The B2B Data Market in 2026: What's Actually Happening (With Numbers)

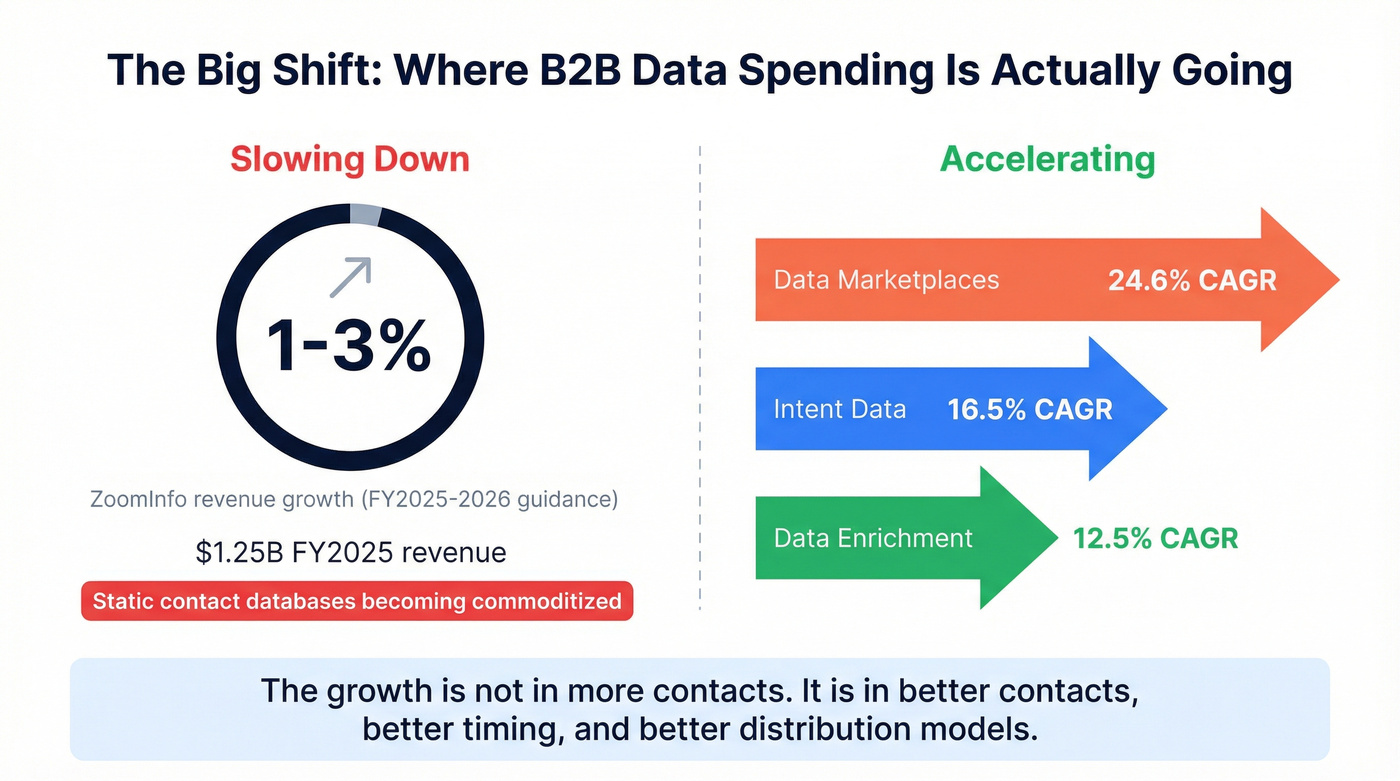

The b2b data market is broken in a way that should make every sales leader nervous. 72% of sales teams pay for data features they never activate. The average B2B data provider delivers 50% accuracy. And ZoomInfo - the market's bellwether - just guided for 1% growth in 2026 after posting $1.25 billion in FY 2025 revenue. The entire model of "buy a big database, blast emails, hope for replies" is collapsing in real time.

