Power Dialer vs Predictive Dialer: Which One Actually Books More Meetings?

Your VP of Sales just approved budget for a dialer. Your team of 6 SDRs is currently manual-dialing from a spreadsheet, making 40 calls a day each. Every Google result is a dialer company telling you to buy their product. Here's the actual answer on the power dialer vs predictive dialer question - from a company that doesn't sell dialers.

The predictive dialer market hit $3.2B in 2024 and is growing at a 42.3% CAGR through 2030. Sales reps still spend only 30% of their time actually selling - the other 70% evaporates into manual dialing, voicemail, CRM logging, and staring at screens between calls. A dialer fixes part of that. But the wrong dialer creates new problems that are worse than slow dials.

Framing this as a binary choice is the wrong approach. The real question is which dialer type matches your team size, compliance exposure, and data quality. And there's a third option - parallel dialers - that most comparison guides still ignore entirely.

Power Dialer vs Predictive Dialer - What You Need (Quick Version)

- Under 8 reps? Power dialer. No debate. Predictive algorithms need volume to work, and you'll create compliance risk for zero upside.

- 10+ reps, high-volume campaigns? Predictive - but only with proper staffing, compliance monitoring, and verified contact data.

- Want predictive volume without the dead air? Look at parallel dialers - the category most guides still ignore.

- Before any dialer: Verify your phone numbers. A dialer calling dead numbers is an expensive way to burn caller ID reputation. Prospeo's verified mobile numbers deliver a 30% pickup rate - 3-6x the industry average for cold outbound.

