Account-Based Selling Best Practices: The Practitioner's Playbook for 2026

Your VP just announced at the all-hands: "We're going account-based." Everyone nods. Nobody asks the obvious question: what does account-based selling actually look like next week?

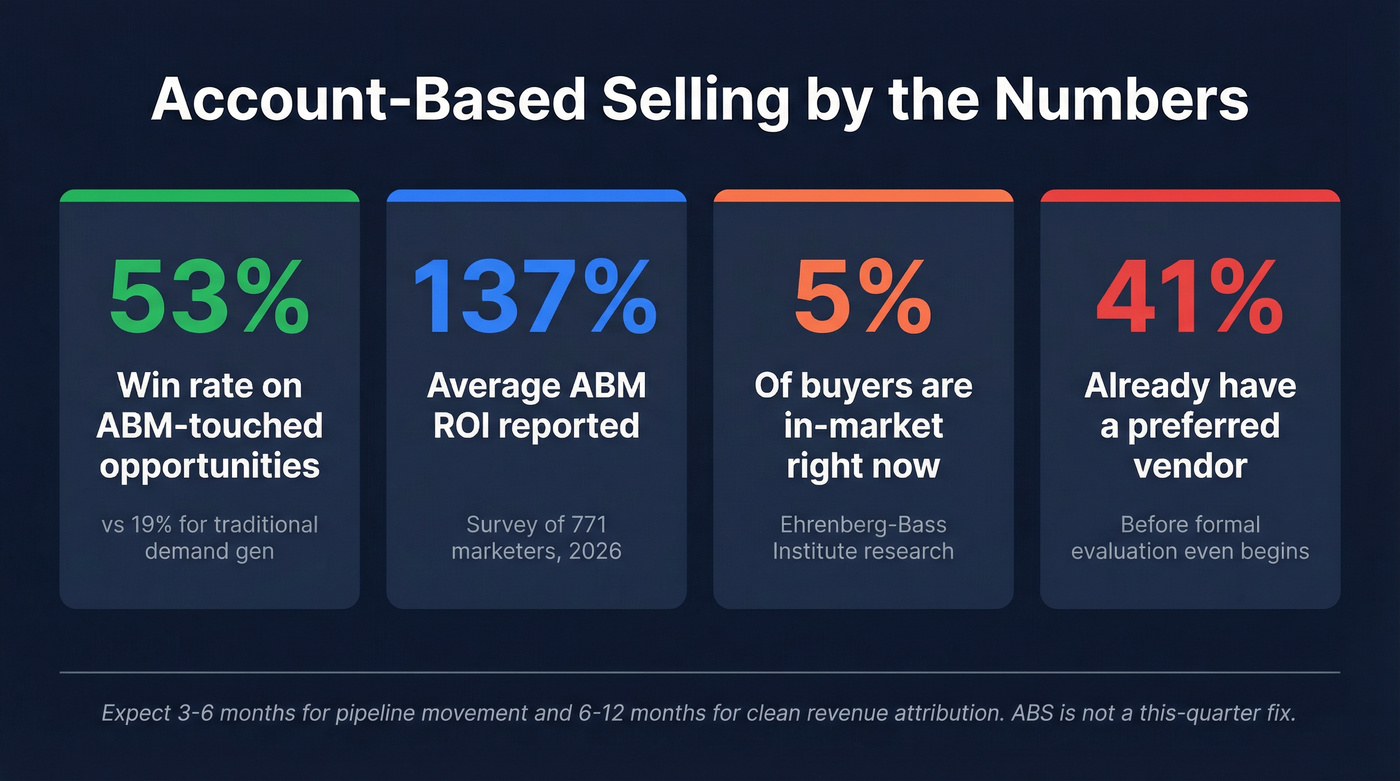

It looks like this: most outbound is wasted because most buyers aren't shopping right now. The Ehrenberg-Bass Institute puts it bluntly - only about 5% of your potential customers are in-market at any given time. So the job of account based selling best practices is to find that 5%, surround it with the right people and the right message, and win deals at rates that make your old funnel math look silly.

And yes, the upside is real: ABM-touched opportunities close at 53% versus 19% for traditional demand gen.

