The Best Lead Generation Tools for Sales (2026 Buyer's Guide)

You buy lead generation tools for sales, launch a sequence, and deliverability falls apart overnight. Then you realize half your budget's disappearing into credits, and the other half's spread across five tools that don't talk to each other.

Here's my POV: "lead gen tools" aren't one category. They're a stack of six categories - and the stack only works when the data layer's clean, fresh, and priced predictably.

Hot take: if you're selling a lower-priced product, you probably don't need a ZoomInfo-sized contract. You need verified emails, a sane sending setup, and a tight workflow reps'll actually follow.

Our picks (TL;DR): best lead generation tools for sales in 2026

Tool sprawl doesn't book meetings.

Clean inputs + consistent execution does.

If I had to trial 3 first: Prospeo, Apollo, Leadfeeder.

My top 5 picks (with "best for"):

- Prospeo - best accuracy-first data foundation (verified emails + mobiles) with self-serve pricing and no contract nonsense

- Apollo - best "get reps moving fast" all-in-one for SMB outbound (data + sequences in one place)

- Leadfeeder - best inbound intent for teams with meaningful site traffic (turns anonymous visits into target accounts)

- Clay - best enrichment/workflow engine when you need weirdly specific lists and custom routing logic

- Cognism - best phone-first prospecting in Europe + compliance-forward workflows

One opinion I'll defend: stop shopping for the "best database" and start shopping for the best unit economics per meeting. Teams win with "smaller" databases all the time because they verify everything, dedupe properly, and don't bleed budget through misunderstood credit systems.

