The Modern B2B Sales Stack (2026): Layers, Buy Order, and Governance

The "perfect" b2b sales stack isn't hard to buy. It's hard to run.

Most stacks don't behave like one system. They behave like six disconnected opinions about the customer, and the CRM becomes a junk drawer.

Here's the blueprint I've used with RevOps teams that want a stack that scales without turning reporting into vibes.

What you need (quick version)

Non-negotiables (in buy order):

☐ CRM as system of record

- ☐ One account/contact schema

- ☐ Required fields + validation rules

- ☐ Clear ownership (RevOps, not "everyone")

☐ Data layer (enrichment + verification + refresh cadence)

- ☐ Enrich missing firmographics + titles

- ☐ Verify emails before outreach

- ☐ Refresh on a schedule (not "when reps complain")

If you're starting data-layer-first, Prospeo's a clean fit because it's built for enrichment + verification + a weekly refresh cycle.

☐ Sales engagement that writes back to CRM

- ☐ Sequences + tasks live in the engagement tool

- ☐ Activities + outcomes sync back to CRM fields you actually report on

Operating rules (the ones everyone learns late):

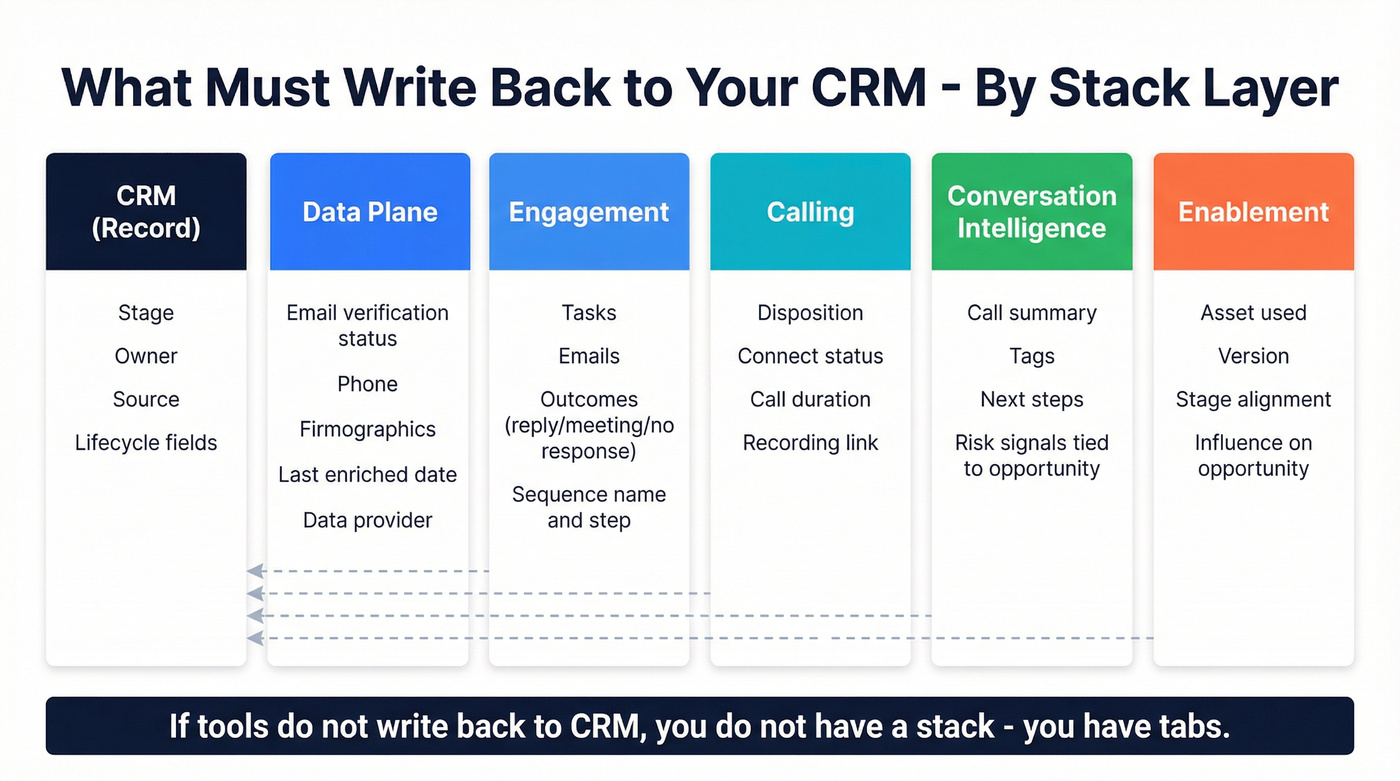

- ☐ If tools don't write back to CRM, you don't have a stack - you have tabs.

- ☐ 5-7 tools beats 12 tools. Ebsta reports teams running consistent outbound average 5.6 tools. Treat that as a ceiling, not a goal.

- ☐ Consolidation rule of thumb:

- ☐ If two tools touch the same workflow step, one of them's probably a tax

- ☐ If a tool's usage is low or overlap is high, it's on the chopping block

What a B2B sales stack is (and the only definition that matters)

A b2b sales stack is the set of systems that creates, updates, and governs customer data and sales activity - with the CRM as system of record. In practice, it's one critical slice of your broader B2B tech stack, because it's where revenue data gets created and where downstream reporting either becomes reliable or collapses.

