La Growth Machine Pricing (2026): What You'll Actually Pay

La Growth Machine pricing looks clean on the surface: EUR60-EUR120 per identity per month (and annual billing marketed as "2 mth free"). The real bill is driven by two things the pricing grid doesn't shout about: how many sending identities you need, and how fast you burn enrichment credits.

Here's the thing: if your outbound motion is under roughly 500 new prospects a month, LGM can be overkill.

I've watched teams buy it for the "multichannel" promise, then run one LinkedIn step + one email step for three months while paying for infrastructure they aren't really using.

Quick take: is the pricing fair?

- Fair for 1-3 identities on Basic (EUR60-EUR180/month) if you're actually running multichannel and replying from one place.

- Gets expensive fast at team scale: 6 identities on Pro = EUR720/month before enrichment overages.

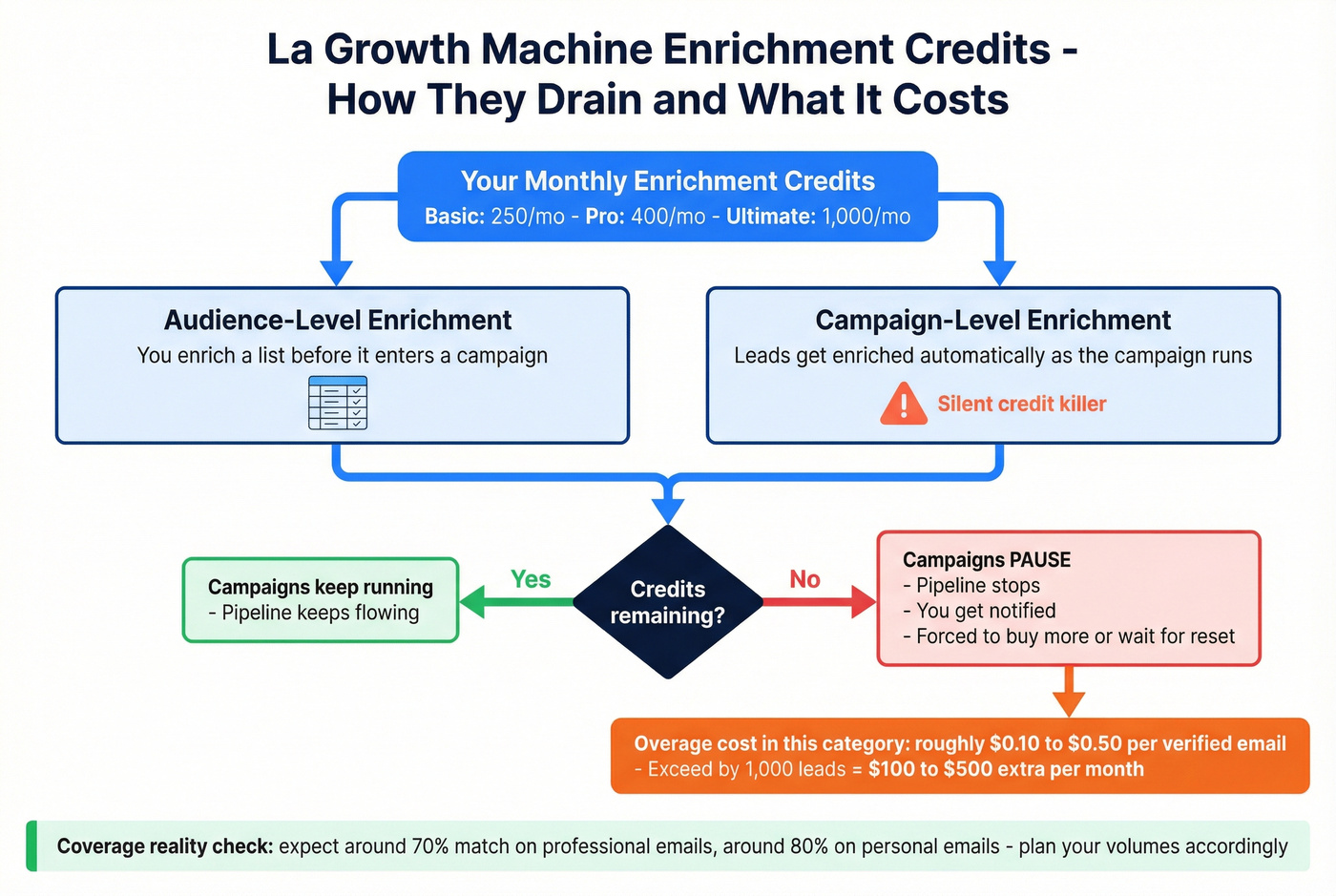

- Enrichment credits are the budget trap: in this category, overages often land around $0.10-$0.50 per verified email, and LGM pauses campaigns when credits hit zero.

La Growth Machine pricing at a glance (2026)

Pricing is published per identity with an annual toggle that advertises "2 mth free" (as shown on LGM's pricing page in February 2026).

| Plan | List price (EUR/identity/mo) | Channels | Included enriched leads/mo | Best for |

|---|---|---|---|---|

| Basic | EUR60 | LinkedIn + Email | 250 | Solo/founder, testing ICP |

| Pro | EUR120 | LinkedIn + Email + Calls | 400 | Small team, rotation + collaboration |

| Ultimate | EUR120* | LinkedIn + Email + X + Calls | 1,000 | Ops-heavy teams, workflows + CRM sync |

*Ultimate has shown higher pricing in some directories. Use the budgeting rule below so you don't get surprised.

Monthly vs annual: what "2 months free" actually means

If "2 mth free" means you pay for 10 months and get 12, your effective monthly rate is roughly:

- Basic: EUR60 -> ~EUR50/identity/mo effective

- Pro: EUR120 -> ~EUR100/identity/mo effective

- Ultimate: EUR120 -> ~EUR100/identity/mo effective (if the EUR120 display holds)

Annual billing is the easiest discount you'll get without changing your workflow.

