Social Listening for B2B in 2026: From Signals to Pipeline

Spending $15k on a "listening platform" feels dumb when your brand only gets a handful of mentions a week. Social listening for B2B is how you catch demand that isn't addressed to you. A prospect posts "anyone have a {category} recommendation?" and your competitor's in the replies 20 minutes later.

That's the whole game.

What you need (quick version)

- Pick a 2-system stack: listening + alerting and enrichment + outreach + attribution

- Start with 6-10 queries, not 60

- Hit 85-90% relevancy before you route anything to Sales/CS

- Assign one owner + a weekday SLA for triage

- Tag every mention by intent (sales-intent, research, support, noise)

- Log outcomes in CRM so you can report influenced pipeline

Social listening in B2B (definition + what it's for)

It means collecting public conversations about your category, competitors, and buyer problems, then turning them into action. The action's the point. If your "listening program" never creates meetings, fixes product issues, or sharpens positioning, it's just an expensive dashboard.

The clean distinction:

- Social monitoring: "Did someone mention us?" (alerts, basic tracking)

- Social listening: "What are buyers trying to do - and what should we do next?" (intent, themes, competitive context, routing)

A concrete B2B example: someone posts "Typeform alternative for enterprise security?" in a community. Monitoring misses it because your brand isn't named. Listening catches it, routes it to a human, and triggers a helpful reply plus a follow-up to the right account.

Dashboard doesn't equal outcome.

A working program produces one of four things every month: meetings, influenced pipeline, product fixes, or content that ranks.

Why B2B listening matters even when your brand is "quiet"

If your brand gets 5-20 mentions a month, leadership assumes listening won't matter. That's backwards. Your brand can be quiet while the category's loud: buyers ask for recommendations, complain about competitors, and share "what we switched to" posts - you're just not in the thread.

Brandwatch has a useful gut-check stat: brand-owned accounts represent 1.51% of brand conversation. The rest happens elsewhere, outside your handles and your posts. https://www.brandwatch.com/blog/how-b2b-brands-can-benefit-from-social-listening/

I've seen this work (and fail) across B2B teams, and here's the trap: obsessing over brand demand. Category demand is where pipeline starts.

Three rules that make this pay off:

- Listen for intent patterns, not volume. Ten "{competitor} pricing is insane" posts beat 1,000 generic mentions.

- Treat it like inbound SDR. You're responding to expressed need - just not through a form. (If you want the mechanics, see Social Listening for Sales.)

- Use it to sharpen positioning. The best copy comes from how buyers talk when no vendor's watching.

Social listening finds the signal. Prospeo turns it into a meeting. Once you spot a prospect asking for recommendations on Reddit or a forum, enrich their company with verified emails and direct dials from 300M+ profiles - 98% email accuracy, 30% mobile pickup rate.

Stop letting competitors reply first because you can't find the contact.

B2B vs B2C listening: what's different (and what to optimize for)

