SDR Manager: The Operating System (Responsibilities, KPIs, Salary)

Most SDR teams don't fail because reps "aren't hungry." They fail because nobody built an operating system: inputs, coaching loops, quality gates, and a scorecard that can't be gamed.

If you're an SDR manager (or hiring one), your job's to make pipeline creation boringly predictable.

Below is the weekly cadence, scorecard, and 30/60/90 plan I'd use to do it.

What you need (quick version)

Do these three things before you touch messaging, territories, or "more activity":

Pick one output target and commit to it. Anchor on The Bridge Group's baseline: 21 meetings set or 13 qualified opps per SDR per month. Choose the one your org will actually pay attention to (meetings held vs accepted opps) and build everything around it.

Install quality gates so the team can't win by spamming calendars. Run your scorecard on meetings held + opp/SAO acceptance, not booked meetings. If AEs reject a lot, you don't have a volume problem - you've got a definition problem.

Force coaching to happen with calendar blocks. Mon-Tue 1:1s by lunch, Tue-Wed call reviews, Thu training. If it isn't blocked, it won't happen.

Two reality anchors to keep you honest:

- Benchmark sanity check: Bridge Group's baseline implies you need consistent daily conversations, not heroic end-of-month sprints.

- Comp reality: RepVue's Feb 2026 data shows 63.4% quota attainment for Sales Development Managers - plans where "everyone hits" are fiction.

What is an SDR manager (and what they're not)

If you're asking "what is an SDR manager," here's the clean version: you lead an SDR/BDR team to create qualified opportunities, you coach the craft, and you own the day-to-day operations that keep the machine reliable.

In practice, you turn "we need more pipeline" into a system: routing, messaging, QA, dashboards, enablement, and cross-functional alignment. That's the core of SDR management.

And no, the job isn't being a hype-person with a gong.

Your real partners aren't just the SDRs. They're:

- Demand Gen (lead quality, SLAs, MQL-SAL definitions, campaign feedback loops)

- Sales/AEs (qualification standards, acceptance, handoff, rejection reasons)

- PMM/Enablement (messaging, proof points, objection handling)

You are:

- A coach (skills, talk tracks, objection handling, sequencing)

- An operator (process, sequence QA, dashboards, lead routing, tooling hygiene)

- A translator (Marketing ↔ Sales ↔ Product feedback)

- A capacity planner (coverage, territories, ramp, hiring plan)

You are not:

- A "mini Head of Sales" who lives in forecast calls all day

- A full-time recruiter (you interview; you don't run Talent)

- IT-on-call for every tech issue (you remove blockers; you don't become helpdesk)

- An AE manager in disguise (unless your company wants you to do two jobs badly)

Day-to-day outputs you should ship every week: a coaching plan, a QA sample + findings, an SLA report (speed-to-lead + routing misses), and an AE rejection analysis with fixes.

Ops expectations (common on enterprise teams)

If you're stepping into a more process-heavy org, expect these to land on your plate:

- Forecasting cadence: weekly attainment rollups, monthly capacity/ramp updates, quarterly headcount planning inputs

- SDR handbook ownership: keep the playbook current (ICP, definitions, sequences, talk tracks, compliance rules)

- Onboarding program upkeep: week-by-week ramp plan, certification, call library, and QA standards

SDR manager responsibilities: the weekly cadence that actually works

The best weekly cadence I've used forces the two things most managers "mean to do" but don't: consistent 1:1s and coaching on real calls.