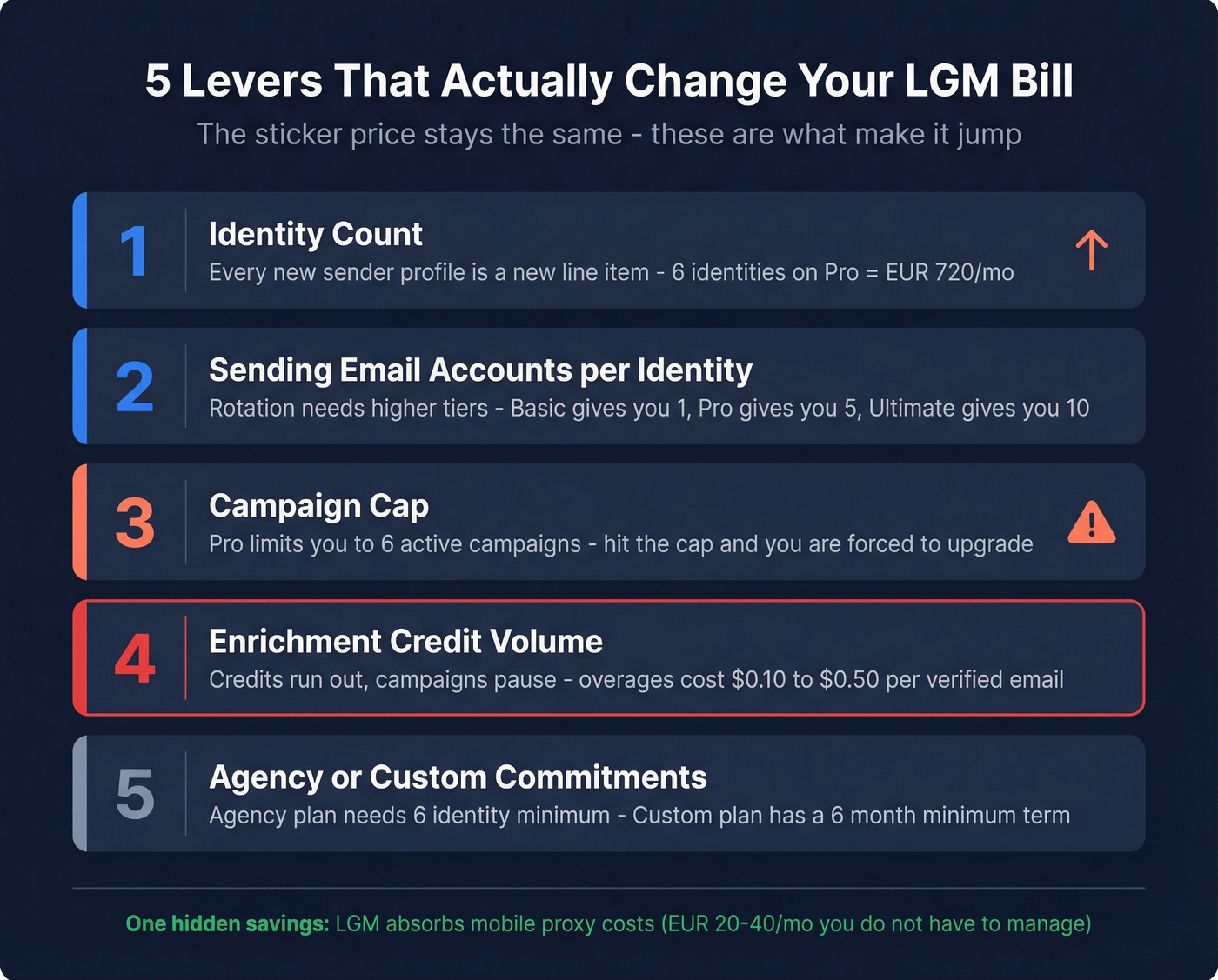

What changes your bill (the 5 levers that matter)

Even if the sticker price stays the same, spend jumps when you hit any of these:

- Identity count (every new sender profile is a new line item)

- Sending email accounts per identity (rotation needs higher tiers)

- Campaign cap (forces tier upgrades when you run many plays)

- Included enrichment volume (credits run out; campaigns pause)

- Agency/custom commitments (minimum identities or minimum term)

One underrated savings: LGM uses mobile proxies and absorbs the EUR20-EUR40/month cost. That's real total cost you don't have to manage.

