Conga alternatives in 2026 (Composer vs CLM vs Sign)

If you're searching Conga alternatives, you're usually in one of two spots: you're a Salesforce admin drowning in brittle Composer templates, or Legal's done waiting on a CLM that feels heavier than the contracts it manages.

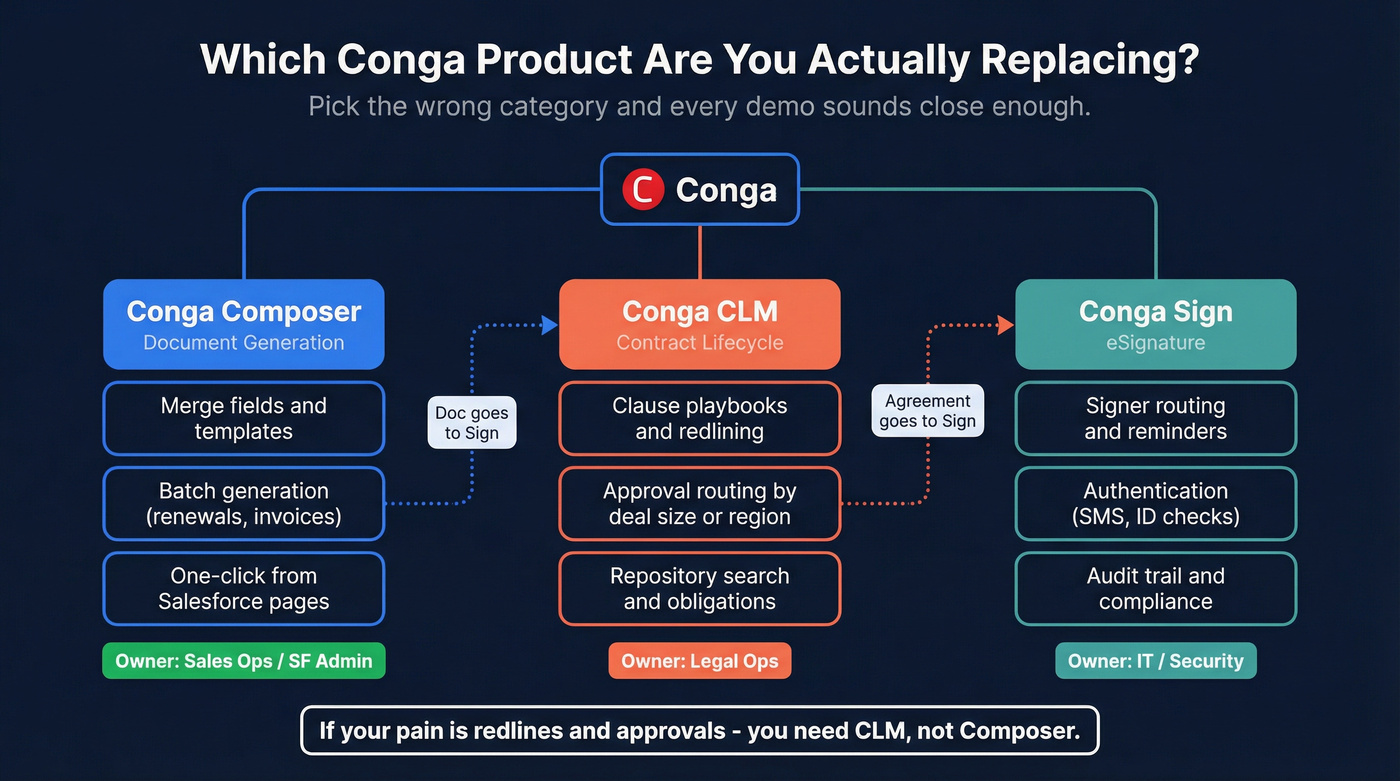

Here's the mistake that burns weeks: treating "Conga" like one product. It isn't. It's Composer (doc gen), CLM (contracts), and Sign (eSignature), plus adjacent modules.

My hot take: if your average deal size is small and your contracts are mostly one template, you don't need a full CLM migration. Fix doc gen + eSign, tighten approvals, and move on.

Look, CLM's worth it when complexity is real, not because a vendor demo made it look "enterprise."

