Strategic Account: Meaning, Examples, and How to Run SAM in 2026

Most teams don't fail at a strategic account because they "don't care." They fail because they confuse activity with strategy: a pretty account plan, a QBR deck, and a CRM full of stale contacts. Strategic Account Management (SAM) only works when it's operational - tiering, coverage, and execution discipline.

Here's the thing: SAM isn't a document. It's a weekly habit.

And yes, that means saying "no" to a bunch of accounts that feel important.

What you need (quick version)

If you do nothing else, do this:

- Pick one definition and enforce it. A strategic account isn't "big." It's important enough to justify cross-functional investment and a multi-threaded plan.

- Implement only three things this quarter:

- Tiered scoring cutoffs: score 3-5 criteria (1-10), weight them, and set Tier 1/2/3 thresholds.

- Coverage target >80%: track account coverage weekly so you stop being single-threaded by accident.

- MAPs for renewals/expansion: Mutual Action Plans create shared milestones and owners - and lift win rates by 26% when AEs use them.

- Run a minimum cadence: weekly internal standup (30 min), monthly stakeholder review (30-45 min), quarterly QBR with an executive sponsor (60 min).

What is a strategic account (and what it isn't)

Strategic Account Management (SAM) is a systematic way to manage and grow your most important customers to maximize mutual value. The point is repeatability: a strategic account should grow because the system works, not because one heroic account manager drags it over the finish line.

Research on formal SAM programs shows the upside is real: top performers are 3.1x more likely to grow existing-account revenue by 20%+.

Why invest in SAM (the outcomes executives actually care about)

If you need the business case in one breath, here it is. SAMA's outcome benchmarks are blunt: strategic account programs drive 10% more gross margin, 2x growth, 95% repaired/saved relationships, and 61% higher customer satisfaction. That's why SAM deserves executive sponsorship: it improves the economics of retention and expansion, not just "account planning hygiene."

Strategic account examples (3 patterns you'll recognize)

Most "is this strategic?" debates disappear when you look for these patterns:

Mission-critical dependency Your product runs a workflow they can't afford to break (revenue, compliance, uptime, security). These accounts demand proactive renewal forecasting and escalation paths.

Multi-region or multi-business-unit runway They've proven value in one area and have obvious white space analysis across regions, teams, or subsidiaries. Expansion is a sequencing problem, not a "maybe someday" dream.

Ecosystem influence They're a lighthouse logo, a co-sell partner, or a reference that unlocks a category. Even modest near-term expansion can be worth it because the partnership value compounds.

Here's what a strategic account is not:

- Not "our biggest customer." Big customers can be low-growth, high-friction, or strategically irrelevant.

- Not "any enterprise logo." Enterprise is a segment. Strategic is a portfolio decision.

- Not "a relationship." Relationships matter, but SAM is an operating model: roles, cadence, stakeholder map, MAPs, and KPIs.

I've seen teams label 40 accounts as "strategic" and then wonder why nothing changes. If everything's strategic, nothing is.

Definition callout (practical): A strategic account is one where (1) expansion is predictable with the right plays, (2) the customer has influence or partnership value beyond revenue, and (3) you're willing to staff it differently than the rest of the book.

Strategic account vs key account vs enterprise account

These terms get thrown around like they're interchangeable. They aren't.

Enterprise account is a segmentation label: company size, complexity, procurement, security review, longer cycles. You can have hundreds of enterprise accounts.

Key account is a named set of your most important customers for an account manager to grow and protect. The list has to be limited or it becomes meaningless.

A strategic account is a smaller subset where you run a different system: cross-functional resources, executive sponsorship, relationship mapping, and a plan that's actually executed.

The economic reason to care is simple: expansion and renewals are easier than net-new, and retention compounds. A 5% increase in retention can increase profits by up to 95% because retention compounds CAC payback and reduces re-acquisition costs.

Mini table to keep your taxonomy clean:

| Term | What it means | Typical count | Primary goal |

|---|---|---|---|

| Enterprise | Segment label | 100s | Land + serve |

| Key account | Named priority set | 10-40 | Protect + grow |

| Strategic account | Cross-functional bet | 3-15 | Expand + partner |

A useful mental model: enterprise is who they are, key is your priority, strategic is your operating model.

