The QBR Agenda: Copy/Paste Templates + a 60-Minute Run of Show (2026)

What happens when your "QBR deck" gets skimmed in 90 seconds... and the rest of the meeting turns into a support ticket review? You don't get alignment, you don't get decisions, and you definitely don't get renewal confidence.

A qbr agenda isn't a formality. It's the guardrails.

The goal isn't a prettier deck. It's a tighter conversation.

What a QBR agenda is (and what it isn't)

A QBR agenda is a decision-focused run of show for a quarterly conversation about outcomes, risks, and the plan forward. It's not "a meeting where we show charts," and it's not a disguised product demo.

Totango ran a poll of customer success professionals that captures why QBRs go sideways: 37% say the hardest part is engaging customers, 33% struggle to create a success plan, and 29% can't pull relevant data. That's not a "better slides" problem. It's an agenda problem.

Quick clarity (QBR vs EBR vs sales QBR):

- QBR: customer-facing operating review (outcomes, adoption, risks, next-quarter plan)

- EBR: executive business review (strategy, ROI, multi-quarter roadmap, commercial alignment)

- Sales QBR: internal performance review (pipeline, forecast, execution commitments)

Here's what a QBR agenda is:

- A decision forum: you're there to agree on priorities, tradeoffs, and next steps.

- A shared operating rhythm: what you'll measure, what "good" means, and what happens if it's not good.

- A commitment machine: every section ends with a concrete output (not vibes).

Here's what it isn't:

- A status meeting where you narrate dashboards.

- A support review where the loudest issue wins the whole hour.

- A roadmap show-and-tell where the customer leaves with zero actions.

Use this format if you need executive alignment, renewal risk reduction, expansion planning, or cross-functional commitments.

Skip the "QBR" label if you're only reviewing tickets, onboarding tasks, or weekly adoption metrics. Call it an ops check-in and keep it short.

Why QBRs matter more in 2026 (the macro pressure)

SaaS has less margin for "we'll figure it out next quarter." Benchmark-focused industry reporting has been blunt about it: net revenue retention hovering around ~101%, expansion representing ~40% of total new ARR, and a CAC payback reality that punishes sloppy retention motions. Translation: if you don't protect renewals and create expansion clarity, growth stalls.

A tight agenda is one of the few levers you can pull that improves retention, expansion, and stakeholder alignment without adding headcount, because it forces the room to do the hard work: pick priorities, name owners, and set dates.

What you need (quick version)

Non-negotiable: keep it <=60 minutes unless it's a true strategic account with multiple workstreams. Long QBRs don't feel "premium." They feel like a tax.

Checklist (copy/paste)

- Pick the right format: 45 / 60 / 90 / async / internal

- Send a pre-read 48 hours before

- Timebox every section

- Every section ends with: Decision / Owner / Date

- Put product updates last (leading with features shifts the meeting from outcomes to you)

- Close by scheduling the next review (or the async deadline)

Segment your book of business (so QBRs scale)

If you run the same agenda for every account, you'll waste time on low-touch customers and under-serve strategic ones. Use a simple four-segment system:

| Segment | Definition (2 lines) | Cadence + format | Minimum viable QBR artifact |

|---|---|---|---|

| Strategic | Multi-threaded stakeholders, meaningful renewal/expansion, exec visibility | Live 60-90 min quarterly + mid-quarter check-in | Scorecard + value proof + risk register + joint plan |

| Growth | Clear expansion path, strong adoption, needs enablement to scale | Live 45-60 min quarterly (or alternating live/async) | Scorecard + 3 decisions + 3-5 actions |

| SMB / Scale | Low-touch, stable usage, limited stakeholder set | Async quarterly + optional 20-min call | 1-page snapshot + decision prompts |

| At-risk | Adoption drop, stakeholder churn, support spikes, renewal friction | Live 30-45 min monthly until stabilized | Risk-first plan + owners + dates (no fluff) |

Hot take: if your deal size is small and your customer isn't multi-threaded, a live QBR is often a waste of everyone's time. Run an async artifact, then only meet if decisions are blocked.

