Market Intelligence in 2026: What It Is, What It Costs, and How to Build a Program That Works

Your CEO asks about competitive positioning. Your last real analysis is from Q3 last year. You've got a Slack thread with screenshots of a competitor's pricing page, a half-finished spreadsheet, and a gut feeling. The sales team wants updated battlecards. Product is scoping a feature nobody validated against the competitive set. And you're about to walk into a board meeting where someone will ask, "What's our moat?"

You'll wing it.

That's not market intelligence. That's improvisation.

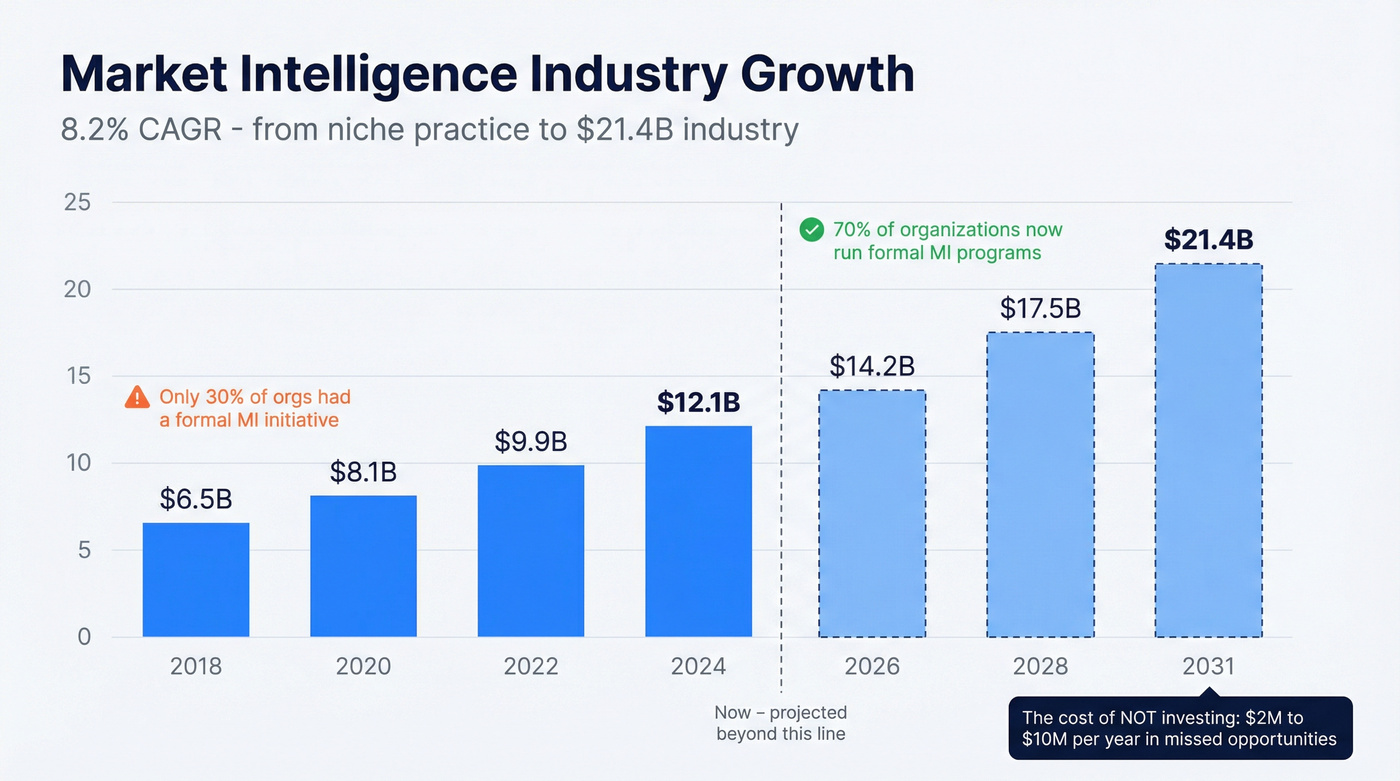

Seventy percent of organizations now run a formal MI initiative, up from 30% in 2018. The industry hit $12.1 billion in 2024 and is growing at 8.2% CAGR toward a projected $21.4 billion by 2031. The gap between companies that know their market and companies that guess is widening fast - and the companies investing in MI aren't doing it because it's trendy. They're doing it because guessing costs real money: $2 to $10 million per year in missed opportunities from inadequate competitive intelligence alone.

What Is Market Intelligence?

Here's the academic definition, from Hedin, Hirvensalo, and Vaarnas in the Handbook of Market Intelligence:

Market intelligence is the distinct discipline by which organisations systematically gather and process information about their external operating environment in order to facilitate accurate and confident decision making that is based on insight.