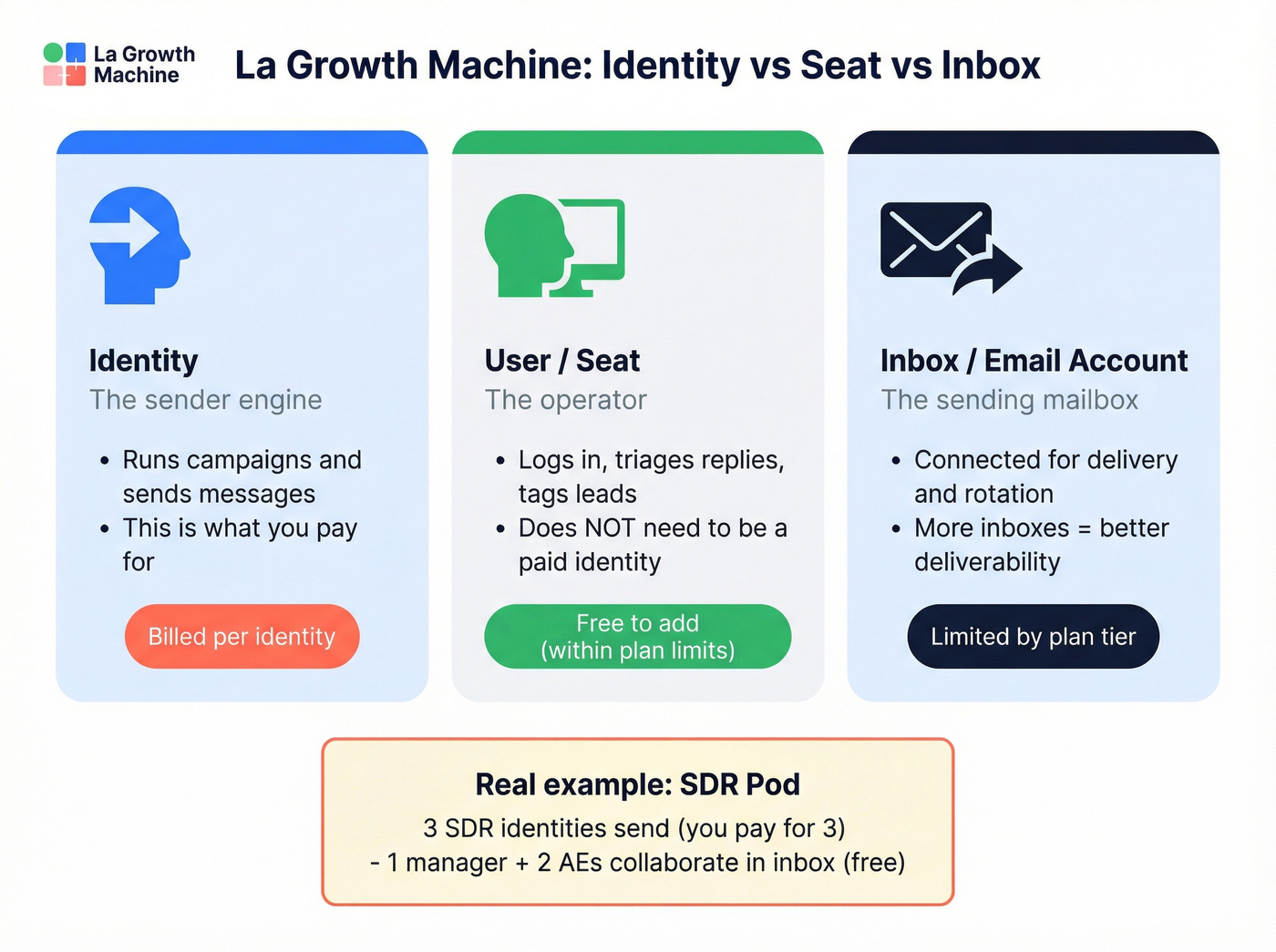

What "per identity" means (and how it differs from seats)

In LGM, an identity is the profile that runs campaigns and sends messages. It's not the same as a user seat.

- Identity = the sender "engine" (the profile actively running campaigns)

- User/seat = the operator (logs in, triages replies, tags leads, manages workflows)

- Inbox/email account = the connected sending mailbox(es) used for delivery and rotation

LGM's model is smart: you don't need an identity to answer replies. That's how teams keep costs down - AEs can jump into conversations without every AE becoming a paid sending identity.

Here are configurations that mirror how teams actually work:

1) Founder + assistant (lean outbound)

- 1 founder identity sends

- 1 assistant logs in to triage and label replies Bill driver: still 1 identity.

2) SDR pod with AE assist (common in B2B)

- 3 SDR identities send

- 1 SDR manager + 2 AEs collaborate in the inbox Bill driver: 3 identities, even if 6 people touch the tool.

3) "One AE = one sender" (expensive fast)

- 6 AEs each want their own sending identity Bill driver: 6 identities immediately - this is where LGM stops feeling "mid-market priced."

4) Agency ops (the identity multiplier)

- 10 client-facing identities running campaigns

- 2 operators manage everything Bill driver: 10 identities (operators don't save you here).

Basic's up-to-3-identities cap is the line in the sand: it's either your forever plan, or it's your trial phase before you pay real money.

LGM pauses your campaigns when enrichment credits hit zero. At $0.10-$0.50 per verified email, overages add up fast. Prospeo delivers 98% accurate emails at ~$0.01 each - with 143M+ verified addresses refreshed every 7 days, not whenever your sequencer feels like it.

Stop paying 10-50x more for the data that fuels your campaigns.

Plan-by-plan breakdown (limits that change your bill)

The pricing grid tells you the monthly rate. The limits tell you when you'll be forced to upgrade.

