The Prospecting Pipeline Playbook (2026): Build, Measure, Scale

You can spend $15,000-$40,000/year on a database and still fail at the only thing that matters: reaching the right buyer with a working email and a direct line.

Then your sequence bounces, your domain reputation tanks, and leadership starts blaming reps. It's not a rep problem. It's a system problem, and a broken prospecting pipeline is usually the culprit.

Here's the operating system: stages + exit criteria + cadence + KPIs + hygiene.

What you need (quick version)

Use this as your "don't overthink it" checklist. Implement the bolded items and you'll have something you can measure within two weeks.

The minimum components

- A single set of prospecting stages (pre-opportunity stages, not your deal stages)

- Exit criteria per stage (required fields + proof, not vibes)

- A 10-14 day outbound cadence with a recycle rule

- A weekly dashboard that shows coverage + velocity + deliverability

- A short SLA between SDR/BDR and AEs (or SDR manager and RevOps)

- A hygiene loop (dedupe, verification, suppression lists, domain health)

3 things to implement this week

- Exit criteria: write "what must be true to move forward" for each stage (template below).

- Cadence: ship a baseline 3-5 touches over 10-14 days, then iterate.

- Coverage/velocity dashboard: one view that answers: "Do we have enough at-bats, and are they moving?"

A simple 2-week implementation plan (so it actually ships)

Week 1 (make it auditable):

- Lock your stages and required fields (one schema).

- Add exit criteria + fail criteria (kick-back rules).

- Turn on verification + suppression so you stop feeding bad contacts into sequences. In our experience, this one change does more for reply rates than rewriting subject lines for a month.

Week 2 (make it measurable):

- Launch one baseline cadence per segment/persona.

- Add a recycle rule (30-45 days) and a stagnation purge rule (time-in-stage limits).

- Build the weekly dashboard and run the first pipeline review.

The hard truth about spray-and-pray

Spray-and-pray doesn't just waste time. It burns your market in 4-6 weeks.

What a prospecting pipeline is (and isn't)

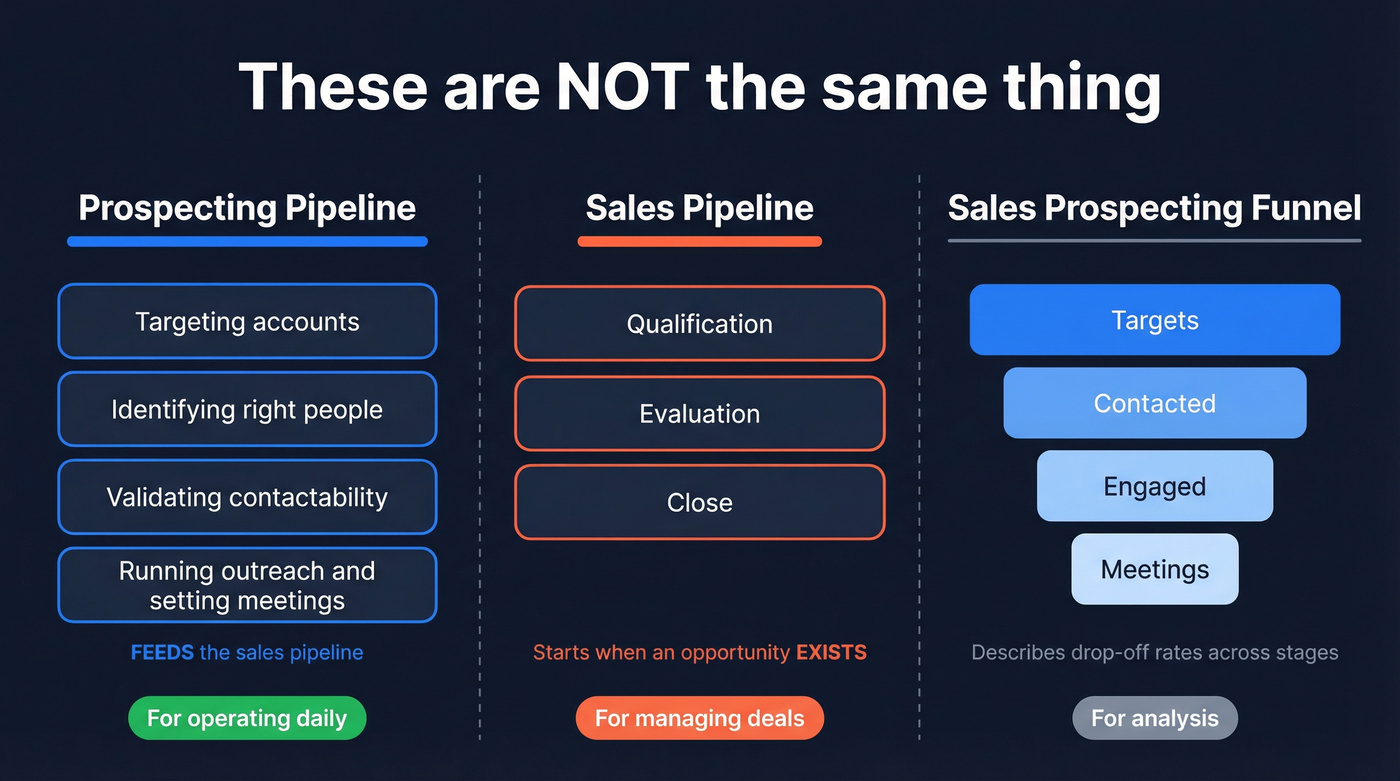

A prospecting pipeline is the pre-sales system that turns "possible buyers exist" into "a specific person at a specific company is reachable and worth a meeting."