The Quick Version

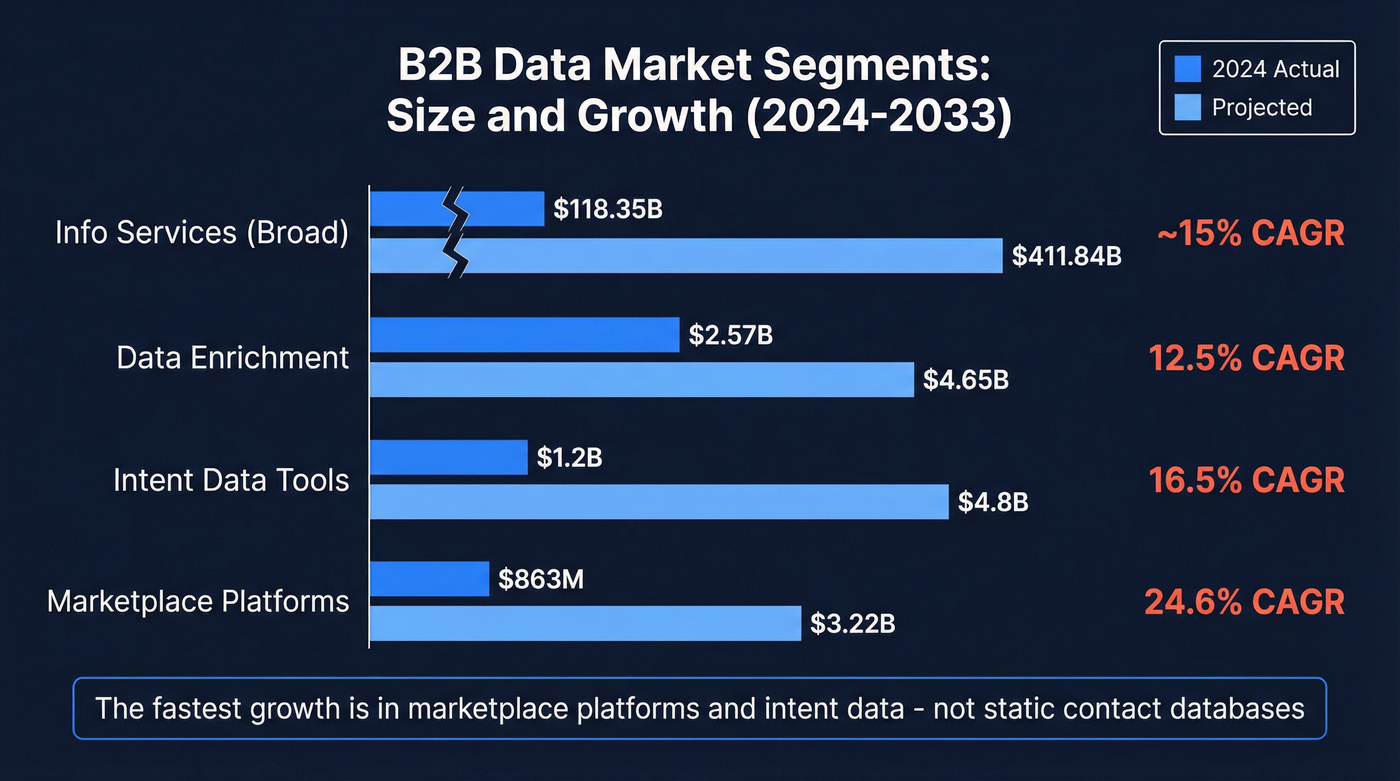

The market sits inside a $118B+ information services umbrella, but the core sales and marketing data segment runs $5-8B, growing 12-25% CAGR depending on sub-segment. Intent data ($1.2B heading to $4.8B by 2032) is the fastest-growing category.

Here's what matters for your budget: the average provider delivers roughly 50% accuracy. The best deliver 97%+. That gap is the entire story. Smart teams in 2026 stack 2-3 specialized tools in a waterfall enrichment model instead of relying on one monolithic platform - getting 85-95% find rates versus 50-60% from single-source approaches.

The Broken Database Moment

A 2025 post on r/b2bmarketing titled "why big lead databases are broken" summed up what most practitioners already feel: contacts are outdated the moment you export them, generic emails (info@, marketing@, support@) pollute every list, and your competitors are emailing the exact same people from the exact same databases. The poster's conclusion? "Who you contact matters, but you need to focus on when and why you contact them."