Mini decision tree

- Need exec decisions + renewal/expansion alignment? -> 60-minute exec-ready review

- Low-touch SMB account, light stakeholder set? -> 45-minute review

- Strategic/enterprise account with multiple stakeholders? -> 90-minute review

- Stakeholders won't attend live / global time zones? -> Async review

- This is your team reviewing pipeline + forecast? -> Internal sales QBR

If you're not asking for decisions, it's not a QBR.

The core QBR agenda sections (baseline you'll improve)

Most QBRs fail because they're organized around what you want to present, not what the customer needs to decide. A clean baseline structure works because it forces a straight line from behavior -> value -> risk -> plan.

Also: product updates last. Put them earlier and you've told the room the meeting is about features, not outcomes.

Here's the baseline structure (and the output each section must produce):

| Section | Purpose | Output |

|---|---|---|

| Usage & adoption | What changed in behavior | 1-2 insights |

| Value delivered | Tie usage to outcomes | Value proof |

| Goals & priorities | Confirm what matters now | Updated goals |

| Obstacles & risks | Surface blockers early | Risk list |

| Joint plan | Agree on next moves | Action plan |

| Product developments | Relevant updates only | 1-3 items |

What makes these sections work is the decision question behind each one. Use these verbatim:

Usage & adoption (decision question): "What behavior change matters enough to change the plan?" Avoid narrating dashboards. Call out one adoption lift and one adoption drop, then move on.

Value delivered (decision question): "Which outcome are we doubling down on next quarter?" Avoid vague wins ("great engagement"). Bring proof: a report, a before/after, a workflow change, a KPI shift.

Goals & priorities (decision question): "What are we optimizing for this quarter - and what are we deprioritizing?" Avoid a laundry list. If everything's priority #1, nothing is.

Obstacles & risks (decision question): "What could break renewal or stall outcomes - and who owns the fix?" Avoid risk theater (12 yellow flags with no owner). Pick the top three that actually matter.

Joint plan (decision question): "What are the 3-5 actions that'll move the scorecard by next review?" Avoid backlogs. A plan's short, owned, and dated.

Product developments (decision question): "Which 1-3 updates directly support the plan we just agreed to?" Avoid feature dumping. If it doesn't support a goal, it goes to the appendix or a separate enablement call.

Two rules that make this work in real life:

Every section ends with Decision / Owner / Date. If you can't write those three fields, the section was commentary.

Put "interesting" metrics in the appendix. The main run-of-show should only include metrics that change the plan.

Your QBR agenda has a "Value Delivered" section - but value starts with reaching the right stakeholders. Prospeo gives you 98% accurate emails and verified direct dials across 300M+ profiles, so every account review starts with real pipeline data, not guesswork.

Multi-thread every strategic account before the next QBR.

