Business Contacts: How to Find, Verify & Manage Them in 2026

"Once things started growing, it completely fell apart." That's a real quote from a founder on Reddit describing what happened when their spreadsheet-based contact system hit a few hundred entries. It's the moment most sales teams realize that business contacts aren't just names in a file - they're the infrastructure your entire revenue engine runs on.

The term means two very different things depending on who's asking. If you're a founder networking at a conference, it means relationships. If you're a RevOps lead building outbound lists, it means data - verified emails, direct dials, job titles, and company firmographics. This guide covers both, because the tools and strategies are completely different.

What You Need (Quick Version)

If you need to organize and manage contacts: HubSpot CRM (free, scales well) or Google Contacts (simplest option if you just need a rolodex).

The one stat you need to know: 70.8% of B2B contacts experience at least one change within 12 months. If you're not refreshing your data, you're emailing ghosts.

The Hidden Cost of Bad Contact Data

Bad contact data doesn't announce itself. It just quietly destroys your pipeline.

The average organization loses $12.9 million per year to poor data quality. Companies lose roughly 15% of revenue to inaccurate contact information. Across U.S. businesses, that number balloons to $3.1 trillion annually. These aren't abstract figures - they show up as bounced emails, disconnected phone numbers, and reps chasing prospects who left the company six months ago.

Here's where it gets personal: sales reps lose roughly 500 hours per year - that's 62 working days - validating and correcting contact information. That's 25% of their selling capacity gone. Not to quota-carrying activities. Not to building relationships. To fixing data.

"Half my day goes into fixing bad data." That complaint shows up constantly in sales communities, and it's not an exaggeration. When 70% of CRM data is outdated, incomplete, or inaccurate, reps learn to distrust their own systems. They build shadow spreadsheets. They Google prospects manually. They waste time that should go toward closing deals.

The damage cascades. Bad emails tank your sender reputation. Bad phone numbers burn through dialer minutes. Bad job titles mean your carefully personalized outreach lands with someone who hasn't held that role in a year. And every bounced email or wrong-number call erodes your team's confidence in the tools they're supposed to rely on.

Most teams don't have a "lead gen problem." They have a data quality problem wearing a lead gen costume.

You just read that bad contact data costs organizations $12.9M per year and reps lose 500 hours fixing it. Prospeo's 7-day data refresh cycle - vs. the 6-week industry average - means your business contacts stay current. 98% verified email accuracy. 125M+ direct dials. At $0.01 per email.

Stop emailing ghosts. Start reaching real buyers today.

Why Business Contacts Go Stale

B2B contact data decays at roughly 22.5% per year. That's the baseline. In high-turnover industries like tech startups, it can hit 30-40% - and up to 70.3% in the most volatile sectors.

The math is straightforward. The average U.S. worker stays at a company for 4.1 years. In tech, that drops to 2-3 years. Every year, 15-20% of professionals change jobs, 5-10% of companies undergo major changes (acquisitions, mergers, rebrands), and 2-5% of records have errors baked in at creation.

But the real story is in the engagement decay. Contacts don't just go stale in your CRM - they go stale in your sequences:

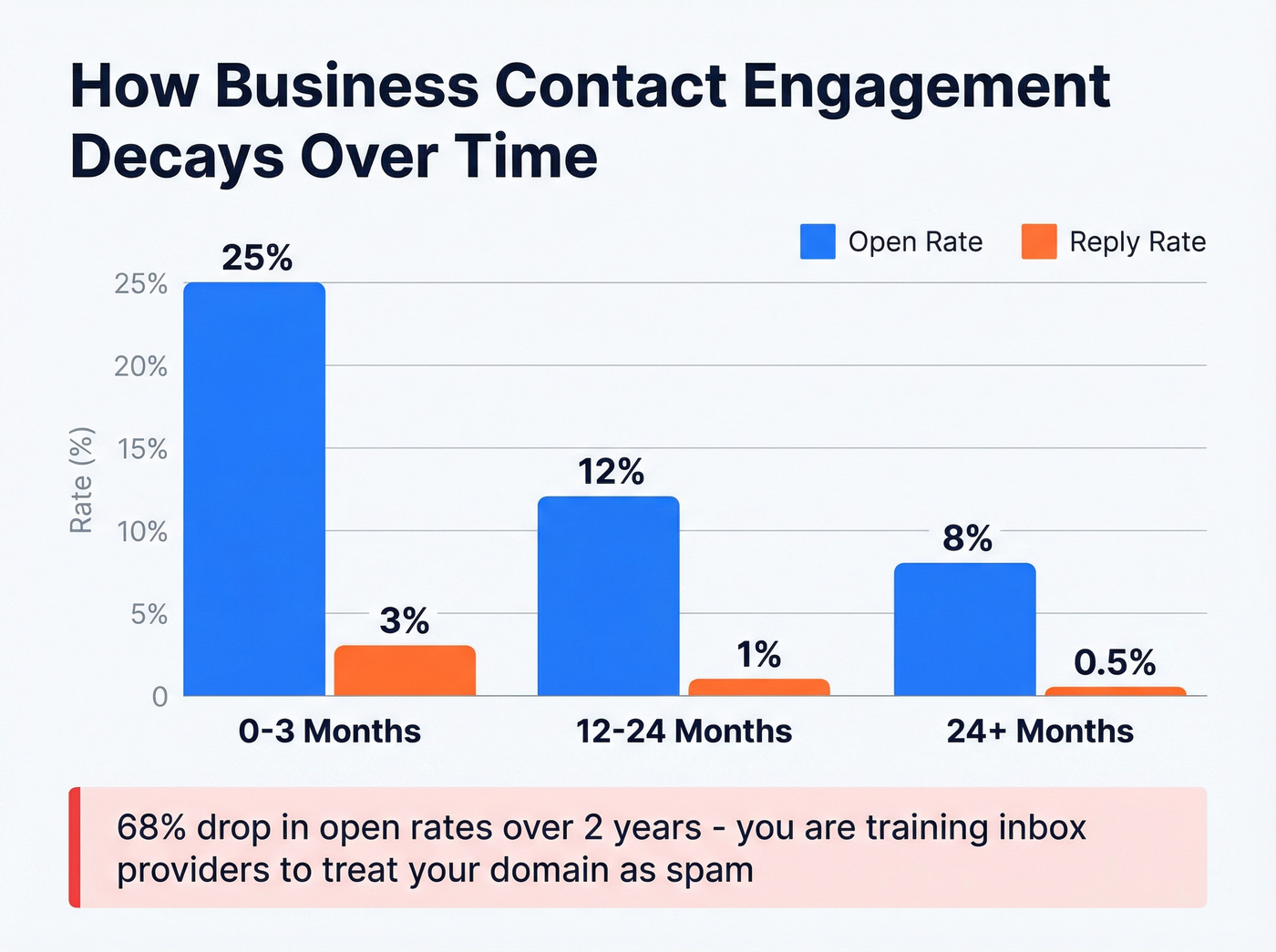

| Contact Age | Open Rate | Reply Rate |

|---|---|---|

| 0-3 months | 25% | 3% |

| 12-24 months | 12% | 1% |

| 24+ months | 8% | 0.5% |

That's a 68% drop in open rates over two years. You're not just emailing outdated contacts - you're training inbox providers to treat your domain as spam.

