Apollo.io Accuracy: The Gap Between 91% Claims and Real-World Results

You just exported 500 leads from Apollo, loaded them into your sequencer, and hit send. Two days later, your bounce rate is sitting at 35%. Your domain reputation just took a hit that'll take weeks to recover from. And those 500 credits? Gone.

That's the apollo io accuracy experience nobody warns you about until it's too late.

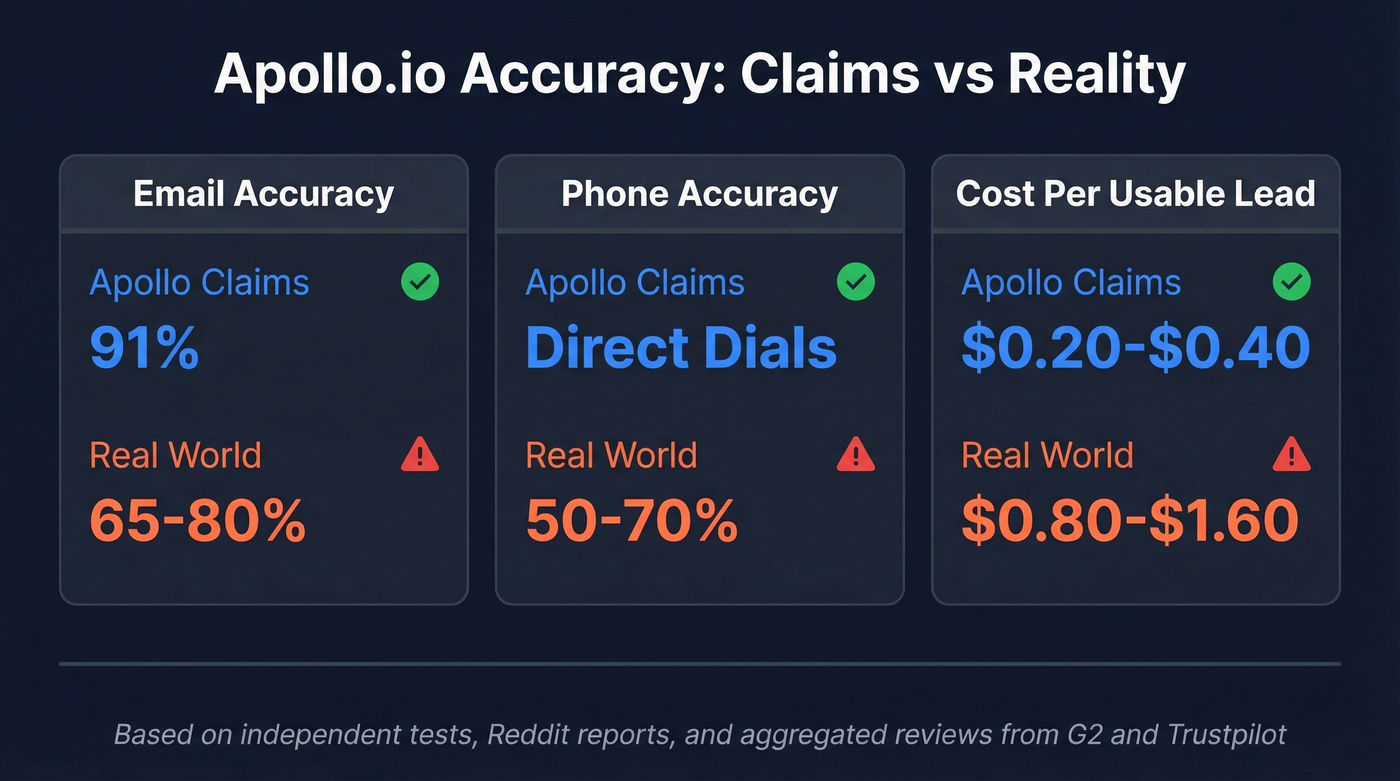

Apollo claims a 91% email accuracy rate. Real-world testing - from independent practitioners, Reddit threads, and aggregated reviews - puts the actual number at 65-80%. Multiple users report data quality has actually declined over time, not improved, making the gap between marketing claims and reality even wider. That's not a rounding error. That's the difference between a healthy outbound program and one that's actively damaging your sender reputation.

Here's what the data actually shows, why the gap exists, and what you can do about it.

