Is ZoomInfo Accurate? A Data-Backed Breakdown for 2026

You just exported 500 contacts from ZoomInfo, loaded them into Outreach, and hit send. By morning, 150 have bounced. That's a 30% bounce rate on a tool your company's paying $30,000 a year for. Your domain reputation just took a hit, your sequences are wrecked, and your SDR manager is asking what happened.

You're not alone. One Reddit user reported a 50.7% bounce rate on their first ZoomInfo-sourced campaign - and noted that two to three years ago, the same tool delivered under 20% bounces.

So is ZoomInfo accurate? The answer depends entirely on what you're measuring. And the gap between the 95% accuracy guarantee and real-world performance is where deals die.

The Short Version

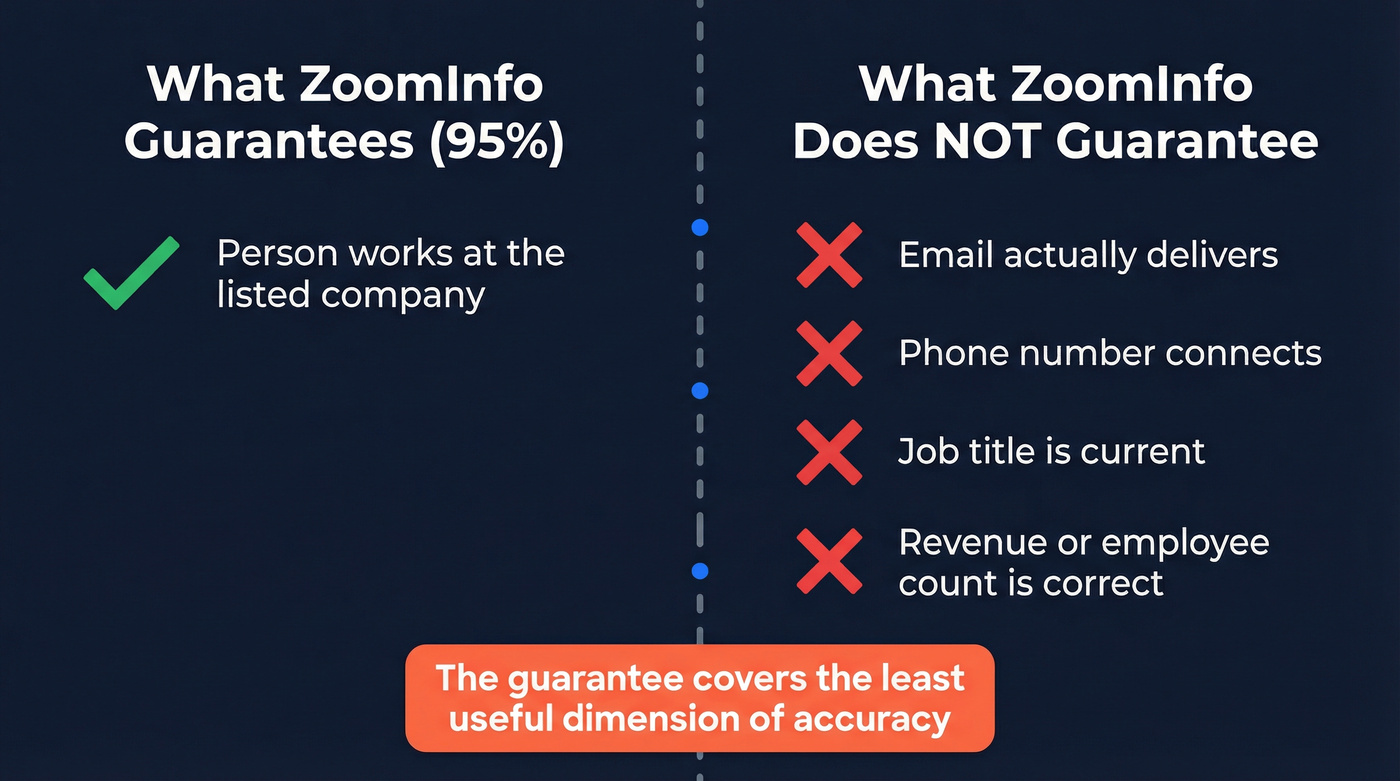

- ZoomInfo's 95% accuracy guarantee only covers company affiliation - whether a person works at the listed company. It says nothing about email deliverability, phone accuracy, or job titles.