Decay Rates by Industry

| Industry | Annual Decay |

|---|---|

| Startups / VC-backed | 30-40% |

| Technology | 25-35% |

| Professional Services | 20-25% |

| Financial Services | 15-20% |

| Manufacturing | 10-15% |

| Government | 8-12% |

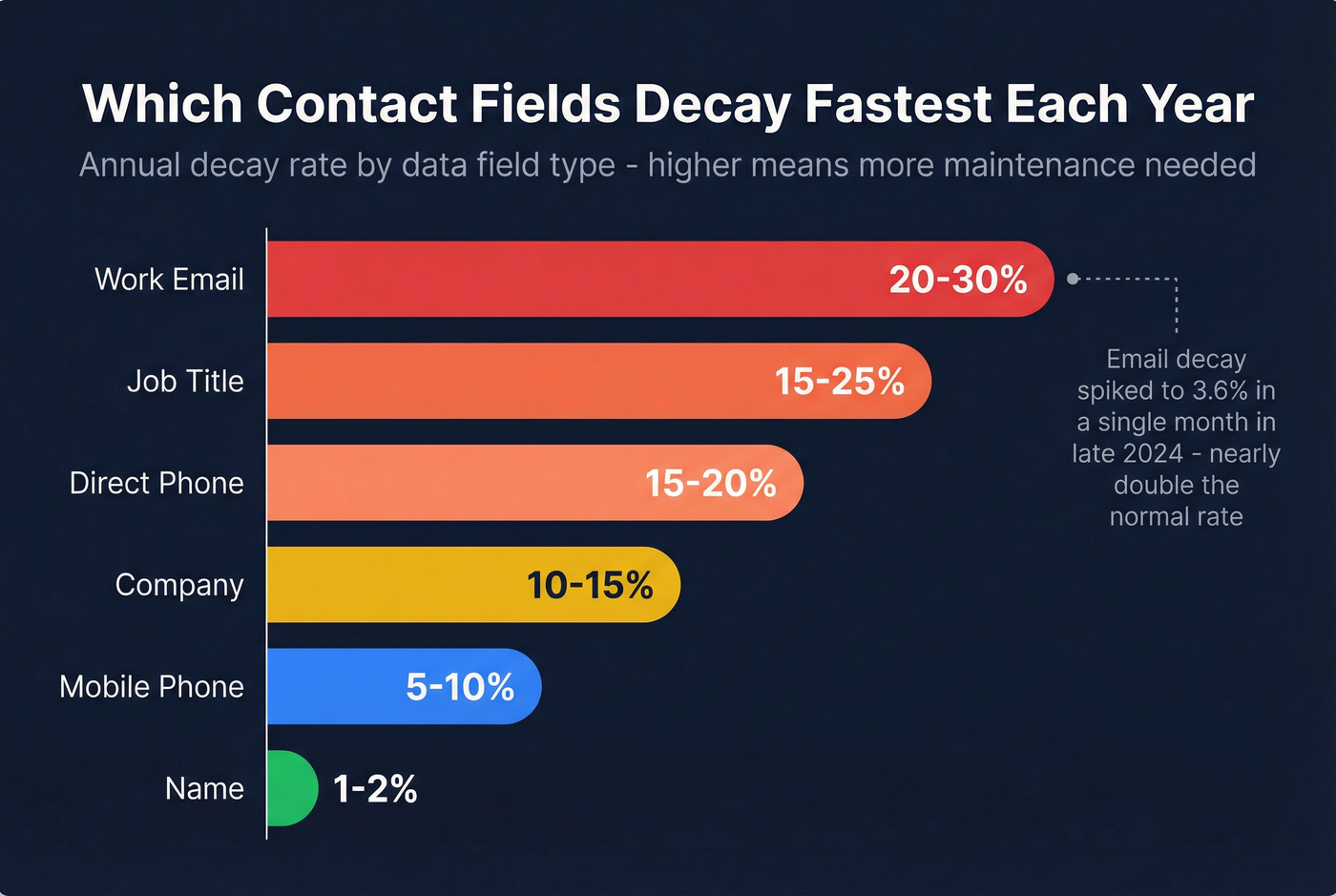

Decay Rates by Field Type

| Data Field | Annual Decay |

|---|---|

| Work email | 20-30% |

| Job title | 15-25% |

| Direct phone | 15-20% |

| Company | 10-15% |

| Mobile phone | 5-10% |

| Name | 1-2% |

Email decay spiked to 3.6% in a single month in late 2024 - nearly double the traditional 1.5-2% monthly rate - and the trend hasn't reversed. That's not a blip. It's a structural shift that wrecked campaigns for teams who weren't watching.

