Intent Data for SDRs: The Honest Playbook That Actually Works in 2026

It's Monday morning. Your intent platform says 47 accounts are "surging." You spend three hours calling into them. Zero meetings. Your manager asks why you're not using the data. You are using it - it's just not working.

That's not a you problem. Intent data for SDRs fails because of bad implementation, not bad data. Here's the short version of how to fix it:

- Start with first-party intent (your own website visitors) - it's free and far more actionable than third-party surges. 89% of SDRs prefer confirmed website visitors over third-party surges, for good reason.

- Use a platform that combines intent signals with verified contact data so you get the signal and the person to call in one place.

- Follow the 48-hour rule. If you're not reaching out within two days of a high-priority signal, a faster competitor is booking that meeting.

Now let's fix the rest.

Why Most SDRs Hate Intent Data (And They're Half Right)

A MarketBetter survey found that 72% of SDR teams say intent signals rarely convert to meetings. 64% felt they were "chasing signals" rather than working real opportunities.

They're not wrong about the experience. They're wrong about the cause.

Most intent platforms deliver account-level signals - "Acme Corp is researching CRM software" - and then leave you to figure out who at Acme Corp actually cares. As one SDR put it on Reddit: "The company-level info is an incredibly dull instrument. Rarely is Sales able to tease out the specific person."

Then there's the cost. A full intent stack - Bombora for signals ($30K/yr), ZoomInfo for contacts ($15K+/yr), a sales engagement tool ($12K+/yr) - runs $60K+ annually. At that price, you need the data to practically book meetings for you. It doesn't.

And the timing is brutal. Third-party surges often fire during the awareness stage, months before a buyer involves sales. You're calling someone who just started Googling a problem. They don't want a demo. They want a blog post.

So yes, most SDR teams get burned by intent signals. But the teams that make it work follow a specific framework. The same principles apply to BDRs - the role title differs, but the playbook is identical. I've watched it play out across dozens of outbound orgs.

What Intent Data Actually Is (And Isn't)

Research Behavior vs. Buying Behavior

The single most important distinction: browsing isn't buying.

Modern B2B buyers complete 60-90% of their decision-making before contacting a vendor. They review an average of 11 pieces of content and run 12 online searches before visiting your website. Intent data captures the research phase. That's valuable - but only if you treat it as a prioritization signal, not a purchase signal. An account researching "sales engagement platforms" might be buying. They might also be writing a blog post, building a competitive analysis for their current vendor, or just curious.

Your job isn't to sell to every surging account. It's to reach the right ones faster than your competitors.

