The Complete Guide to Buying Signals for Outbound Sales in 2026

91% of cold emails get zero response. That's not a scare stat - it's the baseline reality for every SDR hitting send without context.

Teams using buying signals for outbound are producing very different outcomes. Docebo's team hit a 16% average reply rate using signal stacking. The Attention case study generated $1.2M in pipeline in 4 months on roughly $1,500/month in SaaS subscriptions. The gap between cold and signal-based outbound isn't closing. It's widening.

It now takes 4x more activities to book a meeting than it did five years ago. Modern B2B deals require roughly 266 touchpoints and 2,900 impressions from first touch to signature. Prospects are drowning in generic "saw your company is growing" emails from reps who clearly spent zero seconds researching them. Cold calling? A 2.3% success rate. The math doesn't work unless you change the inputs.

Here's the thing: the problem isn't outbound itself. Outbound-sourced deals are roughly 50% larger than inbound-sourced deals. The channel works. What's broken is the targeting. When you reach the right person at the right moment with the right context, outbound is still the highest-leverage growth motion in B2B. The trick is knowing when that moment arrives.

That's what signal-driven outreach solves. It turns outbound from a volume game into a precision game. Gartner predicts that by 2027, 95% of seller workflows will begin with AI-powered signal detection - up from under 20% in 2024. The shift is already happening. And the tools to detect, score, and act on those signals are finally accessible to teams that aren't spending $50K/year on a data platform.

The Short Version

If you're short on time, here's the condensed playbook:

The three signal categories that matter:

- Fit - Does this account match your ICP?

- Intent - Are they actively researching a solution?

- Engagement - Have they interacted with your brand?

Three signals that consistently outperform generic outbound:

- Former customers (3x conversion rate) and champion job changes

- New leadership hires (new leaders often spend 70% of their budget in the first 100 days)

- High-intent website behavior - especially pricing/demo/trial and competitor evaluation paths

The one thing nobody tells you: Signals are worthless without verified contact data. Detecting that a VP just joined a target account means nothing if your email bounces or your phone number is dead.

The benchmark: Signal-based outbound delivers 2-4x higher conversion rates than traditional outbound, and the Revenoid dataset showed a 384% increase in meetings from signal-led approaches.

What Are Buying Signals (And Why They Matter Now)

A buying signal is any indicator that a prospect is ready, approaching readiness, or actively moving toward a purchase. Job changes, funding rounds, pricing page visits, tech stack shifts, hiring patterns - they're all signals. Some are strong. Most are weak. The skill is knowing which ones to act on and how fast.

Less than 5% of your ICP is actively in-market at any given moment. That's the Ehrenberg-Bass finding every SDR should internalize. You're not competing for attention across your entire TAM. You're racing to find the 5% who are actually looking.

And those buyers have completed 57-70% of their research before they'll even talk to a sales rep. By the time they fill out a demo form, they've already built a shortlist. Only three vendors typically get a demo per purchase decision. If you're not on that shortlist before the form fill, you're already behind.