It's not your sales pipeline. And it's not your funnel.

Here's the clean separation:

- Prospecting pipeline: everything that happens before an opportunity exists: targeting accounts, identifying the right people, validating contactability, running outreach, and setting meetings. It feeds the sales pipeline.

- Sales pipeline: opportunities that exist and are moving through qualification, evaluation, and close.

- Sales prospecting funnel: a conversion model that describes drop-off rates across prospecting stages. Funnels are great for analysis; pipelines are for operating.

Teams get stuck because they mix these concepts and then measure the wrong thing.

Two failure modes we've seen over and over:

- "Lead volume is up" while delivered is down. Marketing celebrates more leads, SDRs celebrate more sends, but deliverability quietly collapses (bounces, spam placement, throttling). Your funnel looks bigger, but the system's starving because fewer messages land.

- Stage inflation that hides reality. If you use fake stages like "Contacted" or "Working," reps can move records forward without proof. Your dashboard shows activity, but you can't audit reachability, you can't diagnose leaks, and forecasting becomes theater.

Definition box (copy/paste) A prospecting pipeline is a staged, measurable workflow that turns signals (who to target now) into verified contacts and executed outreach, producing meetings that are ready for a sales hand-off.

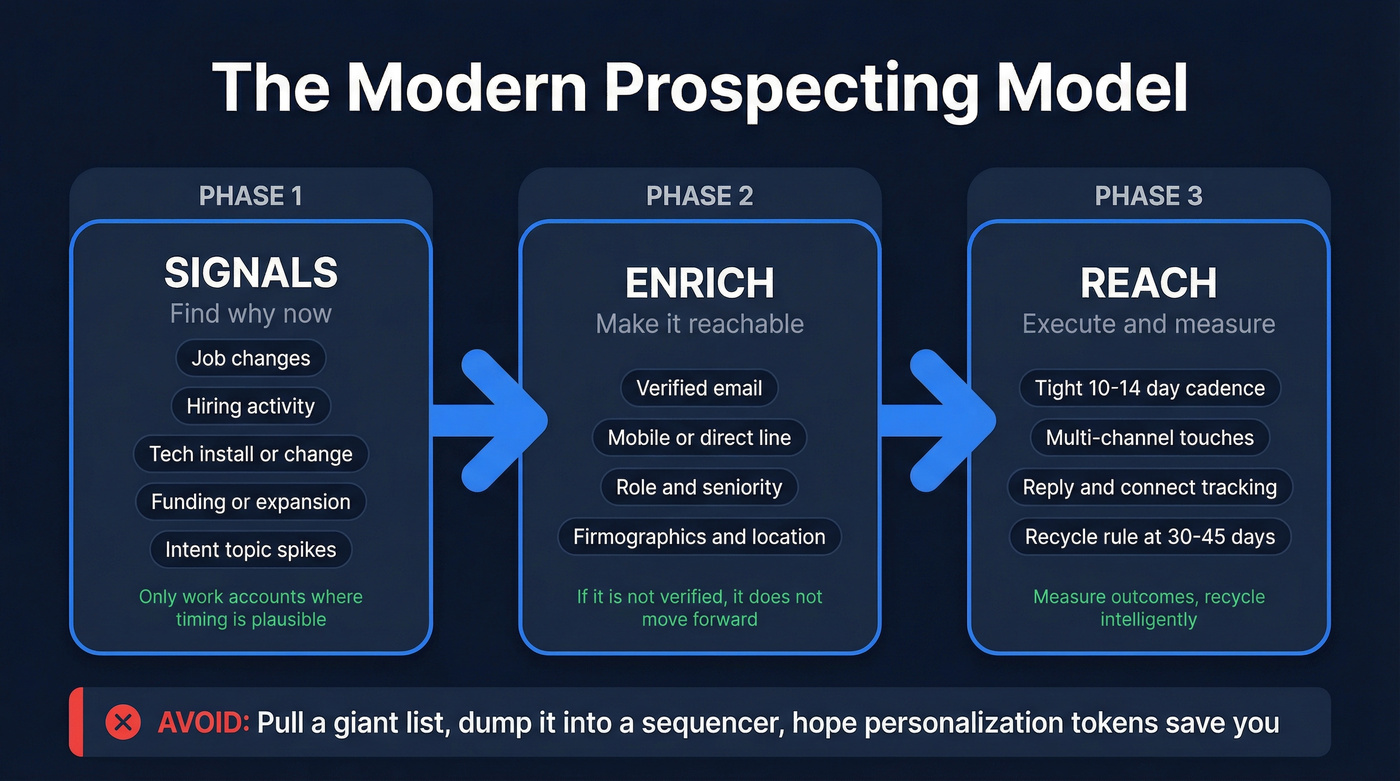

The modern model: Signals → Enrich → Reach (stop spray-and-pray)

Most teams don't have a prospecting problem. They've got a timing problem, and they're trying to solve it with volume.