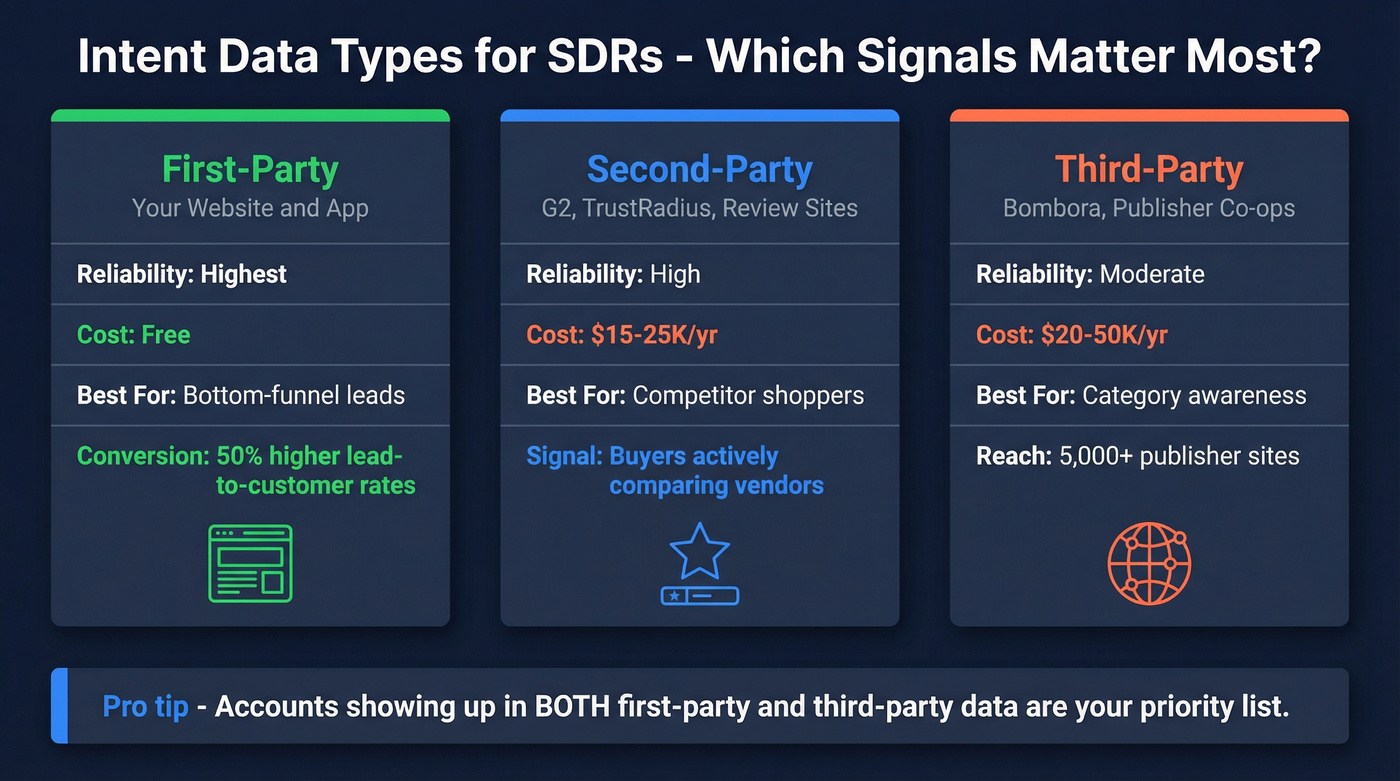

First-Party vs. Third-Party vs. Second-Party

| Type | Source | Reliability | Cost | Best For |

|---|---|---|---|---|

| First-party | Your website, app | Highest | Free | Bottom-funnel leads |

| Second-party | G2, TrustRadius | High | $15-25K/yr | Competitor shoppers |

| Third-party | Bombora, publisher co-ops | Moderate | $20-50K/yr | Category awareness |

First-party data - who's visiting your pricing page, downloading your case studies - is the most actionable signal you have. It achieves 50% higher lead-to-customer conversion rates than third-party data. And it's free.