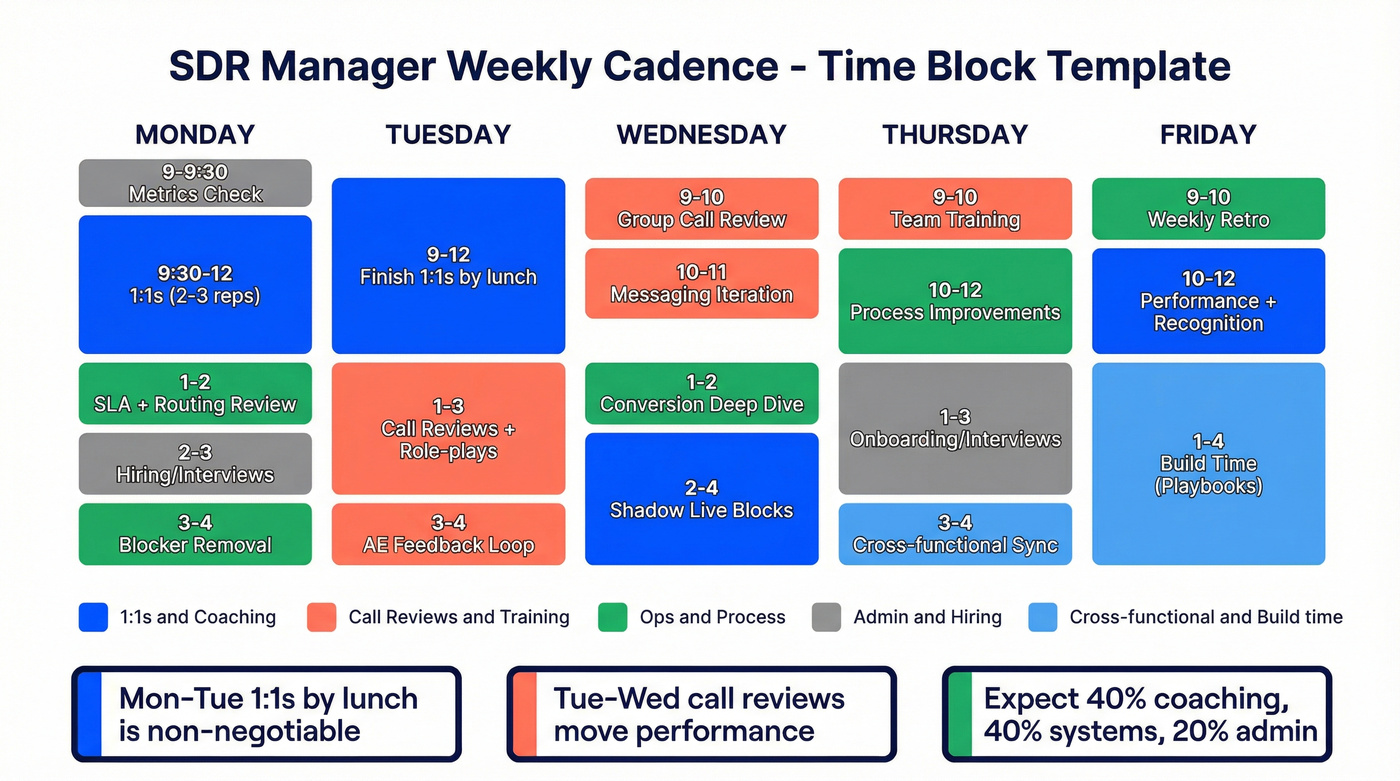

Time-block template (copy/paste into your calendar)

Monday

- 9:00-9:30: Weekly metrics check (team + individuals)

- 9:30-12:00: 1:1s (2-3 reps)

- 1:00-2:00: SLA + routing review (speed-to-lead, lead routing misses, MQL/SAL flow)

- 2:00-3:00: Hiring / interviews (if active)

- 3:00-4:00: Blocker removal (CRM hygiene, email deliverability issues, sequence QA fixes)

Tuesday

- 9:00-12:00: Finish 1:1s by lunch

- 1:00-3:00: Call reviews + role-plays (1:1 or small group)

- 3:00-4:00: AE feedback loop (accepted vs rejected, why, and what changes)

Wednesday

- 9:00-10:00: Group call review

- 10:00-11:00: Messaging iteration (with PMM/enablement)

- 1:00-2:00: Conversion deep dive (connect → meeting held → accepted opp)

- 2:00-4:00: Shadow live blocks (coach in the moment)

Thursday

- 9:00-10:00: Team training session

- 10:00-12:00: Process improvements (territory rules, routing, sequences, QA)

- 1:00-3:00: Onboarding work / interview loop

- 3:00-4:00: Cross-functional sync (Demand Gen + Sales)

Friday

- 9:00-10:00: Weekly retro + next week's focus

- 10:00-12:00: Performance conversations + recognition

- 1:00-4:00: Build time (playbooks, experiments, enablement assets)

The three rules that make this cadence work

- Mon-Tue 1:1s by lunch is non-negotiable. If you push 1:1s to Friday, you coach the past instead of changing the week in front of you.

- Tue-Wed call reviews are where performance moves. Dashboards tell you what happened. Calls tell you why.

- Blocker removal is part of the job, not a distraction. In the wild, the role's often 40% coaching, 40% fixing systems, 20% hiring/admin - and the "systems" part is usually email deliverability, CRM hygiene, routing, and broken sequences.

Here's the thing: the fastest way to lose a team is to become Slack-reactive.

You'll feel busy all day and ship nothing that compounds.