But most teams that announce "we're going account-based" just do the same spray-and-pray outreach with a fancier label. They buy an expensive platform, build a list of 500 accounts that looks suspiciously like their existing CRM, and wonder why nothing changed. A tool purchase isn't a strategy.

This playbook's for the team that wants to do it right.

Hot take: if your average deal size is below $10K, you probably don't need ABS. It's a high-effort motion built for complex B2B deals with real buying committees. Selling a $29/month SaaS tool? Stick with inbound and product-led. Selling a $50K+ platform? Keep going.

What You Need (Quick Version)

You don't need 10 best practices. You need three things done well.

- Accurate data on the right accounts. Not a list of 1,000 logos. Verified emails and direct dials for the 5-11 people who influence the deal.

- Personalized outreach to the right stakeholders. Not "Hi {FirstName}, I noticed {CompanyName} is growing." Personalization tied to real signals.

- A weekly rhythm between sales and marketing. Not quarterly "alignment meetings." Weekly standups with shared KPIs.

Everything else is optimization.

In our experience, teams get the fastest wins by starting with a minimum viable stack and a ruthless focus on Tier 1 accounts. You can run a legitimate account-based motion without a six-figure platform if your data's clean, your tiering's sane, and your weekly cadence actually happens.

What Is Account-Based Selling (and How It Differs from ABM)