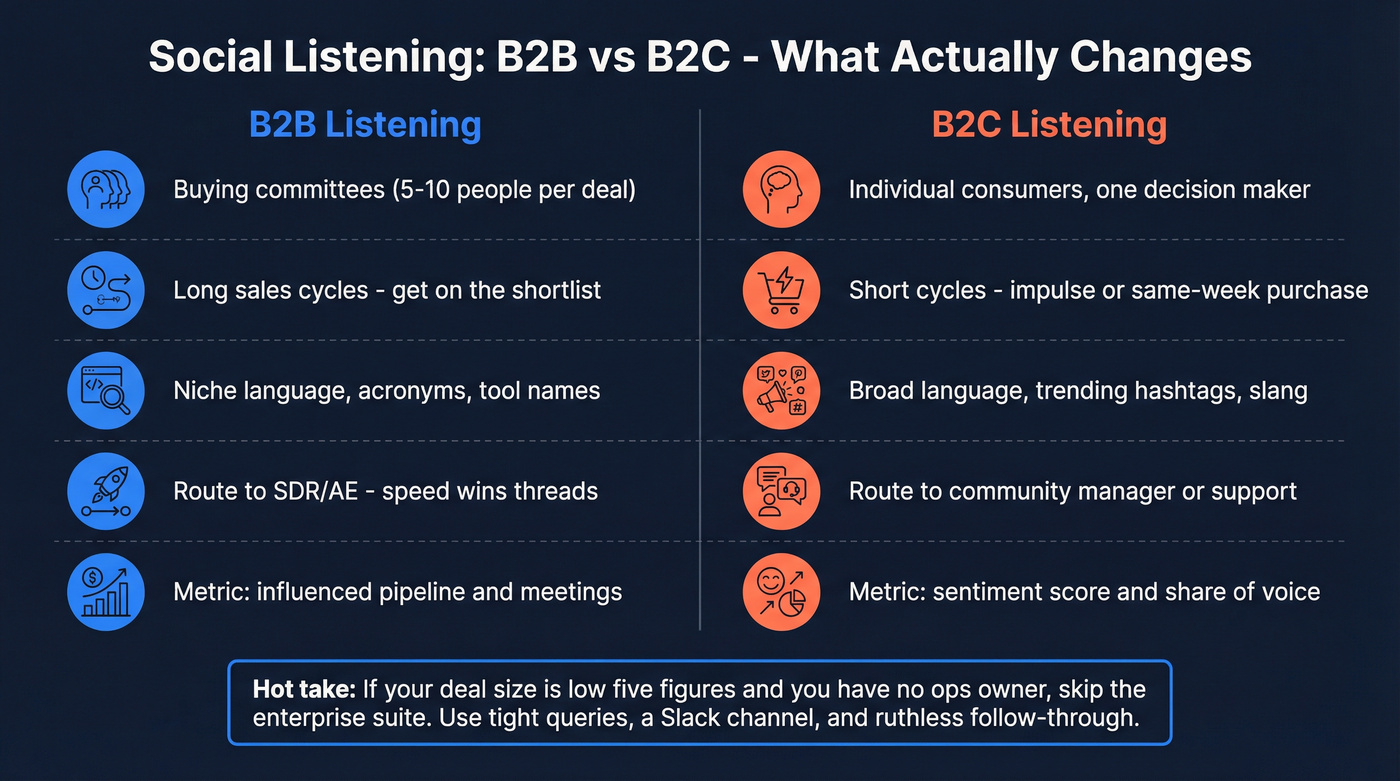

If you copy-paste a B2C listening playbook into B2B, you'll waste money and annoy your sales team.

Use this if you're doing B2B

- Optimize for buying committees. One post can map to an account with 5-10 stakeholders.

- Optimize for long cycles. The win is "get into the shortlist," not "close this week."

- Optimize for niche language. Acronyms, tool names, and misspellings belong in your queries.

- Optimize for routing speed. The first helpful reply often wins the thread. (This is basically speed-to-lead applied to public intent.)

Skip this (it's B2C brain)

Don't chase sentiment scores as your north star. In B2B, sentiment's context-heavy and misleading.

Don't over-index on share of voice. It's easy to inflate and still not move pipeline.

Don't buy an enterprise suite because it "does everything." Most teams never operationalize 80% of the features they pay for.

Hot take: if your average deal size is in the low five figures and you don't have a dedicated ops owner, you don't need an enterprise listening suite. You need tight queries, a Slack channel, and ruthless follow-through.

