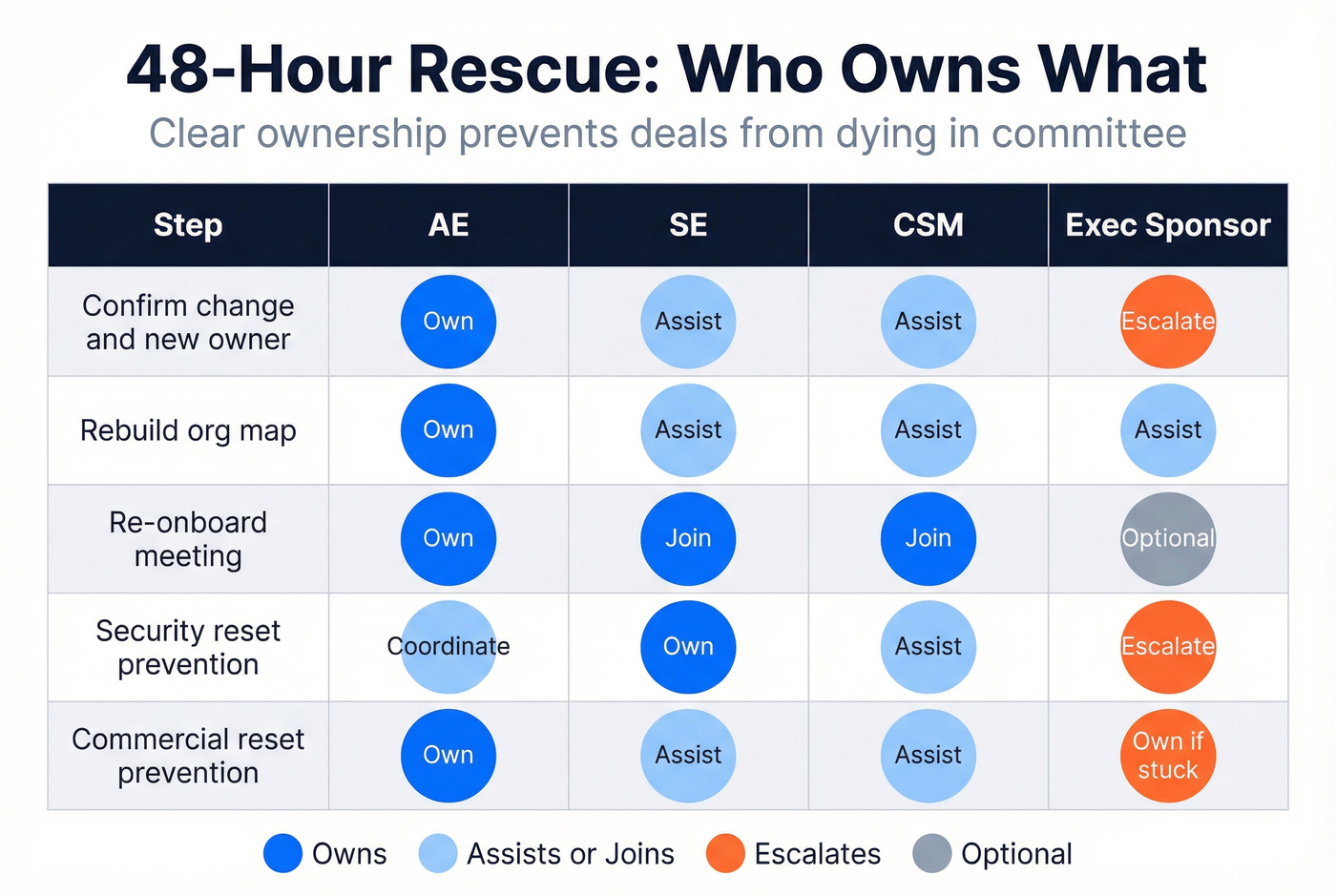

Deal risk champion leaves: the 48-hour rescue plan (owners, steps, and what to send)

This is adapted from ChurnZero's key-contact-change playbook, tuned for active deals. The key is ownership: sales can't rebuild technical and exec alignment alone.

First 48 hours: swimlane ownership (mini-table)

| Step | AE | SE | CSM | Exec sponsor |

|---|---|---|---|---|

| Confirm change + new owner | Own | Assist | Assist | Escalate |

| Rebuild org map | Own | Assist | Assist | Assist |

| Re-onboard meeting | Own | Join | Join | Optional |

| Security reset prevention | Coordinate | Own | Assist | Escalate |

| Commercial reset prevention | Own | Assist | Assist | Own (if stuck) |

Step 1: Confirm the departure and the "new owner" (0-2 hours)

Checklist

- Verify the champion's actually gone (not just OOO).

- Identify who owns the initiative now (manager, peer, program owner).

