How to Email Executives and Actually Get a Reply: The Complete Data-Backed Playbook

A CEO's executive assistant spends two hours every morning doing one thing: deleting emails. Out of 400-500 messages that hit the inbox overnight, at least half are vendor newsletters, conference invites, and cold pitches that all sound the same. Your email outreach strategy to executives is competing against that pile. It has about 8 seconds to survive.

Some guides suggest abandoning cold email entirely for executive events or warm introductions. Those work - but they don't scale. Cold email, done right, is still the highest-leverage channel for reaching c-level executives you don't already know.

Here's the counterintuitive part: C-level executives actually respond 23% more often than non-C-suite employees. The problem isn't that executives don't read cold email - it's that 98% of cold emails to executives go unanswered. The gap between average and elite is enormous. Top reps book 8.1X more meetings than average reps using cold email. Same inbox, same executive, wildly different results.

What follows is built on 85M+ cold emails analyzed by Gong, 1M+ executive-targeted campaigns, and the frameworks practitioners actually use in 2026.

What You Need for Effective Outreach to the C-Suite (Quick Version)

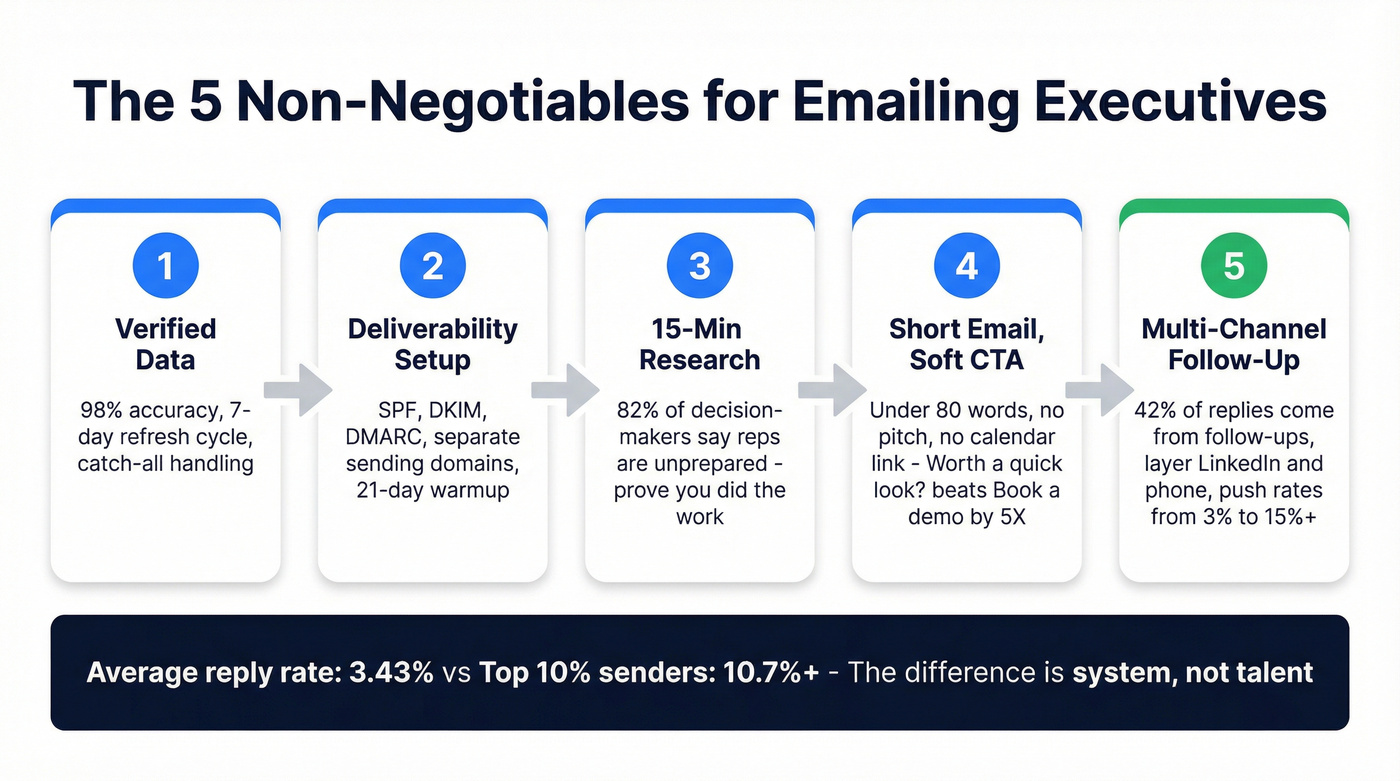

If you don't read anything else, nail these five things:

Verified data so emails reach the inbox. Bad addresses bounce, bounces destroy your domain reputation, and a damaged domain means even good emails land in spam. Verify every address before you send - 98% accuracy with a 7-day refresh cycle keeps you from emailing addresses that went stale three months ago. (If you need a workflow, start with this email verification list SOP.)