The modern model is simple.

Do this (signals → enrich → reach)

- Signals: start with why now (job changes, hiring, tech changes, intent topics, funding, new leadership, competitor moves). If you need a tighter taxonomy, see signals and buying signals.

- Enrich: turn an account + persona into complete, verified contact records (email, mobile, role, location, firmographics). (Related: lead enrichment tools and B2B contact data decay.)

- Reach: run a tight cadence, measure outcomes, recycle intelligently. For templates, use a B2B cold email sequence.

This workflow scales without turning your TAM into a spam graveyard, and it shortens the prospecting cycle because you're not wasting touches on unreachable contacts.

Real-world implementation (what actually works)

Signals sources that don't waste your time

- Hiring pages + role-specific job posts (budget + urgency)

- Leadership changes (new VP/Head = new priorities)

- Tech install/change (stack fit or displacement)

- Funding/expansion (capacity to buy)

- Intent topics (in-market research)

Waterfall enrichment: when it's worth it vs when it's just noise Teams run "waterfalls" because no single provider has perfect coverage. In mature ops teams, it's normal to have multiple enrichers firing in the background and only paying for net-new verified fields, but if you don't yet have clean stages, exit criteria, and deliverability controls, a 10-tool waterfall won't save you - it'll just make failures harder to debug. If you're evaluating providers, start with waterfall alternatives.

Look, most prospecting stacks are louder than they are useful.

Handoff friction checklist (so data doesn't die in transit) Before a record can move from "target" to "sequence live," you need:

- Ownership (who works it)

- Dedupe rules (contact + account)

- Suppression rules (customers, competitors, do-not-contact, unsubscribes)

- Field mapping (title, persona, segment, country/state, verified status)

- A single source of truth (CRM wins; sequencer is execution)

Avoid this (the classic failure mode)

- Pull a giant list.

- Dump it into a sequencer.

- Hope personalization tokens save you.

That's the tool-bloat trap: you buy more tools to compensate for a broken process, then you lose weeks reconciling fields and deduping after every export.