In plain English: MI is how you understand the world outside your company well enough to make smart bets. It's the practice of converting external signals - competitor moves, customer shifts, regulatory changes - into confident strategic decisions.

The concept traces back to Kelley in 1965, but the modern discipline has exploded. That 8.2% CAGR reflects something real: companies are tired of making strategic decisions based on stale reports and executive intuition.

One thing that trips people up: Salesforce and others often conflate "market intelligence" with "marketing intelligence." They're not the same. Marketing intelligence is narrower - it's about understanding your marketing channels, campaign performance, and audience behavior. MI is the broader discipline that covers your entire external environment: competitors, customers, industry trends, regulatory shifts, supplier dynamics, and macroeconomic forces.

MI isn't a tool. It's a practice. Tools help, but the discipline is about building a repeatable system for turning external signals into internal decisions.

Market Intelligence vs. Competitive Intelligence vs. Business Intelligence vs. Market Research

If you can't explain the difference between these four in one sentence each, you're not ready to buy a tool.

| Discipline | Focus | Primary Data Sources | Key Question | Example Output |

|---|---|---|---|---|

| Market Intelligence | Full external environment | Industry reports, trade data, social listening, economic forecasts | Where should we play? | Market entry analysis |

| Market Research | Specific audience deep-dive | Surveys, interviews, focus groups (primary) | What should we build and say? | Product-market fit study |

| Business Intelligence | Internal operations | CRM, ERP, financial systems (internal) | How are we performing? | Sales dashboard, forecast |

| Competitive Intelligence | Rival tracking | Public filings, websites, review sites, job boards | How do we outmaneuver? | Battlecard, win/loss report |

The summary that makes this stick: MI reveals where to play, market research clarifies what to build and say, BI ensures you can deliver, and CI helps you outmaneuver rivals.

These disciplines overlap, but they serve different masters. MI is strategic and broad - the 360-degree view of your external environment, including trends, customer segments, macroeconomic shifts, and category dynamics. It draws primarily from secondary data: analyst briefings, trade publications, economic forecasts, social listening.

Market research goes deep and narrow. It's primary data - surveys, interviews, focus groups - aimed at answering specific questions about a specific audience. You commission market research to validate product-market fit or test messaging. You build an MI program to understand the playing field. Some teams blend both under the umbrella of market research intelligence, but keeping the disciplines distinct prevents scope creep.

BI is the internal mirror. It tells you how your company is performing using your own data - CRM records, financial systems, operational metrics. The BI market was valued at $34.82 billion in 2025, which tells you how much companies invest in understanding their own operations. BI has evolved from static dashboards into real-time analytics, but it still looks inward while MI looks outward.

CI is the sharpest lens - specifically about tracking and analyzing competitors, their moves, their hiring, their pricing, their product launches. The CI software market crossed $4 billion in 2024, and it's the discipline most people think of when they hear "MI." But CI is just one component.

The mistake most teams make is buying a CI tool and calling it their MI program. That's like buying a telescope and calling it an observatory.