Deliverability infrastructure. SPF, DKIM, DMARC, domain warmup, separate sending domains. This is mandatory. Skip it and nothing else matters.

15 minutes of research per prospect. 82% of B2B decision-makers say reps are unprepared - and executives can smell a template from the subject line. Use a repeatable prospect research before outreach system.

Short emails with a soft CTA. Under 80 words. No pitch. No calendar link. "Worth a quick look?" beats "Book a 30-minute demo" by 5X. (More examples: sales CTA.)

A multi-channel follow-up sequence. 42% of replies come from follow-ups. Layer in LinkedIn engagement and phone calls. Channel stacking pushes response rates from ~3% to 15%+.

The average reply rate is 3.43%. The top 10% of senders hit 10.7%+. The difference isn't talent - it's system.

What 85 Million Emails Reveal About Reaching Executives

Not all executives respond equally. VP-level contacts respond at the highest rate of any title - 11.3%. CEOs come in at 7.63%, and CFOs at 7.59%. But when a C-level executive does reply, the quality is dramatically higher.

Note the distinction: total reply rates (including "not interested") hover around 7-8%, but the positive reply rate - responses that lead to meetings - is where C-suite dramatically outperforms. A 0.270% positive reply rate for C-suite vs 0.088% for directors. That's 3X the meeting conversion.