- Real-world email accuracy runs 75-85%. A 15-25% bounce rate is normal, not an outlier.

- Accuracy is strongest for US mid-market and enterprise companies. It drops sharply for European targets, SMBs, and startups under two years old.

- Phone numbers are ZoomInfo's genuine strength in North America. International numbers? Different story entirely.

- If you're keeping ZoomInfo, filter by confidence score and run secondary verification on every single export. No exceptions.

What ZoomInfo's 95% Accuracy Guarantee Actually Covers

Let's read the fine print, because almost nobody does.

ZoomInfo's legal terms define "accuracy" as whether a person is employed by (or similarly affiliated with) the specified company. That's it. The 95% guarantee means that at least 95 out of 100 contacts will have the correct name-to-company match.

It doesn't cover:

- Whether the email address actually works

- Whether the phone number connects

- Whether the job title is current

- Whether the revenue or employee count is correct

If more than 5% of contacts fail the company-affiliation test, ZoomInfo gets 30 days to fix it. If they can't, you can terminate and get a prorated refund. That's the entire guarantee.

So when a sales leader tells their CFO "ZoomInfo guarantees 95% accuracy," they're technically right - but they're describing something far narrower than what anyone assumes. The guarantee covers the least useful dimension of accuracy. Nobody's campaign fails because a contact was matched to the wrong company. Campaigns fail because the email bounces, the phone is disconnected, or the person left that role six months ago.

What ZoomInfo Actually Costs

ZoomInfo doesn't publish pricing, which tells you something.

Based on community data and contract disclosures: the Professional tier starts at roughly $15K/year with 5,000 credits and a 3-seat minimum. Advanced runs around $25K/year with 10,000 credits. Enterprise pushes $40K+ with 15,000 credits. Vendr reports a median contract value of $54K. There's also a free Lite tier with 10-25 monthly credits - enough to test data quality on your specific ICP before committing.

At those prices, "better than average" isn't the bar most teams expect to clear.

Real-World ZoomInfo Accuracy by Data Type

Email Accuracy (75-85%)

ZoomInfo's email accuracy generally runs 75-85%, meaning you should expect a 15-25% bounce rate on any given export. The 50.7% bounce rate from Reddit is a worst case - likely someone who didn't filter by confidence score and targeted a tough segment - but it's not fabricated.

ZoomInfo acquired NeverBounce technology in 2019 and runs a 20+ step proprietary cleaning process that checks each email up to 75 times. That sounds impressive until you learn that standard SMTP verification can only validate about 50% of business domains. Security services like Mimecast, Barracuda, and Proofpoint block verification attempts entirely.

To compensate, ZoomInfo uses proprietary send-and-bounce data and sends research surveys to 90,000+ contacts daily, passively validating addresses in the process. Their machine learning models evaluate hundreds of signals to predict whether an email is valid.

The problem is decay. B2B email data degrades at roughly 2-3% per month - nearly 30% per year. ZoomInfo refreshes many records on 6-12 month cycles. By the time you export a list, a meaningful chunk of those "verified" emails have already gone stale.

Here's the thing: 75-85% deliverability isn't terrible for the industry. Most B2B data providers deliver around 50% accuracy on average. But when you're paying $15-54K per year, you deserve better math.

Phone Number Accuracy (40-60% US Connect Rate)

Phone numbers are genuinely ZoomInfo's stronghold. The database includes 70M+ direct dials, and for North American contacts at mid-market and enterprise companies, you can expect a 40-60% connect rate on mobile numbers.

"Connect rate" and "accuracy" aren't the same thing, though. A number can be accurate (it belongs to the right person) but still not connect (they don't answer unknown numbers, the line is busy, they've switched carriers). The 40-60% range reflects real-world dialing outcomes, not just database correctness.

International numbers are a different story. Users targeting Europe and APAC report connect rates dropping to 20-35%. ZoomInfo added 1.8 million international mobile numbers across the UK, France, Germany, Italy, Spain, and the Netherlands in 2025, but the gap with US coverage remains significant.

Revenue and Firmographic Data (~50% for SMBs)

This is where ZoomInfo's data gets genuinely unreliable, and it doesn't get enough attention.

