Sales Recruiting in 2026: A Repeatable Hiring System (Not "Vibes")

$15k in recruiter fees. Six interviews. Two weeks of "we'll get you feedback soon." Then the hiring manager says, "I'm not sure... something feels off." That's not sales recruiting. That's a slow-motion decision failure, and it costs you the candidate and the quarter.

Real hiring for sales is a measurable funnel with a scoring system. Run it like pipeline: stages, conversion rates, time-in-stage, and a clear "yes/no" bar.

Look, if your process can't explain why you said no, it also can't explain why you said yes.

What you need (quick version)

This is the minimum viable system that stops req churn, forces signal over vibes, and makes your funnel predictable.

Recruiting system checklist (keep it boring on purpose):

- A 30-minute intake with a written definition of done for the role (must-haves, comp, and what "good" looks like in 90 days).

- A 3-stage assessment with time boxes and pass/fail cutoffs (screen -> simulation -> structured interview + references).

- A weighted scorecard with anchored behaviors and a rule for hire/no hire.

- A sourcing plan with explicit inbound vs outbound volume expectations.

- A decision SLA: feedback within 24 hours of every interview.

Implement only 3 things this week:

- Intake: run a 10-point intake agenda (template below) and publish it in your ATS/Doc.

- Mock discovery: add one 15-minute discovery role-play to your loop (hard to fake, easy to score).

- Weighted scorecard with cutoffs: pick 6-8 competencies, weight them, and set a pass line (ex: 70% overall + no "1/5" on coachability).

When you're ready to source proactively (instead of praying inbound works), Prospeo is the execution layer I've used to build targeted candidate lists with verified contact data fast, without turning your deliverability into collateral damage.

What most sales recruiting pages miss (and why hires keep failing)

Most "sales recruiting" pages are either agency directories or generic HR advice. The missing pieces are the ones that actually change outcomes.

- Work sample tests (mock discovery, objection drill, follow-up email) beat "tell me about yourself" every time.

- Structured debriefs beat panel interviews. If feedback isn't tied to a scorecard competency with an example, it's noise.