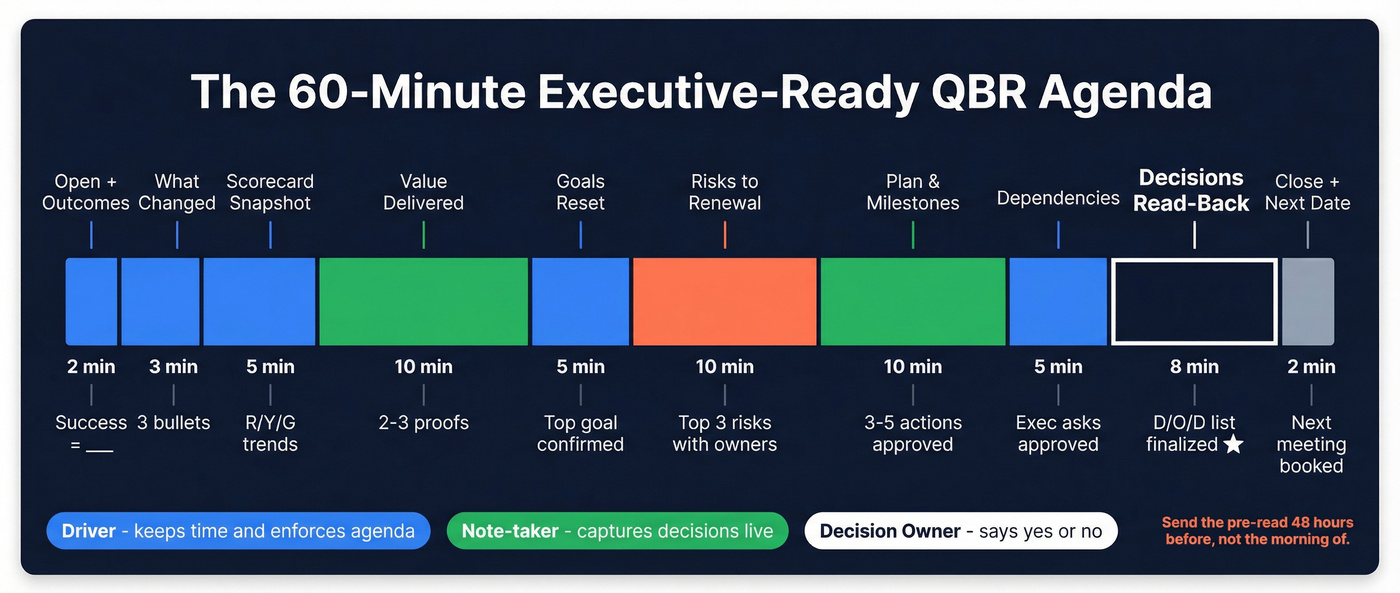

The 60-minute executive-ready QBR meeting agenda (minute-by-minute run-of-show)

Senior execs don't hate QBRs. They hate meetings that pretend to be QBRs.

The numbers are ugly: only 28% of senior execs say vendor QBRs are a valuable use of time. In a separate survey of 200 senior stakeholders, 88% said business reviews lack evidence of value and innovation, and 82% said they've cancelled a contract due to poor QBRs.

So the bar isn't "nice deck." The bar is "decision-ready."

CS teams often use a simple backbone - 5 / 15 / 15 / 15 - then close with owners and dates. The run-of-show below expands that backbone into a minute-by-minute script you can actually run, and it stays tight even when the conversation gets messy because every block has a single output and a single decision attached.

Also: send the pre-read 48 hours before. If you send it the morning of, you've guaranteed the meeting becomes a live read-through.

Roles that prevent drift (Driver / Note-taker / Decision owner)

These three roles stop the "nice conversation" trap. I've watched teams fix QBR quality in a week just by assigning them.

- Driver: keeps time, enforces the agenda, and calls the pivot: "We're parking that - back to the decision."

- Note-taker: captures decisions and action items live in a shared doc.

- Decision owner: the person who can say "yes/no" (or commit to getting a yes/no) for each decision.

We've tested a bunch of formats, and the read-back alone increases follow-through because it forces real commitments while everyone's still paying attention.

Minute-by-minute agenda (0-60)

| Time | Topic | Lead | Output | Decision |

|---|---|---|---|---|

| 0-2 | Open + outcomes | Driver | Success criteria | "Success = ___" |

| 2-5 | What changed | CSM | 3 bullets | What matters now? |

| 5-10 | Scorecard snapshot | CSM | R/Y/G trends | KPI priority |

| 10-20 | Value delivered | CSM + Champion | 2-3 proofs | Double-down area |

| 20-25 | Goals reset | Customer lead | Top goal | Goal #1 |

| 25-35 | Risks to renewal | CSM | Top 3 risks | Owner per risk |

| 35-45 | Plan & milestones | CSM | 3-5 actions | Approve plan |

| 45-50 | Dependencies | Both | Exec asks | Approve asks |

| 50-58 | Decisions read-back | Note-taker | D/O/D list | Final commits |

| 58-60 | Close + next date | Driver | Next meeting | Date + attendees |

"What good looks like" cheat codes (use these to keep the meeting executive)

- Scorecard snapshot: show 2-4 quarters (or 12 months) as a trend; one-quarter numbers start arguments.

- Value delivered: quantify in the customer's language (hours saved, risk reduced, revenue influenced) and show one artifact.

- Risks: pick the 3 that'd actually break renewal or stall outcomes.

- Plan: 3-5 actions max; if it's 12 tasks, it's a backlog.

The Decision / Owner / Date action log (paste this into your doc)

| Decision | Owner | Date | Notes |

|---|---|---|---|

Real talk: if you don't do the read-back in minutes 50-58, your follow-through rate drops fast.

