Difference Between Prospecting and Lead Generation (With Examples)

Most teams don't have a "lead gen problem" or a "prospecting problem." They've got a handoff problem.

Marketing generates names, sales chases ghosts, and RevOps gets blamed for the dashboard. The fix isn't another tool or another meeting. It's getting brutally clear on where lead generation ends, where prospecting starts, and what "accepted" actually means inside your CRM.

One-paragraph answer (featured snippet target)

Lead generation turns anonymous demand into known contacts (someone visits your site, registers for a webinar, or fills out a demo form), while prospecting turns known contacts or target accounts into conversations (an SDR identifies the right VP Ops at an ICP account, verifies contact details, and runs a tailored outbound sequence to book a meeting). A simple micro-example: a webinar signup is lead generation; the moment sales accepts that record, checks fit, finds the right stakeholder, and reaches out with a relevant message, you're prospecting. Inbound prospecting runs on speed-to-lead and clean routing; outbound prospecting runs on a tight ICP list and a reason-now trigger (intent, hiring, tech change, job change). Both create pipeline, but they run on different triggers, different KPIs, and different rules, especially around SLAs, acceptance, and recycling.

What you need (quick version)

If you fix only three things this week, fix these:

Define ICP + intent as two separate levers (grade + score). Grade = fit (industry, size, tech, region). Score = behavior (pricing page, demo request, repeat visits). Do this in your CRM: create two fields -

Lead Grade (A-D or 0-100)andLead Score (0+)- and stop letting one number hide two different truths.Add SAL and an acceptance SLA. SAL (sales accepted lead) is the seam: marketing hands off, sales accepts, and the clock starts. Put a hard rule in writing: "New inbound hand-raisers get first touch in X minutes; all MQLs must be accepted/rejected within Y hours." Do this in your CRM: add a required

SAL Statuspicklist (Accepted/Rejected) and aSAL Accepted Timestampthat's auto-stamped on acceptance. (If you want benchmarks, see sales accepted lead rate.)Write recycle rules like you mean it. "Not now" isn't "dead." Define when a lead goes back to nurture, when it stays with SDR, and what triggers re-routing (job change, new intent spike, new form fill). Do this in your CRM: create

Recycle Reason+Recycle Datefields and a workflow that automatically re-MQLs a recycled lead when high-intent behavior happens again.

That's the operational core. Everything else performs better once those three are locked.

Definitions that stop the confusion (lead, prospect, MQL, SAL, SQL)

Here's the glossary I use when teams keep arguing in Slack about "lead quality."

- Lead: A known contact that might be relevant, but isn't qualified yet. You've got an email, a name, maybe a company. Still top-of-funnel.

- Prospect: A lead that fits your ICP enough to deserve sales time. It's "qualified enough to engage," not "guaranteed to buy."

- MQL (Marketing Qualified Lead): A lead showing interest but not necessarily ready to buy. HubSpot's framing is clean: MQL = engaged/curious; not yet sales-ready intent.

- SAL (Sales Accepted Lead): The lead's been routed to sales and accepted (or at least acknowledged) for follow-up. This is the "it didn't get lost" stage. SAL exists because "assigned" isn't the same as "worked."

- SQL (Sales Qualified Lead): A lead that's ready for direct sales engagement. Per HubSpot's definition, SQLs show sales readiness/intent: pricing questions, demo requests, feature comparisons, implementation timelines, authority/budget/need signals.

The analogy that actually sticks:

MQL = window shopping.

SQL = checking wallet and asking the price.

One nuance that saves a lot of pain: a lead can be high-fit (great grade) and low-intent (low score). That's not "bad." That's nurture or ABM, not an SDR fire drill.