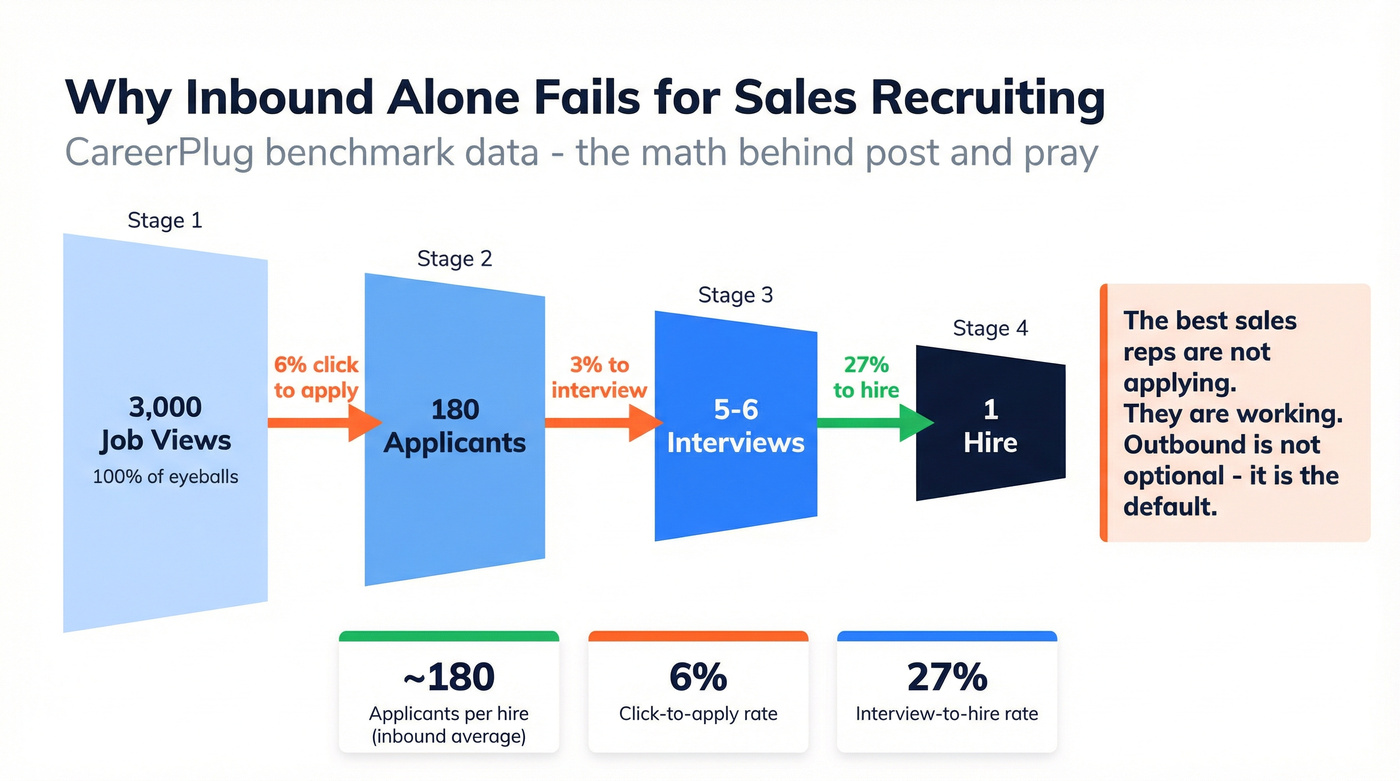

- Funnel math prevents magical thinking. CareerPlug's benchmarks show inbound funnels often land around ~180 applicants per hire, so "post and pray" is a volume game you probably don't want to play.

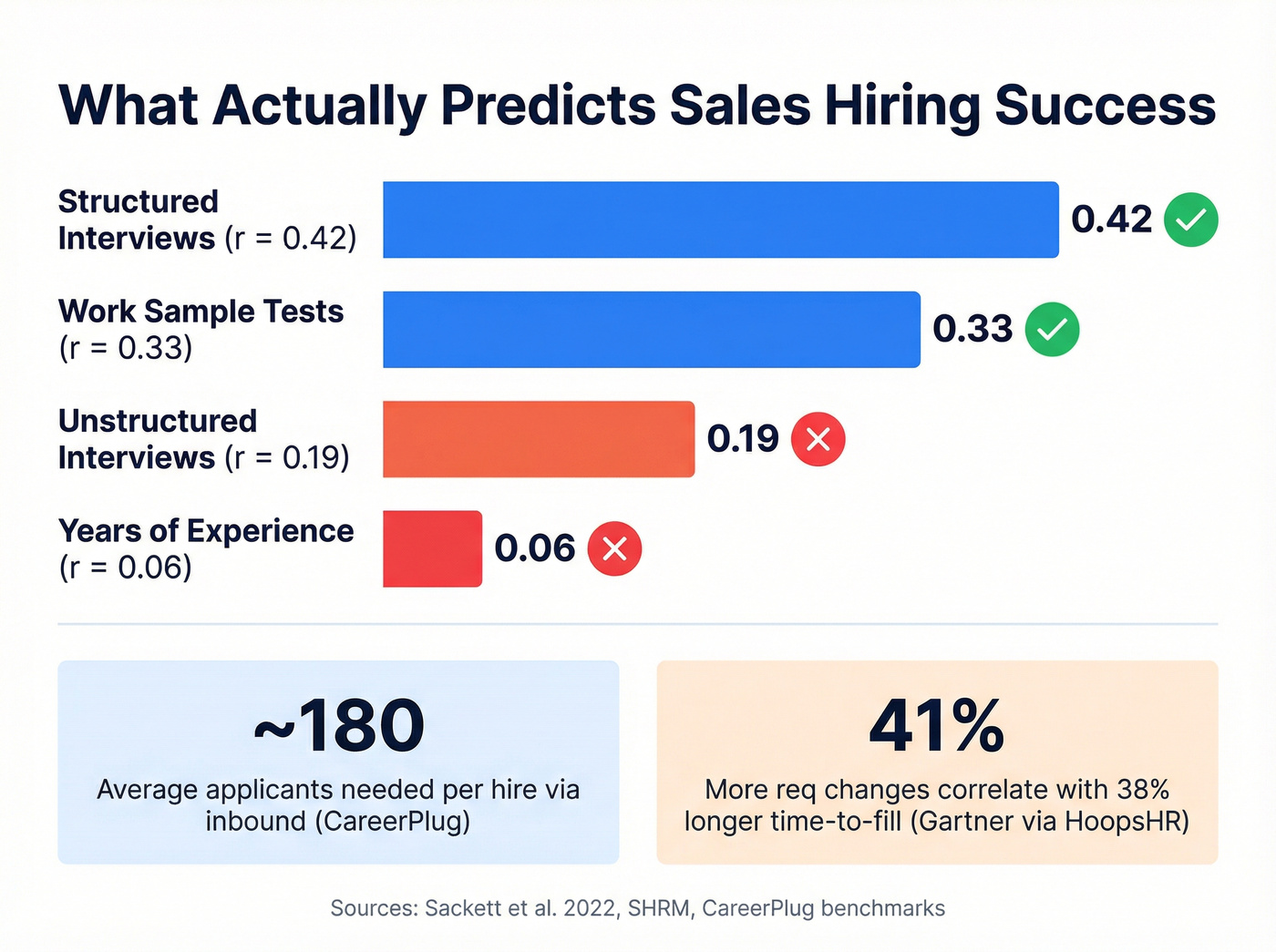

- Structured interviews outperform unstructured: SIOP's summary of Sackett et al. (2022) puts structured interview validity around r ≈ 0.42. Translation: stop adding interviews; add rubrics and work samples.