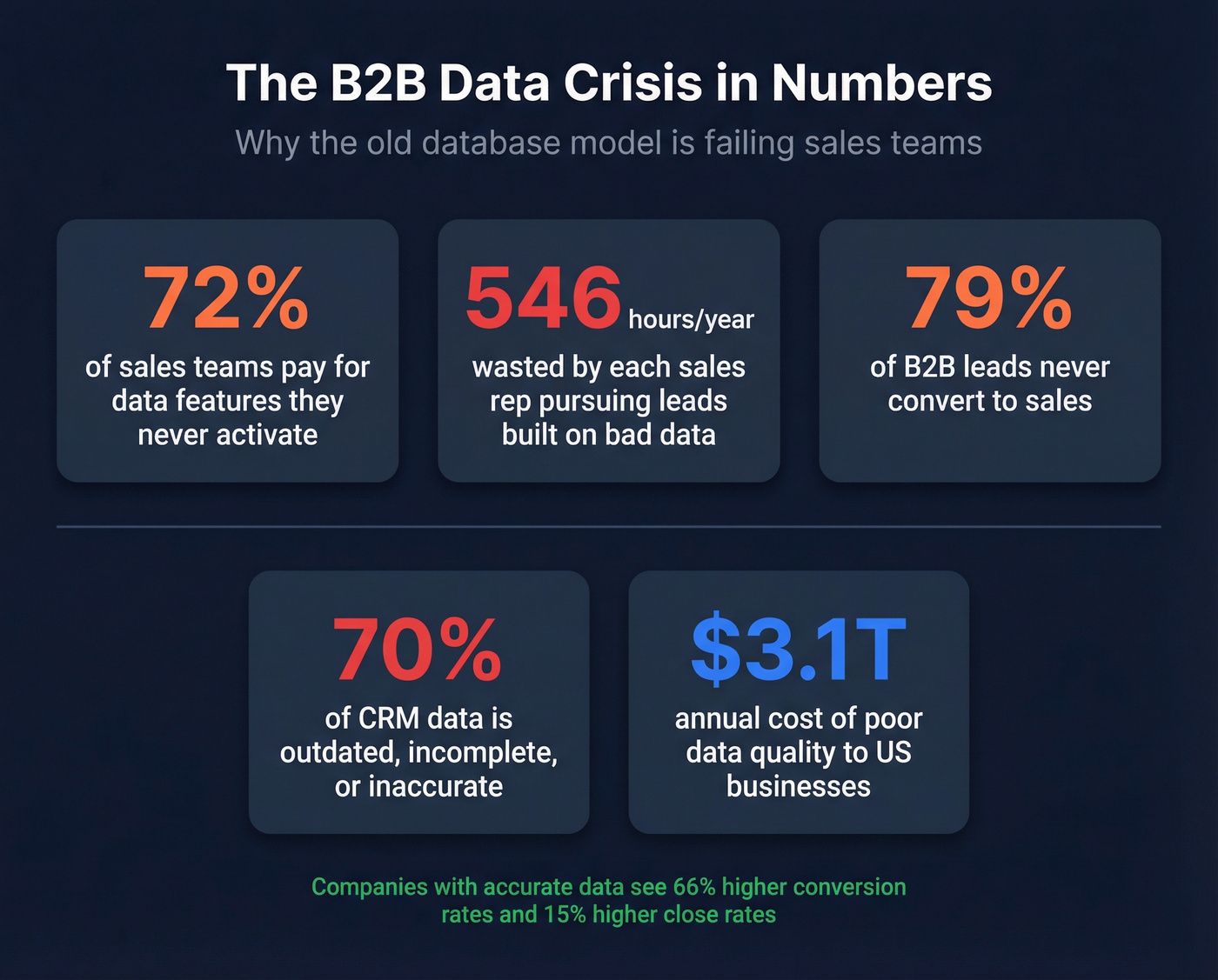

That's not a fringe opinion - it's the mainstream reality in 2026. 70% of CRM data is outdated, incomplete, or inaccurate. Sales reps waste 546 hours per year - 27.3% of their working time - pursuing leads built on bad data. And 79% of B2B leads never convert to sales.

This space isn't shrinking. It's growing fast. But the growth is shifting away from static contact databases and toward signals, enrichment, and verification. Understanding where the money's actually flowing - and where it's drying up - is the difference between buying the right tool stack and overpaying for a database that's already stale by the time you log in.

B2B Data Market Size in 2026: The Numbers That Actually Matter

The phrase "B2B data market" gets thrown around without anyone agreeing on what it actually measures. A recruiter buying resume data, a sales team buying contact info, and a supply chain manager buying firmographic records are all operating in "B2B data" - but they're buying completely different products at completely different price tags.

The Full Market Map

The broadest umbrella - B2B Information Services - hit $118.35B in 2024 and is projected to reach $411.84B by 2033. That includes everything from credit reporting to market research to compliance databases. Useful context, but not what you're shopping for.

The core B2B sales and marketing data market - contact databases, enrichment tools, intent data, and marketplace platforms - is approximately $5-8B. The broader DaaS market, which covers data-as-a-service delivery across industries, is growing even faster as cloud-native distribution replaces legacy licensing models. Here's how the sub-segments break down:

| Segment | 2024 Size | Projected Size | CAGR |

|---|---|---|---|

| Info Services (broad) | $118.35B | $411.84B (2033) | ~15% |

| Data Enrichment | $2.57B | $4.65B (2029) | 12.5% |

| Intent Data Tools | $1.2B (2023) | $4.8B (2032) | 16.5% |

| Marketplace Platforms | $863M | $3.22B (2030) | 24.6% |

The data enrichment market alone - the tools that take your existing CRM records and fill in missing fields - is $2.57B and growing at 12.5% CAGR. North America holds 39% of that market. Cloud-based enrichment accounts for 56% of deployments and is growing slightly faster at 12.7% CAGR.

Where the Growth Is

Three segments are outpacing everything else.

Data marketplace platforms - Snowflake's data exchange, AWS Data Exchange, and similar platforms where companies buy and sell datasets - are the fastest-growing category at 24.6% CAGR. The B2B segment alone represented $863M in 2024 and is heading toward $3.2B by 2030. That's 58% of the total data marketplace platform market.

Intent data tools are the second-fastest at 16.5% CAGR, growing from $1.2B to a projected $4.8B by 2032. This is where the "when and why" of outreach lives - knowing which accounts are actively researching solutions before you cold-call them.

Data enrichment rounds out the growth story at 12.5% CAGR. The driver is simple: companies realized that buying a database once and letting it rot in Salesforce is worse than continuously enriching and refreshing what they already have.

Here's the thing: the growth isn't in "more contacts." It's in better contacts, better timing, and better distribution models. ZoomInfo's 3% revenue growth in a market expanding 12-25% tells you everything about where the value is migrating.

This article shows the average B2B data provider delivers 50% accuracy while your reps waste 546 hours a year on bad leads. Prospeo's 5-step verification and 7-day refresh cycle deliver 98% email accuracy - in a market where the industry average refresh is 6 weeks.

Stop paying for data that's stale before you even log in.

Market Segments That Matter

Not all B2B data is created equal, and the distinctions matter more than most buyers realize. The five core data types each serve different functions, carry different price tags, and decay at different rates.

Contact & Firmographic Data

This is the foundation layer - names, titles, emails, phone numbers, company size, revenue, industry, location. It's the data most people think of when they hear "B2B database." ZoomInfo's 500M+ contacts, Apollo's 275M+, and similar platforms all compete primarily here.

Firmographic data - company-level attributes like revenue, employee count, industry classification, and tech stack - is what turns a contact list into a targetable audience. Without it, you're just cold-emailing names. With it, you can filter for "VP of Marketing at SaaS companies with 50-200 employees that raised Series B in the last 12 months."