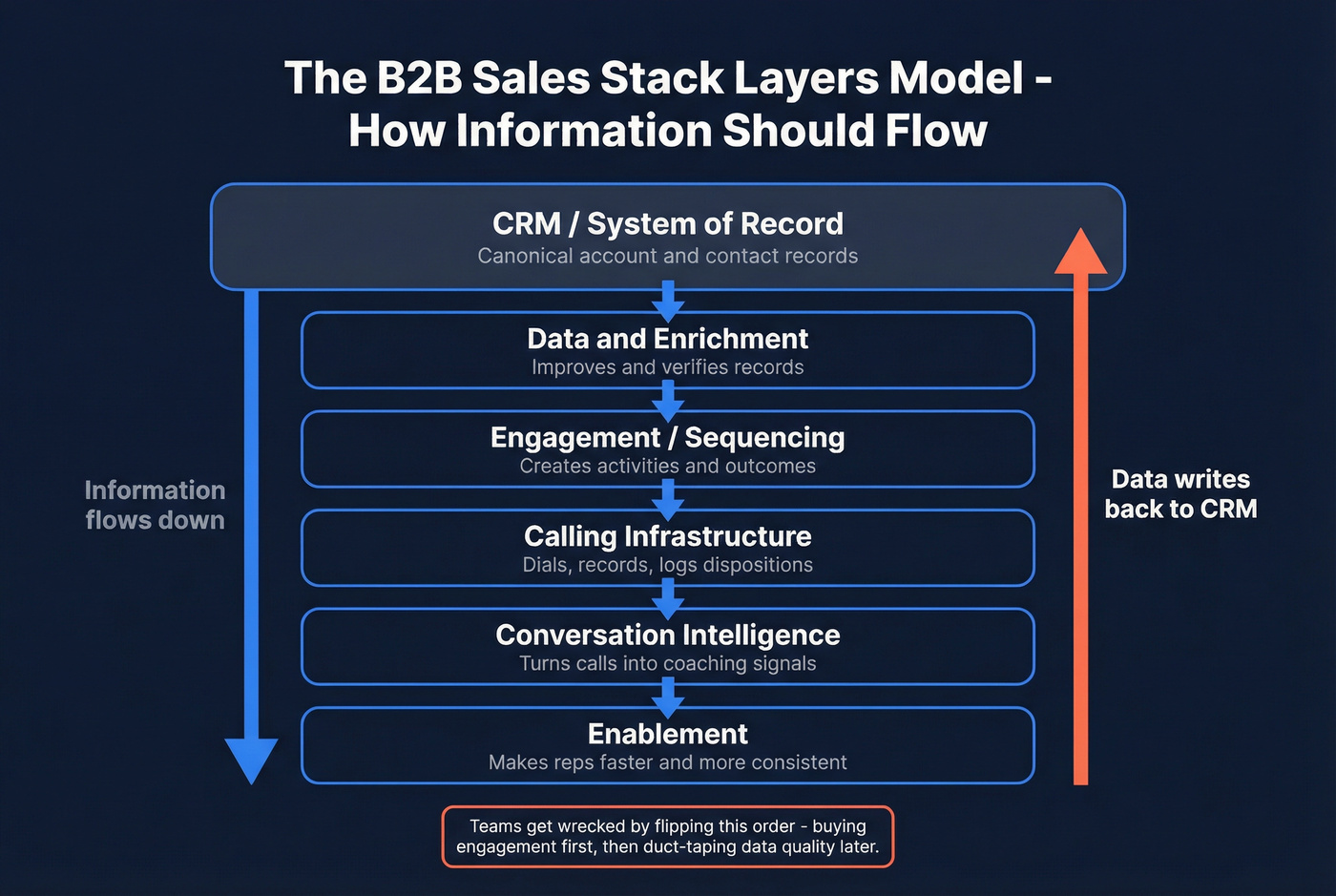

The cleanest mental model is a layers model:

- CRM / system of record

- Data & enrichment

- Engagement / sequencing

- Calling infrastructure

- Conversation intelligence

- Enablement

That order matters because it mirrors how information should flow. The CRM holds canonical account/contact records. The data layer improves and verifies those records. Engagement and calling create activities and outcomes. Conversation intelligence turns calls into coaching signals. Enablement makes reps faster and more consistent.

Teams get wrecked by flipping the order: buying engagement first, then duct-taping data quality later. You end up sequencing bad emails, logging junk activities, and "fixing it in Salesforce" forever.

Definition that matters: Your stack is real only if it creates and updates CRM fields you trust (contacts, accounts, activities, stages, source, campaign membership, and next steps) without manual copy/paste.

The 2026 reference architecture (layers + what writes back to CRM)

Most teams talk about "tools," but the real architecture is systems:

- System of record: where truth lives (CRM)

- System of engagement: where reps work (sequencing, dialer, tasks)

- Data plane: where you source/verify/refresh identity + firmographics so every other layer isn't guessing

Name those roles and you stop buying overlapping products. And you stop arguing about which tab is "right."

A practical 2026 architecture looks like this:

- CRM owns: account/contact objects, lifecycle stages, pipeline, attribution primitives

- Data plane owns: identity resolution, enrichment, verification, refresh cadence, dedupe rules

- Engagement owns: sequences, tasks, templates, rep workflow

- Calling owns: dialer, recording, dispositions

- Conversation intelligence owns: transcripts, coaching tags, call libraries, deal risk signals

- Enablement owns: content, playbooks, onboarding, battlecards

Outreach has one governance point I fully agree with: publish a single schema and enforce validation rules so integrations don't turn into "whatever the last tool wrote."