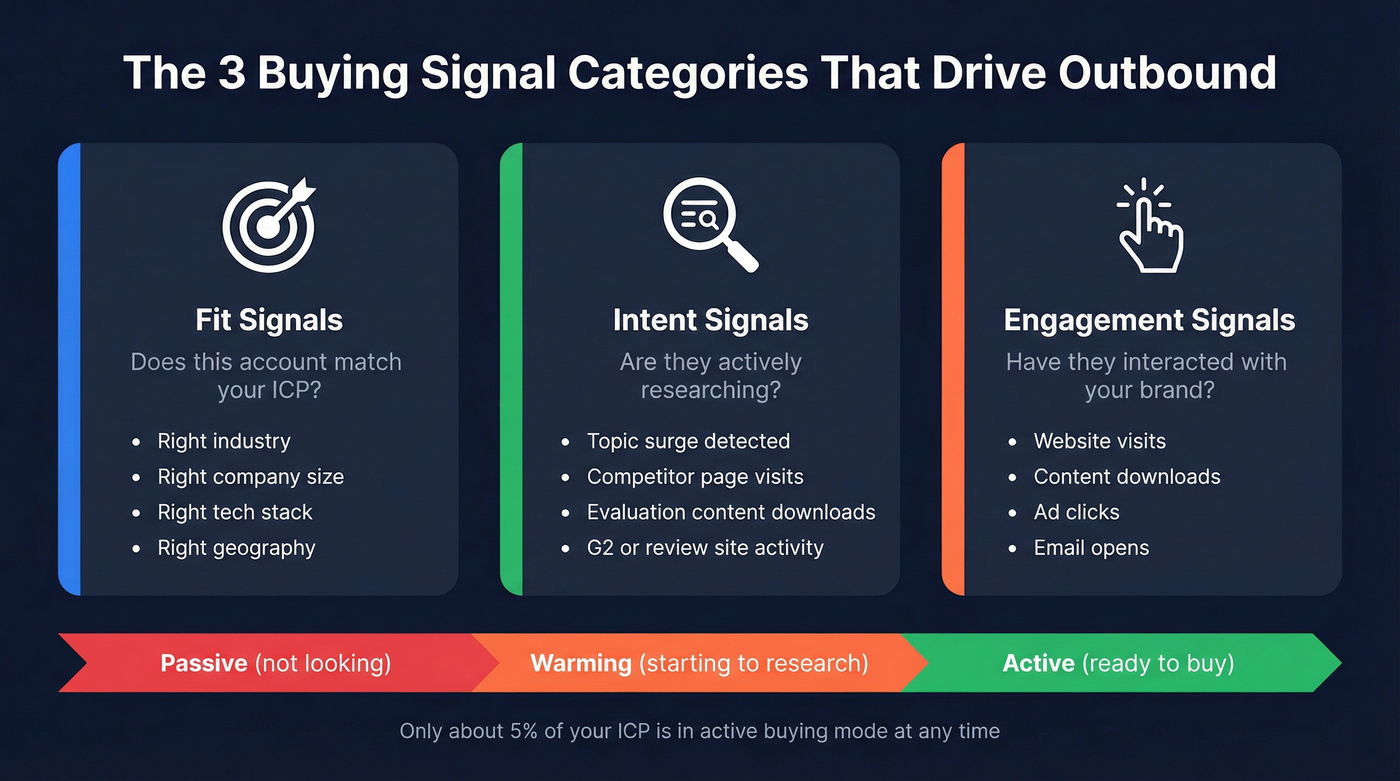

The Demandbase framework breaks signals into three categories that hold up in practice:

- Fit signals tell you whether an account matches your ICP - right industry, right size, right tech stack, right geography.

- Intent signals tell you whether they're actively researching - surging on relevant topics, visiting competitor pages, downloading evaluation content.

- Engagement signals tell you whether they've interacted with your brand - website visits, content downloads, ad clicks, email opens.

Warm outbound - outreach triggered by one or more of these signals - delivers 2-3x higher response rates than cold.

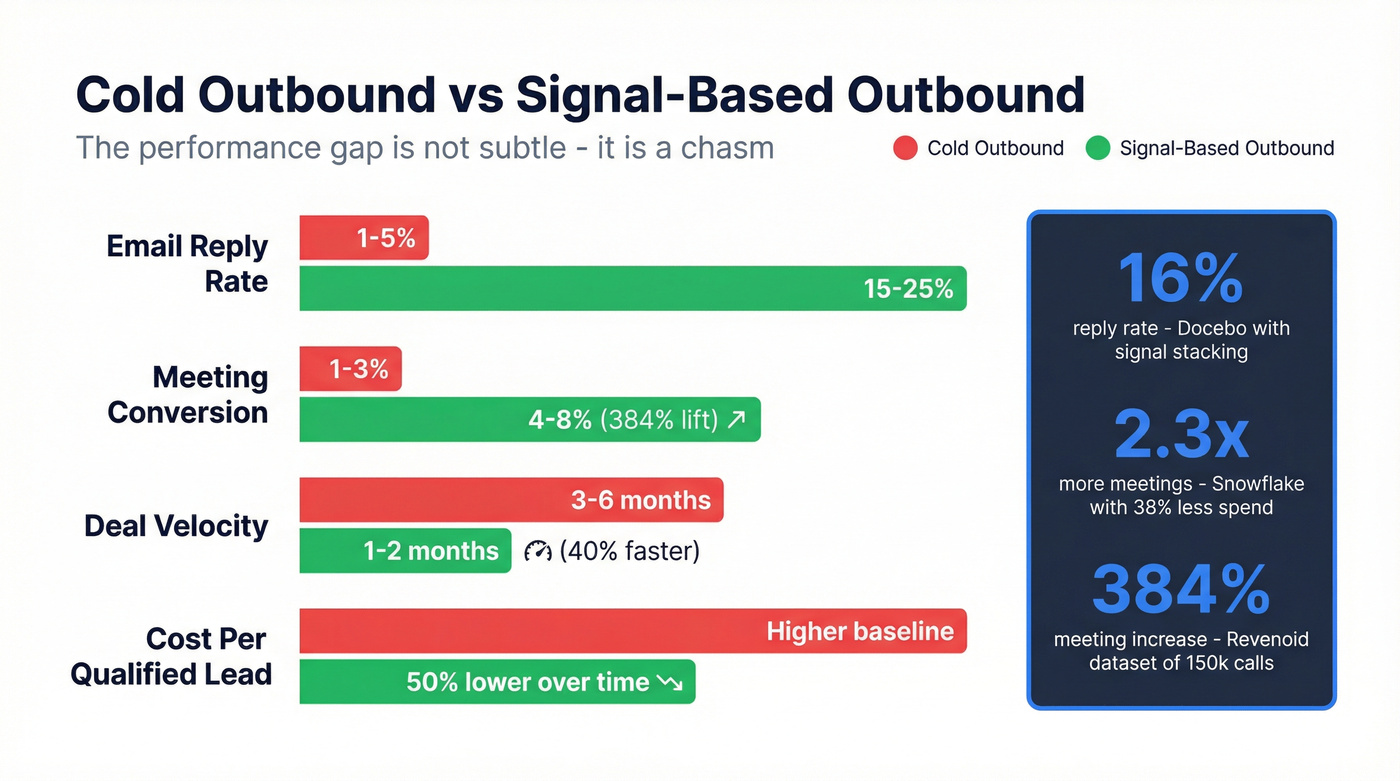

Cold vs. Signal-Based Outbound - The Numbers

The performance gap isn't subtle. It's a chasm.