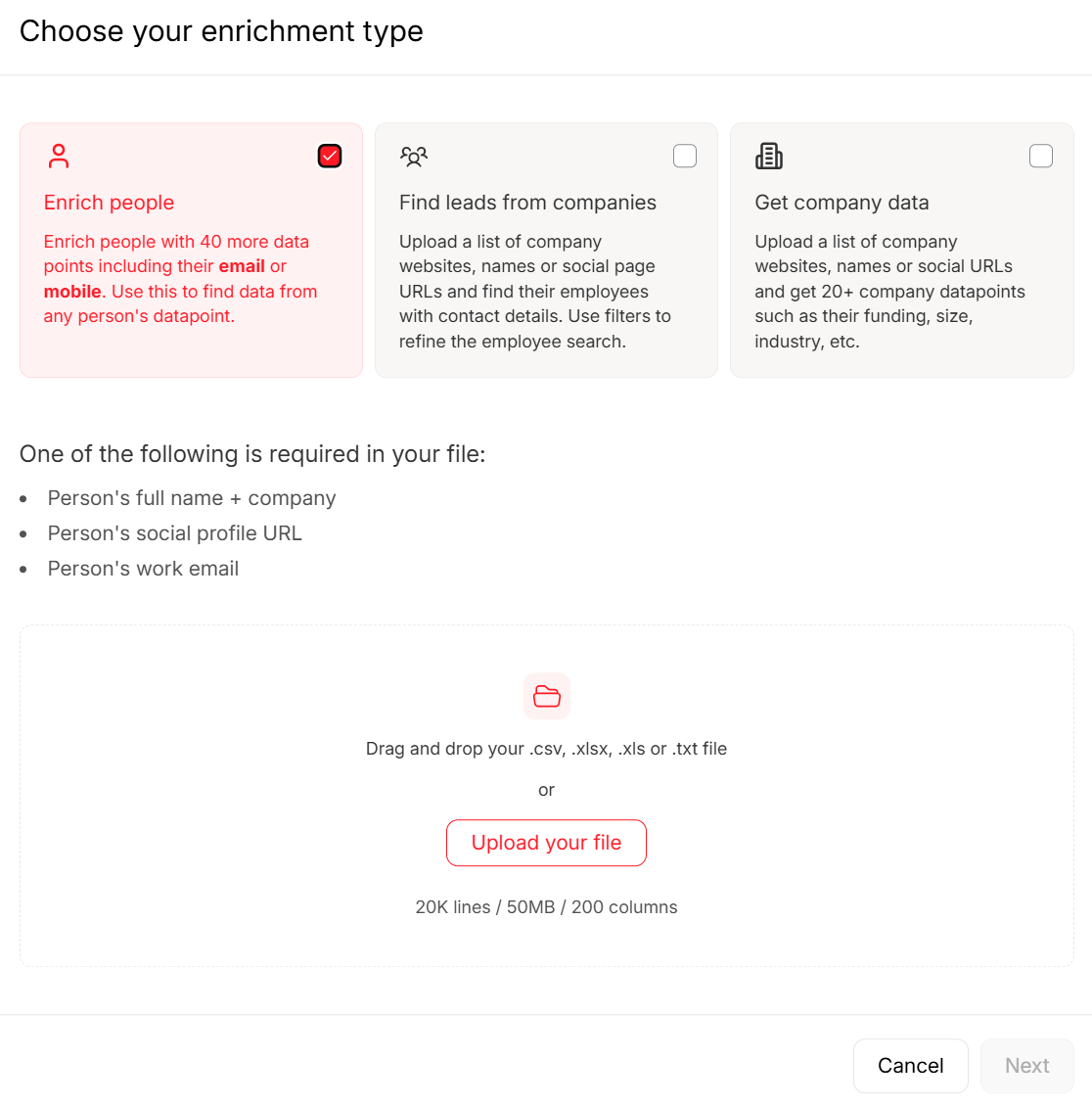

You just built the cadence, scorecard, and quality gates. Now make sure bad data doesn't sabotage the system. Bounce rates above 5% wreck deliverability and kill SDR morale. Prospeo's 98% email accuracy and 7-day data refresh mean your reps spend time on conversations, not cleaning lists.

Snyk's 50 AEs dropped bounce rates from 35% to under 5% and added 200+ opps/month.

SDR manager scorecard (KPIs that prevent "meeting spam")

If your scorecard rewards volume without quality gates, you'll get meeting spam. If it rewards only pipeline, you'll get sandbagging and "I can't control it" excuses.

The clean way to structure KPIs is a split between operational (leading) and strategic (lagging). You need both.

Operational KPIs (leading indicators you can coach weekly)

- Meetings held rate (booked → held)

- Speed-to-lead for inbound (by source: demo, content, events, partners)

- Connect rate (by channel and segment)

- Attempts per prospect (cadence discipline)

- Sequence QA (personalization, compliance language, broken steps, spam triggers)

- Deliverability hygiene (bounce rate, spam traps, catch-all handling, domain health)

Strategic KPIs (lagging indicators you manage, not "coach")

- SAOs / opportunities accepted (core quality gate)

- SAO attainment vs goal

- Net ARR pipeline generated (with stage + source rules)

- Ramp + retention (team durability)