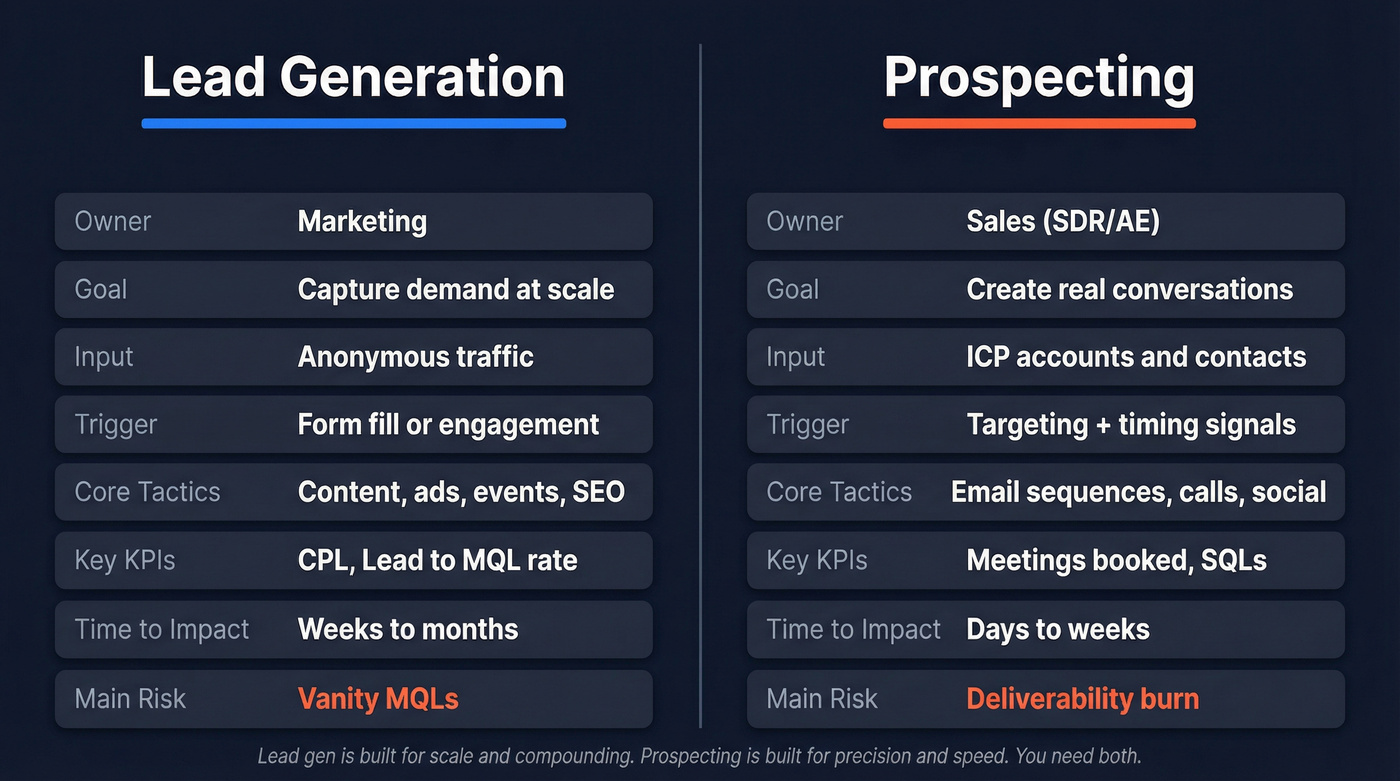

Prospecting vs lead generation: a side-by-side comparison

The difference isn't philosophical. It's ownership + KPIs + tooling. When those three are muddled, you get the classic mess: marketing optimizes for volume, sales optimizes for meetings, and nobody owns the gray zone.

A clean side-by-side:

| Dimension | Lead generation | Prospecting |

|---|---|---|

| Owner | Marketing | Sales (SDR/AE) |

| Goal | Capture demand | Create conversations |

| Input | Anonymous traffic | ICP accounts/contacts |

| Trigger | Form fill/engagement | Targeting + timing |

| Tactics | Content, ads, events | Email, calls, social |

| KPIs | CPL, lead->MQL | Meetings, SQLs |

| Time-to-impact | Weeks-months | Days-weeks |

| Tooling | CMS/SEO, paid ads, webinars/events, marketing automation, forms/chat, CRM | Data provider, enrichment/verification, sequencing, dialer, sales engagement, CRM tasks |

| Main risk | Vanity MQLs | Deliverability burn |

Interpretation in plain English: lead gen is built for scale and compounding. Prospecting is built for precision and speed. You need both, but you can't run them with the same definitions or you'll optimize the wrong behavior.

If you want a deeper take on the same distinction, Topo's breakdown is still one of the clearest: Topo's lead generation vs prospecting article.

Your prospecting is only as good as your data. Bad emails torch deliverability and kill the SAL handoff. Prospeo gives SDRs 98% verified emails, 125M+ direct dials, and intent signals across 15,000 topics - so every sequence targets the right person at the right time.

Stop prospecting ghosts. Start booking meetings with verified contacts.