| Role | Avg Reply Rate | Best Use Case |

|---|---|---|

| ★ VP-Level | 11.3% | Process automation, team scaling |

| CEO/Founder | 7.63% | M&A, market expansion |

| CTO/VP Tech | 7.59-7.68% | Technical migration, build-vs-buy |

| CFO | 7.59% | Vendor consolidation, cost reduction |

Where the Replies Actually Come From

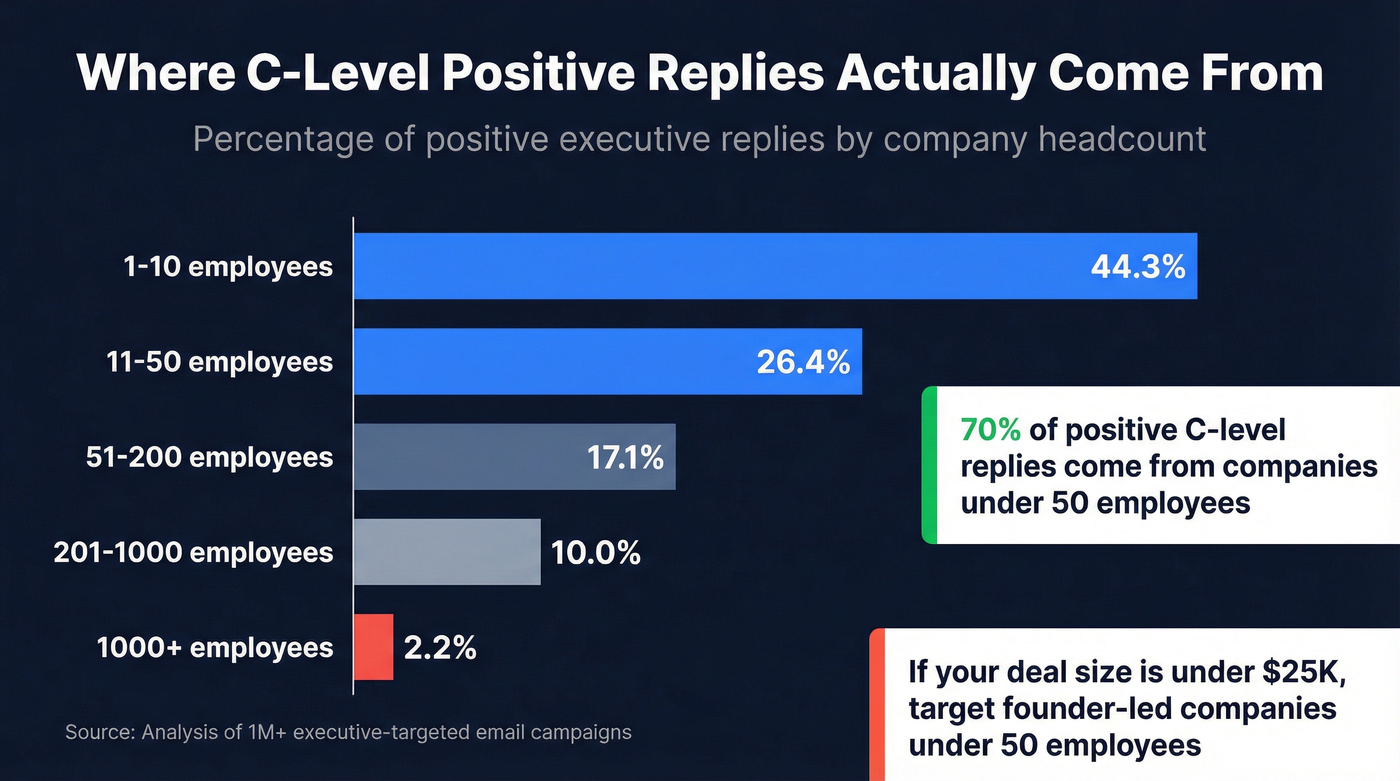

The company size data is even more telling. 70% of C-level positive replies come from companies with 1-50 employees. Break that down: 44.3% from companies with 1-10 employees, 26.4% from 11-50. Once you cross 200 employees, positive reply rates crater to 2.2%.

Why? Small-company CEOs have no gatekeepers, direct decision authority, and hands-on involvement in every vendor relationship. A CEO at a 30-person SaaS company reads their own email. A CEO at a 5,000-person enterprise hasn't seen their inbox unfiltered in years. If you're figuring out how to reach the c suite, start with companies where the C-suite is still hands-on.

Top industries for C-level response: Computer Software leads by a wide margin, followed by Internet, IT Services, Financial Services, and Biotechnology. If you're selling into these verticals, the math is in your favor.

The framing matters too. Timeline-focused messaging ("by Q3" or "before your next board meeting") gets 2.45X higher CEO reply rates than generic problem-focused approaches. Executives think in quarters and milestones, not abstract pain points.

If your deal sizes sit below $25K, stop emailing enterprise C-suite at Fortune 500 companies. Your expected positive reply rate is a fraction of a percent, and the sales cycle will eat you alive. Target founder-led companies under 50 employees instead. That's where the math works for outbound.