What You Need to Know (Quick Verdict)

Before you dig into the details, here's the short version:

- Real-world email accuracy: 65-80%, not the 91% Apollo advertises. Multiple independent tests confirm this range.

- Phone number accuracy: ~50-70% for direct dials. Many "direct" numbers route to main company lines.

- Cost per usable lead: When you factor in bounces, wrong ICP matches, and outdated contacts, you're paying $0.80-$1.60 per lead that actually works - not the $0.20-$0.40 per credit Apollo charges.

- December 2025 waterfall update: Apollo's most recent major accuracy improvement claims 45% fewer bounces. Promising, but too new for independent verification.

- Who should still use Apollo: Teams that value all-in-one features (sequencing, CRM, dialer) over data purity, and who verify externally before sending.

- Who shouldn't: Teams where bounce rates directly damage domain reputation, EMEA-focused orgs, or anyone running phone-heavy outbound.

Hot take: Apollo is still the best value all-in-one sales platform on the market. But most teams don't need all-in-one - they need accurate data. Those are two very different things.

How Apollo Verifies Data (And Where Quality Falls Short)

Apollo describes a 7-step email verification process that sounds thorough on paper. It includes SMTP tickling, analysis against their contributor network, checking connected inboxes and CRMs, tracking email delivery statistics, and monitoring bounce rates across their platform.

The pitch is that this multi-layered approach gives Apollo an edge over tools that rely solely on SMTP verification. That's partially true - SMTP-only verification can't handle catch-all domains, and Apollo's engagement data from millions of active users does provide a signal that standalone verification tools lack.

Here's where it breaks down.

Apollo's own documentation distinguishes between an "email match rate of 84%" and an "accuracy rate of more than 90%." That distinction matters enormously. The 84% match rate means Apollo can find an email for 84% of the contacts in its database. The 91% email accuracy rate only applies to the subset Apollo marks as "verified." It's not measuring accuracy across all contacts you'll export - it's measuring accuracy on the contacts Apollo is most confident about. Big difference.

The contributor network - 2M+ people sharing business contact data - is both Apollo's biggest asset and its biggest liability. It's how they build a 275M+ contact database at a fraction of ZoomInfo's cost. But contributor data comes with problems: personal emails (Gmail, Yahoo) mixed in with corporate addresses, outdated job titles from people who changed roles months ago, and composite records that merge data from multiple sources into unusable chimeras.

Apollo collects data from four sources: the contributor network, their engagement suite (tracking bounces and replies across the platform), public data crawling, and third-party data providers feeding 230M+ records monthly. Each source has different freshness and reliability. When they all agree, you get a solid contact. When they don't, you get a "verified" email that bounces.

The catch-all domains problem is particularly insidious. Apollo claims it can distinguish valid from invalid emails on catch-all domains using engagement data. In practice, catch-all emails represent an estimated 15-25% of any Apollo export, and they're a major source of hidden bounces that don't show up until you actually send.

What Users Actually Experience - Real-World Testing Results

Email Accuracy

The gap between Apollo's claims and user experience is well-documented. One practitioner tested 500-1,000 leads per tool using identical search filters (SaaS companies, 10-200 employees, specific tech stack) and verified results with NeverBounce. Apollo's bounce rate came in at 32-38%.

A more detailed breakdown from a test of 1,847 Apollo contacts found that 60% were rejected before a single message was sent - 1,109 contacts deemed unusable:

- 412 had left their companies

- 287 were wrong ICP (agencies and consultants, not actual SaaS companies)

- 241 had emails likely to bounce (catch-all domains, typos, deprecated formats)

- 169 showed zero buying signals

The remaining 738 "Tier 1" leads performed well - 4.7% bounce rate and 6.3% reply rate. But you had to wade through 60% garbage to get there.

MarketBetter's independent review found bounce rates of 15-25% on Apollo-sourced contacts - lower than the worst cases but still well above the sub-5% industry standard. Aggregated across multiple independent sources, real-world accuracy lands in the 65-80% range. La Growth Machine's review puts it at 65-70%. Salesforge reported similar numbers. GoCustomer referenced G2 and Reddit users estimating 70-80%.

On G2, "Inaccurate Data" is the #1 complaint category with 538 mentions across 9,408 reviews. "Data Inaccuracy" adds another 488 mentions. That's over 1,000 reviews specifically calling out data quality - on a platform where Apollo still carries a 4.7/5 rating.