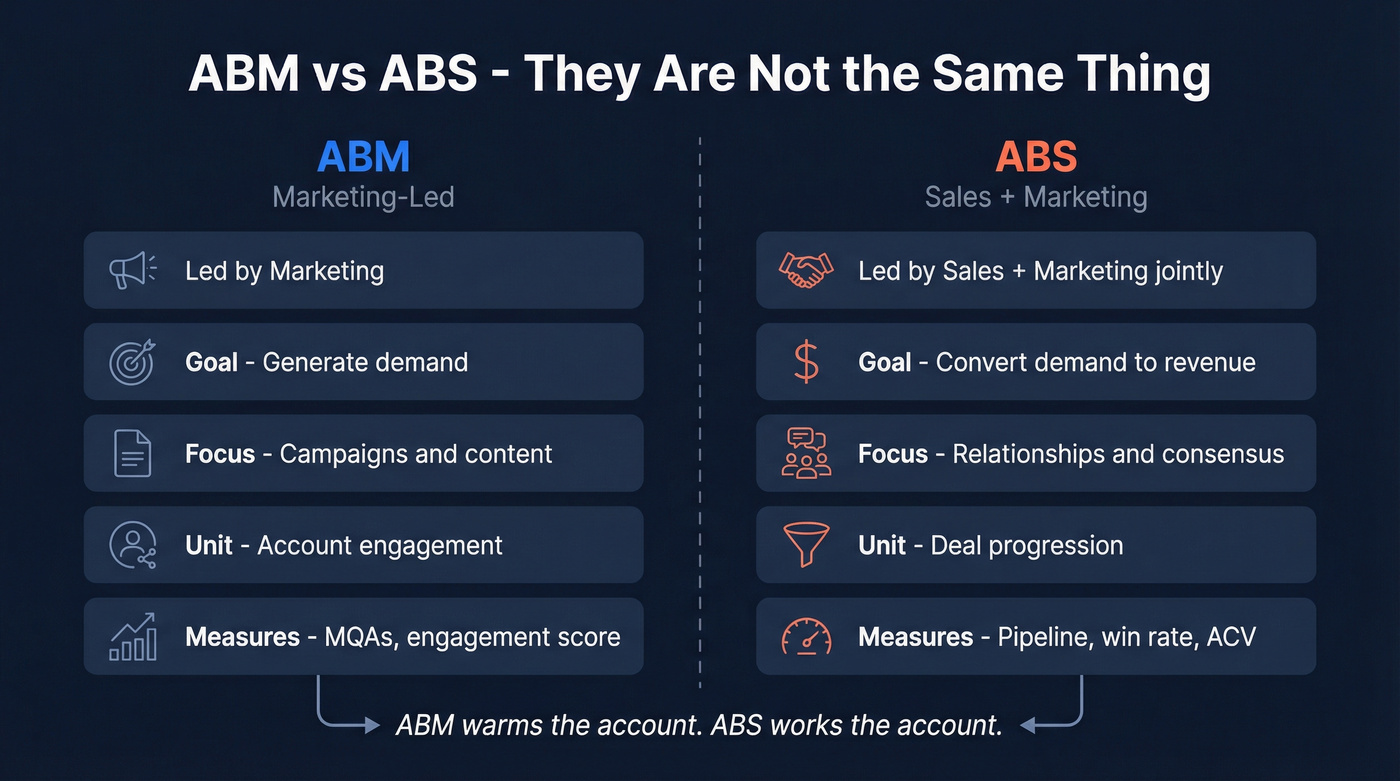

These terms get used interchangeably, and it drives me nuts. They're not the same.

ABM is marketing-led. It creates demand through campaigns, content, events, and targeted ads aimed at a defined set of accounts. ABS is the joint sales-marketing effort that converts that demand into revenue through personalized, multi-stakeholder engagement. ABM creates the air cover. ABS closes the deal.

Think of it this way: ABM warms the account. ABS works the account.

ABM adoption's mainstream now, and the market keeps growing. That doesn't mean execution's good. Most teams are doing "ABM lite" - running some targeted ads and calling it a strategy.

Real ABS means identifying the stakeholders in a buying committee, understanding what each person cares about, and coordinating outreach across multiple channels and multiple people on your team. It's relationship-building and consensus-creation, not lead gen.

One stat should scare you straight: 41% of B2B buyers already have a preferred vendor before formal evaluation begins. If you're not engaging accounts early, you're showing up late to a decision that's already half-made.

| ABM | ABS | |

|---|---|---|

| Led by | Marketing | Sales + Marketing |

| Goal | Generate demand | Convert demand to revenue |

| Focus | Campaigns & content | Relationships & consensus |

| Unit | Account engagement | Deal progression |

| Measures | MQAs, engagement score | Pipeline, win rate, ACV |

Your ABS motion dies when emails bounce and direct dials go nowhere. Prospeo gives you 98% verified emails and 125M+ mobile numbers for every stakeholder on the buying committee - refreshed every 7 days, not 6 weeks.

Stop losing deals because you couldn't reach the CFO.

The Business Case - ABS by the Numbers

The numbers aren't subtle.

ABM-touched opportunities close at 53% compared to 19% for standard demand gen. Companies that implement ABS report higher ACV and more marketing-influenced revenue, and aligned sales + marketing teams consistently outperform teams that operate like two separate companies sharing a logo.

A 2026 survey of 771 marketers put average ABM ROI at 137%, with nearly half saying ABM delivered their highest ROI channel. ABS also tends to shorten sales cycles and cut time spent on dead-end prospecting because you're focusing effort where intent and fit overlap.

Here's the catch: it takes time. Expect 3-6 months to see pipeline movement and 6-12 months for clean revenue attribution. If leadership wants a "this quarter" fix, ABS isn't it.

8 Account-Based Selling Best Practices That Actually Move Pipeline

1. Build Your ICP Before You Build Your List

Most teams skip this step. They pull a list of companies that "look like" their customers and start blasting. That's not ABS - that's demand gen with extra steps.

Your ICP checklist:

- What specific problems does your product solve?

- Which companies feel those problems acutely enough to pay for a solution?

- Which of those companies can afford your product?

- What do your best current customers have in common (firmographics, technographics, behaviors)?

- Why did your top 10 customers buy? Ask them directly.

- What do your competitors' customers look like?

Here's the thing: your ICP needs input from multiple sources. The SDR thinks the ICP is "anyone who'll take a meeting." The AE thinks it's "companies with budget." Marketing thinks it's "companies that match our content." Reconcile all three perspectives into one document, then use it to say "no" more often than you say "yes."

I've seen one counterintuitive move change everything: write more disqualification criteria than qualification criteria. Knowing who you won't sell to saves months of pipeline theater.

Don't limit your ICP to new logos, either. Expansion is often the easiest ABS win because the trust hurdle's already cleared and you can map stakeholders using real internal champions, not guesses.