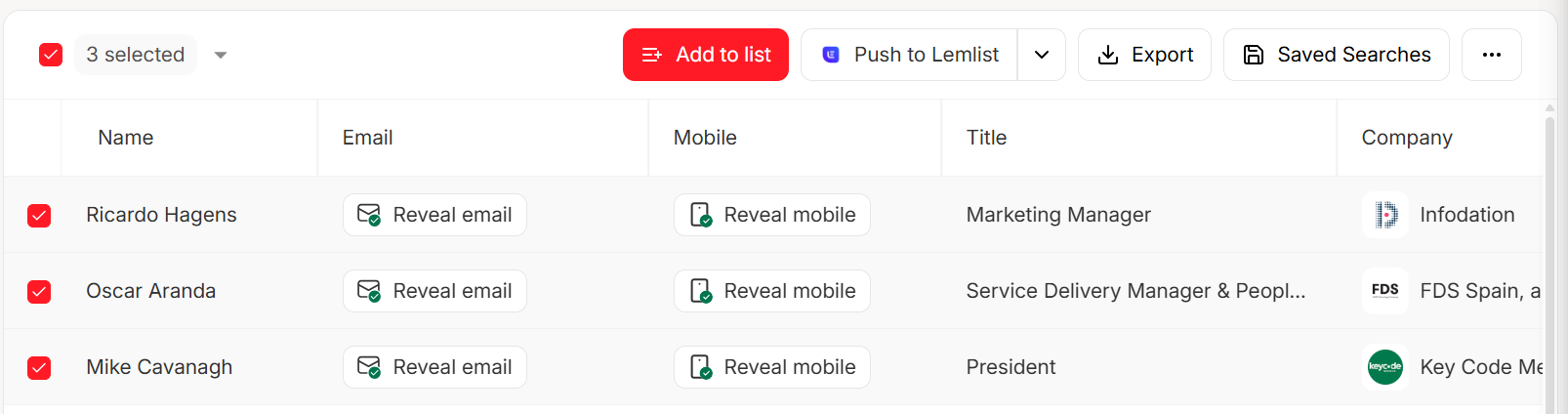

Single-threaded accounts aren't strategic - they're fragile. Prospeo gives you 300M+ profiles with 30+ filters so you can multi-thread every strategic account across economic buyers, champions, and procurement. 98% email accuracy means your outreach actually lands.

Stop running SAM on stale CRM data. Get verified contacts today.

How to identify and tier strategic accounts (selection model you can run)

If you want SAM to work, selection has to be boring and defensible. A simple scoring model (popularized by teams like Gong) is the cleanest starting point: pick 3-5 criteria, score each account 1-10, then rank by total score.

Then add weighting so "nice-to-have" doesn't outrank "actually expands."

