The Best Outbound Calling Software in 2026 (Ranked + Buying Guide)

Enterprise CCaaS bundles plus implementation can easily hit $30k+/year. And reps still burn hours on wrong numbers, voicemail, and "Spam Likely."

Here's the thing: the "best dialer" doesn't win anymore. The best outbound calling software paired with clean calling data wins.

If you're shopping right now, you don't need 40 tabs and a feature checklist. You need a short list, a trial plan, and a way to keep your number reputation from getting torched.

Our picks (TL;DR) - best outbound calling software in 2026

Here's the shortlist I'd put in front of a sales leader who needs results in the next 30 days.

Top 3 tools most teams should trial first

- Nextiva - the most balanced "do it all" option for SMB -> midmarket (voice + contact center options + analytics).

- Prospeo - the data layer outbound teams rely on (verified mobiles + verified emails + 7-day refresh).

- CloudTalk - international-friendly calling with clear starting pricing and a strong compliance/security posture.

Enterprise pick

- Five9 - if you're running a real contact center motion and can handle the implementation + 50-seat minimum.

Pick if / skip if (quick gut-check)

- Pick Nextiva if you want one vendor for business phone + outbound + contact center basics. Skip Nextiva if you're purely a high-velocity SDR floor that needs the most aggressive predictive pacing above all else.

- Pick Prospeo if you're tired of wasting dials on stale numbers and bouncing follow-ups. Best fit: pair it with any dialer; if your first-party numbers are already pristine, use it mainly for verification + refresh.

- Pick CloudTalk if you sell across regions and care about number management + compliance. Skip CloudTalk if you need deep enterprise WFM/QA tooling.

- Pick Five9 if you need enterprise-grade outbound at scale with trust tooling and governance. Skip Five9 if you're under ~20 reps and don't want a project.

Outbound calling software: what it is (and what it isn't)

If your reps are clicking 200 call tasks a day, the tool matters. But the workflow around the tool matters more: how calls get logged, how numbers get rotated, how recordings get reviewed, and how quickly bad data gets suppressed.

Definitions (quick box)

- Outbound calling software = tools that help teams place lots of calls efficiently (dialer modes, routing, recording, analytics, CRM logging).

- Not = a fix for bad targeting, weak messaging, or stale lists.

- Common categories = sales dialers, business phone systems with outbound features, and full CCaaS/contact center platforms.

Dialer modes (the ones that matter)