Our picks (TL;DR): best tools to replace Conga

This is the shortlist I'd hand to a team that wants fewer demos and a faster decision. Each pick includes a price anchor and the one packaging gotcha that surprises buyers.

If you mean Conga Composer (Salesforce doc gen)

- S-Docs - best Salesforce-native Composer replacement when you want "button-click -> perfect PDF" without leaving Salesforce. From $25/user/mo (unlimited docs) and includes 50 e-sign envelopes/year; free tier includes 150 docs/year + 50 envelopes/year. Skip if annual minimums will irritate Finance on the S-Docs with e-Signature plan. Gotcha: G2 lists paid tiers as billed annually, and S-Docs with e-Signature has a minimum.

- PDF Butler - best value for Salesforce-native doc automation when you want a lower per-user entry point. $14/user/mo with a 5-user minimum + 30-day trial. Skip if you hate modular add-ons. Gotcha: "cheap doc gen" turns into a bigger bill once you add batch/community/signature routing.

- Docs Made Easy - simplest "Composer replacement" story when your templates are straightforward and you want fewer moving parts. ~$3k-$15k/year for small teams (scales with volume/features). Skip if you need transparent pricing before a sales call. Gotcha: packaging is quote-led; ask for limits on batch, portals, and template versions.

If you mean Conga CLM (contracts)

- Ironclad - best modern CLM for mid-market+ teams that want strong workflows and a UI Legal actually uses. ~$25k-$150k+/year all-in for real deployments. Skip if repository/search is mission-critical and you won't tolerate search friction. Gotcha: search quality decides adoption.

- LinkSquares - best for faster time-to-value when you want the repository to become useful quickly. ~$30k-$200k/year depending on volume/modules. Skip if you expect "fast implementation" to replace change management. Gotcha: you still need a clause library, taxonomy, and training plan.

- Sirion - best for complex, high-volume contracting where obligations and performance management matter. ~$60k-$300k+/year all-in for serious rollouts. Skip if you want a lightweight CLM. Gotcha: services and modules drive total cost more than seats.

If you mean Conga Sign (eSignature)

- DocuSign eSignature - default choice when you need broad integrations and everyone already knows it. From ~$10/user/mo depending on plan.

- Adobe Acrobat Sign - best when you're already standardized on Adobe and want enterprise controls. From ~$23.99/month.

- OneSpan Sign - best for regulated workflows and stronger identity/authentication patterns. $22/user/mo (Professional plan, annual commitment).

- Nintex AssureSign (Tier 3) - solid for regulated signing and process-heavy orgs. 30-day free trial; pricing is typically sold via annual contracts.

If deals stall after the doc is sent (signer/champion data)

- Prospeo - The B2B data platform built for accuracy. When approvals drag because the signer changed roles or the champion's email bounces, fix the contact data upstream so quotes, contracts, and renewals keep moving. Pricing is self-serve: free, paid plans from ~$39/mo.

Which Conga product are you replacing? (Composer vs CLM vs Sign)

Pick the wrong category and every demo sounds "close enough." Pick the right category and the decision gets a lot simpler.

Replace Conga Composer if...

Owner: Sales Ops / Salesforce Admin (with RevOps and sometimes Finance). Inputs: Salesforce objects like Account, Contact, Opportunity, Quote, Quote Line Items, Products, custom objects; sometimes CPQ objects; sometimes ERP fields via integration. Outputs: PDFs (always), Word docs (often), sometimes email bodies; sometimes multiple docs in one click (quote + order form + SOW). Workflow reality: reps want a button, not a process. They click, it generates, it attaches to the record, and it's correct.

You're in Composer-land when you care about:

- merge fields and conditional logic in templates

- template version control and admin UX

- batch generation (renewals, invoices, statements)

- Experience Cloud/community/portal generation (partners/customers generating docs)

- storage (Salesforce Files vs Box/SharePoint/Google Drive)

- "one click" from Salesforce pages, flows, or CPQ

Hard line: if your pain is redlines, clause playbooks, approvals, and obligations, you're not replacing Composer - you're replacing CLM.

Replace Conga CLM if...

Owner: Legal Ops (with IT/security and RevOps as stakeholders). Inputs: intake forms, Salesforce opportunities, procurement requests, vendor onboarding data, sometimes ERP/procurement suites. Outputs: negotiated agreements, clause libraries, approval trails, obligations, renewals, a searchable repository, and reporting.