That 4.7 on G2 versus a 2.9 on Trustpilot tells you something. G2 reviews skew toward users who got value from the all-in-one platform. Trustpilot reviews skew toward people who got burned by specific failures - bounced emails, account restrictions, outdated contacts. Both are real. The question is which experience you'll have.

Phone Number Accuracy

Apollo's phone data is weaker than its email data. The #1 Reddit complaint? Direct dials that route to main company switchboards, not the person you're trying to reach.

We'd estimate Apollo's phone accuracy at 50-70% for direct dials, based on consistent user reports and industry benchmarks. That's significantly below ZoomInfo's ~80-85%, which remains the benchmark for US phone data. One Reddit user in r/b2b_sales put it bluntly: "Apollo isn't very good" for phone numbers. If phone outreach is a meaningful part of your motion, Apollo's data alone won't get the job done - see our B2B phone number guide for a verification-first workflow.

Filter Accuracy

This one doesn't get enough attention.

One user manually checked 20 "high-revenue" companies from Apollo's revenue filter. Fourteen were completely wrong - a 70% error rate. Revenue data for private companies is essentially guesswork, and Apollo's guesses aren't good.

The buying intent filter isn't much better. Tested across 12 different campaigns, response rates were consistently worse than control lists built without intent filters. That's not just unhelpful - it's actively misleading.

If you're using Apollo's revenue or funding filters to target companies, stop. Use employee count plus industry as a revenue proxy instead. It's less precise in theory but more accurate in practice. Job titles plus employee count plus industry plus verified email status - that's the filter stack that actually works.

Apollo users report 32-38% bounce rates and 60% of contacts unusable before sending. Prospeo's 5-step verification with catch-all handling and spam-trap removal delivers 98% email accuracy - not on a cherry-picked subset, but across every contact you export.

Stop paying for leads that bounce. Get data that actually connects.

Why Apollo Claims 91% But Users Report 65-80%

The gap isn't a lie, exactly. It's a measurement problem - and understanding it will save you from making bad decisions.