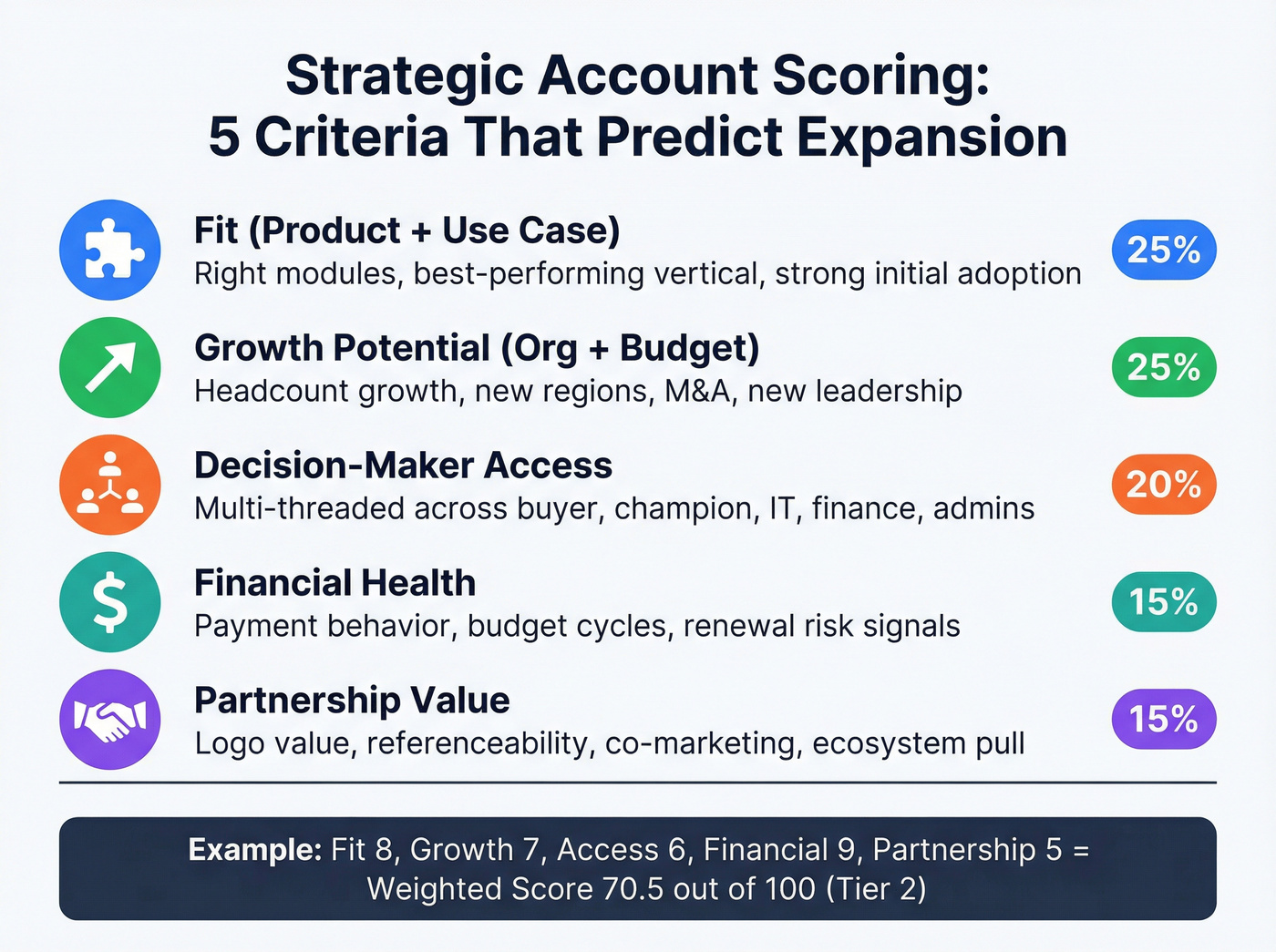

The criteria (3-5) that actually predict expansion

Use criteria that correlate with expansion, not criteria that make you feel safe.

My go-to set:

Fit (product + use case fit) Are they using the right modules? Are they in your best-performing vertical? Expansion is hard when initial fit is shaky.

Growth potential (org + budget trajectory) Headcount growth, new regions, new initiatives, M&A, new leadership. If the customer's not changing, your expansion story usually isn't either.

Financial health (ability to pay + renew) Payment behavior, DSO trend, budget cycles, renewal risk. A "strategic" customer that can't pay on time is a strategic headache.

Partnership value (influence + co-marketing + roadmap pull) Referenceability, logo value, ecosystem pull, partner motions.

Decision-maker access (multi-thread depth) Do you have relationships across economic buyer, champion, IT/security, finance/procurement, and day-to-day admins? Single-threaded accounts aren't strategic; they're fragile.

Look, the temptation is to add 12 criteria. Don't. You'll create a scoring ritual nobody trusts.

Simple weighting recipe

Here's a weighting recipe that works in the real world:

- Pick 5 criteria (above).

- Score each 1-10 with simple anchors:

- 1-3 = weak

- 4-6 = mixed

- 7-8 = strong

- 9-10 = exceptional

- Assign weights that reflect your growth strategy.

Example weights (sum to 100):

- Fit: 25

- Growth potential: 25

- Decision-maker access: 20

- Financial health: 15

- Partnership value: 15

Weighted score formula (copy/paste):

- Weighted Score = Σ(criterion score × criterion weight) (If you score 1-10, keep weights as decimals: 0.25, 0.25, etc.)

Example:

- Fit 8, Growth 7, Access 6, Financial 9, Partnership 5

- Score = 8×0.25 + 7×0.25 + 6×0.20 + 9×0.15 + 5×0.15 = 7.05 -> 70.5/100

Tier cutoffs (operational thresholds)

You need tier cutoffs that drive resourcing and cadence. Otherwise tiering is just labeling.

These cutoffs are operationally sane defaults because they force real resourcing decisions:

Tier 1 (Strategic): 80-100

- Owner: Strategic AM + executive sponsor

- Cadence: weekly standup, monthly stakeholder review, QBR

- Artifacts: 2-page plan + MAP per renewal/expansion motion

- Coverage target: >80% (measured)

Tier 2 (Growth): 60-79

- Owner: AM with specialist support on demand

- Cadence: biweekly standup, quarterly stakeholder review

- Artifacts: 1-page plan + MAP for renewal (optional expansion MAP)

- Coverage target: 60-75%

Tier 3 (Maintain): <60

- Owner: pooled AM/CS coverage

- Cadence: monthly health review

- Artifacts: success plan + renewal checklist

- Coverage target: 40-60%

The "biggest customer" trap (hot take)

Hot take: if your "strategic list" is basically "top ARR customers," you don't have a strategy - you've got a revenue report.

Teams that select accounts based on current spend are 51% less likely to increase revenue. Big spend often correlates with heavy discounting, complex support burden, low adoption outside one team, and procurement-driven renewals. Revenue matters, but it isn't predictive by itself.

Strategic accounts are picked for future mutual value, not past invoices.