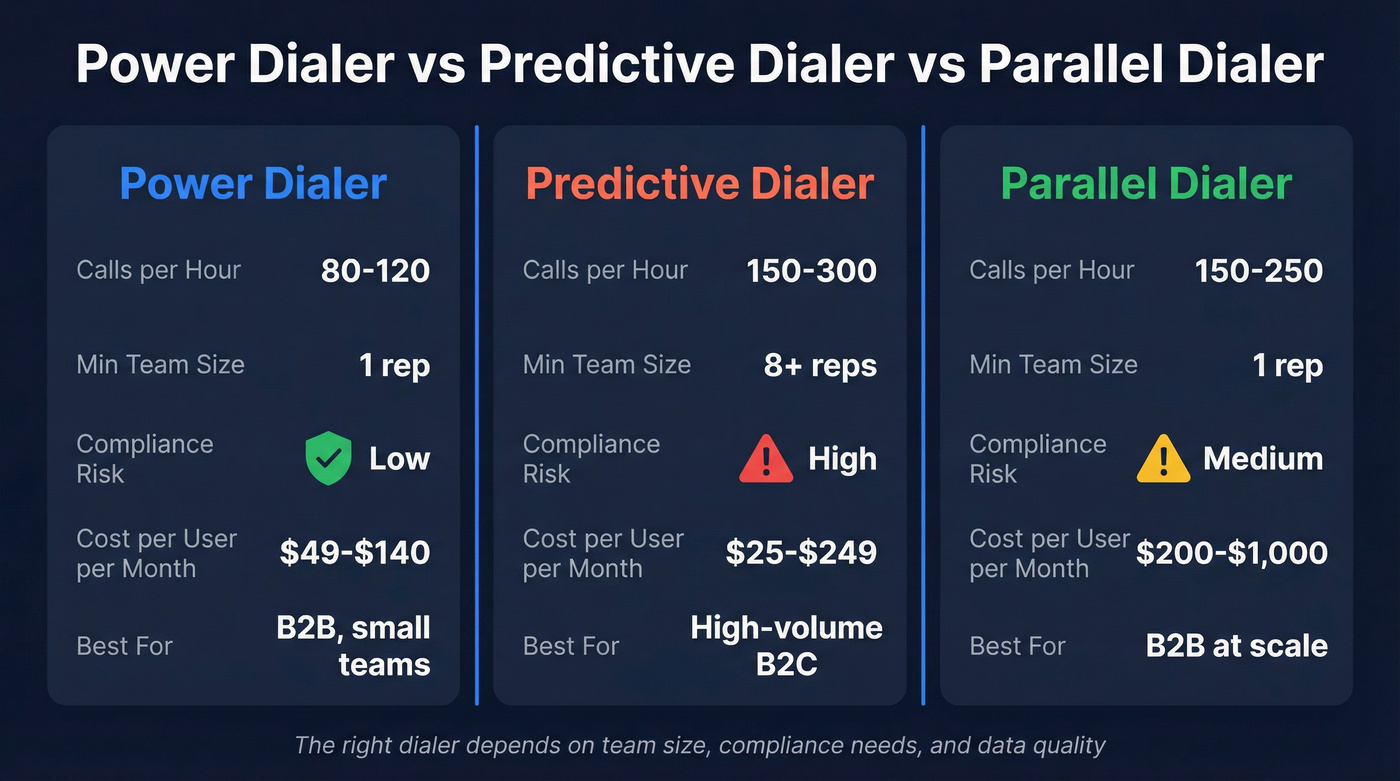

| Dimension | Power Dialer | Predictive Dialer | Parallel Dialer |

|---|---|---|---|

| Calls/hour | 80-120 | 150-300 | 150-250 |

| Min team size | 1 rep | 8+ reps | 1 rep |

| Compliance risk | Low | High | Medium |

| Cost range | $49-$140/user/mo | $25-$249/user/mo | $200-$1,000/mo |

| Best for | B2B, small teams | High-volume B2C | B2B at scale |

The Metrics That Actually Matter

Every dialer vendor leads with "300 calls per hour!" Nobody tells you what percentage of those calls become conversations, let alone meetings.

Let's do the math.

Average B2B cold call conversion sits at 2.3-2.5% - roughly 1 meeting per 40 dials. Top teams using better data, timing, and tooling hit 5-8%, which is 3x more meetings from the same dial volume. Typical U.S. outbound SDR connect rates run 3-10%, meaning 90-97 out of 100 dials never become a conversation. It takes about 18 dials to connect with one prospect on average.

Now apply that to dialer types. A power dialer doing 80 calls/hour at a 5% connect rate produces 4 conversations per hour. A predictive dialer doing 200 calls/hour at a 2% connect rate - factoring in dead air, dropped calls, and agent fatigue - also produces 4 conversations per hour. Same output. But the power dialer doesn't get you sued.

Here's the thing: the metric that matters isn't calls per hour. It's meetings booked per rep-hour. And meetings booked is a function of connect rate x conversation quality x follow-up discipline. Leads contacted within 5 minutes are 10x more likely to convert, and 80% of customers expect a response within 10 minutes. Yet 38% of reps never follow up after initial contact, and a predictive dialer's relentless pace makes follow-up discipline even harder to maintain.

A dialer that boosts dials but tanks conversion is costing you real pipeline.

The best call windows - 8-10am and 4-5pm - don't change based on your dialer type. Teams combining calls with email and social see 2-3x better results than phone-only programs regardless of which dialer they're running.

Volume is a vanity metric. Revenue per rep-hour is the number your CFO cares about.

How Each Dialer Type Works

Most guides lump dialers into two buckets: power and predictive. That's incomplete. There are actually five types on a five-type dialer spectrum from maximum agent control to maximum call volume, and understanding the full range matters because the wrong choice creates problems that are invisible until you're three months into a contract.

Before getting into each type, it helps to understand what an auto dialer is at a fundamental level: any system that automatically dials phone numbers from a list without requiring a rep to manually punch in each one. Power, predictive, progressive, and parallel dialers are all subcategories - they just differ in how aggressively they automate the process.

Preview Dialer

Highest personalization, lowest volume. The agent reviews the contact's info, account history, and notes before manually initiating the call. Built for complex B2B with high-value accounts where showing up unprepared kills the deal. Think enterprise AEs calling into C-suite - you don't want an algorithm deciding when that call happens.