| Metric | Cold Outbound | Signal-Based Outbound |

|---|---|---|

| Email reply rate | 1-5% | 15-25% (top teams) |

| Cold call answered rate | ~2.3% baseline | 13.3% (SDRs using verified data) / 14.4% (AEs calling warm leads) |

| Meeting conversion | 1-3% of emails | 4-8% of emails (384% lift in Revenoid dataset) |

| Deal velocity | 3-6 months | 1-2 months for intent-driven leads (~40% faster closes) |

| Cost per lead | $50-100 | Intent platforms often cost $150-200/lead, but drive ~50% lower cost per qualified lead over time |

Docebo's team hit a 16% average reply rate using signal stacking - against a common 2-3% baseline for cold outreach. They generated 54 enterprise opportunities in their first full quarter.

Snowflake achieved a 2.3x lift in meetings using signal-based ABM while simultaneously cutting spend by 38%. More meetings, less money.

The Revenoid dataset - 150,000 signal-led calls - showed a 384% increase in meetings compared to cold approaches. Intent-driven leads convert 2-3x faster and close 40% faster than traditional leads.

The ROI math is straightforward. Cold email returns roughly $40 per $1 spent, which sounds great until you factor in the volume required to hit those numbers. Signal-based outbound lets you achieve the same (or better) pipeline with a fraction of the sends - fewer burned domains, less spam risk, and reps spending time on conversations instead of list-building.

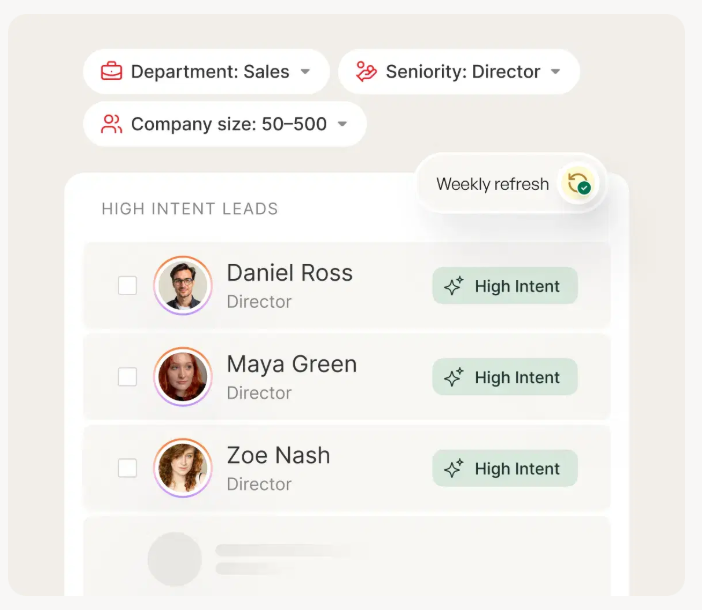

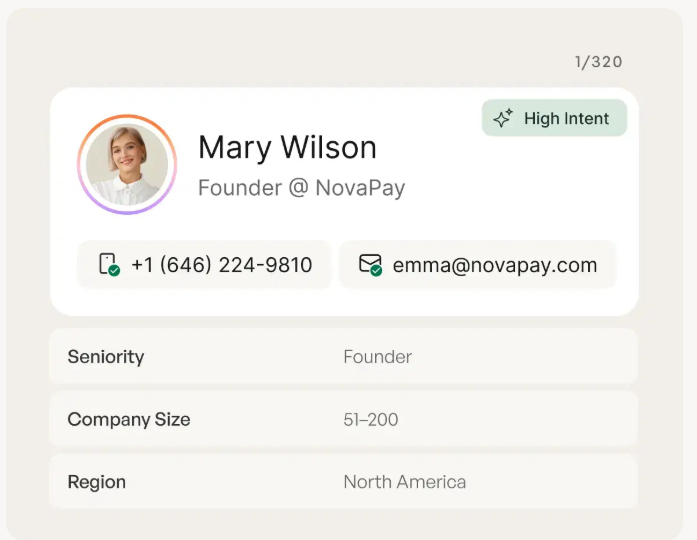

Buying signals are worthless if your email bounces. Prospeo gives you 98% verified emails refreshed every 7 days - so when a champion changes jobs or intent surges on your ICP, you reach real inboxes, not dead ends. At $0.01/email, signal-based outbound finally scales.