Let's put dollar signs on this. A company with 50,000 contacts experiencing 22% annual decay loses roughly 11,000 valid contacts per year. At $50 average lead value, that's $550,000 in potential pipeline evaporating while you're not looking.

This is why data refresh frequency matters more than database size. A 100M-contact database refreshed weekly will outperform a 1B-contact database refreshed monthly. Every time.

If you want a deeper breakdown of benchmarks and fixes, start with contact data decays.

How to Find Business Contacts

There are two tracks here, and most teams need both. The relationship track builds your network. The database track fills your pipeline.

The Relationship Track - Networking, Referrals, and Events

An estimated 65% of new business comes from referrals. That number alone should tell you that your contact database is only half the equation.

The best methods for building relationship-based contacts, in order of ROI:

Referrals from existing customers and partners. Nothing converts better. A warm introduction from someone who's already bought from you carries more weight than any cold email sequence.

Industry events and trade shows. Expensive, time-consuming, and still one of the highest-quality sources of new professional connections. The key is follow-up within 48 hours - not a generic "great meeting you" but a specific reference to your conversation.

Online communities and forums. Industry Slack groups, Reddit communities, and niche forums are where practitioners actually hang out. Contributing genuine value (not pitching) builds relationships that convert over months.

Social media groups. Professional groups where your buyers discuss their challenges. Listen first, contribute second, pitch never.

Alumni networks. Shared educational background creates instant rapport. It's an underused channel.

A 2018 study published in Frontiers in Psychology found that daily networking actually decreased emotional exhaustion while increasing job satisfaction and career optimism. The catch? Quality over quantity. Professionals with hundreds of thousands of connections often see very little engagement. Five deep relationships outperform five hundred shallow ones every time.

The Database Track - Using an Account Finder to Build Your Prospect List

When you need to build a list of 500 VP-level prospects at SaaS companies in the Northeast, relationships won't cut it. You need a B2B contact database that doubles as a powerful account finder.

These platforms aggregate professional data - emails, phone numbers, job titles, company firmographics - and let you search, filter, and export contacts that match your ideal customer profile. The good ones verify data in real time. The bad ones sell you a CSV full of bounces.

Here's the uncomfortable truth: most providers market 95%+ accuracy, while independent testing shows the industry average is closer to 50%. That gap is where your sender reputation goes to die.

Two concepts worth understanding before you pick a tool:

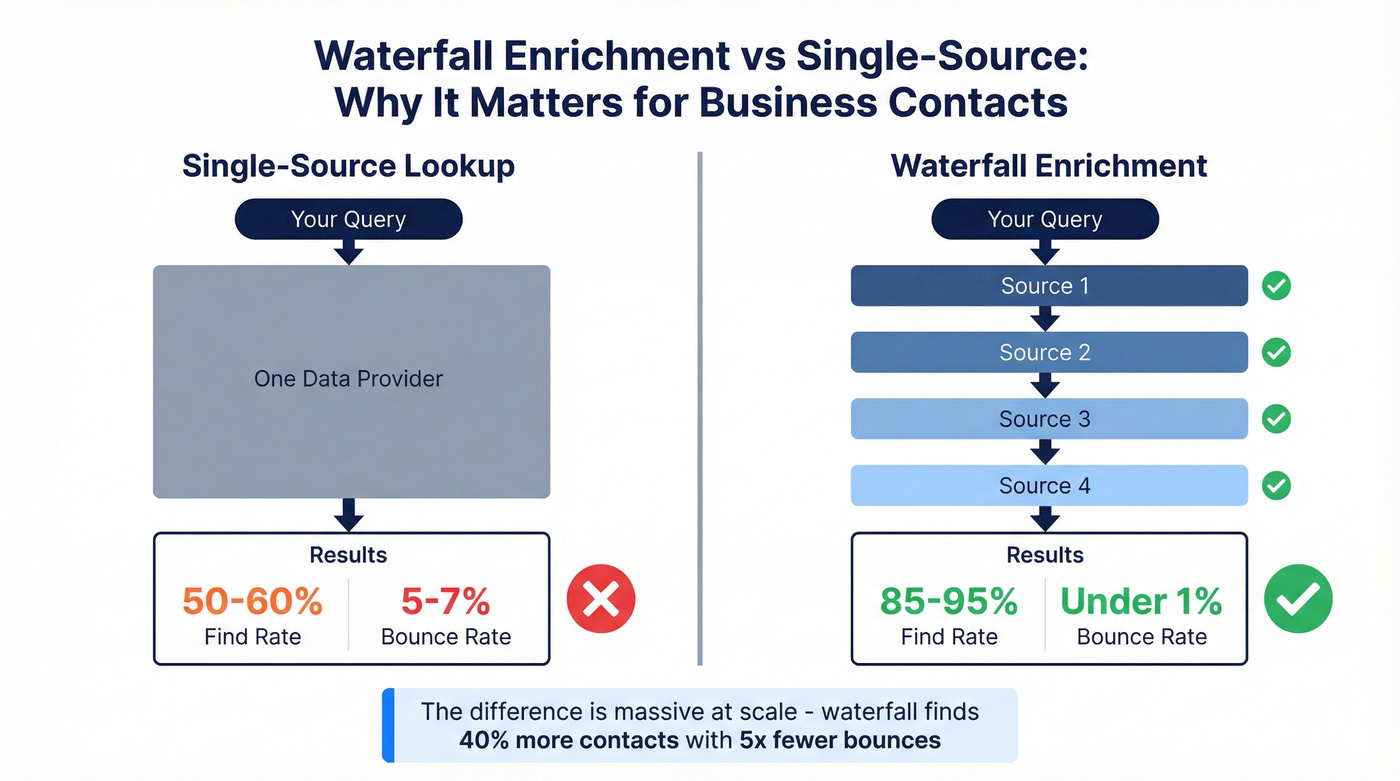

Waterfall enrichment vs. single-source. Waterfall enrichment runs your query through multiple data sources sequentially, achieving 85-95% find rates with bounce rates below 1%. Single-source platforms typically hit 50-60% find rates with 5-7% bounce rates. The difference is massive at scale.

Intent data as a layer. The best platforms layer in intent data - signals that tell you which companies are actively researching solutions like yours. You're not just finding contacts; you're finding contacts who are ready to buy. This single filter can double your reply rates because you're reaching people during an active buying cycle, not interrupting someone who has zero need.

Database size is misleading. A provider with 1 billion "contacts" sounds impressive until you realize half of them haven't been verified in six months. We've seen teams pick the biggest database and end up with worse results than a smaller, fresher one. Verification recency matters more than raw count.

Best Tools for Finding Business Contacts in 2026

| Tool | Database Size | Email Accuracy | Price Range | Best For | Contract Type |

|---|---|---|---|---|---|

| Prospeo | 300M+ | 98% | Free-~$0.01/email | Accuracy & freshness | None / monthly |

| Apollo.io | 275M+ | 85-91% | $0-$149/mo | SMB outbound | Monthly |

| ZoomInfo | 100-320M+ | 85-90% | $15K-40K+/yr | Enterprise ABM | Annual |

| Cognism | 400M+ | 87-90% | ~$1K-3K/mo | EU/UK sales | Annual |

| Lusha | 45-120M+ | 92-93% | $29-99/mo | Quick enrichment | Monthly |

| Hunter.io | 200M+ | ~90% | $0-499/mo | Email verification | Monthly |

Prospeo

Use this if: You care about data accuracy above all else, you're running outbound at scale, or you've been burned by bounced emails from other providers.

Skip this if: You need a built-in sequencing tool (pair with Instantly, Lemlist, or Smartlead for that).