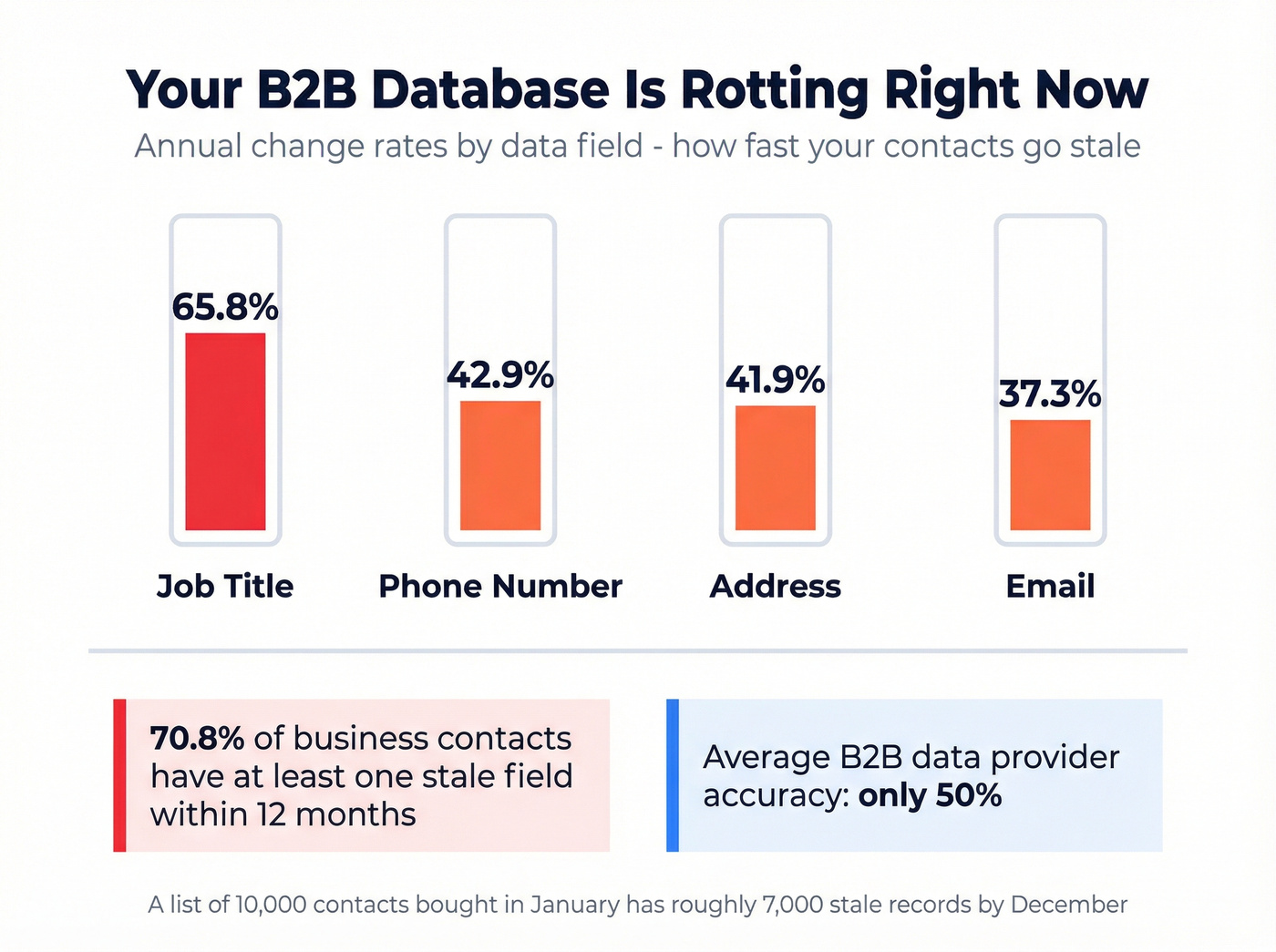

The problem? Contact data decays faster than any other category. 65.8% of job titles change annually. 42.9% of phone numbers go stale. 37.3% of emails bounce within a year. A database that's "accurate" at purchase is measurably worse 90 days later.

Technographic Data

Technographic data tells you what technology a company uses - their CRM, marketing automation platform, cloud provider, analytics tools. It's the targeting layer that lets you say "show me companies using Salesforce but not Gong" or "find HubSpot users with more than 100 employees."

The market for technographic data is harder to size independently because it's bundled into most major platforms. But it's increasingly important for two reasons: competitive displacement campaigns (targeting users of a competitor's product) and integration-based selling (targeting companies already using tools you integrate with). Providers typically use Wappalyzer data plus live job posting signals to identify tech stacks, and the accuracy varies wildly - a company's public-facing tech stack is easy to detect, but internal tools require inference from job postings, integrations, and other signals.

