Outreach Sequences That Work in 2026 (Deliverability-First Playbook)

You can pay $15,000/year for a sequencing tool and still fail the simplest test: "Can I send to 500 people without trashing my domain?"

That's the modern outbound reality for outreach sequences. Deliverability is the bottleneck, not "better subject lines."

Here's the playbook I'd run today if I had to rebuild outbound from scratch.

What you need (quick version)

Fix-first checklist (do this before you touch copy):

- Authenticate: SPF + DKIM + DMARC aligned (DMARC at least

p=none). - Unsubscribe: one-click unsubscribe (List-Unsubscribe) + honor unsubscribes within 2 days.

- Complaints: keep Yahoo spam complaint rate <0.3%.

- Bounces: keep hard bounces <2% (above that, stop scaling).

- Volume: keep daily sending consistent (spikes burn reputation).

- Copy: plain text, <80 words, one clear CTA.

- Links: use branded domains, avoid shorteners, keep links minimal early.

- Stop rules: stop on reply, meeting booked, unsubscribe, hard bounce, DNC flag.

- Benchmarks: average cold reply rate is 3.43% (Instantly, 2026). Plan tests around reality.

Triage (3 fast diagnoses):

- Bounces high -> list hygiene/auth is broken. Pause and fix.

- Opens ok, replies low -> ICP/offer mismatch. Timing won't save it.

- Replies ok, meetings low -> CTA/qualification is the issue.

Put a verification layer in front of every sequence so you're not paying for reputation damage.

What an outreach sequence is (and how it differs from a cadence)

An outreach sequence is a planned series of touchpoints (emails, calls, tasks) that runs until you get a reply, a meeting, or a clear stop condition. It's the operational recipe your team executes: step types, timing rules, and what happens when someone engages.

A cadence is the broader strategy: the rhythm and channel mix you choose for a segment (persona, industry, trigger), plus the rules for when you stop. People mix the terms up, but the distinction helps when you're debugging performance.

- Cadence = strategy (how often, which channels, when you stop)

- Sequence = execution (the actual steps in the tool with scheduling + rules)

In Outreach, sequences aren't "just emails." They're step types like:

- Auto Email (sends automatically)

- Manual Email (rep reviews/sends)

- Phone Call (task step)

- Generic Task (research, voicemail, personalization, etc.)

Two nuances trip teams up.

Sequence vs bulk email (Bulk Compose): bulk sends are one-and-done blasts. Sequences maintain per-prospect history, step progression, and reply-based stop rules, which means cleaner reporting ("which step got the reply?") and fewer duplicate touches when someone responds mid-stream.

Schedule days vs calendar days: "Day 3" can mean "3 business days" or "3 calendar days," depending on your schedule (weekends on/off, sending windows, holidays). If your sequence doesn't send weekends, a "2-day gap" launched on Thursday becomes Monday, and that single setting quietly changes your whole follow-up rhythm around holidays and long weekends.

Definitions (keep these straight) Touchpoint: any attempt (email, call, task, social, direct mail). Step: the item in your sequencer (auto email, call task, etc.). Sequence: the ordered set of steps with timing + stop rules. Cadence: the overall outreach rhythm and channel mix.