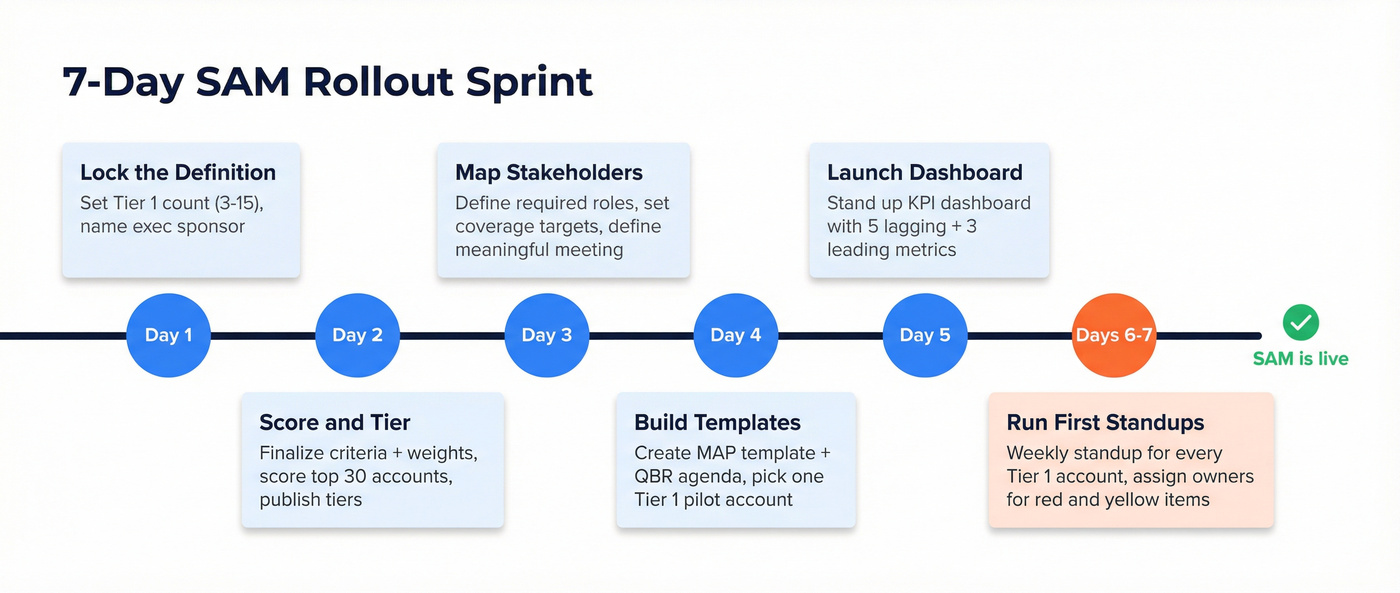

7-day rollout plan (so this doesn't die in a workshop)

If you want momentum fast, run this as a one-week sprint:

- Day 1: lock the definition + Tier 1 count (3-15) and name the executive sponsor for the program.

- Day 2: finalize criteria + weights; score the top 30 accounts; publish Tier 1/2/3 list.

- Day 3: build stakeholder map requirements (roles you must cover) + define "meaningful meeting."

- Day 4: create MAP template + QBR agenda; pick one Tier 1 account to pilot.

- Day 5: stand up the KPI dashboard (5 lagging + 3 leading) and set thresholds.

- Day 6-7: run the first weekly standup for every Tier 1 account; assign owners for every red/yellow item.

Outbound link (most relevant here): Gong's strategic account management guide

Strategic account operating model: roles, RACI, and cadence

SAM breaks when it becomes "the account manager's job." The fix is to name the work and assign it - especially when one person is covering multiple roles.

The six roles (and what they look like in real org charts)

A practical SAM role set includes:

Results Driver (owns growth outcomes) Often: Strategic AM / Enterprise AM / sometimes a CSM in PLG expansions

Relationship Lead (builds stakeholder trust, runs executive sponsor motion) Often: AM + exec sponsor; sometimes Customer Success for post-sale

Innovator (brings new use cases, runs white space analysis) Often: AM + Solutions Consultant + Product Marketing (for vertical plays)

Collaborator (aligns internal teams, removes friction) Often: RevOps / CS Ops / Sales Ops + a strong AM

Technical Expert (solution depth, architecture, security) Often: Sales Engineer / Solutions Architect / Support lead for escalations

Project Manager (keeps execution moving, runs the MAP) Often: AM, CS Program Manager, or a dedicated PM for the biggest accounts

Reality check: in mid-market, one person will cover 3-4 of these roles. That's fine. What's not fine is pretending the work will happen "organically."

RACI table (copy/paste)

Use this as a starting point. Adjust for your org.

| Motion | Results | Rel Lead | Innovator | Collab | Tech | PM |

|---|---|---|---|---|---|---|

| Renewal forecast + plan | A | R | C | C | C | R |

| Expansion pipeline | A | C | R | C | C | R |

| Executive sponsor motion | A | R | C | R | C | C |

| Stakeholder map / relationship mapping | C | A | C | C | C | R |

| Issue escalation | A | C | C | R | R | R |

| QBR agenda + prep | A | R | R | C | C | R |

Legend: R = Responsible, A = Accountable, C = Consulted

Two rules that prevent chaos:

- Only one A per row.

- If nobody owns PM work, MAPs die in email threads.

Cadence that prevents "strategy theater"

Strategy theater is when you have a plan deck and no weekly execution rhythm.