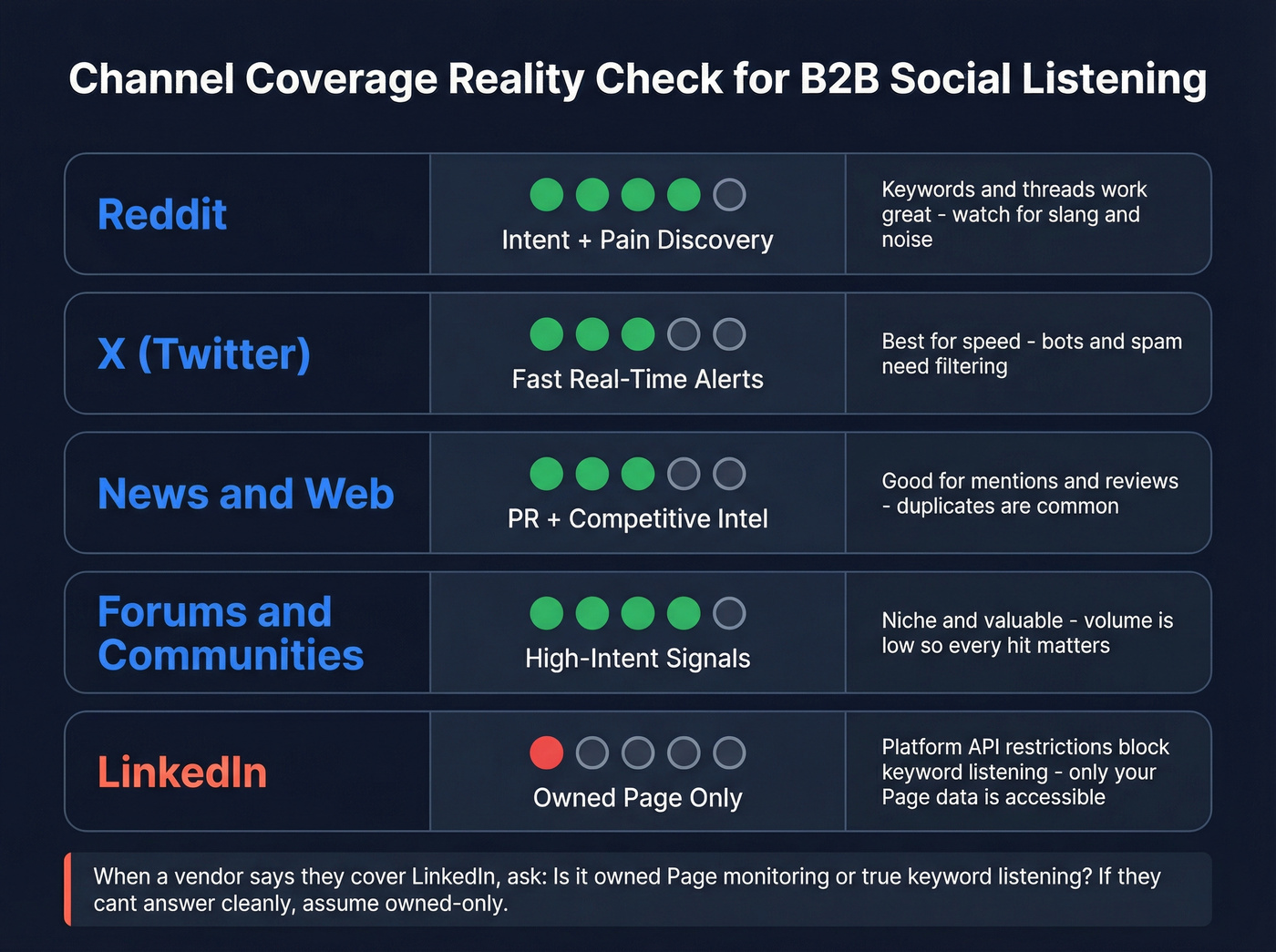

What social listening can't do (and why) - channel reality + compliance

Most disappointment comes from one assumption: "social" means "everything, everywhere, in real time." It doesn't.

The LinkedIn reality (and why vendors can't "just add it")

The biggest gap is LinkedIn. The constraint isn't vendor effort - it's platform policy. LinkedIn's Marketing API restricted use cases limit how member data can be used, including prohibitions that collide with sales and lead-building workflows. Read it here: https://learn.microsoft.com/en-us/linkedin/marketing/restricted-use-cases?view=li-lms-2026-01

What this means in practice:

- Member data use is restricted to approved use cases; advertising, sales, and recruiting use cases are explicitly disallowed

- Restricted use cases prohibit exporting or distributing member data outside the approved experience

- Restricted use cases prohibit combining member data with other datasets to create or append profiles or leads

- Retention limits are strict: member social activity data can only be stored for 48 hours, and most member profile data can only be stored for 24 hours

- "We cover LinkedIn" often means owned Page monitoring, not keyword listening across the platform

So when a tool says it "covers LinkedIn," ask one question: Is it owned Page monitoring, or true keyword listening? If they can't answer cleanly, assume it's owned-only.

Channel coverage reality checklist

| Channel | What works | What breaks | Best use |

|---|---|---|---|

| Keywords, threads | Slang/noise | Intent + pain | |

| X | Real-time alerts | Bots/spam | Fast replies |

| News/web | Mentions, reviews | Duplicates | PR + CI |

| Forums | Niche signals | Low volume | High intent |

| Owned Page data | Platform-wide | Brand mgmt |

If LinkedIn is your buyer channel: a compliant workaround SOP

You can still win deals that start on LinkedIn - you just can't treat it like an open keyword firehose. Here's the workaround that holds up operationally:

Owned Page monitoring (daily): track comments, @mentions, and post engagement on your company Page and key product Pages. Route anything with buying language to the same triage flow as other channels.

Employee advocacy intake (always-on): give sales and execs a simple internal form: "Paste the post URL + 1-line context + company name." Reward submissions. This becomes your distributed listening network.