Types of Market Intelligence

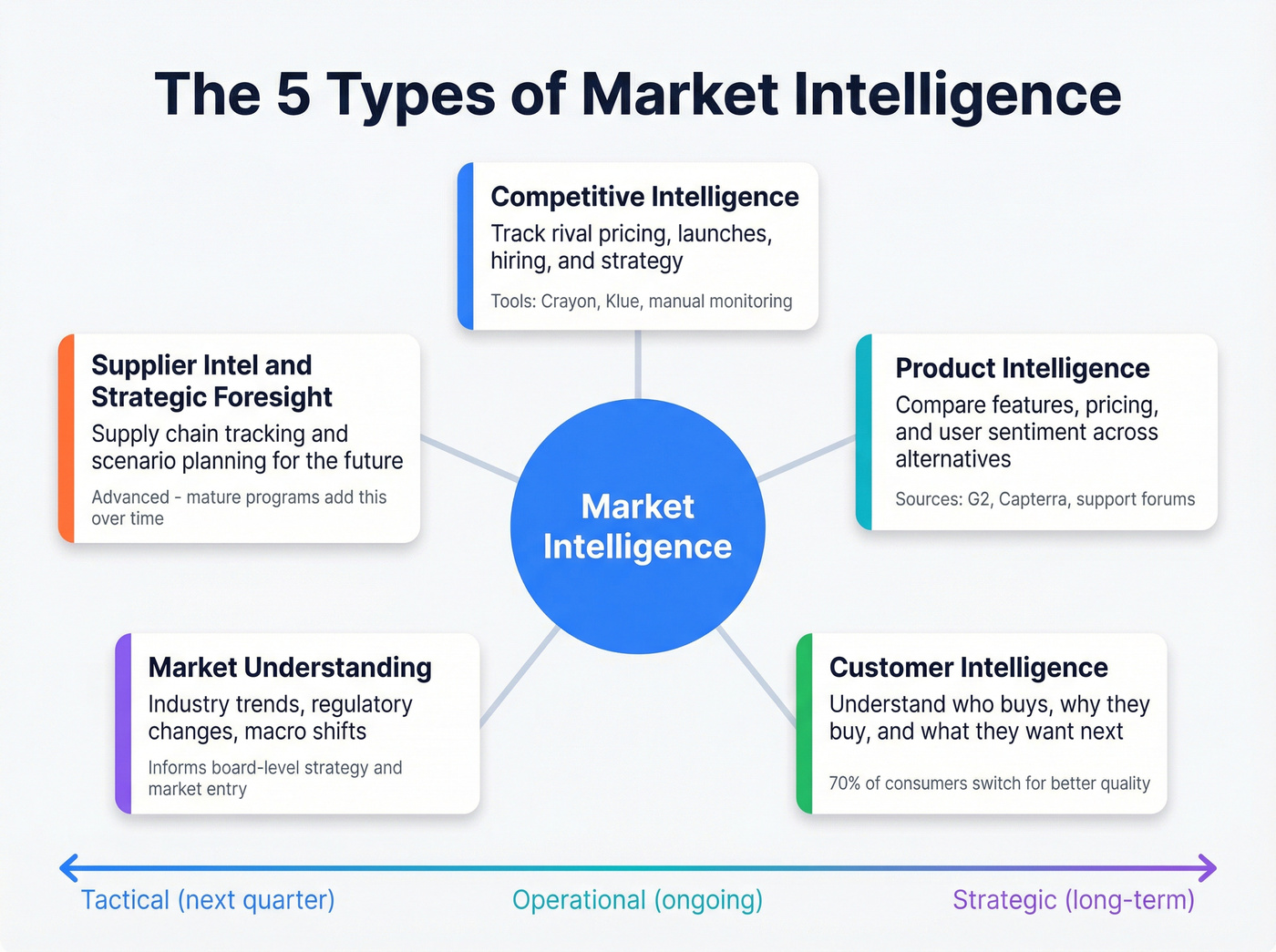

Competitive Intelligence

The most familiar type. Tracking competitor pricing, product launches, hiring patterns, marketing campaigns, and strategic moves. This is where tools like Crayon and Klue live - automated monitoring of competitor websites, review sites, job boards, and press releases. When Coca-Cola repositioned Zero Sugar, it wasn't a guess; research about shifting consumer preferences toward low-sugar options drove the entire launch strategy. The goal isn't just knowing what competitors are doing. It's anticipating what they'll do next.

Product Intelligence

Understanding how your product compares to alternatives - feature gaps, pricing positioning, user sentiment. This pulls from review sites like G2 and Capterra, support forums, and direct customer feedback. 96% of buyers research before talking to sales, which means your product's market perception is being shaped whether you're tracking it or not.

A SaaS company that monitors G2 reviews weekly will spot feature-gap complaints months before they show up in churn data.

Customer Intelligence

Who's buying, why they're buying, and what they'll want next. This overlaps with market research but operates continuously rather than in project-based bursts. 70% of consumers will switch brands if they find one that offers better quality - customer intelligence helps you spot that risk before it shows up in churn numbers. Netflix's recommendation engine is customer intelligence at scale: continuously learning what viewers want next, not waiting for a quarterly survey.

Market Understanding

The macro view: industry trends, regulatory changes, economic shifts, technology adoption curves. This is the type of MI that informs board-level strategy - market entry decisions, M&A targets, geographic expansion. It's the least tactical and the most consequential. Mature programs distinguish between tactical MI (next quarter's competitive moves), operational MI (ongoing market monitoring), and strategic MI (long-term industry shifts) - and resource each differently.

Supplier Intelligence and Strategic Foresight

Two advanced types that mature MI programs add over time. Supplier intelligence tracks your supply chain ecosystem - vendor stability, pricing trends, alternative sources. Strategic foresight extends the time horizon, using scenario planning and trend analysis to prepare for futures that haven't arrived yet. Most teams don't start here, but the best ones get here eventually.

Market intelligence without accurate contact data is just a report nobody acts on. Prospeo gives you 300M+ profiles, 98% verified emails, and intent data tracking 15,000 topics - so you go from insight to outreach without the gap.

Stop analyzing markets you can't actually reach. Start connecting.