I've seen teams "fix" hiring by adding rounds, then act surprised when they still miss. More opinions don't create more signal.

What sales recruiting is (and what it isn't)

Here's the contrarian take that works: sales recruiting is a measurable funnel with a scoring system. If you can't tell me your stage conversion rates and your pass thresholds, you're not recruiting - you're auditioning people until someone feels safe.

It is:

- A sourcing engine (inbound + outbound) with expected volume and conversion.

- A consistent assessment that tests the job (discovery, objection handling, writing).

- A scorecard that turns interviews into comparable data.

- A decision cadence that respects candidate time and your own opportunity cost.

It isn't:

- "Let's do 7 interviews so everyone feels included."

- "We'll know when we see it."

- Hiring for "industry experience" as a proxy for actual selling skill.

- Treating quota attainment as truth without verification.

Use this approach if:

- You're hiring SDRs/AEs/managers and you want predictable time-to-fill, including repeatable hiring sales development representatives at scale.

- You've had "great interview, bad in seat" hires and you're done guessing.

- You want hiring managers to stop changing the target mid-search.

Skip this approach if:

- You're only hiring once a year and you're fine with a slow, high-touch process.

- You won't enforce scorecards and cutoffs (because that's the whole point).

If you meant "sales recruiting agency"... read this first

A lot of people searching this term really mean "I need an agency yesterday." Fair. Just don't outsource your standards.

Before you sign anything, demand:

- A written intake doc + scorecard before they source

- Weekly funnel reporting (candidates by stage + rejection reasons)

- Time-to-first-qualified-candidates SLA (7-10 business days is a real bar)

- Replacement terms (30/60/90 days) in writing, and what triggers them

If an agency can't run a scorecarded process with SLAs, you're not buying recruiting. You're buying resume forwarding.

Your sourcing plan says 'outbound candidates' but your team is guessing at email addresses. Prospeo gives you verified contact data for every sales candidate on your target list - 98% email accuracy, 125M+ mobile numbers, and a 7-day refresh cycle so you're never reaching out to someone who left 3 months ago.

Stop losing A-players to slow sourcing. Find their real contact data in seconds.

Kickoff: the intake meeting that prevents req churn

Req churn is the silent killer of sales recruiting: the role changes, comp changes, territory changes, "actually we need someone more senior," and suddenly you're 6 weeks in with nothing to show.

A HoopsHR write-up citing Gartner found that 41% more req changes correlate with 38% longer time-to-fill. That's what misalignment costs you. https://www.hoopshr.com/blog/why-recruiting-requisitions-change-and-how-to-prevent-it

Pre-intake prep (what each person brings)

Do this prep and your intake becomes a decision meeting instead of a brainstorming session.

Hiring manager brings (30 minutes of prep):

- Prior incumbent performance: what separated top vs bottom (activity standards, pipeline coverage, win rate, ramp time)

- The real constraints: territory quality, inbound volume, product gaps, pricing pressure

- 3 "must-win" deals or accounts the new hire will touch (or a sample patch)

Recruiter/TA brings (30 minutes of prep):

- Market reality: comp bands, time-to-hire baseline, and where candidates are coming from

- A draft scorecard (6-8 competencies) and a draft interview loop

- A list of "deal-breakers" you'll screen for in 10 minutes

Sourcer (if you have one) brings (30 minutes of prep):

- A target company list (20-40) and 2 adjacent "talent ponds"

- A first-pass outreach angle (why this role, why now)

- A channel plan: outbound, referrals, communities/events, inbound

10-point intake agenda (copy/paste)

Bring the hiring manager, recruiter, and (if you have one) the sourcer. Keep it to 30-45 minutes. Leave with a written sourcing brief and a scorecard draft.

Business "why" (not a job description) What's the business problem this hire solves in the next 2 quarters?

Selling motion + segment Inbound vs outbound? SMB vs mid-market vs enterprise? Transactional vs multi-stakeholder?

Success definition (90/180 days) What outcomes prove the hire is working? Pipeline created, meetings held, closed-won, renewal risk reduced, etc.

Must-haves vs nice-to-haves Must-haves should be 3-5 items max. Everything else is preference.

Deal context Typical deal size, sales cycle length, stakeholders, procurement, competition.

Territory + book of business reality Greenfield vs existing accounts, named accounts, vertical focus, geo limits.

Comp + constraints Base/OTE range, accelerators, draw, non-compete constraints, start date needs.