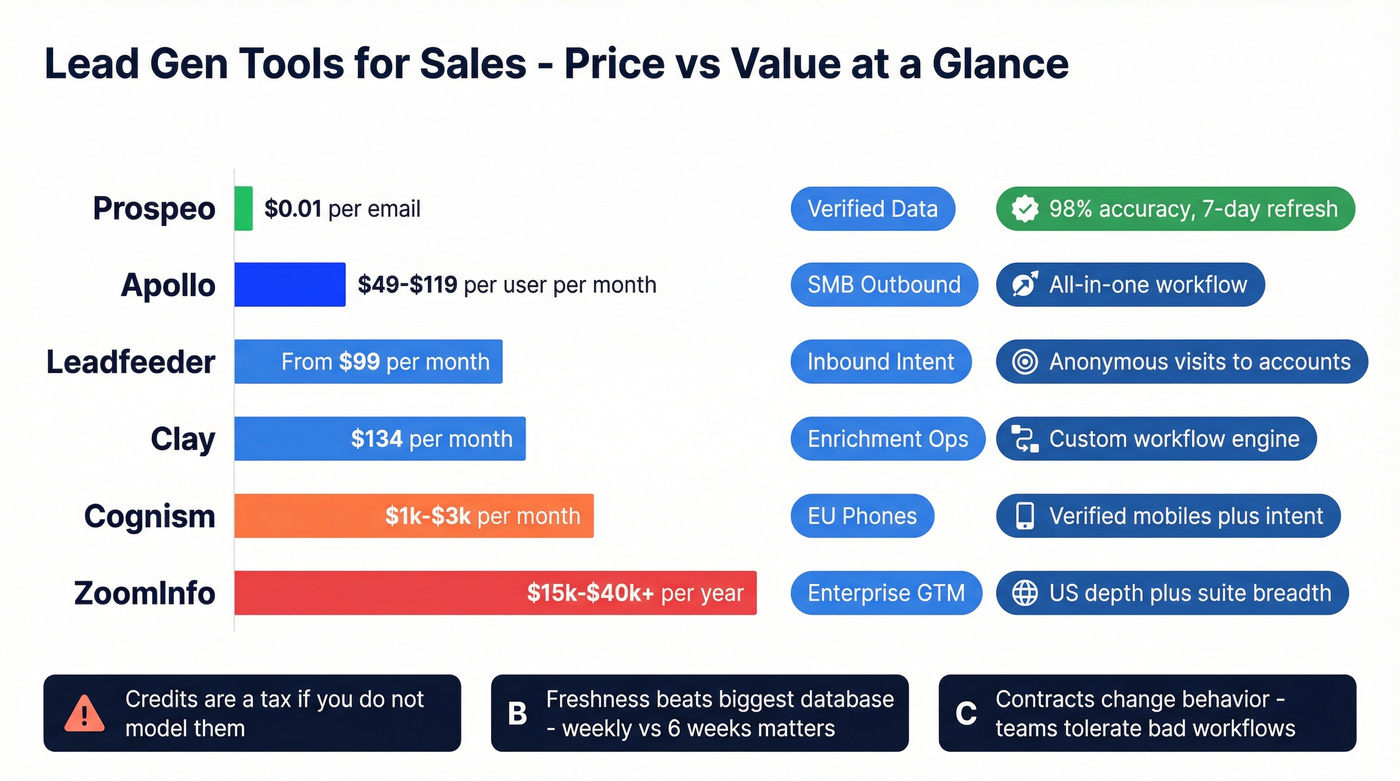

Comparison table: lead generation tools for sales (pricing, trials, strengths)

This table's biased toward what matters in production: pricing model (credits vs contract), what it's best at, whether you can trial without a sales call, and the one strength that decides most bake-offs.

| Tool | Pricing signal | Best for | Trial/free | Key strength |

|---|---|---|---|---|

| Prospeo | Free; ~$0.01/email | Verified data | 75 emails + 100 ext/mo | 98% + 7-day refresh |

| Apollo | ~$49-$119/user/mo (annual) | SMB outbound | Free tier | All-in-one workflow |

| Leadfeeder | Starts at $99/mo (annual) | Inbound intent | Free + 14-day trial | Site visit -> account |

| Clay | $134/mo (annual) | Enrichment ops | Free (1,200 credits/yr) | Custom workflows |

| Cognism | ~$1k-$3k/mo | EU phones | Demo/quote | Verified mobiles + intent |

| ZoomInfo | $15k-$40k+/yr | Enterprise GTM | Quote/trial | US depth + workflows |

| Seamless.AI | Free; ~$79/user/mo+ | Low-cost prospecting | 1,000 credits/user/yr | Big coverage, fast |

| LeadIQ | $200/mo | Capture + CRM sync | Free 50 credits | Hygiene + enrichment |

| Lusha | Free; ~$39-$99/mo | Quick enrichment | Up to 70 credits/mo | Simple extension |

| PDL | $0.28/credit (Person) | API enrichment | Self-serve | Pay per match (200) |

| Instantly | ~$37-$197/mo | Sending at scale | Trial | Inbox rotation |

| HubSpot | Free; $15/seat/mo+ | Inbound + routing | Free CRM | Native lifecycle ops |

A few interpretations that save real money:

- Credits are a tax if you don't model them. Phone-heavy motions get expensive fast when a "phone reveal" costs ~10 credits.

- Contracts change behavior. Annual deals make teams tolerate bad workflows because switching's painful.

- Freshness beats "biggest database." Weekly refresh vs ~6 weeks is the difference between "works this quarter" and "half these people left."

- Inbound intent tools price on volume. Visitor ID scales with traffic; forecast it or you'll get surprised.

- API-first tools (PDL) are brutally efficient - if you've got someone technical. Without that, you pay in time what you save in license cost.

If you want to sanity-check two pricing pages while you compare, use Leadfeeder (clear inbound scaling) and Clay (transparent credits + rollover rules).

Your lead gen stack is only as strong as its data layer. Prospeo delivers 98% email accuracy on a 7-day refresh cycle, so every tool downstream - sequences, enrichment, CRM - actually works. At ~$0.01/email with no contracts, your unit economics per meeting drop fast.