You're in CLM-land when you care about:

- clause playbooks with fallback language and guardrails

- approval routing by deal size, region, risk, data type, or customer type

- redlining workflows (internal + external) and audit trails

- repository search that actually finds the right contract in seconds

- obligation tracking and renewal triggers

- integrations (Salesforce, eSign, storage, procurement, ERP)

Here's the thing: if your "contract process" is basically "send a PDF for signature," CLM's overkill. Buy eSign and tighten your templates.

Replace Conga Sign if...

Owner: IT / Security or Operations (sometimes Legal). Inputs: a finished document (from Composer, Word, Google Docs, or CLM). Outputs: signed PDFs, audit trail, signer authentication, envelope routing.

You're in eSign-land when you care about:

- signer routing order, reminders, and expiration

- authentication (SMS/knowledge-based/ID checks depending on vendor)

- templates, bulk send, and team management

- compliance and audit trail requirements

Hard line: eSign doesn't fix contract creation or negotiation. It finishes a process; it doesn't design one.

Conga pricing & implementation reality (so you don't waste demos)

Conga frustration spikes because packaging's hard to pin down and implementation effort gets underestimated.

Composer pricing reality: Composer pricing is quote-based, and TrustRadius notes there's no public pricing. In the Salesforce doc-gen market, the real band lands at $20-$60/user/month once you add the features teams end up needing.

Here are the usual culprits that push doc gen from $20 -> $60/user/mo:

- Batch generation (renewals, invoices, statements) and higher volume limits

- Automation (Flows, scheduled jobs, approvals, conditional routing)

- Experience Cloud/community use cases (partner/customer doc generation)

- eSign envelopes and advanced routing/authentication

- Multiple environments (sandboxes, extra instances) and admin tooling

- Support tiers and SLAs (especially in regulated orgs)

- Per-document/per-envelope pricing that looks cheap until volume hits

CLM pricing reality: CLM is a different planet. Budget $25k-$150k+/year for mid-market rollouts, and $100k-$500k+/year for enterprise platforms and global scope. Implementation is measured in months because you're rebuilding process: clause library, approvals, repository taxonomy, integrations, and reporting, and every one of those pieces has an owner who already has a full-time job.

eSignature pricing reality: eSign is the cheapest line item and the easiest to buy. It's also the easiest to mis-buy. $15/user/mo eSign isn't a CLM replacement. It's the last mile.

Reality check before you book demos

- Doc gen swaps move fast when templates are clean and ownership's clear.

- CLM swaps move slow because Legal process is the product.

- Bad signer data makes every tool look broken because approvals never happen.

Swapping Conga won't fix deals that stall because the signer changed roles or the champion's email bounces. Prospeo gives you 98% accurate emails refreshed every 7 days - so your quotes, contracts, and renewals reach the right person the first time.

Bad contact data kills more deals than bad contract tools ever will.

Conga alternatives for Composer (Salesforce doc gen)

If you're replacing Composer, your north star's simple: a rep clicks a Salesforce button and the right document appears every time. Everything else is secondary.