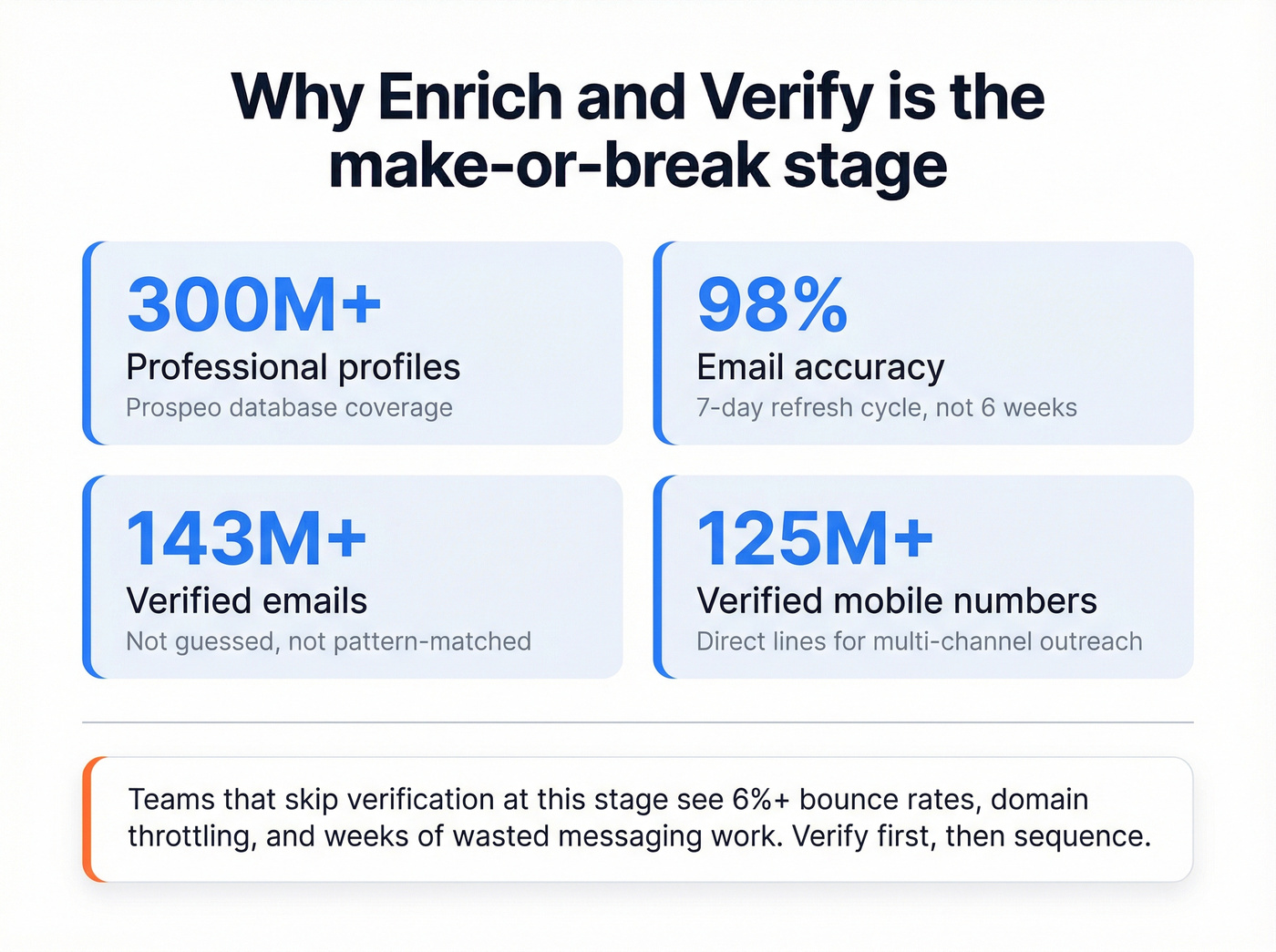

Your prospecting pipeline dies at Stage 2 if enrichment returns bad data. Prospeo's 5-step verification delivers 98% email accuracy and 125M+ verified mobiles - on a 7-day refresh cycle, not the 6-week industry average. Stop feeding unverifiable contacts into sequences.

Fix the enrichment stage and every stage after it gets easier.

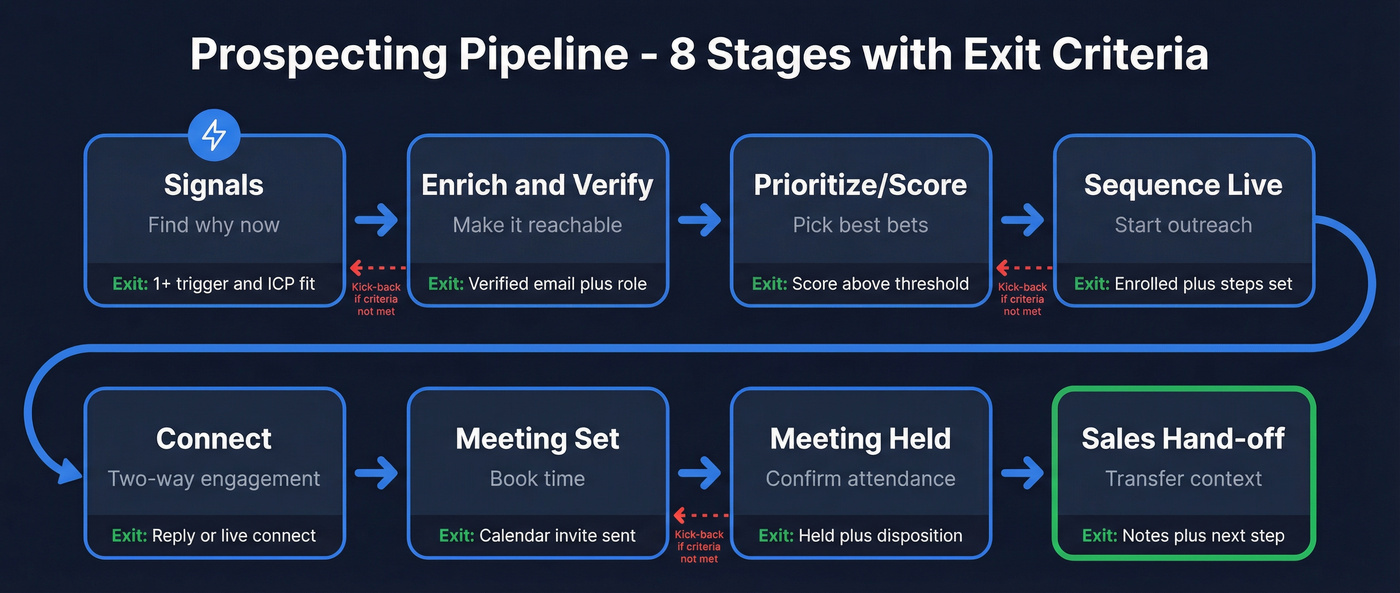

Prospecting pipeline stages + exit criteria (copy/paste template)

These stages are outbound-specific and designed to be auditable. If you can't prove a record meets exit criteria, it doesn't move.