SDR manager scorecard template (team-level)

| KPI | What it measures | Target range | Winner (what to optimize for) |

|---|---|---|---|

| Meetings held | Real conversations | 60-85% show | Held beats booked |

| SAOs / opps accepted | Qualification quality | Role-dependent | Accepted beats created |

| SAO attainment vs goal | Output vs quota | 90-110% | Accepted-based attainment |

| Net ARR pipeline | $ impact | Varies by ACV | Stage-validated pipeline |

| Speed-to-lead (inbound) | SLA discipline | <1 hr avg | Fastest response wins |

| Conversion rates | System health | Trend up | By segment/persona clarity |

| Ramp + retention | Team durability | 3-4 mo ramp | Documented coaching wins |

Definitions (so nobody argues in QBR)

- Meeting booked: a calendar invite exists. Leading indicator only.

- Meeting held: the prospect shows and engages. This is where spam gets exposed.

- SAO / opportunity accepted: Sales accepts the handoff as real. This is your core quality gate.

- Net ARR pipeline generated: pipeline value tied to accepted opportunities, with clear stage definitions and attribution rules.

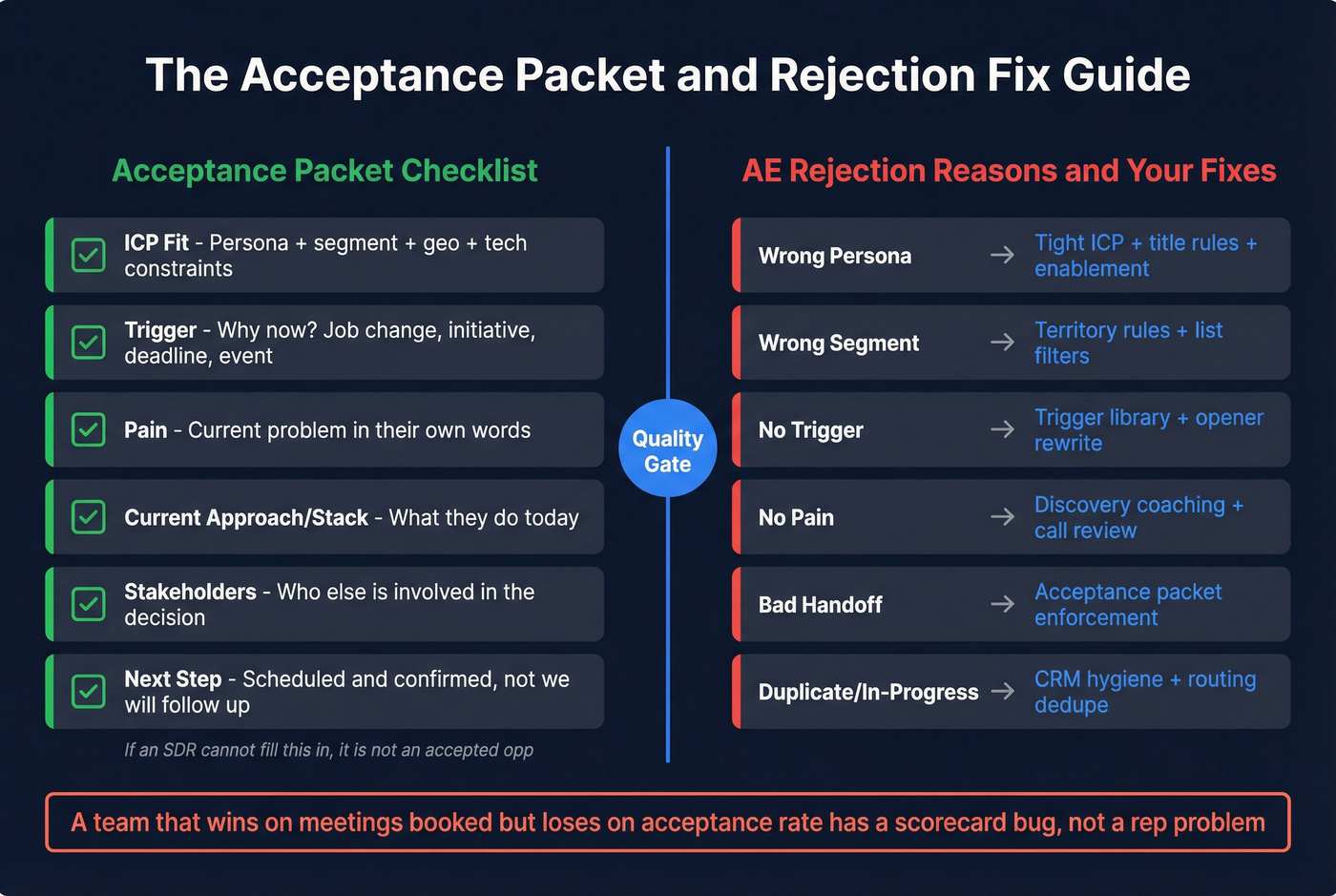

The "acceptance packet" checklist (steal this)