Sequence anatomy: steps, timing, channels, and stop rules

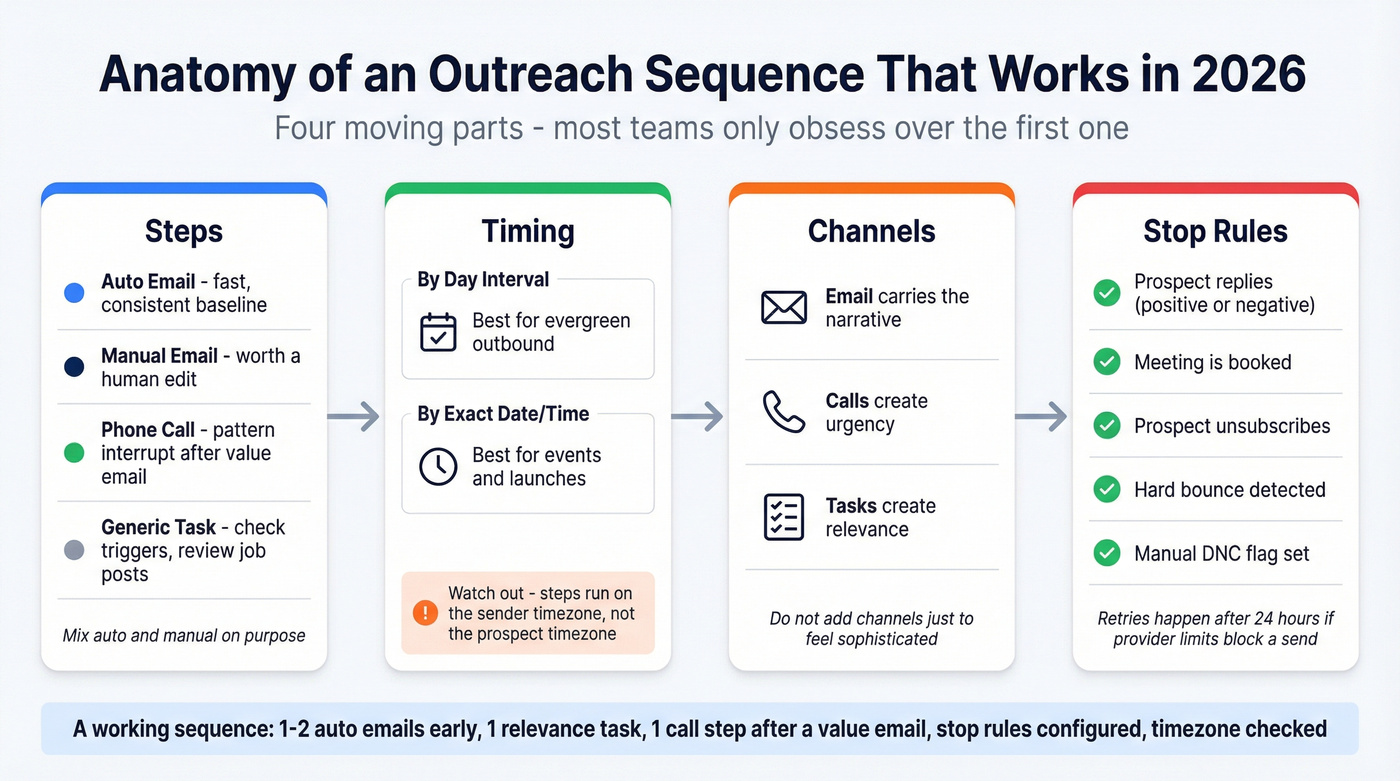

A sequence that works in 2026 has four moving parts: steps, timing, channels, and stop rules. Most teams obsess over steps and ignore the other three, then wonder why results swing week to week.

Steps: pick where automation helps vs hurts

- Auto Email for baseline touches (fast, consistent).

- Manual Email when the account is worth a human edit.

- Phone Call tasks for pattern interrupts (especially after a value email).

- Generic tasks for "do the work" moments: check a trigger, confirm tech stack, review a job post, and so on.

If every step's automated, you're basically running a broadcast. If every step's manual, you'll never scale. Mix them on purpose.

Timing: day interval vs exact date/time

Outreach supports two scheduling models:

- Steps by day interval: "send step 2 two business days after step 1." Best for evergreen outbound.

- Steps by exact date/time: "send Tuesday at 10:15am." Best for events, launches, webinars.

The gotcha (in Outreach "Steps by Day Interval" sequences): steps run on the sender's timezone, not the prospect's. If your SDRs sit in ET and you're emailing APAC, your "perfect send time" lands at 2am local. If timing matters, build region-specific sequences - see time zones.

Channels: don't add channels just to feel sophisticated

Multichannel works when each channel adds a new reason to respond. It fails when it's the same ask copy-pasted into email, call, and social tasks.

A simple rule I use: email carries the narrative, calls create urgency, tasks create relevance.

For bigger-ticket ABM, a direct-mail touch can replace 2-3 low-value follow-ups because it's genuinely different - especially if you’re running ABM.

Stop rules: decide what "success" and "exit" mean

At minimum, stop when:

- prospect replies (positive or negative)

- meeting is booked

- prospect unsubscribes

- hard bounce happens

- you hit a manual "do not contact" flag

Operational reality matters too. Outreach notes that when provider limits block a send, sequences can retry after 24 hours (or when limits reset), so don't let reps "fix" throttling by manually resending and creating duplicates.

Mini-checklist (sequence anatomy):

- 1-2 automated emails early

- 1 task step that forces relevance

- 1 call step after a value email

- stop rules configured (reply/unsub/bounce)

- timezone reality checked

- retry behavior understood (24h)

You just read that hard bounces above 2% mean you stop scaling. Prospeo's 5-step verification and 7-day data refresh keep bounce rates under that threshold - 98% email accuracy, verified before you send.

Stop debugging deliverability. Start with data that doesn't bounce.