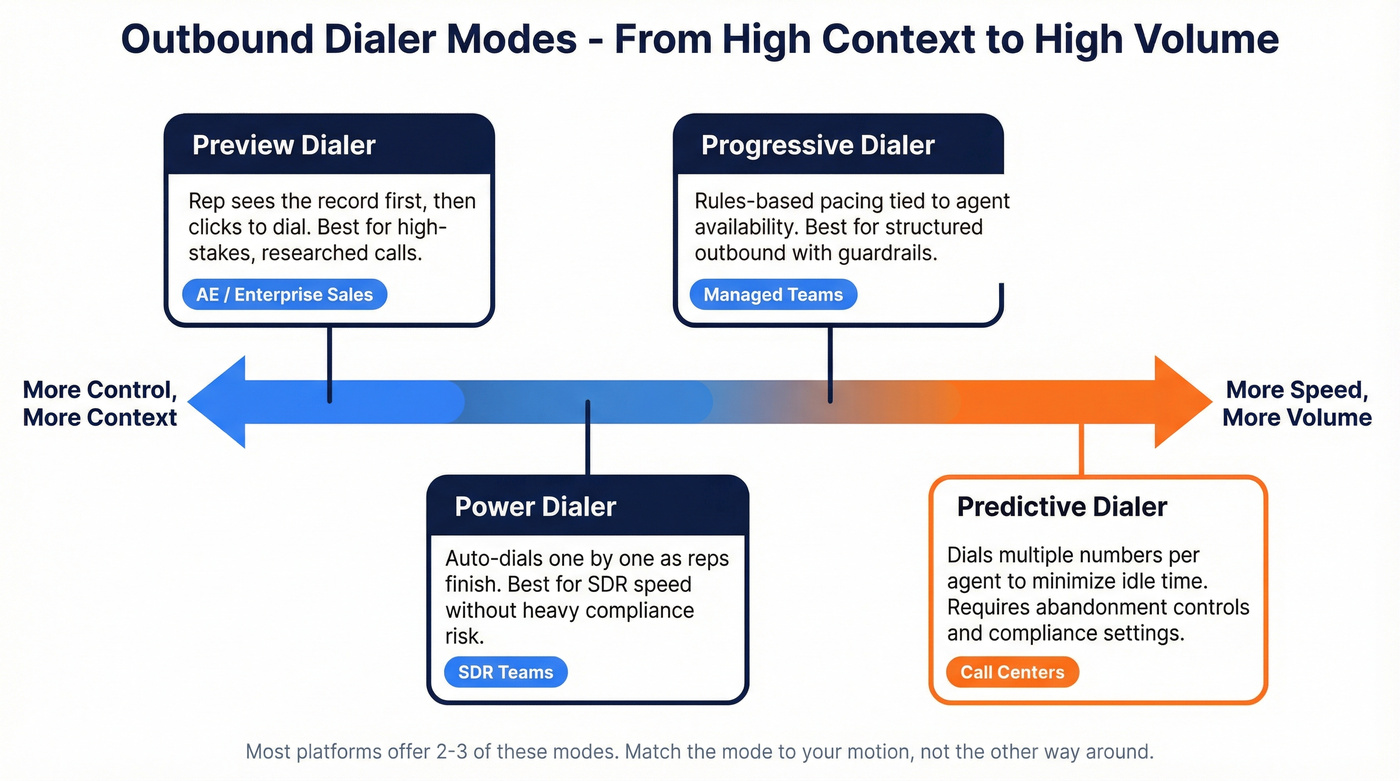

Most platforms mix and match these four:

- Preview dialer: shows the next record; rep clicks to dial. Best for high-context, high-stakes calls.

- Power dialer: auto-dials one-by-one as reps finish calls. Best for SDR speed without heavy compliance risk.

- Progressive dialer: similar to power, but more rules-based pacing and agent availability.

- Predictive dialer: dials multiple numbers per available agent to minimize idle time. Best for high-volume call centers, where abandoned-call settings and compliance controls are non-negotiable.

CRM-first vs dialer-first vs CCaaS (how to think about categories)

- CRM-first tools (like Close) treat calling as a feature inside the sales workflow. Great for SMB velocity, lighter on contact-center depth.

- Dialer-first tools (like CallTools) optimize for volume and dialing modes. Great for floors, sometimes clunky for RevOps hygiene.

- CCaaS tools (like Five9) are built for governance, routing, QA, and scale. Great for enterprise, overkill for most sales teams.

The 2026 reality: connect rates, spam labeling, and why "best dialer" isn't enough