Fix the foundation first. Everything else gets easier.

How to choose lead generation tools for sales (6 categories + decision rules)

Lead gen tools only feel confusing because people shop by brand instead of by job-to-be-done. In practice, you're buying across six categories:

- Data & verification (contacts + emails + mobiles + validity)

- Enrichment & workflows (turn messy inputs into usable lists)

- Outreach (sequencing + sending infrastructure)

- Inbound capture (forms, chat, visitor ID, conversions)

- Intent & signals (who's in-market, who's changing, who's growing)

- CRM/routing/ops (dedupe, assignment, SLAs, reporting)

Decision rules I use with teams:

- If your bounce rate's above ~3-5%, buy data & verification first. Everything downstream gets worse when your inputs are wrong: deliverability drops, reps lose trust, and you end up "needing" more tools to compensate.

- If you've already got traffic and inbound conversions, buy inbound capture/intent next. Warm accounts beat cold accounts. Every time.

- If your ICP's nuanced (technographics + hiring + job changes + "must have X"), buy enrichment/workflows. Clay's the poster child here: it isn't a database, it's a factory line.

- If you're scaling outbound volume, buy outreach infrastructure. Sending's a systems problem now - domain clustering, inbox rotation, throttling, and list hygiene.

- If you're enterprise ABM, buy intent + orchestration. ZoomInfo shines when you actually operationalize workflows, buying groups, and marketing modules. Most teams don't.

One criterion most buyers underweight: data freshness as a first-class requirement. Weekly refresh catches job changes before your next campaign. Monthly refresh creates "stale by default" lists in high-churn roles.

In our experience, the clean architecture's simple: verified data layer first, execution layer second, orchestration third. That's why a lot of teams start with Prospeo as the clean-input layer, then add Apollo (outbound) or Leadfeeder (inbound), and only then layer Clay when they need custom enrichment logic and routing rules.

The best lead generation tools for sales (by category)