Manual search cadence (2-3x/week): run exact-match searches for your highest-intent phrases (use quotes). Keep it tight: 10-15 searches, 10 minutes each. Save links into a shared sheet. Brand24 has a practical write-up on using quotes and narrowing terms for cleaner results: https://brand24.com/blog/linkedin-search/

Shift category listening to accessible channels (daily): Reddit, forums, review sites, newsletters, and the open web are where you can run real keyword queries and build repeatable alerts.

Route + enrich + follow up off-platform (same day): once you've got a company name or domain from any source, move into your enrichment + outreach system and log it in CRM.

That's the trade: less automation on LinkedIn, more discipline everywhere else.

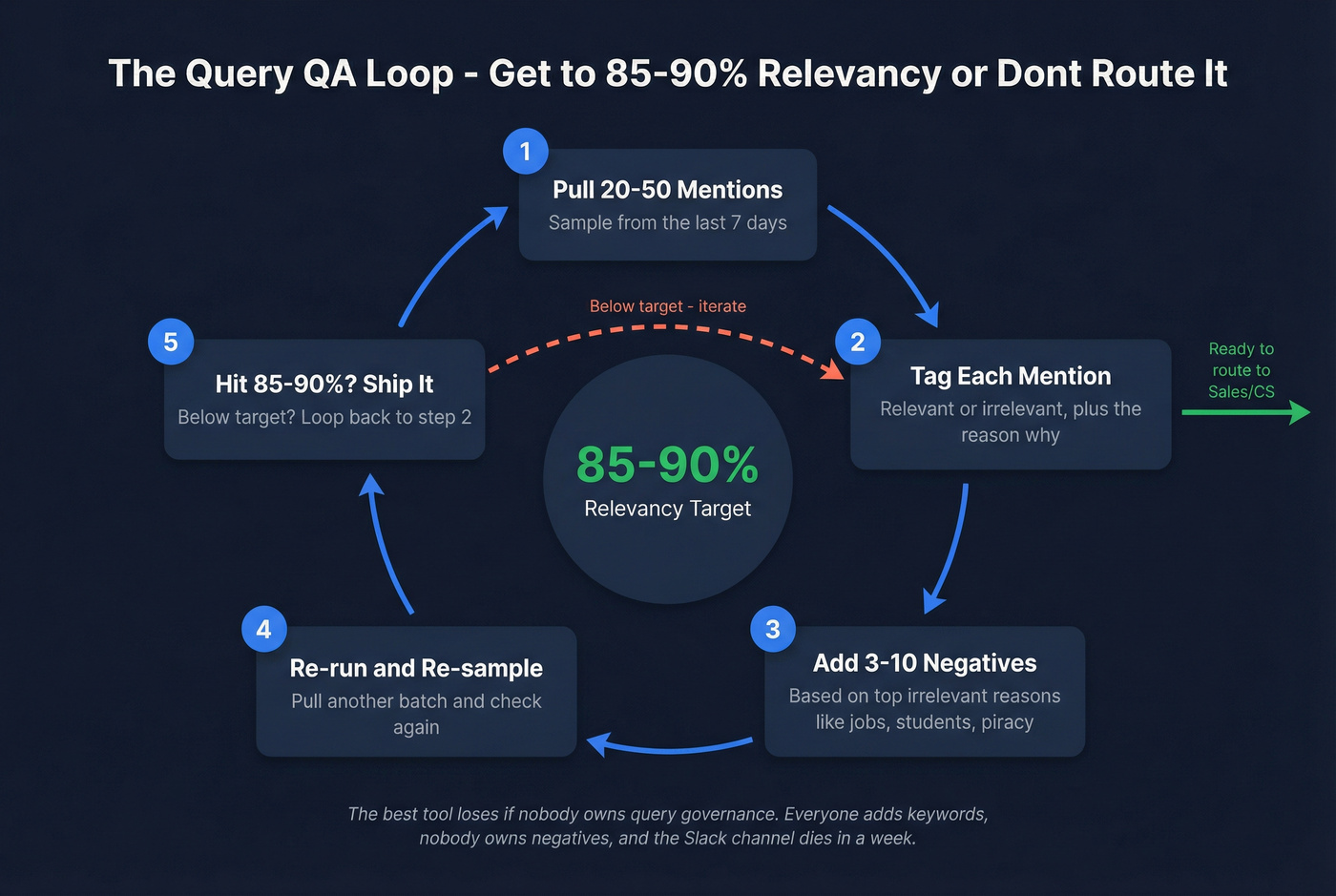

Build queries that don't waste your time (Boolean templates + QA loop)

Query quality is the job. A bad query in a $50k platform still produces garbage.