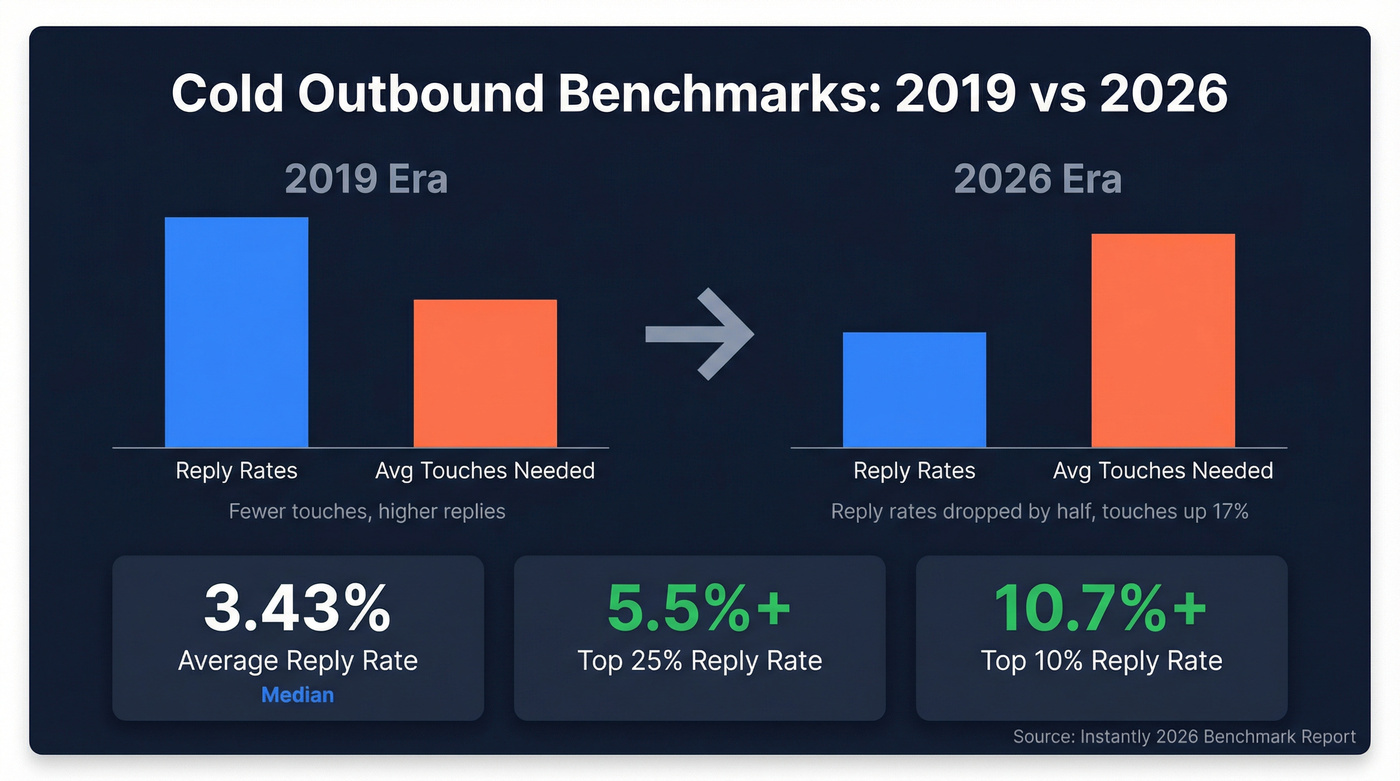

What changed (2019 -> 2026): benchmarks and what "good" looks like now

Reply rates are down. Touches are up. Open rates are basically a vanity metric now.

Outreach has shown reply rates dropped more than half since 2019. At the same time, the "required number of touches" increased 17% to nearly 5 touches in 2024.

Instantly's 2026 benchmark report puts hard numbers on what "good" looks like today:

- Average reply rate: 3.43%

- Top quartile: 5.5%+

- Top 10%: 10.7%+

If you're sitting at 3-4%, you're not failing. You're average.

Here's the thing: if you're selling a lower-priced product and you're running "enterprise-style" 10-touch marathons, you're wasting time. Win with a tighter list, fewer touches, and a cleaner ask.

Industry reality check (don't benchmark against the wrong world)

Outreach's industry breakdowns make one point painfully clear: sales cycles and touch requirements vary wildly by vertical. Finance, for example, tends to run longer cycles and more touches before a first response, so if you sell into Finance, expect more patience and more follow-up than PLG SaaS norms and stop comparing your reply rate to someone selling a $99/month tool to marketers.

That's why "average reply rate" only matters when you pair it with your segment: industry, seniority, and trigger - start with a real ideal customer definition.