Intent Data: The Fastest-Growing Category

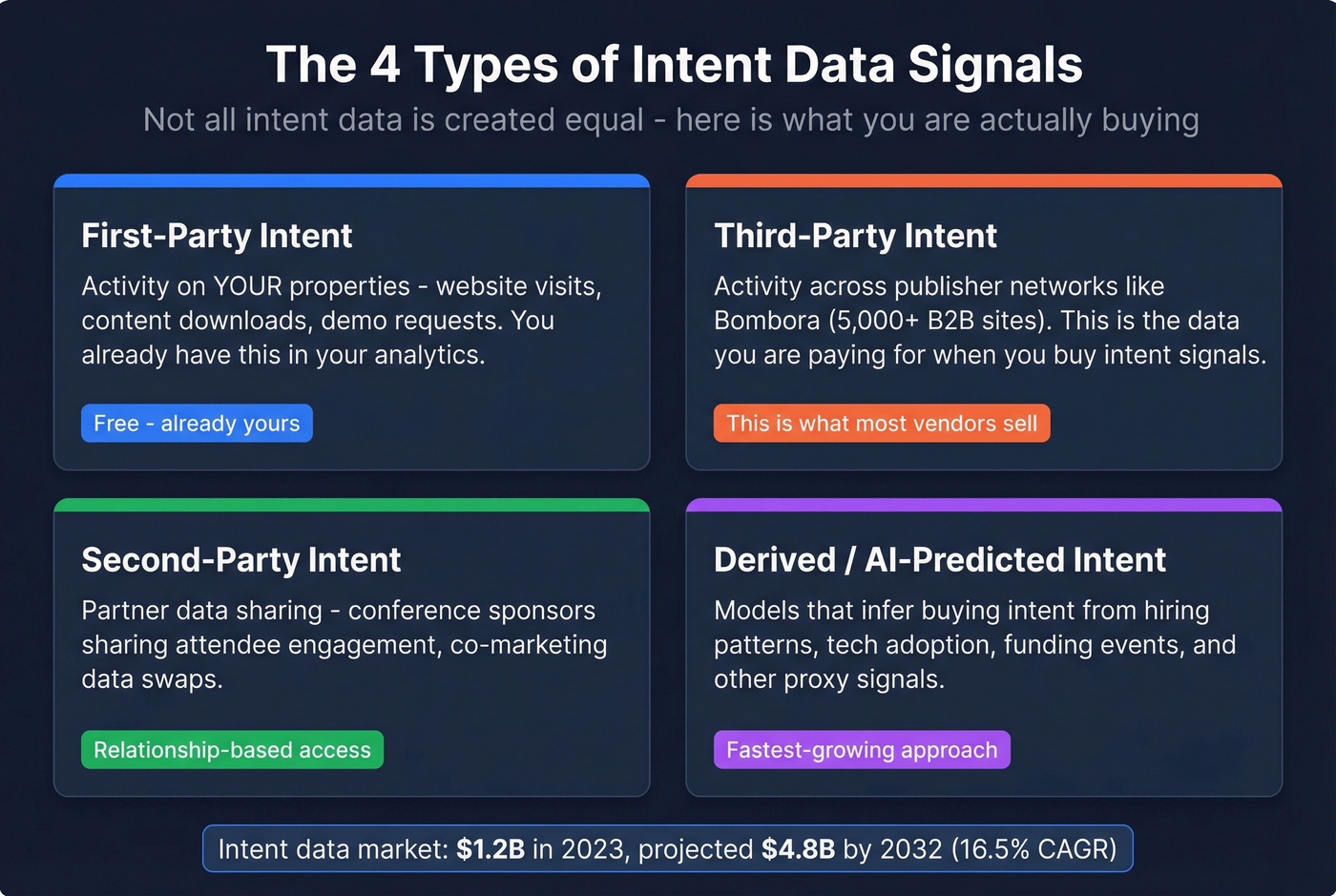

Intent data is the segment reshaping how B2B data gets used. Instead of asking "who fits my ICP?" it asks "who's actively researching solutions like mine right now?"

Bombora pioneered the cooperative model: a network of 5,000+ B2B publisher websites that share anonymized content consumption data across 18,000+ topic categories. When an account surges in research activity around "sales engagement software" or "cloud migration," Bombora flags it.

Most buyers don't realize this: many of the "intent data" features in platforms like 6sense and Demandbase are actually licensing Bombora's data underneath. You're often paying a premium for the same underlying signals wrapped in a different UI.

Four types of intent signals exist in the market:

- First-party intent: Activity on your own properties - website visits, content downloads, demo requests. You already have this in your analytics.

- Third-party intent: Activity across publisher networks (Bombora's model). This is the data you're buying.

- Second-party intent: Partner data sharing - a conference sponsor sharing attendee engagement data, for example.

- Derived/AI-predicted intent: Models that infer buying intent from hiring patterns, tech adoption, funding events, and other proxy signals.

The $1.2B-to-$4.8B trajectory tells you where the market's conviction lies. Static lists are a commodity. Timing signals are the premium product.

Chronographic Data

Chronographic data tracks events and changes - job changes, funding rounds, new hires, office moves, leadership transitions. It's the "when" layer that turns a static contact into a timely opportunity.

A VP of Sales who just started at a new company is 10x more likely to evaluate new tools than one who's been in the role for three years. A company that just raised $20M is actively building infrastructure. These are the signals practitioners keep pointing to as the future of outreach.

The challenge is freshness. Job change data has a lag. Funding data has a lag. The providers that win in chronographic data are the ones that detect changes fastest - ideally within days, not weeks.

The Data Quality Crisis

Poor data quality costs U.S. businesses $3.1 trillion annually. Individual organizations lose $12.9-15M per year. These aren't abstract numbers - they show up as bounced emails, disconnected phone numbers, wasted rep time, and pipeline that never closes.

The decay is relentless. B2B contact data decays between 22.5% and 70.3% annually, with an average monthly decay rate of 2.1%. In November 2024, email decay spiked to 3.6% - nearly double the historical 1.5-2% baseline. That spike coincided with major layoff waves and year-end job transitions.

Here's what's actually changing in your database right now:

| Data Field | Annual Change Rate |

|---|---|

| Job Title | 65.8% |

| Phone Number | 42.9% |

| Address | 41.9% |

| 37.3% |

70.8% of business contacts experience at least one change within 12 months. If you bought a list of 10,000 contacts in January, roughly 7,000 of them have at least one stale field by December. The remote work shift has made this even worse - distributed workforces cycle through personal devices, home addresses, and direct-dial numbers far faster than office-based teams ever did.

And here's the stat that should make every RevOps leader uncomfortable: the average B2B data provider delivers only 50% accuracy.

Half the data you're paying for is wrong or outdated before you ever use it. I've personally tested providers back-to-back against the same CRM records, and the difference between a 50% provider and a 98% provider isn't incremental - it's a fundamentally different product that produces fundamentally different pipeline outcomes. Companies with accurate data see 66% higher conversion rates, 20% better campaign response rates, and 15% higher close rates. The math is straightforward: fixing your data quality is the highest-ROI investment most sales teams can make, and it costs a fraction of what they're spending on the database itself.

Who's Winning the B2B Data Market in 2026

The B2B data provider market is fragmented, competitive, and - if you're a buyer - genuinely confusing. No single player exceeds roughly 15% share. The dynamics are shifting fast.