Candidate profile calibration Review 3 sample profiles: "yes," "no," and "maybe." Align on why.

Interview loop + decision maker Who interviews, what each stage tests, and who owns the final decision.

Timeline + SLAs Target start date, interview availability, and feedback SLA (24 hours).

Sample profile calibration (3 profiles you should literally bring)

This is the fastest way to kill "moving target" syndrome.

"Yes" profile: the closest thing to your ideal rep in your market (not a fantasy resume). Why it matters: it anchors the team on what "good" looks like.

"No" profile: a common trap (big logo, wrong motion; or great talker, weak operator). Why it matters: it defines disqualifiers early.

"Maybe" profile: the tradeoff candidate (less domain experience but strong outbound; or strong discovery but weaker closing). Why it matters: it forces the hiring manager to pick what they'll actually train, and it's often where non-traditional SDR candidates show up as high-upside bets.

Definition of done (for the role)

Write this down. If you can't, you're not ready to open the req.

Role definition of done (template):

- Title/level:

- Segment/motion:

- Top 3 outcomes (first 90 days):

- Top 5 competencies (weighted):

- Non-negotiables (ex: outbound comfort, CRM discipline):

- Disqualifiers (ex: won't do role-play, can't explain pipeline math):

- Comp range:

- Start date target:

- Interview stages + owners:

- Decision rule (score threshold + veto rules):

I've watched teams cut time-to-fill just by forcing this doc to exist before sourcing starts. It's boring. It works.

Who owns what: sourcer vs recruiter vs TA vs hiring manager

Sales recruiting breaks when everyone thinks they "own hiring," but nobody owns the funnel.

The clean split:

- Sourcer owns top-of-funnel (targeting + outreach volume)

- Recruiter owns mid/bottom (screens, process, closing)

- Hiring manager owns decision quality and speed (scorecards + SLAs)

Most companies aren't running massive TA orgs. 55% of companies employ in-house recruiters, and capacity often lands around 20-60 reqs/year per in-house recruiter. If you're above that, you'll slow down or cut corners.

Ownership model (practical version)

| Workstream | Sourcer | Recruiter | TA lead | Hiring mgr |

|---|---|---|---|---|

| Target list + outreach | Own | Support | Set bar | Calibrate |

| Screen + schedule | Support | Own | Unblock | Show up |

| Assess + scorecards | Support | Own | Standardize | Own |

| Offer process | - | Own | Approve | Own |

| Feedback SLA | - | Enforce | Escalate | Own |

| Close + handoff | - | Own | Improve | Own |

Two rules that fix most dysfunction:

- If the hiring manager can't return feedback in 24 hours, reduce interviewers. Don't add one more round.

- If the recruiter can't get a clear scorecard, don't open the req. You're about to waste everyone's time.

Sales recruiting sourcing strategy (inbound is randomness)

Inbound applicants are a lottery ticket. Sometimes you win. Most of the time you get volume without fit.

CareerPlug's funnel benchmarks make the problem obvious: 6% click-to-apply, 3% applicant->interview, 27% interview->hire, and ~180 applicants per hire. That's not "hiring is hard." That's "inbound is inefficient by default."

Sales roles skew even harder because the best reps aren't applying. They're working. Outbound becomes the default if you want quality and speed.

Here's the thing: if you're hiring for outbound, and you're not willing to do outbound to hire, you're already behind.

Hot take (and it'll save you money)

If you're selling a lower-priced product with a short cycle, you don't need a "celebrity" enterprise rep with a perfect logo list. You need someone who can run high-activity outbound, follow a process, and learn fast. Over-hiring pedigree is one of the most expensive mistakes in sales recruiting.

Step-by-step sourcing workflow (built off your scorecard)

Step 1: Translate the scorecard into filters Don't start with "5+ years SaaS." Start with signals that map to performance:

- Sold into your segment (or adjacent) with similar deal complexity

- Evidence of outbound motion (SDR/AE who can self-source)

- Tenure patterns that make sense (context matters; patterns still matter)

- Manager references you can actually reach

- Writing clarity (their public footprint is enough to spot this)

Step 2: Pick 2-3 channels and commit for 2 weeks Most teams "try everything" and learn nothing. Pick channels you can measure.

Step 3: Build a weekly sourcing cadence

Example:

- Mon: build list + first-touch

- Tue: first-touch + referrals push

- Wed: follow-ups + new adds

- Thu: call block + warm intros

- Fri: metric review + targeting tweaks

Step 4: Track a sourcing funnel, not just "responses"

At minimum:

- Prospects added

- Messages sent

- Replies

- Screens booked

- Stage 2 pass rate

- Offers

- Accepts

Channel matrix (what works for sales roles)

| Channel | Best for | Speed | Cost | Predict. |

|---|---|---|---|---|

| Inbound posts | Volume | Med | Low | Low |

| Referrals | Quality | Med | Low | Med |

| Outbound | Quality+speed | High | Med | High |

| Events/comms | Niche | Low | Low | Low |

| Agencies | Speed | High | High | Med |

If you're hiring SDRs or outbound AEs, outbound sourcing should be your default, not your backup plan. You're hiring people whose job is outbound, so your recruiting motion should match the job.