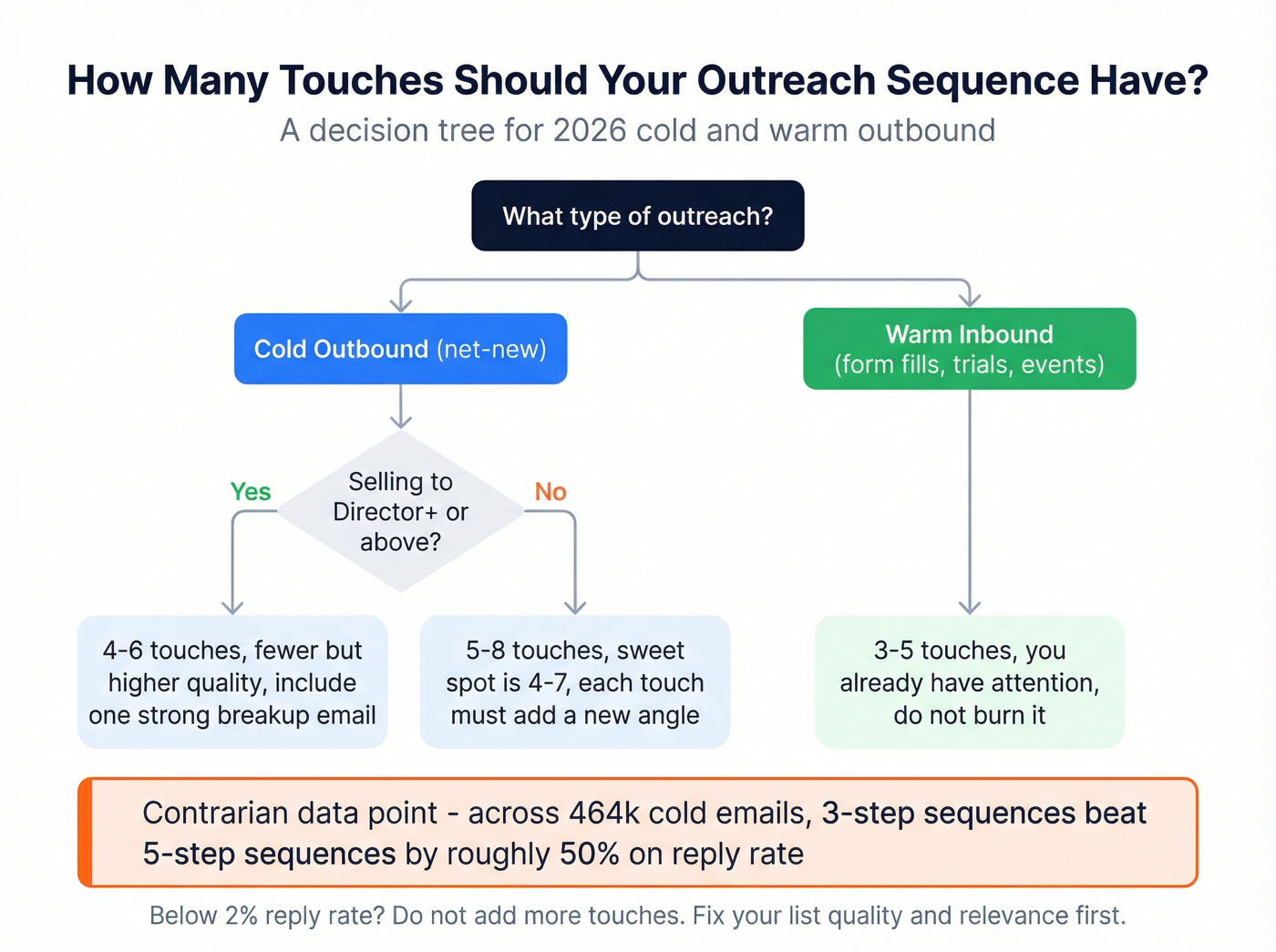

How many touches should outreach sequences have in 2026?

Use this decision tree. It's blunt on purpose.

If you're doing cold outbound (net-new)

- Start with 5-8 touchpoints. That matches Salesforce's guidance for cold outreach.

- Instantly's "sweet spot" is 4-7 touchpoints. Same idea, slightly tighter.

Skip longer than 7 unless each touch adds a new angle (new proof, new trigger, new asset). "Just checking in" is dead weight.

If you're doing warm inbound (form fills, trials, event leads)

Use 3-5 touches. You already have attention; don't burn it with a three-week saga.

If you're selling to director+ and above

Use fewer, higher-quality touches. Exec audiences respond better to 4-6 total touches with one strong breakup than to 9 pings that feel like harassment - use an email outreach to executives lens.

Contrarian take (and it's real)

Across 464k cold emails, one operator found 3-step sequences beat 5-step sequences by ~50% on reply rate. People who won't respond by email 3 usually won't respond by email 5.

My rule:

- Start at 4-6 touches for cold.

- If you're above ~4% reply, test shorter (3-4).

- If you're below ~2% reply, don't add touches. Fix list quality and relevance first.

More touches can't rescue bad targeting. They just create more complaints.