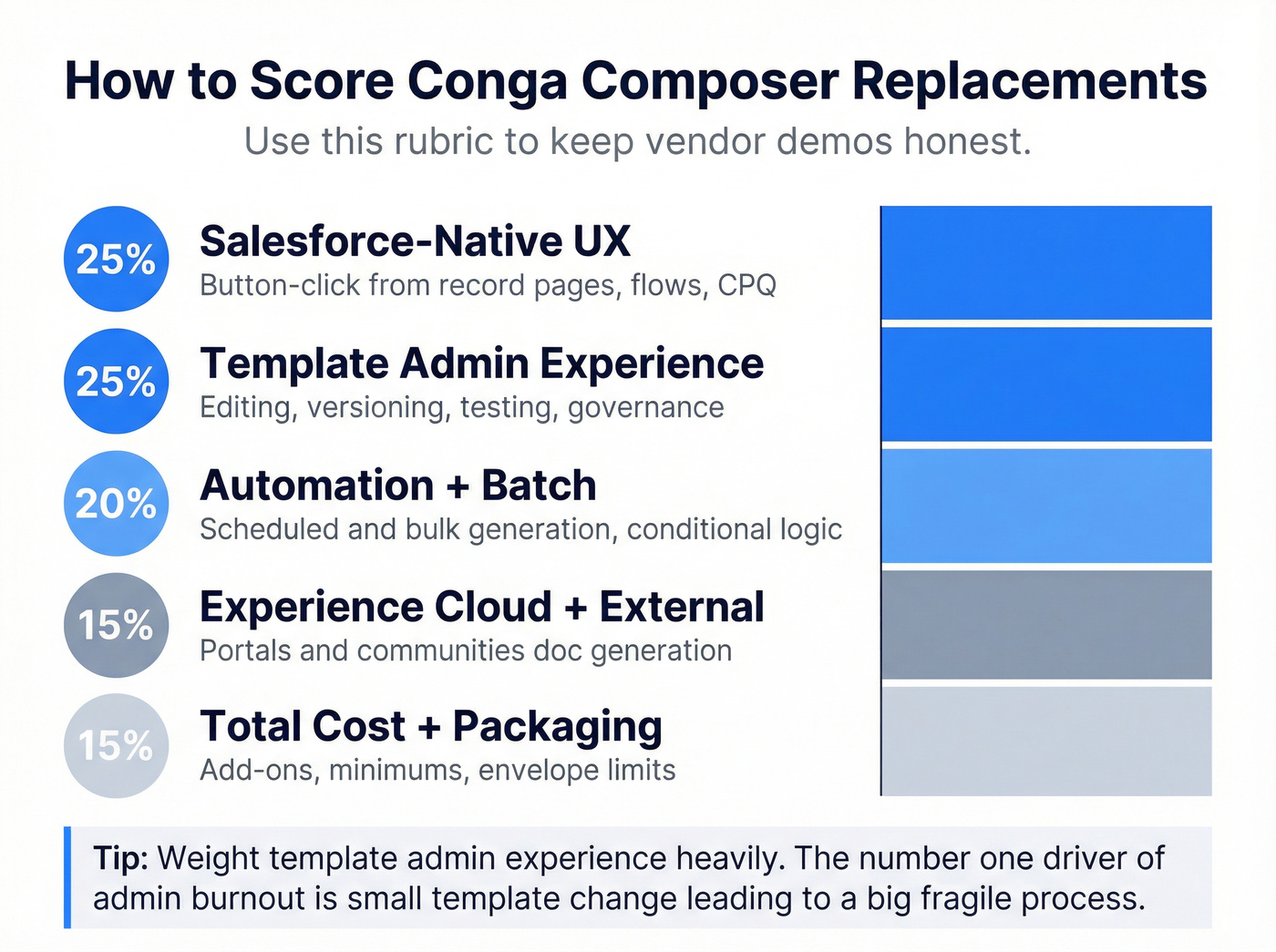

One more thing that matters more than vendors admit: template maintenance. In our audits of Salesforce doc-gen rollouts, the #1 driver of admin burnout is "small template change -> big, fragile process." A TrustRadius comparison calls out that Conga template updates can take ~6 steps - and yeah, that's exactly why teams go shopping.

How we score Composer replacements (quick rubric)

Use this to keep demos honest:

- Salesforce-native UX (25%) - button-click from record pages, flows, CPQ

- Template admin experience (25%) - editing, versioning, testing, governance

- Automation + batch (20%) - scheduled/bulk generation, conditional logic

- Experience Cloud + external generation (15%) - portals/communities

- Total cost + packaging (15%) - add-ons, minimums, envelope limits

Composer alternatives comparison table (committed winners by row)

| Tool | Salesforce-native? | Best for | Public starting price | Trial/free | Key limits/notes |

|---|---|---|---|---|---|

| S-Docs | Yes | Best overall SF swap | $25/user/mo | Free tier | $25 includes 50 eSign env/yr |

| S-Docs with e-Signature | Yes | Best SF doc+eSign | $40/user/mo | Free tier | $4,800 minimum contract (billed annually on G2) |

| PDF Butler | Yes | Best low-cost entry | $14/user/mo | 30-day trial | 5-user minimum |

| Docs Made Easy | Yes-ish | Best simple pitch | ~$3k-$15k/yr | Demo | Quote-led packaging |

| Nintex Drawloop | Integrates | Best for workflows | ~$20k-$100k/yr | Demo | Enterprise scope |

| Formstack (WebMerge) | No | Best multi-app docs | From ~$299/mo | Trial | Salesforce-specific plans sold separately |

S-Docs (best Salesforce-native Conga Composer replacement)

S-Docs wins when you want to stay inside Salesforce and stop fighting your tooling. It feels like it was designed by someone who actually had to support templates at scale.