Progressive Dialer

Auto-dials the next number the moment an agent becomes free. Strict 1:1 ratio - one line dialed per available agent - which means a 0% abandonment rate. This is the safest starting point for teams moving off manual dialing. You get the automation benefit without any compliance exposure. Many guides conflate progressive with power dialers, but the difference matters: progressive dials one line per agent, while a power dialer dials multiple lines simultaneously.

Power Dialer

Here's the precise definition: a power dialer dials a fixed, pre-configured number of lines per agent simultaneously - typically 2, 3, or 4 lines. The agent is always present when someone answers. No algorithm predicting availability. No dead air.

At 2-4 simultaneous lines, you're looking at 80-120 calls per rep per hour. Dialers increase agent talk time by up to 300% by eliminating the 15-30 seconds of dead time between manual dials. The contact doesn't know technology is being used - they just hear a rep ready to talk.

The key constraint: if you set lines too high (say, 4 lines and your list has a high answer rate), you risk multiple people picking up simultaneously. Keep it at 1-3 lines unless your answer rate is unusually low.

Predictive Dialer

This is where it gets complicated. A predictive dialer uses an algorithm to predict when an agent will become available, then dials ahead of that moment. It doesn't predict when consumers will answer - it predicts when your reps will be free. That distinction matters enormously for compliance.

With 8+ agents, the algorithm has enough data to make decent predictions. Throughput jumps to 150-300 calls per rep per hour. But when the algorithm miscalculates - and it will - someone picks up to silence. That "telemarketer delay" is an instant trust killer. The prospect either hangs up or is already annoyed by the time a rep connects.

The FCC's current 3% abandonment cap exists specifically because of predictive dialers. You can't abandon more than 3% of answered calls in a campaign. Violate that, and you're looking at fines up to $43,762 per violation under the TSR. After the Supreme Court's Facebook v. Duguid ruling in 2021, the dialing software itself doesn't determine TCPA compliance - it's how you use it. Abandoned calls can happen with any dialer type, but predictive systems make them structurally likely.

Parallel Dialer

The newest category. A parallel dialer calls multiple numbers simultaneously - like predictive - but uses AI to route the first live answer to an available rep in real time. No forecasting. No dead air. The rep is always there when someone picks up.

Think of it as predictive volume with power dialer reliability. Nooks, Orum, and Koncert are the main vendors. The tradeoff? Cost. Parallel dialers run $200-$1,000/mo per user, and as one Reddit user put it, a "$1,000 starter package" is common. But for B2B teams that need volume without compliance headaches, it's the category to watch in 2026.

A predictive dialer doing 200 calls/hour on bad numbers is just an expensive way to burn your caller ID reputation. Prospeo's 125M+ verified mobile numbers deliver a 30% pickup rate - 3x the industry average. Fix the data before you pick the dialer.

Stop dialing dead numbers. Start booking meetings.

Comparing Power and Predictive Dialers Head-to-Head

Here's the direct comparison across every dimension that actually matters for your buying decision:

| Dimension | Power Dialer | Predictive Dialer |

|---|---|---|

| Calls/hour | 80-120 | 150-300 |

| Min team size | 1 rep | 8+ reps |

| Abandoned call risk | Near zero | 1-3% (capped) |

| Compliance complexity | Low | High |

| Agent prep time | Some (sees contact) | None (call arrives) |

| Connect quality | High (rep is ready) | Lower (delay risk) |

| Dead air risk | None | Significant |

| Best for | B2B, <10 reps | B2C, 10+ agents |

| Typical cost/user/mo | $49-$140 | $25-$249 |

When Power Dialers Win

Teams under 10 reps. Predictive algorithms need volume to generate reliable predictions. With 6 SDRs, the algorithm is basically guessing - and guessing wrong means dropped calls, dead air, and wasted prospect patience. A power dialer at $49-$95/user/month gives you 2-5x your current manual dial volume with zero compliance risk.

B2B with personalization needs. If your reps need 10 seconds to glance at the account before speaking, a predictive dialer rips that away. Power dialers let agents see who they're calling. That matters when you're selling $50k+ deals and the first impression is everything.