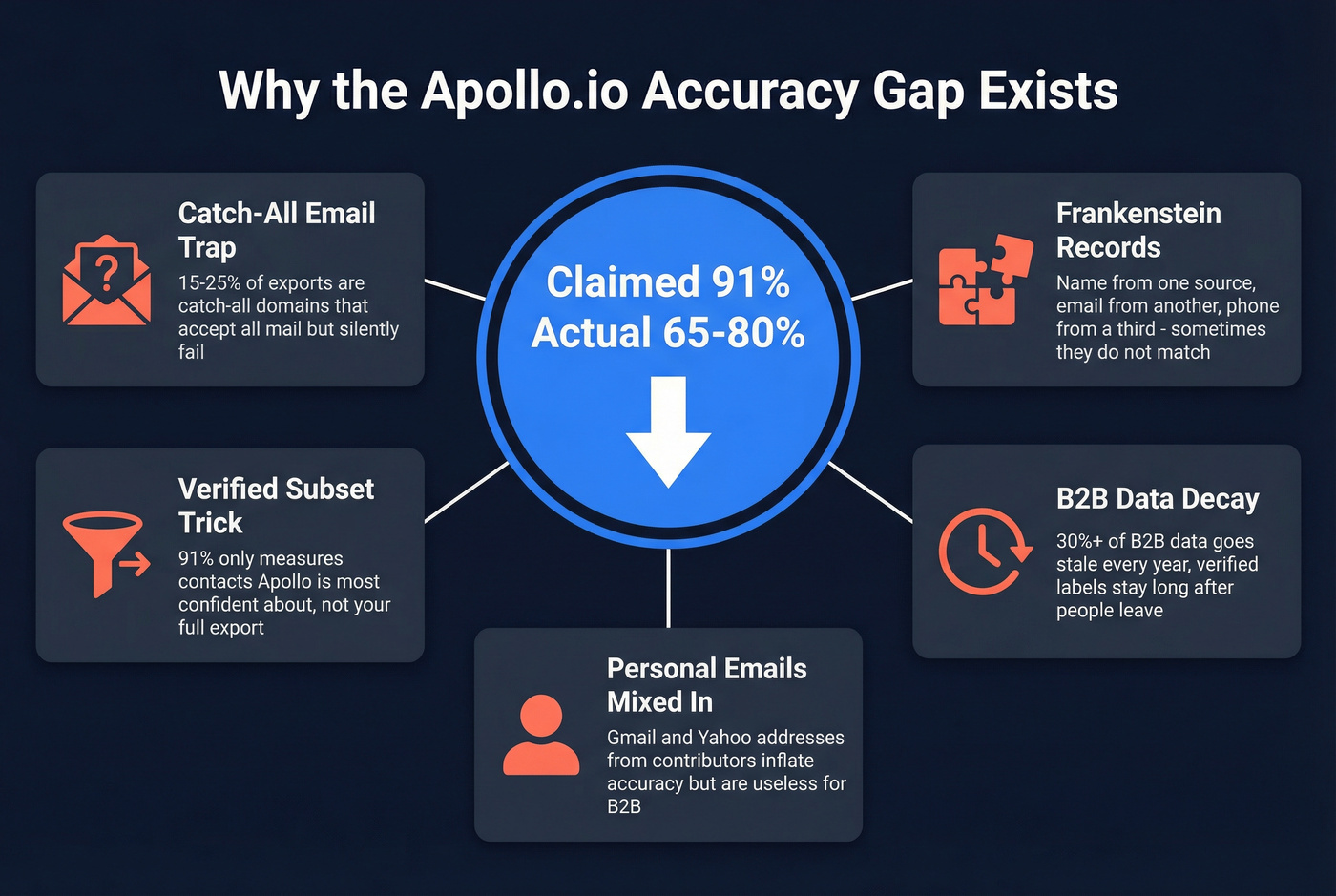

The catch-all email trap. An estimated 15-25% of any Apollo export contains emails on catch-all domains. These domains accept all incoming mail regardless of whether the specific address exists. Apollo marks many of these as "verified" because its SMTP check gets a positive response. The email technically "exists" at the domain level. But when you send to john.smith@catchall-company.com and John left two years ago, that email either silently disappears or eventually bounces. Apollo's 91% number doesn't fully account for this.

The "verified" subset trick. Apollo's 91% accuracy rate is measured on the contacts Apollo itself marks as verified - not on your entire export. When you pull 1,000 contacts, some are marked "verified," some "guessed," some "unavailable." The 91% applies to the first bucket. Your export includes all three. The blended accuracy across everything you actually download is much lower.

Personal emails in the database. Apollo's contributor network of 2M+ people shares contact data that includes personal email addresses - Gmail, Yahoo, Outlook. These are technically valid emails, but they're not the corporate addresses you need for B2B outreach. They inflate the "accuracy" number while being useless for your campaigns.

B2B data decay is brutal. Industry research puts B2B data decay at over 30% per year. People change jobs, companies get acquired, domains expire. If Apollo verified an email six months ago and the person has since left, that email is still sitting in the database marked "verified" until enough bounces trigger a status change.

Frankenstein records. When you're merging data from contributor networks, public crawling, CRM imports, and third-party providers, you inevitably create composite records. The name comes from one source, the email from another, the phone from a third. Sometimes they all belong to the same person. Sometimes they don't.

The frustrating part? Apollo's "verified" label creates false confidence. Teams trust it, skip external verification, and send. That's when bounce rates spike and domain reputation drops.