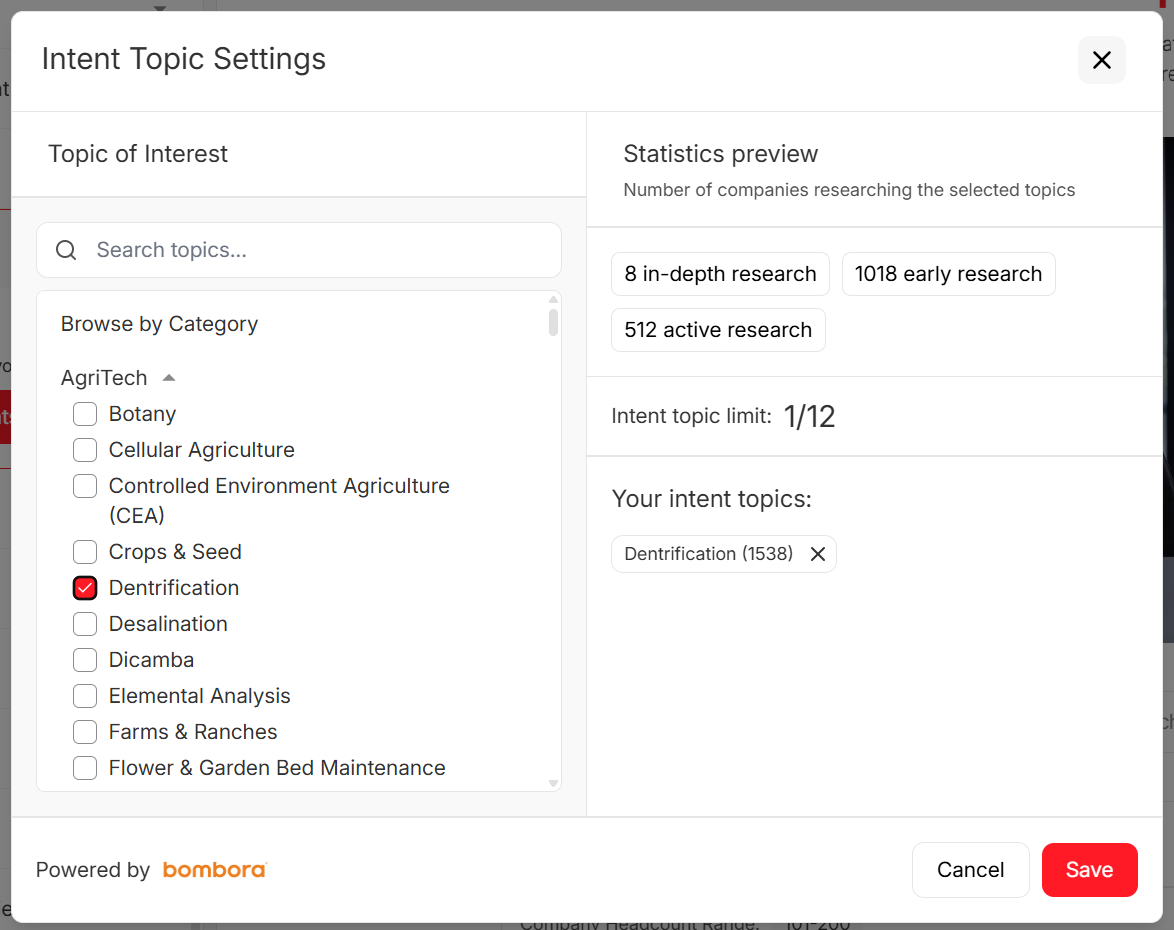

Third-party data casts a wider net. Bombora's cooperative spans 5,000+ B2B publisher sites tracking what companies are researching across the web. The reach is massive, but the signal is noisier. Combine both: first-party tells you who's interested in you, third-party tells you who's interested in your category. Accounts showing up in both? That's your priority list.

Account-Level vs. Contact-Level - The Gap That Kills Most Intent Programs

Here's where most intent programs die.

Forrester found that up to 99% of marketing leads never convert to customers, largely because of imprecise targeting. Account-level intent tells you "Acme Corp is surging on cybersecurity." It doesn't tell you whether to call the CISO, the VP of Engineering, or the procurement director. Buying committees average 6-10 people. Gartner puts the number at 14-23 stakeholders for complex purchases. Account-level intent is like knowing which building has a fire but not which floor - and definitely not which person pulled the alarm.

The Signal Hierarchy Framework

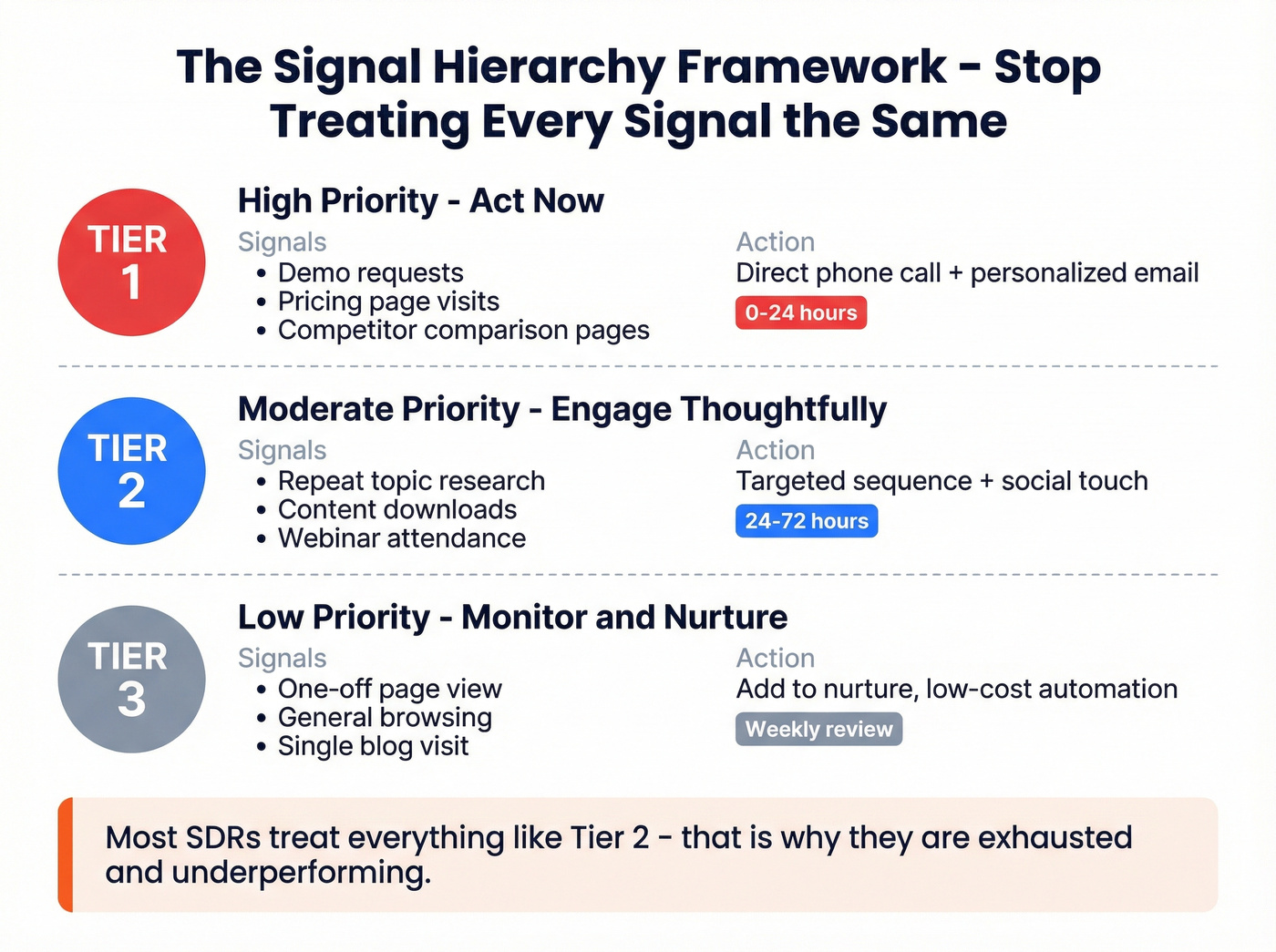

Not all intent signals are created equal. Treating a pricing page visit the same as a one-off blog view is why SDRs burn out on intent signals. You need a tiered system.