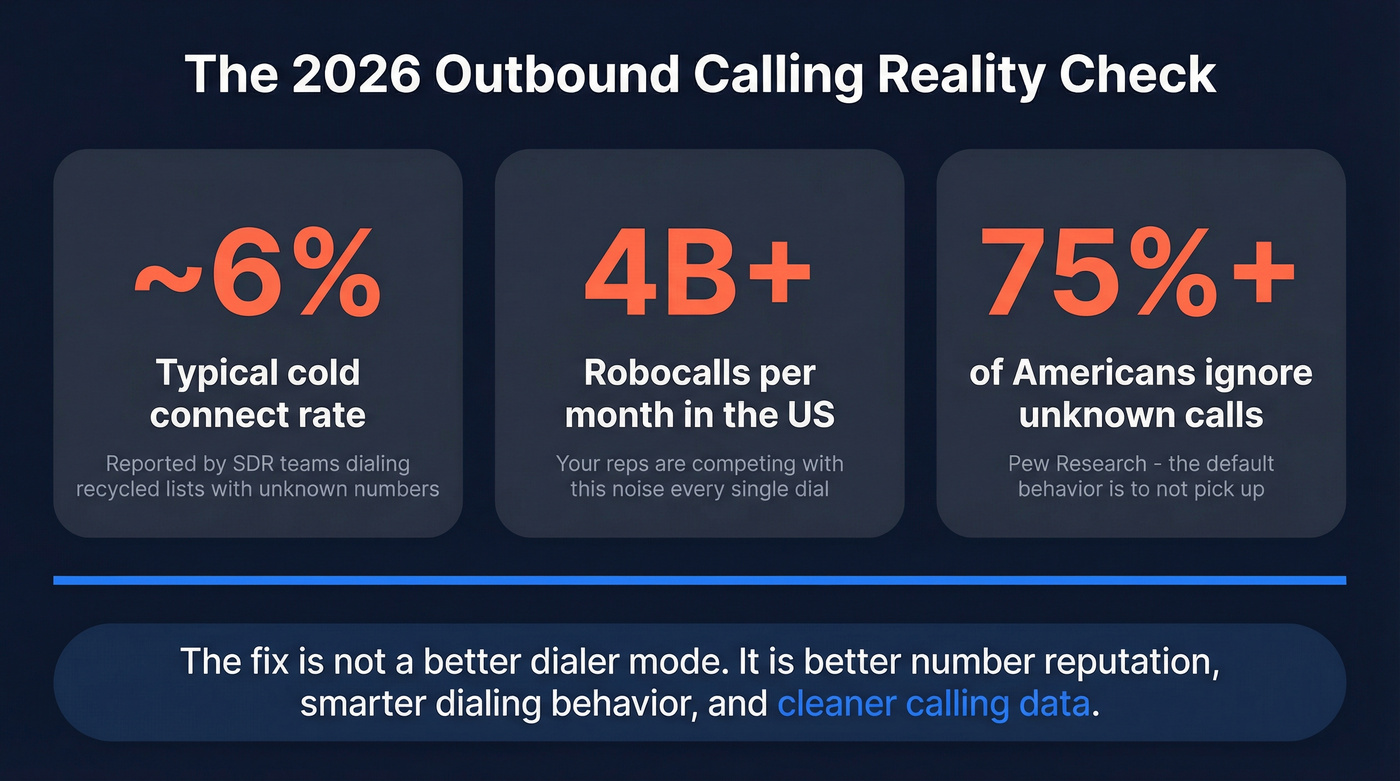

A pattern we see constantly: teams buy a dialer to "increase connects," then discover their real problem is answer rates collapsing and list quality decaying. That's why outbound call automation and data hygiene matter just as much as the dialer mode.

In a 2026 r/SalesOperations thread, an SDR leader asked what "realistic" connect rates look like because their 12-person team was sitting around ~6% connect rate. That's not a universal benchmark. It is a realistic picture of what cold outbound feels like when you're dialing unknown numbers on recycled lists (see answer rates and contact rate vs connect rate).

Now layer in trust issues. Twilio's branded calling explainer puts the US at around 4B robocalls per month and notes more than three-quarters of Americans won't answer unknown numbers. That's not "your reps need better talk tracks." That's "the default behavior is ignore you."

Real talk: I hate watching teams spend months arguing about predictive vs power while their list is 20% wrong numbers and their number pool is getting flagged. Fix the inputs first (start with B2B contact data decay and data quality).

What actually moves the needle

- Better number reputation (registration, branded calling, remediation)

- Better dialing behavior (pacing, retries, time windows, local presence with guardrails)

- Cleaner calling data (fewer wrong numbers, fewer recycled contacts, fewer complaints)

Hot take: if you're selling a lower-ticket product, you probably don't need an enterprise contact-center platform. You need a simple dialer, clean lists, and a ruthless process around number reputation.

Mini box: what buyers actually ask for (in plain English)

- "Can we keep this under $100/user/month?"

- "Can multiple reps share numbers without breaking compliance or reporting?"

- "Can we SMS from the same line we call from (and keep it logged in the CRM)?"

- "Will recordings and links actually show up in Salesforce/HubSpot without manual cleanup?"

You just read that teams sit at ~6% connect rates on recycled lists. The fix isn't a better dialer - it's cleaner numbers. Prospeo gives you 125M+ verified mobile numbers refreshed every 7 days, with a 30% pickup rate across all regions. At $0.10/mobile, you pay only when a number is found.

Stop burning dials on wrong numbers. Fix your data first.

How to choose outbound calling software (criteria that predicts results)

Most buyers compare features like they're shopping for headphones. That's how you end up with a dialer that demos well and underperforms in production.