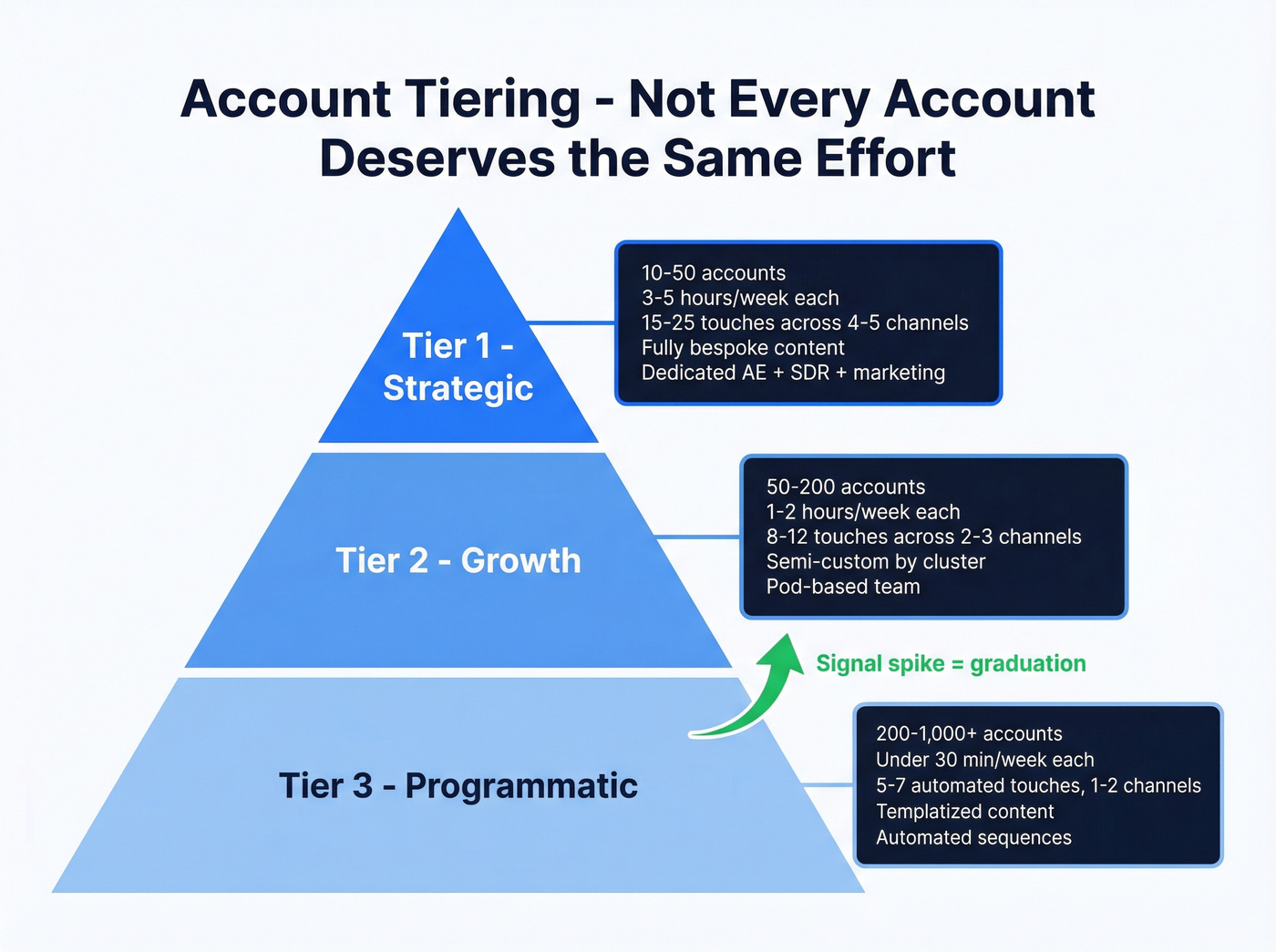

2. Tier Your Accounts and Resource Accordingly

Not every account deserves the same effort. Sounds obvious. Yet I've watched teams give white-glove treatment to 200 accounts and burn out in six weeks.