Compliance-sensitive industries. Healthcare, financial services, insurance - anywhere TCPA exposure is existential. Power dialers with a 1:1 or 2:1 line ratio keep you well under the 3% abandonment threshold without monitoring.

When Predictive Dialers Win

10+ agent teams running high-volume campaigns. If you've got 15 SDRs blasting through a list of 50,000 contacts for a product launch, predictive throughput matters. The algorithm works when it has enough agents to model.

B2C with low connect rates. When your list has a 2-3% connect rate, raw throughput is the only way to generate enough conversations. Predictive dialers were built for this exact scenario.

Lists where personalization doesn't move the needle. Some campaigns are pure numbers games. If the script is identical for every call and the product is transactional, agent prep time is wasted time.

When Neither Wins

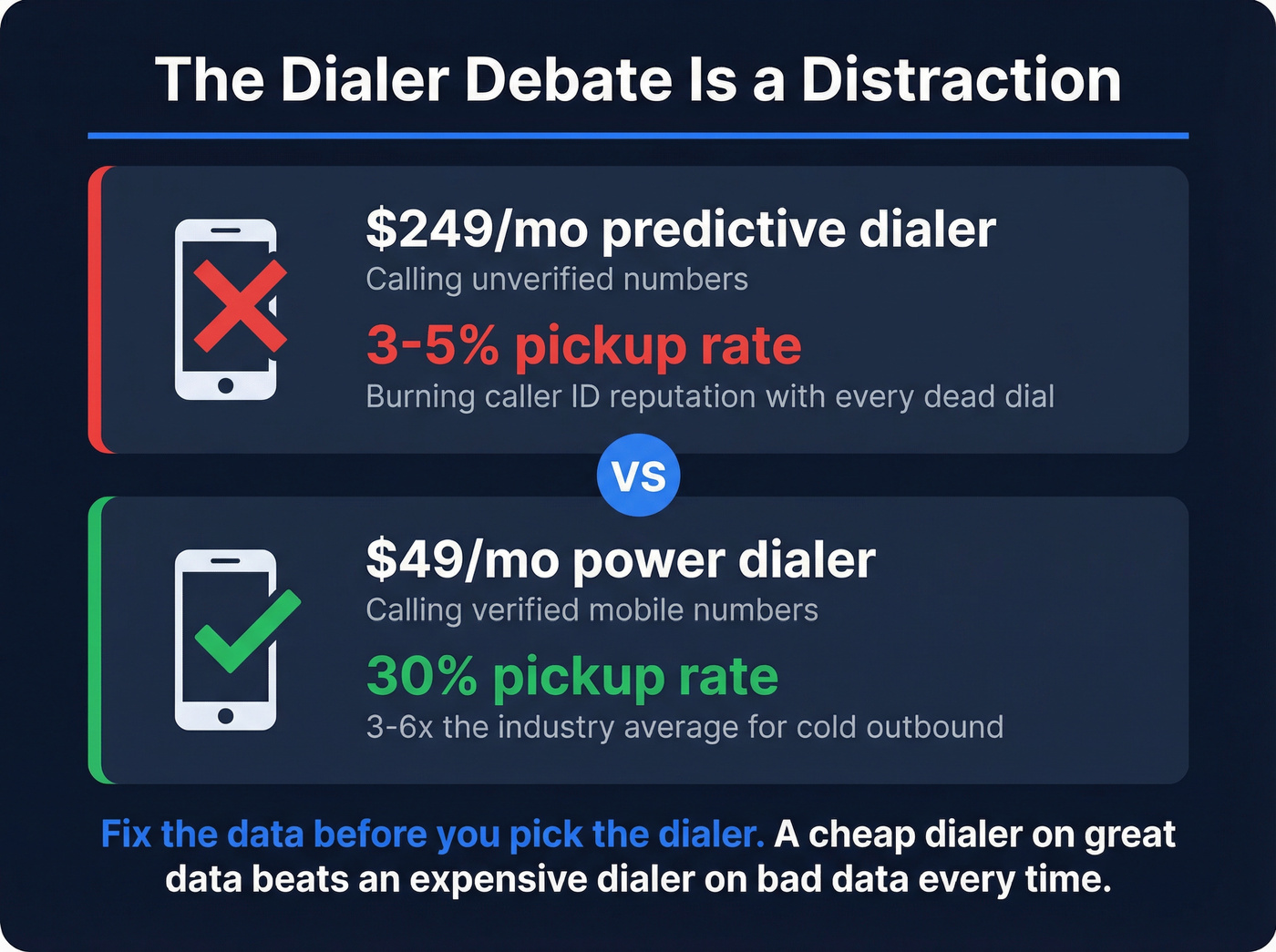

When your data is bad.

A power dialer calling 100 dead numbers per hour is just a faster way to burn your caller ID. A predictive dialer calling 300 dead numbers per hour is an even more expensive way to do the same thing. Data quality is the upstream variable that determines whether any dialer actually books meetings.

Most teams agonizing over this choice would get a bigger pipeline lift from spending that evaluation time cleaning their contact data. A $49/month power dialer fed verified numbers will outperform a $249/month predictive dialer fed garbage data every single time. The dialer debate is a distraction from the real problem.

The Third Option: Parallel Dialers

If you're evaluating dialers in 2026 and your guide doesn't mention parallel dialers, it's outdated.

Parallel dialers solve predictive's core problem - dead air - without sacrificing volume. Instead of an algorithm predicting when a rep will be free, a parallel dialer dials multiple lines simultaneously and routes the first live answer to an available rep in real time. The rep is always there. The prospect never hears silence.

The vendor-reported results are eye-catching (these are vendor-selected case studies, so take the specific numbers directionally): Greenhouse grew pipeline 933% and revenue 550% after switching to Nooks. HubSpot's sales team saw 95% more dials and a 50% higher connect rate after adopting Nooks. Seismic reduced ramp time 40% and tripled meetings. Most teams switching from predictive to parallel report 2-5x more connects in month one.