Outbound outreach templates (copy/paste)

These are built for sales candidates: direct, specific, and respectful of time.

Template 1: SDR / outbound AE (short + punchy)

Subject: Quick question about your outbound motion

Body: Hi {{FirstName}} - I'm hiring for a {{Role}} selling into {{Segment}}.

What caught my eye: {{SpecificSignal}} (ex: outbound-heavy role, tenure, segment match). This role is {{Inbound/Outbound mix}}, typical deal is {{DealSize}} with a {{SalesCycle}} cycle. Open to a 12-minute chat this week? If not, reply "later" and I'll follow up next month.

Template 2: "You're not actively looking" angle

Subject: Not sure timing is right

Body: {{FirstName}}, you're probably not job hunting. That's fine. I'm building a small slate for a {{Role}} and I'm only talking to people who can run discovery and follow a process. If you're open, I'll share comp range + territory reality up front. 12 minutes, no prep.

Template 3: Follow-up (value + frictionless)

Subject: Worth a quick screen?

Body: Two details so you can decide fast:

- Comp: {{Base}} / {{OTE}}

- Assessment: 3 stages, capped at ~2.5 hours total (screen -> mock discovery -> structured + refs) Want me to send the role scorecard so you can self-qualify?

Follow-up cadence that works (and doesn't annoy people):

- Day 0: first-touch

- Day 2: follow-up + one new detail (territory, comp, product angle)

- Day 5: "close the loop" message (ask for a no)

- Day 10: final touch + referral ask ("who's the best outbound rep you know?")

Prospeo workflow: turn your scorecard into a verified outbound list

When you're doing outbound recruiting, bad contact data is a tax: bounces hurt deliverability, wrong numbers waste hours, and your team starts blaming "the market" for a problem that's really just data quality.

Prospeo ("The B2B data platform built for accuracy") gives you 300M+ professional profiles, 143M+ verified emails, 98% verified email accuracy, and 125M+ verified mobile numbers, all refreshed on a 7-day cycle (the industry norm is closer to 6 weeks). It's self-serve, no contracts, and built for teams that want to move fast without begging a vendor for access.

Useful pages: https://prospeo.io/b2b-leads-database and https://prospeo.io/email-finder

A practical workflow:

- Build your candidate universe using 30+ filters (role, seniority, location, company size, job changes, headcount growth, technographics).

- Export only verified emails/mobiles, or run real-time verification before outreach.

- Push into your sequencer and run a tight 2-week sprint.

- Feed results back into the scorecard: which backgrounds actually pass Stage 2?

What you should be seeing in the UI (so the screenshot below actually helps):

- A left-side filters panel where you stack role + seniority + geo + company size

- A "verified only" behavior (so you're not exporting guessy data)

- Verification badges on each record (email/mobile status)

- An export modal where you choose fields and confirm credit usage

If you want a demo-style walkthrough, embed a short "list building + verification" clip from Prospeo's library.

The 3-stage sales hiring assessment (copy/paste)

Stop doing 6-8 interviews. It doesn't make you thorough. It makes you inconsistent.

Here's a real scenario I've watched play out: a candidate nails five conversational interviews because they're charismatic, then faceplants in week two because they can't run discovery without a script, they avoid uncomfortable questions, and they never send a clean recap email - and nobody caught it because nobody tested the job.

This 3-stage structure (adapted from Evalufy's framework) is tight, fast, and hard to game. It also forces you to define what "good" means.

Stage 1: Smart Screen (20-30 minutes)

Goal: eliminate obvious mismatches quickly without burning interviewer time.

Components (time-boxed):

- Aptitude mini-test (8-10 min): basic reasoning + simple math + prioritization

- Micro-scenarios (5-7 min): "What would you do if..." tied to your motion

- Writing check (5 min): short prompt, clear answer

- Values pulse (2-3 min): alignment with how your team sells (not "culture fit")

Scoring weights (100 points total):

- Aptitude + micro-scenarios: 50%

- Writing: 30%

- Values pulse: 20%

Pass threshold: 75%+ If they can't clear this bar, they won't magically become great in a role-play.

Stage 2: Simulation (40-60 minutes)

Goal: test the job. This is where you catch the "great talker, weak operator" profile.

Components:

- Discovery role-play (15 min) Give them a basic prompt: persona, company context, one pain hint. Score for call control, curiosity, and next steps.