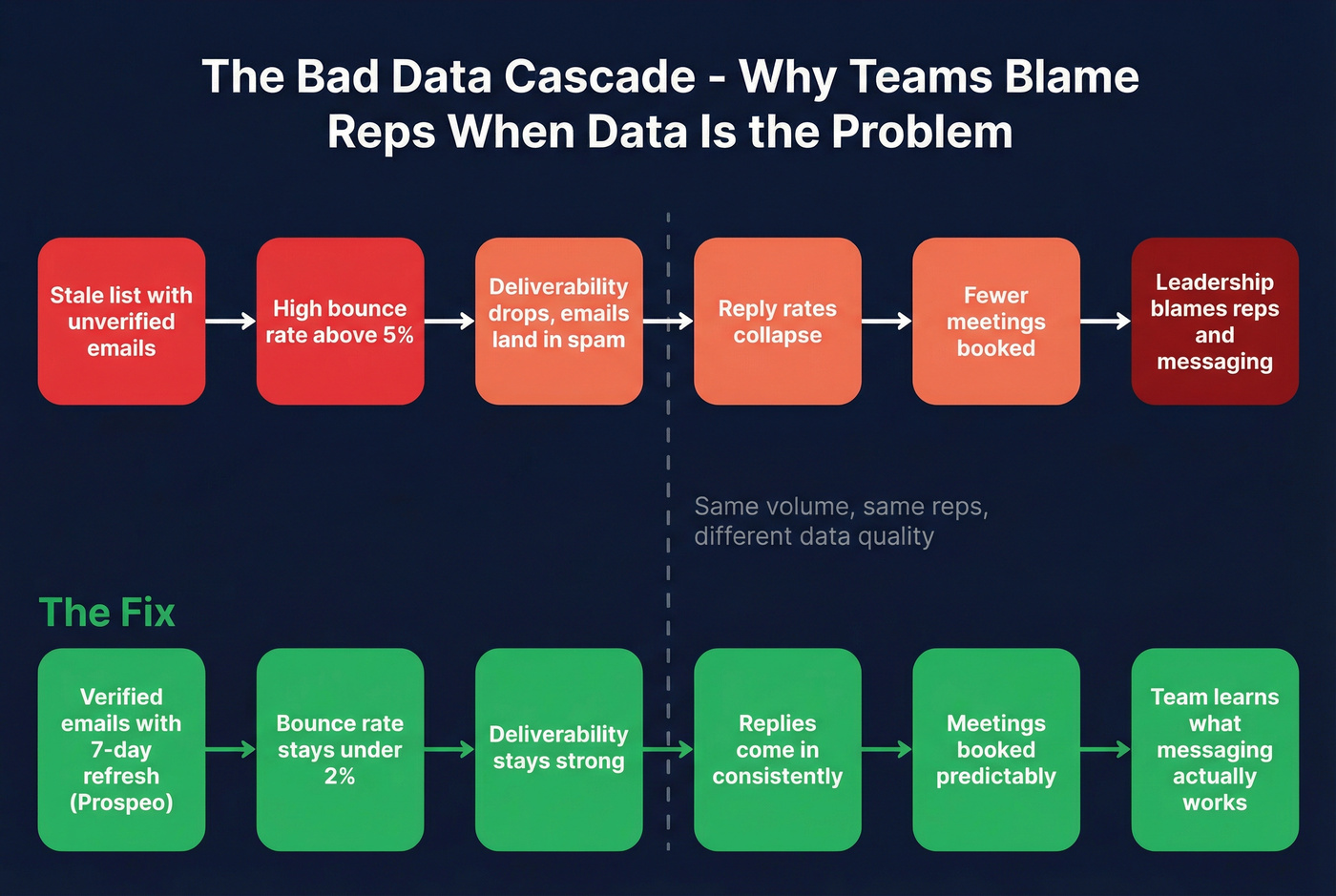

B2B data & verification (the backbone)

Bad data doesn't just waste credits. It creates bounces, which hurts deliverability, which reduces replies, which reduces meetings - and then leadership blames the reps. I've seen teams spend months "fixing messaging" when the real issue was a list full of stale roles and catch-all domains that never should've made it into a sequence.

The "database" decision is really a deliverability decision. And for most orgs, it's the core of the whole stack.

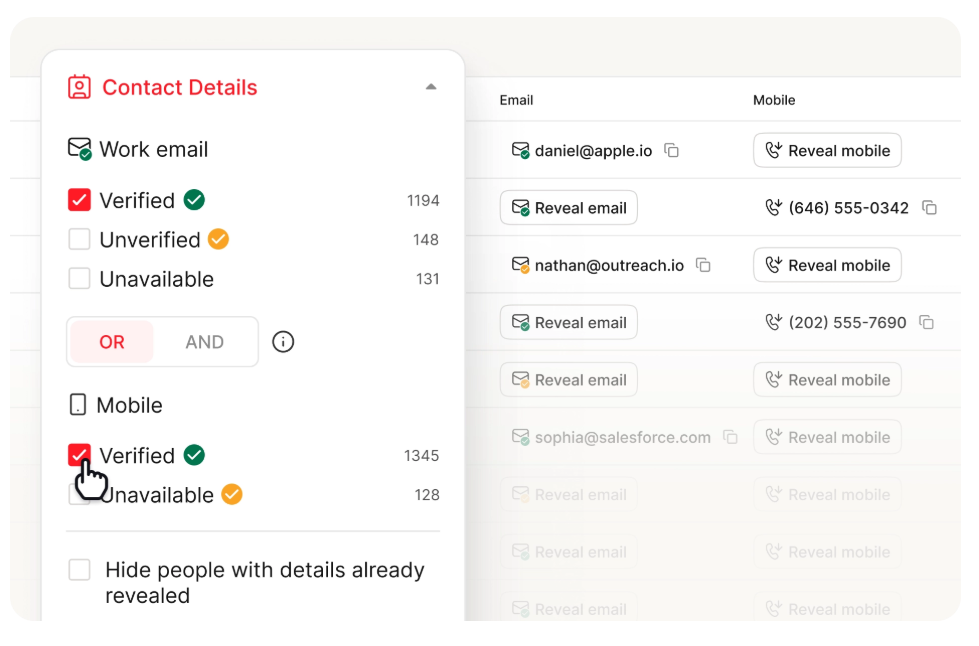

Prospeo (Tier 1)