I've seen teams cut their "quote template tweak" time from days to hours just by moving to a tool where versioning, testing, and rollback aren't an afterthought.

Pricing (clear and usable):

- Free tier: unlimited templates + unlimited users, 150 documents/year and 50 e-sign envelopes/year

- $25/user/month: unlimited documents + 50 e-sign envelopes/year

- $40/user/month: doc gen + eSign bundle with unlimited e-signature envelopes G2 lists paid tiers as billed annually, and also lists a $4,800 minimum contract for S-Docs with e-Signature.

What to test in the demo (don't skip these):

- Template change workflow: edit -> test -> publish -> rollback

- Output fidelity: complex tables, line items, conditional sections, branding

- Batch runs: renewal letters for 500 accounts without timeouts

- Experience Cloud: can partners/customers generate docs with correct permissions?

- Storage + naming: Salesforce Files vs external storage, consistent naming rules

My opinion: if your team lives in Salesforce, S-Docs is the cleanest "replace Composer without rebuilding your world" move.

Pricing signal: $0, $25/user/mo, $40/user/mo; eSign bundle $4,800 minimum contract (billed annually on G2). See S-Docs Salesforce pricing.

PDF Butler (best value if you want Salesforce-native doc automation)

PDF Butler's the budget-friendly way to get Salesforce-native doc gen without feeling like you bought a toy. Security teams like it because the "built on Salesforce" story is straightforward.

Where it shines: low entry price ($14/user/mo, 5-user minimum) and a modular path to add batch, signatures, and CLM-style components.

Where teams get surprised: modular pricing. The first quote looks great. The second quote - after you add batch, portal use, advanced routing, and higher volume - looks like every other serious doc-gen tool.

Pricing signal: $14/user/mo, 5-user minimum, 30-day trial. See PDF Butler pricing on G2.

Docs Made Easy (simple Composer-style replacement pitch)

Docs Made Easy is for teams who want a direct "replace Composer" story and don't want to adopt a bigger automation platform.

Good fit: straightforward templates, a small admin team, and a desire to reduce moving parts. Ask upfront: batch limits, portal/Experience Cloud support, template versioning, and how they handle complex line-item tables.

Pricing signal: ~$3k-$15k/year for small teams; larger teams land ~$15k-$50k+/year with volume and advanced features. If you want their angle, see Docs Made Easy's Conga alternative post.

Nintex Drawloop (doc gen + workflow for process-heavy orgs)

Drawloop is what you buy when "document generation" is really "process automation with documents attached." If IT and governance are driving the project, Drawloop belongs in the room.

Pricing signal: ~$20k-$100k+/year depending on modules, environments, and workflow scope (plus implementation services in many cases).

Formstack (WebMerge) (flexible doc automation outside Salesforce)

Formstack's the multi-app option: forms, payments, support workflows, and documents across systems. It's fast to stand up, and it's great when Salesforce is only one input.

Pricing signal: from ~$299/month for the Suite; Salesforce-specific plans are sold separately.

Also considered: PandaDoc (why it's not a Composer replacement)

PandaDoc shows up in almost every "document automation" SERP, so readers expect it. It's strong for proposal-style workflows and eSign in one place.

Skip this if your real requirement is "Salesforce record page button generates the final PDF, attaches it, and nobody leaves Salesforce." PandaDoc can work, but the center of gravity is the PandaDoc workspace, not Salesforce.

Pricing signal: $35/user/mo (Essentials) and $65/user/mo (Business); 14-day free trial.

Conga alternatives for CLM (contract lifecycle management)

Conga CLM is a real CLM platform, and it's rated strongly: 4.3/5 on G2 (618 reviews) with an average 4 months to implement. Teams replace it for the same reasons they replace any CLM: heavy setup, steep learning curve, and performance friction that kills adoption.

I'll give you a concrete scenario I've watched play out: Legal wants "one intake form for everything," Sales wants "generate from Opportunity in one click," Security wants SSO and retention policies, and nobody owns the clause library cleanup, so implementation drags, the repository fills with junk metadata, and six months later everyone says the tool "doesn't work" when the truth is the operating model never got finished.