Tier 1 / Tier 2 / Tier 3 Signals

| Signal Tier | Examples | Priority | Action | Response Window |

|---|---|---|---|---|

| Tier 1 (High) | Demo request, pricing page, competitor comparison | Urgent | Direct call + personalized email | 0-24 hours |

| Tier 2 (Moderate) | Repeat topic research, content downloads, webinar | Standard | Targeted sequence + social touch | 24-72 hours |

| Tier 3 (Low) | One-off page view, general browsing | Monitor | Add to nurture, low-cost automation | Weekly review |

Tier 1 signals deserve phone calls. Tier 3 signals deserve an automated email at most. Most SDRs treat everything like Tier 2 - and that's why they're exhausted and underperforming.

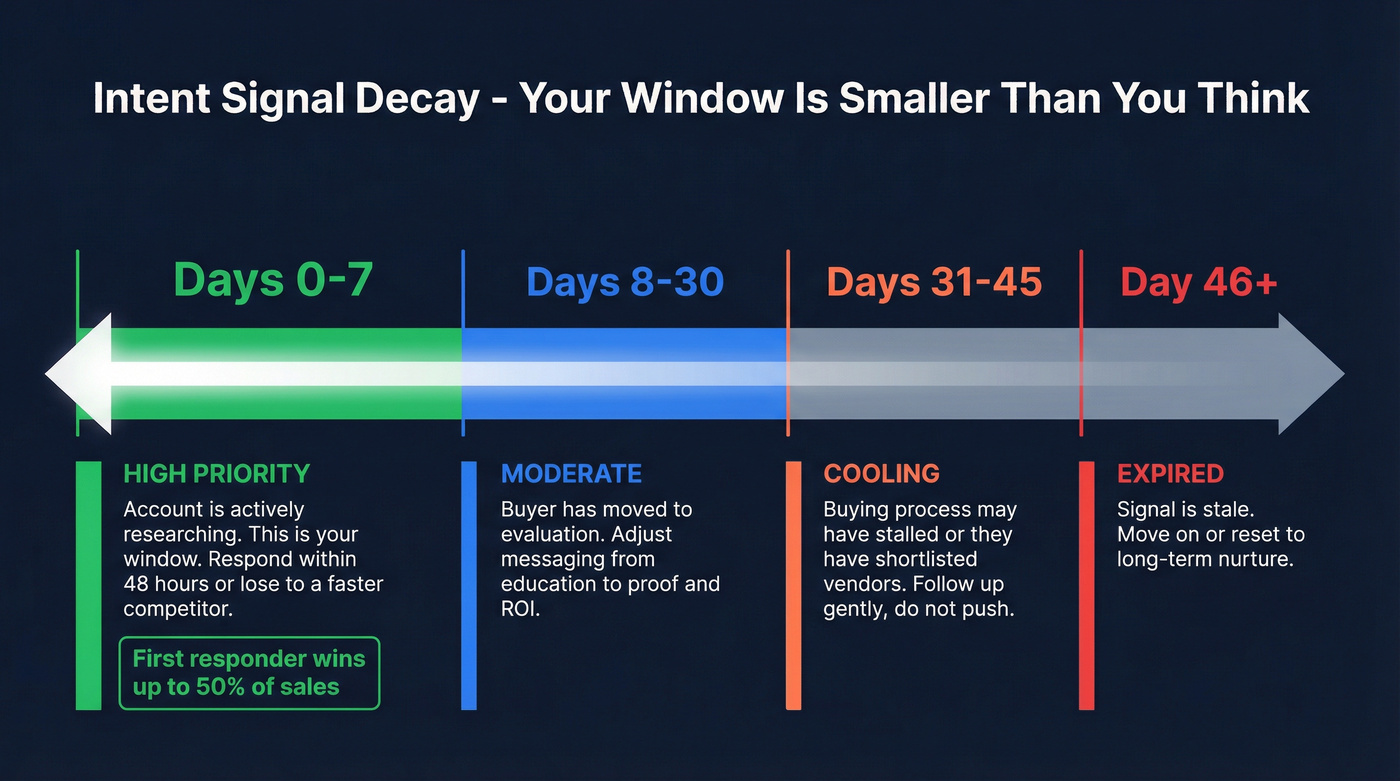

The Time-Based Decay Model

Intent data has a half-life. A company researching solutions today may have made a decision by next week:

- Days 0-7: High priority. The account is actively researching. This is your window.