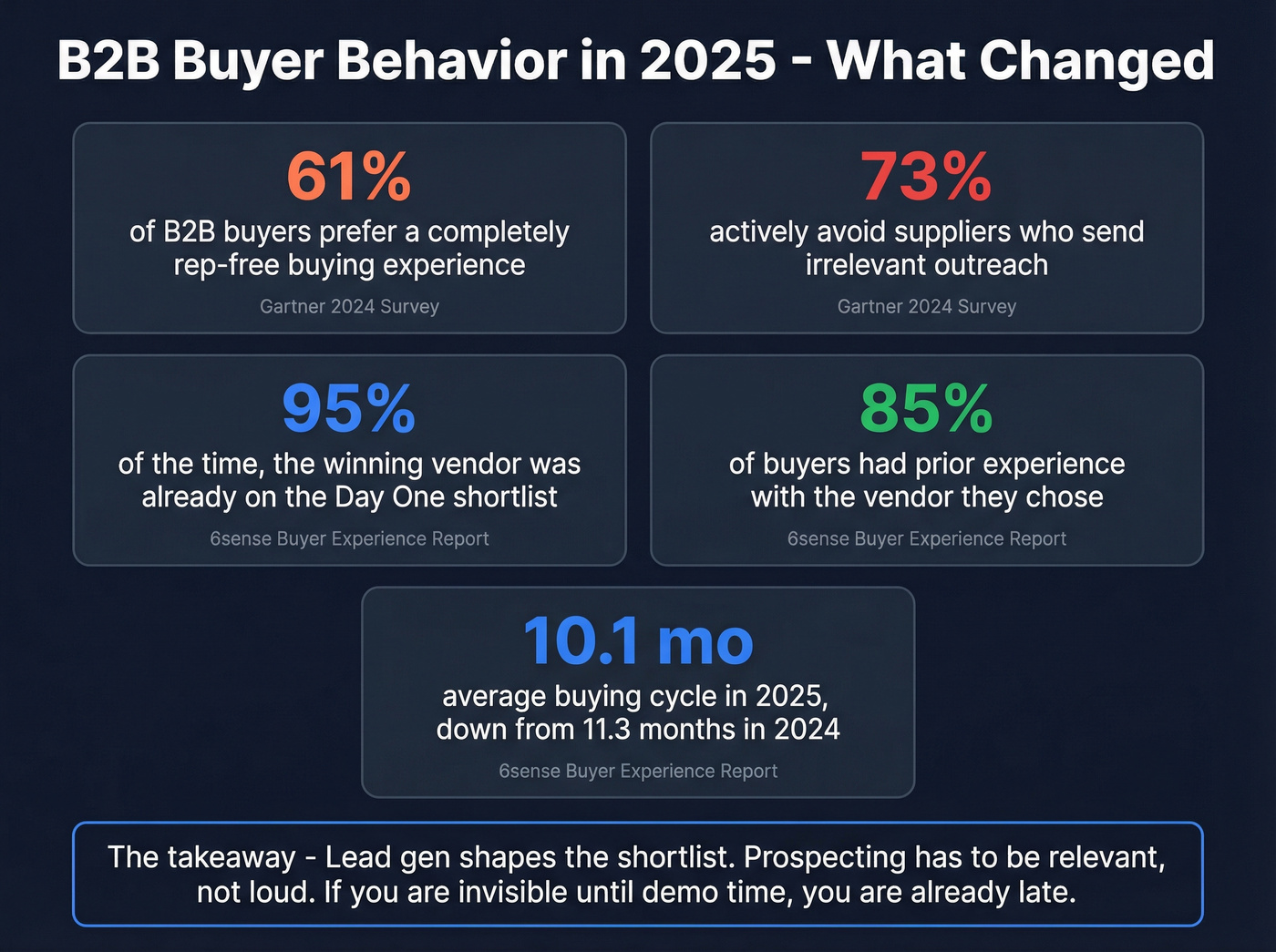

Why the difference matters in 2026 (buyer behavior changed)

Look, buyers didn't "suddenly hate sales." They hate wasted time.

And they punish teams that show up late or show up irrelevant.

What changed

In a Gartner press release (survey run Aug-Sep 2024, 632 B2B buyers), 61% prefer an overall rep-free buying experience, and 73% actively avoid suppliers who send irrelevant outreach. Gartner also found 69% of buyers report inconsistencies between supplier websites and seller interactions. If your outbound pitch contradicts your site, you lose trust fast, and you don't get a second chance.

6sense's Buyer Experience Report (nearly 4,000 buyers) adds the part that should make every SDR manager sweat: 95% of the time, the winning vendor is already on the Day One shortlist, and the pre-contact favorite wins about 80% of the time. Point of first contact moved earlier - from 69% to 61% of the journey - about 6-7 weeks earlier. They also found buying cycles shortened from 11.3 months (2024) to 10.1 months (2025).

The part most teams miss (and it changes your strategy)

6sense also found 85% of buyers had prior experience with the vendor they chose, mostly from prior evaluations.

That's the real job of lead gen in 2026: not just "capture a lead," but earn repeated exposure and create evaluation moments (comparison pages, ROI calculators, implementation guides, security docs). Prospecting works best when it's timed to those evaluation signals, not sprayed at random, which is why the teams that win tend to look "lucky" from the outside even though their process is boring and consistent.

So what you do about it

- Lead gen has to shape the shortlist. If you're invisible until "demo time," you're late.

- Prospecting has to be relevant, not loud. You're often trying to displace a favorite, not "introduce yourself."