- Objection drill (10 min) Pick 3 objections you actually hear. Score structure and diagnosis, not bravado.

- Follow-up email (10-15 min) "Write the recap + next steps." This predicts real performance more than people want to admit.

- Optional commercial judgment (10 min) For AE/closing roles: discount ask, procurement stall, multi-year tradeoff.

Rubric weights (100 points total):

- Discovery depth: 30%

- Objection handling: 25%

- Written communication: 25%

- Commercial judgment: 20%

Pass threshold: 70%+, plus a hard rule: they must be solid on discovery and objections.

What "good" looks like in discovery (use common entities so interviewers stay concrete):

- MEDDICC/MEDPICC-style clarity on pain, metrics, decision process, and next steps

- SPICED-style situation + impact + critical event (even if they don't name it)

- Clean qualification logic (BANT is fine for SDR; don't worship it for enterprise)

Quota stories are easy to inflate. Work samples are harder to fake. https://www.reddit.com/r/sales/comments/1h6j7wq/what_are_your_best_sales_interview_questions/

Stage 3: Structured interview + references (30-45 minutes)

Goal: verify patterns and reduce risk.

Structured interview rules:

- Ask the same core questions for every candidate at that level.

- Tie every question to a competency on the scorecard.

- Score immediately in your ATS (or scorecard doc) while the evidence is fresh.

Reference checks (structured prompts):

- "What did they do when pipeline was behind?"

- "How coachable were they, specifically?"

- "Would you rehire them for the same role? Why or why not?"

- "What environment did they struggle in?"

Decision rule: If they pass Stage 1 and Stage 2 but fail references on coachability or integrity, it's a no. Sales is too expensive to gamble on character.

Scoring table (copy/paste)

| Stage | Time | Test | Pass line |

|---|---|---|---|

| 1 | 20-30m | Screen | 75% |

| 2 | 40-60m | Sim | 70% |

| 3 | 30-45m | Struct.+refs | Must pass |

Scorecards that actually predict quota (SDR + Sales Manager)

Scorecards are where sales recruiting falls apart. People build them, then ignore them the moment a charismatic candidate shows up.

A good scorecard has:

- 6-8 competencies max

- weights that reflect the job

- anchored behaviors (what a 2 vs 4 looks like)

- cutoffs (what fails automatically)

SDR scorecard (weights you can steal)

SDR competencies + weights (100% total):

- Outbound prospecting: 20%

- Qualification/discovery: 20%

- Messaging/cadence: 15%

- Objection handling/conversion: 15%

- CRM/data hygiene: 10%

- Collaboration/coaching: 10%

- Metrics/time management: 10%

These weights map cleanly to what shows up in seat: activity tolerance, learning speed, and the ability to run a repeatable cadence without supervision.

Scoring rules that keep you honest:

- Score 1-5 with anchored behaviors (write them once, reuse forever).

- Require a minimum overall score (ex: 3.7/5 weighted).

- Require at least two "4+" signals for senior SDR (ex: prospecting + discovery).

Sales manager scorecard: question categories + red flags

Sales manager interviews get derailed by "leadership philosophy" talk. You need operational proof.

Use categories like these:

- Operating system: forecasting cadence, pipeline inspection, deal reviews, CRM expectations

- Coaching: how they diagnose skill gaps, run 1:1s, and coach to behaviors

- Hiring + performance management: how they set bars, run scorecards, handle underperformance

- Territory + capacity planning: coverage model, account segmentation, activity standards

- Cross-functional leadership: marketing alignment, product feedback loops, RevOps partnership

Red flags I don't ignore:

- "My team just needs to be hungry" with no operating system behind it

- Can't explain how they improved forecast accuracy or pipeline quality

- Blames reps for everything; never mentions enablement, process, or segmentation

- No examples of coaching someone from "okay" to "great"

- Treats CRM hygiene as "admin work" (that's how you get fantasy forecasts)

Why this works: structured beats "vibes"

Structured interviews win because they reduce noise. You're comparing candidates on the same competencies, under similar conditions, with a rubric that forces specificity.

SIOP's summary of Sackett et al. (2022) puts a number on it: structured interviews show mean operational validity around r ≈ 0.42. Translation: structured interviews are one of the highest-ROI changes you can make in hiring because they replace confidence theater with repeatable evidence, and they do it without adding headcount or dragging candidates through a month of scheduling chaos.

It's also absurd we wing it on $200k hires. You'd never approve a $200k software purchase based on "I liked the demo." But teams do that with salespeople every week.

Callout: the "no vibes" rule If feedback can't be tied to a scorecard competency with an example, it doesn't count. "Not a fit" isn't feedback. It's avoidance.

One behavior change that upgrades your whole process: every interviewer submits the scorecard within 30 minutes. No exceptions.