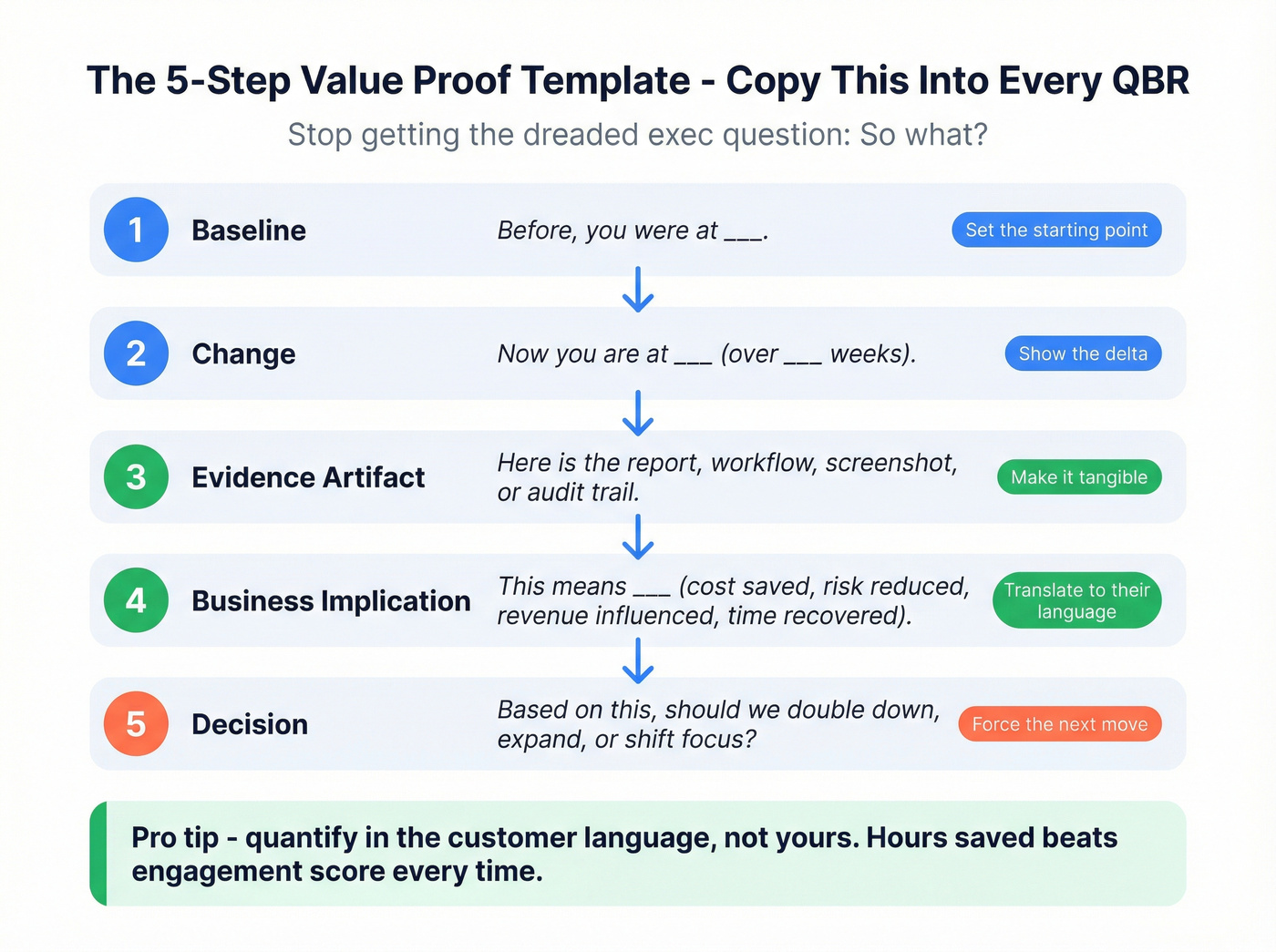

Value proof in 5 minutes (repeatable template)

Most "value" sections fail because they're storytelling without evidence. Use this five-part pattern and you'll stop getting the dreaded exec question: "So what?"

Copy/paste value proof:

- Baseline: "Before, you were at ___."

- Change: "Now you're at ___ (over ___ weeks)."

- Evidence artifact: "Here's the report / workflow / screenshot / audit trail."

- Business implication: "This means ___ (cost, risk, revenue, time)."

- Decision request: "To extend this outcome, we need approval for ___."