If an SDR can't fill this in, it's not an accepted opp:

- ICP fit: persona + segment + geo + tech constraints (if any)

- Trigger: why now (job change, initiative, deadline, event)

- Pain: current problem in their words

- Current approach/stack: what they do today

- Stakeholders: who else is involved

- Next step: scheduled and confirmed (not "we'll follow up")

AE rejection reason taxonomy (so you can actually fix quality)

| Rejection reason | What it usually means | Fix you control |

|---|---|---|

| Wrong persona | SDR targeted a non-buyer | Tight ICP + title rules + enablement |

| Wrong segment | Too small/too large/not supported | Territory rules + list filters |

| No trigger | Nice-to-have, no urgency | Trigger library + opener rewrite |

| No pain | SDR pitched features, not problems | Discovery coaching + call review |

| Bad handoff | Missing context/notes | Acceptance packet enforcement |

| Duplicate/in-progress | Already in pipeline | CRM hygiene + routing dedupe |

I once watched a team "win" on meetings booked and lose the quarter because AEs rejected half of them, then stopped trusting anything with an SDR's name on it. The scorecard was the bug, not the reps.

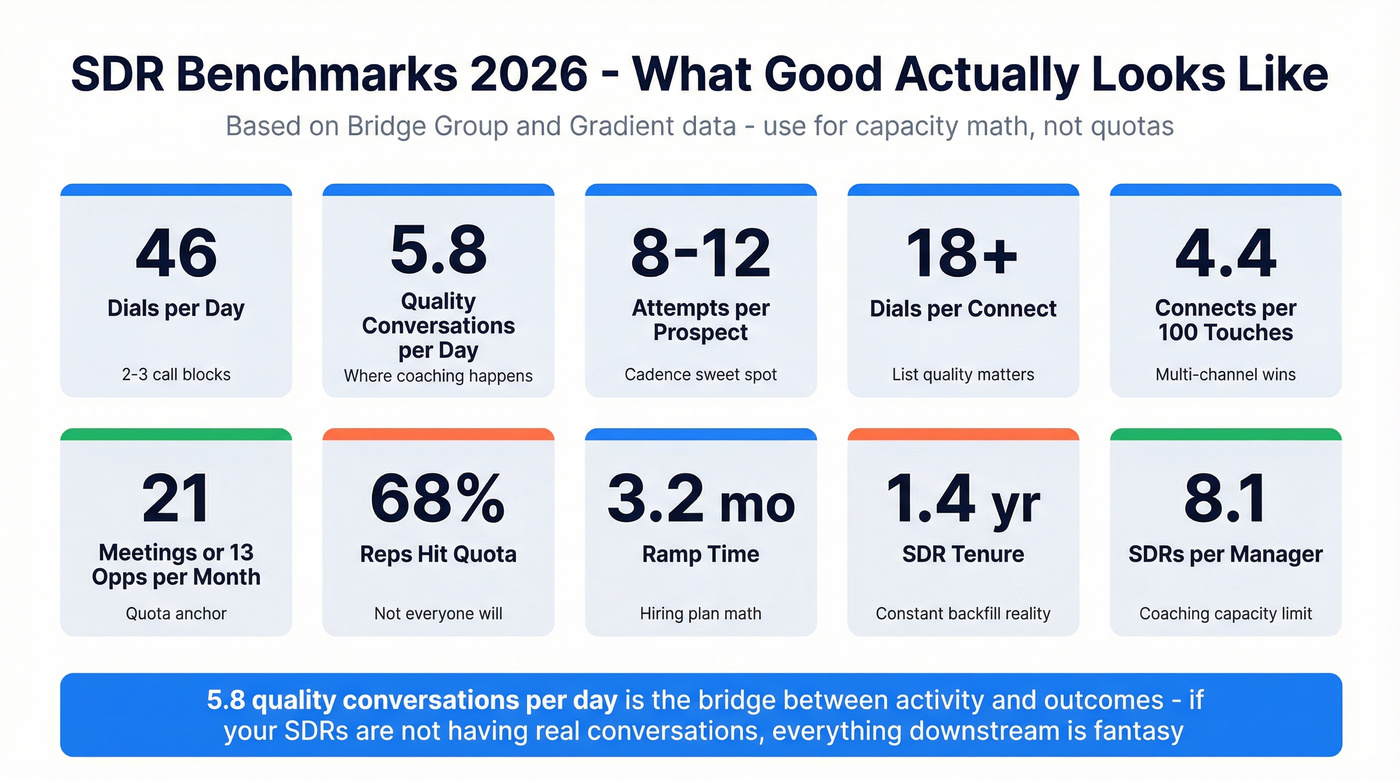

Benchmarks: what "good" looks like in 2026 (capacity + activity reality)

Benchmarks are useful as capacity math, not as quotas.