Stages and exit criteria template

| Stage | Goal | Exit criteria (examples) | Proof / audit |

|---|---|---|---|

| Signals | Find "why now" | 1+ trigger + ICP fit | Signal field + link |

| Enrich & Verify | Make it reachable | Verified email + role | Verification status |

| Prioritize/Score | Pick best bets | Score ≥ threshold | Score + inputs |

| Sequence Live | Start outreach | Enrolled + steps set | Sequencer record |

| Connect | Two-way engagement | Reply or live connect | Reply/call log |

| Meeting Set | Book time | Calendar invite sent | Invite + notes |

| Meeting Held | Confirm attendance | Held + disposition | Call outcome |

| Sales Hand-off | Transfer context | Notes + next step | CRM task + doc |

Minimum schema (required fields) by stage

If you want a pipeline you can run like an assembly line, standardize the fields:

- Signals: ICP segment, industry, employee band, geo, trigger type, trigger date, trigger URL (see ideal customer for a clean ICP definition)

- Enrich & Verify: first/last name, title, department, seniority, verified email status, email, phone status, phone (if found), source, last refreshed date

- Prioritize/Score: fit score, signal score, reachability score, total score, score timestamp

- Sequence Live: owner, sequence name, channel mix, start date, suppression check = pass

- Connect: outcome category (positive/neutral/objection/referral/unsubscribe), reply date, call disposition

- Meeting Set/Held: meeting date, attendees, agenda, held status, disposition, next step date

- Sales Hand-off: qualification snapshot, key pains, tools/stack notes, objections, next step + owner

Fail criteria (kick-back rules) that keep stages honest

Add these rules and your pipeline stops lying:

- If no trigger proof, kick back from Signals to Research (or close as "no signal").

- If email isn't verified, kick back from Enrich & Verify (don't allow "Sequence Live").

- If suppression check fails, close as "suppressed" (don't recycle).

- If no owner, kick back from Sequence Live (unowned records rot).

- If meeting set without agenda/notes, kick back before hand-off (AEs shouldn't walk in blind).

Now the details that make this work in the real world.

Signals (what qualifies an account/person to enter)

Goal: Only work accounts where timing is plausible.

Exit criteria examples

- ICP match fields completed: industry, size, geo, tech constraints

- At least one signal captured:

- Hiring in target function

- New exec in role you sell to

- Funding/expansion

- Intent topic spike

- Tech install/change

Proof: a URL, screenshot, or captured signal event. No "gut feel."

Enrich & Verify (where most pipelines quietly die)

Goal: Convert "target" into "outreach-ready."

Exit criteria examples

- Required fields: first name, last name, title, company, country/state

- Email verified (not "guessed")

- Mobile/direct line if calling's part of your motion

- Dedupe check passed (no duplicate contact in CRM)

This stage is where accuracy and freshness stop being "nice to have" and start being the whole game. I've watched teams "fix messaging" for weeks while their bounce rate sat at 6% and their domains got throttled; once they cleaned the list and only sent to verified contacts, replies came back without changing a single line of copy.

If you want a clean, self-serve way to keep contact data accurate and fresh before outreach, Prospeo fits naturally here. It's the B2B data platform built for accuracy, with 300M+ professional profiles, 143M+ verified emails, 125M+ verified mobile numbers, and 98% email accuracy on a 7-day refresh cycle, so you're not sequencing people who changed jobs six weeks ago. If you're comparing options, start with an email verifier website shortlist.

Here's what "good" looks like: enrich a contact, record the verification outcome, and export only what's usable.

Prioritize/Score (stop treating all leads equally)

Goal: Decide who gets touches first.

Exit criteria examples

- Score computed from explicit inputs (not rep opinion):

- ICP fit (0-40)

- Signal strength (0-40)

- Reachability (0-20: verified email + mobile)

- Score threshold met (example: ≥70)

Proof: score stored on the record + the input fields populated. For scoring models, see lead scoring systems.

Sequence Live (your "work in progress" stage)

Goal: Start outreach with a defined plan.

Exit criteria examples

- Enrolled in the correct sequence for persona + segment

- Owner assigned

- Suppression checks passed (competitors, customers, do-not-contact)

Proof: sequencer enrollment record + sequence name.

Connect (the first real conversion point)

Goal: Two-way engagement, not "sent."

Exit criteria examples

- Positive reply, neutral reply, objection reply, referral, or live conversation

- If calling: connected conversation logged (not voicemail)

Proof: reply text captured or call disposition logged.

Meeting Set

Goal: A real calendar commitment.

Exit criteria examples

- Calendar invite sent and accepted (or at least tentatively held)

- Meeting type and agenda captured

- Attendees confirmed (multi-threading if needed)

Proof: invite + notes in CRM.

Meeting Held

Goal: Attendance + outcome.

Exit criteria examples

- Held status = true

- Disposition captured: qualified, nurture, wrong persona, no fit

- Next step scheduled if qualified

Proof: meeting outcome field + next step task.

Sales Hand-off

Goal: Transfer context so AEs don't restart discovery.

Exit criteria examples

- Account + contact history attached (touches, replies, objections)

- Qualification snapshot (lightweight BANT or early MEDDIC fields)

- Clear next step + owner

Proof: CRM handoff task completed + notes link.

My rule: if handoff notes aren't present, the record doesn't move. Period.