- Check whether the champion moved internally (different team). That's often salvageable.

Internal message (copy/paste)

- Slack your manager: "Champion left. Running 48-hour rescue. I'll update MAP + stakeholder coverage by EOD and re-forecast if we're single-threaded."

Step 2: Pull the deal history and isolate what can reset (0-4 hours)

Checklist

- Last 3 meeting notes: what did they commit to?

- Open threads: security questionnaire, legal redlines, pricing approval, implementation plan.

- What did the champion "translate" internally (ROI deck, email forwards, internal memo).

Mini-template: "Deal Memory" email paste (6 lines)

Subject: [Account] - deal memory after champion change

- Goal: [business outcome] by [date]

- Why now trigger: [event]

- Validated: [2 bullets]

- Open risks: [security/legal/procurement]

- Decision path (known): [steps + signer]

- Next milestone we were driving: [milestone + date]

Step 3: Run the "you, we, me" meeting (book within 24 hours)

Agenda (20 minutes)

- You (customer): "What's on your plate in the next 30-60 days? What would make this initiative a win for you?"

- We (together): "Here's what's been validated, what's pending, and what we can simplify."

- Me (one ask): "Can we align on the next milestone and who must be involved to hit it?"

Non-negotiable follow-up: send recap within 24 hours with decisions, owners, and dates.

Step 4: Rebuild the org map fast (0-12 hours)

If you don't rebuild stakeholder coverage, you'll spend the next month emailing into a void.

Here's a real scenario I've seen: your champion leaves on a Friday, your Monday call stays on the calendar, and then the new owner shows up with two people you've never met who ask questions you answered three weeks ago. If you can't say "Great, here's the MAP, here's the security packet, and here's the one decision we need this week," you're back to square one.

Minimum viable buying committee (MVBC) to rebuild immediately

- Replacement champion / program owner (day-to-day)

- Economic buyer (budget authority)

- Technical validator (security/IT/data)

- Optional but powerful: procurement/legal contact if you're late-stage

Operational shortcut: Prospeo ("The B2B data platform built for accuracy") helps you rebuild coverage fast when internal intros disappear, because you can find verified emails and mobile numbers for the successor path instead of waiting for someone to forward your thread.

- 300M+ professional profiles on a 7-day refresh cycle (industry average: 6 weeks)

- 143M+ verified emails at 98% accuracy

- 125M+ verified mobile numbers; 30% mobile pickup rate

- 30+ search filters, including job change and intent topics across 15,000 topics

- CRM/CSV enrichment with 83% enrichment match rate and 50+ data points per contact

Workflow (5 minutes)

- Filter the account by department (IT/security/finance), seniority, and location.

- Add job-change filters to find the most likely successor.

- Export verified emails + mobiles and sync to your CRM/enrichment workflow.

Step 5: Multi-thread with permission (0-24 hours)

You're not "going around" anyone. You're reducing burden and de-risking the project.

Checklist

- Ask the new owner: "Who else should be in the loop so you're not the middleman?"

- Offer direct support to IT/security for compliance questions.

- Offer direct support to finance for payback/pricing structure.

Look, if your new owner says "Let's keep it just us for now," that's a signal. It means they don't own the internal narrative yet, or they don't want visibility. Either way, you need a MAP and a decision path in writing before you pretend the deal's healthy.

Step 6: Stabilize the narrative (24-48 hours)

Checklist

- Update the MAP with the new owner's success criteria (not your old champion's).

- Re-send the MAP broadly (don't keep it private).

- Reconfirm next milestone date and what "done" means in writing.

The teams that win after a champion leaves stop treating the deal like a relationship and start treating it like a project with named owners, dates, and artifacts.

Deal-stage triage: what changes in Discovery vs Security vs Legal vs Close

Champion departure doesn't hit every stage the same way. The risk is "reset," and resets are expensive.

Baseline estimate: in late-stage deals, a champion departure adds 2-6 weeks unless you already have a MAP and real multi-thread coverage.

Reset risk by stage (table)

| Stage | Reset risk | What resets | Your move |

|---|---|---|---|

| Discovery | Medium | Problem framing | Re-qual fast |

| Evaluation | High | Criteria + shortlist | Re-anchor value |

| Security | Very high | Trust + process | Pre-pack answers |

| Legal/Proc | High | Terms + timeline | Reconfirm gates |

| Close | Medium | Signature path | Exec alignment |

Discovery: you're rebuilding "why now"

If the champion was the one articulating pain, the new owner often downgrades urgency. Don't re-demo.

Reconfirm the business problem, the cost of delay, and the internal trigger event.