Operational benchmark: 85-90% relevancy for anything that triggers alerts to Sales/CS/Product. Exploration can be messier because a human's reviewing every mention.

Category intent templates

Copy/paste starters (swap in your terms):

("{category} alternative" OR "alternatives to {category}" OR "best {category}" OR "recommend a {category}" OR "looking for a {category}")("switching to" AND "{category}") OR ("moving from" AND "{category}")("{category}" AND ("pricing" OR "cost" OR "quote"))

If your category has multiple labels:

("{category}" OR "{category synonym}" OR "{acronym}")

Competitor displacement templates

("{competitor}" AND ("alternative" OR "alternatives" OR "vs" OR "versus"))("{competitor}" AND ("leaving" OR "switching" OR "migrating" OR "moving off"))("{competitor}" AND ("pricing" OR "renewal" OR "contract" OR "quote"))("{competitor}" AND ("implementation" OR "onboarding" OR "support"))

Build one query per competitor. You'll want different negatives and routing rules.

Problem-aware templates

("how do I" OR "how to" OR "anyone know" OR "recommend") AND ("{pain phrase 1}" OR "{pain phrase 2}")("tool for" OR "software for") AND ("{job to be done}")("anyone using" OR "anyone tried") AND ("{approach}" OR "{workflow}")

Noise filters (the fastest way to get clean)

Common negatives to adapt:

- Jobs/students:

-job -jobs -hiring -intern -internship -student -homework -course - Piracy/low intent:

-cracked -torrent -keygen -free download - Consumer confusion:

-game -movie -song(category-dependent)

Query QA loop (non-negotiable)

- Pull 20-50 mentions from the last week

- Tag each: relevant / irrelevant + reason

- Add 3-10 negatives based on the top reasons

- Re-run and re-sample

- Stop when you hit 85-90% for operational queries

I've run bake-offs where the "best" tool lost because nobody owned query governance. Everyone added keywords, nobody owned negatives, and the Slack channel became unusable in a week.

The workflow that actually works: listening -> routing -> enrichment -> outreach -> attribution

Tools don't create pipeline. Workflows do.

A simple pattern that holds up: pipe high-intent mentions into one Slack channel, triage daily, assign an owner fast, enrich immediately, then log everything.

Here's a real scenario I've watched play out: a founder posts on Reddit asking for "a {category} tool that doesn't break on SSO" and names two competitors; one SDR replies with a generic pitch, another replies with a 6-bullet checklist and a short "if you want, I'll sanity-check your requirements" note, and guess which one gets the DM and the meeting.

1) Capture

- Pick sources your buyers use: Reddit, X, niche communities, review sites, web/news

- Alert frequency by intent:

- Real-time: "alternative / switching / pricing / vs"

- Daily digest: problem-aware research threads

2) Triage (use a rubric, not vibes)

Here's a rubric your team can follow without arguing in Slack:

| Intent tag | What it looks like | Owner | SLA |

|---|---|---|---|

| Sales-intent | "alternative," "vs," "switching," "pricing," "recommend a tool" | SDR/AE | Same day |

| Research | "how do I," "what is," "best practices," broad advice | PMM/Content | 48h |

| Support | "bug," "error," "down," "can't log in," "billing issue" | Support/CS | 4h |

| Noise | jobs, students, irrelevant industries, spam | Ops | Close out |

If you want one rule that prevents chaos: only sales-intent gets real-time alerts. Everything else goes to a digest. (For a broader taxonomy, see intent signals.)

3) Route (a simple matrix beats a fancy workflow)

Routing rules that work in B2B:

- Sales-intent -> assigned SDR/AE by territory/segment

- Product complaints -> PM + Support lead

- Competitor intel -> PMM (this plugs into competitive intelligence quickly)

Escalation rule: if it's a named ICP account, it gets an owner within 2 business hours.