How we score CLM replacements (quick rubric)

This is the framework we use to prevent shiny-demo decisions:

- Workflow + approvals (25%) - intake, routing, playbooks, audit trails

- Repository + search (25%) - find clauses/obligations fast, metadata quality

- Integrations (20%) - Salesforce, eSign, storage, procurement/ERP

- Admin burden (15%) - configurability vs maintainability

- Implementation effort + TCO (15%) - time, services, modules, volume pricing

CLM alternatives comparison table (with Conga baseline)

| Tool | Best for | Review signal | Impl. time | Pricing anchor | Watch-outs |

|---|---|---|---|---|---|

| Conga CLM | Baseline | G2 4.3/5 (618) | 4 months | $25k-$150k+/yr | Setup/perf |

| Ironclad | Modern workflows | G2 4.4/5 (285) | 4 months | Quote-based; directory anchor ~$500/mo | Search quality |

| LinkSquares | Faster value | G2: ROI 14 mo; avg discount 21% | 3 months | ~$30k-$200k/yr | Change mgmt |

| Sirion | Complex volume | Gartner shortlist | 4-9 months | ~$60k-$300k+/yr | Services/modules |

| DocuSign CLM | DocuSign ecosystem | Gartner shortlist | 4-8 months | ~$30k-$200k/yr | Not eSign pricing |

| Agiloft | Highly configurable | Gartner shortlist | 4-10 months | ~$50k-$250k/yr | Admin-heavy |

| Icertis | Enterprise scale | Gartner shortlist | 6-12+ months | ~$100k-$500k/yr | Big rollout |

For buyer-shortlist signal, Gartner's "buyers also considered" list for Conga CLM is a good reality check: Gartner's Conga CLM alternatives page.

Ironclad (best for modern workflows; mid-market+)

Ironclad's the modern CLM archetype: strong workflow design, solid integrations, and a UI Legal actually adopts. It's the pick when you want CLM to feel like a product, not a project.

What we see in real evaluations: teams love workflow design and intake structure; teams fight over repository/search because that's where CLM lives day-to-day.

What to test in the demo (make them prove it):

- Search: find a clause, obligation, and renewal date in under 10 seconds

- Metadata: bulk tagging, required fields, and "garbage in" prevention

- Approval routing: deal size + region + data type + customer segment

- Redlining: internal/external collaboration without losing audit trail

- Salesforce integration: create from Opportunity, sync status, push signed PDF back

Pricing reality: quote-based; directory listings show a starting anchor around ~$500/month. Real deployments land $25k-$150k+/year once you include implementation and integrations. See Ironclad's pricing page.

LinkSquares (best for faster time-to-value)

LinkSquares is the "get value fast" CLM: leadership sees progress quickly because the repository becomes usable and reporting shows up earlier.

Common implementation trap (I see this constantly): teams import contracts, declare victory, and never build a real taxonomy. Three months later, search is messy and nobody trusts the data. Fix it by defining required metadata fields, naming conventions, and ownership before migration.

Pricing signal: ~$30k-$200k/year depending on contract volume, modules, and integrations. G2 pricing insights highlight 3 months to implement, ROI in 14 months, and an average discount of 21%. See LinkSquares pricing insights on G2.

Sirion (best for complex, high-volume contracting)

Sirion shows up when contracting is operationally complex: high volume, lots of variation, and a need to manage obligations and performance at scale. If your contracts behave like operational systems, Sirion fits that reality.

Pricing signal: ~$60k-$300k+/year all-in for serious deployments, driven by users + modules + contract volume, plus implementation/services.

DocuSign CLM (best if you're standardizing on DocuSign)

DocuSign CLM is the consolidation play: one vendor for signature + CLM + integrations. Procurement loves it, and it reduces vendor sprawl.

Pricing signal: ~$30k-$200k/year for CLM (implementation and integrations drive the total). DocuSign eSignature remains a separate line item starting around ~$10/user/mo.

Agiloft (most configurable without going full enterprise suite)

Agiloft is the "we have weird workflows" answer. It fits complex processes and custom objects, and it rewards teams that invest in Legal Ops/admin capacity.

Pricing signal: ~$50k-$250k/year, driven by configuration scope, modules, and implementation.