The Bridge Group baseline (as summarized by Crunchbase, last updated Nov 12, 2026) gives a practical starting point:

- 46 dials/day

- 5.8 quality conversations/day

- 8.2 attempts/prospect

- Ramp: 3.2 months

- Tenure: 1.4 years

- SDR:AE ratio: 1:2.5

- Manager span: 8.1 SDRs

- Quota anchor: 21 meetings or 13 qualified opps/month

- ~68% of reps hit quota

- SDR manager compensation average: $129,000 (different sample than RepVue; use as a sanity check, not a comp plan)

Gradient's benchmarks add the reality check most leaders ignore:

- 18+ dials to get a connect

- 4.4 connects per 100 touches

- Attempts-per-prospect "sweet spot": 9-12

How the "5.8 quality conversations/day" number should change your planning

If your SDRs aren't having real conversations, everything downstream is fantasy. 5.8 quality conversations/day is the bridge between activity and outcomes: it's where objections show up, where meetings get set, and where you can coach something real.

Activity benchmarks (outbound-heavy teams)

| Metric | 2026 anchor | What it implies |

|---|---|---|

| Dials/day | 40-50 | 2-3 call blocks |

| Quality conversations/day | ~5-6 | Conversation-first coaching |

| Attempts/prospect | 8-12 | Cadence design discipline |

| Dials per connect | 18+ | Inputs + list quality matter |

| Connects/100 touches | 4.4 | Multi-channel wins |

Capacity + org design benchmarks

| Metric | 2026 anchor | Why you care |

|---|---|---|

| Ramp time | 3.2 months | Hiring plan math |

| SDR tenure | 1.4 years | Constant backfill |

| SDR:AE ratio | 1 : 2.5 | Coverage planning |

| Span of control | 8.1 reps | Coaching capacity |

Practical insert: fix the list before you coach the script

Look, when your average deal size is small, you don't have a "messaging problem" - you've got a throughput problem. Stop rewriting openers and start fixing reachability.

In our experience, the fastest "inputs lever" is data quality: fewer bounces, fewer catch-alls, fewer dead numbers, and fewer wrong titles that waste an entire call block. Tools like Prospeo are built for exactly that: a 7-day data refresh cycle, 98% verified email accuracy, a 5-step verification process (including catch-all handling, spam-trap removal, and honeypot filtering), plus enrichment that returns 50+ data points with an 83% enrichment match rate and a 92% API match rate.

And yes, the self-serve part matters more than people admit, because if reps have to "request data" and wait two days, they won't use it and you'll end up coaching around a problem you could've removed in an hour.

For tooling context, most SDR stacks land in these ranges:

- CRM: Salesforce or HubSpot (typically $75-$200/user/mo depending on edition)

- Engagement: Outreach or Salesloft (typically $100-$180/user/mo)

- Conversation intelligence: Gong (typically $100-$160/user/mo)

- Data quality: credit-based, often $0.01-$0.03 per verified email equivalent depending on volume and vendor

Why your team isn't booking meetings (a 3-part diagnostic)

Most SDR problems are one of three constraints. Fix the constraint and performance moves fast. Fix the wrong thing and you get busy reps and no pipeline.

Decision tree: use this / skip this

1) If connect rates are the bottleneck...

Use: list quality, channel mix, deliverability hygiene, better territory rules.

Skip: rewriting the entire pitch deck.

Inbound is even less forgiving than outbound. Gradient's SLA stats are brutal: only 7% of leads get a response within 5 minutes, average response time is 42 hours, and 55% don't get a response within 5 business days. If inbound is part of your motion, your "meeting problem" might be an SLA + lead routing problem.

2) If connects happen but meetings don't...

Use: objection handling, discovery control, tighter ICP, and sequence QA.

Skip: forcing more activity.

You're not trying to make reps "sound better." You're trying to make them diagnose and advance.

3) If meetings happen but SAOs/opps don't...

Use: qualification rubric, AE alignment, and quality gates.

Skip: celebrating booked meetings.

This is the meeting spam trap: SDRs "hit," AEs revolt, and pipeline doesn't move.

Attempts-per-prospect: the sweet spot

The Bridge Group and Gradient framing is consistent: 9-12 attempts per prospect is where persistence works without turning into harassment. If reps do 3 attempts and quit, you're leaving meetings on the table. If they do 20 attempts on cold accounts, you're wasting capacity.

Quick lever when connects are the constraint

Data quality is a throughput constraint. If you can't connect, nothing downstream matters.

A fast fix is to verify emails (to protect deliverability) and add verified mobiles so call blocks hit real people. (If you need a vendor short list, start with these email lookup tools and email verifier websites.)