Stop wasting buying signals on bad data. Verify before you send.

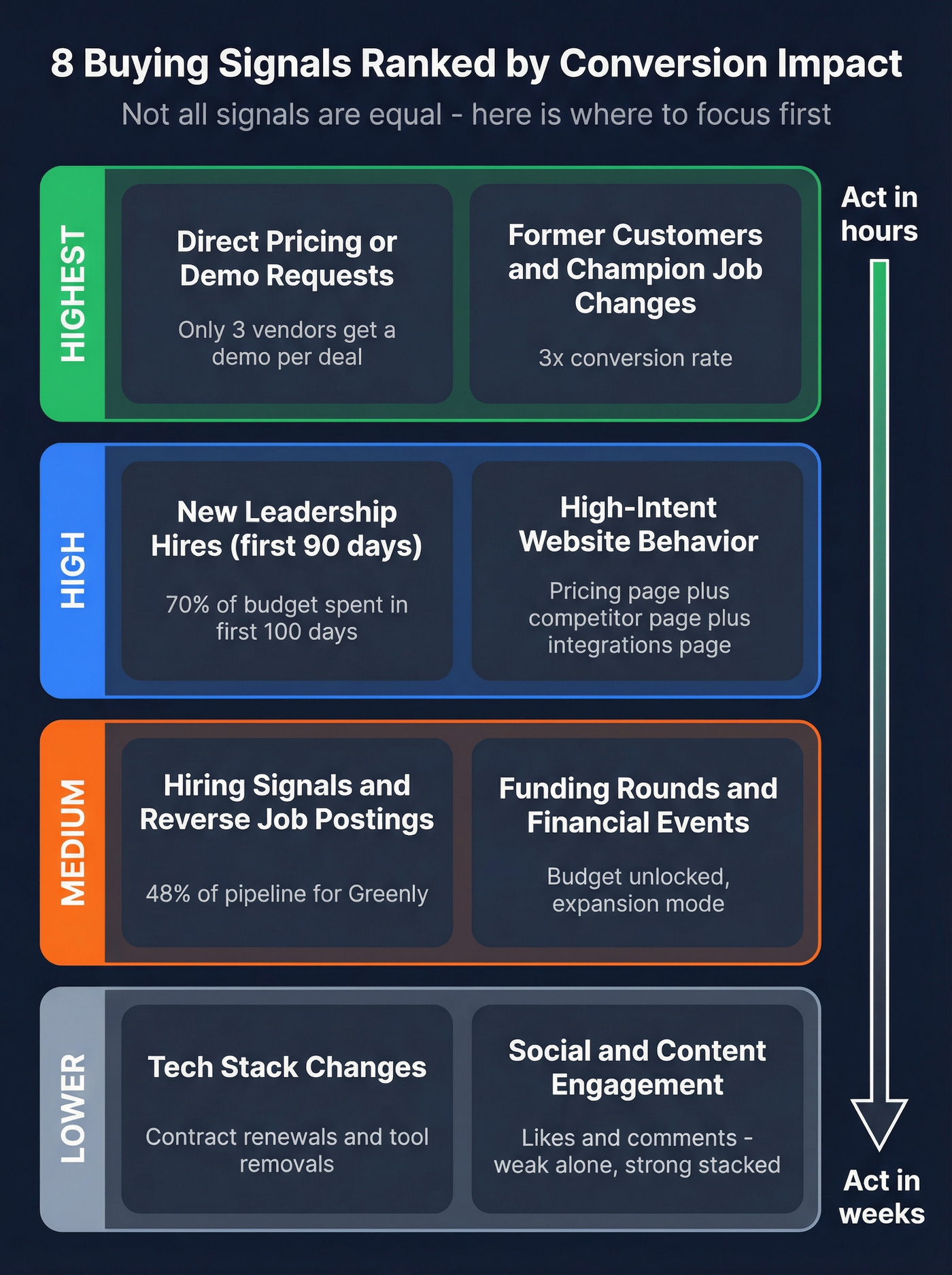

The 8 Buying Signals Ranked by Conversion Impact

Not all signals are created equal. A social media like and a pricing page visit are both technically "signals," but one converts at under 1% and the other can convert in the high teens or better when it's an opt-in buying action. The ranking below is based on three criteria: correlation with purchase timing, ease of detection, and time-to-meeting.