Regional Accuracy - Where Apollo Struggles Most

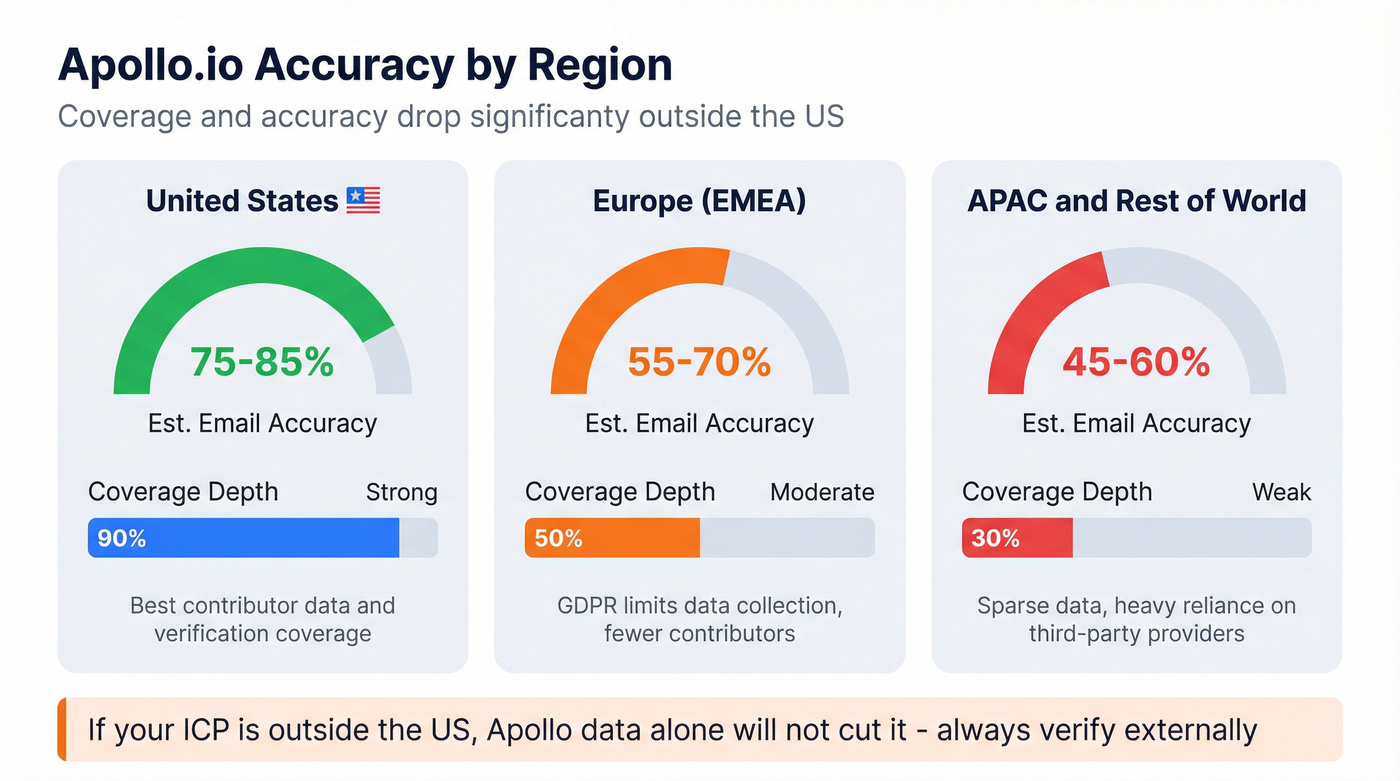

Apollo's accuracy problems aren't evenly distributed. The US is where the platform's data is strongest, and even there, it's not hitting the 91% mark. Outside the US, things get significantly worse.

An Artisan.co test searched for the same ICP across regions and found stark differences. Content Marketing Managers in Europe returned only 866 contacts versus 1,134 in the US. Solution Architects showed an even wider gap: 31,900 in Europe versus 66,000 in the US. The database simply has less coverage outside North America.

| Region | Est. Email Accuracy | Coverage Depth | Notes |

|---|---|---|---|

| US | 75-85% | Strong | Best contributor data |

| EMEA | 55-70% | Moderate-Weak | Far fewer contacts per ICP |

| APAC | 50-65% | Weak | Least reliable region |

For EMEA specifically, Cognism's Diamond Data delivers 3x higher connect rates compared to generic databases. Their 16-step verification process and DNC checking across 15 countries make them the clear specialist. Apollo only checks DNC lists for the UK and US - if you're calling prospects in Germany, France, or the Nordics, you're flying blind on compliance.

I've seen teams waste entire quarters trying to make Apollo work for European outbound before switching to a regional specialist. If EMEA is more than 20% of your target market, Apollo alone won't cut it.

Has Apollo Fixed Its Accuracy Problem? (2026 Updates)

Apollo hasn't been sitting still. The biggest update landed in December 2025: waterfall enrichment became the default for all accounts. Instead of relying solely on Apollo's own database, the system now checks Apollo first, then queries trusted third-party sources as fallback.

Apollo's internal numbers on the update: ~5% more emails found, ~7% more phone numbers, and 45% fewer bounces. Three modes are available: "maximize accuracy" (validates across multiple providers), "maximize coverage" (more sources, less validation), and "cost-efficient" (Apollo data only).

In January 2026, Apollo extended waterfall enrichment to job change data and improved funding data freshness to 48-72 hours - both meaningful for keeping records current. Earlier, in October 2025, they improved mobile vs. phone tagging and employee size data for private companies with 100+ employees.

If the 45% bounce reduction holds up, that would move Apollo from a ~20% bounce baseline to ~11%. Real progress - but still above the sub-5% that most deliverability experts consider acceptable.