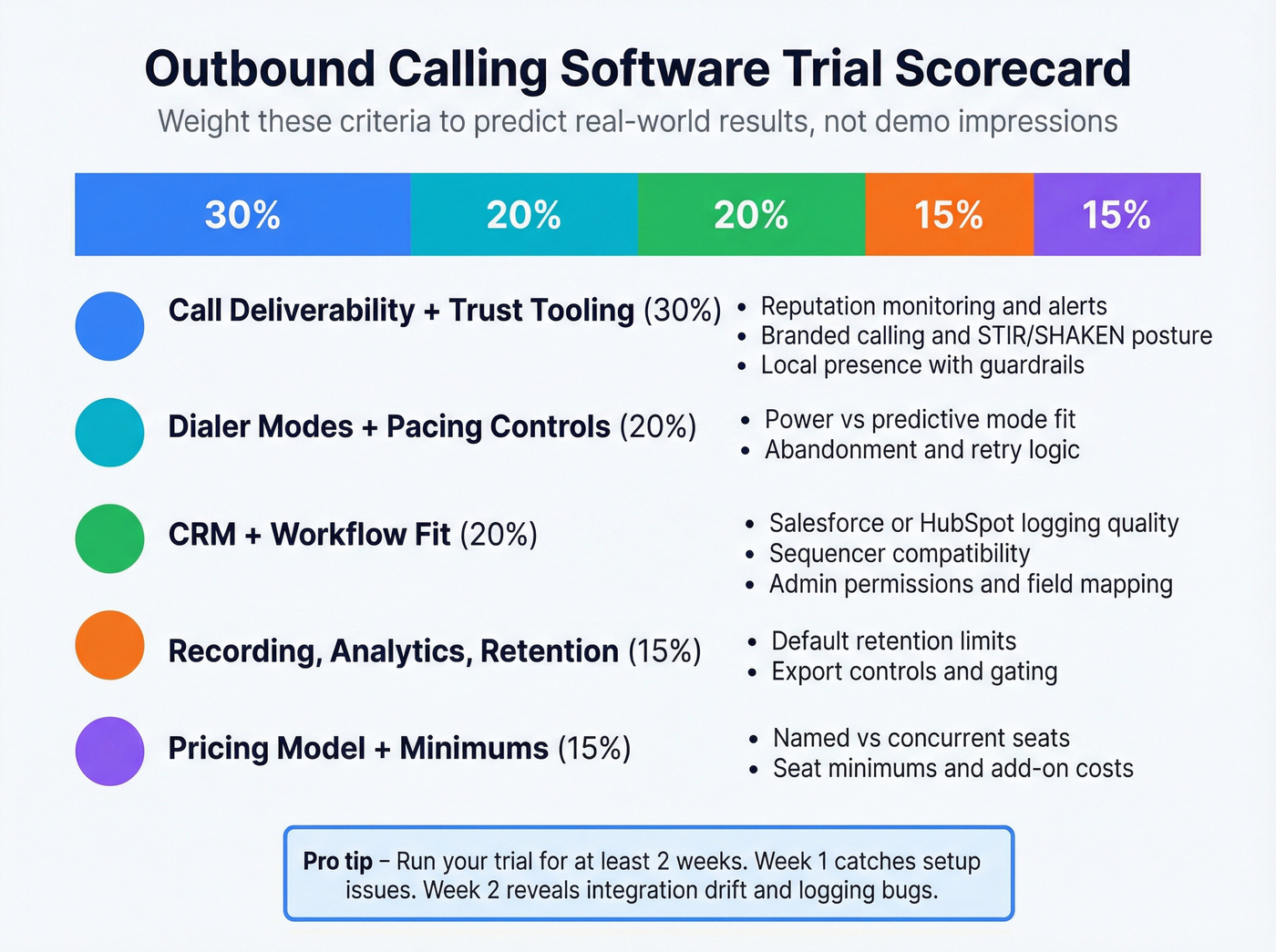

Trial scorecard (what I'd weight)

1) Call deliverability + trust tooling (30%)

- Reputation monitoring (alerts before performance tanks)

- Branded calling / registration options (or partners)

- Local presence controls with guardrails (not just a toggle)

- STIR/SHAKEN posture: what attestation level you'll get, and what they need from you (business verification, number ownership)

2) Dialer modes + pacing controls (20%)

- Mode you actually need (power vs predictive) - if you're still deciding, use this power dialer vs predictive dialer breakdown

- Abandonment and pacing controls (especially predictive)

- Retry logic (time windows, max attempts, disposition-based rules)

3) CRM + workflow fit (20%)

- Salesforce/HubSpot logging quality (dispositions, recordings, tasks)

- Sequencer fit (Outreach/Salesloft task flows, if you use them)

- Admin experience (permissions, field mapping, dedupe behavior)

4) Recording, analytics, and retention limits (15%)

- Recording retention (what you get by default vs paid tiers)

- Analytics retention (how far back you can report without exporting)