For the evidence-minded, SIOP's write-up is a good starting point: https://www.siop.org/tip-article/is-cognitive-ability-the-best-predictor-of-job-performance-new-research-says-its-time-to-think-again/

Sales recruiting benchmarks + funnel math (plan your speed and volume)

Benchmarks won't run your process, but they'll stop you from lying to yourself.

SmartRecruiters' US benchmarks (from a dataset of ~90M applications across 1.5M jobs) are a clean baseline:

- 74 applications per opening

- Median time-to-hire: 35 days

- ~20% offer declines

CareerPlug's funnel math is the other side of the coin: if you rely on inbound, plan for ~180 applicants per hire.

Benchmark table (use for planning)

| Metric | Benchmark |

|---|---|

| Apps/opening | 74 |

| Time-to-hire | 35 days |

| Offer declines | ~20% |

| Applicants/hire | ~180 |

Links: https://www.smartrecruiters.com/resources/article/united-states-benchmark-recruiting-metrics/ https://www.careerplug.com/recruiting-metrics-and-kpis/

Simple funnel calculator (the version you'll actually use)

Use these formulas to plan volume and interviewer time:

- Offers needed = Target hires ÷ (1 - offer decline rate)

- Interviews needed = Offers needed ÷ (interview->hire rate)

- Applicants needed (inbound) = Target hires × applicants per hire

Example assumptions from CareerPlug: interview->hire = 27%, offer declines = 20%, applicants per hire = 180.

Worked example: "We need 2 hires" (clean math)

Goal: 2 accepted offers.

- Offers needed = 2 ÷ (1 - 0.20) = 2 ÷ 0.80 = 2.5 -> round up to 3 offers

- Interviews needed = 3 ÷ 0.27 = 11.1 -> round up to 12 interviews

- Applicants needed (inbound) = 2 × 180 = 360 applicants

That's why inbound-only recruiting feels like drowning: it's a volume engine with low signal. Outbound lets you trade volume for targeting.

Decision SLA rules (steal these):

- Interview feedback due in 24 hours

- Final decision within 48 hours of last interview

- Offer out within 24 hours of decision

- If you can't meet this, cut interviewers, not urgency

You just built a 40-company target list and identified your talent ponds. Now you need direct-dial numbers and verified emails to actually reach those top performers before your competitors do. Prospeo's Chrome extension lets you pull verified contact data from any profile in one click - 40,000+ recruiters and sales pros already use it.

Reach candidates directly at $0.01 per email. No recruiter fees required.

KPI dashboard for sales recruiting (definitions + formulas)

If you want sales recruiting to behave like pipeline, you need a dashboard that doesn't lie.

Here's the KPI set I'd put on one page (weekly review, 20 minutes):

Funnel health KPIs (top -> bottom)

Prospects added (weekly) Count of new outbound targets added to your ATS/CRM list.

Reply rate = Replies ÷ Messages sent If this is low, your targeting or message is off.

Screen rate = Screens booked ÷ Replies If this is low, your pitch/comp/timing is off.

Stage conversion (per stage) = Candidates who pass stage ÷ Candidates who enter stage Track Stage 1->2 and Stage 2->3 separately. Stage 2 pass rate is your bar realism indicator.

Onsite/loop-to-offer rate = Offers ÷ Final loops If this is low, your loop is miscalibrated or interviewers aren't using the scorecard.

Offer acceptance rate = Accepts ÷ Offers If this is low, fix comp, speed, and closing. Don't blame candidate quality.

Speed KPIs (the ones that actually lose candidates)

Time-in-stage (median) Median days a candidate sits in each stage. This is where processes die.

Scheduling lag = Interview requested date -> interview held date This is the easiest place to win back days.

Feedback SLA compliance = Interviews with feedback <24h ÷ Total interviews Treat this like a sales SLA. If it drops, escalate.

Quality KPIs (lagging, but essential)

- 90-day ramp hit rate = New hires meeting 90-day outcomes ÷ Total new hires

- Quality of hire (simple) = (Manager rating + quota proxy + retention) normalized to 100 Keep it simple. The point is trendlines, not perfection.

What sales recruiting costs (in-house vs agency) + what to demand

Agency fees aren't "too expensive" when you're staring at an empty territory and a missed number. They're expensive when you pay them and still run a sloppy process.

In-house recruiting cost model (simple and honest)

Internal recruiting isn't free. It's salary, overhead, tools, and time.