I use this exact structure because it forces the commercial and operational ask to be earned, not slid in.

After the QBR (15-minute closeout system)

The QBR isn't done when the call ends. It's done when the plan's in motion.

Closeout checklist (do it within 24 hours):

- Update the success plan (goals, milestones, owners)

- Update the health index (see model below) and note what changed

- Log actions in your system of record (CRM / CS platform / project tool)

- Send recap: Decisions + Owners + Dates (no long narrative)

- Schedule the next QBR (or set the async deadline)

- Create a mid-quarter check-in if any risk is red

- Roll unfinished items into the next pre-read (don't let them disappear)

Before the QBR: prep workflow + pre-read checklist (48 hours)

The meeting quality is mostly decided before anyone joins the call.

One scheduling move that changes everything: invite execs 2-3 weeks ahead and ask for agenda input. That single step forces you to tailor the review around what they care about, not what you want to present.

Treat the agenda like a workflow: collect inputs, turn questions into tasks, and make action items assigned work - not "we'll follow up."

48-hour prep SOP (simple, repeatable)

T-3 weeks (scheduling + scope)

- Send invite with a 1-line purpose + 3 bullets of expected decisions.

- Ask: "What's the one thing you want to leave this QBR aligned on?"

- Confirm who the decision owner is for renewal, security, and rollout.

T-5 days (data + narrative)

- Pull KPI trends (not raw exports).

- Draft 3 insights: what improved, what regressed, what's stuck.

- Identify 1-2 tradeoffs you want the customer to choose between.

T-48 hours (pre-read)

- Send a 1-2 page pre-read: scorecard + value proof + risks + proposed decisions.

- Add a comment deadline: "Please add notes by EOD tomorrow."

T-0 (meeting)

- Open with outcomes, then drive decisions.

- Capture Decision / Owner / Date live.

T+24 hours (follow-through)

- Send the action log + owners + dates.

- Create tasks in your system and assign them.

An "Asana-style" workflow spec you can steal

If you want QBRs to scale across a CS team, standardize the plumbing:

- Intake form fields (internal): account segment, renewal date, top goal (customer words), top risk, KPI snapshot link, proposed decisions (3-5), stakeholders + roles

- Task template created from the form: "Build pre-read," "Confirm attendees," "Draft value proof," "Draft risk register," "Draft plan," "Send pre-read"

- Owners: CSM owns narrative; Ops owns data pulls; AE owns commercial path; champion owns internal alignment

- Due dates: auto-set relative to meeting date (T-5, T-2, T+1)

- Where the action log lives: one shared doc/table per account (linked in CRM) so it's searchable and persistent

- Escalation rule: any red risk without an owner within 48 hours triggers manager review

- Roll-forward rule: unfinished actions automatically become the first section of next quarter's pre-read ("Open Actions from Last QBR")

Pre-read checklist (copy/paste)

- Account goals (in customer's words)

- KPI scorecard (trend view)

- Value delivered (2-3 outcomes + evidence artifact)

- Risks (top 3, ranked)

- Proposed decisions (3-5 max)

- Draft action plan (3-5 actions)

- Attendees + roles (who decides what)

One operational detail that's weirdly common: QBR follow-ups fail because the stakeholder list is wrong or outdated.

I've seen this happen in a painfully normal scenario: you send the pre-read to last quarter's "owner," they changed roles, the recap never reaches the actual decision-maker, and two weeks later you're hearing "we didn't know that was blocked" like it's a surprise. It's not. It's contact hygiene.

That's where Prospeo - "The B2B data platform built for accuracy" - is genuinely useful in a non-glamorous way: before you send the pre-read and after you assign owners, verify stakeholder contact info so the pre-read and follow-ups actually land. Prospeo verifies emails with 98% accuracy and refreshes data every 7 days (industry average: 6 weeks), so stakeholder lists don't rot between quarters.

Practical workflow:

- Export your attendee + action-owner list (CSV is fine).

- Run verification/enrichment in Prospeo.

- Update your CRM and resend the pre-read to the right people.

QBR scorecard: KPIs, formulas, and benchmark ranges (so it's not opinion)

If your QBR scorecard is "a bunch of charts," you'll spend half the meeting debating the numbers and none of it deciding what to do.

A good scorecard does three things:

- shows trends,

- ties to outcomes,

- forces tradeoffs.