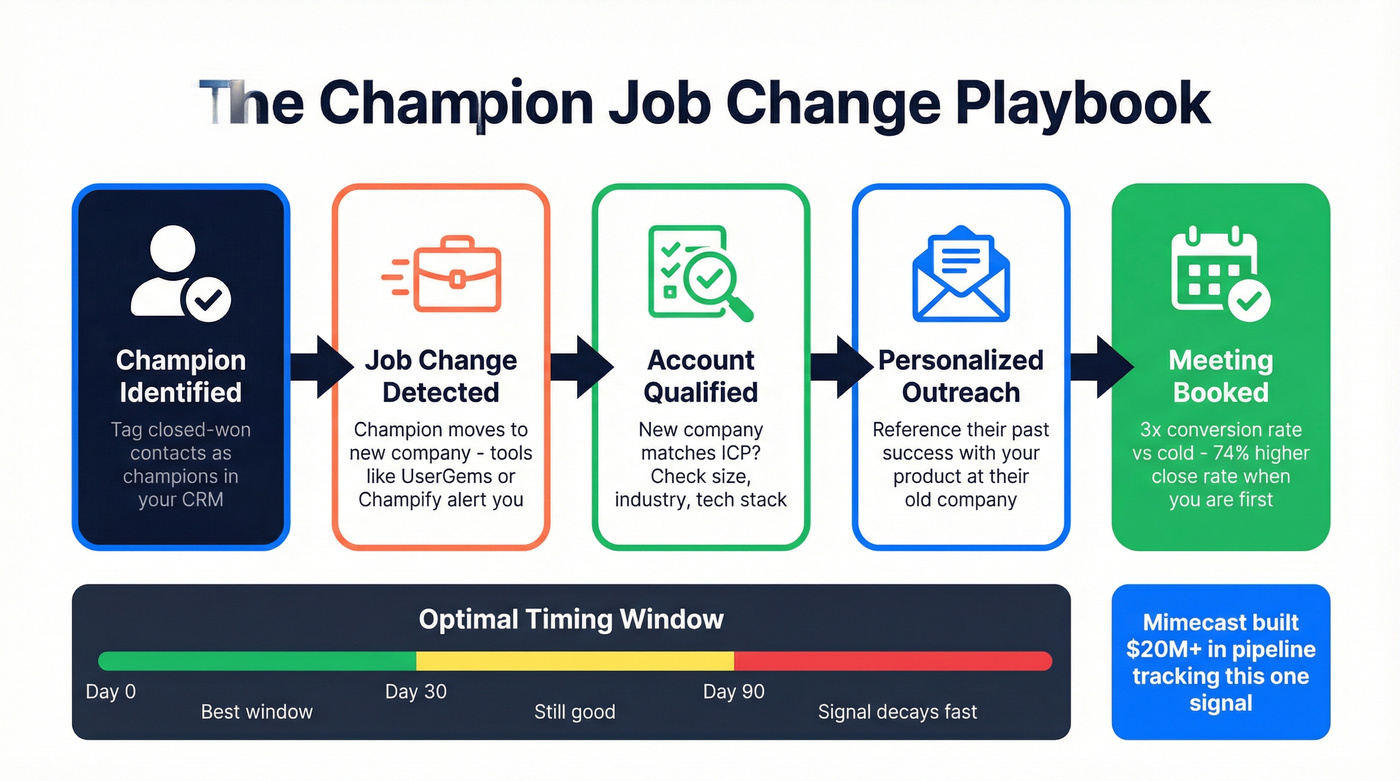

Signal #1: Former Customers & Champion Job Changes

Strength tier: High

This is the most powerful purchase indicator outbound sales teams can act on. Past customers convert at 3x the rate of normal leads. They already know your product, they've already been through your sales process, and they've already seen the value.

Thirty percent of people change jobs every year. When a champion from a closed-won account moves to a new company, they bring institutional knowledge of your product with them - and a bias toward what worked before. Mimecast built $20M+ in pipeline by tracking exactly this signal through UserGems.

Being first in front of a new buyer increases your chance of closing by 74%, per Forrester. That's not a marginal edge. That's the difference between winning and losing the deal.

Detection tools: UserGems, Champify, LoneScale, Common Room

Timing window: First 30-90 days after the job change.

CRM field: Signal_Type: Champion_Job_Change / Previous_Account / Days_Since_Change

Template:

Hi {{first_name}}, congrats on the move to {{company}}. At {{previous_company}}, your team used [Product] to {{specific_outcome}}. I'd love to explore whether there's a fit at {{company}} - especially since most new leaders lock in vendors early. Worth a 15-minute call this week?

Signal #2: New Leadership Hires (≤90 Days)

New executives spend 70% of their budget within the first 100 days. There's a vendor amnesty period during leadership transitions - new leaders want to evaluate, renegotiate, and put their stamp on the tech stack. This is your window.

Why this signal decays fast: A new VP of Sales who started three weeks ago is gold. The same person six months in has already locked in their vendors. You need data sources refreshing weekly, not on a 6-week cycle, to catch these hires while they're still evaluating. Combine job change filters with verified contact data, and you've got a direct line to the decision-maker before the "congrats on the new role" email pile gets too tall.

UserGems recommends a 14-touchpoint cadence combining email, calls, and social for new hire outreach. That's aggressive, but the conversion rates justify it.

Timing window: First 90 days. Ideally first 30.

CRM field: Signal_Type: New_Hire / Hire_Type: Leadership / Leader_Tenure_Days

Template:

{{first_name}}, most {{title}}s I talk to in their first 90 days are re-evaluating their {{category}} stack. The top performers at {{company_size}} companies are prioritizing {{specific_initiative}}. I put together a quick breakdown - want me to send it over?