Security: assume a partial restart

Security is where deals go to die quietly because it's risk-first and slow by design. APQC's survey of 2,500 cybersecurity professionals shows the tempo: median 28 days to apply patches, about 6 months to detect incidents, 1 month to notify customers after a breach, and roughly 1.5 months to respond and recover. That's the mindset you're selling into, so a new security stakeholder doesn't "pick up where we left off" unless you make it easy.

Hard call: if the champion exits during Security and you don't already have an active technical validator thread, assume slip and re-forecast today. Waiting for "maybe they'll pick it back up" is how you miss the quarter twice.

Legal/procurement: the signature path is personal

Legal doesn't approve contracts. People do.

If your champion was navigating internal approvals, you need the new owner to confirm the exact steps: redlines, vendor onboarding, PO process, and who signs.

Close: don't celebrate early

Late-stage champion loss is survivable if you've already multi-threaded. If you haven't, the deal can still slip because nobody wants to sign something they didn't help shape.

Multi-threading that prevents resets (MVBC + succession thinking)

Treat this as a key contact change / succession event. Your job isn't to "find a new champion." Your job's to build a successor path and redundancy across roles.

Benchmarks from Gartner (shared via Dock) match what you see in real deals: buying groups run 6-10 people, 77% say the process is too complex, and 95% pivot when new insights show up. A new stakeholder is a new insight, and it changes the deal whether you like it or not.

Custify's simplest operational rule holds up: nurture at least 3 POCs from the start. Not 3 random contacts - 3 roles that cover the deal's failure modes.

Minimum viable buying committee (MVBC) thresholds

You're "multi-threaded enough" when:

- You have 3+ active threads (meetings or meaningful email exchanges).

- You've mapped a chain of contact (who they report to, who that leader reports to).

- You have at least one technical validator who's seen your security packet.

- You have at least one economic buyer who's seen the business case.

Gong's benchmark is the punchline: closed-won deals involve 3x the number of people compared to lost deals. Redundancy wins, and it wins in boring ways like "we already had the CFO looped in before the org chart changed."

Turnover-proof artifacts: MAP + business case + security packet

When a champion leaves, your artifacts become your champion. If they're weak, the deal resets. If they're strong, the new stakeholder can onboard in 15 minutes.

Outreach's MAP benchmark is worth stealing: deals with a MAP see a 26% higher win rate. That's not a motivational poster. That's pipeline math.

MAP template (copy/paste fields)

| Field | What to write |

|---|---|

| Objective | Business outcome |

| Milestones | Stage gates + dates |

| Owner | Buyer + seller owners |

| Deliverables | Docs, reviews, calls |

| Status | Not started / In progress / Done |

| Success metrics | KPIs + targets |

Rules that make MAPs turnover-proof

- Keep it to one page.

- Put names next to dates (not "customer").

- Start meetings with "what changed on the MAP since last time?"

- Share it widely across stakeholders so new people can self-serve context.

Business case mini-template (one page)

- Problem + cost of doing nothing

- Expected impact (revenue, time saved, risk reduced)

- Implementation plan (who does what)

- ROI / payback model

- Decision + procurement steps

Security packet (preempt the reset)

- SOC 2 / ISO docs (or equivalent)

- Data flow diagram (simple)

- Subprocessors list

- SSO/SAML support notes

- Standard security questionnaire answers

If you wait for the new security owner to ask, you've already lost two weeks.

Copy/paste scripts: permission-based multi-threading + the re-onboard email sequence

These are adapted from Nomi's permission-based multithreading approach. The tone matters: you're helping the new owner succeed, not escalating around them.

Email 1: re-onboard the replacement owner

Subject: Quick context + next step on [initiative]

Hi [Name] - congrats on the new role.

We were working with [Champion] on [initiative] to achieve [business outcome]. Here's where things stand:

- Done: [validated item]

- Pending: [security/legal/ROI step]

- Target timeline: [date]

Could we do a quick 20 minutes this week to align on your priorities and confirm the next milestone? I'll keep it tight with a "you, we, me" agenda.

Thanks, [Your name]

Email 2: if no response (48-72 hours later)

Subject: Close the loop on [initiative]?

Hi [Name] - quick follow-up.

If [initiative] isn't a priority right now, tell me and I'll close the loop on my side. If it is, I'll send a 1-page MAP and we'll confirm owners/dates in 20 minutes.

Which is best? [Your name]

Permission-based loop-in: IT/CTO (technical validator)

Call talk track

- "I don't want you to be the middleman for security questions."

- "Would a 15-minute working session with your IT/security owner help to walk through the security packet and data flow?"

- "If you prefer, you can stay on - or I can handle it directly and send you a summary."

Permission-based loop-in: CFO/finance (economic buyer)

Email snippet Hi [Name] - [Owner] and I are aligning on the business case for [initiative]. Rather than sending a spreadsheet through them, I can walk you through the payback model in 15 minutes and answer pricing/terms questions directly. Open to that?