- Days 8-30: Moderate. They've likely moved to evaluation. Adjust messaging accordingly.

- Days 31-45: Cooling. The buying process may have stalled or they've shortlisted vendors. Follow up, don't push.

- Day 46+: Expired. The signal is stale. Move on or reset to nurture.

The 48-hour rule matters most for Tier 1 signals. The vendor who responds first wins up to 50% of sales. If your workflow has a three-day lag between signal and outreach, you're handing meetings to competitors who move faster.

This article's biggest lesson: intent data without contact-level accuracy is a waste of an SDR's time. Prospeo combines Bombora intent data across 15,000 topics with 143M+ verified emails and 125M+ direct dials - so you get the signal and the person to call in one place. No $60K stack required.

Get the surge and the phone number for $0.01 per lead.

Mapping Intent Signals to Buying Stages

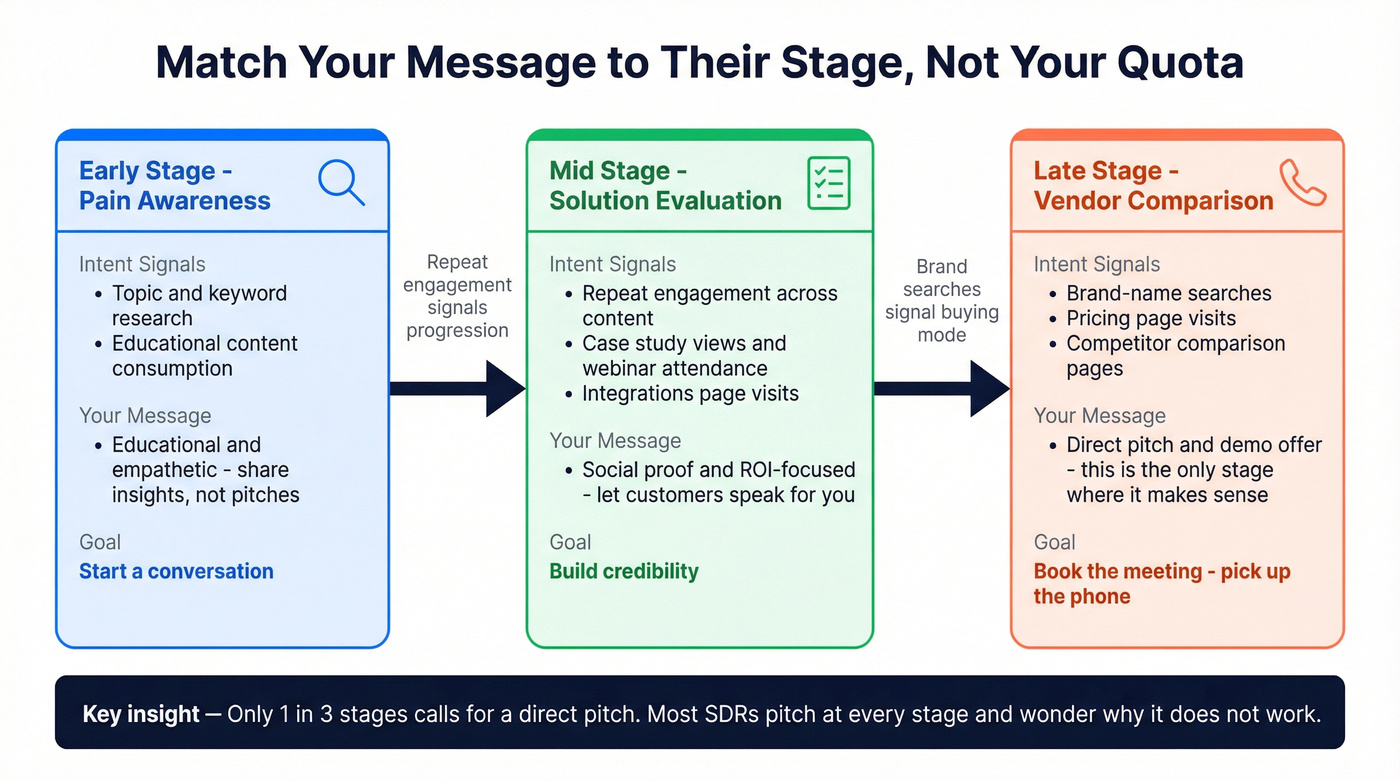

The signal type tells you where the buyer is in their journey. Match your message to their stage, not your quota.

| Stage | Intent Signals | Message Type | Outreach Goal |

|---|---|---|---|

| Early - Pain Awareness | Topic/keyword research, educational content | Educational, empathetic | Start a conversation |

| Mid - Solution Evaluation | Repeat engagement, case study views, webinars | Social proof, ROI-focused | Build credibility |

| Late - Vendor Comparison | Brand searches, pricing pages, competitor comparisons | Direct pitch, demo offer | Book the meeting |

Early Stage - When an account is researching broad topics like "how to improve outbound response rates," they're in pain awareness. Don't pitch. Educate. Share a relevant insight that positions you as someone who understands their problem. SDRs should have a table mapping intent topics to tailored messages for each stage.