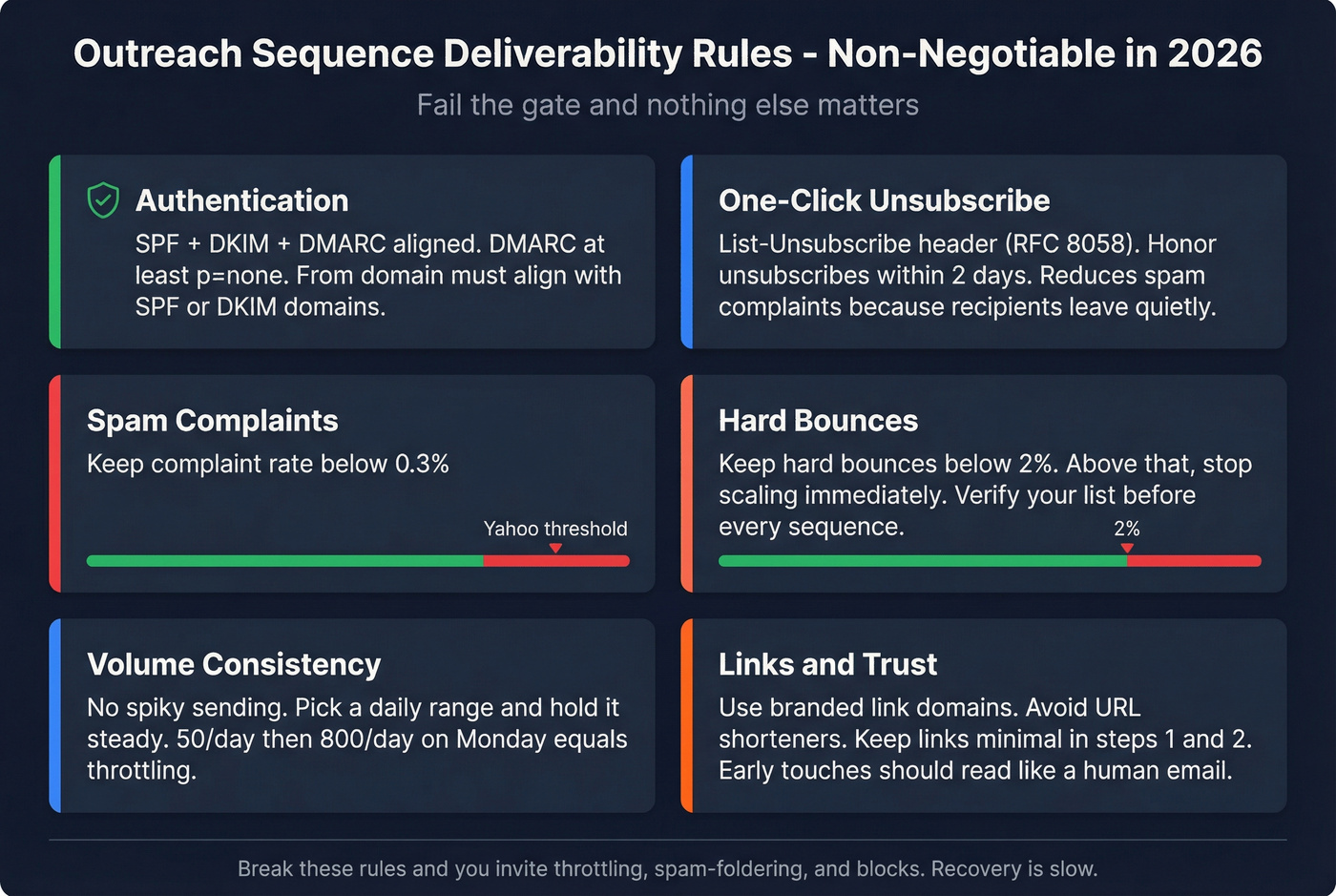

Deliverability rules for outreach sequences (non-negotiable in 2026)

Deliverability's a gate. If you fail the gate, nothing else matters.

The Yahoo rules you can't ignore

Yahoo's bulk sender requirements are the clearest line in the sand for 2026 outbound:

- Keep spam complaint rate <0.3%

- Support one-click unsubscribe via List-Unsubscribe (RFC 8058 one-click)

- Publish a DMARC policy (at least

p=none) - Honor unsubscribes within 2 days

Break these and you invite throttling, spam-foldering, and blocks. Recovery's slow.

CAN-SPAM basics (operational, not theoretical)

If you're emailing US recipients, treat these as table stakes:

- Truthful headers and subject lines (no deceptive From/Reply-To/Subject).

- Physical mailing address in your footer/signature (company address or registered mailbox).

- Unsubscribe that works for 30+ days, and processed fast (you're already aiming for 2 days).

Authentication: SPF, DKIM, DMARC (and alignment)

You need:

- SPF configured for your sending provider

- DKIM signing turned on

- DMARC published (>=

p=none)

And you need alignment: the domain in your From address must align with SPF or DKIM domains. Plenty of teams "set up SPF" and still fail here - use this SPF/DKIM setup guide.

Links: don't sabotage trust

Links are a deliverability multiplier in both directions.

- Use your own branded link domain (or your primary domain) so reputation is yours, not a shared tracking domain.

- Avoid URL shorteners in cold steps. They scream "spam."

- Keep links minimal in steps 1-2. Early touches should read like a human email, not a campaign.

Unsubscribe isn't optional (and it's reputation-positive)

A working unsubscribe link and header reduces spam complaints because annoyed recipients can leave quietly instead of hitting "Report spam." Don't hide it.