- Your message has to match your website. That 69% inconsistency stat is a warning label.

- The SAL seam becomes mission-critical. When buyers do raise their hand, slow follow-up is self-sabotage.

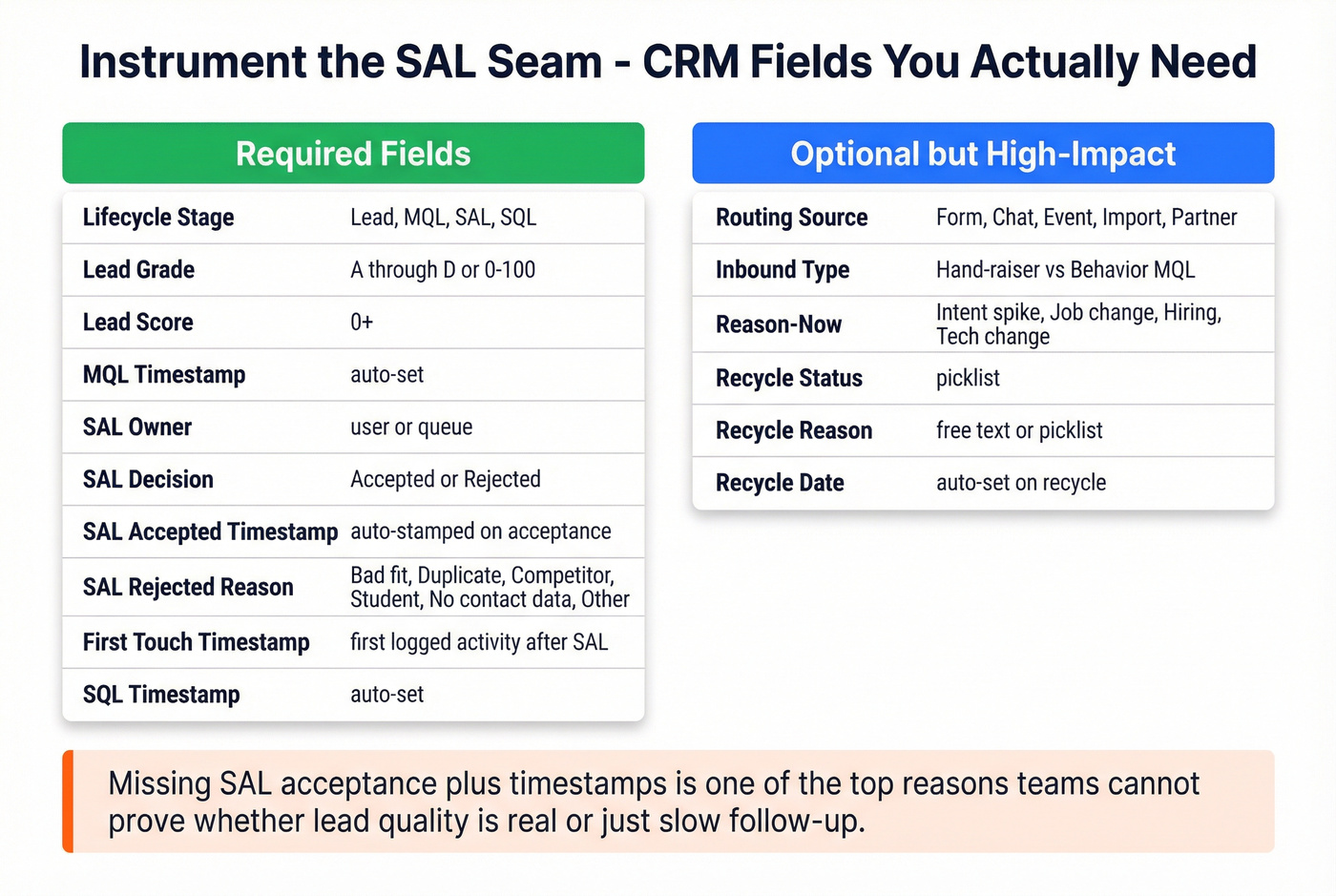

Difference between prospecting and lead generation in the funnel (SAL seam + SLA)

RevBlack's framing is a solid operational anchor: lead gen manages the funnel; prospecting creates pipeline; SAL is the bridge. Marketing moves a lead to MQL. Sales accepts it to SAL. Sales qualifies it to SQL (and then opportunity).

Here's the step-by-step that keeps teams honest and measurable.

Step 1: Define MQL as grade + score (not vibes)

- Lead Grade (fit): ICP match (industry, size, geo, tech, role).

- Lead Score (behavior): intent signals (demo request, pricing page, repeat visits, high-intent content).

If you only score behavior, you'll chase students and consultants. If you only grade fit, you'll chase accounts that don't care yet.