Icertis (enterprise scale and global complexity)

Icertis is built for large orgs with global templates, deep compliance requirements, and heavy integrations. It's a serious platform with a serious rollout.

Pricing signal: ~$100k-$500k+/year, driven by global scope, integrations, and services.

Budget/lighter CLM options (when you need "repository + basics")

These tools win when you need a clean repository and basic workflows, not a full legal-ops transformation.

| Tool | Starting price | Best for | Skip if |

|---|---|---|---|

| CobbleStone | $59/user/mo | Budget CLM basics | Deep playbooks |

| ContractSafe | $450/mo | Simple repository | Complex approvals |

| Concord | $400-$1,500/mo | Mid-market CLM | Heavy procurement |

CobbleStone and ContractSafe are the fastest way to get contracts out of shared drives. They won't match Ironclad/Conga/Icertis depth in clause automation and complex approvals.

"Also considered" CLM tools (pricing signals included)

- Leah CLM - strong shortlist presence for mid-market CLM. Pricing signal: ~$30k-$120k/year depending on users/modules and contract volume.

- Coupa - best when procurement drives contracting inside a broader spend suite. Pricing signal: ~$50k-$250k+/year depending on modules and suite scope.

- Gatekeeper - vendor management + contracts when supplier governance matters. Pricing signal: ~$12k-$60k/year depending on users and modules.

- Webdox - regional/mid-market CLM option. Pricing signal: ~$15k-$80k/year depending on volume and integrations.

- Juro - browser-first CLM for fast-moving teams. Pricing signal: ~$400-$2,000/month depending on seats and workflow needs.

Conga module -> replacement mapping (pick the right category fast)

Here's the fastest way to stop comparing apples to oranges.

| Conga module | What it really is | Best-fit replacements |

|---|---|---|

| Conga Composer | Salesforce doc gen | S-Docs, PDF Butler, Docs Made Easy |

| Conga CLM | Full CLM | Ironclad, LinkSquares, Sirion |

| Conga Sign | eSignature | DocuSign, Acrobat Sign, OneSpan Sign |

The most common mis-map is the expensive one: eSign != CLM. eSign finishes a document. CLM manages the lifecycle: intake, drafting, redlines, approvals, repository, obligations, renewals.

If you also use Conga CPQ/Billing/Commerce, don't pretend this is a "swap one tool" project. That's revenue architecture. Decide whether you're:

- Decoupling (keep CPQ/billing, replace doc gen/CLM), or

- Replatforming (bigger project, bigger risk, bigger payoff)

If you must consolidate vendors, do it with intent:

- Consolidate eSign + CLM only if Legal and IT want one security model and one audit trail.

- Keep doc gen Salesforce-native if Sales lives in Salesforce and speed matters.

- Don't force "one platform" if it slows quoting; revenue teams will route around it.

Migration & implementation checklist for Salesforce teams

Conga swaps fail for one reason: teams treat it like a feature comparison instead of a rollout. Use this phased plan and you'll finish with fewer surprises.

Week 1: scope and inventory (don't skip this)

- List every doc type: quote, order form, invoice, SOW, renewal, amendment.

- Export template inventory and map merge fields to Salesforce objects (including CPQ objects if relevant).

- Identify every entry point: custom buttons, quick actions, flows, CPQ quote actions.

- Decide outputs: PDF only vs PDF + Word; single doc vs multi-doc packets.

- For Experience Cloud: list every external user scenario and permission model.

- For CLM: document the real workflow (intake -> draft -> redline -> approvals -> signature -> repository -> renewals) and who owns each step.

Weeks 2-4: build the minimum lovable version

- Rebuild the top 3 templates first (usually quote, order form, SOW).

- Validate permissions: who can generate docs, who can edit templates, who can batch.

- Confirm batch/automation limits and which add-ons you'll need (don't guess).

- Test line-item tables, conditional sections, and branding edge cases.

- For CLM: build clause library + fallback rules + approval routing + repository taxonomy before importing everything.

- Integrations: Salesforce objects, storage, eSign, and any ERP/procurement hooks.

Month 2+: adoption, governance, and performance

- Train admins and power users (end-user training alone doesn't stick).

- Add monitoring: doc generation errors, envelope failures, contract cycle time, stuck approvals.

- Lock template governance so you don't end up with 17 "final_v3" versions.