Mid Stage - Repeat engagement is the signal. An account that downloaded one whitepaper is browsing. An account that downloaded three whitepapers, attended a webinar, and visited your integrations page is evaluating. Case studies and social proof do the heavy lifting here.

Late Stage - Brand-name searches, pricing page visits, competitor comparison pages. These are buying signals, not research signals. The account has a shortlist. This is the only stage where a direct pitch and demo offer make sense. Pick up the phone.

Here's the thing: if your average deal size is under $10K, you probably don't need a $60K intent stack. First-party signals plus a composable data tool will outperform enterprise platforms at a fraction of the cost. The teams I've seen waste the most money on intent data are the ones whose deal sizes can't justify the data spend.

Intent-Based Outreach Templates for SDRs

Email Templates by Signal Type

Template 1: Pricing Page Visit (Tier 1 - Late Stage)

Subject: {{Company}} <> {{Your_Company}}

Hi {{First_Name}},

Saw some activity from your team around [solution category] - figured the timing might be right to connect.

{{Company1}}, {{Company2}}, and [X] other {{Industry}} companies use [Your Company] to [short value prop]. The common thread: they were evaluating [2-3 competitors] and chose us because [specific differentiator].

Worth a 15-minute call to see if there's a fit?

Template 2: Competitor Comparison Research (Tier 1 - Late Stage)

Subject: Quick comparison - {{Competitor}} vs. us

Hi {{First_Name}},

Your team's been looking at options in [category]. I won't pretend to be unbiased, but here's what I can offer: a transparent comparison.

[One-sentence differentiator]. [One-sentence proof point].

Happy to walk through the differences live - 15 minutes, no pitch deck. Interested?

Template 3: Repeat Content Engagement (Tier 2 - Mid Stage)

Subject: Thought this might help

Hi {{First_Name}},

Your team at {{Company}} seems to be digging into [topic]. We just published [resource] that covers [specific angle] - thought it might be useful.

If you're evaluating solutions in this space, happy to share what we're seeing work for teams like yours.

The structure: intent-based opener, social proof, low-friction CTA. Notice what's missing - any reference to "we noticed you visited our website" or "our data shows your company is researching." That's intentional.

Cold Call Openers Using Intent Context

49% of buyers prefer phone as their first sales touch. And a friendly opener - specifically "How have you been?" - yields 6.6x higher success rates based on an analysis of 90,000 cold calls.

Opener 1: Pricing Page Signal

"Hey {{First_Name}}, it's [Your Name] from [Company]. How have you been? ... Great. I'll be quick - I know your team's been looking at [category], and I wanted to see if it makes sense to compare notes. We work with [peer company] on exactly this. Is now a terrible time?"

Opener 2: Competitor Research Signal

"Hey {{First_Name}}, how have you been? ... So I'm calling because a few companies in [their industry] have been evaluating [category] lately, and I wanted to see if {{Company}} is in the same boat. We just helped [peer] cut their [metric] by [result]. Worth 2 minutes?"

You're using intent to choose who to call and what to say. You're never revealing how you know.

The Surveillance Trap - What Not to Say

Never reference the data source directly. "We noticed you've been researching solutions like ours" sounds like surveillance, not sales. "Our platform flagged your company as high-intent" is even worse. The buyer doesn't know they're being tracked, and reminding them creates distrust, not urgency.

Let intent data guide your message, not become it. "I work with companies in your space" is fine. "I saw you visited our pricing page" is not. This single rule separates SDRs who convert intent signals from SDRs who creep prospects out.

How Intent Signals Fit into Your Daily SDR Workflow

Buyer intent doesn't work as a separate activity. It has to be woven into your existing rhythm:

08:30 - Inbox triage. Reply to responses, clean up calendar, check for overnight intent alerts.

09:00 - Parallel dialing block #1. Hit Tier 1 signals first - pricing page visitors, demo requests, competitor comparison activity. These are your highest-conversion calls. Warmed accounts convert 2-3x better than cold outreach.

10:30 - Personalization sprint. Five accounts, two minutes each. Pull up the signal, find the right contact, write the personalized touch. Cross-reference geographic data with intent signals - an account surging on your category and located in a territory you serve is a stronger signal than either alone.

11:30 - Social touches. Engage on accounts in active sequences. Comment on their posts. React to their content. Stay visible.

13:00 - Parallel dialing block #2. Time-zone matching for West Coast or EMEA accounts. Tier 2 signals get attention here.

15:00 - Follow-ups. Book handoff calls, send follow-up materials, confirm meetings.

16:00 - QA and next-day list build. Review call recordings, log objections, refresh your Tier 1 list for tomorrow from fresh intent signals.