Reference table: what must write back to CRM

| Layer | Owns data | Must write back fields |

|---|---|---|

| CRM (Record) | Canonical objects + required fields | Stage, owner, source, lifecycle fields |

| Data plane | Identity + freshness | Email verification status, phone, firmographics, last enriched date, data provider |

| Engagement | Activity workflow | Tasks, emails, outcomes (reply/meeting/no response), sequence name/step |

| Calling | Call events | Disposition, connect status, call duration, recording link |

| Conversation intelligence | Insights | Call summary, tags, next steps, risk signals tied to opportunity |

| Enablement | Content usage | Asset used, version, stage alignment, influence on opportunity |

Three write-back examples that prevent broken reporting

Example 1: Engagement outcomes (what breaks if you don't log them)

- Write back:

last_outbound_touch_date,last_reply_date,outreach_outcome,meeting_booked = true/false,sequence_name - If you don't: pipeline reviews become activity theater. Reps swear they're working accounts; the CRM shows nothing; managers overcorrect with more meetings and more micromanagement.

Example 2: Verification status (what breaks if you don't stamp it)

- Write back:

email_status = valid/catch-all/invalid,verified_date,data_provider - If you don't: deliverability incidents look random. You can't suppress risky addresses, can't explain bounce spikes, and can't prove the data layer's doing its job.

Example 3: Call dispositions tied to opportunities (what breaks if you don't connect it)

- Write back:

call_disposition,connected = true/false,next_step_date,opportunity_id - If you don't: forecasting becomes vibes. You can't separate "we talked" from "we progressed," so every stage looks equally healthy.

How to test "writes back to CRM" in 30 minutes (no vendor promises)

Pick 100 contacts and run a controlled test:

- Enrich/verify them (data plane)

- Sequence them (engagement)

- Call 20 of them (dialer/CI if you've got it)

- Open the CRM and check:

- Are new fields populated (verification status, last enriched date)?

- Are activities logged with outcomes (reply/meeting/connect)?

- Are timestamps consistent (no future dates, no missing last-touch)?

- Did anything create duplicates?

If the CRM doesn't show clean, queryable fields after that test, the integration isn't production-ready.

Minimum viable b2b sales stack (by stage + headcount)

Most teams don't need a "modern stack." They need a minimum viable stack that doesn't collapse under growth.

Hot take: if your average deal size is small and your team is under 10 sellers, you don't need an all-in-one enterprise suite. You need clean data, clean activity capture, and one place to run the day.

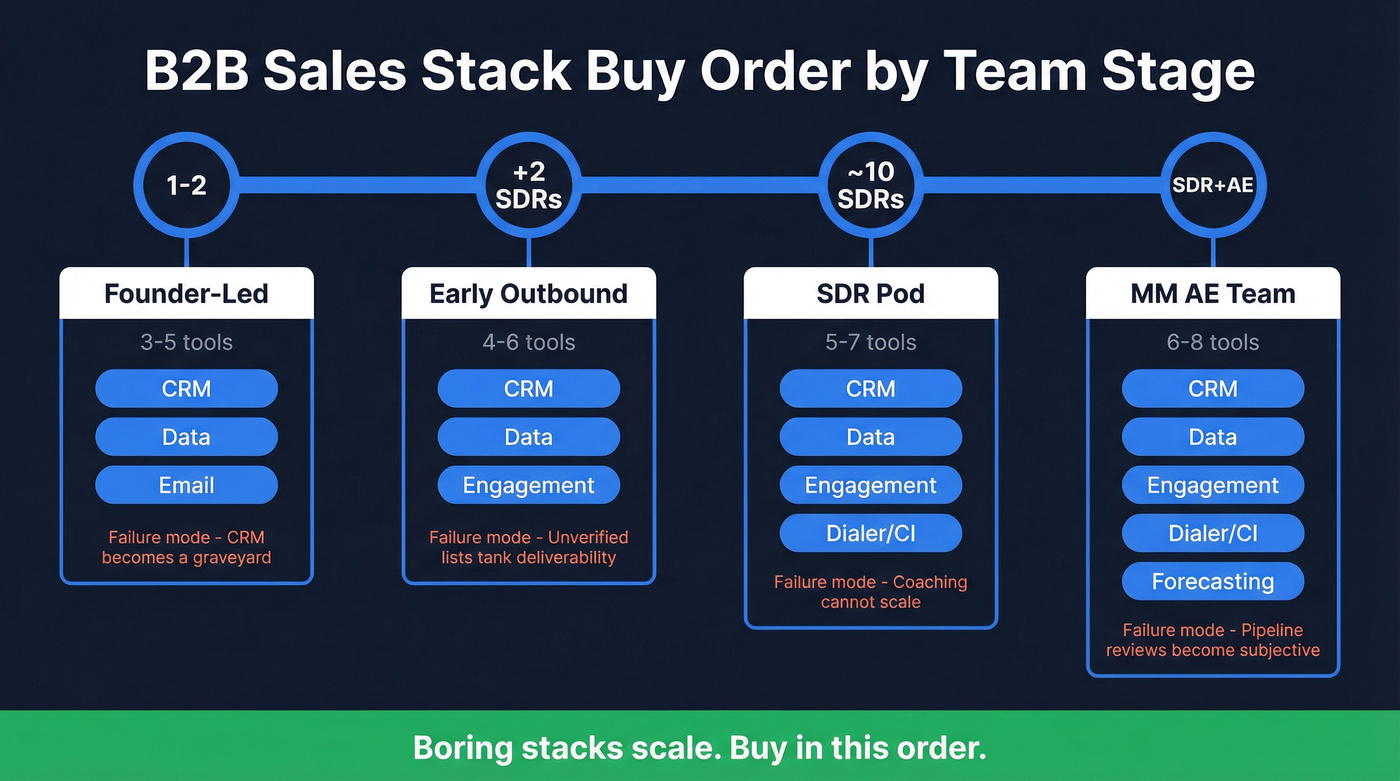

Below is the strict buy order I use by stage. It's intentionally boring because boring stacks scale.