Prospeo's database covers 300M+ professional profiles with 143M+ verified emails at 98% accuracy and 125M+ verified mobile numbers that hit a 30% pickup rate. The 7-day data refresh cycle is the fastest in the market - most competitors refresh every 4-6 weeks, which means you're working with stale data before your first campaign even finishes.

The 30+ search filters go deep: buyer intent powered by Bombora (15,000 topics), technographics, job change signals, headcount growth, department-level headcount, funding rounds, and revenue ranges. You can also exclude contacts based on criteria like existing customers, competitors, or previously contacted leads - a critical feature for keeping your prospect list clean and avoiding embarrassing duplicate outreach. The proprietary email-finding infrastructure doesn't rely on third-party email providers, which is why the accuracy numbers hold up in production.

Pricing is refreshingly simple. Free tier gives you 75 emails per month. Paid plans run roughly $0.01 per email - 90% cheaper than ZoomInfo - with no contracts and no annual commitments. Teams book 26% more meetings compared to ZoomInfo and 35% more compared to Apollo. Meritt tripled their pipeline from $100K to $300K per week after switching, with bounce rates dropping from 35% to under 4%. At enterprise scale, Snyk's 50-person AE team saw bounce rates fall from 35-40% to under 5%, with AE-sourced pipeline up 180%.

Apollo.io

Use this if: You're an SMB team that wants prospecting and outreach in one tool, and you don't want to pay for separate platforms.

Skip this if: You're sending high-volume cold email where bounce rates above 5% will tank your domain.

Apollo's database covers 275M+ contacts with a free tier that's genuinely useful - you get credits, basic search, and built-in email sequences without spending a dollar. Paid plans start at $49/user/month.

The all-in-one approach is Apollo's biggest strength and its biggest limitation. The outreach tools are solid for simple workflows. But the data quality is inconsistent - in independent testing, Apollo hits 85-91% email accuracy depending on the market segment. The Reddit consensus matches: "data feels bad sometimes, lots of bounces on older contacts." For SMB teams running moderate-volume outbound, it's the obvious starting point. For agencies sending thousands of emails daily, the accuracy gap adds up fast.

If you're comparing claims vs reality, see Apollo hits 85-91% email accuracy.

ZoomInfo

Use this if: You're running multi-threaded ABM campaigns into Fortune 500 accounts and need the deepest company intelligence available.

Skip this if: Your team has fewer than 10 reps or your annual data budget is under $15K.

ZoomInfo is the heavyweight. The database runs 100M+ contacts (some sources cite 320M+ depending on methodology), with 85-90% accuracy and the deepest company intelligence in the market - technographics, org charts, intent signals, and buying committee mapping.

Where ZoomInfo wins: US database depth, enterprise features, and workflow breadth. Where it falls short: price. A 10-seat contract with intent data and mobile numbers runs $15K-40K+ per year with mandatory annual commitments.

Here's the thing: ZoomInfo is still the best all-in-one enterprise platform. But most teams don't need all-in-one enterprise. If your deal sizes are modest or your team is under 10 reps, you're paying for features you'll never touch - and getting lower accuracy than lighter-weight alternatives.

If you want the bounce-rate reality check, start with ZoomInfo.

Cognism

Cognism's sweet spot is EU/UK sales. The database covers 400M+ contacts with 87-90% accuracy, and their phone-verified mobile numbers are genuinely strong for European markets - they maintain one of the largest databases of manually verified mobile numbers in EMEA. GDPR compliance is baked in, not bolted on.

Reddit users consistently praise the EU/UK data quality. Custom pricing typically runs ~$1,000-3,000/month for small teams, with annual contracts. If you're selling into EMEA, Cognism deserves a serious look. If you're US-only, you're paying a premium for compliance features you don't need.

Lusha

Who it's for: Individual reps and small teams who need to enrich one prospect at a time, fast.

Who should look elsewhere: Anyone building large outbound lists from scratch.