The target: a 12-step sequence over 28-32 days mixing email, phone, and social. Intent data doesn't replace the sequence - it tells you which accounts deserve the sequence first.

The Missing Layer - Turning Company Signals into Verified Contacts

Look: account-level intent is useless without contact-level data. Knowing that Acme Corp is surging on "sales engagement software" means nothing if you can't reach the VP of Sales, the RevOps Director, and the CRO.

Multi-threading the buying committee - mapping at least three roles (economic buyer, technical gatekeeper, daily user) - increases win rates by 8-15 percentage points and shortens sales cycles by 15-30%.

This is where Prospeo bridges the gap. Instead of paying $30K for Bombora signals and another $15K+ for ZoomInfo contacts, the platform combines 15,000 Bombora intent topics with 300M+ verified profiles. Filter by intent topic, layer on job title and company size, and export verified emails (98% accuracy) and direct dials (30% pickup rate) - all refreshed every 7 days.

The Meritt team saw this play out in practice: after switching, their pipeline tripled from $100K to $300K per week. Bounce rates dropped from 35% to under 4%. Connect rates 3x'd to 20-25%. That's the math on replacing a $60K stack with a single platform that doesn't need a six-month implementation cycle.

Intent Data Tools for Sales Development - What They Cost and What They Actually Do

The Enterprise Intent Stack

| Tool | What It Does | Annual Cost | Key Strength | Key Limitation |

|---|---|---|---|---|

| Bombora | Topic surge data across 5,000+ publishers | ~$30K/yr | Broadest topic coverage | No workflow layer |

| 6sense | Intent + ABM orchestration platform | ~$35-50K/yr | Full-funnel ABM | 3-6 month implementation |

| G2 Buyer Intent | Review-site buyer signals | ~$22K/yr | High-intent comparison shoppers | Limited to G2 ecosystem |

| Demandbase | Intent + B2B advertising | ~$18K+/yr | Ad targeting integration | Advertising-first design |

| ZoomInfo | Contacts + intent add-on | ~$15-40K/yr | Largest contact database | Intent is a paid add-on |

6sense gets the most negative feedback from SDRs of any tool on this list. Reddit threads from practitioners are consistently brutal - reps describe it as "vaporware" and report account-level signals that don't translate to booked meetings. One r/sales thread is literally titled "Please don't suggest 6Sense." The core issue: $35-50K/yr with a 3-6 month implementation doesn't produce ROI fast enough for most teams, and by the time you've built the workflows, your contract is half over.

Skip 6sense if you're under 20 reps. Seriously.

The DIY Composable Stack

| Tool | Role in Stack | Monthly Cost | Key Strength |

|---|---|---|---|

| Prospeo | Intent + verified contacts | From ~$0.01/email | Signal + contact data in one platform |

| Clay | Workflow orchestration | ~$149/mo | Flexible GTM automation |

| Apollo | Prospecting + LeadSift intent | ~$49-99/mo/user | Large database, built-in sequences |

| Databar | Multi-source data aggregation | ~$39/mo | Aggregates 90+ data sources |

| Instantly / Lemlist / Smartlead | Email sequencing | ~$30-97/mo | Deliverability + automation |

We've tested both the $60K enterprise stack and the $500/month composable stack. The composable stack wins for any team under 20 reps, and the math isn't close:

Enterprise stack: $60K/year. If that generates just 4 meetings per year from intent data alone, you're paying $15K per meeting before the rep's salary.

DIY stack: $300-500/month. Same intent signals, verified contacts, and a sequencing layer. That's $3,600-6,000/year. Even at half the meeting volume, your cost-per-meeting drops by 80%.

Companies like OpenAI, Vanta, and Rippling use Clay as their central GTM orchestration layer. Pair it with a data platform for contacts and Instantly or Lemlist for sequencing, and you've got an intent-powered outbound machine for less than a single 6sense seat. This composable approach is why more BDR and SDR teams are ditching monolithic platforms entirely.

You just read about the 48-hour rule. Prospeo's 7-day data refresh means you're never calling a number that went stale six weeks ago. With 98% email accuracy and a 30% mobile pickup rate, your Tier 1 signals actually turn into booked meetings.

Beat your competitors to every surging account with data that connects.

Common Mistakes SDRs Make with Buyer Intent Signals

SDR intent mistakes fall into three categories. Know which ones you're making.

Timing Mistakes

Waiting too long. The 48-hour rule exists because intent decays fast. I've seen teams batch their intent reviews weekly - by then, the buyer has already talked to three competitors. If you can't act on a signal within two days, your process needs fixing before you spend another dollar on data.

Ignoring first-party signals. Teams spend $30K+ on third-party intent while ignoring the people literally visiting their website. First-party data is free, more reliable, and higher-converting. Start there. Layer third-party on top once you've maxed out first-party.