Weekly account standup (30 min)

- Wins/risks since last week (5 min)

- MAP status: green/yellow/red (10 min)

- Stakeholder changes + coverage gaps (5 min)

- Next 7 days: 3 commitments, owners, dates (10 min)

Monthly stakeholder review (30-45 min)

- Adoption/usage trends (leading indicator)

- Open issues + time-to-resolution

- Expansion hypotheses: 1-2 bets, not a brainstorm list

- Executive sponsor notes: what they need to unblock

Quarterly QBR (60 min)

- Outcomes vs success metrics

- Value delivered (customer language)

- Roadmap alignment + joint priorities

- Renewal forecast + expansion pipeline timeline (MAP milestones)

My opinion: the weekly standup is the highest-leverage meeting in SAM. It's where "we should" becomes "who owns it by Friday."

The strategic account plan template (keep it to 2 pages)

Account plans fail when they're written for leadership, not for execution. The best plans are boring, short, and used every week.

Here's a 2-page template you can copy into a doc:

Page 1: Account snapshot

- Account overview (industry, regions, business model)

- Current products/modules in use

- Current ARR + renewal date + term

- Key stakeholders (economic buyer, champion, admins, IT/security, finance/procurement)

- Success metrics the customer cares about (in their words)

Page 1: SWOT (short, specific)

- Strengths: where you're winning today

- Weaknesses: adoption gaps, support pain, political risks

- Opportunities: 1-3 expansion vectors tied to outcomes

- Threats: competitors, budget cuts, executive changes, security blockers

Page 2: Growth strategy + rhythm

- 3 strategic initiatives (each with hypothesis + owner + metric)

- Risks + mitigation plan

- Cadence: weekly/monthly/QBR owners and dates

- MAP links (renewal + any expansion MAP)

Manager pressure-test prompts (use these in reviews)

- "If we lost this account in 90 days, what would've been the first warning signal?"

- "Which stakeholder could kill the renewal, and what's our plan to neutralize that risk?"

- "What's the single adoption metric that predicts expansion here?"

- "Which initiative are we willing to stop doing if capacity gets tight?"

- "What's the customer's internal deadline that matters more than ours?"

A filled-in example (anonymized)

Completed artifacts are weirdly rare. This is a realistic anonymized example so you can see what "good" looks like end-to-end.

Account snapshot (example)

| Field | Value |

|---|---|

| Account | "Northwind Logistics" |

| ARR | $420k |

| Renewal | Oct 15 |

| Products | Core + Analytics |

| Goal | Reduce SLA misses 15% |

3 initiatives (next 2 quarters)

| Initiative | Hypothesis | Owner | Success metric |

|---|---|---|---|

| Multi-site rollout | Expansion if 2nd region hits ROI | Results Driver | +$180k expansion |

| Exec value story | Exec sponsor reduces renewal risk | Relationship Lead | EB meeting/month |

| Adoption program | Usage lift predicts upsell | Innovator | +25% WAU |

MAP milestones (renewal + rollout)

| Milestone | Owner | Due | Status |

|---|---|---|---|

| Security review | Customer IT | May 20 | Green |

| Pilot in Region B | Joint | Jun 15 | Yellow |

| ROI readout | AM + Ops Dir | Jul 10 | Green |

| Renewal terms | Procurement | Sep 10 | Not started |

That level of specificity is the bar: owners, dates, and measurable outcomes.

Mutual Action Plans (MAPs): the execution layer that makes plans real

An account plan is your internal strategy. A Mutual Action Plan is the shared execution contract with the customer: milestones, owners, deliverables, and dates.

MAPs matter because B2B cycles can run 3 to 24 months, and long cycles turn into "checking in" emails plus surprise procurement delays unless you've got a shared timeline that both sides actually use. Deals where sellers use a MAP see a 26% higher win rate, which tracks with what we've seen in the field: MAPs don't just organize work, they force the hard conversations early (security, procurement, who signs, and what "done" means).

Worked MAP example (renewal + expansion)

Here's a MAP you can actually run. Notice it's written in customer language, not internal stage names.

| Milestone | Buyer owner | Seller owner | Deliverable | Due date | Status |

|---|---|---|---|---|---|

| Success metrics confirmed | Ops Director | Relationship Lead | 1-page success scorecard | Mar 8 | Green |

| Security + privacy review | Security Lead | Technical Expert | Security packet + answers | Mar 22 | Yellow |

| Expansion pilot kickoff | Program Manager | Project Manager | Pilot plan + timeline | Apr 5 | Green |

| ROI readout | CFO delegate | Results Driver | ROI deck + next-step decision | May 3 | Not started |

| Commercial terms draft | Procurement | Results Driver | Order form draft | Jun 7 | Not started |

| Renewal signature | Procurement | Results Driver | Signed agreement | Jun 28 | Not started |

If you want MAPs to stick, print this rule on a sticky note: no deliverable, no milestone.

MAP review script (what to say in the meeting)

Use this verbatim in your monthly stakeholder review:

- "Let's confirm the objective and the date that matters most on your side."

- "Which milestone is most likely to slip - and what would cause it?"

- "For each yellow item: what's the next deliverable, who owns it, and by when?"