- Export controls (and whether exports are gated behind enterprise plans)

5) Pricing model + minimums (15%)

- Named vs concurrent seats (this changes TCO fast)

- Seat minimums (50-seat minimums are a deal-breaker for most teams)

- Add-ons that matter (dialer module, CRM adapters, analytics, SMS)

The two things that quietly decide whether your rollout succeeds (and most teams ignore)

Integration traps that kill adoption

- Duplicate logging (two call activities per call = reporting becomes fiction)

- Disposition mapping drift (reps pick "No Answer," CRM shows "Connected")

- Recording links that break (or require separate logins - reps stop using them)

- Silent API changes (everything "works," but fields stop syncing and nobody notices for weeks)

I've watched teams blame reps for "not using the dialer," when the real issue was a broken recording link and messy call logging that made managers stop trusting the dashboard. (If you're tightening this, start with a cold calling CRM integration checklist.)

Coaching/QA stack (what separates "calls made" from "revenue created")

- Whisper/barge for live coaching (especially for new reps)

- Scorecards + QA sampling (random + disposition-based sampling)

- Transcription + keyword moments (objection handling, pricing, competitor mentions)

- Coaching loops that tie back to outcomes (connect -> meeting set -> show rate)

If your tool can't support coaching, you'll end up coaching off vibes and anecdote. That's expensive (use a simple cold call coaching framework to operationalize it).

Outbound calling software comparison table (features + pricing snapshots)

Two tight tables, because nobody wants to pinch-zoom a 10-column monster on mobile.

Table A - calling capabilities

| Tool | Best for | Dialer modes | Local presence | SMS |

|---|---|---|---|---|

| Nextiva | SMB->midmarket voice + CC | Preview/Power/Progressive/Predictive | Yes | Yes |

| CloudTalk | International sales teams | Preview/Power/Progressive | Yes | Yes |

| Five9 | Enterprise CCaaS | Preview/Progressive/Predictive | Yes | Yes |

| Dialpad Connect | UCaaS calling baseline | Manual calling (no power dialer) | Limited | Yes |

| Dialpad Sell | Sales dialer + coaching | Power dialer | Yes | Yes |

| RingCentral (RingEX + RingCX) | IT-standardized comms | Preview/Progressive/Predictive (module-dependent) | Yes | Yes |

| Aircall | Simple sales phone | Power dialing (plan-dependent) | Yes | Yes |

| Close | CRM-first calling | Power (inside CRM) | Often missing | Limited |

| CallTools | High-volume dialer floors | Preview/Power/Predictive | Yes | Yes |

| PhoneBurner | Fast power dialing | Power | - | - |

Table B - ops details (what bites you later)

| Tool | Integrations | Recording + analytics retention (expectations) | STIR/SHAKEN + branded calling/registration notes | Pricing model + minimum | Starting price |

|---|---|---|---|---|---|

| Nextiva | Major CRMs | Retention varies by plan/policy | STIR/SHAKEN support matters for spam-risk reduction | Named; min 1 | $15-$75+/user/mo |

| CloudTalk | Salesforce, HubSpot | Retention varies by plan | Anti-spam number registration features; strong compliance/security posture | Named; min 1 | EUR 19/user/mo (annual) |

| Five9 | Salesforce, Zendesk | Retention varies by plan/policy | Enterprise trust posture; authentication/registration options via partners | Concurrent; min 50 | $119-$159/concurrent seat/mo |

| Dialpad Connect | Google/Microsoft, CRM connectors | Retention varies by plan | STIR/SHAKEN supported; branded calling options depend on region | Named; min 1 | $15-$25/user/mo |

| Dialpad Sell | Salesforce | Retention varies by plan | Power dialer + voicemail drop; STIR/SHAKEN depends on routing/carrier | Named; min 1; quote-based | ~$60-$150/user/mo (quote) |

| RingCentral | Salesforce, HubSpot | Retention varies by plan/add-ons | STIR/SHAKEN supported; branded calling/registration often add-on/partnered | Named; min 1; quote-based | RingCX ~$65-$165 + RingEX $20+ |

| Aircall | Salesforce, HubSpot | Essentials: up to 1 year (by request); Professional: unlimited (by request); analytics up to 6 months | STIR/SHAKEN depends on carrier; branded calling varies | Named; min 3 | ~$30-$50/user/mo |

| Close | Native CRM | Retention varies by plan | Local ID calling + texting are common gaps | Named; min 1 | ~$99-$149/user/mo |

| CallTools | APIs, webhooks | Retention varies by plan | STIR/SHAKEN depends on carrier setup; focus is dialing controls | Per-agent; min varies | Starts at $79.99/agent/mo |

| PhoneBurner | CRM + Zapier-style | Retention varies by plan | Trust tooling depends on underlying carrier | Named; min 1 | ~$150-$200/user/mo |

Footnotes (read these before you buy)

- Retention is where vendors hide pain. Treat the table as what to expect, then confirm in your trial: "How long do recordings stay accessible in-app?" and "How far back can we report without exporting?"