Lusha is the Chrome extension play. The database runs 45-120M+ contacts with 92-93% accuracy. Plans start at $29-99/month with no annual commitment. It's fast, simple, and great for enriching individual prospects on the fly - think of it as a sniper rifle next to a primary database's machine gun. SDRs who live in their browser love it. Ops teams building 5,000-contact campaigns need something bigger.

Hunter.io

The Reddit take on Hunter is spot-on: "works better as a verification layer than a primary source." Hunter covers 200M+ emails with roughly 90% accuracy. Free tier gives you 50 searches per month; paid plans scale to $499/month. If you're pulling contacts from another database and want to double-check emails before sending, Hunter is solid. As a standalone prospecting tool, the database is too thin for most outbound motions.

If you're evaluating verification vendors, compare more options in email verifier websites.

Other Notable Tools

Seamless.AI claims 1B+ contacts and offers a generous free plan. Paid plans run $0-147/month. The database size claim is aggressive - take it with a grain of salt - but the free tier is worth testing if you're bootstrapping.

Snov.io starts at $30/month and punches above its weight for international leads. Built-in automation makes it a decent all-in-one for small teams selling outside the US.

GetProspect covers 200M contacts with 50 free emails per month. Paid plans start around $49/month. Solid filters and native CRM integrations (HubSpot, Zoho, Salesforce). A reasonable mid-tier option if the Tier 1 tools don't fit your budget.

Contact data decays 22.5% per year, and most databases refresh monthly at best. Prospeo refreshes every 7 days across 300M+ profiles with 5-step verification, spam-trap removal, and catch-all handling. Teams using Prospeo book 26% more meetings than ZoomInfo and 35% more than Apollo.

Replace your stale spreadsheets with contacts that actually connect.

How to Organize and Manage Business Contacts

When Spreadsheets Stop Working

Every team starts with a spreadsheet. And every team hits the wall around 500 contacts.

"Once things started growing, it completely fell apart" - that Reddit founder wasn't describing a unique problem. It's the universal experience. Spreadsheets don't deduplicate. They don't log interactions. They don't remind you to follow up. And they definitely don't tell you when a contact changed jobs three months ago.

The same problem hits on the relationship side. As one Reddit user put it, browsing connections "becomes kind of hard after 500+ connections and also you can't add notes for specific people." The transition from spreadsheet (or mental rolodex) to a real system is painful, but waiting makes it worse. Every month you delay, you're losing data integrity you'll never recover.

Choosing the Right Contact Management Tool

| Tool | Price | Best For |

|---|---|---|

| HubSpot CRM | Free-$3,600/mo | Inbound + scaling |

| Google Contacts | Free | Simplest rolodex |

| Salesforce | ~$25-300/user/mo | Enterprise |

| Zoho CRM | ~$14-52/user/mo | Mid-market + AI |

| Streak | Free-$59/user/mo | Gmail power users |

60% of small business owners now use digital CRM tools, and the results speak for themselves: businesses moving to a CRM see a 29% jump in sales and a 34% lift in team productivity.

For most small teams, HubSpot's free CRM is the right starting point. It scales, it integrates with everything, and you won't outgrow it for a while. If you literally just need a digital rolodex with zero learning curve, Google Contacts syncs across Gmail, Calendar, and mobile for free. Salesforce is the enterprise standard but overkill (and overpriced) for teams under 20 reps.

If you’re evaluating options, compare more stacks in CRM software.

Five Rules for Keeping Your Contact Data Clean

Clean data drives 30% higher sales revenue. These five rules keep it that way:

Qualify before CRM entry. Score firmographic fit (industry, size, region), buying intent (page views, content engagement), and channel source before a contact touches your CRM. Garbage in, garbage out.

Automate enrichment on entry. The moment a lead enters your system, enrichment tools should populate fields like revenue range, tech stack, and contact role automatically. Manual data entry is how errors breed.