- "If we hit every milestone, what decision happens at the end?"

- "What changed in your org since last month - new stakeholders, priorities, or risks?"

MAP red flags (the patterns that kill deals)

If you see these, fix them immediately:

- All owners are on your side. That's not mutual; it's a task list.

- Milestones are meetings, not outputs. Meetings don't move deals; deliverables do.

- No procurement/legal lane. If procurement isn't in the MAP early, you're choosing a surprise later.

- No executive sponsor touchpoints. Strategic accounts need executive air cover, especially on renewals.

Real talk: I've watched teams "do MAPs" by sending a spreadsheet once and never referencing it again. That's not a MAP. That's a file.

Strategic account KPIs: formulas, targets, and benchmarks

If you can't measure it, you can't run it. But if you measure everything, you'll drown. The win is a small set of KPIs tied to specific plays.

The "choose 5 + 3" KPI set

Pick 5 core outcomes (lagging) and 3 leading indicators (early warning).

5 core outcomes (lagging)

- Net revenue retention (NRR) / expansion revenue

- Renewal rate / churn

- Customer satisfaction (NPS or CSAT)

- Average deal size (expansion)

- DSO (cash discipline)

3 leading indicators

- Account coverage ratio (relationship depth)

- Adoption/usage trend (product telemetry or admin activity)

- Engagement gaps (days since last meaningful meeting with key roles)

My opinion: leading indicators are where SAM programs win. If you only track churn, you're always late.

KPI definitions + formulas (copy/paste)

- Churn rate (%) = (Customers Lost ÷ Total Customers at Start of Period) × 100

- CLV = Average Purchase Value × Purchase Frequency × Average Customer Lifespan

- NPS = %Promoters - %Detractors

- Repeat customer rate (%) = (Repeat Customers ÷ Total Customers) × 100

- Average deal size = Total Sales Revenue ÷ Number of Deals

- Account Coverage Ratio (%) = (Number of contacts engaged ÷ Total contacts in account) × 100

- Time to Resolution = time from critical issue opened -> resolved

- DSO = (Accounts Receivable ÷ Total Credit Sales) × Number of Days

Targets & benchmarks (defaults that force behavior)

Coverage ratio: >80% for strategic accounts Fastest proxy for "are we multi-threaded or delusional?"

Critical issue resolution: <24 hours Miss this and executive trust erodes fast.

DSO bands

- Low: <40 days

- Moderate: 40-60 days

- High: 60+ days

Define "meaningful meeting" and "role coverage" (so your dashboard isn't fake)

Two definitions make your metrics real:

- Meaningful meeting: a live conversation (video/phone/in-person) with a stakeholder that advances a renewal, adoption outcome, or expansion decision. A "checking in" call doesn't count unless it produces a deliverable or MAP update.

- Role coverage: you have at least one active relationship in each required lane: economic buyer, champion, technical owner (IT/security), finance/procurement, and day-to-day admin/user lead.

If you don't define these, your coverage ratio becomes a vanity metric.

"If this metric drops, do this" (operational triggers table)

This is the part most KPI sections skip. Don't.

| Metric | Threshold | Owner | Next action in 7 days | Where tracked |

|---|---|---|---|---|

| Coverage ratio | <80% (Tier 1) | Relationship Lead | Add 3 missing roles to stakeholder map; book 2 intro meetings via exec sponsor | CRM + stakeholder map |

| Adoption trend | 2-week decline | Innovator | Run a usage diagnosis; ship a 30-day adoption plan with 2 training sessions | Product analytics + account plan |

| Engagement gap | >30 days since meaningful EB touch | Results Driver | Schedule EB value review; send 1-page outcomes recap + next decision | Calendar + QBR notes |

| Time to resolution | >24 hours on critical | Technical Expert | Escalate; publish incident update cadence; confirm root-cause ETA | Support system |

| Renewal forecast | Slips by >30 days | Project Manager | Re-baseline MAP dates; pull procurement/legal into the plan | MAP + forecast |

One-page dashboard layout (what to put on screen)

If your dashboard needs scrolling, it isn't a dashboard. Put this on one page:

- Top row: Renewal date, renewal forecast (green/yellow/red), expansion pipeline ($), NRR trend

- Middle: Coverage ratio by role lane (EB / champion / IT-security / finance-procurement / admin)

- Bottom: Adoption sparkline (last 8-12 weeks), open critical issues + time to resolution, last meaningful meeting dates

Strategic account tooling & data hygiene (stop running $5M accounts in stale spreadsheets)

The most honest SAM tooling summary I've seen is brutal: people manage "$5M accounts on Excel, ppts & a CRM" that's "static & outdated." That's exactly how accounts slip - nobody trusts the data, so nobody uses the system, so everything happens in side channels.