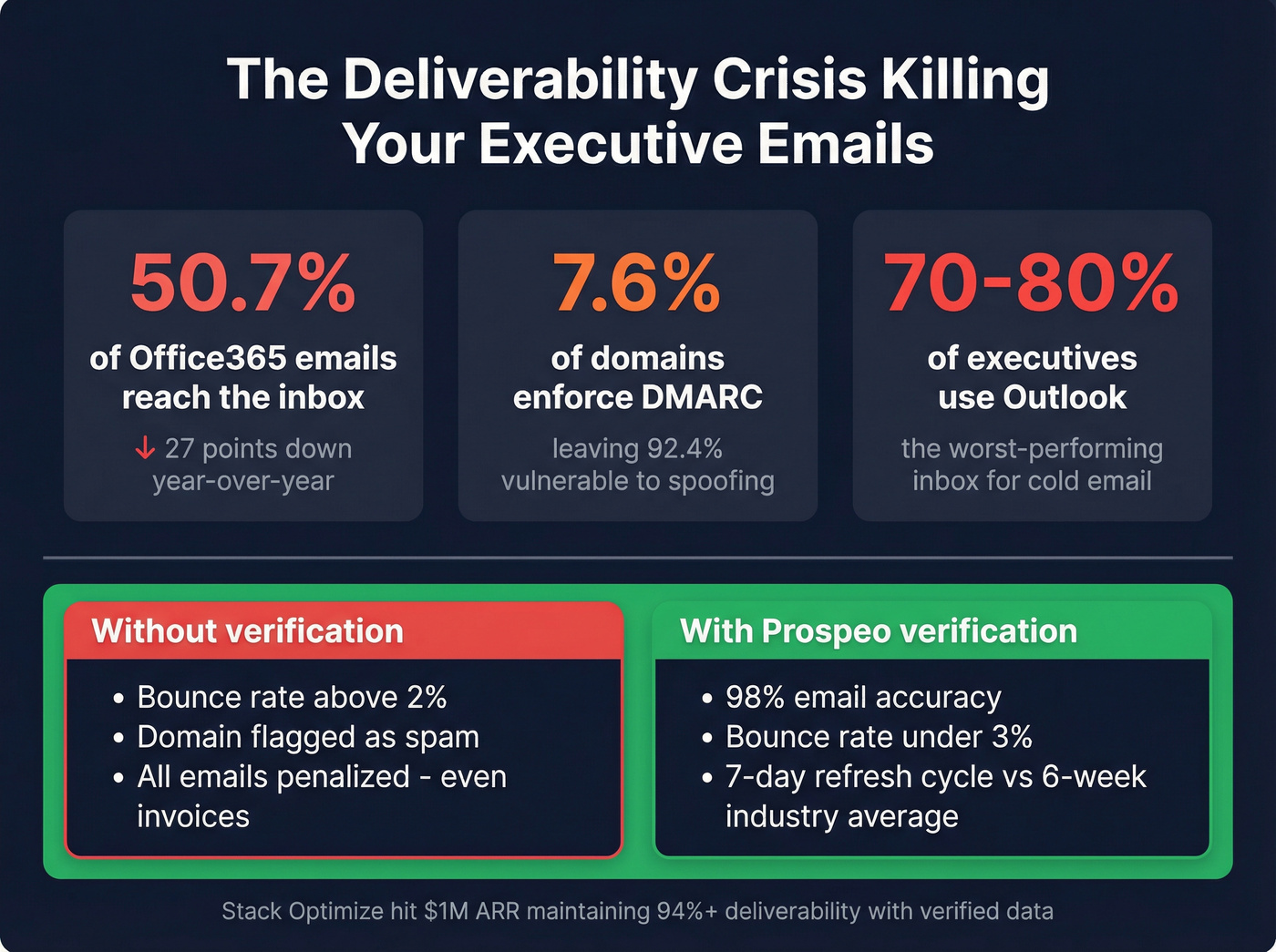

Your perfectly crafted executive email is worthless if it bounces. Prospeo's 5-step verification delivers 98% email accuracy on 143M+ addresses - refreshed every 7 days, not the 6-week industry average. Stack Optimize kept bounce rates under 3% across every client and hit $1M ARR on that foundation.

Stop losing CEO replies to stale data. Verify every address for ~$0.01.

Fix Your Data Before You Write a Word

The Deliverability Crisis Nobody Talks About

Here's the thing most cold email guides skip entirely: your email copy doesn't matter if it never reaches the inbox.

Office365 inbox placement dropped 27 percentage points year-over-year, landing at just 50.70%. That means roughly half of all emails sent to Office365 addresses don't make it to the primary inbox. And 70-80% of executives at mid-to-large companies use Outlook.

You craft the perfect 60-word email, nail the subject line, reference the CEO's earnings call - and there's a coin-flip chance it lands in spam because your sending infrastructure is broken.

Only 7.6% of domains enforce DMARC. Bounce rates above 2% damage your domain reputation. And once your domain is flagged, every email you send - cold outreach, customer communication, invoices - gets penalized.

This is where data quality becomes the foundation of everything. Prospeo runs a 5-step verification process with catch-all handling, spam-trap removal, and honeypot filtering - 98% email accuracy on 143M+ verified addresses, refreshed every 7 days. The industry average refresh cycle is 6 weeks, which is plenty of time for executives to change roles, companies to restructure, and email addresses to go dead. (If you’re comparing vendors, see email verifier websites.)

Stack Optimize built their agency from $0 to $1M ARR using verified data, maintaining 94%+ deliverability, bounce rates under 3%, and zero domain flags across all their clients.

The data says 70% of C-level positive replies come from companies under 50 employees. Prospeo's 30+ search filters - headcount, funding, intent signals - let you build that exact list in minutes, not hours. Every contact comes pre-verified so your domain reputation stays clean.

Find the founder-led companies where outbound actually converts.

Technical Setup Checklist

Before you send a single cold email, this infrastructure needs to be in place:

- SPF, DKIM, DMARC: All three. Non-negotiable. Authenticated senders are 2.7X more likely to reach inboxes. Microsoft mandated authentication in May 2025; Google and Yahoo did the same in February 2024.

- Separate cold email from transactional email. Use a different domain (e.g., "getacme.com" instead of "acme.com") so cold outreach bounces don't tank your main domain's reputation.