Schedule quarterly data audits. Delete outdated contacts, merge duplicates, and flag records that haven't been updated in 90+ days. In tech, do this monthly.

Log all communication. Every email, call, and meeting should live in the CRM, not in someone's inbox. When a rep leaves, their relationship history shouldn't leave with them.

Score leads contextually, not just by activity. A CEO who opens one email is worth more than an intern who opens ten. Weight your scoring by role, company fit, and intent signals - not just clicks.

Benchmarks to track: email bounce rate under 2%, records updated within 90 days above 80%, duplicate rate under 5%. AI automation cuts manual data work by 41%, and teams using organized data close deals 23% faster.

For a full SOP, see keep CRM data clean.

Networking Mistakes That Kill Your Professional Relationships

Ivan Misner founded BNI - the world's largest business networking organization - and he's watched thousands of professionals sabotage their own networking efforts. His four don'ts are worth memorizing:

Don't sell on the first meeting. "It never hurts to ask, right?" is completely wrong when networking for the first time. The person you just met doesn't owe you a pitch meeting. They owe you nothing. Build the relationship first. The business follows.

Don't complain. You want to be remembered, but not as the person who spent 20 minutes trashing their last vendor. Negativity is sticky, and not in a good way.

Don't be a sycophant. Generic flattery ("I love your work!") is forgettable. Instead, share a specific story about how their work helped someone. "Your talk at SaaStr last year changed how we think about pricing" lands differently than "you're amazing."

Don't assume they remember you. This one stings, but it's practical. When you follow up, give context on how you know each other. Misner's specific advice: send a photo from the event where you met. It's a small gesture that does the heavy lifting of re-establishing the connection.

The contrarian angle here is that quality crushes quantity. I've seen teams obsess over collecting 500 business cards at a conference and converting zero of them. Five genuine conversations with follow-up within 48 hours will outperform that stack of cards every single time.

Putting It All Together - Your Business Contact Strategy

You need two systems, not one. A CRM for relationships and a data platform for prospecting. They solve different problems, and trying to make one tool do both is how teams end up with messy data and missed opportunities.

The maintenance cadence depends on your industry. Tech companies should audit contact data monthly - the 25-35% annual decay rate means your list is noticeably stale by quarter's end. Manufacturing and government teams can get away with quarterly refreshes.

The central thesis of everything above: data freshness matters more than database size. Your outbound campaigns, your sender reputation, your reps' confidence in the tools - all of it depends on whether the data is current, not whether the database is big.

Look, building and maintaining business contacts isn't glamorous work. But it's the foundation everything else sits on. Get the data right, nurture the relationships, and the pipeline takes care of itself.

FAQ

What is a business contact?

A business contact is any professional connection who can advance your goals - customers, prospects, partners, vendors, referral sources, or industry peers. The term also covers verified data (email, phone, job title) stored in a CRM or database for outreach and relationship management.

How do I find business contacts for free?

Prospeo offers 75 free verified emails per month, Apollo.io has a free tier with built-in outreach tools, and Hunter.io provides 50 free searches monthly - none require a credit card. For relationship-based contacts, referrals, industry events, and online communities remain the highest-ROI channels.

How often should I update my contact list?

At minimum quarterly. B2B contact data decays at 22.5% per year, and 70.8% of records experience at least one change within 12 months. In high-turnover industries like tech, monthly audits keep bounce rates under 2% and protect your sender reputation.

What's the difference between a CRM and a B2B contact database?

A CRM (like HubSpot or Salesforce) manages relationships - tracking interactions, deals, and follow-ups with people you already know. A B2B contact database (like Prospeo or Apollo) helps you discover new prospects with verified emails and phone numbers. Most outbound teams need both working together.

How accurate are B2B contact databases?

Independent testing shows the industry average hovers around 50%, despite most providers marketing "95%+ accuracy." The gap comes down to verification infrastructure and refresh frequency - tools with weekly refresh cycles and proprietary verification deliver dramatically better results than databases that update monthly or less.