Step 2: Create SAL as a real stage (not a synonym for "assigned")

SAL means: routed correctly, accepted by the right queue/rep, and awaiting follow-up. This is where lead gen ends and prospecting begins.

We've audited dozens of CRMs, and missing SAL acceptance plus timestamps is one of the top reasons teams can't prove whether "lead quality" is real or just slow follow-up.

Step 3: Instrument the SAL seam (fields you actually need)

If you want SAL to work, you need more than a lifecycle stage. Add these fields (lead or contact level - pick one and stay consistent):

Required fields

Lifecycle Stage(Lead -> MQL -> SAL -> SQL)Lead Grade(A-D or 0-100)Lead Score(0+)MQL TimestampSAL Owner(user/queue)SAL Decision(Accepted / Rejected)SAL Accepted TimestampSAL Rejected Reason(Bad fit / Duplicate / Competitor / Student / No contact data / Other)First Touch Timestamp(first logged call/email/task after SAL acceptance)SQL Timestamp

Optional but high-impact

Routing Source(Form / Chat / Event / Import / Partner)Inbound Type(Hand-raiser vs Behavior MQL)Reason-Now(Intent spike / Job change / Hiring / Tech change / Other)Recycle Status+Recycle Reason+Recycle Date

Step 4: Build 4 reports that end the "lead quality" argument

These are the dashboards I insist on when we implement SAL. No exceptions.

- MQL -> SAL acceptance rate (by rep, by source, by inbound type)

- Speed-to-lead (MQL timestamp -> first touch timestamp)

- SAL accepted -> SQL conversion (by rep, by segment, by source)

- Reject reasons trend (if "no contact data" spikes, you've got a data problem; if "bad fit" spikes, you've got an ICP/routing problem)

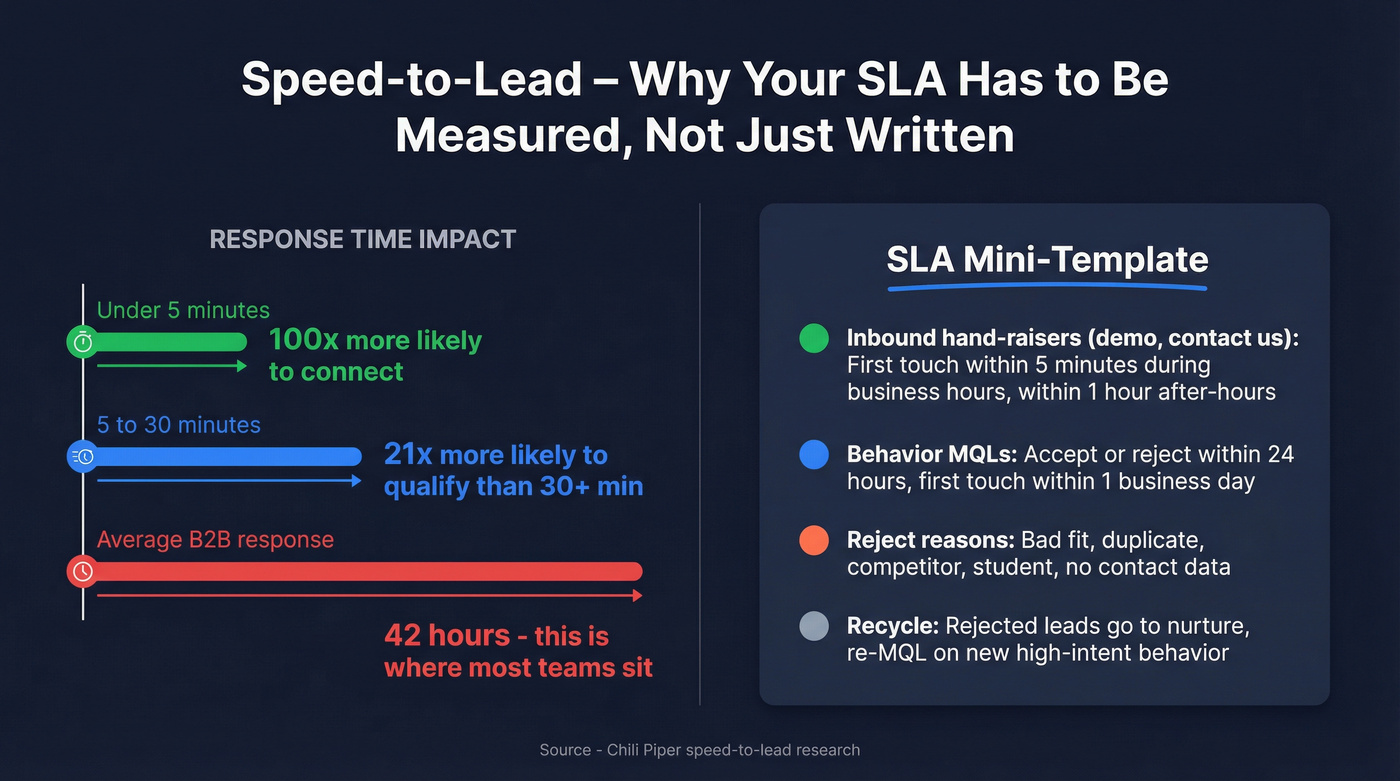

Step 5: Put a speed-to-lead SLA in writing (because humans won't "just do it")