Cadence, recycling, and SLAs (templates that keep it honest)

This system stays honest when (1) the cadence's short enough to measure, (2) recycling's controlled, and (3) handoffs are enforced.

Cadence checklist (baseline rules)

- Keep the first pass tight: 3-5 touches over 10-14 days.

- If you're running true multichannel, run it like you mean it: 7-10 touches over 10-14 days.

- Never "check in." Every touch needs a hook: a signal, a relevant insight, or a clear ask.

- Log outcomes consistently: positive, neutral, objection, referral, unsubscribe. (If you need a definition and rules, use email cadence meaning.)

If calling's part of your motion (most teams under-call)

Email-only prospecting is fragile. Calling gives you a second path to conversion and a faster truth signal.

Operational expectations that keep teams grounded:

- 3-5 call attempts per prospect inside the cadence (paired with email touches).

- Connect rate: 3-10% is a normal band depending on list quality and segment.

- Dial-to-meeting rate: ~2.3% is a realistic planning number for cold calling performance (2026 planning benchmark). For the full model, see B2B cold calling guide.

If your connect rate's 1-2%, don't coach objection handling first. Fix reachability and list quality first.

Recycling rule (so you don't spam)

- If there's no response after the cadence, recycle in 30-45 days.

- Re-enter only if something changed: new signal, new persona, new message angle.

- If you hit a hard no, suppress for 90-180 days depending on your category.

SLA checklist (simple and enforceable)

- New "Sequence Live" records must have: verified email, persona, segment, and sequence name.

- "Meeting Set" must have: agenda + qualification notes.

- AEs must disposition meetings within 24-48 hours (qualified / nurture / no fit) so scoring improves.

Template: 8 touches / 12 days (copy/paste)

Day 1: Email #1 (signal-based hook + 1 question)

Day 2: Call attempt #1 (voicemail optional) + short follow-up email

Day 4: Email #2 (case snippet + "worth exploring?")

Day 5: Call attempt #2

Day 7: Social touch (comment or connect) + Email #3 (breakup-lite)

Day 9: Call attempt #3

Day 11: Email #4 (new angle or referral ask)

Day 12: Final touch (clear opt-out + next step)

Recycle: 30-45 days if no response

The KPIs that run the prospecting pipeline (with formulas + benchmarks)

If you only track "meetings booked," you'll always be surprised at the end of the month.

This is a production system. You need coverage (enough at-bats), conversion (stage-to-stage health), and velocity (how fast value moves).

KPI scoreboard (what to track weekly)

| KPI | Formula | Weekly use |

|---|---|---|

| Coverage ratio | Pipeline ÷ target | "Enough at-bats?" |

| Stage conversion | Next ÷ prior | "Where's the leak?" |

| Cycle time | Days in stage | "Where's it stuck?" |

| Velocity ($/day) | (Opp×Deal×Win)÷days | "Is it moving?" |

| Bounce rate | Bounces ÷ sent | "Data hurting us?" |

| Positive reply | Pos replies ÷ delivered | "Message-market fit?" |

| Meeting held rate | Held ÷ set | "Quality + follow-through?" |

Pipeline shape cheat sheet (diagnose the real problem in 60 seconds)

Pipeline has a shape. When the shape's wrong, your fixes should be obvious.

- Top-heavy (lots of Signals / Enrich, few Connect): targeting's too broad or deliverability's broken. Fix verification, suppression, and segment focus before you touch copy.

- Mid-stuck (Sequence Live piles up, Connect doesn't move): offer/message mismatch or weak hooks. Tighten segmentation, rewrite the first touch, and add a stronger reason-now.

- Bottom-heavy (Meetings Set high, Meetings Held low): meeting quality and confirmation are broken. Fix agenda discipline, reminders, and handoff context.

Hot take: if your deal size is small, you don't need a perfect enterprise stack. You need ruthless focus on one segment, clean data, and a cadence you can run every week without burning out.

Time-in-stage limits (timeboxes) + stagnation purge rule

Timeboxes stop zombie records from inflating your pipeline.

Use these defaults, then tune by segment:

- Signals: ≤ 7 days (if the trigger's old, it's not a trigger)

- Enrich & Verify: ≤ 48 hours

- Prioritize/Score: ≤ 72 hours

- Sequence Live: ≤ 14 days (one full cadence window)

- Connect: ≤ 14 days

- Meeting Set: ≤ 7 days from first positive reply

- Meeting Held: scheduled date + 0 days (it either happened or it didn't)

- Sales Hand-off: ≤ 24 hours after held meeting

Stagnation purge rule (non-negotiable): if a record exceeds its timebox twice, close it as "stagnant" and only let it re-enter with a new signal.

Coverage ratio (and the benchmarks people actually use)

Coverage ratio = total pipeline value ÷ sales target

Benchmarks commonly used in RevOps:

- SMB: 2-3x

- Mid-market: 2.5-4x

- Enterprise: 3-5x

Reference: https://www.outreach.io/resources/blog/pipeline-coverage

Stop doing this: "coverage = 1 / win rate"

That math creates dumb behavior (stuffing pipeline with junk to "hit coverage").