A deal sourcing intermediary on SearchFunder reported that revenue accuracy was "about 50% for us looking at companies in the lower middle-market." When they combined accurate revenue + accurate contact info + correct industry + no company name confusion, the hit rate dropped to roughly 50%. The anecdote that sticks: a team member called a roofer thinking they had $40M in revenue, only to discover it was a solopreneur doing $150K a year. That's not a rounding error. That's a data hallucination.

A searcher from Queen's University put it bluntly: "None of these companies are really good at it. Even a premium brand like D&B has to model out sales and employee numbers based on a really small sample size."

Job Title Accuracy (80-90%, Decaying)

Job titles start accurate and decay fast.

It's common to export a list where 10-20% of contacts have already changed roles by the time you hit send. With 30% annual data decay across the industry and ZoomInfo refreshing on 6-12 month cycles, the math doesn't work in your favor.

"Outdated Contacts" appears in 198 separate G2 reviews - making it one of the top five complaints across nearly 9,000 reviews. Users consistently describe reaching out to people who left the company months ago, or who've been promoted out of the role they were targeting.

ZoomInfo Accuracy Scorecard

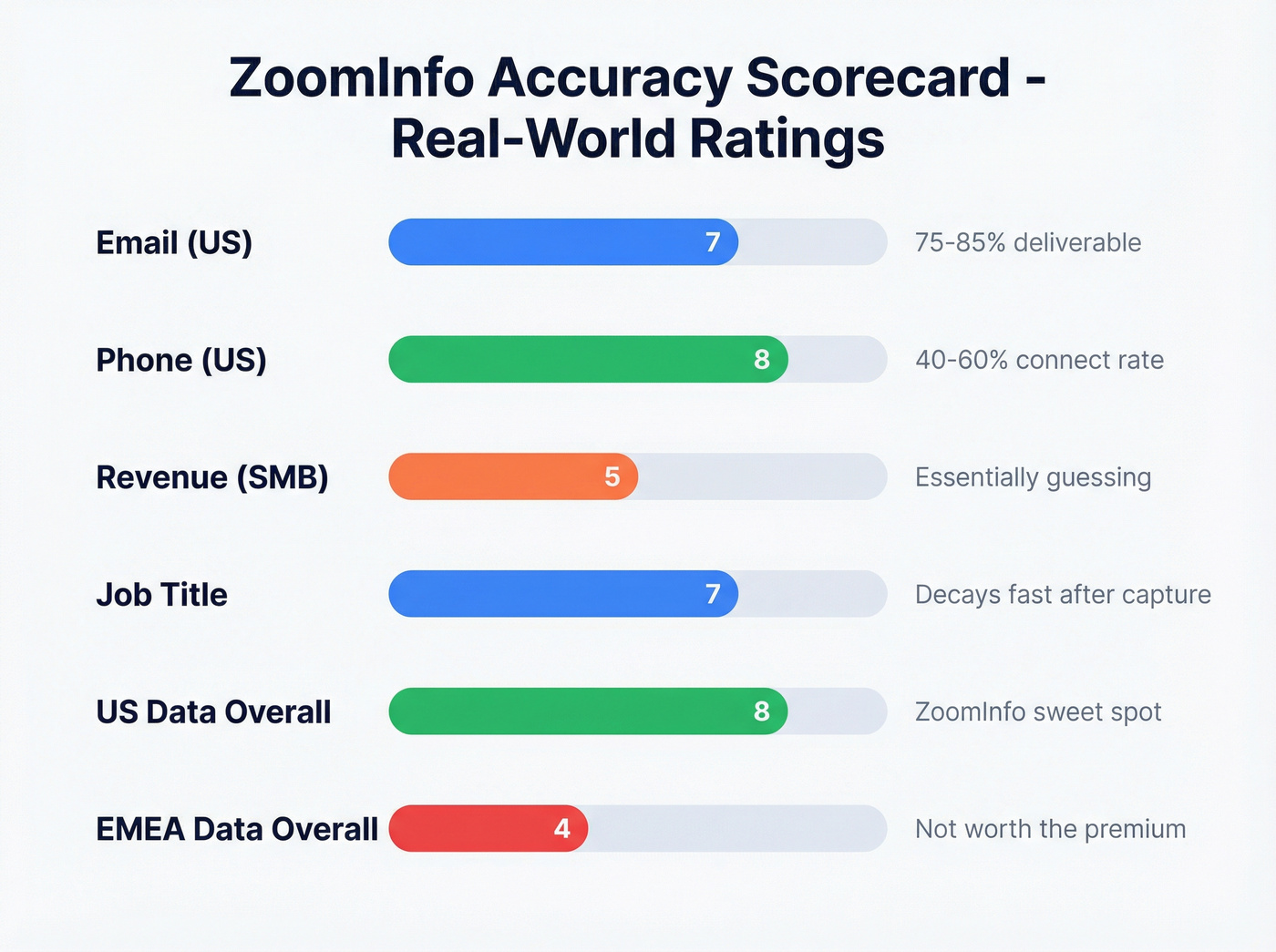

| Data Type | Rating | Notes |

|---|---|---|

| Email (US) | 7/10 | 75-85% deliverable |

| Phone (US) | 8/10 | 40-60% connect rate |

| Revenue (SMB) | 5/10 | Essentially guessing |

| Job Title | 7/10 | Accurate at capture, decays fast |

| US Data Overall | 8/10 | ZoomInfo's sweet spot |

| EMEA Data Overall | 4/10 | Not worth the premium |

You just read that ZoomInfo's real-world email accuracy runs 75-85%. Prospeo hits 98% - verified through a 5-step process with proprietary infrastructure, not recycled third-party data. Our 7-day refresh cycle means you're never sending to contacts who left six months ago.

Stop paying $30K/year for 25% bounce rates.