The fastest upgrade triggers are inbox rotation, campaign caps, and included enrichment (because campaigns pause when credits hit zero).

Basic: the best deal - until you hire

Basic is the right plan for 1-3 identities running a simple LinkedIn + email motion.

What you get that matters:

- 250 enriched leads/month

- 1 sending email per identity (no real rotation)

- Up to 3 identities

- 3 team members included

- Channels: LinkedIn + Email

In our experience, Basic is excellent for founders because it forces discipline. You'll learn your ICP and messaging before you scale volume.

Use this if:

- You're validating ICP/messaging and want a tight, controlled outbound motion.

- You're fine with simple deliverability ops (one mailbox per sender).

Skip this if:

- You're planning 4+ sending profiles this quarter.

- You need rotation to protect domains at higher volume.

Pro: where LGM becomes a team system

Pro is the real team tier. The unlock is rotation and collaboration.

What changes operationally:

- 400 enriched leads/month

- Up to 5 sending emails per identity (rotation)

- Up to 6 active campaigns (this limiter sneaks up on you)

- 25 team members included

- Adds Calls

Look, 6 campaigns disappears fast if you run multiple segments (SMB vs mid-market vs enterprise), plus inbound follow-up, plus event lists, plus partner lists. I've seen teams do "campaign Tetris" every Friday afternoon just to stay under the cap, and it's a waste of time when you're paying for an automation tool in the first place.

Use this if:

- You can keep your core plays under 6 and you want rotation + collaboration.

Skip this if:

- You're an agency or multi-segment team that needs lots of parallel plays.

Ultimate: ops features + fewer constraints (and the pricing weirdness)

Ultimate is the "stop fighting the tool" tier:

- 1,000 enriched leads/month

- 10 sending emails per identity

- Unlimited campaigns

- Channels include X + Calls

- HubSpot/Pipedrive sync + CRM enrichment + workflow triggers

That last line is the real value. Once you're serious about pipeline hygiene, workflows and sync matter more than another channel, because the cost of messy data shows up later as missed follow-ups, duplicate outreach, and reporting you can't trust.

Budgeting rule (do this, don't guess): If you need Ultimate-only features, budget EUR120-EUR180 per identity per month. The official page shows EUR120 today, but older directory listings have shown EUR180; if the price snaps back, you don't want your outbound program to be the surprise.

Plans vs limits (split for mobile readability)

Core pricing & volume

| Item | Basic | Pro | Ultimate |

|---|---|---|---|

| Price (EUR/identity/mo) | EUR60 | EUR120 | EUR120* |

| Included enriched leads/mo | 250 | 400 | 1,000 |

| Sending emails per identity | 1 | 5 | 10 |

| Active campaigns | Campaign cap applies | Up to 6 | Unlimited |

*Budget EUR120-EUR180 if you're planning around Ultimate features.