There's a trust problem, though. In March 2025, Apollo's page on a major professional network was removed after that network determined Apollo's Chrome extension violated its terms of service. CEO Tim Zheng said the removal "does not disrupt Apollo's services or impact our core platform functionality." By late April, Apollo had redesigned its website and scrubbed mentions of that platform's prospecting features entirely.

That removal matters for accuracy because it was a key data source for verifying job titles, company affiliations, and contact freshness. Without that signal, Apollo's data verification pipeline lost one of its most reliable inputs. Users in r/GrowthHacking reported that automated connection features stopped working entirely - "no errors, tasks just don't show anymore."

The waterfall enrichment update is genuinely promising. But it's too new for independent verification. Until third-party tests confirm the 45% bounce reduction, treat it as directionally positive but unproven.

How to Get Accurate Data From Apollo (Workarounds That Actually Work)

If you're committed to Apollo's ecosystem, here's the workflow that practitioners report gets bounce rates under 2%:

Step 1: Build your list with the right filters. Use job titles, employee count, and industry - not revenue or funding filters. Skip Apollo's buying intent filter entirely.

Step 2: Don't filter by "Email Status: Verified." Counterintuitive, but Apollo's "verified" label creates a false sense of security. Export everything and verify externally.

Step 3: Export and preserve credits. Some practitioners use third-party export tools like Apify (~$1.20 per 1,000 leads) to reduce credit burn, though this may conflict with Apollo's terms of service - check before using.

Step 4: Verify with a dedicated tool. Run the exported list through a verification service. Remove all bounces, catch-alls, and unknowns. This step alone transforms your data from unreliable to usable (see a full email verification list SOP).

The math on this workaround: ~$1.20 per 1,000 leads (export) plus ~$5-10 per 1,000 for verification, versus $200-400 per 1,000 leads using Apollo credits directly. You save money and get better data.

The team that filtered their Apollo export down to Tier 1 leads achieved a 4.7% bounce rate and 6.3% reply rate. That's excellent - but it required discarding 60% of their contacts. The question is whether your time is better spent filtering bad data or starting with good data.

Apollo vs. Alternatives - What Accurate Data Actually Costs

Here's how Apollo stacks up against the tools people actually switch to when accuracy matters:

| Tool | Email Accuracy | Phone Accuracy | Starting Price | Best For |

|---|---|---|---|---|

| Prospeo | 98% | 30% pickup rate | ~$0.01/email | Email accuracy (7-day refresh) |

| Apollo.io | 65-80% | 50-70% | $49/user/mo | All-in-one value |

| ZoomInfo | 75-85% | 80-85% | $14K+/yr | Enterprise phones |

| Cognism | 80-90% (EMEA) | Phone-verified | $1K-$3K/mo | EMEA/GDPR compliance |

| Clay | 86-90% | Varies | $134/mo | Multi-source waterfall |

| Lusha | 72-78% | Good for mobiles | Free (40 credits) | Quick enrichment |

Prospeo - Accuracy Without the Workaround

Prospeo covers 300M+ professional profiles with 98% email accuracy, verified through a proprietary 5-step process that includes catch-all handling, spam-trap removal, and honeypot filtering. Unlike Apollo's crowdsourced approach, Prospeo uses proprietary email-finding infrastructure - no third-party email providers - and refreshes its entire database every 7 days (versus the 6-week industry average). That freshness cycle is why the accuracy holds up in practice, not just in marketing claims.

Pricing starts at ~$0.01/email with a free tier (75 emails/month) and no contracts. Meritt went from a 35% bounce rate to under 4% after switching, tripling their pipeline from $100K to $300K/week. For teams whose domain reputation has already been damaged by bad Apollo data, that kind of turnaround isn't theoretical - it's a real recovery path.

ZoomInfo - Best Phone Data, Enterprise Price

ZoomInfo remains the gold standard for US direct dials at 80-85% accuracy. If phone-heavy outbound is your primary motion, nothing else comes close. But you're paying $14K-$25K+/year to start, and enterprise contracts push well past $30K. Where ZoomInfo wins over Apollo: phone data depth and US coverage. Where Apollo wins: price, by a mile. (More detail: Is ZoomInfo accurate?)

Cognism - The EMEA Specialist

If you're selling into Europe, Cognism's Diamond Data delivers 3x higher connect rates than generic databases. Their 16-step verification and DNC checking across 15 countries make compliance a non-issue. Typically $1,000-$3,000/mo for small teams.