You don't need a giant tech stack. You need three things:

- A system of record for account plans and MAPs (often your CRM)

- A way to keep stakeholder/contact data current

- A lightweight dashboard for KPIs and leading indicators

Salesforce made this easier with Account Plans. It became generally available shortly after the Winter '26 release and rolled out broadly by late November 2026. It includes standard objects like Account Plan, Account Plan Objective, and measures/relations, plus an optional Buyer Relationship Map inside the Account Plan record. It's included in Sales Cloud Enterprise+.

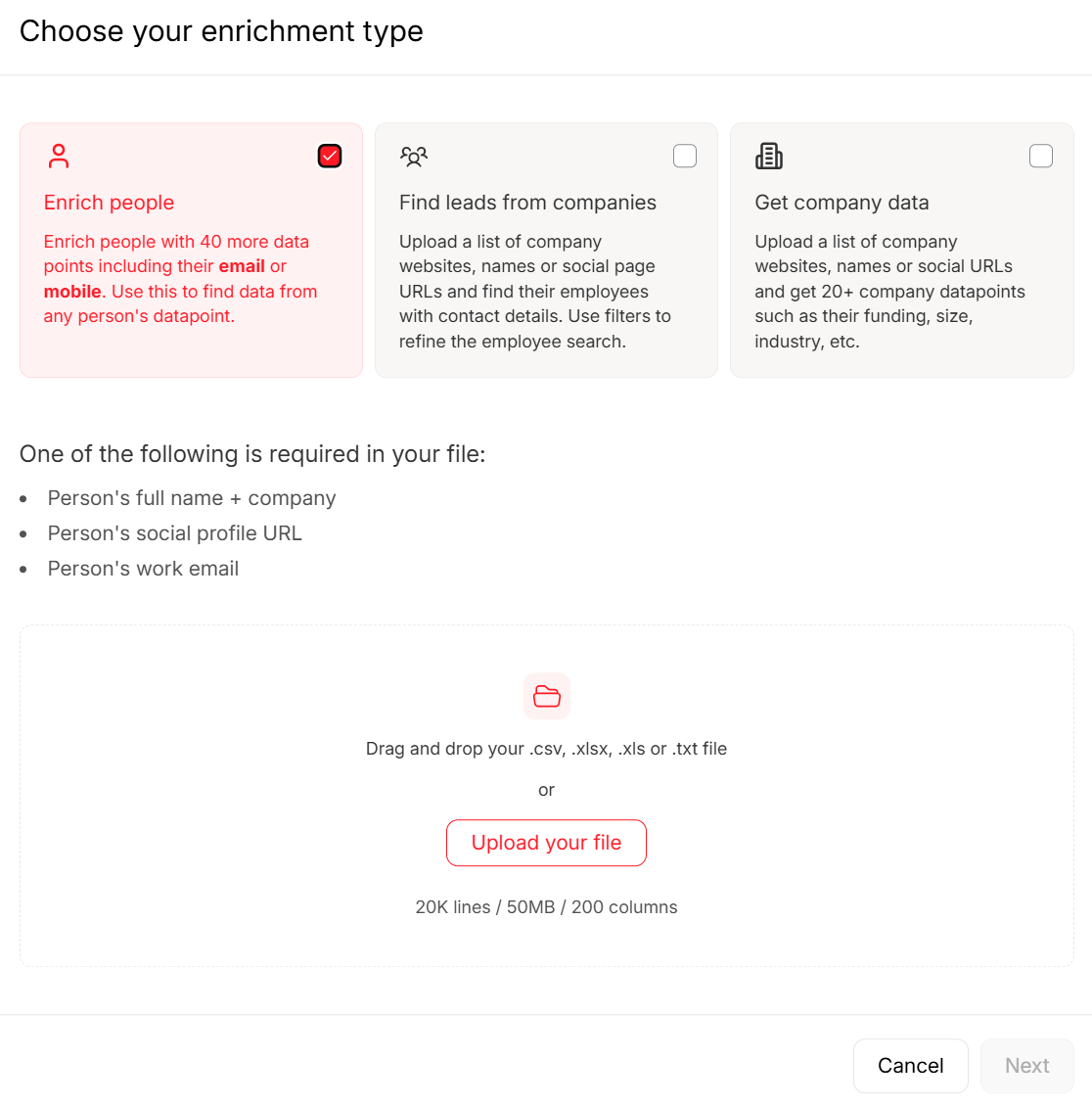

Now the part most teams ignore: coverage dies when contact data goes stale. People change roles, champions leave, and your plan becomes a museum exhibit.

We've tested a bunch of ways to keep stakeholder maps current, and the only ones that hold up are the ones that (a) verify emails and mobiles in real time, (b) refresh frequently enough to catch job changes, and (c) don't require an ops person to babysit the process every week.

Prospeo, "The B2B data platform built for accuracy", fits that workflow cleanly: 300M+ professional profiles, 143M+ verified emails, 125M+ verified mobile numbers, and a 7-day refresh cycle (industry average: 6 weeks). For CRM/account plan hygiene, it returns 50+ data points per enrichment, with an 83% enrichment match rate and a 92% API match rate.