Tiering is how you make ABS sustainable.

| Tier 1 (Strategic) | Tier 2 (Growth) | Tier 3 (Programmatic) | |

|---|---|---|---|

| Accounts | 10-50 | 50-200 | 200-1,000+ |

| Hours/week | 3-5 per account | 1-2 per account | <30 min per account |

| Touches/30 days | 15-25 across 4-5 channels | 8-12 across 2-3 channels | 5-7 automated, 1-2 channels |

| Content | Fully bespoke | Semi-custom by cluster | Templatized |

| Team | Dedicated AE + SDR + marketing | Pod-based | Automated sequences |

Tier 1 accounts get executive sponsorship, custom content, personalized landing pages, and direct mail. These are your whales - each one worth 10x a typical deal.

Tier 2 accounts get clustered by sub-industry or shared challenge. You're building semi-custom campaigns for groups of 10-15 similar accounts. Still personal, but scalable.

Tier 3 should be mostly automated and signal-driven. When a Tier 3 account spikes intent, visits pricing, or engages multiple stakeholders, it graduates to Tier 2. That's the whole point: your programmatic layer feeds your high-touch layer.

3. Map the Buying Committee (Don't Stop at "The Champion")

Complex deals stall because you missed someone. Usually finance. Sometimes security. Often the ops person who actually has to live with the tool.

Forrester's research has put typical buying committees in the double digits, and that tracks with what we've seen: if you're only talking to one or two people, you're not selling enterprise - you're auditioning.

Use a simple taxonomy for Tier 1 and Tier 2 accounts:

| Role | Who They Are | How to Engage |

|---|---|---|

| Project Sponsor | Initiates the buying process | Validate pain, provide business case ammo |

| Champion | Your internal advocate | Arm with ROI data and internal talking points |

| Executive Sponsor | Senior leader with authority | Peer-to-peer exec outreach, strategic vision |

| Financial Approver | Controls the budget | ROI models, TCO comparisons, risk mitigation |

| Technical Buyer | Evaluates technical fit | Demos, security docs, integration architecture |

| Operations Owner | Ensures operational fit | Implementation plans, change management |

| Business User | Day-to-day practitioner | Workflow-specific use cases, trials |

| Legal Reviewer | Compliance and risk | DPAs, security certs, contract redlines |

| Influencer | Trusted internal voice | Peer references, analyst material |

| Final Authority | Ultimate veto power | Executive briefings, board-level framing |

Your map's a living document. People leave. Reorgs happen. A "quick security review" turns into a month-long procurement process because someone new got looped in and nobody pre-briefed them.

This is where accurate contact data stops being a nice-to-have and becomes the whole game. If you can't reliably find and verify the right stakeholders, your committee map turns into a fantasy org chart and your outreach turns into bounce-rate roulette.