Keep it simple. Health score guidance from CS operators is consistent: use 6-10 KPIs, grouped into 2-3 categories. More than that and you'll overfit the story.

First: separate account-level QBR KPIs from company-level SaaS metrics

Most CSMs can credibly present account-level signals (adoption, outcomes, risk). They usually can't credibly present company portfolio metrics (like overall NRR) in a customer QBR.

So split your scorecard into two layers:

- Account QBR scorecard (customer-facing): "Are they getting value and progressing?"

- Commercial/renewal scorecard (customer-facing but sensitive): "What's the renewal path and what could block it?"

- Portfolio metrics (internal CS leadership / partner programs): NRR/GRR benchmarks, churn targets, etc.

Account QBR scorecard (customer-facing)

| KPI | How to calculate | Good | Red flag |

|---|---|---|---|

| Active usage | Active users / licensed users | Stable or up | Down 2 periods |

| Key feature adoption | Users of key feature / active users | Up | Flat/down |

| Time-to-value | Days to first meaningful outcome | Down QoQ | Up QoQ |

| Outcome KPI | Customer's KPI (e.g., cycle time) | Improving | Stalled/regressing |

| Support load | Tickets per month + severity | Flat/down | Spike or Sev-1 |

| Stakeholder engagement | Attendance + response time | Consistent | Ghosting |

One-time glossary: QoQ = quarter over quarter.

Commercial / renewal scorecard (customer-facing, decision-oriented)

| Signal | What you track | Good | Red flag |

|---|---|---|---|

| Renewal date + timeline | Date, steps, stakeholders | Confirmed | Unowned timeline |

| Product footprint | Teams, seats, use cases | Expanding | Shrinking usage |

| Expansion pipeline | Use case, sponsor, next step | Named path | "Maybe later" |

| Risk rating | Green/yellow/red with reason | Green | Yellow/red w/ no plan |

| Stakeholder map | Champion + exec sponsor | Multi-threaded | Single-threaded |

Simple Health Index for QBRs (your objective spine)

If you want QBRs to feel consistent across a team, use a basic health index that triggers a decision.

3-category model (100 points total):

- Adoption (40 points): active usage, key feature adoption, breadth across teams

- Outcomes (40 points): progress vs customer KPI, time-to-value, realized wins

- Relationship & risk (20 points): stakeholder engagement, support severity, renewal readiness

Weighting rule: don't argue about weights in the QBR. Pick weights once, then iterate quarterly.

Decision rule (the part most teams skip):

- 80-100: invest to expand (new team/use case)

- 60-79: maintain + remove friction (enablement, process fixes)

- <60: de-risk (exec alignment, rescue plan, tighter cadence)

Backtest your health score against renewals. If "green" accounts churn, your score is lying. Fix the inputs or the weights until it predicts reality.

Portfolio benchmarks (internal or partner/channel QBRs)

If you're running an internal CS leadership QBR or a partner/channel business review, portfolio metrics like NRR and GRR belong in the scorecard.

KoalaFeedback's 2026 benchmark ranges are a practical starting point:

- NRR (SMB/PLG): 110% good, 120%+ world-class, <100% red

- NRR (mid-market): 115% good, 125%+ world-class, <100% red

- NRR (enterprise): 120% good, 130%+ world-class, <100% red

- Monthly churn "safe zone": SMB <=3% (red flag >5%), mid-market 1-2% (red flag >3%), enterprise <1% (red flag >=1.5%)

- GRR targets: SMB acceptable 88-90% (world-class 95%+), mid-market 90-92% (world-class 97%+), enterprise 92-94% (world-class 98%+)

NRR formula (for internal use): NRR = (Beginning MRR + Expansion MRR - Churned MRR - Contraction MRR) ÷ Beginning MRR × 100

How to present trends so execs don't argue with you

- Show 2-4 quarters (or 12 months) as a line, not a single number.

- Use traffic-light status (green/yellow/red) with one sentence: "Why it's this color."

- Add one "so what" per KPI: "Adoption dipped in Team X; decision needed: re-enable or reduce scope."

In our experience, the fastest way to make a QBR feel executive is to stop over-explaining metrics and start explaining the decisions the metrics force.