Minimum viable stacks by stage (with common failure modes)

| Stage | Headcount | Strict buy order | Tool count target | Common failure mode (what actually breaks) |

|---|---|---|---|---|

| Founder-led | 1-2 | CRM → data → email | 3-5 | Founder works from inbox + notes; CRM becomes a graveyard |

| Early outbound | +2 SDRs | CRM → data → engagement | 4-6 | Reps sequence unverified lists; deliverability tanks; duplicates explode |

| SDR pod | ~10 SDRs | CRM → data → engagement → dialer/CI | 5-7 | Coaching can't scale; "best reps" win, everyone else stalls |

| MM AE team | SDR+AE | Add CI + forecasting | 6-8 | Pipeline reviews become subjective; stages mean different things per rep |

Use / skip guidance (so you don't overbuy)

Founder-led (1-2 people)

- Use: a CRM you'll keep, a data layer that verifies, and a lightweight sequencer.

- Skip: enablement suites, proposal tooling, heavy automation. Earn the right to buy it by proving repeatable outbound.

2 SDRs

- Use: engagement that writes back to CRM, plus a real data layer so you're not burning domains.

- Skip: ABM suites and heavy intent platforms. You won't operationalize them yet.

10 SDRs

- Use: conversation intelligence (or at least recording + tagging). Coaching becomes the bottleneck, not activity volume.

- Skip: custom BI until CRM reporting's already clean. Dashboards don't fix missing fields.

MM AE team

- Use: forecasting once you've standardized stages, exit criteria, and next-step fields.

- Skip: "agentic AI" add-ons until your activity capture's clean. AI on messy CRM data is just confident nonsense.

Your stack blueprint starts with the data plane. Prospeo handles enrichment, verification, and a 7-day refresh cycle in one layer - 98% email accuracy, 92% API match rate, 50+ data points per contact. No duct-taping data quality later.

Lock in the data layer first. Everything else writes back clean.

Data quality is the stack (enrichment, verification, refresh cadence)

Real talk: your "stack" is only as good as your data. Bad data turns every downstream tool into a random number generator - sequencing, routing, scoring, forecasting, even coaching.

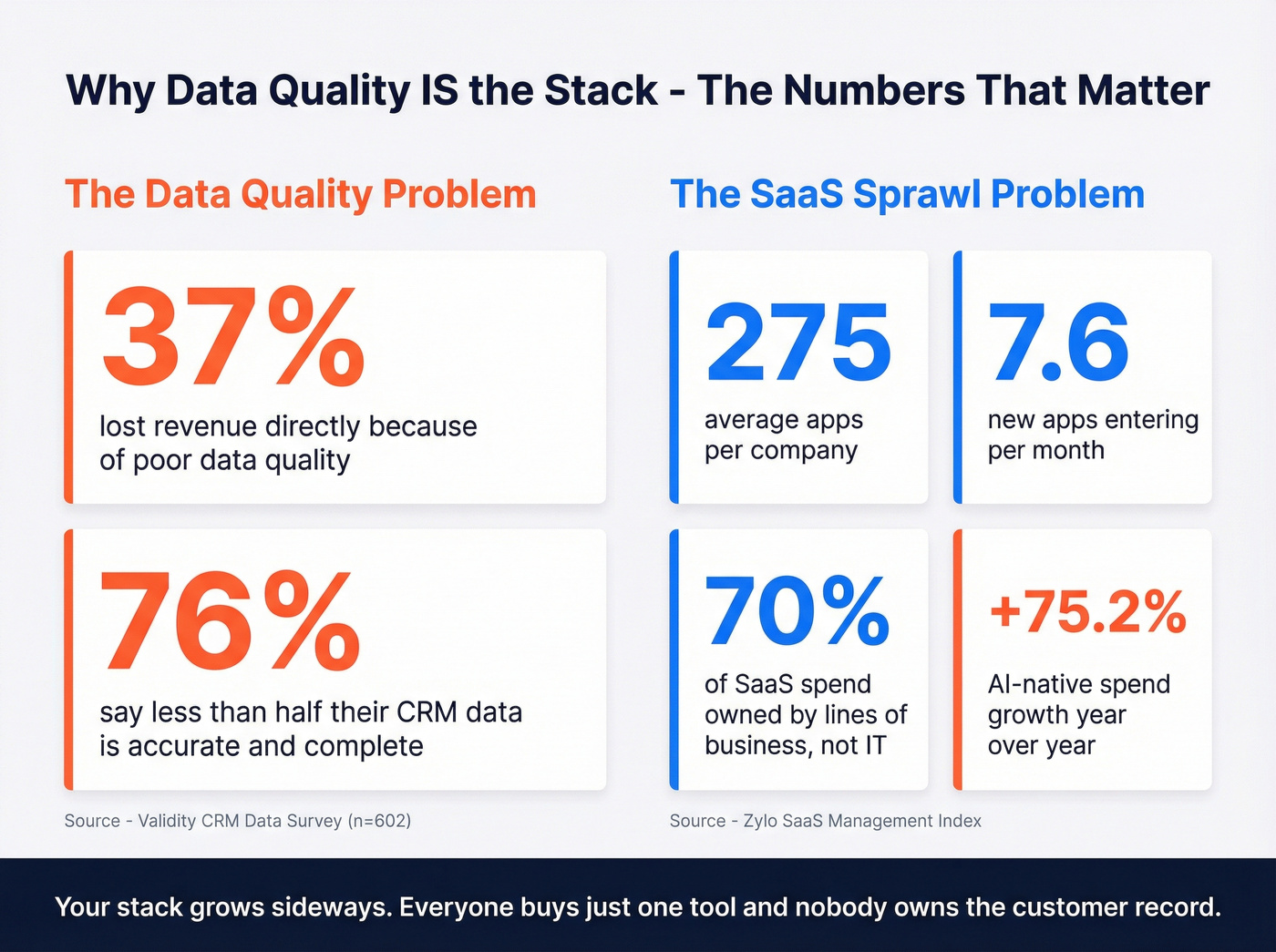

Validity's CRM data survey (n=602) is the gut punch:

- 37% lost revenue directly because of poor data quality

- 76% said less than half their CRM data's accurate and complete

That's why I treat data as a managed plane, not a feature sprinkled across five tools. If you want a KPI-first way to run it, start with a simple data quality scorecard.

Zylo's SaaS Management Index explains why governance fails without that plane: IT owns 26.1% of SaaS spend (and 15.9% of apps); lines of business own 70% of spend (and 50.5% of apps). Translation: the stack grows sideways. Everyone buys "just one tool" and nobody owns the customer record end-to-end. Zylo also reports 275 apps on average, 7.6 applications entering per month, and AI-native spend up 75.2% YoY - so sprawl isn't slowing down in 2026. It's accelerating.

The practical pro/con of "data layer first"

Pros

- Fewer bounces, fewer spam traps, fewer burned domains

- Higher connect rates because phone + email coverage improves

- Cleaner CRM reporting because fields are standardized and refreshed

Cons

- You'll surface duplicates and field conflicts you've been ignoring

- You'll have to pick a schema and enforce it (annoying, necessary)

Mini-workflow: the data plane that actually works

- Define your CRM schema

- Required fields: persona, ICP segment, source, verification status, last enriched date

- Validation rules: no "CEO" title on an SDR lead, no free email domains for target accounts, etc. (More on keeping the system clean in How to Keep CRM Data Clean.)

- Enrich + verify before sequencing

- Enrich missing firmographics and role data

- Verify email status (valid/invalid/catch-all)

- Stamp fields:

email_verified,verified_date,data_provider(Use a repeatable email verification list SOP.)

- Refresh on a cadence

- Weekly for active outbound lists

- Monthly for TAM/account lists

- Quarterly for long-cycle enterprise opportunities

- Write back outcomes

- Engagement writes activity + outcomes back to CRM

- Conversation intelligence writes coaching tags + next steps back to CRM

Data quality math (the part finance understands)

Callout: Data quality math If you sequence 10,000 prospects/month and 20% are invalid, that's 2,000 bad sends. Even at $0.002-$0.01 per send, the real cost isn't the send fee - it's domain reputation, lost replies, and rep time spent chasing ghosts instead of booking meetings.

Prospeo (Tier 1): a data plane that keeps the rest of your stack honest

I've seen teams spend six figures on engagement and "AI" add-ons, then wonder why results swing week to week. The root cause is almost always the same: they never built a real data plane, so every other layer's guessing.

Prospeo ("The B2B data platform built for accuracy") is the fastest way to fix that without signing your life away to an annual contract. It's built for the stuff that actually moves outbound metrics: 98% email accuracy, a 7-day refresh cycle (vs a 6-week industry average), and verification you can stamp back into your CRM so suppression and reporting finally work.

What you get, in plain terms:

- 300M+ professional profiles, including 143M+ verified emails and 125M+ verified mobile numbers (If you're comparing vendors, see Best B2B Data Providers.)