Why Market Intelligence Matters in 2026

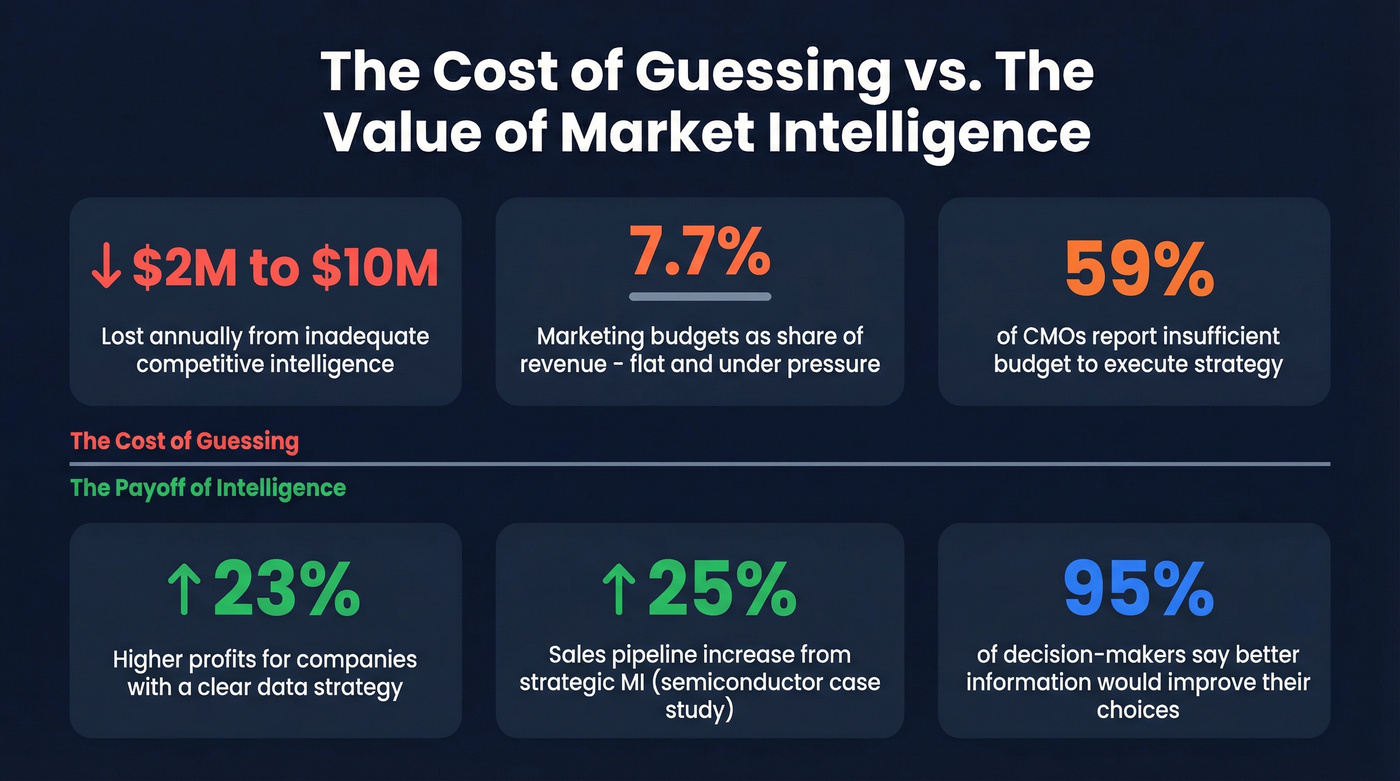

Marketing budgets sit flat at 7.7% of overall company revenue. CFO pressure on marketing leaders increased 52% between 2023 and 2025. And 59% of CMOs report insufficient budget to execute their strategy.

The math is brutal: you're expected to do more with less, and "more" increasingly means making better decisions, not running more campaigns.

Companies lose $2-$10 million annually from inadequate competitive intelligence alone. That's not a theoretical number - it's the cost of entering the wrong market, missing a competitor's pivot, or building features nobody asked for. Nokia and Blockbuster are the dramatic examples, but the quiet version happens every quarter at companies that simply didn't see the shift coming.

One mid-size B2B SaaS marketer put it bluntly: "Our exec team keeps asking about competitive positioning and I feel like I'm guessing half the time." That's not a tooling problem. It's an intelligence problem - and increasingly, teams are turning to specialized market intelligence services to close the gap rather than trying to build everything from scratch.

The upside is equally real. Companies with a clear data strategy achieve 23% higher profits than competitors without one. A semiconductor manufacturer used strategic MI to increase sales pipeline by 25% and reduce customer churn by 50%. And 95% of decision-makers say better access to information would improve their choices - which is both obvious and damning, because it means most decisions are still being made with incomplete information.

The pressure isn't going away. If anything, the combination of tighter budgets, faster market cycles, and AI-driven disruption makes MI more critical than it's ever been.