Agenda variants you can standardize (45 / 90 / async / internal sales)

Standardizing variants is how you scale QBR quality across a team. You don't want every CSM inventing their own meeting format.

Here's the quick comparison:

| Format | Best for | Live time | Output |

|---|---|---|---|

| 45-min | SMB / low-touch | 45 | 3 decisions |

| 60-min | Exec-ready | 60 | Plan + D/O/D |

| 90-min | Strategic acct | 90 | Joint roadmap |

| Async | Busy execs | 10-15 | Comments + tasks |

| Internal sales | Pipeline/forecast | 60-90 | Commitments |

45-minute QBR agenda (SMB / low-touch live)

This is the 60-minute version with less ceremony and fewer slides. You're still decision-first.

Copy/paste agenda (45 minutes)

- 0-3: outcomes + agenda confirmation (Driver)

- 3-10: KPI snapshot (CSM)

- 10-20: value delivered (CSM + customer lead)

- 20-30: risks + blockers (CSM)

- 30-40: plan + next milestones (CSM)

- 40-45: decisions + action log read-back (Note-taker)

Non-negotiable: end with Decision / Owner / Date for the top 3 items.

90-minute QBR agenda (strategic / enterprise)

This is for accounts where you're multi-threading across teams and the plan actually has workstreams.

Copy/paste agenda (90 minutes)

- 0-5: outcomes + what changed since last review

- 5-20: scorecard + value narrative (trend view)

- 20-35: stakeholder goals reset (each leader: 2 minutes)

- 35-55: risks + renewal path (commercial + operational)

- 55-75: joint plan by workstream (owners + milestones)

- 75-85: roadmap + product developments (only what's relevant)

- 85-90: decisions + action log + next date

Hot take: if you can't name the 3-5 stakeholders who own outcomes on the customer side, you're not ready for a 90-minute QBR. You're about to run a 90-minute monologue.

Async QBR agenda (no meeting required)

Async QBRs work when the artifact's short, decision-ready, and easy to comment on. I've used async QBRs to unblock "we can't get everyone in a room" accounts, and the only time it fails is when the artifact reads like a deck someone exported to PDF.

A useful practitioner pattern is: 1-page KPI snapshot + 3-page brief + appendix, plus a 10-15 minute talk-through. One practitioner report also noted lifts like action logging up ~35% and the readout being used as the actual agenda up ~15% after switching to this shorter brief format.

Copy/paste async QBR workflow

- Deliverable: 1-page KPI + 3-page narrative + appendix

- Video: 10-15 min walkthrough (record once)

- Comment deadline: 3 business days

- Decisions: customer replies inline with "approve / reject / needs discussion"

- Optional live: 20-minute follow-up only if decisions are blocked

Async agenda (the artifact itself)

- Page 1: KPI snapshot (trend + R/Y/G) + "Decisions requested"

- Pages 2-4: narrative (value proof, risks, plan)

- Appendix: detailed charts, ticket list, feature notes

Make async work with these mechanics (steal this):

- Add decision tags to every ask:

[APPROVE],[REJECT],[NEEDS DISCUSSION] - Use comment prompts under each section: "What should we stop doing?" "Which KPI matters most next quarter?"

- Set an escalation rule: if any decision is

[NEEDS DISCUSSION]after the deadline, schedule a 20-minute call within 5 business days - Convert approved actions into tasks immediately (same day), with owners and dates

Use these 4 visuals (they get read):

- Small multiples (same chart repeated by segment/team)

- Waterfall (baseline -> change drivers -> current)

- KPI tree (goal -> leading indicators -> actions)

- Before/after screenshot pair (one artifact beats ten bullets)

Avoid these 3 visuals (they waste time):

- 12-slide dashboard collage

- Pie charts for everything

- Single-quarter bar charts with no trend context

Internal sales QBR agenda (not customer-facing)

Sales QBRs are internal. They're about pipeline reality, execution, and commitments.

Copy/paste internal sales QBR (90 minutes)

- 0-5: kickoff + goals

- 5-25: pipeline health (coverage, stages, aging)

- 25-40: KPI recap (activity -> outcomes)

- 40-50: what worked / what didn't

- 50-70: forecasting + next-quarter goals

- 70-85: adjustments (territory, plays, enablement)

- 85-90: action items + owners + next steps

Make the "data-guided" idea real by enforcing one rule: pick 3 metrics that'll change rep behavior next quarter; everything else goes to the appendix.