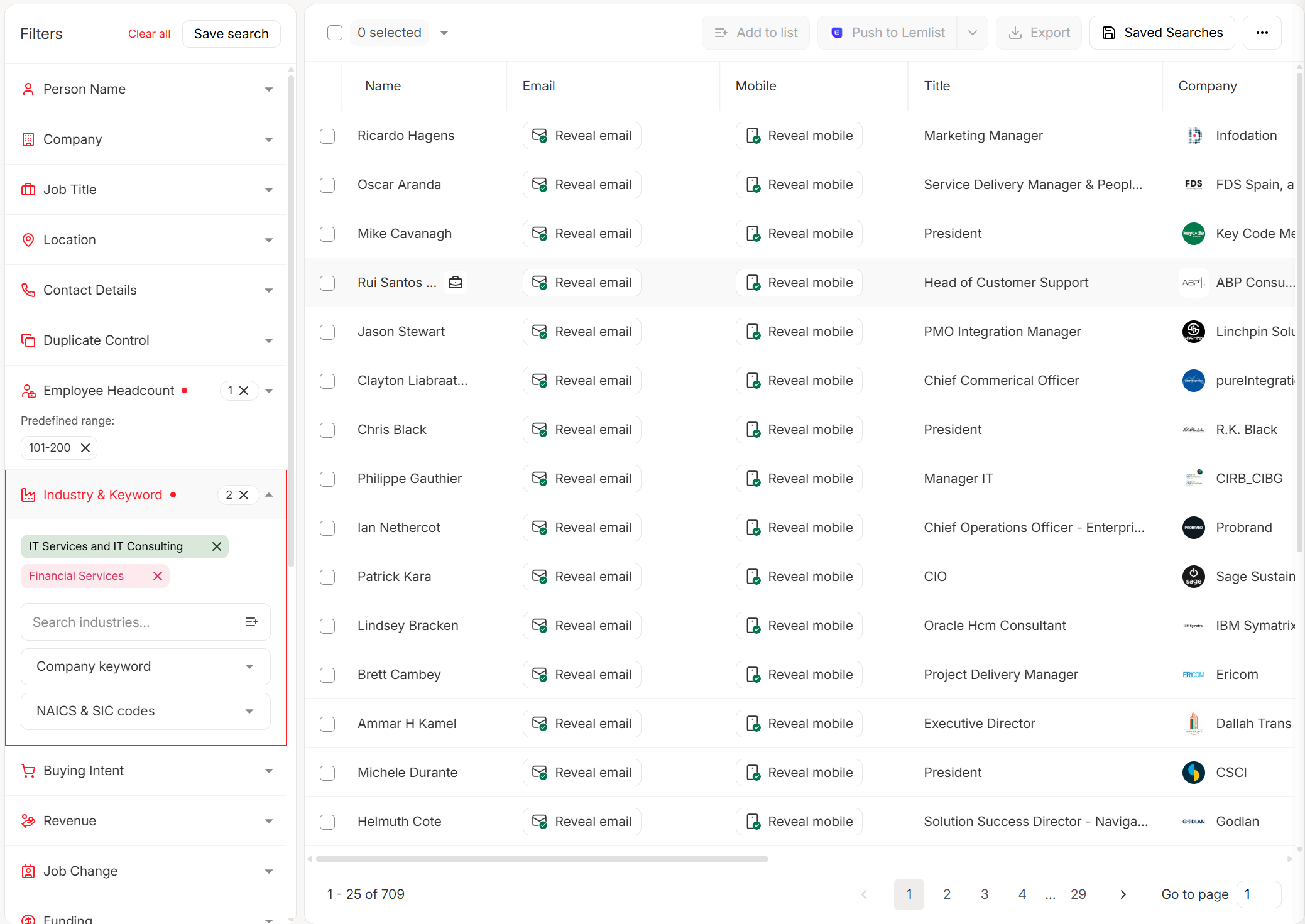

- 30+ search filters (intent, technographics, job change, headcount growth, department headcount, funding, revenue)

- 15,000 intent topics (powered by Bombora) you can route with 7/30/90-day windows

- Enrichment that returns 50+ data points per contact, with an 83% enrichment match rate and 92% API match rate

- A Chrome extension used by 40,000+ people for one-click prospecting across web sources and inside CRMs

Pricing signal: self-serve and credit-based. Plan around ~$0.01 per verified email and 10 credits per mobile, with a free tier (75 emails + 100 extension credits/month). Credits are only consumed for verified/found results, which is how pricing should work. (Full breakdown: Prospeo pricing.)

If you want the simplest workflow: connect your CRM or upload a CSV, enrich missing fields, filter to verified emails/mobiles, then push into your engagement tool with verification status stamped.

ZoomInfo (Tier 2): when the enterprise price tag's actually justified

ZoomInfo's the default when you're scaling outbound across multiple segments and you want a big US-heavy database plus add-ons like intent and workflow modules.

Where it wins: suite breadth (contacts + companies + org charts + add-ons). Where it loses: cost and freshness economics if your core need is verified contactability.

Pricing signal: budget $15k-$50k+/year for mid-market usage; larger deployments with intent/modules often land $40k-$60k+/year+. (If you're sanity-checking data quality claims, see Is ZoomInfo accurate?.)

Outbound engagement that doesn't destroy deliverability

Outbound in 2026 isn't about "more sequences." It's about not getting your domains cooked.

MediaPost's summary of ZeroBounce's decay report is the number that ends arguments: email data decays 28% per year, and they found 2.5B invalid emails in 2024. Lists rot. People change jobs. Catch-alls explode. (More benchmarks + mitigation: B2B contact data decay.)

Deliverability checklist (the rules that keep you off the penalty box)

- ☐ Verification's mandatory before sequencing

- ☐ Segment by email status:

- ☐ Valid → safe to sequence

- ☐ Catch-all → throttle and monitor

- ☐ Invalid/abuse/do-not-mail → never send

- ☐ Warm sending domains and ramp volume gradually

- ☐ Keep complaint rates low (targeting beats "send more")

- ☐ Don't mix cold outbound and customer comms on the same domain

- ☐ Write outcomes back to CRM so you can suppress intelligently

Deliverability rules (non-negotiable): If you're not verifying before every meaningful send, you're gambling with domain reputation. And when it breaks, it breaks for weeks - not days.

Sales engagement platforms (what they are + how to choose)

Sales engagement platforms are the rep's cockpit: sequences, tasks, multichannel touches, and the workflow layer that must capture everything back into your CRM.

Gartner's definition of Sales Engagement Applications (SEA) boils down to: multichannel engagement + outbound workflow execution + automation, with activity capture back into your CRM.

Salesloft vs Outreach: pick based on the operating model (not features)

G2's head-to-head comparison shows Salesloft at 4.5/5 (4,261 reviews) vs Outreach at 4.3/5 (3,528 reviews), with Salesloft ahead on Ease of Use (8.8 vs 8.3) and Quality of Support (8.6 vs 8.3). That matches what we've seen in rollouts: Salesloft tends to win adoption battles, Outreach tends to win process battles.

- Pick Salesloft when adoption's the priority and you want reps productive fast.

- Pick Outreach when you're enforcing process rigor and you've got RevOps capacity to govern it.

Here's the thing: teams blame the engagement tool for problems caused by (1) missing required CRM fields, (2) broken activity/outcome mapping, and (3) unverified lists. Fix those three and either platform performs.

Salesloft (Tier 1): the default trial pick for most teams

Salesloft is the engagement platform I'd trial first for most SMB and mid-market orgs because it balances power with usability. Adoption beats feature depth every time.