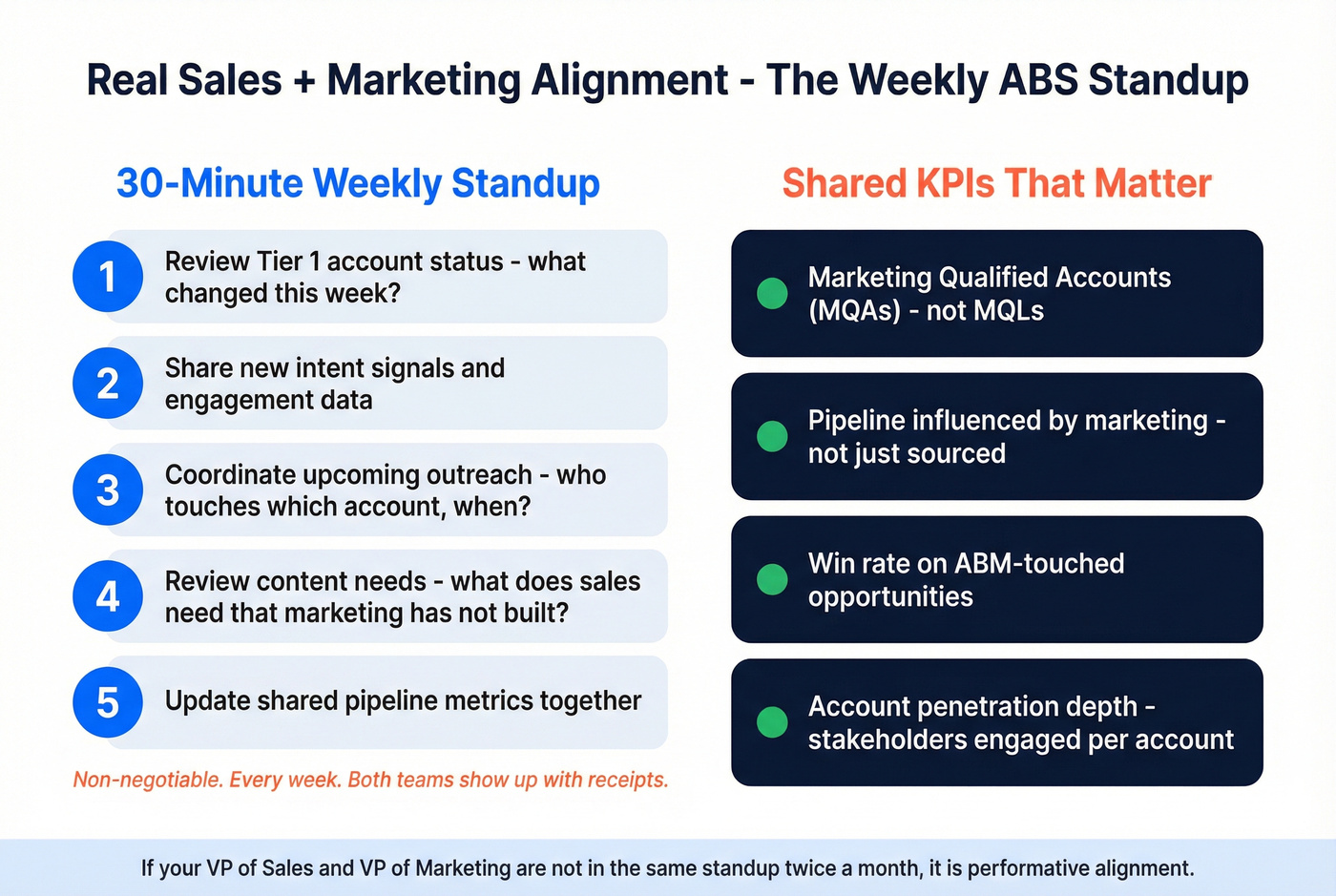

4. Align Sales and Marketing (For Real This Time)

"Alignment" is the most abused word in B2B. Most teams mean "we share a Slack channel and argue less than last quarter."

Real alignment is operational: shared targets, shared account lists, and a weekly cadence where both sides show up with receipts.

Weekly ABS standup (30 minutes, non-negotiable):

- Review Tier 1 account status: what changed this week?

- Share new intent signals and engagement data

- Coordinate upcoming outreach: who's touching which account, when?

- Review content needs: what does sales need that marketing hasn't built?

- Update shared pipeline metrics

Shared KPIs that matter:

- Marketing Qualified Accounts (MQAs) instead of MQLs

- Pipeline influenced by marketing (not just sourced)

- Win rate on ABM-touched opportunities

- Account penetration depth (stakeholders engaged per account)

If your VP of Sales and VP of Marketing aren't in the same standup at least twice a month, you're doing performative alignment. And yes, I'm opinionated about this because I've watched good programs die from "we'll sync next month" more times than I can count.

5. Personalize Outreach by Tier and Role (and Stop Faking It)

If your outreach could be sent to any account in your CRM, it's not ABS. It's just email with a logo swap.

Buyers spend a small slice of their time talking to vendors; the rest is internal research and internal politics. Your job is to show up with the right message for the right person, in the channel they actually pay attention to, at the moment the account's leaning in.

Do this per tier:

- Tier 1: Custom research per account. Reference their tech stack, leadership changes, earnings call quotes, hiring patterns, or a specific workflow you can improve. Build a landing page that only makes sense for them. Coordinate exec-to-exec outreach.

- Tier 2: Cluster-level personalization. "Teams in fintech scaling past 200 employees run into X" is specific enough to feel relevant without pretending it's 1:1.