ZoomInfo: The Bellwether Is Stalling

ZoomInfo posted $1.25B in FY 2025 revenue - up just 3% year-over-year. Their FY 2026 guidance? $1.247-1.267B. Essentially flat. In a market growing 12-25% depending on segment, flat is a problem.

As of Q4 2025, the stock sat at $7.17. Net revenue retention dropped to 90% - meaning existing customers are spending less, not more. ZoomInfo has 1,921 customers paying $100K+ annually, and those accounts make up over 50% of total ACV. They're increasingly an enterprise play, with 74% of ACV coming from upmarket customers.

I've seen this pattern repeatedly: finance flags the ZoomInfo renewal, someone asks "what are we actually using?", and the answer is usually "the search bar and the Chrome extension." A 10-seat ZoomInfo contract with intent data and mobile numbers can run $40-60K/year. That's real money for an early-stage company using 20% of the platform.

Hot take: ZoomInfo is still the most complete all-in-one platform. But most teams don't need all-in-one. They need accurate emails, working phone numbers, and timely signals - and they can get all three for a fifth of the price by stacking specialized tools. If your average deal size is closer to five figures than six, you almost certainly don't need ZoomInfo-level spend.

The Provider Landscape

Here's how the major players stack up:

| Provider | Database Size | Starting Price | Contract? | Best For |

|---|---|---|---|---|

| ZoomInfo | 500M+ contacts | ~$15K/yr | Annual | US enterprise |

| Prospeo | 300M+ profiles | Free / ~$39/mo | No | Email accuracy |

| Apollo.io | 275M+ contacts | Free / $49/mo | No | SMB prospecting |

| Cognism | Not disclosed | ~$25K/yr | Annual | EMEA + mobiles |

| Lusha | 200M+ contacts | Free / $29.90/mo | No | Mid-market |

| UpLead | 160M+ contacts | $99/mo | No | Accuracy guarantee |

| Clearbit (HubSpot) | 400M+ contacts | ~$12-50K/yr | Varies | API enrichment |

| D&B | 500M+ records | ~$20-100K+/yr | Annual | Risk + compliance |

| Kaspr | 500M+ contacts | Free / $49/mo | No | Free-tier users |

| 6sense | Proprietary | ~$35K/yr | Annual | Enterprise ABM |

| Demandbase | Proprietary | ~$30-100K/yr | Annual | ABM + advertising |

| Bombora | Intent only | ~$30K+/yr | Annual | Intent data |

| Clay | Aggregator | ~$150-500/mo | No | Enrichment workflows |

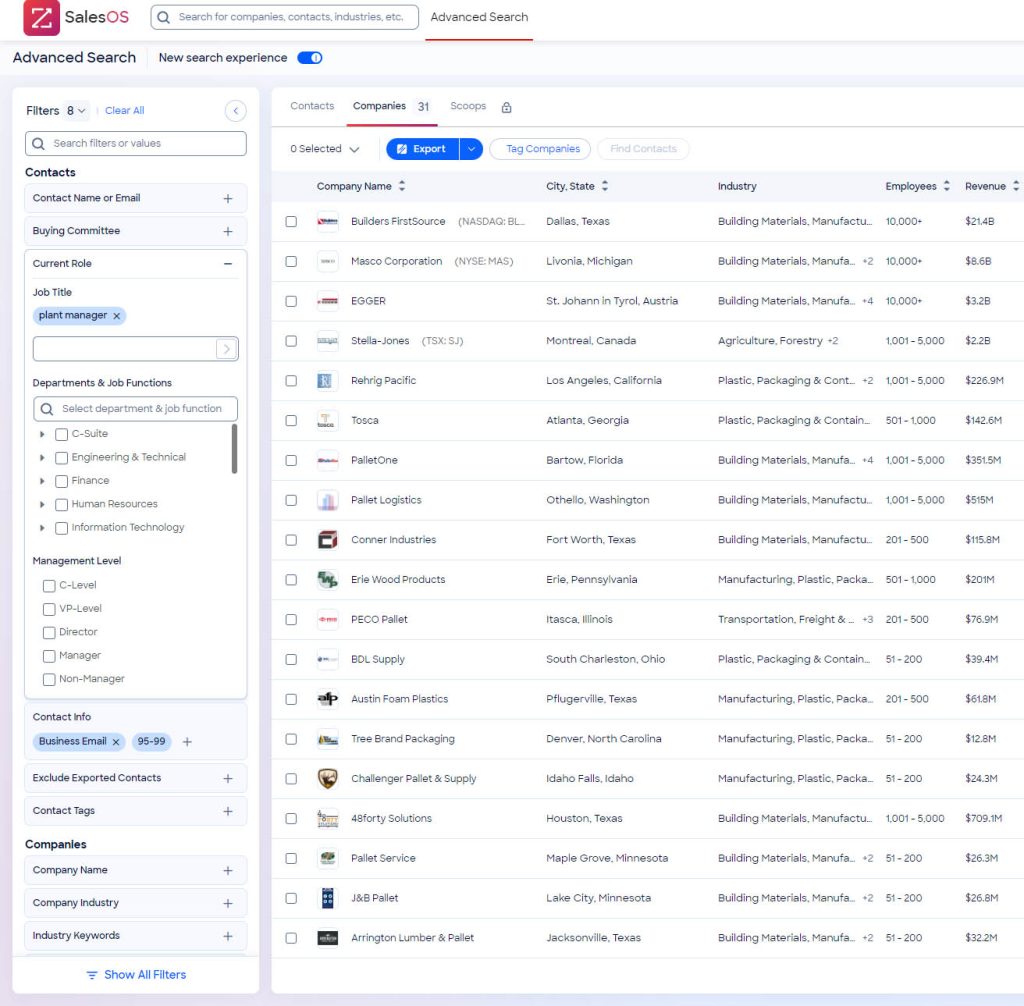

Apollo.io dominates the SMB segment with a generous free plan and 275M+ contacts. It's the default starting point for early-stage teams. The tradeoff: accuracy reviews are mixed, especially for phone numbers and international contacts. One Reddit user running "Crunchbase + Apollo" for startup targeting described it as "good enough for initial list building, but I verify everything before sequencing." That's the right approach - treat Apollo as a starting point, not the final word.