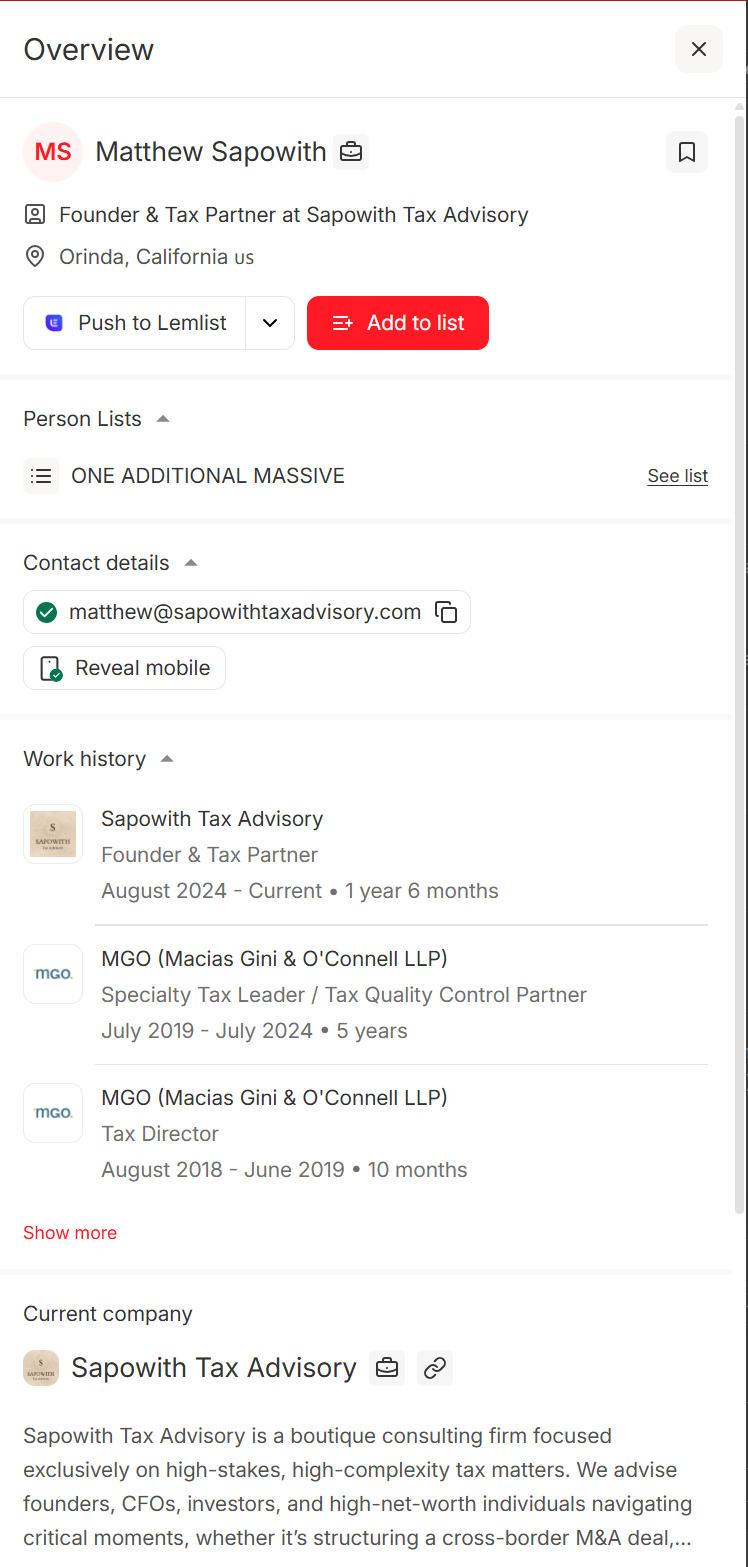

4) Enrich (turn "a post" into "a reachable account")

This is where most teams drop the ball: they reply publicly, feel productive, then fail to follow up because they can't map the company to the right people.

Prospeo ("The B2B data platform built for accuracy") is the cleanest after-triage layer I've used for this workflow because it turns "we found a thread" into "we found the account and the right contacts" fast: 300M+ professional profiles, 143M+ verified emails, 125M+ verified mobile numbers, 98% email accuracy, a 7-day refresh, 92% API match rate, and 83% enrichment match rate. That matters because the window between "public intent" and "competitor reply" is short, and the team that follows up the same day usually gets the next call. (If you're comparing vendors, start with a B2B data provider rubric.)

5) Outreach (don't be creepy; be useful)

The fastest way to get muted is pitching in-thread like it's 2017. The play is simple:

- Reply with a short framework or checklist first

- Drop a resource that helps the whole thread

- Follow up privately only after you've been useful (and only where appropriate)

Look, real talk: if your reps treat listening like a loophole to spam strangers, you'll burn the channel and your brand at the same time. (Related: avoid pitch slaps.)

I've watched teams do this and it's painful.