Skip this if your stakeholder map is already pristine and you actually update it weekly. Most teams don't.

Lightweight comparison (what matters for SAM):

| Need | What "good" looks like | Pricing signal |

|---|---|---|

| Account plans in CRM | Native objects + fields + stakeholder map | Included in Sales Cloud Enterprise+ |

| MAP workflow | Shared owners + dates + deliverables | Usually included in CRM or sales engagement tooling |

| Contact freshness | Weekly refresh + verification + enrichment | Prospeo: ~$0.01/email; free tier available |

If you want to see the Salesforce side: Salesforce Account Plans overview (SalesforceBen)

Your strategic account scoring model is only as good as the data behind it. Prospeo refreshes every record on a 7-day cycle, tracks headcount growth and job changes, and enriches contacts with 50+ data points - so your tier rankings reflect reality, not last quarter's org chart.

Fresh data turns account plans into pipeline. Start for free.

Common failure modes (and fixes) in strategic accounts

Use this as your post-mortem before the incident.

Anti-pattern: Post-sale engagement drops after the contract's signed

Fix: Put post-sale check-ins on the cadence and tie them to outcomes. If you can't name the next value milestone, you're coasting.

Anti-pattern: You understand product usage, not customer goals

Fix: Run a goals reset twice a year. Write success metrics in customer language, then tie adoption and expansion initiatives to those metrics.

Anti-pattern: Feedback goes into a black hole

Fix: Create a feedback loop with owners and dates. If feedback doesn't change roadmap, process, or enablement, customers stop giving it.

Anti-pattern: Reactive adoption

Fix: Track adoption as a leading indicator and set thresholds that trigger action. If usage drops for two weeks, that's a red status - don't wait for a support ticket.

Anti-pattern: "Strategic" means more meetings

Fix: Strategic means clearer owners, fewer initiatives, and MAP milestones that move.

Cross-functional alignment + incentives (the part everyone ignores)

SAM is a cross-functional sport, but most orgs run it like a solo act. High-growth organizations are 60% more likely to have a central planning process with strong alignment across marketing, sales, and product stakeholders. That's basically the definition of execution: shared priorities, shared owners, shared accountability.

A simple cross-functional planning loop that works:

- Goal setting (what outcome matters this quarter?)

- Audience insights (what changed in the account?)

- Asset mapping (what do we need - case studies, security docs, exec sponsor time?)

- Engagement plan (who does what, by when - inside the MAP)

Now incentives: if comp doesn't match the SAM motion, you'll get new-logo behavior in a retention job.

A practical incentive mix for strategic account managers is 70/30 base-variable. Variable should be tied to a balanced scorecard:

- Retention / renewal rate

- Expansion revenue (or NRR)

- NPS/CSAT (with guardrails so it isn't gamed)

- Renewal timeliness (forecast accuracy + MAP adherence)

If you only pay on expansion, you'll get short-term upsells and long-term churn. If you only pay on retention, you'll get "don't rock the boat" behavior and no growth.

FAQ

What qualifies an account as "strategic"?

A strategic account qualifies when you expect outsized future mutual value and you commit to a different operating model: exec sponsor, multi-threaded stakeholder map, a short plan, MAP milestones, and weekly execution. In practice, keep Tier 1 to 3-15 accounts total and require >80% coverage across buyer roles to earn the label.

How many strategic accounts should one manager own?

Most teams land at 3-8 Tier 1 accounts per manager, depending on complexity and internal support. If you're running weekly standups, monthly stakeholder reviews, and QBRs with MAPs, owning 12+ "strategic" accounts usually means you're doing shallow admin instead of real execution.

What's the difference between a strategic account plan and a Mutual Action Plan (MAP)?

A strategic account plan is your internal document (snapshot, SWOT, initiatives, risks, cadence), while a MAP is the shared customer-facing execution plan (milestones, owners on both sides, deliverables, dates, status). If it doesn't have owners + deliverables + due dates, it isn't a MAP - it's just notes.

What is a good account coverage ratio for strategic accounts?

A good account coverage ratio is over 80% for Tier 1, meaning you're actively engaged with most required roles (economic buyer, champion, IT/security, finance/procurement, admin lead). If you're below 60-75%, you're exposed to champion churn and surprise procurement blockers at renewal.

How do teams keep stakeholder data current without manual research?

Use a recurring enrichment workflow (weekly or biweekly): refresh contacts, verify emails, and update job changes so your stakeholder map stays real. Prospeo is a strong option here because it delivers 98% email accuracy, a 7-day refresh cycle, and CRM/CSV enrichment with an 83% match rate - fast enough to keep coverage from decaying between QBRs.

Summary: run SAM like an operating system, not a deck

If you want a strategic account program that actually works in 2026, keep it operational: tier with a defensible scoring model, enforce role coverage, run weekly execution against MAP milestones, and track a small set of leading indicators. Do that, and your "strategic" accounts stop being a label and start behaving like a predictable expansion engine.