Chili Piper's speed-to-lead stats are the blunt instrument you need for alignment: average B2B response time is 42 hours, and responding fast makes you 21x more likely to qualify than waiting 30+ minutes. They also cite that responding within 5 minutes can make you 100x more likely to connect. (More on measurement in speed to lead metrics.)

I'm going to be annoying about this: if your "SLA" isn't measured, it isn't real. It's a poster.

SLA mini-template (copy/paste)

Inbound hand-raisers (demo/contact): first touch <= 5 minutes during business hours; <= 1 hour after-hours. Behavior MQLs: accept/reject within 24 hours; first touch within 1 business day. Reject reasons: bad fit / duplicate / competitor / student / no contact data. Recycle: rejected leads go to nurture; re-MQL triggers include pricing visit, new form fill, intent spike, job change.

Prospecting execution depends on clean routing and accurate contact data. If the record lands on the wrong rep or the email bounces, your SLA's fiction.

Hard rules (non-negotiables)

If you want fewer meetings about "alignment" and more pipeline, follow these.

- If you don't track SAL acceptance, stop arguing about lead quality. You're arguing opinions because you refused to instrument the seam.

- If inbound first-touch is >15 minutes, don't scale paid spend. You're paying to create demand you won't capture.

- If bounce rate is >3-5%, pause outbound and fix data before you write another sequence. Deliverability is a tax you pay for sloppy lists. (If you're troubleshooting rejections, see 550 Recipient Rejected.)

- If sales rejects >40% of behavior MQLs, tighten MQL rules or split the stream. Hand-raisers and "engaged" leads aren't the same animal.

- If your outbound pitch contradicts your website, you lose. Gartner's 69% inconsistency finding is exactly why buyers go rep-free.

Hot take: if you're selling a lower-priced product with a short sales cycle, you probably don't need a fancy MQL model at all. Route hand-raisers instantly, run lightweight scoring for everyone else, and spend your energy on speed-to-lead and clean follow-up.

How they work together (two workflows: inbound and outbound)

The fastest way to stop the confusion is to map two flows and mark the handoff points.

Inbound workflow (use this if you've got forms, trials, demos)

Lead capture -> MQL rules -> SAL routing -> first-touch SLA -> SQL criteria

- Lead capture: form fill, chat, trial signup, event scan.

- MQL rules: grade + score thresholds (and separate rules for hand-raisers vs behavior MQLs).

- SAL routing (handoff point): assign to the right SDR/AE queue; rep accepts within SLA.

- First-touch SLA: call/email/task logged fast (minutes, not days).

- SQL criteria: confirmed pain/timeline/stakeholder, or meeting held with buying intent.

Use inbound-first if:

- You've got consistent inbound volume (even 10-30 hand-raisers/month is enough to justify SLAs).

- Your product has clear "hand-raiser" moments (demo, pricing, trial, security page).

- You can route by territory/segment without constant exceptions.

Skip inbound-first if:

- Marketing can't define MQL consistently (you'll manufacture noise).

- Your routing's political ("who gets this lead?") instead of rules-based.

- You can't measure first-touch time (no timestamps, no enforcement).

Outbound workflow (use this if you sell into a defined ICP)

ICP list -> enrichment/verification -> sequencing -> meeting -> SQL

- ICP list: target accounts + roles (the "who").

- Enrichment/verification: fill missing fields, verify emails/mobiles, de-dupe (the "can we actually reach them?"). Use an email verifier before you scale.

- Sequencing: multi-touch outreach with relevance hooks (intent, tech stack, hiring, job change).

- Meeting: discovery or qualification call.

- SQL: confirmed buying intent + next step (opportunity created).

Here's a real scenario I've watched play out: an SDR team launched a "new ICP" sequence to 8,000 contacts, got a bunch of bounces in week one, and spent the next month arguing about copy while their domain reputation quietly cratered. The copy wasn't the problem. The list was.

If you're running outbound at any real volume, verify and enrich contacts before you sequence so bounces don't waste touches or damage deliverability. Tools like Prospeo help here because the data's refreshed every 7 days and emails are verified at 98% accuracy, which is exactly what you want before you start burning through domains and inboxes. (Related: B2B contact data decay.)