Collaboration & channels

| Item | Basic | Pro | Ultimate |

|---|---|---|---|

| Channels | LinkedIn + Email | + Calls | + X + Calls |

| Team members included | 3 | 25 | Unlimited |

| CRM sync / triggers | No | No | Yes (HubSpot/Pipedrive) |

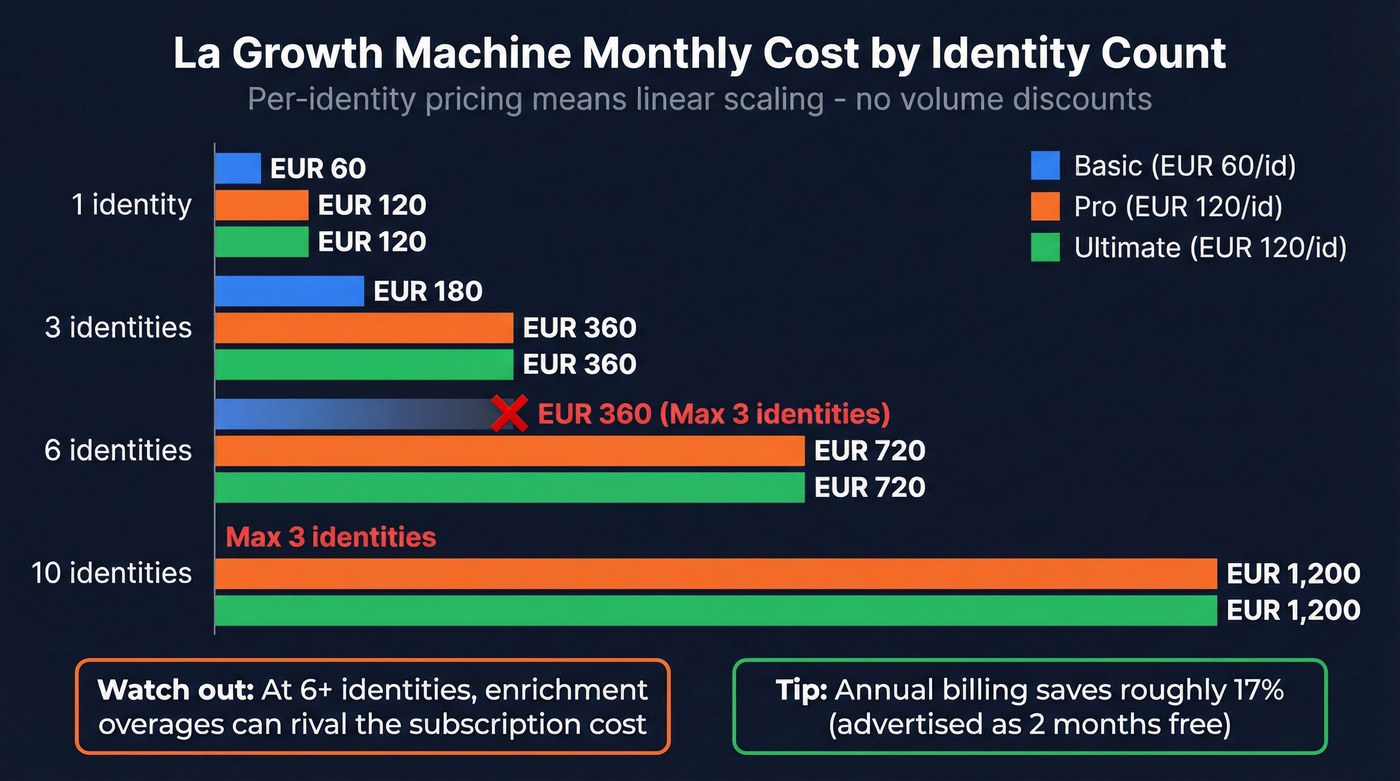

Scaling math: what you'll pay at 1, 3, 6, and 10 identities

LGM's math is refreshingly direct: identities x EUR/identity. That's great for forecasting - and brutal when you scale headcount.

Monthly totals using the published EUR/identity pricing:

| Identities | Basic (EUR60) | Pro (EUR120) | Ultimate (EUR120) |

|---|---|---|---|

| 1 | EUR60 | EUR120 | EUR120 |

| 3 | EUR180 | EUR360 | EUR360 |

| 6 | EUR360 | EUR720 | EUR720 |

| 10 | EUR600 | EUR1,200 | EUR1,200 |

Reality checks:

- 3 identities is the Basic ceiling. If you're hiring SDR #4, plan the upgrade now.

- 6 identities is where campaign caps + enrichment overages start to matter more than the sticker price.

- 10 identities is where finance starts asking hard questions (and they're right to).

Agency reality check: 25 and 50 identities (this is where "per identity" bites)

If you run client work or multiple workspaces, you need to see the compounding effect:

| Identities | Pro (EUR120) | Ultimate (EUR120) |

|---|---|---|

| 25 | EUR3,000/mo | EUR3,000/mo |

| 50 | EUR6,000/mo | EUR6,000/mo |

Two plan notes that change commitments:

- Agency plan requires a 6-identities minimum commitment.

- Custom plan comes with a 6-month minimum.