How to Build a Market Intelligence Program

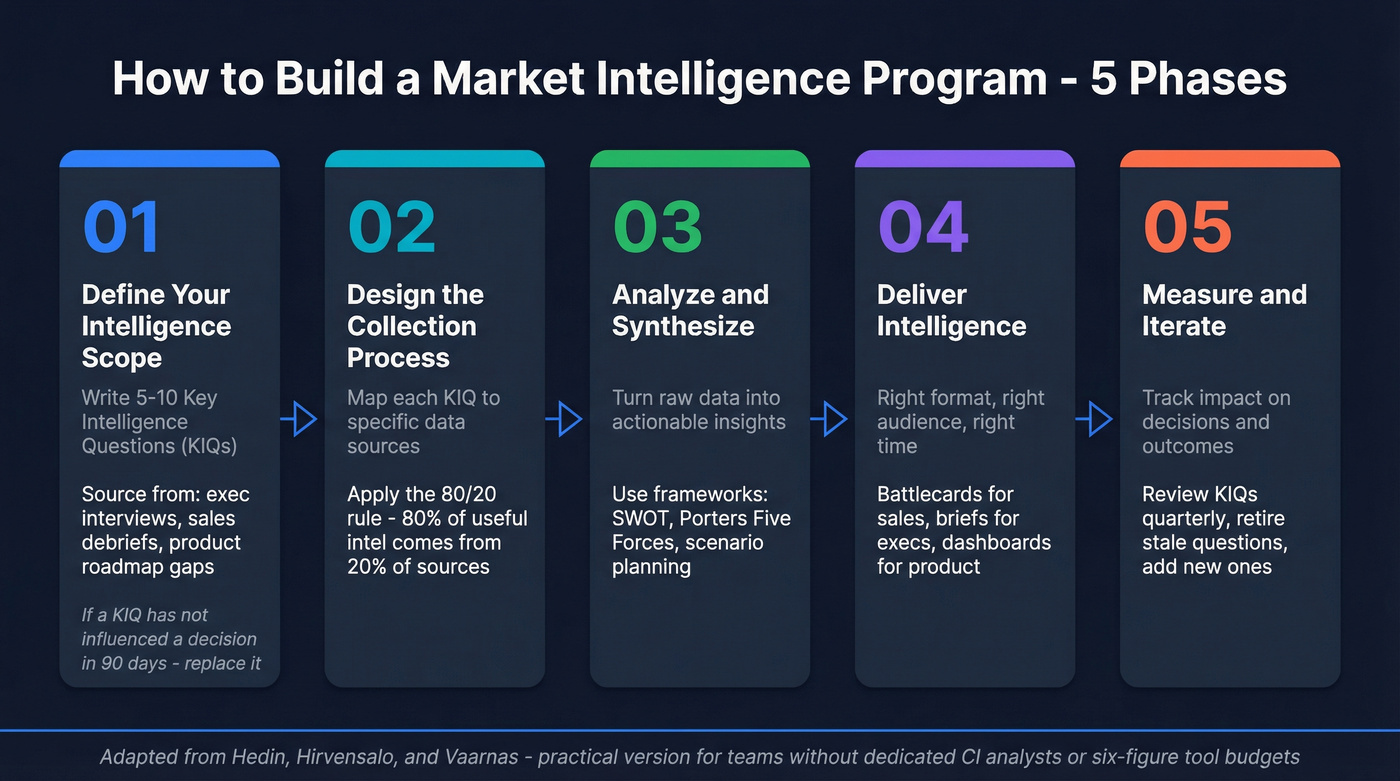

The Hedin et al. framework breaks MI implementation into five phases. I've adapted it with practical guidance for teams that don't have a dedicated CI analyst or a six-figure tool budget.

Define Your Intelligence Scope (KIQs)

Start with Key Intelligence Questions - the 5-10 questions your leadership team actually needs answered. Not "what are our competitors doing?" (too broad) but "which competitors are expanding into our mid-market segment, and what's their pricing strategy?"

KIQs are the antidote to information overload. Without them, you'll collect everything and analyze nothing.

Get your KIQs from three sources: executive interviews, sales team debriefs, and product roadmap gaps. Write them down. Review them quarterly. If a KIQ hasn't influenced a decision in 90 days, replace it.

Design the Collection Process

Map each KIQ to specific data sources. Competitive pricing questions need website monitoring and win/loss analysis. Market trend questions need industry reports and analyst briefings. Customer intelligence questions need review site monitoring and support ticket analysis.

The 80/20 rule applies here: 80% of useful intelligence comes from 20% of your sources. Identify those sources early and automate what you can. AI is flipping the traditional ratio - analysts used to spend 80% of their time gathering information and 20% analyzing it. The goal is to reverse that. Structured scraping of competitor pages, pricing feeds, and job boards can replace hours of manual research, and that's where automation pays off fastest.