Pricing signal: budget $100-$300/user/month depending on package and volume.

Outreach (Tier 2): when you need governance and an audit framework

Outreach is the right pick when you treat engagement as a workflow system, not just "where sequences live." Its governance mindset (including the 4R audit framing) helps teams run consolidation without politics.

Pricing signal: budget $120-$300/user/month depending on modules and scale.

HubSpot (Tier 2): the SMB suite that actually works

HubSpot's the exception to "best-of-breed always wins." For smaller teams, a unified CRM + basic engagement is the difference between shipping and stalling.

Pricing signal: freemium entry, then budget ~$20-$150/user/month plus hub add-ons as you scale.

AI-readiness gate: don't buy agentic AI until your CRM's clean

Vendors love pitching AI as a shortcut. It's not. AI amplifies whatever you feed it - good process or garbage process.

Use this gate before you buy agentic AI, auto-scoring, or "AI pipeline inspection":

- Duplicates: under 5% duplicate accounts/contacts in your active outbound segment

- Activity capture: over 90% of emails/calls/meetings logged automatically (not manually)

- Verification: email status present on outbound contacts, with a verified date

- Stage hygiene: every opportunity stage has exit criteria and a required next step/date

If you can't pass that gate, AI won't fix your stack. It'll recommend the wrong next steps faster.

Intent layer (optional): score with 7/30/90-day recency windows

Intent's useful when you treat it like a time-windowed signal, not a magic "buy now" button. If you're training SDRs on how to use intent without spraying, this intent data for SDRs playbook is a solid baseline.

A simple scoring model that works:

- 7-day intent: route to SDR fast lane (highest urgency)

- 30-day intent: standard sequencing + personalized angle

- 90-day intent: nurture + light touches, then re-verify before re-activating

The key is governance: write back fields like intent_topic, intent_recency_window, and intent_last_seen_date so routing and reporting stay consistent. If intent lives only inside the intent tool, it becomes another tab nobody trusts.

Calling, conversation intelligence, forecasting (and the decision rules)

Calling and conversation intelligence are where activity turns into improvement:

Conversation intelligence → coaching → pipeline hygiene → forecasting

Here are the triggers that keep you from buying too early - or too late:

- Buy conversation intelligence when managers will review 10+ calls per week and you've got a coaching cadence. If nobody reviews calls, you're buying an expensive call library.

- Buy forecasting tooling when weekly pipeline reviews cover 50+ active deals or when you've got 3+ stages that must be inspected consistently across reps. At that point, spreadsheets stop being "simple" and start being a risk.

Gong (Tier 2): conversation intelligence that pays off with real coaching

Gong pays off when managers run call reviews, tag patterns, and enforce next-step hygiene. Without that cadence, it's shelfware.

Pricing signal: budget $100-$200/user/month for conversation intelligence, depending on recording volume and features.

Clari (Tier 3): forecasting when spreadsheets stop working

Clari forces inspection discipline: commit logic, rollups, and consistent deal views. It's not magic. It's structure.

Pricing signal: budget $20k-$60k/year depending on team size and modules.

Optional layers (when you're ready): enablement, deal execution, ABM/intent

These layers matter once the core stack's stable:

- Enablement (Highspot): buy it when you want to measure content by revenue outcomes, not "downloads." If you can't tie assets to stage progression, you're just building a content library.

- Deal execution (Accord): buy it when deals involve multiple stakeholders and you need mutual action plans, shared timelines, and clean next steps that map back to the opportunity.

- ABM/intent (Demandbase + Bombora): buy it when routing and segmentation are already disciplined. These tools add account-level intent and engagement signals; they work best when you operationalize recency windows and write key fields back to the CRM.

B2B sales stack governance + procurement checklist (so your stack survives scale)

Governance's the difference between "we have tools" and "we have a system." It's also how you avoid Frankenstack - where every tool writes a slightly different truth and your pipeline meetings turn into debates about whose dashboard's right.

Procurement-grade checklist (RevOps + Security + IT)

Data + schema

- ☐ What objects does the tool touch? (Lead/Contact/Account/Opportunity/Activity)

- ☐ What fields does it write? What fields does it read?

- ☐ Does it support a published schema + validation rules?

- ☐ How does it handle duplicates (match rules, merge rules, survivorship)?

Integration questions

- ☐ Which API endpoints are used for sync?

- ☐ What are the daily API limits and retry behavior?

- ☐ How are field conflicts handled (priority rules, timestamps)?

- ☐ Is there a sandbox integration path for testing?

- ☐ Can we run reconciliation tests (sample records, before/after diffs)?

- ☐ What's the failure mode - silent drop, queue, or hard error?

Data capture + attribution

- ☐ Does it pass campaign member data cleanly? If campaign membership can't flow through tools, attribution becomes fiction.

- ☐ Does it log outcomes (reply, meeting booked, connect, no-show) in CRM fields you report on?

Security + compliance

- ☐ SSO/OAuth support

- ☐ Audit logs + data residency options

- ☐ GDPR/opt-out enforcement and DPA availability

- ☐ Role-based access controls and admin separation

Operational ownership

- ☐ Who owns the integration runbook?

- ☐ Who owns quarterly field audits?

- ☐ Who owns vendor relationship + renewal calendar?

What users get wrong (the three repeat offenders)

- They buy tools before they publish a schema. Then every integration invents its own field mapping.

- They measure adoption instead of outcomes. A tool can be "used daily" and still produce garbage data.

- They let every team write to the same fields. If five tools can overwrite

Lead SourceorNext Step, your CRM becomes unauditable.