Org design decisions SDR managers must influence

You don't "own" org design on paper, but you'll live with the consequences, so you've got to influence it.

Inbound vs outbound: different jobs, different scorecards

- Inbound SDRs live and die by speed-to-lead, lead routing, and qualification discipline. They need tight SLAs with Demand Gen and clear definitions for MQL → SAL → SQL. (If you need a template for the SLA + stages, use a lead qualification process.)

- Outbound SDRs live and die by list quality, messaging iteration, and activity blocks. They need clean territories, clean ICP, and a feedback loop with AEs.

Trying to run both motions with one generic playbook is how you get mediocrity in both.

SMB vs enterprise: don't pretend the same cadence works

- SMB outbound can tolerate more volume and broader targeting. The win is fast iteration.

- Enterprise outbound is about account research, multi-threading, and relevance. If you measure enterprise SDRs like SMB SDRs, you train them to be spammy.

Span of control: the number that tells you if coaching is real

The only span that consistently works is 8-10 reps max, and 10 only works when the manager has no side tasks. That matches the Bridge benchmark: 8.1 SDRs per manager.

If you're managing 11-12 SDRs, running hiring, and doing RevOps projects, you're not coaching. You're supervising.

Don't combine SDR + AE management (except tiny teams)

Don't have your SDR manager also manage AEs unless they're effectively your Head of Sales. The priorities conflict, and SDRs always lose because revenue is louder than pipeline.

It's only workable when you've got 2-3 SDRs and 2-3 AEs, and everyone agrees it's temporary.

SDR manager salary & comp mechanics (what to expect in 2026)

Comp is where good intentions go to die. Pay for the wrong thing and you'll get the wrong behavior fast.

2026 pay benchmarks (US)

RepVue's Feb 2026 medians for Sales Development Managers:

- Median base: $105,000

- Median OTE: $155,000

- Top performer earning potential: $212,512

- Quota attainment: 63.4%

Betts ranges are best used as leveling guidance in 2026 (these are Betts 2026 ranges, still widely used for offers and leveling):

- 0-2 years experience: $100k-$140k base; $140k-$200k OTE

- 3-5 years experience: $135k-$190k base; $170k-$230k OTE

Comp table (use this for offers + leveling)

| Level | Base (USD) | OTE (USD) | Notes |

|---|---|---|---|

| RepVue median (Feb 2026) | 105k | 155k | 63.4% attain |

| Early (0-2 yrs) | 100-140k | 140-200k | Betts 2026 leveling range |

| Mid (3-5 yrs) | 135-190k | 170-230k | Betts 2026 leveling range |

| Top performer | - | 212,512 | RepVue top |

The split that works (and why)

Frontline manager plans commonly sit in the 60-70% base / 30-40% variable band. That's enough variable to drive behavior without turning managers into comp gamers.

Comp mechanics that prevent gaming (and free-riding)

If you want a plan that doesn't get exploited in month two, add three mechanics:

- Threshold: no variable payout until the team hits 70% of the primary metric (meetings held or accepted opps). This prevents "we tried" payouts.

- Accelerator: a kicker above 110% (for example, 1.25x) to reward real outperformance without forcing heroics every month.

- Small individual modifier: keep 10% tied to manager-controlled execution (QA completion, coaching logs, onboarding completion) so one strong pod doesn't carry everyone.

Example SDR manager variable plan (simple, hard to game)

Variable weighting (team-based):

- 50% meetings held or SAOs accepted (pick one primary)

- 30% pipeline accepted (Net ARR pipeline from accepted opps)

- 20% ramp + retention + QA (new hire ramp completion, QA audits, coaching completion)

Quality gates (non-negotiable):

- No payout on "booked" meetings unless they're held

- SAOs must be accepted in CRM with required fields completed

- Pipeline must meet stage + attribution rules (no junk opps)

I've seen comp plans that paid managers on raw meeting volume. It created a short-term spike and a long-term AE revolt.

Don't do that to yourself.

If you want more reading on metric design, Gradient's benchmark library is worth your time: benchmarks for SDR metrics that matter.

First-time SDR manager playbook (30/60/90) + hiring rubric

Most first-time SDR managers try to prove they're valuable by changing everything. That's usually the fastest way to lose trust.

Happily.ai's onboarding stats are a gut punch: 57% of new managers receive no training, and structured onboarding makes leaders 2.5x more likely to be high performers at 12 months. So if you feel behind, good. You're normal.