Mistakes that sink QBRs (and the fix for each)

These are the patterns that waste everyone's time - and the fixes that actually work.

- Too much past -> Spend 70% on forward plan and decisions.

- Not tailored to the customer -> Start with their goals, not your product areas.

- No next steps -> Every section ends with Decision / Owner / Date.

- Too much data -> 6-10 KPIs, trend view, appendix for the rest.

- Wrong stakeholders -> Invite decision-makers; don't "hope they forward it."

- Feature dumping -> Product updates last, and only if relevant to goals. (If this is a recurring issue, fix the pattern with a clear definition of feature dumping.)

- No evidence of value -> Use baseline -> change -> artifact -> implication -> decision.

Driver enforcement mini-script (use these lines to cut drift)

If you want an agenda to work, you need language that politely shuts down rabbit holes:

- "What decision are we making here?"

- "Which option are we saying no to?"

- "Let's park that - who owns it and by when?"

- "Is this a today decision or an offline task?"

- "What would change your mind?"

Here's the thing: QBRs don't fail because teams don't work hard. They fail because nobody's willing to cut content and force decisions.

Free QBR agenda templates (downloads + what to use them for)

If you want ready-made formats, start with Smartsheet. Their library includes Excel/Word/PowerPoint templates for executive QBRs, small business QBRs, sales QBRs, and a prep checklist. Grab what matches your audience and then retrofit it to Decision / Owner / Date.

If you're looking for a quarterly business review agenda example to start from, these libraries are also a solid source of examples you can trim down and make decision-first.

Smartsheet (Excel/Word/PPT): best for teams that want a standard template library fast; limitation is that templates can encourage "fill the slides" behavior. Trim aggressively and add an action log. Smartsheet's QBR template library

Impact.com (Sheets + Slides auto-populate): best for partner/agency QBRs where you want data to flow into a consistent deck; limitation is that auto-populated slides still need decision prompts. Impact.com's free QBR template (Sheets + Slides)

Customer Success Collective (EBR framework): best when you need a more executive, semi-annual/annual structure; limitation is that it's higher-level. Pair it with a quarterly action log so it doesn't become a strategy-only conversation. Customer Success Collective EBR template framework

How to adapt any template in 2 minutes:

- Delete 30% of slides.

- Add a "Decisions requested" slide at the top.

- Add a Decision / Owner / Date table at the end.

- Move product updates to the appendix unless they support a goal.

QBRs expose expansion gaps. When your joint plan calls for new stakeholder engagement, Prospeo's 30+ filters - including buyer intent, headcount growth, and job changes - surface the exact decision-makers you need. At $0.01 per email, scaling account coverage costs less than one lost renewal.

Stop walking into QBRs without the contacts to execute the plan.

Copy the 60-minute table, delete 30% of your deck, and force 3-5 decisions. If you do nothing else, enforce Decision / Owner / Date like it's policy. Your qbr agenda will instantly feel more executive and actually drive follow-through.

QBR agenda FAQ

How long should a QBR be - 45, 60, or 90 minutes?

A QBR should be 45 minutes for low-touch accounts, 60 minutes for most exec-ready reviews, and 90 minutes only for strategic accounts with multiple workstreams and real decisions to make. If you can't name the decisions up front, shorten it. Long meetings don't create value by default.

What should you send as a QBR pre-read (and when)?

Send a pre-read 48 hours before: a 1-2 page doc with KPI trends, value delivered, top risks, proposed decisions, and a draft action plan. Include a comment deadline so stakeholders react before the live meeting, and you can spend the session deciding, not explaining.

What KPIs belong in a customer success QBR scorecard?

A CS QBR scorecard should include 6-10 KPIs across adoption (active usage, key feature usage), outcomes (customer KPI progress, time-to-value), and risk signals (support severity, stakeholder engagement). Keep portfolio metrics like NRR/GRR for internal CS leadership or partner/channel reviews, and present trends so each KPI drives a decision.

How do you make sure QBR action items actually get done?

You make QBR actions stick by ending every section with Decision / Owner / Date, reading the action log out loud, and sending the recap within 24 hours. Also verify action owners' contact info so the recap lands with the people who actually agreed to the work.