Choose Your Tools

Don't buy tools before you've defined your KIQs and collection process.

I've watched teams spend $40K on a CI platform and then realize they needed a $125/month website monitoring tool instead. 61% of B2B buyers now prefer a rep-free buying experience, which means self-serve tools with transparent pricing aren't just convenient - they're aligned with how modern teams want to buy. Your foundation layer is data quality. For B2B teams, that means accurate contact and company data. Layer monitoring tools (Feedly MI, Visualping) on top for competitive tracking, and add a CI platform (Crayon, Klue) only when you have someone dedicated to using it.

Build the Organization

Someone needs to own MI. In companies under 50 people, that's usually a product marketer or a strategic ops person who spends 20-30% of their time on intelligence. In larger organizations, it's a dedicated CI analyst or a small MI team reporting into strategy or product marketing. Some companies outsource parts of the function to a market intelligence firm, particularly for specialized research like market sizing or regulatory analysis that doesn't justify a full-time hire.

Research from Queen's University Belfast found that MI utilization in small businesses depends heavily on the owner-manager's commitment. Translation: if leadership doesn't care about intelligence, nobody else will either.

Develop an Intelligence Culture

This is the hardest phase. Intelligence culture means decisions are expected to reference external data, not just internal metrics. It means sales reps share competitive intel from calls. It means product managers check the competitive set before scoping features.

Expect 12-18 months to build this. The 3-6 month mark gets you the basics - defined KIQs, initial tools, a regular reporting cadence. Maturity means intelligence is embedded in how teams think, not just what one person produces.

For Small and Mid-Size Teams: Only about 20% of teams under 50 people have a formal CI function - but the ones that do outperform. You don't need a $50K platform to start. Begin with one person, three tools, and five KIQs. Build the habit before you build the stack.

Best Market Intelligence Tools in 2026

Most MI guides are written by vendors who want to sell you a $50K platform. Here's what's actually worth your time, organized by category and priced honestly.

Competitive Intelligence Platforms

AlphaSense

AlphaSense is the heavyweight for deep market and investment research. It indexes earnings calls, SEC filings, broker research, news, and market reports with AI-powered search that understands synonyms and sentiment. The expert call library is the real differentiator - neither Crayon nor Klue offers anything comparable. If your strategy team needs to understand market dynamics at the level of a financial analyst, this is the tool.

It earned a 4.6 on Gartner Peer Insights and was named to Fortune's Top 50 AI Innovators in 2025. The tradeoff is price and audience - enterprise pricing (~$10K-$25K/year per user), geared toward finance and strategy users, not product marketers building battlecards.

Crayon

Use Crayon if you're a product marketing team with a dedicated CI analyst who needs real-time competitive tracking, automated battlecards, and AI-powered alerts. It starts at $39/user/month, which makes it accessible for mid-stage companies.

Skip Crayon if you don't have someone to manage the noise. The #1 complaint from users: irrelevant alerts and stale data creeping into feeds. Without active curation, Crayon becomes a firehose you stop checking after two weeks. Gartner Peer Insights: 4.5.

Klue

Why it wins: Klue is built for sales enablement. Unlimited competitor tracking, customizable battlecards, and collaboration tools that get intelligence into the hands of reps, not just analysts. It's the highest-rated CI platform on Gartner Peer Insights at 4.7.

Key tradeoff: Klue only crawls public data sources. If you need premium content, expert calls, or financial filings, you'll need to supplement with AlphaSense or manual research. Users also report filtering challenges - similar to Crayon's noise problem, but from a narrower data pool.

Pricing: Custom, typically ~$20K-$50K/year for mid-market companies.

B2B Data and Prospecting Intelligence

Cognism runs phone-verified mobile numbers and Bombora intent data, with strong EMEA coverage. Two tiers (Grow and Elevate), both custom-priced - expect ~$1,000-$3,000/month for small teams. Good complement if you need verified direct dials in European markets.

ZoomInfo is the enterprise default - massive US database, org charts, intent data, and workflow tools. But a mid-market contract typically runs $15K-$40K/year, and the #1 complaint on Reddit is paying for modules you don't use. If you need the full GTM platform, it delivers. If you just need accurate contact data, you're overpaying.

Digital Market Analysis and Research

Similarweb

Pros:

- Tracks 100M+ websites with traffic data, keyword intelligence, and competitive benchmarking

- Free tier is genuinely useful for quick competitive checks

- Starter plan at $125/mo is reasonable for the depth of digital market data

Cons:

- Traffic estimates can be unreliable for smaller sites (under ~50K monthly visits)

- Professional tier jumps to $349/mo, which adds up fast for multi-user teams

- Focused on digital - won't help with offline market dynamics

Statista covers 1M+ statistics across 80K+ topics from 22.5K+ sources. It's the go-to for market sizing, trend data, and industry benchmarks. Free tier for basic stats; Starter at $199/mo, Professional at $959/mo. Worth it if you're producing regular market reports or board presentations.