Better method: week-3 starting pipeline conversion rate

- Take a trailing set of quarters.

- For each quarter, compute: Week-3 starting pipeline conversion rate = new ARR closed ÷ pipeline open at week 3

- Average it, then invert it to get a realistic implied coverage target.

Mini example:

- Trailing average week-3 conversion rate = 28% → implied coverage target ≈ 3.6x

- Trailing average week-3 conversion rate = 18% → implied coverage target ≈ 5.6x

Pipeline velocity (the KPI that forces tradeoffs)

Pipeline velocity = (# Opportunities × Avg Deal Value × Win Rate) ÷ Sales Cycle Length (days)

Reference: https://fullcast.io/blog/pipeline-velocity

Two rules:

- Only count sales-qualified opportunities. If you include junk, velocity becomes a vanity metric.

- Track velocity weekly, but manage it monthly.

Worked example:

- 40 qualified opps

- $18,000 average deal

- 20% win rate

- 60-day cycle

Velocity = (40 × 18,000 × 0.20) ÷ 60 = $2,400/day

Now you can make real tradeoffs: more opps, higher deal size, better win rate, or shorter cycle.

Outbound vs inbound expectations (so you don't benchmark yourself into stupidity)

Inbound meeting booking is a different sport. Inbound "request a demo" flows convert at multiples of outbound because intent's explicit. Outbound has to manufacture intent with timing + relevance.

Don't punish your outbound team for not matching inbound conversion rates; punish the system if it can't show delivered, replies, and held meetings cleanly.

Stage conversion baselines (sanity check)

Broad funnel baselines are useful for spotting "we're wildly off," not for setting targets:

- Lead → MQL: 22%

- MQL → SQL: 15%

- SQL → Opportunity: 11%

- Opportunity → Closed-won: 7%

Reference: https://www.marketjoy.com/blog/sales-funnel-conversion-rates

For prospecting-specific health, track these weekly:

- Delivered → reply

- Reply → positive reply

- Positive reply → meeting set

- Meeting set → meeting held

If you can't track delivered → reply, your pipeline isn't measurable. Fix instrumentation before you optimize.

SDR output benchmarks (capacity planning anchor)

A solid planning anchor: ~15 meetings/SALs booked per SDR per month with ~20% drop-out from booked to attended, so ~12 held meetings/month.

Reference: https://about.crunchbase.com/blog/sdr-metrics

A simple weekly dashboard spec (copy/paste)

Dashboard tiles

- New Signals added (count)

- Enriched & Verified (count + % of signals)

- Sequence Live (count)

- Replies (count + reply rate)

- Positive replies (count + rate)

- Meetings set (count)

- Meetings held (count + held rate)

- Bounce rate (target <2%)

- Coverage ratio (by segment)

- Velocity ($/day) for qualified opps

Breakdowns

- By segment (SMB/MM/ENT)

- By persona

- By source (signals channel)

- By rep/team

Reference: https://www.gong.io/blog/pipeline-data

Deliverability & data hygiene (the hidden reason pipelines starve)

Most teams think they've got a messaging problem. They've got a deliverability problem.

Global inbox placement sits around ~84%. Microsoft inbox placement is lower at 75.6%. And once complaint rates creep above 0.3%, inbox placement drops fast.

Reference: https://mailreach.co/blog/inbox-placement-rate

So before you touch copy, you're fighting physics. If you want the updated playbook, see email deliverability.

The operating standard (keep it consistent)

- Target bounce rate: <2%.

- If you're at 3-5%, you're already in the danger zone. Pause scaling.

- If you're above 5%, stop the line. Fix data and list hygiene before you send another batch.

Good hygiene (what "healthy" looks like)

Pros

- Bounce rate stays <2%

- Positive reply rate lands 2-5%+

- Meetings held rate stays 70-85%

- You can scale volume without results collapsing

What you do

- Verify emails before sequencing

- Suppress risky segments (old lists, scraped domains, role accounts)

- Remove spam traps and honeypots

- Keep lists fresh (job changes alone will wreck you)

Bad hygiene (what "pipeline starvation" looks like)

Cons

- Bounces spike, then opens drop, then replies disappear

- Reps work harder and burn out

- You churn tools because you think the database's the issue

What you do

- Upload unverified CSVs

- Treat catch-all as "good enough"

- Keep hammering the same dead segment

Skip this if you're only sending 20 hand-picked emails a week from referrals. Everyone else needs a verification gate. If you need an SOP, use an email verification list.

Here's the workflow I recommend: verify first, then export only deliverable contacts into your sequencer/CRM so bounce risk can't silently poison the whole pipeline.

Weekly pipeline review agenda (governance that compounds)

Pipelines don't fail because people are lazy. They fail because nobody runs the operating system.

Run this weekly. Same time. Same dashboard. Same definitions.