6) Log + attribute (make it measurable)

Non-negotiable: if it isn't in CRM, it didn't happen. (This gets easier when you follow a keep CRM data clean SOP.)

Minimum CRM fields (copy/paste schema):

- Source channel (Reddit/X/web/forum/news)

- Post URL

- Query name

- Intent tag (sales-intent/research/support/noise)

- Matched account (yes/no) + account domain

- Owner (user)

- Action taken (reply/DM/email/call)

- Outcome (meeting, opp created, opp influenced, closed-lost reason)

Influenced pipeline rule (simple and defensible):

Mark "Listening influenced" if a listening mention happens within 30 days before opp creation or during an active opportunity and it triggers a meaningful action (reply, DM/email, meeting, stakeholder intro).

Keep "Listening sourced" as a bonus metric when the first identifiable touch is the listening motion.

KPIs for social listening for B2B (what to report to leadership)

Leadership doesn't care about "mentions." They care about pipeline, risk, and learning velocity.

Measurement's still messy, but you don't need perfection to be credible. 6sense's benchmark data on attribution and contribution is a useful reference point for leading with influenced pipeline (not just sourced). https://6sense.com/science-of-b2b/2026-b2b-marketing-attribution-and-contribution-benchmark/

KPI table (monthly dashboard)

| KPI | Target | Why it matters | Owner |

|---|---|---|---|

| Relevancy rate | 85-90% | Keeps ops usable | RevOps |

| Time to triage | <24h | Speed wins threads | Ops/PMM |

| Time to first touch | <4h | Beat competitors | SDR/AE |

| Routed mentions | Up + steady | Signal volume | Ops |

| Meetings | 2-10/mo | Proof of value | Sales |

| Influenced pipeline | Primary | Real impact | RevOps |

Implementation note: don't let "influenced" become a vanity metric. Tie it to logged actions and a clear time window (like the 30-day rule above), and you'll stop having the same argument every QBR.

Tools for social listening for B2B (2026) - shortlist + pricing expectations

Buying mistake I see constantly: teams buy a social media management suite, bolt on listening, then discover it's per-seat plus add-ons plus limits. That combo's a tax on ops.

Pricing + fit comparison

| Tool | Best for | Pricing signal | Watch-outs |

|---|---|---|---|

| Awario | SMB intent alerts | Starts at $49/mo | Topic/mention caps |

| Brand24 | Mid-market ops | $199-$599/mo | Keyword limits |

| Talkwalker | Enterprise governance | Starts around $9,600/yr (quote-based) | Quote expands with volume/modules |

| Meltwater | PR + suite | ~$25k-$100k+/yr (quote-based) | Onboarding + annual contracts |

| Brandwatch | CI + research | ~$20k-$60k+/yr (quote-based) | Procurement heavy |

| Sprout Social | Publishing + reporting | Starts at $199/seat/mo | Listening add-on + per-seat costs |

Awario (Tier 1): fastest path to "alerts that don't suck"

Buy it if: you want Boolean, clean alerting, and transparent pricing without an enterprise sales cycle. Skip it if: you need deep research workflows or heavy governance.

Awario works when your goal's simple: track 10-20 intent phrases, route to Slack, and export cleanly. Pricing's public: Starter $49/mo, Pro $149/mo, Enterprise $399/mo (lower effective monthly rates on annual plans). The thing that bites teams is quotas - topics and mentions per month - so set expectations before you scale queries. https://awario.com/pricing/

Brand24 (Tier 1): packaging clarity for teams that hate surprises

Brand24 wins on one thing most vendors avoid: it tells you exactly what you're buying (keywords, mentions/month, users). That makes it easier to operationalize because you can budget and plan query volume.

Pricing runs $199-$599/mo, with Enterprise from $1,499/mo billed annually. For B2B teams, the real starting point is usually the plan that gives enough keywords to separate intent levels and competitors without cramming everything into one noisy query, because "one mega-query" always turns into a firehose and then everyone mutes the channel. https://brand24.com/prices/

Talkwalker (Tier 1): governance + global coverage (procurement included)

Talkwalker is for orgs that need global coverage, permissions, and a platform that survives enterprise reality: multiple teams, multiple regions, formal onboarding, and the kind of reporting that has to stand up in exec reviews without someone explaining caveats every time.

Plans are quote-based, but there's a real anchor: listings commonly cite $9,600/year as a starting point, and it climbs with data volume, regions, and modules. https://www.talkwalker.com/pricing

Meltwater (Tier 2): best when PR and marketing need one system

Meltwater's strongest as a suite: PR + media monitoring + social listening + reporting. If comms owns the budget and needs one platform, it's a solid choice.