Feedly Market Intelligence has the highest Gartner Peer Insights rating in the category at 4.9. It's a competitive monitoring and news aggregation platform that's particularly strong for tracking industry trends and competitor mentions across thousands of sources. Custom pricing - based on community reports, expect ~$6,000-$18,000/year depending on team size and features.

Monitoring and Alerts

Owler offers crowd-sourced company intelligence on 15M+ companies. Free community tier; Pro at $35/mo. Useful for quick competitor snapshots but limited depth.

Visualping monitors website changes - pricing pages, product pages, job boards. Free tier; premium from $13/mo. Simple and effective for the specific use case of "tell me when this page changes." Gartner Peer Insights: 4.6.

SpyFu handles competitor keyword and ad research from $39/mo. Narrow but deep - if competitive SEO/SEM intelligence is a priority, it's worth the price.

Competeshark tracks competitor website changes starting at $29/mo, tiered by pages monitored. Niche but useful for product marketing teams obsessed with competitor messaging shifts.

Pricing Comparison

| Tool | Best For | Starting Price | Free Tier? | Gartner Rating |

|---|---|---|---|---|

| AlphaSense | Deep market research | ~$10K-$25K/yr/user | No | 4.6 |

| Crayon | Competitive tracking | $39/user/mo | No | 4.5 |

| Klue | Sales enablement | ~$20K-$50K/yr | No | 4.7 |

| Prospeo | B2B contact intel | ~$0.01/email | Yes (75 emails) | - |

| Cognism | EMEA B2B data | ~$1K-$3K/mo | No | - |

| ZoomInfo | Enterprise B2B | ~$15K-$40K/yr | No | - |

| Similarweb | Digital analysis | $125/mo | Yes | - |

| Feedly MI | News monitoring | ~$6K-$18K/yr | No | 4.9 |

| Statista | Market statistics | $199/mo | Yes (basic) | - |

| Owler | Company snapshots | $35/mo | Yes | - |

| Visualping | Page monitoring | $13/mo | Yes | 4.6 |

| SpyFu | SEO/SEM intel | $39/mo | No | - |

How AI Is Changing Market Intelligence

The traditional MI workflow was brutal: analysts spent 80% of their time gathering information and 20% analyzing it. AI is reversing that ratio. The promise is that analysts become strategic enablers instead of information gatherers, spending most of their time on synthesis and recommendation rather than collection and formatting.

There's real substance behind the promise. AI-powered MI can save up to 80% of traditional research time. Both Andreessen Horowitz and Foundation Capital have published investment theses predicting generative AI will dramatically transform the $140 billion global market research industry. MI sits at the strategic layer above market research - meaning the transformation will cascade upward. Gartner projects 40% of enterprise applications will include task-specific AI agents by the end of 2026.

But here's the reality check.

2026 is shaping up to be what analysts are calling "The Great AI Reality Check." Enterprises are expected to delay 25% of planned AI spending into 2027 because the disconnect between vendor promises and actual value is becoming impossible to ignore. Companies that can't demonstrate concrete ROI within 6-12 months risk having AI initiatives shelved entirely.

Practitioners feel this tension firsthand. One product marketer tried ChatGPT for competitive analysis and reported it produced "ok output, but didn't see anything I don't already know." Google NotebookLM was better for feeding specific sources - G2 reviews, product docs, competitor pages - but "feeding info into it was tedious." A Fortune 500 researcher raised a sharper concern about synthetic data: the worry that marketers will use AI-generated user data to "extract the data they want to hear."

Here's the thing: AI makes MI faster, not smarter. It's exceptional at summarizing earnings calls, monitoring competitor websites at scale, and flagging anomalies in large datasets. It's terrible at contextual judgment - understanding why a competitor made a specific move, or what a regulatory shift means for your specific market position. The analysts who thrive in 2026 won't be the ones who adopt the most AI tools. They'll be the ones who know which questions AI can't answer.

The hallucination problem is real and underappreciated in MI contexts. When an AI tool confidently tells you a competitor launched a new product line - and they didn't - the downstream decisions based on that "intelligence" can be expensive. The quality of data feeding your AI models determines the quality of every output. Garbage in, hallucinations out.

Common Market Intelligence Mistakes

Collecting Everything, Analyzing Nothing

The most common MI failure mode. You set up 15 monitoring feeds, subscribe to 8 newsletters, and build a 200-row competitor tracking spreadsheet. Six weeks later, nobody's looked at any of it.