Back-of-napkin model:

- Recruiter fully loaded cost (salary + benefits + overhead): $140k-$220k/year (varies by market/seniority)

- Tools (ATS seat, sourcing tools, scheduling, assessments): $8k-$25k/year

- Total annual cost: $148k-$245k/year

Now divide by hires supported:

- If one recruiter supports 20 hires/year -> $7.4k-$12.3k per hire

- If one recruiter supports 40 hires/year -> $3.7k-$6.1k per hire

- If one recruiter supports 60 hires/year -> $2.5k-$4.1k per hire

Cost models (ranges you can budget)

| Model | Typical price | Best for | Guarantee |

|---|---|---|---|

| Contingency | 15-25% | Speed hires | 30-90d |

| Retained | 25-40% | Exec/VP+ | 30-90d |

| Flat fee | $5k-$30k | Repeat roles | 30-90d |

| Hourly | $75-$250/hr | Surge help | Limited |

| Subscr. | $650-$3,200/mo + 10-15% | Ongoing | Varies |

| Contract/temp | 1.5-2.0× markup | Backfill | N/A |

Notes:

- Subscription is often quoted in the UK as £500-£2,500/mo; the USD range above is a practical conversion for planning.

- Contract/temp markups vary by role and region; use it when you need coverage now and can't wait for a full-time hire.

Concrete example (contingency): $120k base / $200k OTE -> fee lands around $18k-$30k (15-25% of first-year comp, depending on contract terms).

What to demand from an agency (negotiation checklist)

Agencies love to promise outcomes. Good. Turn those promises into reporting and SLAs.

SLAs to ask for (make them commit):

- Time to first qualified candidates (within 7-10 business days)

- Qualified candidates per week

- Outreach volume and reply rates

- Interview-to-offer and offer-to-accept rates

- Replacement terms (30/60/90 days) and what triggers them

Process artifacts you should require:

- A written intake doc + scorecard before outreach starts

- Weekly pipeline report (candidates by stage + reasons for rejection)

- Calibration after first 5 screens (tighten targeting fast)

If they can't run scorecards and funnel reporting, you're not buying recruiting. You're buying a resume forwarding service.

Example market sidebar: Los Angeles SDR comp (how to sanity-check your offer)

Comp is part of hiring whether we like it or not. If your offer is off-market, you'll feel it as "candidate quality" problems and offer declines, not as a neat spreadsheet issue.

For Los Angeles SDRs, RepVue's market data (updated 02/16/2026) is a strong anchor:

- Median base: $60,000

- Median OTE: $80,000

- Quota attainment: 46.4% (last 12 months)

PayScale gives you a second angle on base pay in LA:

- Average base: $51,716

- 10th-90th base range: $45k-$62k PayScale's dataset is smaller and last updated May 2026, so use it as a floor/second anchor, not the primary benchmark.

Sanity-check links: https://www.repvue.com/salaries/sales-development-representative/los-angeles-anaheim-ca https://www.payscale.com/research/US/Job=Sales_Development_Representative_(SDR)/Salary/6ab0dcb7/Los-Angeles-CA

One practical takeaway: that 46.4% quota attainment number is your reminder to ask better questions. Lots of SDR orgs have broken territories, weak enablement, or unrealistic targets. Don't punish candidates for your market's math. Verify context.

FAQ

What's a good time-to-hire target for sales roles in 2026?

A good time-to-hire target for sales roles in 2026 is 30-45 days end-to-end, with 35 days as a realistic median benchmark. You hit the low end when intake is tight, interview stages are capped at three, and feedback SLAs are enforced.

How many interview stages should a sales hiring process have?

A strong sales hiring process should have three stages: a 20-30 minute screen, a 40-60 minute simulation (mock discovery + objections + writing), and a 30-45 minute structured interview plus references. More than three stages usually adds opinions, not signal.

How do you verify quota attainment and pipeline claims in interviews?

Verify quota attainment by asking for specific numbers and context (quota, attainment %, ramp period, territory, inbound/outbound mix), then cross-check consistency during a mock discovery and reference calls. If their story changes across stages, treat it as a risk signal and don't explain it away.

Should we use an agency (contingency/retained) or hire in-house first?

Use in-house first when you'll hire repeatedly and can support a consistent process; one recruiter can handle 20-60 reqs/year with a tight system. Use an agency when speed matters, you lack sourcing capacity, or you're hiring niche leadership, then demand scorecards, SLAs, and weekly funnel reporting.

What tool helps build outbound candidate lists with verified contact data?

Prospeo helps build outbound candidate lists with verified contact data by combining a B2B database with real-time email/mobile verification, 98% verified email accuracy, and a 7-day refresh cycle. The free tier includes 75 emails + 100 Chrome extension credits/month, which is enough to run a real sourcing sprint.

Summary: make sales recruiting boring, fast, and measurable

If you want sales recruiting to stop feeling like chaos, treat it like pipeline: lock the intake doc, cap the loop at three stages, score everything against a weighted rubric, and enforce a 24-hour feedback SLA.

Do that and the whole thing gets calmer.

And you stop paying for "vibes" with real money.