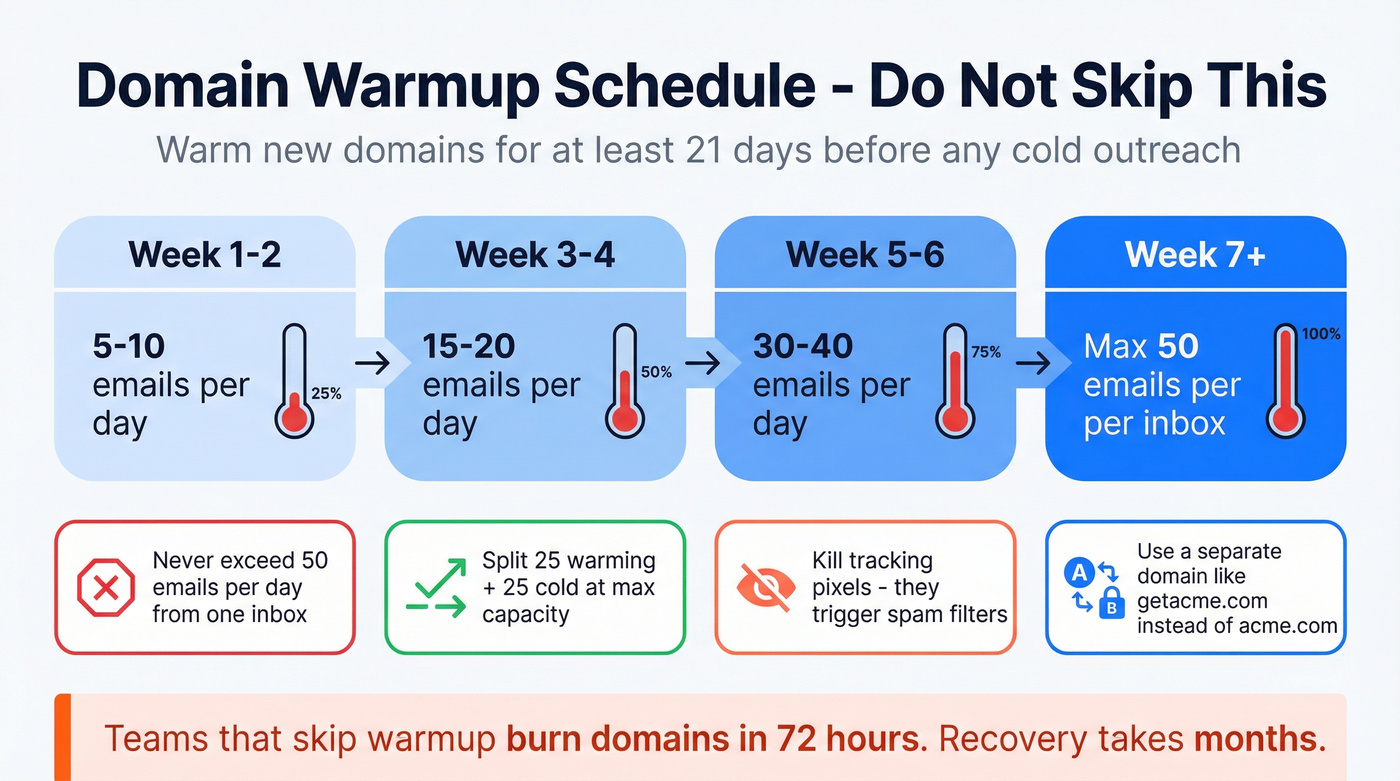

- Domain warmup schedule:

- Week 1-2: 5-10 emails/day

- Week 3-4: 15-20/day

- Week 5-6: 30-40/day

- Week 7+: Max 50/day per inbox

- Never exceed 50 emails per day from a single inbox. At max capacity, split 25 warming emails and 25 cold emails.

- Kill tracking pixels. Open-rate tracking pixels trigger spam filters. Yes, you lose open rate data. You gain inbox placement. That's a trade worth making. (If you still want measurement options, see best email open tracker.)

- Target metrics: Reply rates 5%+, bounce rates under 2%, spam complaints under 0.1%.

Warm new domains for at least 21 days before any cold outreach. I've seen teams skip this step and burn a domain in 72 hours. It takes months to recover. If you want a deeper playbook, use email sending infrastructure as your checklist.

The 15-Minute Research Process

90% of salespeople fail when selling to the C-Suite. Not surprising when you see the emails executives actually receive - generic templates with a first name swapped in. Reaching c-suite decision makers requires more effort upfront, but the payoff per email is dramatically higher.

Here's the research checklist that takes 15 minutes per prospect and separates you from 90% of senders:

Sources to check (pick 2-3 per prospect):

- Recent earnings calls or shareholder letters (public companies)

- Press releases from the last 90 days (funding, acquisitions, product launches)

- Podcast appearances or conference talks

- Recent posts on professional platforms

- Company blog or case studies

- Leadership changes or new hires

Role-specific research lens:

- CEO: What growth initiative are they betting on? What competitive threat keeps them up at night?

- CFO: Where are they cutting costs? What efficiency metric are they tracking this quarter?

- CTO: What technical migration or integration is underway? What's their build-vs-buy philosophy?

Condense everything into 1-2 actionable findings. You don't need a dossier - you need one sentence that proves you did the work.