- Tier 3: Automated but signal-driven. Trigger sequences based on intent spikes, job changes, or technographic shifts. Kill "just checking in" follow-ups.

Skip this if you want your reps to hate you: Don't demand Tier 1-level personalization for Tier 3 accounts. It's a great way to burn out your SDR team and still miss quota.

Data quality is the quiet killer here. If your contact left six months ago, your "personalized" email isn't just ineffective - it's embarrassing. A weekly refresh cycle beats the industry norm for a reason: it keeps your outreach from rotting in place.

6. Use AI and Intent Data to Prioritize (Not to Write Spam)

AI in ABS is useful for one thing above all: focus. It helps you decide where to spend human effort.

Teams use AI for personalization, predictive scoring, and targeting, and intent data's become standard for prioritizing accounts. None of that matters if you treat it like a magic eight ball. Use it to rank accounts and surface signals, then have a rep do the thinking.

A practical workflow that works: intent spike + ICP match + stakeholder coverage. If you can't reach at least 3-5 relevant roles with verified contact info, don't pretend it's a Tier 1 push. Fix coverage first, then run the play.

If you want a tighter model, use a simple account scoring framework that weights fit + intent + engagement.

7. Build Your Tech Stack Without Breaking the Budget

"ABM tools like 6sense or Demandbase are expensive reminders to sell to your ICP." That's a real quote from a practitioner on Reddit, and it's painfully accurate.

Most teams don't need a six-figure platform to start. They need clean data, a CRM that isn't a dumpster fire, and a way to run coordinated sequences and ads.

Here's a sane way to think about it.

Lean Stack ($200-500/mo, plus ads) - for teams proving the model:

- Data & enrichment: Prospeo (The B2B data platform built for accuracy). 300M+ professional profiles, 143M+ verified emails, 125M+ verified mobile numbers, and 98% email accuracy on a 7-day refresh cycle. It's self-serve, no contracts, and it gives you the verified stakeholder coverage ABS lives or dies on.

- CRM: HubSpot Free ($0)

- Sequencing: Instantly or Smartlead ($30-97/mo)

- Ads: whatever you can afford to test ($500+/mo is a common starting point)

Growth Stack ($1,000-3,000/mo, plus ads) - once you have early wins:

- Data + intent layering

- A paid CRM plan (or Salesforce)

- A sales engagement platform if your team needs governance and reporting

Enterprise Stack ($50K-150K+/yr) - only after ABS is already producing revenue:

- A full ABM platform (6sense/Demandbase class)

- Enterprise data providers

- Conversation intelligence and advanced attribution

Look, I've seen teams spend $100K on a platform and still have reps manually Googling email addresses because the data's stale and the enrichment flow's broken. Start lean, prove the motion, then add tools to remove bottlenecks you can name in one sentence.

One more thing: if you're early, don't overbuy "orchestration." Your real constraint is usually stakeholder coverage and message quality, not dashboards.

If you're trying to pressure-test tool choices, start with a simple B2B sales stack blueprint and add components only when you can measure the bottleneck.

8. Measure What Matters (and Stop Worshipping MQLs)

Most teams measure ABS wrong. They track MQLs (wrong unit), email open rates (vanity), and "accounts touched" (meaningless without context). Then they declare ABS "didn't work" after eight weeks.

Measure three buckets:

Engagement metrics - are the right people paying attention?

- Account engagement score (web visits, content, email interactions, event attendance)

- Key contact engagement depth (stakeholders active per account)

- Meeting participation rate (did more than one role show up?)

Journey metrics - are accounts progressing?

- Stage conversion rates by tier

- Pipeline velocity (time between stages)

- Account penetration (stakeholders engaged vs expected committee size)

- Win rate by tier

Attribution metrics - what's driving revenue?

- Marketing-influenced pipeline (not just sourced)

- ROI by campaign type

- Cost per influenced opportunity

- Revenue per account by tier

If you're not seeing meaningful lift after 6-12 months, something's broken. It's usually one of three things: your ICP's too broad, your tiering's fantasy, or your data's dirty.

If you're struggling to separate "activity" from results, run a lightweight win-loss analysis every month on Tier 1 deals.