I haven't tested every parallel dialer deeply enough to recommend one confidently over the others, but here's what I've seen:

- Nooks - Market leader with the strongest case studies and the highest price tag (~$1,000/mo starter). Best for teams that can justify the spend.

- Orum - ~$300-$500/user/month with solid enterprise adoption, though one Reddit user noted it "worked about 80% of the time." Reliability concerns are worth probing in your trial.

- Koncert - ~$200-$400/user/month, targeting mid-market teams. The budget-friendly parallel option.

The cost barrier is real. A 10-rep team on CloudTalk pays $490/month. The same team on Nooks pays $10,000+. The question is whether 2-5x more connects justifies 20x the cost. For teams with deal values above $25k, it usually does.

Parallel dialers also handle local presence by region, rotate numbers automatically, and enforce time zone and DNC guardrails - compliance features that predictive dialers often bolt on as afterthoughts.

The 2026 Compliance Reality Check

The compliance picture for outbound dialing shifted dramatically in 2025, and the changes heading into 2026 are reshaping how predictive dialers operate entirely.

The Litigation Surge

TCPA lawsuits surged 95% in 2025 compared to 2024. Class actions spiked 285% in September alone. These aren't theoretical risks - they're six-figure liabilities landing on real companies.

The Supreme Court's McLaughlin v. McKesson ruling in June 2025 made things worse. Courts are no longer bound by FCC interpretations in civil TCPA cases - judges must now interpret the statute independently. The compliance playbook you built around FCC guidance might not protect you in court.

In August 2025, the FCC ordered 1,200+ voice service providers removed from the Robocall Mitigation Database for deficient filings. The FCC also clarified that AI-generated voices qualify as "artificial or prerecorded" under TCPA - relevant for any team using AI voice agents or voicemail drops.

Getting this wrong isn't a slap on the wrist. TSR fines run up to $43,762 per violation. One bad campaign can generate thousands of violations.

The 3% Rule Might Disappear

In October 2025, the FCC released an NPRM proposing to eliminate both the 15-second/4-ring minimum ring rule and the 3% abandonment cap. Since 2003, callers have been banned from abandoning more than 3% of outbound calls - a live agent must be available for at least 97% of calls answered within two seconds.