How Data Quality Varies by Geography and Company Size

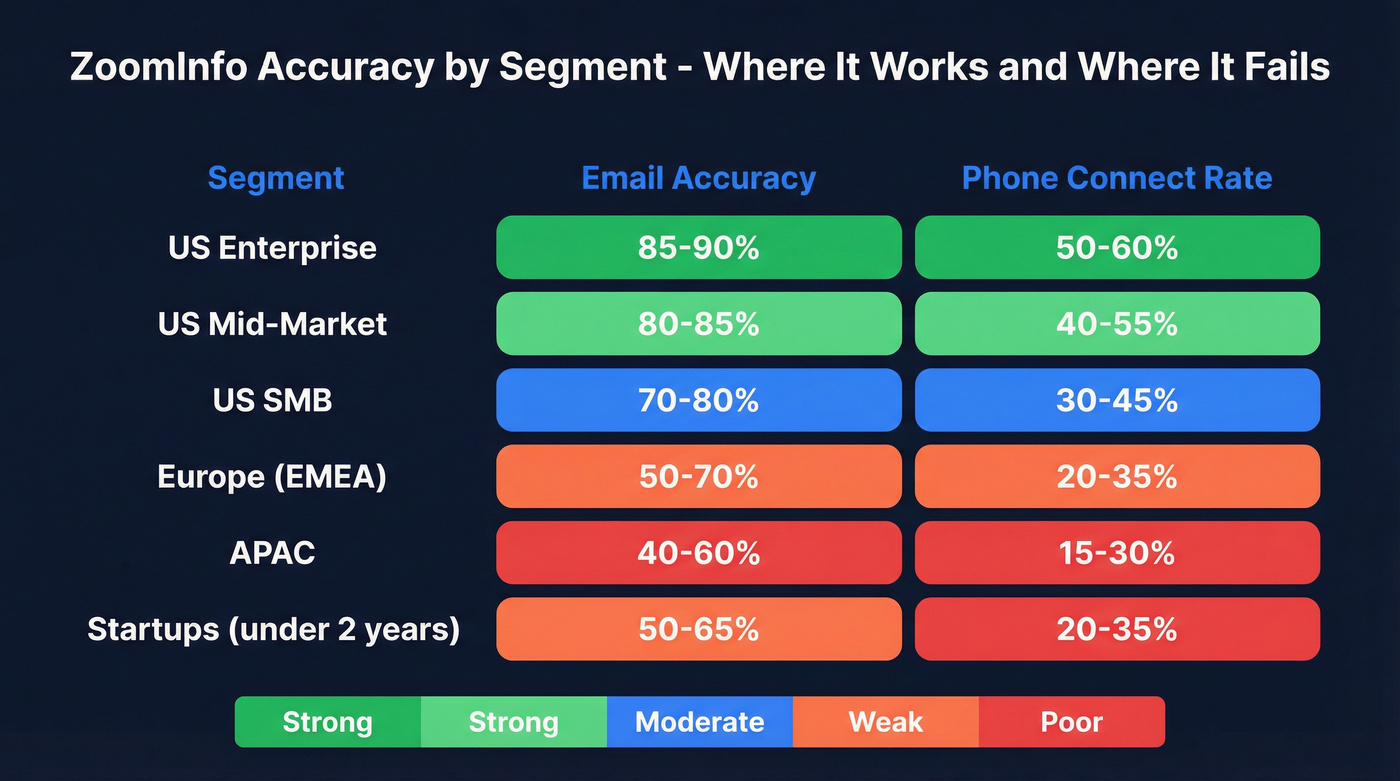

ZoomInfo's accuracy isn't one number. It varies dramatically based on where your prospects are and how big their companies are.

| Segment | Email Accuracy | Phone Connect | Notes |

|---|---|---|---|

| US Enterprise | ~85-90% | 50-60% | ZoomInfo's sweet spot |

| US Mid-Market | ~80-85% | 40-55% | Strong, but decay hits |

| US SMB | ~70-80% | 30-45% | Fewer public signals |

| Europe (EMEA) | ~50-70% | 20-35% | Data Passport add-on |

| APAC | ~40-60% | 15-30% | Weakest coverage |

| Startups (<2 yrs) | ~50-65% | 20-35% | Minimal data signals |

About 50% of ZoomInfo's database is North American contacts. If you're selling into the US mid-market and enterprise, the data is genuinely good - not perfect, but good enough to build a motion around.

Europe is a different story. Users targeting EMEA report bounce rates from 20-50%. One reviewer called ZoomInfo "extremely US-centric" with "the worst accuracy in Europe." ZoomInfo charges extra for European data through a "Data Passport" add-on, which feels like paying a premium for a problem they haven't solved.

A Cognism customer put it directly: "With ZoomInfo, the data quality in Europe isn't what we would need." That's not a competitor taking shots - it's a real buyer explaining why they switched.

For startups under two years old, accuracy drops across the board. These companies have minimal digital footprints, few public filings, and employees who change roles frequently. ZoomInfo's web crawlers and AI models simply don't have enough signal to work with.

How ZoomInfo Gets Its Data (And Why Accuracy Varies)