Prospeo is "The B2B data platform built for accuracy"--and it's the first tool I reach for when a team wants bounce rates under control fast without signing a contract just to run a test. You get 98% verified email accuracy, 125M+ verified mobile numbers with a 30% pickup rate, and a 7-day refresh cycle (industry average: 6 weeks).

Here's the thing: that refresh + verification combo is what keeps campaigns usable week after week. If you're prospecting into fast-churn roles (SDR managers, RevOps, growth, IT), a monthly refresh isn't "a little worse." It's a different product.

What you actually get (not marketing fog):

- 300M+ professional profiles (from 800M+ collected records) with a 5-step verification

- 143M+ verified emails

- 30+ search filters (including intent, technographics, job change, growth signals)

- Intent data across 15,000 topics (powered by Bombora)

- CRM/CSV enrichment with 50+ data points per contact, 92% API match rate, and 83% enrichment match rate

- A Chrome extension used by 40,000+ users, plus adoption across 15,000+ companies

- Proprietary email-finding infrastructure (it doesn't rely on third-party email providers)

A quick scenario that comes up constantly: you're launching a new outbound motion, and you need 2,000 contacts by Friday. If you pull a list, don't verify it, and blast it, you'll spend the next month repairing domains and arguing about copy. If you start with verified emails and deduped accounts, you can keep volume steady, keep bounces low, and actually learn what messaging works.

Useful pages while you're evaluating: Email Finder, Mobile Finder, Data Enrichment, Integrations.

If you're comparing verification options, start with an email verifier checklist and a simple email verification list SOP.

Apollo (Tier 1)

Apollo's the fastest path from "we have no list" to "reps are actively prospecting." It combines database + filters + sequencing in one place, and reps adopt it quickly because the workflow's straightforward: build a list, drop it into a sequence, and get activity moving the same day.

Where teams get burned is assuming "all-in-one" means "no tradeoffs." Data quality varies by niche and geography, and you feel that variance hardest on phone coverage outside North America. If your motion's phone-first or compliance-heavy, put a stricter verification layer in front of your sends before you scale volume.

Apollo's published annual pricing includes Basic ($49/user/month), Professional ($79/user/month), and Organization ($119/user/month, 3+ seats), plus a free tier.

If you're running sequences from Apollo, this Apollo cold email guide helps avoid the usual setup mistakes.

Cognism (Tier 1)

Cognism's the pick when the motion is EU/UK phone-first and you care about compliance and verified mobiles. It's built for teams that measure success in connects, not just "emails sent," and it feels designed around that reality.

What teams love: phone-verified mobile coverage (their "Diamond Data"), structured packaging, and strong signals (job changes, hiring, funding, M&A). What teams hate: list/export caps and premium pricing. Cognism isn't a cheap add-on; it's a commitment.

Pricing's quote-based; smaller teams typically land around ~$1,000-$3,000/month, higher as seats and data needs grow.

If you need a workflow for direct dials, see this B2B phone number guide.

ZoomInfo (Tier 2)

ZoomInfo's still the default enterprise line item - and the one CFOs love to challenge. Expect $15k-$40k+/year depending on seats and modules; multi-year deals are common.

Where it wins: US depth, company intelligence, and suite breadth (Sales + Marketing packaging, intent, website visitors, buying groups). It's built for teams that want governance, workflows, and a single vendor.