Cognism dominates the European market. Their Diamond Data - human-verified mobile numbers - delivers 98% accuracy for verified contacts. If you're selling into the UK, Germany, or France, Cognism is the obvious choice over ZoomInfo, whose international accuracy drops noticeably outside the US. Expect to pay around $25K/year.

6sense and Demandbase are enterprise ABM platforms that happen to include data, not data platforms that happen to do ABM. Both license Bombora's intent data underneath. 6sense starts around $35K/year with 3-6 month implementation timelines. Demandbase adds B2B advertising capabilities. Skip both if you're under 200 employees.

Lusha is the mid-market credit-based option - solid for teams that need occasional lookups without a big commitment. UpLead differentiates on its 95% accuracy guarantee with real-time verification. Clearbit (now part of HubSpot) is API-first and marketing-focused. D&B is the legacy player - massive global records, but primarily used for risk management and supply chain, not sales prospecting. Kaspr connects to Cognism's data sets and offers a free plan, making it a decent entry point for individual reps in Europe. Clay isn't a data provider at all - it's an enrichment orchestration layer that waterfalls across multiple sources, and it's become a practitioner favorite for exactly that reason.

The Waterfall Approach: Why Smart Teams Stack Providers

No single provider covers everything.

We've run bake-offs where the "best database" missed 40% of the contacts another provider found easily. The math is simple - single-source enrichment delivers 50-60% find rates. Waterfall enrichment across 2-3 providers delivers 85-95%.

The waterfall model works like this: you run your target list through Provider A first, then push unfound contacts to Provider B, then Provider C. Each provider has different strengths - one excels at US tech companies, another at European manufacturing, a third at verified mobile numbers.

Clay has become the default orchestration tool for this approach, but you can build a similar workflow with Zapier, Make, or direct API calls. The key insight is that paying for two $50/month tools often beats paying for one $1,500/month tool - and delivers better coverage.

How B2B Data Is Bought and Sold

The distribution model for B2B data is shifting as fast as the data itself. Three models now coexist, and the balance between them is changing.

Direct vendor sales - the traditional model - still dominates. You talk to a ZoomInfo or Cognism sales rep, negotiate a contract, and get platform access. This model is under pressure because buyers hate annual lock-ins, opaque pricing, and the "talk to sales" gate that hides what you're actually paying.

Cloud marketplace distribution is the fastest-growing channel. Snowflake passed $2B in annual sales through AWS Marketplace in 2025, with transaction volume doubling year-over-year. Major enterprises like AstraZeneca, Booking.com, and DraftKings now procure data through marketplace channels because it simplifies billing, shortens sales cycles, and lets them draw down existing cloud commitments. This isn't just a procurement convenience - it's fundamentally changing how data providers reach customers.

API-first and self-serve models are the third leg. Providers like Prospeo and Apollo let you sign up, enter a credit card, and start pulling data in minutes. No sales call, no annual commitment, no three-week procurement process. This model is winning with SMBs and increasingly with mid-market teams whose RevOps leaders don't want to wait six weeks for a vendor evaluation.

There's a fourth trend worth watching: non-data companies monetizing their own data. Financial institutions, media companies, and SaaS platforms generate massive quantities of behavioral and transactional data as a byproduct of their core business. Many are starting to package and sell this data through marketplace channels - creating new competition for traditional data providers from unexpected directions.

The Regulatory Landscape in 2026

If you're buying B2B data in 2026 and not thinking about compliance, you're building on a foundation that could crack at any moment.

The inflection point was January 1, 2023, when California's B2B exemption under CCPA expired. Before that date, business contact information was largely exempt from consumer privacy protections. After it, a business email with a person's name (jane.doe@company.com) became protected personal data under California law. That single change reshaped how every US-focused data provider operates.

Since then, the regulatory cascade has accelerated. 19 US states now have complete data protection laws active or rolling out through 2026. Maryland's law restricts data collection to only what's needed for the specific service requested - a direct challenge to the "collect everything, figure out use later" model that most data providers built their businesses on.

GDPR remains the strictest framework globally, with fines up to EUR20M or 4% of global revenue. For any European contacts in your database, GDPR applies regardless of where your company is based.

What counts as protected data in 2026:

- Business email addresses containing personal names

- Direct phone numbers and mobile numbers

- IP addresses

- Any data that can identify a specific individual

Acceptable data sources:

- Opt-in forms with explicit consent checkboxes

- Conference attendees who agreed to data sharing

- Website signups with clear disclosure

- Cooperative publisher networks (Bombora's model)

Sources that create compliance risk:

- Scraped lists without consent documentation

- Purchased emails from brokers who can't prove sourcing

- Auto-enriching contacts without disclosure

Gmail's November 2025 authentication mandates added another layer. SPF, DKIM, and DMARC are now mandatory for high-volume senders. If your data provider is giving you unverified emails and you're blasting sequences without proper authentication, you're not just wasting money - you're risking domain reputation damage that takes months to recover from.

Real talk: compliance isn't optional anymore, and "we didn't know" isn't a defense. When evaluating providers, ask for their data sourcing documentation. If they can't explain where every record comes from, walk away.