- For CLM: plan for a real implementation timeline - 4 months is normal for platforms like Conga CLM and Ironclad.

- Update playbooks, not just software: Legal and Sales need one shared contracting operating model.

Prospeo - the upstream fix after you choose your tool

Most teams blame doc gen or CLM when deals stall. The real culprit is uglier: the signer or champion data's wrong, so the contract sits in limbo.

Prospeo (the B2B data platform built for accuracy) fixes that upstream with 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers. It's used by 15,000+ companies and 40,000+ Chrome extension users, delivers 98% email accuracy, and refreshes data every 7 days (industry average: 6 weeks). For RevOps hygiene, its Data Enrichment returns 50+ data points per contact with an 83% enrichment match rate, and the API delivers a 92% match rate - so your CRM stays usable after the first rollout.

Here's the workflow that actually moves cycle time:

- Before sending for signature: verify the signer's email + mobile; if the email's risky, switch to a verified address and add a mobile nudge.

- Weekly RevOps hygiene: enrich champions and approvers so job changes don't break renewals.

- After any bounce: run enrichment immediately and update Salesforce so the next touch hits a real human.

Prospeo's self-serve with transparent pricing (no contracts). You can start on the free tier (75 emails + 100 Chrome extension credits/month) and scale usage as your team standardizes the workflow. If you want details on how it works, see Data Enrichment (https://prospeo.io/b2b-data-enrichment), the Chrome extension (https://prospeo.io/contact-finder-extension), the Email Finder (https://prospeo.io/email-finder), and the Mobile Finder (https://prospeo.io/lead-mobile-finder).

On-screen, you're looking at a simple flow: paste a company/contact URL or domain, Prospeo returns a verified email and verified mobile, then you click export/enrich to push the fields into Salesforce so the record stays clean.

You're upgrading doc gen, CLM, or eSign - but none of that matters if the decision-maker's contact info is stale. Prospeo's 300M+ verified profiles at $0.01/email ensure every contract lands in the right inbox, not a dead end.

Stop sending perfect contracts to outdated email addresses.

Final recommendation (what I'd pick)

If you want the safest, fastest Composer swap inside Salesforce, pick S-Docs. It's the cleanest "rep clicks a button, doc generates correctly" replacement and it keeps admins sane.

If you're replacing Conga CLM because Legal needs a modern workflow engine, pick Ironclad - then obsess over repository/search in the demo, because that's where adoption lives or dies.

If your contracts are simple and your deal sizes are modest, don't buy CLM to feel enterprise. Tighten templates, standardize eSign, and ship.

Net: the best Conga alternatives depend on whether you're swapping doc gen, CLM, or eSign - and after you pick your platform, keep signer and champion data accurate so approvals and renewals stop stalling for the dumbest reason in B2B: emailing the wrong person.

FAQ

Is Conga the same as Apttus (and does it matter for switching)?

Conga acquired Apttus, and Conga CLM is the evolution of that lineage, so you'll still see "Apttus" in older docs and admin muscle memory. For switching, what matters is your current module (Composer vs CLM vs Sign) and your Salesforce footprint.

What's the fastest Conga Composer replacement for Salesforce button-click docs?

S-Docs is the fastest path for most Salesforce teams because it's Salesforce-native, has a free tier, and starts at $25/user/month for unlimited documents (with 50 e-sign envelopes/year included). PDF Butler is the best low-cost entry point if you're fine with a 5-user minimum.

How long does a typical CLM implementation take?

A CLM implementation takes months, not weeks. Conga CLM averages 4 months on G2, and Ironclad also averages 4 months. That's normal once you rebuild clause libraries, approvals, integrations, and repository taxonomy.

Is DocuSign $15/month a Conga CLM alternative?

No. $15/month is DocuSign eSignature, which replaces Conga Sign, not Conga CLM. DocuSign CLM is a separate product that lands in the ~$30k-$200k/year range once implementation and integrations are included.

After switching tools, how do we keep signer/champion contact data accurate?

Verify signer details before signature, enrich champions weekly, and enrich immediately after any bounce; that 3-step loop prevents most "stuck contract" situations. Prospeo's a practical option because it delivers 98% email accuracy, 125M+ verified mobiles, and a 7-day refresh, so Salesforce records stay current without annual contracts.