Signal #3: High-Intent Website & Content Engagement

Strength tier: High

Not all website visits matter. Someone reading your blog post about industry trends is low-intent. Someone hitting your pricing page, then your competitor comparison page, then your integrations page in the same session? That's a buying committee member doing evaluation research.

The BOFU pages that matter: pricing, competitor comparisons, demo/trial, integrations, and case studies. High-intent opt-in actions (like trial signups, pricing inquiries, and clear "next steps" requests) convert around 18-25%. In one intent-data example, 45% of anonymous visits converted to MQLs within 30 days when the accounts were in active research.

Detection tools: HubSpot, Clearbit Reveal, Warmly (~$499/mo), Leadfeeder (~$99/mo)

Timing window: Hours, not days. Website intent decays fast.

CRM field: Signal_Type: Web_Intent / Pages_Visited / Visit_Recency

Template:

Hi {{first_name}}, noticed your team at {{company}} has been researching {{category}}. Here's a 2-minute breakdown of how we compare to {{competitor}} on {{specific_dimension}}. Happy to walk through it live if useful - I can hold 15 minutes on {{day}}.

Signal #4: Direct Pricing/Demo Requests

Strength tier: Highest. When someone fills out a demo form or asks about pricing, they're in active buying mode. Only three vendors get a demo per purchase decision. The challenge isn't detection (your CRM handles this) - it's speed-to-lead. Every hour of delay drops conversion rates. Own this with automation, not manual routing.

Signal #5: Hiring Signals (Reverse Job Posting)

The case study that sold me on this signal: Greenly built 48% of their pipeline from hiring-related signals - specifically by reaching companies as they built out sustainability teams. Welcome to the Jungle saw a 3x increase in deal velocity and a 10x ROI after automating hiring signal tracking.

Real talk: this is one of the most underrated buying triggers for cold outreach. If a company is hiring a Head of CRM, they have budget and they feel the problem. Job postings reveal strategic initiatives, expansion regions, tech stack decisions, and budget allocation. A company posting for three SDRs and a RevOps manager is about to scale outbound. If you sell sales tools, that's your moment.

Detection tools: TheirStack, Sumble, BuiltWith job post parsing

Timing window: 2-4 weeks after posting.

CRM field: Signal_Type: Hiring / Role_Posted / Department / Days_Since_Posted

Template:

{{first_name}}, saw {{company}} is building out a {{department}} team. Most companies at your stage run into {{specific_problem}} around month 3. Here's a quick framework for avoiding it - and I can share what {{similar_company}} did differently. Worth a call?

Signal #6: Tech Stack Changes

Strength tier: Medium

Three scenarios matter here: they uninstalled a competitor (they're shopping), they installed a complementary tool (they're building a stack you fit into), or they mentioned a relevant tool in a job posting (they're committed to the category).

BuiltWith and Wappalyzer offer nightly diff monitoring. Platforms with technographic filters combined with live job posting signals reveal which tools companies are actively adopting - and which they're abandoning.

Timing window: 1-4 weeks after the change.

CRM field: Signal_Type: Tech_Change / Tech_Event: Uninstall|Install|Job_Post / Tool_Category

Outreach hook: "Noticed you recently moved off [Competitor]. Most teams switching to [Category] hit [specific friction point]. Here's what we've seen work."

Signal #7: Expansion Events (Funding, New Markets)

Skip this signal if: your average deal size is under $15K. Funded companies get hammered by every vendor in the category the week the press release drops. Unless you can differentiate hard, you're email #47 in the inbox.

Funding rounds and market expansions create conditional budget tied to near-term initiatives. A Series B company that just raised $30M has money to spend - and a board expecting them to spend it on growth.

Here's the tradeoff: everyone gets the same Crunchbase alert. Every SDR in your category is emailing that VP of Sales the same week. This is signal saturation in action - and it's why "congrats on the funding" emails have become the new "just checking in."

Detection tools: Crunchbase, Apollo, Clay

Timing window: The first few months post-announcement.

Outreach hook: Skip "congrats on the raise." Try: "Post-Series B, most [Industry] companies prioritize [specific initiative]. Here's a framework for [relevant outcome]."

Signal #8: Social & Content Engagement - A Myth-Bust

The myth: social engagement is a buying signal.

The reality: Low-intent signals like likes and reactions convert under 1%. I've seen teams build entire outbound motions around social engagement and wonder why nothing converts.

The exception: When acted on within 24 hours and stacked with a business signal, social engagement can drive 20%+ reply rates. A prospect who liked your competitor's post AND just got promoted AND works at a company showing intent surges? Now you've got something. But the social signal is the seasoning, not the meal.

Detection tools: Common Room, Clay

Timing window: 24 hours.

Rule: Never lead with "I saw you liked a post." Lead with the business signal. Use the social engagement as a P.S. or secondary context.

How to Stack Buying Signals for Outbound Campaigns

Individual signals are useful. Stacked signals are where the real conversion lift happens.