Where it frustrates people: module bloat. Too many orgs buy it "for the data," never turn on the workflows, and still live in a browser extension. That's the most expensive way to use ZoomInfo.

If you're trying to validate bounce rates before you renew, this Is ZoomInfo accurate? breakdown is useful.

Seamless.AI (Tier 2)

Seamless.AI's popular because it feels like a quick win: a free tier, lots of coverage, and reps can grab contacts fast. The free plan includes 1 user + 1,000 credits per user/year (granted monthly), which is a legit way to test fit.

The tradeoff is predictability. Above the free tier, you're back in sales-call land, and credit burn surprises teams that don't model usage. If your org's already struggling with "where did our credits go?", this isn't the hill to die on.

Enrichment & workflows (turn messy inputs into usable lists)

This is where "AI lead gen" becomes real: you take messy inputs (CSV, form fills, scraped URLs, partial names) and turn them into a clean, deduped, routed list with the right fields.

Real talk: if nobody owns this layer, it turns into a graveyard of half-built automations and one heroic spreadsheet that only one person understands.

Clay (Tier 1)

Clay's the best enrichment/workflow layer when you need custom logic: "find companies hiring X, using Y tech, in Z region, then find the right persona, then verify, then score, then route." It's spreadsheets-meets-automation, and it's lethal in the hands of someone who enjoys building systems.

The complaint's also simple: Clay's powerful enough to become a part-time job. If you don't have an owner, skip it for now and come back when you've earned the complexity.

Pricing's public: Free includes 1,200 credits/year; Starter is $134/mo billed yearly for 24K credits/year; Explorer is $314/mo; Pro is $720/mo. Credits roll over up to 2x your monthly limit, and annual rollover is 15% of unused credits if you renew on the same/higher plan.

If you're evaluating this layer broadly, compare against other lead enrichment tools.

People Data Labs (PDL) (Tier 2)

PDL's the cleanest "pay per successful match" enrichment model in the market. If you're building your own enrichment, scoring, or routing, it's a great backbone because you pay for outcomes.

The catch: it's API-first. Without engineering (or a technical RevOps owner), teams buy it and then never ship the integration.

Pricing signal: Person API Tier 1 is $0.28/credit; Company is $0.10/credit; credits are consumed per successful match (status 200).

Prospect capture & CRM sync (rep workflow speed)

This category's underrated. It isn't "more leads," it's less friction: capture -> dedupe -> enrich -> route. If you don't do this, your CRM fills with junk and reps stop trusting anything.

LeadIQ (Tier 2)

LeadIQ's a workflow tool disguised as a lead gen tool. It's best when reps build lists during research and you care about CRM hygiene.

Pros

- Free includes 50 credits; Pro is $200/month

- Clear credit math: email = 1, phone = 10, email+phone = 11, account enrichment = 3

- Strong for syncing to CRM without creating duplicates

Cons

- Not a massive database replacement

- Phone-heavy teams feel the 10-credit cost quickly

If you're trying to reduce duplicates and junk records, follow a keep CRM data clean workflow.

Lusha (Tier 2)

Lusha's the "quick enrichment" tool many reps keep around even when the company has a bigger platform. It's simple, and the credit rules are clear.

Use it when you need fast enrichment during research - not when you need to build huge outbound lists from scratch every week.

Inbound intent (warm leads already on your site)

If you've got traffic, inbound intent is the closest thing to "free meetings" you'll find. Visitor ID tools don't create demand; they reveal it.

Leadfeeder (Tier 1)

Leadfeeder's the tool I like when a team says, "We're getting traffic, but sales has no idea who's interested." It identifies the companies visiting your site and gives you a feed you can actually work: what pages they hit, how often they came back, and which accounts are heating up.

The underrated benefit: it forces focus. Instead of arguing about who to target, you work accounts that already raised their hand.