What's Next: AI, Synthetic Data, and the Shift from Volume to Precision

Every B2B data vendor is slapping "AI-powered" on their marketing pages. Most of it is noise.

But some of it matters, and separating the two requires understanding where AI actually works in data and where it's still hype. MIT Sloan Management Review's 2026 predictions are blunt: the AI bubble will deflate, and the economy will suffer - parallels to the dot-com era. That doesn't mean AI is useless. It means the gap between AI marketing and AI reality is about to get painfully visible.

Johnson & Johnson's experience is instructive. They started with 900 AI use cases, then pivoted to a handful of strategic projects. The lesson for B2B data: AI works best when applied to specific, well-defined problems (like email verification, data matching, and decay detection) rather than as a magical "AI enrichment" layer that promises to fix everything.

The synthetic data trend deserves particular scrutiny. Gartner predicts synthetic data will eventually outnumber real data. But a Dig Insights study found that model predictions correlated 0.75 with real data during the training period, dropped to 0.43 for recent data, and collapsed to 0.15 when removing familiar patterns. That's a correlation collapse, not a minor accuracy dip. Models trained on AI-generated data risk "model collapse" - a degradation spiral where each generation of synthetic data is slightly worse than the last.

For B2B data specifically, this means: don't trust "AI-generated" contact data. AI is excellent at verifying, matching, and enriching existing data. It's terrible at inventing accurate contact information from scratch.

The real shift isn't AI - it's the move from static lists to intent signals. Practitioners are increasingly combining chronographic triggers (job changes, funding rounds, hiring surges) with intent data (content consumption patterns, search behavior) to time outreach precisely. The Reddit consensus is clear: "lead gen's honestly getting harder these days" - but the teams winning are the ones who stopped buying bigger lists and started buying better signals.

As the MIT SMR piece notes, channeling Amara's Law: "We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run." AI will transform B2B data. It just won't do it on the timeline vendors are promising.

How to Evaluate a B2B Data Provider in 2026

After watching dozens of teams pick (and regret) data providers, the evaluation framework that actually works comes down to five criteria - and a set of red flags that should kill any deal immediately.

Five evaluation criteria:

Accuracy benchmarks. Ask for documented accuracy rates, not marketing claims. Then test them yourself. Export 500 contacts from your existing CRM, run them through the provider's enrichment, and measure match rate and accuracy against what you already know is correct.

Refresh frequency. How often does the provider update its database? The industry average is six weeks. The best providers refresh weekly. Ask specifically - "when was this contact record last verified?" - not "how often do you update your database?"

Compliance documentation. Can the provider explain exactly where every record comes from? Do they have DPAs available? Are they GDPR compliant? If they hesitate on any of these questions, that's your answer.

Pricing transparency. If you can't find pricing on their website, you're about to enter a negotiation designed to extract maximum budget. Self-serve pricing isn't just convenient - it's a signal that the provider competes on value, not on sales tactics.

Integration depth. Does the provider push data directly into your CRM, sequencer, and enrichment workflows? Or do you need to export CSVs and manually import? In 2026, any provider that doesn't integrate with Salesforce, HubSpot, and at least two major sequencers is creating unnecessary friction.

Red flags that should kill the deal:

- No published pricing anywhere on the site

- No accuracy guarantee or benchmark data

- Annual lock-in with no trial period

- Can't explain data sourcing methodology

- "Talk to sales" is the only path to a free trial

The best way to evaluate? Use free tiers. Export 100 known-good contacts, run them through each provider's enrichment, and compare. The numbers don't lie - and they'll tell you more in 30 minutes than any sales demo will in an hour.

Intent data is growing at 16.5% CAGR for a reason: timing beats volume. Prospeo combines Bombora intent signals across 15,000 topics with 300M+ verified profiles and 30+ filters - so you reach buyers who are actively researching, not just names on a list.

Layer intent data on verified contacts for $0.01 per email.

FAQ

How big is the B2B data market?

The broadest umbrella - B2B Information Services - is $118.35B (2024), but the core sales/marketing segment is about $5-8B. Within that, data enrichment is $2.57B and intent tools are $1.2B, with most sub-segments growing 12-25% CAGR depending on category.

What's the fastest-growing segment of the B2B data market?

Data marketplace platforms are the fastest-growing at 24.6% CAGR, rising from $863M (2024) to about $3.2B by 2030. Intent tools are next at 16.5% CAGR, projected to grow from $1.2B to $4.8B by 2032, outpacing classic contact databases by a wide margin.

How fast does B2B data decay?

Expect 22.5% to 70.3% annual decay in contact records, with an average monthly decay rate of 2.1%. Job titles change the most (65.8% annually), then phone numbers (42.9%) and emails (37.3%), which is why weekly or continuous refresh beats "buy once and forget."

What accuracy should I expect from a B2B data provider?

Most teams see roughly 50% accuracy from average providers, while top-tier vendors deliver 97%+ email accuracy with sub-1% bounce rates. As a practical bar, don't renew anything that can't prove 90%+ accuracy on a 200-500 contact test against your CRM, including verification timestamps.

Is waterfall enrichment worth the complexity?

Yes. Single-source enrichment delivers 50-60% find rates. Stacking 2-3 providers in a waterfall delivers 85-95%. The setup takes a few hours with tools like Clay, Zapier, or Make, and the coverage improvement pays for itself within the first campaign.

Summary: Where the B2B Data Market Is Going

In 2026, the b2b data market is still growing - but the value is moving away from "big static databases" and toward verification, refresh frequency, intent signals, and workflow-friendly distribution. If you want better pipeline outcomes, stop optimizing for list size and start optimizing for accuracy, freshness, and timing - then stack providers in a waterfall so you're not betting your quarter on one dataset.