Volume consistency: the silent killer

Spiky volume looks like a compromised sender. If you send 50/day for two weeks and then 800/day on Monday, you're begging for throttling.

Pick a daily range and hold it steady. Scale slowly - use email pacing and sending limits rules.

Bounces: the easiest way to burn trust

Hard bounces are a neon sign that your list is stale or scraped badly. Keep hard bounces under 2%. If you're above that, stop and fix your data before you send another "test."

Non-negotiable gate (print this) If complaints trend up or bounces exceed 2%, pause scaling. Fix data + volume first. Copy tweaks won't save a damaged sender.

List quality & data hygiene (the hidden driver of sequence performance)

Most "sequence optimization" is fake work if your list is dirty.

A practical baseline I use: hard bounce target <2%. That's not a vanity metric; it's a deliverability survival metric. Once you're bouncing 5-10%+, you're training mailbox providers to distrust you.

I've seen this play out in a painfully predictable way: a team buys a big list, loads it into a sequencer, sees 6-10% bounces on day one, and then spends the next month arguing about subject lines while their inbox placement quietly collapses. It's infuriating because the fix isn't clever. It's boring.

A public case study on Reddit showed how dramatic the swing can be when hygiene becomes a real system: bounce rate from 25% -> 2.4%, and reply rate from 1.2% -> 6.3%. The unsexy changes mattered most: verification, warmup discipline, and lowering volume to 35-40/day/inbox.

Here's the cleanest setup we've used for stable sequencing:

- Build your list (ICP filters, triggers, exclusions).

- Verify + enrich before step 1 so you can add prospects without feeding invalid addresses into your sequencer.

- Segment by persona + trigger + "why now."

- Launch with conservative per-inbox volume.

- Cull fast: remove bouncers, unsubscribers, and obvious non-fit.

Prospeo, "The B2B data platform built for accuracy", is built for step 2: 300M+ professional profiles, 143M+ verified emails, 125M+ verified mobile numbers, 98% email accuracy, and a 7-day refresh cycle (while the industry average sits around 6 weeks). It's self-serve, GDPR compliant, and it plugs into the tools people actually use (HubSpot, Salesforce, Outreach, Instantly, Smartlead, Lemlist, Clay, Zapier, Make). If you’re comparing vendors, start with email verifier websites and B2B data providers.

One more opinionated note: if you're running tiny, high-stakes tests (new domain, new offer, new segment), skip any data workflow that doesn't handle catch-all domains and spam traps well. That's how you end up "testing copy" on garbage addresses.

Every sequence in this playbook assumes clean contact data underneath. Prospeo gives you 300M+ verified profiles, 125M+ direct dials, and a 92% API match rate - so your carefully timed touches actually reach real inboxes.

Build sequences on data you trust for $0.01 per email.

Copy rules for sequences: short, plain-text, one CTA

The best-performing sequence copy in 2026 looks "too simple" to teams that grew up on marketing emails.

Instantly's benchmark guidance is clear: keep emails under 80 words, use a single CTA, and write follow-ups like you're replying in-thread (those perform about 30% better than formal reminders). For openers, keep a swipe file of email opener examples.

Rules I'd enforce on every SDR team

- One idea per email. If you need two ideas, you need two emails.

- One CTA. Not "open to a quick call or should I send a deck?" Pick one.

- No fake personalization. "Noticed you're crushing it at {Company}" is worse than nothing.

- Specificity beats adjectives. "Cut onboarding time by 18%" beats "improve efficiency."

- Follow-ups add value. New proof, new angle, new trigger, not "bumping this."

The 75-word structure that keeps winning

Use this as your default skeleton:

- Name + context (why them, in one line)

- Observation (something true about their world)

- Pain question (make it easy to answer)

- Proof (one metric or credible peer)

- Soft ask (one CTA)

Fill-in template (keep it tight): "{{first_name}} - noticed {{trigger/observation}}. When {{situation}}, teams usually run into {{pain}}. Is that on your radar this quarter? We helped {{peer}} get {{result}} in {{time}}. Worth a quick 10-min chat to see if it applies?"

Single-CTA variants (pick one per email)

- Call CTA: "Worth a 10-min call next week to see if this is relevant?"

- Permission-based asset CTA: "Want me to send a 3-bullet breakdown of what we're seeing with {{topic}}?"

Before/after (what I mean by "short wins")

Before (too long, too many asks): "Hi Sarah - I'm reaching out because we help teams like yours streamline workflows, improve productivity, and reduce costs. We've worked with companies in your industry and I'd love to show you a quick demo. Are you free Tuesday or Thursday? Also happy to send over a deck."

After (plain, one CTA): "Sarah - saw you're hiring 3 ops roles. When teams scale ops fast, handoffs usually break first. Worth a 10-min call to compare notes on where handoffs are leaking today?"

Short doesn't mean generic. Short means you earned the right to be read.