30-minute agenda (copy/paste)

- 5 min - Inputs: signals added, enriched & verified count, sequences launched

- 5 min - Deliverability: bounce rate, complaint signals, spam placement indicators

- 10 min - Conversions: replies → positive replies → meetings set → meetings held (by segment + persona)

- 5 min - Bottlenecks: where cycle time's growing (stuck stages)

- 5 min - Decisions: 3 actions with owners (pause a segment, change scoring, fix data source, adjust cadence)

Weekly tracking beats ad-hoc tracking on growth and forecast accuracy.

Reference: https://firstpagesage.com/seo-blog/sales-pipeline-velocity-metrics/

Troubleshooting flow (if/then, print this)

- If bounce rate >2% → stop scaling, verify lists, tighten suppression, and refresh contacts.

- If delivered's fine but replies are low → narrow segment + rewrite the first touch around a single signal.

- If replies are fine but meetings set is low → your CTA is weak; ask for a specific next step and offer two time options.

- If meetings set is fine but held is low → fix confirmation (agenda, reminders, "what we'll cover"), and qualify harder before booking.

- If held is fine but handoff opp creation is low → your AE disposition and handoff notes are broken; enforce the SLA.

Minimal tool stack by stage (keep it lean)

Tool stack bloat is real. It's also expensive in the only metric that matters: cost per held meeting.

Minimum viable stack (by stage)

| Stage | Minimum tool | Typical cost signal (2026) |

|---|---|---|

| Signals | Sales Navigator (or equivalent) | ~$99-$149/user/mo |

| Signals (optional) | Intent platform | ~$10k-$60k+/year (often annual) |

| Enrich & verify | Prospeo | Free tier + ~$0.01/email; 10 credits/mobile |

| Sequencing | Smartlead / Instantly / Lemlist | ~$30-$120/user/mo |

| CRM | HubSpot / Salesforce | ~$25-$330+/user/mo |

| Automation | Zapier / Make | ~$20-$200/mo |

Cost-per-meeting math (the part teams ignore)

Use this simple equation:

Cost per held meeting = (tooling + data + labor) ÷ held meetings

Worked example (round numbers):

- Tooling + data: $1,200/month

- Labor: $6,000/month (one SDR fully loaded)

- Held meetings: 30/month Cost per held meeting = (1,200 + 6,000) ÷ 30 = $240

Now watch what bad data does:

- If bounce/deliverability issues cut held meetings from 30 → 20, your cost per held meeting jumps to $360 without spending a dollar more. That's why "cheap" data is the most expensive line item in outbound.

Keep the stack lean with one rule

Add tools only when they remove a bottleneck you can already see on the dashboard. If you can't point to the leak (deliverability, connect rate, held rate, handoff), you're not buying help - you're buying distraction.

Also, if you're running sequences fed by targeted account/persona lists (from your CRM, CSVs, or web sources), the only thing that matters is that enrichment pushes clean, verified contacts into your CRM and sequencer without CSV gymnastics. That's where systems compound, or stall across the prospecting cycle.

Spray-and-pray burns your TAM in 4-6 weeks. The Signals → Enrich → Reach model only works when enrichment actually works. Prospeo returns 50+ data points per contact at a 92% match rate - so your exit criteria are met before a single sequence fires.

Start with contacts that pass every exit criterion on day one.

FAQ: Prospecting pipeline

What's the difference between a prospecting pipeline and a sales pipeline?

A prospecting pipeline covers everything before an opportunity exists: signals, contact enrichment, verification, outreach, and meetings. A sales pipeline starts at opportunity creation and tracks deals to close. Keep separate stages and dashboards so you can audit reachability, conversion, and handoffs without "activity" masking reality.

What are good prospecting pipeline KPIs to track weekly?

Track: signals added, enriched & verified count, sequence-live count, delivered rate, reply rate, positive reply rate, meetings set, meetings held rate, and bounce rate (keep it under 2%). If you can't measure delivered → reply each week, fix deliverability and tracking before changing copy.

How many touches should an outbound cadence include in 2026?

For most teams, start with 3-5 touches over 10-14 days and iterate by segment. For true multichannel, use 7-10 touches over 10-14 days. If you can't explain the reason-now in one sentence for each touch, you're adding noise, not conversion.

What bounce rate is "safe" for outbound prospecting?

Under 2% is safe. At 3-5%, pause scaling and tighten verification, freshness, and suppression. Above 5%, stop sending until the list's fixed. This one metric predicts whether replies will collapse next week, even if your copy's solid.

What tool helps verify emails before sequencing (to protect deliverability)?

A reliable verifier confirms deliverable addresses, handles catch-all domains, and lets you export "valid only" so bounces don't poison your sending domain. Prospeo does this with 98% email accuracy and a 7-day refresh cycle, which is ideal for keeping outreach lists clean.

Summary: how to make your prospecting pipeline actually work

If you want this to produce meetings (not dashboards), keep it simple: define stages, enforce exit criteria, run a tight cadence, and review the same KPIs weekly.

Most "pipeline problems" are really reachability and hygiene problems. Fix verification and suppression first, then iterate messaging.

Do that, and your prospecting pipeline becomes a measurable production system instead of a vibes-based activity report.