Expect annual contracts (their pricing page makes it clear most partnerships have a minimum contract length of 12 months), and budget ~$25k-$100k+/year depending on modules, sources, and seats. https://www.meltwater.com/en/pricing

Brandwatch (Tier 2): deep research, heavy buying motion

Brandwatch is built for consumer intelligence-style analysis and enterprise research workflows. It's powerful, and it's a commitment.

Budget $20k-$60k+/year for many B2B teams once modules and volume are included. Final pricing depends on data access and usage. https://www.brandwatch.com/plans/

Sprout Social (Tier 3): great for publishing - expensive for listening

Sprout's excellent for social media management. As a listening buy, it's where teams get burned: it's per-seat, and listening is an add-on. Pricing starts at $199 per seat/month (annual billing), then increases on higher tiers. https://sproutsocial.com/pricing/

If you're buying primarily for listening, here's my blunt recommendation: don't. You'll pay management-suite pricing for a listening workflow that still needs ops glue.

Mention + BuzzSumo (Tier 3 quick hits)

- Mention: lightweight monitoring for basic alerts and brand protection. Expect ~$49-$179/mo depending on users and volume.

- BuzzSumo: content/web mentions and trend discovery more than true listening. Expect ~$199-$499/mo depending on seats and features.

Also considered (niche monitoring tools)

Teams also look at Octolens and Trigify for niche monitoring workflows. Evaluate them the same way you evaluate any tool: be strict about what "coverage" means per channel, and be strict about export and downstream usage constraints.

Your listening workflow breaks at step 5: route, enrich, follow up off-platform. Prospeo closes that gap - 92% API match rate, 50+ data points per contact, and CRM enrichment that pushes fresh data into HubSpot or Salesforce same-day. All at $0.01 per email.

Turn every captured mention into a CRM-ready contact in minutes.

What teams hate about social listening tools (so you can avoid churn)

Most churn isn't because the tool's "bad." It's because procurement bought a platform, and ops inherited the mess.

Recurring complaints I hear across buyer conversations:

- Overpriced packaging (especially per-seat + add-on listening)

- Contract surprises (auto-renewal and upgrade pressure)

- Hard caps on campaigns/keywords right when the workflow starts working

One grounded example: Sprout Social's review ecosystem includes repeated complaints about pricing and renewal friction. That's not a product flaw - it's a buying-motion mismatch. If you want a listening engine, buy a listening engine.

Buyer rules that prevent regret:

- Demand quota clarity: keywords/topics, mentions/month, retention, exports, API access

- Ask what "coverage" means per channel - especially LinkedIn (owned Page monitoring isn't platform-wide listening)

- Don't buy a suite until you've proven the workflow with tight queries, routing, and logging

FAQ

What's the difference between social monitoring and social listening for B2B?

Social monitoring tracks brand mentions and sends alerts. Social listening for B2B captures category and competitor conversations and routes them into actions like outreach, content, and product decisions. A good program produces meetings and measurable influenced pipeline, not just dashboards.

Can you do true platform-wide listening on every network?

No. Access varies by network, and some platforms restrict collection, retention, export, and downstream use. LinkedIn's the biggest constraint: member social activity data can only be stored for 48 hours, and most profile data for 24 hours, under restricted use cases. https://learn.microsoft.com/en-us/linkedin/marketing/restricted-use-cases?view=li-lms-2026-01

What relevancy rate should a B2B listening query hit before you operationalize it?

Hit 85-90% relevancy before routing alerts to Sales, CS, or Product, because real-time noise kills adoption fast. If you're below 85%, add negatives, tighten phrases, and re-sample 20-50 recent mentions until the feed's usable.

What's a good free way to turn listening signals into real contacts?

Prospeo's free tier includes 75 emails + 100 Chrome extension credits per month, which is enough to enrich a handful of high-intent threads into verified decision-maker contacts. Pair it with a low-cost alerting tool (or manual capture) and a same-day follow-up SLA to prove pipeline before you scale. https://prospeo.io/pricing

Summary: make social listening for B2B operational, not aspirational

The teams that win don't "do listening." They run a tight system: a handful of high-intent queries, an owner with a weekday SLA, a routing rubric, and CRM logging that makes influenced pipeline defensible.

Do that, and social listening for B2B stops being a dashboard and starts being a repeatable pipeline motion.