- STIR/SHAKEN is widely supported in US carrier stacks, but your attestation level depends on business verification and number ownership. Ask for specifics.

Every outbound calling tool on this list performs better with accurate contact data underneath it. Prospeo pairs with any dialer to deliver 98% email accuracy and verified direct dials - no stale lists, no recycled numbers, no "Spam Likely" from bad data inputs.

Pair Prospeo with your dialer and watch connect rates climb.

The best outbound calling software (ranked list)

1) Nextiva (Tier 1)

Nextiva's the "balanced suite" pick: business phone plus contact center capabilities without forcing an enterprise implementation. It's the tool we recommend when a team wants one vendor for voice, basic routing, and reporting, and doesn't want to stitch together five add-ons that all break in different ways.

Buy it if: you're SMB -> midmarket and want a clean rollout with solid admin controls. Skip it if: you need hardcore predictive dialing and call-center WFM/QA depth.

Pricing: $15-$75+/user/month depending on voice vs contact center needs and annual terms.

2) Prospeo - The B2B data platform built for accuracy (Tier 1)

Prospeo isn't a dialer. It's the data layer that makes your dialer perform like it should.

It includes 300M+ professional profiles, 143M+ verified emails (98% accuracy), and 125M+ verified mobile numbers with a 30% pickup rate. Everything refreshes every 7 days (the industry average is about 6 weeks), which matters because stale numbers don't just waste time - they create the exact frustration and complaint signals that get your number pools labeled.

In our experience, the cleanest way to use Prospeo in an outbound calling stack is boring and effective: run a verification/enrichment pass on the list you're about to dial, suppress invalids and wrong numbers, then push the cleaned set into your dialer so your trial measures dialing performance instead of data decay. If you're doing this at scale, the API makes it straightforward: Prospeo returns contact data on 83% of leads and hits a 92% match rate via API, with 50+ data points per contact so RevOps can map fields once and stop babysitting spreadsheets. (If you need a broader benchmark, compare against other B2B data providers.)

Useful links: pricing, mobile finder, data enrichment.

3) CloudTalk (Tier 1)

CloudTalk's the international-friendly pick that doesn't play pricing games. If you sell across regions, number management and compliance posture stop being "nice to have" and become your day-to-day reality, and CloudTalk is built for that.

Why I like it: clear entry pricing, low minimums, and a product designed around multi-region operations. Where it falls short: it's not an enterprise contact center replacement with deep WFM/QA.

Pricing: starts at EUR 19/user/month billed annually (or EUR 27 billed monthly).

4) Five9 (Tier 1)

Five9's the grown-up choice for outbound at scale. Start with the reality check: 50-seat minimum and an implementation that's a real project. If that doesn't scare you off, Five9 can be excellent.

Where it wins: governance, routing, QA, and dialing at contact-center scale. Where it loses: speed-to-value for smaller teams; total cost is subscription plus rollout effort.

I've seen number pools tank after a team "turns on predictive" without tight pacing and QA. Platforms like Five9 give you the controls. Your ops discipline decides whether you use them well.

Pricing: $119-$159/month per concurrent seat, 50-seat minimum.

5) Dialpad Connect (Tier 2) - best for company-wide calling baseline

Dialpad Connect is a UCaaS/business calling baseline with AI features. It's a strong fit when you want one calling tool across the org and outbound is only part of the job.

Buy it if: you need a modern phone system and light outbound. Skip it if: you expect a true power dialer out of the box. Connect isn't that product.

Pricing: $15-$25/user/month.

6) Dialpad Sell (Tier 2) - best for sales dialer + coaching

Dialpad Sell is the "sales motion" plan: power dialer plus coaching workflows. It's a better fit than Connect when outbound is a core activity and you want tighter Salesforce execution.