Write the Email: Copy That Gets Executive Replies

The 4-Filter Model: How Executives Read Email

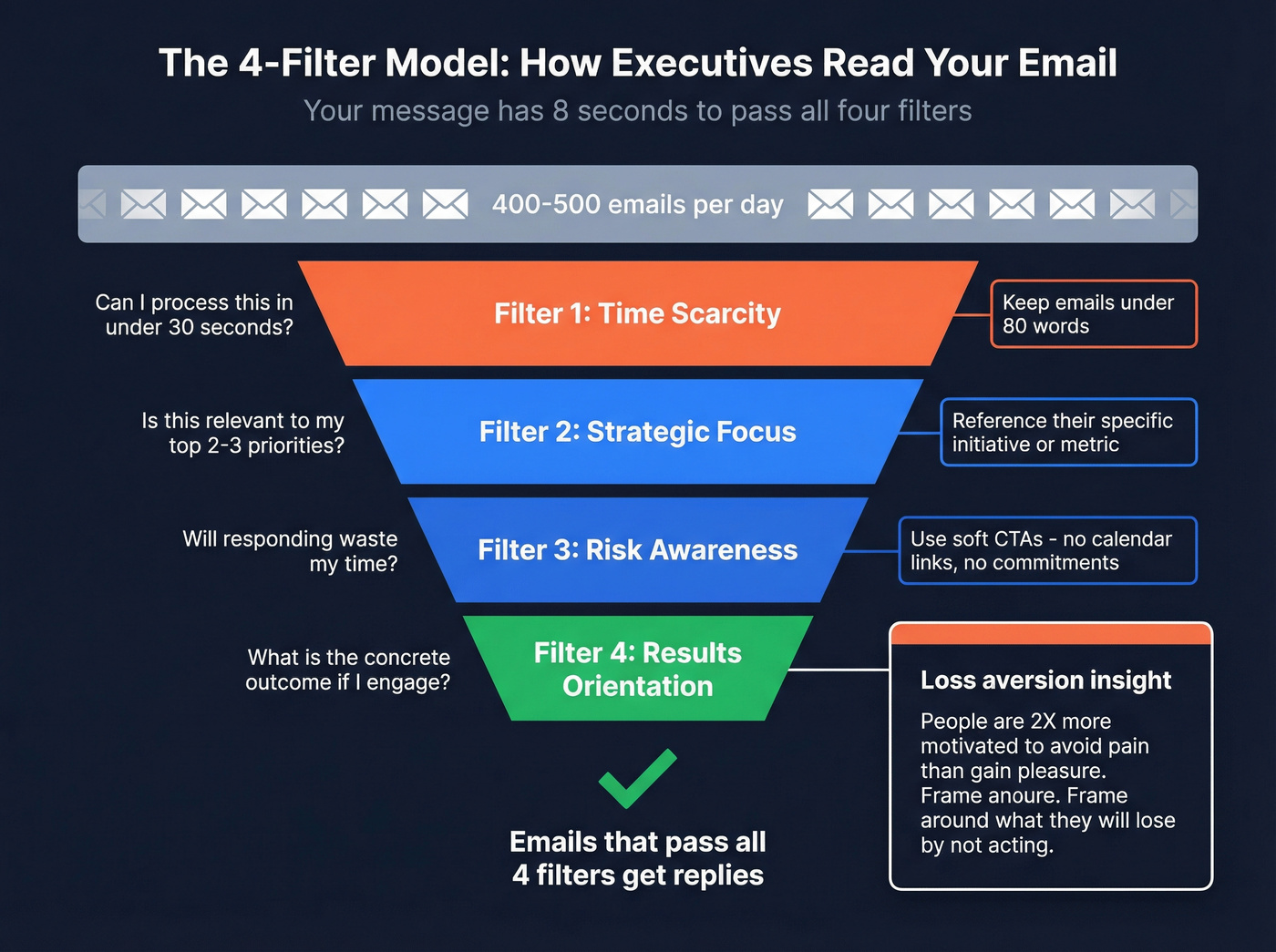

Every executive runs incoming email through four unconscious filters. Your message has about 8 seconds to pass all four:

- Time Scarcity: "Can I process this in under 30 seconds?" Long emails get deleted unread.

- Strategic Focus: "Is this relevant to my top 2-3 priorities?" 71% of decision-makers cite irrelevance as the top reason they don't respond.

- Risk Awareness: "Is responding to this going to waste my time?" Executives are allergic to open-ended commitments.

- Results Orientation: "What's the concrete outcome if I engage?" Vague value props die here.

Loss aversion drives executive behavior - people are 2X more motivated to avoid pain than gain pleasure. Frame your email around what they'll lose by not acting, not what they'll gain. "Your competitors are already doing X" outperforms "You could gain Y" almost every time.

The subject line handles filters 1 and 2. The first sentence handles filter 3. The CTA handles filter 4. That's the architecture.

Subject Lines That Get Opened

Top reps achieve 58%+ open rates on cold emails. The secret isn't clever copywriting - it's restraint.

The rules:

- 1-4 words. That's it.

- All lowercase. It looks like an internal email, not a marketing blast.

- No buzzwords, no numbers, no salesy language. These reduce open rates by up to 17.9%.

Four formulas that work (from Gong's analysis of 85M+ emails):

| Formula | Example | Why It Works |

|---|---|---|

| Pervasive Problem | "hiring bottleneck" | Names their pain |

| Industry Trend | "ai pricing shift" | Triggers curiosity |

| Pattern Interrupt | "quick thought" | Breaks inbox monotony |

| Competitor Share | "how drift does it" | Competitive instinct |

The wildcard approach: one team tested absurd subject lines like "Switzerland + Cheeseburger + [Company Name]" and hit a 43% open rate with a 20% reply rate. Pure pattern interrupt - the executive opens it because they genuinely can't guess what's inside. I wouldn't use this on Fortune 500 CFOs, but for startup founders? It works.