Mini decision block: what to prioritize first

If you're deciding where to put headcount and budget this quarter, use this:

Prioritize lead generation if...

- You're not consistently on the Day One shortlist in your category.

- Your site doesn't answer evaluation questions (pricing, security, implementation, comparisons).

- Your inbound is low because you're under-invested in distribution (SEO, paid, partners, events).

Prioritize prospecting if...

- You've got a tight ICP and a clear list of target accounts.

- Your TAM is known and reachable, but inbound is lumpy.

- Your team can execute fast follow-up and high-relevance outreach.

Two diagnostic questions

- Do we have enough demand to keep reps busy without outbound? If no, prospecting has to carry pipeline creation.

- When someone raises their hand, do we respond in minutes? If no, fix the SAL seam before buying more clicks.

Benchmarks you can use (KPIs + targets for both motions)

Benchmarks aren't goals. They're guardrails. If you're way off, something's broken upstream.

KPI benchmark table (scan this first)

| KPI | Lead gen or prospecting? | Benchmark / target | Notes |

|---|---|---|---|

| Lead -> MQL conversion | Lead gen | ~31% average | First Page Sage overall average |

| Lead -> MQL (SEO) | Lead gen | ~41% | Channel cut |

| Lead -> MQL (PPC) | Lead gen | ~29% | Channel cut |

| Lead -> MQL (Webinars) | Lead gen | ~19% | Channel cut |

| Lead -> MQL (B2B SaaS) | Lead gen | ~39% | First Page Sage industry cut |

| Lead -> MQL (Manufacturing) | Lead gen | ~26% | First Page Sage industry cut |

| Lead -> MQL (Product/landing pages) | Lead gen | ~38% | First Page Sage page-type cut |

| Lead -> MQL (Thought leadership/blog) | Lead gen | ~30% | First Page Sage page-type cut |

| Cost per lead (CPL) | Lead gen | ~$84 average | Flyweel CPL index |

| Google Ads CPL | Lead gen | ~$70.11 | Flyweel |

| LinkedIn CPL | Lead gen | ~$110+ | Flyweel |

| Speed-to-lead (avg B2B) | Prospecting (inbound) | 42 hours (industry average) | Chili Piper |

| Speed-to-lead (hand-raisers) | Prospecting (inbound) | <= 5 minutes (target) | Strong SLA target |

| MQL -> SAL acceptance | Handoff | 60-90% (hand-raisers) | Practical starting target (heuristic) |

| MQL -> SAL acceptance | Handoff | 30-60% (behavior MQLs) | Practical starting target (heuristic) |

| MQL -> SQL conversion | Prospecting | 10-30% | Practical starting target (heuristic; varies by deal size/motion) |

| Cold email reply rate | Prospecting (outbound) | 1-5% | Any human reply; list/offer/deliverability dominate |

One clarification that prevents bad math: count "reply rate" as any human reply (including "not interested"). "Positive reply" is typically 20-40% of replies in B2B outbound, and booked meetings are a subset of that.

Quick takeaways (what I'd actually do with these)

- If lead->MQL is under ~20% on SEO pages, your forms/offer/ICP targeting is off.

- If speed-to-lead is measured in hours, fix routing before you buy more ads.

- If MQL->SAL is low, you've got a trust/definition/routing problem, not a "marketing problem."

- If outbound reply is under 1%, tighten ICP and verify contact data before rewriting sequences for the 10th time.

A copy/paste lead scoring model (how a lead becomes a prospect)

RevBlack's "grade vs score" model prevents the classic mistake: treating interest as fit, or fit as intent.

Lead Grade (fit) - 0 to 100

This is mostly firmographic + role.

| Fit factor | Example rule | Points |

|---|---|---|

| Company size | 200-2,000 emp | +25 |

| Industry | Core vertical | +20 |

| Region | Supported geo | +10 |

| Tech | Uses target stack | +15 |

| Role | Director+ in dept | +20 |

| Disqualifier | Student/agency | -50 |

Lead Score (behavior) - starts at 0

Belkins has practical point examples that map well to modern tracking:

| Behavior signal | Points | |---|---|---| | Pricing page view | +10 | | Download form | +15 | | Clicked 10+ emails | +10 | | Demo/contact form | +30 | | Email bounced | -25 |

Two rules that save you from bad automation:

- Open rates aren't reliable now. Privacy changes turned opens into noise. Weight on-site behavior and bottom-funnel actions instead.

- Data hygiene is part of scoring. A bounce shouldn't just hurt deliverability; it should reduce priority. Better: prevent the bounce in the first place by verifying before you sequence.

You can also layer intent topics (15,000) into scoring so "fit + in-market" rises to the top faster, especially for outbound and ABM lists.