At 25-50 identities, the subscription isn't the whole story. Enrichment overages and deliverability operations can match it if you let list-building get sloppy.

Enrichment credits: the hidden cost lever (with real overage math)

LGM's per-identity price rarely blows up budgets. Enrichment does.

And because campaigns pause when credits hit zero, it isn't just a cost line - it's an operational dependency.

How credits get consumed (the two trigger points)

Use this checklist to avoid accidental spend:

- Audience-level enrichment: you enrich a list before it enters a campaign.

- Campaign-level enrichment: leads get enriched automatically as the campaign runs.

Campaign-level enrichment is the silent killer: you're focused on copy and replies while credits drain in the background.

What happens when you run out (and why it hurts)

When credits hit zero, campaigns pause and you're notified. That's a good guardrail, but it's also the worst possible moment to be forced into a purchase or a plan change because pipeline doesn't care that your credits reset next month.

Overage economics (estimate, but useful)

LGM doesn't make extra-credit economics as obvious as the plan pricing, so here's the budgeting model that matches this category:

- Typical enrichment + verification overages: ~$0.10-$0.50 per verified email

Concrete example you can drop into a spreadsheet:

- You exceed your included enrichment by 1,000 leads/month

- Budget ~$100-$500/month in overages

If you're running 10 identities and pushing volume, it's easy for overages to rival the subscription, especially if you enrich broadly and filter later.

Coverage expectations (budget with reality, not hope)

LGM sets clear expectations:

- ~70% professional emails

- ~80% personal emails

So if you queue 1,000 leads expecting 1,000 verified work emails, you'll be disappointed. Plan for match rates, and design your workflow so you're not paying to enrich records you won't contact.

Data hygiene detail that matters (CRM governance)

One operational win: LGM enrichment only fills empty fields and doesn't overwrite your existing values. RevOps teams love that because it prevents "data wars" inside the CRM.

Cost-control move I recommend: separate automation from data economics

If enrichment and verification are your cost driver, stop buying data at automation-tool economics.

Prospeo - "The B2B data platform built for accuracy" - is a clean way to control this: 300M+ professional profiles, 143M+ verified emails, 125M+ verified mobile numbers, 98% email accuracy, and a 7-day refresh cycle (industry average: 6 weeks). It's self-serve with transparent pricing at about $0.01 per email and no contracts, so you can pre-verify contacts and then push only valid records into LGM to run the multichannel steps.

That one change makes your spend predictable: LGM stays the orchestration layer, and your data costs stop spiking mid-campaign.

Running 6 identities on LGM Pro? That's EUR720/month before enrichment overages even kick in. Feed LGM with Prospeo's 300M+ profiles and 98% email accuracy instead of burning included credits. Teams using Prospeo book 35% more meetings than Apollo users.

Separate your data budget from your sequencer bill and save on both.

What's included vs what usually costs extra (TCO reality)

LGM quietly saves you money by bundling infrastructure that many teams pay for separately: mobile proxies.

Benchmark proxy ranges:

- Server proxies: EUR1-3/month

- Residential proxies: EUR8-15/month

- Mobile proxies: EUR20-40/month

LGM absorbs the EUR20-EUR40/month mobile proxy cost per identity. At 10 identities, that's the difference between "this tool is pricey" and "this tool replaced a whole proxy stack I didn't want to own."

Pros:

- No proxy vendor shopping, no setup overhead.

- Per-identity pricing already includes a meaningful infra line item.

Cons:

- You can't opt out if you already have your own setup.

- It reinforces the identity-based curve: more senders = more baked-in infra cost.

Billing & pricing fine print (renewals, VAT, and why prices differ online)

This is the stuff that creates surprise Slack threads after someone clicks "upgrade."

Trial, payment, and renewal behavior

- 14-day trial starts when you create the account.

- To continue after trial, you'll need to enter payment details.

- Subscriptions auto-renew at the end of the term and on each anniversary.

If you're buying annual, set a renewal reminder 30-45 days before the renewal date. That's enough time to decide whether you're renewing, downgrading, or reducing identities without doing it in a panic.