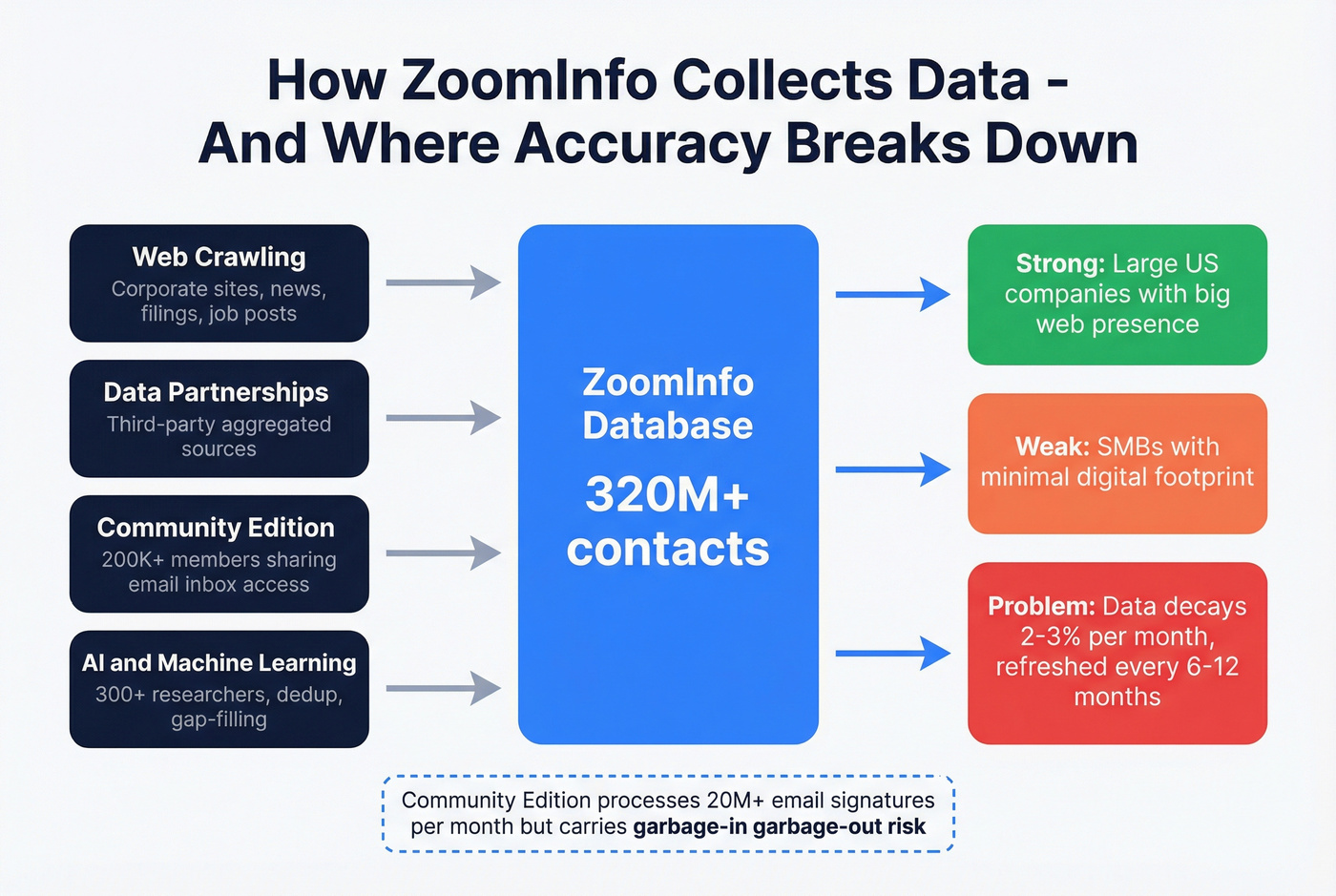

Understanding the data collection methodology explains most of the accuracy patterns.

Web crawling. Automated systems scan corporate websites, news articles, press releases, financial filings, and job postings. Works well for large companies with active web presences. Works poorly for small businesses that barely maintain a website.

Data partnerships. ZoomInfo aggregates data from various third-party sources. The quality varies, and the data is only as good as the original source.

Community Edition. Over 200,000 members share access to their email inboxes in exchange for free ZoomInfo access. ZoomInfo analyzes the email signatures of messages sent and received - processing 20M+ signatures per month and updating records for 4M+ individuals and 1M+ companies daily. Powerful, but it carries a garbage-in-garbage-out risk. If someone's email signature is outdated, that outdated information flows into the database.

AI and machine learning. ZoomInfo's systems identify duplicates, fill gaps, and detect outdated records. A team of 300+ in-house researchers spends roughly half their time on data quality initiatives. ZoomInfo was named a Leader in the 2025 Gartner Magic Quadrant, which speaks to the platform's breadth - though breadth and accuracy aren't the same thing.