Audit & consolidation playbook (4R + hard thresholds)

Tool sprawl's normal. Staying sprawled is optional.

Outreach's 4R framework is a clean way to audit without turning it into a political fight:

- Record: what system's the source of truth for this data?

- Redundancy: where else does this data live?

- ROI: what measurable outcomes does the tool drive?

- Risk: security/compliance/vendor viability + operational risk

Hard thresholds (the ones that force decisions)

- <70% utilization → consolidation candidate

- >50% feature overlap → consolidation candidate

Scoring table (keep / consolidate / sunset)

Score each tool 0-100 across the 4Rs.

| Score | Decision | Meaning |

|---|---|---|

| >75 | Keep | Strategic + adopted |

| 50-75 | Consolidate | Reduce overlap |

| <50 | Sunset | Replace/remove |

Rollout timeline that doesn't blow up the quarter

- Pilot: 5-10 people cross-functional (SDR, AE, RevOps, CS)

- Parallel run: 2-4 weeks (old + new side-by-side)

- Phased rollout: 5-12 months for bigger stacks

Parallel runs are where you catch the ugly stuff: field conflicts, duplicate creation, and "why did this activity disappear?" Better to find it with 10 users than 100.

What a b2b sales stack costs in 2026 (realistic ranges)

Budgets go wrong in two predictable ways:

- Teams overpay for "platform" bundles when they only use 20% of the modules.

- Teams underfund the data layer, then spend the difference on deliverability fixes and manual cleanup.

Salesforce (Tier 1): the system-of-record you must protect

Salesforce is still the default system of record for a reason: it's flexible enough to model your business, strict enough to enforce governance, and widely supported by every serious GTM tool.

But that flexibility's also the trap. Without field ownership, validation rules, and a published schema, Salesforce becomes a junk drawer: duplicate accounts, inconsistent stages, and "custom fields" that mean different things to different teams.

Protect it like production infrastructure:

- Assign one owner for schema changes (RevOps)

- Use required fields at the right moments (stage entry/exit, meeting booked, closed-won)

- Lock down "everyone can edit everything" permissions

- Treat integrations as code: test, document, and audit quarterly

Pricing anchor (public): Salesforce Sales Cloud ranges from $25-$350/user/month, with Agentforce 1 Sales at $550/user/month.

Pricing anchors (CRM + category ranges)

Salesforce Sales Cloud pricing is public and useful as a baseline:

| CRM tier | Price (per user/mo) |

|---|---|

| Free Suite | $0 (2 users) |

| Starter Suite | $25 |

| Pro Suite | $100 |

| Enterprise | $175 |

| Unlimited | $350 |

| Agentforce 1 Sales | $550 |

Now the category ranges we see most often in real budgets:

| Category | Typical range |

|---|---|

| Engagement | $100-$300/user/mo |

| Conversation intelligence | $100-$200/user/mo |

| Data platforms | $5k-$60k+/yr (self-serve to enterprise) |

| ABM/intent | $30k-$120k/yr |

| Forecasting (Clari class) | $20k-$60k/yr |

Budget model example (simple, usable)

For a 12-person sales org (8 AEs + 4 SDRs):

- CRM: $100-$175/user/mo → ~$14k-$25k/year

- Engagement: $150-$250/user/mo → ~$22k-$36k/year

- Conversation intelligence (subset or all): $100-$200/user/mo → ~$10k-$29k/year

- Data platform: ~$5k-$60k/year depending on volume and coverage

That's how you end up in the $60k-$140k/year band without doing anything "enterprise."

FAQ

How many tools should a B2B sales stack have in 2026?

Run 5-7 tools end-to-end. Every extra tool adds integration risk, field conflicts, and adoption drag. Ebsta's 5.6 tools benchmark for consistent outbound is a solid sanity check. If you're above 10 tools, consolidate unless you're truly enterprise-scale.

What should you buy first: sales engagement or data enrichment?

Buy data enrichment + verification first if you're doing outbound. Bad data tanks deliverability and wastes rep time no matter how good your sequencer is. Then buy sales engagement once you can reliably feed it verified contacts and write outcomes back to the CRM.

What does "write back to CRM" actually mean?

It means the tool creates or updates CRM records and fields automatically - contacts, accounts, activities, outcomes, and key timestamps - so your CRM reports reflect reality. If reps copy/paste outcomes or update stages manually, dashboards become untrustworthy and forecasting turns into guesswork.

How often should you refresh and verify prospect data?

Refresh and verify weekly for active outbound lists, monthly for your broader TAM, and quarterly for long-cycle opportunities. Email data decays fast (about 28% per year), so "we verified it last quarter" isn't a strategy.

What's a good self-serve option for verified emails and enrichment?

Prospeo is the fastest self-serve way to build a reliable data layer: 98% accurate emails, a 7-day refresh cycle, enrichment with 83% match rate and 92% API match rate, plus transparent usage-based pricing (about $0.01 per verified email) and no contracts.

If you do only three things...

- Lock your CRM schema (required fields, validation rules, field ownership).

- Put the data plane first (verify before you send; refresh on a cadence; stamp verification status + dates).

- Force write-back (outcomes, dispositions, next steps - queryable fields, not notes).

One warning: don't buy "AI" to compensate for missing fields. Clean data and clean write-back beat shiny automation every single time.

Bad data breaks every layer above it - sequences bounce, dispositions mean nothing, and forecasting becomes vibes. Prospeo's 5-step verification stamps email_status, verified_date, and data_provider fields directly into your CRM. At $0.01/email, it costs less than one broken report.

Stop sequencing unverified lists. Start with data you can trust.