Credits rollover (what rolls, what doesn't)

- Purchased additional credits roll over to the next month.

- Your included monthly allowance doesn't roll over. Treat it as "use it or lose it."

VAT (what to expect at checkout)

LGM lists prices in EUR; expect VAT added at checkout unless you enter a valid VAT ID for reverse-charge.

Procurement checklist (use this before you sign)

Confirm these before you commit:

- What counts as an identity in your workspace setup

- Your plan's campaign cap and whether it's per workspace or per identity

- How enrichment credits are consumed (audience vs campaign)

- What happens operationally when credits hit zero (pause behavior)

- Renewal term, notice period, and whether downgrades apply immediately or at renewal

Why you're seeing different LGM prices online (and what to budget)

You'll see conflicting Ultimate pricing because directories lag behind vendor pages.

Example: G2 lists Basic EUR60, Pro EUR120, Ultimate EUR180, and shows a "last updated" date of 2026-10-09 on its pricing page for that snapshot; treat directory pricing as directional and budget with a buffer if Ultimate features are non-negotiable.

My rule for budgeting:

- If you're buying Basic/Pro, budget the official page number.

- If you're buying Ultimate, budget EUR120-EUR180 per identity per month so a pricing reversion doesn't break your plan.

Helpful references:

Is La Growth Machine worth it? (value verdict + when to look elsewhere)

LGM is worth it when you want multichannel outbound with strong operational guardrails and you're comfortable paying per sending identity. On G2 it's rated 4.6/5 from 56 reviews; the pattern is consistent: teams like the workflow, then get annoyed when scaling costs and limits show up.

Real talk: the moment your outbound program becomes "how do we keep this under the campaign cap" instead of "how do we book more meetings," you're paying for friction.

The most common pain points people mention:

- Expensive to scale (identity-based pricing compounds)

- Campaign limits pushing upgrades

- Bugs or sync issues that create operational drag

One clarification on the "shared inbox" idea: LGM centralizes conversations in-app, but replies still originate from the underlying sender accounts. If your team needs a true shared mailbox experience, confirm LGM matches your definition before you commit.

Reference: https://www.g2.com/products/la-growth-machine/reviews

Decision tree (simple and honest)

Pick LGM if:

- You need multichannel and want one conversation thread per lead.

- You'll use inbox rotation (5-10 sending emails/identity) and automation seriously.

- You're fine budgeting per sender profile, not per user.

Look elsewhere if:

- Your biggest cost is enrichment/verification and you want to optimize data economics first.

- You run lots of parallel plays and hate campaign caps.

- You want an email-first sequencer and don't need heavy multichannel.

Alternatives (quick picks, no fluff)

Pricing changes constantly across these tools, so treat this as fit guidance, not a quote.

- Prospeo: Choose this when enrichment economics are your problem and you want the best accuracy (98%) and freshness (7-day refresh) with self-serve pricing.

- HeyReach: Choose this if you're an agency managing lots of sender identities and client workspaces.

- Lemlist: Choose this if you want a simpler, email-first sequencer with a strong deliverability ecosystem.

- Expandi: Choose this if social automation is the core motion and you don't need deep enrichment or workflow features.

- Dripify: Choose this if you want lightweight automation for a small team and you value simplicity over ops-heavy controls.

Closing recommendation (a budgeting heuristic you can actually use)

Here's the clean way to budget la growth machine pricing without getting surprised:

- Subscription budget = identities x plan price

- Example: 6 identities on Pro = 6 x EUR120 = EUR720/month (or ~EUR600/month effective on annual)

- Enrichment overage budget = max(0, enriched leads needed - included) x $0.10-$0.50

- Example: if you need 1,400 verified emails/month on Pro (400 included), you're 1,000 over -> budget ~$100-$500/month in overages

If you're staying at 1-3 identities, LGM's pricing is fair and the product's a solid buy. If you're heading to 10+ identities or agency scale, treat enrichment as a first-class cost center: lock down your data economics first, then let LGM do what it's great at - running the multichannel machine.