Information overload kills more MI programs than budget constraints do. One practitioner nailed it: "The real bottleneck isn't access to data. The bottleneck is turning scattered pages into structured insight quickly enough to influence decisions."

No Key Intelligence Questions

Without KIQs, every piece of information feels equally important - which means nothing gets prioritized. KIQs are the filter that turns a firehose into a focused stream. Define 5-10 questions that map directly to strategic decisions. If you can't connect a KIQ to a decision, drop it.

Relying on Stale Data

This one hits B2B teams especially hard. Your contact database says the VP of Sales at your target account is Sarah Chen. Sarah left four months ago. Your outreach bounces, your domain reputation takes a hit, and your "intelligence" is worse than useless - it's actively harmful. Data quality is the foundation, and "clear data strategy" starts with "current data."

Buying Tools Before Building Habits

I've watched teams drop $30K on a CI platform before they'd even defined what intelligence they needed. The platform sat unused for months while the product marketer who was supposed to run it kept doing manual Google searches because the tool was "too complex to set up."

Build the habit first. Define your KIQs, establish a weekly intelligence review, and prove the value with free tools before you invest in enterprise platforms.

Ignoring Web Data

Teams that limit their collection to industry reports and analyst briefings miss a massive signal layer. Web data - competitor site changes, job posting patterns, pricing page updates, review site sentiment - provides real-time indicators that traditional sources can't match. The companies extracting the most value from MI programs are the ones systematically harvesting these digital signals alongside conventional research.

Not Acting on What You Find

This is the most frustrating mistake, because it wastes everything that came before it. Industry estimates suggest only 20-30% of gathered intelligence is actually acted upon. The rest sits in Notion docs and Slack channels, acknowledged but never integrated into decisions.

If your MI program doesn't have a clear path from insight to action - a standing meeting, a decision framework, an executive sponsor who demands intelligence-backed recommendations - you're building a library nobody reads.

Your MI program identified the right segments. Now reach them. Prospeo layers buyer intent signals with 30+ filters - technographics, funding, headcount growth - so intelligence turns into pipeline, not slide decks.

Every signal is worthless until someone picks up the phone.

Measuring Market Intelligence ROI

One global consumer goods company implemented AI-powered MI and reported 450% ROI with 24,000 hours saved per year on global performance reporting. That's a dramatic number, and it's not typical for a first-year program. But it illustrates the ceiling.

For most teams, MI ROI shows up in four measurable KPIs:

Data Quality Score - What percentage of your intelligence inputs are accurate and current? If your contact data bounces at 15% or your competitor tracking flags stale information, your foundation is cracked.

Time to Insight - How long does it take from "something happened in the market" to "our team knows about it and has a recommendation"? Mature MI programs measure this in hours, not weeks.

Data Utilization Rate - What percentage of produced intelligence actually gets used in decisions? If you're producing weekly competitive briefs that nobody reads, your utilization rate is zero regardless of quality.

ROI on Data Investments - Total value of decisions influenced by MI divided by total MI program cost (tools + time + personnel). Hardest to measure, most important to track.

Here's my hot take that most MI guides won't give you: if your deals typically close below $10K, you probably don't need an enterprise MI platform at all. You need an intelligence habit. The team that spends 30 minutes every Monday reviewing five competitor moves and connecting them to strategic decisions will outperform the team with a $50K CI platform and no review cadence.

Tools amplify habits. They don't create them.

FAQ

Is market intelligence the same as competitive intelligence?

No - competitive intelligence is one subset of the broader MI discipline. MI covers the full external picture: customers, industry trends, regulations, macroeconomic shifts, and competitors. CI focuses specifically on tracking rival companies. Most teams start with CI and expand to full MI as they mature.

How much does a market intelligence program cost?

Budget-conscious teams can start for under $300/month using tools like Feedly MI, Similarweb's free tier, and Prospeo's free plan for B2B contact data. Enterprise CI platforms like AlphaSense or Klue typically run $20,000-$50,000+ per year. The biggest cost isn't tools - it's the analyst time to turn data into decisions.

How long does it take to build a market intelligence program?

Expect 3-6 months for a basic setup: defined KIQs, initial tools, and a regular reporting cadence. Reaching maturity - where intelligence culture is embedded across teams - takes 12-18 months. The biggest variable isn't budget; it's leadership commitment to acting on what you find.

Can AI replace market intelligence analysts?

Not yet. AI reverses the traditional 80/20 ratio so analysts spend less time gathering data and more time analyzing it, saving up to 80% of research time. But practitioners report oversimplified output and hallucinations. AI makes analysts faster, not obsolete - contextual judgment still requires a human.