"You, we, me" agenda (copy/paste into calendar invite)

- You: priorities + success criteria (5 min)

- We: current status + what's validated (10 min)

- Me: one decision + next milestone owner/date (5 min)

Make it operational (without MEDDPIC theater): fields, triggers, and alerts

You don't need a giant methodology rollout. You need a few fields, a few triggers, and a habit, because the moment a deal goes single-threaded, you want your CRM to tell you whether you're protected or exposed.

Real talk: MEDDPIC is fine until leadership turns it into homework. Then reps start typing fiction into required fields just to get Salesforce to stop yelling at them, and your "process" becomes a data-quality problem.

Lightweight CRM spec (fields)

- Champion status: Confirmed / Suspected / None

- Threads count: 1 / 2 / 3+

- MVBC roles covered: Econ / Tech / User (checkboxes)

- MAP link: URL

- Last stakeholder change date: date

Triggers/alerts (key contact change signals)

- Alert on contact deactivation (champion account disabled)

- Alert on job change (new title/company detected)

- Alert on no activity for 14 days in late-stage deals

- Alert on security thread missing when stage = Security (simple validation rule)

Make it hard to over-document

- Reduce required fields to 5 (the list above).

- Auto-calc Threads count from meetings/emails logged (even rough automation beats manual policing).

- Make "Commit" require MVBC = Econ + Tech + User. No exceptions.

Databox's benchmark group reported a median churn value of 7 (Feb 2026). Use it as a directional reminder that monitoring beats surprises, not as a universal rate.

When the champion leaves, don't waste it - turn it into pipeline

Champion departure is painful inside the deal. It's also a lead source if you run it like a system.

We've tested this as a simple weekly motion: track job changes for your champions, reach out with context, and ask one clean question. It's not magic, but it creates warm starts that your competitors miss because they're only watching net-new inbound.

Turn champion departure into new opportunities (operating model)

Playbook

- Identify: Tag champions in CRM (not just "main contact").

- Monitor job changes: Review weekly; treat it like a pipeline hygiene ritual.

- Re-engage: When they move, reach out with context and a clean value hypothesis for their new role.

Skip "champion platform shopping" unless you've already got CRM hygiene and an intake workflow. The operating model matters more than the software.

2-touch re-engage sequence when the champion moves companies

Touch 1 (within 7 days of the move)

Subject: Congrats + quick question

Hi [Name] - congrats on the move to [Company]. When we worked together at [Old Company], you were driving [initiative]. Curious: is [problem] on your radar in your new role, or should I point this to someone else?

If helpful, I can send the 1-page business case we used last time.

Touch 2 (5-7 days later, if no reply)

Subject: Worth a 10-minute reset?

Hi [Name] - I'll keep this simple. If [problem] matters at [Company], I can share what worked (and what didn't) in a 10-minute call. If it's not relevant, reply "not now" and I'll disappear.

FAQ

What's the first thing to do when your champion leaves mid-deal?

Confirm the new owner within 2 hours, then book a 20-minute re-onboard within 24 hours and send a one-page MAP. If you can't get a meeting on the calendar in 48 hours, push the close date at least 2 weeks and treat it as a re-qualification event.

How many stakeholders is "multi-threaded enough" to reduce deal risk?

Minimum is 3 active threads covering: user/program owner, technical validator, and economic buyer. If you've only got 1 thread, assume the deal's fragile and require 1 technical meeting plus 1 budget conversation before you put it back in Commit.

How do you re-onboard a replacement stakeholder without restarting the cycle?

Send three bullets (done, pending, next milestone), then run a 20-minute "you, we, me" call and update the MAP the same day. The practical goal is a written decision path (steps + signer) within 24 hours, so the deal doesn't drift into "next quarter."

What's a good free way to rebuild contacts after a champion change?

Use a self-serve data tool that returns verified emails and mobiles, then target 3 roles (successor, econ, tech) in the same day. Prospeo's free tier includes 75 emails plus 100 Chrome extension credits per month, which is enough to rebuild coverage on a few at-risk accounts fast.

Summary

Deal risk spikes when your champion leaves because the internal owner disappears and the account defaults to status quo unless you re-establish ownership fast. Run this like incident response: confirm the new owner, rebuild the buying committee, resend a MAP broadly, and multi-thread with permission within 48 hours so the reset doesn't turn into a quarter-killer.

Single-threaded deals die when champions leave. The fix is multi-threading before it happens - and rebuilding fast when it does. Prospeo maps entire buying committees with verified emails and 125M+ direct dials, so you can loop in IT, finance, and the new owner within hours, not weeks. At $0.01 per email, rebuilding stakeholder coverage costs less than one lost deal.

Multi-thread every deal before the next champion walks out the door.