In 2025, ZoomInfo added 10.2 million contacts through enhanced title classification and expanded international mobile coverage by 1.8 million numbers. They also verified location data for 160 million contacts to reflect remote work realities. These are real improvements - but they're incremental against a database of 320M+ contacts decaying at 2-3% per month.

Here's the financial context that makes the accuracy problem tangible: ZoomInfo reported FY 2025 revenue of $1.25 billion, but a 90% net revenue retention rate. That means roughly 10% of contract value churns annually - over $125 million in lost revenue. When that many customers aren't renewing, data quality is usually the reason.

What 9,000 G2 Reviews Actually Say

ZoomInfo holds a 4.5/5 rating across 8,997 G2 reviews, with 71% giving five stars. That's genuinely strong. But the pattern in the reviews tells a more nuanced story.

What users love:

- Contact Information: 421 mentions

- Data Accuracy: 397 mentions

- Ease of Use: 397 mentions

- Features: 328 mentions

- Lead Generation: 319 mentions

What users hate:

- Outdated Data: 219 mentions

- Inaccurate Data: 219 mentions

- Outdated Contacts: 198 mentions

- Data Inaccuracy: 175 mentions

- Outdated Information: 171 mentions

Notice the pattern? All five of the top complaints are variations of the same problem: the data goes stale. G2's own AI summary notes that "data accuracy can vary, particularly for smaller companies." Beyond data quality, users on Reddit describe ZoomInfo's support as "god awful terrible" and "definitely third-party" - a frustration compounded when you're paying enterprise prices.