With enterprise deals now involving 11+ stakeholders on average, you need multiple signal types just to map the buying committee - let alone time your outreach. Docebo's CRO built what they call a "GTM brain" - a centralized command center unifying signals from CRM data, first-party signals (Demandbase, Crossbeam, Metadata), and third-party intelligence (UserGems). The results: 54 enterprise opportunities in their first full quarter, 16% average reply rate, and record pipeline generation.

The gold standard rule from Docebo's team: maximum two signals per email. They tested this extensively. More than two signals overwhelms prospects and dilutes the message. Pick the strongest signal as your lead, use a second for context, and save the rest for follow-up touches in the sequence.

Here's what a stacked signal looks like in practice: a VP downloads a whitepaper, two colleagues visit the pricing page, and intent data shows the account is researching your category. That's three signals across two categories (engagement + intent). The outreach writes itself. Workforce Software used this kind of multi-signal approach and saw a 121% increase in in-market account engagement over six months.

The scoring engine approach:

Build a simple scoring model. Weight each signal by strength tier:

- High-intent signals (champion job change, new leadership, pricing page visit): 10 points

- Medium-intent signals (hiring, tech stack change, funding): 5 points

- Low-intent signals (social engagement, content download, ad click): 1 point

Accounts scoring 15+ get immediate outreach. Accounts scoring 5-14 go into a nurture sequence. Below 5? Don't waste the rep's time.

Docebo's team introduces new signals every 2-4 weeks, measures performance against pipeline creation, and removes underperformers. Their next step: feeding Gong call transcripts into the scoring system for personalization from past conversations.

The Data Quality Foundation Nobody Talks About

Here's the gap nobody wants to discuss: the distance between detecting a signal worth acting on and actually reaching the person.

Contact data degrades at 2% monthly. That's 20%+ of your database becoming unusable every year. And 17% of cold emails are blocked or land in spam before a human ever sees them. You can have the most sophisticated signal detection engine in the world, and it means nothing if your emails bounce or your phone numbers are dead.

We've watched teams invest $30K+ in intent data platforms, build beautiful signal-scoring models, and then watch their sequences bounce at 35-40% because the underlying contact data was garbage. It's the most expensive mistake in outbound, and it happens constantly.

The proof is in the turnarounds. Snyk's team of 50 AEs was prospecting 4-6 hours per week with bounce rates of 35-40%. After switching to verified contact data with a weekly refresh cycle, bounces dropped under 5%, AE-sourced pipeline jumped 180%, and they were generating 200+ new opportunities per month.

Meritt tripled their pipeline from $100K to $300K per week after implementing a verification layer - bounce rates went from 35% to under 4%, and connect rates tripled to 20-25%.

The math is simple: signals x data quality = pipeline. If either variable is zero, the output is zero.

Track job changes, layer intent data across 15,000 Bombora topics, and pull verified direct dials with a 30% pickup rate. Prospeo connects every signal in this guide to the contact data that actually converts - 300M+ profiles, 125M+ verified mobiles, no annual contracts.

Turn every signal into a conversation. Start with 100 free credits.

Building Your Signal Stack - 3 Budget Tiers

You don't need $50K/year to run signal-based outbound. The Attention case study generated $1.2M in pipeline in 4 months on roughly $1,500/month in SaaS subscriptions. The tools are accessible. The question is which combination fits your budget and team size.

Hot take: If your deals average under $10K, you probably don't need ZoomInfo-level data or a $30K intent platform. A $500/month stack with verified contact data and manual signal detection will outperform a $50K platform you only use 20% of.

Starter ($0-500/mo)

| Tool | Cost | Role |

|---|---|---|

| Apollo free tier | $0 | List building + basic signals |

| Job boards + news | $0 | Manual signal detection |

| Prospeo free tier | $0 | 75 verified emails/mo + Chrome extension |

This is the founder/solo SDR stack. You're manually scanning job postings, funding announcements, and leadership changes. You're using Apollo to build lists and verifying every email before you send. It's labor-intensive, but it works.

Growth ($500-1,500/mo)

| Tool | Cost | Role |

|---|---|---|

| Clay | ~$149-349/mo | Signal orchestration + enrichment |

| Apollo paid | ~$49-99/mo/user | List building + sequences |

| Instantly | ~$30-97/mo | Cold email infrastructure |

| Prospeo | ~$39-99/mo | Verified emails + mobiles + intent data |

This mirrors the approach that generated $1.2M in pipeline for Attention - with tools like Prospeo handling verified contact data and Clay managing signal orchestration.

Enterprise ($15K+/yr)

| Tool | Cost | Role |

|---|---|---|

| Demandbase or 6sense | $18K-50K+/yr | ABM + intent platform |

| UserGems | ~$1-3K/mo | Champion tracking |

| ZoomInfo | From $15K/yr | Primary database |

| Verification layer | Varies | Catch degraded records |

For 50+ rep teams with dedicated RevOps. Demandbase or 6sense handles account-level intent scoring and orchestration. UserGems tracks champion job changes automatically. ZoomInfo provides the primary database. Even at this tier, a verification layer on top catches the records that degrade between refresh cycles.