Another practitioner reported that referencing something the executive actually said publicly - "[Specific thing they posted about]" - hit a 30-35% response rate. It requires the most work but delivers the highest return.

The worst-performing subject lines? Anything that sounds like marketing. "Unlock 3X Revenue Growth" gets deleted before the preview text loads. If you want more examples, use these cold email subject lines that get opened.

The Friction-Vision Framework

This framework generated 40 qualified meetings in 30 days for one practitioner:

- Specific Hook - A real signal (award, merger, quote, hire)

- The Friction - A story about a problem (observation, not accusation)

- The Vision - "I imagine how..."

- The Offer - Position yourself as a specialist

- Chill CTA - "Would that work?"

In our experience, this structure outperforms AIDA and PAS for executive outreach because it leads with observation, not accusation. Here's a filled-in example:

Subject: warehouse expansion

Hi Sarah,

Saw the announcement about the new Dallas distribution center - congrats on the growth.

Most ops leaders I talk to at this stage find their existing WMS starts breaking around 3 facilities. Inventory sync issues, fulfillment delays that weren't there at two locations.

I imagine you're already thinking about how to keep fulfillment times flat as you scale.

We've helped three 3PL companies maintain sub-24hr fulfillment through expansions like this. Happy to share what worked.

Worth a quick look?

That's 78 words. It sounds like a human typing a quick thought, not a marketing bot. Notice: no pitch, no feature list, no calendar link. Every sentence passes the WIIFT test: What's In It For Them?

Pitching in your first email drops reply rates by 57%. The goal of email one isn't to sell - it's to start a conversation. If you want a deeper system, follow a full B2B cold email sequence.

Two More Templates That Work

The "Show Me You Know Me" (Ian Koniak's framework)

Ian Koniak used this approach at Salesforce to land six and seven-figure deals:

Subject: customer retention

Hi Marcus,

Listened to your episode on the SaaS Metrics podcast last week. Your point about net revenue retention being the "silent growth engine" stuck with me.

You mentioned your team is focused on getting NRR above 120% by Q4. We helped Datadog's CS team move from 108% to 127% in two quarters by restructuring their QBR process and health scoring model.

Would it make sense to compare notes on what worked? No pressure either way.

The CFO-Specific Template (ROI framing)

Subject: procurement costs

Hi Jennifer,

After your Q2 earnings call, it sounds like vendor consolidation is a priority this year. I've seen similar-sized fintech companies cut procurement overhead 15-20% by consolidating their compliance tooling.

We helped Plaid's finance team reduce their compliance vendor spend from 7 tools to 2, saving $340K annually.

Mind if I send a one-pager on how they did it?

"Mind if I send more info?" outperforms "Book a 30-minute demo" by 5X. Soft CTAs work because they reduce the perceived commitment. An executive can say "sure, send it" without blocking 30 minutes on their calendar.

Keep every email between 40-80 words. Across all cold email campaigns, emails in the 50-125 word range achieve ~50% reply rates - dramatically higher than longer messages.

The Multi-Channel Warm-Up and Follow-Up Sequence

Social Warm-Up Before You Hit Send

Cold email works better when it's not actually cold. A LinkedIn warm-up sequence before your first email creates familiarity - the executive has seen your name before they see your message.

The 4-week warm-up:

| Week | Action | Purpose |

|---|---|---|

| Week 1 | Visit profile, like 2-3 posts | Trigger notifications |

| Week 2 | Comment on a post thoughtfully | Build recognition |

| Week 3 | Send connection request with a short note | Establish link |

| Week 4 | Send first cold email | Convert recognition into a reply |

Multi-channel outreach delivers 3X better reply rates than email alone. Channel stacking - email plus LinkedIn plus phone - pushes response rates from ~3% to 15%+. That's the difference between needing 300 prospects to book a meeting and needing 30. (More benchmarks: social selling statistics.)

Space out interactions naturally. Liking three posts in 10 minutes looks like a bot. One interaction every 2-3 days looks like a human who's genuinely interested.

The Follow-Up Sequence (Day by Day)

58% of replies come from the first email. But 42% come from follow-ups - and the first follow-up specifically drives the majority of those additional responses. If you're sending one email and moving on, you're leaving almost half your replies on the table.

Executives typically require 7-9 touches to respond, compared to 4-5 for mid-level contacts.