6 ABS Mistakes That Kill Pipeline

1. No clearly defined strategy. ABS is a structural change, not a campaign. Fix: Write the one-pager before you buy tools.

2. No specific market analysis. "We sell to mid-market SaaS companies" isn't an ICP. It's a category. Fix: Define firmographic, technographic, and behavioral criteria with disqualifiers.

3. Letting sales pick all the accounts. Sales gravitates toward "cool logos," not highest probability. Fix: Let sales nominate 20% of the list; data picks the rest.

4. Fake personalization. Swapping a company name into a template isn't personalization. Fix: Bespoke for Tier 1, cluster-based for Tier 2, signal-triggered for Tier 3.

5. Neglecting the people inside the accounts. People close deals, not logos. Fix: Map the committee and build stakeholder coverage early.

6. Measurement failures. If you're measuring MQLs and opens, you're measuring the wrong things. Fix: Track MQAs, penetration, velocity, and win rate by tier.

The meta-mistake is performative ABS: buying a platform, building a list, sending some emails, and calling it "account-based" while changing nothing about how sales and marketing work together. It's the fastest way to waste money and lose internal trust.

If this feels familiar, it's usually a symptom of broader sales pipeline challenges, not a "bad ABM channel."

ABS in Action - 3 Case Studies That Prove the Model Works

DocuSign: Content-Led ABS at Scale

The challenge: DocuSign needed to break out of generic "e-signature" positioning across diverse verticals where buying committees had different priorities.

The approach: They targeted key industries with tailored content, customer testimonials, and peer logos specific to each vertical. Instead of generic messaging, they built industry-specific value props that matched what each committee cared about.

Results: 60% increase in engagement, 300% rise in page views, and 22% growth in sales pipeline.

LiveRamp: High-Touch ABS for Enterprise

The challenge: LiveRamp needed to crack a small set of high-value enterprise accounts where traditional outbound had stalled.

The approach: A true 1:1 program: customized display ads, personalized emails, direct mail, and coordinated SDR outreach. Stakeholders got role-specific messaging, and the team did committee research before the first touch.

Results: 33% conversion rate from cold leads to meetings within four weeks. Over two years, customer lifetime value increased 25x.

Cognism: Lean Stack, Big Pipeline

The challenge: Cognism's marketing team needed to prove ABM ROI without an enterprise budget.

The approach: A lean stack: their data tool, ads, AI-assisted landing page personalization, and Salesforce. The big win wasn't "AI magic" - it was making Tier 1 pages fast enough that the economics worked.

Results: $700K+ in pipeline without a six-figure platform.

Tier 1 accounts need real signals, not guesses. Prospeo combines 30+ filters - buyer intent, technographics, job changes, headcount growth - so you target the 5% actually in-market. At $0.01 per email, your ABS budget goes 90x further than ZoomInfo.

Find the 5% in-market and reach every decision-maker.

FAQ

What is the difference between account-based selling and account-based marketing?

ABM is marketing-led demand generation through campaigns and targeted ads aimed at defined accounts. ABS is the joint sales-marketing effort that converts demand into revenue through multi-stakeholder engagement. ABM warms the account; ABS closes the deal.

How many accounts should I target with ABS?

Tier 1: 10-50 with bespoke outreach. Tier 2: 50-200 with cluster-based campaigns. Tier 3: 200-1,000+ with programmatic automation. Start with 10-20 Tier 1 accounts to prove the model before scaling. 500 "strategic" accounts is an oxymoron.

How long does it take to see results from account-based selling?

Expect 3-6 months for pipeline impact and 6-12 months for clear revenue attribution. Measure engagement and account progression from day one; those leading indicators show whether the motion's working before closed-won revenue appears.

Do I need an expensive ABM platform to start?

No. Start lean: verified data, a CRM, sequencing, and a small ad budget. Add platforms like Demandbase or 6sense after pipeline justifies the spend and you can name the exact bottleneck you're paying to remove.

What are the most common reasons account-based sales programs fail?

Misalignment between sales and marketing, a sloppy ICP, fake personalization, and tracking the wrong KPIs. Teams that treat ABS like a campaign instead of a go-to-market change stall fast; disciplined tiering, committee mapping, and shared weekly metrics prevent most failures.