I've seen this play out repeatedly: teams sign up for ZoomInfo, love the search filters and the breadth of the database, then gradually realize that the contact data requires significant cleanup before it's usable. The tool is powerful. The data just isn't as fresh as the price tag implies.

How to Improve ZoomInfo Accuracy (If You're Keeping It)

If you're locked into a ZoomInfo contract - or if the intent data and workflow features justify the cost - here's how to get more out of the data.

Filter by confidence score before every export. ZoomInfo assigns confidence scores to contact records. Most teams ignore this and bulk-export everything. Don't. Set a minimum threshold (typically 85+) and accept a smaller, cleaner list over a larger, dirtier one. In our testing, filtering by confidence score 85+ before export cut bounce rates by roughly 40% compared to unfiltered lists.

Run secondary email verification on every list. Non-negotiable. Run your ZoomInfo exports through a dedicated verification tool before loading them into your sequencing platform. This single step can cut bounce rates from 25% to under 5%. It costs pennies per email and saves your domain reputation. (If you need options, start with a ranked list of email verifier websites.)

Use a waterfall enrichment approach for high-value targets. One user on Reddit went from ~65% valid emails with a single source to ~90% by stacking multiple data providers through a waterfall enrichment tool. For your top-tier accounts, the extra cost is worth it.

Never load unverified ZoomInfo exports directly into sequencing tools. This is the mistake that kills domain reputation. ZoomInfo to Salesforce to Outreach with no verification step in between is how you end up with a 50% bounce rate and a blacklisted domain.

Always verify first.

More Accurate Alternatives to ZoomInfo

If the data quality isn't cutting it - or if you're paying enterprise prices for a contact database you could replace - here are the tools worth evaluating.

Prospeo - Best for Email Accuracy and Data Freshness

Prospeo delivers 98% email accuracy across 300M+ professional profiles, with a 7-day data refresh cycle that makes ZoomInfo's 6-12 month cycles look glacial. This isn't a lab number. Snyk's sales team went from 35-40% bounce rates to under 5% after switching their email sourcing - across 50 AEs generating 200+ new opportunities per month. At roughly $0.01 per lead versus ~$1 per lead on ZoomInfo, the economics aren't even close.

Self-serve, no contracts, and there's a free tier to test before committing. Prospeo also includes 125M+ verified mobile numbers with a 30% pickup rate, intent data tracking 15,000 topics, and native integrations with Salesforce, HubSpot, Smartlead, Instantly, and Clay.

Use this if: Email deliverability is your primary pain point, you're tired of paying for bounced emails, or you need fresh data without a five-figure annual contract.

Cognism - Best for European Data

If you're selling into EMEA and ZoomInfo's Data Passport isn't cutting it, Cognism is the obvious move. Their Diamond Verified mobile numbers deliver 87% list reachability, and DNC screening across 15 countries is included in every package - not bolted on as an add-on.

EMEA data comes standard at no extra charge, which is a direct shot at ZoomInfo's paid European data tier. One customer at Mollie reported "30% better data quality" compared to alternatives. Typical pricing runs $25,000-$50,000/year for full deployments.

Use this if: Your ICP is heavily European. Skip this if: You're US-only and don't need GDPR/DNC compliance - you'd be overpaying for capabilities you won't use.

Apollo.io - Best Budget All-in-One

Apollo packs a CRM, sequencer, and database into one platform at $49-119/user/month. The 4.7/5 G2 rating across 9,250 reviews is earned. But contacts are populated by other users with no independent verification - expect 32-38% bounce rates on raw email exports. (If you're comparing providers, see our breakdown of Apollo.io accuracy.)

Clay + Waterfall Enrichment - Best for Power Users

Clay stacks multiple data sources through waterfall enrichment, checking providers sequentially until it finds a verified result. Users report 10-14% effective bounce rates. Pricing runs $149-800/month depending on volume. Requires technical setup - RevOps teams love it, individual SDRs won't.