Pricing scales by identified companies/month. Free gives you 7 days of data and 100 identified companies, unlimited users. Paid starts at $99/month billed annually and climbs through higher tiers up to $1,199/month as volume increases. Trial is a 14-day free trial, and it auto-downgrades to Free if you don't purchase.

If you're building the inbound engine, this B2B lead capture playbook pairs well with visitor ID.

Outreach & sending infrastructure (the hidden lead gen tool)

Most "lead gen" failures are sending failures. Your list can be great, but if your domains are burned or your inbox setup's sloppy, you'll still get zero meetings.

A practitioner rule I follow: run lists through two verifiers minimum before high-volume sends. It's annoying. It's also cheaper than repairing deliverability, re-warming domains, and explaining to leadership why reply rates fell off a cliff.

Instantly (Tier 2)

Instantly's a strong SMB-friendly sequencing + sending platform when you need to scale outbound volume without buying an enterprise sales engagement suite. It's built for the modern reality: inbox rotation, throttling, and keeping campaigns separated so one mistake doesn't poison everything.

The tradeoff's blunt: it won't fix bad data. If your inputs bounce, Instantly just helps you bounce faster.

Pricing signal: ~$37-$197/month depending on plan and sending volume.

If you're building a safer outbound system, use this email sending infrastructure checklist.

Outreach (Tier 3)

Outreach is enterprise sales engagement: great when you've got process, enablement, and RevOps maturity. It's overkill for most SMBs and perfect for teams that already run a tight cadence machine.

Pricing's quote-based; plan on ~$12k-$40k+/year depending on seats and modules.

CRM & routing/ops

CRMs don't "generate" leads, but they prevent lead leakage. If you don't dedupe, route, and measure, you'll swear lead gen "doesn't work" when the real issue is follow-up.

HubSpot (Tier 2)

HubSpot's a strong choice when your whole funnel lives in HubSpot and you want inbound enrichment/scoring without stitching together five vendors. It's the cleanest "one system" experience for inbound-heavy teams: capture, score, route, and report without duct tape.

Where teams complain: costs climb fast when you add hubs, seats, and advanced automation. HubSpot's worth it when you commit to using it as the operating system - not when it's just a contact database.

Pricing signal: free CRM; Sales Hub paid plans include Starter from $15/seat/month, Professional $1,450/month (5 seats included) + $1,500 onboarding, and Enterprise $4,700/month (7 seats included) + $3,500 onboarding.

If routing speed is your bottleneck, use these speed to lead metrics to set SLAs.

Pricing reality in 2026: credits, contracts, and true cost per meeting

Most pricing pages hide the only number that matters: cost per meeting booked.

And yes, I'm opinionated about this because I've watched teams light five figures on fire while arguing about which UI "feels nicer."

A simple cost-per-meeting template (use this before you sign anything)

You only need three variables:

- Cost per usable lead (after verification)

- Leads per meeting (your real conversion rate)

- Monthly meeting target

Then:

Monthly data cost ≈ (meetings × leads per meeting × cost per usable lead)

Worked example for a cold outbound motion:

- You want 10 meetings/month

- You need 300 usable leads per meeting (3,000 usable leads total)

- Your all-in cost per usable lead is $0.20 (data + verification blended)

Monthly data cost ≈ 10 × 300 × $0.20 = $600/month

That's the number to compare against contracts and credit bundles - not "how many contacts are in the database."

What this looks like in the real world

ZoomInfo economics: A typical contract lands $15k-$40k+/year. If you mostly export contacts and don't operationalize the suite, you're paying enterprise pricing for a browser-extension habit.

Seamless.AI credit burn: A rep starts on ~$79/user/month for 1,000 credits, then adds extra credits and ends up paying materially more than planned. The frustration isn't the price; it's the unpredictability.

Prospeo unit economics: At ~$0.01 per verified email, the spend stays predictable as you scale, and the 7-day refresh keeps lists from going stale between campaigns. That's not a "nice to have"--it's the difference between learning fast and chasing ghosts in your reporting.