The FCC's rationale: predictive dialers have "evolved to become more efficient." But as TCPAWorld's analysis pointed out, this shows a "complete misunderstanding" of how predictive dialers actually work. Predictive dialers don't predict when consumers will answer - they predict when agents will be free. Remove the abandonment cap, and call centers can crank line assignments to 20 or even 100 per agent.

This is still in comment period - not final rule. But the direction is clear: the regulatory ground is actively shifting, and the rules you're operating under today may not exist in 12 months.

State-Level Minefield

At least 15 states now enforce mini-TCPA statutes as of fall 2025. Federal rules are only the floor.

Texas SB 140, effective September 1, 2025, expanded "telephone solicitation" to include texts and tied violations to the Deceptive Trade Practices Act - meaning treble damages plus attorney's fees. Courts are already issuing conflicting rulings: an Illinois court said texts aren't "telephone calls" under TCPA while an Oregon court reached the opposite conclusion on the same day.

If you're running a predictive dialer across multiple states, you need state-by-state compliance monitoring. That's an operational cost most dialer vendors don't mention in their sales pitch.

What You'll Actually Pay - Pricing for 20+ Dialers

Power Dialer Pricing

| Tool | Price/user/mo | Notes |

|---|---|---|

| CloudTalk | $49 | Expert tier required |

| JustCall | $49 | 2-user minimum |

| Aircall | $50 | 3-user minimum |

| Ringover | $54 | - |

| VoiceSpin | $77 | - |

| Kixie | $95 | Best CRM integration |

| PowerDialer.ai | $99-$199 | Free plan available |

| PhoneBurner | $140 | Up to 80 contacts/hr |

PhoneBurner at $140/user/month for a single-line power dialer is hard to justify when CloudTalk and JustCall offer power dialing at $49. Kixie at $95 makes sense if you're deep in HubSpot or Salesforce and want native integration - otherwise, you're paying a premium for the CRM connector.

Predictive Dialer Pricing

| Tool | Price/user/mo | Notes |

|---|---|---|

| DialedIn | $25-$79 | Budget option |

| RingCentral RingCX | $65-$145 | Per agent |

| Nextiva | From $75 | Enterprise tier |

| Five9 | $119-$159 | Per concurrent user |

| Genesys | $75-$240 | Enterprise platform |

| NICE CXone | $110-$249 | Per agent |

| Talkdesk | $165 | Elite tier |

| Convoso | ~$150-$300 | Quote-based |

Look, Five9 and NICE CXone are enterprise contact center platforms. If you're an SDR team of 10, you're shopping in the wrong aisle. DialedIn at $25-$79/user is the budget predictive option that actually makes sense for sales teams. RingCentral's $65 starting point is reasonable if you're already in their ecosystem.

Parallel Dialer Pricing

| Tool | Price/user/mo | Notes |

|---|---|---|

| Koncert | ~$200-$400 | Mid-market focus |

| Orum | ~$300-$500 | Enterprise adoption |

| Nooks | ~$1,000/mo starter | Market leader |

The price gap between parallel and power dialers is stark. A 10-rep team on CloudTalk pays $490/month total. The same team on Nooks pays $10,000+. Whether 2-5x more connects justifies 20x the cost depends entirely on your deal values. For teams closing $25k+ deals, it usually does.

Your Dialer Is Only as Good as Your Data

Here's the part every dialer comparison skips.

If 25% of your phone numbers are disconnected or wrong - and that's the reality for many business contacts phone databases - your dialer is spending a quarter of its time calling dead numbers. That's not a dialer problem. It's a data problem.

We've seen teams spend $200/user/month on a parallel dialer, then feed it an unverified list where half the numbers bounce. They blame the dialer. The dialer was fine - the data was garbage.