Targeting Mistakes

Treating all signals equally. A pricing page visit and a blog skim aren't the same signal. Use the tier framework above. Tier 1 gets a phone call within 24 hours. Tier 3 gets an automated nurture email. As one SDR put it: "I got better leads reading tarot cards and star signs." That's what happens when every signal gets the same treatment.

Using intent without context. A surging account that's outside your ICP is still a bad lead. Layer intent with firmographics - industry, company size, tech stack, buying authority. Intent should prioritize within your ICP, not expand beyond it.

Mistaking intent for qualification. Intent tells you who to call first. BANT tells you whether they can buy. An account surging on your category with no budget and no authority is still a waste of time.

Messaging Mistakes

Referencing the data source in outreach. "We noticed your company is researching..." is the fastest way to get ignored or reported. The surveillance trap kills more deals than bad data ever will.

Sales and marketing misalignment on signal definitions. If marketing considers a Tier 3 signal "sales-ready" and passes it to SDRs, everyone loses. Align on what constitutes Tier 1 vs. Tier 2 vs. Tier 3 before you turn anything on. 53% of B2B marketers say intent data's biggest value is sales-marketing alignment - but only if both teams agree on the definitions first.

When Intent Data Actually Works - Case Studies

Greenhouse - $27M Pipeline from Intent + AI SDR

Greenhouse switched from Drift to Qualified's Piper AI SDR and saw a 91% increase in meetings booked in the first two months. Over the first year: 15,000 conversations, 2,000 meetings, $27M influenced pipeline, $4M closed-won revenue.

This isn't a pure intent data story - it's an automation story. But the lesson applies directly: 60% of their leads weren't being followed up because they weren't the "hottest of hot" leads. The AI SDR handled lower-priority signals that humans ignored and converted them at a 50% rate from chat to booked meeting. Intent signals only convert when someone (or something) acts on them fast enough.

Demandbase - Same-Day Meeting from Person-Based Intent

SDR Omid Gholizadeh at Demandbase received an alert that a top account visited their website. The platform recommended specific buying group contacts ranked by confidence score. He added them to his sales engagement tool, connected on social, and within hours had responses from two buying group members.

Meeting booked with the decision-maker the same day.

As Sean Magee, Sr. Director of Sales Development at Demandbase, put it: "Person-Based Intent solves the age-old sales question of 'which account, why, who, when, and what to say.'" This is the clearest example of intent-driven sales development working as designed - signal, contact, and action compressed into a single workflow.

The DIY Stack Pattern - Job Changes as the Killer Signal

On Reddit, practitioners building Clay + Apollo + Instantly stacks report strong results - particularly with one signal type that outperforms everything else: job changes.

"Job changes though? That one's gold... 8 times out of 10 it turns into a real convo."

That tracks with Gartner's finding that 40% of deals stall because the primary contact left or changed roles. When someone new lands in a role, they're evaluating tools, building relationships, and open to conversations. It's the highest-converting intent signal that most enterprise platforms underweight.

FAQ

Is intent data worth it for small SDR teams?

Yes, but only with a composable stack costing $200-500/month - not enterprise platforms at $30K+/year. Start with first-party signals from your website (free) and layer in a tool that includes Bombora intent data alongside verified contacts. The ROI math only works when your data cost stays proportional to your team size and deal value.

What's the difference between first-party and third-party intent data?

First-party intent captures who visits your own website and engages with your content - it's the most reliable signal but limited in scope. Third-party intent tracks research behavior across thousands of publisher sites, giving broader reach but noisier signal quality. Combine both: first-party for bottom-funnel urgency, third-party for top-of-funnel awareness.

How quickly should SDRs act on an intent signal?

Within 48 hours for Tier 1 signals like pricing page visits and competitor comparisons - the vendor who responds first wins up to 50% of sales. Intent decays fast; a company researching solutions today may have shortlisted vendors by next week. Build your workflow around same-day or next-day response for high-priority signals.

Why do enterprise intent platforms disappoint SDR teams?

At $35-50K/year with 3-6 month implementations, the ROI math breaks for most teams. 6sense is the most common example - SDRs report account-level signals that don't translate to booked meetings, and Reddit sentiment is overwhelmingly negative. The root cause: these platforms solve the signal problem but not the contact problem, leaving reps without verified emails or direct dials for the right person at the surging account.

How do I turn an account-level intent signal into a booked meeting?

Filter surging accounts by intent topic, job title, and company size to find verified contacts for the right person - not just the company name. Map at least three roles per account (economic buyer, technical gatekeeper, daily user) to multi-thread the buying committee. The combination of intent signal + verified contact + multi-threading is what separates teams booking meetings from teams chasing surges.

Intent data for SDRs isn't broken. The way most teams buy it, implement it, and act on it is broken. Start with first-party signals, use the tier framework to prioritize, respond within 48 hours, and never - ever - tell a prospect you've been watching their browsing behavior. That's the whole playbook.