Lusha - Best for Small Teams

The simplest option at $20-52/user/month. Fast Chrome extension, dead-simple workflow. Email accuracy lands around 72-78%. Fine for a 2-person team doing light prospecting.

Accuracy Comparison Table

| Tool | Email Accuracy | Pricing | Best For | G2 Rating |

|---|---|---|---|---|

| ZoomInfo | 75-85% | $15K-54K/yr | US enterprise + intent | 4.5/5 (8,997) |

| Cognism | 87% reachability | $25K-50K/yr | European/EMEA data | 4.5/5 (1,200) |

| Apollo.io | 62-68% | $49-119/user/mo | Budget all-in-one | 4.7/5 (9,250) |

| Clay | 86-90% (waterfall) | $149-800/mo | Power users | 4.8/5 (174) |

| Lusha | 72-78% | $20-52/user/mo | Small teams | 4.3/5 (1,566) |

ZoomInfo's firmographic data is ~50% accurate for SMBs, and their 6-12 month refresh cycles guarantee stale contacts. Prospeo refreshes every 7 days, delivers 125M+ verified mobiles with a 30% pickup rate, and costs 90% less. Teams using Prospeo book 26% more meetings than ZoomInfo users.

Replace data decay with weekly-fresh contacts for $0.01 each.

The Bottom Line on ZoomInfo's Data Quality

ZoomInfo is an above-average data platform in a below-average industry.

The 95% accuracy guarantee is misleading - it covers company affiliation, not the data fields that actually determine whether your outbound motion works. Real-world email accuracy of 75-85% is better than most competitors, but it's not what you'd expect from a tool that can cost $54K per year.

Hot take: If your average deal size is under five figures, you almost certainly don't need ZoomInfo. The platform's real value is in its intent signals, integrations, and workflow automation - not the contact database alone. Most teams are paying for an ecosystem and only using the phonebook.

Here's how to think about it by segment:

If you're a US-focused enterprise team that uses ZoomInfo's intent data, integrations, and workflow features - not just the contact database - it's worth the investment. The platform does more than data, and the ecosystem is genuinely powerful.

If you're selling primarily into Europe, ZoomInfo isn't the answer. The data quality in EMEA doesn't justify the cost, even with the Data Passport add-on. Look at Cognism instead.

If you're an SMB or startup with a budget under $20K per year, you're overpaying for ZoomInfo's contact database. Apollo plus a verification tool like Prospeo will get you comparable results at a fraction of the cost.

And regardless of which tool you use, never skip verification. The economics of bad data aren't just wasted credits - they're damaged domain reputation, tanked deliverability, and sequences that never reach an inbox. One bad export can take months to recover from. On a 500-contact export, that's $5 in verification costs versus potentially hundreds of dollars in wasted sequences and weeks of domain recovery.

It's the cheapest insurance in your entire sales stack.

FAQ

What does ZoomInfo's 95% accuracy guarantee actually cover?

ZoomInfo guarantees that 95% of contacts will be matched to the correct employer - nothing more. It doesn't cover email deliverability, phone connectivity, job title currency, or revenue figures. If more than 5% fail the company-affiliation check, ZoomInfo has 30 days to fix it or you can terminate for a prorated refund.

What's ZoomInfo's real email bounce rate?

Most teams see 15-25% bounce rates on unfiltered ZoomInfo exports, translating to roughly 75-85% email deliverability. Filtering by confidence score 85+ and running secondary verification can bring bounces below 5%. Without those steps, worst-case bounce rates above 40% are documented.

Is ZoomInfo worth it for European prospecting?

No. ZoomInfo's EMEA data quality is significantly weaker than its US coverage, with reported bounce rates of 20-50%. The "Data Passport" add-on costs extra but doesn't close the gap. Cognism is purpose-built for European data, and Prospeo's 7-day refresh cycle delivers 98% email accuracy globally at a fraction of the cost.

What's the most accurate ZoomInfo alternative for email?

Prospeo delivers 98% verified email accuracy across 300M+ profiles with a 7-day data refresh - compared to ZoomInfo's 75-85% and 6-12 month refresh cycles. At roughly $0.01 per lead with a free tier, it's the strongest option for teams where deliverability matters most. Cognism (87% reachability) and Clay's waterfall approach (86-90%) are also strong contenders.