Buy it if: you want power dialing plus coaching in one vendor. Skip it if: you're trying to keep spend predictable. Sell's quote-based.

Pricing: ~$60-$150/user/month (quote-based).

7) RingCentral (RingEX + RingCX) (Tier 2)

RingCentral is the classic "we already have it" vendor. If IT's standardizing communications, RingCentral's often the path of least resistance, even if the packaging is annoying.

Reality: you'll often need RingEX first, then add RingCX on top, and key features can sit behind add-ons. Budgeting is the hard part.

Pricing: RingEX $20+/user/month plus RingCX ~$65-$165/user/month (quote-based).

8) Aircall (Tier 2)

Aircall's popular because it's simple and integrates well. The tradeoff is that user sentiment tends to circle the same pain points: support responsiveness, billing friction, and occasional reliability issues.

That isn't "annoying." It's pipeline risk when you're calling all day.

When it still makes sense: if you're a 5-15 rep team and you value simplicity over advanced dialer modes, it can be a perfectly fine choice.

Pricing: ~$30-$50/user/month (annual) with a 3-seat minimum.

9) Close (Tier 2)

Close is the CRM-first option that reps actually enjoy using. If you want fast adoption and clean activity history without a heavy admin tax, Close is hard to beat.

Tradeoff: it's a sales CRM with calling, so you won't get deep routing/WFM/QA.

Pricing: ~$99-$149/user/month depending on tier and calling needs.

10) CallTools (Tier 2)

CallTools is dialer-centric and built for high-volume outbound floors. If your world is pacing rules, predictive dialing, and throughput, it's in its element.

What to watch: dialing volume amplifies everything. Good scripts scale, but bad data and sloppy dispositions scale too. When we've tested dialers in high-volume setups, the biggest variance in outcomes came from list hygiene and suppression rules, not the dialer UI, and that's why teams that treat data cleaning as a weekly ops task usually beat teams that treat it as a one-time import.

Pricing: starts at $79.99/agent/month depending on channel and packaging; many teams land in the ~$101.99-$119.99/agent/month range on term-based plans. SMS is often priced separately (commonly around $0.015/message).

11) PhoneBurner (Tier 3)

PhoneBurner is a fast power dialer for reps who want speed and a tight daily workflow. It's not a contact-center platform, and that's the point.

Pricing: typically ~$150-$200/user/month.

Notable mentions (good tools that didn't make the top list)

If you're shopping broadly, these are worth a look depending on your motion: Kixie (popular SMB power dialer + CRM workflows), CallHippo (budget-friendly cloud phone with lots of integrations), Ringover (EU-friendly cloud telephony with sales features), Squaretalk (call-center oriented dialer options), Talkdesk and NICE CXone (enterprise CCaaS alternatives when you need deep WFM/QA).

Skip this section if you're already down to 2-3 finalists and just need to run trials.

They didn't make the ranked list here because the 11 above cover the most common buying scenarios with clearer pricing signals.

Deliverability-first outbound ops (the playbook most tools don't teach)

Most outbound teams treat "Spam Likely" like weather. It's not. It's operations.

Step 1: Authenticate the caller ID layer (STIR/SHAKEN + mitigation reality)

STIR/SHAKEN is the framework carriers use to authenticate caller ID over IP networks. It's table stakes for legitimacy, not a guarantee you'll never be labeled.

Important detail most vendors gloss over: providers also operate under robocall mitigation obligations (including filings tied to the Robocall Mitigation Database). Ask your vendor: Are you listed? What's your mitigation plan posture? If they can't answer cleanly, that's a red flag.

Step 2: Register and brand where it makes sense

Branded calling can lift answer rates because it reduces "unknown number" fear. It helps, but it isn't a cheat code.

If your dialing behavior looks abusive, branding won't save you.

Step 3: Monitor reputation like a KPI, not a complaint

Numeracle's public metrics show how persistent this problem is: 161,440+ remediations in 2026 and 1,032,800+ numbers protected.

Run this like ops:

- Weekly answer-rate check by number pool

- Watchlist for sudden drops by carrier/region

- Quarantine process for numbers that start getting flagged

Step 4: Remediate fast (and assume you'll do it again)

When a number gets labeled, remediate or rotate. The worst move is pretending it'll fix itself while reps keep hammering it.