30/60/90 checklist (practical, not fluffy)

Days 1-30: audit + trust + baseline

- Build a stakeholder map: Demand Gen, AEs, RevOps, PMM, CS

- Run "listening tour" 1:1s with every SDR + 5-10 AEs

- Pull baseline metrics: meetings held, SAO acceptance, pipeline accepted, conversion rates by segment

- Listen to 10-15 calls per rep (not just top/bottom performers)

- Identify 3 blockers you can remove fast (routing, sequences, data hygiene, enablement gaps)

Mini-template: stakeholder map

- Name / role

- What they need from SDR

- What SDR needs from them

- SLA or recurring meeting cadence

Days 31-60: install the operating rhythm

- Implement the weekly cadence (1:1s by Tue lunch, call reviews Tue-Wed, training Thu)

- Publish a one-page qualification rubric (what counts as SAO/opportunity)

- Add quality gates to dashboards (held + accepted)

- Create a coaching log (what was coached, what changed, what improved)

- Align on SLAs with Demand Gen (speed-to-lead, lead stages, recycling rules)

Mini-template: 1:1 agenda (30 minutes)

- 5 min: wins + energy check

- 10 min: pipeline/SAO review (what's stuck and why)

- 10 min: skill focus (one call snippet, one objection)

- 5 min: weekly plan + commitment

Days 61-90: scale what works + hire for the gaps

- Run 2-3 controlled experiments (new opener, new persona, new channel mix)

- Build a "golden path" sequence library by segment

- Formalize onboarding for new SDRs (week-by-week checklist)

- Create a hiring scorecard and interview loop

- Present a capacity plan: headcount, ramp, coverage, expected pipeline

Hiring rubric (what to screen for)

Your loop should test:

- Operating cadence: can they run a week that forces coaching to happen?

- Metrics fluency: can they explain conversion rates and quality gates without hiding behind activity?

- Coaching ability: can they diagnose calls and change behavior?

- Cross-functional leadership: can they align Demand Gen + Sales + PMM without politics?

- Process + tooling hygiene: can they keep CRM/engagement data clean enough to trust?

- Compliance literacy: GDPR/TCPA/CASL basics + deliverability hygiene (spam traps, opt-outs, domain reputation). (For a practical outbound baseline, start with GDPR for sales and marketing.)

Mini-template: interview scorecard (1-5)

- Coaching: call review + feedback quality

- Systems thinking: scorecard + quality gates

- Execution: weekly cadence + prioritization

- Stakeholder mgmt: SLAs + alignment

- Hiring/onboarding: ramp plan + training

Take-home prompt idea (2 hours max)

- "Here's a dashboard snapshot + 3 call transcripts + 20 'booked' meetings with outcomes. Diagnose the constraint and propose a 2-week plan with metrics."

This loop reliably separates operators from talkers, and it also gives you a real artifact you can compare across candidates instead of hiring the best storyteller in the room.

If you want to operationalize the "fix inputs before coaching" step, here's the exact verify → enrich → export workflow.

SDR manager FAQ

What's the difference between an SDR manager and a sales manager? An SDR manager runs top-of-funnel execution: prospecting systems, coaching outreach, qualification standards, and SDR-sourced pipeline. A sales manager runs closing execution: deal strategy, forecasting, negotiation, and quota. Combining them usually starves SDR coaching because revenue fire drills always win.

How many SDRs should one SDR manager manage? A practical cap is 8-10 SDRs, with 10 only working when the manager has no side projects. Bridge benchmarks put the average at 8.1 SDRs per manager, which matches the reality that coaching, call reviews, hiring, and cross-functional work don't scale linearly.

What KPIs should an SDR manager own? Own meetings held, SAOs/opportunities accepted, SAO attainment vs goal, and Net ARR pipeline generated from accepted opportunities. The key is quality gates: measure held and accepted outcomes, not just booked meetings or raw activity, or you'll incentivize meeting spam.

What is a typical SDR manager salary and OTE in 2026? In 2026, RepVue's US median for Sales Development Managers is $105,000 base and $155,000 OTE, with top performer earning potential around $212,512. Betts' leveling ranges commonly run $140k-$200k OTE for early managers and $170k-$230k OTE for 3-5 years experience.

How can an SDR manager improve connect rates quickly (without burning reps out)?

Fix reachability first: cleaner lists, verified emails (to protect deliverability), and verified mobile numbers, then run focused call blocks instead of random dialing all day. If you want the simplest version, start by verifying your next week's list before you coach a single call - it removes a ton of fake "performance problems" that are really just bad inputs.

Summary: make pipeline boring on purpose

If you do only three things this month: (1) lock definitions and quality gates, (2) run Mon-Thu cadence blocks like they're customer meetings, and (3) fix reachability before rewriting scripts.

That combination makes pipeline creation predictable - and makes the SDR manager job a lot less chaotic.

Speed-to-lead and connect rate are on your scorecard now. Both collapse when your team dials dead numbers. Prospeo's 125M+ verified mobiles hit a 30% pickup rate - nearly 3x the industry average. At $0.01/email and 10 credits per mobile, scaling the team doesn't blow your budget.

Stop coaching effort when the real blocker is data quality.