Paste-ready outreach sequence templates (email-only + multichannel)

These are built to be pasted into a sequencer and tested. Don't "perfect" them. Run them, measure replies/meetings, then iterate.

Email-only template library (3 emails, 2-4 business day gaps)

Cadence: Day 1 -> Day 3/4 -> Day 6/8 (2-4 business days between touches)

Template A: Intro -> value -> ask (general B2B)

Email 1 (Day 1)

Subject: quick question, {{first_name}}

Body: "{{first_name}} - are you the right person for {{area}} at {{company}}? We're helping {{peer_companies}} reduce {{pain}} by {{mechanism}}. Worth a 10-min chat next week to see if it's relevant?"

Email 2 (Day 3/4)

Subject: re: {{area}}

Body: "{{first_name}} - quick follow-up. Most teams hit {{pain}} when {{trigger}} happens. Want me to send 2 bullets on what we're seeing in {{industry}}?"

Email 3 (Day 6/8)

Subject: should I close this?

Body: "{{first_name}} - last try. Should I (a) send a short summary, (b) loop in someone else, or (c) close this out?"

Template B: Referral / "who owns this?"

Email 1

Subject: who owns {{topic}} at {{company}}? "{{first_name}} - quick one: who owns {{topic}}? We're seeing {{pattern}} across {{industry}} and I'm trying to sanity-check if it's on your roadmap."

Email 2 (reply-style)

Subject: re: who owns {{topic}} "Bumping this - even a 'not me' helps. Who's the best person?"

Email 3 (new angle)

Subject: example "Different angle: we helped {{peer}} go from {{before}} to {{after}} in {{time}}. Want the 3-line breakdown?"

Template C: Non-responder "nudge -> new info -> breakup"

Email 1

Subject: {{company}} + {{outcome}} "{{first_name}} - do you have a plan for {{pain}} this quarter? We built {{thing}} that helps {{persona}} get {{outcome}} without {{tradeoff}}. Worth a quick chat?"

Email 2

Subject: re: {{company}} + {{outcome}} "Quick add: teams usually see {{metric}} move within {{time}} once {{change}} is in place. Want me to send a short example?"

Email 3 (breakup-lite)

Subject: closing the loop "Seems like timing's off. Want me to circle back in {{30/60/90}} days, or close this out?"

Add-on follow-ups (use these as conditional steps)

These are the money steps most teams forget to write. They're short, specific, and tied to a real signal.

After click, no reply (send within 24-48 hours)

Subject: re: {{topic}} "{{first_name}} - saw you clicked the {{asset/page}}. If you tell me which of these is closer - (1) {{option_a}} or (2) {{option_b}} - I'll send the most relevant 2-minute example."

After voicemail (same day)

Subject: left you a quick voicemail "{{first_name}} - just left a 20-sec voicemail.

The reason I called: {{one-line value}} for teams dealing with {{pain}}. Worth a quick 10-min call, or should I send a 3-bullet summary instead?"

After referral ("talk to X") (same day)

Subject: looping in {{ref_name}} "{{first_name}} - thanks, I'll reach out to {{ref_name}}.

Before I do: are you mainly focused on {{priority_a}} or {{priority_b}}? I'll tailor the note so it doesn't waste their time."

Multichannel cadence (copy-ready schedule)

Pipedrive's example cadence is a solid "don't overthink it" baseline:

- Day 1: intro email

- Day 3: follow-up phone call

- Day 5: social task (connection request + personalized message)

- Day 8: second email

- Day 10: second phone call

If you run this in Outreach, make the social step a task, not an automated message. The point is to force a human check: "Is this person active? Did they post something relevant? Did they change roles?" If you want a broader system, use multi-channel sales automation.

Breakup guidance (when to stop)

Outreach's guidance is pragmatic: send a breakup after 7-10 touchpoints over 2-3 weeks.

My opinion: if you're selling to senior buyers, you'll often do better with 5-7 total touches and a clean breakup. Past that, you're increasing complaint risk for marginal upside.

A breakup that doesn't sound like a breakup:

Subject: timing "{{first_name}} - I'm going to pause outreach after this. If {{pain}} becomes a priority, want me to send a short checklist we use with teams like {{peer}}?"

Measurement & optimization loop (what to track, what to test)

If you track the wrong metrics, you'll "improve" your sequence into a deliverability problem.

Outreach's engagement scoring weights reflect what matters:

- Open = 1

- Click = 2

- Reply = 3

That hierarchy's right. Replies (and meetings) are the goal. Opens are noisy, especially with privacy changes and bot filtering.

Hunter has also warned that tracking pixels can hurt deliverability; if inbox placement's unstable, turn off open tracking and compare reply + complaint rates. If replies rise and complaints fall, keep pixels off - more context in email outreach analytics.