Connect rates for cold outbound typically run 3-10%. Prospeo's verified mobile numbers deliver a 30% pickup rate with 98% email accuracy and a 7-day refresh cycle that keeps numbers current. At $0.01 per lead, the math is simple: before you spend $50-$200/user/month on a dialer, spend a penny per lead to make sure the numbers actually work.

The proof is in the results. Meritt tripled their connect rate to 20-25% after switching to verified data - and their pipeline went from $100K to $300K per week.

Spam flagging compounds the problem. High call volume from a single number, unregistered business numbers, and negative consumer feedback all trigger spam labels. But the fastest path to spam flags? Calling disconnected numbers repeatedly. Your dialer doesn't know the number is dead - it just keeps dialing, and the carrier analytics notice the pattern.

Decision Framework - Which Dialer Should You Choose?

Step 0: Audit your contact data. If more than 10% of your phone numbers bounce, fix that before buying any dialer. Verified mobile data saves credits, protects caller ID, and boosts connect rates from day one.

1-3 reps: Progressive dialer. Keep it simple. You don't need multi-line dialing yet, and the compliance overhead of anything more aggressive isn't worth it at this scale.

4-8 reps: Power dialer. Kixie for HubSpot/Salesforce shops, JustCall for best value, CloudTalk for international teams. Budget $49-$95/user/month.

8-15 reps, B2B: Power dialer or parallel dialer. Predictive only if you have dedicated compliance infrastructure and your legal team has signed off. Most B2B teams in this range get better results from a power dialer with great data than a predictive dialer with mediocre data.

15+ reps, high-volume outbound: Predictive or parallel. Budget for compliance monitoring - either a dedicated person or a compliance platform. If you're running multi-state campaigns, you need state-by-state TCPA tracking.

Any team size, budget for premium: Parallel dialer (Nooks or Orum) paired with verified data. This is the highest-performance stack in 2026, but it's also the most expensive. Make sure your deal values justify the investment.

Skip this if your list is under 1,000 contacts per month - at that volume, even a progressive dialer is overkill. Just use your phone.

The bottom line on power dialer vs predictive dialer: your dialer choice matters far less than the data feeding it. Pick the type that matches your team size and compliance tolerance, then invest the rest of your budget in verified contact data that actually connects. If you want a deeper dive on predictive systems specifically, see our Predictive Dialer guide.

You just read that connect rates decide whether a dialer actually works. At $0.01 per email and 10 credits per verified mobile, Prospeo gives your SDRs direct dials that people actually answer - refreshed every 7 days, not 6 weeks.

Feed your dialer data that converts at 30% pickup rate.

FAQ

Can a small team use a predictive dialer?

Predictive algorithms need 8+ agents to generate reliable availability predictions. With fewer reps, the system guesses wrong frequently, producing more dropped calls and dead air than a $49/month power dialer while adding unnecessary TCPA compliance risk from higher abandonment rates.

What's the difference between a power dialer and an auto dialer?

An auto dialer is the broad category - any system that dials numbers automatically. Power dialers, predictive dialers, and progressive dialers are all subtypes. A power dialer specifically dials 2-4 lines per agent simultaneously, while "auto dialer" covers everything from simple sequential systems to aggressive predictive algorithms. Always ask which subtype you're getting.

Are predictive dialers legal?

Yes, but heavily regulated. The FCC's 3% abandonment cap, TCPA consent requirements, and 15+ state mini-TCPA statutes all apply. With TCPA lawsuits up 95% in 2025 and class actions spiking 285%, compliance isn't optional - budget for legal review before deploying any predictive system.

How do I improve my dialer's connect rate?

Start with verified contact data - verified mobile numbers with a 30% pickup rate beat the 3-10% industry average by a wide margin. Then add local presence dialing, call during optimal windows (8-10am and 4-5pm), rotate numbers to avoid spam flags, and register your business caller IDs with carriers.

What is a parallel dialer?

A parallel dialer calls multiple numbers simultaneously and uses AI to route the first live answer to an available rep in real time - delivering 150-250 calls/hour without dead air or abandoned call risk. Nooks, Orum, and Koncert are the main vendors, with pricing from ~$200 to $1,000+/month per user.