Skip this if you're US-only - you're paying a premium for EMEA infrastructure you won't use.

Clay - Waterfall Enrichment for Maximum Coverage

Clay doesn't have its own database. Instead, it queries 100+ data providers with fallback logic - if Source A doesn't have the email, it tries Source B, then C. Independent testing shows 10-14% bounce rates, which is solid. Real-time enrichment means you're always getting the freshest available data. Starts at $134/mo with unlimited users. Use this if you want maximum coverage and don't mind building your own enrichment workflows. Skip it if you want something that works out of the box.

Lusha - Quick Enrichment on a Budget

Lusha delivers 72-78% email accuracy with solid mobile number coverage. The free tier gives you 40 credits per month - enough to test before committing. The catch: credits burn fast once you're running real campaigns, and you'll hit the paywall quickly. Best for individual reps who need quick lookups, not teams running volume outbound. Paid plans start around $36/user/mo. (Full breakdown: Lusha pricing)

The Verdict - Should You Trust Apollo's Data in 2026?

Here's a contrarian take: Apollo's accuracy problem isn't entirely Apollo's fault. It's yours for using it wrong.

Apollo is wholesale produce. You're buying in bulk at a great price, but you still need to wash it, sort it, and throw out the bruised stuff before you serve it. The problem is that Apollo's marketing - especially that "91% accuracy" claim - implies the produce arrives pre-washed and ready to eat. It doesn't.

Apollo is right for you if: You want an all-in-one platform (database + sequencing + CRM + dialer) at a fraction of ZoomInfo's cost, and you're willing to verify externally before sending. For US-focused teams running high-volume outbound where some waste is acceptable, Apollo at $49/user/mo is genuinely hard to beat on value.

Apollo is wrong for you if: Bounce rates directly damage your domain reputation (cold email at scale), you're targeting EMEA or APAC primarily, or phone outreach is your primary channel. In these cases, the cost of Apollo's inaccuracy - in burned domains, wasted rep time, and missed connections - exceeds what you save on the subscription.

The "verified" label is the real villain here. It creates false confidence that leads teams to skip external verification. If Apollo renamed "verified" to "probably good but check anyway," their users would have better outcomes. And if you're tired of building workarounds to compensate for apollo io accuracy gaps, a tool where the data arrives clean is often cheaper than the verification stack you're already paying for.

At Apollo's real-world accuracy, you're paying $0.80-$1.60 per usable lead. Prospeo gives you verified emails at $0.01 each with a 7-day data refresh cycle - so you're never sending to someone who left their company months ago.

Replace Apollo's guesswork with contacts verified this week.

FAQ

What is Apollo.io's real email accuracy rate?

Apollo claims 91%, but independent testing consistently shows 65-80% across practitioner tests, Reddit reports, and aggregated review data. The gap exists because Apollo measures accuracy only on the subset it marks "verified," not across your entire export. You'll want to verify externally before sending any campaign.

Why do Apollo "verified" emails still bounce?

Catch-all domains are the biggest culprit - they accept all incoming mail at the domain level, so Apollo's SMTP check returns a positive result even for nonexistent addresses. B2B data also decays at 30%+ per year, meaning contacts verified months ago may have changed jobs. Apollo's contributor network introduces stale records that take time to cycle out.

Is Apollo's phone number data reliable for cold calling?

Apollo's phone accuracy runs 50-70% for direct dials, with many numbers routing to main company switchboards instead of the named contact. ZoomInfo leads for US phone data at ~80-85%. Prospeo's 125M+ verified mobiles deliver a 30% pickup rate across all regions - a strong option if you need global mobile coverage without ZoomInfo's price tag.

Did Apollo's December 2025 waterfall update fix the accuracy problem?

Apollo claims 45% fewer bounces by checking third-party sources when its own data falls short. If verified, that would bring bounce rates from ~20% to ~11% - real progress but still above the sub-5% threshold deliverability experts recommend. Independent confirmation of these numbers is still pending as of mid-2026.

What's the most accurate alternative to Apollo for email outreach?

Prospeo leads at 98% email accuracy with a 7-day data refresh cycle, covering 300M+ profiles at ~$0.01/email with a free tier of 75 emails/month. Clay's waterfall approach (86-90%) is another strong option for teams wanting multi-source enrichment with custom workflow control. Both eliminate the external verification step that Apollo requires.