The 21-day executive sequence:

| Day | Channel | What to Send |

|---|---|---|

| Day 1 | Friction-Vision framework (see above) | |

| Day 3 | New angle - different pain point, same company research | |

| Day 7 | Case study or specific result from a peer company | |

| Day 14 | Industry insight or relevant data point | |

| Day 21 | Breakup - "Seems like timing isn't right. Happy to reconnect next quarter." |

Critical rules:

- Each follow-up must add new value. "Just following up" with no new information is the fastest way to get blocked.

- Change your subject line and CTA framing between emails.

- Best send times: Wednesday 8-10 AM (+12% vs average), Thursday 10 AM-12 PM (+10%). Avoid Monday morning and Friday afternoon.

- If someone opens multiple times or clicks a link, accelerate. If they ghost across the full sequence, stop.

We've tested 10-12 step sequences to executives. Don't bother. 4-7 touchpoints over 14-21 days is the sweet spot. After that, you're just annoying someone who's already decided not to respond.

How to Get Past Gatekeepers and Reach Upper Management

Stop thinking of executive assistants as obstacles. They're curators of the executive's time - and they have context about what matters right now that you don't.

The best approach: treat the EA as an ally.

Instead of trying to sneak past them, try: "You know [VP]'s priorities better than I do. Is this the type of initiative they'd want to see?"

This works because it respects the EA's judgment and gives them a reason to advocate for you. Their implicit question is always: "Will I regret putting this person on the calendar?" Give them a reason to say no to that fear. (More scripts: how to get past an executive assistant.)

The bypass strategy is simpler: use direct dials and mobile numbers. If you have a verified cell phone number, you skip the gatekeeper entirely. Tools like Prospeo include 125M+ verified mobile numbers with a 30% pickup rate - useful when you need to follow up on a cold email with a direct call. The email-then-call approach works well: send a cold email, then call the next day to "follow up on the email I sent." It gives you a reason to be calling that isn't a pure cold call. (If you need sourcing options, start with B2B phone number.)

Calling at off-peak times - early morning before 8 AM or after 5 PM - also increases your odds of reaching the executive directly. EAs work standard hours. Executives don't.

Mistakes That Kill Your Cold Emails to Executives

Look, I've audited hundreds of outbound sequences. The same mistakes show up over and over:

- Pitching in the first email. Drops reply rates by 57%. Email one earns a conversation. Email two (or three) earns the pitch.

- Blasting large lists. Campaigns targeting 50 recipients average 5.8% response rates. Lists of 1,000+ drop to 2.1%. Micro-segmentation wins.

- Buzzwords in subject lines. AI mentions, ROI language, "unlock" and "transform" - these reduce open rates by up to 17.9%.

- No authentication setup. No SPF, DKIM, or DMARC means your emails are 2.7X less likely to reach the inbox. This is table stakes in 2026.

- "Just following up" with no new value. Every follow-up needs a new angle, new data point, or new piece of social proof. Repeating your first email is worse than not following up at all.

- Tracking pixels. Open-rate tracking triggers spam filters. Sacrifice the vanity metric to protect deliverability.

- Fake personalization. "Saw you liked a post about AI :)" isn't personalization - it's creepy. Reference something specific they said, did, or decided.

Skip the "spray and pray" approach entirely. If you can't spend 15 minutes researching a prospect, that prospect isn't worth emailing.

FAQ

How long should a cold email to an executive be?

Keep it to 40-80 words, or 3-4 sentences. Gong's analysis of 85M+ emails confirms the 50-125 word range achieves the best overall response rates - around 50%. Anything over 150 words gets skimmed or deleted. Executives process hundreds of messages daily; respect their time by being concise.

What's the best day and time to email executives?

Wednesday between 8-10 AM in the recipient's timezone delivers 12% higher engagement than average. Thursday 10 AM-12 PM is the second-best window at +10%. Avoid Monday mornings (executives are triaging weekend backlog) and Friday afternoons (they've mentally checked out).

Should I email the CEO or a VP?

VPs respond at 11.3% - the highest rate of any title - while CEOs respond at 7.63%. But C-level replies convert to meetings at 3X the rate of director-level responses. Target CEOs at companies with 1-50 employees where they're most responsive. At larger companies, VPs are your best entry point into the C-suite.

How many follow-ups should I send an executive?

Send 4-7 follow-ups over 14-21 days. 42% of all replies come from follow-ups, not the initial message, and the first follow-up drives the majority of those additional responses. Each touchpoint must add new value - a different angle, case study, or industry insight. Stop after the full sequence if there's zero engagement.

What's a good free tool for finding executive email addresses?

Prospeo's free tier includes 75 verified emails per month with 98% accuracy - enough to test campaigns against a focused executive list. Hunter offers 25 free searches monthly but caps enrichment. For teams running real outbound, a 7-day data refresh cycle means you're less likely to bounce on stale addresses, which is critical when your domain reputation is on the line.