Three Mistakes That Kill Signal-Based Outbound

Treating All Signals as Equal

A student downloading an eBook registers the same as a CISO evaluating solutions in most intent platforms. That's a problem. Low-intent signals convert at under 1%. High-intent actions convert dramatically higher. Treating them the same means your reps waste time on accounts that were never going to buy - a flood of false positives that look active but aren't in-market.

The fix: tier your signals explicitly. High-intent gets immediate outreach. Medium-intent gets a nurture sequence. Low-intent gets monitored but not acted on until it stacks with something stronger.

Buying Commoditized Intent Data

Most intent providers are reselling the same bidstream data or aggregated third-party cookies. There's a massive difference between someone accidentally clicking a display ad and a buying committee researching "competitor X vs competitor Y" on a review site.

Ask your vendor: "What percentage of this data is proprietary vs. sourced from external exchanges?" If they can't answer clearly, you're buying noise. In 2015, just having intent data was a superpower. In 2026, it's table stakes - and the quality variance between providers is enormous.

Chasing Volume Over Accuracy

Look, if you're targeting 5,000-10,000 accounts with 15-person buying committees, that's roughly 150,000 contacts that actually matter. Accuracy on those 150,000 matters infinitely more than having a database of 200 million records you'll never touch.

Vendors fuel this fallacy by boasting "world's largest B2B database." Irrelevant. The #1 lesson from Reddit threads on outbound? More messages didn't help. Better-targeted ones did. Every time.

Generate Your Own Signals - The Active Signal Advantage

There's a distinction most teams miss: passive signals vs. active signals.

Passive signals come from third-party sources everyone has access to - job changes, funding rounds, intent data. They're valuable, but they're not differentiated. Every competitor in your space is buying the same Bombora topics and getting the same Crunchbase alerts.

Active signals are the ones your team generates through outbound activity itself. Call transcripts containing "follow-up in December," "contact my VP," or "we're using your competitor" - that's proprietary intelligence no one else has. Email replies revealing timeline, budget, and decision-making structure. These are gold.

Modern Health saw a 50% increase in meetings booked after combining their dialer (action layer) with AI-driven prospecting (intelligence layer). The key shift: treating signals as a KPI. Instead of measuring activities completed, measure signals generated.

The teams winning in 2026 aren't just consuming signals. They're producing them.

Your Implementation Timeline

Week 1-2: Foundation

Define your ICP with specificity. Build your initial target list in Apollo. Clean the data: delete records with empty emails, no website, or wrong industries. Verify every email before it goes into a sequence.

Pick your top three signals to start. Don't try to monitor all eight on day one. Former customer job changes, new leadership hires, and high-intent website behavior give you the highest leverage with the least tooling complexity.

Week 3-4: First Sequences

Build dedicated cadences for each signal type. Use the "Why now? Why them? Why you?" framework for every email. 20% personalization brings 2x reply rates.

Target a 12-18 touch sequence over 20-30 days, blending email, calls, and social. Multichannel outreach increases response rates by 287% vs. single-channel.

Month 2-3: Optimize and Scale

Measure conversion by signal type. Introduce one new signal every 2-4 weeks. Remove underperformers ruthlessly.

The goal by month three: your reps start each morning with their top 30 prospects already sorted into the right sequences with reasons. That's the "GTM brain" in action - and the clearest proof that buying signals for outbound have moved from nice-to-have to the core operating system of modern B2B sales.

FAQ

What are buying signals for outbound sales?

Buying signals are indicators a prospect is approaching a purchase - job changes, funding rounds, pricing page visits, tech stack shifts, and hiring patterns. Intent data (third-party tracking of online research behavior) is one specific type. Think of intent data as a subset of buying signals, not a synonym.

How many signals should I include in a single outreach email?

Maximum two per email. Docebo's team tested this extensively and found that stacking more than two signals overwhelms prospects and dilutes the message. Lead with the strongest signal, use a second for context, and save the rest for follow-up touches.

What's the minimum budget to start signal-based outbound?

Under $500/month for a solo user. A free tier covering 75 verified emails, Apollo for list building, and manual signal detection via job boards costs nothing. The Attention case study generated $1.2M in pipeline on roughly $1,500/month in tools.

How quickly do buying signals decay?

Website visits to pricing pages decay within hours. Job changes are most actionable in the first 30-90 days. Funding announcements lose relevance within the first few months as budgets get allocated. Speed-to-lead is the single biggest factor in signal-based outbound success.

Is third-party intent data worth the cost?

For teams with 50+ reps and enterprise deal sizes above $30K, platforms like Bombora or 6sense can justify $30-50K annually. For smaller teams, first-party signals (website behavior) combined with job change and hiring data deliver better ROI per dollar. Ask vendors whether their data is proprietary or resold bidstream - the difference is enormous.