Minimal-stack recommendations (what to buy first)

You only need 2-3 tools. Everything else is an optimization.

SMB outbound stack (fastest path to meetings)

Use this if: you need reps productive this week. Buy: Prospeo + Apollo (+ Instantly optional)

- Prospeo for verified emails/mobiles, enrichment, and predictable economics

- Apollo for rep-friendly prospecting + sequencing in one place

- Instantly if you need higher-volume sending, inbox rotation, and campaign separation

Skip this if: you're trying to do enterprise ABM with buying groups and multi-touch attribution.

Inbound-heavy stack (turn traffic into pipeline)

Use this if: you've got traffic and want sales working warm accounts. Buy: Prospeo + Leadfeeder (+ HubSpot)

- Leadfeeder to identify companies visiting your site and prioritize outreach

- Prospeo to enrich those accounts into the right contacts with verified emails/mobiles

- HubSpot for scoring, routing, and lifecycle reporting in one system

Skip this if: your site traffic's tiny.

EU phone-first stack (compliance + connect rates)

Use this if: you sell into Europe and calls matter. Buy: Prospeo + Cognism (+ outreach tool)

- Cognism for phone-verified mobiles and compliance-forward prospecting

- Prospeo for verified emails, fresh data, and mobile coverage with strong pickup rates

- Add your preferred engagement tool based on org size and process maturity

Skip this if: you're email-only and budget-sensitive.

Three automation recipes you can copy (steal these)

- Hot site visit -> meeting task in minutes: Leadfeeder identifies a target account -> enrich the right persona -> create a CRM task + assign owner -> send a Slack alert to the account owner.

- Outbound list -> safe sending pipeline: build list in Apollo -> verify + dedupe -> push clean leads into Instantly with throttling and inbox rotation enabled.

- Form fill -> instant enrichment + routing: inbound form submission -> enrich company + contact fields -> score -> route to the right rep with an SLA timer and a "no-touch" fallback queue.

These flows beat "buy another tool" because they remove the real bottleneck: handoffs.

Bounce rates above 5% mean your "database" is costing you meetings, not creating them. Prospeo's 5-step verification, catch-all handling, and 7-day refresh turned 35% bounce rates into under 4% for teams like Snyk and Meritt - without a $15K annual contract.

Replace stale data with 300M+ verified profiles for $0.01 each.

FAQ

What's the difference between lead generation tools and sales engagement tools?

Lead generation tools for sales focus on finding, verifying, enriching, and capturing contacts, while sales engagement tools run sequences, calls, tasks, and follow-ups. A practical split is: data/intent = inputs, engagement = execution. If bounces are above 3-5%, fix the input layer before scaling outreach.

Are credit-based lead gen tools actually cheaper?

They're cheaper when you track burn rate and pay for verified outputs (valid emails or found mobiles), not raw "records." Model one month of usage by rep and assume phones cost about 10x an email reveal. If you can't predict spend within +-20%, you'll hate the plan.

How often should a B2B database refresh its data in 2026?

At least weekly, because job changes and role churn can break lists in days. A 7-day refresh cycle keeps campaigns usable across quarters, while monthly updates create stale-by-default contact data. If you run outbound weekly, your data should update weekly too.

Which lead gen tool is best for verified emails without contracts?

Prospeo's a strong pick for verified emails without contracts because it delivers 98% email accuracy, refreshes data every 7 days, and stays self-serve with transparent credits. You can start free with 75 emails + 100 Chrome extension credits/month, then scale when your meeting targets demand it.

Summary: build the stack, not the tool collection

The best lead generation tools for sales aren't the ones with the biggest database or the loudest "AI" claims. They're the ones that keep your inputs clean, your spend predictable, and your workflow simple enough that reps actually use it.

If you want the shortest path to more meetings in 2026: start with a verified data layer, add an execution layer, and only then add intent/workflows when you've earned the complexity.