If you want one simple threshold to start: MQL = Grade >= 70 and Score >= 20, with a separate fast-lane for hand-raisers (demo/contact) regardless of score.

Which should you prioritize this quarter? (a practical decision framework)

This is where teams waste months. They debate "inbound vs outbound" like it's a religion instead of a resource allocation problem.

Answer these five questions:

- Pipeline coverage: Do you have 3-4x pipeline coverage for next quarter's target? If not, prioritize prospecting (and speed-to-lead) to create pipeline now.

- Inbound volume: Are you getting enough hand-raisers to keep reps busy? If yes, prioritize lead gen conversion + SLAs before adding outbound volume.

- ACV & complexity: Higher ACV and longer cycles reward lead gen that builds prior evaluations (guides, comparisons, security). Lower ACV rewards fast routing and tight follow-up.

- TAM saturation: If your ICP is narrow and you've already hit the obvious accounts, lead gen that expands awareness matters more than brute-force outbound.

- Sales capacity: If reps can't follow up within SLA, adding more leads is just paying for backlog.

My recommendation when teams are split: fix the SAL seam first, then decide. If you can't accept, route, and work leads fast, every other "strategy" is theater.

Common failure modes (and how to fix them fast)

These are the patterns I've seen sink otherwise-good teams.

Problem: Marketing throws leads over the wall. Fix: Add SAL and review MQL->SAL acceptance weekly with Marketing + SDR leadership. When we implement this cadence, the "lead quality" fight usually dies within two weeks.

Problem: Speed-to-lead is hours or days. Fix: Put the SLA in writing, automate routing, and alert on breaches. Chili Piper's 42-hour average is the cautionary tale. Don't be average.

Problem: Prospecting turns into spam. Fix: Enforce relevance rules: ICP fit + a reason-now (intent, hiring, tech change, job change). Gartner's 73% "avoid irrelevant outreach" stat is the standard.

Problem: No recycle rules, so leads die in SDR purgatory. Fix: Define "recycle to nurture" triggers and "re-activate" triggers. If it's not in the CRM as a rule, it won't happen consistently.

Problem: Everyone uses different definitions. Fix: One shared lifecycle doc + CRM picklists that match it. If the CRM can't represent your lifecycle, your reporting will always be political.

What we see in real audits (the uncomfortable truths)

- "We have MQLs" often means "we have form fills." That's not qualification; it's capture.

- "Sales ignores leads" often means "routing is wrong and nobody trusts the score."

- "Outbound isn't working" often means "the list is stale and deliverability's already damaged."

FAQ

What's the simplest difference between lead generation and prospecting?

Lead generation creates known contacts from anonymous interest (like a form fill or event scan), while prospecting turns known contacts or target accounts into sales conversations through targeted outreach. In practice, lead gen is measured by CPL and lead->MQL, while prospecting is measured by speed-to-lead, meetings, and SQLs.

Is prospecting part of lead generation (or separate)?

Prospecting is separate but connected: lead generation is usually marketing-owned and ends at MQL, while prospecting is sales-owned and begins when a rep accepts and works a lead/account. A practical rule: if there's an SLA clock and a rep's responsible for first touch, you're in prospecting.

What is SAL and why do RevOps teams add it?

SAL (sales accepted lead) is the stage between MQL and SQL that proves sales actually received and accepted the lead for follow-up. Teams that add SAL can track acceptance rates (often 60-90% for hand-raisers) and speed-to-lead, which makes "lead quality" debates measurable instead of political.

What's a good speed-to-lead SLA for inbound leads?

A strong inbound SLA is first touch within 5 minutes for demo/contact requests during business hours, and within 1 hour after-hours, with acceptance within 15-60 minutes. That target exists because the industry average response time is 42 hours, and fast response is linked to dramatically higher qualification rates.

How do you verify contact data before prospecting?

Verify emails and mobiles before you launch sequences so bounces don't tank deliverability and reps don't waste touches. Prospeo, "The B2B data platform built for accuracy," gives you 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers, with 98% email accuracy and a 7-day refresh cycle, so your outbound starts with reachability instead of guesswork.

6sense says 85% of buyers already know their vendor before sales reaches out. Win the shortlist by prospecting accounts showing real intent - Prospeo tracks 15,000 Bombora topics and refreshes data every 7 days so your outbound hits while the signal is still hot.

Reach in-market buyers before they pick your competitor.

Summary: the difference between prospecting and lead generation (what to do next)

The difference between prospecting and lead generation is simple in theory and brutal in execution: marketing captures and qualifies demand (lead->MQL), sales turns accepted records and target accounts into conversations (SAL->SQL), and RevOps keeps the seam from ripping with timestamps, SLAs, and recycle rules. If you want immediate lift, instrument SAL, enforce speed-to-lead, and clean your contact data before you scale volume.