What to track (deliverability gates first)

| Metric | Why it matters | What to do next |

|---|---|---|

| Spam complaints | Reputation gate | Pause, reduce volume, tighten targeting |

| Hard bounces | Reputation gate | Verify list, purge, fix sources |

| Unsubs | Relevance signal | Narrow ICP, adjust offer, reduce frequency |

| Replies | True engagement | Segment by persona + trigger |

| Meetings | Pipeline signal | Tighten CTA + qualification |

| Clicks | Interest proxy | Test asset + CTA |

| Opens | Noisy/volatile | Don't optimize for it |

When metrics conflict: do this, not guess

- High opens + low replies -> your first line's fine; your offer/ICP is wrong. Rewrite the value prop, or narrow the segment.

- Low opens + high bounces -> you have a data/auth problem. Fix list hygiene and alignment before you touch copy.

- Replies but low meetings -> your CTA's either too heavy ("30-min demo") or too vague ("thoughts?"). Switch to a 10-15 minute micro-commitment with a clear agenda.

- Unsubs rising but complaints stable -> you're annoying the right people, not spamming everyone. Tighten targeting and shorten the sequence.

- Complaints rising -> stop scaling immediately. Reduce volume, remove links in early steps, and tighten segmentation.

Segmentation that actually changes outcomes (examples)

Don't segment by "Industry = SaaS" and call it a day. Segment by reason to care:

- Trigger segment: hiring, funding, new leadership, headcount growth, tech change.

- Persona segment: operator vs exec (operators want steps; execs want risk/ROI).

- Maturity segment: "already has a tool" vs "DIY" vs "no process."

Most "AI sequence optimizers" won't fix a segmentation problem. Do segmentation first, then use AI to draft variants inside each segment - see AI cold email campaigns.

Testing checklist (simple, repeatable)

- Test one variable at a time (subject OR CTA OR first line).

- Run until 100 contacts per version minimum.

- Keep volume stable during tests.

- Review results by segment: persona, industry, trigger, seniority.

If you use Outreach: setup notes that prevent sequence chaos

Outreach is powerful, but it's also easy to turn into a messy factory if you don't set guardrails, especially once you're trying to standardize a master outbound motion across multiple reps and regions.

Do this:

- Follow Outreach's sequence creation guidance: minimum five steps as a platform baseline.

- Clone, don't edit active sequences. Editing live sequences creates inconsistent behavior for prospects already mid-flight.

- Pick the right scheduling model:

- Day interval for ongoing outbound

- Exact date/time for one-time events

- Remember timezone behavior: steps run on the user's timezone, not the prospect's. Build separate sequences for regions if timing matters.

- Use sequence recipient search to spot-check who's currently enrolled before you make changes, and to prevent duplicate enrollments across similar campaigns.

- If you need to pause around holidays or an event shift, reschedule a sequence rather than hacking step delays mid-flight.

Avoid this:

- Don't mix event follow-up logic into evergreen outbound. Use exact date/time sequences for events.

- Don't let reps create 40 one-off sequences. Centralize templates, then allow controlled variants.

Pricing sidebar (so you can budget sanely):

- Sales engagement platforms like Outreach typically land around $15k-$50k/year depending on seats and modules.

- SMB cold email senders often run $30-$100/user/month.

- Data verification is usually pennies per contact. If you're paying $15k-$50k/year for sequencing, spending pennies to verify every address is the highest-ROI insurance you can buy.

For the mechanics, Outreach's own Sequence Overview documentation is the clearest reference for step types, scheduling, and retry behavior.

FAQ about outreach sequences

How long should an outreach sequence be in 2026?

Most teams win with 2-3 weeks total runtime, using 4-7 touchpoints for cold outbound and 3-5 for warm leads. Stop immediately on reply, unsubscribe, hard bounce, or a DNC flag. If you need more than 7 touches, your targeting or offer needs work.

What's a good reply rate for cold outreach sequences?

A realistic baseline in 2026 is 3-4% reply rate at scale, with 5.5%+ considered top-quartile and 10.7%+ top 10%. If you're under ~2%, don't extend the sequence; tighten your segment, improve list quality, and simplify the CTA to a 10-15 minute ask.

What deliverability rules can get your sequence blocked?

Yahoo's bulk-sender requirements are the fastest way to get throttled: keep spam complaints <0.3%, enable one-click unsubscribe (List-Unsubscribe), publish DMARC (at least p=none), and honor unsubscribes within 2 days. Pair that with hard bounces under 2% to avoid reputation damage.

What's a good free tool to verify emails before sending?

Prospeo includes a free tier (75 emails + 100 extension credits/month) and delivers 98% email accuracy with a 7-day refresh cycle, which is exactly what you want if you're trying to keep hard bounces under 2% before you launch.

Summary: the 2026 playbook for outreach sequences

Outreach sequences win in 2026 when you treat deliverability and data quality as the system, not the afterthought: authenticate properly, keep complaints under 0.3%, keep hard bounces under 2%, and hold volume steady.

Then run 4-7 touches, keep emails <80 words with one CTA, and test one variable at a time, because more steps can't rescue bad targeting.