Step 5: Adjust dialing behavior to reduce complaint signals

Quick wins I've seen work:

- Reduce rapid redials to the same area code block

- Use smarter time windows (stop calling the same persona at the same time every day)

- Don't "local presence" your way into looking like spoofing

- Tighten dispositions and suppress wrong numbers immediately

Step 6: Start with clean data (so you don't create the signals)

Wrong-number dials create frustration. Frustration creates complaints. Complaints create labels.

Clean inputs reduce the ugly signals before they start. (If you want the SOP, use a BDR contact data QA + refresh workflow.)

A concrete scenario: an SDR team runs a "local presence" campaign to 20 states, but they're feeding the dialer a list that's 15% stale and they retry "No Answer" three times in the same afternoon; two weeks later, answer rate falls off a cliff in three regions, managers blame the dialer, and the real fix is boring ops work: suppress bad records, slow the retry cadence, and rotate the number pool before you burn it completely.

Compliance checklist + what's changing in 2026 (FCC NPRM watch)

Outbound calling compliance is a moving target, and the worst time to learn that is after you've scaled a predictive dialer motion.

Settings-level compliance checklist (practical, not legal advice)

- Consent + purpose tagging: mark records by consent type and call purpose (sales vs support vs renewal).

- Time windows: enforce calling hours by contact timezone.

- Do-not-call hygiene: global suppression lists + internal DNC + disposition-based suppression.

- Abandonment controls (predictive dialers): set conservative pacing; monitor abandoned-call rate daily.

- Recorded-call disclosures: enable region-specific disclosures where required.

- Retention policies: set recording retention by region and role; restrict access by permission.

- Audit trail: keep logs of consent, call attempts, dispositions, and suppression actions.

Regulatory watch (proposed, not final)

The FCC published an NPRM titled Advanced Methods To Target and Eliminate Robocalls on 12/05/2026 (Federal Register: Document 2026-22063, 90 FR 56101), with comments due 01/05/2026 and reply comments due 02/03/2026.

One of the more interesting proposals (summarized by Kelley Drye) is deleting older TCPA rules designed around predictive dialers, including:

- the 3% abandoned-call cap, and

- the "don't disconnect before 15 seconds or four rings" rule.

Two realities:

- It's proposed, not final. Don't change your dialer settings based on a proposal.

- Even if FCC rules change, the FTC's Telemarketing Sales Rule has comparable provisions, so you can end up with a standards mismatch if you treat this like a green light.

Best tools by scenario (pick your stack fast)

SMB sales team (<20 reps)

- Pick: Nextiva or Aircall for calling + basic workflows

- Skip: Five9 (overkill under ~20 reps unless you're compliance-heavy)

- Stack tip: run a list-cleaning pass before any dialer bake-off so you're testing the dialer, not your data.

CRM-first team (RevOps wants everything logged cleanly)

- Pick: Close if you want the CRM to be the system of record

- Alternative: Dialpad Sell if you're Salesforce-heavy and want coaching + power dialer

International dialing (multi-region numbers and compliance posture)

- Pick: CloudTalk

- Alternative: RingCentral if IT standardization matters more than rep UX

Enterprise contact center (governance, scale, concurrent seats)

- Pick: Five9

- Tip: bake QA/coaching into the rollout plan on day one (sampling, scorecards, and a feedback loop tied to outcomes).

FAQ

What's the difference between a power dialer and a predictive dialer?

A power dialer calls one lead at a time as soon as a rep's available, while a predictive dialer calls multiple numbers per available rep to reduce idle time. For most sales teams, power dialing's the safer default; predictive works best in high-volume contact centers with tight pacing and abandonment controls.

How do I stop my outbound calls from showing "Spam Likely"?

Authenticate your numbers (STIR/SHAKEN), register/brand where available, and monitor answer rates by number pool weekly so you can remediate or rotate fast. Then tighten behavior: cap retries, avoid rapid redials in the same area-code block, and suppress wrong numbers immediately to reduce complaint signals.

What's a good free tool to improve call list quality before we dial?

What's the minimum I should test in a 14-day dialer trial?

Test 2,000-5,000 dials across multiple number pools with consistent lists, scripts, and time windows. Track wrong-number rate, voicemail rate, call quality, and any sudden answer-rate drops by number. If you only test with 200 hand-picked leads, you'll buy the wrong tool.

Summary: picking outbound calling software that actually performs

The best outbound calling software isn't the one with the flashiest dialer demo. It's the one that fits your motion (power vs predictive), logs cleanly in your CRM, and gives you the trust tooling to avoid getting buried by spam labels.